#tdameritrade

Text

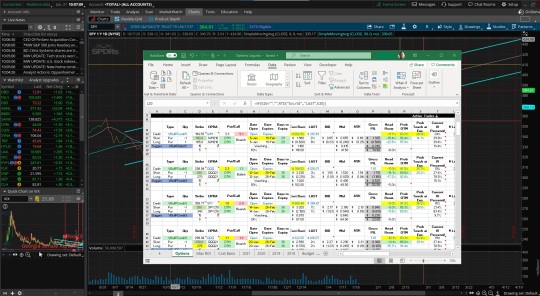

How to Connect Excel with Thinkorswim

How do you connect Schwab’s Thinkorswim (TOS) desktop trading platform with your Excel spreadsheet? How about how to use the Thinkorswim RTD commands to live stream data into your Excel Watch List? Even better, how about downloading my Excel Options Watch List to see how it works?

The Avengers (2012) is an action-packed superhero film that tells the story of a group of superheroes who must come…

View On WordPress

#Ameritrade#Charles Schwab#Excel#Open Positions Monitor#Options Trader#Options Trading#Schwab#Stock Options#TDAmeritrade#ThinkorSwim#Tos#Watch List

1 note

·

View note

Link

#beginnertraders#cryptocurrencies#eToro#Forex#IG#onlinetrading#Plus500#Robinhood#stocks#TDAmeritrade#Tradingplatforms

0 notes

Text

Cash flow per share. One should calculate the cash flow per share. One should think of things as an owner. I will disclose whether Tdameritrade or Interactive Brokers do a GOOD job. This may take me several posts. For further details visit Fastjer.com.

Cash flow per share. One should calculate the cash flow per share. One should think of things as an owner. I will disclose whether Tdameritrade or Interactive Brokers do a GOOD job. This may take me several posts. For further details visit Fastjer.com.

View On WordPress

0 notes

Text

TD Ameritrade – Tất tần thông tin về sàn giao dịch TD Ameritrade

TD Ameritrade chính là sàn giao dịch Forex và CFD. Thành lập từ năm 1975, SEC loại bỏ thông lệ hoa hồng môi giới cố định. Đây chính là sự bắt đầu của một làn sóng môi giới giảm giá. Một trong các công ty đó là First Omaha Securities, công ty cuối cùng trở thành TD Ameritrade. Từ lúc đó, sàn TD Ameritrade đã là 1 trong các sàn giao dịch sáng tạo nhất ở trên Phố Wall.

Nguồn bài viết: https://giaiphapchungkhoan.com/td-ameritrade/

#giaiphapchungkhoan #tdameritrade

0 notes

Text

Что такое фьючерсы?

New Post has been published on https://cripta.today/kriptopedija/chto-takoe-fjuchersy/

Что такое фьючерсы?

Ключевые выводы

Фьючерсный контракт — это соглашение о торговле товаром, валютой или акцией по установленной цене, сумме и дате.

Предприятия используют фьючерсные контракты для хеджирования рисков, а трейдеры могут использовать их для спекулятивных ставок.

Фьючерсами можно торговать с кредитным плечом более 30х, и из-за этого кредитного плеча это рискованно.

Как работают фьючерсы?

Фьючерсные контракты — это деривативы, которые заранее фиксируют цену и объем торговли товарами, валютой или акциями. Фьючерсы обычно торгуются на бирже, такой как CME Group, где спекулянты могут сопоставляться друг с другом, а владельцы бизнеса могут торговать фьючерсными контрактами.

Дата, установленная во фьючерсном контракте, называется датой экспирации и торгуется в тиках. Тики — это наименьшее приращение цены для сделки, обычно равное одному центу. Исключением являются фьючерсы на S&P 500, у которых тики равны четверти на индексном пункте.

Примечание

Расчет фьючерсного контракта по истечении срока действия может происходить либо с поставкой базового актива, либо наличными, в зависимости от типа вашего контракта. Например, фьючерсы на фондовые индексы рассчитываются наличными.

Фьючерсы, которые торгуются на бирже, обычно имеют стандартизированный контракт, установленный биржей, и не имеют риска контрагента, поскольку биржа оплачивает все сделки.

Зачем торговать фьючерсами?

Владельцы бизнеса обычно используют фьючерсные контракты для хеджирования рисков. Например, фермер, выращивающий кукурузу, может использовать фьючерсный контракт, чтобы зафиксировать определенную цену на свою кукурузу на несколько месяцев вперед. Авиакомпания может использовать фьючерсы для хеджирования риска роста цен на топливо.

Трейдеры могут использовать фьючерсные контракты для спекуляций. Физические лица могут торговать фьючерсами, используя брокерский счет , такой как Schwab или TDAmeritrade.

Торговля фьючерсами известна своим кредитным плечом. Если для торговли акциями обычно требуется 50% капитала, то для торговли фьючерсами можно использовать всего 3%. Это означает, что на каждую 1000 долларов в сделке вам нужно вложить всего 30 долларов. Такой уровень кредитного плеча делает торговлю фьючерсами одной из самых рискованных инвестиций.

Примечание

Поскольку фьючерсы являются чрезвычайно рискованными инвестициями, они могут не подходить для всех индивидуальных инвесторов.

Пример фьючерсов

Допустим, фермер, выращивающий сою, обеспокоен тем, что цены на сою упадут до сбора урожая, и хочет зафиксировать цену на часть потенциального урожая сейчас. Фермер может использовать брокерский счет или даже веб-сайт CME Group для просмотра текущих котировок различных фьючерсных контрактов (они обозначены датой, поэтому фьючерсы со сроком погашения в ноябре будут называться фьючерсами на сою NOV).

Если фермер находит цену, гарантирующую достаточную прибыль, он может продать контракт и поставить сою в дату контракта.

Типы фьючерсов

Фьючерсы могут быть основаны на широком спектре базовых активов. Вот несколько различных типов фьючерсных контрактов:

Финансовые фьючерсы : Финансовые фьючерсы включают фондовые индексы , товарные индексы и долговые инструменты Казначейства США.

Примечание

Фьючерсы на отдельные акции, которые были представлены в США в 2012 году, прекратили торговлю в 2020 году после закрытия OneChicago — биржи, на которой они торговались.

Валютные фьючерсы : есть несколько валют, доступных для торговли через фьючерсные контракты, включая все, от доллара США и бразильского реала до криптовалют, таких как биткойн и эфириум.

Энергетические фьючерсы : Энергетические фьючерсы включают сырую нефть, природный газ и другие нефтепродукты, такие как бензин и мазут, а также этанол.

Сельскохозяйственные фьючерсы : к ним относятся фьючерсы на зерно, домашний скот, продукты питания и волокна, такие как пшеница, крупный рогатый скот и кофе соответственно.

Фьючерсы на металлы: можно торговать драгоценными металлами, такими как золото и серебро, и промышленными металлами, такими как медь.

Стоимость фьючерсов и торговые требования

Затраты на торговлю фьючерсами представляют собой комиссионные брокеру. Например, Чарльз Шваб берет 2,25 доллара за сделку. Также взимаются обменные и регуляторные сборы. Плата за обмен варьируется в зависимости от продукта, а регулирующие сборы составляют два цента за контракт.

Примечание

Требования к торговле фьючерсами гораздо мягче, чем требования к торговле акциями. Для внутридневных трейдеров, торгующих акциями, существует минимальное требование к марже в размере 25 000 долларов США. Для фьючерсных трейдеров, в зависимости от типа контракта, типичный маржинальный счет может составлять несколько сотен долларов.

Фьючерсы против опционов

Опционы и фьючерсы являются производными; разница в обязательствах. Соглашения о фьючерсных контрактах обязывают продавца осуществить поставку в сроки, указанные в контрактах. Опционные контракты дают покупателю право, но не обязательство, купить или продать контракт до даты погашения.

Альтернативы фьючерсам

Инвесторы, которые хотят спекулировать на товарах, но не хотят использовать маржу или открывать специальный счет для торговли фьючерсами, могут использовать биржевые фонды (ETF) или биржевые ноты (ETN) для инвестирования в товары.

Что такое фьючерсы Доу?

Фьючерсы на Доу — это контракты, основанные на промышленном индексе Доу-Джонса . Фьючерсы на Dow можно использовать для прогнозирования краткосрочных движений фондового рынка, когда рынок закрыт, или для спекуляций на направлении рынка в среднесрочной перспективе.

Как вы торгуете фьючерсами?

Фьючерсы торгуются на бирже, такой как CME Group, через брокерские конторы , такие как TDAmeritrade и Charles Schwab.

0 notes

Photo

New Post has been published on https://primorcoin.com/cme-group-to-face-off-with-ftx-after-filing-for-futures-commission-merchant-status-finance-bitcoin-news/

CME Group to Face off With FTX After Filing for Futures Commission Merchant Status – Finance Bitcoin News

According to a recent report, the world’s largest derivatives exchange CME Group is looking to register as a direct futures commission merchant (FCM). CME Group’s decision follows the digital currency exchange FTX, as the crypto company applied to become a derivative clearing organization and awaits approval from the U.S. Commodity Futures Trading Commission (CFTC). If CME Group is approved to be an FCM, the company can bypass third-party brokers and offer futures directly on the CME platform.

Derivatives Exchange CME Group Registers for FCM While FTX Awaits CFTC Approval

The world’s largest financial derivatives exchange, CME Group, has reportedly filed paperwork to become a futures commission merchant (FCM), according to a report published by the Wall Street Journal (WSJ). WSJ author Alexander Osipovich explained CME filed the registration in August and Osipovich opines that the company is “taking cue from [the] crypto rival FTX.”

If CME Group’s FCM registration is approved, CME will be able to offer derivatives directly without the need for brokerage houses like TDAmeritrade, Saxo Bank Interactive Brokers, Robomarkets, and Grandcapital. FTX is awaiting approval from the CFTC to become a derivatives clearing organization. Last March, the CFTC opened public comments so it could get insight into FTX’s proposal. In mid-May, CME Group chair and chief executive officer Terry Duffy wrote that the move by FTX could present “market risk.”

“FTX’s proposal is glaringly deficient and poses [a] significant risk to market stability and market participants,” Duffy opined at the time. “FTX proposes to implement a ‘risk management light’ clearing regime that would significantly increase market risks by potentially removing up to $170 billion of loss-absorbing capital from the cleared derivatives market, eliminating standard credit checks, and destroying risk management incentives by limiting capital requirements and mutualized risk.”

The report written by Osipovich details that the chairman and chief executive of Advantage Futures, Joseph Guinan, says the move could be very dramatic. “I would not expect the CME to go down the path where they compete directly with FCMs for clients,” Guinan remarked. “However, if they did go down this path, that would be a game-changer for the FCM industry and a dramatic concern for every FCM.”

While the CFTC weighs in on the FTX proposal, Osipovich cited Craig Pirrong, a finance professor at the University of Houston when he said that CME’s FCM decision was a response to the FTX plan. “From a philosophical perspective, they would prefer not to do this,” Pirrong said on September 30. “But in the event that the CFTC does approve the FTX model, from a competitive perspective, they may feel that they have to do this.”

Osipovich also published commentary from a CME Group spokesperson who commented on CME’s FCM August filing. “Our commitment to the FCM model and the significant risk management benefits it provides to all industry participants remains unwavering,” the CME Group representative said. In terms of bitcoin (BTC) futures volume, FTX and CME Group have relatively the same amount of bitcoin futures open interest and BTC futures trade volume as well.

Tags in this story

bitcoin futures, CME Group, CME Group CEO, CME Group chair, Craig Pirrong, derivatives, derivatives exchange, derivatives markets, ftx, FTX Exchange, Futures, futures exchange, Grandcapital, Joseph Guinan, Options Exchange, Robomarkets, Saxo Bank Interactive Brokers, TDAmeritrade, Terry Duffy, trading

What do you think about CME Group going face to face with FTX by applying for a futures commission merchant status? Let us know what you think about this subject in the comments section below.

Jamie Redman

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

More Popular News

In Case You Missed It

Source link

#Bitcoin #Crypto #CryptoExchange #DEFI #DEFINews

#Bitcoin#Crypto#CryptoExchange#DEFI#DEFINews#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#Finance

0 notes

Text

Where to Buy Tencent Stock: China's Biggest Internet Company

What is the Tencent Stock Exchange Code (HK) for Tencent? If you're looking to invest in Tencent (HK:700.HK) — China's largest internet company, this post is a must-read. I'll walk you through everything you need to know beyond the Tencent Stock quotes and, most notably, which exchange has the lowest Tencent stock price.

Dear Tencent Stockholders, We've Got Some News for You

I've listed top picks for brokerage firms currently offering free trading of Tencent stock. If you're not already a member of one of these services, I encourage you to register today, as it will save you money on commissions and help your portfolio grow faster.

Here's a quick look at the top three brokerages offering free trading of Tencent stock (or any other stock):

1) BIYAPAY: The top pick for a brokerage for its good features. Unlike other platforms, We are happy to announce that Biyapay now offers the ability to trade Tencent stocks on our platform. You can sign up quickly and start selling immediately, and no requirements are needed. You can also buy USDT and Hongkong stocks at the same time. The exchange rate is the same as real-time global exchange. We will also add more features shortly, such as margin trading and lending, which will help you make more money from your investment!

Biyapay is a professional digital asset trading platform, and we are specialized in blockchain technology research and application for many years with rich experience in this field. Our products have been well received by users worldwide, including in the United States, Canada, Australia, New Zealand, Japan, South Korea, and other countries.

2) Ameritrade: The online discount brokerage firm is offering free trading for all stocks that trade on the New York Stock Exchange (NYSE), including Alibaba.com (BABA) and its parent company, Yahoo! Inc. (YAHOO). If you're an existing member of Ameritrade, simply log into your account and click on "Make an Account" to choose this option during the registration process. It's that easy!

3) TDAmeritrade: Since 1999, TD Ameritrade has been helping investors protect their hard-earned money by offering low commissions and no account minimums. They also provide access to over 7500 mutual funds and ETFs – as well as excellent customer service – so if you're looking for a broker who cares about your success as much, then this one is for you.

How to Buy Tencent Shares in the U.S.

Tencent Holdings is one of the biggest tech companies in China. It operates several social media and messaging platforms, including WeChat, which has more than one billion users worldwide. The company also offers mobile games and online payment services.

Tencent shares are listed on the Hong Kong Stock Exchange (HKEX), and the company is still majority owned by its founders. But it's possible to buy Tencent shares in the U.S., thanks to a brokerage called Biyapay.

Biyapay allows investors to buy US stocks with its brokerage service. You can choose from over 8,000 American stocks and ETFs anytime, including many tech companies like Amazon, Microsoft, and Facebook.

Here's how it works:

1) Sign up for an account on Biyapay's website (or use your existing account). You'll need to pass KYC authentication only. No requirements need!

2) Deposit money into your new Biyapay brokerage account using a wire transfer from your bank account or credit card (or you can use Bitcoin).

3) Choose USDT to buy stocks. Just easy, right? Our stock-trading app allows you to purchase shares in companies that we provide. Once a company has been selected, the feature will be enabled inside our app as soon as it becomes available for your region.

There is a 1% fee for withdrawing cryptocurrency or fiat currency from exchanges, with a minimum charge of 20 USD. Send unlimited amounts of money without making a deposit, unlike other platforms. We don't set a maximum cap on the amount you can deposit or minimum requirements for opening an account. On our trading platform, traders can see all the fees they will pay for each trade.

0 notes

Text

Where to Buy Tencent Stock: China's Biggest Internet Company

Where to Buy Tencent Stock: China's Biggest Internet Company

What is the Tencent Stock Exchange Code (HK) for Tencent? If you're looking to invest in Tencent (HK:700.HK) — China's largest internet company, this post is a must-read. I'll walk you through everything you need to know beyond the Tencent Stock quotes and, most notably, which exchange has the lowest Tencent stock price.

Dear Tencent Stockholders, We've Got Some News for You

I've listed top picks for brokerage firms currently offering free trading of Tencent stock. If you're not already a member of one of these services, I encourage you to register today, as it will save you money on commissions and help your portfolio grow faster.

Here's a quick look at the top three brokerages offering free trading of Tencent stock (or any other stock):

1) BIYAPAY: The top pick for a brokerage for its good features. Unlike other platforms, We are happy to announce that Biyapay now offers the ability to trade Tencent stocks on our platform. You can sign up quickly and start selling immediately, and no requirements are needed. You can also buy USDT and Hongkong stocks at the same time. The exchange rate is the same as real-time global exchange. We will also add more features shortly, such as margin trading and lending, which will help you make more money from your investment!

Biyapay is a professional digital asset trading platform, and we are specialized in blockchain technology research and application for many years with rich experience in this field. Our products have been well received by users worldwide, including in the United States, Canada, Australia, New Zealand, Japan, South Korea, and other countries.

2) Ameritrade: The online discount brokerage firm is offering free trading for all stocks that trade on the New York Stock Exchange (NYSE), including Alibaba.com (BABA) and its parent company, Yahoo! Inc. (YAHOO). If you're an existing member of Ameritrade, simply log into your account and click on "Make an Account" to choose this option during the registration process. It's that easy!

3) TDAmeritrade: Since 1999, TD Ameritrade has been helping investors protect their hard-earned money by offering low commissions and no account minimums. They also provide access to over 7500 mutual funds and ETFs – as well as excellent customer service – so if you're looking for a broker who cares about your success as much, then this one is for you.

How to Buy Tencent Shares in the U.S.

Tencent Holdings is one of the biggest tech companies in China. It operates several social media and messaging platforms, including WeChat, which has more than one billion users worldwide. The company also offers mobile games and online payment services.

Tencent shares are listed on the Hong Kong Stock Exchange (HKEX), and the company is still majority owned by its founders. But it's possible to buy Tencent shares in the U.S., thanks to a brokerage called Biyapay.

Biyapay allows investors to buy US stocks with its brokerage service. You can choose from over 8,000 American stocks and ETFs anytime, including many tech companies like Amazon, Microsoft, and Facebook.

Here's how it works:

1) Sign up for an account on Biyapay's website (or use your existing account). You'll need to pass KYC authentication only. No requirements need!

2) Deposit money into your new Biyapay brokerage account using a wire transfer from your bank account or credit card (or you can use Bitcoin).

3) Choose USDT to buy stocks. Just easy, right? Our stock-trading app allows you to purchase shares in companies that we provide. Once a company has been selected, the feature will be enabled inside our app as soon as it becomes available for your region.

There is a 1% fee for withdrawing cryptocurrency or fiat currency from exchanges, with a minimum charge of 20 USD. Send unlimited amounts of money without making a deposit, unlike other platforms. We don't set a maximum cap on the amount you can deposit or minimum requirements for opening an account. On our trading platform, traders can see all the fees they will pay for each trade.

0 notes

Text

In this month’s Trade Journal post, I want to explore what to expect when my TdAmeritrade accounts are transferred to the Charles Schwab platform. There’s going to be a little sphincter tightening for me until the transfers are completed.

#options trading#investing#trading journal#options spreads#tradingjournal#makingmoneyathome#verticalspreads#options strategies#cover calls#options assignment

0 notes

Text

What Happened: If you woke up on Friday horrified, you're not alone! With the S&P 500, Dow, and Nasdaq all down over 2%, I also had to cross a few percentage points off my Thanksgiving list of things I was thankful for.

If you can still afford beer, remember to pour one out for our boys in the energy sector, as Crude Oil dropped a whopping 13% in the worst single trading day in months.

Why Did it Happen: Big surprise here! It's covid related. There's a new variant in town named "Omicron," which I had previously thought was a villain from Transformers. Anyway, fresh fears of new government shutdowns and travel restrictions had traders mashing "sell" like it was an obnoxious button on Jim Cramer's soundboard.

What To Do About It: We sell fear here! All this fresh panic has the premium from selling puts looking J U I C Y.

My trade of choice? Sell puts on the SPY anywhere below 453. With technical support at 453, and the 50-day moving average remaining intact, that should be enough to slow the drop long enough for a little time to expire, handing you that sweet inflated premium in the process.

Pro Tip! I'd stick to shorter durations here, son. Weekly options only. This will protect you from a worst-case scenario. If the market were to continue to move lower, you don't want to give it months to drag your account down with it.

#market report#options#naked options#puts#calls#selling options#income#spy#qqq#dow#iwm#stocks#stock market#tdameritrade#robinhood

3 notes

·

View notes

Photo

What technical patterns do you know? 👇 #stockmemes #stockmarketmemes #stockinvestment #investing101 #financenews #stockstotrade #etrade #learntoinvest #yahoofinance #tradingoptions #investormindset #forexmemes #tdameritrade #bearmarket #warrenbuffett #forexsignals #forex #tradinglife #investingforbeginners #forextrading #stockcharts #livetrading #stocktrade #stockmarkettips #sharemarketmemes https://www.instagram.com/p/CQUM26EAStH/?utm_medium=tumblr

#stockmemes#stockmarketmemes#stockinvestment#investing101#financenews#stockstotrade#etrade#learntoinvest#yahoofinance#tradingoptions#investormindset#forexmemes#tdameritrade#bearmarket#warrenbuffett#forexsignals#forex#tradinglife#investingforbeginners#forextrading#stockcharts#livetrading#stocktrade#stockmarkettips#sharemarketmemes

4 notes

·

View notes

Video

URGENT - REAL ESTATE STOCKS to WATCH

#realestatestocks#realestate#stocks#stockmarket#realestatestockmarket#reits#realtorstocks#realestatestockinvesting#stockinvesting#webull#tdameritrade#webullinvesting#tdameritradetrading#webulltrading#realtors#realestateagents

1 note

·

View note

Text

If you want to become a professional trader. Open a million dollar phony account at Tdameritrade or Interactive Brokers. But I warn you it will take all your time. You could do worse than read my posts.

If you want to become a professional trader. Open a million dollar phony account at Tdameritrade or Interactive Brokers. But I warn you it will take all your time. You could do worse than read my posts.

View On WordPress

0 notes

Photo

But has other ideas. On Wednesday, Vance’s office filed felony charges for eavesdropping and computer trespass against Kurson, 52, a close

0 notes

Photo

A partir de hoje no Lupa vamos começar a abrir os horizontes de possibilidades dos seus investimentos e já faço essa pergunta: Já imaginou se seus investimentos não tivessem fronteiras? . Hoje em dia é fácil e prático poder fazer seu dinheiro crescer através dos ativos internacionais. Claro que as questões tributárias e demais taxas devem fazer parte do planejamento, mas não é nenhum bicho de 7 cabeças como se ouve por aí. . Neste post lhe mostro 3 cenários, onde você pode se beneficiar: . 1️⃣ Investir no Brasil, em Reais, através dos BDRs (Brazilian Depositary Receipts), ETFs (Exchange Traded Funds) ou ainda os BDRs de ETFs, todos disponíveis em suas corretoras através da @b3_oficial ; . 2️⃣ Investir no exterior, em dólares, através de corretoras estrangeiras, como a @avenuesecurities , @tdameritrade ou @passfolioapp ; . 3️⃣ Investir através dos criptoativos. Aqui existem várias possibilidades de ganhos, que vamos detalhar em outros posts. . Dê uma olhada nas imagens e confira mais alguns pontos interessantes. . Já possui alguma experiência em algum dos 3 tópicos? Conta pra gente nos comentários. . Acompanhe nossos posts pois vem muita coisa boa pela frente, para fazer você começar a ganhar proventos em dólares, aumentar seu patrimônio em moeda forte e poder entrar no mundo dos criptoativos com total segurança. . #investirnoexterior #dividendosemdolar #comoinvestir #investimentos #rendavariável #bdr #etfs #bdrdeetf #b3 #avenue #avenuesecurities #tdameritrade #passfolio #stocks #reits #alemdasfronteiras #pensandonaaposentadoria #lupanodinheiro #luizhenriqueoliveiraef #joãopessoa (em João Pessoa, Brazil) https://www.instagram.com/p/CPYX7UFhfFA/?utm_medium=tumblr

#investirnoexterior#dividendosemdolar#comoinvestir#investimentos#rendavariável#bdr#etfs#bdrdeetf#b3#avenue#avenuesecurities#tdameritrade#passfolio#stocks#reits#alemdasfronteiras#pensandonaaposentadoria#lupanodinheiro#luizhenriqueoliveiraef#joãopessoa

0 notes