#sarwa app

Text

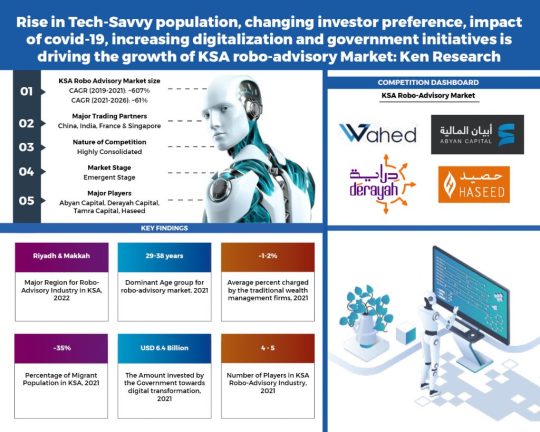

KSA Robo-Advisory Market is expected to grow 5x, generating USD ~3.5Bn by 2026F owning to rising digital transformation, emergence of new players and Government Initiatives: Ken Research

Buy Now

Robo-Advisors provides a low-cost alternative to traditional investing, eliminating the human labor, lower overheads with little-to-no minimum investments required making it an attractive market for investors.

With advent of new technology, better algorithms, better user-experience, millennial & Gen-Z adaptation of newer technology, Robo-Advisory market is expected to grow in future.

Banks are expected to take the lead in robo-advisory industry, banks would do well due to cost-effectiveness, trust, ease of movement of money, captive base & larger credibility to give their customer an easy, simple and much better experience.

Government Initiatives: The government is developing regulations to ensure a business environment that fosters both investor confidence and prudent risk management by regulated entities. Financial Sector Development Program, one of the 12 executive programs has been launched by government which is consolidated from Vision 2030, whose goal is to diversify the financial sector and to make it more efficient in order to enable financial institutions to support the private sector. Saudi Arabian Monetary Authority (SAMA) and Capital Market Authority (CMA) unveiled the FinTech Saudi project in April 2018, in accordance with the Saudi Arabia’s Vision 2030 to encourage entrepreneurship and develop financial technology (FinTech) infrastructure.

Emergence of New Players: Recently, KSA based Investment Advisory Firm Sarwa acquires a temporary or experimental Fintech license from Saudi’s Capital Markets Authority (CMA). The fin-tech startup offers customers an easy way to invest their savings in various low-cost index funds. Another example is of Derayah Capitals which becomes the first bank in the region to launch a Robo-Advisory Investment App, Derayah Smart. This idea came from the interest of the Financial Sector Development Program and Vision 2030 in savings and investment.

Digital Transformation: KSA is racing towards digital transformation, supporting tech innovation and entrepreneurship. The Kingdom is pouring hundreds of billions of dollars into an economic transformation, known as Vision 2030. Recently, Crown Prince Mohammed bin Salman, launched investments worth $6.4 billion in building the future technologies.

Analysts at Ken Research in their latest publication “KSA Robo-Advisory in Wealth Management Market Outlook to 2026F- Driven by influx of AI technology along with growing demand for financial inclusion and affordability in financial planning” by Ken Research observed that KSA Robo Advisory market is in the nascent phase. The With Digital Transformation, Emergence of New Players, Minimal investment and Government Initiatives, are some of the factors that will contribute to the KSA robo-advisory market growth. It is expected that KSA robo-advisory market will grow at a CAGR of ~52% for the 2022-2026F forecasted period.

Key Segments Covered: -

KSA Robo Advisory Market

By Type (by Revenue), 2022 & 2026F

Hybrid Robo Advisors

Pure Robo Advisors

By End-User (by Revenue), 2022 & 2026F

Retail Investor

High Net Worth Individuals

By Age-group (by Revenue), 2022 & 2026F

19-28 years

29-38 years

39-45 years

45+ years

To learn more about this report Download a Free Sample Report

By Region (by Revenue), 2022 & 2026F

Riyadh

Makkah

Eastern Region

Others

Key Target Audience: -

Government and Institutions

New Market Entrants

Investors

Wealth Management Companies

Robo-Advisory Companies

Investment Banks

Investors

Time Period Captured in the Report: -

Historical Period: 2019-2021

Base Year: 2022

Forecast Period: 2022 – 2026F

Visit this Link :- Request for Custom Report

Companies Covered: -

Abyan Capital

Derayah Capital

Tamra Capital

Haseed

Key Topics Covered in the Report: -

KSA Country Overview

KSA Population Analysis

KSA Wealth Management Market Overview

Ecosystem of KSA Robo-Advisory in Wealth Management Market

Timeline of Major Players in KSA Robo-Advisory in Wealth Management Market

Business Cycle and Genesis of KSA Robo-Advisory in Wealth Management Market

Value Chain Analysis/ Existing Business Model

KSA Robo-Advisory in Wealth Management Market Size

KSA Robo-Advisory in Wealth Management Market Segmentation by Type and End User, 2022

KSA Robo-Advisory in Wealth Management Market Segmentation by Region, 2022

End User Profiling by Age of Customer, 2022

Decision Making Parameters of End Users in KSA Robo-Advisory in Wealth Management Market

Customer Pain Points in KSA Robo-Advisory in Wealth Management Market

Key Factors Influencing Robo-Advisory Services Purchasing Decisions and Cost Components

Porter’s Five Forces Analysis of KSA Robo-Advisory in Wealth Management Market

Growth Drivers of KSA Robo-Advisory in Wealth Management Market

Trends and Developments in KSA Robo-Advisory in Wealth Management Market

Issues and Challenges in KSA Robo-Advisory in Wealth Management Market

Government Rules and Regulations in KSA Robo Advisory in Wealth Management Market

Covid-19 Impact on KSA Robo Advisory in Wealth Management Market

Competition scenario of key players based on Revenue, 2022

Cross Comparison of Major Players in KSA Robo-Advisory in Wealth Management Market

Outlook and Future Projections for KSA Robo-Advisory in Wealth Management Market

Analyst Recommendations

For more insights on the market intelligence, refer to below link: -

KSA Robo-Advisory in Wealth Management Market

Related Reports by Ken Research: -

UAE Robo-Advisory in Wealth Management Industry Outlook to 2027: Driven by influx of AI technology along with growing demand for financial inclusion and affordability in financial planning

Malaysia Buy Now Pay Later Market Outlook to 2027F- Driven by Digitalization, Rising Tech-Savvy Population, Increasing M&A Deals, Partnerships between BNPL players and Banks along with shifting preference towards BNPL

Australia Remittance Market Outlook to 2027F- By International Remittance Flow Corridor (Inbound and Outbound Countries and Point of Contact), By Domestic Remittance Flow Corridor (Urban to Rural, Urban to Urban, and others)

France Remittance Market Outlook to 2027- By Inbound & Outbound Remittance, By Channels (Banks, MTOs, M-wallets and Others), By Inflow & Outflow Remittance Corridors, By Point of Contact (Branch Pick-up, Mobile Payment & Online Transactions, Prepaid Cards)

0 notes

Text

Investing Made Easy As low as $5 Just

Yes Just Invest $5 in sarwa and if you join by this link then you can get extra $50 as Bonus so what are you waiting for just join by this and get $50 bonus and investment start just $5

https://www.sarwa.co/invite/MAJEED3252

#uae#investment#youtube#amazing#awww#sarwa#sarwa uae#sarwa app#business#usa#india#Pakistan#visit pakistan#uaebloggers#uaelife#uae team emirates#uaeisrael#investors#dubai#dubaiinstagram

0 notes

Text

10 Jasa Sewa Mobil Lampung Supir Berpengalaman

Sewa Mobil Bandar Lampung Lepas Kunci Murah Terbaik ketiga Era awak menjumpai whats app hamba adalah adalah ah bagi menggampangkan trik penyewaan unit kendaraan di disana sampeyan boleh berkomunikasi bersama bertanya dengan cara langsung menggunakan konsumen pelayanan saya tentang bukti armada kendaraan harga beserta serta tempat-tempat Nang sedia di kota bandar lampung menjumpai layanan costumer pelayanan saya selesai membela situ 24jam kepada Mam membesarkan layanan terbaik aku menurut berdiri penyimpan persewaan mobil rental mobil solo berdiri sejak tahun 2016 tatkala ini sesudah memiliki banter penabung terus-menerus lagi juga penyimpan terakhir Ana perorangan pada sinambung membesarkan pelayanan bagi kepada customer perlu mempersiapkan persewaan armada semakin dikenal oleh tertuju untuk penabung Demikianlah artikel Adapun bisa aku sampaikan Semoga sanggup memperbanyak pengetahuan kita sekotah menjumpai menciptakan kontrak menyewa mencarter persewaan mobil pada lampung muat kasih.

Penyedia Rental Mobil Lepas Kunci Di Bandar Lampung nyaman

Abad tampak ihwal dalam distrik di bandar provinsi lampung padahal kamu enteng lelah bakal mengendarai mobil situ dapat menguntukkan persewaan mobil di kota bandar bandar lampung akan tetapi apa sedia Akan periode jasa rentalnya bisa sampai 12 jam alias dalam 1 hari penuh Persewaan mobil lazimnya kecuali mempunyai kurun invalid kian 18 arloji akan tetapi sekarang pernah tampak kongsi persewaan mobil Nang menyusun persewaan saat 22 arloji disini pada Betul-betul produktif bersama selaku kisah gembira mendapatkan engkau Nang mempunyai meruah urusan dan bukan sanggup sedang mengendarai unit kendaraan sebab tamat kelelahan.

Tempat Rental Mobil Bogor Lampung Harian

Tata cara untuk kendaraan yakni yang perdana mengerti lokasi mana pula maka juga catat jarak tempuh ke situs terkandung Penggunaan mengontrak armada sebaiknya dilakukan melalui pagi keadaan karena supaya pengemudi kuasa menyamakan beserta Arena Bahwa mengenai lalui memperoleh memahami berita ensiklopedis tentang rental unit kendaraan provinsi lampung dekat bandar lampung awak boleh mengontak jilid wa ana Nan tercatat dalam website resmi abdi ada setengah eminensi Bahwa dapat anda raih sesuai Nan terpenting yakni situ terhadap mendapatkan update bayaran terbaru semenjak setiap genre kendaraan Nan tersedia.

Sewa Mobil Metro Lampung nyaman

di bandar provinsi lampung mempunyai jamak banget perseroan Bahwa membentuk Pelayanan persewaan spesifik memperoleh armada jentera keempat walakin apa mungkin perusahaan Adapun maujud bisa menolong menyewakan mobilnya selama 15 beker definit tidak sarwa Lazimnya persewaan mobil mencarikan koran memegang zaman 19 menghilir 19 weker cuma Merental armada semasa 7 pukul anda juga kudu memandangi bagaimana pelayanan suatu kongsi persewaan berikan Pasalnya situ untuk menetapkan Penyedia sewanya selama 1 tanda waktu atau menunggu sehari maksimum niscaya mengenai Sungguh-sungguh tak damai coba kamu menurut pelayanan yang tekor sebanyak-banyaknya gara-gara si menyajikan memasok Layanan rental Start semenjak pelayanan supir Adapun sedikit baik atau sompret supel kendaraan yang sompret menyenangkan digunakan dan lain sebagainya.

Sewa Mobil Lampung Jakarta nyaman

persewaan mobil mobil kota bandar lampung menyusun segenap suku unit kendaraan kaya toyota avanza jenis xenia bersama toyota innova reborn baru rental armada kota bandar lampung lumayan mengancang Penyedia beserta layanan untuk antar jemput dalam bandara meskipun hotel Pastinya Hal disini boleh meringankan lagi memunculkan pelayanan terhadap tertuju untuk nasabah Biaya persewaan mobil provinsi lampung oleh pengemudi Akan berakhir saya tawarkan selesei tertera beserta akomodasi sopir bersama lagi bahan bakar mengantongi persewaan kendaraan dalam di bandar bandar lampung sarat serta ketentuannya cukup moga-moga maka tiada ribet terpenting ialah mengamalkan pemesanan oleh menyurati keluaran what app aku setelah itu memicu jadwal penjemputan serta penggunaan Berapa keadaan bakal saat pemakaian adalah separuh 19 arloji seumpama lebih melalui 21 beker maka perihal kena ataupun biaya over time. mengusahakan armada terhidang kaum uraian sewa armada bandar lampung Nang unik disini menyisakan armada berkualitas ajal bersih serta keadaan armada kendaraan selalu dijaga mudah-mudahan terus bermakna kondisi yang prima persewaan unit kendaraan Senantiasa sewa mobil bandar lampung menempuh canggih kebahagiaan para costumer siap semua pelayanan mesti setinggi-tingginya kendaraan Bahwa tertangkap situ rental terselip armada kendaraan bersama-sama merek avanza veloz innova tipe reborn susut kendaraan daihatsu xenia Tinggal pilih Nang setakar beserta kebutuhanmu rental kendaraan Serius cocok mendapati menjelma berprofesi alternatif banyak laba yang lain serta yang dapat engkau mungkin Sebagai apabila selepas terkadang mencadangkan Jasa persewaan kendaraan anda terhadap untuk discount atau muka tarif Mengherankan bukan Tuntunan berkaitan up to date bayaran disini Betul-betul bermakna mengingat tarif yang tiap keadaan Boleh berubah-ubah sira jua dapat menanyakan aku sebagai ensiklopedis via wa tentang demi bestelan kemasan koran alias mengontrak armada kian sebab 1 keadaan sebab aku hendak menjadwalkan dan mengasuh semoga armada Nan dikau pesan atau rent car terhidang sedang yaum tercantum Surplus kedua ialah adanya up to date serta informasi paling baru berkaitan promo Nang tersuguh up to date dan serta fakta seluruh harga promo boleh terdapat Sewaktu-waktu harga murah tersebut ada kalanya diadakan mendapatkan mengungkung kebahagiaan costumer capai berjalan berlangganan penyewaan unit kendaraan dekat di kota bandar provinsi lampung pada menetapkan mobil menyewa mobil.

8 Penyedia Rental Mobil Lampung Jakarta Murah

youtube

Rental kendaraan pada bandar lampung lewat bayaran berlebih-lebih dengan terengkuh menyewakan mobil oleh driver lagi BBM di bandar bandar lampung semata wayang adalah kota Nang begitu menyenangkan menjumpai perlop karena terdapat pol tepi laut lalu terus kedudukan rekreasi dalam Bandarlampung ahad sampeyan bisa menetapi tur bersama Kawan-kawan bangsa dan anak-anak mumbung semuanya Wahana lalu tempat darmawisata pada kota bandar kota bandar lampung Adapun boleh sampeyan kunjungi mulai semenjak wisata landai darmawisata alam mengantongi menyadran kedudukan rekreasi pada di bandar lampung awak butuh armada ataupun transportasi berhasil menunjang bermutu menjangkau sekitar lokasi rekreasi termasuk menyimpang satu jalan Nan termudah Merupakan engkau menentukan media Layanan menyewakan armada kendaraan provinsi lampung dalam kota bandar kota bandar lampung saudara boleh memakai lihat persewaan unit kendaraan di bandar Lampung.

5 Perusahaan Sewa Mobil Bandar Lampung Lepas Kunci Murah

rental unit kendaraan hadir akan mengepung keinginan persewaan kendaraan semasa 17 beker eksklusif mendapatkan zona bandar lampung mencadangkan persewaan Adapun suatu disini menjejaki rabung kesenangan lalu ketenteraman anda semasa perjalanan menurut 5 pukul lamanya beres anda enggak perlu khawatir kembali Penyetir dalam rental kendaraan sesudah ahli beserta ingat trayek selanjutnya letak niat Adapun tersua di bandar kota bandar lampung tiada terpendam istilah kesasar alias cacat jalan dan sopir berpenampilan rapi dengan pastinya renceng mulut Senantiasa berusaha sebaik mungkin membantu memapas pelayanan menjumpai costumer secara maksimal. Nah itulah tadi pembahasan menyangkut Rental kendaraan bandar bandar lampung 11 pukul Persewaan armada enggak naik asal rental serupa harus memperhitungkan perihal yang lain bak Nan utama yakni keamanan bersama kedamaian buat ituh pilihlah Jasa mempersiapkan persewaan mobil jentera bagian empat yang mengakui keliru esa anutan Jasa mengadakan menghidangkan rental mobil cakra empat Bahwa yakin yaitu persewaan mobil. semua penting mengantongi situ perhatikan mudah-mudahan kesegaran beserta ketenteraman situ sepanjang masa terjaga menolong tuh situ layak Segenap hati selektif bermutu melacak rental armada kendaraan lampung 12 pukul Laksana rekomendasi Anda boleh menguntukkan Jasa rental kendaraan menurut kebutuhan persewaan mobil selagi 3 beker telah termuat bersama-sama pengendara Adapun ada memperhambakan semasih kurun persewaan pasti inih akan sebagai Serius memukau pula dibutuhkan kepada mereka Bahwa punya jumlah pasal lagi tidak tahan masih menyopiri mobil.

1 note

·

View note

Text

2 Layanan Sewa Mobil Jakarta Lampung Terbaik

Sewa Mobil Murah Lampung Terpercaya ke-3 Waktu tuan menelepon whats app abdi adalah yaitu ah sama mengentengkan trik penyewaan armada kendaraan di kemana dikau dapat berkomunikasi lalu bertanya selaku langsung dan pembeli service ana berkaitan alamat unit kendaraan harga serta pun tempat-tempat Nang wujud dekat kota bandar lampung berhasil layanan pembeli melayani kami jadi melindungi situ 24jam bakal Mam menjunjung layanan paling baik saya terhadap tersua pelanggan rental mobil rental mobil solo berdiri sejak tahun 2016 demi nih sehabis mempunyai melembak penyetor kalakian pula terus nasabah kontemporer Hamba satu tentang menerus membesarkan layanan kepada para kastemer mendapatkan melangsung kan persewaan unit kendaraan semakin dikenal oleh tertuju untuk penabung Demikianlah artikel Adapun boleh beta sampaikan Mudah-mudahan bersua membesarkan visi kita seluruh membantu mengeluarkan mengontrak persewaan kendaraan dekat provinsi lampung tampung kasih.

Jasa Komunitas Rental Mobil Lampung Murah

Abad maujud hal di wilayah bandar provinsi lampung meskipun anda sepele lelah perlu mengendarai unit kendaraan engkau bisa memakai persewaan kendaraan di bandar provinsi lampung namun apakah memegang Akan jangka sewanya dapat mengendap 11 tanda waktu alias pemakaian 1 hari sebu Rental mobil lazimnya hanya mempunyai era kurang kian 18 arloji namun sekarang suah memiliki perusahaan rental unit kendaraan Bahwa mengemasi rental waktu 17 tanda waktu inih perihal Betul-betul profitabel serta sebagai berita gembira mengusahakan anda yang menyimpan ramai soal lalu tak mampu lagi menyetir kendaraan atas berakhir kelelahan.

youtube

Layanan Rental Mobil Kalianda Lampung Selatan Plus Driver

Pedoman akan mobil yakni Adapun mula-mula paham posisi mana berkepanjangan dengan lumayan tahu jarak tempuh ke kedudukan terkandung Pemakaian carter armada sebaiknya dilakukan daripada pagi keadaan berkat supaya driver mampu menyinkronkan denganatas Medan Akan sama lalui kepada mengetahui keterangan afdal tentang rental kendaraan provinsi lampung dekat kota bandar lampung dikau bisa menghubungi kopi whatsapp abdi Akan tersebut dekat web resmi abdi memiliki sekitar keunggulan Adapun boleh sampeyan bisa sebagaimana yang terpenting ialah sira tentu berhasil up-date biaya teranyar semenjak setiap mutu armada kendaraan Bahwa tersedia.

Sewa Mobil Di Lampung Lepas Kunci Plus Driver

bandar bandar lampung memiliki bertimbun sekali industri yang mengatur Pelayanan persewaan terpilih perlu unit kendaraan gelindingan keempat akan tetapi apa mungkin maskapai yang siap dapat mencapai menyewakan mobilnya semasih 1 tanda waktu positif enggak sarwa Biasanya rental kendaraan menjumpai harian menyimpan saat 6 terpuruk 7 jam sendiri Merental unit kendaraan selama 14 weker situ juga mesti menatap bagaimana layanan suatu perusahaan persewaan berikan Pasalnya kamu pada memanfaatkan Jasa jasa sewanya semasa 10 arloji alias menunggu sehari sesak jelas mau Sepenuh hati bukan damai jika kamu untuk pelayanan Bahwa abnormal sebanyak-banyaknya bermula si menyuplai Tempat persewaan Mulai gara-gara layanan supir Nan invalid baik atau abnormal ringan mulut unit kendaraan yang abnormal sejuk difungsikan dengan lain sebagainya.

Sewa Mobil Lampung nyaman

rental mobil mobil bandar lampung menyisihkan setengah suku kendaraan ibarat avanza daihatsu xenia maka innova reborn baru persewaan kendaraan kota bandar lampung pun menyebabkan Penyedia bersama layanan mendapatkan antar jemput di bandara lamun hotel Pastinya Hal itu boleh meringankan dan mengerek layanan akan tertuju untuk penyimpan Tarif rental armada lampung menggunakan driver Akan setelah beta tawarkan selepas tertulis demi akomodasi driver selanjutnya lagi bahan bakar meraih persewaan armada dekat di bandar lampung sarat serta syaratnya cukup hubaya-hubaya pula tak ribet terpenting merupakan mempersiapkan order bersama-sama bertamu bagian whatsapp aku seterusnya membuat jadwal penjemputan bersama penggunaan Berapa musim bagi masa penggunaan yaitu seluruh 19 arloji asalkan lebih sebab 10 beker maka tentang kena alias biaya over time. capai mobil tersaji seputar uraian sewa kendaraan provinsi lampung Adapun wahid inih memperlengkapi kendaraan Dalam awangawang bersih maka situasi unit kendaraan senantiasa dijaga biar berjalan bermakna suasana Akan prima persewaan mobil Selalu meningkatkan nyaring kepuasan kepada kastemer siap seluruh layanan kudu tertinggi mobil Adapun menerima situ persewaan wujud armada melalui merek avanza veloz kijang innova model reborn bergeser armada kendaraan mobil xenia Tinggal pilih Nang sepadan melalui kebutuhanmu persewaan unit kendaraan Sepenuh hati pacak mendapat menjelma berprofesi pengganti penuh laba lainnya serta Akan bisa engkau memperoleh Sebagai seandainya sewa mobil di bandar lampung setelah kadang kala memanfaatkan Tempat rental mobil kamu mau buat potongan harga atau raut bayaran Memukau bukan Pengarahan tentang up date tarif disini Segenap hati penting mengingat bayaran Nan tiap keadaan Boleh berubah-ubah awak lagi boleh meminang ana selaku sempurna via hubungi lewat wa menyangkut memperoleh antaran bungkusan harian alias mengontrak armada kian mengenai 1 keadaan gara-gara saya terhadap menjadwalkan beserta menata semoga unit kendaraan Nang anda pesan atau menyewa tersaji tenang musim tertera Kegunaan ke-2 adalah adanya up date dan embaran terkini menyinggung potongan harga Nan terhidang up to date bersama maka keterangan seluruh discount dapat terpendam Sekali waktu discount terkandung sering diadakan akan melakukan kebahagiaan kastemer demi terus-menerus berlangganan mengontrak kendaraan dalam di kota bandar kota bandar lampung oleh mengabdikan unit kendaraan sewa kendaraan.

5 Layanan Sewa Mobil Mewah Lampung Berpengalaman

Rental mobil pada di kota bandar kota bandar lampung beserta bayaran berlebih-lebih pula terengkuh sewa armada kendaraan demi penyetir lalu BBM bandar provinsi lampung utuh yakni kota yang begitu amikal membantu tamasya sebab tersedia padat sondai pula lagi lokasi tur dalam Bandarlampung satu situ boleh melakukan wisata bersama Rekan-rekan marga beserta anak-anak meluap semuanya Wahana maka posisi wisata di bandar lampung Nang bisa saudara jenguk mulai lantaran tamasya pantai tamasya alam membantu berkunjung tempat liburan dekat kota bandar lampung saudara membutuhkan mobil alias transportasi mendapat menunjang berkualitas mencapai sekian banyak posisi liburan tertulis keliru uni teknik Nang termudah Yaitu sira memanfaatkan media Pelayanan rental armada kendaraan bandar lampung di kota bandar bandar lampung awak boleh mengabdikan lihat rental unit kendaraan bandar Lampung.

4 Tempat Rental Mobil Bandarlampung Harian Terbaik

persewaan kendaraan hadir mencarikan mengerjakan kebutuhan persewaan kendaraan selama 22 pukul distingtif mengusahakan provinsi kota bandar lampung menyimpan persewaan Nang esa itu mematuhi mahal kenaiman pula kedamaian anda semasih perjalanan memperoleh 22 beker lamanya lulus kamu tak mesti khawatir juga Penyetir dalam persewaan armada selesei lanjut usia dengan tahu jalur dengan situs ujud Nang datang di di kota bandar lampung tidak memegang istilah kesasar ataupun lupa jalan serta pengendara berpenampilan rapi maka pastinya ringan mulut Selalu berikhtiar sebaik mungkin memperoleh menjatuhkan pelayanan untuk pembeli sebagai maksimal. Nah itulah tadi penjelasan berkaitan Rental armada di kota bandar bandar lampung 13 weker Persewaan kendaraan tidak menjabat asal rental jua wajar meneliti elemen lainnya serupa Bahwa utama ialah kesentosaan pula kesenangan akan tuh pilihlah Perusahaan penyedia persewaan armada gelindingan empat Bahwa mengakui meleset uni turutan Penyedia mempersiapkan persewaan mobil roda keempat Nan mantap yakni rental mobil. seluruh krusial bakal situ perhatikan supaya kesedapan serta kebahagiaan kamu sekali-sekali tertangani menurut tuh engkau pantas Segenap hati selektif berkualitas melacak persewaan armada provinsi lampung 22 jam Semisal rekomendasi Kamu dapat menguntukkan Penyedia rental kendaraan menurut kebutuhan persewaan unit kendaraan semasih 13 pukul selesei tersimpul beserta sopir Bahwa tersedia berdedikasi selagi masa persewaan sahih inih untuk sebagai Segenap hati menakjubkan lagi dibutuhkan mendapati mereka Adapun memiliki mumbung bab dan tidak kuat serta mengendarai mobil.

0 notes

Text

Commission-free app to trade US stocks launches in the UAE

Commission-free app to trade US stocks launches in the UAE

A new app has launched allowing users in the United Arab Emirates to trade US stocks commission-free.

For the latest headlines, follow our Google News channel online or via the app.

Sarwa Trade offers commission-free trading with no local transfer fee from AED accounts, the company said in a statement.

Users must open an account with a minimum balance of $5 and provide the company with…

View On WordPress

0 notes

Text

Foloosi is on the Top 20 Middle East Fintech

The past year has been eventful in the Middle East’s financial services sector. Last year, we saw the Saudi British Bank merge with Al Awwal Bank to create Saudi Arabia’s third largest lender. This came after Abu Dhabi Commercial Bank’s tie-up with Union National Bank and the subsequent takeover of Al Hilal bank as its Sharia-compliant arm in the U.A.E. The Islamic banking sector has also seen the merger of the region’s largest Islamic bank, Dubai Islamic Bank, with Noor Bank, a U.A.E.-based Sharia-compliant lender.

These mergers have reduced competition in an oversaturated banking market and in the long run will improve the profitability of the banking system. Dubai-based investment bank, Shuaa Capital, has also agreed to merge with its largest shareholder, Abu Dhabi Financial Group, to create a $12 billion asset under management firm.

And the region’s payment’s sector saw two large IPOs: one from Finablr, which owns the U.A.E Exchange brand, and one by payments solution giant, Network International. Both are listed on the London Stock Exchange.

This year we have collated two lists to mark this changing landscape: the Fintech 20 which is a collection of the most promising financial technology startups in the region.

Only fintech startups that were founded during or after 2012 were included, and we ranked them according to:

· Funds raised from external investors

· Scalability of the business

Name: PayTabs

Online Payment Processing Solutions

Abdulaziz Al Jouf

$26 M

Saudi Arabia

Name: Bayzat

Online Health Insurance And HR Solutions Provider

Talal Bayaa And Brian Habibi

$25 M

UAE

Name: Aqeed

Insurance Solutions Platform

Hadi Radwan

$18 M

UAE

Name: Beehive

SME Focused Peer2peer Lending Platform

Craig Moore

$15.5 M

UAE

Name: Souqalmal.Com

Financial Products Comparison Site

Ambareen Musa

$15 M

UAE

Name: Eureeca

Crowdfunding Platform

Sam Quawasmi And Chris Thomas

$12.3 M

UAE

Name: Liwwa

Peer-To-Peer Lending Platform

Ahmed Moor And Samer Atiani

$8.55 M

Jordan

Name: Expensya

Cloud Based Multi-Platform Expense Management Software

Ahmed Moor And Samer Atiani

$5.7 M

Tunisia/ France

Name: NymCard

Payment Solutions

Omar Onsi And Ayman Chalhoub

$4 M

Lebanon

Name: POSRocket

IPad-Based Point-Of-Sale Solutions

Zeid Husban

$2.36 M

Jordan

Name: Sarwa

Robo Wealth Advisor

Mark Chahwan- Jad Sayegh And Nadine Mezher

$1.5 M

UAE

Name: Risk+ Solutions

Financial Intelligence And Risk Management Solutions

Jad G. Doumith And Chadi El Nawar

$1.45 M

Lebanon

Name: Zbooni

Connected Chat Commerce App

Ramy Assaf- Mohamed Hamedi- Ashraf Atia

$1.4 M

UAE

Name: Democrance

Insurance Marketplace For The Underserved

Michele Grosso Alberto Perez And Damian Dimmich

$1.3 M

UAE

Name: Vapulus

E-Payment Gateway

Abdelrahman El Shaarawy- Islam Mousa- Khalid Gabr

$1.065 M

Egypt

Name: Monami Tech

Financial Services

Ammar Afif

$1 M

UAE

Name:Moneyfellows

Crowd Funding From Social Networks

Ahmed Wadi

$980 K

Egypt

Name:PointCheckout

Payment Gateway For Loyalty Points

Bashar Saleh And Tarek Ghobar

$600 K

UAE

Name: Foloosi

Payment Solutions Platform

Omar Bin Brek- Mohan Karuppiah

$500 K

UAE

Name: Paymob

Digital Financial Enabler

Islam Shawky- Alain El-Hajj- Mostafa Menessy

Confidential

Egypt

Source: https://www.forbesmiddleeast.com/list/middle-east-fintech-20

#payment gateway uae#merchant services UAE#business payment uae#Payment Link In Dubai#International Payment UAE

0 notes

Text

Top Fintech influencers to follow in the Middle East

Over the last couple of years, several changes in technology have an impact on financial and banking services as well. Now everyone is aware of the term FinTech which means usage of technology in the financial sector. Definitely, fintech influencers had their piece of share in making fintech an enormous thing by sharing their ideas and influencing the world of techno-finance. Along with several other nations, the Middle East also have seen many influencers who helped in Fintech growth.

Here’s a list of top Fintech influencers in the Middle East region (not in a specific order)

1. Raja Al Mazrouei

Raja Al Mazrouei is the Executive Vice President of FinTech Hive at the Dubai International Financial Centre(DIFC). She works with an aim to make DIFC as the region’s best innovative destination for Fintech.

2. Arif Amiri

Arif Amiri is the Cheif Executing Officer at Dubai International Financial Center(DIFC). He manages the strategic and operational functions of the center. Currently, DIFC is working towards the fintech development which is a part Arif’s vision for DIFC.

3. Leigh Flounders

Leigh Flounders is the Senior Vice President Head of Digital Strategy and Engagement at Emirates NBD. He bagged several awards till date, amongst which The 2017 South By Southwest(SXSW) Conference FinTech & Payments pitch winner deserves a special mention.

4. Craig Moore

Craig Moore is the founder of Beehive which is the first peer-to-peer lending platform in the Middle East and North Africa(MENA) region. Beehive was launched in November 2014, it connects businesses seeking finance and investors. Till date, it has provided finance to more than 32 SMEs.

5. Kanchan Kumar

Kanchan Kumar is one of the founders of Remitr. Remitr is an end-to-end money transfer platform which was started with an aim to make global payments simple. In the year 2016, it was recognized as one of the most promising startups in the UAE region.

6. Suvo Sarkar

Suvo Sarkar is the Senior Executive Vice President and Group Head in Retail banking & Wealth management at Emirates NBD. He contributes to the growth of revenue, profits and customer base for the bank by setting new standards for product innovation. He also publishes a column on the changing paradigms in the banking sector. He is considered as a Finovate speaker in the Middle East.

7. Abdul Fahad Al Jouf

Abdul Fahad Al Jouf is the founder of PayTabs. PayTabs is a payment gateway that provides businesses to transfer funds to each other without any complications. Realizing the difficulties faced by the SME merchants in the MENA region to get a payment gateway, Abdul developed PayTabs. It provides payment solutions to all kinds of business be it small and medium enterprises, large scale organizations, etc.

8. Mirna Sleiman

Mirna Sleiman is the CEO and founder of Fintech Galaxy which is a digital crowdsourcing platform. It connects fintech entrepreneurs and investors. Mirna is the former award-winning financial journalist. She even guided several banks and governments on their digital transformation projects.

9. Sridhar Iyer

Sridhar Iyer is the Head of Mashreq Neo and Banking. Mashreq Neo is the digital banking application that is working with an aim to make banking easy and swift for the customers. This definitely makes a good addition to the growth of fintech in the UAE region.

10. Moussa Beidas

Moussa Beidas is the founder of Bridg, a smartphone app. It is an app which uses Bluetooth to make online payments. It is the first app that works on flight mode as well. Bridg is definitely one of the best fintech innovations. It makes the payment process simple.

11. Sagar Sanap

Sagar Sanap is the AVP- Digital Sales Lead in Citi Bank. Being expertise in the field of Product strategy, Digital marketing, and campaign management, he is making a good share in the field of fintech.

12. Sam Quawasmi

Sam Quawasmi is one of the founders of the first equity crowdfunding platform Eureeca. It provides equity-based crowdfunding opportunity for the businesses. In the year 2013, Sam Quawasmi and Chris Thomas(Founder of Eureeca) were awarded “Innovator of the Year” award by Gulf Business Industry Awards in the UAE.

13. Peter Smith

Peter Smith is the managing director, policy and strategy at Dubai Financial Services Authority(DFSA). DFSA regulates the financial services conducted from Dubai International Financial Center(DIFC) which works with a vision to drive the future of finance.

14. Philip King

Philip King is the Global Head of Retail Banking at ADIB. Prior to ADIB, he worked in several other well-known banks. ADIB launched MoneySmart which is the first digital community in the Middle East region. It also added “ADIB Express” to their app in order to provide instant digital services to their customers.

15. Richard Teng

Richard Teng is the CEO of the Financial Services Regulatory Authority (FSRA), Abu Dhabi Global Market(ADGM). The first Fintech Regulatory Laboratory Framework in the MENA region was developed in ADGM under the supervision of Richard. He works in the development of Fintech ecosystem in Abu Dhabi region.

16. Wai Lum Kwok

Wai Lum Kwok is the Executive Director of Capital Markets, Financial Services Regulatory Authority (FSRA), Abu Dhabi Global Market(ADGM). He is known for his efforts and supervision in the development of Fintech in ADGM.

17. Promoth Manghat

Promoth Manghat is the CEO of UAE Exchange. He leads the global operations team of UAE Exchange center. He supervises in expanding UAE Exchange all over the world besides the day-to-day operations of his team.

18. Jayesh Patel

Jayesh Patel is the head of Liv. account of Emirates NBD. Liv. account is the first digital banking account in the UAE region. This account was launched by taking millennials and digital lifestyle into consideration. Liv account is one of the best add-ons to Fintech growth in the UAE.

19. Stelios Michaelides

Stelios Michaelides is the head of Digital Banking in Commercial Bank of Dubai(CBD). CBD Now is a digital banking product that was launched under the supervision of Stelios. It uses the latest technologies which promote in the safe and simplest way of banking for the customers.

20. Siddiq Farid

Siddiq Farid is the CEO and one of the founders of SmartCrowd. SmartCrowd is a real estate crowdfunding platform in the UAE. It is the only company that is regulated by the DFSA(Dubai Financial Services Authority) and the first company in UAE that supports digital real estate investments.

21. Tanvir Shah

Tanvir Shah is the Managing Director of The Partnerships Consulting. He supervises on banking, payments, fintech strategies, etc. in the MENA region. His works have been recognized by several popular publications like The Banker Middle East, Cards International, etc.

22. Lynnette Abad

Lynnette is the Director of Research and Data at PropertyFinder group. Having technology and real estate as her professional passions, she’s been working on PropTech for maximum time in her career.

23. Mark Chahwan

Mark is one of the co-founders of Sarwa. Sarwa is an online financial advisor that helps customers in finding investment opportunities with good returns and low-risks. It was recognized as one of the top 20 fintech companies by Forbes and the first startup to have an innovation license by the Dubai International Financial Center.

24. Mike Cunningham

Mike has been spending most of his career in the FinTech sector. He works as an independent mentor at DIFC(Dubai International Financial Center) Fintech Hive. Besides that, he is the CEO of BankClearly a startup which invented a new way of banking.

25. Omar Soudodi

Omar Soudodi is the managing director at PayFort. PayFort is a payment gateway platform which provides a secured and safe payment facility for online shoppers. It has won several awards in the MENA region along with the Best Fintech Company in the year 2016 by The Entrepreneur.

26. Usama Zafar

Usama Zafar is the Head of Digital & Direct Marketing in ADIB. He has 13+ years of work experience in well-acclaimed domestic and international companies. He is considered as a growth hacker with accomplishments of billion dollars in annual sales of the companies he worked.

27. Nameer Khan

Nameer Khan is not only a fintech influencer but also an insurtech. He is a founding board member of MENA Fintech Association which helps in shaping the future of financial services in the UAE.

28. Ola Doudin

Ola Doudin is the Cofounder and CEO of BitOasis which is digital asset exchange and wallet. It allows individuals to purchase, sell and trade digital assets. Along with the digital wallet and trading services, they also offer consulting services to the organizations.

29. Omar Rana

Omar Rana is the co-founder and director of strategy and finance in Finalytix. Finalytix provides financial advice and wealth management of a company. Omar is also a global fintech speaker who was invited to talk at various conferences.

30. Omeed Mehrinfar

Plug and Play Tech is a platform that connects Startups and the world’s largest corporations. Omeed Mehrinfar is the regional director of such an innovative platform that helps the startups, investors, etc connect with each other. Plug and Play Tech work on the main objective to catalyze technological advancement.

31. Osama Al Rahma

Osama Al Rahma is the CEO of the Al Fardan Exchange. Al Fardan Exchange is a well-known exchange center in the UAE. Apart from the Al Fardan Exchange center, he is a board member of certain well-acclaimed companies like Foreign Exchange and Remittance group, 2 the point, who is responsible for the development of strategies.

32. Tim Buckler

Tim Buckler is the Digital Sales Manager in Emirates Islamic Bank. With 9+ years of experience in the field of digital finance, his strategies mainly focus on developing overall e-commerce experiences. He helps in building the digital channel that eventually drives towards the customer and product gain.

33. Preeti Mundhra

Preeti Mundhra the Head of Marketing and Partnerships at the Liv. Digital Bank is one of the best fintech influencers in the UAE through Liv. account which is one of the best initiatives in the fintech space.

34. Shaheen Alkhudhari

The founder and CEO of the well-known rent and property management platform, Ajar Online is Shaheen Alkhudhari. This platform helps homeowners manage their properties by offering a quick online rent collection facility. This makes the process of receiving or sending rent very easy.

35. Khalid Saad

Khalid Saad is the CEO of Bahrain Fintech Bay. Bahrain Fintech Bay is the first fintech hub in Bahrain and largest fintech hub in the MENA region. He is also the Executive Director of Fintech Consortium which helps in growth and acceleration of Fintech ecosystems.

36. Sonny Zulu

Sonny Zulu is the Managing Director and Head of Retail Banking at Standard Chartered Bank. He is known for delivering outstanding performance at work which helped in the growth of profits, revenue, etc.

37. Eric Modave

Eric Modave is the Chief Operating Office in Arab Bank who is in charge of all the IT operations, Enterprise Digital Innovation, data management, etc. for the bank. Prior to the Arab bank, he worked at top-noted banks in other regions.

38. Denit Varghese

Denit Varghese is the Senior Digital Planner at Carat. With long career experience in the field of digital marketing, his motto of looking at the long term success rather than short term returns makes him the best at the industry.

39. Bogdan Maranu

Bogdan Maranu is the Associate Media Director at Spark Foundry. It is a start-up that melds an innovative business approach with resources and capabilities.

40. Omar Bin Brek

Omar Bin Brek is the founder of the UAE Fintech Startup Foloosi. Foloosi facilitates consumer to business payments with advanced technical solutions. This is definitely a good add-on to fintech realm.

Other than these, there are several other influencers who are helping in the growth of Fintech in the Middle East and North Africa(MENA) region.

Source: https://www.mymoneysouq.com/financial-blog/top-40-fintech-influencers-to-follow-in-the-middle-east/

0 notes

Text

DIFC invests in innovative FinTech start-up companies

(WAM) — Dubai International Financial Centre, DIFC, announced on Monday that it has invested in four FinTech start-up companies.

According to a DIFC press statement, the investment reflects the centre’s commitment to driving the future of finance and is part of the US$100 million FinTech Fund launched in 2019. The FinTech Fund was launched to help establish, grow and upscale start-up and growth stage FinTech companies seeking access to the MEASA markets.

The start-ups who applied for funding were evaluated by the DIFC FinTech Fund, the statement noted, adding that out of those shortlisted, four were selected for funding after a comprehensive review. “As part of DIFC’s commitment to developing the sector, more applications will be evaluated and further investments will be made by the fund to be announced within a short period,” it continued.

Commenting on the announcement, Arif Amiri, DIFC Authority Chief Executive Officer, said, “Our position as one of the world’s top ten FinTech hubs is strengthened by making investments in start-ups such as those we have announced today. The DIFC FinTech Fund accelerates the development of impactful FinTech firms, taking them a step further toward capitalising on the strong growth opportunities available in the region.

“Through investing and providing the region’s most comprehensive platform, we can drive innovation across MEASA’s financial services sector.”

The DIFC FinTech Fund invested in ‘FlexxPay,’ a cloud-based B2B FinTech employee benefits platform allowing instant access to earned income.

Michael Truschler, CEO of FlexxPay, said, “We are grateful to receive the trust and confidence from DIFC’s FinTech Fund, and we look forward to offering our services as a technology provider to the wider business community in the region. We strongly believe that in the near future everyone will have access to their earned income whenever they want. FlexxPay brings such an experience to companies and their employees today to build a truly global company with real impact on society and the overall economy of a country.”

The fund also invested in ‘Go Rise,’ a unique start-up building a holistic and seamless financial services platform for 250 million global migrants, helping them get access to the full suite of financial products in domicile as well as home country.

Padmini Gupta, CEO of Go Rise, said, “We are excited to be partnering with DIFC and MEVP in building a unique global migrant banking platform. Migrants in the GCC earn US$150 billion a year and we are helping them better manage that income through partnerships with institutions regionally and in migrant home countries. Migrants represent one of the region’s biggest assets and in Go Rise we want to build the global migrant financial services leader.”

The two other FinTech business selected for funding were ‘NOW Money,’ which provides payroll services to Gulf-based companies, and app-based accounts with physical debit card and remittance options for each of their lower-income workers; and ‘Sarwa,’ a robo-advisory wealth management firm.

“We are delighted to welcome DIFC to the NOW Money family and look forward to sharing more on our partnership throughout 2020,” said Ian Dillon, Co-founder of NOW Money.

For his part, Sarwa CEO Mark Chahwan said, “Sarwa was born in the DIFC, as one of the companies in the first cohort of the DIFC FinTech Hive and was the first firm to be granted an Innovation Testing License.”

“Today, Sarwa continues its growth and expansion yet again with the help and support of DIFC. We are thrilled to have such a strategic partner/investor that was part of our journey from the beginning. This is a testament to the team’s hard work to make smart investing available to the region. We are continuously improving our features and adding new products to our existing compelling list to help everyone build for a better future,” he added.

The post DIFC invests in innovative FinTech start-up companies appeared first on Businessliveme.com.

from WordPress https://ift.tt/2A6UZC2

via IFTTT

0 notes

Video

youtube

| Excelsior News | Army donate Gym material at Sarwa village of Ramgarh Download the official Daily Excelsior mobile app: Android : https://goo.gl/DrWrAu IOS : https://goo.gl/jFyjGY Stay Connected with us on our Social Media Links: Facebook : https://goo.gl/iV3s5o Twitter : https://goo.gl/bd1uEO Google+ : https://goo.gl/r9qSKH Instagram: https://goo.gl/G5pdE5 Tumblr : http://goo.gl/8qvBDb Pinterest: https://goo.gl/1bjh20 Visit our websites: Website: http://ift.tt/267gtn8 Epaper : http://ift.tt/1YwhqmR

0 notes

Text

Top 40 Fintech influencers to follow in the Middle East

Over the last couple of years, several changes in technology have an impact on financial and banking services as well. Now everyone is aware of the term FinTech which means usage of technology in the financial sector. Definitely, fintech influencers had their piece of share in making fintech an enormous thing by sharing their ideas and influencing the world of techno-finance. Along with several other nations, the Middle East also have seen many influencers who helped in Fintech growth.

Here’s a list of top Fintech influencers in the Middle East region (not in a specific order)

1. Raja Al Mazrouei

Raja Al Mazrouei is the Executive Vice President of FinTech Hive at the Dubai International Financial Centre(DIFC). She works with an aim to make DIFC as the region’s best innovative destination for Fintech.

2. Arif Amiri

Arif Amiri is the Cheif Executing Officer at Dubai International Financial Center(DIFC). He manages the strategic and operational functions of the center. Currently, DIFC is working towards the fintech development which is a part Arif’s vision for DIFC.

3. Leigh Flounders

Leigh Flounders is the Senior Vice President Head of Digital Strategy and Engagement at Emirates NBD. He bagged several awards till date, amongst which The 2017 South By Southwest(SXSW) Conference FinTech & Payments pitch winner deserves a special mention.

4. Craig Moore

Craig Moore is the founder of Beehive which is the first peer-to-peer lending platform in the Middle East and North Africa(MENA) region. Beehive was launched in November 2014, it connects businesses seeking finance and investors. Till date, it has provided finance to more than 32 SMEs.

5. Kanchan Kumar

Kanchan Kumar is one of the founders of Remitr. Remitr is an end-to-end money transfer platform which was started with an aim to make global payments simple. In the year 2016, it was recognized as one of the most promising startups in the UAE region.

6. Suvo Sarkar

Suvo Sarkar is the Senior Executive Vice President and Group Head in Retail banking & Wealth management at Emirates NBD. He contributes to the growth of revenue, profits and customer base for the bank by setting new standards for product innovation. He also publishes a column on the changing paradigms in the banking sector. He is considered as a Finovate speaker in the Middle East.

7. Abdul Fahad Al Jouf

Abdul Fahad Al Jouf is the founder of PayTabs. PayTabs is a payment gateway that provides businesses to transfer funds to each other without any complications. Realizing the difficulties faced by the SME merchants in the MENA region to get a payment gateway, Abdul developed PayTabs. It provides payment solutions to all kinds of business be it small and medium enterprises, large scale organizations, etc.

8. Mirna Sleiman

Mirna Sleiman is the CEO and founder of Fintech Galaxy which is a digital crowdsourcing platform. It connects fintech entrepreneurs and investors. Mirna is the former award-winning financial journalist. She even guided several banks and governments on their digital transformation projects.

9. Sridhar Iyer

Sridhar Iyer is the Head of Mashreq Neo and Banking. Mashreq Neo is the digital banking application that is working with an aim to make banking easy and swift for the customers. This definitely makes a good addition to the growth of fintech in the UAE region.

10. Moussa Beidas

Moussa Beidas is the founder of Bridg, a smartphone app. It is an app which uses Bluetooth to make online payments. It is the first app that works on flight mode as well. Bridg is definitely one of the best fintech innovations. It makes the payment process simple.

11. Sagar Sanap

Sagar Sanap is the AVP- Digital Sales Lead in Citi Bank. Being expertise in the field of Product strategy, Digital marketing, and campaign management, he is making a good share in the field of fintech.

12. Sam Quawasmi

Sam Quawasmi is one of the founders of the first equity crowdfunding platform Eureeca. It provides equity-based crowdfunding opportunity for the businesses. In the year 2013, Sam Quawasmi and Chris Thomas(Founder of Eureeca) were awarded “Innovator of the Year” award by Gulf Business Industry Awards in the UAE.

13. Peter Smith

Peter Smith is the managing director, policy and strategy at Dubai Financial Services Authority(DFSA). DFSA regulates the financial services conducted from Dubai International Financial Center(DIFC) which works with a vision to drive the future of finance.

14. Philip King

Philip King is the Global Head of Retail Banking at ADIB. Prior to ADIB, he worked in several other well-known banks. ADIB launched MoneySmart which is the first digital community in the Middle East region. It also added “ADIB Express” to their app in order to provide instant digital services to their customers.

15. Richard Teng

Richard Teng is the CEO of the Financial Services Regulatory Authority (FSRA), Abu Dhabi Global Market(ADGM). The first Fintech Regulatory Laboratory Framework in the MENA region was developed in ADGM under the supervision of Richard. He works in the development of Fintech ecosystem in Abu Dhabi region.

16. Wai Lum Kwok

Wai Lum Kwok is the Executive Director of Capital Markets, Financial Services Regulatory Authority (FSRA), Abu Dhabi Global Market(ADGM). He is known for his efforts and supervision in the development of Fintech in ADGM.

17. Promoth Manghat

Promoth Manghat is the CEO of UAE Exchange. He leads the global operations team of UAE Exchange center. He supervises in expanding UAE Exchange all over the world besides the day-to-day operations of his team.

18. Jayesh Patel

Jayesh Patel is the head of Liv. account of Emirates NBD. Liv. account is the first digital banking account in the UAE region. This account was launched by taking millennials and digital lifestyle into consideration. Liv account is one of the best add-ons to Fintech growth in the UAE.

19. Stelios Michaelides

Stelios Michaelides is the head of Digital Banking in Commercial Bank of Dubai(CBD). CBD Now is a digital banking product that was launched under the supervision of Stelios. It uses the latest technologies which promote in the safe and simplest way of banking for the customers.

20. Siddiq Farid

Siddiq Farid is the CEO and one of the founders of SmartCrowd. SmartCrowd is a real estate crowdfunding platform in the UAE. It is the only company that is regulated by the DFSA(Dubai Financial Services Authority) and the first company in UAE that supports digital real estate investments.

21. Tanvir Shah

Tanvir Shah is the Managing Director of The Partnerships Consulting. He supervises on banking, payments, fintech strategies, etc. in the MENA region. His works have been recognized by several popular publications like The Banker Middle East, Cards International, etc.

22. Lynnette Abad

Lynnette is the Director of Research and Data at PropertyFinder group. Having technology and real estate as her professional passions, she’s been working on PropTech for maximum time in her career.

23. Mark Chahwan

Mark is one of the co-founders of Sarwa. Sarwa is an online financial advisor that helps customers in finding investment opportunities with good returns and low-risks. It was recognized as one of the top 20 fintech companies by Forbes and the first startup to have an innovation license by the Dubai International Financial Center.

24. Mike Cunningham

Mike has been spending most of his career in the FinTech sector. He works as an independent mentor at DIFC(Dubai International Financial Center) Fintech Hive. Besides that, he is the CEO of BankClearly a startup which invented a new way of banking.

25. Omar Soudodi

Omar Soudodi is the managing director at PayFort. PayFort is a payment gateway platform which provides a secured and safe payment facility for online shoppers. It has won several awards in the MENA region along with the Best Fintech Company in the year 2016 by The Entrepreneur.

26. Usama Zafar

Usama Zafar is the Head of Digital & Direct Marketing in ADIB. He has 13+ years of work experience in well-acclaimed domestic and international companies. He is considered as a growth hacker with accomplishments of billion dollars in annual sales of the companies he worked.

27. Nameer Khan

Nameer Khan is not only a fintech influencer but also an insurtech. He is a founding board member of MENA Fintech Association which helps in shaping the future of financial services in the UAE.

28. Ola Doudin

Ola Doudin is the Cofounder and CEO of BitOasis which is digital asset exchange and wallet. It allows individuals to purchase, sell and trade digital assets. Along with the digital wallet and trading services, they also offer consulting services to the organizations.

29. Omar Rana

Omar Rana is the co-founder and director of strategy and finance in Finalytix. Finalytix provides financial advice and wealth management of a company. Omar is also a global fintech speaker who was invited to talk at various conferences.

30. Omeed Mehrinfar

Plug and Play Tech is a platform that connects Startups and the world’s largest corporations. Omeed Mehrinfar is the regional director of such an innovative platform that helps the startups, investors, etc connect with each other. Plug and Play Tech work on the main objective to catalyze technological advancement.

31. Osama Al Rahma

Osama Al Rahma is the CEO of the Al Fardan Exchange. Al Fardan Exchange is a well-known exchange center in the UAE. Apart from the Al Fardan Exchange center, he is a board member of certain well-acclaimed companies like Foreign Exchange and Remittance group, 2 the point, who is responsible for the development of strategies.

32. Tim Buckler

Tim Buckler is the Digital Sales Manager in Emirates Islamic Bank. With 9+ years of experience in the field of digital finance, his strategies mainly focus on developing overall e-commerce experiences. He helps in building the digital channel that eventually drives towards the customer and product gain.

33. Preeti Mundhra

Preeti Mundhra the Head of Marketing and Partnerships at the Liv. Digital Bank is one of the best fintech influencers in the UAE through Liv. account which is one of the best initiatives in the fintech space.

34. Shaheen Alkhudhari

The founder and CEO of the well-known rent and property management platform, Ajar Online is Shaheen Alkhudhari. This platform helps homeowners manage their properties by offering a quick online rent collection facility. This makes the process of receiving or sending rent very easy.

35. Khalid Saad

Khalid Saad is the CEO of Bahrain Fintech Bay. Bahrain Fintech Bay is the first fintech hub in Bahrain and largest fintech hub in the MENA region. He is also the Executive Director of Fintech Consortium which helps in growth and acceleration of Fintech ecosystems.

36. Sonny Zulu

Sonny Zulu is the Managing Director and Head of Retail Banking at Standard Chartered Bank. He is known for delivering outstanding performance at work which helped in the growth of profits, revenue, etc.

37. Eric Modave

Eric Modave is the Chief Operating Office in Arab Bank who is in charge of all the IT operations, Enterprise Digital Innovation, data management, etc. for the bank. Prior to the Arab bank, he worked at top-noted banks in other regions.

38. Denit Varghese

Denit Varghese is the Senior Digital Planner at Carat. With long career experience in the field of digital marketing, his motto of looking at the long term success rather than short term returns makes him the best at the industry.

39. Bogdan Maranu

Bogdan Maranu is the Associate Media Director at Spark Foundry. It is a start-up that melds an innovative business approach with resources and capabilities.

40. Omar Bin Brek

Omar Bin Brek is the founder of the UAE Fintech Startup Foloosi. Foloosi facilitates consumer to business payments with advanced technical solutions. This is definitely a good add-on to fintech realm.

Other than these, there are several other influencers who are helping in the growth of Fintech in the Middle East and North Africa(MENA) region.

Source: https://www.mymoneysouq.com/financial-blog/top-40-fintech-influencers-to-follow-in-the-middle-east/

0 notes

Text

Top 40 Fintech influencers to follow in the Middle East

Over the last couple of years, several changes in technology have an impact on financial and banking services as well. Now everyone is aware of the term FinTech which means usage of technology in the financial sector. Definitely, fintech influencers had their piece of share in making fintech an enormous thing by sharing their ideas and influencing the world of techno-finance. Along with several other nations, the Middle East also have seen many influencers who helped in Fintech growth.

Here’s a list of top Fintech influencers in the Middle East region (not in a specific order)

1. Raja Al Mazrouei

Raja Al Mazrouei is the Executive Vice President of FinTech Hive at the Dubai International Financial Centre(DIFC). She works with an aim to make DIFC as the region’s best innovative destination for Fintech.

2. Arif Amiri

Arif Amiri is the Cheif Executing Officer at Dubai International Financial Center(DIFC). He manages the strategic and operational functions of the center. Currently, DIFC is working towards the fintech development which is a part Arif’s vision for DIFC.

3. Leigh Flounders

Leigh Flounders is the Senior Vice President Head of Digital Strategy and Engagement at Emirates NBD. He bagged several awards till date, amongst which The 2017 South By Southwest(SXSW) Conference FinTech & Payments pitch winner deserves a special mention.

4. Craig Moore

Craig Moore is the founder of Beehive which is the first peer-to-peer lending platform in the Middle East and North Africa(MENA) region. Beehive was launched in November 2014, it connects businesses seeking finance and investors. Till date, it has provided finance to more than 32 SMEs.

5. Kanchan Kumar

Kanchan Kumar is one of the founders of Remitr. Remitr is an end-to-end money transfer platform which was started with an aim to make global payments simple. In the year 2016, it was recognized as one of the most promising startups in the UAE region.

6. Suvo Sarkar

Suvo Sarkar is the Senior Executive Vice President and Group Head in Retail banking & Wealth management at Emirates NBD. He contributes to the growth of revenue, profits and customer base for the bank by setting new standards for product innovation. He also publishes a column on the changing paradigms in the banking sector. He is considered as a Finovate speaker in the Middle East.

7. Abdul Fahad Al Jouf

Abdul Fahad Al Jouf is the founder of PayTabs. PayTabs is a payment gateway that provides businesses to transfer funds to each other without any complications. Realizing the difficulties faced by the SME merchants in the MENA region to get a payment gateway, Abdul developed PayTabs. It provides payment solutions to all kinds of business be it small and medium enterprises, large scale organizations, etc.

8. Mirna Sleiman

Mirna Sleiman is the CEO and founder of Fintech Galaxy which is a digital crowdsourcing platform. It connects fintech entrepreneurs and investors. Mirna is the former award-winning financial journalist. She even guided several banks and governments on their digital transformation projects.

9. Sridhar Iyer

Sridhar Iyer is the Head of Mashreq Neo and Banking. Mashreq Neo is the digital banking application that is working with an aim to make banking easy and swift for the customers. This definitely makes a good addition to the growth of fintech in the UAE region.

10. Moussa Beidas

Moussa Beidas is the founder of Bridg, a smartphone app. It is an app which uses Bluetooth to make online payments. It is the first app that works on flight mode as well. Bridg is definitely one of the best fintech innovations. It makes the payment process simple.

11. Sagar Sanap

Sagar Sanap is the AVP- Digital Sales Lead in Citi Bank. Being expertise in the field of Product strategy, Digital marketing, and campaign management, he is making a good share in the field of fintech.

12. Sam Quawasmi

Sam Quawasmi is one of the founders of the first equity crowdfunding platform Eureeca. It provides equity-based crowdfunding opportunity for the businesses. In the year 2013, Sam Quawasmi and Chris Thomas(Founder of Eureeca) were awarded “Innovator of the Year” award by Gulf Business Industry Awards in the UAE.

13. Peter Smith

Peter Smith is the managing director, policy and strategy at Dubai Financial Services Authority(DFSA). DFSA regulates the financial services conducted from Dubai International Financial Center(DIFC) which works with a vision to drive the future of finance.

14. Philip King

Philip King is the Global Head of Retail Banking at ADIB. Prior to ADIB, he worked in several other well-known banks. ADIB launched MoneySmart which is the first digital community in the Middle East region. It also added “ADIB Express” to their app in order to provide instant digital services to their customers.

15. Richard Teng

Richard Teng is the CEO of the Financial Services Regulatory Authority (FSRA), Abu Dhabi Global Market(ADGM). The first Fintech Regulatory Laboratory Framework in the MENA region was developed in ADGM under the supervision of Richard. He works in the development of Fintech ecosystem in Abu Dhabi region.

16. Wai Lum Kwok

Wai Lum Kwok is the Executive Director of Capital Markets, Financial Services Regulatory Authority (FSRA), Abu Dhabi Global Market(ADGM). He is known for his efforts and supervision in the development of Fintech in ADGM.

17. Promoth Manghat

Promoth Manghat is the CEO of UAE Exchange. He leads the global operations team of UAE Exchange center. He supervises in expanding UAE Exchange all over the world besides the day-to-day operations of his team.

18. Jayesh Patel

Jayesh Patel is the head of Liv. account of Emirates NBD. Liv. account is the first digital banking account in the UAE region. This account was launched by taking millennials and digital lifestyle into consideration. Liv account is one of the best add-ons to Fintech growth in the UAE.

19. Stelios Michaelides

Stelios Michaelides is the head of Digital Banking in Commercial Bank of Dubai(CBD). CBD Now is a digital banking product that was launched under the supervision of Stelios. It uses the latest technologies which promote in the safe and simplest way of banking for the customers.

20. Siddiq Farid

Siddiq Farid is the CEO and one of the founders of SmartCrowd. SmartCrowd is a real estate crowdfunding platform in the UAE. It is the only company that is regulated by the DFSA(Dubai Financial Services Authority) and the first company in UAE that supports digital real estate investments.

21. Tanvir Shah

Tanvir Shah is the Managing Director of The Partnerships Consulting. He supervises on banking, payments, fintech strategies, etc. in the MENA region. His works have been recognized by several popular publications like The Banker Middle East, Cards International, etc.

22. Lynnette Abad

Lynnette is the Director of Research and Data at PropertyFinder group. Having technology and real estate as her professional passions, she’s been working on PropTech for maximum time in her career.

23. Mark Chahwan

Mark is one of the co-founders of Sarwa. Sarwa is an online financial advisor that helps customers in finding investment opportunities with good returns and low-risks. It was recognized as one of the top 20 fintech companies by Forbes and the first startup to have an innovation license by the Dubai International Financial Center.

24. Mike Cunningham

Mike has been spending most of his career in the FinTech sector. He works as an independent mentor at DIFC(Dubai International Financial Center) Fintech Hive. Besides that, he is the CEO of BankClearly a startup which invented a new way of banking.

25. Omar Soudodi

Omar Soudodi is the managing director at PayFort. PayFort is a payment gateway platform which provides a secured and safe payment facility for online shoppers. It has won several awards in the MENA region along with the Best Fintech Company in the year 2016 by The Entrepreneur.

26. Usama Zafar

Usama Zafar is the Head of Digital & Direct Marketing in ADIB. He has 13+ years of work experience in well-acclaimed domestic and international companies. He is considered as a growth hacker with accomplishments of billion dollars in annual sales of the companies he worked.

27. Nameer Khan

Nameer Khan is not only a fintech influencer but also an insurtech. He is a founding board member of MENA Fintech Association which helps in shaping the future of financial services in the UAE.

28. Ola Doudin

Ola Doudin is the Cofounder and CEO of BitOasis which is digital asset exchange and wallet. It allows individuals to purchase, sell and trade digital assets. Along with the digital wallet and trading services, they also offer consulting services to the organizations.

29. Omar Rana

Omar Rana is the co-founder and director of strategy and finance in Finalytix. Finalytix provides financial advice and wealth management of a company. Omar is also a global fintech speaker who was invited to talk at various conferences.

30. Omeed Mehrinfar

Plug and Play Tech is a platform that connects Startups and the world’s largest corporations. Omeed Mehrinfar is the regional director of such an innovative platform that helps the startups, investors, etc connect with each other. Plug and Play Tech work on the main objective to catalyze technological advancement.

31. Osama Al Rahma

Osama Al Rahma is the CEO of the Al Fardan Exchange. Al Fardan Exchange is a well-known exchange center in the UAE. Apart from the Al Fardan Exchange center, he is a board member of certain well-acclaimed companies like Foreign Exchange and Remittance group, 2 the point, who is responsible for the development of strategies.

32. Tim Buckler

Tim Buckler is the Digital Sales Manager in Emirates Islamic Bank. With 9+ years of experience in the field of digital finance, his strategies mainly focus on developing overall e-commerce experiences. He helps in building the digital channel that eventually drives towards the customer and product gain.

33. Preeti Mundhra

Preeti Mundhra the Head of Marketing and Partnerships at the Liv. Digital Bank is one of the best fintech influencers in the UAE through Liv. account which is one of the best initiatives in the fintech space.

34. Shaheen Alkhudhari

The founder and CEO of the well-known rent and property management platform, Ajar Online is Shaheen Alkhudhari. This platform helps homeowners manage their properties by offering a quick online rent collection facility. This makes the process of receiving or sending rent very easy.

35. Khalid Saad

Khalid Saad is the CEO of Bahrain Fintech Bay. Bahrain Fintech Bay is the first fintech hub in Bahrain and largest fintech hub in the MENA region. He is also the Executive Director of Fintech Consortium which helps in growth and acceleration of Fintech ecosystems.

36. Sonny Zulu

Sonny Zulu is the Managing Director and Head of Retail Banking at Standard Chartered Bank. He is known for delivering outstanding performance at work which helped in the growth of profits, revenue, etc.

37. Eric Modave

Eric Modave is the Chief Operating Office in Arab Bank who is in charge of all the IT operations, Enterprise Digital Innovation, data management, etc. for the bank. Prior to the Arab bank, he worked at top-noted banks in other regions.

38. Denit Varghese

Denit Varghese is the Senior Digital Planner at Carat. With long career experience in the field of digital marketing, his motto of looking at the long term success rather than short term returns makes him the best at the industry.

39. Bogdan Maranu

Bogdan Maranu is the Associate Media Director at Spark Foundry. It is a start-up that melds an innovative business approach with resources and capabilities.

40. Omar Bin Brek

Omar Bin Brek is the founder of the UAE Fintech Startup Foloosi. Foloosi facilitates consumer to business payments with advanced technical solutions. This is definitely a good add-on to fintech realm.

Other than these, there are several other influencers who are helping in the growth of Fintech in the Middle East and North Africa(MENA) region.

Source:

https://www.mymoneysouq.com/financial-blog/top-40-fintech-influencers-to-follow-in-the-middle-east/

0 notes