Text

#Forextrading#forexmarket#forexstrategy#goldanalysis#trading#xauusd#xauusdtrading#xauusdstrategy#currencytrading#currencypairs#chartanalysis#technicalanalysis#fundamentalanalysis#dailyanalysis#dollar#usd#Nysession#NY#NYsession#NYSE#Stockmarket#stockexchange#candlestickpattern#patterns

0 notes

Text

#Forextrading#forexmarket#forexstrategy#goldanalysis#trading#xauusd#xauusdtrading#xauusdstrategy#currencytrading#currencypairs#chartanalysis#technicalanalysis#fundamentalanalysis#dailyanalysis#dollar#usd#Nysession#NY#NYsession#NYSE#Stockmarket#stockexchange#candlestickpattern#patterns

0 notes

Text

#Forextrading#forexmarket#forexstrategy#goldanalysis#trading#xauusd#xauusdtrading#xauusdstrategy#currencytrading#currencypairs#chartanalysis#technicalanalysis#fundamentalanalysis#dailyanalysis#dollar#usd#Nysession#NY#NYsession#NYSE#Stockmarket#stockexchange#candlestickpattern#patterns

0 notes

Text

#Forextrading#forexmarket#forexstrategy#goldanalysis#trading#xauusd#xauusdtrading#xauusdstrategy#currencytrading#currencypairs#chartanalysis#technicalanalysis#fundamentalanalysis#dailyanalysis#dollar#usd#Nysession#NY#NYsession#NYSE#Stockmarket#stockexchange#candlestickpattern#patterns

0 notes

Text

#Forextrading#forexmarket#forexstrategy#goldanalysis#trading#xauusd#xauusdtrading#xauusdstrategy#currencytrading#currencypairs#chartanalysis#technicalanalysis#fundamentalanalysis#dailyanalysis#dollar#usd#Nysession#NY#NYsession#NYSE#Stockmarket#stockexchange#candlestickpattern#patterns

0 notes

Text

youtube

#Forextrading#forexmarket#forexstrategy#goldanalysis#trading#xauusd#xauusdtrading#xauusdstrategy#currencytrading#currencypairs#chartanalysis#technicalanalysis#fundamentalanalysis#dailyanalysis#dollar#usd#Nysession#NY#NYsession#NYSE#Stockmarket#stockexchange#candlestickpattern#patterns#Youtube

0 notes

Text

youtube

#Forextrading#forexmarket#forexstrategy#goldanalysis#trading#xauusd#xauusdtrading#xauusdstrategy#currencytrading#currencypairs#chartanalysis#technicalanalysis#fundamentalanalysis#dailyanalysis#dollar#usd#Nysession#NY#NYsession#NYSE#Stockmarket#stockexchange#candlestickpattern#patterns#Youtube

0 notes

Text

Join us for FREE LIVE trading sessions! Gain insights from our live trades and detailed trade journals. Get access to in-depth fundamental and technical analysis during our sessions.

#Forextrading#forexmarket#forexstrategy#goldanalysis#trading#xauusd#xauusdtrading#xauusdstrategy#currencytrading#currencypairs#chartanalysis#technicalanalysis#fundamentalanalysis#dailyanalysis#dollar#usd#Nysession#NY#NYsession#NYSE#Stockmarket#stockexchange#candlestickpattern#patterns

0 notes

Text

https://www.linkedin.com/in/shalika-dogra-ba01882ba

0 notes

Text

youtube

#Forextrading#forexmarket#forexstrategy#goldanalysis#trading#xauusd#xauusdtrading#xauusdstrategy#currencytrading#currencypairs#chartanalysis#technicalanalysis#fundamentalanalysis#dailyanalysis#dollar#usd#Nysession#NY#NYsession#NYSE#Stockmarket#stockexchange#candlestickpattern#patterns#Youtube

2 notes

·

View notes

Text

youtube

#Forextrading#forexmarket#forexstrategy#goldanalysis#trading#xauusd#xauusdtrading#xauusdstrategy#currencytrading#currencypairs#chartanalysis#technicalanalysis#fundamentalanalysis#dailyanalysis#dollar#usd#Nysession#NY#NYsession#NYSE#Stockmarket#stockexchange#candlestickpattern#patterns#Youtube

2 notes

·

View notes

Text

#Forextrading#forexmarket#forexstrategy#goldanalysis#trading#xauusd#xauusdtrading#xauusdstrategy#currencytrading#currencypairs#chartanalysis#technicalanalysis#fundamentalanalysis#dailyanalysis#dollar#usd#Nysession#NY#NYsession#NYSE#Stockmarket#stockexchange#candlestickpattern#patterns

2 notes

·

View notes

Text

#Forextrading#forexmarket#forexstrategy#goldanalysis#trading#xauusd#xauusdtrading#xauusdstrategy#currencytrading#currencypairs#chartanalysis#technicalanalysis#fundamentalanalysis#dailyanalysis#dollar#usd#Nysession#NY#NYsession#NYSE#Stockmarket#stockexchange#candlestickpattern#patterns

2 notes

·

View notes

Text

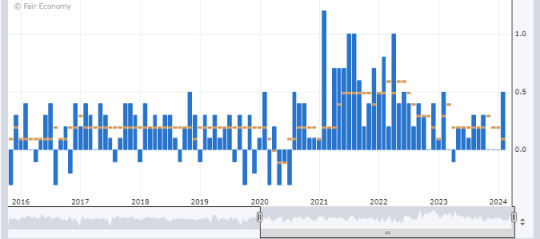

Understanding the Core PPI and Its Impact on Currency and Gold Markets!

The Producer Price Index (PPI) serves as a vital economic indicator, shedding light on changes in the prices of finished goods and services sold by producers. However, when analyzing PPI data, one must pay close attention to the Core PPI, which excludes the volatile components of food and energy prices. This exclusion is significant because food and energy prices often exhibit erratic fluctuations that can skew the overall PPI reading.

A noteworthy shift occurred in February 2014 when the calculation formula for the Core PPI underwent a modification. This alteration aimed to provide a more accurate representation of underlying inflation trends by eliminating the influence of volatile food and energy prices.

It's crucial to recognize that food and energy prices typically constitute around 40% of the overall PPI. Consequently, when analyzing the Core PPI, which excludes these volatile components, one may find a more stable and reliable measure of inflationary pressures.

Now, let's delve into the implications of Core PPI releases on currency and gold markets.

When the Core PPI data release exceeds market expectations, it signals that inflationary pressures are building up in the economy. This can lead to an appreciation of the dollar as investors anticipate potential interest rate hikes by the central bank to curb inflation. A stronger dollar makes gold, which is priced in dollars, relatively more expensive for investors holding other currencies. As a result, the price of gold may decline in response to a stronger dollar.

Conversely, if the Core PPI data release falls below expectations, it suggests subdued inflationary pressures. In such a scenario, the dollar may weaken as investors adjust their expectations regarding future monetary policy actions. A weaker dollar tends to make gold more attractive as a hedge against currency depreciation, leading to an increase in its price.

For instance, let's consider a hypothetical scenario where the Core PPI data release indicates a higher-than-expected increase in producer prices. This prompts investors to anticipate tighter monetary policy by the Federal Reserve, causing the dollar to strengthen. Consequently, the price of gold, denominated in dollars, declines as it becomes less appealing to investors.

On the other hand, if the Core PPI data release comes in below expectations, signaling subdued inflation, investors may interpret this as a dovish signal from the central bank. In response, the dollar weakens, leading to an increase in the price of gold as investors seek refuge in the precious metal amid currency uncertainty.

In conclusion, the Core PPI serves as a crucial economic indicator that can influence both currency and gold markets. By understanding its significance and the factors driving its movements, traders and investors can make informed decisions to navigate the ever-changing landscape of financial markets.

2 notes

·

View notes

Text

XAU/USD overview!

Gold experienced a downward correction yesterday, reaching a support zone between 2151 and 2146. This support zone held firm, indicating a potential buying opportunity following a specific pattern, with a target set at the high of March 8th.

However, if during trading, the support is breached downwards, it signals a continuation of the correction. In this case, the next target would be the support zone ranging from 2129 to 2122. This zone marks the border of the short-term uptrend. Buying opportunities could arise at this level, presenting a potential profit-making opportunity.

trading ideas for today:

Buy according to the pattern at 2151 - 2146.

Buy according to the pattern at 2129 - 2122.

Sell when the previous support is breached.

2 notes

·

View notes

Text

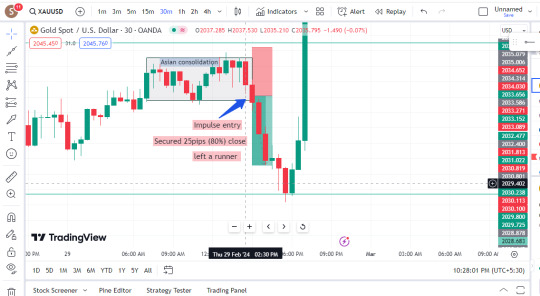

Gold Today! along with the rationale behind each trade.

Have a great weekend Guys! See you On Monday. Take care.

3 notes

·

View notes

Text

Gold! Remember to backtest and journal your trades. Simplify your charts for clearer opportunities. Keep it straightforward, folks! Clean charts enhance opportunity visibility.

2 notes

·

View notes