#Corporate Bonds

Text

Bonds Investment in India: A Top N Overview

Discover the key insights into bond investment in India: from government securities to corporate bonds, and explore strategies, risks, and opportunities in this comprehensive guide. Explore lucrative opportunities for high returns with bond investment in India. Bonds typically have a fixed interest rate and maturity date. They are considered relatively safer investments compared to stocks, but the level of risk varies depending on the issuer's credit rating and prevailing economic conditions

#bond investment platform#Bonds Investment#Corporate Bonds#Tax-Free Bonds#online bond platform#Invest in Bonds Online

0 notes

Text

Unlock the Power of Bonds: Dive into a treasure trove of bond strategies tailored to supercharge your portfolio. Discover the secrets to managing risk and maximizing returns with expert insights!

For more such blogs:

Visit our blog site today: https://tradingbells.com/blogs

And for Financial Advice reach us at: https://tradingbells.com/

Phone: +91 932 953 6100

0 notes

Text

This started as a simple rant about gift cards but is probably turning into my master post on the lost story of the corporate gift card valuation crisis.

Starts as the simple rant but gets more technical in economics and accounting as it goes on- so fair warning.

-----

Gift cards are often thought of as a boring, low effort gift, although more polite than cash. Plenty of good reasons why they are a bad gift from a thoughtfulness standpoint, but I'm going to focus on the financial value.

Adult humans that live under capitalism are generally, learnedly able to understand the time value of money, even if they cant physically execute the calculations on paper. If you dont believe me, just trust me-- its how all of economics works. We are generally able to value things very well according to our own subconscious estimations.

This is not to say people who receive a gift card are just focused on the dollar figure, however I think the financial frustration lies with the fact that, inherently a $25 gift card is worth less than $25 cash. Probably a lot less

-------

As a present, gift cards remind me, actually, of the stereotype of a grandparent buying their descendents, "war bonds", but somehow gift cards are even worse.

Sorry this is going to be a long explanation of why gift cards suck--

A war bond, which is now simply called a US Treasury bill or bond, is a 'redeemable certificate', which allows the current owner to be sure that the dollar amount (face value) shown on the certificate will be granted, plus interest accumulated from the point of issue until the present date, and the note is redeemable early in most common cases, and is redeemable at most banks or financial institutions around the world. Well... they might not now but they are supposed to

Section 1. Bond overviews

These Treasury bonds are just debt that the US government, i.e. the taxpayers, have to pay back to whoever purchased this bond.

Economics is intended to be confusing to understand, an example of this being how they love to make it hard to understand that every time you hear about bonds and interest rates they are talking about gambling with our public taxpayer debt. Calling it "buying bonds" makes it seem more normal investy stuff

Anyway-- so this is debt right? Well like all debt, it requires a good credit score, and collateral. The official term is "backed by the full faith and credit of the United States Government"

In summary of this section using numbers:

If you get a treasury bond that says $100 & 5% annual interest, the Treasury department guarentees you can receive $100 amount in the future (maturity date), as well as $5 per year for your troubles, unless the US government is toast at any point.

If the holder sells the bond prematurely on the 'secondary market'--which is the clever term for the stock market for bonds-- they might get more or less than the "face value" depending on current interest rates, if those current rates differ from the interest rate set on the bond at hand.

---

Section 2: Basic Bond Valuation

So using previous example, the face value of $100, and that only comes back from the treasury department on maturity day (up to 30 years away now for long term bonds)

So in the meantime, people "trade" (gamble most of the time) those bonds on the market. Cause why the fuck not?

---

Most of the time, in a non inflationary environment, bonds with expiration dates of less than 5 years do not change price much at all in this 'secondary market'.

Why? Well--

In an inflationary environment (only recent examples are 1970s & 2020s) most bonds are decreasing in value, with the lowest interest rate bonds decreasing the most. Every other period has bond prices generally flat (so you still get the 5% interest) or trending up

The economic mechanics behind what lowers bond prices in high interest rate environments is pretty simple-- if I have a 30 year loan the government owes me, with 5% annual interest, and the guy who bought the same 30 year bond back in 2017 only got 2% interest, then I have an inherently more valuable loan or bond.

Going to start circling back to gift cards-- A 0% bond is only worth more than a negative interest bond.

(looking at you japan they were briefly paying banks 0.5% interest to borrow money from the government. As in a -0.5% interest loan)

Okay gift cards time

$25 Gift card = corporate bond of face value $25, with 0% interest, and is only redeemable in person at the companies restaurant with immediate purchase of their product

A gift card is identical then to the boring "war bond" gift, except that:

1) it can only be redeemed at their limited locations in person, and only with immediate purchase of their product or service

2) this certificate does not accrue any interest, which means that from a value standpoint its guarenteed to lose value over time unless interest rates are below 0% like japan had

------

Again, most people are very capable of understanding that the value of a 0% corporate bond which cannot be easily sold is worth less than the face value-- much less. Just most people probably dont have the experience in finance to put to words why exactly that situation is so frustrating from a financial standpoint

What a stupid gift, cash is way better.

Especially in an inflationary environment like the 2020s. my god the valuation loss of all the gift cards recently is incalculablely enormous

It would be a very snarky, not nice response to being gifted a gift card if the receiver replies back that the technical market value of this $25 gift card is actually $14.75 due to the current globally high interest rate environment in addition to the company having a BBB Moody's credit rating rather than a perfect AAA

I'm very, very tempted to do a sample valuation of a random hypothetical gift card to reinforce this point, but valuations arent quick and I already know it would take me half the day just researching the numbers to put together for it

----

I had no idea I was going to have this much to say but we're on edit #4 to this post Im gonna keep going:

The inflation of the 2020s has led to the largest (by dollar value and probably other metrics) corporate bond valuation crash of the.. ever

But corporate bonds are mostly held by the upper middle class & higher, as well as other corporations. So of course we hear them crying about their loss of wealth. Easiest example can be found by looking for the annual returns on an ETF which trades only corporate bonds. They got fucked in 2021 and arent back yet

What I'm getting at is that most poor people do not own individual bonds-- its just not really something that makes sense as a poor person.

Back to poor people's wealth--

Someone who has a retirement funds might invest in corporate bonds through that fund. But dont get me started on how complicated those funds investment strategies are to mitigate the risk (but yes they arent good at risk mitigation lose value a lot from dumb preventable mistakes).

And also looking at 5 yr price charts for many retirement funds, the ones with more corporate bond holdings have done way worse than their peers in the retirement fund game who put more money in stocks over that period

Poor people do, however, give each other gift cards... a lot. Weve kind of been told for a long time that its a more appropriate gift than cash. I wonder whod want us to think that. Maybe the corporations who are getting away with selling hard-to-redeem junk bonds as "gift cards"?

Likewise with all corporate bonds lately, the total balance of gift cards issued & held by the general public is larger than it has ever been in prior decades like the 1970s. There was issues with gift cards then, just the total amount was much, much less

Except probably not anymore-- only the face value being reported on their financial statements is that high, as accounting standards do not require companies to regularly value their gift card balances at market value. They are allowed to report it at face value, until it is removed from their balance sheet and resolved as pure income. Not 100% sure the GAAP guidance for it, but I know they dont HAVE to specifically mark down gift cards as they dont have expiration dates. I know that if a company did need to mark down that debt balance for whatever reason, the only way to lower that balance is by calling it "other income".

So poor people have felt a multi-billion dollar loss of wealth from gift card values, which is obviously not ever going to be studied or talked about cause who the fuck cares about poor people

And when that loss does get "realized" from an accountant standpoint-- it would be considered income for the fucking corporations.

Actually reminds me of Starbucks class action about the gift card balance. Lot to dig into there but thats more because of their extra predatory practices around redeeming it

#unique gifts#gifts#stocks#bonds#gift cards#I really hate all the $15 gift cards I have to shitty restaurants that I dont want to eat at#I would much prefer it if I had a collection of $15 treasury bonds#if anyone has trouble understanding bonds#just think of them as gift cards that change in value depending on the health of the company#which is what you would want out of a gift card#because if the company is going tk bad financial health they might go bankrupt and youd never be able to redeem the gift card#gift cards were a good scam companies thought of#corporate bonds#wealth#economics#accounting

1 note

·

View note

Text

Invest in High-Return Bonds and Debt Securities in India | Altifi.ai

With AltiFi, you can invest in bonds and debt securities from leading institutions, including financial institutions, large and emerging mid sized corporates, start ups, and unicorns Our products are backed by high standards of corporate governance, and we offer a variety of investment options to meet your individual needs

#bonds#Fixed deposit#types of bonds#bonds and types of bonds#bonds india#Invest in bonds#Corporate bonds#Bond market

0 notes

Text

Bank of England Takes Strides Towards Green Investments

“In a significant move, it has integrated climate considerations into its corporate bond purchase scheme. The decision has been taken as part of a broader effort by central banks globally to incorporate environmental sustainability into their monetary policy frameworks.”

[COMMENTARY] The Bank of England, the European Central Bank, and a few other central banks are taking steps to assist in…

View On WordPress

0 notes

Text

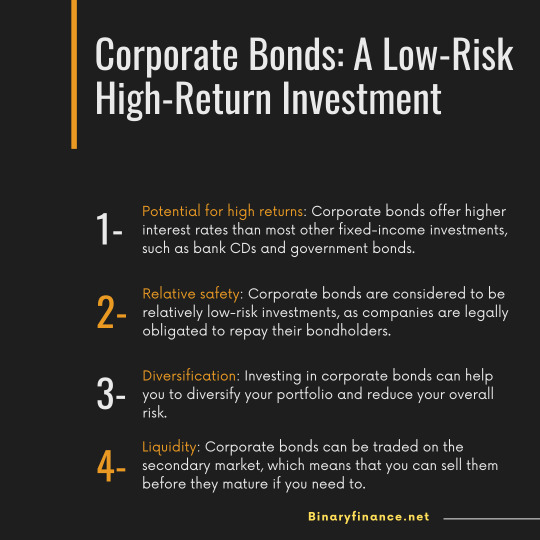

Corporate Bonds: A Low-Risk High-Return Investment

0 notes

Text

Có nên đầu tư vào trái phiếu doanh nghiệp?

Trái phiếu doanh nghiệp là trái phiếu được doanh nghiệp phát hành ở dạng tài sản dữ liệu điện tử, chứng chỉ hay bút toán ghi nợ. Đồng nghĩa khia mua trái phiếu là người mua cho doanh nghiệp mượn nợ. Và doanh nghiệp có nghĩa vụ thanh nợ (cả gốc và lãi suất) cho người sở hữu trái phiếu vào ngày đáo hạn, theo quy định. Có 2 loại trái phiếu doanh nghiệp, là trái phiếu niêm yết và trái phiếu OTC. Ưu điểm khi đầu tư vào trái phiếu doanh nghiệp là lãi suất ổn định và an toàn hơn đầu tư cổ phiếu, cao hơn so với tiết kiệm ngân hàng. Về rủi ro, thì có nguy cơ sẽ không được thanh toán nợ nếu doanh nghiệp phá sản mất khả năng thanh toán. Do đó, khi đầu tư vào trái phiếu doanh nghiệp, ưu tiên hàng đầu tư phân tích và tìm hiểu quá trình hoạt động kinh doanh, và tiềm năng tăng trưởng của doanh nghiệp đó. Xem chi tiết trái phiếu doanh nghiệp tại: https://seiofva.com/trai-phieu-doanh-nghiep-la-gi/

#seiofva #traiphieudoanhnghiep #traiphieu #doanhnghiep #chungkhoan #bonds #stock #corporatebond

#trai-phieu-doanh-nghie #trai-phieu #chung-khoan #doanh-nghiep #corporate-bond

#seiofva#trái phiếu#trái phiếu doanh nghiệp#doanh nghiệp#chứng khoán#stock#bonds#corporate#corporate bonds

1 note

·

View note

Text

Best Bonds to Buy in India

When it comes to smart financial decisions, investing in bonds is a path worth considering. In India, a diverse range of bonds offer stability and attractive returns. In this guide, we'll explore the best bond options available for you to buy, helping you make informed decisions to secure your financial future.

Understanding Bonds:

Bonds are essentially loans that you provide to the government or a company. In return, they promise to pay you back with interest over a specified period. These investments are generally considered safer than stocks and can be an excellent way to diversify your portfolio.

Top Bond Options in India:

Government Bonds: These bonds are issued by the Indian government. They are considered highly safe, making them an ideal choice for risk-averse investors. Within this category, you can view:

Sovereign Gold Bonds (SGBs): These bonds allow you to invest in gold electronically, eliminating the need to physically store the metal. They offer interest and potential capital appreciation.

RBI Savings Bonds: Backed by the Reserve Bank of India, these bonds provide a fixed interest rate and come with various tenure options.

Corporate Bonds: These bonds are issued by companies to raise capital. They offer higher interest rates compared to government bonds, but they also involve slightly higher risk. Some prominent corporate bonds include:

AAA-rated Corporate Bonds: These bonds come from highly reputable companies with a strong credit history, reducing the risk significantly.

Tax-Free Bonds: Issued by government-backed institutions, these bonds offer tax benefits to investors.

Municipal Bonds: Issued by local governments or municipalities, these bonds fund public projects. They can offer tax advantages and contribute to local development.

Factors to Consider:

Credit Rating: Always check the credit rating of the bond issuer. Higher-rated bonds are generally safer investments.

Yield and Duration: Considproducte yield (interest rate) and the duration of the bond. Longer durations might offer higher yields but also carry higher interest rate risk.

Tax Implications: Different bonds have varying tax treatments. It's important to understand whether the interest is taxable or tax-free.

Diversification: Spread your investments across different types of bonds to minimize risk.

How to Buy Bonds:

You can buy bonds through various channels, including:

Banks and Financial Institutions

Stock Exchanges

Online Trading Platforms

Conclusion:

Investing in bonds can be a wise decision to balance your investment portfolio and generate consistent returns. The best bond to buy in India depends on your risk tolerance, financial goals, and investment horizon. Government bonds provide safety, corporate bonds offer higher yields, and municipal bonds contribute to local development. Remember to research thoroughly, diversify your investments, and stay updated with market trends. By doing so, you can secure your financial well-being and achieve your long-term aspirations.

Remember, while bonds are generally considered safer than stocks, no investment is entirely risk-free. Always consult with a financial advisor before making significant investment decisions.

#finance#investment#invest#invest in bonds#bonds#bonds market#Tax-Free Bonds#Corporate Bonds#Sovereign Gold Bonds (SGBs)#Sovereign Gold Bonds#SGB

0 notes

Video

The Fixed Income is the biggest platform to buy and invest in bonds online. Types of bonds are available online to invest. Learn how to invest in bonds with our bond guru. Read our latest blog and news on bonds.

0 notes

Text

Why are Bonds Known as Fixed Income Investments?

Savvy investors love to diversify their portfolios across several asset classes to protect themselves against unforeseen turns in the investment market. One of the ways they do this is through ownership of bonds.

Bonds have developed a reputation for being less volatile than other investment sources; they deliver a steady income stream while shielding the investor’s principal even in a falling market. This characteristic is no surprise, as bonds are generally classified as fixed-income investments. But what does the term ‘fixed-income’ mean, and what are the benefits of owning fixed-income assets? Read along to find out.

What are Fixed Income Investments?

Fixed-income investments pay their investors fixed interest or dividend payments until maturity. They tend to focus more on capital preservation and a steady income stream. They are typically low-risk, low-reward investments whose principal goal is to deliver as much income as possible with as little risk to the investor and the amount invested. Fixed income has three significant characteristics:

They are more focused on capital preservation.

They have an unwavering stipulated (fixed) interest payment at specified intervals.

The owners bear little to no risk of the business they invested in, nor do they own any part of the business.

Government and corporate bonds are prominent examples of fixed-income investments.

What are Fixed Income Bonds?

Bonds are debtor notes issued by either government or corporations to investors. Other investments usually pay out variable income securities based on underlying measures like short-term interest rates. Fixed-income bonds pay a fixed, predetermined rate that doesn’t change throughout the bond’s duration.

When many fixed-income bonds mature, the company pays the investors the equivalent of their principal and specified fixed interests. If the bond issuer defaults, the investor gets paid first before the stockholders.

Types of Fixed Income Bonds

Fixed-income bonds are an essential concept for both the issuer and the investor. The bond issuer gets to raise needed capital for projects or other operations without losing shares or control over its company. In contrast, the investor gets a regular fixed income with minimal risk of loss. Here are some common types of fixed-income bonds:

Government Bonds

Government bonds are fixed-income bonds entirely issued and backed by the government of a country or region. They are also called municipal bonds at the state or local government levels. They are considered among the safest bonds to undertake amongst investors, while the government uses the funds to embark on annual expenditures. Most of them are tax-free.

Corporate Bonds

Corporate bonds are issued and backed by private institutions; their value and risk assessment are based on their creditworthiness and the collateral to which the bond is tied. Corporations with higher credit ratings pay lower interest rates, and money obtained from bonds is helpful to a company’s expenditure.

Junk Bonds or High Yield Bonds

Because many bonds are low-risk investments, they usually come with lower returns. High-yield bonds come with higher returns but at a significantly higher risk. This increased risk results from being issued by corporations with low credit ratings or the assets tied to them being shaky. Investors who can manage more risks go for this bond type.

Certificate of Deposits

A certificate of deposit is a fixed deposit account with significantly higher profit rates, and financial institutions usually offer them a maturity of fewer than five years. Additionally, certificates of deposits come with National Credit Union Association (NCUA) protection.

Fixed Income Bonds to Buy in the United States

With a sound investment strategy, you can buy several fixed bonds in the United States. Here are some of the more prominent ones:

Treasury Bonds (T-Bonds)

Treasury bonds are issued at the Federal level and backed by the United States. They are considered one of the safest bonds and have 20 to 30 years of maturity. You can purchase them in multiples of $100.

Treasury Inflation-Protected Securities (TIPS)

One of the risks often associated with bonds is the depreciation of the principal’s value due to inflation. TIPS protect the investor from all that as the value adjusts with deflation and inflation.

Treasury Notes (T-Notes)

Treasury Notes are similar to treasury bonds but have a lower maturity length. While T-bonds mature in at least two decades, T-Notes have a much shorter time frame of two to ten years. Like T-bonds, however, they are acquired by an increment of $100.

Municipal and Private Corporate Bonds

Municipal bonds are issued at state and local government levels and can also be invested in the United States. In addition, several private corporations also offer bonds to investors when they wish to raise funds for a project or venture.

Fixed Income Investment Strategies

Although bonds are relatively safe for the investor, they still must be cautiously approached. Here are just a few strategies you might want to use:

Laddered Bond Portfolio Investment

The laddered investment strategy is focused on diversifying bond portfolios by acquiring bonds with different maturity dates. This strategy enables the investor to use the principal of lower rung bonds in higher rung bonds.

Bullet Bond Portfolio Investment

This investment strategy involves purchasing various bonds at different dates but with the exact maturity dates. The strategy works for investors who need massive amounts of cash at a future date.

Barbell Bond Portfolio Investment

The Barbell strategy requires investing in very short-term and long-term bonds. The investor has to pay attention to his investments to keep reinvesting the short-term bonds when they mature.

Benefits of Fixed Income Investments

Fixed-income investments are highly beneficial in many ways. Some of the advantages of this sort of investment include the following:

They make it easier to diversify your investment, especially when the market is very volatile.

They provide good returns and a steady stream of income.

Fixed income comes with a relatively lower risk exposure than other investment classes.

Fixed-income bonds are less likely to be affected by market volatility.

Conclusion

Bonds are known as fixed investments because they offer fixed interest returns and have significantly lower risk exposure than most investments. You can choose multiple bond investment types and strategies for these investment routes. Investing in fixed investment bonds is one way to save something for a rainy day. Contact REICG Real Estate Investment Fund.

#Real Estate Investment Fund#diversifying bond portfolios#Fixed Income Investments#Fixed Income Bonds#Government Bonds#Corporate Bonds#Benefits of Fixed Income Investments

1 note

·

View note

Text

What Are Corporate Bonds And Why You Should Invest In Them

Corporate bonds are a type of debt security issued by companies to raise capital. They are typically used to finance expansion, acquisitions, or other major projects. Unlike stocks, which represent ownership in a company, corporate bonds represent a loan that must be repaid with interest.While corporate bonds offer several advantages for investors, there are also some disadvantages to consider.Advantages:- Corporate bonds typically offer higher interest rates than other types of debt securities, such as government bonds. This makes them an attractive option for investors seeking income.- Corporate bonds are generally less volatile than stocks, which means they can provide stability for portfolio.- Interest payments on corporate bonds are usually tax-deductible, which can lower your overall tax bill.Disadvantages:- If the company issuing the bond defaults on its loan, you could lose your entire investment.- Corporate bonds are often less liquid than other types of investments, which means it may be difficult to sell them when you need the cash.- You may be required to pay a commission or fee when you buy or sell corporate bonds.

0 notes

Link

Are you are confused? Are you unable to decide on the best investment option between the two Corporate Bonds and Fixed Deposits ? Do not worry. FDs in India are a popular saving instrument and It is facilitated by private, nationalized banks, NBFCS, and other entities. Unlike other investment instruments, FDs have their own limitation.

0 notes

Text

How to invest in bonds in India?

In India, there are three ways to invest in bonds. You can purchase bonds through a broker, ETFs or mutual funds. You can also buy it through RBI Retail Direct.

0 notes

Text

#themedifiguy#medifiguy#medical student#medical doctor#south africa#personal finance#investing#bonds#government bonds#corporate bonds

0 notes

Text

Corporate Bonds in India

0 notes

Text

Finest Arbitrage Funds In 2021 To Park Cash For The Brief

A excessive expense ratio places downward stress on your take-home returns. One of the first disadvantages of arbitrage funds is their mediocre reliability. As famous above, arbitrage funds aren't very profitable during secure markets.

This permits traders to profit from market volatility without taking up too much danger.

Riskier offers might represent smaller allocations in the portfolio.

The arbitrage fund's fund supervisor can usually search for arbitrage alternatives since these can influence the fund's returns.

The fund must be a certified participant in the ETF market to use this strategy.

These funds will provoke an arbitrage position by shopping for a inventory in the money phase and promoting concurrently equal portions of the stock in the futures segment of the market. The positions thus initiated are to be reversed before or during the expiry of the futures collection. Merger arbitrage is a fundamentally completely different investment technique whose threat and returns are not depending on the path of the stock market. This web site is neither an offer to promote nor a solicitation of a suggestion to purchase any of the securities described herein. An investment in any of the NexPoint choices involves threat, and there may be no assurance that the funding goals will be met. life insurance understood that benefiting from a short-term worth difference is its core.

Baroda Bnp Paribas Arbitrage Fund Direct Growth

Munn is a portfolio manager of Water Island Capital, LLC. Prior to changing into a portfolio supervisor of the Fund, Mr. Munn was a senior fairness analyst for the Fund. Mr. Munn acquired a Master of Business Administration degree from Fordham Graduate School of Business in 2003 and a Bachelors degree from Gettysburg College in 1993 — with a double main in Finance and Accounting. Units within the funds are therefore not being offered or sold within the United States/ Canada or to United States/ Canadian Persons.

Suppose the fairness share of an organization ABC trades within the cash market at Rs 1,220 and in the future market at Rs 1,235. The fund supervisor buys ABC shares from the money market at Rs 1,220 and kinds a futures contract to promote the shares at Rs 1,235. Towards the end of the month when the costs coincide, the fund manager will sell the shares within the futures market and generate a risk-free revenue of Rs 15 per share much less the transaction prices. They give traders exposure to a wide variety of belongings by pooling together cash from different investors and purchasing shares, bonds, and other securities. Funds are managed by portfolio or cash managers who attempt to generate features or earnings for his or her traders. Fund portfolios are designed to match their targets and aims.

Short Movie: When The Bride Is Left On The Altar, It Makes For A Foul Event Understanding Merger Arbitrage

The fund invests sixty nine.9% in domestic equities, 18.2% in treasury bills, 8.8% in money equal and money equivalents, 2.5% in commercial paper and zero.7% in corporate debt. Arbitrage funds maintain a minimal of 65% in equities where the identical is hedged, thus they're taxed as equity oriented funds. If an investor redeems investments after one year, the gains from total equities are tax-free up to Rs 1 lakh, as per present tax legal guidelines.

youtube

#accounting#actuarial science#arbitrage funds#bank investments#bearer debenture#become a billionaire#become a millionaire#behavioral finance#bond market#bond yields#business ideas#business that can make you a billionaire#capital investment#capital market#compound interest#convertible bonds#corporate bonds#corporate finance#debt instruments#debt market#debt securities#dividend stocks#equity investors#equity research#etf mutual funds#finance#finance investment#finance management#financial accounting#financial advisor

1 note

·

View note