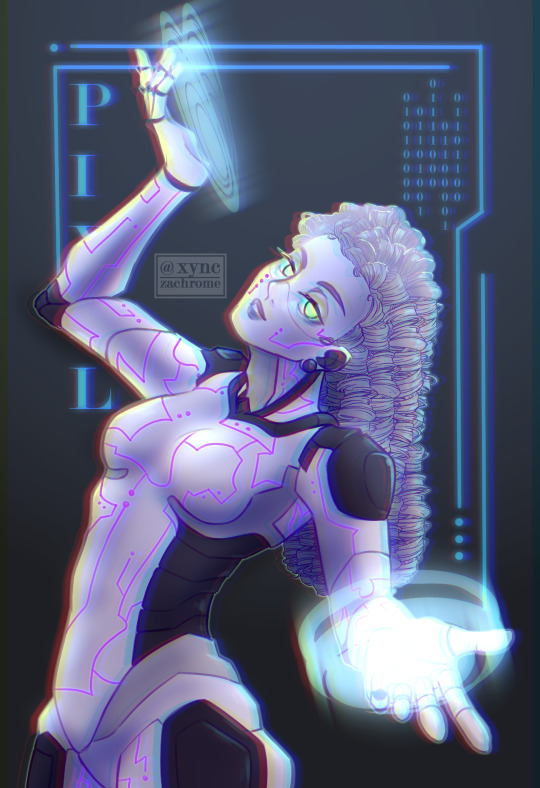

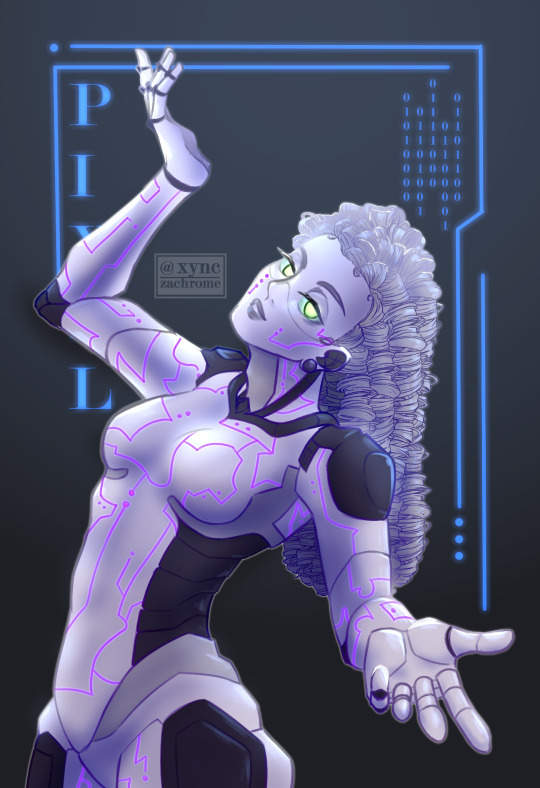

#we love robo women in this household

Text

@raishifts dtiys go brrr

#I LOVE THEIR PIXAL DESIGN SO MUCH#raishiftsig1k#ninjago#ninjago fandom#ninjago fanart#omg pixal yessss#pixal borg#ninjago pixal#pixal#we love robo women in this household#nindroid design go brr

210 notes

·

View notes

Text

[Translation] Tsukino Empire - First Fleet「Genbu」

Here’s a continuation of my previous translation. From now on each fleet will be presented and, as usual, Six Gravity starts the list. I will add a mini masterlist at the end of each translation for an easier flow.

Special thanks to @clearui for helping me with proofreading. Don’t repost my translation.

Before starting, here is a translation note.

【STR】= Strength

【VIT】= Vitality

【DEX】= Dexterity, Technique

【INT】= Intelligence, Magic

【HP】= Endurance, Stamina

【MOFU】= Fluffiness

It was explained on the official twitter here

Six Gravity - Mutsuki Hajime & Yayoi Haru

Mutsuki Hajime

Cast comment

In order to match the military-type costumes, I have cut my hair after a long time… personally, this hairstyle has become a little nostalgic to me. The members are also saying various things as “I missed this” and “it’s been a while” and whatnot, but as I remember the original purpose, I think we can create a stage play filled with tension and impact. Please enjoy it until the end.

Story data

Spirit Beast: Kuro (Genbu1 and Kiryuu2 Type) ※First Rank

Affiliation: First Fleet (Kuro) ※Commandant

【STR】★★★★★★★

【VIT】★★★★★★★

【DEX】★★★★★★☆

【INT】★★★★★★☆

【HP】★★★★★★★

【MOFU】★☆☆☆☆☆☆

The first young man in history to be compatible with The First Rank’s Head【Genbu】, who didn’t have a host until now. Despite the fact that he achieved astonishing numerical values breaking all the records, no official documents have been made public after the compatibility was discovered, and he himself keeps quiet about his origins, so there are many mysteries.

Because of Genbu’s compatibility, the four gods said to rule over the four directions were all present for the first time,which in fact influenced the war situation on a grand scale. The time when the human race will counterattack is getting closer but… …

T/N:

玄武 (genbu)1 = The Black Tortoise

亀龍 型 (kiryuu kata)2 = tortoise dragon type (something like that)

Yayoi Haru

Cast comment

Welcome to the Empire Stage! This time there are stage outfits with a different direction from usual & I get to put on an eyepatch over contact lenses, so I am excited to wear such an unusual outfit (laughs). Based on the outward appearance, everyone told me that I looked like a traitor but… … Well, I wonder how that actually is. Please make sure to watch the stage until the end, okay?

Story data

Affiliation: First Fleet (Kuro)

Spirit Beast: Aosa (Tori3 Type) ※Second Rank

【STR】★★★★★☆☆

【VIT】★★★★☆☆☆

【DEX】★★★★★★★

【INT】★★★★★★★

【HP】★★★★☆☆☆

【MOFU】★★★☆☆☆☆

An outstanding young man who was recognized as a Second Rank host at the age of 12, and henceforth becoming a cadet, he maintained his position in the top. However, at one point, Mutsuki Hajime appeared out of nowhere and took over the first position, the two having a tense relationship for a while.

Albeit one day, the tension suddenly disappeared, and he accepted on his own free will to become aid and support for Hajime, who is easily misunderstood. Now their relationship evolved to the point of being treated as a set, but nobody knows what happened that day.

Incidentally, that was the day when he started to wear the eyepatch.

T/N:

鳥 型 (tori kata)3 = bird type

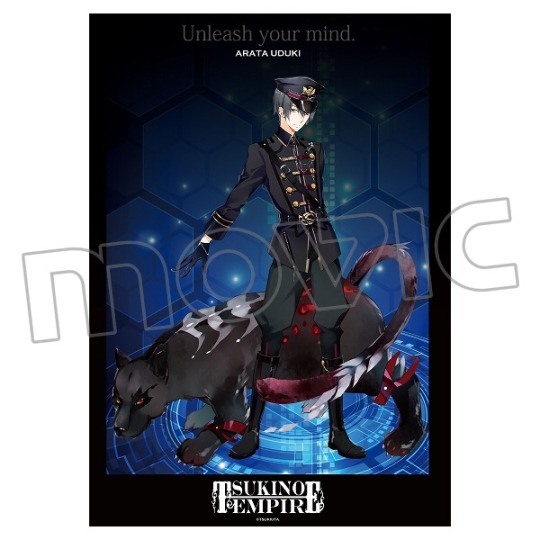

2. Six Gravity - Uduki Arata & Satsuki Aoi

Uduki Arata

Cast comment

Uniforms are uniforms, but this time they’re military uniforms, and black too. It suits me, right?

On the stage, I might be the third one to have the most action scenes out of all the performers, but I’ll do my best to be seen in a cool spot.

P.S. Tama is cute~.

Story data

Affiliation: First Fleet (Kuro)

Spirit Beast: Tama (Black Jaguar Type)

【STR】★★★★★★☆

【VIT】★★★★☆☆☆

【DEX】★★★☆☆☆☆

【INT】★★★★☆☆☆

【HP】★★★★★☆☆

【MOFU】★★★★☆☆☆

Although he seems cool, he’s the ultimate self-paced type. On the other hand, he’s the type who gets things done when necessary. He has an unpredictable habit.

Possessing a divine animal instinct by far, he makes use of it at the maximum on the battlefield. Sometimes he is left out, but he doesn’t mind.

He’s Aoi’s childhood friend. Whenever he tries to study, he is tormented by a severe illness called “drowsiness attacks” (and mainly by his teacher in charge), but it is no exaggeration to say that he graduated the military school without problems with Aoi’s support.

Because there are many female troops, he comes in the headquarters frequently to play.

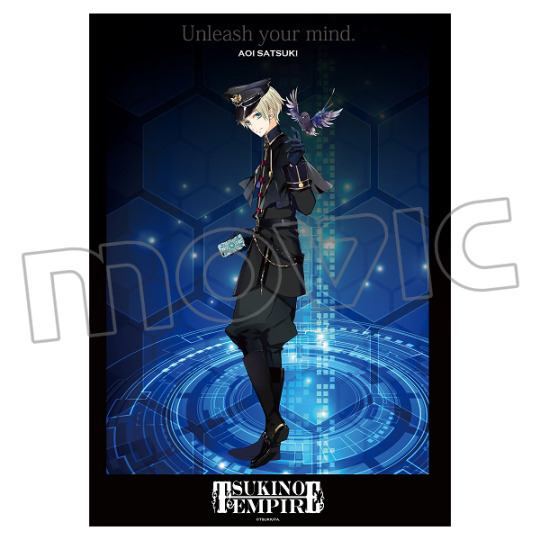

Satsuki Aoi

Cast comment

Hello! Welcome to Tsukipro Talent’s All Stars stage play!

While I’m nervous to work for a stage play in a long while, the performers are the same age as me and our close friends, so rehearsals have been the most enjoyable so far (laughs). This time my character will be close to the position of navigator for everyone in the audience. Let’s follow this magnificent story together!

Story data

Affiliation: First Fleet (Kuro)

Spirit Beast: Ruri4 (Tori Type)

【STR】★★★☆☆☆☆

【VIT】★★★☆☆☆☆

【DEX】★★★★★★☆

【INT】★★★★★★☆

【HP】★★☆☆☆☆☆

【MOFU】★★★☆☆☆☆

A calm honour student with a firm character. Due to his naturally kind personality, he works well with anyone and he’s in charge with The First Fleet’s public relations and diplomat position. Apart from that, he’s participating actively in all the situations.

He is Arata’s childhood friend and capable partner. Even though he’s smiling bitterly at Arata’s self-paced behaviour, Aoi is proud to be reliable at the right time.

His parents died due to an accident during an experiment, but because he was raised with affection by his grandparents and older brother ever since, he wasn’t bothered by that. Incidentally, one of his parents’ family is a distinguished and distantly-related household to the imperial family.

His elder brother is also a host, but he left the front lines for the Medical Care Bureau where he’s in charge of spirit beasts. The brothers have a good relationship and there are many female troops who are curious to see them side-by-side.

T/N:

瑠璃 (Ruri)4 is Aoi’s spirit beast’s name, but the kanji itself has more meanings. It can mean “lapis lazuli” or some mall blue passerine birds like the blue-and-white flycatcher and the Siberian blue robin, but also the red-flanked bluetail

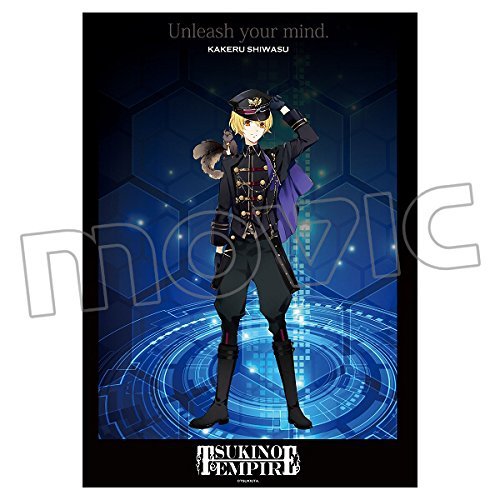

3. Shiwasu Kakeru & Kisaragi Koi

Shiwasu Kakeru

Cast comment

Welcome, to Tsukino Empire! I’m Shiwasu Kakeru, concerned about food even in such a fantasy setting. This stage play is military related, so wearing the black uniform makes me feel tense both physically and mentally. This costume fits me perfectly. If possible, I think I will deliver something different from the usual cool Shiwasu Kakeru. Please take care of me!

Story data

Affiliation: First Fleet (Kuro)

Spirit Beast: Yezo (Squirrel Type)

【STR】★★★★★☆☆

【VIT】★★☆☆☆☆☆

【DEX】★★★★★☆☆

【INT】★★★★☆☆☆

【HP】★★☆☆☆☆☆

【MOFU】★★★★★☆☆

An energetic young man in charge of operating the First Fleet. Contrary to his appearance which makes him look younger than his age, the fact that he can manage a large amount of information makes him look reliable.

His father is a member of the Supreme Council, with a family line, which is quite wealthy.

His spirit beast’s appearance (Yezo’s) certainly looks cute in general, but actually, it can get as big as four and a half tatami mats, thus taking naps on its belly seems to be pure bliss. And more than that, Yezo is, in fact, an offensive type. Taking advantage of its high flexibility during battles, he settles in the vanguard and finds many occasions to make breakthroughs.

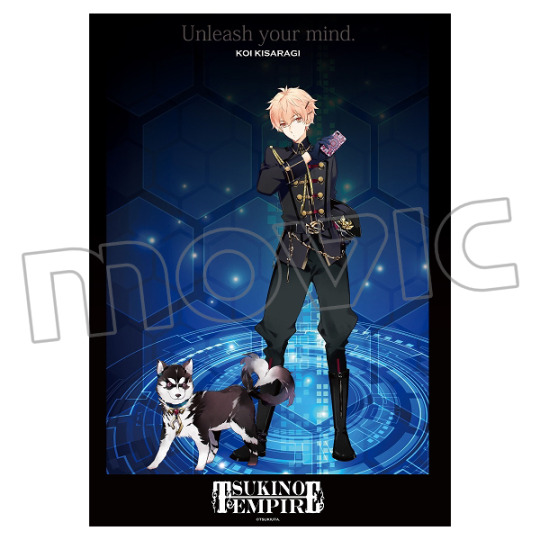

Kisaragi Koi

Cast comment

Ta-dah! An empire! Military! Space Opera! As someone who loves this sort of manga and anime, it makes me, Kisaragi Koi, qui~te excited! The robo animation world is every man’s dream, isn’t it? I wonder how shall I deliver the amazing scene where we have to confront our allies onstage… ...I am also looking forward to it!

Story data

Affiliation: First Fleet (Kuro)

Spirit Beast: Heart-kun (Inu5 type)

【STR】★★★★☆☆☆

【VIT】★★★★☆☆☆

【DEX】★★★★★☆☆

【INT】★★☆☆☆☆☆

【HP】★★★★☆☆☆

【MOFU】★★★★★★★

The cheerful mood maker of The First Fleet, who loves fashion and chattering! Together with his spirit beast, Heart-kun, he’s the one to refresh the atmosphere onboard.

The origin of his spirit beast partner's name (Heart-kun) is its tail, which at one point splits into a heart shape. Cute and friendly as every inu-type, its popularity among women is very high and it received the impressive first place in the Spirit Beast Popularity Contest for hosting voluntary activities a few days ago.

His twin sister, Ai, is also a host belonging to The Fifth Fleet. Heart-kun resembles her spirit beast, Kokoro, though the black and white tints are inverted.

T/N:

犬 型 (inu kata)5 = dog type

Tsukino Empire Plot | Six Gravity | Procellarum | Soara | Growth | SolidS

#tsukiuta#tsukino empire#english translation#six gravity#mutsuki hajime#yayoi haru#uduki arata#satsuki aoi#kisaragi koi#shiwasu kakeru

98 notes

·

View notes

Text

I made a pact with mum friend involving much pain and sacrifice. Heres why it was worth it

Posted

August 11, 2019 06:00:19

Photo:

Kylie Mitchell and Freya Petersen completed a half marathon on the Sunshine Coast. (Supplied)

There’s plenty about the start of a big race that resembles a cattle saleyard. Hundreds of warm bodies shuffling about in close quarters, feet stamping, jets of nervous breath visible in the frosty pre-dawn air.

The energy of a crowd of thousands of runners is palpable and, despite the multitude of shapes, sizes, ages and abilities, so is the sense of common purpose.

After months of training, abstinence and rabbiting on about it to partners, colleagues and friends, they’re all here to prove that running 10, or 21, or 42 kilometres before breakfast is doable, perhaps even enjoyable, if not a life goal.

My running partner and I are as keen as anyone to get going on this early-August day in the “Sunny Coast half”. Both full-time working mothers and both in our 40s — ish — we have been “training” for this run for months, but neither of us is entirely thrilled about the 21.09km slog ahead.

Me less so than her. And I’ve run a half-marathon — once, a decade ago in another country, which may as well be another lifetime, as it was before children, ailing parents and mid-career challenges began daily siphoning off any reserves of time, energy and self-focus. It was bloody hard enough then.

Training for the 2009 Rhode Island half-marathon consisted of maybe doing a second lap of my Boston neighbourhood after work and staying off hard spirits for a month.

Training for a run in 2019 meant sneaking 45 minutes here or there to lap the park after work while the kids were at swim training. Or early — so very early — on a Sunday morning.

A well-worn path

Three illnesses in a six-week period in the lead-up to the race tempted thoughts of pulling out. But the idea of dishonouring a pact made with my running buddy Kylie, an equally busy mum friend staring down the challenges of her 50th year on earth, silenced the sook within.

Which brings us to Queensland’s Sunshine Coast last Sunday.

At the starting line, I see a two- to three-hour grind that may leave me feeling, yet again, like I long ago hit my peak and it’s all downhill from here.

Shuffling along for those first few kilometres as the sun rises over the oceanfront course, Kylie remarks on the number of young people running alongside us and we agree that we really should have done more of this when we were like them. Young, and fit, and free.

Good-natured, all-night revellers yell encouragement from a high-rise, and we joke that back then, we were probably more like them. Back then, we could barely start to imagine — not that we’d even try — how life changes for women who take this well-worn path into motherhood and middle age.

And yet each generation seems destined to live out the same fate as ours, rejecting the very notion that the more things appear to change the more they stay the same.

“I feel sometimes that my life and the way I lead it is just so different from what was available to my mum,” said a young friend recently, as we discussed her thoughts about career and family.

I said I’d recently realised how little had changed since I started out in the workforce, a devil-may-care risk-taker to whom no one person or circumstance posed an insurmountable obstacle to achieving my dreams.

But now, the sad fact is the world middle-aged working mums inhabit is defined by its insurmountable obstacles:

Children are your absolute priority

Despite your experience, your workplace seems less interested in what you have to offer

Whether working or not, you are statistically very likely to be shouldering the burden of home admin and housework

You are far more likely to be tapped for unpaid volunteering duties at your school/sporting club

Your good health is no longer a given, as the robo-letters encouraging breast screens and colonoscopies might attest

Photo:

Conquering a marathon —even a half — is months of hard work. (Pexels)

The invisibility of middle age

The recently released Australia’s Household, Income and Labour Dynamics Survey (HILDA) would appear to support the argument that women aren’t living their best lives now any more than their mothers did then, or perhaps even their grandmothers before them.

At least when over-the-counter access to the Pill was introduced in 1961 they began to have a choice about whether they even became mothers, which no doubt felt like progress.

Still now, more than half a century later, HILDA data shows women are earning less than men in the workplace — to the tune of $34,000 on average — and doing more than them at home. And confirming what many moneypants mums already knew, female breadwinners in households with children still do the most unpaid weekly work — 43.4 hours to the male counterpart’s 26.

Worse than all of this, said another middle-aged friend, society does not suddenly begin showing you the respect and common courtesies you once might have expected to be offered by now. The invisibility of middle-aged women is, for us, an observable thing.

The feeling that society values you only insofar as you are fit for purpose — ie do the grunt work of raising kids and life admin — is strong. Yet even this quiet usefulness can seem largely unacknowledged.

The very antithesis of extraordinary

The hints about what to expect if you are headed towards middle-aged mumdom, and perhaps a few tips and guidelines, can be found on the pages of Facebook. A little post here saying “I ran a half marathon, yay me”, one there saying “the kids did great today at soccer, yay them”, or “our P&C got the grant for the new sprinkler system, yay us”.

It’s an insight into a demographic that might seem the very antithesis of extraordinary —just busy mums, doing their bit, like they should. Yay them.

And so it was with me, when I let anybody who’d care to know via Facebook that I’d not only run my race but improved my time over 21km by a whopping 15 minutes — 10 years on and several major obstacles in my way.

Amid the virtual pats on the back, a young mum friend said:

“I think you should write about this. About the power of commitment and achievement when you’re suffering through the daily grind and trying to be everything for everyone else. Represent all of us disenchanted women who wonder if we can make ourselves proud after babies and wrinkles and wobbly butts.”

And I had the strange flash, in which I visualised myself not as a middle-aged mum limping around because my body wasn’t ever going to be ready for last weekend’s flogging, but as Pheidippides, the messenger dispatched from the battlefield to deliver the news of a victory.

For a morning, my mum friend and I put aside the doubts, time pressures and troubles of our alternative existences and mowed down 21km of bitumen together. We’ve had harder mornings. Much harder.

To those who suggested a full marathon might now be on the cards, we say no. We are strong, and determined, and resilient and resourceful. But we do actually love our families, sometimes our jobs, occasionally even our unpaid labour, and definitely what remains of our bone density.

We are Supermums, but we are not Captain bloody Marvel.

Topics:

womens-health,

community-and-society,

women,

alexandra-headland-4572,

qld

Source: https://opengeekhouse.com.br/2019/08/10/i-made-a-pact-with-mum-friend-involving-much-pain-and-sacrifice-heres-why-it-was-worth-it/

0 notes

Text

I’ve updated my best-selling book. Here’s what’s new and what to expect

Ten years ago, I published my book, “I Will Teach You to Be Rich.”

Do you remember what also happened 10 years ago?

In March 2009, we were in the depths of a once-in-a-lifetime financial crisis and full-blown recession. Chances are, you know someone who was laid off.

In fact, it was so bad that, as The New York Times noted:

On March 9, 2009, the day the bull market was born, the stock market, like the economy, was in deep, seemingly existential distress. The S&P 500 was down 57 percent from its 2007 peak.

Compounding the pain was the nationwide collapse in home prices, which landed a direct hit on most households’ greatest source of wealth.

Yes, my book was published at the bottom of the worst financial crisis of our generation.

The day it launched, it became the #1 book on all of Amazon, then sold out within hours, and became an instant New York Times best-seller.

That was what happened in public, but behind closed doors…

…my publisher was freaking out. Before the book went to print, they frantically asked me if I wanted to change any of my advice because of the recession.

I was like, “Why would I? Long-term investing doesn’t change.” They were concerned.

If you bought the first edition of “I Will Teach You to Be Rich” and applied the book’s lessons when it was released, you’re financially set for life.

And now, after receiving the 19,435th email correcting or yelling at me about the interest rates I published in the book, I am thrilled to say that the new, updated version of the IWT book is here!

You can pre-order it on Amazon here.

In the 10 years since the first edition, I’ve added 80 pages with new tools, new insights on money and psychology (including why millennials continue to believe buying a house is always the best investment — untrue), a greater focus on managing money when you have a part-time side gig, and integrating money and relationships.

A majority of the things I said in the book 10 years ago still hold true today.

I’m proud that the advice I gave in the first edition stood the test of time (I’ve included dozens of real reader testimonials in the new book to show it). That’s the kind of advice I like — timeless advice that doesn’t fall apart after a few years. It doesn’t change with the whims of the market.

Below is a Q&A I put together as part of my publisher’s press kit, and I wanted to share my answers on what’s new, what I’ve learned, and what’s changed with you too.

Fortune called you “the new finance guru,” but your background is in technology and psychology — how did you come to occupy this spot within the world of personal finance?

Anyone who chooses to write about personal finance is a little weird. In my case, I don’t really get that excited learning the intricacies of Roth IRAs any more. But ever since I was a kid, I’ve been fascinated by human behavior — today more than ever.

Why do we claim we want to do something, then do exactly the opposite? (In the book, I explore the similarities between fitness and finance.)

When does it make sense to let peer pressure affect us — and when should we ignore it? (Should you buy a house? What if you want to spend $1,000/month on clothes, or eating out, or traveling? I show you how to decide.)

Most of all, understanding psychology taught me why most personal finance advice (like “stop spending money on lattes” and “keep a budget”) is forever doomed to failure. There is a better way.

Reaching financial independence seems like it takes a lot of work — what are the first steps you recommend readers take?

The good news is you don’t have to be the smartest person in the room to be rich — you just have to get started. Follow the automation system in the book, which will automatically move your money to save, invest, and give you guilt-free spending every month.

I show you exactly where to start, including the best accounts to use (and the ones to avoid), where your money should go first, then second, and so on … and finally, how to invest your money for real growth.

Plus, answers to questions like “What’s the best way to get free vacations using points?” and “Am I too late to start investing?”

The real fun comes in deciding what your Rich Life looks like: Do you want to pay off your debt years faster? Or travel for 4 weeks every year? You decide. Then use your money to create your Rich Life.

“I Will Teach You to Be Rich” features real reader results and testimonials throughout the book. What have your readers found to be the most effective during their personal finance journey?

I love this question. We included an incredible number of reader stories in the book, showing how they used this book to create their Rich Lives:

Notice when you look at their photos — they’re men, women, young, old, black, white, and every possible combination. The diversity is breathtaking. And representation is important. I want every reader to know that there is someone out there who looks like you and talks like you … who created their own Rich Life.

How has the insurgence of cryptocurrency, robo-advisors, and more shifted the way money is used and the relationship between money and technology?

What’s funny is if you ask most bitcoin speculators what the rest of their portfolio looks like, they’ll give you a blank stare back. “What? Portfolio? LOL, what a Luddite.”

I have zero tolerance for scams and fads that deprive ordinary people of their money. As an investment, bitcoin is great — only after you’ve already built a diversified portfolio.

In reality, if you want to make high-risk investments, it’s important to have a diversified portfolio first. Then, you can take 5-10% of your investments and go high-risk. I show you how and when it’s appropriate. Sadly, for the vast majority of bitcoin speculators, they fell all in with yet another fad.

Robo-advisors are a real presence, especially for my readers. I cover my thoughts in the book, including when to use a robo-advisor vs. a traditional advisor (and the exact accounts I use).

In the book, you focus on the importance of having the right mindset to attain a Rich Life. Why is that mindset important?

Think about the invisible money messages you grew up with. For example, how many of us had parents who said, “We don’t talk about money in this family.” Or “Easy come, easy go.”

In the book, you’ll be surprised to discover that your own spending behavior might be guided by the phrases you heard decades ago.

And once you understand your own behavior, you can change it. I’ll show you exactly how to rewrite your invisible money scripts and focus on the future.

What have you learned about integrating finances when marrying since your recent nuptials?

I’m still learning!

This was one of the most eye-opening financial journeys I’ve ever been on. I had to learn to compromise and to see money as a team. Along the way, my wife and I had a lot of tough conversations: How do we see money? How do we want to use money? Should we sign a prenup? I cover this in Chapter 9.

What do you hope readers walk away with after reading the second edition of “I Will Teach You to Be Rich”?

I’ve always wanted people to know a few key things about money:

You can spend extravagantly on the things you love, as long as you cut costs mercilessly on the things you don’t.

Buy as many lattes as you want. Get the 10 Big Wins right, and you’ll never worry about $5 expenses.

Don’t listen to everyone. Buying a house isn’t always the best investment.

It’s not too late. You can take control of your money this week. Nobody is going to do it for you.

Most people say money is about “no”: no lattes, no vacations, no fun. I want to show you how to reframe money to saying “yes”: YES, I can take an extravagant vacation. YES, I can pay off debt years faster. And YES, I can decide on my Rich Life — and use this book to create it.

Mark your calendars: The book officially comes out on May 14, 2019! Preorder the book now on Amazon.

Thank you for reading, and if you’re a long-time reader, for your support all these years.

I’ve updated my best-selling book. Here’s what’s new and what to expect is a post from: I Will Teach You To Be Rich.

from Surety Bond Brokers? Business https://www.iwillteachyoutoberich.com/blog/ive-updated-my-best-selling-book-heres-whats-new-and-what-to-expect/

0 notes

Text

I’ve updated my best-selling book. Here’s what’s new and what to expect

Ten years ago, I published my book, “I Will Teach You to Be Rich.”

Do you remember what also happened 10 years ago?

In March 2009, we were in the depths of a once-in-a-lifetime financial crisis and full-blown recession. Chances are, you know someone who was laid off.

In fact, it was so bad that, as The New York Times noted:

On March 9, 2009, the day the bull market was born, the stock market, like the economy, was in deep, seemingly existential distress. The S&P 500 was down 57 percent from its 2007 peak.

Compounding the pain was the nationwide collapse in home prices, which landed a direct hit on most households’ greatest source of wealth.

Yes, my book was published at the bottom of the worst financial crisis of our generation.

The day it launched, it became the #1 book on all of Amazon, then sold out within hours, and became an instant New York Times best-seller.

That was what happened in public, but behind closed doors…

…my publisher was freaking out. Before the book went to print, they frantically asked me if I wanted to change any of my advice because of the recession.

I was like, “Why would I? Long-term investing doesn’t change.” They were concerned.

If you bought the first edition of “I Will Teach You to Be Rich” and applied the book’s lessons when it was released, you’re financially set for life.

And now, after receiving the 19,435th email correcting or yelling at me about the interest rates I published in the book, I am thrilled to say that the new, updated version of the IWT book is here!

You can pre-order it on Amazon here.

In the 10 years since the first edition, I’ve added 80 pages with new tools, new insights on money and psychology (including why millennials continue to believe buying a house is always the best investment — untrue), a greater focus on managing money when you have a part-time side gig, and integrating money and relationships.

A majority of the things I said in the book 10 years ago still hold true today.

I’m proud that the advice I gave in the first edition stood the test of time (I’ve included dozens of real reader testimonials in the new book to show it). That’s the kind of advice I like — timeless advice that doesn’t fall apart after a few years. It doesn’t change with the whims of the market.

Below is a Q&A I put together as part of my publisher’s press kit, and I wanted to share my answers on what’s new, what I’ve learned, and what’s changed with you too.

Fortune called you “the new finance guru,” but your background is in technology and psychology — how did you come to occupy this spot within the world of personal finance?

Anyone who chooses to write about personal finance is a little weird. In my case, I don’t really get that excited learning the intricacies of Roth IRAs any more. But ever since I was a kid, I’ve been fascinated by human behavior — today more than ever.

Why do we claim we want to do something, then do exactly the opposite? (In the book, I explore the similarities between fitness and finance.)

When does it make sense to let peer pressure affect us — and when should we ignore it? (Should you buy a house? What if you want to spend $1,000/month on clothes, or eating out, or traveling? I show you how to decide.)

Most of all, understanding psychology taught me why most personal finance advice (like “stop spending money on lattes” and “keep a budget”) is forever doomed to failure. There is a better way.

Reaching financial independence seems like it takes a lot of work — what are the first steps you recommend readers take?

The good news is you don’t have to be the smartest person in the room to be rich — you just have to get started. Follow the automation system in the book, which will automatically move your money to save, invest, and give you guilt-free spending every month.

I show you exactly where to start, including the best accounts to use (and the ones to avoid), where your money should go first, then second, and so on … and finally, how to invest your money for real growth.

Plus, answers to questions like “What’s the best way to get free vacations using points?” and “Am I too late to start investing?”

The real fun comes in deciding what your Rich Life looks like: Do you want to pay off your debt years faster? Or travel for 4 weeks every year? You decide. Then use your money to create your Rich Life.

“I Will Teach You to Be Rich” features real reader results and testimonials throughout the book. What have your readers found to be the most effective during their personal finance journey?

I love this question. We included an incredible number of reader stories in the book, showing how they used this book to create their Rich Lives:

Notice when you look at their photos — they’re men, women, young, old, black, white, and every possible combination. The diversity is breathtaking. And representation is important. I want every reader to know that there is someone out there who looks like you and talks like you … who created their own Rich Life.

How has the insurgence of cryptocurrency, robo-advisors, and more shifted the way money is used and the relationship between money and technology?

What’s funny is if you ask most bitcoin speculators what the rest of their portfolio looks like, they’ll give you a blank stare back. “What? Portfolio? LOL, what a Luddite.”

I have zero tolerance for scams and fads that deprive ordinary people of their money. As an investment, bitcoin is great — only after you’ve already built a diversified portfolio.

In reality, if you want to make high-risk investments, it’s important to have a diversified portfolio first. Then, you can take 5-10% of your investments and go high-risk. I show you how and when it’s appropriate. Sadly, for the vast majority of bitcoin speculators, they fell all in with yet another fad.

Robo-advisors are a real presence, especially for my readers. I cover my thoughts in the book, including when to use a robo-advisor vs. a traditional advisor (and the exact accounts I use).

In the book, you focus on the importance of having the right mindset to attain a Rich Life. Why is that mindset important?

Think about the invisible money messages you grew up with. For example, how many of us had parents who said, “We don’t talk about money in this family.” Or “Easy come, easy go.”

In the book, you’ll be surprised to discover that your own spending behavior might be guided by the phrases you heard decades ago.

And once you understand your own behavior, you can change it. I’ll show you exactly how to rewrite your invisible money scripts and focus on the future.

What have you learned about integrating finances when marrying since your recent nuptials?

I’m still learning!

This was one of the most eye-opening financial journeys I’ve ever been on. I had to learn to compromise and to see money as a team. Along the way, my wife and I had a lot of tough conversations: How do we see money? How do we want to use money? Should we sign a prenup? I cover this in Chapter 9.

What do you hope readers walk away with after reading the second edition of “I Will Teach You to Be Rich”?

I’ve always wanted people to know a few key things about money:

You can spend extravagantly on the things you love, as long as you cut costs mercilessly on the things you don’t.

Buy as many lattes as you want. Get the 10 Big Wins right, and you’ll never worry about $5 expenses.

Don’t listen to everyone. Buying a house isn’t always the best investment.

It’s not too late. You can take control of your money this week. Nobody is going to do it for you.

Most people say money is about “no”: no lattes, no vacations, no fun. I want to show you how to reframe money to saying “yes”: YES, I can take an extravagant vacation. YES, I can pay off debt years faster. And YES, I can decide on my Rich Life — and use this book to create it.

Mark your calendars: The book officially comes out on May 14, 2019! Preorder the book now on Amazon.

Thank you for reading, and if you’re a long-time reader, for your support all these years.

I’ve updated my best-selling book. Here’s what’s new and what to expect is a post from: I Will Teach You To Be Rich.

from Money https://www.iwillteachyoutoberich.com/blog/ive-updated-my-best-selling-book-heres-whats-new-and-what-to-expect/

via http://www.rssmix.com/

0 notes

Text

Hamster (Mesocricetus Auratus).

Hamsters are extremely resilient little bit of animals, they create great very first time household pets for little ones to take care of because as a whole, these little bit of rodents are actually very easy to always keep. The correct condition for this hamster would be actually the Mandarin hamster although they are actually commonly misinterpreted for dwarf hamsters as a result of their measurements and probably their black dorsal stripe. DO certainly not seek to participate in hide as well as look for with your hamster while other people is performing the vacuuming. Hamsters possess very unsatisfactory vision Their scent glandulars on their spines secrete a quickly identifiable odor. When you loved this post and you want to receive details with regards to parkfitness.info generously visit the web-site. In between its own right as well as left switches, a computer mouse could also have a tire that can be made use of for scrolling or other special procedures determined due to the software program.

Hamsters inhabit semi-desert regions worldwide along with the soft ground supplying a great component for the hamster to delve in. The den from a hamster commonly consists of a lot of passages and chambers, including distinct places for the hamster to eat as well as rest in. Some hamster managers feed their pet dogs a blend from pelleted blocks and also seed mixes, integrating the meals along with total health and nutrition with food that is extra eye-catching and also often a lot more tasty to their dog.

You could obtain a round or even steering wheel for the hamster to playing around the area in. If you are ready to eventually make the major jump for your boy and acquire him his very own little dog, think about the diverse assortment from hamster items offered coming from trustworthy homeowners on ebay.com. Put on a dense sweatshirt or bathrobe as well as store your hamster your upper arms if you do not such as exactly how your hamster's paws experience. The term lavish Russian dwarf hamster" just pertains to Russian dwarf hamsters that are magnificently colored. This cross reproduction is normally carried out to produce desirable colouring and also is actually debatable, as hybrid dwarf hamsters tend to build health problems. To maintain the teeth well-maintained as well as worn, provide some plastic crunchy playthings to have fun with. The dwarf hamster need to have very clear eyes as well as nose, and no hairless spots or even scabs on its skin layer.

Although hamsters rest a great part from the time, do not let their resting moron you; Robo hamsters are actually especially energetic and also spirited pets that enjoy an exercise tire, run-about round and also just about anything else they can easily spend their energy on. Like other tiny creatures, hamsters possess pearly whites that expand constantly throughout their lifestyle, so they ought to be provided with munch stay with protect against the pearly whites from becoming excessive.

Sure enough, the vitamin-enriched diet sufficiented to deal with the dreadful signs, as well as protect against the women hamsters off consuming their youthful. Dogs that have been actually bred for rodent management as well as most pet cats may not have the capacity to avoid the instinct to tackle a hamster. Nowhere in the study perform they show any of this is in fact occurring to hamsters in the wild. To begin with the hamster should only be offered a small part of fruit product or vegetable once or twice a week and also over a period from full weeks this could be increased to a little part every day. To make certain that your hamster comes to be loving and also tamed that is crucial that you handle that regularly as well as the right way. After hamsters are birthed, that is actually almost 2 weeks prior to they'll open their eyes-- however even after that, they go to a downside, because they're colorblind and myopic.

Instantly the hamsters being actually given extra vitamins began performing typical hamster tasks instead of enjoying their progeny like psychopaths. And due to the fact that hamsters will sample basically everything to observe if it is actually edible, that's definitely crucial certainly not to offer your little hairy pal open door to your home kitchen counter tops, trash bin, or some other region of your home where meals is held, prepped or consumed. Disordered teeth: Syrian hamsters can easily dealing with thick teeth that could must be actually affixed through a veterinary specialist. Hamsters are singular pets, 17 so they carry out certainly not essentially need another hamster as a buddy.

Hamsters should maintain match, similar to our team. Part of the routine of well being that you might present your hamster to is doing yoga. We look like a moist hamster making an effort certainly not to lose consciousness on the treadmill, but Priyanka looks directly ethereal. A lot of breeders additionally reveal their hamsters, therefore breed towards creating an excellent, healthy, present hamster for always keeping one or two on their own, thus premium and personality are actually life-and-death when considering the breeding. Lots of folks choose a hamster randomly and also have difficulty pinpointing its own gender later on when they are actually aiming to call that. Inquire an employee at the outlet to establish the sex from your new animal so you do not have to bother with it eventually.

If there is a damaged tooth, or their pearly whites carry out not fulfill appropriately, this might trigger over growing as well as discomfort, and also your hamster will discover this challenging to consume. The ordinary life expectancy for a Syrian hamster is 2 to 2.5 years, although like many animals, there are some individuals that reside longer in comparison to this. Still, to be happy and well-adjusted, your hamster should receive day-to-day dealing with as well as communication. All pet proprietors have to put in some physical exertion to look after creatures, and are often up as well as energetic to become near, play, as well as snuggle along with them. After researching ways to deal with the hamster effectively, she offered the creature the best lifestyle feasible. Although rare, hamsters have been known to bring Lymphocytic choriomeningitis, an infection that may very seriously sicken kids.

Being on the smaller sized end of the size scale for household pet mice they are less expensive to take care of, cleaner and also easier family pets to deal with when compared to larger rats. A well-balanced hamster diet need to include bunches of selection, yet since the boys are sensitive to foods items you might not believe, it is vital to become incredibly educated concerning just what to stay away from. Domestic hamsters maintain this impulse and also will certainly commonly try to drain their meals dish as well as conceal it at yet another area in the crate. Due to these concerns, hamsters from any type of kind are not proper animals for families with little kids. Take your hamster to the animal medical practitioner for a brand-new family pet assessment, and also once again every six months for wellness examinations. Perhaps the hamsters below ground layers were actually being ruined, triggering the populace drowse off.

Some species from Hamster, including Dwarf or Roborovski Hamsters could be inhibited very same sex pairs, having said that Syrian Hamsters and Mandarin Dwarf Hamsters ought to be kept one by one as they are going to deal with, often to fatality. The name has actually changed off Bullet Verification Scratch Hamsters to Space Travelers to Bullet Evidence Scrape, randomly conducting 2-3 opportunities a year in other combinations. Hamsters are reasonably individual and also could occupy themselves for prolonged time periods, delivered their housing is actually appropriately enriched with toys, bed linen, and also possibilities for going up as well as tunneling. You might need to be actually an audition mum for some time, though, as hamsters do not similar to intense lights. Kim Jong Un, a hamster in the serpent pit of the regime, has actually just made a brand new foe.

These 5 are Roborovski hamsters (frequently referred to as Robo hamsters), Syrian hamsters, Russian dwarf wintertime white colored hamsters, Chinese hamsters, and Campbell's dwarf hamsters. Hamster pearly whites that are actually regularly increasing, so this is crucial to deliver all of them with things to munch. In bush, they dig retreats, which are a. set of passages, to breed as well as live in. Hamsters will additionally save food items in their lairs. Slowly unclench your first as well as give your palm if your Hamster is actually self-assured and seems interested. A diet regimen of corn is actually turning crazy hamsters in northeastern France in to insane cannibals that enjoy their progeny, alarmed analysts have turned up.

If you possess more than one Dwarf hamster living with each other, i advise enclosures that possess a broad open space as opposed to areas and pipes as these could motivate territorial behavior as well as fighting. When resting, a hamster is actually quickly shocked as well as may be tilted to attack defensively. Scientists have actually assessed this through mading a treadmill in the cage and also tape-recording the turnings from the tire as a procedure of the hamsters' activity. When you get your hamster you should perform this promptly, along with assurance, and also without triggering any distress. The majority of hamster owners feed a combination from a business hamster diet plan discovered at dog source stores, as well as supplement along with suitable new, folks food items.

0 notes

Text

New Post has been published on OmCik

New Post has been published on http://omcik.com/30-under-30-part-3-young-life-health-and-annuity-stars/

30 Under 30, Part 3: Young Life, Health and Annuity Stars

Here’s our final batch of ThinkAdvisor Life Health 30 Under 30 award winners for 2017.

These life, health and benefits sector professionals have survived the same economic ups and downs, and underlying societal changes, that have faced the other 2017 award winners, and they’ve survived another, additional challenge: the alphabet.

(Related: 30 Under 30, Part 1: Young Life, Health and Annuity Stars)

The award winners we honored in our first two batches may have occasionally received some opportunities partly because their surnames start with an A, or some letter close to A. Not these winners. These millennials have made a mark, fast, despite having to put up with waiting in more lines, for longer, than about two-thirds of their peers.

All were believed to be under 30 by the time we stopped taking nominations and stopped scouting for own candidates, in early January.

We plan to begin taking entries for our 2018 30 Under 30 program in January.

Meanwhile, here’s a look at what these winners have said about their careers, the current state of the financial services sector, and the future of the sector.

Zachary A. Meissner

29

Bellevue, Washington

Vice president/sales manager

Pacific Capital Resource Group (The Penn Mutual Life Insurance Company)

ThinkAdvisor Life Health: Why did you choose a career in insurance or financial services?

Zachary A. Meissner: I majored in entrepreneurship because I always wanted to start my own company. Once you actually start to dive into starting a business, the real world risks involved become a bit daunting. The notion of becoming a financial planner really clicked for me because it was an opportunity to start a potentially lucrative independent business venture, but with a set of instructions and low financial outlay.

Describe what you do.

I work to imbue others with passion. I split about a third of my time between running my personal practice, recruiting advisors into our office (and often into the industry), and developing the practices of new advisors.

With clients, it’s about getting them to feel excited about planning for their future. Having a plan dramatically increases your chances for success in life.

When I’m recruiting or working with new advisors, I talk a lot about “The 4 I’s” of why people do what we do: Impact, Income, Independence, and Intellectual stimulation.

Share an achievement you are especially proud of.

I’m most proud of earning my designations: Chartered Life Underwriter, Chartered Financial Consultant and Chartered Financial Planner.

This is a competitive industry and being the best means balancing the triad of success, which in my opinion comes down to: client interaction and service, practice management, and professional knowledge and/or continuing education. I am currently working on my Masters of Science in Financial Services (MSFS).

Another achievement that I am very proud of is building our clientele.

What is the biggest challenge that you see in the industry or what is the one thing you would change?

The first challenge is the lack of millennials entering the business combined with the fact that the average age of a financial advisor is around 57 years old. The second challenge is the threat of technology or robo-advisors combined with a misunderstanding of what financial planning actually is. With the advent of robo-advisors, consumers are increasingly looking toward online resources for advice.

Also, we no longer mirror the markets we serve: millennials continue to show increasing dedication to planning for their future and women are taking a more pivotal role in the planning process. Constantly changing laws and regulations require new fresh minds to reinvent the industry and client service.

What is the biggest opportunity that you see in the industry?

The biggest opportunity is getting young people, women and minorities excited about a career in financial services. This will allow us to stay viable as an industry.

We also need to be better about leveraging technology to serve our needs, not just within planning and advising but within marketing.

What do you think millennials are looking for in an advisor? How can advisors best serve this market?

Our generation spends a lot of time online. When we want advice on things, our knee-jerk response is to search for the answer on the Internet.

What millennials want from an advisor is both the types of advice that they can’t get from a robot, and an ear to listen and counsel. It comes down to emotional management.

What is the No. 1 piece of advice you would give to a young person looking to enter this industry?

The main concern I hear from young people is: “I don’t know if I am comfortable approaching my family or friends for business or referrals”.

Rather than seeing yourself as a sales person, see yourself as an advocate. The vast majority of people do not have a financial plan, and not one that is comprehensive and addresses the entire gamut of financial planning needs.

You won’t always be prospecting through your friends and family; eventually your market will expand and referrals will flow from many different sources. View the interaction with friends and family as an opportunity to help the people you care for most.

(Related: What Is the Best Way to Maintain a Focus on Growth?)

Alexa Meyer

26

Bellevue, Washington

Financial advisor

Pacific Capital Resource Group (The Penn Mutual Life Insurance Company)

ThinkAdvisor Life Health: Why did you choose a career in insurance or financial services?

I’ve always been a people person. I’ve always been a numbers person. There aren’t many careers where these two components go hand in hand.

I loved that financial services gave me the ability to develop a practice in my own way and with my own personality showing through. I also sought an industry where I can have it all — the family life I always envisioned and a career that made an impact on the world.

Describe what you do.

I help empower families and business owners to make educated financial decisions for themselves and their future. My approach with my clients is to ensure that we are collaborating in the decision making process; I am the informant, educator, and advisor; they are not being told what to do. We form long-lasting, trusted relationships through this collaboration process as we continue to build their plan through the years.

Share an achievement you are especially proud of.

I was extremely honored to have earned the Bronze award for Penn Mutual’s Career Builder of the Year. I really pushed myself that year beyond what I thought was possible and I’m so grateful I had the opportunity to make an impact on so many families that year.

What is the biggest challenge that you see in the industry or what is the one thing you would change?

I see a lack of understanding in what kind of value we can impart. With so much media around robo-advisors and DIY solutions, it may look like we are heading toward obsolescence in the marketplace. However, as our clients know, a financial advisor’s value doesn’t necessarily always come in the form of high returns, but in the intangibles: hand-holding clients through complex strategies, having the tough conversations regarding risk management that they might otherwise not address or even think about, educating the client on options they may have never realized they had. This component of the relationship is often more valuable to our clients than the reduced fees they could get elsewhere by doing things on their own. This is what we need to focus on marketing in the future: the relationship.

What is the biggest opportunity that you see in the industry?

Women — that doesn’t necessarily mean only working with single women or women as the primary breadwinner, but making sure you are connecting with the woman in the family in an important way. Women tend to enjoy working with professionals more than men. They are often more receptive to advice and therefore end up implementing planning faster.

Long-term, women also refer more clients than men typically do. Many women have been left of the financial planning process in the past, as it is traditionally an aspect of the household that men handle. By making them an equal partner at the table and getting everyone on the same page, the whole planning process moves a lot smoother.

What do you think millennials are looking for in an advisor? How can advisors best serve this market?

Millennials are looking for information and education catered specifically to their situation. Young professionals are taught to research, to use their networks, and to use the internet as a sounding board for major decisions in life.

Despite this, most people realize that all the ready-made financial advice available to them on the web might not be as fine-tuned as they need it to be for practical and highly personal decision-making. This is where we can be of value. By demystifying the world of finance and taking an educational, unbiased approach to our client meetings, millennials see the value in working with professionals.

What is the No. 1 piece of advice you would give to a young person looking to enter this industry?

Begin with the end in mind! Create systems that you know you can sustain or reformat as your practice grows.

(Related: Penn Mutual’s President Was Talking About You)

Vladimir Nikitenko

25

Atlanta

Financial planner

Lincoln Financial Advisors

ThinkAdvisor Life Health: Why did you choose a career in insurance or financial services?

Vladimir Nikitenko: I always believed that people should pursue a career in something they were genuinely interested in. When talking to buddies in college, I would always ask if whatever they are studying for, if they research it and learn about it outside of what is taught in class and what was assigned. Following that logic, I was interested in finance well outside just the scope of school work… This lead me to purse my passion and become a financial advisor.

Describe what you do.

I am an independent financial planner that focuses on comprehensive financial planning. I make an effort to know every detail about my client and use all that information to put together an all-encompassing financial planning, this includes retirement planning, investments, life insurance, long term care, college planning, and income planning. Once I have an objective plan, we then find the right products or services from a variety of sponsors to meet the needs of the plan.

Share an achievement you are especially proud of.

To me, sentimental achievements are much more important than purely worldly ones. Having said that, I honestly feel the greatest sense of accomplishment when I was able to take a client from start to finish, from chaotic to orderly, from uncertain to protected and knowing that after working with me, they are financially in a much better place than before they met me.

What is the biggest challenge you see in the industry, or what is the one thing you would change?

Self-reliance. With easy access to information, many people believe that they can do everything themselves and ignore advice from professionals. This is not only in the finance industry, I see this in my wife when she tries to diagnose herself and our kids on WebMD. We cannot all be experts in everything, and people need to understand that they cannot do enough research to know what professionals that spend their whole day, and life doing.

What is the biggest opportunity you see in the industry?

The average age of the current advisor. There are not enough young people in the industry and I believe that within the next decade there will be a ton of business and clients that will have to be passed down to the next generation of financial professionals. The need for good advice, planning, and quality financial products will remain, and being there to capture that opportunity is huge.

What do you think millennials are looking for in an advisor? How can advisors best serve this market?

I think millennials need an advisor to tell them what they do not know. Professionals working with millennials need to be sharper and more educated and informed than ever before. With so much information out there, we need to truly be experts in our field. If millennials see this, I believe they will not hesitate to give us their business.

What is the No. 1 piece of advice you would give to a young person looking to enter this industry?

Do plenty of research to make sure you understand what will be expected of you, and how hard you will have to work to succeed, once you are in the business, no matter what happens, stick to your decision and know that you are in it for the long run.

(Related: Great American Parent Explains Annuity Unit to Wall Street)

Martin Pfannenstiel

27

Director of business development and chief compliance officer

ChangePath

Kansas City, Missouri

ThinkAdvisor Life Health: Why did you choose a career in insurance or financial services?

Martin Pfannenstiel: I got involved in the insurance industry while playing football at Washburn University in Topeka, Kansas. I grew up playing sports and was always an involved student, so when I was approached by Mark Heitz of Aviva a carrier located in Topeka, I was intrigued. I studied accounting during my undergrad, and working for a life insurance and annuity carrier allowed me to use both my analytical skills and outgoing personality simultaneously. I’ve always been somewhat of a go-getter, so after experiencing one aspect of the industry with Aviva, I was motivated to see how I could put my skills and background to use in other areas of the industry.

Please describe what you do.

Essentially, I help provide advisors with advice on how to properly handle and allocate clients in order to ensure the best interest of the client is being met. ChangePath is a registered investment advisor with a direct affiliation to CreativeOne, an agent development organization, so I utilize both advisory and insurance services in order to meet clients’ needs. In order to help advisors prepare for approaching DOL deadlines and fiduciary responsibilities, without incurring additional overhead costs, I utilize insurance products as an asset class to hedge portfolios, teach advisors how to weather economic volatility using insurance and integrate annuities into client portfolios.

Please share an achievement you are especially proud of and describe why.

The achievement I am proudest of is obtaining my juris doctorate degree, along with successfully becoming certified to practice law in Kansas. The ability to have a legal understanding, while obtaining my taxation certification in law school, enables me to better serve others, advocate on behalf of advisors and positively impact those I work alongside.

What is the biggest challenge you see in the industry, and what is the one thing you would do to change it?

I think nearly everyone can agree one of the biggest challenges everyone faces is time. There’s never enough time in the day to complete everything that needs to be done, such as implement technologies that could drastically mitigate or eliminate the majority of non-revenue driving activities or confer with peers and mentors about struggles and successes they’ve faced. We can’t create more time — there are only so many hours in the day — but as an industry, we need to break down barriers so more advisors can implement technologies to scale their business and heighten the client experience. How do you change that? Embrace technology. Not only do the new technologies available provide time efficiencies, effectively scale practices, but they also provide transparency and better client experiences.

What is the biggest opportunity you see in the industry?

Opportunity lies in the middle class. It’s truly an underserved market, but one that has significant potential. Although we’re in an information-overload culture and many are influenced by Google searching, it’ hard to identify the intricacies of retirement planning that could impact them. Often, many don’t know what they don’t know. Nor, will they know where to look. And therein lies the opportunity for advisors. With the current regulations, opportunities are going to swing in favor of holistic planners because of the very nature of our business — clients seek long-lasting, foundational relationships with their planners. And, studies show the middle class sticks with them. As advisors, can we earn a coveted place with clients by being the primary contact for financial resources and knowledge? This increases your value and client retention. Like I said, clients often don’t know what they don’t know, and it’s our responsibility to continually earn their business.

What do you think millennials are looking for in an advisor? How can advisors best serve this market?

I believe millennials are looking for many of the same things others seek: integrity, transparency, lower fees, better value and better stewards in general. And why shouldn’t they get those things? I also believe they’re in search of advisors who utilize better technology in their practices, in keeping up with the times. Older advisors with less innovative technology aren’t having success capturing millennial clients as a result of the lack of a number of the factors I mentioned above.

The difference is millennials also want the long-term financial journey to be simplified and straightforward, so that’s the approach we should take. And, how do you overcome those millennials seeking instant gratification? We effectively communicate and help them visualize the tremendous impact planning can have on their lifestyle. We’re not trading oranges for apples. We’re teaching them to trade oranges for a full apple tree later. If you can hone in on your presentation skills in a manner that resonates, it immediately becomes relevant. And that’s the key to compensate for instant gratification-minded clients: relevancy. As advisors, everyone benefits when we are powerful and relevant story tellers that can help clients visualize their future.

What is the No. 1 piece of advice you would give to a young person looking to enter this industry?

My advice: finding a quality mentor is the key to success. And, there are qualities to look for in mentors that can help grow your business acumen and round out your soft skill set. Great mentors can be individuals who are still climbing, deeply vested in seeing you succeed, want to shape your future or help you better yourself. I am fortunate enough to have two extraordinary colleagues who have tremendously helped me, Mark Heitz and Lance Sparks. And those connections have been paramount in sculpting me as a professional.

(Related: Opportunity Creation: 5 Ways to Grow Your Business)

Zoltan Pongracz Jr.

29

Shelton, Connecticut

Financial advisor/financial planner

Barnum Financial Group

ThinkAdvisor Life Health: Why did you choose a career in insurance or financial services?

Zoltan Pongracz Jr.: A career in financial services kind of chose me. My parents and I immigrated to the United States when I was around four years old. I attended several elementary schools, and I did not think much about a career in my younger years. Fast forward some years, I ultimately became the first in my family to attend college and I set out to pursue a career in hotel and casino management, which the school that I chose was well-known for. Along the way, I took a finance course and fell in love. When I graduated, I connected with a friend who had gone to work for Barnum Financial Group, and he encouraged me to come in for an interview. I entered the firm’s training program and became an advisor in 2011. Since then, I’ve enjoyed building a business and truly helping my clients at the same time.

Describe what you do.

If I had to sum it up, I would say that I help my clients make smart financial decisions to achieve what they want, protect what they already have, and provide support for the people who depend on them. Most of my clients have multiple needs and they are looking for a personal CFO to quarterback their entire situation. I will often work with the other professionals in clients’ lives such as their CPA and estate planning attorney.

Share an achievement you are especially proud of.

I’ve won industry awards and firm recognition, but my biggest accomplishments I would mention are actual cases where my team has had a tremendous impact on a family. I’ve done a decent amount of work in the field of special needs planning, and one financial plan in particular ended with a result that was not only life-changing for the clients but also for me. Times like that remind me of why I am in this business.

What is the biggest challenge you see in the industry, or what is the one thing you would change?

The upcoming changes to the Department of Labor’s fiduciary rules going into effect in 2017 and 2018. I could not agree more that financial professionals should be held to high standards and this overall should be a good thing.

What is the biggest opportunity you see in the industry?

This isn’t exclusive to financial services, but for me the biggest opportunity I see is that, as things change, many advisors may not. This leaves such a huge gap to be filled by advisors who can put their clients’ needs first and give solid advice.

Demographically, there are more and more people reaching certain milestone ages such as retirement, and also the older baby boomers aging a bit needing estate planning advice. At the same time, millennials are starting to have an impact on the economy and be in a position where they are able to save.

What do you think millennials are looking for in an advisor? How can advisors best serve this market?

I think millennials want someone who is really engaged with them and trustworthy. They want to be able to reach you instantly if the need arises. The main way we can serve this market is by always innovating and remaining a few steps ahead of the game. We have to be able to use technology that will appeal to this younger generation. For example, I use a financial planning tool that allows a lot of interaction between the client and advisor, aggregates all of a person’s finances on one screen, is viewable on an app, and supplements the financial education that my team personally gives.

What is the No. 1 piece of advice you would give to a young person looking to enter this industry?

Come into the industry truly wanting to help people. Of course, as with starting any business, hard work is absolutely key, but even more important I would say is organization. Everything my team does is process driven, and because people have had a good experience much of our business currently comes from word of mouth and direct introductions.

Also, when I first came into the business, I did joint work with other advisors frequently and have always had a mentor. One way that I developed quickly and built the business in a short period of time is by learning from each and every one of these relationships. I always wanted to find that one valuable lesson or one great trait that others had and make it my own.

(Related: Meet 4 Leaders That Are Transforming the Insurance Industry)

Maxwell Schmitz

29

San Rafael, California

Vice president, marketing

DI & LTC Insurance Services

ThinkAdvisor Life Health: Why did you choose a career in insurance or financial services?

Maxwell Schmitz: I came for the work-life balance and stayed for the fulfillment of helping others. Working for a family agency, it was always evident to me that my parents had the unique ability to coach all my teams, join all the field trips, and kind of get away with taking a break at any point during the year. I was attracted to that. It didn’t take long for me to realize that the products we sell are used to help people in their darkest hour. A devastating diagnosis can lead to a massive change in a client’s lifestyle — for their whole family. There is so much to deal with at that moment in time. We are charged with insulating our clients from financial ruin in the wake of one of these life-changing events, even if we can’t be there for them emotionally or physically. It’s extremely rewarding to know that we have a role to play for someone going through so much.

Describe what you do.

I work with insurance advisors, benefits brokers, and financial planners to protect their clients in the event of a disability. It’s my job to educate our network of advisors about the importance of income and asset protection, and how these policies actually work. My other job is to make sure our agency is still relevant in 10 to 30 years. That means innovation and market expansion. And that’s been the driving force for our office since I joined seven years ago.

Share an achievement you are especially proud of.

I was proud to serve as president of my [National Association of Insurance and Financial Advisors] chapter at the age of 25. It was at that time that I co-authored a book on disability insurance. Since then I have completed my master of science in financial services. I am undertaking the tall task of making disability insurance accessible to the millennial marketplace by developing in-house drop-ticket solutions.

What is the biggest challenge you see in the industry, or what is the one thing you would change?

The biggest challenge from my perspective as a disability specialist is the dwindling number of carriers. Most people are more likely to experience a disability during their working years than they are likely to die. Yet life insurance sales dwarf disability sales. Insurance, and financial planning in general, is very much a top-down marketing business. Clients buy what the agent sells. Agents sell what the industry supplies. An abundant supply of life insurance products has spawned a culture of life insurance. A sparse supply of disability and long-term care companies means there is simply not a natural consumer appetite for these products. If I had it my way each life insurer would carry a disability product so that advisors would understand the necessity of covering the risk of disability before the risk of death.

What is the biggest opportunity you see in the industry?

My generation. A workforce that is coming of age. The imminent realization that our parents are no longer a viable backup plan if we can’t make it to work tomorrow. Many of us are now married. Having kids. Taking a mortgage. Adulting. We just refinanced our home and when it was finalized and sunk in I felt like I got suckerpunched with how old I felt in that moment. Many of my peers are having similar moments where they ask themselves, “Who am I and how did I get here?”

What do you think millennials are looking for in an advisor? How can advisors best serve this market?

I think it’s important to consider the psychology of where we were and what we were watching when our financial brains were developing. Many of us were in school seeing headlines of a collapsing market, a housing crisis, and now paying down a mounting student loan debt with figures that are reminiscent of the subprime mortgage loans of yesteryear. We are looking forward to the “auto” industry — not cars, but automation and autonomy. Most millennial consumers have an expectation that has been met in some parts of the insurance economy: a self-guided sales process powered by an algorithm instead of a salesperson or advisor. However, this only works for commodities. The complicated nature of DI underwriting is the keystone that keeps disability insurance advice from crumbling into commodity-status like car insurance or term life. Fortunately, there are simplified underwriting programs for DI that are essentially designed for millennials (realistic but still significant benefit amounts). These programs utilize a few shortcuts that make it worthwhile for the casual consumer.

What is the No. 1 piece of advice you would give to a young person looking to enter this industry?

Have an open mind and pave your own way. Constantly evolving media and advancing technology mean that there is boundless opportunity for innovation in our field. I always root for the little guy and would love to see independent advisors relish the evolution as opposed to Big Tech coming in with the next wave of disruption. We are at a crossroads.

(Related: Individual Disability Insurance Sales Were Stable in 2016)

Wesley G. Stout

28

Virginia Beach, Virginia

Investment advisor representative

Lincoln Financial Advisors

ThinkAdvisor Life Health: Why did you choose a career in insurance or financial services?

Wesley G. Stout: I wanted to help individuals understand everyday risks when it comes to protecting their families and preparing themselves for a secure retirement lifestyle.

Describe what you do.

We are a financial advisory team that offers a unique financial planning experience for every individual. As a team, we work together to alleviate the fear in the financial planning process and offer a wide variety of solutions to meet our clients’ specific needs. Our tools provide a plan to guide individuals and their families, to and through retirement.

Share an achievement you are especially proud of.

The achievement I’m proud of was being named the 2015 Advisor of the Future for Lincoln’s Southeast Region.

What is the biggest challenge you see in the industry, or what is the one thing you would change?

From a client perspective, the biggest challenge is always saving enough to retire. The old pension plans and quality social security payments will be out the door for millennials and Generation X. If these individuals do not properly save for retirement, then they will have to work a lot longer than the generations before them.

What is the biggest opportunity you see in the industry?

The biggest opportunity in the industry is that the average advisor is between the ages of 55 and 65. These “baby boomer advisors” will be looking to retire in the near future and their clients will want to work with someone that’s going to be around for the years to come.

What do you think millennials are looking for in an advisor? How can advisors best serve this market?

I believe millennials are looking for someone that’s easy to work with and is trustworthy. Advisors can best serve this market by meeting these millennials face-to-face and demonstrating how they will be able to make their retirement saving strategy as streamlined as possible.

What is the No. 1 piece of advice you would give to a young person looking to enter this industry?

I would recommend having your finance degree along with a master’s degree. This shows credibility upon entering the business. Since there is a 90% turnover rate in the industry, young individuals that don’t build a successful practice within the first four years will be able to fall back on their education and apply themselves to a different position.

(Related: Formulas for Success: Howl at the Moon)

Jennifer Swedenburg

23

Retirement specialist

Poseyville, Indiana

American Senior Benefits

ThinkAdvisor Life Health: Why did you go into the industry?

Jennifer Swedenburg: I did not exactly plan or have a specific reason as to why I went in the insurance and financial industry. I saw the potential to help a lot of people and earn a good living depending on how hard I wanted to work. I also saw the potential with the market we work with at Bankers Life which focuses on baby boomers and seniors who have already retired.

Describe what you do

I meet with individuals in retirement or pre-retirement who are needing help with insurance or financial planning. The company I work for has a specific process that I like to navigate through when it comes to helping these individuals. Prospecting is huge in this industry and that is the first step to getting in front of someone who needs my help. It is something that is always constant in my business.

When I sit down with a couple or individual the first thing I do is fact find. This is by far the most important step in my company’s process. You can never properly nor ethically make a professional recommendation without this step. It is gathering information about what individuals have already planned for and what they still need to plan for. After fact finding is completed I make a recommendation if one is needed and 90 percent of the time it is. I am able to help my clients with a variety of different types of planning. Medicare, long-term care planning, financial planning, estate planning, etc.

The most important thing I do out of all of those things is building relationships. I strive to get to know each and every client very well along with their families. I have built some of the most valuable relationships a person could ask for. My clients do not just see me when they need something or have a question. If I am in the area I will just stop in sometimes and have a cup of coffee. That’s what makes my career so enjoyable.

Share an achievement you are especially proud of

I have many that I am proud of but the one that keeps me going was being named Rookie of the Year in 2014. Everyone always said that your first year is the hardest in this business. I am blessed to have achieved this award because there were many days I wanted to quit and give up but I just kept going. I knew there were people out there that needed my help and I wanted more for myself and my family so those are the things that made that achievement happen.

What is the biggest challenge you see in the industry?