#BankruptcyAttorney

Text

Bankruptcy Attorney Near Me: How to Find the Right One for You

PO Lawyer - Are you struggling with mounting debt and financial hardship? If so, you may be considering filing for bankruptcy to regain control of your finances.

However, navigating the complex legal process of bankruptcy can be overwhelming and stressful, especially if you are not familiar with the laws and regulations.

That’s where a bankruptcy attorney comes in. A skilled and experienced bankruptcy attorney can help you understand your options, guide you through the legal process, and represent you in court if necessary.

Understanding Bankruptcy

Before we dive into how to find a bankruptcy attorney, let’s take a moment to understand what bankruptcy is and how it works.

See Also : How to Choose the Right Estate Planning Attorney for Your Needs

Bankruptcy is a legal process that allows individuals and businesses to eliminate or repay their debts under the protection of a federal court. There are two primary types of bankruptcy for individuals: Chapter 7 and Chapter 13.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy, also known as liquidation bankruptcy, is designed for individuals who cannot afford to repay their debts.

In a Chapter 7 bankruptcy, a court-appointed trustee sells off the debtor’s non-exempt assets to pay back creditors.

Most unsecured debts, such as credit card debt and medical bills, can be discharged in a Chapter 7 bankruptcy.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy, also known as reorganization bankruptcy, is designed for individuals with a steady income who can afford to repay some or all of their debts over time.

In a Chapter 13 bankruptcy, the debtor creates a repayment plan that lasts between three and five years. At the end of the repayment period, any remaining unsecured debts are discharged.

Why Hire a Bankruptcy Attorney?

Bankruptcy is a complex legal process that requires a thorough understanding of the law and the ability to navigate the court system.

Here are a few reasons why hiring a bankruptcy attorney is a smart choice:

Knowledge and Expertise

A bankruptcy attorney has the knowledge and expertise to help you understand your options, navigate the legal process, and represent you in court if necessary.

They can help you make informed decisions about which type of bankruptcy is right for you and ensure that your bankruptcy petition is filed correctly.

Protection from Harassment

Once you file for bankruptcy, creditors are required by law to stop all collection efforts, including phone calls, letters, and legal action.

Read More : How to Become an Attorney: Education and Career Path

A bankruptcy attorney can help you stop creditor harassment and protect your legal rights.

Increased Chances of Success

Hiring a bankruptcy attorney can increase your chances of success. Studies have shown that individuals who hire a bankruptcy attorney are more likely to have their debts discharged than those who try to file on their own.

How to Find a Bankruptcy Attorney Near You

Now that you understand the importance of hiring a bankruptcy attorney, let’s discuss how to find the right one for you.

Related : The Importance of Hiring an Attorney for Bankruptcy

Here are some tips to help you get started:

Ask for Recommendations

Start by asking friends, family members, or colleagues for recommendations. If someone you know has gone through the bankruptcy process, they may be able to recommend a good attorney.

Check Online Reviews

Check online reviews on websites like Yelp, Google, and Avvo. Look for attorneys with positive reviews and a track record of success.

Consult with a Local Bar Association

Contact your local bar association for a referral. They can provide you with a list of qualified bankruptcy attorneys in your area.

Schedule a Consultation

Once you’ve found a few potential attorneys, schedule a consultation to discuss your case. This will give you an opportunity to ask questions, learn more about the attorney’s experience and expertise, and determine if they are the right fit for you.

Dont Miss : Bankruptcy Attorney: Navigating Financial Hardship with Professional Help

Filing for bankruptcy is a significant decision that can have long-term implications for your financial future.

That's why it's crucial to find the right bankruptcy attorneys near you. By following the tips above, you can find an attorney who can guide you through the legal process and help you achieve a fresh financial start.

Remember, a good bankruptcy lawyer should be knowledgeable, experienced, and have a track record of success.

They should also be someone who you feel comfortable working with and trust to represent your interests.

By taking the time to find the right attorney, you can have peace of mind knowing that you have an experienced professional on your side.

FAQs

- What is the role of a bankruptcy attorney?

A bankruptcy attorney helps individuals and businesses navigate the complex legal process of bankruptcy. They can help you understand your options, create a repayment plan, and represent you in court if necessary.

- How much does a bankruptcy attorney cost?

The cost of a bankruptcy attorney varies depending on the complexity of your case, your location, and the attorney's experience. Most bankruptcy attorneys charge a flat fee for their services.

- Can I file for bankruptcy without an attorney?

While it is possible to file for bankruptcy without an attorney, it is not recommended. Bankruptcy is a complex legal process that requires a thorough understanding of the law and the ability to navigate the court system.

- What should I look for in a bankruptcy attorney?

When looking for a bankruptcy attorneys, you should look for someone who is knowledgeable, experienced, and has a track record of success. They should also be someone who you feel comfortable working with and trust to represent your interests.

- Will filing for bankruptcy ruin my credit?

Filing for bankruptcy will have a negative impact on your credit score, but it can also provide an opportunity for a fresh financial start. With time and responsible financial behavior, you can rebuild your credit after bankruptcy.

Read the full article

#attorney#AttorneyNearMe#attorneys#bankruptcy#BankruptcyAttorney#find#for#how#me:#near#news#one#right#the#UnderstandingBankruptcy#you

0 notes

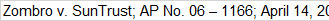

Photo

Do you have a bankruptcy you need removed from your credit report? Our team can help get results in 30 days! #bankruptcy #bankruptcyattorney #creditrepair #credit #creditscore #creditreport #creditagent #creditsweep https://www.instagram.com/p/ClKbR2EJj4v/?igshid=NGJjMDIxMWI=

0 notes

Text

Bankruptcy Attorneys - New Financial Beginnings

https://newfinancialbeginnings.com/meet-our-attorneys/

Highly Experienced and Aggressive Bankruptcy Attorneys. We defend people against unfair lending and debt collection practices.

1 note

·

View note

Photo

Navigating the commercial insolvency process can be difficult. When it’s time for advice, the attorneys at Ryan Swanson & Cleveland can help.

#commercialbankruptcy#commercialinsolvency#bankruptcy#insolvency#bankruptcyattorneys#bankruptcylawyers

0 notes

Photo

What Happens to Your Savings Accounts if You File for Chapter 13 Bankruptcy

https://bit.ly/3FWdrwF

In general, you don’t have to worry about your savings and checking accounts if you file for Chapter 13 bankruptcy in Raleigh, NC.

You can even open new bank accounts as long as the court approves it. You can even have your Chapter 13 payments deducted automatically from your bank account to make the process more convenient.

However, Chapter 13 debtors are not completely immune to having their bank accounts garnished.

Here’s a closer look at what you need to know about your savings and checking accounts if you’re considering Chapter 13 bankruptcy in Raleigh, NC.

Chapter 13 Protects Your Bank Account Funds (in Most Cases)

Chapter 13 bankruptcy is often called a “reorganization” bankruptcy because it allows debtors to reorganize their debts and create a repayment plan to pay back their creditors over time.

Unlike Chapter 7, which liquidates your assets to pay off your debts, Chapter 13 lets you keep your property and assets. This includes your savings and checking accounts

In some cases, Chapter 13 may also allow you to keep funds in your bank account in excess of the exemption amount. The caveat is that you’ll need to work these excess funds into your Chapter 13 repayment plan.

Banks, Credit Unions & the “Set-Off” Privilege

While Chapter 13 bankruptcy offers protection for your bank account funds, it’s not 100% immune from creditors.

Namely, banks and credit unions have what’s called the “set-off” privilege. This allows them to take funds out of your account to pay off any debts you owe them.

This is particularly common among credit union members, who usually have auto loans, personal loans, mortgages, and other debts with their credit unions in addition to their checking and savings accounts.

Still, that doesn’t mean they can just take funds anytime they want from your accounts. If you’re concerned about this happening to you, please mention it during your free consultation with Attorney Weik.

What NOT To Do If You Have Bank Accounts & Are Considering Chapter 13

Chapter 13 has powerful protections in place for debtors – as long as you avoid sabotaging your own filing in the first place.

Never do the following to your bank accounts if you plan on filing for Chapter 13 in Raleigh:

Don’t make any large deposits or withdrawals without consulting with your Weik bankruptcy attorney first.

Don’t try to hide any assets by transferring them to friends or family members. This is considered fraud and can result in jail time.

Don’t close or open any bank accounts without prior approval from the court.

Don’t sign over any bank accounts to anyone else without court permission.

Don’t take out new loans or lines of credit without first informing Attorney Weik and getting court permission.

There are other things to avoid doing as well – which is why it’s always best to consult with a knowledgeable Raleigh Chapter 13 bankruptcy attorney before taking any action.

Call Weik Law Office today at 919-845-7721 for a free consultation, and set up a time to speak with one of our friendly professionals. We look forward to hearing from you soon!

#bankruptcy raleigh#raleighbankruptcy bankruptcyinraleigh bankruptcyattorney chapter13limits bankruptcyattorney chapter13bankruptcy bankruptcychapter7nc

0 notes

Photo

19659001 @shurlaw #familylawattorney #familylaw #lawfirm #legaladvice #familylawadvice #bankruptcy #bankruptcyattorney #bankruptcylawyer #bankruptcylawfirm #womanowned #womanownedbusiness #womanownedlawfirm #cincinnatlawyer #cincinnatilawfirm #northernkentucky #northernkentuckylawfirm #cleveland #clevelandattorney #clevelandlawyer #shurlaw #paralegal #paralegals

0 notes

Text

Bankruptcy And Student Loans: Understanding Your Options

Bankruptcy And Student Loans: Understanding Your Options - #jayweller #bankruptcy, #Bankruptcyassistance, #Bankruptcyattorney, #BankruptcyLawyer, #Chapter13, #Chapter7, #Clearwater, #CreditCounseling, #FilingForBankruptcy, #Law, #studentloans, #Tips, #WellerLegalGroup - https://www.jayweller.com/bankruptcy-and-student-loans-understanding-your-options/

#bankruptcy#bankruptcy and student loans#Bankruptcy Attorneys#Bankruptcy Law#chapter 13 bankruptcy#chapter 7#Chapter 7 Bankruptcy#Clearwater#file for bankruptcy#Filing For Bankruptcy#Florida#student loan debt#student loans#Student Loans and Bankruptcy#Weller Legal Group

0 notes

Video

Bad Credit Renters,

You can't find a scapegoat for your bad credit or criminal background? Housing Problem Solvers Company can get you approved for a place to live! Call 800-915-2683 or www.housingpsg.com

#badcredit #bankruptcy #bankruptcyattorney #lowcreditscore #evictions#shortsale #criminalbackground #foreclosure #renters #renter #felony

0 notes

Text

Bankruptcy Attorney

Bankruptcy Attorney

A bankruptcy attorney is a legal professional who specializes in assisting individuals and businesses in filing for bankruptcy. They provide advice on the different types of bankruptcy,

#yankiz #lawyer #attorney #bankruptcy #BankruptcyAttorney #Bankruptcylawyer #Bankruptcylawfirm #lawfirm

0 notes

Text

RT @FisherSandler: The bankruptcy process begins with a consultation with an attorney to determine if it's the right option for your financial situation. #bankruptcyadvice #bankruptcyattorney https://t.co/IwoJFC3Z1j https://t.co/IwoJFC3Z1j

RT @FisherSandler: The bankruptcy process begins with a consultation with an attorney to determine if it's the right option for your financial situation. #bankruptcyadvice #bankruptcyattorney https://t.co/IwoJFC3Z1j https://t.co/IwoJFC3Z1j

— Darlyl Ricks (@DarlylRicks) Jan 30, 2023

from Twitter https://twitter.com/DarlylRicks

https://twitter.com/DarlylRicks/status/1620203547173294082

from Blogger https://ift.tt/RomXU4c

RT @FisherSandler: The bankruptcy process begins with a consultation with an attorney to determine if it's the right option for your financial situation. #bankruptcyadvice #bankruptcyattorney https://t.co/IwoJFC3Z1j https://t.co/IwoJFC3Z1j

0 notes

Text

Attorneys for Bankruptcy: How to Find the Right One for Your Case

PO Lawyer - Bankruptcy is a complex legal process, and it's essential to have a knowledgeable and experienced attorney on your side to guide you through it. Choosing the right attorney for your bankruptcy case can be a challenging task, especially if you don't know what to look for.

Bankruptcy can be a difficult and stressful process, and it's crucial to have the right attorney on your side to help you navigate through it.

A good bankruptcy attorneys will not only guide you through the legal process but also provide you with emotional support during this challenging time.

What is Bankruptcy?

Bankruptcy is a legal process that helps individuals and businesses who can no longer pay their debts to get a fresh financial start.

Bankruptcy can eliminate or reduce debt, stop collection actions, and provide the debtor with the opportunity to reorganize their finances.

There are two primary types of bankruptcy for individuals:

Chapter 7 and Chapter 13. Chapter 7 bankruptcy involves the liquidation of assets to pay off debts, while Chapter 13 bankruptcy involves the reorganization of debts to make them more manageable.

Bankruptcy is a complex legal process, and it's essential to have an experienced lawyers on your side to guide you through it.

An attorney can help you understand your options, navigate the legal system, and ensure that your rights are protected.

Qualities to Look for in a Bankruptcy Attorney

When looking for a bankruptcy lawyers, it's essential to find someone with the right experience and qualifications.

Some of the qualities to look for in a bankruptcy attorneys include:

- Experience in bankruptcy law

- Knowledge of local bankruptcy courts and trustees

- Good communication skills

- A track record of success

- Compassion and empathy

How to Find a Bankruptcy Attorney

There are several ways to find a bankruptcy attorney. You can ask for referrals from friends or family members, search online, or contact your local bar association.

Also Read : Finding Affordable Bankruptcy Lawyers

When searching for an attorney, make sure to do your research, read reviews, and ask questions. When meeting with a bankruptcy attorney, it's essential to ask the right questions.

Some of the questions you should ask include:

- How many bankruptcy cases have you handled?

- What is your success rate?

- What are your fees?

- How long will my case take?

- What are my options?

What to Expect During Your Initial Consultation

During your initial consultation with a bankruptcy attorney, you can expect to discuss your financial situation, your options, and the bankruptcy process.

The attorney will also review your case and determine whether bankruptcy is the right option for you.

The cost of a bankruptcy law can vary depending on several factors, including the complexity of your case and the attorney's experience.

Some attorneys charge a flat fee, while others charge by the hour. It's essential to discuss fees with your attorney before hiring them.

Related : Bankruptcy Attorney: Navigating Financial Hardship with Professional Help

Choosing the right lawyer for your bankruptcy case can be a challenging task, but it's essential to find someone who has the experience, knowledge, and compassion to guide you through the process.

When looking for a bankruptcy attorney, make sure to do your research, ask the right questions, and find someone who you feel comfortable working with.

Questions And Answer

- Can I file for bankruptcy without an attorney?

While it's technically possible to file for bankruptcy without an attorney, it's not recommended. Bankruptcy is a complex legal process, and an attorney can help ensure that your rights are protected and that you get the best outcome possible.

- How do I know if bankruptcy is the right option for me?

The best way to determine if bankruptcy is the right option for you is to consult with a bankruptcy attorney. They can review your financial situation and recommend the best course of action.

- How long does the bankruptcy process take?

The length of the bankruptcy process can vary depending on several factors, including the type of bankruptcy, the complexity of your case, and the court's schedule. However, most cases take between three and six months to complete.

- What if I can't afford to hire a bankruptcy attorney?

If you can't afford to hire a bankruptcy attorney, you may be able to get help from a legal aid organization or pro bono program. Some attorneys may also offer payment plans or reduced fees.

- Will bankruptcy ruin my credit?

Bankruptcy will have a negative impact on your credit score, but it doesn't necessarily mean that your credit will be ruined. With time and effort, you can rebuild your credit and improve your financial situation.

We will provide information on Lawyers and Attorneys and Lawyers Near Me, Bankruptcy Attorneys, Personal Injury Lawyer, Auto Accident Lawyer, Family Lawyer and others.

Don’t forget. With. Development Perfect Organiztion Lawyer by clicking on the link. In. Lower. This :

Facebook. (By clicking on this link, you will be logged into PO Lawyer Facebook) Let’s click now.

Or you can also see our Twitter or you can visit our Google News.

We Are Also There Channels YouTube For Look Lawyers Information us Visually Come on Now Join Us.

Read the full article

#attorneys#bankruptcy#BankruptcyAttorney#bankruptcyforattorney#bankruptcylawyer#case#find#for#how#news#one#right#the#your

0 notes

Text

Bankruptcy Attorney in Brooklyn, New York

Hanna & Vlahakis Law Offices

7504 5th Ave, Brooklyn, NY 11209

Phone: (718) 680-8400

https://hvlawoffices.com/

https://goo.gl/maps/BBEEcVvYp5FhPgSB8

#DivorceLawyer#BankruptcyLawyer#BankruptcyAttorney#DivorceAttorney#BankruptcyLawFirm#DivorceLawFirm#FamilyLawFirm

0 notes

Text

Attorneys, Bankruptcy Experts and Vermont Residents…

I am looking to sell one of my domains. Check it out, share with colleagues and take advantage of the great Geo.

Happy Holidays.

#bankruptcyattorney

#domainnamesforsale

#godaddy

#vermont

#businessowner

#url

Www.vermontbankruptcyattorneys.com

0 notes

Photo

Social Security Attorney

If you are in need of a social security attorney, allow Mayfield Law Firm to help. It is our attorney's goal to provide the best possible service and help you in every possible way. With over 42 years in business, you can be sure that our social security attorneys will provide you with the legal aid you deserve. To learn more about our legal services, contact Mayfield Law Firm today.

https://www.southavenautoaccidentlawyer.com

#AutoAccidentAttorney#AutoAccidentLawyer#Chapter7Attorney#Chapter7Lawyer#Chapter13Attorney#Chapter13Lawyer#SocialSecurityAttorney#SocialSecurityLawyer#DisabilityLawyer#PersonalInjuryAttorney#PersonalInjuryLawyer#CarAccidentAttorney#CarAccidentLawyer#CarWreckAttorney#CarWreckLawyer#BankruptcyAttorney#BankruptcyLawyer

3 notes

·

View notes

Photo

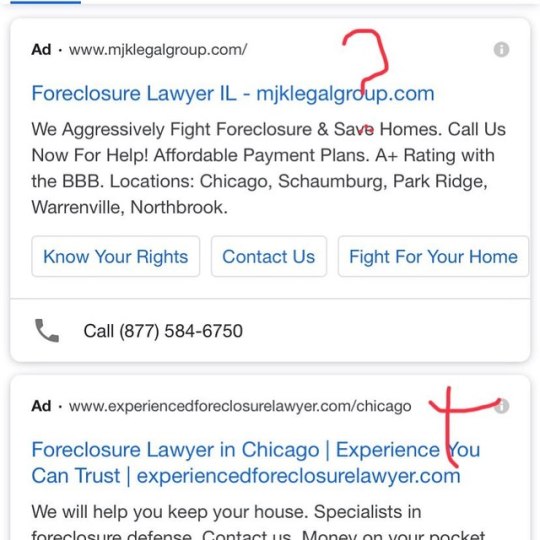

Ad is great but landing page is bad! . . . #lawyer #lawyergirl #lawyerlife #lawyergirls #lawyersofinstagram #lawyerfashion #law #lawyerproblems #lawyerbae #bankruptcy #bankruptcylaw #bankruptcylawyer #bankruptcyattorney #attorney #attorneyatlaw #attorneyproblems #attorneylife (at Chicago, Illinois) https://www.instagram.com/p/B0MPafdnPRR/?igshid=1ngg5h4msxcjj

#lawyer#lawyergirl#lawyerlife#lawyergirls#lawyersofinstagram#lawyerfashion#law#lawyerproblems#lawyerbae#bankruptcy#bankruptcylaw#bankruptcylawyer#bankruptcyattorney#attorney#attorneyatlaw#attorneyproblems#attorneylife

1 note

·

View note