#recordkeepingCalifornia

Text

Bookkeeping Mistakes Made By Small Businesses: How To Avoid Them

Small and Medium-sized businesses are eager to grow, but they often miss the fundamentals like understanding the value of Bookkeeping which may undermine business procedures.

Accounting is often overlooked by business owners who consider it easy. Incorrect accounting and bookkeeping processes may adversely impact any company’s finances. Recurring bookkeeping errors can actually bankrupt your business.

Bookkeeping Mistakes

Keeping financial records is a very important part of running a business, big or small. Bookkeeping that is accurate and well-organized makes sure that your financial records are up-to-date and precise, which helps you make good decisions and compliance with legal policies.

There are however some mistakes that small businesses often make with their books. Here are some of these mistakes.

Failure To Keep Records

Some small businesses fail to keep accurate financial records, which can lead to confusion and errors. Record-keeping is an essential process in organizing your financial records. Adopt best practices and create a system for organizing and storing your financial documents. These relevant documents may include invoices, receipts, and bank statements. It is helpful to consider using accounting software to automate the process and centralize everything.

Irregular Reconciling of Accounts

Failure to reconcile your bank and credit card accounts on a regular basis can lead to inconsistencies and inaccuracies. Reconciliation entails matching your financial records with your bank and credit card statements. Reconcile your accounts on a regular basis and resolve any discrepancies quickly to avoid problems.

Combining Personal and Business-Related Finances

It is critical to separate your personal and business finances by avoiding using personal accounts for business transactions. This can complicate bookkeeping and make it difficult to accurately track expenses and income. You must establish a separate business bank account and use it solely for business transactions.

Inconsistent Categorization

It is critical to properly categorize your income and expenses for accurate financial reporting. Refrain from inconsistent or ambiguous categorization, as it can make evaluating of your company’s financial health a lot more difficult. It will be helpful to create a chart of accounts with distinct categories that correspond to your field of business and use it regularly.

Neglecting Cash Transactions

Small businesses often transact in cash, which can be overlooked easily and not properly recorded. To ensure that cash transactions are accurately accounted for, use cash registers, petty cash logs, or digital tools. Better yet, set up a system for keeping track of and documenting all cash transactions, including sales and expenses.

Failure To Keep Track of Receivables and Payables

Failure to maintain track of unpaid invoices (accounts receivable) and bills to be paid (accounts payable) might jeopardize your cash flow and client-vendor relationships. Use accounting software with invoicing and payment tracking features to implement a structured strategy for monitoring and following up on both receivables and payables.

Mishandling Payroll

Payroll can be complicated, and mistakes can have legal and financial ramifications. Keep up with advances in payroll requirements, calculate wages and taxes accurately, and make timely payments to employees and tax authorities. To ensure accuracy and compliance, consider adopting efficient payroll software or you can also outsource payroll duties.

Failure To Keep Backup of Records

Financial records might be lost because of corrupted data, hardware failure, or other unanticipated factors. Back up your financial data on a regular basis and keep it secure. Cloud accounting software can back up your data automatically to add an extra degree of security.

Neglect To Track and Remit Sales Taxes

If your company is obligated to collect sales taxes, it is critical that you track and remit them appropriately. Understand your sales tax duties, register with the proper tax authorities, and maintain accurate sales and tax collection records. To simplify the process, consider employing seamless sales tax automation software.

Doing-It-Yourself

This is a critical error that can have serious consequences for your company. Because bookkeeping is a complex process, it is best to seek professional help from a bookkeeper or accountant to set up and review your bookkeeping system on a regular basis. They can assist you in avoiding mistakes, providing financial insights, and ensuring tax compliance.

You can reduce the likelihood of these frequent errors and retain accurate financial records for your small business by being proactive and following appropriate bookkeeping practices with the help of expert bookkeepers and record-keepers.

How to Avoid Bookkeeping Errors

To avoid bookkeeping errors some proactive steps must be taken by small business owners. This may include familiarizing yourself with basic bookkeeping principles and practices to help you navigate your financial records effectively and make informed decisions.

This can be further established by using a good bookkeeping system coupled with reliable accounting software. As a business owner, it is important to invest in a reputable accounting software solution that suits the needs of your business and reduces errors.

In addition, it is important to reconcile accounts regularly to ensure your financial records match financial statements to help identify discrepancies and errors promptly.

Keep meticulous records by maintaining detailed records of all financial transactions and accept that it is always best to seek professional assistance from reliable bookkeepers and record-keepers who specializes in small business finances.

By implementing these practices, small business owners can reduce the likelihood of committing bookkeeping errors while maintaining accurate financial records.

The Bottomline

When you own a company, you put yourself in a position to take advantage of many different possibilities, including the chance to learn from your errors. When it comes to making mistakes, the key to success is to steer clear of those that are readily apparent and cut down on others as much as you possibly can. Remember that good bookkeeping and record-keeping practices contribute to informed decision-making and long-term business success.

Consider this list seriously and implement its suggestion so you will be well on your way to running your business in profitable ways and expanding it in all ways possible.

There is more that you can achieve with the most reliable team of professional bookkeepers and record-keepers. Visit us now and get started!

#bookkeepingservicesca#recordkeepingcalifornia#smallbusinesssolutionsca#healthcaresupport#healthcare bookkeeping#cpa firm

7 notes

·

View notes

Text

Break out of your comfort zone! Level up your #bookkeeping and #recordkeeping processes with #thebookkeepersrus team of #experts😃. 📲Contact us! and we will help you #thrive💯!

#bookkeepingservicesla#reliablebookkeepersla#taxconsultancy#smallbusinessconsultancy#recordkeepingcalifornia#smallbiz#recordkeeping#thebookkeepersrus#healthcare bookkeeping#financial support#Los Angeles#California

4 notes

·

View notes

Photo

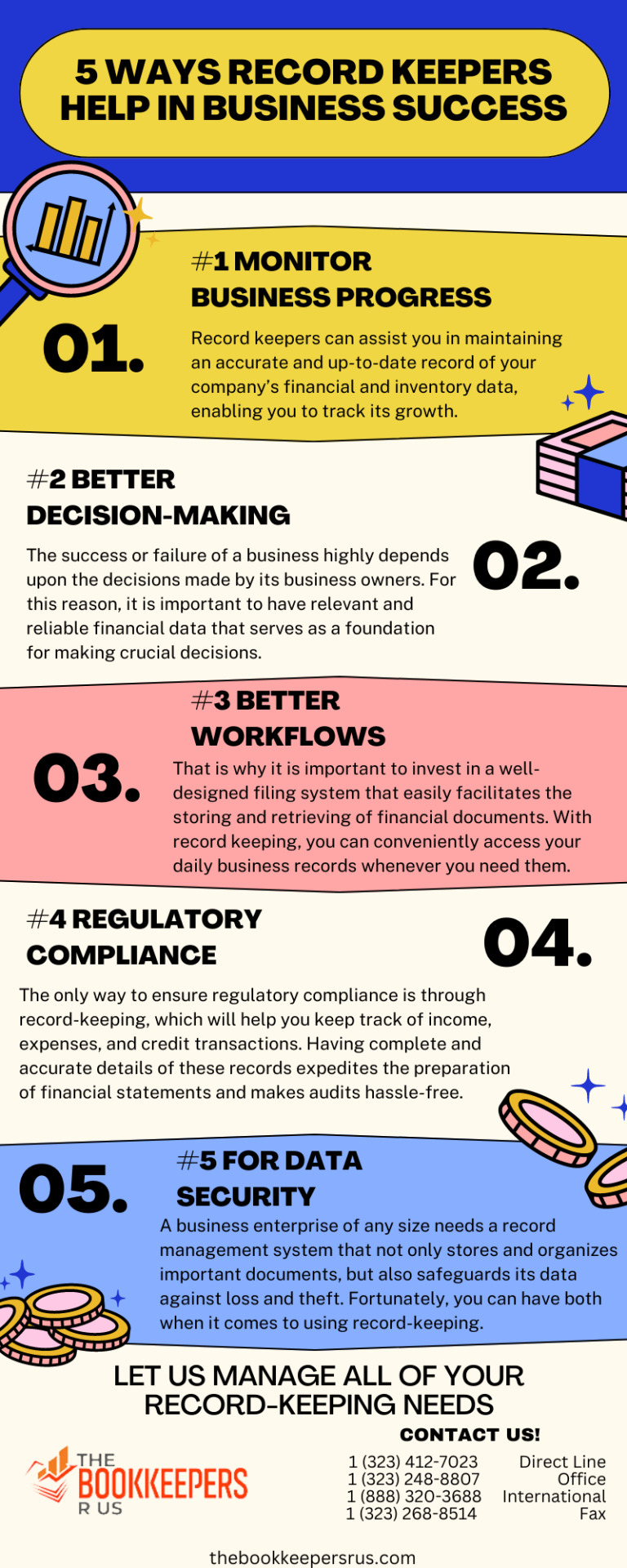

To learn more about bookkeeping services and how they can help your company succeed, consider the following best practices.

#thebookkeepersrus#recordkeepingCalifornia#affordablerecordkeepingLA#LArecordkeepers#Hirebookkeepersservice#bookkeeping

3 notes

·

View notes

Text

0 notes

Text

The Bookkeepers R Us is one of the leading CPA firms in California. Composed of reliable accountants and bookkeeping professionals this team specializes in providing high-quality financial and consultancy services to all clients and enterprises.

#bookkeepingLA#recordkeepingCalifornia#BestBookkeepersLA#reliablerecordkeepersLosAngeles#bookkeepingprofessionals#Hirebookkeepers

0 notes

Text

Does Smallbiz Need Bookkeepers Or Record Keepers?

Both professional services are considered critical components of any accounting process that contribute to the achievement of any business objective.

Bookkeeping is a component of the accounting process in businesses and other organizations which keeps books or financial transactions, such as income and expenses. On the other hand, the creation, collection, and management of records, particularly those of a business or government nature, is the coverage of recordkeeping.

Bookkeepers vs Record-keepers

Though bookkeepers and record keepers may perform similar work, they definitely have different skill sets. Let us see how their role varies.

Bookkeeper Role

Bookkeepers are in charge of keeping track of financial transactions, making sure that accounts are balanced, and making financial statements. They use accounting software and systems to keep accurate records of purchases, sales, payments, and receipts.

Bookkeepers also keep track of accounts payable and accounts receivable, manage payroll, and generate financial reports. They make sure that the financial records are correct, up-to-date, and in compliance with the laws and rules that apply.

Record-keeper Role

Record-keepers are responsible for keeping track of all kinds of business transactions, not just financial ones. They make and keep records about vital business records like those pertaining to their employees, customers, and sales.

Record keepers also have the task of organizing and preserving records in a way that makes them easy to locate and obtain when they are needed. To make sure that the records are correct, complete, and protected, they could utilize software to keep track of records or create and manually maintain documents.

Bookkeeping and Record-Keeping Helping Small Businesses

Prevents Fraud & Mistakes From Happening. Bookkeepers and recordkeepers are both very important to small businesses because they help the owners know how their finances are faring. All financial transactions are recorded correctly and on time. This will help keep fraud from happening and keep small business owners from making mistakes.

Help Organize Financial Records. Bookkeepers and recordkeepers help small business owners organize their financial records and keep track of how much money the business owes to its suppliers and how much money its customers owe the business. Organized financial records are crucial for business growth and expansion.

Making Smart Financial Decisions. They help business owners make smart financial decisions, like where to cut costs or make more money. By looking at their balance sheets, income statements, and cash flow statements, they can easily see how financially stable the business is. This is important for making budgets for improvement and for filing taxes.

Comply With Tax laws and Rules. These experts offer reliable services that make it easier for small business owners to follow tax laws and rules. It is assumed that employees are paid correctly and on time and that tax laws are followed, so that audits and fines, which can be very expensive and cause a lot of trouble, don’t arise.

Make Financial Processes Easier. They make the process easier for small businesses, which can be helpful for a busy business owner. Keeping track of receipts, invoices, and bank statements on their own can take a lot of time for business owners. It provides free time for small business owners to take care of other essential tasks like sales, marketing, and customer service.

In Summary!

It can be said that recordkeeping and bookkeeping functions are both valuable assets for any small business and even start-up. These reliable professionals like The Bookkeepers R Us provide expertise, organization, and financial insights, which can help small businesses to succeed and grow.

Bookkeeping and record-keeping expert services will help ensure that financial records are accurate, organized, accessible, and secure so every small business owner can arrive at informed decisions that will definitely give a competitive edge to the business.

As a business owner, it is our goal to improve sales and increase profit margins. To achieve these you must work with the best bookkeepers and experienced record-keepers today!

Get started! Call us now!

#recordkeepingcalifornia#bookkeepingservicesca#losangeles#healthcarebookkeepers#honest recordkeepers#californiaservices

5 notes

·

View notes

Text

We understand the importance of your time and want to help you run your business more efficiently and effectively. Our team is committed to providing the highest quality of customer service.

#reliablebookkeepersla#bookkeepingservicesla#recordkeepingcalifornia#best recordkeepers la#smallbusinesssolutions#smallbiz#startup tips

3 notes

·

View notes

Text

#Thrive with our reliable services. Visit Us!

#recordkeepingcalifornia#bookkeeping#record keepers#smallbusinesssolutions#business success#business tips#thebookkeepersrus

5 notes

·

View notes

Text

The Los Angeles and California reliable services for every business, big and small. Visit us!

#reliablebookkeepersla#bookkeepingservicescalifornia#recordkeepingcalifornia#smallbusinesssolutions#foryou

5 notes

·

View notes

Text

Reliable and trustworthy Record-Keepers and Bookkeepers in Los Angeles, California. Hire The Bookkeepers R Us!

#thebookkeepersrus#reliablecpas#recordkeepingcalifornia#los angeles bookkeepers#cpa california#affordablebookkeepingla

3 notes

·

View notes

Text

Reliable and trustworthy Record-Keepers and Bookkeepers in Los Angeles, California. Hire The Bookkeepers R Us!

#reliablecpas#recordkeepingcalifornia#cpa firm los angeles#bookkeepingservicesla#bookkeepingsocal#southern california services#cpa california

2 notes

·

View notes

Photo

Does a Small Business Need a Bookkeeper?

#bookkeepingLA#thebookkeepersrus#affordablerecordkeepingLA#recordkeepingCalifornia#LArecordkeepers#Hirebookkeepersservice

3 notes

·

View notes

Photo

What Are The 5 Ways By Which Record Keepers Help Achieve Business Success?

#thebookkeepersrus#LArecordkeepers#affordablerecordkeepingLA#recordkeepingCalifornia#bookkeepingLA#Hirebookkeepers

3 notes

·

View notes

Text

Speed is essential to achieve #business success! #thebookkeepersRUs will help 100%

#TopBookkeepers#bookkeepingservicescalifornia#outsourcebookkeepersla#recordkeepingcalifornia#hirebookkeepersla#affordablerecordkeepingla

2 notes

·

View notes

Text

When Should You Hire a CPA?

There are critical times when your small business requires the services of a CPA (Certified Public Accountant), from selecting a company structure that allows you to save the most money on taxes to offering advice on a significant business move.

As a small business owner, you may find it challenging to determine when to outsource tasks and when to manage them yourself. This is especially true if you’re looking for a certified public accountant (CPA), if you’ve recently established your business or if it’s grown beyond expectations.

While you can easily handle day-to-day accounting on your own, especially if you have decent accounting software or a bookkeeper, there are times when the knowledge of a CPA may help you make wise business decisions, avoid costly mistakes, and save you time.

When to Hire a CPA

#1 When Your Business is Starting Off

Accountantscan assist a small business at different stages of growth. To get your business off to a good financial start you need to consult a CPA. Your accounting and tax reporting responsibilities will be determined by how you register and run your business for the rest of your career.

A CPA may evaluate your business plan, ensure its financial viability, and assist you in preparing a budget to carry it out. If you intend to manage your day-to-day bookkeeping at first, a CPA will also point you in the direction of the best software choices for your specific business plan.

#2 When Filing Taxes or Being Audited

Whether you run a sole proprietorship or a corporation it is a given fact that tax season is a business burden. It is full of risky and expensive mistakes when done incorrectly. Long before the deadline for filing, business owners need to have a second pair of eyes to review their tax forms.

You can assign your tax-related tasks to an accountant, tax preparer, or a CPA who can perform both of these functions in order to spare yourself the hassle. CPAs handle both personal and business taxes, and they are skilled at navigating tax season, reducing your responsibilities, and protecting your company in the event of an error or tax audit. Also, it is best to hire an accountant before an audit happens, especially if you can find one who would provide audit insurance.

It is essential to be reminded that not allaccountantsprepare taxes so before outsourcing a professional be sure to find out whether tax services and protections are provided.

#3 When You Apply for a Loan, Grant, or Other Funding

Even for business owners with a track record of profitable operations, applying for a business loan and other forms of funding can be difficult. Establishing credibility is the first challenge, which is particularly challenging for new firms and startups. However, aCPAcan help you in staying on top of things and navigate the rough waters.

They will assist you in evaluating various strategies for establishing business credit and directing you to low-risk options. Even better, a CPA can help you in narrowing the field of loan options to those that are best suited to your budget such as choosing between a microloan or a standard term loan.

#4 When You Require Assistance with Financial Planning and Analysis

Planning and analysis are two areas where accountants thrive. One of the main advantages of employing an accountant is having access to their depth of financial knowledge.

This is especially true if you work with a CPA who has experience in your field or industry. You can involve them in any financial decision or goal, such as buying property, merging with a rival business, or cutting operating expenses.

#5 When You Need to Save Time

Managing your time can be challenging, especially when you’re facing many deadlines, clients, and complex client tasks.

If daily duties like tracking expenses, verifying transactions, data entry or processing receipts are taking up your time, a bookkeeper could be the right fit for the job. However, if you require a front-line professional to analyze your company’s operations, trends, costs, and revenue on a regular basis, it may be time tohire a CPA.

Time is an important resource, and hiring an accountant may simply come down to how much time your business can save.

The Bottom Line

As you can see, accountants can assist you at every level of your company’s growth. The right accountant should make your life easier so you can focus on what you love.

There is no exact science to knowing when to hire an accountant. However, there are some clear cases where it makes sense to use their skill set. When starting or growing your business, creating a financial plan, evaluating business reports, or applying for funding, consult with an accountant.

Understand your financial situation and make your money work for you and your business. Outsource experts from The Bookkeepers R Us and get those stress off your shoulders! Call us!

#bookkeepingLA#recordkeepingCalifornia#BestBookkeepersLA#reliablerecordkeepersLosAngeles#bookkeepingprofessionals#Hirebookkeepers#SmallBusinessSolutionsCA#bookkeepingservicesCA

4 notes

·

View notes

Photo

Does a Small Business Need a Bookkeeper?

#bookkeepingservicesCA#thebookkeepersrus#Hirebookkeepers#TopBookkeepers#recordkeepingCalifornia#LArecordkeepers#affordablerecordkeepingLA

2 notes

·

View notes