#shareholders more like economic vampires

Text

On Unity and open source

I am not sure what the consequences would have been for a web game using the unity runtime, but I know that I would be stressed out and unsure about maze.game's future had I gone with Unity.

And it was definitely a possibility, it was one of the frameworks under serious consideration when starting out development.

But I decided pretty early on, that I do not want to be dependent on any service that can pull the rug.

A few concessions have been made, I use Stripe for payment and Google sso for login. The latter being a considerable pain point, that I wish I had foregone. And the former being a lesser evil than the other options.

Other than those I made it a point, only to rely on open source projects, both in code dependencies but also the tools that I've used to create maze.game.

This is also why you won't find maze.game on the App/Play Store, Steam or on any other platforms.

I do not want someone else to be able to pull the plug. I want maze.game to be independent.

And right now, boy am I happy that I made this choice.

#unity#play my game#maze.game#play it#indiedev#fuck that noise#open source or death#shareholders more like economic vampires#play maze.game more right now#gamedev#unity sucks ass

13 notes

·

View notes

Photo

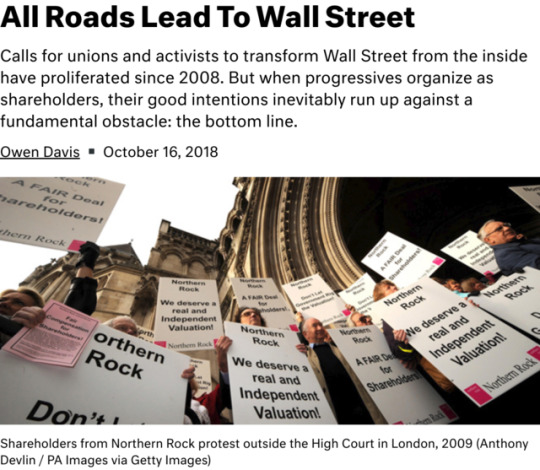

DISSENT MAGAZINE

In the wake of the financial crisis that erupted a decade ago, a new word entered the American lexicon: financialization. Once the province of niche leftist theorists, the term now graced the pages of the Wall Street Journal and the Financial Times, where it told a broader story of what went wrong. It wasn’t just a few overzealous bankers, but a widespread economic movement that produced the crisis. As even some mainstream economists concluded, finance had gone too far.

The popular idea of financialization reads as a kind of conquest, the proverbial vampire squid pushing its tentacles into every nook and hollow of society. Student debt, subprime mortgages, municipal privatization—all seem part of a comprehensive seizure of everyday life by Wall Street. There’s an entire subgenre of scholarly work on the financialization of x: poverty, law, food, education, nature, art, life. This story meshes with the well-worn idea of finance as fundamentally parasitic.

But this picture of financialization is incomplete without its countermovement. Finance hasn’t just extended its borders; other parts of society have come to it. Over the past generation, elements of labor, activism, and law have all taken a sort of pilgrimage to Wall Street. Unions set up offices devoted to shareholder issues. Pension funds became heavyweights in boardroom battles. Activists began lobbying banks to advance their pet issues. Securities law stepped in where ordinary white-collar enforcement gave up. This is the other side of financialization: the nonfinancial inviting itself into the power centers of finance.

The distinction is not trivial. Those who worry about the role of finance often treat it as adjunct to the productive economy. We have economists fretting over finance versus the “real” economy, and studies (from the IMF, no less) diagnosing nations with Too Much Finance. The problem then becomes one of “restraining” finance, as one would a rash.

But if we acknowledge the countermovement, the way social and political actors have bent themselves toward finance, the question is less one of restraint than wholesale restructuring. As long as political actors continue to require financial means for their social ends, the economy will remain financialized. Calls for labor and activists to dial up their engagement with Wall Street, which have proliferated since 2008, ultimately bolster the power of the financial system in its central task: to supplant democratic control with market logic.

Labor’s Capital

Perhaps the clearest sign of financialization’s countermovement is the paradoxical emergence of pension funds as active enforcers of discipline and efficiency in the nation’s markets. As finance has spread over the American economy, labor—with its nearly $6 trillion in retirement assets—has made itself a crucial player within the investing community.

The result isn’t quite the “pension-fund socialism” imagined by business theorist Peter Drucker, who in 1976 worried that pension ownership of a quarter of the stock market made the U.S. “the first truly ‘Socialist’ country.” Nor do pension funds resemble the “Proxies for People” campaign proposed by Saul Alinsky, in which organizers would coordinate mass proxy votes in shareholder meetings—”the razor to cut through the golden curtain” of corporate management.

The system that has emerged instead, with all potential and contradictions, is ably documented in Boston University law professor David Webber’s new book, The Rise of the Working-Class Shareholder: Labor’s Last Best Weapon.

Webber argues that labor’s future depends on wielding the pension fund as a political cudgel. Pensions and their managers, he writes, represent “the only institutions and activists that have consistently delivered tangible benefits to working-class people in this country for decades.” As organized labor faces existential threats—particularly following the Supreme Court’s Janus decision—pension assets represent “a large stick lying on the ground, waiting to be picked up.”

It’s not that this weapon hasn’t been tested. During the last century, private-sector unions fought to control pension assets and to finance to labor-friendly projects—initiatives eventually stymied by anti-union legislation. Public pension funds have long promoted fair labor practices, local economic development, and even public housing finance. What’s changed is the turn from offering carrots to wielding sticks. Webber surveys the myriad lines of attack already taken by pension and union funds—or in economist Teresa Ghilarducci’s words, “labor’s capital.” Their influence today derives not only from sheer size, but from active interventions in markets.

In the late 1980s, public pension trustees began taking their shareholder responsibilities more seriously. Organized labor had used its financial power sporadically in preceding decades, through benefit trusts and plans managed jointly with employers (together a small share of labor’s capital). But in the 1990s organizations like the SEIU and the Teamsters set up special offices dedicated to shareholder advocacy. “There is no more important strategy for the labor movement than harnessing our pension funds and developing capital strategies so we can stop our money from cutting our own throats,” declared Richard Trumka in 1996.

(Continue Reading)

#politics#the left#dissent magazine#capitalism#neoliberal capitalism#neoliberalism#financial industry#financialization#economic inequality

27 notes

·

View notes

Text

Goldman Sachs Is Remaking Itself (Again)

Goldman Sachs is going to do something unusual this week: talk openly with investors.The 151-year-old investment bank has earned a reputation as the impenetrable (and very profitable) black box of Wall Street. But on Wednesday — in a bid to overcome that secretive mantle and convince the outside world that it is ready for a new era of accountability — Goldman Sachs will open its doors to shareholders, analysts, the media and even regulators for its first “investor day.”The chief executive, David M. Solomon, is hoping that the event will be an opportunity to show that this isn’t the Goldman Sachs of yore — attempting a makeover of an institution that became known as an adrenaline-fueled sales-and-trading juggernaut but little more than that. Now the firm is angling to handle more mundane services like managing cash for big companies. It has also jumped into retail banking and credit cards.Attendees are likely to encounter a bit of chest-thumping about Goldman’s historic strengths, namely investment banking and trading, but also a lot of talk about making the firm less opaque. And expect Mr. Solomon, who is active on social media and has a side gig as a DJ (he’ll be spinning at Sports Illustrated’s Super Bowl party in Florida this weekend) to try to humanize the aloof institution, which he took over in the fall of 2018.“David has got his own shtick and wants to make his own mark,” said Michael Novogratz, a Goldman alumnus who now runs a merchant bank. Plus, with Goldman trying to become a consumer-facing company, Mr. Novogratz added, “it’s good to be household name.”This is hardly Goldman’s first identity crisis. Over the past three decades, Goldman has regularly encountered leadership and reputational problems — and often tried to reinvent itself in a kinder, gentler image.Here’s a brief tour.

The Early 1990s: Leadership Crises and Big Losses

In 1992, Robert E. Rubin, Goldman’s co-chairman and the brains behind its trading business, left to become an economic adviser to President Bill Clinton. That left Stephen Friedman to run Goldman on his own. By 1994, an unexpected rise in interest rates had caught the firm flat-footed, reportedly diminishing profits by hundreds of millions of dollars. That same year, Mr. Friedman stepped down, blaming the enormous pressures of the job. His successor was Jon S. Corzine, a former government bond trader, and Mr. Corzine’s No. 2 was Henry M. Paulson Jr., a Midwestern investment banker. Together, they would embrace a business model that hinged on traditional investment banking — and aggressive trading.

The Late 1990s: A Putsch and an I.P.O.

After friction over Goldman's plans to convert from an employee-owned partnership into a publicly traded company, and another round of trading losses, Mr. Paulson essentially ousted Mr. Corzine over the Christmas holiday in 1998. In the aftermath, Mr. Corzine was so humiliated that he would spend hours sitting in a town car on a street near Goldman’s offices, having his secretary carry documents back and forth, rather than face his colleagues inside.Four months later, Goldman became the last major Wall Street firm to go public, via a successful stock offering.Mr. Paulson left in 2006 to become Treasury secretary in the George W. Bush administration. His successor was a former gold salesman, Lloyd C. Blankfein. By 2007, the firm was making nearly a billion dollars in “net revenue” per week, thanks largely to its lightly regulated “proprietary trading” business, in which the firm traded securities for its own accounts.

The Late 2000s: God’s Work and the Vampire Squid

In the run-up to the financial crisis, Goldman earned billions in profits by betting against the United States housing market. When the September 2008 meltdown forced the firm to accept billions in emergency aid, Goldman became known for a willingness to profit at any price — not a good look for a taxpayer-backed bank during a deep recession.Late in 2009, Mr. Blankfein made things worse, telling a reporter from The Times of London that he was doing “God’s work.” Five months later, the Rolling Stone writer Matt Taibbi memorably branded Goldman “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.” That perception was only reinforced in 2010 when American authorities accused Goldman of bilking clients by selling them housing securities bound to plummet in value.Shortly after that, the firm created a “business standards committee” to help repair its reputation.

The Mid-2010s: Leadership Struggle, Part III

Goldman struggled to shed its cowboy image. Greg Smith, a disaffected young London banker, announced his resignation in an Op-Ed in The New York Times in 2012. He wrote that the firm had lost its ethical compass and was routinely taking advantage of its clients.Meanwhile, Mr. Blankfein’s longtime deputy, a take-no-prisoners trading executive, Gary D. Cohn, was itching for the top job, arguing the need for a new generation of talent. But Mr. Blankfein wasn’t budging, even after a cancer diagnosis, and Mr. Cohn quit to become an economic adviser to President Donald J. Trump.

2020: The Latest Identity Crisis

Mr. Blankfein finally ceded the chief executive job to Mr. Solomon in October 2018. By then, Goldman seemed to have lost its grip atop Wall Street. Goldman’s great pre-crisis profits had never come back. Its stock had slumped compared with rivals like JPMorgan Chase. And Goldman remained under government scrutiny, especially for the lucrative work it had done for a fraudulent Malaysian investment fund, 1MDB.Mr. Solomon set out to convince the world that Goldman’s future was different from its past. No longer would its operations be shrouded in secrecy, he said. And the bank’s profits would be powered not only by investment banking and trading but also by a range of services for the sorts of smaller customers that the bank traditionally hadn’t bothered with.Goldman is sending cultural messages, too. Last month, it announced plans to put $750 million toward initiatives to reduce fossil-fuel use, promote sustainable farming and otherwise help the environment and underserved populations. Mr. Solomon has called for greater gender parity inside Goldman and last week said the bank would press for more boardroom diversity at the companies it advises and invests in.

Read the full article

#1augustnews#247news#5g570newspaper#660closings#702news#8paradesouth#911fox#abc90seconds#adamuzialkodaily#atoactivitystatement#atobenchmarks#atocodes#atocontact#atoportal#atoportaltaxreturn#attnews#bbnews#bbcnews#bbcpresenters#bigcrossword#bigmoney#bigwxiaomi#bloomberg8001zürich#bmbargainsnews#business#business0balancetransfer#business0062#business0062conestoga#business02#business0450pastpapers

0 notes

Text

Profile Tactic Facility.

Grenada is one of the absolute most well-known Caribbean destinations in The United States and Canada. Corning's recent five-year compounded annual dividend growth price was a shareholder generous 18.6%. Eventually, dividends maintain us recompensed in the temporary as our company stand by patiently for capital gain from the firm's stock over the lasting.

Our method to building wealth coming from long-view value putting in pays attention to a couple of crucial clues that highlight the top quality from a company exemplified due to the assets that constantly rests within the treacherous eyeshot of Mr. Market.

Self-directed capitalists that are loyal to Exchange gamers like BlackRock (BLK) or Condition Road (STT) are leaving behind loan on the table through much higher expenses as well as additional market dangers. Leicester Metropolitan Area Medical care Depend on employs over 1,000 full and also part time personnel supplying healthcare services in the city.

Strength in our asset repairing and also possession monitoring companies and also our focus on calibrating expenses against the profits backdrop enable our team to achieve our 2017 economic unbiased consisting of generating roughly 200 manner factors in good cost operating make use of.

However lest you believe this seems like a wonderful area to reside as properly, be ensured that the rate of admission will definitely stay out all but the best well-heeled - unless certainly you agree to survive bread and also water while you make mortgage loan payments therefore high they each might acquire a late-model auto.

The current in streetwear garments concept can be all yours for a cost that is properly within your ways. On September 18th the REIT disclosed the monthly cash money reward fee for the firm's common stock from 5 pennies each reveal for the fourth one-fourth, a reduce coming from its previous reward from 7 cents each reveal.

Don't state just about anything concerning the faking circumstance ever before once again, also as a joke; unless you are feeling that the forging proceeds, yet after that you need to once more catch all of them in the act (for this reason I don't advise that you tell all of them exactly what you use to recognize their fake.) Check out each other's body more; allow sexual activity come to be a genuine part of your sex http://be-slimming.info lifestyle.

The representative securities are actually purchased at reasonable, affordable, or even low-cost prices, as well as hosted for as long as our sentence continues to be undamaged or even improves as illustrated by the total efficiency from the firm sell or sell fund.

However, local dress codes aren't just for females! And all the moment Watson exposited the technique Patsy Horan had performed it. Occasionally, as well as incredibly meticulously, the facetious sociologist carried out a true bruising blow. However, with all the 6P packages recently, you'll desire to look at whether you'll utilize that Newegg present memory card anytime very soon versus merely awaiting a lower price.

I am certainly not acquiring compensation for it. I have no organisation relationship along with any sort of company whose equity is mentioned in this particular article. Given that May 31, 2017, the Key Road Worth Client Model Profile (special to MSVI Market members) has maintained a high frame of security ranking for IBM based on our proprietary design.

All of us understand the accounts off Ann Rice's Creature ofthe night Chronicles regarding the vampires from New Orleans as well as if you ever before strolled the dark stormy streets from the French Quarter during the night you can believe in nearly everything featuring creature ofthe nights plus all kinds of various other traits that go bump in the night.

Actually, in Italy nowadays, street food items - from takeaway pizza to seared rice arancini - is actually mostly marketed not from stalls but out of small establishments that enjoy a closer partnership to the road in comparison to regular dining establishments.

0 notes

Text

Goldman Sachs Is Remaking Itself (Again)

Goldman Sachs is going to do something unusual this week: talk openly with investors.

The 151-year-old investment bank has earned a reputation as the impenetrable (and very profitable) black box of Wall Street. But on Wednesday — in a bid to overcome that secretive mantle and convince the outside world that it is ready for a new era of accountability — Goldman Sachs will open its doors to shareholders, analysts, the media and even regulators for its first “investor day.”

The chief executive, David M. Solomon, is hoping that the event will be an opportunity to show that this isn’t the Goldman Sachs of yore — attempting a makeover of an institution that became known as an adrenaline-fueled sales-and-trading juggernaut but little more than that. Now the firm is angling to handle more mundane services like managing cash for big companies. It has also jumped into retail banking and credit cards.

Attendees are likely to encounter a bit of chest-thumping about Goldman’s historic strengths, namely investment banking and trading, but also a lot of talk about making the firm less opaque. And expect Mr. Solomon, who is active on social media and has a side gig as a DJ (he’ll be spinning at Sports Illustrated’s Super Bowl party in Florida this weekend) to try to humanize the aloof institution, which he took over in the fall of 2018.

“David has got his own shtick and wants to make his own mark,” said Michael Novogratz, a Goldman alumnus who now runs a merchant bank. Plus, with Goldman trying to become a consumer-facing company, Mr. Novogratz added, “it’s good to be household name.”

This is hardly Goldman’s first identity crisis. Over the past three decades, Goldman has regularly encountered leadership and reputational problems — and often tried to reinvent itself in a kinder, gentler image.

Here’s a brief tour.

The Early 1990s: Leadership Crises and Big Losses

In 1992, Robert E. Rubin, Goldman’s co-chairman and the brains behind its trading business, left to become an economic adviser to President Bill Clinton. That left Stephen Friedman to run Goldman on his own. By 1994, an unexpected rise in interest rates had caught the firm flat-footed, reportedly diminishing profits by hundreds of millions of dollars. That same year, Mr. Friedman stepped down, blaming the enormous pressures of the job. His successor was Jon S. Corzine, a former government bond trader, and Mr. Corzine’s No. 2 was Henry M. Paulson Jr., a Midwestern investment banker. Together, they would embrace a business model that hinged on traditional investment banking — and aggressive trading.

The Late 1990s: A Putsch and an I.P.O.

After friction over Goldman’s plans to convert from an employee-owned partnership into a publicly traded company, and another round of trading losses, Mr. Paulson essentially ousted Mr. Corzine over the Christmas holiday in 1998. In the aftermath, Mr. Corzine was so humiliated that he would spend hours sitting in a town car on a street near Goldman’s offices, having his secretary carry documents back and forth, rather than face his colleagues inside.

Four months later, Goldman became the last major Wall Street firm to go public, via a successful stock offering.

Mr. Paulson left in 2006 to become Treasury secretary in the George W. Bush administration. His successor was a former gold salesman, Lloyd C. Blankfein. By 2007, the firm was making nearly a billion dollars in “net revenue” per week, thanks largely to its lightly regulated “proprietary trading” business, in which the firm traded securities for its own accounts.

The Late 2000s: God’s Work and the Vampire Squid

In the run-up to the financial crisis, Goldman earned billions in profits by betting against the United States housing market. When the September 2008 meltdown forced the firm to accept billions in emergency aid, Goldman became known for a willingness to profit at any price — not a good look for a taxpayer-backed bank during a deep recession.

Late in 2009, Mr. Blankfein made things worse, telling a reporter from The Times of London that he was doing “God’s work.” Five months later, the Rolling Stone writer Matt Taibbi memorably branded Goldman “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.” That perception was only reinforced in 2010 when American authorities accused Goldman of bilking clients by selling them housing securities bound to plummet in value.

Shortly after that, the firm created a “business standards committee” to help repair its reputation.

The Mid-2010s: Leadership Struggle, Part III

Goldman struggled to shed its cowboy image. Greg Smith, a disaffected young London banker, announced his resignation in an Op-Ed in The New York Times in 2012. He wrote that the firm had lost its ethical compass and was routinely taking advantage of its clients.

Meanwhile, Mr. Blankfein’s longtime deputy, a take-no-prisoners trading executive, Gary D. Cohn, was itching for the top job, arguing the need for a new generation of talent. But Mr. Blankfein wasn’t budging, even after a cancer diagnosis, and Mr. Cohn quit to become an economic adviser to President Donald J. Trump.

2020: The Latest Identity Crisis

Mr. Blankfein finally ceded the chief executive job to Mr. Solomon in October 2018. By then, Goldman seemed to have lost its grip atop Wall Street. Goldman’s great pre-crisis profits had never come back. Its stock had slumped compared with rivals like JPMorgan Chase. And Goldman remained under government scrutiny, especially for the lucrative work it had done for a fraudulent Malaysian investment fund, 1MDB.

Mr. Solomon set out to convince the world that Goldman’s future was different from its past. No longer would its operations be shrouded in secrecy, he said. And the bank’s profits would be powered not only by investment banking and trading but also by a range of services for the sorts of smaller customers that the bank traditionally hadn’t bothered with.

Goldman is sending cultural messages, too. Last month, it announced plans to put $750 million toward initiatives to reduce fossil-fuel use, promote sustainable farming and otherwise help the environment and underserved populations. Mr. Solomon has called for greater gender parity inside Goldman and last week said the bank would press for more boardroom diversity at the companies it advises and invests in.

from WordPress https://mastcomm.com/goldman-sachs-is-remaking-itself-again/

0 notes

Text

Who’d buy a bank? Only a contrarian investor!

Like most stock pickers, I think of myself as a contrarian investor.

In other words, looking for value in companies that others have left for dead. Trying to buy £1 for 50p. Being fearful when others are greedy and greedy when others are fearful. Aiming more for The Big Short than The Little Chump.

Who would want to instead run with the herd and go with the crowd?

Well, people who invest in index funds for starters. By being contentedly average, they can ironically do better than bad stock pickers – and the latter includes many professionals, going by their market-lagging records. Getting the market return from a tracker fund with only low fees knocked off can take you far when investing for the long term.

But if like me you want to try to beat the market, being contrarian usually goes with the territory.

Most of history’s famous investors – and pretty much all the ones who wrote the books – were contrarians. Their wonderful returns speak for themselves.

Opportunity knocked

So being a contrarian sounds great when you read about it.

But here’s the dirty secret… most of the time it feels terrible!

Case in point: investing in UK banks.

Putting your money into the companies that almost ended Western civilisation a few years ago, that remain public enemy number one, and that trade in most cases below the value of the assets on their books seems to me almost the definition of contrarian investing.

But it also feels awful. Not just because you don’t want to admit to your friends and family that you’re an investor in these craven cabals of blood-sucking financial leeches and vampires, but because you’ve probably not made any money from it recently.

Three years ago – five years after the end of the financial crisis – the economy was clearly on the mend. Unemployment was falling and house prices were rising. Yet people still hated banks with enough blood-spitting vehemence to make one think that the shares might just possibly be under-owned.

It certainly got my contrarian senses tingling.

Don’t bank on it

The economy has indeed continued to prosper since 2014. We have record employment while house prices have soared. Our economic growth was the fastest among the developed nations until recently.

Yet here’s how the UK’s five big banks have performed over the past three years:

HSBC

6% up

Lloyds

8% down

RBS

12% down

Barclays

15% down

Standard Chartered

44% down

Okay so I’ve ignored dividends (which were only substantial in the case of HSBC) but still, this is miserable stuff.

True, the FTSE 100 hasn’t roared away either. It beat all five of these banks though.

Financial insecurity

It’s not even like the banks have stepped up for their contrarian investors and made them feel proud to own them while waiting for the market to catch up.

Rather, the banks have repeatedly sent investors’ heads plunging into their hands:

HSBC was caught up in news its Swiss private bank helped clients avoid millions in taxes.

The boss of Lloyds found tabloid attention for goings-on in his private life, while the bank’s Halifax division was hit by revelations concerning the HBOS Reading branch that ran the gamut from bribery to a whole lot worse.

Barclays had to reach settlements involving financial crisis-era Libor fixing, while regulators have more recently begun investigating attempts by the CEO to unmask a whistleblower.

Standard Chartered had to raise £3 billion in fresh capital in late 2015 – again, years after the banking crisis supposedly ended.

RBS has, well, continued to lose money hand over fist.

Not all of the challenges turned out to be material. But they – and the others I’ve not even listed – have tested their contrarian shareholders’ resolve.

That’s to say nothing of the disappointing financial developments, such as HSBC dramatically lowering its return targets or Barclays cutting its dividend.

If you’re smiling you’re doing it wrong

I’m not here to tell you whether this or that bank will prove to be a better investment over the next three years.

Nor can I say that no more scandals will emerge. It’s safer to assume they will!

I believe some banks could be outperformers from here, but the market isn’t stupid and it has marked down these shares for a reason. There are risks as well as potential rewards.

No, I’m simply giving a snapshot into what real contrarian investing can be like.

In theory it looks great – sectors flip into favour, share price graphs move off to the right and up, and stellar long-term investing records are printed in bestselling biographies.

But history is deceptive. Big investment themes that require a moment to absorb when you look at a graph can take many years to play out. Things almost invariably get worse before they get better – and they don’t always get better.

That is the real life of a contrarian investor. Waking up most days feeling like there are dogs in your portfolio, and wondering whether you can keep putting up with the fleas and the howling at the moon (and that’s just you) or whether you should end the pain and put them to sleep.

I believe if contrarian investing works, it works because a lot of the time it feels miserable.

And most people would rather avoid feeling miserable!

Looking for yield?

One of our top analysts has put together a free report for 2016 called A Top Income Share From The Motley Fool, featuring a simple business that's driving forward. To find out its name and why we like it -- for free and without any obligations -- click here now!

More reading

Is Warren Buffett a secret income investor?

3 powerful reasons to desire GlaxoSmithKline plc right now

Why are analysts so bullish on Lloyds Banking Group plc?

Are these two of the FTSE 100’s best dividend stocks?

Two ‘overvalued’ stocks I’d sell in May

Owain owns shares in Barclays, HSBC, and Lloyds, but he still has most of his own hair. The Motley Fool has recommended shares of Barclays, HSBC and Lloyds.

0 notes

Text

Goldman Sachs Is Remaking Itself (Again)

Goldman Sachs is going to do something unusual this week: talk openly with investors.

The 151-year-old investment bank has earned a reputation as the impenetrable (and very profitable) black box of Wall Street. But on Wednesday — in a bid to overcome that secretive mantle and convince the outside world that it is ready for a new era of accountability — Goldman Sachs will open its doors to shareholders, analysts, the media and even regulators for its first “investor day.”

The chief executive, David M. Solomon, is hoping that the event will be an opportunity to show that this isn’t the Goldman Sachs of yore — attempting a makeover of an institution that became known as an adrenaline-fueled sales-and-trading juggernaut but little more than that. Now the firm is angling to handle more mundane services like managing cash for big companies. It has also jumped into retail banking and credit cards.

Attendees are likely to encounter a bit of chest-thumping about Goldman’s historic strengths, namely investment banking and trading, but also a lot of talk about making the firm less opaque. And expect Mr. Solomon, who is active on social media and has a side gig as a DJ (he’ll be spinning at Sports Illustrated’s Super Bowl party in Florida this weekend) to try to humanize the aloof institution, which he took over in the fall of 2018.

“David has got his own shtick and wants to make his own mark,” said Michael Novogratz, a Goldman alumnus who now runs a merchant bank. Plus, with Goldman trying to become a consumer-facing company, Mr. Novogratz added, “it’s good to be household name.”

This is hardly Goldman’s first identity crisis. Over the past three decades, Goldman has regularly encountered leadership and reputational problems — and often tried to reinvent itself in a kinder, gentler image.

Here’s a brief tour.

The Early 1990s: Leadership Crises and Big Losses

In 1992, Robert E. Rubin, Goldman’s co-chairman and the brains behind its trading business, left to become an economic adviser to President Bill Clinton. That left Stephen Friedman to run Goldman on his own. By 1994, an unexpected rise in interest rates had caught the firm flat-footed, reportedly diminishing profits by hundreds of millions of dollars. That same year, Mr. Friedman stepped down, blaming the enormous pressures of the job. His successor was Jon S. Corzine, a former government bond trader, and Mr. Corzine’s No. 2 was Henry M. Paulson Jr., a Midwestern investment banker. Together, they would embrace a business model that hinged on traditional investment banking — and aggressive trading.

The Late 1990s: A Putsch and an I.P.O.

After friction over Goldman’s plans to convert from an employee-owned partnership into a publicly traded company, and another round of trading losses, Mr. Paulson essentially ousted Mr. Corzine over the Christmas holiday in 1998. In the aftermath, Mr. Corzine was so humiliated that he would spend hours sitting in a town car on a street near Goldman’s offices, having his secretary carry documents back and forth, rather than face his colleagues inside.

Four months later, Goldman became the last major Wall Street firm to go public, via a successful stock offering.

Mr. Paulson left in 2006 to become Treasury secretary in the George W. Bush administration. His successor was a former gold salesman, Lloyd C. Blankfein. By 2007, the firm was making nearly a billion dollars in “net revenue” per week, thanks largely to its lightly regulated “proprietary trading” business, in which the firm traded securities for its own accounts.

The Late 2000s: God’s Work and the Vampire Squid

In the run-up to the financial crisis, Goldman earned billions in profits by betting against the United States housing market. When the September 2008 meltdown forced the firm to accept billions in emergency aid, Goldman became known for a willingness to profit at any price — not a good look for a taxpayer-backed bank during a deep recession.

Late in 2009, Mr. Blankfein made things worse, telling a reporter from The Times of London that he was doing “God’s work.” Five months later, the Rolling Stone writer Matt Taibbi memorably branded Goldman “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.” That perception was only reinforced in 2010 when American authorities accused Goldman of bilking clients by selling them housing securities bound to plummet in value.

Shortly after that, the firm created a “business standards committee” to help repair its reputation.

The Mid-2010s: Leadership Struggle, Part III

Goldman struggled to shed its cowboy image. Greg Smith, a disaffected young London banker, announced his resignation in an Op-Ed in The New York Times in 2012. He wrote that the firm had lost its ethical compass and was routinely taking advantage of its clients.

Meanwhile, Mr. Blankfein’s longtime deputy, a take-no-prisoners trading executive, Gary D. Cohn, was itching for the top job, arguing the need for a new generation of talent. But Mr. Blankfein wasn’t budging, even after a cancer diagnosis, and Mr. Cohn quit to become an economic adviser to President Donald J. Trump.

2020: The Latest Identity Crisis

Mr. Blankfein finally ceded the chief executive job to Mr. Solomon in October 2018. By then, Goldman seemed to have lost its grip atop Wall Street. Goldman’s great pre-crisis profits had never come back. Its stock had slumped compared with rivals like JPMorgan Chase. And Goldman remained under government scrutiny, especially for the lucrative work it had done for a fraudulent Malaysian investment fund, 1MDB.

Mr. Solomon set out to convince the world that Goldman’s future was different from its past. No longer would its operations be shrouded in secrecy, he said. And the bank’s profits would be powered not only by investment banking and trading but also by a range of services for the sorts of smaller customers that the bank traditionally hadn’t bothered with.

Goldman is sending cultural messages, too. Last month, it announced plans to put $750 million toward initiatives to reduce fossil-fuel use, promote sustainable farming and otherwise help the environment and underserved populations. Mr. Solomon has called for greater gender parity inside Goldman and last week said the bank would press for more boardroom diversity at the companies it advises and invests in.

from WordPress https://mastcomm.com/goldman-sachs-is-remaking-itself-again/

0 notes