#sebi norms

Text

Pritam Deuskar - The Benefits of Investing in IPO in India

Pritam Deuskar - An IPO, or initial public offering, is the first time a company's stock is made available to the general public for purchase. An IPO can be viewed as a way for the company's founders and early investors to realize the full value of their private investment. This improves the company's capacity for growth and expansion. The increased transparency and credibility of the share listing may also help in obtaining better terms when seeking borrowed funds.

Why Investors Invest

According to Pritam Deuskar There are many reasons for investing in an IPO (Initial Public Offering). There are numerous reasons to invest in an IPO (Initial Public Offering). The most common reason is to generate capital quickly. The ability of the general public to purchase shares in a company is the most significant benefit of IPOs. That can be appealing for a variety of reasons. Investing in an IPO gives you early access to a company with high growth potential. It can provide you with a high profit percentage in a short period of time while also growing your funds over time. This is a great investment path for you if you are good at predicting the future of companies and determining whether the latest IPO to be released will be successful. wealthyvia provide research notes as SEBI registered Research Analyst RA.

IPO Advantages

Expanding and diversifying the equity base

Cheaper ways to raise capital

More visibility, prestige, and a better public image

Ability to attract and hire better professionals, as well as manage them through liquidity participation

To make acquisitions possible

Creating multiple financing options such as equity, convertible debt, and so on.

IPO Benefits:

Listing Gains

Gain on listing day is one of the advantages of investing in an IPO. Companies have their stock valued and the offer price is stated in the prospectus. An investor can apply for a specific number of shares at that price. When the share price on a listing day is higher than the price paid when applying for the IPO, the listing gain occurs.

Greater Liquidity

Investors can sell a company's stock on the open market once it has gone public. This allows investors to profit without having to wait for their shares to be repurchased. Because a company's shares can be bought or sold at any time, investors have more liquidity.

IPO Norms

The IPO markets are secure and professional, shielding retail investors. The prospectus of a company contains all relevant information such as performance, financials, growth, risks, and future plans. As a result, investors have enough information to decide whether or not to invest in an IPO.

Buy cheap, earn big

If you want to invest in a small company with big potential, the IPO price is often the best deal. Because the company may provide a discounted rate. If you miss the IPO window, it may be difficult to invest in that promising company because the stock price may skyrocket.

About Pritam Deuskar

Pritam Deuskar works as a SEBI registered research analyst. He has spent many years working in stock market research and business analysis. He previously worked for reputable portfolio management firms, and PMS houses. His opinions, interviews, and articles have appeared in all major financial newspapers and television channels, including cnbc, cnbc bazaar, moneycontrol, economic times, business standard, and others. Pritam Deuskar is well-known for identifying small and mid-cap multibagger companies at an early stage. He has experience working with hni and institutional clients. If you need more information than you can check the wealthyvia site.

2 notes

·

View notes

Text

FPIs' Navigating New Cross-Border Horizons: SEBI's Amended Disclosure Norms

Introduction

The Securities Exchange Board of India (SEBI) recently issued a Circular dated March 20, 2024, marking a significant milestone in the regulatory framework governing Foreign Portfolio Investors (FPIs). This circular introduced amendments to the existing disclosure norms, aimed at streamlining the regulatory landscape and enhancing market integrity. In this comprehensive analysis, we delve into the key provisions of the amended norms, their implications, and the broader implications for cross-border investments in India.

Background of the Amendment

The genesis of the amendment lies in SEBI's commitment to fostering a conducive environment for foreign investment while maintaining transparency and market integrity. The previous framework, outlined in a Circular dated August 24, 2023, imposed additional disclosure requirements on FPIs, particularly those with significant investments in Indian corporate groups. However, concerns were raised regarding the practicality and effectiveness of these requirements, prompting SEBI to reevaluate and refine the regulatory approach.

Objective of the Amendment: Balancing Regulatory Oversight for FPIs

The overarching objective of the amendment is to strike a balance between regulatory oversight and market dynamics, ensuring that FPIs can manage their investment portfolios efficiently while safeguarding investor interests. By introducing targeted exemptions and refining the disclosure requirements, SEBI seeks to mitigate risks associated with opaque ownership structures and concentrated investment models, thereby promoting market stability and investor confidence.

Key Provisions of the Amendment: Enhancing Disclosure Norms for FPIs

The amended norms introduce several key provisions aimed at exempting FPIs from additional disclosure requirements under specific conditions. These provisions include:

Exemption for FPIs with Significant Investments in Corporate Groups:

FPIs with over 50% of their Indian equity Assets under Management (AUM) in a single corporate group are exempt from extra disclosure requirements, subject to certain conditions.

The investment in the corporate group, excluding any stake in the apex company without an identifiable promoter, should not exceed 50% of the FPI's total equity AUM in India.

Aggregate investment by all such FPIs meeting the 50% concentration threshold in a company lacking an identifiable promoter must remain below 3% of the company's total equity share capital.

Limitation on Equity AUM in Corporate Groups:

FPIs must not hold more than 50% of their Indian equity AUM in the corporate group, excluding their stake in the apex company.

Cap on Collective Holdings in Apex Company:

The collective holdings of all FPIs in the apex company must not exceed 3% of its total equity share capital.

These provisions aim to provide FPIs with greater flexibility in managing their investment portfolios while ensuring that regulatory oversight is maintained to protect investor interests and market stability.

Implications of the Amendment

The amended disclosure norms have far-reaching implications for both FPIs and the Indian capital markets. Some of the key implications include:

Enhanced Market Attractiveness:

By exempting FPIs from additional disclosure requirements, the amendment makes the Indian capital markets more attractive to foreign investors.

This enhanced attractiveness can lead to increased foreign investment inflows, contributing to market liquidity and depth.

Diversified Investments:

The exemption criteria allow FPIs to diversify their investment portfolios without triggering additional regulatory burdens.

This encourages FPIs to explore a wider range of investment opportunities in the Indian market, potentially reducing portfolio concentration risks.

Stable Investment Environment:

For corporate groups without identified promoters, the exemption provides a stable investment environment by removing immediate regulatory burdens on their investors.

This stability can attract foreign investments, fostering a more diversified and stable investment base for these companies.

Critique of the Amendment

While the amendment aims to strike a balance between regulatory oversight and market dynamics, it has faced criticism on several fronts:

Arbitrary Thresholds:

Critics argue that the prescribed thresholds for exemption lack a clear rationale and may not effectively prevent market manipulation or protect investor interests.

The 50% concentration threshold and the 3% limit for collective holdings are seen as arbitrary and may not adequately address underlying risks.

Operational Challenges:

The daily tracking of the 3% limit poses significant operational challenges for custodians and depositories, requiring robust systems for real-time monitoring and reporting.

This could increase compliance costs and operational burden, particularly for smaller entities, impacting them disproportionately.

Potential for Regulatory Arbitrage:

The exemption criteria may incentivize FPIs to structure their investments strategically to avoid disclosure, potentially masking underlying risks.

This could lead to regulatory arbitrage, where FPIs exploit loopholes in the regulatory framework to circumvent disclosure requirements.

SEBI's Response to Criticism

SEBI has responded to criticism by emphasizing the need for periodic regulatory review and stakeholder engagement. The regulator has indicated its willingness to reevaluate the effectiveness of the amendment and make necessary adjustments to address concerns raised by market participants.

In addition, SEBI has underscored the importance of international collaboration in refining regulatory frameworks governing cross-border investments. By engaging with global regulatory bodies and adopting best practices, SEBI aims to ensure that India's regulatory framework remains robust and aligned with international standards.

Conclusion: SEBI's FPIs Amendment Balances Regulation & Market Dynamics

The amendment to SEBI's disclosure norms for FPIs represents a significant step towards enhancing market integrity and investor protection in India. While the amendment has been met with criticism on certain fronts, it underscores SEBI's commitment to striking a balance between regulatory oversight and market dynamics.

Going forward, it will be essential for SEBI to engage with stakeholders and conduct periodic reviews of the regulatory framework to address any concerns and ensure that regulations achieve their intended objectives without imposing undue burdens on market participants.

Overall, the amendment reflects SEBI's proactive approach to regulatory reform, aimed at fostering a conducive environment for foreign investment while maintaining transparency and market stability in India's capital markets.

Read the full article

0 notes

Text

Enhancing Wealth Through Portfolio Management Services in India

Introduction:

Welcome to our blog dedicated to exploring Portfolio Management Services (PMS) in India, along with insights into Wealth Management Services. In today's dynamic financial landscape, managing one's wealth effectively is paramount. With the proliferation of investment options and the ever-changing market conditions, individuals are increasingly turning to professional services to optimize their portfolios and secure their financial future. In this blog, we delve into the intricacies of PMS and how it complements wealth management strategies in the Indian context.

Understanding Portfolio Management Services (PMS)

Portfolio Management Services (PMS) refer to customized investment solutions offered by professional portfolio managers to cater to the unique financial goals and risk profiles of individual investors. In India, PMS is regulated by the Securities and Exchange Board of India (SEBI), ensuring transparency and investor protection.

Key Features of PMS:

Customization: PMS providers tailor investment strategies according to the client's financial objectives, risk tolerance, and investment horizon.

Active Management: Experienced portfolio managers actively monitor the market trends, adjust the portfolio allocations, and seize investment opportunities to deliver optimal returns.

Diversification: PMS portfolios are diversified across various asset classes such as equities, fixed income securities, and alternative investments to mitigate risks and enhance returns.

Transparency: Investors receive regular reports and updates on their portfolio performance, holdings, and transactions, ensuring transparency and accountability.

Minimum Investment: While minimum investment thresholds vary among providers, PMS typically caters to affluent investors with substantial investable assets.

Wealth Management Services: A Holistic Approach

Wealth Management Services encompass a broader spectrum of financial advisory and planning solutions aimed at optimizing overall wealth accumulation, preservation, and transfer. In addition to investment management, wealth managers offer comprehensive services including tax planning, estate planning, retirement planning, and succession planning.

Integration of PMS with Wealth Management:

Goal Alignment: PMS strategies are aligned with the client's overarching financial goals and integrated into a comprehensive wealth management plan.

Risk Management: Wealth managers assess the client's risk appetite and incorporate PMS as a component of the overall risk management strategy, ensuring diversification and asset allocation alignment.

Tax Efficiency: Through strategic tax planning, wealth managers optimize the tax implications of PMS investments, enhancing after-tax returns for the client.

Liquidity Management: Wealth managers ensure adequate liquidity to meet short-term cash flow requirements while maximizing the long-term growth potential through PMS investments.

Challenges and Considerations:

Regulatory Compliance: SEBI regulations govern PMS providers, and investors should ensure compliance and adherence to regulatory norms while selecting a PMS provider.

Fee Structure: PMS providers charge management fees, performance fees, and other expenses, which should be carefully evaluated against the expected returns and value proposition.

Track Record and Reputation: Assessing the track record, expertise, and reputation of PMS providers is crucial in making informed investment decisions.

Market Volatility: While PMS offers active management to navigate market volatility, investors should have a long-term investment horizon and risk tolerance to withstand short-term fluctuations.

Conclusion:

Portfolio Management Services in India, coupled with Wealth Management Services, offer a robust framework for individuals to optimize their wealth accumulation and achieve their financial aspirations. By partnering with experienced professionals, investors can benefit from customized investment strategies, holistic financial planning, and prudent risk management practices. As the financial landscape continues to evolve, leveraging PMS within a comprehensive wealth management framework remains instrumental in maximizing wealth potential and securing financial well-being.

Stay tuned for more insights and updates on navigating the complexities of portfolio management and wealth optimization in India. Remember, informed decisions today pave the way for a prosperous tomorrow.

#investment portfolio#wealth management services#portfolio managers#portfolio management#investment portfolio management#portfolio management services in india#sharemarket#portfolio management services#portfolio manager#wealth management company

0 notes

Text

Understanding the Sahar India Refund Saga: A Tale of Financial Controversy

Introduction: The Sahara India Refund issue has been a longstanding saga in the Indian financial landscape, marked by controversy, legal battles, and complexities. Spanning over several years, it involves the Sahara Group, one of India's leading conglomerates, and its dealings with investors regarding refund obligations. This article delves into the intricacies of the Sahara India Refund case, shedding light on its origins, legal battles, implications, and the broader context of financial regulation in India.

Origins of the Sahara India Refund Issue: The roots of the Sahara India Refund issue can be traced back to the early 2000s when Sahara India Real Estate Corporation Ltd. (SIRECL) and Sahara Housing Investment Corporation Ltd. (SHICL) raised funds from investors through Optionally Fully Convertible Debentures (OFCDs). These funds were raised purportedly for real estate and infrastructure projects. However, the Securities and Exchange Board of India (SEBI) raised concerns about the legality of these OFCDs, alleging that they violated securities laws by not seeking regulatory approval.

Legal Battles and Regulatory Scrutiny: The Sahara Group's refusal to comply with SEBI's directives led to a protracted legal battle between the two entities. In 2011, the Supreme Court of India directed Sahara to refund the money collected through OFCDs to investors, with interest. However, the process of refunding proved to be complex and contentious. Sahara claimed to have refunded a significant portion of the money directly to investors, while SEBI contested the authenticity of these claims and demanded a verifiable mechanism for refund.

Contempt of Court and Imprisonment: As the dispute continued, the Supreme Court found Sahara in contempt for non-compliance with its orders regarding refunds. Subrata Roy, the chairman of the Sahara Group, was eventually arrested in 2014 for failing to comply with court orders. His incarceration further intensified the legal and public scrutiny surrounding the Sahara India Refund case.

Resolution Attempts and Settlement Proposals: Over the years, there have been several attempts to resolve the Sahara India Refund issue through settlement proposals and negotiations between Sahara and SEBI. However, these efforts have often been marred by disagreements over the modalities and timelines of the refund process, leading to further delays and legal battles.

Implications and Lessons Learned: The Sahara India Refund saga has significant implications for investor protection, financial regulation, and corporate governance in India. It highlights the challenges associated with regulating complex financial instruments and enforcing compliance with regulatory directives. Moreover, it underscores the importance of transparency, accountability, and adherence to legal norms in corporate conduct.

Conclusion: The Sahara India Refund issue remains an unresolved chapter in India's financial history, reflecting the complexities and challenges inherent in regulating the financial sector. While efforts to address the issue continue, it serves as a stark reminder of the need for robust regulatory mechanisms, effective enforcement, and ethical corporate practices to safeguard investor interests and maintain trust in the financial system.

0 notes

Text

Maximizing Investment Opportunities: A Comprehensive Guide for NRIs Investing in Indian Mutual Funds

For Non-Resident Indians (NRIs), the exploration of investment avenues in their homeland often prompts inquiries, particularly concerning mutual funds. A thorough comprehension of the intricacies surrounding NRI investment in Indian mutual funds is paramount for optimizing returns and diversifying portfolios effectively.

Understanding NRI Status:

Defining NRI Status: Gaining clarity on NRI classification under the Foreign Exchange Management Act (FEMA).

NRI vs. PIO vs. OCI: Distinguishing between NRIs, Persons of Indian Origin (PIO), and Overseas Citizen of India (OCI) for investment considerations.

Eligibility Criteria for NRI Mutual Fund Investment:

Regulatory Compliance: Adhering to regulations set forth by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI).

KYC Norms: Comprehending the Know Your Customer (KYC) procedures and requisite documentation for NRI mutual fund investments.

Types of Mutual Funds NRIs Can Invest In:

Equity Funds: Exploring opportunities in diversified equity funds, sectoral funds, and thematic funds.

Debt Funds: Understanding the potential of debt funds for stable returns and risk mitigation.

Hybrid Funds: Balancing risk and return with hybrid funds offering a mix of equity and debt exposure.

Repatriation and Tax Implications:

Repatriation Rules: Guidelines on repatriating investments and earnings back to the NRI's country of residence.

Taxation Framework: Delving into tax implications for NRIs investing in Indian mutual funds, encompassing capital gains tax and TDS (Tax Deducted at Source).

Investing via NRE/NRO Accounts:

NRE and NRO Accounts: Leveraging Non-Resident External (NRE) and Non-Resident Ordinary (NRO) accounts for seamless fund transactions.

Currency Conversion: Managing currency conversion for investing and repatriating funds efficiently.

Choosing the Right Fund and Fund House:

Research and Analysis: Conducting thorough research on fund performance, risk metrics, and investment objectives.

Fund House Reputation: Selecting reputable fund houses with a proven track record of transparency and investor-friendly practices.

Expert Tips for NRI Mutual Fund Investors:

Diversification Strategy: Spreading investments across asset classes and fund categories for risk mitigation.

Regular Portfolio Review: Periodic review and rebalancing of investment portfolios to align with changing financial goals and market conditions.

Conclusion:

Navigating the landscape of mutual fund investments in India as an NRI necessitates a blend of regulatory awareness, financial acumen, and strategic planning. By adhering to compliance norms, understanding tax implications, and making informed investment decisions, NRIs can effectively harness the potential of Indian mutual funds to achieve their wealth creation objectives. Embark on your journey towards financial prosperity in India today!

#financialplanning#mutualfundadvisor#mutualfundonline#mutualfundinvesting#wealthadvisor#financialservices#finance#marketing#business#entrepreneur

0 notes

Text

Navigating The Legal Landscape: Foreign Investment Laws in India

The dynamism of India's economic landscape, coupled with its potential for growth and innovation, has made the nation an enticing destination for foreign investors seeking lucrative opportunities. Amidst this backdrop, comprehending and navigating the legal framework governing foreign direct investment (FDI) in India stands as a pivotal factor for businesses eyeing entry or expansion into the Indian market. The regulatory landscape of FDI in India embodies a blend of liberalization, regulatory oversight, and sector-specific guidelines, shaping the contours within which foreign investors operate. Understanding the nuances of these laws and regulations forms the bedrock for making informed investment decisions, ensuring compliance, and leveraging the vast potential that India offers.

Evolution of FDI Regulations in India

India's journey toward liberalizing its FDI regime traces back to the early 1990s, marking a significant shift from a tightly regulated economy to one that progressively embraced globalization and foreign investments. The dismantling of restrictive policies, simplification of procedures, and sector-specific reforms set the stage for an influx of foreign capital into the country. Over the years, the government introduced policy amendments, streamlining FDI norms, and periodically revising sectoral caps, aligning with India's evolving economic needs and global market trends.

Key Features of India's FDI Policy

The FDI policy in India embodies certain core features, including sectoral caps, entry routes, approval mechanisms, and prohibited sectors. Sectoral caps define the maximum permissible FDI allowed in various industries, such as defense, insurance, retail, aviation, and more. Entry routes delineate the avenues through which foreign investors can enter the Indian market, such as automatic route (where FDI is allowed without prior approval) and government route (requiring approval from relevant ministries or departments). Additionally, certain sectors are prohibited from FDI, preserving strategic interests or sensitive domains.

Sector-Specific Guidelines and Conditions

India's FDI policy entails sector-specific guidelines that outline conditions, restrictions, and eligibility criteria for foreign investment across different industries. For instance, in sectors like insurance, retail, single-brand retail trading, and e-commerce, specific conditions regarding local sourcing, investment thresholds, and compliance requirements apply. These guidelines serve as crucial markers for foreign investors, delineating the parameters within which they can operate and invest in India.

Reforms and Amendments: Enhancing Ease of Doing Business

India continually undertakes reforms and amendments to enhance the ease of doing business and attract foreign investments. Initiatives such as Make in India, Digital India, Startup India, and Atmanirbhar Bharat Abhiyan aim to foster a conducive environment for businesses, encourage innovation, promote domestic manufacturing, and bolster India's position as a global investment destination. Reforms in labor laws, taxation, land acquisition, and regulatory frameworks contribute to creating a more investor-friendly ecosystem.

Compliance and Regulatory Bodies

Ensuring compliance with FDI regulations necessitates understanding the regulatory bodies and compliance mechanisms governing foreign investments in India. The Department for Promotion of Industry and Internal Trade (DPIIT), Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), and sector-specific regulators oversee and regulate FDI inflows, approvals, compliance reporting, and monitoring across different industries. Aligning with these regulatory bodies' requirements is imperative for foreign investors to navigate the legal landscape effectively.

Recent Trends and Policy Outlook

In recent years, India has witnessed significant FDI inflows across various sectors, indicating sustained investor confidence in the Indian market. The government's commitment to further liberalizing FDI norms, addressing sectoral bottlenecks, and easing regulatory hurdles signals a positive outlook for foreign investments in India. Continued efforts toward simplifying procedures, enhancing transparency, and fostering investor-friendly policies augur well for the nation's attractiveness as an investment destination.

The legal landscape governing FDI in India embodies a delicate balance between liberalization and regulation, offering a plethora of opportunities while ensuring regulatory oversight. Understanding the nuances of India's FDI policy, sector-specific guidelines, compliance requirements, and regulatory mechanisms is indispensable for foreign investors eyeing the vast potential that India presents. As the nation strides forward on its path of economic growth and innovation, navigating the legal terrain of FDI regulations stands as a crucial determinant in unlocking the myriad opportunities and leveraging India's growth story for investors worldwide.

Sector-Specific Insights: FDI Regulations Across Industries

Retail Sector:

India's retail sector has witnessed a phased opening to FDI. While 100% FDI is permitted in single-brand retail under the automatic route, multi-brand retail is subject to stringent conditions, including minimum investment thresholds and mandatory local sourcing norms. These regulations aim to balance the influx of foreign capital with safeguarding local businesses and encouraging domestic production.

Insurance Sector:

In the insurance sector, FDI is allowed up to 74%, subject to the infusion of capital, compliance with certain conditions, and adherence to regulatory frameworks. The government's objective is to encourage increased penetration of insurance services while ensuring that domestic players remain competitive.

E-commerce and Digital Marketplaces:

E-commerce in India operates under complex FDI regulations, with 100% FDI permitted in the marketplace model while restricting inventory-based models. Regulations mandate that marketplaces function as facilitators without controlling inventory, ensuring a level playing field for domestic retailers while leveraging the benefits of FDI in boosting digital commerce.

Manufacturing and Infrastructure:

The manufacturing sector, especially in segments like defense and railways, allows higher FDI limits but operates under the government route, necessitating approval for foreign investments. Initiatives like Make in India incentivize foreign investors to establish manufacturing units, promoting local production, job creation, and technology transfer.

Information Technology (IT) and Startups:

The IT sector enjoys significant FDI inflows due to its service-oriented nature and technological advancements. India's startup ecosystem, propelled by FDI and government initiatives like Startup India, attracts foreign investors looking for innovative ventures, fostering entrepreneurship and technological innovations.

Entry Routes and Approval Mechanisms:

Foreign investors intending to invest in sectors under the automatic route can do so without prior approval, subject to compliance with prescribed conditions. Conversely, sectors falling under the government route mandate obtaining approval from relevant ministries or departments, highlighting the need for comprehensive due diligence and meticulous planning before initiating investments.

Regulatory Bodies and Compliance Requirements:

Navigating India's FDI landscape involves interfacing with regulatory bodies such as the DPIIT, RBI, SEBI, and sector-specific regulators. Understanding their guidelines, compliance requirements, reporting mechanisms, and adherence to sectoral norms form the crux of ensuring smooth operations and regulatory compliance.

Policy Reforms and Amendments:

India continually undertakes policy reforms and amendments to enhance the ease of doing business and attract foreign investments. Recent reforms in labor laws, taxation, land acquisition, and regulatory frameworks aim to streamline processes, remove bottlenecks, and foster a conducive environment for foreign investors seeking long-term commitments in India.

Emerging Trends and Opportunities:

India's commitment to liberalizing FDI norms, coupled with favorable policy shifts and technological advancements, presents immense opportunities for foreign investors. Emerging sectors such as renewable energy, healthcare, infrastructure development, biotechnology, and research and development (R&D) beckon investors seeking sustainable and innovative avenues for investment.

The landscape of foreign direct investment in India embodies a tapestry of opportunities, complexities, and regulatory nuances, shaping the contours within which global investors operate. As we navigate the various facets of India's FDI regime, it becomes evident that understanding and adhering to these regulations are critical determinants of success for foreign investors seeking to capitalize on India's vast potential.

India's evolution from a tightly regulated economy to one embracing globalization reflects the nation's commitment to fostering an investor-friendly environment while safeguarding its strategic interests. The liberalization of FDI norms across sectors signifies the government's proactive approach in attracting foreign capital, encouraging innovation, and bolstering economic growth.

However, amidst the liberalization, sector-specific guidelines, entry routes, and compliance requirements underscore the need for a balanced approach. The sectoral nuances demand careful consideration, strategic planning, and meticulous alignment with regulatory frameworks to ensure seamless operations and compliance with the law.

The convergence of liberalization with sector-specific guidelines aims to strike a balance between attracting foreign investments and safeguarding domestic interests. It facilitates global collaboration, encourages technology transfer, promotes job creation, boosts infrastructure development, and fosters innovation, propelling India's growth trajectory.

Foreign investors exploring India's vibrant market need to navigate through entry routes, understand approval mechanisms, and comply with sectoral guidelines. Partnering with local experts, conducting thorough due diligence, and staying updated with evolving regulations are imperative steps in fostering successful investments and operations in India.

India's recent policy reforms, such as Make in India, Digital India, and Startup India, alongside broader economic initiatives, signal the nation's commitment to facilitating an investor-friendly ecosystem. These reforms aim to streamline processes, remove bottlenecks, enhance transparency, and reinforce India's standing as an attractive investment destination.

Amidst these developments, emerging sectors like renewable energy, healthcare, technology-driven innovations, and sustainable ventures present compelling opportunities for foreign investors. Embracing these sectors, aligning with regulatory frameworks, and capitalizing on India's growth potential can pave the way for mutual success and long-term partnerships.

In conclusion, India's FDI landscape presents a myriad of opportunities intertwined with regulatory intricacies. Navigating this terrain demands astute planning, regulatory compliance, adaptability, and a strategic vision. As India continues its journey toward economic prosperity and technological advancements, foreign investors poised to navigate and embrace the nuances of India's FDI regulations stand poised to forge successful and mutually beneficial partnerships in this vibrant and dynamic market.

This post was originally published on: Foxnangel

#foreign direct investment#fdi#fdi in india#india's fdi policy#foreign investments in india#foreign investments#foreign direct investment in india#fdi and india#Invest In India#franchise in india#foxnangel

1 note

·

View note

Text

What is the Bombay Stock Exchange? (BSE)

The Bombay Stock Exchange (BSE) is one of the oldest and most prominent stock exchanges in India. Established in 1875, the BSE is located in Mumbai (formerly Bombay), Maharashtra, and serves as a vital platform for trading in equities, derivatives, debt instruments, mutual funds, and other financial products.

Key features and functions of the Bombay Stock Exchange (BSE) include:

Trading Platform: The BSE provides an electronic trading platform known as the BOLT (BSE OnLine Trading) system, which facilitates trading in a wide range of securities. The BOLT system offers efficient order matching, real-time trading, and market surveillance capabilities.

Listed Securities: The BSE lists thousands of companies from various sectors of the Indian economy, including large-cap, mid-cap, and small-cap companies. These companies raise capital by issuing equity shares, preference shares, and other securities to investors through the BSE.

Market Indices: The BSE maintains several market indices, with the most notable being the Sensex (or BSE Sensex). The Sensex is a benchmark index that tracks the performance of the 30 largest and most actively traded stocks listed on the BSE. It serves as a key indicator of the Indian equity market's performance and is widely followed by investors, analysts, and market participants.

Market Regulation: The BSE is regulated by the Securities and Exchange Board of India (SEBI), which sets rules and regulations to ensure fair, transparent, and orderly trading. The BSE enforces compliance with listing requirements, trading rules, and corporate governance norms to maintain market integrity and protect investors' interests.

Market Surveillance: The BSE conducts market surveillance to detect and prevent market manipulation, insider trading, and other fraudulent activities. It employs sophisticated surveillance systems to monitor trading activity, analyze market data, and identify irregularities or suspicious trading patterns.

Investor Education and Awareness: The BSE undertakes various initiatives to promote investor education, awareness, and literacy. It organizes seminars, workshops, and training programs to educate investors about stock market fundamentals, investment strategies, and risk management practices.

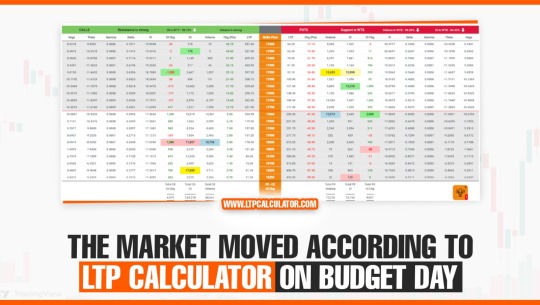

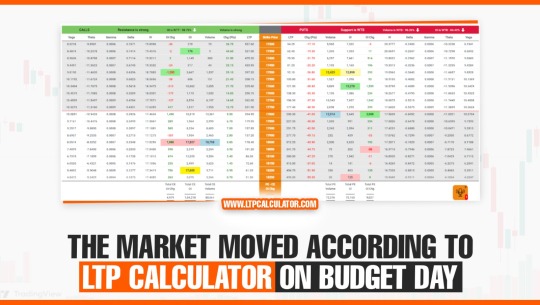

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in india.

You can also downloadLTP Calculator app by clicking on download button.

The Bombay Stock Exchange (BSE) plays a crucial role in the Indian capital markets, facilitating capital formation, price discovery, and liquidity provision. It contributes to the growth and development of the Indian economy by providing companies with access to public capital and investors with opportunities to invest in a wide range of securities.

0 notes

Text

Understanding NBFC Audit: Ensuring Financial Integrity

Non-Banking Financial Companies (NBFCs) play a vital role in the Indian financial system by providing an array of financial services, ranging from loans and credit facilities to investment advice. As entities that operate outside the purview of traditional banks, NBFCs are subject to regulatory oversight to ensure financial stability and consumer protection. One critical aspect of this oversight is the NBFC audit, which serves to verify the financial integrity and compliance of these institutions.

What is an NBFC Audit?

An NBFC audit is a comprehensive examination of the financial records, processes, and compliance measures of a Non-Banking Financial Company. Conducted by independent auditors, typically Chartered Accountants (CAs) or audit firms, these audits aim to assess the financial health, risk management practices, and adherence to regulatory guidelines of the NBFC.

Objectives of NBFC Audit:

Financial Integrity: The primary objective of an NBFC audit is to ensure the accuracy and reliability of financial statements. Auditors meticulously review the company's books, accounts, and transactions to verify that they reflect a true and fair view of its financial position Insurance Audit.

Compliance Verification: NBFCs are subject to a myriad of regulatory requirements imposed by the Reserve Bank of India (RBI) and other governing bodies. Auditors assess whether the NBFC complies with these regulations concerning capital adequacy, lending practices, investment norms, asset classification, and provisioning requirements.

Risk Assessment: Auditors evaluate the risk management framework of the NBFC to identify potential vulnerabilities and weaknesses. They assess credit risk, liquidity risk, operational risk, and other factors that may impact the company's financial stability.

Operational Efficiency: Beyond financial and regulatory compliance, NBFC audits also examine the efficiency and effectiveness of operational processes. This includes evaluating internal controls, governance structures, and management practices to ensure optimal performance and risk mitigation.

Key Components of an NBFC Audit:

Financial Statements Audit: This involves examining the balance sheet, income statement, cash flow statement, and notes to the financial statements to ascertain accuracy and compliance with accounting standards.

Regulatory Compliance Audit: Auditors review the NBFC's adherence to regulatory requirements, including those prescribed by the RBI, Securities and Exchange Board of India (SEBI), and other relevant authorities.

Internal Control Evaluation: Auditors assess the effectiveness of internal controls implemented by the NBFC to safeguard assets, prevent fraud, and ensure compliance with policies and procedures.

Asset Quality Review: An analysis of the quality of assets held by the NBFC, including loans and investments, to determine their classification, provisioning, and adequacy.

Risk Management Assessment: Evaluating the NBFC's risk management policies and procedures to identify gaps and recommend improvements for better risk mitigation.

Benefits of NBFC Audit:

Enhanced Credibility: A clean audit report enhances the credibility and trustworthiness of the NBFC among investors, regulators, and other stakeholders.

Improved Governance: Audit findings and recommendations help NBFCs strengthen their governance structures, internal controls, and risk management practices.

Risk Mitigation: By identifying and addressing risks, audits help NBFCs mitigate potential losses and ensure long-term financial stability.

Regulatory Compliance: Ensuring compliance with regulatory requirements through audits helps NBFCs avoid penalties and reputational damage.

In conclusion, NBFC audits are indispensable for maintaining the integrity, stability, and trustworthiness of Non-Banking Financial Companies. By subjecting these institutions to rigorous examination and scrutiny, audits play a crucial role in safeguarding the interests of investors, consumers, and the broader financial system.

0 notes

Text

Unveiling The Unseen: Understanding NBFC Regulations

The financial landscape can be daunting, especially for those new to investing. Amidst the plethora of terms and acronyms, one that often arises is NBFCs. Non-Banking Financial Companies (NBFCs) play a significant role in India's financial sector, offering a wide array of services. However, their operations are governed by a unique regulatory framework that distinguishes them from traditional banks. Let's delve into the intricacies of NBFC regulations to shed light on this vital aspect of the financial world.

What are NBFCs?

Before we dive into regulations, let's grasp the essence of NBFCs. These entities provide various financial services, similar to banks, but they do not hold a banking license. Instead, they engage in activities such as lending, investments, wealth management, and more. NBFCs play a crucial role in catering to the diverse financial needs of individuals and businesses across the country.

Also Read: Mastering Asset Quality with Finance Leaders like Abhay Bhutada and Aditya Puri

Understanding the Regulatory Framework

Unlike banks, which fall under the purview of the Reserve Bank of India (RBI), NBFCs are regulated by different bodies depending on their activities. The regulatory framework governing NBFCs aims to ensure financial stability, consumer protection, and market integrity. Here's a breakdown of the key regulations impacting NBFCs:

1. Reserve Bank of India (RBI) Regulations

- NBFCs accepting deposits are regulated by the RBI under the Banking Regulation Act, 1949.

- RBI mandates certain capital adequacy norms, prudential regulations, and corporate governance guidelines for NBFCs to maintain financial soundness.

2. Securities and Exchange Board of India (SEBI)

- NBFCs engaged in activities related to securities market intermediation, such as mutual funds, portfolio management, and investment advisory services, are regulated by SEBI.

- SEBI ensures investor protection, transparency, and fair practices in the securities market.

3. Ministry of Corporate Affairs (MCA)

- NBFCs incorporated as companies under the Companies Act, 2013, are subject to regulations administered by the MCA.

- MCA oversees compliance with corporate governance norms, financial reporting standards, and regulatory filings.

4. Other Regulatory Authorities

- Depending on the nature of their operations, NBFCs may be subject to oversight by other regulatory bodies such as the National Housing Bank (NHB) for housing finance companies and Insurance Regulatory and Development Authority of India (IRDAI) for insurance-related activities.

Also Read: MD Abhay Bhutada Provides Glimpse of Poonawalla’s Co-Branded Card Strategy in Q4

Compliance And Oversight

Maintaining regulatory compliance is paramount for NBFCs to operate smoothly and safeguard stakeholders' interests. Compliance entails adhering to various regulatory requirements, including capital adequacy norms, risk management practices, and disclosure standards. Additionally, NBFCs are subject to regular inspections, audits, and reporting obligations to ensure ongoing oversight and accountability.

Impact On Investors

For beginner investors, understanding NBFC regulations can provide insights into the stability and credibility of these entities. Regulatory compliance serves as a crucial indicator of an NBFC's reliability and risk management practices. By assessing an NBFC's adherence to regulatory norms, investors can make informed decisions regarding their investments.

Expert Insights

Renowned investor Warren Buffett once emphasized the importance of understanding the regulatory environment in finance. He famously said, "Risk comes from not knowing what you're doing." Buffett's sage advice underscores the significance of regulatory awareness for investors navigating the complex terrain of finance.

Also Read: Abhay Bhutada Shares Insights on Poonawalla Fincorp’s Long-Term Objectives

Conclusion

Navigating the world of NBFC regulations may seem daunting at first glance, but it is essential for investors to grasp the regulatory framework governing these entities. By understanding the regulatory landscape, investors can make informed decisions and mitigate risks associated with investing in NBFCs. As you embark on your investment journey, remember to stay informed, stay vigilant, and stay empowered. Happy investing!

With this newfound understanding of NBFC regulations, you're better equipped to navigate the financial landscape with confidence and clarity. So, dive in, explore, and seize the opportunities that await in the realm of non-banking financial companies.

0 notes

Text

Paytm shares hit upper circuit again at Rs 428

Shares of Paytm owner One97 Communications jumped 5 per cent in the morning trade on Monday after Reserve Bank asked retial payment settlement body NPCI to examine the possibility of migrating Paytm Payments Bank customers using '@paytm' UPI handle to other banks.

The stock of crisis-hit fintech company climbed 5 per cent each to Rs 428.10 and Rs 427.95 apiece -- also its upper circuit limit -- on the NSE and BSE.

In the morning trade, the 30-share BSE Sensex benchmark slumped 288.71 points or 0.39 per cent, while NSE Nifty fell 71.55 points to 22,141.15.

On Friday, the scrip of One97 Communications rallied 5 per cent and locked in upper circuit limit on the BSE.

In a bid to prevent any disruptions in the payment ecosystem, the Reserve Bank of India (RBI) on Friday asked the National Payments Corporation of India (NPCI) to examine the possibility of migrating Paytm Payments Bank customers using the UPI handle '@paytm' to 4-5 other banks.

The central bank came out with additional steps for the benefit of customers, wallet holders and merchants who are availing banking services from Paytm Payments Bank, which has been barred from accepting deposits and credits after March 15, 2024.

As the PPBL cannot accept further credits into its customer accounts and wallets after March 15, 2024, certain additional steps have become necessary to ensure seamless digital payments by UPI customers using '@paytm' handle operated by the bank, and minimise concentration risk in the UPI system by having multiple payment app providers, the RBI said in a statement.

"NPCI has been advised by the RBI to examine the request of One97 Communication Ltd (OCL) to become a Third-Party Application Provider (TPAP) for UPI channel for continued UPI operation of the Paytm app, as per the norms," it said.

Meanwhile, an advisory committee, set up by One97 Communications after the Reserve Bank's action on its payments bank business, is at a stage of engagement with the company on matters related to the terms of reference for the panel.

The panel's head and former chairman of Sebi M Damodaran on Sunday said, "We have been engaging with the group on matters relating to the Advisory Committee's terms of reference."

He said that the panel members are external advisors and at present Paytm is engaged in dealing with the RBI.

On January 31, the RBI asked PPBL (Paytm Payments Bank Ltd) to stop further deposits, credit transactions, or top-ups in any customer accounts, prepaid instruments, wallets, FASTags, and National Common Mobility Cards, after February 29. Later, the central bank extended the deadline till March 15.

Paytm on February 9 announced setting up of a group advisory committee headed by Damodaran. The committee was set up to advise the company on strengthening compliance and on regulatory matters.

One97 Communications Ltd (OCL) holds a 49 per cent stake in PPBL.

Source : Paytm shares hit upper circuit again at Rs 428

1 note

·

View note

Text

Some Trends to Watch in Mutual Funds

Mutual funds in India have become more and more popular among investors. People are turning to them to diversify their investments and take advantage of the expertise offered by professional fund managers. Since starting in 1963, the mutual fund industry in India has seen significant changes. Various reforms and rules have been introduced to ensure that investors are protected.

In this blog, we'll take a closer look at the trends and insights that play a crucial role in shaping the future of mutual funds in India

What are Mutual Funds?

A mutual fund is a financial vehicle managed by a professional Fund Manager, serving as a trust that consolidates capital from diverse investors who share common investment objectives. This pooled capital is then strategically invested in a varied portfolio comprising equities, bonds, money market instruments, and other securities. The returns generated from these investments are distributed proportionately among the investors after deducting applicable expenses and levies, determined by the scheme's "Net Asset Value" or NAV.

Top 5 Trends in Mutual Funds

Now that we've covered what mutual funds are, let's explore the top trends influencing the industry:

Embracing Digital Transformation

India's mutual fund landscape is evolving with technology integration, enhancing user experiences, and simplifying investment processes. Mobile apps and online platforms empower investors with seamless transactions and real-time monitoring. Robo-advisory services are gaining popularity, offering personalized investment advice based on individual risk preferences and financial goals.

Rise of Passive Investing

While actively managed funds remain popular, there's a noticeable shift towards passive investing. These funds, which track specific indices, aim to replicate performance at lower costs than actively managed counterparts. The increasing popularity of low-cost investment options is evident in India's growing assets under management (AUM) of passive funds.

Sustainable Investing on the Rise

Environmental, Social, and Governance (ESG) investing is gaining traction in India, reflecting a global trend. Investors are now prioritizing companies that align with their values and positively impact society and the environment. As Indian companies adopt sustainable practices and disclosure norms improve, we can anticipate the growth of ESG-themed mutual funds, providing investors with socially responsible investment choices.

Navigating Regulatory Changes

The Securities and Exchange Board of India (SEBI) is actively implementing regulatory changes to safeguard investor interests and boost transparency. Recent regulations focus on categorizing and rationalizing mutual fund schemes and introducing the Total Expense Ratio. SEBI's commitment to investor education is expected to bolster confidence, fostering greater participation in the mutual fund industry.

Diversification Beyond Traditional Assets

Traditionally concentrated on equity and debt funds, the Indian mutual fund industry is diversifying its offerings to include alternative asset classes like real estate, commodities, and infrastructure. This expansion caters to the growing investor interest in diversifying portfolios and gaining exposure to alternative assets, providing a broader range of investment opportunities.

Conclusion

In conclusion, there appears to be a bright future for mutual funds in India due to rising penetration, technological use, asset class development, and regulatory improvements. As the industry evolves, we can expect further developments, including emerging new players, customization of investment solutions, and increasing participation from smaller cities.

To navigate this evolving landscape effortlessly, investors can leverage user-friendly tools like the mutual fund app, making the world of mutual funds more accessible and convenient.

0 notes

Text

3rd phase of Development of Indian banking system

The third phase of the development of the Indian banking system unfolded from the 1980s onwards and continued into the early 21st century. This phase was marked by economic liberalization, globalization, and a series of reforms aimed at enhancing efficiency, competitiveness, and financial stability.

The catalyst for this phase was the economic liberalization policy initiated in 1991. The government, led by then-Finance Minister Dr. Manmohan Singh, introduced a series of reforms to open up the Indian economy, attract foreign investment, and foster greater competition. These reforms had a profound impact on the banking sector.

One of the key milestones during this phase was the introduction of measures to strengthen the banking system's regulatory framework. The Narasimham Committee, in 1991 and later in 1998, recommended several reforms to improve the efficiency and competitiveness of the banking sector. These included the reduction of government interference in the functioning of public sector banks, the introduction of prudential norms, and the enhancement of transparency and disclosure standards.

Another significant development was the entry of new private sector banks, which ended the monopoly of public sector banks. The Reserve Bank of India (RBI) granted licenses to private players, leading to the establishment of banks like HDFC Bank, ICICI Bank, and Axis Bank. These new entrants brought in modern technology, innovative products, and a customer-centric approach, fostering a more competitive and dynamic banking environment.

The third phase also witnessed the evolution of technology in the banking sector. The advent of information technology revolutionized banking operations, leading to the introduction of electronic banking, internet banking, and mobile banking services. This not only improved the efficiency of banking services but also increased financial inclusion by reaching remote areas through technology-driven solutions.

The establishment of the Securities and Exchange Board of India (SEBI) in 1988 and the National Stock Exchange (NSE) in 1992 contributed to the development of the capital market and facilitated the growth of retail participation in financial markets. The integration of banking with capital markets and the insurance sector further broadened the scope of financial services available to the public.

In summary, the third phase of the Indian banking system was characterized by economic liberalization, regulatory reforms, the entry of private sector banks, technological advancements, and the integration of financial markets. These changes transformed the banking sector into a more competitive, efficient, and technologically advanced industry, contributing to India's overall economic growth and development.

For more visit Aniisolution

0 notes

Text

The Definitive Guide: How to Register for KYC Certification in India

Introduction

In the ever-evolving landscape of financial regulations, Know Your Customer (KYC) certification has become a crucial aspect of ensuring transparency and preventing financial crimes. India, as a growing economic hub, has implemented stringent KYC norms to safeguard its financial system. In this comprehensive guide, we will walk you through the process of registering for KYC certification in India, providing expert insights and firsthand knowledge to enhance your understanding.

Why KYC Certification Matters

Before delving into the registration process, let's understand why KYC certification is essential. KYC is a set of protocols designed to verify the identity of individuals and entities involved in financial transactions. It acts as a protective shield against money laundering, fraud, and other financial crimes, contributing to a more secure and transparent financial ecosystem.

The Registration Process

Choose the Right Authority

To initiate the KYC certification process in India, you must first identify the appropriate authority responsible for overseeing KYC compliance. Typically, this falls under the purview of regulatory bodies such as the Reserve Bank of India (RBI) for financial institutions or the Securities and Exchange Board of India (SEBI) for capital markets.

Gather Required Documents

Accurate documentation is the cornerstone of a successful KYC certification. Ensure you have all the necessary documents, including proof of identity, proof of address, and any other specific documents mandated by the regulatory authority. Commonly accepted documents include Aadhar card, passport, and utility bills.

Submit the Application Form

Most regulatory bodies provide an online portal for KYC certification. Fill out the application form diligently, providing accurate and up-to-date information. Double-check the details to avoid any discrepancies that may hinder the approval process.

Verification Process

Once the application is submitted, the regulatory authority will initiate the verification process. This may involve in-person verification or digital methods, depending on the nature of the certification. Be prepared for follow-up queries or requests for additional information during this phase.

Expert Insights and Tips

Stay Informed about Regulatory Updates

The regulatory landscape is dynamic, with amendments and updates occurring regularly. Stay informed about any changes in KYC norms to ensure ongoing compliance. Subscribing to newsletters from regulatory bodies or financial news outlets is a proactive way to stay in the loop.

Seek Professional Assistance if Needed

Navigating the complexities of KYC certification can be challenging, especially for businesses. Consider seeking professional assistance from experts well-versed in regulatory compliance. This step can streamline the process and minimize the risk of errors.

Conclusion

Registering for KYC certification in India is a crucial step in fostering a secure financial environment. By adhering to the outlined process and incorporating expert insights, you can navigate the certification journey with confidence. Remember to stay vigilant about regulatory changes and leverage professional assistance when necessary to ensure a seamless and compliant experience.

By following these guidelines, you not only demonstrate your commitment to compliance but also showcase your expertise, authority, trustworthiness, and experience in navigating the intricate landscape of KYC certification in India.

1 note

·

View note

Text

Unraveling the Mystery of Sahara Refund: What You Need to Know

Introduction: In recent years, the term "Sahara refund" has captured public attention, sparking curiosity and concern alike. The phrase, seemingly enigmatic, pertains to a significant financial episode involving the Sahara Group, a conglomerate with diverse business interests spanning real estate, media, and finance. This article aims to delve into the intricacies of the Sahara refund saga, shedding light on its origins, implications, and the broader context of financial regulations in India.

Origins of the Sahara Refund: The genesis of the Sahara refund can be traced back to a protracted legal battle between the Sahara Group and the Securities and Exchange Board of India (SEBI), the regulatory body overseeing the securities market. In 2012, SEBI accused Sahara of raising funds from investors through optionally fully convertible debentures (OFCDs) in contravention of securities laws, alleging that the group had not complied with regulatory provisions regarding the issuance of securities.

Legal Proceedings and Supreme Court Intervention: Following SEBI's allegations, legal proceedings ensued, culminating in a landmark verdict by the Supreme Court of India. In August 2012, the Supreme Court directed Sahara to refund an estimated amount of ₹24,000 crores ($3.4 billion) to investors, deeming the OFCDs issued by the group as illegal. This verdict marked a watershed moment in India's financial landscape, underscoring the judiciary's commitment to investor protection and regulatory compliance.

Challenges and Complexities: Despite the Supreme Court's directive, the process of Sahara refund encountered numerous hurdles and complexities. The sheer magnitude of the refund amount, coupled with logistical challenges in identifying and reimbursing investors, posed formidable obstacles. Additionally, disputes arose over the valuation of assets offered by Sahara as collateral for the refund, further complicating the resolution process.

Resolution Efforts and SEBI's Oversight: In the years following the Supreme Court verdict, SEBI diligently supervised the Sahara refund process, overseeing the disbursement of funds to eligible investors. Through meticulous scrutiny and coordination with various stakeholders, including banks and market intermediaries, SEBI endeavored to ensure the expeditious and equitable distribution of refunds to affected investors.

Implications and Lessons Learned: The Sahara refund episode underscores the critical importance of regulatory vigilance and investor protection in fostering a transparent and accountable financial ecosystem. It highlights the imperative for companies to adhere scrupulously to regulatory norms and uphold the highest standards of corporate governance. Moreover, the saga underscores the need for robust mechanisms for dispute resolution and asset recovery to address complex financial disputes effectively.

Conclusion: The saga of Sahara refund serves as a cautionary tale, emphasizing the far-reaching consequences of financial malfeasance and the paramountcy of regulatory oversight in safeguarding investor interests. As India's financial markets continue to evolve, it is incumbent upon regulators, market participants, and corporate entities alike to uphold the principles of transparency, integrity, and accountability, thereby fostering a climate conducive to sustainable economic growth and investor confidence.

0 notes

Text

Strategic Moves Unveiled: Srestha Finvest Ltd.'s Decisive Board Meeting Outcomes

Srestha Finvest Ltd., a prominent financial institution, has officially intimated the Manager of the Listing Department at the Bombay Stock Exchange Limited, Mumbai, and the Metropolitan Stock Exchange of India Limited, Mumbai, regarding their forthcoming Board Meeting scheduled for December 19, 2023. This notification aligns with Regulation 29 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

The purpose of this meeting is to deliberate on crucial matters that hold significant importance for the future strategies of Srestha Finvest Ltd. The key agendas to be discussed and considered during this meeting include:

Approval of Fund Raising: The Board aims to discuss and decide on the approval for fundraising activities, targeting an aggregate amount not exceeding Rs. 50 Crores. This fundraising will be executed in one or more tranches while ensuring full compliance with the prevailing legal provisions.

Any Other Business: In addition to the primary agenda, the Board will entertain any other pertinent business, subject to the chair's approval.

By regulatory guidelines and in the interest of transparency, it has been notified that the trading window for dealing in securities of the company by Designated Persons shall remain closed from December 14, 2023, until 48 hours from the conclusion of the board meeting.

This communication serves as an official intimation of the Board as mentioned in earlier Meetings and its crucial agendas. Srestha Finvest Ltd. recognizes the significance of informing stakeholders, including investors, shareholders, and interested parties, about the meeting's importance and the decisions that might transpire.

The institution emphasizes effective governance and unwavering compliance with regulatory norms. As such, this meeting will play a pivotal role in shaping Srestha Finvest Ltd.'s strategic direction and enhancing its financial prospects.

Following the significant Board Meeting of Srestha Finvest Ltd. held on December 19, 2023, the company has taken crucial steps by the provisions of Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015. This update is addressed to The General Manager - Listing, Corporate Relationship Department at the Bombay Stock Exchange Limited and the Metropolitan Stock Exchange of India Limited.

Increase in Authorized Share Capital: The Board approved an increase in the company's authorized share capital from the current Rs. 117,00,00,000/- (Rupees One Hundred Seventeen Crores Only) divided into 58,50,00,000 equity shares of face value of Rs. 2/- each to Rs. 167,00,00,000/- (Rupees One Hundred Sixty-Seven Crores Only) divided into 83,50,00,000 equity shares of face value of Rs. 2/- each. This alteration will be made in clause V of the Memorandum of Association.

Approval for Rights Issue: The Board approved raising funds through the issuance and allotment of equity shares with a face value of Rs. 2.00/- each for an aggregate amount not exceeding Rs. 49,00,00,000/- (Rupees Forty-Nine Crore Only) on a rights issue basis. This issuance will be offered to eligible equity shareholders as on the record date (to be notified subsequently), subject to regulatory approvals and under SEBI regulations and the Companies Act, 2013.

Appointment of Intermediaries and Rights Issue Committee: Various intermediaries for the Rights Issue were appointed, and a Rights Issue Committee, consisting of specific members, was constituted.

Notice of Postal Ballot and Cut-Off Date: The Board approved the notice of Postal Ballot to seek requisite member approval for the aforementioned items and established the Cut-Off date as Friday, December 15, 2023, for determining member eligibility for remote e-voting.

Period of E-voting: Details regarding the period of electronic voting and postal ballot were decided, starting from Saturday, December 23, 2023, at 9:00 A.M., until Sunday, January 21, 2024, at 5:00 P.M.

Appointment of Scrutinizer: M/s. S. Praharaj & Associates were appointed as the scrutinizer for the e-voting/Postal Ballot process.

This communication informs stakeholders and interested parties about the outcomes of the Board Meeting. The details and results are also available on the company's website (www.srestha.co.in) and the respective Stock Exchange's website (www.bseindia.com).

0 notes

Text

How do NSE and BSE contribute to the Indian stock market?

The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) play crucial roles in the Indian stock market, contributing to its development, liquidity, efficiency, and transparency in various ways. Here's how NSE and BSE contribute to the Indian stock market:

Facilitating Trading: NSE and BSE provide electronic trading platforms where investors can buy and sell securities such as stocks, bonds, and derivatives. Their trading platforms offer efficient order execution, transparency, and accessibility, enabling investors from across the country to participate in the market.

Market Capital Formation: NSE and BSE serve as platforms for companies to raise capital by issuing securities to investors through initial public offerings (IPOs) and subsequent secondary offerings. By listing on these exchanges, companies gain access to a wide pool of investors, which helps them raise funds for business expansion, investment in infrastructure, and other capital requirements.

Price Discovery: NSE and BSE facilitate price discovery by providing transparent and regulated marketplaces where buyers and sellers come together to determine the prices of securities through supply and demand dynamics. The continuous trading and real-time dissemination of price information contribute to efficient price discovery in the Indian stock market.

Market Indices: NSE and BSE maintain benchmark indices (Nifty 50 and Sensex, respectively) that serve as barometers of the Indian equity market's performance. These indices track the price movements of select stocks listed on their respective exchanges and provide valuable insights into market trends, investor sentiment, and overall market health.

Market Regulation: NSE and BSE are regulated entities governed by the Securities and Exchange Board of India (SEBI), which sets rules and regulations to ensure fair, transparent, and orderly trading. Both exchanges enforce compliance with listing requirements, trading rules, and corporate governance norms to maintain market integrity and protect investors' interests.

Market Surveillance: NSE and BSE conduct market surveillance to detect and prevent market manipulation, insider trading, and other fraudulent activities. They employ sophisticated surveillance systems to monitor trading activity, analyze market data, and identify irregularities or suspicious trading patterns.

Investor Education and Awareness: NSE and BSE undertake various initiatives to promote investor education, awareness, and literacy. They organize seminars, workshops, and training programs to educate investors about stock market fundamentals, investment strategies, and risk management practices, thus empowering them to make informed investment decisions.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

You can also downloadLTP Calculator app by clicking on download button.

Overall, NSE and BSE play pivotal roles in the Indian stock market ecosystem, contributing to its growth, stability, and resilience. Their efforts to enhance market infrastructure, investor protection, and market transparency help foster confidence in the Indian capital markets and attract domestic and international investors.

0 notes