#Apply For Instant Loan

Text

Mobile banking app for Iphone.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online bank accounts opening#apply for instant loan#instant money loan#bank balance check#instant personal loan#instant account opening bank#apply for credit cards#book train tickets#book flights and hotels

0 notes

Text

Impact of E-Banking Service on Customer Satisfaction

Have you ever considered how the introduction of E-Banking Services has altered the landscape of consumer satisfaction in the banking sector? In an era driven by advances in technology, the impact of E-Banking on consumer satisfaction is a fascinating subject to explore. The dynamics of client experience are changing dramatically as financial institutions progressively switch to premium mobile banking. This research digs into the many facets of E-Banking and its outstanding impact on consumer satisfaction. Here, you can see the complicated relationship between E-Banking developments and the contentment of today's tech-savvy customers.

Enhanced Customer Control

Customers are empowered by e-banking because they have more control over their financial issues. Web interfaces allow Customers to monitor account activity, set notifications, and personalize preferences. This amount of control generates a sense of empowerment and contributes to increased customer satisfaction since customers value the opportunity to adapt their banking experience to their tastes.

Security measures

While the ease of E-Banking contributes significantly to customer happiness, the necessity of security cannot be emphasized. Encryption, multi-factor authentication, and secure communication methods are all used in e-banking services. These safeguards establish trust in clients by assuring them that their financial information is secure. Individuals are more likely to engage in E-Banking when they are confident in the security of their transactions. Hence, the perception of a secure environment positively increases consumer satisfaction.

Convenience and Accessibility

One of the most significant effects of E-Banking on client satisfaction is the increased level of convenience and accessibility it provides. Customers can do numerous banking operations from the comfort of their homes or on the go using premium mobile banking. Customers who enjoy the flexibility to complete transactions at their leisure have expressed appreciation for this convenience, defined by 24-hour availability.

Excellent customer support

Regardless of technological developments, customer happiness with E-Banking is also determined by the quality of customer care. Efficient issue resolution, whether via online chat, email, or phone assistance, is critical in molding the overall customer experience. By swiftly addressing problems, e-banking systems that provide rapid and effective customer assistance contribute greatly to client satisfaction.

Speed and efficiency

E-banking has increased the speed and efficiency of financial transactions dramatically. Traditional banking procedures frequently entailed time-consuming actions such as queuing or waiting for paper-based paperwork. Transactions are handled in real-time using E-Banking, minimizing the amount of time clients spend on ordinary banking tasks. Customer satisfaction benefits from the speed and efficiency of electronic transactions.

Instant information access

Customers benefit greatly from real-time information access through e-banking services. Account statements, transaction history, and other financial facts are easily accessible, allowing users to monitor and manage their finances transparently. This transparency generates a sense of control and awareness. It improves customer happiness by empowering and informing them about their financial decisions.

Final thoughts

E-banking services have a clear and far-reaching impact on client satisfaction. Banks must be innovative to satisfy changing client expectations as technology evolves. When done correctly, Fast Mobile Banking has the potential to leave a lasting favorable impression, fostering consumer loyalty in the volatile terrain of digitalized banking.

#online instant loan#credit card payment#online payment#money transfer app#payment app#apply for instant loan#instant money loan#money transfer#apply for credit cards#book flights and hotels

0 notes

Text

#apply for instant loan#apply for instant loan online#instant loans in Delhi#instant loan approval online#instant loan apply

0 notes

Text

Instant Loan App | Stashfin

Elevate your financial agility with the Stashfin Instant Loan App. This app is your gateway to swift access to funds, competitive interest rates, and personalized loan options. Whether you need to cover unexpected expenses, seize immediate opportunities, or pursue your aspirations, our user-friendly app ensures quick approvals and a hassle-free borrowing experience. Download the Stashfin Instant Loan App now to empower your financial journey and enjoy the convenience of instant loans at your fingertips.

Read More: The Merits of Keeping An Instant Personal Loan App on Your Phone

1 note

·

View note

Text

Quick Loan Apps | Stashfin

Experience financial freedom on the go with Stashfin's quick loan apps. Get fast access to funds, competitive interest rates, and flexible repayment options. Cover emergencies, seize opportunities, or pursue your goals with ease. Our user-friendly app streamlines the borrowing process for your convenience. Download the Stashfin app today for quick and hassle-free financial solutions.

Read More: The Merits of Keeping An Instant Personal Loan App on Your Phone

1 note

·

View note

Text

#immediate loan#instant loan#instant loans in Delhi#quick money loans#instant loans online in India#instant loan approval online#apply for instant loan online#online loan with low interest#get instant loan#instant loan approval#instant loan online#instant loan apply#apply for instant loan

0 notes

Photo

With the help of TrueBalance you can now apply for instant loan to help you financially. It is one of the best lending apps that offer affordable loans suitable for salaried and self-employed without any paperwork or bank visit! If you are looking for an online loan simply apply for a Cash Loan, get up to ₹50,000 instant and fulfill your money needs without any stress. Hurry Up! Your dreams are just to get fulfilled with just a few clicks.

0 notes

Photo

Apply for Instant Loans Online | Pre-approved Loan

Get a pre-approved instant loans online in India with the best interest rate. Apply now and get instant approval in 8 seconds.

0 notes

Text

Instant Loans in Nigeria - Fastest Solutions to Financial Problems

The loan market is flooded with types of loans that meet a borrower's specific needs - auto loans, education loans, mortgages, home loans, and more. Instant Online Loan in Nigeria is built to cover financial emergencies. If borrowers are looking for a source that gives them a small amount of money quickly, instant loans are just what they need. Instant Loans eliminate all those tedious procedures and get approved in a day or less. Real instant loans give you instant cash.

Many financial institutions offer instant loans through online transactions and this is one of the fastest and easiest ways to access cash. When you find these sites on the internet, you just need to fill out their online application form with some basic personal information. The application form will only take a few minutes to complete and you don't need to step out of your home or office to apply and get such instant loans. Once the companies have received your application, their manager will contact you to analyze your financial needs. Usually, loans will be processed within 2 hours of your approval and you can get the money instantly into your account.

Quick Loan in Nigeria allows you to have cash in your account whenever you need it. Typically loans are short-term and the loan can be repaid electronically on your next payday through a postpaid check that you deposit with the company at the time of sanctioning readiness. These loans benefit many people who would otherwise have no choice in the event their funds run out long before their next payment is due. They can now continue with their current lifestyle if they have cash transferred to their account through these instant transfers. Even for those with a bad credit history in the past, loans are easily accessible and they can also get instant cash when needed. Instant loans are an easy and convenient way to get cash when you really need it.

Some expenses can't wait, such as bill payments, medical bills, and other everyday household expenses. Lack of finances will make your life standstill and it also affects your family and loved ones. Therefore, it is better to choose short-term loans with instant approval and transfer money to your account when you need it urgently. Also, because repayments are made within two or three weeks, you don't have to bear the burden of debt for long. Signing up and getting instant loans is like borrowing money from a close friend, so go for it.

While many loans can take a while to get approved, the credit check process is actually pretty straightforward. As a result, Loan Sites in Nigeria are now able to offer fast online decision loans without bypassing the lengthy decision process familiar to past borrowers.

Source & Reference: https://medium.com/@stanbicibtcbank1/instant-loans-in-nigeria-fastest-solutions-to-financial-problems-618aec4f0c9e

#Apply For Instant Loan#Personal Loans in Nigeria#Emergency Online Loan in Nigeria#Borrow Money Online In Nigeria#Online Instant Loan in Nigeria#Small Loan in Nigeria#Apply For Loan in Nigeria#Get Loan Online In Nigeria#Instant Cash Loan in Nigeria

0 notes

Text

Apply Online for Quick Loan with Instant Approval

We often run out of finance and need quick funding to fulfill our dreams and aims. The obvious solution for the same is to choose for the loan. But in the fear of rejections or due to less knowledge we often end up taking financial aid from informal sources at higher interest rates. This puts our life in debt and creates financial stress. To avoid all these things the easier solution is to opt for the loan that can help you to overcome your financially harder time.

There are many financial aid companies that are making the tough task of taking loans easy by helping the borrowers in documentations and processing of the loan. With the introduction of technology many financial aid companies have inculcated and have shifted successfully to the technology to ease the process of loans. Now you can apply online for loan online and avail of the loan without much trouble. The article below is an attempt to make the readers understand about the loan providers companies. Further it will explain to you the benefits of choosing the loan providers. At the end, the article will conclude by giving you the list of top loan providers in Delhi.

What are loan Providers companies? What are the benefits of choosing Loan Providers?

Loan providers are companies or financial institutions that offer loans to individuals, businesses, or other entities in need of financial assistance. You can apply for quick loan and fulfill your dreams. These loans can be used for various purposes, such as personal expenses, buying a house or a car, funding a business venture, or consolidating debts.

Some common types of loan providers include:

Banks

Credit Unions

Online Lenders

Peer-to-Peer Lending Platforms

Microfinance Institutions

Payday Lenders

Credit Card Companies

Finance Companies

Choosing loan providers can offer several benefits, depending on your financial needs and circumstances. Here are some of the advantages of opting for loan providers:

Access to Funds: Loan providers offer you access to the funds you need when you are facing financial constraints or have specific financial goals, such as purchasing a home or funding a business.

Flexible Repayment Options: Many loan providers offer various repayment plans, allowing you to choose a schedule that aligns with your income and financial capabilities. This flexibility can make it easier to manage your debt.

Quick Processing and Approval: These companies offer easy loan applications to the borrowers. With the advent of online lending platforms, the loan application and approval process have become quicker and more streamlined. In many cases, you can receive loan approval within a short period, providing you with swift access to funds.

Build Credit History: Responsible borrowing and timely repayments can help you build a positive credit history. A good credit score can open doors to better loan options and lower interest rates in the future.

Consolidating Debt: Loan providers may offer debt consolidation loans, allowing you to combine multiple debts into a single loan with a potentially lower interest rate. This can simplify your finances and reduce overall interest costs.

Competitive Interest Rates: By shopping around and comparing different loan providers, you can find competitive interest rates that suit your budget and save you money over time.

Specialized Loan Products: Some loan providers offer specialized loan products tailored to specific needs, such as home loans, auto loans, student loans, or small business loans.

Online Accessibility: Many loan providers now offer online applications, making it convenient to apply for a loan from the comfort of your home and access customer support through digital channels.

Avoiding Depletion of Savings: Taking out a loan for planned expenses can help you preserve your savings for emergencies or unexpected financial situations.

Top Loan Providers in Delhi

Here is the list of top finance companies in Delhi with their locations. These loan companies in Delhi shall help you to get instant loan the assistance you need in financial aid matters.

My Mudra: It is a largest growing fintech having headquartered in Delhi. The company is providing financial services since decades.

Credset: It is a loan provider agency based in Karol Bagh Delhi.

Finance loan in India online

Trust: They are providing different types of loans and have been based out in Netaji Subhash Palace, Pitampura, Delhi.

KG Loan Expert Pvt. Ltd: It is a loan provider agency based in Netaji Subhash Palace in Delhi.

GRD India Financial Service: This is a financial aid provider company based out in Ashok Nagar Delhi.

Conclusion

It's essential to carefully consider the terms and conditions, interest rates, and repayment terms offered by different loan providers before committing to a loan. Borrowers should also ensure that they can comfortably meet their repayment obligations to avoid financial difficulties. My Mudra is one of the top fintech organizations which has been making loans and helping people since decades.

#Apply Online for Loans#apply for quick loan#loan instant approval#get instant loan#loan in India online#top fintech organizations

2 notes

·

View notes

Text

Apply for Credit Card Balance Transfer Loan Online

Ready to tackle your credit card debt with ease? Ours Apply for Credit Card Balance Transfer Loan Online is the answer you've been searching for! No need to stress about complicated paperwork or lengthy processing times. With just a few clicks, you can secure a new loan with a lower interest rate and start saving money. Instant Loans Against Property apply online. now and breathe a sigh of relief. Click here: https://tinyurl.com/5a6hj8wd

#Apply for Credit Card Balance Transfer Loan Online#Apply for instant personal loan#Personal loan apply online#Apply for home loan balance transfer#Home loan apply online#Apply for overdraft facility#Pre approved personal loan apply online

2 notes

·

View notes

Link

This makes for a good credit history, amongst other factors. IndiaLends offers multipurpose personal loan in Bangalore at the best rate of interest to let you meet your financial needs. Interest rates starting from 10.75% with multiple repayment options.

#online bank loan#loan apply#bank loan#personal loan interest#instant loan in Bangalore#Personal loan in Bangalore salaried#Online loan in Bangalore#Urgent loan Bangalore

2 notes

·

View notes

Text

Introduction

In the rapidly evolving financial landscape of India, instant loans have emerged as a popular financial tool, providing quick and easy access to funds when needed. This article delves into the concept of instant loans, their benefits, the application process, eligibility criteria, interest rates, and potential pitfalls to be aware of.

Understanding Instant Loans

Instant loans are short-term personal loans that can be availed quickly, typically through online platforms. These loans are designed to cater to immediate financial needs, such as medical emergencies, home repairs, travel expenses, or even debt consolidation. The application process is streamlined and can often be completed within minutes, with disbursal happening in a few hours to a couple of days.

Benefits of Instant Loans

1. Speed and Convenience

One of the primary advantages of instant loan apply is the speed at which they are processed. Traditional loans from banks can take days or even weeks to get approved and disbursed, but instant loans can provide funds almost immediately. The entire process, from application to disbursal, is conducted online, eliminating the need for physical visits to banks or financial institutions.

2. Minimal Documentation

Instant loans require minimal documentation compared to traditional loans. Typically, applicants need to provide basic identification documents, proof of income, and bank statements. The reduced paperwork makes the process hassle-free and less time-consuming.

3. Flexible Loan Amounts and Tenures

Instant loans offer flexibility in terms of loan amounts and repayment tenures. Borrowers can choose the amount they need and a repayment period that suits their financial situation. This flexibility makes instant loans an attractive option for a wide range of financial needs.

4. Accessibility

Instant loans are accessible to a broader audience, including those who may not have a high credit score. Many online lenders use alternative credit scoring methods, such as social media profiles, mobile usage patterns, and other non-traditional data, to assess an applicant's creditworthiness.

How to Apply for an Instant Loan

Applying for an instant loan in India is a straightforward process. Here’s a step-by-step guide:

1. Research Lenders

Start by researching various online lenders. Look for those that offer competitive interest rates, flexible repayment terms, and a good reputation. Reading customer reviews and checking the lender’s credibility can help in making an informed decision.

2. Check Eligibility

Each lender has specific eligibility criteria that applicants must meet. Common requirements include being an Indian citizen, being at least 21 years old, and having a stable source of income. Some lenders may also have minimum income requirements.

3. Gather Required Documents

Prepare the necessary documents before starting the application process. These typically include:

Identity proof (Aadhaar card, PAN card, passport, etc.)

Address proof (utility bills, rental agreement, etc.)

Income proof (salary slips, bank statements, etc.)

Recent passport-sized photographs

4. Fill Out the Application Form

Visit the lender’s website or mobile app and fill out the online application form. Provide accurate information and double-check for any errors before submitting the form.

5. Upload Documents

Upload the required documents in the prescribed format. Ensure that the scanned copies are clear and legible to avoid any delays in processing.

6. Verification and Approval

After submitting the application and documents, the lender will verify the information provided. This process can take a few hours to a couple of days. If the application is approved, the lender will notify the applicant and disburse the loan amount to the specified bank account.

Interest Rates and Fees

Interest rates for instant loans can vary significantly depending on the lender, loan amount, and borrower’s credit profile. Typically, these loans have higher interest rates compared to traditional loans due to the convenience and speed they offer. Interest rates can range from 12% to 36% per annum.

Apart from interest rates, borrowers should also be aware of other fees associated with instant loans, such as:

Processing Fees: A one-time fee charged for processing the loan application. This fee is usually a percentage of the loan amount.

Late Payment Fees: Penalties for missing or delaying repayments.

Prepayment Charges: Fees for repaying the loan before the end of the tenure, although some lenders may offer prepayment without any charges.

Potential Pitfalls of Instant Loans

While instant loans offer numerous benefits, there are also potential drawbacks that borrowers should consider:

1. High Interest Rates

The convenience of instant loans comes at a cost, with interest rates often being higher than those of traditional loans. Borrowers should carefully assess their repayment capacity before opting for an instant loan.

2. Short Repayment Tenures

Instant loans typically have shorter repayment tenures, ranging from a few months to a year. Short tenures mean higher monthly installments, which can strain the borrower’s finances if not planned properly.

3. Impact on Credit Score

Failure to repay the loan on time can negatively impact the borrower’s credit score, making it difficult to secure loans in the future. It is crucial to ensure timely repayments to maintain a healthy credit score.

4. Hidden Charges

Some lenders may have hidden charges that are not immediately apparent during the application process. Borrowers should read the terms and conditions carefully and clarify any doubts with the lender to avoid unpleasant surprises.

Responsible Borrowing

To make the most of instant loans and avoid falling into a debt trap, borrowers should adopt responsible borrowing practices:

1. Assess Financial Needs

Borrow only what is necessary and avoid taking loans for non-essential expenses. Evaluate your financial situation and ensure that you can comfortably repay the loan within the stipulated tenure.

2. Compare Lenders

Don’t settle for the first lender you come across. Compare multiple lenders to find the best interest rates, terms, and fees. Use online comparison tools and read customer reviews to make an informed choice.

3. Read the Fine Print

Carefully read the loan agreement, including the terms and conditions, interest rates, fees, and repayment schedule. Clarify any doubts with the lender before signing the agreement.

4. Maintain a Good Credit Score

A good credit score can help you secure better interest rates and terms on instant loans. Make timely repayments on existing loans and credit cards to maintain a healthy credit score.

Conclusion

Instant loans have revolutionized the way individuals in India access quick funds for various financial needs. Their speed, convenience, and minimal documentation make them an attractive option for many. However, it is essential to approach instant loan with caution, understanding the associated costs and potential risks. By adopting responsible borrowing practices and making informed decisions, borrowers can leverage instant loans to meet their financial goals without falling into a debt trap.

#instant loan#instant loan apply#instant cash loan#instant loan cash#instant loan India#quick cash loan

0 notes

Text

Discover the benefits of a personal loan! Whether it's for wedding expenses, pay credit card bills, sudden medical expenses, plan a vacation, relocation needs, we've got you covered. Enjoy quick access to funds, flexible repayment options, low interest rates, and hassle-free application process. Apply now and take control of your finances!

0 notes

Text

Apply For Loan Online for business expansion. Proven track record and solid plan. Ready for prompt processing.

#apply for loan#apply for loan online#apply online for loan#apply online loan#apply loan online#apply for a loan#apply for a loan online#best loans india#best loans in india#cheapest loans#cheapest loans india#cheapest loans in india#instant loan#instant loan online#instant loan online approval#instant loan online approvals#loans in india#loans in north india#loans in chandigarh#loans in tricity#loans in tricity chandigarh#loans in punjab#loans in south india#online loan#online loans#online loan india#online loans india#various loans#various kind of loan#various kinds of loan

0 notes

Text

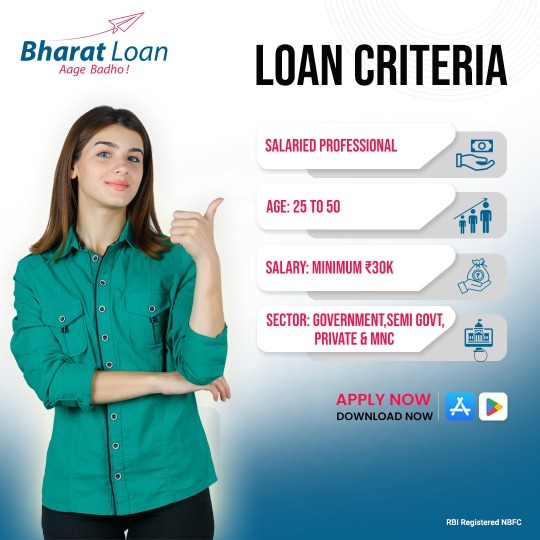

Redefining Financial Solution - Personal loan in Faridabad

Everyone is in the pursuit of achieving more; it can be getting a new car, a salary hike, a new job that pays more, starting a business, etc. While making sure every need and want is fulfilled, what if financial emergencies arise and you are left with nothing? When such situations arise, anyone, especially salaried employees, can access support from Bharat Loan, offering short-term loans ranging from ₹5k to ₹1Lakh. Visit the blog to read more.

Visit- Redefining Financial Solution - Personal loan in Faridabad

#Apply Online For Emergency Loan Ghaziabad#Salaried Loan Providers Ghaziabad#Best Instant Personal Loan App Ghaziabad#Instant Emergency Loan Ghaziabad#Best Instant Personal Loan App Ahmedabad#Payday Loans For Salaried Employees Faridabad#Urgent Personal Loans Ghaziabad#Emergency Personal Loans Delhi#Instant Personal Loan App Ahmedabad

0 notes