#15 key stock trading terms

Text

Top 15 Must-Know Stock Market Terms for New Investors

#stock market for beginners#stock market#investing for beginners#how to invest in stocks for beginners#stock market investing#how to invest in stock market#how to invest in stocks#stocks#how to invest in the stock market#stock market crash#stock market for beginners 2023#stock market terms#best stocks to buy now#stock market news#15 key stock trading terms#stock market terms for beginners#stocks to buy now#how to outperform the stock market

1 note

·

View note

Text

How many shares should a beginner buy?

Determining how many shares a beginner should buy depends on various factors, including:

Investment Goals: Consider your investment objectives. Are you looking for long-term growth, short-term gains, income generation, or a combination of these? Your goals will influence the number of shares you buy and the type of stocks you invest in.

Risk Tolerance: Assess your risk tolerance. If you're risk-averse, you may prefer to start with a smaller number of shares or invest in less volatile assets. If you're comfortable with risk, you might be more inclined to buy a larger number of shares or invest in higher-risk, higher-reward opportunities.

Financial Situation: Evaluate your financial situation, including your income, expenses, debts, and emergency savings. Make sure you have sufficient funds to cover your living expenses and emergencies before investing. Only invest what you can afford to lose, especially as a beginner.

Diversification: Diversification is key to managing risk. Instead of putting all your money into a single stock, consider spreading your investment across multiple stocks or other asset classes. This helps mitigate the impact of any one investment underperforming.

Brokerage Fees: Keep in mind brokerage fees, which can eat into your returns, especially if you're buying a small number of shares. Look for brokers with low or no commission fees, especially for beginner investors.

Research and Education: Take the time to research and educate yourself about the stock market, individual companies, and investment strategies. Building a solid foundation of knowledge will help you make more informed investment decisions.

As a general guideline, many experts recommend starting with a diversified portfolio of at least 10 to 15 different stocks or other assets. However, the specific number of shares you buy will depend on your personal circumstances and preferences. It's always a good idea to start small, gain experience, and gradually increase your investment as you become more comfortable and confident in your abilities.

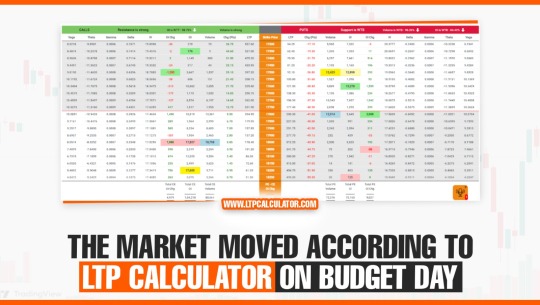

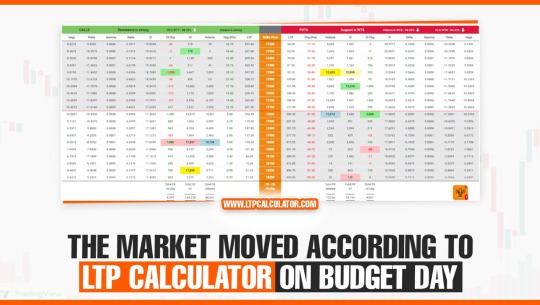

LTP Calculator Overview

LTP Calculator is a comprehensive stock market trading tool that focuses on providing real-time data, particularly the last traded price of various stocks. Its functionality extends beyond a conventional calculator, offering insights and analytics crucial for traders navigating the complexities of the stock market.

Also Available on Play store - Get the App

Key Features:

Real-time Last Traded Price:

The core feature of LTP Calculator is its ability to provide users with the latest information on stock prices. This real-time data empowers traders to make timely decisions based on the most recent market movements.

User-Friendly Interface:

Designed with traders in mind, LTP Calculator boasts a user-friendly interface that simplifies complex market data. This accessibility ensures that both novice and experienced traders can leverage the tool effectively.

Analytical Tools:

Beyond basic price information, LTP Calculator incorporates analytical tools that help users assess market trends, volatility, and potential risks. This multifaceted approach enables traders to develop a comprehensive understanding of the stocks they are dealing with.

Customizable Alerts:

Recognizing the importance of staying informed, LTP Calculator allows users to set customizable alerts for specific stocks. This feature ensures that traders receive timely notifications about significant market movements affecting their portfolio.

Vinay Prakash Tiwari - The Visionary Founder:

At the helm of LTP Calculator is Vinay Prakash Tiwari, a renowned figure in the stock market training arena. With a moniker like "Investment Daddy," Tiwari has earned respect for his expertise and commitment to empowering individuals in the financial domain.

Professional Background:

Vinay Prakash Tiwari brings a wealth of experience to the table, having traversed the intricacies of the stock market for several decades. His journey as a stock market trainer has equipped him with insights into the challenges faced by traders, inspiring him to develop tools like LTP Calculator.

Philosophy and Approach:

Tiwari's approach to stock market training revolves around education, empowerment, and simplifying complexities. LTP Calculator reflects this philosophy, offering a tool that aligns with his vision of making stock market information accessible and understandable for all.

Educational Initiatives:

Apart from his contributions as a tool developer, Vinay Prakash Tiwari has actively engaged in educational initiatives. Through online courses, webinars, and seminars, he has shared his knowledge with aspiring traders, reinforcing his commitment to fostering financial literacy.

In conclusion, LTP Calculator stands as a testament to Vinay Prakash Tiwari's dedication to enhancing the trading experience. As the financial landscape continues to evolve, tools like LTP Calculator and visionaries like Tiwari sir play a pivotal role in shaping a more informed and empowered community of traders.

0 notes

Text

10 Things to know about Indian Stock Market

Understanding the Indian stock market can be complex, but here are 10 key things to know:

Regulatory Bodies: The Securities and Exchange Board of India (SEBI) is the primary regulatory body governing the Indian stock market. It regulates securities markets and protects the interests of investors.

Major Stock Exchanges: The two major stock exchanges in India are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). These exchanges facilitate trading in equities, derivatives, commodities, and other financial instruments.

Index Performance: The performance of benchmark indices such as the BSE Sensex and the NSE Nifty is closely monitored to gauge the overall health of the Indian stock market. These indices represent a basket of top-performing stocks from various sectors.

Market Participants: Market participants include retail investors, institutional investors (such as mutual funds, foreign institutional investors), traders, and market makers. Institutional investors often have a significant influence on market movements.

Market Hours: The Indian stock market operates from Monday to Friday, with trading hours typically between 9:15 AM to 3:30 PM Indian Standard Time (IST). There are pre-market and post-market sessions as well, where limited trading occurs.

Market Segments: The Indian stock market comprises various segments such as equity (stocks), derivatives (futures and options), commodities, and currency derivatives. Each segment has its own set of rules and regulations.

Volatility and Risk: The Indian stock market can be volatile due to various factors such as economic indicators, global events, government policies, and corporate earnings. Investors should be prepared for fluctuations and assess their risk tolerance accordingly.

Investment Strategies: Investors in the Indian stock market employ various investment strategies, including value investing, growth investing, momentum trading, and technical analysis. It's essential to conduct thorough research and analysis before making investment decisions.

Market Regulations: SEBI regularly introduces regulations and guidelines to ensure transparency, fairness, and stability in the Indian stock market. Investors must stay updated with regulatory changes and comply with relevant laws.

Market Risks and Rewards: Investing in the stock market offers the potential for significant returns over the long term, but it also carries inherent risks. Diversification, risk management, and a disciplined approach are crucial for navigating the ups and downs of the market effectively.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

You can also downloadLTP Calculator app by clicking on download button.

Understanding these key aspects can provide a solid foundation for anyone looking to participate in the Indian stock market. However, it's essential to continue learning and staying informed about market developments to make informed investment decisions.

0 notes

Text

Wall Street Hedge Funds are Missing Out On This Stock.

Hello, my name is Jiayi Chen from Tradebase, and today I will be explaining one of my top stocks; Shopify Inc (NYSE: SHOP), and why it has the potential to outperform the market in 2024 significantly.

March 24 Weekly Rankings

1. Shopify

2. Nice Ltd

3. Eld Beauty

4. Advanced Micro Devices

5. EQT Corp

6. PayPal

7. Amplify Energy Corp

8. Microsoft

9. Tesla

10. The Trade Desk

Shopify Inc (NYSE: SHOP)

Shopify is the world’s leading platform offering an e-commerce platform that helps businesses easily sell products and services. Shopify has long been admired for the simplicity and straightforwardness with which merchants can set up storefronts on its platform. In recent years, it’s invested in and improved every conceivable merchant need, from providing point-of-sale software and hardware to extending its back office software to include cross-border sales tax compliance.

So, what makes Shopify especially compelling at this moment? I believe the company is currently leveraging significant scale advantages, driven by its technological superiority over competitors and its burgeoning brand influence. As highlighted by Tom Gardener during The Motley Fool’s recommendation unveiling, founder and CEO Tobi Lütke remains fundamentally focused on enhancing the functionality of the Shopify platform.

This meticulous attention to detail is yielding tangible outcomes. For instance, Shopify’s proprietary shopping cart payment technology, Shop Pay, demonstrates notably higher conversion rates compared to rival solutions — averaging at least 15% higher in completed transactions. Even Shopify president Harley Finkelstein states: “Our data also indicates that the mere presence of Shop Pay, even if unused by the buyer, results in a 5% increase in conversion, with usage potentially boosting conversion rates by up to 50% compared to guest checkout, surpassing all other accelerated checkout options by at least 10%. These trends are reflected in our performance.”

Furthermore, notable product enhancements such as “Hydrogen,” a robust programming environment tailored for large enterprises, enable intricate customization of storefronts. Despite this, Shopify has been consistently updating its program and maintaining its community; furthermore helping customers with their needs.

The convergence of product focus, brand resilience, and high-profile clientele has propelled Shopify to achieve consistent double-digit growth. In its most recent quarter, the company witnessed a 30% surge in revenue (adjusted for the divestiture of its logistics arm).

Another key aspect of why I think high of Shopify is its brand recognition and social media dominance. For example, Shopify has been blowing up on the internet, fueled and helped by Dropshipping or E-Commerce gurus that teach the art of online sales on social media platforms. Shopify is widely acknowledged and known as the best platform to sell online; what we like is it’s natural, unfiltered, organic brand development and reviews, in which the popularity of the brand spreads through the word of mouth from a person rather than from digital advertisements.

Of particular interest to long-term investors, Shopify attained a free cash flow margin of 21% in the last quarter, indicating its ability to convert a significant portion of sales revenue into free cash flow. We anticipate further improvement in this margin as Shopify continues to expand its gross merchandise volume (GMV) and net revenue. Already, Shopify is displaying signs of emerging as a cash-generating powerhouse, with free cash flow reaching $905 million over the past 12 months.

Investors must be ready to withstand short-term fluctuations in these stocks. Presently, Shopify’s valuation stands at 77 times the forward one-year earnings, which may appear steep initially. However, this valuation becomes more reasonable when factoring in consensus analyst forecasts indicating the company’s net earnings are expected to more than double from 2024 to 2026.

The transitional phases for companies, shifting from break-even to high-profit states, often pose challenges for investors as they weigh the importance of revenue growth versus profitability in their valuation assessments. I am confident that Shopify is poised to significantly increase its worth over the next five years and beyond.

Thank you for reading my article. I am Jiayi Chen, a stock trader at Tradebase. (If the link tells you to download WhatsApp, click on the compass icon on the bottom right)

I put my heart and soul into everything I write and publish for free. I’ve been struggling to maintain my studies and grades at near-perfect scores and my 5 social media blogs with articles. If you enjoyed this article, I would ask you to kindly take 20 seconds out of your life to click here to join my official trading channel where I broadcast my top stock recommendations and newsletters for FREE. It means a lot to me. If you don’t want to join then I am completely ok since everyone likes different things and you might not like what I write or disagree with my stock picks. But anyways, I appreciate you for reading my article and I wish you the best on your investment journey and your quest to financial freedom.

1 note

·

View note

Text

Arbitrage Investment

Arbitrage Investment AG is a multifaceted investment and asset management company with a diverse portfolio spanning various industries. Its investment strategy prioritizes long-term growth opportunities in innovative markets, with a particular focus on low-risk arbitrage. The company operates primarily through its subsidiaries, each specializing in different sectors of the market.

The portfolio of Arbitrage Investment AG encompasses a wide range of sectors, reflecting its commitment to diversification and innovation. These sectors include:

1. Investment Management: Offering services related to asset management, investment advisory, and portfolio optimization.

2. Equity Management: Managing investments in publicly traded stocks and securities markets.

3. Property Leasing: Engaged in leasing and management of commercial and residential properties.

4. Fintech Services: Providing financial technology solutions and services, potentially including digital banking, payment processing, and blockchain-based applications.

5. Renewable Energy: Investing in renewable energy projects such as solar, wind, hydroelectric, and biomass.

6. Pharmacy Publishing: Publishing and distribution of pharmaceutical-related literature, journals, and educational materials.

7. Biotechnology: Investing in companies involved in research, development, and commercialization of biotechnological products and services.

8. Medical Technology: Investing in companies producing medical devices, equipment, and diagnostic tools.

9. In vitro Diagnostics: Supporting companies engaged in developing diagnostic tests conducted outside the living organism, typically in test tubes or culture dishes.

10. Wearables and IoMT (Internet of Medical Things): Investing in wearable medical devices and technologies that connect to the internet for monitoring and data collection.

11. Recycling and Second Life of Electronic Components: Engaged in recycling and repurposing electronic waste, promoting sustainability and resource efficiency.

12. Consumer Electronics: Investing in companies manufacturing electronic devices for personal use, such as smartphones, tablets, and home appliances.

13. Lithium Batteries: Supporting the production and development of lithium-ion batteries, commonly used in portable electronic devices and electric vehicles.

14. Electromobility: Investing in companies involved in electric vehicle manufacturing, charging infrastructure, and related technologies.

15. Groundbreaking Artificial Intelligence: Investing in companies at the forefront of artificial intelligence research and development, leveraging AI for various applications across industries.

Arbitrage Investment AG's diversified approach allows it to capitalize on emerging opportunities across different sectors while mitigating risks through strategic investment choices. Its focus on long-term growth and innovation positions it as a key player in the investment landscape, particularly in markets driven by technological advancement and sustainability initiatives.

Website:https://arbitrageinvestment.de/

1 note

·

View note

Text

CBOE Volatility Index (VIX): What Does It Measure in Investing?

What Is the CBOE Volatility Index (VIX)?

The CBOE Volatility Index (VIX) is a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500 Index (SPX). Because it is derived from the prices of SPX index options with near-term expiration dates, it generates a 30-day forward projection of volatility. Volatility, or how fast prices change, is often seen as a way to gauge market sentiment, and in particular the degree of fear among market participants.

The index is more commonly known by its ticker symbol and is often referred to simply as “the VIX.” It was created by the CBOE Options Exchange and is maintained by CBOE Global Markets. It is an important index in the world of trading and investment because it provides a quantifiable measure of market risk and investors’ sentiments.

KEY TAKEAWAYS

The CBOE Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the coming 30 days.

Investors use the VIX to measure the level of risk, fear, or stress in the market when making investment decisions.

Traders can also trade the VIX using a variety of options and exchange-traded products, or they can use VIX values to price derivatives.

The VIX generally rises when stocks fall, and declines when stocks rise.

How Does the CBOE Volatility Index (VIX) Work?

The VIX attempts to measure the magnitude of price movements of the S&P 500 (i.e., its volatility). The more dramatic the price swings are in the index, the higher the level of volatility, and vice versa. In addition to being an index to measure volatility, traders can also trade VIX futures, options, and ETFs to hedge or speculate on volatility changes in the index.

In general, volatility can be measured using two different methods. The first method is based on historical volatility, using statistical calculations on previous prices over a specific time period. This process involves computing various statistical numbers, like mean (average), variance, and finally, the standard deviation on the historical price data sets.

The second method, which the VIX uses, involves inferring its value as implied by options prices.

Options are derivative instruments whose price depends upon the probability of a particular stock’s current price moving enough to reach a particular level (called the strike price or exercise price).

Since the possibility of such price moves happening within the given time frame is represented by the volatility factor, various option pricing methods (like the Black-Scholes model) include volatility as an integral input parameter. Since option prices are available in the open market, they can be used to derive the volatility of the underlying security. Such volatility, as implied by or inferred from market prices, is called forward-looking implied volatility (IV).

Extending Volatility to Market Level

The VIX was the first benchmark index introduced by CCOE to measure the market’s expectation of future volatility. Being a forward-looking index, it is constructed using the implied volatilities on S&P 500 index options and represents the market’s expectation of 30-day future volatility of the S&P 500 Index, which is considered the leading indicator of the broad U.S. stock market.

Introduced in 1993, the VIX is now an established and globally recognized gauge of U.S. equity market volatility. It is calculated in real-time based on the live prices of the S&P 500 Index. Calculations are performed and values are relayed from 3 a.m. to 9:15 a.m., and from 9:30 a.m. to 4:15 p.m. EST. CBOE began the dissemination of the VIX outside of U.S. trading hours in April 2016.

Calculation of VIX Values

VIX values are calculated using the CBOE-traded standard SPX options, which expire on the third Friday of each month, and the weekly SPX options, which expire on all other Fridays. Only SPX options are considered whose expiry period lies within more than 23 days and less than 37 days.

While the formula is mathematically complex, it theoretically works as follows: It estimates the expected volatility of the S&P 500 Index by aggregating the weighted prices of multiple SPX puts and calls over a wide range of strike prices.

All such qualifying options should have valid nonzero bid and ask prices that represent the market perception of which options’ strike prices will be hit by the underlying stocks during the remaining time to expiry.

For detailed calculations with an example, one can refer to the section “The VIX Index Calculation: Step-by-Step” of the VIX white paper.

Evolution of the VIX

During its origin in 1993, VIX was calculated as a weighted measure of the implied volatility of eight S&P 100 at-the-money put and call options, when the derivatives market had limited activity and was in its growing stages.

As the derivatives markets matured, 10 years later, in 2003, the CBOE teamed up with Goldman Sachs and updated the methodology to calculate VIX differently. It then started using a wider set of options based on the broader S&P 500 Index, an expansion that allows for a more accurate view of investors’ expectations of future market volatility. A methodology was adopted that remains in effect and is also used for calculating various other variants of the volatility index.

VIX vs. S&P 500 Price

Volatility value, investors’ fear, and VIX values all move up when the market is falling. The reverse is true when the market advances—the index values, fear, and volatility decline.

The price action of the S&P 500 and the VIX often shows inverse price action: when the S&P falls sharply, the VIX rises—and vice versa.

Tip: As a rule of thumb, VIX values greater than 30 are generally linked to large volatility resulting from increased uncertainty, risk, and investors’ fear. VIX values below 20 generally correspond to stable, stress-free periods in the markets.

How to Trade the VIX

The VIX has paved the way for using volatility as a tradable asset, albeit through derivative products. CBOE launched the first VIX-based exchange-traded futures contract in March 2004, followed by the launch of VIX options in February 2006.

Such VIX-linked instruments allow pure volatility exposure and have created a new asset class. Active traders, large institutional investors, and hedge fund managers use the VIX-linked securities for portfolio diversification, as historical data demonstrate a strong negative correlation of volatility to the stock market returns—that is, when stock returns go down, volatility rises, and vice versa.

Like all indexes, one cannot buy the VIX directly. Instead, investors can take a position in VIX through futures or options contracts, or through VIX-based exchange traded products (ETPs). For example, the ProShares VIX Short-Term Futures ETF (VIXY) and the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXXB) are two such offerings that track a certain VIX-variant index and take positions in linked futures contracts.

Active traders who employ their own trading strategies and advanced algorithms use VIX values to price the derivatives, which are based on high beta stocks. Beta represents how much a particular stock price can move with respect to the move in a broader market index. For instance, a stock having a beta of +1.5 indicates that it is theoretically 50% more volatile than the market. Traders making bets through options of such high beta stocks utilize the VIX volatility values in appropriate proportion to correctly price their options trades.

Following the popularity of the VIX, the CBOE now offers several other variants for measuring broad market volatility. Examples include the CBOE Short-Term Volatility Index (VIX9D), which reflects the nine-day expected volatility of the S&P 500 Index; the CBOE S&P 500 3-Month Volatility Index (VIX3M); and the CBOE S&P 500 6-Month Volatility Index (VIX6M). Products based on other market indexes include the Nasdaq-100 Volatility Index (VXN); the CBOE DJIA Volatility Index (VXD); and the CBOE Russell 2000 Volatility Index (RVX).

What Does the VIX Tell Us?

The CBOE Volatility Index (VIX) signals the level of fear or stress in the stock market—using the S&P 500 index as a proxy for the broad market—and hence is widely known as the “Fear Index.” The higher the VIX, the greater the level of fear and uncertainty in the market, with levels above 30 indicating tremendous uncertainty.

How Can an Investor Trade the VIX?

Like all indices, the VIX cannot be bought directly. However, the VIX can be traded through futures contracts and exchange traded funds (ETFs) and exchange traded notes (ETNs) that own these futures contracts.

Does the Level of the VIX Affect Option Premiums and Prices?

Yes, it does. Volatility is one of the primary factors that affect stock and index options’ prices and premiums. As the VIX is the most widely watched measure of broad market volatility, it has a substantial impact on option prices or premiums. A higher VIX means higher prices for options (i.e., more expensive option premiums) while a lower VIX means lower option prices or cheaper premiums.

How Can I Use the VIX Level to Hedge Downside Risk?

Downside risk can be adequately hedged by buying put options, the price of which depend on market volatility. Astute investors tend to buy options when the VIX is relatively low and put premiums are cheap. Such protective puts will generally get expensive when the market is sliding; therefore, like insurance, it’s best to buy them when the need for such protection is not obvious (i.e., when investors perceive the risk of market downside to be low).

What Is a Normal Value for the VIX?

The long-run average of the VIX has been around 21. High levels of the VIX (normally when it is above 30) can point to increased volatility and fear in the market, often associated with a bear market.

0 notes

Text

Top Stock Market Books to Read in 2024: A Guide for Investors

In the ever-evolving world of stock market investing, staying informed and continually enhancing one's knowledge is paramount. Whether you're a seasoned investor or just starting, the right books can provide valuable insights and strategies. Here's a curated list of top stock market books to consider reading in 2024:

1. "The Intelligent Investor" by Benjamin Graham:

Why Read: Considered the bible of value investing, this book by Benjamin Graham lays the foundation for intelligent and disciplined investing.

Key Concepts:

Margin of Safety: Graham emphasizes the importance of a margin of safety, advocating for buying stocks when they are priced below their intrinsic value to protect against downside risk.

Mr. Market Analogy: Graham introduces the concept of Mr. Market, an imaginary partner who offers to buy or sell stocks daily. Investors should not be swayed by Mr. Market's emotional fluctuations but instead take advantage of his occasional irrationality.

Defensive Investing: The book encourages defensive investing, focusing on minimizing losses and preserving capital rather than attempting to maximize gains.

2. "A Random Walk Down Wall Street" by Burton G. Malkiel:

Why Read: Burton Malkiel's book provides a comprehensive guide to various investment strategies and explores the concept of efficient markets.

Key Concepts:

Efficient Market Hypothesis (EMH): Malkiel discusses EMH, which posits that stock prices reflect all available information, making it difficult for investors to consistently outperform the market through stock picking or market timing.

Random Walk: The author introduces the idea of a random walk, suggesting that stock price movements are unpredictable, akin to the randomness of a walk. This challenges the notion of consistently beating the market through stock selection.

Investment Strategies: Malkiel covers various investment strategies, including passive investing, index funds, and the importance of asset allocation for individual investors.

3. "Common Stocks and Uncommon Profits" by Philip Fisher:

Why Read: Philip Fisher's book focuses on qualitative aspects of investing, offering insights into identifying high-quality companies with long-term growth potential.

Key Concepts:

Scuttlebutt Method: Fisher introduces the scuttlebutt method, emphasizing the importance of conducting thorough research by gathering information from various sources, including customers, competitors, and suppliers.

15 Points to Look For: The book outlines 15 points to consider when evaluating a company, covering aspects such as management quality, competitive advantages, research and development efforts, and the company's relationship with labor.

Long-Term Perspective: Fisher advocates for a long-term investment horizon, aligning with companies that have strong growth prospects and sound business fundamentals.

4. "Market Wizards" by Jack D. Schwager:

Why Read: Jack Schwager interviews successful traders in this book, extracting valuable lessons and strategies from a diverse group of market participants.

Key Concepts:

Diverse Perspectives: "Market Wizards" provides insights from a variety of traders with different approaches, showcasing that successful trading can take various forms.

Risk Management: Many of the traders highlighted in the book stress the importance of effective risk management, emphasizing the need to preserve capital and avoid significant losses.

Psychology of Trading: The interviews delve into the psychological aspects of trading, exploring the mindset and discipline required for success in the dynamic and often emotional world of financial markets.

5. "One Up On Wall Street" by Peter Lynch:

Why Read: Peter Lynch, one of the most successful fund managers, shares his investment philosophy and practical insights for individual investors.

Key Concepts:

Invest in What You Know: Lynch advocates for investing in companies whose products or services you understand and use regularly. Individual investors can gain an edge by leveraging their everyday knowledge.

Long-Term Approach: The book encourages a long-term investment approach, emphasizing the benefits of patience and allowing investments to compound over time.

Categorizing Stocks: Lynch categorizes stocks into different types, such as slow growers, stalwarts, and fast growers, providing a framework for investors to assess and manage their portfolios.

These five books offer a diverse range of perspectives, covering fundamental principles, efficient market concepts, qualitative investing, trading strategies, and practical advice from a successful fund manager. Reading these books can provide investors with a well-rounded understanding of the stock market and valuable insights to enhance their investment strategies.

0 notes

Text

Why Nvidia is a Buy Despite a Hefty Price

Nvidia Hit a Market Cap of 1 Trillion Dollars in Spring

Staying the Course with Strong Initiatives

Nvidia's strategic move involves staying the course with its latest initiatives in videogaming and automotive technology, unveiled ahead of the CES trade show. The focus on generative artificial intelligence (AI) through new GeForce graphic processors showcases the company's commitment to innovation.

Data-Center Business Driving Growth

The explosive growth of Nvidia's data-center business is a key factor contributing to its market value tripling. With booming demand for specialized systems powering genAI capabilities, Nvidia's data-center business is expected to reach nearly $78 billion in annual sales in fiscal 2025, a substantial increase from $15 billion two years prior.

Valuation Challenges and Investor Focus

Despite being valued at nearly $1.3 trillion, more than twice its closest chip-making peer, Nvidia faces the challenge of valuation. However, Wall Street seems to be honing in on the bottom line and cash reserves. The stock currently trades at about 26 times projected per-share earnings, near its lowest range in at least five years and below its average of 40 times. Analysts project strong revenue growth, with a 55% increase expected in the next fiscal year after a remarkable 118% surge in the soon-to-end year.

Booming Bottom Line and Cash Flow

Nvidia's financial performance is a standout feature. The company's adjusted operating income surged to $22.4 billion in the first nine months of the current fiscal year, compared with about $5 billion in the same period last year. Wall Street foresees annual adjusted per-share earnings exceeding $20 in fiscal 2025, more than six times the earnings in the latest fiscal year. This impressive bottom line has paradoxically made Nvidia's stock appear cheaper, trading at around 26 times projected per-share earnings.

Competitive Pricing and Free Cash Flow

Stacy Rasgon of Bernstein notes that Nvidia is trading at a discount to the peer PHLX Semiconductor Index, making it the cheapest AI play. Nvidia's stock price surge over the past year contrasts with its competitive pricing, trading near its lowest range in at least five years.

Cash Flow Strength and Future Projections

Nvidia is generating substantial free cash flow, tying with Broadcom as the highest in the chip sector at $17.5 billion for the past four quarters. Analysts project that Nvidia will produce $100 billion in free cash flow over the 2024-25 calendar years. About a third of this is expected to go towards share buybacks, with the remaining amount available for pursuing growth options, including mergers and acquisitions.

Potential Challenges and Geopolitical Considerations

While Nvidia faces challenges in a tech M&A market, particularly in a geopolitical minefield for chip companies, domestic AI demand is expected to keep the order book robust. The recent concern about Chinese companies' interest in downgraded chips appears to be offset by strong domestic demand.

Summary: Why Nvidia is a Buy

In the landscape of hot stock picks, Nvidia stands out as a potential buy despite its high price. Numerical evidence, including strong financials, competitive pricing, and robust projections, suggests that Nvidia has room for further growth. The company's strategic focus on generative AI and its ability to navigate challenges make it a stock worth considering for investors eyeing long-term gains in the dynamic world of tech investments.

Want More? Get AI Stock Pick Reports.

0 notes

Text

Top 5 Stock Screeners in India

The best stock screeners now in India are as follows.

Tickertape

Tickertape is one of India's leading screeners, which can be accessed via the same credentials as that of brokers like Zerodha, Upstox, Groww, Angle one, 5paisa, HDFC Sec, Axis Direct, IIFL Sec, Alice Blue, Kotak Sec, Motilal Oswal, ICICIdirect, Trustline.

Many people use this website to check stock, especially those who are just starting out in the stock market and looking for a good company to invest in. Tickertape can be used to make a better trade. That is why it is so popular among traders and stock market investors.

The main features of Tickertape are:

It has an easy to use interface.

It has a collection of 100+ filters which are easy to customise

It has a market mood indicator which depicts the sentiments of the market.

It shows the stocks deals, which shows the bulk deal carried out by HNIs. (High Net-Worth Individuals)

What makes "Tickertape pro" - Pro?

Data export: Enables you to obtain data across different asset classes.

Advance screening:

It gives you 'Premium screens', which have prebuilt screens based on a particular theme or idea.

Gives you access to 200+ pro filters

It has unlimited custom filters

Can build unlimited 'custom universes' based on your ideas and themes, which can be linked to your active watch list

Investment Insights: Gives additional information such as-

Default probability

Quality check

Growth score

Stock Forecasts: Predicts the future trend of the stock. It provides you with-

Price Forecast

EPS forecast

Revenue Forecast

Key metrics: This allows you to screen stocks based on the key metrics that resonate with your theme and objective.

Ticker by Finology

Like Google, Ticker brands itself as "Investing ka search Engine: The modern stock screener that helps you pick better stocks." Due to its easy to use design and advanced Artificial Intelligence integration, Ticker is among the top stock screeners in India. It is a tool designed to assist you with intelligent and smart stock picking with three-way assistance.

Like Tickertape, it also comes with a subscription model - Ticker Plus, but unlike Tickertape Pro, which is sold separately, Ticker plus comes along with Finology One. Finology One gives you added filters, tools and bundles in Ticker with 25+ Courses on Quest and 15+ stocks on Recipe.

The main features of Ticker by Finology are :

It has an easy to use interface.

One of the best in the market as a free version tool.

It has more than 1200 ratios for investors to select from and has a feature of smart suggestions for the ratios.

It comprises prebuilt screens having calculated ratios and described ideas to help kickstart the investment journey.

It is a very beginner-friendly tool. For example, a newbie may not be aware of the parent company of Maggi. So he can simply search the brand "Maggi", and Ticker will show the data of the parent company.

What gives TickerPlus a Plus?

It gives exclusive assorted premium bundles that help in strategic investing.

Common size statement

This gives investors the idea of revenue or sales in terms of percentage.

It helps you identify the true value of a stock.

It comes with Dupont analysis, EPS Multiple approaches, Book value analysis, and Discounted cash flows and where their parameters are used in combination, they direct the investor towards fair valuation.

Give access to Smart Portfolio.

Add up to 50 companies along with a watchlist of 100 companies.

Plus includes additional features like con calls, updating you with only the relevant news cutting the noise, presentations etc.

Screener

Screener is another well-known stock screener in India. It is an easy-to-use website for stock analysis. It can be used to read, analyse, and filter companies based on different metrics. It has a large database of companies and can show the company's performance for the past 10-12 years. The platform provides its users with information about the industry in which the company operates, stock P/E, market capitalisation, and book price information about the company. Screener also has two plans.

Hobby Investor (free plan)

Active investor (paid plan)

The main features of Screener are :

Let you create stock screens with up to 2 screen alerts.

Investors can follow up to 50 companies to keep track of them

Shows key insights of stocks limited to 20 per month.

Allows to set custom ratios

Lets the investor set 15 columns for comparison

Lets investors customise export to excel

What makes a hobby investor(free plan) an active investor(paid plan)?

Lets investors follow unlimited companies with unlimited screen alerts

Screener does have a clause that unlimited access has internal limits on a few resources.

Segment results with quarterly result tracker

50 columns for comparison instead of the 15 in the free version

Gives you up to 300 key insights per month

Lets you download screen results and watchlists

It has a feature of detailed peer comparison

Provides priority support

Capital Cube

Capital Cubes is one of the largest stock screeners available for use. Created by AnalytixInsights, an AI company that converts data into information. Capital Cube provides company analysis and portfolio assessment, basic to advance research, etc. It makes decision-making easier for investors by providing an in-depth analysis of the company's past performance, benefits and liabilities, budget strength and equity, and performance compared to peers. It comes in 3 versions:

Free

Premium Pack

Pro Pack

The main features of Screener are :

Easy to use interface

Natural Search can be performed.

Example: If an investor wants to search for debt-free companies or high ROE stocks, he can directly search "debt-free" or "high roe", respectively.

Has a collection of 40k global equities.

Allows in-depth peer-to-peer comparison

Capital cube premium and pro pack benefits :

Downloadable reports with deep analysis (part of the pro pack)

Downloadable screener data

Company news and alerts

Technical charting

Option to customise peers (part of the pro pack)

TradingView

TradingView is another stock screener which allows stock analysis across the globe with cryptoanalysis as well.TradingView has a huge customer base because of its free features.

Traders and investors alike love this tool, and some even subscribe to the Pro version. The free features can be accessed even without registration. A subscription can be considered when an investor needs more features for in-depth analysis. The subscription model for TradingView is divided into four categories, viz.

Basic

Pro

Pro+

Premium

The main features of TradingView are :

Worldwide market coverage

Create custom screener

Provides three main filters: Fundamental, technical and descriptive, apart from other filters. You can even choose all.

You can export the screener.

Multi Timeframe setting

Allows to set custom columns like performance, valuations, balance sheet etc

TradingView Alerts automatically applies alerts to current active filters.

For example, if an alert is set for a new all-time high, TradingView will alert when the stock makes a new all-time high.

How does the feature chart change from Basic to Premium?

Pro onwards TradingView is ad-free.

The number of charts per tab can be up to 8.

Allows setting a custom time interval. Can change frequency between 1 min to 12 months

Indicators per chart can be up to 25

Export strategy data

Up to 400 alerts can be set on price, indicators, drawing and strategies.

Improved customer support

Continue reading...

#best stock screeners#best stock screeners india#best stock screeners in india#top stock screeners india

0 notes

Text

Market Review / Outlook of the day Primary Sentiment : Neutral Immediate Trend : Slight Negative with support at lower level BMD Market Re-cap: - Malaysian palm oil futures advanced. This came despite a lackluster outlook for consumer demand from key importers, which was offset by a drop in the Malaysian currency. Dry weather conditions and concerns among traders about output led to higher prices. - According to the Indonesian Palm Oil Association, Indonesia’s palm oil exports in October amounted to 3.001 million tons. Output and stocks were 4.953 million tons and 2.874 million tons, respectively. - Oil prices jumped on Monday, fueled by worries about increased supply costs and possible maritime restrictions following the Houthi attacks in the Red Sea. - The current premium of soybean oil over palm oil stands at $309 per ton, significantly lower than the average of $418 per ton seen over the past year. World Oil and Grains - CBOT soybean futures climbed on Monday, fueled by strong export demand and anticipation of increased soy product export taxes in Argentina. This positive momentum outweighed market pressure from recent beneficial rains in dry Brazilian regions. - Argentina announced plans on Monday to increase the export tax on soybean oil and meal by 2%, from 31% to 33%. The move aims to boost domestic supply and stabilize domestic prices, but could lead to higher export prices for these products. - Forecasting models predict a shrinking window for vital near-term rainfall in northern Brazil, raising concerns about potential crop stress persisting in some areas. This dry spell could impact soybean and corn yields over the next fortnight. Market Outlook - Palm oil prices saw a significant uptick yesterday, closing at RM3,745 after weak start of the day. The commodity initially dipped below RM3,687 but found strong support, leading to a surge towards RM3,772 before retreating slightly at the close. This bullish candlestick pattern suggests potential buying momentum, although further confirmation may be needed in the coming sessions. - Palm oil is poised for a modest upward nudge at the start of trading, likely influenced by the strong performance of U.S. soybeans overnight. The market could see the price initially move towards RM3,800, with potential for further upward momentum towards RM3,900. Opening range: 3790 to 3800 Projected range of the day: 3600 to 3900 Support 3600 Next 3550 Resistance 3800 Next 3900 BMD FCPO Total Open Interest 01/12/2023: 208,661 (+2,519) 04/12/2023: 208,321 (-340) 05/12/2023: 211,963 (+3,642) 06/12/2023: 216,557 (+4,594) 07/12/2023: 216,188 (-369) 08/12/2023: 214,153 (-2,035) 11/12/2023: 215,539 (+1,386) 12/12/2023: 216,723 (+1,184) 13/12/2023: 217,271 (+548) 14/12/2023: 219,433 (+2,162) 15/12/2023: 215,935 (-3,498) 18/12/2023: 216,689 (+754) Source: Bursa Malaysia Futures

0 notes

Text

"Navigating the Waves: A Comprehensive Guide to Financial Markets Updates"

Introduction:

Staying abreast of financial market updates is essential for anyone keen on making informed investment decisions and understanding the broader economic landscape. This blog post serves as a comprehensive guide, providing insights into why financial market updates matter and how individuals can interpret and utilize this information.

Why Financial Markets Updates Are Crucial:

1. Economic Indicator:

• Financial markets are a reflection of the overall economy. Updates serve as real-time indicators, offering insights into economic health, growth, and stability.

2. Investment Decision-Making:

• Investors rely on market updates to make informed decisions about buying, selling, or holding assets. Understanding market trends helps in crafting a robust investment strategy.

3. Global Influences:

• Financial markets are interconnected globally. Updates provide a window into international economic trends, geopolitical events, and their impact on markets.

4. Risk Management:

• Awareness of market updates aids in risk management. By staying informed, investors can better anticipate and navigate potential market volatility.

Key Components of Financial Markets Updates:

5. Stock Market Performance:

• Regular updates on stock indices, individual stocks, and sectors provide insights into market sentiment and trends.

6. Currency Markets:

• Changes in currency values impact international trade and investments. Monitoring currency markets is crucial for a comprehensive financial outlook.

7. Bond Markets:

• Updates on bond yields and interest rates offer insights into economic conditions and investor confidence.

8. Commodities Market:

• Commodities, such as gold, oil, and agricultural products, are sensitive to market dynamics. Monitoring their prices is key for various industries and investors.

9. Economic Indicators:

• Updates on economic indicators like GDP growth, employment rates, and inflation contribute to a holistic understanding of the economic landscape.

Interpreting Financial Markets Updates:

10. Trend Analysis:

- Recognizing market trends and identifying potential shifts is crucial. Technical and fundamental analysis techniques can aid in this process.

11. News and Events Impact:

- Understanding how global events, corporate news, and economic releases can impact markets helps in making timely and informed decisions.

12. Investor Sentiment:

- Monitoring investor sentiment indicators, such as the Fear and Greed Index, provides insights into market psychology.

Utilizing Financial Markets Updates:

13. Long-Term Planning:

- Financial market updates contribute to long-term financial planning. Understanding trends aids in setting realistic goals and expectations.

14. Diversification Strategies:

- Based on market updates, investors can adjust their portfolios to ensure diversification and mitigate risks.

15. Opportunistic Investing:

- Market updates reveal investment opportunities. Being proactive allows investors to capitalize on favorable market conditions.

Conclusion:

Regularly staying informed about financial markets updates is a proactive approach to financial management. Whether you are a seasoned investor or someone just beginning their financial journey, leveraging market insights can empower you to make prudent decisions, navigate uncertainties, and work towards your financial goals with confidence. Remember, knowledge is a powerful asset in the dynamic world of finance.

For read more your favourite posts...

0 notes

Text

What is the recommended candle size for trading?

The recommended candle size for trading depends on various factors, including the trader's timeframe, trading strategy, market volatility, and personal preferences. Candlestick charts are a popular tool used by traders to analyze price movements, and the size of the candles can significantly impact trading decisions. Here's a detailed explanation:

Timeframe:

Shorter Timeframes: For day traders or scalpers who focus on short-term price movements, smaller candle sizes such as 1-minute, 5-minute, or 15-minute candles are commonly used. These smaller candles provide more detailed information about intraday price action.

Longer Timeframes: Swing traders or position traders who hold positions for days, weeks, or months may prefer larger candle sizes such as 1-hour, 4-hour, daily, or weekly candles. These larger candles help identify broader trends and significant price levels.

Volatility:

High Volatility: In highly volatile markets, smaller candle sizes may capture price movements more effectively, allowing traders to react quickly to rapid price changes. However, smaller candles can also generate more noise, making it challenging to identify meaningful patterns.

Low Volatility: In less volatile markets, larger candle sizes may be more suitable as they smooth out price fluctuations and provide clearer signals. Traders may opt for larger timeframes to filter out noise and focus on longer-term trends.

Trading Strategy:

Scalping: Scalpers typically use very small candle sizes (e.g., 1-minute or 5-minute candles) to capitalize on short-term price fluctuations. They aim to profit from small price movements within a short time frame.

Trend Following: Traders following trends may use larger candle sizes (e.g., daily or weekly candles) to identify and ride long-term trends. They focus on significant price reversals or trend continuation patterns.

Range Trading: Traders who trade within a defined price range may use a combination of small and large candle sizes, depending on the timeframe they're operating in and the duration of the price range.

Personal Preferences:

Some traders may have personal preferences for specific candle sizes based on their comfort level, trading style, and past experiences. Experimentation and backtesting can help traders determine the most suitable candle size for their individual needs.

Confirmation and Validation:

Regardless of the candle size chosen, traders often use multiple timeframes to confirm and validate their trading decisions. For example, a trader might analyze price action on both the 1-hour and 4-hour charts to identify potential entry and exit points.

In summary, there is no one-size-fits-all answer to the recommended candle size for trading. Traders should consider their timeframe, trading strategy, market conditions, and personal preferences when selecting the most appropriate candle size. It's essential to continually assess and adjust candle size choices based on evolving market dynamics and trading objectives.

LTP Calculator Overview:

LTP Calculator is a comprehensive stock market trading tool that focuses on providing real-time data, particularly the last traded price of various stocks. Its functionality extends beyond a conventional calculator, offering insights and analytics crucial for traders navigating the complexities of the stock market.

Also Available on Play store - Get the App

Key Features:

Real-time Last Traded Price:

The core feature of LTP Calculator is its ability to provide users with the latest information on stock prices. This real-time data empowers traders to make timely decisions based on the most recent market movements.

User-Friendly Interface:

Designed with traders in mind, LTP Calculator boasts a user-friendly interface that simplifies complex market data. This accessibility ensures that both novice and experienced traders can leverage the tool effectively.

Analytical Tools:

Beyond basic price information, LTP Calculator incorporates analytical tools that help users assess market trends, volatility, and potential risks. This multifaceted approach enables traders to develop a comprehensive understanding of the stocks they are dealing with.

Customizable Alerts:

Recognizing the importance of staying informed, LTP Calculator allows users to set customizable alerts for specific stocks. This feature ensures that traders receive timely notifications about significant market movements affecting their portfolio.

Vinay Prakash Tiwari - The Visionary Founder:

At the helm of LTP Calculator is Vinay Prakash Tiwari, a renowned figure in the stock market training arena. With a moniker like "Investment Daddy," Tiwari has earned respect for his expertise and commitment to empowering individuals in the financial domain.

Professional Background:

Vinay Prakash Tiwari brings a wealth of experience to the table, having traversed the intricacies of the stock market for several decades. His journey as a stock market trainer has equipped him with insights into the challenges faced by traders, inspiring him to develop tools like LTP Calculator.

Philosophy and Approach:

Tiwari's approach to stock market training revolves around education, empowerment, and simplifying complexities. LTP Calculator reflects this philosophy, offering a tool that aligns with his vision of making stock market information accessible and understandable for all.

Educational Initiatives:

Apart from his contributions as a tool developer, Vinay Prakash Tiwari has actively engaged in educational initiatives. Through online courses, webinars, and seminars, he has shared his knowledge with aspiring traders, reinforcing his commitment to fostering financial literacy.

In conclusion, LTP Calculator stands as a testament to Vinay Prakash Tiwari's dedication to enhancing the trading experience. As the financial landscape continues to evolve, tools like LTP Calculator and visionaries like Tiwari sir play a pivotal role in shaping a more informed and empowered community of traders.

0 notes

Text

What is Demat Account in Trading so Important ?

A Demat (Dematerialized) Account is a crucial component of the trading and investing ecosystem, especially in the context of stock markets. Here are the key reasons why a Demat Account is important:

1. Electronic Form of Securities:

A Demat Account holds financial instruments such as stocks, bonds, mutual funds, and other securities in electronic form. This eliminates the need for physical share certificates, making the process of buying, selling, and holding securities more efficient.

2. Trading and Investing:

Investors use Demat Accounts to facilitate the buying and selling of stocks on stock exchanges. It acts as a central repository for all the securities in an investor's portfolio.

3. Safety and Security:

Holding securities in electronic form reduces the risk of loss, theft, or damage associated with physical certificates. The Demat system provides a secure and convenient way to manage and safeguard investments.

4. Quick and Easy Transactions:

With a Demat Account, transactions such as buying and selling stocks can be executed seamlessly through online trading platforms. This ensures faster settlement and reduces paperwork.

5. No Stamp Duty on Transfer:

Unlike physical securities, there is no need for stamp duty on the transfer of securities held in Demat form, leading to cost savings.

6. Electronic Credit of Bonuses and Dividends:

Dividends and bonuses declared by companies are automatically credited to the investor's Demat Account. This eliminates the need for physical cheques and paperwork.

7. Portfolio Management:

Investors can easily monitor and manage their investment portfolios through online access to their Demat Accounts. It provides a consolidated view of holdings and transactions.

8. Simplifies Corporate Actions:

Corporate actions such as stock splits, mergers, and rights issues are automatically updated in the Demat Account, simplifying the process for investors.

9. Loan Against Securities:

Investors can avail of loans against the securities held in their Demat Accounts, providing liquidity without the need to sell the assets.

10. Facilitates Electronic IPOs:

javaCopy code

- Investors can apply for initial public offerings (IPOs) in electronic form through their Demat Accounts. Allotment of shares and refunds are also managed electronically.

11. Nomination Facility:

vbnetCopy code

- Demat Accounts allow investors to nominate beneficiaries, ensuring the smooth transfer of securities in case of the account holder's demise.

12. Regulatory Compliance:

csharpCopy code

- Holding securities in Demat form ensures compliance with regulatory requirements. It aligns with the current industry standards and regulations set by stock exchanges and regulatory authorities.

13. Tax Benefits:

csharpCopy code

- Certain tax-related processes, such as the settlement of long-term capital gains tax, are facilitated through the Demat system.

14. Accessibility and Convenience:

csharpCopy code

- Investors can access their Demat Accounts from anywhere, providing flexibility and convenience in managing their investments.

15. Record of Transactions:

cssCopy code

- A Demat Account maintains a comprehensive record of all transactions, facilitating easy tracking and audit of investments.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in india.

You can also downloadLTP Calculator app by clicking on download button.

In summary, a Demat Account streamlines and modernizes the process of buying, selling, and managing securities. It enhances the efficiency, safety, and convenience of transactions in the financial markets, contributing to a more investor-friendly environment.

0 notes

Text

What is Equity Investment: Meaning, Types and How to Start

WHAT IS EQUITY INVESTING AND WHY IS IT ESSENTIAL?

Quite often it is exciting to hear stories of how certain stocks in India have multiplied manifold over the last 10-15 years. It is also interesting to see how global and Indian investors have made their fortunes in the equity markets.

Before we get into equity investment, there is an important aspect of risk-return trade-off that we must understand. Compared to bonds and FDs, equity investment is riskier and more volatile. But equities also have the potential for higher returns. The BSE Sensex, which represents 30 of the most liquid stocks on the BSE, has grown from 100 to 66,000 in the last 44 years. That is compounded annual returns of 15.9% each year over the last 44 years. It may not have happened each year, but if you had stuck on, you would have made a lot of profits. That is the core of long term investment in equities.

As the legendary mathematician, Euclid told King Ptolemy, “Your Highness, there is no royal route to geometry.” Similarly, there is no royal route to equity investing. To invest in equity calls for planning, analysis, and the willingness to stay put for the long term.

First things first: What is equity?

Equity is the risk capital for any business. When we buy equity or shares or stocks (they all mean the same), we become part owners of the company. It may be small, but it is still ownership. Returns in equity come from dividends distributed by the company and capital gains when the stock price goes above the purchase price. So, equity is ownership, and as the owner, the equity shareholder has potential to earn higher returns with a higher risk.

That brings us to the next practical question, how to invest in equity? For investing in equity in India, need to open a trading account with a broker and a demat account. Remember, trading account is for transactions and demat account is for holding the shares. Both these accounts are mandatory, as per SEBI regulations. And thanks to digital India, understanding the process of how to open demat account and trading account has become a lot quicker and simpler these days.

Types of equity investment

If you thought that opening a trading and demat account and buying shares was the only way to invest in equities, think again. Here are some other ways of participating in different types of equity shares, apart from direct investing.

A very popular way of investing in equities is the mutual funds route. You can invest in lumpsum or even monthly SIPs.

You can invest in preference shares of a company, which is between a pure equity share and a bond.

It is possible to take on higher risk and invest in private equity (PE), where you actually invest in start-ups.

You can also buy equities via index investing; through index funds and index ETFs (exchange traded funds) mirroring the market as a whole.

Why to invest in equities?

When you decide to invest in equities, your close friends and relatives may caution you about equities being risky. They are correct, to an extent. Equities entail higher risk, but do you know what is the biggest risk? It is not taking enough risk when you can afford it. It is looking beyond the risk of investing in share market.

If at the age of 25, you put all your money in bank deposits, your money may be safe, but it will yield nothing after inflation. Equities, not only beat inflation, but also create wealth in the long term. For example, by putting Rs. 5,000 a month in an equity fund giving 14% a year for 25 years, you end up with Rs. 1.36 crore on an investment of Rs. 15 lakhs. That is the power of sustained long-term investment in equities.

Key benefits of investing in equity shares

How do investors benefit by investing in equity shares? Here is a sampler.

Equities are the most reliable asset class to create wealth over 8-10 years and above.

A portfolio of 8-10 stocks can diversify risk. Alternatively, you may opt for an equity mutual fund.

Transfer of shares is simple and can be done by giving instructions online.

You can monitor the portfolio value live on your trading platform 24X7.

Equities are taxed lower compared to FDs and bonds.

How to start investing in equities?

The first step is to understand the risk and return in equities. Once you are mentally prepared for equities, the next step is to open a trading account and demat account with a broker and activate online trading.

Once you fund your trading account, you are all set to invest in equities. Don’t get carried away by tips and rumours on multi-baggers. Rely on solid research to identify quality stocks, monitor these stocks, and stick to them for the long haul. Equities manage risk and returns much better in the long run.

Risks of stock market investing

Stock market or equity investing is more volatile and unpredictable in the short term, but more consistent over the long term. Secondly, buy quality stocks or rely on the power of equity mutual funds. Thirdly, be patient with equities. Don’t expect miracles to happen. If you want instant gratification, stock market is not the place to be. Lastly, factors outside your control can often hit equities. You may have little control over what is happening in Russia or Israel. The best way to manage the risk of investing in share market is to diversify your portfolio.

Equity is not a luxury but a necessity if you want to create wealth in the long run. As Warren Buffett summed it up in his 1987 letter to shareholders: “In the short run, stock market is like voting machine, but in the long run it works like a weighing machine.”

Source: https://www.sbisecurities.in/blog/all-about-equity-investment

0 notes

Text

How to Use Intraday Trading to Achieve Your Financial Goals

Day trading, or intraday trading, is a special chance for people to actively participate in the stock market and reach their financial objectives. That being said, it's critical to approach intraday trading with a well-thought-out strategy and a clear grasp of your goals. This post will offer advice on using intraday trading as a tool to achieve your financial objectives, with an emphasis on goal-setting and the use of practical tactics.

1. Define Your Financial Goals:

Start by outlining your Financial Success with Intraday. Are you hoping to make extra money, put money aside for a particular project, or make trading your full-time job?

The basis of your Intraday Trading Goals is the establishment of quantifiable and realistic financial objectives.

2. Create a Trading Plan:

Create a thorough trading plan that details your methodology, tactics, level of risk tolerance, and money allocation.

Your strategy should take into account the amount of time you have available for trading, your preferred method of trading, and the markets or instruments you wish to concentrate on.

3. Risk Management:

In your trading plan, give risk management first priority. Establish the highest amount of capital that you are prepared to lose on each transaction.

Establish stop-loss orders and strictly follow them to reduce possible losses.

4. Capital Allocation:

Make sensible capital allocations. Refrain from investing all of your money in one transaction.

Spread out the assets in your trading portfolio to lower the risk attached to any one of them.

5. Continuous Learning:

Remain dedicated to honing your intraday trading techniques.

To obtain insights, stay up to date on market movements, research trading tactics, and participate in trading communities.

6. Practice with a Demo Account:

Use a demo account to practise if you're new to intraday trading so you may get experience without risking real money.

With a demo account, you may hone your tactics and gain self-assurance.

7. Choose the Right Broker:

Choose a trustworthy and dependable brokerage platform for your needs when trading intraday.

Think about things like affordable brokerage costs, dependable trading instruments, and up-to-date market information.

8. Technical and Fundamental Analysis:

To make wise trading decisions, combine technical and fundamental analysis.

While fundamental analysis takes into account economic issues and the financial health of firms, technical analysis focuses on charts and patterns.

.

9. Trading Strategies:

Investigate several Intraday Achievements, including breakout, momentum, and scalping trading.

Select the trading techniques based on your trading objectives and risk tolerance.

10. Monitor the Markets:

During trading hours, remain watchful and keep a constant eye on the financial markets.

Keep an eye on news stories, earnings reports, and economic developments that may have an effect on your trading.

11. Set Realistic Targets:

Set attainable and precise daily, weekly, and monthly trading goals.

To keep yourself motivated, make sure your goals are both difficult and attainable.

12. Track and Review Your Performance:

To keep track of the specifics of your transactions, such as the entry and exit points, the rationale for each trade, and the result, keep a trading journal.

Examine your Goal-Oriented Intraday Trading journal on a regular basis to spot trends and potential improvement areas.

13. Consistency is Key:

In intraday trading, consistency is often key to reaching your financial objectives.

Adhere to your trading strategy, abstain from snap judgments, and maintain discipline even when you have losses.

14. Patience and Discipline:

You'll benefit greatly from having discipline and patience in intraday trading.

Steer clear of the fast track and concentrate on a methodical, long-term strategy.

15. Adjust Your Goals as Needed:

Regarding your trading plan and financial objectives, be adaptable.

As you acquire experience and adjust to shifting market conditions, modify your goals.

Reaching your financial objectives through Intraday Mastery for Goals is possible, but it takes commitment, knowledge, and a disciplined approach. Through the use of efficient tactics, a solid trading plan, and well-defined goals, intraday trading can be a useful tool in helping you gradually achieve your financial goals. Keep in mind that intraday trading requires patience and consistent work, so stick with it and keep trying to get better at techniques and tactics.

0 notes

Text

Formulating Market Strategy: Key Points for TraderPearl

In the ever-changing world of stock markets, traders like TraderPearl are always on the lookout for winning strategies to deal with the complexities and make smart decisions. To help marketers like you succeed, we've compiled a list of essential product marketing strategies and key points to keep in mind. 1. Understand your risk tolerance:

Before investing in the stock market, evaluate your risk tolerance. This will help you decide your investment style, whether you are a conservative investor or a risk taker like TraderPearl.

2. Diversification is key:

Spread your investments across different sectors and asset classes to reduce risk. Diversification can help protect your portfolio during market downturns. 3. Stay informed:

Follow financial reports and market trends regularly. TraderPearl's success is often attributed to its keen awareness of market development.

4. Set clear goals:

Define your financial goals and time limits. Are you looking for short-term gains or long-term wealth accumulation? Your goals will shape your business strategy.

5. Risk Management:

Use stop-loss orders to limit potential losses. TraderPearl is the owner of risk management, ensuring that no single trade can delete an important part of its portfolio. 6. Technical Analysis:

Learn the basics of technical analysis, such as charting patterns, support and barrier levels. TraderPearl often relies on these factors to make entry and exit decisions.

7. Basic analysis:

Understand the financial health of the companies you are investing in. Analyze factors such as benefits, cost levels and competitive conditions. 8. Patience Pays:

Success in marketing is not a sprint but a marathon. TraderPearl's persistence in maintaining winning positions is a hallmark of its strategy.

9. Keep your feelings:

Emotional decisions can lead to destruction. Stick to your marketing plan and avoid aggressive behavior. 10. Learn from mistakes:

- Mistakes are part of the learning process. Review your losses so you don't do the same thing.

11. A major accident turns:

- calculate the dangerous story before entering the business. Good description supports those who can tolerate the disadvantages. 12. Stay hydrated:

- Always have money for opportunities that may arise. TraderPearl is known for its ability to enter undervalued stocks.

13. Next step:

- Consider the process that follows the plan. Marketing with practice can increase your chances of success. 14. Continuing education:

- The product market evolves, and you do. Invest in your education and update yourself with new business techniques.

15. Beware of over-selling:

- Overtrading can result in excessive work and losses. TraderPearl avoids this by carefully selecting its trades. 16. Taxation:

- Understand the tax implications of your business. Effective tax planning can save you money in the long run.

17. Manage Business Journals:

- Record your transactions, plans and results. This will help you identify trends and improve your decisions over time. 18. Review your portfolio regularly:

- Review the performance of your portfolio periodically. Adjust your strategy as necessary to achieve your goals.

19. Long term investment:

- Consider part of your portfolio for long-term investment. TraderPearl handles short-term trading and solid long-term investment strategies. 20. Network and learn from others:

- Connect with other customers, attend conferences and join online forums to exchange ideas and get information. TraderPearl's success in the market is not just about luck; it is the result of a well-thought-out strategy and commitment to continuous improvement. By integrating these points into your trading strategy, you can increase your chances of achieving your financial goals and become a successful trader like TraderPearl.

#TradingStrategies#StockMarketTrading#OptionTrading#SwingTrading#WinningStrategies#TraderPearl#MarketStrategy#StockMarketStrategy#ComplexMarkets#EverchangingTrading#Please

1 note

·

View note