#IL & FS CRISIS

Photo

Tra Andrea Damante e Elisa Visari l'amore è finito, lei viaggia per il mondo mentre il Dama segue il suo tour da deejay: dopo 3 anni insieme la coppia si è detta addio... senza una parola Le crisi non erano mancate ma, dopo 3 anni insieme, Elisa Visari, 22 anni, e Andrea Damante, 34, sembravano essere riusciti ad appianare ogni possibile ostacolo così da poter continuare il loro cammino insieme. Tra i progetti a lungo termin... Continua a leggere.. https://www.eva3000.com/tra-andrea-damante-e-elisa-visari-lamore-e-finito-lei-viaggia-per-il-mondo-mentre-il-dama-segue-il-suo-tour-da-deejay-dopo-3-anni-insieme-la-coppia-si-e-detta-addio-senza-una-parola/?feed_id=5942&_unique_id=662512c21b96a&utm_source=Tumblr&utm_medium=%40Redazione30&utm_campaign=FS%20Poster

0 notes

Text

The Sensex is down 8% today, the steepest drop since 2008; the Dow opens with another crash

As India's stock market index, the Sensex, dropped by a startling 8%, the world's financial markets had a turbulent day. This decrease represents the biggest one-day slump since the 2008 financial crisis. The Dow Jones Industrial Average began with another huge collapse, adding to the depressing mood and alarming investors all over the world. Selling avalanches reportedly caused SBI to incur a decline of 13.23% in India and a loss of 9.82% in the oil and gas sectors, according to Siddharth Mehta, IL&FS Former Director and CIO of Bay Capital. Real estate, metal, bankex, finance, oil, and IT all saw declines in their sector indices. For well-run, non-leveraged businesses, prudent investing is advocated despite market volatility.

Numerous variables, the biggest one being the growing worries about the COVID-19 pandemic's economic impact, can be blamed for the Sensex's sharp decrease. A serious setback for the global economy has resulted from businesses across all sectors ceasing operations because of sudden lockdowns, travel restrictions, and interruptions in supply chains. The stock market has experienced significant selloffs because of investors' anxiety over the economy's future and their struggle with uncertainty. Siddharth Mehta Bay Capital, CIO and Former Director IL&FS believes stock markets are essential for a free-market economy, allowing buyers and sellers to trade equity shares. He emphasizes the need for concentration and intelligent choices to achieve substantial gains, emphasizing the importance of clear goals in stock market engagement.

Additionally, the decline in the Dow Jones Industrial Average is indicative of a wider pattern of unrest in the world's stock markets. The outbreak's focal point, the United States, has already seen major market changes in recent weeks. Investors' confidence in the long-term stability of the financial markets is eroding as the number of confirmed COVID-19 incidents rises globally.

The effects of current market volatility extend beyond investors. The stock market's decline has repercussions for firms, consumers, and even governments. Companies that rely on the stock market to raise money or pay for expansion plans may experience tighter access to liquidity, which would hurt their chances of expanding. Additionally, falling stock prices undermine consumer confidence, which may result in less spending and a decrease in economic growth. The task for governments is to reduce these harmful consequences and put policies in place to stabilize their economy.

Central banks and governments are acting swiftly to combat the economic slowdown in light of these developments. To stabilize and support the financial markets, central banks have taken steps like lowering interest rates and injecting more liquidity. To promote economic growth and lessen the effects of the crisis on firms and consumers, governments have also introduced fiscal stimulus programs.

Although historically resilient, the short-term future of stock markets is uncertain. Investors should keep a long-term perspective because there may be possibilities for value investing during difficult times. Siddharth Mehta views, that the overall Sensex decline and Dow Jones Industrial Average crash indicate global stock markets are struggling due to COVID-19, Investor panic is triggered by economic uncertainty, but governments and central banks are working to stabilize the situation.

1 note

·

View note

Text

Analyzing Market Flexibility: Insights from Shyam Maheshwari SSG.

In the dynamic realm of finance, adaptability reigns supreme. Shyam Maheshwari, an esteemed financial expert at SSG Capital, sheds light on the intriguing interplay between regulated financial players and their leveraged counterparts, unveiling the crucial concept of flexibility in the market. Drawing distinctions between banks and non-banking entities, Maheshwari unveils how these players impact the financial landscape.

Regulation vs. Leverage: A Delicate Balance

Mr.Shyam Maheshwari underscores the regulatory might of established players who have long dominated the market. Banks, as regulated entities, play a pivotal role in maintaining stability. On the other side of the spectrum, non-banking institutions operate with leverage, which presents unique challenges. Shyam Maheshwari SSG, observes that these leveraged platforms encounter limitations, a reality that surfaced during events like the Infrastructure Leasing & Financial Services (IL&FS) crisis, revealing vulnerabilities in areas such as Liquidity and Liability Management (LLM) and provisioning norms.

The Dual Facets of Flexibility

Flexibility, as Shyam Maheshwari articulates, unfolds in two dimensions - speed and tailored solutions. He accentuates that these dimensions are particularly pertinent for borrowers seeking diverse financial needs, such as capital formation. Maheshwari points out that traditional financing avenues in India often struggle to accommodate such requirements, creating a gap that demands attention.

Unraveling the Sectoral Landscape

Maheshwari’s insights traverse across various sectors, spotlighting the often-overlooked realms. He spotlights real estate and intangibles as crucial building blocks for the country's progress. With a discerning eye, he highlights that real estate, despite its significance, remains inadequately addressed by the banking sector.

The Burgeoning Need and Its Constraints

In an era marked by rapid growth and innovation, certain sectors experience escalated demand. Maheshwari notes that this demand has surged beyond sectoral expectations, a phenomenon attributed to existing constraints. The banking sector’s challenge lies in maintaining healthy double-digit Marginal Propensity to Lend (MPL) ratios while catering to these mounting needs.

Empowering Creditor Protection and Market Access

Maheshwari discerns positive shifts in the global investment perspective. He acknowledges the Insolvency and Bankruptcy Code (IBC) process, which enhances creditor protection. He notes that the market's access has improved and remains open. Yet, Maheshwari asserts that further strides can be taken to enhance market conditions.

Pathways to Progress: Access and Expansion

Shyam Maheshwari SSG, proposes avenues to advance market dynamics. One such path involves expanding access, which currently mainly benefits foreign participants through External Commercial Borrowings (ECB) in dollar or rupee terms. The bond market, while promising, grapples with its own intricacies. However, Maheshwari is optimistic about recent signs indicating its gradual opening over the last decade.

In summary, Shyam Maheshwari's expert perspectives offer a captivating glimpse into the intricate dance between regulated and leveraged financial players. The concept of flexibility emerges as a pivotal force, shaping solutions tailored to borrowers' unique needs. As India's financial landscape evolves, Maheshwari's insights serve as a compass, guiding us toward a more adaptive and robust future.

0 notes

Text

Siddharth Mehta speaks about the huge growth of Fintech after COVID-19

The COVID-19 pandemic has accelerated the growth of fintech as consumers and businesses increasingly turned to digital financial services during the pandemic says Siddharth Mehta IL&FS. Here are some ways in which fintech has experienced huge growth during and after COVID-19:

Digital Payments: The pandemic led to a surge in demand for digital payments as consumers avoided cash and in-person transactions. Fintech companies that offered digital payment solutions saw a huge increase in usage during this time, with many consumers adopting these solutions for the first time.

Digital Lending: As businesses struggled during the pandemic, fintech companies that offered digital lending platforms saw a surge in demand for their services. These platforms enabled businesses to apply for loans online and receive funds quickly, helping them to stay afloat during the crisis.

Remote Work: The pandemic also led to a rise in remote work, which created a demand for digital solutions to manage finances and payments remotely. Fintech companies that offered solutions for remote financial management and payment processing saw a significant increase in usage during this time.

Contactless Solutions: The pandemic also accelerated the adoption of contactless payment solutions, such as mobile payments and e-wallets, as consumers and businesses sought to minimize physical contact. Fintech companies that offered these solutions experienced a surge in usage during this time.

Digitization of Financial Services: The pandemic has also led to a greater focus on the digitization of financial services. Traditional financial institutions are increasingly partnering with fintech companies to offer digital solutions to their customers, and the adoption of fintech solutions is expected to continue to grow in the post-pandemic world.

According to Siddharth Mehta IL&FS former director overall, the COVID-19 pandemic has accelerated the growth of fintech as consumers and businesses increasingly turned to digital financial services during the crisis. The adoption of fintech solutions is expected to continue to grow in the post-pandemic world as the focus on digitization of financial services continues.

#siddharth mehta il&fs#siddharth mehta#il&fs#siddharth#mehta#digitalization#india#fintech#siddharth mehta ilfs#covid-19#tumblr

0 notes

Photo

Before we get into the reforms and policies being established by the government to help deal with the liquidity crunch, let’s briefly discuss what got them there- the IL&FS crisis of 2018. During August 2018, Infrastructure Leasing and Financial Services defaulted in the repayment of their obligations to SIDBI.

0 notes

Text

Kotak Mutual Fund, PGIM India move SAT against SEBI order

Kotak Mutual Fund, PGIM India move SAT against SEBI order

SEBI

PGIM India Mutual Fund and Kotak Mutual Fund have moved the Securities Appellate Tribunal (SAT) to appeal against the Securities and Exchange Board of India’s (SEBI) orders against them in July.

In separate orders, SEBI had penalised the fund houses’ key officials for inter-scheme transfers and investment decisions taken after the IL&FS crisis.

“We have filed an appeal against the order of…

View On WordPress

0 notes

Text

A decade after Satyam scam, systems still take long time to detect discrepancies at companies: Gurnani

A decade might have passed after the infamous Satyam Computer scam and subsequent regulatory actions but Tech Mahindra chief C P Gurnani feels systems still take a long time to detect discrepancies at corporates and better data analytics are needed to plug the loopholes.

Satyam Computer Services was hit by an accounting scam perpetrated by its founder B Ramalinga Raju that came to light in January 2009 and the once storied company was later acquired by Tech Mahindra in April the same year.

In an interview to PTI, Gurnani said that even after ten years of Satyam Computer scam, “our systems still take a long time to get alerted to discrepancies which may lead to crisis situations”.

“All stakeholders, including banks, lending agencies and companies, need to be more responsible. We need to incorporate better data analytics and dashboards to capture loopholes and avoid crisis like Satyam or IL&FS. I think we all are wiser but we need to have better processes and systems in place,” he said.

Incidentally, the now crisis-hit IL&FS had acquired Maytas Infra, an entity that was promoted by Raju, after the Satyam Computer scam.

IL&FS group has a debt burden of more than Rs 94,000 crore and its board was taken over by the government last year.

The Rs 7,800 crore fraud at Satyam Computer came to light in January 2009 after Raju admitted to cooking up account books and inflated profits for several years.

After the takeover by Tech Mahindra in April 2009, the firm was initially operated as separate entity Mahindra Satyam.

In 2012, Mahindra Satyam was merged with Tech Mahindra. About the turnaround at Satyam Computer, Tech Mahindra claims to have delivered around eight-fold return to small investors who had invested with the company at the time of takeover.

“For an initial investment of Rs 830.45 crore in April 2009, we have returned Rs 6,614.80 crore, including a dividend of Rs 332. This is nearly an eight-fold return for small investors,” Gurnani said.

Shares of erstwhile Satyam Computer traded at Rs 7,229 apiece in March 2000 and had plunged to Rs 6.30 on the National Stock Exchange in January 2009.

“A lot of work was done to bring back the business and to reassure the clients. The employees also did a lot in terms of delivering superior services to customers in order to ensure that no client left them because of service dissatisfaction,” Gurnani said.

According to him, the total client base has grown over three-fold from 300 clients to 930 at present. An only big client of Satyam Computer — British Petroleum — had snapped contract because of their cost-cutting measures.

“Today, we are around 1,20,000 people, which is, almost three times the size since 2009. A lot of that growth has been in the BPO business in addition to our performance in the traditional IT business,” Gurnani said.

The processes are now well defined compared to the situation in 2009, he noted.

0 notes

Photo

Lessons from the NBFC Crisis of India. Recently the default by IL&FS in coupon payments to debt based mutual funds triggered a crisis which exposed the fault lines of India's shadow banking sector also known as Non Banking Financial Companies (NBFCs).

1 note

·

View note

Text

Government Extends Uday Kotak's Tenure As IL&FS Non-Executive Chairman

Government Extends Uday Kotak’s Tenure As IL&FS Non-Executive Chairman

Uday Kotak’s term as IL&FS Non-Exec Chairman has been extended many times before.

New Delhi: The government has decided to extend the tenure of veteran banker Uday Kotak as the IL&FS Non-Executive Board Member and Chairman by six more months. Mr Kotak will continue on the Board of Infrastructure Leasing and Financial Services Limited for a further period up to April 2, 2022, a notification…

View On WordPress

0 notes

Text

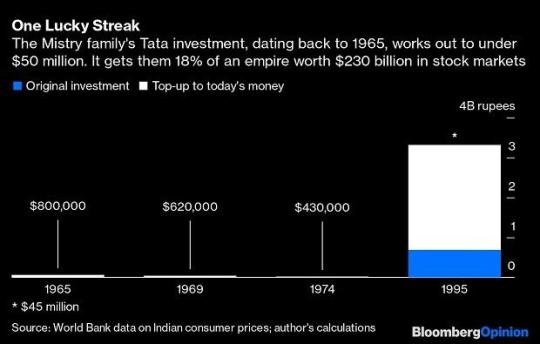

Tata empire in stronger position against Mistry after Supreme Court verdict

Tata empire in stronger position against Mistry after Supreme Court verdict

After several years of legal wrangling, India’s Tata Group has won a decisive victory over its disgruntled minority shareholder. But the boardroom coup that turned into a courtroom drama will only be over with a divorce. That could still get messy.

The Shapoorji Pallonji Group’s claim of being an oppressed junior partner in the storied Indian empire has been set aside by the country’s Supreme…

View On WordPress

#Cyrus Mistry#IL&FS group#Indian Hotels Co#lehman brothers#majority shareholder#Reliance Industries Ltd#shadow banking crisis#Shapoorji Pallonji Group#software services#Supreme Court#Tata#Tata Consultancy Services Ltd.#Tata Sons Ltd.#Tata vs Mistry

0 notes

Photo

Fedez al Coachella va a spasso con la tiktoker Giulia Ottorini e lei smentisce il flirt: «ho già una relazione, con nessuno di famoso» In questi giorni Fedez si è voluto lasciare alle spalle polemiche, la difficile crisi con Chiara Ferragni (che in questi giorni è rimasta ben lontana dai social) e la scomoda intervista a Belve che è rimbalzata su tutti i giornali e i siti ... Continua a leggere.. https://www.eva3000.com/fedez-al-coachella-va-a-spasso-con-la-tiktoker-giulia-ottolini-e-lei-smentisce-il-flirt-ho-gia-una-relazione-con-nessuno-di-famoso/?feed_id=5749&_unique_id=661e65483fe9c&utm_source=Tumblr&utm_medium=%40Redazione30&utm_campaign=FS%20Poster

0 notes

Text

Vineet Nayyar resigns from IL&FS board on medical grounds

Vineet Nayyar resigns from IL&FS board on medical grounds

MUMBAI: The board of IL&FS Group on Monday announced the resignation of Vineet Nayyar as the Executive Vice Chairman. Nayyar, has requested the board to relieve him of his duties as Executive Vice Chairman of IL&FS with effect from October 31, 2020, on grounds of indifferent health, the company said in a statement.

In the interim, C S Rajan, MD, IL&FS, has been asked to discharge Nayyar’s…

View On WordPress

0 notes

Photo

बढ़ते कोरोना संकट के बीच आर्थिक मोर्चे पर राहत की खबर, एनबीएफसी की हालत में हो रहा है सुधार मुंबई2 घंटे पहले कॉपी लिंक तीन अन्य पैमानों पर भी अगस्त में एनबीएफसी का प्रदर्शन जुलाई के मुकाबले स्थिर रहा। इसमें आउटस्टैंडिंग डेट, बॉन्ड स्प्रेड, बाजार में शेयर का प्रदर्शन शामिल है। बॉन्ड स्प्रेड और शेयर परफॉर्मेंस के पैमानों पर भी इसमें मजबूती के संकेत मिले हैं।

#Bloomberg#Corona#crisis#finance companies#FS#government#IL&amp#Indian#Indian economy#report#Shadowbanks

0 notes

Link

0 notes

Text

debt mutual funds: Five recent changes that made your debt mutual fund safer

debt mutual funds: Five recent changes that made your debt mutual fund safer

By Bekxy Kuriakose

The credit crisis which engulfed debt funds over the past two years, starting with ILFS Group default, has been exacerbated by the black swan event of COVID-related lockdown in several parts of the country over past few months. As a debt mutual fund investor how should you pick and choose funds in this new landscape?

A very positive outcome of this crisis has been several…

View On WordPress

#Bekxy Kuriakose#covid#Credit crisis#IL&FS#investment#liquid funds#Mutual Fund News#mutual funds

0 notes

Text

IL&FS case takes new turn: Auditor BSR was not eligible, says govt report; finds multiple failures

[ad_1]

IL&FS reported Rs 201.96 crores as Profit Before Tax (PBT) for the year 2017-18, which was after including the credit.

The IL&FS crisis, which shook the foundation of non-banking financial services in India, has taken a new turn after the National Financial Reporting Authority (NFRA) released its new report today. In the Audit Quality Review Report (AQRR), the NFRA mentioned that the…

View On WordPress

0 notes