Text

Investing in Fixed Deposit Scheme? Find Out the Right Ones For You

Investing in fixed deposit schemes can be a prudent financial decision, offering stability and assured returns. However, with numerous options available, finding the right one for your financial goals can be daunting. Let us guide you through the process of selecting the ideal fixed deposit scheme that suits your needs.

Understanding Fixed Deposit Schemes

Fixed deposit schemes are investment instruments offered by banks and financial institutions, where individuals can deposit a lump sum for a fixed period at a predetermined interest rate. These schemes provide a safe and secure way to grow your savings while offering guaranteed returns.

Types of Fixed Deposit Schemes

Traditional Fixed Deposits: Traditional fixed deposit schemes offer a fixed interest rate for a specified tenure, with the option of choosing cumulative or non-cumulative interest payouts.

Tax-Saving Fixed Deposits: Tax-saving fixed deposit schemes allow investors to claim tax deductions under Section 80C of the Income Tax Act, making them an attractive option for individuals looking to save on taxes.

Senior Citizen Fixed Deposits: Senior citizen fixed deposit schemes offer higher interest rates and special benefits for elderly investors, making them ideal for retirees seeking regular income.

Special Fixed Deposit Schemes: Some banks and financial institutions offer special fixed deposit schemes with unique features, such as flexible tenure options, higher interest rates for long-term deposits, and loyalty rewards for existing customers.

Factors to Consider When Choosing a Fixed Deposit Scheme

Interest Rate: Compare the interest rates offered by different banks and financial institutions to find the most competitive option that maximizes your returns.

Tenure: Consider your investment horizon and liquidity needs when choosing the tenure of the fixed deposit scheme. Short-term deposits offer quick access to funds, while long-term deposits provide higher interest rates.

Tax Implications: Evaluate the tax implications of the fixed deposit scheme, especially if you're considering tax-saving options. Choose schemes that offer tax benefits while aligning with your overall tax planning strategy.

Safety and Security: Ensure that the bank or financial institution offering the fixed deposit scheme is reputable and regulated by the relevant authorities to safeguard your investments.

Conclusion

Investing in fixed deposit schemes can be a lucrative option for individuals seeking stable returns and capital preservation. By understanding the different types of fixed deposit schemes available and considering key factors such as interest rates, tenure, tax implications, and safety, you can make informed decisions to achieve your financial goals.

0 notes

Text

Briyani Map of India

Which is your favourite biryani?

Please comment below

briyani #food #chicken #briyanilover #foodie #indianfood #foodphotography #biryani #instafood #foodblogger #foodporn #chennaifoodie #chickenbriyani #foodstagram #foodlover #chennaifoodblogger #chennai #mutton #nasibriyani #briyanirice #biryanilove #love #streetfood #briyaniforlife #muttonbriyani #yummy #chickenbiryani #foodgasm #chennaifood #foodpics

0 notes

Text

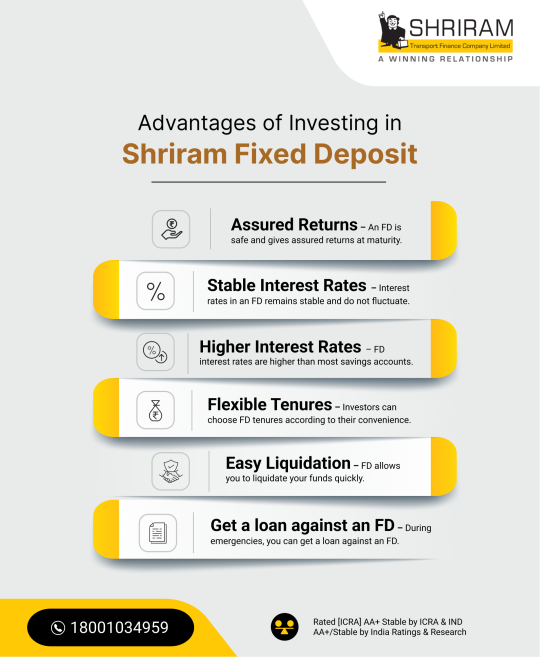

Advantage Of Investing in a Shriram Fixed Deposit

A Shriram Fixed Deposit offers comparatively higher interest rates of 8.75% per annum, which includes a bonus of 0.50% interest for senior citizens. Apart from the high-interest rates, with a Shriram FD, you also get an additional interest of 0.25% per annum on all renewals after the maturity of the deposit.

#fixeddeposit#frbs#investment#finance#mutualfunds#savings#fd#money#financialfreedom#investments#goldloan#bank#recurringdeposit#financialplanning#stockmarket#insurance#personalloan#stocks#wealth#rd#mutualfund#ettutharayil#chitfund#financialliteracy#gold#moneytransfer#investing#sip#personalfinance#financetips

1 note

·

View note