#fundamental analysis

Text

WHAT DOES THE FUNDAMENTAL ANALYSIS CONSIST OF?

WHAT DOES THE FUNDAMENTAL ANALYSIS CONSIST OF?

Investments in the digital market, whether in Bitcoin or any other cryptocurrency found here, require preliminary analysis and study; these investments should not be made empirically, much less without having a theoretical basis of the necessary tools for decision making.

Let us remember that any business project, whether through the commercialization of goods and services or financial…

View On WordPress

163 notes

·

View notes

Text

2 notes

·

View notes

Text

Tips for keeping calm during uncertain market conditions

OOUUCH!!!

The stock market is notorious for its unpredictability, and this volatility can lead to anxiety and stress for many investors. However, it’s important to remember that market fluctuations are a natural part of investing and can present opportunities as well as challenges. The key to weathering uncertain market conditions is to stay informed, disciplined, and focused on your long-term…

View On WordPress

#Automated trading#CFD Trading#Currency Exchange#Currency trading#Forex analysis#Forex brokers#Forex charts#Forex education#Forex market#Forex Market Hours#Forex Market Trends#Forex news#Forex signals#Forex strategies#Forex Tips#Forex trading#Forex trading software#Forex Trading Strategies#Forex trading systems#Fundamental analysis#Indicators#Online Forex Trading#Price Action#Psychology#Risk Management#Technical analysis#Trading Forex#Trading platforms#Trading Psychology#Trading robots

2 notes

·

View notes

Text

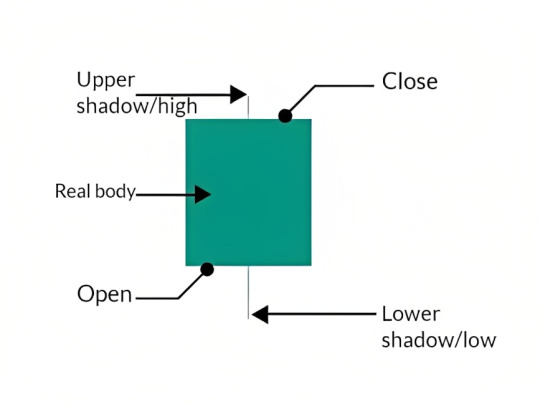

How is a candlestick drawn in stock market?

A candlestick is a widely used chart in technical analysis.The candles tick consists of the following parameters,

1)Open

2)Close

3)Low

4)High

5)Upper shadow

6)Lower shadow

The above parameters together help to draw a single candlestick.However these 6 components are more than just a constructive element for a candlestick.

They provide information related to market behaviour, bull and bearish activities, who is gonna dominate the market etc.

To understand the stockmarket very easily, the first step is to learn the above parameters in detail.

Click Candlestickspot.online to read about them in detail.

#stock market#stock trading#technical analysis#fundamental analysis#forex trading#crypto traders#candlestick pattern#indian stock market

3 notes

·

View notes

Text

fundamental analysis Tools and Skills for smart Investing

What is fundamental analysis?

Fundamental Analysis is a comprehensive way to examine a firm. If an investor is looking to put money into a business for the long haul say 3 – 5 years, it is vitally important to gain insight into the company from different views. It’s essential to separate the daily stock price movements and pay attention to how the company performs overall. Usually, stocks of companies with strong fundamentals appreciate over time, thus generating wealth for their investors.

There are many companies in the Indian market that have given investors returns of over 20% CAGR yearly for at least a decade. TCS, Nestle, and Infosys, among others, are some examples. With a 20% CAGR rate, your money can double in roughly 3.5 years. But an even higher CAGR – such as 30% by Bosch India Ltd. – further accelerates this wealth-building process.

Do remember these are just 3 examples of the many that you may find in Indian markets. Here are long-term charts for 3 companies that can get you thinking about long-term wealth creation.

There are many companies that also deplete wealth. These are just three examples.

The trick has always been to separate the investment-grade companies that create wealth from the companies that destroy wealth. Investment-grade companies all share a few common characteristics that set them apart from the rest. A wealth destroyer shares a few common traits that are evident to an astute investor as well.

By identifying these attributes of wealth-creating companies, Fundamental Analysis gives you the conviction to invest long-term.

– Can I be a fundamental analyst?

There is a widespread misconception that individuals who are skilled in fundamental analysis must exclusively possess a chartered accountant designation or come from a commerce background. This is not true at all. An analyst adds two and two and ensures they add up to four. You will need a few basic skills to become a fundamental analyst.

A basic understanding of financial statements

Know the industry in which a business operates

Multiplication, division, and addition of basic arithmetic operations

The objective here is to ensure that you acquire the first two skills.

– I’m happy being a Technical Analyst, so why bother about Fundamental Analysis?

With Technical Analysis (TA), you can get quick short-term returns. It helps you find the right time to enter and exit the market. However, TA is not an effective way to generate wealth. Wealth can only be created by making intelligent long-term investments. For a better understanding of your market strategy, here is Eicher Motors’ chart:

A market participant might take a FA approach and choose Eicher Motors as a stock to invest in 2006. Unfortunately, however, the stock saw only a modest rise until 2010. This means investors’ returns were insignificant if they stuck with it. To make more money, shorter-term trades should have been taken instead, which is where TA plays an integral role. Having both approaches as part of one’s strategy is key – this particular methodology is known as the Core Satellite Strategy.

Let’s say a market participant has a corpus of Rs.1,000,000/-. The capital can be divided into two unequal portions, for example, 70 – 30. The 70% of the capital, Rs.700,000/-, can be invested for the long term. This portion, known as the core portfolio, is expected to grow at an annual rate of at least 8% to 10%.

The remaining 30% of the capital, which is Rs.300,000/-, can be allocated to the satellite portfolio. It is anticipated that this portfolio will generate a minimum absolute return of 6% to 8% per year. The satellite portfolio aims to capture additional returns beyond the core portfolio, utilising more active investment strategies.

By diversifying the capital into the core and satellite portfolios, the market participant seeks to achieve a balanced approach, with the core providing stability and steady growth, while the satellite offers the potential for higher returns.

– Tools of FA

For fundamental analysis, you will need the following tools, most of which are free.

You can download the annual report from the company’s website for free and find all the information you need for FA.

You will need industry data to see how the company under consideration is performing in relation to the industry. Basic data is available for free on the website of the industry’s association.

You can stay on top of the latest developments in the industry and the company you are interested in with the help of a good business newspaper or services such as Google Alert.

Although it is not free, MS Excel can be extremely helpful when performing fundamental calculations

By using just these four tools, one can create a fundamental analysis that is on par with institutional research. It is unnecessary to rely on additional tools for conducting effective fundamental research. Interestingly, even at the institutional level, the aim is to maintain simplicity and logic in the research process.

0 notes

Text

Balancing the Technicals & Fundamentals in Investing with Mr. Vivek Mashrani

Join Mr. Vivek Mashrani in this engaging course as he unveils the art of Tecno-Funda investing - a fusion of technical and fundamental analysis that can revolutionize your approach to investment. This course goes beyond the conventional methods, teaching you the power of patterns and analysis, optimal entry points identification, navigation in investments, and a deeper understanding of the market. Get ready to enhance your investing skills and unleash your inner investing guru under the guidance of an industry expert with a wealth of experience in both Technical and Fundamental analysis. Let Mr. Vivek Mashrani empower you with the right financial insights to make informed investment decisions and elevate your investment game to new heights.

0 notes

Text

Are you a person who wishes to invest in stock market for long term but don't know on what to invest and when to invest? You definitely need to read this book my friend! This book is a very good beginners book. This book explains basics of fundamental analysis of stocks in 5 rules. These 5 rules helps you to identify undervalued stocks, filter out overvalued stocks and accumulate a fundamentally sound stock. Do give it a try! I have attached reviews and descriptions about the book. Please have a look on it to know more about the book 😁

Visit vkrproducts.etsy.com for more details about the book or directly click the below eBook link 👇🏻👇🏻👇🏻

#investing stocks#investment#share market#investors#stock market#stocks#beginnersguide#fundamental#economy#finance#fundamental analysis#long term investment#market share#share market tips#good ebooks#ebook#equity#cash market#stockstowatch#stockstobuy#watchlist#portfolio#investing#learntoearn#wealth#wealth building

0 notes

Text

Binance Exclusive: Start Trading with $100 for Free!

Take your first steps into the exciting realm of cryptocurrency trading with Binance! Sign up now and receive a complimentary $100 to kickstart your trading journey. Explore a diverse selection of cryptocurrencies, hone your trading skills, and potentially turn that initial $100 into something more. Don't miss this exclusive offer – seize the opportunity to trade on Binance with free funds! #binance #cryptotrading #freemoney

Link Below : https://bit.ly/BinanceFree100

#Cryptocurrency#Forex#Stocks#Day Trading#Swing Trading#Technical Analysis#Fundamental Analysis#Trading Strategies#Risk Management#Options Trading#Futures Trading#Bull Market#Bear Market#Market Trends#Stop-Loss#Take Profit#Margin Trading#Leverage#Candlestick Patterns#Market Volatility

0 notes

Text

Conquer Exness: Your Fast Track to Registration and Verification

View On WordPress

#Currency trading#Forex brokers#Forex charts#Forex education#Forex market#Forex signals#Forex trading#Forex trading software#Fundamental analysis#Trading robots

0 notes

Text

Understanding Dividends and Their Importance to Investor

Dividends represent a portion of a company’s profits that are distributed to its shareholders as a reward for their investment. They serve as a key component of investing, offering tangible benefits to shareholders. Dividends provide a source of regular income, offer stability during market fluctuations, signal a company’s financial health, and contribute significantly to long-term wealth…

View On WordPress

0 notes

Text

Unveiling the Phenomenal Growth of Quick-Service Restaurants (QSRs) in India

Introduction:

The Quick-Service Restaurant (QSR) industry in India has undergone a spectacular evolution, transforming the culinary landscape and redefining the dining experience for millions. This article explores the impressive growth trajectory of QSRs in India, examining the key factors contributing to their success and the impact they've had on the nation's dining culture.

Rising Urbanization and Changing Lifestyles:

The rapid urbanization and shifting lifestyles in India have played a pivotal role in the burgeoning success of QSRs. As cities expand and individuals embrace a faster pace of life, the demand for quick, convenient, and affordable dining options has surged. QSRs, with their emphasis on speedy service and accessible menus, perfectly align with the evolving preferences of urban consumers.

Diverse Culinary Offerings:

QSRs in India have gone beyond the traditional fast-food model, diversifying their menus to cater to the diverse and culturally rich tastes of the Indian population. From global fast-food giants offering localized items to homegrown QSRs presenting fusion cuisines, the variety of culinary offerings has been a significant driving force behind the industry's growth. This adaptability to local flavors has broadened the appeal of QSRs across different regions.

Embracing Technology and Digitisation:

The integration of technology has been a game-changer for QSRs in India. With the widespread use of smartphones and increasing digital literacy, QSRs have capitalized on online ordering platforms, mobile applications, and digital payment systems. This not only enhances customer convenience but also contributes to the efficiency of operations, reducing wait times and streamlining the overall dining experience.

Catering to Millennial Preferences:

The millennial demographic, known for its fast-paced lifestyle and inclination towards experiences, has been a key target for QSRs. These establishments have successfully tapped into the preferences of millennials by offering not just a meal but an entire dining experience. Engaging marketing strategies, social media campaigns, and collaborations with influencers have further endeared QSRs to this demographic, contributing to their sustained growth.

Expansion Strategies and Accessibility:

QSRs in India have adopted aggressive expansion strategies, extending their reach to various corners of the country. This includes both metropolitan areas and smaller towns, ensuring that QSRs are accessible to a wide spectrum of consumers. Franchising models and strategic partnerships have played a crucial role in achieving this widespread presence.

Health and Wellness Considerations:

As awareness of health and wellness grows, QSRs in India have adapted their menus to include healthier options. This shift reflects changing consumer preferences and the industry's responsiveness to evolving dietary trends. From introducing low-calorie meals to incorporating plant-based alternatives, QSRs are aligning their offerings with health-conscious choices.

Conclusion:

The growth of the Quick-Service Restaurant industry in India is a testament to its adaptability, innovation, and resonance with the evolving preferences of consumers. From addressing the needs of a fast-paced urban lifestyle to embracing technology and diversifying culinary offerings, QSRs have become an integral part of the Indian dining experience. As the industry continues to evolve, it is poised to play a significant role in shaping the future of the country's food-service sector.

If you want to know more about the business model of the QSR industry, then CLICK HERE.

#qsr#quick service restaurant#qsr restaurants#qsr industry in india#what is qsr#qsr model#qsr business model#Dominos case study#Dominos business model#fundamental analysis

0 notes

Video

youtube

Fundamental Analysis of any company

0 notes

Text

BSE Institute Certified Financial Statement Analysis: Master the Art of Analyzing Financial Statements

Enroll in the BSE Institute Certified Financial Statement Analysis course and gain an edge in the world of investing. This comprehensive course equips you with the skills to evaluate company financial statements, identify potential risks, and make informed investment decisions. With two phenomenal courses - Analysis of Financial Statements and How to Read Financial Statements - this program offers a deep understanding of financial analysis techniques. Earn a shareable certificate from the prestigious BSE Institute, access 10 video lectures, and downloadable notes. Take the first step towards foolproof investing by interpreting financials like a pro. Visit now!

#Financial Statement Analysis#Interpreting Financial Statements#Analysis of Financial Statements#How to Read Financial Statements#Fundamental Analysis#Personal Finance

0 notes