#GSTIN

Text

Streamline your business today with GST registration and make your business more efficient and organized!

#GSTRegistration#GSTIN#businessgrowth#GST#gstindia#business#startup#india#gstfiling#accounting#ofinlegal

4 notes

·

View notes

Text

Shaavi Professional: Offering Integrated GST, Accounting, and Return Filing Services in Gurugram.

💬WhatsApp link:- https://wa.me/919811811991

📞Mobile:- 9811811991/ 9355533535

🌐Google Form:- https://forms.gle/LJH93v6NNpp9oWdG9

#GST#GSTServices#gstreturns#GSTRegistration#gstfiling#gstupdates#gstindia#GSTIN#shaavi#gstwithshaavi#gstregistrationonline#accountingservices#Taxationservices#ContactUs#shaavicapitalspvtltd

1 note

·

View note

Text

Easy Guide to GST Registration for Your Business

#gstregistration#gstfiling#gstservices#gstapply#gst#gstconsultation#gstreturn#gstin#gstreturns#registration#gstcouncil#gstexperts#gstindia#tax#taxfiling#taxconsultants#taxes#taxation#inadvises

1 note

·

View note

Text

Important of EPR Certificate In India

According to Section 25 of the Central Goods and Services Tax (CGST) Act, 2017, if the taxpayer is liable to register under the act but fails to do so. Then the GST officer can start a Suo moto registration in GST. As it is an important method for tax officials to enforce the GST registration.

0 notes

Text

#GST registration#Indian businesses#tax regime#compliance#business growth#online resources#tax consultant#input tax credit#interstate trade#market access#GSTIN

0 notes

Text

Mera Bill Mera Adhikar Scheme

#merabillmeraadhikarscheme#CentralGovernment#GoodsandServicesTax#GST#GSTportal#GSTupdates#gstcouncil#GSTIN#invoice#dailycurrentaffairs#currentaffairs#generalknowledge#UPSC#UPSCPrelims2024#UPSCPrelims#UPSC2023#infographic

1 note

·

View note

Text

Gst filing software India - WeP Digital

Streamline your GST filing process with WeP Digital, the leading GST filing software in India. Simplify compliance and save time with our user-friendly solution

#GSTfillingsoftware#gstplatform#gstreconciliations#MISreports#GSTreturnfiling#WePSolutions#gstautomation#gstin#tax#gstfilling

0 notes

Text

0 notes

Text

EXCEL TO TALLY

Top Features of Fast In Flow- Excel to Tally Software

Simple Installation and Instant Start

Setting up and connecting our software to Tally takes minimal time. Without using TDL or XML, exporting to Tally only requires one click.

Missing Ledger Detection

whenever data is exported from Excel to Tally. First, software locates lost ledgers. Missing Ledgers can be generated with a single click.

A sheet map

You may map your purchase, sales, and GST ledgers according to the tax rate and supply location. The name of the purchase/sale ledger does not need to be supplied for each voucher after the mapping is finished.

brand-new technology

Our product was created using the most contemporary technology, which works with any computer hardware and a number of third-party software formats.

Excel To Tally Software #1

Our product is readily available for free download, has little setup time, is easy to use, and includes comprehensive technical support. Additionally, we promise complete accuracy and client pleasure.

Using Party, Auto Fetch GSTIN

Party names from Tally can be automatically imported using this programme based on their GSTIN and vice versa.

Excel's built-in tools and utilities

You can use all of Excel's built-in functions, including copy and paste, drag and drop, search and replace, filter and sort, usage of formulas, and more because our programme was totally developed in Excel.

Online assistance

Our devoted customer support team quickly addresses your inquiries and resolves issues via remote desktop and other online assistance options.

Fastest Import - No Rivalry

Our programme makes it easy to import data from Excel to Tally with just two clicks! After choosing your file, use our software to map it so that it displays all of your data. After confirming your data, click to import it into Tally.

Safe Financial Information

No upload or download to a server is necessary

Get FREE Demo of Excel to Tally software

0 notes

Link

The Goods and Services Network has implemented a new feature called functionality to check PAN usage to address bogus/fake GST registrations. Read more on this blog to know how you can report Fake GSTIN. https://bit.ly/3yz49kJ

0 notes

Text

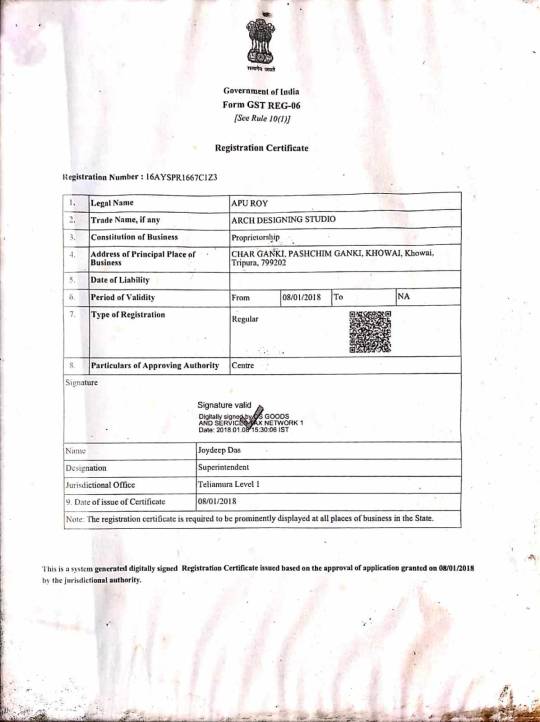

#*@@@my GSTIN:16AYSPR1667C1Z3(IND)..........<<<FOUNDER#CEO&ARCHITECT ON BEHALF OF “ARCH DESIGNING STUDIO” (IND)....*#@@@architecture...

3 notes

·

View notes

Text

All GST registered businesses have to file monthly or quarterly GST returns and an annual GST return based on the type of business. GST Return Filing is mandatory in nature and non – filing will attract penalty and may result of GST Cancellation also. Simplify the GST return filing process for your small business with our comprehensive guide. Stay compliant with India’s GST regulations effortlessly.

Read More >> https://setupfiling.in/gst-return-filing/

#gst registration check#tax system#e file income tax return#tax portal#tax tutorial#free online certificate courses in taxation in india#apply for gstin number#one tax#gst account opening#gst registration requirements#tax ser#file your taxes login#gst website india#invoice without tax#search gst number by name#my gst certificate#online tax app#us gov tax filing#goods and services tax e invoice system#apply for gstin#tax filing india#register with gst#new gst registration online

0 notes

Text

Are you looking for GST services for your business?

We provide our clients' one-stop solution for all GST services under one roof. Our GST Services For Business👇

✓ GST Registration

✓ GST Return Filing

✓ GST Invoicing

✓ GST Annual Return

✓ GST Registration Cancellation

✓ GST Accounting

What are you waiting for give us a Call or WhatsApp: +91-9811811991 / 9355533535

Visit 🌐:-

#gstfilingservices#GSTReturnFiling#gstupdates#GSTServices#GSTCompliance#gstreturns#shaaviprofessional#gstinvoice#GSTIN

1 note

·

View note

Text

#How to apply GSTIN for a Meesho Supplier#apply GSTIN for a Meesho Supplier#gst registration#meesho seller#messho supplier

0 notes

Text

Guide to obtain GSTIN

Guide to obtain GSTIN number here we provide a complete description about how to get a GSTIN number and complete detail about how it will be applied and the document required for GSTIN.

0 notes

Text

Demystifying GST Registration: A Guide for Indian Businesses

The Goods and Services Tax (GST) revolutionized India's indirect tax regime, simplifying the tax landscape for businesses. However, navigating the registration process can still be daunting, especially for newcomers. This article aims to demystify GST registration in India, providing a comprehensive guide for businesses of all sizes.

Who needs to register for GST?

GST registration is mandatory for businesses with an annual turnover exceeding ₹40 lakhs (₹20 lakhs for businesses in the North-Eastern states and Himachal Pradesh). Additionally, businesses involved in interstate supply of goods, those supplying taxable goods or services to a GST-registered entity, and e-commerce sellers are required to register regardless of their turnover.

Benefits of GST Registration:

Formalization: GST registration lends credibility and legitimacy to your business, opening doors to larger markets and better credit facilities.

Input Tax Credit: Claiming input tax credit on purchases reduces your overall tax liability, boosting profitability.

Simplified compliance: GST simplifies tax filing and compliance procedures compared to the pre-GST era.

Wider market access: Registration allows you to participate in interstate trade and supply to GST-registered entities, expanding your customer base.

Documents required for GST Registration:

PAN card of the applicant

Aadhaar card

Proof of business registration (certificate of incorporation, partnership deed, etc.)

Identity and address proof of promoters/directors with photographs

Bank account details

Cancelled cheque/passbook copy

Steps for online GST Registration:

Visit the official GST portal: https://www.gst.gov.in/

Click on "Services" and then "Registration"

Select the type of taxpayer (e.g., proprietor, partnership)

Fill in the required details and upload documents

Verify and submit the application

Pay the registration fee (if applicable)

Upon successful verification, you will receive a GSTIN (Goods and Services Tax Identification Number)

Additional Tips:

Seek professional assistance from a tax consultant if needed, especially for complex cases.

Keep your registration details and documents updated.

File GST returns regularly to avoid penalties.

Utilize online resources and tutorials provided by the government for further guidance.

Conclusion:

GST registration is a crucial step for businesses in India to reap the benefits of the simplified tax regime. By understanding the requirements, following the process, and staying compliant, businesses can navigate the GST landscape smoothly and unlock new opportunities for growth.

#GST registration#Indian businesses#tax regime#compliance#business growth#online resources#tax consultant#input tax credit#interstate trade#market access#GSTIN

0 notes