#Foreign Exchange Marketplace

Text

Explore a seamless online currency exchange platform. Buy, sell, or trade foreign currencies hassle-free. Join the leading foreign exchange marketplace for easy and secure transactions.

0 notes

Text

Buy & Sell Foreign Currency | Online Currency Exchange

Buy and Sell Foreign Currency online with Zenith Forex. Join us for Inward and Outward Remittance, International Money Transfer online, Wire Transfer & TT services in India. We are India’s leading largest Online Currency Exchange marketplace.

#buy & sell foreign currency#get forex card#transfer money abroad online#India's largest foreign exchange marketplace#zero margin forex rates#money transfer service#online currency exchange

0 notes

Text

Global Brands Expanding Their Market in India: A Gateway to Cultural Fusion.

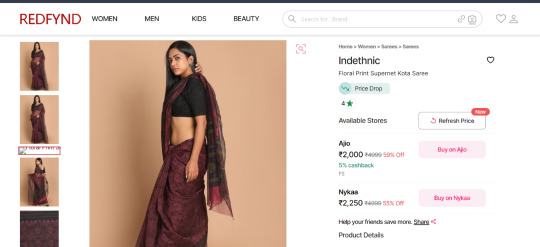

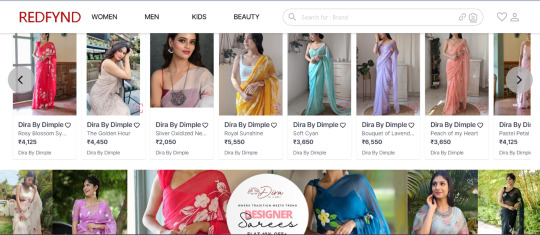

In today's world, the reach of international brands into new markets has become a common catch. One such brand that has caught the attention of many international brands is REDFYND. India is a country rich in heritage and has a diversified customer base, so fashion and beauty are always top priorities. REDFYND is a platform that has more than 100 brands listed on it, including Nykaa, Ajio, Myntra, etc. Starting from sarees, black saree trousers, shirts, jackets, and lehengas to all the beauty and fashion-related products. They are not only working to add more and more brands to the platform but also to make the lives of users easier by bringing a variety of products to one platform and allowing users to save time and money.

Rise of E-commerce in India

With the rise of technology and an increased internet user base, e-commerce websites have noticed a huge rise in India. REDFYND is leading from the front in this digital revolution, giving the option of more than 2 million products to its Indian consumer base with just a click of a single button. REDFYND has become a one-stop solution for shoppers interested in quality products at competitive prices.

Cultural Sensitivity and Localization

Global brands understand the meaning of expanding their brand in India. REDFYND understands its user base and is also working to onboard local premium brands on its platform so that users can get a taste of all the local fashion and beauty related to their cultural background. By providing quality products, cashback reward programs, and engaging marketing campaigns, brands like REDFYND are creating a loyal and repeat customer base. Apart from this, REDFYND also engages with its users through social media platforms like Instagram, Facebook, Quora, Medium, Tumblr, etc., keeping them posted about all the deals and cashback reward programs that are currently live on the website. REDFYND users can also reach out to their brands with any insightful feedback to enhance their offerings.

In a nutshell, the widening of global brands in India and vice versa represents a unique opportunity for cultural diversity and exchange. All the local traditions are getting more and more popular with a wide range of people, and in return, brands can grow their businesses in different parts of the country and globally as well. Due to this, the future relationship between Indian brands and global brands looks promising.

Challenges and opportunities

While Indian brands are growing day by day, it's not an easy piece of cake as there are challenges lined up. Regulatory challenges as well as the adaptability of the new brands among consumers, local brands, and the brands that are present for the long run are some examples of the challenges faced by brands for expansion in India. Understanding market dynamics and investing at the right time with the right resources can help brands grow rapidly.

Moreover, the fusion of Indian brands with foreign brands is the best way to grow and benefit one another by sharing cross-cultural diversity. This exchange not only helps the marketplace but also gives the consumer a wide variety of products and services.

6 notes

·

View notes

Text

Taobao Proxy Service

In the bustling realm of online shopping, Taobao stands tall as a mecca of variety and affordability. But for many foreigners, accessing this treasure trove of products has been a challenge. This is where "Taobao proxy" services come into play, providing a bridge between international shoppers and the wonders of the Chinese online marketplace. In this article, we will delve into the world of Taobao proxy, exploring its benefits and explaining why it's a game-changer for global consumers.

Can Foreigners Use Taobao?

The short answer is yes, foreigners can use Taobao. However, the platform is primarily designed for the Chinese market, and its user interface and customer service are mainly in Mandarin. This language barrier can be intimidating for non-Chinese speakers, making the shopping experience confusing and potentially leading to errors during the purchase process.

How to Buy from Taobao?

Buying from Taobao directly involves creating an account, searching for products, adding them to your cart, and proceeding to checkout. However, as mentioned earlier, the language barrier can complicate each step. Additionally, the payment methods accepted on Taobao, such as Alipay or WeChat Pay, might not be accessible to everyone.

Why Need Taobao Proxy?

This is where the concept of a "Taobao proxy" comes into play. A Taobao proxy is essentially a service that acts as an intermediary between the buyer and the platform. It helps non-Chinese speakers navigate the website, place orders correctly, and manage payments. Additionally, proxy services can provide access to international payment methods like credit cards, which might not be directly supported on Taobao.

Taobao Proxy Service

A Taobao proxy service typically offers a user-friendly platform in English or other languages commonly spoken by foreigners. Through this platform, users can search for products, view detailed descriptions, and communicate with the proxy's customer support in their preferred language. The proxy service assists in placing orders accurately, handling payments, and addressing any issues that may arise during the purchasing process.

Taobao Proxy Shipping

One of the significant challenges when buying from Taobao as a foreigner is international shipping. Many sellers on Taobao do not offer direct international shipping, or their rates can be exorbitant. A Taobao proxy service often provides consolidation and forwarding services. This means that the proxy collects your ordered items from different sellers, repackages them into a single shipment, and then sends them to your international address. This not only saves on shipping costs but also streamlines the delivery process.

Taobao Proxy Shopping

With the assistance of a Taobao proxy, the shopping experience becomes more enjoyable and accessible. Users can explore a vast range of products, from fashion and electronics to home decor and more, without feeling overwhelmed by the language barrier. The proxy service bridges the gap, making it possible for international shoppers to indulge in the diverse offerings of Taobao.

In fact, Taobao is indeed accessible to foreigners, but the language barrier and complexities of the platform can pose challenges. Taobao proxy services serve as a vital link, enabling global shoppers to seamlessly navigate the website, make purchases, and receive their desired products through efficient shipping solutions. With these proxy services, the world of Taobao becomes open and inviting to a broader audience, fostering cross-cultural exchange through online commerce. So, whether you're in search of the latest fashion trends or unique home decor items, a Taobao proxy can be your gateway to an exciting shopping journey on this Chinese online marketplace.

2 notes

·

View notes

Text

It was nearly time for the Jewish Passover celebration, so Jesus went to Jerusalem. In the Temple area he saw merchants selling cattle, sheep, and doves for sacrifices; he also saw dealers at tables exchanging foreign money. Jesus made a whip from some ropes and chased them all out of the Temple. He drove out the sheep and cattle, scattered the money changers’ coins over the floor, and turned over their tables. Then, going over to the people who sold doves, he told them, “Get these things out of here. Stop turning my Father’s house into a marketplace!”

Then his disciples remembered this prophecy from the Scriptures: “Passion for God’s house will consume me.”

John 2:13-17

#faith in god#christianity#faith in jesus#bible verse#bibleverse#bible scripture#word of god#scripture#bible quote#christian#new testament#gospel

3 notes

·

View notes

Text

Forex Broker Regulations: Understanding The Importance Of Regulatory Compliance

The Forex market is an ever-evolving space that requires traders and brokers to stay up-to-date with current regulations. Understanding the importance of regulatory compliance helps protect investors from potential losses caused by fraudulent activities, and ensures a fair trading environment for all participants. This article provides an overview of forex broker regulation, discussing the different types of regulation, their objectives, and why it is important for both brokers and traders to adhere to these rules.

Regulation in the financial sector has become increasingly relevant as technology advances have allowed greater access to global markets. As retail trading continues to expand into new countries around the world, regulatory authorities are becoming more active in protecting investor safety through increased oversight on market participants. Regulations provide numerous benefits such as safeguarding customer funds held at intermediaries, preventing manipulation or insider trading among other things. However, they also impose costs on firms due to compliance requirements which can affect profitability negatively.

Given its critical role in maintaining a secure and efficient marketplace, understanding how forex broker regulations work is essential for any trader who wants to trade successfully while managing risk effectively. In this article we will discuss the various types of regulations governing FX brokers, their objectives and importance in relation to successful trading practices.

What Is A Forex Broker?

A Forex broker is a financial services company that facilitates trading in the foreign exchange (Forex) market. It acts as an intermediary between its clients and the currency markets by providing access to trading platforms, allowing them to buy or sell currencies at current prices. By offering competitive spreads, commissions, and other charges, brokers can attract traders wishing to speculate on price movements of various currencies.

The purpose of forex broker regulations is to ensure fair competition among brokers and protect investors from any unethical practice. These regulations also aim to maintain market integrity and prevent any manipulation of the marketplace. Regulatory agencies such as the Financial Conduct Authority (FCA), Commodity Futures Trading Commission (CFTC), National Futures Association (NFA), Financial Industry Regulatory Authority (FINRA) have specific rules for their respective jurisdictions regarding licensing requirements for Forex Brokers. Most countries require all Forex brokers operating within their jurisdiction to be registered with these regulatory bodies.

Regulatory compliance has become increasingly important in recent years due to increased scrutiny from government authorities aimed at protecting investors from fraudulent activities in the global markets. As such, it is essential for Forex brokers to understand the importance of adhering to these regulations in order to remain compliant and protect both themselves and their customers.

Regulatory Bodies Governing Forex Brokers

Regulation of forex brokers is a vital component in ensuring the security and integrity of global financial markets. Regulatory bodies governing forex brokers strive to ensure that industry participants abide by predetermined standards for safety, reporting, risk management disclosure and protection of customer funds. Non-compliance with these regulations can result in severe penalties including fines or suspensions from trading.

The importance of regulatory compliance cannot be overstated as it helps protect investors' capital while enabling safe market transactions. In order to participate in business activities related to foreign exchange, brokerages must comply with all applicable laws and regulations imposed by the relevant authorities in their jurisdiction. This includes registering with an authorized regulator, obtaining a license and submitting regular reports on activity such as client trades and positions held.

In addition, brokerages must disclose any potential risks associated with certain investments so that clients are aware of the possible outcomes before they commit to trade. As technology revolutionizes the world economy, regulators continue to update existing rules and develop new ones designed to protect customers while promoting fair competition among traders. Therefore, staying informed about changes in regulation is essential for successful forex trading operations as well as avoiding costly penalties resulting from non-compliance.

Why Regulatory Compliance Is Important

Regulatory compliance is a key component of the framework for forex brokers. It refers to meeting specific standards and requirements set out by regulatory bodies that ensure the safety of clients, as well as maintaining proper business practices within the industry. Regulatory compliance also encompasses risk management requirements and client protection mechanisms that are designed to reduce potential losses from trading activities.

One of the primary benefits of regulatory compliance lies in its ability to protect investors from unscrupulous behavior. By adhering to strict standards set out by government agencies, it is possible for forex brokers to provide their clients with reliable services while minimizing the risk associated with investing in foreign currencies. With enhanced security measures such as Know Your Customer (KYC) processes, Anti-Money Laundering (AML) reporting and other verification procedures, customers can be assured that their investments will remain safe under any circumstances.

Any failure to adhere to these regulations could result in severe penalties or sanctions depending on the severity of non-compliance. These may include financial fines, temporary suspension or even permanent closure of an affected broker’s operations. As such, it is critical for forex brokers to stay abreast of any changes that occur within this area so they can ensure full compliance at all times.

In order to safeguard investor interests, maintain high ethical standards and minimize risks related to transactions conducted through online platforms, regulators have put in place stringent rules regarding how forex brokers operate within global markets; understanding their importance is essential for ensuring success in this field.

Client Protection Mechanisms

Client protection mechanisms are a key component of regulatory compliance for forex brokers. The purpose of these measures is to ensure that clients’ funds and trading activities are kept secure at all times, while also providing effective risk management strategies. To achieve this goal, many different types of protective procedures have been adopted by brokers worldwide.

One form of client protection is through the use of segregated accounts. These accounts keep clients’ funds separate from those belonging to the broker and other investors. This prevents any potential conflicts of interest between parties involved in the Forex market, as well as ensuring clients' funds remain protected even if there were financial difficulties faced by the brokerage firm itself. Another mechanism used to protect traders is negative balance protection (NBP). NBP ensures that losses never exceed what has already been deposited into an account, and can be triggered automatically or manually when certain conditions are met.

Finally, most forex brokers must adhere to strict capital adequacy requirements before they can begin offering services to their customers. By doing so, firms demonstrate that they possess sufficient resources should any liabilities arise during operations or due to external events. In addition, such regulations may include provisions that require companies to maintain records on customer transactions and provide customers with regular statements detailing their activity within the markets over time. All these measures help ensure optimal levels of safety and security when engaging in Forex trading activities with a given broker entity, thus helping them meet their obligations under applicable regulatory frameworks.

Risk Management And Disclosure Requirements

The importance of risk management and disclosure requirements for forex brokers is integral to regulatory compliance. Forex traders rely upon their broker to provide detailed information regarding the risks associated with trading, including potential losses or gains. It is essential that this information be communicated clearly in order for clients to make sound investment decisions. To ensure that these expectations are met, it is important for all forex brokers to adhere to standards set forth by governing bodies such as the Commodity Futures Trading Commission (CFTC) and other regional regulators.

Risk management entails more than simply providing accurate trade data; a broker must also protect its clients from any financial harm they may encounter while engaging in online currency trading. This includes protecting them from fraud and unethical practices, which can cause significant losses if not properly managed. Furthermore, forex brokers should regularly review their procedures and policies related to client protection measures so as to ensure ongoing compliance with applicable regulations.

In addition to client protection mechanisms, another key component of regulatory compliance lies in the disclosure of certain financial metrics prior to executing trades on behalf of customers. Brokers must disclose both expected returns and possible losses associated with each position taken by a customer in order for them to understand the full scope of their investments. By adhering strictly to these rules, forex brokers help create an atmosphere that encourages ethical behavior among its traders while simultaneously minimizing exposure from potential legal issues arising from non-compliance with existing regulations.

Penalties For Non-Compliance

Regulatory compliance is an important factor for forex brokers to consider, as non-compliance may result in hefty fines and penalties. Forex broker regulations are set forth by authorities overseeing the financial industry that seek to protect clients from fraudulent activities. These laws also help ensure that brokers abide by ethical standards of conduct while providing a safe trading environment. Brokers who fail to comply with regulatory requirements can face severe penalties including suspension or revocation of their license, large monetary fines, or both.

The severity of the penalties imposed on non-compliant brokers will depend on the nature of their violation and whether they have prior offenses. For instance, if a broker has committed fraud against its customers, regulators may impose harsher sanctions such as permanent license revocation and substantial fines. On the other hand, minor violations such as failure to submit paperwork within deadlines may result in more lenient punishments like temporary suspension of license and smaller fees. Regardless of the infraction, these penalties exist to deter future misconduct from occurring so that clients remain protected when trading with forex brokers.

In addition to potential criminal liability for violating broker regulation laws, there is also civil liability for failing to adhere to client protection rules. Civil lawsuits can be brought forward by aggrieved parties seeking compensation for losses incurred due to negligence or unethical behavior by the broker. Such suits are often costly both financially and reputationally; therefore, it is essential for firms involved in foreign exchange transactions to take preventative measures and prioritize compliance with applicable regulations.

Benefits Of Strict Compliance

Strict compliance with forex broker regulations provides significant benefits to both clients and brokers. Compliance is essential in order to ensure client protection, as it mandates that all necessary risk management disclosures are made available to customers before they enter into any trading contract. Furthermore, by adhering to the regulatory requirements set forth by governing bodies such as the Financial Conduct Authority, brokers can be assured of a certain level of trustworthiness and legitimacy. This ultimately helps protect consumers from fraudulent activity or other unethical practices within the industry.

In addition to providing consumer protection, strict compliance also serves an important role in ensuring fair market conditions for traders. By implementing stringent protocols and procedures, brokers are able to reduce conflicts of interest between themselves and their clients, thus allowing them to operate more efficiently while still protecting customer interests. Moreover, through proper regulation adherence, firms can ensure that their services comply with international standards and promote healthy competition amongst participants within the foreign exchange (forex) market.

Regulatory compliance is therefore integral to maintaining a safe financial environment for both investors and brokers alike. By following established guidelines and enforcing best practices across the sector, companies are better able to protect their clients’ assets while promoting transparency and accountability throughout the entire process. As such, understanding the importance of these rules is essential for anyone looking to participate in forex trading activities on a global scale.

Frequently Asked Questions

How Do I Know If A Forex Broker Is Regulated?

When considering investing in the forex market, it is essential to understand how to check broker regulation. Verifying that a forex broker is regulated by an appropriate authority can be achieved through research into different regulations and authorities governing brokerage services. This process should involve researching both local and international regulatory compliance for any given broker.

It is possible to find up-to-date information on various financial regulators from government websites or from other publications such as trade journals. When conducting research it may also be useful to investigate what kind of trading conditions a particular broker offers, their level of customer service, and the reputation they have within the industry. Additionally, one should review whether the regulator has imposed certain restrictions on brokers regarding leverage amounts or margin requirements. Doing this can help investors make a more informed decision when selecting which broker best suits them.

Once all necessary information has been collected and checked against relevant sources, it becomes easier to determine if a given forex broker is compliant with applicable regulations and therefore suitable for investment purposes. While some brokers might offer attractive features that are not necessarily backed by regulation, these could potentially lead to serious losses if proper precautions are not taken beforehand. Therefore, verifying that a specific forex broker adheres to invest regulator compliance is key before deciding whether or not to commit funds into trading activities with that particular firm.

What Are The Main Risks Of Trading With An Unregulated Forex Broker?

When trading with an unregulated forex broker, investors are exposed to a variety of risks that can have a negative impact on their capital. It is essential for traders to fully understand the different types of risks associated with this kind of investing before entering into any type of agreement. This article will explore the main risks posed by using an unregulated forex broker and how to determine if your chosen broker is compliant with all applicable regulations.

The primary risk posed by using an unregulated broker is the lack of financial protection in case something goes wrong. Unregulated brokers are not subject to rigorous capital requirements like regulated brokers, which means they may be unable to meet client obligations when it comes time to pay out profits or return deposited funds. Additionally, without regulatory oversight, there is also no guarantee that these brokers adhere to industry standards regarding fair treatment and honest dealing practices. This can mean higher fees, hidden costs, and other unethical behavior such as front-running trades or market manipulation.

It is important for traders to take steps to ensure that their chosen forex broker is properly regulated before engaging in any type of transaction. Investors should look for evidence that the brokerage has been approved by a recognized financial regulator such as the U.S Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA). Brokers must comply with specific rules relating to customer disclosure agreements, leverage limits, minimum account balances and more in order to remain compliant with local laws and regulations. Those who fail to do so may face hefty fines or even revocation of their license.

Traders should conduct due diligence prior to selecting a broker and make sure that they are aware of all potential risks – both from an economic standpoint as well as legal repercussions – when choosing an unregulated entity over one that is officially registered and monitored by authorities. By taking appropriate measures beforehand, clients can minimize exposure while maximizing returns from their investments within the highly competitive foreign exchange markets .

What Are The Key Differences Between A Regulated And An Unregulated Forex Broker?

The key differences between a regulated and an unregulated forex broker need to be understood in order to make informed decisions when trading. Regulated brokers are those that adhere to regulatory compliance, while unregulated brokers may not meet the same standard as their counterparts. Forex traders should take into account these distinctions before deciding on which type of broker they wish to trade with.

A regulated forex broker is subject to oversight by government authorities, who will ensure that all financial regulations are being followed by the brokerage firm. This provides a degree of security for investors since the rules governing a regulated broker must be adhered to or else risk penalties from the overseeing body. Additionally, traders can expect higher standards of customer service and transparency when dealing with a regulated broker due to their adherence to stringent requirements concerning operations and practices set forth by regulators.

In contrast, an unregulated forex broker does not have any governmental supervision, meaning that there is no assurance that it follows any sort of guidelines or complies with industry standards. Furthermore, customers do not benefit from consumer protection laws provided by governments if something goes wrong with trades made through an unregulated broker. Due to this lack of regulation, traders run the risk of becoming victims of fraud or other malicious activities such as market manipulation or insider trading conducted by unscrupulous brokers using funds deposited by unsuspecting clients.

It is important for potential investors in foreign exchange markets to understand the risks associated with each type of broker and how they differ in terms of regulation; this knowledge can help them decide which option best meets their needs while also protecting themselves against possible losses incurred through fraudulent activity.

What Is The Difference Between A Regulated And An Authorized Forex Broker?

The current H2 focuses on the difference between a regulated and authorized forex broker. Regulated brokers are subject to specific regulations that must be followed in order to operate within their jurisdiction, while authorized brokers have been approved by a government agency or regulatory body as meeting its standards. In essence, a regulated broker is mandated to comply with rules set forth by an external authority in comparison to an authorised broker which has already achieved compliance within those same laws.

Regulation of forex trading can vary from one country to another due to the different legal frameworks governing the activity. The general objective for any regulating entity is mainly centered around protecting traders from financial malpractices such as fraud or manipulation of prices. Regulatory bodies also strive to ensure fairness and transparency when it comes to pricing across all market participants, allowing traders access to reliable data they need when making decisions on trades.

Authorized Forex Brokers meanwhile have met certain criteria set out by regulators that prove their ability and reliability in providing services related to currency markets; this includes having sufficient capital reserves, training staff adequately and investing heavily in technology infrastructure in order to provide timely execution of orders placed by clients. Furthermore, authorised brokers may also benefit from additional bonuses such as lower transactional costs or preferential terms given by some institutions like banks.

Given these differences, it is important for investors who wish to trade currencies online via a broker platform should assess both options carefully before selecting which type of broker best suits their needs. Moreover, understanding how regulation works helps ensure that investments remain safe and secure at all times whilst providing peace of mind knowing there are processes in place designed specifically for investor protection purposes.

What Is The Minimum Capital Requirement For A Regulated Forex Broker?

The minimum capital requirement for a regulated forex broker is an important aspect of the overall regulatory compliance framework. In order to be recognized as a legitimate and authorized forex brokerage, companies must abide by certain standards set forth in capital requirements regulations. These regulations are designed to protect both investors and brokers from financial losses due to improper trading practices or other fraudulent activities.

Capital requirements vary depending on where the brokerage is located, but generally speaking they involve having adequate funds available to cover any potential losses that may occur while conducting business with customers. For example, if a customer loses money through trades made using the broker’s platform, then the broker must have enough capital reserves to cover these losses without putting their own assets at risk. This ensures that there is sufficient protection for all parties involved in trading activities.

In terms of legal obligations imposed upon brokers, it is essential that they maintain records of all transactions so that authorities can audit them at any given time. By ensuring that forex brokers comply with the applicable rules and regulations regarding their capital requirements, this helps create trust between traders and brokers; it also helps enhance market efficiency by providing transparency into how much each party involved has put into play during a transaction process. Ultimately, this serves as one of many steps taken towards achieving successful regulation compliance within the industry.

Conclusion

It is important for Forex traders to understand the importance of regulatory compliance when choosing a broker. It is crucial to check if a Forex broker is regulated in order to protect oneself from potential risks associated with trading with an unregulated entity. There are significant differences between a regulated and an unregulated Forex broker, such as capital requirements, customer protection measures, and services offered. Furthermore, it is essential to differentiate between a regulated and an authorized Forex broker, since one cannot assume that authorization implies regulation.

In conclusion, due diligence must be conducted when selecting a Forex broker. Traders should research the necessary information regarding regulations applicable in the country or region where their chosen brokers operate. Understanding these regulations will help traders make informed decisions that can potentially save them time and money while engaging in profitable trades. Regulatory compliance ensures fair market conditions and investor protection which ultimately promote financial stability around the world.

5 notes

·

View notes

Text

Forex Trading For Idiots

Forex trading is a popular choice for investors seeking to diversify and grow their portfolios in the current global economy. It can be a bit daunting and overwhelming for those who are new to the world of foreign currency trading. This guide for beginners will help you understand Forex trading.

This complete guide will provide Forex trading basics, discuss aspects that impact the price of currency and provide strategies to ensure your trades are profitable. This guide will provide you with the information and tools to understand the fascinating realm of Forex trading, regardless of whether you are an experienced investor or a novice.

Foreign Exchange Market's daily trading volume is more than USD 6 trillion.

Forex trading (also called foreign currency trading) is the act or selling or buying currency to make money. Out of all financial markets that exist, the Forex market is the biggest in the world, with an average daily turnover of $5 trillion. Contrary to bonds and stocks currency exchanges can occur by pairs. One currency is bought while the other is sold. If you think that the Euro will rise against US dollars and you want to buy Euros, and then sell US Dollars.

Investors who wish to diversify their portfolios or make a profit from currency fluctuations need to understand currency trading. Today's global economy is susceptible to fluctuations in currency due to a range of political and economic factors such as inflation rates, interest rates and geopolitical issues.

Forex trading can be a means investors can earn money from fluctuations. They can buy at a low price and then sell them at a higher price. However, it requires knowledge and expertise to be successful in this marketplace. Investors may lose money rather than earn a profit if they do not understand how Forex trading works and the elements influence the prices of currency.

Forex trading is a thrilling investment opportunity. Before investing in the currency trading industry with actual money, it is important that investors are well-versed.

A study carried out by the Bank for International Settlements found that the most popular currency pairs traded in Forex markets included USD/USD, USD/JPY and GBP/USD. Forex trading is the trading of futures on the market.

Chapter 1 - Understanding the basic principles of Forex trading

Currency Pairs:

Forex trading is a market based on pairs where currency pairs can be traded. One currency is bought while the other one is sold. The currency that is the base usually the first currency in a pair. The second currency is known as the quote. In the EUR/USD scenario in the example, the Euro is the base currency, and the US dollars the quote currencies.

Pips:

Pip (percentage to point) determines the variation between currencies in terms of exchange rates. It represents the smallest possible price shift exchange currencies can create. A pip is a unit of measurement which represents the smallest change in price an exchange rate could create for major currency pairs.

Bid/Ask Spread:

The bid/ask spread explains the difference between the top price a buyer would pay for an item (the bid price) and the cheapest price a seller will accept (the asking cost). This spread covers transaction costs for traders and brokers.

Broker:

A broker acts as an intermediary between sellers and buyers in Forex trading. They execute trades on behalf clients. They charge commissions or may charge charges for trades that they conduct through their platform.

Leverage:

Leverage is a way for traders to control large amounts of money with relatively low investments. This can be done by borrowing funds from their broker. A trader who has an account with $1,000 can utilize leverage of 50:1 to manage up to $50,000 in currency their trades. While leverage may help boost profit, it could also increase risk as losses could exceed the initial investment amount because of the increased risk. A high degree of leverage can lead to the loss of the Forex trade, which could wipe out your entire account.

What are the steps to make currency pairs work?

Forex trading relies on currencies being exchanged in pairs. A currency pair simply refers to the exchange of two currencies against one another, and the value of the two currencies is listed together.

The first currency of the pair is known as the base currency, while the second is called the quote currency. One US Dollar for 110.50 Japanese Yoen, for instance, by looking at an exchange rate of USD/JPY at 110.50.

Currency pairs are commonly abbreviated with three letters. The first two letters signify the country code and the third letter is the name of the currency. USD is the abbreviation for United States Dollar. JPY stands to Japanese Yen.

There are three kinds: major, minor, and exotic currency pair. Major pairs are comprised of major currencies from developed countries like the US dollar (USD), Euro, EUR), British pound(GBP), Japanese currency (JPY), Swiss and Canadian dollars (CAD). These currencies account for around 80% of Forex trades.

Minor pairs are less-traded currencies such as South African rands, Australian dollars (AUD), New Zealanddollar (NZD) or the Australian dollar. Exotic pairs are currencies that originate from emerging and developing countries , like the Brazilian real (BRL), Mexican Pesososososososososososososososos (MXN) or Turkish lirasososososososososososososososus (TRY).

The goal of a trader when trading currency pairs is to earn profits from any changes to exchange rates. If they believe that the value of the base currency of a particular pair will rise in relation to its quoted currency the pair will be purchased by that specific pair. They could also decide to sell the pair if they believed that a base currency would decrease relative to its quoted counterpart.

Forex trading success is dependent on knowing how currency pairs function. It forms the basis of studying market trends, making informed trading decisions, and permitting you to make informed choices.

Chapter 2 - Factors that Influence Forex Prices

Forex prices are affected by a myriad of factors, such as the mood of the market, economic indicators as well as political and economic events. It is vital to know these variables for Forex trading because they can have a major impact on price of currency.

Economic Indiantors:

The value of the currency can be affected by economic indicators, like GDP (gross domestic product), inflation rates , and employment statistics. For instance, if the growth rate of a country's GDP is higher than anticipated and its currency appreciates, it could due to increased investor confidence in its economy. If inflation rates rise, it may cause the central bank to raise rates of interest to manage the rate of inflation, leading to an increase in value of its currency.

Politic Events:

Events like elections and government policies can affect the value of currency. Imagine a nation experiencing instability or uncertainty due to upcoming elections or changes in the policies of its government. Investors might be less likely to invest in the country's currency when this happens and can result in a drop in value. Positive developments in the political arena, such as trade deals or stimulus programs, can improve investor confidence and increase the value of currency.

Market Sentiment:

Market sentiment is the overall attitude or mood of investors towards a market or asset. Forex trading is an example of market sentiment. It can be affected by news stories and rumors as and speculation regarding the future.

The general optimism regarding the possibility of an economic recovery across the globe following the COVID-19 pandemic could result in an increase in market for more risky instruments like emerging market currencies, to the detriment of safe-haven currencies, like the US Dollar.

In order for traders to be successful in trading, it is important to know how these elements impact Forex price. This allows them to make informed trade decisions in light of the current conditions in the market.

Chapter 3: Strategies that make Forex trading successful

Forex trading is a complex business that requires various strategies for each trader the risk tolerance and their preferences. The three most sought-after strategies for Forex traders are technical analysis, basic analysis and risk management.

Technical Analys:

The term "technical analysis" refers to the study of previous market data, particularly volume and price, in order to discover patterns and patterns that could be used to predict future price movements. The traders who employ technical analysis depend on charts as well as other tools to determine the levels of resistance and support, trend lines, and other key indicators that can assist them in making informed trading decisions.

Fundamental Analysis:

Fundamental analysis involves analyzing economic indicators, such as a GDP growth rate and inflation rates, central bank policies, political developments and other vital factors that influence currency values.

Fundamental analysis allows traders to gain a better understanding of the forces that impact the currency's value. They can then make informed trade decisions by focusing more on long-term patterns than the short-term fluctuations in market prices.

Risk Management:

Forex trading success depends on the management of risk. It helps protect the capital of traders and aids to limit losses. To reduce your losses on trading that is against you the rules, you can create stops-loss orders, spread your portfolio through different currencies and asset types, and use leverage responsibly. This means that you should only take on positions with an acceptable risk.

Forex traders need to be skilled in fundamental analysis, technical analysis strategies for risk management, and various other aspects of Forex trading. This knowledge and staying up to current on the latest developments in the market will give you a significant advantage in this complicated arena. The path to success is achievable with dedication and hard work to learn the intricate nuances of Forex trading.

Finance Magnates discovered that 84% Forex traders are losing capital due to their trades, but only 16% are profitable.

Chapter 4 - How to choose a Forex Broker

The choice of the correct Forex broker can have a significant impact on the experience of traders and their performance. There are a few things to take into consideration when choosing an agent:

Basic criteria

Regulation:

Selecting a regulated broker which adheres to strict regulations and guidelines set by government agencies (e.g., the National Futures Association of (NFA) and Commodity Futures Traders Commissions (CFTC). These organizations ensure that brokers are honest and with integrity.

Fees:

Brokers have different fees. They have spreads and commissions. Thus, traders need to compare fees across multiple brokers to find one that has a price that is competitive.

Leverage:

This is the most commonly offered type offered by Forex brokers. It permits traders to manage accounts with more than balance, with typical ratios of 50:1 up to 400:1.

Customer Support:

Forex brokers that are reliable and responsive should offer customer assistance 24 hours a day. This is crucial because traders may need assistance anytime during the trading day.

Mobile Trading

As we approach 2023, mobile trading on forex becomes more crucial for traders. Trading accounts for traders are accessible anywhere, because of the rapid growth of mobile technology and increasing use of smartphones and tablets. This lets traders monitor and make trades, as well as monitor their portfolios, without having to rely on desktop computers.

Mobile trading applications are increasing in popularity in the Forex sector. Statista conducted a study and found that 47% of Forex traders utilized trading apps on mobile devices for trading purposes in 2020.

Brokers can offer a variety of accounts, such as:

Demo Accounts:

These accounts allow traders to trade with virtual money prior to risking real funds.

Standard Accounts

These accounts are ideal for traders who have very little capital.

No Swap/Interest/Islamic Accounts:

A Islamic Forex account (also known as a no swap or interest Forex account) is a trading account that follows the Islamic Finance principles. Islamic Finance forbids interest on investment and loans. The same principle applies to Forex trading.

Forex trading accounts without interest or swap need traders to pay fee for swaps that are not overnight. The accounts do not charge any fees to trade Forex. Instead they charge a fixed commission. It covers the administrative expenses.

Avoid scams and fraudulent brokers by following these guidelines:

Choosing a regulated broker that is licensed by reputable regulatory bodies.

You can read reviews online by traders to judge the credibility of the broker.

Avoid brokers who offer unrealistic returns or employ aggressive selling techniques.

Some examples of U.S.-based Forex News are OANDA as well as TD Ameritrade. Interactive Brokers. Charles Schwab.

If you are looking for the top Forex broker, you need be aware of key elements like regulatory oversight, transaction fees and account types. Before making any commitments, thoroughly research potential brokers to avoid common pitfalls and to find a trustworthy broker to partner with in your trading ventures.

This will allow you to make an informed decision in deciding on the most suitable Forex brokerage firm.

Automated Forex trading systems have experienced significant growth in recent times. Transparency Market Research projects that the market worldwide for trading algorithms will exceed $27 Billion in 2026 as per their report.

These are interesting facts

Automated trading platforms, commonly known as "bots," are becoming more popular because they allow traders to trade without human intervention based on pre-defined requirements.

Through the implementation of monetary policies that affects the price of currency central banks play a crucial role in the Forex market.

The Forex market is available 24 hours a day, seven days a week and allows traders to take part in trading at any time.

Forex market trades over the counter (OTC) using a decentralized platform. There is no central clearinghouse exchange, clearinghouse, or exchange.

USD/USD/JPY, USD/JPY/USD and GBP/ are among the most well-known currency pairs used in Forex. USD makes up more than half of transactions. USD also accounts for around 80% of all trading volume.

Before selecting a broker for trading, traders should consider their investment goals and risk tolerance. Traders must also be kept updated on fluctuations in the market and conditions so that they can make informed trade decision.

Demo accounts are highly recommended to anyone who is unfamiliar with Forex trading. Brokers usually provide demo accounts that allow traders to trade using virtual money in an actual market. This is a great way to help traders gain confidence and gain experience prior to opening a real account.

Forex trading can be a lucrative opportunity for traders who are willing and able to invest the necessary time to understand the markets and create trading strategies. Understanding leverage is only one element of the success of Forex trading, but it's an important one that could significantly affect your trading performance. Start learning about Forex trading using a demo account today! It's a risk-free way to begin your journey towards becoming a successful Forex trader!

4 notes

·

View notes

Text

Virtual Currency Games

Every little boy's (and plenty of grown guys's) dream of making a dwelling by way of gambling video video games is edging closer to truth. The recent launch of HunterCoin and the in-improvement VoidSpace, video games which reward players in virtual currency in preference to virtual princesses or gold stars point closer to a destiny in which one's ranking on a scoreboard might be rewarded in dollars, and sterling, euros and yen.

The tale of the millionaire (virtual) real property agent…

Digital currencies have been slowly gaining in maturity both in terms of their capability and the financial infrastructure that enables them for use as a credible alternative to non-virtual fiat currency. Though Bitcoin, the 1st and most widely recognized of the crypto-currencies was created in 2009 there were sorts of digital currencies utilized in video video Top NFT Games for extra than 15 years. 1997's Ultima Online was the first exceptional try to comprise a big scale virtual financial system in a recreation. Players may want to collect gold cash by way of venture quests, fighting monsters and locating treasure and spend those on armour, guns or real property. This became an early incarnation of a virtual forex in that it existed only within the game though it did replicate real global economics to the volume that the Ultima foreign money experienced inflation because of the game mechanics which ensured that there was a in no way finishing deliver of monsters to kill and therefore gold coins to acquire.

Released in 1999, EverQuest took virtual currency gaming a step in addition, allowing players to alternate virtual goods among themselves in-recreation and although it become prohibited with the aid of the game's clothier to also promote virtual objects to each other on eBay. In a actual global phenomenon which became entertainingly explored in Neal Stephenson's 2011 novel Reamde, Chinese game enthusiasts or 'gold farmers' have been employed to play EverQuest and different such video games complete-time with the intention of gaining revel in points with the intention to degree-up their characters thereby making them more effective and favourite. These characters would then be bought on eBay to Western game enthusiasts who have been unwilling or unable to put in the hours to degree-up their own characters. Based at the calculated alternate rate of EverQuest's foreign money due to the real international buying and selling that happened Edward Castronova, Professor of Telecommunications at Indiana University and an professional in virtual currencies anticipated that in 2002 EverQuest become the 77th richest usa inside the international, somewhere among Russia and Bulgaria and its GDP per capita was more than the People's Republic of China and India.

Launched in 2003 and having reached 1 million everyday users by using 2014, Second Life is perhaps the most whole example of a digital economy thus far wherein it is virtual forex, the Linden Dollar which can be used to shop for or promote in-recreation goods and services can be exchanged for real international currencies through market-based totally exchanges. There were a recorded $3.2 billion in-sport transactions of digital goods inside the 10 years among 2002-13, Second Life having end up a marketplace where gamers and organizations alike have been able to design, promote and promote content material that they created. Real estate became a specifically beneficial commodity to exchange, in 2006 Ailin Graef have become the 1st Second Life millionaire whilst she grew to become an initial funding of $9.95 into over $1 million over 2.5 years via buying, promoting and trading digital actual estate to different players. Examples inclusive of Ailin are the exception to the rule of thumb but, simplest a recorded 233 customers making greater than $5000 in 2009 from Second Life activities.

1 note

·

View note

Text

choose Zenith Forex for International payments👇

👉 Competitive Exchange Rates

👉 Transparent Fee Structure

👉 Personalised Service

👉 100+ Currencies Supported

👉 Secure & Regulated

👉 Flexible Transfer Options

#Forex Card Discount Offer#Online Currency Exchange#Foreign Exchange Marketplace#Forex Travel Card Discount Offer

0 notes

Text

Are you trying to exchange your currency? Zenith Forex Online is one of India's Largest Foreign Exchange Marketplaces that allows easy currency exchange, forex cards, International Remittances, and travel insurance, etc. If you are planning for your trip then buy a forex Card from Zenithforexonline.com.

#buy & sell foreign currency#get forex card#transfer money abroad online#India's largest foreign exchange marketplace#zero margin forex rates#money transfer service#online currency exchange#best foreign exchange

1 note

·

View note

Text

In forex, what are funds?

The biggest global marketplace in the foreign exchange industry. where foreign currency are bought and sold. In the US, a currency fund is often a private investment partnership established so that it is immune from the registration requirements that federal and state law place on publicly traded funds.

#xtreamforex#forex#forextrading#forexbroker#forexmarket#forexsignals#forexeducation#forextraders#copytrading#pammtrading#ecnforexbrokers

2 notes

·

View notes

Text

WHAT IS THE DIFFERENCE BETWEEN FOREX TRADING AND INVESTMENT?

The foreign exchange market or forex is a globally largest marketplace which trade the world’s currencies. It is the most liquid market place in the world. It stands as exchanges of national currencies. This is because it reaches trade, commerce and finance. Currencies trade against each other as exchange rate pairs.

#Xtreamforex#ECN#Earn#iB#forex#tarding#crypto#stocks#shares#broker#trader#money#investment#bitcoin#binaroptions#gold#success#forextrading#commodity#business#opportunity#Pammtrading#copytrading#platform

2 notes

·

View notes

Text

DEFINE THE OPERATING SYSTEM OF FOREX

Forex refers to the global electronic marketplace for trading international currenices. Forex.com is the best forex system to bid and ask currencies. Forex exchange company offers many interventions operation like sales of interest of traders income of forex broker etc, this is all derived from the foreign transacations.

#Xtreamforex#ECN#Earn#iB#forex#tarding#crypto#stocks#shares#broker#trader#money#investment#bitcoin#binaroptions#gold#success#forextrading#commodity#business#opportunity#Pammtrading#copytrading#platform

2 notes

·

View notes

Text

The Business Case for Algo Trading Bots: Efficiency, Accuracy, and Profits

In the dynamic and competitive world of monetary trading, technological improvements are constantly changing how business is performed. Among these improvements, algorithmic trading bots have emerged as a game-changer. These bots leverage advanced algorithms to execute trades with extremely good efficiency and accuracy and, in the end, forceful good-sized earnings for groups.

What Are Algo Trading Bots?

Algo trading bots, short for algorithmic trading bots, are automatic structures that use pre-described rules and complicated mathematical fashions to execute trades in monetary markets. These bots can analyze extensive amounts of records, perceive trading possibilities, and execute orders quicker and greater properly than any human dealer. They are utilized in numerous markets, including shares, foreign exchange, and cryptocurrencies.

Efficiency: The Speed and Scalability of Algo Trading Bots

One of the maximum extensive benefits of algo trading bots is their performance. Human investors are limited by way of their physical and cognitive talents; they can only analyze a lot of information and execute a positive number of trades within a given timeframe. In comparison, algo trading bots can:

Execute Trades in Milliseconds: Speed is essential in trading. Algo trading bots can process and react to market records in milliseconds, executing trades at the most opportune moments. This speed can be the distinction between a profitable alternate and an overlooked opportunity.

Analyze Large Data Sets: Algo trading bots can examine large amounts of statistics from more than one source simultaneously. This capability permits them to perceive trends and styles that won't be apparent to human traders.

Operate 24/7: Unlike human traders who need rest, algo trading bots can function around the clock. This non-stop operation is especially valuable in markets like cryptocurrencies, which in no way near.

Accuracy: Minimizing Human Error and Emotional Bias

Accuracy in trading is paramount, and algo trading bots excel in this area by minimizing human error and emotional bias:

Precision: Algo trading bots comply with predefined rules and algorithms to execute trades. This precision ensures that trades are performed exactly as planned, without deviation because of human errors.

Consistent Decision-Making: Human traders can be motivated by emotions, mainly by inconsistent choice-making. Fear and greed can bring about poor trading decisions. Algo trading bots, but, operate based totally on good judgment and data, ensuring regular and goal selection-making.

Backtesting Capabilities: Before deploying a trading strategy, algo trading bots can backtest with the usage of ancient statistics. This method enables refining the approach, making sure of its effectiveness in diverse marketplace conditions.

Risk Management: Algo trading bots can control advanced threat control strategies, automatically adjusting positions to mitigate losses and shield earnings. This computerized threat management is more efficient and reliable than guide procedures.

Profits: Unlocking Greater Financial Gains

The closing purpose of any trading activity is to maximize earnings, and algo trading bots offer numerous ways to obtain this:

Exploiting Market Inefficiencies: Algo trading bots can pick out and take advantage of market inefficiencies that may be too delicate for human investors to trip on. These inefficiencies can offer opportunities for profitable trades.

High-Frequency Trading: Some algo trading bots are designed for high-frequency trading (HFT), executing lots of trades in line with the second. This approach can generate significant profits with the advance of capturing small rate discrepancies throughout one-of-a-kind markets.

Diversification: Algo trading bots can manage a couple of techniques throughout diverse markets simultaneously. This diversification reduces risks and will increase the ability for earnings by no longer trust on an single market or strategy.

Cost Efficiency: By automating trading procedures, companies can lessen the prices related to guide trading, consisting of salaries for investors and operational costs. This price performance contributes to higher usual profitability.

Conclusion

In the quick-paced world of monetary trading, algo trading bots have turn out to be classic tools for groups searching for to decorate performance, accuracy, and profitability. These bots provide extraordinary speed, precision, and scalability, allowing organizations to execute trades greater successfully and capitalize on market opportunities. By minimizing human blunders and emotional bias, algo trading bots make sure regular and objective choice-making, leading to higher trading effects. Moreover, their capacity to perform across the clock and manipulate a couple of techniques together unlocks extra monetary profits and cost efficiency.

When it involves choosing the proper algo trading bot company, Fire Bee Techno Services could be a nice choice. Their superior technology, customizable answers, robust guide, and revealed track record cause them to be the precise associate for groups looking to leverage the energy of algorithmic trading.

0 notes

Text

Unlocking Global Opportunities: The Power of Forex Merchant Accounts for High-Risk Businesses

In the fast-paced world of e-commerce, high-risk businesses face unique challenges when it comes to payment processing. From regulatory hurdles to volatile market conditions, navigating the complexities of online transactions requires specialized solutions tailored to the needs of high-risk merchants. Amidst these challenges, forex merchant accounts emerge as a strategic tool for unlocking global opportunities and maximizing revenue potential.

Understanding High-Risk Dynamics

High-risk businesses, spanning industries such as adult entertainment, online gaming, and nutraceuticals, face a myriad of obstacles when it comes to securing reliable payment processing services. According to industry reports, high-risk merchants experience chargeback rates that are significantly higher than those of low-risk businesses, averaging around 1-3% of total transactions.

Moreover, the dynamic nature of high-risk industries, coupled with regulatory uncertainties and market volatility, exacerbates the challenges faced by merchants seeking to process payments efficiently and securely. In this context, finding the best high-risk merchant account becomes paramount for businesses looking to thrive in the digital marketplace.

The Role of Forex Merchant Accounts

Forex (foreign exchange) merchant accounts offer a compelling solution for high-risk businesses seeking to optimize their payment processing capabilities and expand their global footprint. With forex merchant accounts, merchants gain access to a wide range of benefits tailored to the unique needs of high-risk industries.

One of the key advantages of forex merchant accounts is their ability to facilitate multi-currency payment processing, enabling merchants to accept payments in multiple currencies and mitigate the risks associated with currency fluctuations. According to industry data, cross-border e-commerce is expected to reach $6.5 trillion by 2023, highlighting the growing importance of multi-currency payment solutions for businesses operating in global markets.

Moreover, forex merchant account offer enhanced security features and fraud prevention measures designed to safeguard transactions and protect merchants from fraudulent activities. With advanced encryption protocols and real-time transaction monitoring systems, forex accounts provide peace of mind to high-risk merchants while ensuring compliance with regulatory requirements.

Maximizing Revenue Potential

For high-risk businesses, maximizing revenue potential requires proactive risk management strategies and access to reliable payment processing services. Forex merchant accounts empower merchants to optimize their revenue streams by offering competitive transaction fees, flexible payment options, and seamless integration with international payment networks.

According to industry reports, the forex market is projected to reach a value of $10.7 trillion by 2026, driven by increasing demand for currency trading and cross-border transactions. By leveraging forex merchant accounts, high-risk businesses can tap into this lucrative market opportunity and capitalize on the growing trend towards global commerce.

Choosing the Best High-Risk Merchant Account

When it comes to selecting the best high-risk merchant account, merchants must prioritize reliability, security, and scalability. With the right partner, high-risk businesses can overcome regulatory obstacles, mitigate financial risks, and unlock new avenues for growth in the global marketplace.

At Paycly, we specialize in providing tailored payment solutions for high-risk merchants, including forex merchant accounts designed to meet the unique needs of businesses operating in dynamic and challenging environments. With our industry expertise, advanced technology platforms, and commitment to customer satisfaction, we empower high-risk merchants to thrive in an ever-changing business landscape.

Conclusion

In conclusion, forex merchant accounts offer high-risk businesses a strategic advantage in today's competitive e-commerce landscape. By providing access to multi-currency payment processing, enhanced security features, and global market opportunities, forex accounts enable merchants to optimize their revenue potential and achieve long-term success.

At Paycly, we are dedicated to supporting the growth and resilience of high-risk businesses through innovative payment solutions and unparalleled customer service. With our expertise and commitment to excellence, we empower merchants to navigate the complexities of online transactions and unlock the full potential of their businesses in the global marketplace.

Visit us at: High risk merchant account instant approval

#High risk merchant account instant approval#forex merchant account#Best high risk merchant account#High risk merchant account

0 notes

Text

Bookkkeping for E-commerce

Bookkeeping for E-commerce: Navigating the Digital Ledger

In the bustling world of e-commerce, bookkeeping stands as the backbone of financial management, ensuring that every transaction is accounted for and that business owners have a clear picture of their financial health. As the e-commerce industry continues to expand, the importance of adept bookkeeping practices becomes increasingly paramount.

The Digital Ledger: A New Era of Accounting

E-commerce bookkeeping diverges from traditional accounting due to the unique nature of online transactions. It involves meticulous tracking of sales, purchases, payments, and other financial activities that occur in the digital marketplace. With the rise of e-commerce platforms, bookkeepers must adapt to the nuances of virtual stores and the complexities they introduce.

Key Components of E-commerce Bookkeeping

• Sales Tax Compliance: Navigating the labyrinth of sales tax regulations is critical. E-commerce businesses must accurately collect, report, and remit sales taxes across different jurisdictions.

• Inventory Management: Efficient tracking of inventory levels ensures that e-commerce businesses can meet demand without overstocking, which ties up capital and storage space.

• Merchant Fees: Understanding and recording the fees charged by e-commerce platforms and payment processors is essential for accurate profit calculation.

• Revenue Tracking: E-commerce bookkeepers must diligently record all revenue streams, including product sales, shipping fees, and any additional services offered.

Challenges and Solutions in E-commerce Bookkeeping

The dynamic nature of e-commerce brings forth unique challenges:

• Handling Returns and Refunds: E-commerce has a higher rate of returns compared to brick-and-mortar stores. Bookkeepers must have a system in place to track these transactions and adjust financial records accordingly.

• Multi-channel Sales: Many e-commerce businesses sell across various platforms, necessitating a consolidated bookkeeping system that provides a unified financial view.

• International Transactions: Dealing with foreign currencies and exchange rates adds another layer of complexity to e-commerce bookkeeping.

To address these challenges, e-commerce businesses are turning to specialized bookkeeping software that integrates with their sales platforms. This software automates many of the tedious tasks associated with e-commerce bookkeeping, allowing business owners to focus on growth and customer satisfaction.

Best Practices for E-commerce Bookkeeping

• Integrate Accounting Software: Utilize software that seamlessly connects with your e-commerce platform to streamline bookkeeping processeshttps://www.shopify.com/blog/bookkeeping-101.

• Regular Reconciliation: Frequently reconcile your accounts to catch discrepancies early and maintain accurate financial records..

• Stay Informed: Keep abreast of changes in tax laws and e-commerce regulations to ensure compliance and avoid penalties.

Conclusion

Bookkeeping in the e-commerce realm is a vital, albeit complex, aspect of running an online business. By embracing modern bookkeeping practices and leveraging technology, e-commerce entrepreneurs can ensure their finances are in order, paving the way for sustained success in the digital marketplace.

0 notes