#Coal Mining Market Demand

Text

The Global Coal Mining Market share, Growth and Outlook

The Global Coal Mining Market remains a vital sector in the energy industry, providing a significant portion of the world's electricity and fueling industrial activities worldwide. However, the landscape of coal mining is undergoing profound changes, influenced by market dynamics, regulatory shifts, and environmental concerns. Let's explore the industry's intricacies with a closer look at the latest statistics and insights.

Harnessing the Power of Industry Research Reports

In-depth Coal Mining Industry Research Reports offer valuable insights and intelligence to industry stakeholders, enabling informed decision-making and strategic planning:

Market Analysis: These reports provide comprehensive analyses of market trends, demand-supply dynamics, competitive landscapes, and regulatory frameworks, empowering businesses to identify opportunities and mitigate risks.

Competitive Intelligence: By assessing the strategies and performance of key market players, companies can gain valuable insights into industry dynamics and competitive positioning, facilitating effective market entry and expansion strategies.

Understanding the Scale of the Coal Mining Industry

The Coal Mining Market is characterized by its expansive reach and substantial economic impact. Here are some compelling statistics that underscore its significance:

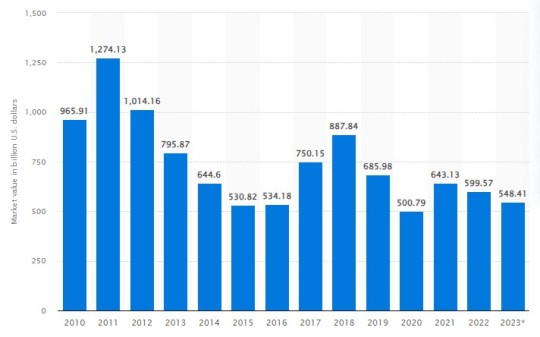

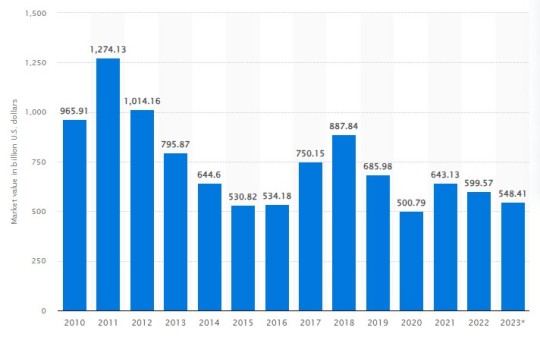

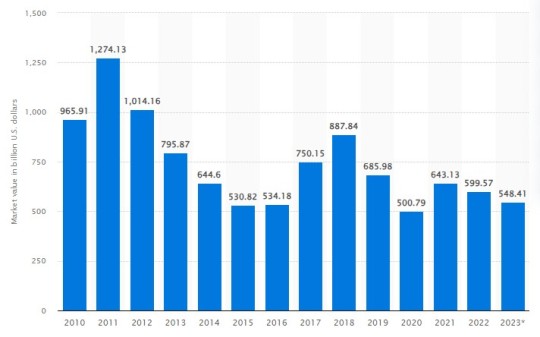

Market Size: With a market value exceeding $869 billion in 2020, the global coal mining industry continues to play a pivotal role in the energy sector's overall landscape.

Market Share: Leading coal mining companies, including BHP Group, Glencore, and China Shenhua Energy, command a substantial share of the market, leveraging their extensive operations and strategic investments.

Click here – To know more about Mining market

Addressing Key Challenges Facing the Industry

Despite its prominence, the coal mining sector faces a host of challenges that necessitate strategic adaptation and innovation:

Environmental Pressures: Heightened concerns over climate change and air pollution have led to increased regulatory scrutiny and calls for cleaner energy alternatives, challenging the traditional dominance of coal in the energy mix.

Market Volatility: The coal mining industry is susceptible to fluctuations in commodity prices, geopolitical tensions, and shifts in energy policies, necessitating agility and resilience to navigate uncertain market conditions.

Exploring Opportunities for Growth and Innovation

Amidst the challenges, the coal mining industry also presents opportunities for innovation and growth:

Technological Advancements: Advancements in mining technologies, such as automation, robotics, and remote sensing, are enhancing operational efficiency, safety, and productivity, driving cost savings and competitive advantage.

Diversification Strategies: Coal mining companies are diversifying their portfolios to include cleaner energy sources like natural gas and renewable energy, positioning themselves for long-term sustainability and resilience in a transitioning energy landscape.

Conclusion

The Global Coal Mining Market continues to evolve in response to changing market dynamics and regulatory imperatives. By leveraging industry insights, embracing innovation, and adopting sustainable practices, coal mining companies can navigate challenges, capitalize on opportunities, and chart a course towards long-term success in an ever-changing energy landscape.

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market Challenges#Coal Mining Market in India#Coal Mining Market Value#Global Coal Mining Market#Coal Mining Market Competitors#Coal Mining Market Analysis#Coal Mining Market Forecast#Coal Mining Market Outlook#Coal Mining Industry Research Reports#Coal Mining Market Research Reports#Coal Mining Market Major Players#Coal Mining Market Share

0 notes

Text

Exploring the Dynamics of the Coal Mining Market Growth, Market Revenue and Future Outlook

The Coal Mining Market stands as a vital pillar in the global energy landscape, navigating constant evolution and diverse challenges. This exploration delves into the growth, size, demand, challenges, regional nuances, competitive forces, and the future outlook that characterize the intricate terrain of the Coal Mining industry.

Growth Trajectory: Illuminating the Coal Mining Market

Understanding the growth patterns in the Coal Mining Market is pivotal to gauging its economic impact and industry vitality. The industry has witnessed steady growth, driven by increasing global demand for coal as a primary energy source. The key highlights include an annual growth of 5%, indicating sustained demand, and developing economies contributing significantly to this upward trajectory.

Sizing Up: Coal Mining Market Size Analysis

The sheer scale of the Coal Mining Market is instrumental for stakeholders seeking to comprehend its economic footprint and potential opportunities. The market size is substantial, with a valuation of USD 50 billion in the last fiscal year. Variations in market size are influenced by factors such as coal reserves, production capacities, and regional demand.

Meeting Demand: Coal Mining Market Demand Dynamics

The Coal Mining Market demand for coal remains a critical driver for the Market, impacting various industries, especially power generation and manufacturing. Despite global efforts to diversify energy sources, coal continues to meet a substantial portion of the world's energy demand.

Navigating Challenges: Coal Mining Market Challenges Unveiled

Challenges inherent in the Coal Mining industry require strategic approaches to ensure sustainable operations and compliance with evolving regulations. Environmental concerns, regulatory complexities, and the emergence of renewable energy sources are among the key challenges faced by the industry.

Regional Dynamics: Focus on Coal Mining Market in India

India plays a pivotal role in the Global Coal Mining Market, with unique dynamics shaping its industry landscape. The Coal Mining Market in India is characterized by extensive coal reserves and a significant contribution to the country's energy mix. Policy initiatives and technological advancements influence the growth trajectory of the Coal Mining Market in India.

Competing Forces: Coal Mining Market Competitors in the Limelight

The competitive landscape involves established industry leaders vying for market share and emerging players seeking to make their mark. Coal Mining Market Competitors engage in strategic alliances and investments in advanced mining technologies.

Future Outlook: Coal Mining Market Forecast and Outlook

The Coal Mining Market future outlook is influenced by global energy transitions, technological advancements, and evolving consumer preferences. The Coal Mining Market Forecast is optimistic, driven by sustained demand from industrial and power generation sectors.

Conclusion

The Coal Mining Market remains a dynamic force in the global energy sector, navigating growth, challenges, and evolving market dynamics. Stakeholders must stay attuned to these dynamics for informed decision-making in this critical industry.

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market Challenges#Coal Mining Market in India#Coal Mining Market Value#Global Coal Mining Market#Coal Mining Market Competitors#Coal Mining Market Analysis#Coal Mining Market Forecast#Coal Mining Market Outlook#Coal Mining Industry Research Reports#Coal Mining Market Research Reports#Coal Mining Market Major Players#Coal Mining Market Share

0 notes

Text

#Mining Shovel Market Current Scenario and Industry Growth Forecast with Major Key Players data by 2032#The global mining shovel market is estimated to create an absolute dollar opportunity of over US$ 10 Bn by the end of 2032. The sales of mi#exhibiting growth at 2% to 3% CAGR during the forecast period 2022-2032. Increasing emphasis on the development and introduction of advance#Mining shovels are mostly electric powered#and are primarily utilized for digging and loading earth#and for the extraction of minerals. Mining shovels are utilized in the surface mining of gold#copper#coal#and other commodities across the globe. Mining shovels are available in a wide range of payload capacities all over the world. They are des#Due to the rapid industrialization of emerging economies#particularly China and India#there has been significant growth in the demand for mined resources such as coal#iron ore#etc. Thus#it is anticipated that the demand for mining shovels will increase in the near future.#To Know more@#https://www.futuremarketinsights.com/reports/mining-shovel-market

0 notes

Text

Solarpunk is not archievable under Capitalism

Okay, let me make one thing very clear: We will never have a Solarpunk future as long as we live under capitalism. Again and again I will find people, who have fallen in love with the idea of Solarpunk, but are unwilling to consider any alternative to capitalism. So, please, let me quickly explain what that just is not gonna work out that way. There will be no Solarpunk under capitalism. Because the incentives of capitalism are opposing anything that Solarpunk stands for.

So let me please run over a few core points.

What is capitalism?

One issue that a lot of people do seem to have is understanding what capitalism even is. The defining attribute of capitalism is that "the means of production" (e.g. the things needed to create things) are privately owned and as such the private owners will decide both what gets created through it and who will get a share in any profits created through them. The ultimate goal in this is, to generate as large as a profit as possible, ideally more and more profit with every year. In real terms this means, that most of those means of productions in the way of companies and the like are owned mostly by shareholders, that is investors who have bought part of the company.

While capitalism gets generally thaught in schools with this entire idea of the free market, that... actually is not the central aspect of capitalism. I would even go so far to argue something else...

The market is actually not free and cannot be free

The idea of the free market is, that prices are controlled by the concept of supply and demand, with the buyer in the end deciding on whether they want to spend their money on something and being able to use that power to also enact control on the supplier.

However... that is actually not what is happening. Because it turns out that the end consumer has little influence, because they are actually not actively participating in the market. The market mainly is something that is happening between multimillionaires. It is their demand (or the lack thereoff) that is the influence. Investors, mainly. Which is logical. In a system, where the power to buy is deciding, the person who can spend multiple millions is gonna have a lot more power, than the person who has twenty bucks to their name.

Hence: 99% of all people are not participating in anything resembling a free market, and the remaining 1% are not interested in such a system.

Money under capitalism

One thing everyone needs to understand is, that for the most part money under capitalism is a very theoretical concept. It might be real for the average joe, who for the most part will not have more than maybe ten grand to their name, but it is not real to multi millionaires, let alone billionairs. Something that is going to be thrown around a lot is the concept of "net worth". But what you need to realize is that this net worth is not real money. It does not exist. It is the estimated worth of stuff these people own. Maybe houses and land, maybe private jets, maybe shares in companies and other things. These people's power and literal worth is tied to them being able theoretically able to sell these assets for money.

In fact a lot of these very rich people do not even have a lot of liquid money. So money they can spend. In fact there are quite a few billionairs who do not even own a million in liquidated money. The money they use in everyday life they borrow from banks, while putting their assets up as a security.

Why capitalism won't abolish fossil fuels

Understanding this makes it quite easy to understand why the capitalists cannot have fossil fuels ending. Because a lot of them own millions, at times billions in fossil fuel related assets. They might own a coal mine, or a fracking station, or maybe an offshore rig, or a power plant burning fossil fuels. At times they have 50% or more of their net worth bound in assets like this. If we stopped using fossil fuels, all those assets would become useless from one day to the next. Hence it is not in the interest of these very rich people to have that happen.

But it goes further than that, because politicians cannot have that happen either. Because the entire economy is build around these assets existing and being used as leverage and security for other investments.

Why capitalism won't build walkable cities and infrastructure

The same goes very much for the entire infrastructure. Another thing a lot of people have invested a lot of money into is cars. Not physical cars they own, but cars manufacturing. So, if we were building walkable cities with bikelanes and public transportation, a lot less people would buy cars, those manufactoring factories becoming worthless and hence once more money... just vanishing, that would otherwise be further invested.

Furthermore, even stuff like investing into EVs is a touch call to get to happen, because the investors (whose theoretical and not real money is tied to those manufacturers) want to see dividents at the end of the quartal. And if the manufactuerer invested into changing their factories to build EVs for a while profits would go down due to that investment. Hence, capitalism encourages them not doing that.

Why capitalism won't create sustainable goods

A lot of people will decry the fact that these days all goods you buy will break within two years, while that old washing machine your grandparents bought in 1962 is still running smoothly. To which I say: "Obviously. Because they want to make profits. Hence, selling you the same product every two years is more profitable."

If you wonder: "But wasn't that the same in 1962?" I will answer: "Yes. But in 1962 the market was still growing." See, with the post war economic boom more and more people got more divestable income they could spend. So a lot of companies could expect to win new costumers. But now the market is saturated. There is not a person who could use a washing machine, who does not have one. Hence, that thing needs to break, so they can sell another one.

The market incentive is against making sustainable, enduring products, that can be repaired. They would rather have you throw your clothing, your smartphone and your laptop away every two years.

Why workers will always be exploited under capitalism

One other central thing one has to realize about capitalism is that due to the privitization of the means of production the workers in a capitalist system will always be exploited. Because they own nothing, not even their own work. Any profit the company makes is value that has in the end been created by the workers within the company. (Please note, that everyone who does not own their work and cannot decide what happens to the value created by it is a worker. No matter whether they have a blue collar or a white collar job.)

That is also, why there is the saying: All profit is unpaid wages.

Under capitalism the profits will get divided up under the shareholders (aka the investors), while many of the workers do not even have enough money to just... live. Hence, good living standards for everyone are explicitly once more against the incentives of capitalism.

Why there won't be social justice under capitalism

Racism, sexism and also the current rise of queermisia are all a result of capitalism and have everything to do with capitalist incentives. Because the capitalists, so the people who own the means of production, profit from this discrimination. This is for two reasons.

For once having marginalized people creates groups that are easier exploitable. Due to discrimination these people will have a harder time finding a job and living quarters, making them more desperate and more likely to take badly paid jobs. Making it easier to exploit them for the profit of the capitalists.

A workforce divided through prejudice and discrimination will have a harder time to band together in unions and strikes. The crux of the entire system si, that it is build on the exploitation of workers - but if the workers stopped working, the system would instantly collapse. Hence the power of strikes. So, dividing the workforce between white and non-white, between queer and straight, between abled and disabled makes it easier to stop them from banding together, as they are too busy quaralling amoung themselves.

Why we won't decolonize under capitalism

Colonialism has never ended. Even now a lot of natural ressources and companies in the former colonies are owned by western interest. And this will stay that way, because this way the extraction of wealth is cheaper - making it more profitable. Colonialism has never ended, it has only gotten more subtle - and as long as more money can be made through this system, it will not end.

There won't be Solarpunk under capitalism

It is not your fault, if you think that capitalism cannot end. You have been literally taught this for as long as you can think. You never have been given the information about what capitalism is and how it works. You have never been taught the alternative mechanisms and where and when they were implemented.

You probably look at Solarpunk and think: "Yeah, that... that looks neat. I want that." And here is the thing: I want that, too.

But I have studied economics. Literally. And I can tell you... it does not work. It will not create better living situations for everyone. It will not save the world. Because in the end the longterm goals are not compatible with a capitalistic system.

I know it is fucking scary to be told: "Yeah, change the world you know in massive ways - or the world will end." But... it is just how the things are standing.

You can start small, though. Join a local party. Join a union. Join a mutual aid network. Help repair things. Help people just deal. Our power lies in working together. That is, in the end, what will get us a better future.

#solarpunk#anarchism#anti capitalism#unions#environmentalism#save the planet#explanation#sustainability#renewable energy#end fossil fuels#communism

757 notes

·

View notes

Text

But sleep will not come. What is the cause of this cruelty, this stupidity? A million workmen come from Japan to kill or mutilate a million Chinese workmen. Why should the Japanese worker attack his brother worker, who is forced merely to defend himself. Will the Japanese worker benefit by the death of the Chinese? No, how can he gain? Then, in God's name, who will gain? Who is responsible for sending these Japanese workmen on this murderous mission? Who will profit from it? How was it possible to persuade the Japanese workmen to attack the Chinese Workman -- his brother in poverty; his companion in misery?

Is it possible that a few rich men, a small class of men, have persuaded a million men to attack, and attempt to destroy, another million men as poor as they? So that these rich may be richer still? Terrible thought! How did they persuade these poor men to come to China? By telling them the truth? No, they would never have cone if they had known the truth, Did they dare to tell these workmen that the rich only wanted cheaper raw materials, more markets and more profit? No, they told them that this brutal war was "The Destiny of the Race," it was for the "Glory of the Emperor," it was for the "Honour of the State," it was for their "King and Country."

False. False as hell!

The agents of a criminal war of aggression, such as this, must be looked for like the agents of other crimes, such as murder, among those who are likely to benefit from those crimes. Will the 80,000,000 workers of Japan, the poor farmers, the unemployed industrial workers -- will they gain? In the entire history of the wars of aggression, from the conquest of Mexico by Spain, the capture of India by England, the rape of Ethiopia by Italy, have the workers of those "victorious" countries ever been known to benefit? No, these never benefit by such wars. Does the Japanese workman benefit by the natural resources of even his own country, by the gold, the silver, the iron, the coal, the oil? Long ago he ceased to possess that natural wealth. It belongs to the rich, the ruling class. The millions who work those mines live in poverty. So how is he likely to benefit by the armed robbery of the gold, silver, iron, coal and oil from China? Will not the rich owners of the one retain for their own profit the wealth of the other? Have they not always done so?

It would seem inescapable that the militarists and the capitalists of Japan are the only class likely to gain by this mass murder, this authorized madness, this sanctified butchery. That ruling class, the true state, stands accused.

Are wars of aggression, wars for the conquest of colonies, then, just big business? Yes, it would seem so, however much the perpetrators of such national crimes seek to hide their true purpose under banners of high-sounding abstractions and ideals. They make war to capture markets by murder; raw materials by rape. They find it cheaper to steal than to exchange; easier to butcher than to buy. This is the secret of war. This is the secret of all wars. Profit. Business. Profit. Blood money.

Behind all stands that terrible, implacable God of Business and Blood, whose name is Profit. Money, like an insatiable Moloch, demands its interest, its return, and will stop at nothing, not even the murder of millions, to satisfy its greed. Behind the army stand the militarists. Behind the militarists stand finance capital and the capitalist. Brothers in blood; companions in crime.

What do these enemies of the human race look like? Do they wear on their foreheads a sign so that they may be told, shunned and condemned as criminals? No. On the contrary. they are the respectable ones. They are honoured. They call themselves, and are called, gentlemen. What a travesty on the name, Gentlemen! They are the pillars of the state, of the church, of society. They support private and public charity out of the excess of their wealth. they endow institutions. In their private lives they are kind and considerate. they obey the law, their law, the law of property. But there is one sign by which these gentle gunmen can be told. Threaten a reduction on the profit of their money and the beast in them awakes with a snarl. They become ruthless as savages, brutal as madmen, remorseless as executioners. Such men as these must perish if the human race is to continue. There can be no permanent peace in the world while they live. Such an organization of human society as permits them to exist must be abolished.

From "Wounds," by Norman Bethune, a Canadian Communist who died serving the Chinese Communist Revolution

37 notes

·

View notes

Text

In the late 1920s, the Great Western Railway was paying close attention to its South Welsh coal traffic. A Pandora’s Box had been opened by the Great War; ten years after its end, the mining industry was still simultaneously roiled by labor strife and the new issue of competition from other countries who could sell their coal cheaper. Beyer-Peacock was contracted to draw and construct a small number of Garratts, (the GWR leadership was too conservative to build them themselves, although the blue collar rank of Swindon had been eager to try and distraught at being denied,) each of which would do the work of two eight-coupled heavy goods engines. This would cut down on crewing costs and beneficially not require alteration to the existing permanent way.

Six 2-8-0+0-8-2 Garratts were built in a single batch in 1933, hitting the rails just as demand for coal was cratering. Their introduction also meant the redundancy of a dozen or so 4200 Class tanks which already were under scrutiny due to market trends of the day. The Garratts, quickly named “Super Taffys,” were at first resented for their foreignness, but their comfortable cabs and smooth riding quickly won enginemen over.

They survived intact as a class until 1959 when withdrawals began, and never strayed much from their home turf. As a result, they drew trainspotters from the country over to South Wales. A much overpowered double-header Farewell Special was arranged in the summer of 1964, (which worked out beautifully as the class weren’t fitted to steam heat passenger stock,) and these two last survivors were sold right into preservation. This was for the best, not merely for posterity but because Woodham Brothers of Barry Island “couldn’t be buggered” with storing them had they gone for scrap.

#alternate railway history#fictional real life engines#fictional real life railways#houseboat’s writing

34 notes

·

View notes

Photo

On this day, 15 April 1946, mine workers in Takahagi, Japan, won a crucial victory against their employer after seizing control of the mines they worked in. The dispute took place during the period of US occupation of Japan after World War II, when the Japanese workers' movement began to reassert itself after years of oppression of workers' organisation. A wave of strikes began, new unions emerged and workers developed a tactic called "production control" to put pressure on employers. Beatrice Reubens, a US State Department official, who wanted to end the practise, described it thusly: "the workers, instead of striking and holding up production, locked out their employers and took over the operation of the establishment. While the owners were considering the union demands or carrying on negotiations for a settlement, the workers continued to produce, buy and sell, without permitting company officials either voice in the enterprise or access to the premises. After settlement, usually with a full victory for the workers, the plant was turned back to the management." Takahagi miners near Tokyo wanted better pay and conditions, and so took over their mines in March, then began to try to sell coal directly on the market, bypassing their employer. The government first declared production control illegal, but after 6,000 union activists held a protest meeting outside the ministries of Transport and Commerce on April 12 and chased off the police guard, the Commerce Minister backtracked and agreed that the workers could sell the coal freely. At this point the mining company then began negotiations over the workers' demands. Elsewhere, miners in Hokkaido not only took over Mitsubishi mines but set up a "people's court" to try senior company officials as war criminals. More information, sources and map: https://stories.workingclasshistory.com/article/8637/takahagi-miners-win-payment Pictured: Japanese coalminers, 1950s https://www.facebook.com/photo.php?fbid=609253857914500&set=a.602588028581083&type=3

235 notes

·

View notes

Text

Okay so I’ve been thinking about this for a while. Basically in the Hunger Games, district 12 would have to be mostly seam.

So we know there is the seam and the ‘downtown’ sorta place, where the tailors, bakers, doctors, and other goods are, and then the seam which all the coal miners and their families.

A majority of District 12, would have to work in the mines, considering how much the capital demands of them, and how they punish them if they don’t work.

Also coal miners are very poor, hince the terrible conditions of the seam, they couldn’t shop to but fruits and sweets, most can’t keep food on the table. But I don’t think the town area could keep itself a float with just each other buying things so how does it work?

Also there’s the hob or the black market, which is much less pricey than the town, driving them out of business more. They would have collapsed in on itself by now.

District 12 seems to be one of the only districts to have two different classes when in itself.

Katniss says in the books that her mother left town when she married her father, that would mean if you marry a coal miner you would have to move to the seam.

Do you think that the capital would create a system like this to maintain the poverty of District 12, and have more coal miners born for them each year.

Also the more children in the seam the terrence they would have to take, which means they’re names in the bowl more times.

Did I connect everything together or just have a minor mental breakdown?

#the hunger games#thg series#thg#katniss everdeen#katniss everdeen father#district 12#capital#i connected the dots#you didn’t connect shit#my hunger games stuff

21 notes

·

View notes

Text

December 13th 1911 saw the death of Thomas Glover, an industrial pioneer in Japan.

Glover was born in Fraserburgh, the son of a coast guard officer in 1838 and grew up in Aberdeen, Scotland, he joined the trading company on finishing school and worked briefly in the company's Shanghai office before taking up his assignment in Japan.

After performing well for two years selling opium to local middlemen, and trading in silks, tea and guns, Glover had reportedly already developed the gruff, imposing presence necessary to those in his position so far away from home — as well as the clout to command his own cut of the deals he was doing for his employer.

When he arrived in Nagasaki in 1859, aged 21 soon started his own company trading in ships and weapons with the rebellious Satsuma and Chosu clans in Kyushu and the Tosa from Shikoku, these factions were trying to overthrow the Shogun dynasty that ruled Japan in those days so it was initially a dangerous game he was playing and it could have all went pear shaped if the rebels had not won on the day. Glover not only survived, but he prospered mightily in his first eight years in Japan.

It has to be said that up till this point, around 1863, Japan was still basically pre industrial revolution, there disputes were settled by sword, Glover and others like him changed all that, and it became a matter of urgency to acquire sidearms, rifles, machine guns — and warships, he soon became the biggest arms dealer in the on Kyushi, Japan's third biggest island.

When the Shoguns were overthrown and Japan now more open than ever before for trade with the world, the market for his weaponry soon became saturated as the new Meiji administration assumed sole control of acquisitions, while many of his old trading and drinking partners took up managerial positions. However, though his direct political influence waned, Glover’s connectedness and his experience brokering the building and sale in Japan of ocean-going ships guaranteed a favourable role for him under the new regime.

Demand for coal surged as steamships multiplied in Japanese waters. Glover, in partnership with the Hizen Clan, invested in developing the Takashima coal mine on an island near Nagasaki in 1868. Their mine was the first in Japan to employ Western methods of mining. Financial troubles later forced Glover to sell his stake, but he stayed on as manager of the mine for several more years. Mitsubishi acquired the mine in 1881 in the organization's first main diversification beyond shipping.

Another enterprise Glover played a role in that later became part of Mitsubishi is the Nagasaki Shipyard. Japan lacked modern facilities for repairing ships. So, Glover imported the necessary equipment for a slip dock in Nagasaki in 1868. He later sold his share to the government, which leased the dock to Mitsubishi as part of the shipyard in 1884.

While his involvement in the arms trade is questionable morally Glover is seen as having helped influence Japan in other ways, indeed an Enlightenment similar to The Scottish one has been mentioned in some of the sources I have looked at while compiling this post, with the spread of the new Meiji Era universities which evolved from English schools in the country.

Glover never returned to Scotland, he did spend two years in the US but returned to Japan, he had a common-law marital relationship with a Japanese woman named Awajiya Tsur and they had a daughter together.

Glover's former residences in Nagasaki has since been turned into museums, with the Glover Garden house in Nagasaki attracting two million visitors each year. There is also a statue of Thomas Blake Glover in Glover Garden, Nagasaki.

9 notes

·

View notes

Text

Global Drilling Dynamics: A Comprehensive Overview of Directional Drilling Services Worldwide

Directional drilling is technique where multiple holes are dug from same surface. This form of digging is used by oil companies for accessing the reservoir of oil which saves the operational cost and done with less damage to the environment. The directional drilling has been a part of oil industry for a longer period. The use of Directional Drilling has economic uses as well for the oil drilling companies because it has low maintenance and low equipment cost which is why it is preferred mainly. With the rising demand for sources of energy, companies are investing huge amount into advanced methods for drilling services. Use of advanced tools and technique for the discovery for finding new reservoirs with minimum expense and drilling them to bring out maximum output. The market will be driven by increasing demand for energy, rapid industrialization.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-toc-and-sample/14171

COVID-19 Impact analysis

The COVID-19 outbreak has highly impacted the oil & gases market. With rise in cases day by day, countries have been under complete lockdown. This resulted in low sales of automobiles and halt in industries such as airlines, transportation, and oil production.

The companies have to follow the lockdown protocol and shut down their production unit as per government rules and regulation. Also, because of shortage of labor and including their safety. Many ongoing projects have to be temporarily ceased with immediate effect. The oil & gas price and supply have been affected globally.

Top Impacting Factors

The population is growing rapidly and so is the demand for energy. The demand is more from developing countries owing to increasing infrastructure and changing lifestyle of people. To cope with the demand, it has become important to discover new oil and gas fields, to meet the energy demand. Thus, the market has been expanding due to increasing investment. The fluctuating crude oil price in the global market oil field operators are cutting down their expenses in field operations. Also, the government is now strict on the oil & gas mining. In several regions, government has applied some rules and regulation regarding the safety of workers and environment. The companies have to submit a rough plan to the government about their drilling plans and environment safety measures which they are taking. Apart from this, the list of equipment to be used and an evacuation plan in case of emergency if anything happens. Before drilling to get the permissions can take time and slower down the production and increase in production cost, which is expected to hamper the directional drilling services market. The increase in adoption of green energy sources will reduce dependency on oil & gas in the future is expected to affect the directional drilling services market.

Market Trends

The growing investment in off-shore sector to find more reservoirs and increase the oil & gas production. This makes it the fastest growing segment into the market. Countries like China, America, and Russia have already invested, because the cost of offshore drilling has declined over the past few years.

Currently the demand for coal, gases and fuels for transportation has been increasing due to globalization and urbanization, which needs the expansion of oil & gas industry and biggest market vendors such as China, Russia and the U.S. have increased their investment in search for oil fields.

The increased use of energy has expanded the global oil & gas industry. They are mainly used for the purpose of transportation, power generation, and industrial use with many other industries.

Technological advancement which helps drillers to go into more depth and advancement of drilling tools with better visibility under the water, America is dominating the market because of their better technology.

Countries which are largest consumer of oil & gas are China and the U.S.; they are investing more into renewable source of energy power generation to reduce carbon emission and their dependency on fossil fuels. They are setting hydro, solar and wind power energy substation at a larger extent, which will affect the oil, gas and drilling market at a larger level.

Enquiry Before Buying : https://www.alliedmarketresearch.com/purchase-enquiry/14171

Key Benefits of the Report

This study presents the analytical depiction of the directional drilling services industry along with the current trends and future estimations to determine the imminent investment pockets.

The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the directional drilling services market share.

The current market is quantitatively analyzed to highlight the directional drilling services market growth scenario.

Porter’s five forces analysis illustrates the potency of buyers & suppliers in the market.

The report provides a detailed directio

Directional Drilling Services Market Report Highlights

Aspects & Details

By Drilling Technique

Conventional Methods

Rotary Steerable System

By Service Type

Rotary Steerable System (RSS) Logging-While-Drilling(LWD

Logging-While-Drilling(LWD

Measurement-While-Drilling (MWD)

Motors (MUD Motors)

Get a Customized Research Report @ : https://www.alliedmarketresearch.com/request-for-customization/14171

By Application

Onshore Applications

Offshore Applications

By Region

North America (U.S, Canada, Mexico)

Europe (Russia, France, Germany, Italy, Spain, UK, Rest of Europe)

Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific)

LAMEA (Brazil, Saudi Arabia, South Africa, Rest of LAMEA)

Key Market Players

Weatherford International Plc, Jindal Drilling & Industries Limited., Schlumberger Limited, Baker Hughes Incorporated, Nabors Industries Ltd, Halliburton Company, Cathedral Energy Services Ltd, General Electric Oil & Gas, National Oilwell Varco

3 notes

·

View notes

Text

Navigating the Coal Mining Market: Trends and Insights

Introduction

The Coal Mining Market remains a cornerstone of the global energy sector, providing a vital source of fuel for power generation, industrial processes, and steel production. In this article, we delve into the intricacies of the Coal Mining Market, exploring its growth trajectory, challenges, and competitive landscape.

Coal Mining Market Research Reports: Informing Strategic Decisions

Coal Mining Market Research Reports offer a comprehensive overview of the industry, encompassing production trends, consumption patterns, and regulatory developments. These reports serve as invaluable tools for stakeholders, providing insights into market dynamics, investment opportunities, and competitive analysis. The Global Coal Mining Research Reports is expected to witness a compound annual growth rate (CAGR) of 5% over the forecast period, indicating sustained demand for market intelligence among industry participants.

Market Forecast: Anticipating Future Trends and Developments

A forward-looking Market Forecast enables stakeholders to anticipate shifts in demand, regulatory changes, and technological advancements impacting the coal mining industry. It aids in strategic planning, risk mitigation, and resource allocation for coal mining companies and investors. The global coal mining market is projected to reach a valuation of $1.5 trillion by 2030, driven by growing energy demand from emerging economies and investments in clean coal technologies.

Market Outlook: Evaluating Growth Prospects and Challenges

The Market Outlook for coal mining reflects both opportunities and challenges facing the industry, including fluctuating commodity prices, environmental regulations, and geopolitical factors. Industry players must adapt to changing market dynamics and embrace innovation to remain competitive in the global energy landscape. Coal mining companies are investing heavily in research and development to enhance safety, efficiency, and environmental sustainability, with global R&D expenditure in the sector reaching $2.5 billion annually.

Coal Mining Market Analysis: Understanding Industry Trends and Drivers

Coal Mining Market Analysis provides a holistic view of the industry, examining factors such as production volumes, reserves, cost structures, and market segmentation. It helps stakeholders identify emerging opportunities, assess competitive threats, and formulate effective business strategies. The Asia-Pacific region dominates the global coal mining market, accounting for over 60% of total production, driven by robust demand from countries like China, India, and Indonesia.

Click here – To Know more about the Mining Industry

Market Growth: Harnessing Innovation for Sustainable Development

Market Growth in coal mining hinges on technological innovation, operational efficiency, and responsible resource management. Companies are investing in advanced mining techniques, automation, and clean coal technologies to enhance productivity and reduce environmental impact. The adoption of autonomous mining equipment is projected to increase by 15% annually over the next decade, leading to significant improvements in safety and productivity across coal mining operations.

Market Size: Evaluating the Scope of Industry Expansion

The Market Size of coal mining reflects the total value of coal produced globally, encompassing both thermal and metallurgical coal. It provides an indication of the industry's economic significance and contribution to energy security and industrial development. The global market for coal mining equipment is estimated to surpass $40 billion by 2025, driven by the modernization of coal mines and investments in machinery replacement and upgrade.

Market Demand: Meeting the Global Energy Needs

Market Demand for coal remains strong, fueled by the continued reliance on coal-fired power plants, particularly in developing economies. Despite efforts to diversify energy sources, coal remains a crucial component of the global energy mix, supporting base-load electricity generation and industrial processes. Coal consumption in the Asia-Pacific region is expected to grow by 3% annually through 2030, driven by urbanization, industrialization, and population growth in emerging markets.

Market Challenges: Addressing Environmental and Social Concerns

The Market Challenges facing the coal mining industry include environmental regulations, community opposition, and the transition to low-carbon energy sources. Coal mining companies must navigate these challenges by adopting sustainable practices, engaging stakeholders, and investing in clean coal technologies. The global coal mining industry faces $100 billion in stranded asset risk due to climate change mitigation efforts and the shift towards renewable energy alternatives.

Global Coal Mining Market: Assessing Competitive Dynamics

The Global Coal Mining Market is characterized by intense competition among major players, including multinational corporations, state-owned enterprises, and regional mining companies. Market consolidation, mergers, and acquisitions are common strategies employed by coal mining companies to enhance market share and operational efficiency. The top five coal mining companies account for over 50% of global coal production, reflecting the concentration of market power in the hands of a few industry giants.

Conclusion

The Coal Mining Market presents a complex tapestry of opportunities and challenges for industry stakeholders. By leveraging market intelligence, embracing innovation, and adopting sustainable practices, coal mining companies can navigate the evolving landscape and contribute to energy security and economic development. With a forward-thinking approach and a commitment to responsible mining, the coal industry can play a vital role in powering the global economy while addressing environmental and social concerns.

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market Challenges#Coal Mining Market in India#Coal Mining Market Value#Global Coal Mining Market#Coal Mining Market Competitors#Coal Mining Market Analysis#Coal Mining Market Forecast#Coal Mining Market Outlook#Coal Mining Industry Research Reports#Coal Mining Market Research Reports#Coal Mining Market Major Players#Coal Mining Market Share

0 notes

Text

Exploring the Coal Mining Market Growth, Share, and Major Players

The Coal Mining Market stands as a fundamental pillar, providing the essential fuel for global energy production. This comprehensive exploration delves into the nuanced intricacies of the market, shedding light on its growth trajectories, size, demand dynamics, challenges, global presence, competitive landscape, forecasts, research reports, and the major players shaping the industry's trajectory.

Fueling Progress: The Growth Trajectory of Coal Mining Market

The market serves as an indispensable contributor to the world's energy demands. In understanding the growth trajectory, it's essential to dissect the factors propelling its expansion. The Global Coal Mining Market has experienced commendable growth, boasting a compound annual growth rate (CAGR) of 3% over the last five years. This sustained growth is attributable to the unwavering reliance on coal for electricity generation, particularly in emerging economies.

Regional Dynamics:

Regional disparities in growth patterns exist, with Asia-Pacific dominating the coal mining landscape. China, India, and Australia emerge as pivotal contributors, fueled by their burgeoning economies and significant coal reserves.

Sizing Up the Industry: Coal Mining Market Size and Demand

Understanding the market's size and the dynamics driving coal demand is imperative for stakeholders seeking holistic insights into the industry. The current valuation of the Global Coal Mining Market exceeds USD 695 billion, indicative of its substantial influence. The demand for coal surpasses 8 billion metric tons annually, driven primarily by the insatiable energy needs of industries and the power sector.

Click here – To Know more about this industry

Meeting Energy Needs: Exploring Coal Mining Market Demand

The demand for coal intricately aligns with global energy requirements, making it imperative to dissect the factors shaping demand and its pivotal role in meeting diverse energy needs.

Energy Generation Backbone:

Coal's significance in electricity generation remains pronounced, contributing to over 40% of the world's electricity. The reliable and consistent energy output from coal-fired power plants positions it as a critical contributor to the global energy mix.

Overcoming Hurdles: Coal Mining Market Challenges

Despite its integral role, the coal mining industry faces a myriad of challenges, ranging from environmental concerns to the shifting dynamics of the global market.

Environmental Concerns and Market Dynamics:

Stringent environmental regulations pose a substantial challenge, prompting the industry to pivot towards cleaner technologies and sustainable mining practices. The perpetual challenge lies in finding the delicate balance between meeting energy needs and environmental stewardship. The evolving landscape of the global energy market, with a growing emphasis on renewable sources, presents a challenge for the coal mining industry. Adapting to these market dynamics requires strategic foresight and innovative approaches.

Global Reach of the Global Coal Mining Market

The coal mining industry's influence extends far beyond national borders, necessitating an examination of the global landscape and the role of key players in shaping its dynamics.

Major Players and Market Competitors:

Leading companies, including Coal India Limited, China Shenhua Energy, and BHP Billiton, command the industry. Their strategic investments, technological advancements, and sustainable practices contribute significantly to their competitive positions on the global stage. The competition within the coal mining sector is fierce, with major players engaging in strategic maneuvers to secure resources and market dominance. Collaboration, innovation, and sustainability initiatives define their competitive strategies.

Forecasting the Future: Coal Mining Market Forecast

Anticipating future trends and trajectories is integral for strategic planning within the coal mining industry. Despite challenges and the growing emphasis on renewable energy, the coal mining market is forecasted to maintain a stable trajectory with a modest annual growth rate of 2%. The continued demand for coal in steel production and power generation contributes to this resilience.

Insights from the Earth: Coal Mining Market Research Reports

Informed decision-making within the industry relies on robust research, emphasizing the significance of Coal Mining Market Research Reports in providing actionable insights for stakeholders. An annual influx of 25 comprehensive research reports enriches the industry's knowledge base. These reports cover diverse aspects, including market dynamics, technological advancements, and regulatory changes, offering valuable guidance for strategic planning.

Pillars of the Industry

Certain players lead the way, steering the industry towards innovation and sustainability. Coal Mining Market Major players, such as Peabody Energy and Glencore, are pioneers in clean coal technologies and sustainability practices. Their efforts align with the industry's evolution towards more environmentally responsible mining, ensuring a balance between energy needs and environmental stewardship.

Conclusion

The Coal Mining Market remains a linchpin in global energy production, overcoming challenges and evolving to meet changing demands. As the industry navigates environmental concerns, explores cleaner technologies, and adapts to market dynamics, its steadfast role in powering economies underscores its enduring significance.

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market challenges#Coal Mining Market in India#Coal Mining Market value#Global Coal Mining Market#Coal Mining Market competitors#Coal mining market analysis#Coal Mining Market Forecast#Coal Mining Market outlook#Coal Mining Industry research reports#Coal Mining Market research reports#Coal Mining Market major players#Coal Mining Market Share

0 notes

Text

By Brett Wilkins

Common Dreams

Aug. 24, 2023

"This growing unseen and unacknowledged banking crisis is going to become visible soon as the climate-related disasters and losses pile up and insurance companies continue to go bankrupt."

Insurance companies bankrupted by climate disasters are the "canaries in the coal mine" portending "a much worse banking crisis," and regulators must act with urgency to avert financial crashes and costly bailouts, a report published Wednesday warned.

Amid increasingly frequent and severe fires, flooding, hurricanes, tornadoes, landslides, and hail storms across the U.S., "it's no surprise that there is a great deal of attention on the burgeoning crisis among insurance companies and their insured individuals and businesses," says the report, which was published by the financial reform advocacy group Better Markets.

"The U.S. property and casualty industry suffered losses of $5 billion in 2021, which ballooned to losses of $26.5 billion in 2022," Better Markets notes. "There have already been 15 confirmed weather/climate disaster events with losses exceeding $1 billion each in the U.S. as of August 8, 2023, with losses almost certain to exceed 2022."

That tally notably does not include the Hawaiian island of Maui, where a wildfire spread by hurricane-force winds leveled Lahaina, killing at least 115 people and causing an estimated $5.52 billion in damage.

"The number of insurance companies going bankrupt, withdrawing from states, limiting coverage, and significantly raising premiums is increasing by the day," the publication continues. "In addition, the reinsurance market, which is key for insuring major climate events, is facing a reduced investor demand, which is going to decrease coverage while increasing costs even more."

"However, this isn't just a crisis for insurance companies and their customers," Better Markets stresses. "The ongoing and worsening insurance crisis is the leading edge of a coming banking and financial crisis."

According to the report:

While climate risk is tragic for homeowners and problematic for insurance companies, it is exponentially worse for banks and the financial system. That's because insurance companies limiting their losses do not eliminate the losses entirely; they merely shift losses to other entities like banks which have large and increasingly concentrated portfolios of loans and other credit instruments to those now uninsured or underinsured real estate properties and businesses. When the inevitable climate disasters occur, those exposures will quickly become realized losses, potentially at levels that will cause banks to collapse, and possibly ignite a credit contraction, precipitate contagion, and result in a banking crisis if not a financial crash.

"There's a major untold story behind the unprecedented climate disasters pummeling the country and capturing the headlines: Today's climate crisis is tomorrow's banking crisis," said report author and Better Markets CEO Dennis Kelleher, who criticized federal regulators' lack of action.

"The Financial Stability Oversight Council (FSOC) and banking regulators' response thus far have been grossly inadequate and inconsistent with the material climate risks bearing down on banks and the financial system," he argued. "For example, the FSOC member agencies were called on just two years ago to bolster the financial system's resilience to climate-related financial risks. Yet, since then, the actions have been slow and half-hearted."

"This growing unseen and unacknowledged banking crisis is going to become visible soon as the climate-related disasters and losses pile up and insurance companies continue to go bankrupt and stop insuring homes, businesses, cars, and other bank assets in state after state," Kelleher warned.

"Just as insurance companies are acting to limit their losses, the FSOC and other banking and financial regulators must require banks and financial firms to assess their exposure to those losses and have an action plan to mitigate them before they materialize and cause banking crisis," he added. "Climate disasters are bad enough; a banking disaster on top of that will make everything much worse."

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0). Feel free to republish and share widely.

#climate change#costs of climate change#insurance claims#insurance crisis#banking system#u.s. economy

3 notes

·

View notes

Text

We are extremely pleased to announce the grand opening of our new state-of-the-art Meltingshop and Rolling Mill facility at Jalna, Maharashtra on 28th April 2023 which has brought us one step closer to fulfilling our vision of expanding our horizons to meet the ever growing demand and be the market leader while delivering quality TMT Rebars and focusing on customer satisfaction.

The inauguration of our new facility would be done by Smt. Ruchika Chaudhry Govil, Additional Secretary, Ministry of Steel and Hon’ble MP Raosaheb Patil Danve, Union Minister of State for Railways, Coal and Mines.

We are commited to serving our customers better by developing leading edge solutions in the technology, processes and products.

With our customer-first approach, innovative products, and continuous nurturing of our distribution channel, Rajuri Steel has emerged as a market leader in the Steel Rebar Industry with an evergrowing and strong PAN India dealer network.

We owe our success to all our dealers, customers, associates, and employees.

Thank you for your support and confidence in us and we assure you that Rajuri Steel is poised to achieve a lot of milestones in the future.

The Real Strength Of Togetherness!

#inauguration #steelplant #plantinauguration #rollingmill #openingceremony #growth #jalna #jalnaindustry #ministryofsteel #steelindustry #steel #RajuriSteel #TMTsteel #TMTbars #RCC #construction #architecture #building #TMTBar #TMT #Steelbar #TMTSariya #qualitysteel #TMTBarManufacturer #StrengthofTogetherness #InternationalQuality #GermanTechnology #33StrengtheningYears #Rajuri500 #Rajuri500DPlus #Rajuri550

3 notes

·

View notes

Text

ASX BHP: A Diversified Mining and Petroleum Giant with Strong Financial Performance

BHP Group, also known as ASX BHP, is a multinational mining, metals, and petroleum company headquartered in Melbourne, Australia. With operations in over 90 locations worldwide, BHP is one of the largest diversified resource companies in the world.

In this article, we will take a closer look at ASX BHP, including its history, current operations, financial performance, and future prospects.

History of ASX BHP

BHP was originally founded in 1885 as the Broken Hill Proprietary Company Limited, named after the Broken Hill silver and lead mine in western New South Wales, Australia. Over the years, the company expanded into other commodities, including iron ore, copper, coal, and petroleum.

In 2001, BHP merger with Billiton plc, a mining company based in London, to form BHP Billiton. The merger created one of the largest mining companies in the world, with operations in over 25 countries.

In 2017, the company simplified its name to BHP Group, reflecting its focus on its core operations in mining, metals, and petroleum.

Current Operations

BHP operates in four main segments: iron ore, copper, coal, and petroleum. The company is the world's largest producer of iron ore and the second-largest producer of copper.

Iron Ore: BHP's iron ore operations are located in the Pilbara region of Western Australia. The company's operations in the region include five mines, a railway network, and two port facilities.

Copper: BHP's copper operations are located in Chile, Peru, and the United States. The company's copper assets include the Escondida mine in Chile, the world's largest copper mine.

Coal: BHP's coal operations are located in Australia, Colombia, and South Africa. The company produces both metallurgical coal (used in steelmaking) and thermal coal (used in electricity generation).

Petroleum: BHP's petroleum operations are located in Australia, the Gulf of Mexico, Trinidad and Tobago, and the Caribbean. The company produces both oil and gas.

Financial Performance

In the first half of the 2022 financial year, BHP reported a net profit of US$10.9 billion, up from US$3.9 billion in the same period the previous year. The company attributed the increase to higher commodity prices and increased production.

BHP's share price has also performed well in recent years, with the company's market capitalization reaching over A$300 billion in 2021.

Future Prospects

BHP is well-positioned to benefit from the growing demand for commodities, particularly from emerging economies such as China and India. The company has also been investing in renewable energy and technology to reduce its carbon footprint and improve its environmental performance.

In 2021, BHP announced plans to invest over US$5 billion in its petroleum business over the next five years, focusing on high-return growth opportunities in the Gulf of Mexico and Trinidad and Tobago.

Overall, ASX BHP is a well-established and financially sound company with a strong position in the global mining, metals, and petroleum markets. Its focus on sustainable and responsible business practices, combined with its diversified operations, make it a compelling investment opportunity for long-term investors.

Also check related tickers

ASX CBA

ASX FMG

ASX APT

ASX NAB

2 notes

·

View notes

Text

It's rough, because in our hypercapitalist society, the only way to keep people off the street is to make jobs available. But all the jobs are being done by fewer and fewer people as technology advances and the requirement for extensive schooling becomes necessary for advanced fields. You will notice that there are more and more people and fewer of them have access to/can afford to all become engineers or whatever. So what do you, as an elected official, do? You settle.

A company approaches you and says "we want to cut down every tree in a thousand mile radius, even the ones in people's yards. We will provide employment for 200 people" AND YOU HAVE TO SERIOUSLY CONSIDER IT! It's the same with oil fields or coal mining, environmental disasters in general because I hate to be the one to explain capitalism again but all the necessary jobs already exist and are filled. Like people make fun of Oregon "oh you're all so stupid you can't even pump your own gas" it's so every gas station has to employ more than one person. It's literally just so there are more jobs available. People here are always screaming about how lumber jobs would save us all but it's a giant saw strapped to the front of a truck for most of it. Supply and demand means that we only need like 2k people to process all the lumber we can sell, and we have more than that already. And who takes the blame if people can't find jobs? In a market that doesn't really need more people? You, the elected official. So you settle.

You see this dynamic at its worst in areas where either the land itself is what has value or its far enough out that poisoning everything is cost effective. If your only option is opening up the land rights to someone who wants to use toxic chemicals to leech out copper or something similar... then that's what's going to happen because your alternative is everyone ends up on the streets. If your area is sparsely inhabited enough that no one will notice this company is poisoning the water table for decades, but they'll hire anyone who applies.. better jobs today than water tomorrow. Someone will figure it out.

And this is where I think conservatives are coming from when they make policy decisions because part of conservatism is that the status quo is there for a reason and shouldn't be changed because if there was a way to do things better then that would be the status quo already, you see? It's why they're so vicious to anyone who wants to change things, because things right now are working! (For a certain definition of working, and a heavy dose of survivor bias) So I think a conservative would define their views as "realist" as in conforms to the way things are. But it's also why problems can never be "fixed" with a conservative leadership, because change is unnecessary, and in fact wildly dangerous. "The Devil you know" made a pillar of reality.

I dont know where I'm going with this to be honest, except to say that as a leftist, I do have a very good grasp of economics and I do have a very good understanding of why we do things the way we do, and I also know they're wrong. Both in practice and in theory. Wealth accumulation past "a reasonable store for emergencies" is a symptom of a disease on the human psyche, not a noble pursuit we all have to become slaves to. Ayn Rand was a monster inhabiting human skin who couldn't even live by the fascist principles she espoused. "Some people deserve to rule over us actually" is the fundamental underpinning of an ideology that has kept humanity in the dirt for thousands of years and I for one long for the sun.

We have to have jobs if we want to live in the society none of us had a say in creating. Fine. It shouldn't be unreasonable to ask for a job that doesn't poison my children along with feeding them.

2 notes

·

View notes