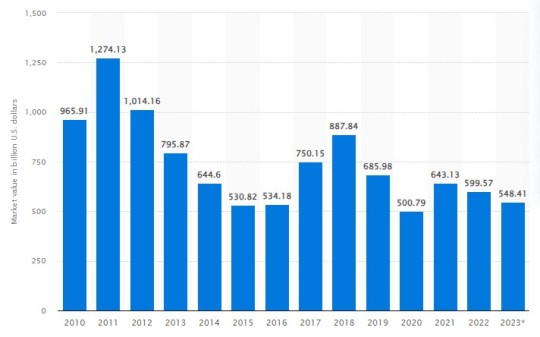

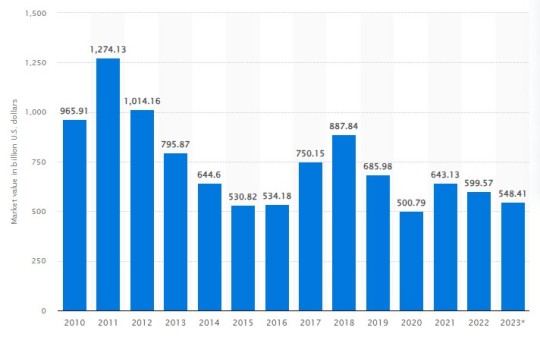

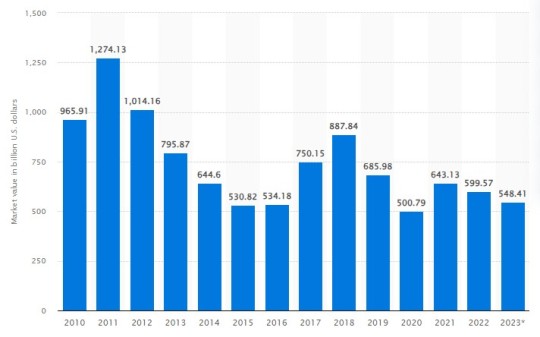

#Coal Mining Market Value

Text

The Global Coal Mining Market share, Growth and Outlook

The Global Coal Mining Market remains a vital sector in the energy industry, providing a significant portion of the world's electricity and fueling industrial activities worldwide. However, the landscape of coal mining is undergoing profound changes, influenced by market dynamics, regulatory shifts, and environmental concerns. Let's explore the industry's intricacies with a closer look at the latest statistics and insights.

Harnessing the Power of Industry Research Reports

In-depth Coal Mining Industry Research Reports offer valuable insights and intelligence to industry stakeholders, enabling informed decision-making and strategic planning:

Market Analysis: These reports provide comprehensive analyses of market trends, demand-supply dynamics, competitive landscapes, and regulatory frameworks, empowering businesses to identify opportunities and mitigate risks.

Competitive Intelligence: By assessing the strategies and performance of key market players, companies can gain valuable insights into industry dynamics and competitive positioning, facilitating effective market entry and expansion strategies.

Understanding the Scale of the Coal Mining Industry

The Coal Mining Market is characterized by its expansive reach and substantial economic impact. Here are some compelling statistics that underscore its significance:

Market Size: With a market value exceeding $869 billion in 2020, the global coal mining industry continues to play a pivotal role in the energy sector's overall landscape.

Market Share: Leading coal mining companies, including BHP Group, Glencore, and China Shenhua Energy, command a substantial share of the market, leveraging their extensive operations and strategic investments.

Click here – To know more about Mining market

Addressing Key Challenges Facing the Industry

Despite its prominence, the coal mining sector faces a host of challenges that necessitate strategic adaptation and innovation:

Environmental Pressures: Heightened concerns over climate change and air pollution have led to increased regulatory scrutiny and calls for cleaner energy alternatives, challenging the traditional dominance of coal in the energy mix.

Market Volatility: The coal mining industry is susceptible to fluctuations in commodity prices, geopolitical tensions, and shifts in energy policies, necessitating agility and resilience to navigate uncertain market conditions.

Exploring Opportunities for Growth and Innovation

Amidst the challenges, the coal mining industry also presents opportunities for innovation and growth:

Technological Advancements: Advancements in mining technologies, such as automation, robotics, and remote sensing, are enhancing operational efficiency, safety, and productivity, driving cost savings and competitive advantage.

Diversification Strategies: Coal mining companies are diversifying their portfolios to include cleaner energy sources like natural gas and renewable energy, positioning themselves for long-term sustainability and resilience in a transitioning energy landscape.

Conclusion

The Global Coal Mining Market continues to evolve in response to changing market dynamics and regulatory imperatives. By leveraging industry insights, embracing innovation, and adopting sustainable practices, coal mining companies can navigate challenges, capitalize on opportunities, and chart a course towards long-term success in an ever-changing energy landscape.

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market Challenges#Coal Mining Market in India#Coal Mining Market Value#Global Coal Mining Market#Coal Mining Market Competitors#Coal Mining Market Analysis#Coal Mining Market Forecast#Coal Mining Market Outlook#Coal Mining Industry Research Reports#Coal Mining Market Research Reports#Coal Mining Market Major Players#Coal Mining Market Share

0 notes

Text

Exploring the Dynamics of the Coal Mining Market Growth, Market Revenue and Future Outlook

The Coal Mining Market stands as a vital pillar in the global energy landscape, navigating constant evolution and diverse challenges. This exploration delves into the growth, size, demand, challenges, regional nuances, competitive forces, and the future outlook that characterize the intricate terrain of the Coal Mining industry.

Growth Trajectory: Illuminating the Coal Mining Market

Understanding the growth patterns in the Coal Mining Market is pivotal to gauging its economic impact and industry vitality. The industry has witnessed steady growth, driven by increasing global demand for coal as a primary energy source. The key highlights include an annual growth of 5%, indicating sustained demand, and developing economies contributing significantly to this upward trajectory.

Sizing Up: Coal Mining Market Size Analysis

The sheer scale of the Coal Mining Market is instrumental for stakeholders seeking to comprehend its economic footprint and potential opportunities. The market size is substantial, with a valuation of USD 50 billion in the last fiscal year. Variations in market size are influenced by factors such as coal reserves, production capacities, and regional demand.

Meeting Demand: Coal Mining Market Demand Dynamics

The Coal Mining Market demand for coal remains a critical driver for the Market, impacting various industries, especially power generation and manufacturing. Despite global efforts to diversify energy sources, coal continues to meet a substantial portion of the world's energy demand.

Navigating Challenges: Coal Mining Market Challenges Unveiled

Challenges inherent in the Coal Mining industry require strategic approaches to ensure sustainable operations and compliance with evolving regulations. Environmental concerns, regulatory complexities, and the emergence of renewable energy sources are among the key challenges faced by the industry.

Regional Dynamics: Focus on Coal Mining Market in India

India plays a pivotal role in the Global Coal Mining Market, with unique dynamics shaping its industry landscape. The Coal Mining Market in India is characterized by extensive coal reserves and a significant contribution to the country's energy mix. Policy initiatives and technological advancements influence the growth trajectory of the Coal Mining Market in India.

Competing Forces: Coal Mining Market Competitors in the Limelight

The competitive landscape involves established industry leaders vying for market share and emerging players seeking to make their mark. Coal Mining Market Competitors engage in strategic alliances and investments in advanced mining technologies.

Future Outlook: Coal Mining Market Forecast and Outlook

The Coal Mining Market future outlook is influenced by global energy transitions, technological advancements, and evolving consumer preferences. The Coal Mining Market Forecast is optimistic, driven by sustained demand from industrial and power generation sectors.

Conclusion

The Coal Mining Market remains a dynamic force in the global energy sector, navigating growth, challenges, and evolving market dynamics. Stakeholders must stay attuned to these dynamics for informed decision-making in this critical industry.

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market Challenges#Coal Mining Market in India#Coal Mining Market Value#Global Coal Mining Market#Coal Mining Market Competitors#Coal Mining Market Analysis#Coal Mining Market Forecast#Coal Mining Market Outlook#Coal Mining Industry Research Reports#Coal Mining Market Research Reports#Coal Mining Market Major Players#Coal Mining Market Share

0 notes

Text

George Lauder was born on November 11th 1837 at Dunfermline, Fife.

Lauder is probably a wee bit more well known in his native Dunfermline, or maybe so Americans, I would think this is due to him being a bit overshadowed by a guy described as his "cousin-brother", Andrew Carnegie.

George Lauder was the son of George Lauder, Sr. and Seaton Morrison. His father, a local shop owner on the high street, Dunfermline. Very well read, Lauder Sr. was instrumental in the upbringing of his only son George, as well as his nephew the aforementioned Carnegie.

Lauder Jr. and Carnegie were two years apart in age and best friends as a result of their shared experiences. They affectionately referred to one another as “Dod” and “Naig”, as young children. After Andrew and his family left for America, George stayed in Scotland where he would go on to graduate from Glasgow University with a degree in mechanical engineering while studying under another famous name Lord Kelvin.

Carnegie wrote to Lauder asking him to join him in America as a partner in the Carnegie Steel Corporation. At the time, the major shareholders were Carnegie himself, Carnegie’s brother and two others.

Lauder brought several new developments to the steel business in America, including the process for washing and coking dross from coal mines, which resulted in a significant increase to the overall value of the business.

Lauder would go on to lead the development of the use of steel in armour and armaments. By the turn of the Twentieth Century, Lauder was a director of Carnegie Steel and its second largest shareholder behind his cousin Andrew. Throughout the course of his career, Lauder created a number of patented scientific advancements useful both in the steel industry and beyond.

The sale of Carnegie Steel to JP Morgan in 1901 created U.S Steel where Lauder sat on the board of directors. This became the first corporation in the world with a market capitalization exceeding $1 billion ($43 billion today).

Lauder’s oldest daughter, Harriet married Dr. James C. Greenway combining the Lauder and Greenway families into what is now known as the Lauder Greenway Family, their influence in American political and economic affairs dates from the 1640s through the contemporary era. Their primary contributions have been in the sciences, government, and intelligence. His son George Lauder III, was a high-profile sailor who set the record in 1900 (held until 1905) for the fastest trans-Atlantic crossing with his yacht, Endymion,

In 1905 Harriet bought, what has become known as The Lauder-Greenway Estate a 50-acre property in Greenwich, Connecticut, where George lived out the last eleven years of his life passing away on August 24th, 1924.

The Estate, for a time, was the most expensive private residence in the United States in 2014 when it sold for an eye watering $120 million.

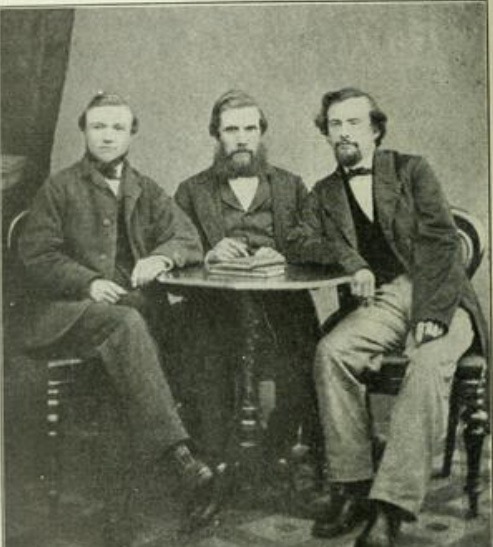

Pics are of George Lauder, the second is Andrew Carnegie, George Lauder, and Thomas Miller in 1862 taken in Glasgow, it is one of very few pics of Carnegie without a beard, Thomas Miller is said to be the man who started Carnegie in the steel business.

5 notes

·

View notes

Text

Indonesian President Joko Widodo on Wednesday confirmed an export ban for bauxite starting in June next year as scheduled, to encourage domestic processing of a material used as the main ore source of aluminium.

The resource-rich nation has surprised markets with its commodity exports policies, including brief but controversial bans earlier this year on shipments of palm oil and coal, of which Indonesia is the world's biggest exporter.

It is also among the world's top suppliers of bauxite, with China its key buyer. The timing of Indonesia's ban, however, is in line with its current mining law.

The president said the bauxite ban aimed to replicate Indonesia's success in developing its nickel processing capacity after halting exports of its raw form in January 2020, which enticed foreign investors, mostly from China, to build local smelters.[...]

"The government will remain consistent in implementing downstreaming so the value add can be enjoyed domestically for the country's development and people's welfare," said Widodo, who is popularly known as Jokowi, emphasising the importance of jobs creation.[...]

Indonesia has four bauxite processing facilities with 4.3 million tonnes of alumina output capacity, while more are under construction with collective capacity of nearly 5 million tonnes, said chief economic minister Airlangga Hartarto.

Indonesia's bauxite reserves are enough for up to 100 years production, he said.

The country's mining law also states exports of other unprocessed minerals such as copper will also be stopped. Jokowi did not specify the timing of shipment bans on the other materials.

20 Dec 22

22 notes

·

View notes

Text

The Cost of Bitcoin

Hello! Today I will be talking about the negative environmental toll of Bitcoin. In the past half decade we have seen Bitcoin rise from an unheard of electronic currency to making headlines on the wall street journal’s investment articles. Everyone wants in on cryptocurrency and anyone can make their own crypto mining set up at home using parts from your PC which is why it’s been described as the new gold rush. But not everything that shines is always gold and crypto is no exception to this rule. In recent months crypto currency’s value has started to decline and the initial influx in popularity is starting to flicker out. But the risk to your investment portfolio isn’t the only negative impact of crypto, in order to mine crypto currency you have to have a powerful computer that can run complex algorithms. To maintain the upkeep of these computers running constantly in order to mine Bitcoin requires large amounts of electrical input to the machines. Now that everyone is mining crypto it is estimated that “crypto-miners” have the same annual carbon output as the entirety of Argentina. Even if the electricity being used is from a clean source it doesn’t change the fact that crypto-miners are incentivised by cheap electricity (typically coal based sources) to maximize profits. Studies have shown that the equivalent of one U.S Dollar of bitcoin has double the amount of carbon output as one U.S Dollar of platinum, gold or copper making it a rather harmful form of making money. Although there is development from Ethereum which is the second most popular crypto currency on the market whose goal is make crypto mining more environmentally friendly, hopefully in the future we can see more efforts being made to preserve what little healthy environment we have left.

Bibliography: https://futurism.com/hidden-cost-bitcoin-our-environment , https://www.theguardian.com/technology/2021/feb/27/bitcoin-mining-electricity-use-environmental-impact

7 notes

·

View notes

Text

It's rough, because in our hypercapitalist society, the only way to keep people off the street is to make jobs available. But all the jobs are being done by fewer and fewer people as technology advances and the requirement for extensive schooling becomes necessary for advanced fields. You will notice that there are more and more people and fewer of them have access to/can afford to all become engineers or whatever. So what do you, as an elected official, do? You settle.

A company approaches you and says "we want to cut down every tree in a thousand mile radius, even the ones in people's yards. We will provide employment for 200 people" AND YOU HAVE TO SERIOUSLY CONSIDER IT! It's the same with oil fields or coal mining, environmental disasters in general because I hate to be the one to explain capitalism again but all the necessary jobs already exist and are filled. Like people make fun of Oregon "oh you're all so stupid you can't even pump your own gas" it's so every gas station has to employ more than one person. It's literally just so there are more jobs available. People here are always screaming about how lumber jobs would save us all but it's a giant saw strapped to the front of a truck for most of it. Supply and demand means that we only need like 2k people to process all the lumber we can sell, and we have more than that already. And who takes the blame if people can't find jobs? In a market that doesn't really need more people? You, the elected official. So you settle.

You see this dynamic at its worst in areas where either the land itself is what has value or its far enough out that poisoning everything is cost effective. If your only option is opening up the land rights to someone who wants to use toxic chemicals to leech out copper or something similar... then that's what's going to happen because your alternative is everyone ends up on the streets. If your area is sparsely inhabited enough that no one will notice this company is poisoning the water table for decades, but they'll hire anyone who applies.. better jobs today than water tomorrow. Someone will figure it out.

And this is where I think conservatives are coming from when they make policy decisions because part of conservatism is that the status quo is there for a reason and shouldn't be changed because if there was a way to do things better then that would be the status quo already, you see? It's why they're so vicious to anyone who wants to change things, because things right now are working! (For a certain definition of working, and a heavy dose of survivor bias) So I think a conservative would define their views as "realist" as in conforms to the way things are. But it's also why problems can never be "fixed" with a conservative leadership, because change is unnecessary, and in fact wildly dangerous. "The Devil you know" made a pillar of reality.

I dont know where I'm going with this to be honest, except to say that as a leftist, I do have a very good grasp of economics and I do have a very good understanding of why we do things the way we do, and I also know they're wrong. Both in practice and in theory. Wealth accumulation past "a reasonable store for emergencies" is a symptom of a disease on the human psyche, not a noble pursuit we all have to become slaves to. Ayn Rand was a monster inhabiting human skin who couldn't even live by the fascist principles she espoused. "Some people deserve to rule over us actually" is the fundamental underpinning of an ideology that has kept humanity in the dirt for thousands of years and I for one long for the sun.

We have to have jobs if we want to live in the society none of us had a say in creating. Fine. It shouldn't be unreasonable to ask for a job that doesn't poison my children along with feeding them.

2 notes

·

View notes

Text

ARK Trims Coinbase Holdings & Bitcoin Boom Faces Headwinds

ARK Invest, the prominent investment management firm led by Cathie Wood, has made headlines recently as it disclosed trimming its holdings in Coinbase Global Inc. The move comes amidst a backdrop of increasing volatility and headwinds facing the cryptocurrency market, particularly Bitcoin, despite its recent boom.

The decision by ARK Invest to reduce its exposure to Coinbase, one of the largest cryptocurrency exchanges, signals a cautious approach amid uncertainties surrounding the regulatory environment and market dynamics. While Coinbase listing on the public market was highly anticipated and marked a significant milestone for the cryptocurrency industry, concerns over regulatory scrutiny and competition have tempered investor sentiment.

Coinbase's stock has experienced significant volatility since its direct listing on the Nasdaq exchange, reflecting the broader fluctuations in the cryptocurrency market. As a leading cryptocurrency exchange, Coinbase's performance is closely tied to the price movements of digital assets such as Bitcoin and Ethereum, making it susceptible to market sentiment and regulatory developments.

ARK Invest's decision to trim its Coinbase holdings underscores the firm's focus on actively managing its portfolio and adjusting its exposure to reflect changing market conditions. While ARK Invest remains bullish on the long-term potential of cryptocurrencies and blockchain technology, it is exercising caution amid heightened uncertainty and regulatory scrutiny in the industry.

In addition to concerns surrounding individual cryptocurrency companies like Coinbase, the broader Bitcoin boom is also facing headwinds that could impact its trajectory in the near term. One of the key challenges facing Bitcoin is the growing regulatory scrutiny from governments around the world.

Regulators are increasingly scrutinizing Bitcoin and other cryptocurrencies for their potential role in illicit activities such as money laundering, terrorism financing, and tax evasion. Governments are also exploring regulatory frameworks to address investor protection, market integrity, and systemic risks associated with digital assets.

Furthermore, Bitcoin's environmental impact has come under scrutiny, with concerns raised about its energy consumption and carbon footprint. The energy-intensive process of Bitcoin mining, particularly in regions powered by coal-fired electricity, has drawn criticism from environmental advocates and policymakers, leading to calls for greater sustainability measures within the cryptocurrency industry.

Despite these challenges, proponents of Bitcoin remain optimistic about its long-term prospects, citing its scarcity, decentralization, and store of value properties. Bitcoin has attracted significant institutional interest in recent years, with corporations and asset managers allocating capital to the digital asset as a hedge against inflation and currency debasement.

Moreover, the growing adoption of Bitcoin as a payment method by companies such as Tesla and PayPal has contributed to its mainstream acceptance and visibility. As Bitcoin continues to mature as an asset class, its role in investment portfolios and financial markets is likely to evolve, presenting both opportunities and challenges for investors and market participants.

In conclusion, ARK Invest's decision to trim its Coinbase holdings and the headwinds facing the Bitcoin boom underscore the complexities and uncertainties surrounding the cryptocurrency market. While the long-term potential of cryptocurrencies remains compelling, investors must navigate regulatory scrutiny, market volatility, and environmental concerns in their investment decisions. As the cryptocurrency industry continues to evolve, proactive risk management and diligent research will be essential for investors seeking to capitalize on the opportunities presented by digital assets.

0 notes

Text

Navigating the Coal Mining Market: Trends and Insights

Introduction

The Coal Mining Market remains a cornerstone of the global energy sector, providing a vital source of fuel for power generation, industrial processes, and steel production. In this article, we delve into the intricacies of the Coal Mining Market, exploring its growth trajectory, challenges, and competitive landscape.

Coal Mining Market Research Reports: Informing Strategic Decisions

Coal Mining Market Research Reports offer a comprehensive overview of the industry, encompassing production trends, consumption patterns, and regulatory developments. These reports serve as invaluable tools for stakeholders, providing insights into market dynamics, investment opportunities, and competitive analysis. The Global Coal Mining Research Reports is expected to witness a compound annual growth rate (CAGR) of 5% over the forecast period, indicating sustained demand for market intelligence among industry participants.

Market Forecast: Anticipating Future Trends and Developments

A forward-looking Market Forecast enables stakeholders to anticipate shifts in demand, regulatory changes, and technological advancements impacting the coal mining industry. It aids in strategic planning, risk mitigation, and resource allocation for coal mining companies and investors. The global coal mining market is projected to reach a valuation of $1.5 trillion by 2030, driven by growing energy demand from emerging economies and investments in clean coal technologies.

Market Outlook: Evaluating Growth Prospects and Challenges

The Market Outlook for coal mining reflects both opportunities and challenges facing the industry, including fluctuating commodity prices, environmental regulations, and geopolitical factors. Industry players must adapt to changing market dynamics and embrace innovation to remain competitive in the global energy landscape. Coal mining companies are investing heavily in research and development to enhance safety, efficiency, and environmental sustainability, with global R&D expenditure in the sector reaching $2.5 billion annually.

Coal Mining Market Analysis: Understanding Industry Trends and Drivers

Coal Mining Market Analysis provides a holistic view of the industry, examining factors such as production volumes, reserves, cost structures, and market segmentation. It helps stakeholders identify emerging opportunities, assess competitive threats, and formulate effective business strategies. The Asia-Pacific region dominates the global coal mining market, accounting for over 60% of total production, driven by robust demand from countries like China, India, and Indonesia.

Click here – To Know more about the Mining Industry

Market Growth: Harnessing Innovation for Sustainable Development

Market Growth in coal mining hinges on technological innovation, operational efficiency, and responsible resource management. Companies are investing in advanced mining techniques, automation, and clean coal technologies to enhance productivity and reduce environmental impact. The adoption of autonomous mining equipment is projected to increase by 15% annually over the next decade, leading to significant improvements in safety and productivity across coal mining operations.

Market Size: Evaluating the Scope of Industry Expansion

The Market Size of coal mining reflects the total value of coal produced globally, encompassing both thermal and metallurgical coal. It provides an indication of the industry's economic significance and contribution to energy security and industrial development. The global market for coal mining equipment is estimated to surpass $40 billion by 2025, driven by the modernization of coal mines and investments in machinery replacement and upgrade.

Market Demand: Meeting the Global Energy Needs

Market Demand for coal remains strong, fueled by the continued reliance on coal-fired power plants, particularly in developing economies. Despite efforts to diversify energy sources, coal remains a crucial component of the global energy mix, supporting base-load electricity generation and industrial processes. Coal consumption in the Asia-Pacific region is expected to grow by 3% annually through 2030, driven by urbanization, industrialization, and population growth in emerging markets.

Market Challenges: Addressing Environmental and Social Concerns

The Market Challenges facing the coal mining industry include environmental regulations, community opposition, and the transition to low-carbon energy sources. Coal mining companies must navigate these challenges by adopting sustainable practices, engaging stakeholders, and investing in clean coal technologies. The global coal mining industry faces $100 billion in stranded asset risk due to climate change mitigation efforts and the shift towards renewable energy alternatives.

Global Coal Mining Market: Assessing Competitive Dynamics

The Global Coal Mining Market is characterized by intense competition among major players, including multinational corporations, state-owned enterprises, and regional mining companies. Market consolidation, mergers, and acquisitions are common strategies employed by coal mining companies to enhance market share and operational efficiency. The top five coal mining companies account for over 50% of global coal production, reflecting the concentration of market power in the hands of a few industry giants.

Conclusion

The Coal Mining Market presents a complex tapestry of opportunities and challenges for industry stakeholders. By leveraging market intelligence, embracing innovation, and adopting sustainable practices, coal mining companies can navigate the evolving landscape and contribute to energy security and economic development. With a forward-thinking approach and a commitment to responsible mining, the coal industry can play a vital role in powering the global economy while addressing environmental and social concerns.

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market Challenges#Coal Mining Market in India#Coal Mining Market Value#Global Coal Mining Market#Coal Mining Market Competitors#Coal Mining Market Analysis#Coal Mining Market Forecast#Coal Mining Market Outlook#Coal Mining Industry Research Reports#Coal Mining Market Research Reports#Coal Mining Market Major Players#Coal Mining Market Share

0 notes

Text

Exploring the Coal Mining Market Growth, Share, and Major Players

The Coal Mining Market stands as a fundamental pillar, providing the essential fuel for global energy production. This comprehensive exploration delves into the nuanced intricacies of the market, shedding light on its growth trajectories, size, demand dynamics, challenges, global presence, competitive landscape, forecasts, research reports, and the major players shaping the industry's trajectory.

Fueling Progress: The Growth Trajectory of Coal Mining Market

The market serves as an indispensable contributor to the world's energy demands. In understanding the growth trajectory, it's essential to dissect the factors propelling its expansion. The Global Coal Mining Market has experienced commendable growth, boasting a compound annual growth rate (CAGR) of 3% over the last five years. This sustained growth is attributable to the unwavering reliance on coal for electricity generation, particularly in emerging economies.

Regional Dynamics:

Regional disparities in growth patterns exist, with Asia-Pacific dominating the coal mining landscape. China, India, and Australia emerge as pivotal contributors, fueled by their burgeoning economies and significant coal reserves.

Sizing Up the Industry: Coal Mining Market Size and Demand

Understanding the market's size and the dynamics driving coal demand is imperative for stakeholders seeking holistic insights into the industry. The current valuation of the Global Coal Mining Market exceeds USD 695 billion, indicative of its substantial influence. The demand for coal surpasses 8 billion metric tons annually, driven primarily by the insatiable energy needs of industries and the power sector.

Click here – To Know more about this industry

Meeting Energy Needs: Exploring Coal Mining Market Demand

The demand for coal intricately aligns with global energy requirements, making it imperative to dissect the factors shaping demand and its pivotal role in meeting diverse energy needs.

Energy Generation Backbone:

Coal's significance in electricity generation remains pronounced, contributing to over 40% of the world's electricity. The reliable and consistent energy output from coal-fired power plants positions it as a critical contributor to the global energy mix.

Overcoming Hurdles: Coal Mining Market Challenges

Despite its integral role, the coal mining industry faces a myriad of challenges, ranging from environmental concerns to the shifting dynamics of the global market.

Environmental Concerns and Market Dynamics:

Stringent environmental regulations pose a substantial challenge, prompting the industry to pivot towards cleaner technologies and sustainable mining practices. The perpetual challenge lies in finding the delicate balance between meeting energy needs and environmental stewardship. The evolving landscape of the global energy market, with a growing emphasis on renewable sources, presents a challenge for the coal mining industry. Adapting to these market dynamics requires strategic foresight and innovative approaches.

Global Reach of the Global Coal Mining Market

The coal mining industry's influence extends far beyond national borders, necessitating an examination of the global landscape and the role of key players in shaping its dynamics.

Major Players and Market Competitors:

Leading companies, including Coal India Limited, China Shenhua Energy, and BHP Billiton, command the industry. Their strategic investments, technological advancements, and sustainable practices contribute significantly to their competitive positions on the global stage. The competition within the coal mining sector is fierce, with major players engaging in strategic maneuvers to secure resources and market dominance. Collaboration, innovation, and sustainability initiatives define their competitive strategies.

Forecasting the Future: Coal Mining Market Forecast

Anticipating future trends and trajectories is integral for strategic planning within the coal mining industry. Despite challenges and the growing emphasis on renewable energy, the coal mining market is forecasted to maintain a stable trajectory with a modest annual growth rate of 2%. The continued demand for coal in steel production and power generation contributes to this resilience.

Insights from the Earth: Coal Mining Market Research Reports

Informed decision-making within the industry relies on robust research, emphasizing the significance of Coal Mining Market Research Reports in providing actionable insights for stakeholders. An annual influx of 25 comprehensive research reports enriches the industry's knowledge base. These reports cover diverse aspects, including market dynamics, technological advancements, and regulatory changes, offering valuable guidance for strategic planning.

Pillars of the Industry

Certain players lead the way, steering the industry towards innovation and sustainability. Coal Mining Market Major players, such as Peabody Energy and Glencore, are pioneers in clean coal technologies and sustainability practices. Their efforts align with the industry's evolution towards more environmentally responsible mining, ensuring a balance between energy needs and environmental stewardship.

Conclusion

The Coal Mining Market remains a linchpin in global energy production, overcoming challenges and evolving to meet changing demands. As the industry navigates environmental concerns, explores cleaner technologies, and adapts to market dynamics, its steadfast role in powering economies underscores its enduring significance.

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market challenges#Coal Mining Market in India#Coal Mining Market value#Global Coal Mining Market#Coal Mining Market competitors#Coal mining market analysis#Coal Mining Market Forecast#Coal Mining Market outlook#Coal Mining Industry research reports#Coal Mining Market research reports#Coal Mining Market major players#Coal Mining Market Share

0 notes

Text

Anthracite Market Insights: Adapting to Shifting Landscapes in the Age of Renewable Energy

Anthracite, a premium-grade coal with high carbon content and superior energy value, finds diverse applications in steel production, power generation, and manufacturing. However, the global anthracite market is projected to witness a decline in the coming years due to various influencing factors.

Anthracite Market Demand

The demand for anthracite is expected to decrease in the future, driven by several factors, including:

Rise of Renewable Energy Sources: The increasing availability and cost-competitiveness of renewable energy options like solar and wind power are enticing businesses and consumers away from coal.

Environmental Regulations: Stricter regulations on coal mining and combustion are elevating production costs, making anthracite less economically attractive.

Declining Demand in Steel Industry: As the steel industry increasingly adopts scrap metal for steel production, the need for anthracite as a reducing agent is diminishing.

Anthracite Market Supply

The supply of anthracite is likely to face limitations in the upcoming years, mainly due to:

Limited Reserves: The global reserves of anthracite are finite, imposing a natural cap on production levels.

Environmental Constraints: Environmental regulations impacting coal mining are making it more challenging and expensive to extract anthracite, further constraining supply.

Anthracite Market Size

As of 2023, the global anthracite market is estimated to be valued at $116.20 billion. However, projections indicate a decline to $103.11 billion by 2030.

The Asia Pacific region is anticipated to hold the largest market share in 2023, followed by North America and Europe.

Download FREE Sample of this Report @ https://www.24chemicalresearch.com/download-sample/198540/global-anthracite-market-2023-2029-513

Anthracite Market Forecast

The forecast for the global anthracite market anticipates a Compound Annual Growth Rate (CAGR) of -2.24% from 2023 to 2030.

The market decline can be attributed to the aforementioned factors impacting demand and supply.

Anthracite Market Production

In 2023, global anthracite production is expected to reach 800 million tonnes, but this is projected to decrease to 720 million tonnes by 2030.

The Asia Pacific region is set to lead global anthracite production in 2023, followed by North America and Europe.

Anthracite Market Volume

The volume of anthracite trade worldwide is projected to reach 150 million tonnes in 2023.

However, it is expected to decline to 135 million tonnes by 2030. The Asia Pacific region is predicted to account for the largest share of the global anthracite trade in 2023, followed by North America and Europe.

0 notes

Text

Unlocking Opportunities: Commercial Coal Mines Currently Available for E-Auction

In recent years, India’s coal sector has undergone significant transformations, opening up avenues for private sector participation through e-auctions of commercial coal mines. This article explores the current landscape of commercial coal mines available for e-auction, shedding light on the opportunities and implications for stakeholders in the energy sector.

Overview of E-Auctions:

E-auctions have emerged as a transparent and efficient mechanism for the allocation of coal blocks, promoting competition and attracting investment in the coal mining industry. The Government of India’s decision to introduce e-auctions for commercial coal mining marks a pivotal shift towards liberalizing the coal sector and encouraging private sector participation.

Status of Commercial Coal Mines:

As of now, there are eight of the thirteen commercial coal mines currently available for e-auction in India. These coal mines offer lucrative opportunities for private entities seeking to invest in coal mining operations and contribute to India’s energy security.

Key Features of Commercial Coal Mines E-Auction:

Transparency: The e-auction process ensures transparency and fairness in the allocation of coal blocks, minimizing the scope for corruption and favoritism.

Competitive Bidding: Interested bidders participate in competitive bidding, driving up the value of coal blocks and maximizing revenue for the government.

Ease of Participation: The e-auction platform provides a user-friendly interface, allowing prospective bidders to participate in the auction process seamlessly.

Flexibility: Bidders have the flexibility to choose coal blocks based on their specific requirements and investment capabilities, fostering a conducive environment for diverse participation.

Opportunities for Stakeholders:

Investors: Commercial coal mines e-auction presents investors with an opportunity to venture into the coal mining sector and capitalize on India’s growing energy demand.

Coal Consumers: Access to commercial coal mines ensures a stable and reliable supply of coal for various industrial and commercial purposes, supporting the growth of key sectors such as power generation, steel, and cement.

Government: E-auctions generate significant revenue for the government through upfront payments, royalties, and other levies, bolstering economic growth and infrastructure development initiatives.

Challenges and Considerations:

Regulatory Framework: Adherence to regulatory requirements and compliance with environmental norms are essential considerations for prospective bidders.

Market Dynamics: Fluctuations in coal prices and market demand may influence investment decisions and project viability.

Infrastructure Development: Infrastructure development, including transportation and logistics, is crucial for the efficient extraction and transportation of coal from commercial mines.

Conclusion:

The e-auction of commercial coal mines represents a paradigm shift in India’s coal sector, offering unprecedented opportunities for private sector participation and investment. As the government continues to prioritize energy security and infrastructure development, stakeholders must navigate regulatory complexities and market dynamics to leverage the potential of commercial coal mining effectively.

0 notes

Photo

George Lauder was born on November 11th 1837 at Dunfermline, Fife.

Lauder is probably a wee bit more well known in his native Dunfermline, or maybe so Americans, I would think this is due to him being a bit overshadowed by a guy described as his "cousin-brother", Andrew Carnegie.

George Lauder was the son of George Lauder, Sr. and Seaton Morrison. His father, a local shop owner on the high street, Dunfermline. Very well read, Lauder Sr. was instrumental in the upbringing of his only son George, as well as his nephew the aforementioned Carnegie.

Lauder Jr. and Carnegie were two years apart in age and best friends as a result of their shared experiences. They affectionately referred to one another as “Dod” and “Naig”, as young children. After Andrew and his family left for America, George stayed in Scotland where he would go on to graduate from Glasgow University with a degree in mechanical engineering while studying under another famous name Lord Kelvin.

Carnegie wrote to Lauder asking him to join him in America as a partner in the Carnegie Steel Corporation. At the time, the major shareholders were Carnegie himself, Carnegie’s brother and two others.

Lauder brought several new developments to the steel business in America, including the process for washing and coking dross from coal mines, which resulted in a significant increase to the overall value of the business.

Lauder would go on to lead the development of the use of steel in armour and armaments. By the turn of the Twentieth Century, Lauder was a director of Carnegie Steel and its second largest shareholder behind his cousin Andrew. Throughout the course of his career, Lauder created a number of patented scientific advancements useful both in the steel industry and beyond.

The sale of Carnegie Steel to JP Morgan in 1901 created U.S Steel where Lauder sat on the board of directors. This became the first corporation in the world with a market capitalization exceeding $1 billion ($43 billion today).

Lauder’s oldest daughter, Harriet married Dr. James C. Greenway combining the Lauder and Greenway families into what is now known as the Lauder Greenway Family, their influence in American political and economic affairs dates from the 1640s through the contemporary era. Their primary contributions have been in the sciences, government, and intelligence. His son George Lauder III, was a high-profile sailor who set the record in 1900 (held until 1905) for the fastest trans-Atlantic crossing with his yacht, Endymion,

In 1905 Harriet bought, what has become known as The Lauder-Greenway Estate a 50-acre property in Greenwich, Connecticut, where George lived out the last eleven years of his life passing away on August 24th, 1924.

The Estate, for a time, was the most expensive private residence in the United States in 2014 when it sold for an eye watering $120 million.

Pics are of George Lauder, the second is Andrew Carnegie, George Lauder, and Thomas Miller in 1862 taken in Glasgow, it is one of very few pics of Carnegie without a beard, Thomas Miller is said to be the man who started Carnegie in the steel business.

5 notes

·

View notes

Text

Colombia's Congress on Thursday approved a tax reform bill that will raise an additional 20 trillion pesos ($4 billion) annually for the next four years, in part through increased duties on oil and coal.

The new law, the centrepiece of new President Gustavo Petro's economic policies, seeks to fund social projects and put the country's public finances in order.

But it has also been heavily criticised by business lobbies who argue that the levies on the country's top exports will discourage investment, while uncertainty over the bill has contributed to a steep decline in the peso with the currency hitting a historic low earlier in the day.

In addition to duties of up to 10% on coal and up to 15% on crude oil when prices go above a certain level, the law will impose higher taxes on people who earn more than 10 million pesos, about $2,000, per month, as well as on single-use plastics, sugary drinks and ultra-processed foods.[...]

[The Finance Minister] added that agriculture, education, healthcare and peace programs can now count on significantly more financing and that the markets should not fear that the government would not be fiscally responsible.

But the bill, approved on Wednesday by the Senate and on Thursday by the lower house, is less ambitious in scope than the initial proposal from Petro's leftist government which called for generating 25 trillion pesos in additional taxes annually. [...]

Petro has also pledged to transition away from hydrocarbons, though the government said last week it may reverse a much-maligned ban on new oil contracts.

The new law states that oil companies will be taxed an additional 5% when international prices are between $67.3 and $75 per barrel. That then becomes an additional 10% when prices are between $75 and $82.2 per barrel and then 15% if they climb any higher.

Coal companies will face similar extra charges when prices exceed certain thresholds. Oil and mining companies will also not be able to deduct the value of royalties from income taxes.

3 Nov 22

18 notes

·

View notes

Text

Indonesia's Feb trade surplus smallest in 9 months JAKARTA, March 15 (Reuters) - Indonesia booked its smallest trade surplus in nine months in February as imports came in stronger than expected, while exports slumped, data from the statistics bureau showed on Friday. Its trade surplus last month was around $870 million, below the $2.32 billion expected by economists polled by Reuters and January's $2 billion surplus. The February surplus was the smallest since May 2023. Resource-rich Indonesia is the world's biggest exporter of coal, palm oil and nickel. A drop in commodity prices last year pressured its external balance. This year, exports may also have been affected by delays in the government's issuance of mining permits, which have disrupted activities in coal, nickel and tin mines, among others. In February, exports dropped 9.45% from a year earlier to $19.31 billion, more than the 6.5% predicted in the poll. Shipments of Indonesia's biggest export products, coal and palm oil, were each down 18.7% and nearly 40%, respectively, year-on-year by value. Imports were worth $18.44 billion in February, up 15.84% from a year earlier, against market expectations for a 9.3% increase, with the biggest rise recorded for imports of machinery, plastic, and electrical equipments.

0 notes

Text

Internet Of Things In Energy : Worldwide Market is set to Fly Massive Growth in Years to Come

According to HTF Market Intelligence, theGlobal Internet Of Things In Energy market to witness a CAGR of 11.39% during forecast period of 2024-2030. Global Internet Of Things In Energy Market Breakdown by Application (Oil and Gas, Coal Mining, Smart Grid) by Type (Cellular Network, Satellite Network, Others) by Service (Consulting, Integration and Deployment, Support and Maintenance) by Solution (Energy Management, Mobile Workforce Management, Field Surveillance, Monitoring of Equipment, Power Distribution, Others) and by Geography (North America, South America, Europe, Asia Pacific, MEA). The Internet Of Things In Energy market size is estimated to increase by USD Billion at a CAGR of 11.39% from 2024 to 2030. The report includes historic market data from 2019 to 2023E. Currently, market value is pegged at USD 22.02 Billion.

Get Detailed TOC and Overview of Report @

The integration of Internet of Things (IoT) technology into the energy sector, allowing for the interconnectedness and smart management of energy-related devices, infrastructure, and systems to improve efficiency, sustainability, and monitoring.

Some of the key players profiled in the study are Agt International (Switzerland), Carriots S.L. (Spain), Cisco Systems Inc. (United States), Davra Networks (Ireland), Flutura Business Solutions LLC (India), IBM (United States), Intel Corp. (United States), Maven Systems Private Limited (India), SAP SE (Germany), Symboticware Inc. (Canada), Wind River Systems Inc (United States).

Book Latest Edition of Global Internet Of Things In Energy Market Study @ https://www.htfmarketintelligence.com/buy-now?format=1&report=913

About Us:

HTF Market Intelligence is a leading market research company providing end-to-end syndicated and custom market reports, consulting services, and insightful information across the globe. HTF MI integrates History, Trends, and Forecasts to identify the highest value opportunities, cope with the most critical business challenges and transform the businesses. Analysts at HTF MI focuses on comprehending the unique needs of each client to deliver insights that are most suited to his particular requirements.

Contact Us:

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +1 4343220091

[email protected]

0 notes