#Financial Brokerage Market Trends

Text

Navigating Success in the Financial Brokerage Industry: Expert Insights and Strategies

Stay ahead of the curve in the Financial Brokerage Market Trends. Discover the latest trends and innovations driving success in this competitive landscape.

#Financial Brokerage Market Size#Financial Brokerage Industry#Financial Brokerage Sector#Financial Brokerage Industry Competitors#Opportunities in Financial Brokerage Industry#Major Financial brokerage firm#Financial Brokerage Market Trends#Financial Brokerage Market Forecast#growth of Financial Brokerage industry

0 notes

Text

2023 Financial Market Outlook: Insights into Brokerage Dynamics

This comprehensive report unfolds the secrets to unlocking profitable paths in financial brokerage market, offering strategic insights that illuminate the present and forecast the future.

#Financial Brokerage Trends#financial Market Outlook 2023#Investment Strategies#Digital Evolution in Finance

0 notes

Text

FoxTrade - Unveiling the Best Brokers Online in 2024: A Comprehensive Review

In the ever-evolving landscape of online trading, finding a reliable broker is paramount for both seasoned investors and newcomers alike. With countless options available, it's crucial to sift through the noise and identify platforms that offer the right blend of features, reliability, and user experience. Among the plethora of choices, FoxTrade stands out as a beacon of excellence in the realm of online brokerage services in 2024.

Introducing FoxTrade:

At the forefront of online trading platforms, FoxTrade has garnered a reputation for providing unparalleled services to traders worldwide. Boasting an intuitive interface, robust security measures, and a diverse range of assets, FoxTrade offers a comprehensive solution for traders of all levels. Whether you're a novice exploring the world of trading or a seasoned investor seeking advanced tools, FoxTrade caters to your needs with precision and efficacy.

The Rise of Foxtrade.org:

Foxtrade.org has emerged as the go-to destination for traders seeking reliable information and resources in the online trading sphere. With insightful articles, expert analyses, and up-to-date market trends, Foxtrade.org serves as a knowledge hub, empowering traders to make informed decisions. From beginner's guides to advanced trading strategies, the platform equips users with the tools and knowledge needed to thrive in the dynamic world of online trading.

FBS Broker Assessment:

In the realm of online brokerage, FBS has established itself as a prominent player, offering a range of services tailored to the needs of diverse traders. With a focus on innovation and customer satisfaction, FBS has garnered praise for its user-friendly interface, competitive spreads, and extensive educational resources. Through meticulous assessment, FoxTrade recognizes FBS as a reputable broker, worthy of consideration for traders seeking a reliable platform to execute their trades.

JustMarkets Broker Analysis:

JustMarkets emerges as another noteworthy contender in the competitive landscape of online brokerage. With a commitment to transparency, integrity, and innovation, JustMarkets offers a suite of features designed to enhance the trading experience. From advanced charting tools to personalized account management, JustMarkets caters to the diverse needs of traders, positioning itself as a trusted ally in the pursuit of financial success. Through thorough analysis, FoxTrade acknowledges the strengths of JustMarkets, making it a viable option for traders seeking a reliable brokerage partner.

Conclusion:

In the dynamic world of online trading, finding the right brokerage partner is paramount for success. With FoxTrade leading the way as a beacon of excellence, traders can navigate the complexities of the market with confidence and precision. Whether you're drawn to the innovative offerings of FBS or the transparent approach of JustMarkets, FoxTrade's comprehensive review ensures that you can make informed decisions aligned with your trading goals. As you embark on your trading journey in 2024, let FoxTrade be your guiding light towards financial prosperity.

2 notes

·

View notes

Text

What are commercial real estate services?

Commercial real estate services refer to a range of professional services and activities related to the buying, selling, leasing, managing, and investing in commercial properties. Commercial properties include office buildings, retail spaces, industrial facilities, hotels, warehouses, and other income-producing real estate assets. These services are typically offered by real estate professionals, companies, and organizations specializing in the commercial real estate sector. Here are some of the key components of commercial real estate services:

Brokerage Services: Commercial real estate brokers help clients buy, sell, or lease commercial properties. They facilitate transactions, negotiate terms and conditions, and provide market insights to help clients make informed decisions.

Property Management: Property management companies oversee the day-to-day operations of commercial properties on behalf of owners. This includes tasks such as rent collection, maintenance, tenant relations, and financial reporting.

Leasing and Tenant Representation: Commercial real estate agents and brokers specializing in leasing help property owners find suitable tenants for their spaces. Tenant representation services assist businesses in finding suitable properties to lease.

Investment Services: Investment firms and professionals provide guidance on real estate investment strategies. They may help investors acquire, manage, or divest commercial properties to optimize returns.

Appraisal and Valuation: Appraisers determine the market value of commercial properties, which is crucial for financing, taxation, and decision-making purposes. Valuation services help property owners understand the worth of their assets.

Development and Construction: Developers and construction companies focus on creating new commercial properties or renovating existing ones. They handle the design, permitting, and construction phases of commercial real estate projects.

Financing and Mortgage Services: Lenders and financial institutions offer loans and mortgage products tailored to commercial real estate projects. These services help property buyers secure the necessary capital for their investments.

Market Research and Analysis: Real estate research firms provide market data, trends, and analysis to assist clients in making informed decisions. This includes information on vacancy rates, rental rates, and demand trends.

Consulting and Advisory Services: Real estate consultants offer strategic advice and planning services to property owners, investors, and developers. They may help clients optimize property portfolios, assess market risks, or formulate investment strategies.

Legal and Regulatory Services: Real estate attorneys specialize in handling legal aspects of commercial real estate transactions. They ensure that contracts, leases, and other legal documents comply with local laws and regulations.

Environmental Assessment: Environmental consultants assess commercial properties for environmental risks and compliance with environmental regulations. This is particularly important for properties with potential contamination issues.

Property Tax Services: Property tax consultants assist property owners in managing and minimizing property tax obligations by evaluating assessments and pursuing tax appeals when necessary.

Overall, commercial real estate services encompass a wide range of activities aimed at facilitating the acquisition, management, and optimization of commercial properties, with the goal of maximizing returns and minimizing risks for property owners, investors, and businesses.

2 notes

·

View notes

Text

Imperial Wealth International

Advantages of working with Imperial Wealth International:

Reliability and security: the broker is committed to providing a high level of reliability and security for its clients. The company follows strict regulations and uses advanced technology to protect data and financial transactions.

Professionalism and Experience: The team consists of experienced professionals with deep knowledge of the financial markets. They provide expert support and help clients make informed decisions based on data analysis and market trends.

Educational Resources: The brokerage company attaches great importance to the education and financial literacy of its clients. The broker provides educational resources, including webinars, seminars and training materials to help clients develop their skills and learn more about the financial markets.

User experience: the company strives to provide a user-friendly and excellent user experience. The user interface of the platform is designed with clients in mind and provides quick access to necessary information and tools for trading and investing.

Conclusion:

This is a reliable broker that offers a wide range of financial services and tools for investors. Whether you are an experienced trader or a newcomer to the world of finance, the company is ready to support you in achieving your financial goals. With its professionalism, safety and wide range of possibilities, Imperial Wealth International is an attractive choice for those who strive to succeed in the financial markets.

4 notes

·

View notes

Text

How a Mortgage Brokerage Can Help You Secure the Ideal Mortgage

When it comes to obtaining a mortgage, there are various crucial steps involved, from securing a favourable interest rate and minimizing fees to completing the application process and closing the loan promptly. For individuals, especially first-time homebuyers, seeking guidance from a mortgage broker can prove to be a prudent decision. Our team at Cashin Mortgages possesses the essential expertise and in-depth knowledge required to navigate the ever-changing market landscape, ensuring a seamless and hassle-free mortgage experience for you.

What is a Mortgage Broker?

Imagine you're on a quest to find the perfect mortgage for your dream home. A mortgage broker is like a bridge, connecting you to various lenders and helping you navigate the mortgage process smoothly. Instead of visiting each lender individually, your broker does the legwork for you, presenting you with a range of mortgage choices.

With their deep knowledge of the mortgage market, mortgage brokers are like seasoned guides who know all the ins and outs of the industry. They keep up with the latest trends, regulations, and lender policies, and they're eager to share their expertise with you. From understanding your financial goals to explaining complex terms, they provide valuable guidance tailored to your unique situation.

Ways Mortgage Brokerage Can Help You

Here are some key ways a mortgage brokerage can assist you:

Extensive Market Access - Mortgage Brokers have access to a wide network of lenders, including traditional banks, credit unions, and specialized lenders. This access enables them to explore multiple options and compare offerings from different lenders. By presenting you with a range of choices, they increase your chances of finding a mortgage with favourable terms such as competitive interest rates, flexible repayment options, and beneficial loan features.Negotiation Expertise - Mortgage brokers are competent negotiators who can advocate on your behalf. They have in-depth knowledge of the mortgage industry and understand the intricacies of lender policies and practices. This positions them to negotiate with lenders to secure the most favourable terms for your mortgage. They can work on obtaining lower interest rates, reducing or eliminating certain fees, and negotiating other beneficial terms to save you money in the long run.

Personalized Mortgage Solutions - Mortgage brokers recognize that everyone's financial situation is unique. They take the time to assess your specific needs, financial goals, and future plans. With this information, they can tailor mortgage solutions that align with your requirements. Whether you have a unique employment situation, a lower credit score, or require a specialized loan program, a mortgage broker can find lenders who are more likely to work with you and offer favourable terms.

Guidance and Expert Advice - Mortgage brokers are experts in the mortgage process and can provide you with valuable guidance every step of the way. They can help you understand complex mortgage terms and conditions, explain the pros and cons of different loan options, and offer insights into the implications of your choices. Their expertise ensures that you make informed decisions and select a mortgage that suits your long-term financial goals.

Streamlined Application Process - Applying for a mortgage involves a considerable amount of paperwork and documentation. Mortgage brokers simplify this process for you by gathering all the necessary information and ensuring that your application is complete and accurate. They have a thorough understanding of lender requirements and can guide you through the application process, reducing the chances of errors or delays. This increases the likelihood of your mortgage application being approved and helps you secure favorable terms in a timely manner.Ongoing Support - Even after you secure a mortgage, a mortgage brokerage can continue to provide support. They can assist you in understanding the terms of your mortgage agreement, explain prepayment options, and provide advice on refinancing opportunities in the future. If you have any questions or concerns about your mortgage, they are available to address them and offer guidance.

How much does a Mortgage Broker cost?

Mortgage brokers are typically compensated through commissions paid by lenders. This means that, as a borrower, you generally do not directly pay the mortgage broker for their services. Instead, the broker receives a commission from the lender once your mortgage is finalized. The commission paid to the broker is usually a percentage of the mortgage amount. The exact percentage can vary depending on factors such as the lender, the type of mortgage, and the specific agreement between the broker and the lender. The commission can range from 0.50% to 1.20% or more of the mortgage amount.

Securing a mortgage can be a daunting task, but with Cashin Mortgages, the process becomes much more manageable. Our dedicated team of professionals is here to guide you through every step, leveraging our expertise, industry connections, and personalized approach to help you achieve your mortgage goals.

Ready to make your mortgage experience a smooth and successful one? Contact Cashin Mortgages today and let's get started on finding the perfect mortgage solution for you! How can we assist you in achieving your homeownership dreams?

Source:

https://www.bankrate.com/mortgages/mortgage-broker/#broker-do

Read the full article

2 notes

·

View notes

Text

List of Best Trading Apps in India 2023

The world of trading has become more accessible than ever before, thanks to the rise of trading apps. With just a few clicks on your smartphone, you can now buy and sell shares in real-time from anywhere in India. But with so many options available, which trading app should you choose? In this article, we've compiled a list of the top 10 best trading apps in India for 2023. Whether you're a seasoned trader or just starting out, this comprehensive review will help you find the perfect app for your needs. So let's dive right into it!

List of the Top 10 Trading Apps in India

Zerodha: With over 3 million users, Zerodha is one of the most popular trading apps in India. It offers a user-friendly interface and low brokerage fees, making it an excellent choice for both beginners and experienced traders.

Upstox: Another top-rated app is Upstox, which boasts a simple yet effective platform for buying and selling stocks. It has competitive pricing and advanced charting tools to help you make informed decisions.

Angel Broking: Known for its extensive research capabilities, Angel Broking provides valuable insights into market trends that can help investors maximize their profits. The app also features a range of financial products like mutual funds and insurance.

Groww: A relatively new player in the market, Groww has quickly gained popularity thanks to its zero-commission policy on stock trades and easy-to-use interface.

Kotak Securities: This app by Kotak Mahindra Bank offers seamless integration with your bank account, allowing you to transfer funds seamlessly between them while trading shares or investing in mutual funds.

Sharekhan: With more than 20 years of experience in the market, Sharekhan is known for its robust research reports that provide detailed analysis of stocks from various sectors.

Edelweiss: Offering customizable watchlists and charts along with real-time news updates, Edelweiss makes it easier for investors to stay up-to-date with current events affecting their investments.

HDFC Securities: This app by HDFC Bank provides access to global markets along with local ones at affordable prices while providing comprehensive research reports covering several industries

ICICI Direct: ICICI direct allows you not only trade through mobile but also via call-n-trade. Their simplified version makes it perfect even if you are a beginner

Axis Direct: Last but not least AxisDirect comes equipped with all essential features including personalized alerts, easy order placement and comprehensive market analysis tools.

Complete Review of All Best Trading Apps in India

When it comes to choosing the best trading app in India, there are plenty of options available. But which one is right for you? In this complete review of all the best trading apps in India, we will take a closer look at each one and help you make an informed decision.

First up is Angel Broking. With its user-friendly interface and advanced charting tools, Angel Broking makes it easy for beginners to get started with trading. It also offers low brokerage fees and instant fund transfer options.

Next on our list is Zerodha. Known for its no-brokerage policy, Zerodha has quickly become a popular choice among traders in India. The app offers various features such as market depth analysis, advance charts and technical indicators.

Groww is another great option for those looking for a seamless trading experience. Its simple design allows users to navigate through the app with ease while offering commission-free investments in mutual funds.

Kotak Securities’ mobile application provides real-time updates on the stock market along with research reports from their team of experts giving you valuable insights about specific companies' performances based on their financial history.

Edelweiss Trading App combines investment opportunities with insightful advice from analysts making sure that traders make informed decisions before investing money into stocks or mutual funds

These are just some of the top contenders when it comes to finding the best trading app in India - but ultimately, your choice will depend on what suits your needs as an investor or trader.

To sum up, in this article we have discussed the top 10 trading apps in India for the year 2023. We have reviewed each app based on its features, user interface and overall performance.

Whether you are a beginner or an experienced trader, these apps offer you a seamless experience with no brokerage charges and easy access to market data.

Angel Broking, Zerodha and Kotak Securities are some of the popular names that provide unique features to make your trading journey smooth. Edelweiss also offers reliable services with advanced charts and tools.

Groww is another great option for beginners as it has a simple user interface along with low brokerage fees. nifty bees share price can be easily tracked through Angel One while Old Mumbai Chart provides historical data essential for analysis.

Each app excels in different areas making them suitable for different types of traders. So choose the one that best fits your requirements and start trading today!

After analyzing and reviewing the top 10 trading apps in India, it is evident that each app has its unique features and benefits. Whether you are a beginner or an experienced trader, there is an app on this list that will suit your needs.

From Angel Broking's seamless user interface to Zerodha's low brokerage fees, each app offers something special. Other notable mentions include Kotak Securities' advanced charting tools, Edelweiss' research reports, and Groww's zero brokerage platform for mutual funds.

Choosing the best trading app in India can be challenging. However, by assessing your needs as a trader and comparing them with the offerings of these top 10 trading apps, you can find one that perfectly suits you. So go ahead and download your favorite trading app today

Related - https://hmatrading.in/best-trading-app-in-india/

Source - https://sites.google.com/view/list-of-best-trading-apps

#best trading app in india#best trading app in india 2022#angel broking login#zerodha brokerage calculator#nifty bees share price#angel one share price#kotak securities login#edelweiss share price#old mumbai chart#angel broking share price#no brokerage#groww brokerage calculator#angelone share price#HMA Trading

2 notes

·

View notes

Text

The Impact of Market Volatility on Options Trading in India

The economics for Options Trading are greatly impacted by market swings, particularly in an expanding financial market such as India. Traders might potentially increase their returns and make well-informed judgments by having a thorough understanding a complex relationship between volatility & options trading.

Understanding Market Volatility

The number of movement in an investment instrument value over a certain period of time is referred to as market risk. Being that it indicates a level of risk and uncertainty in the market its a vital gauge for traders. Volatility plays an important part in the context of Indian options trading effecting option rates technique & the state of the market as an entire.

Types of Volatility

· This measures past market fluctuations and provides an insight into how much the price of an asset has varied over a specific period.

· This is a forward-looking metric that reflects the market's expectations of future volatility. It is derived from the price of options and plays a significant role in determining option premiums.

Impact of Volatility on Option Premiums

Extrinsic (time value) and intrinsic value make up option premiums. In general volatility has an impact on the extrinsic value. The extrinsic value of options rises under high market volatility, resulting in greater premiums. Conversely, option premiums typically decline during times of low volatility.

In fact, the Indian stock market faces increased volatility about key market events like economic shifts global conflicts or large financial developments. Option writers could be enabled to boost their premiums as a result of this rise in fluctuation in price for options.

Volatility Strategies in Options Trading

· Owning call or put options with the same expiration date but distinct strike prices is the basis of these strategies.

· In order to protect this technique entails selling out-of-the-money call or put options and buy extra out-of-the-money choices. Because the objective is to profit from the options expiring useles it is right for trader who anticipate low volatility.

· The difference in projected volatility over several strike prices is known as the volatility tilt & it is a feature that trader are able to advantage of. Trader may identify mispriced options or even profit from adjustments by looking at the tends.

The Role of SEBI in Regulating Volatility

Its Securities A vital role of the Exchange Board of India (SEBI) is to regulate instability & maintain stability in the markets. To avoid sell-offs and maintain orderly market SEBI use protects like breaker which temporarily stop trading in the event of major economic fluctuations.

Also, SEBI allows publicly traded organizations to provide some data this encourages accountability & reduces information disparity. This structure of regulation promotes a more safe trading environment or lessens excessive fluctuation.

Tools and Resources for Managing Volatility

Indian traders have access to various tools and resources to manage volatility effectively:

· That the VIX as referred to as the "aware assess" assesses how much the market anticipated short-term volatility. The India Volatility is an accepted measure of market sentiment & an indicator of potential rises in volatility in India.

· On the analysis of past price trends and volatility signs traders are able to forecast future market moves and change their option strategy properly.

· Leading brokerage homes like are Motilal Oswal supply traders with a range of forward-thinking trading platforms forefront charting tools, real-time information and training resources to help clients navigate a unstable market..

Conclusion

Market volatility had an enormous impact on Indian options traders impacting trading tactics or option premiums & the state of the market as a whole. Having an in-depth knowledge of volatility & the application of proper strategies traders can maximize their revenue while efficiently reducing risk.

Leading trading firms like Motilal Oswal & SEBI all offer regulatory guidelines and instruments that are vital in assisting trader in managing the complex rule of erratic markets. the Indian stock market keeps evolving being knowledgeable or adaptive can be essential for successful options trading in the face of market volatility.

#stockmarket#best stock market in rajasthan#best stock market advisor#broking firm#invest#india#broking firm in jaipur#investment#motilal oswal#best stock trading apps in india#optionstrading#options#Best MFT brokers

0 notes

Text

What is Trading ?

Trading in the context of finance refers to the buying and selling of financial instruments, such as stocks, bonds, commodities, currencies, and derivatives, with the aim of making a profit. Here are the main components and types of trading:

Learn Trading course in Meerut

Types of Trading

Stock Trading: Involves buying and selling shares of publicly traded companies. Traders aim to profit from price movements in individual stocks.

Forex Trading: The exchange of currencies on the foreign exchange market. Traders speculate on the relative values of currency pairs (e.g., EUR/USD).

Commodity Trading: Involves trading physical goods like gold, oil, and agricultural products. This can be done through futures contracts, options, or spot trading.

Options and Futures Trading:

Options: Contracts that give the right, but not the obligation, to buy or sell an asset at a predetermined price before a certain date.

Futures: Contracts obligating the buyer to purchase, or the seller to sell, an asset at a predetermined future date and price.

Cryptocurrency Trading: Involves buying and selling digital currencies like Bitcoin, Ethereum, and others on various cryptocurrency exchanges.

Methods of Trading

Day Trading: Involves buying and selling financial instruments within the same trading day, closing out all positions before the market closes. Day traders often use high levels of leverage and short-term strategies.

Swing Trading: Involves holding positions for several days to weeks, aiming to profit from expected price moves or "swings."

Scalping: A strategy that involves making dozens or hundreds of trades in a single day, aiming to "scalp" small profits from each trade.

Position Trading: Involves holding positions for weeks, months, or even years, based on long-term trends and fundamental analysis.

Algorithmic Trading: Uses automated software to execute trades based on predefined criteria and algorithms. High-frequency trading (HFT) is a subset of this, involving extremely fast order execution.

Trading Strategies

Technical Analysis: Involves analyzing statistical trends from trading activity, such as price movement and volume, to identify patterns and make trading decisions.

Fundamental Analysis: Focuses on evaluating a security's intrinsic value by examining related economic, financial, and other qualitative and quantitative factors.

Sentiment Analysis: Gauges the mood of market participants through indicators, news sentiment, and other tools to predict future market movements.

Trading Platforms and Tools

Trading Platforms: Software provided by brokerage firms that allows traders to execute trades, analyze market data, and manage accounts. Examples include MetaTrader, thinkorswim, and Robinhood.

Charting Tools: Tools that provide visual representations of market data to help traders identify trends and make decisions. Examples include TradingView and StockCharts.

Order Types: Different types of orders can be placed, such as market orders, limit orders, stop-loss orders, and trailing stops, each serving different purposes in a trading strategy.

Risks and Rewards

Trading can offer significant rewards, but it also carries substantial risk. Successful trading requires knowledge, skill, discipline, and a good understanding of the markets and risk management techniques. Traders can lose substantial amounts of money, especially when leveraging positions. Therefore, proper education and preparation are crucial for anyone considering entering the trading world.

0 notes

Text

2024 IPO Calendar: Key Dates and Companies

The initial public offering (IPO) market continues to be a hotbed of activity, with exciting new companies seeking to raise capital and join the public stock exchanges. As an investor, navigating the IPO landscape can be both thrilling and daunting. The potential for high returns beckons, but so does the risk of overhype and unforeseen challenges.

Before you jump on the IPO bandwagon in 2024, here's a comprehensive checklist to equip you for informed investment decisions:

Understand Your Investment Goals and Risk Tolerance:

What are your investment goals? Are you seeking long-term growth, short-term gains, or diversification? IPOs can offer all three, but with varying degrees of risk.

How comfortable are you with risk? IPOs are inherently speculative. New companies haven't established a long track record of performance. Be honest about your risk tolerance before committing any capital.

Research the Company Thoroughly:

Read the Red Herring Prospectus: This document, mandated by the Securities and Exchange Board of India (SEBI), provides a wealth of information about the company, including its business model, financials, management team, risk factors, and future plans.

Dig Deeper: Don't just rely on the prospectus. Analyze industry trends, competitor performance, and the overall market sentiment.

Seek Out Independent Analysis: Look for research reports from reputable financial institutions or independent analysts to gain diverse perspectives.

Scrutinize the Company Financials:

Revenue Growth: Analyze the company's revenue growth trajectory. Look for consistent and sustainable growth, not just a one-time spike.

Profitability: While profitability isn't always a deal-breaker for high-growth companies, understand their path to becoming profitable.

Debt Levels: Excessive debt can be a significant burden. Evaluate the company's debt-to-equity ratio and its ability to manage its debt obligations.

Evaluate the Management Team:

Experience and Expertise: Assess the management team's experience in the industry and their track record of success.

Leadership and Vision: Look for a leadership team with a clear vision for the company's future and the ability to execute their plans.

Corporate Governance: Ensure the company adheres to good corporate governance practices with transparency and accountability.

Understand the IPO Structure:

Fresh Issue vs. Offer for Sale (OFS): In a fresh issue, the company raises new capital, while in an OFS, existing shareholders sell their stake.

Pricing: Analyze the IPO pricing compared to industry benchmarks and the company's valuation. Is it a fair price that reflects the company's true potential?

Lock-in Period: Be aware of any lock-in periods where you might not be able to sell your shares immediately after the IPO.

Consider the Market Conditions:

Overall Market Sentiment: A bull market can fuel IPO hype, while a bear market might lead to post-listing price corrections.

Industry Performance: Evaluate how companies in the same industry are performing. Look for tailwinds that might benefit the IPO.

Liquidity: Ensure the IPO has sufficient liquidity, meaning enough shares are available for trading to ensure you can easily enter and exit your position.

Develop an Investment Strategy:

Allocation: Determine how much of your investment portfolio you're comfortable allocating to IPOs. Remember, diversification is key.

Entry and Exit Strategy: Decide on a price point for entry and a target return for exiting your investment.

Risk Management: Have a risk management plan in place, including stop-loss orders to limit potential losses.

Choose a Reputable Broker:

IPO Access: Ensure your broker has access to IPO offerings and can guide you through the application process.

Experience and Expertise: Choose a broker with a strong reputation in handling IPOs and providing sound investment advice.

Fees and Charges: Be aware of any brokerage fees or charges associated with participating in IPOs.

Remember: IPOs are not guaranteed successes. By following this checklist and conducting thorough research, you can increase your chances of making informed investment decisions and navigating the exciting world of 2024 IPOs.

Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Here is the list of IPO 2024

Kronox Lab Sciences IPO GMP Today

Awfis Space Solutions IPO GMP Today

Go Digit IPO GMP Today

Aadhar Housing Finance IPO GMP Today

TBO TEK IPO GMP Today

Indegene IPO GMP Today

JNK India IPO GMP Today

Vodafone Idea IPO GMP Today

Bharti Hexacom IPO GMP Today

SRM Contractors IPO GMP Today

Krystal Integrated IPO GMP Today

Popular Vehicles IPO GMP Today

BLS-E Services IPO GMP Today

Nova Agri Tech IPO GMP Today

Azad Engineering IPO GMP Today

RBZ Jewellers IPO GMP Today

Muthoot Microfin IPO GMP Today

Suraj Estate Developers IPO GMP Today

DOMS IPO GMP Today

India Shelter Finance IPO GMP Today

Sattrix Information Security IPO GMP Today

TBI CornI PO GMP Today

Associated Coaters IPO GMP Today

Aimtron Electronics IPO GMP Today

Ztech India IPO GMP Today

Beacon Trusteeship IPO GMP Today

Vilas Transcore IPO GMP Today

GSM Foils IPO GMP Today

Rulka Electricals IPO GMP Today

Quest Laboratories IPO GMP Today

Indian Emulsifier IPO GMP Today

Veritaas Advertising IPO GMP Today

Mandeep Auto Industries IPO GMP Today

ABS Marine Services IPO GMP Today

Piotex Industries IPO GMP Today

Aztec Fluids & Machinery IPO GMP Today

Premier Roadlines IPO GMP Today

Energy Mission Machineries IPO GMP Today

TGIF Agribusiness IPO GMP Today

Finelistings Technologies IPO GMP Today

Refractory Shapes IPO GMP Today

0 notes

Text

Navigating Success: Key Players in the Financial Brokerage Sector Revealed

The power players shaping the Financial Brokerage Market. Gain valuable insights into major contributors driving growth and innovation in this vital sector of the financial industry.

#Financial Brokerage Industry#Financial Brokerage Sector#Financial Brokerage Market Size#Financial Brokerage Industry Competitors#Opportunities in Financial Brokerage Industry#Challenges in Financial Brokerage market#Financial Brokerage Market Segmentation#Top Players in Financial Brokerage Market#Financial Brokerage Market Trends#Financial Brokerage Market Report#Financial Brokerage Market Forecast

0 notes

Text

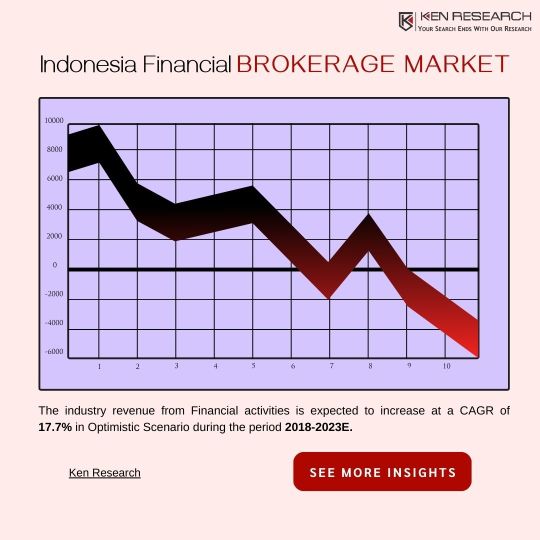

Strategic Insights: Sizing Up Indonesia's Financial Brokerage Market in 2023

The 2023 outlook for Indonesia's financial brokerage sector hinges on macroeconomic stability, regulatory dynamics, and technological advancements. A strategic analysis is essential to navigate changes, including the impact of digital transformation and evolving market players. Crafting informed strategies based on these factors will be key to success in the dynamic landscape of Indonesia's financial brokerage sector.

#Financial Brokerage Trends#financial Market Outlook 2023#Investment Strategies#Digital Evolution in Finance

0 notes

Text

Let’s Get Aware About special Immediate Momentum Reviews

Investment is an expansive and intricate field, full of layers to uncover and concepts to absorb. This website connects all investors with top-tier learning resources that make understanding investments simpler than ever.

Simulation results of their past performance were strong; however, risk management remains essential until real world results validate its algorithms. Furthermore, it provides several features designed to assist traders in crafting trading strategies.

It’s free

Immediate Momentum stands out from its competitors by not charging its users to use its service or execute trades and generate profit. Instead, the company focuses on creating a secure trading environment by employing security protocols such as SSL encryption to safeguard user information; users should take additional safety steps by creating strong passwords and activating two-factor authentication to maintain safety themselves.

This website simplifies learning by connecting users with investment firms that match their educational goals, and breaking down complex concepts into simpler ones, easing confusion over investing and helping reduce fear and anxiety about investing. To understand more about immediate momentum reviews, click here or visit our site.

Furthermore, the website offers free customer support by email and phone 24/7 - representatives are always ready to provide answers for any inquiries that arise. Verifying your account on this site is also simple - simply complete a signup form by providing your name, phone number and email address - after registering you'll get either an SMS message or call from one of their representatives confirming registration of your account.

It’s easy to use

Immediate momentum is a trading platform designed to meet the needs of traders of all experience levels, offering secure environments, comprehensive tools, and user-friendly interfaces and superior support to enable users to focus solely on trading activities without being distracted by technical glitches - making it easier for traders to meet their financial goals and ultimately realize success.

This platform provides educational materials to assist traders with learning to trade and making profitable investments, as well as analytical reports and tutorials to understand market trends. Furthermore, users can select their level of assistance from the system.Visit our website or click here to find out everything about is immediate momentum a scam.

Immediate Momentum offers traders the ability to open an account by funding their trading accounts with cash or digital assets - either cash or digital - which will then be used for trade execution on the platform and profit generation. Unlike traditional brokerages, Instant momentum does not charge fees for trading; as its bot does not trade crypto directly but instead employs Contracts for Difference (CFDs), which track prices of underlying assets like crypto.

It’s reliable

Immediate Momentum stands apart from traditional trading software by being fully automated and eliminating emotional trading decisions from traders' decisions. New investors can also easily invest without constantly monitoring the market; as well as offering an instantaneous demo account where traders can test out strategies before investing with real funds.

Customer support at CoinTracking is accessible via both email and live chat, with traders noting their responsive and helpful team who can assist with everything from registering accounts to depositing funds - their zero fees policy makes the investment in cryptocurrency even more appealing for newcomers.

The website doesn't display any details regarding its founders; however, there have been multiple internet rumors suggesting Elon Musk, founder of Tesla and SpaceX was behind it all. These reports may or may not be true but have caused considerable interest among potential users; additionally, this site values up-to-date knowledge and regularly refreshes learning resources to keep users up-to-date.

It’s secure

Immediate momentum is a free to use trading bot with an impressive 85% success rate. Utilizing SSL encryption to safeguard users, as well as partnerships with regulated brokers to safeguard funds safely, the platform also provides real-time market data to keep traders abreast of emerging trends.

The immediate momentum platform also enables users to practice their strategies using virtual funds before transitioning to live trading - this provides an effective way of learning the ropes and avoiding making costly errors when trading for real money. Furthermore, tailored support ensures users get exactly the assistance they require when needed.

Joining is completely free and no licensing fees apply, though a minimum deposit of $250 is necessary for making trades. Multiple payment methods including credit cards and direct crypto payments are accepted, while customer service representatives are available 24/7 through email and live chat support.

0 notes

Text

Investing in Upcoming IPOs: A Guide to Seizing Investment Opportunities

Understanding Initial Public Offerings (IPOs)

An Initial Public Offering (IPO) is the process through which a private company offers its shares to the public for the first time. It allows the company to raise capital from investors and enables shareholders, including founders and early investors, to sell their stakes in the company. Know the benefits of investing in upcoming IPO.

Benefits of Investing in IPOs

Early Investment Opportunity: IPOs provide a chance to invest in companies during their early growth stages, potentially offering substantial returns if the company performs well post-listing.

Market Excitement: IPOs often generate significant market interest and media coverage, leading to potential price appreciation in the early trading days.

Diversification: Investing in IPOs allows diversification of your investment portfolio by adding exposure to new sectors and industries.

Access to Promising Companies: IPOs frequently involve companies with innovative business models, disruptive technologies, or strong growth prospects, offering investors exposure to promising ventures.

Risks Associated with Investing in IPOs

Volatility: IPO stocks can experience high volatility in their initial trading days, influenced by market sentiment, investor demand, and external factors.

Limited Historical Data: Unlike established companies, IPOs have limited historical financial performance data available for analysis, making it challenging to assess their future prospects accurately.

Lock-up Periods: Founders, early investors, and insiders typically have lock-up periods during which they cannot sell their shares, potentially affecting market supply and stock price stability post-IPO.

Market Conditions: IPO performance can be influenced by broader market conditions, economic factors, industry trends, and geopolitical events.

How to Invest in Upcoming IPOs

Stay Informed: Keep track of upcoming IPOs through financial news, company announcements, and IPO calendars provided by stock exchanges and financial websites.

Research the Company: Conduct thorough research on the company’s business model, industry outlook, competitive landscape, financial performance, management team, and IPO pricing details.

Review the Prospectus: Read the company’s prospectus, which provides detailed information about its operations, financial statements, risks, and IPO offering terms.

Evaluate IPO Valuation: Assess the IPO valuation relative to industry peers, considering factors such as price-to-earnings (P/E) ratio, revenue growth, profitability projections, and market demand.

Consult with Financial Advisors: Seek advice from financial advisors or brokerage firms with expertise in IPO investments to gain insights and make informed decisions.

Steps to Participate in an IPO

Open a Demat Account: Ensure you have a Demat account with a Depository Participant (DP) to hold securities in electronic form.

Apply for IPO: IPO applications can be made through your brokerage firm or using online platforms provided by stock exchanges. Fill out the IPO application form with accurate details and submit it within the specified timeframe.

Allotment of Shares: After the IPO subscription period closes, shares are allotted based on the IPO allocation process determined by the company and underwriters.

Listing and Trading: Once listed on the stock exchange, IPO shares can be traded freely in the secondary market. Monitor the stock’s performance and market conditions to decide on holding or selling your investment.

Considerations for Investing in IPOs

Investment Horizon: Determine your investment horizon and risk tolerance when considering IPO investments, as short-term volatility may impact initial returns.

Diversification Strategy: Allocate investments across different sectors and asset classes to mitigate risks associated with individual IPO investments.

Long-Term Potential: Assess the company’s long-term growth prospects, competitive advantages, and ability to generate sustainable profitability beyond the initial hype of the IPO.

Exit Strategy: Have a clear exit strategy in place based on your investment goals, whether it involves capitalizing on short-term price movements or holding for long-term growth.

Conclusion

Investing in upcoming IPOs offers investors an opportunity to participate in the growth potential of early-stage companies entering the public markets. By understanding the IPO process, conducting thorough research, evaluating risks and potential rewards, and staying informed about market dynamics, investors can make informed decisions to capitalize on promising IPO opportunities. However, it's essential to approach IPO investments with caution, considering the inherent risks and uncertainties associated with new public offerings. With diligence and strategic planning, investing in upcoming IPOs can be a rewarding addition to your investment portfolio.

0 notes

Text

In-Depth Analysis of BNP Paribas SA's Strategic Deals and Acquisitions

BNP Paribas SA is one of the largest banking groups in the world, with a significant presence across Europe, Asia, and the Americas. This comprehensive analysis focuses on BNP Paribas's strategic deals and acquisitions, providing insights into the company's growth strategy, market expansion, and financial performance. Understanding these deals sheds light on BNP Paribas's approach to maintaining its leadership position in the global banking sector.

Overview of BNP Paribas SA

Founded in 1848 and headquartered in Paris, France, BNP Paribas offers a wide range of financial services, including retail banking, corporate and institutional banking, asset management, and insurance. The bank's extensive network and diversified service offerings make it a key player in the global financial industry.

Core Services and Market Reach

BNP Paribas operates through three main business divisions:

Retail Banking: Provides a comprehensive range of financial products and services to individuals, small businesses, and corporates.

Corporate and Institutional Banking (CIB): Offers financing, advisory, and market solutions to large corporates, financial institutions, and government entities.

Investment Solutions: Includes asset management, insurance, and private banking services, catering to a wide array of client needs.

BNP Paribas's global presence is bolstered by its strategic partnerships, subsidiaries, and a strong digital banking platform, which enhances its service delivery and customer engagement.

Strategic Deals and Acquisitions

BNP Paribas has a robust history of strategic deals and acquisitions aimed at expanding its market footprint, enhancing service offerings, and driving growth. Here, we review some of the most significant deals and their impact on the company's strategic objectives.

Acquisition of Fortis Bank (2008)

One of BNP Paribas's most notable acquisitions was the purchase of a majority stake in Fortis Bank during the financial crisis in 2008. This deal was pivotal for several reasons:

Market Expansion: The acquisition significantly expanded BNP Paribas's presence in Belgium and Luxembourg, strengthening its position in the European market.

Customer Base: By integrating Fortis's customer base, BNP Paribas enhanced its retail banking and wealth management services.

Asset Growth: The deal added substantial assets to BNP Paribas's portfolio, boosting its financial stability and market competitiveness.

Acquisition of DAB Bank (2014)

In 2014, BNP Paribas acquired DAB Bank, a German direct bank specializing in online brokerage and financial services.

Digital Banking Enhancement: This acquisition reinforced BNP Paribas's digital banking capabilities, aligning with the growing trend towards online financial services.

Market Penetration: It provided BNP Paribas with greater access to the German market, one of the largest in Europe, enhancing its competitive edge.

Partnership with Orange Bank (2016)

BNP Paribas entered into a strategic partnership with Orange Bank in 2016, focusing on the French digital banking market.

Innovation and Technology: The partnership leverages Orange's technological expertise and BNP Paribas's financial acumen to offer innovative digital banking solutions.

Customer Engagement: It aims to attract a tech-savvy customer base, particularly younger demographics, by providing seamless, mobile-first banking services.

Acquisition of Deutsche Bank's Prime Brokerage and Electronic Equities (2019)

In 2019, BNP Paribas acquired the prime brokerage and electronic equities businesses of Deutsche Bank.

Strengthening CIB Division: This acquisition bolstered BNP Paribas's Corporate and Institutional Banking division, enhancing its capabilities in prime brokerage and equity trading.

Client Base Expansion: The deal added numerous high-profile clients to BNP Paribas's portfolio, increasing its market share in the institutional banking sector.

Partnership with Tink (2020)

BNP Paribas formed a partnership with Tink, a leading European open banking platform, in 2020.

Open Banking Capabilities: This partnership enables BNP Paribas to offer enhanced open banking services, facilitating better financial management tools for customers.

Data Integration: By integrating Tink's platform, BNP Paribas can leverage data analytics to provide personalized financial services and improve customer experience.

Impact of Strategic Deals on Financial Performance

The strategic deals and acquisitions undertaken by BNP Paribas have had a significant impact on its financial performance and market positioning. Key financial metrics influenced by these deals include:

Revenue Growth

Enhanced Service Offerings: By expanding its service portfolio through acquisitions and partnerships, BNP Paribas has been able to attract new customers and increase revenue streams.

Geographical Diversification: The bank's presence in new markets, especially through acquisitions like Fortis Bank and DAB Bank, has contributed to diversified revenue sources and reduced reliance on any single market.

Profitability and Cost Efficiency

Economies of Scale: Integrating acquired businesses has allowed BNP Paribas to achieve economies of scale, reducing operational costs and enhancing profitability.

Synergy Realization: Strategic deals often result in synergies, such as shared technology platforms and streamlined processes, which improve cost efficiency and profit margins.

Market Positioning

Competitive Edge: The acquisitions have strengthened BNP Paribas's market position, making it one of the top banking institutions globally with a comprehensive range of services.

Brand Strength: Successful integration of acquired businesses and strategic partnerships has enhanced BNP Paribas's brand reputation as a forward-thinking, customer-centric bank.

Financial Stability

Asset Growth: Acquisitions like Fortis Bank significantly increased BNP Paribas's asset base, providing greater financial stability and resilience against market fluctuations.

Capital Adequacy: The bank has maintained strong capital adequacy ratios, supported by the growth in equity and retained earnings from profitable acquisitions.

Future Strategic Directions

BNP Paribas's strategic deals and acquisitions have set a solid foundation for future growth. The bank continues to explore opportunities in the following areas:

Digital Transformation

Investment in Fintech: BNP Paribas is likely to continue investing in fintech companies and digital banking platforms to enhance its technological capabilities and offer cutting-edge financial services.

Customer-Centric Innovations: Focusing on customer experience through personalized services, leveraging data analytics, and AI-driven solutions.

Sustainable Finance

Green Investments: Increasing focus on sustainable finance and green investments aligns with global trends towards environmental responsibility and offers new revenue opportunities.

ESG Integration: BNP Paribas aims to integrate environmental, social, and governance (ESG) criteria into its investment and lending decisions, catering to the growing demand for responsible banking.

Global Expansion

Emerging Markets: Exploring opportunities in emerging markets, particularly in Asia and Africa, to tap into high-growth regions and expand its global footprint.

Strategic Partnerships: Forming alliances with local banks and financial institutions to navigate regulatory landscapes and establish a strong presence in new markets.

Conclusion

BNP Paribas SA's strategic deals and acquisitions have been pivotal in shaping its growth trajectory, enhancing its market position, and driving financial performance. By continually adapting to market trends and investing in innovative solutions, BNP Paribas remains a leading force in the global banking industry.

0 notes

Text

Cloud Services Brokerage Market Size, Segment and Growth by Forecast to 2031

The Insight Partners market research Cloud Services Brokerage Market Size and Share Report | 2031 is now available for purchase. This report offers an exclusive evaluation of a range of business environment factors impacting market participants. The market information included in this report is assimilated and reliant on a few strategies, for example, PESTLE, Porter's Five, SWOT examination, and market dynamics

Cloud Services Brokerage market is evaluated based on current scenarios and future projections are added keeping the projected period in consideration. This report integrates the valuation of Cloud Services Brokerage market size for esteem (million USD) and volume (K Units). Research analysts have used top-down, bottom-up, primary, and secondary research approaches to evaluate and approve the Cloud Services Brokerage market estimation.

Detailed scrutiny of market shares, optional sources, and basic essential sources has been done to integrate only valid facts. This research further reveals strategies to help companies grow in the Cloud Services Brokerage market.

Key objectives of this research are:

To contemporary market dynamics including drivers, challenges, threats, and opportunities in the Cloud Services Brokerage market.

To analyze the sum and market estimation of the worldwide Cloud Services Brokerage market

Based on key facets, market segments are added.

The competitive analysis covers key market players and their business strategies.

To examine the Cloud Services Brokerage Market for business probable and strategic outlook.

To review the Cloud Services Brokerage Market size, key regions and countries, end-users, and statistical details.

To offer strategic recommendations based on the latest market developments, and Cloud Services Brokerage market trends.

Perks of The Insight Partners’ Cloud Services Brokerage Market Research

Market Trends: Our report reveals developing Cloud Services Brokerage market trends that are poised to reshape the market preparing businesses with the foresight to retain their competitive edge. This Market research report presents market trends, supply chain analysis, leading participants, and business growth strategies. This research covers technological progress and key developments covering various aspects of the inclusive market. It is valuable market research for existing key players as well as new entrants in the Cloud Services Brokerage Market. Through inputs derived from experts, this research attempts to guide future investors about market details and potential returns on investment.

Competitive Landscape: This research reveals key market players, their strategies, and possible areas for differentiation.

Analysts Viewpoint: We have industry-specific experts who add credibility to this report with their exclusive viewpoints based on market understanding and expertise. This report goes further into details of entire business processes and doesn’t restrict to only operational aspects. These insights cover venture economics and include tactics for capital investment, investor funding, and projections of ROIs. Net income and profit loss financial stats are crucial metrics of this Cloud Services Brokerage market report. With these meticulous insights companies can reduce their risks and increase the success rate in the coming decade.

Cloud Services Brokerage Market Report Coverage:

Report Attributes

Details

Segmental Coverage

Service

Operations Management

Catalog Management

Workload Management

Integration

Reporting and Analytics

Security and Compliance

Training and Consulting

Support and Maintenance

Platform

Internal Brokerage Enablement

External Brokerage Enablement

Deployment

Public cloud

Private cloud

Hybrid cloud

Organization Size

SMEs

Large enterprises

Large enterprises

BFSI

Healthcare and Life Sciences

IT and Telecommunications

Retail and Consumer Goods

Manufacturing

Government and Public Sector

Media and Entertainment

Energy and Utilities

Others

Vertical

North America

Europe

Asia Pacific

South and Central America

and Geography

Regional and Country Coverage

North America (US, Canada, Mexico)

Europe (UK, Germany, France, Russia, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, Australia, Rest of APAC)

South / South & Central America (Brazil, Argentina, Rest of South/South & Central America)

Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA)

Market Leaders and Key Company Profiles

Acronis International GmbH

Cloudmore AB

Cognizant

Dell, Inc

DXC Technology Company

IBM

Jamcracker, Inc

NEC Corporation

Open Text Corporation

Wipro Limited

Other key companies

What all adds up to the credibility of this research?

A comprehensive summary of the contemporary Cloud Services Brokerage market scenario

Precise estimations on market revenue forecasts and CAGR to rationalize resources

Regional coverage to uncover new markets for business

Rivalry analysis aims to help corporations at a modest edge

Facts-based crystal-clear insights for business success

The research can be customized as per business necessities

Access to PDF, and PPT formats of this research

Author’s Bio:

Aniruddha Dev

Senior Market Research Expert at The Insight Partners

#Cloud Services Brokerage Market#Cloud Services Brokerage Market Size#Cloud Services Brokerage Market Share#Cloud Services Brokerage Market Trends

0 notes