#affordablerecordkeepingLA

Text

If you want timely, accurate, complete, cost-effective record keeping service then our team is here to provide you the service you need! Call us!

#affordablerecordkeepingLA#outsourceBookkeepersLA#reliablebookkeepersLA#LosAngelesCPAfirm#LAbookkeepers#LArecordkeepers#Hirebookkeepersservice#TopBookkeepers

6 notes

·

View notes

Text

5 Ways Bookkeeping Can Help You Run Your Business

It is risky to operate a business without understanding how finances work, and the same holds for those with no time for financial planning. One way to guarantee the success of running a business is through bookkeeping.

Why Bookkeeping?

Bookkeeping is the process of tracking financial transactions. It provides accurate and up-to-date accounting records such as invoices, subsidiary accounts, general ledgers, and payroll.

The use of bookkeeping can contribute to the growth and success of a business, while its absence makes financial planning more complicated, not to mention the risk to your company’s financial security.

So if you’re considering to outsource bookkeeping services in Los Angeles, then here are five essential things you need to consider so it can be of help in running your business:

#1 Keeps Information Organized

Any inaccuracies or errors in the company’s financial records can result in significant issues. This includes late payments, penalties, and additional fees. These inconveniences that cause delays can be avoided with the help of regular bookkeeping.

Bookkeeping organizes all financial data, making it easier to track and retrieve any necessary financial information. It ensures that errors are minimized so that transactions can be interpreted clearly and analyzed accurately. In addition, bookkeeping ensures the prompt payment of bills and submission of tax documents.

Having systematic records eliminates the need to make last-minute arrangements. Instead, bookkeeping will help you maximize your time and increase your business’s productivity to its fullest potential.

#2 Leads To Better Decision-Making

A business owner must make numerous decisions, the majority of which entail the expenditure of funds, such as hiring a new employee or opening a second location. Therefore, it is vital to make the best choices regarding the company’s financial status to ensure continuous operations.

Bookkeeping provides detailed and up-to-date financial information, which serves as a foundation for making effective and efficient decisions for your business. With visible financial performance, you can confidently decide if your company can afford investments such as loan applications or office renovations.

If you have doubts about making significant decisions, why notoutsource bookkeepers in LAwho can recommend to you the best course of action for the growth and success of your business?

#3 Monitors Your Profit

Keeping track of your company’s finances can be challenging, particularly throughout an expansion. Monitoring your income statements is fortunately one of the benefits of bookkeeping.

Bookkeeping provides a record of financial statements that enables you to quantify your company’s earnings over a specific time period. Using this relevant data, you can observe and compare your current progress to your past progress.

In addition, a comprehensive view of your revenue enables you to determine how much your business is earning and whether it is sufficient to cover expenses, while also making it easier to develop the business strategies and objectives required for business success.

If you are in need of assistance with your company’s profits, The Bookkeepers R Us is an affordablerecord keeping company in LAthat guarantees an accurate timeline for identifying guaranteed Return of Investments (ROI).

#4 Keeps Track Of Your Expenses

Aside from monitoring your profit, bookkeeping also tracks your expenses that are both profitable and insignificant. Using this financial data will give you an idea of how to control your costs and create the optimal budget your company requires.

It is advantageous for businesses and even small business owners to be financially secure from the start in order to avoid unnecessary expenses and set aside funds for unforeseen costs.

So if you own a small business and have difficulty keeping track of your expenses, it’s probably time to outsource experts who providesmall business solutions in CA.

#5 Prepares Taxes In Advance

Tax preparation can be extremely stressful, particularly if you are unprepared and pressed for time. Every tax season, you can hire bookkeepers to organize your books.

Bookkeeping services ensure the accuracy and organization of financial records, allowing you to determine the amount of tax your company owes and make timely tax payments.

In addition, having an experiencedbookkeeperprepare your taxes could indeed reduce the amount of work you need to complete and minimize the likelihood of receiving costly bills and penalties.

Wrap It Up!

So there you go! You can confidently plan for the future of your business with proper bookkeeping, as tracking financial transactions enables you to be more organized, receive financial assistance, and make well-informed choices.

Hiring bookkeeping professionals simplifies the process to record and manage financial data, allowing you to devote more time to achieving the business growth you envisioned.

The Bookkeepers R US offers the most trustworthy bookkeeping services in California, allowing you to make the best financial decisions for your company.

No more second thoughts, contact us now!

#affordablerecordkeepingLA#outsourceBookkeepersLA#reliablebookkeepersLA#LosAngelesCPAfirm#LAbookkeepers#LArecordkeepers#Hirebookkeepersservice#TopBookkeepers

5 notes

·

View notes

Photo

To learn more about bookkeeping services and how they can help your company succeed, consider the following best practices.

#thebookkeepersrus#recordkeepingCalifornia#affordablerecordkeepingLA#LArecordkeepers#Hirebookkeepersservice#bookkeeping

3 notes

·

View notes

Text

Mistakes are risky to businesses of all sizes! Fortunately, this is something that can be handled by Bookkeepers R Us's regular bookkeeping and record-keeping services. Let's get in touch!

Source: thebookkeepersrus.com

#affordablerecordkeepingLA#outsourceBookkeepersLA#reliablebookkeepersLA#LosAngelesCPAfirm#LAbookkeepers#LArecordkeepers

0 notes

Photo

Does a Small Business Need a Bookkeeper?

#bookkeepingLA#thebookkeepersrus#affordablerecordkeepingLA#recordkeepingCalifornia#LArecordkeepers#Hirebookkeepersservice

3 notes

·

View notes

Photo

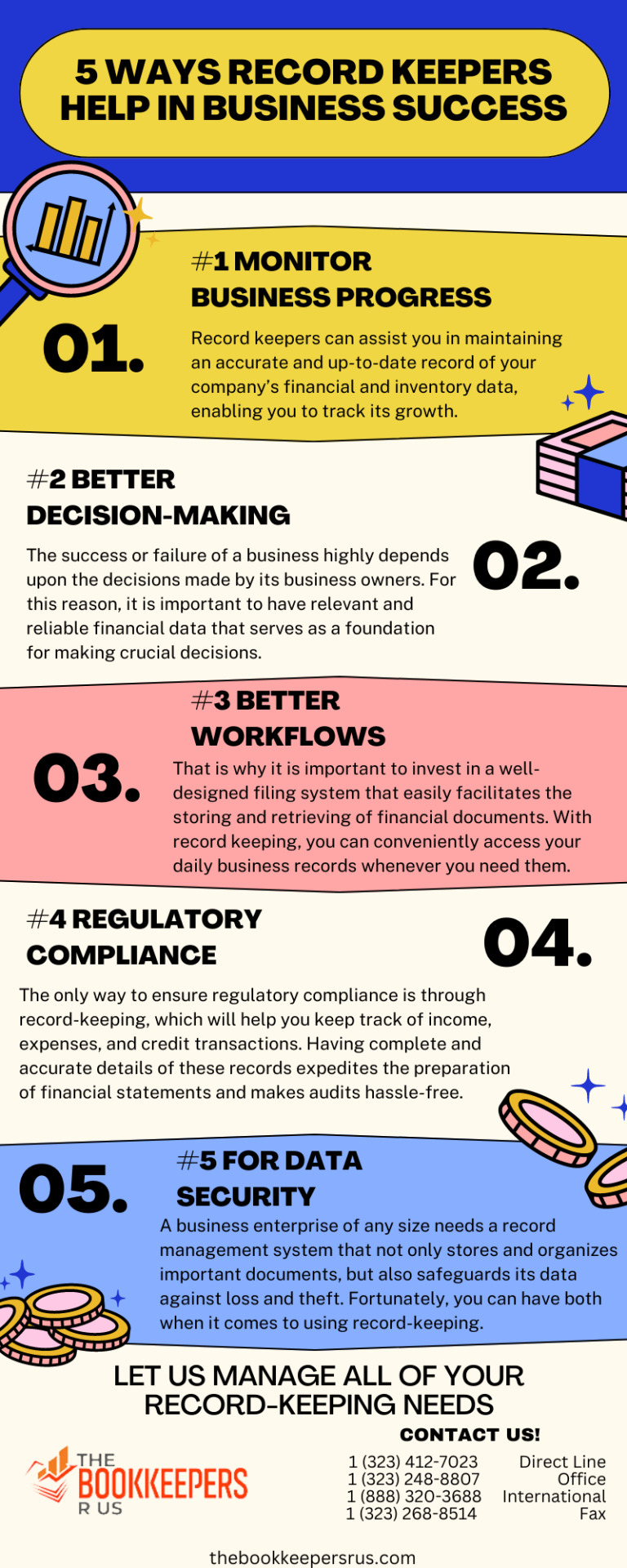

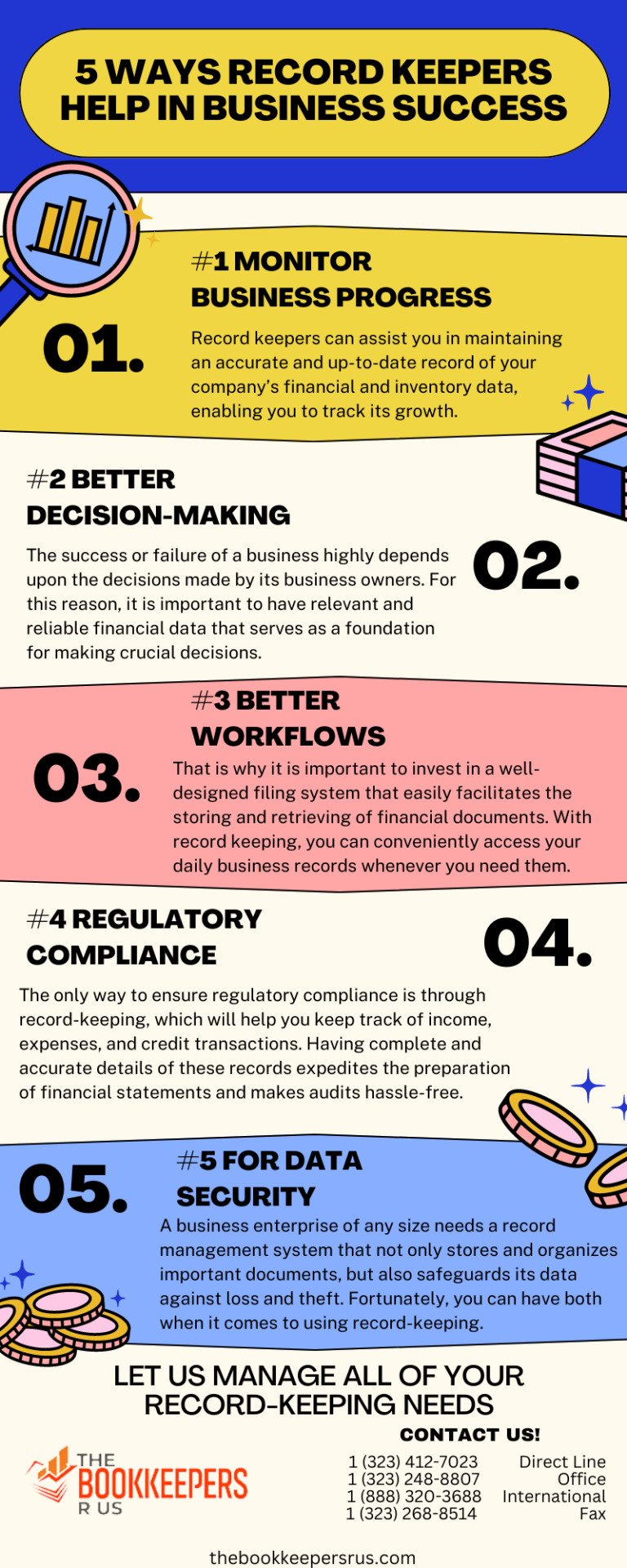

What Are The 5 Ways By Which Record Keepers Help Achieve Business Success?

#thebookkeepersrus#LArecordkeepers#affordablerecordkeepingLA#recordkeepingCalifornia#bookkeepingLA#Hirebookkeepers

3 notes

·

View notes

Text

Speed is essential to achieve #business success! #thebookkeepersRUs will help 100%

#TopBookkeepers#bookkeepingservicescalifornia#outsourcebookkeepersla#recordkeepingcalifornia#hirebookkeepersla#affordablerecordkeepingla

2 notes

·

View notes

Text

Time to drive solutions! Visit The Bookkeepers R Us and find out more about #business #success.#Hirebookkeepersservice #Los Angeles #California Services

2 notes

·

View notes

Photo

Does a Small Business Need a Bookkeeper?

#bookkeepingservicesCA#thebookkeepersrus#Hirebookkeepers#TopBookkeepers#recordkeepingCalifornia#LArecordkeepers#affordablerecordkeepingLA

2 notes

·

View notes

Photo

Record-keeping offers a wide range of services that are incredibly helpful for companies of all kinds. Additionally, it is a core part of managing a business that you must not overlook. Read on to learn more about the practice of sound business record-keeping.

https://thebookkeepersrus.com/the-art-of-good-record-keeping/

#thebookkeepersrus#recordkeepingCalifornia#affordablerecordkeepingLA#LArecordkeepers#Hirebookkeepers#bookkeepingLA#bookkeepingprofessionals

2 notes

·

View notes

Photo

5 Reasons Why The Bookkeepers R Us is the Best CPA Firm in Los Angeles

#accountant#bookkeepingLA#Hirebookkeepers#thebookkeepersrus#affordablerecordkeepingLA#recordkeepingCalifornia#LArecordkeepers

2 notes

·

View notes

Text

Mistakes are risky to businesses of all sizes! Fortunately, this is something that can be handled by Bookkeepers R Us's regular bookkeeping and record-keeping services. Let's get in touch!

#affordablerecordkeepingLA#outsourceBookkeepersLA#reliablebookkeepersLA#LosAngelesCPAfirm#LAbookkeepers#LArecordkeepers#Hirebookkeepersservice#TopBookkeepers

3 notes

·

View notes

Text

Is your accounting too complicated? We guarantee that our professional #bookkeeping and #recordkeeping services will enhance your financial strategies! Visit The Bookkeepers R Us today!

#affordablerecordkeepingLA#outsourceBookkeepersLA#reliablebookkeepersLA#LosAngelesCPAfirm#LAbookkeepers#LArecordkeepers#Hirebookkeepersservice#TopBookkeepers

2 notes

·

View notes

Text

Net Income Versus Cash in The Bank—Why They Never Match!

When you look at your net income versus cash flow, why are they different? If net income is the money that you bring in, and cash flow is the cash you have on hand, aren’t they the same thing?

Nope. And that’s one of the things that trips up many small business owners. And this isn’t just semantics. The difference really matters. Have you ever looked at your income statement and seen that it reads at $15,000 for the month, but your bank account shows you have less cash than that? That’s because net income and cash flow mean different things, and shouldn’t be used interchangeably, or you’ll get a misleading picture of your business.

Here’s what net income and cash flow both mean, and why that’s important to you.

For starters, net income is the profit that your small business earned over a period of time. Specifically, net income is your revenues minus the expenses you incurred to earn those revenues. The word revenue is key here. In accounting, you only record revenue when you’ve earned it (when you’ve done the work)—not when it’s received (when someone actually pays you).

Whereas your cash flow is the money you actually have on hand—what people have actually paid you that you deposit into your bank account.

For many small businesses, just looking at net income and not cash flow can be misleading. You might have earned $60,000 in revenue last month. But if your customers don’t pay you for a few months, your cash flow will be lower.

Things get even more complicated if you, like many small businesses, get paid on terms (for example, if you receive a deposit for work you haven’t completed). For example, if you are paying back loans, that will affect cash but not the income statement.

So keep this in mind when you’re looking at revenue versus cash flow!

#affordablerecordkeepingLA#outsourceBookkeepersLA#reliablebookkeepersLA#LosAngelesCPAfirm#LAbookkeepers#LArecordkeepers#Hirebookkeepersservice#TopBookkeepers

2 notes

·

View notes

Text

How much is your franchise actually worth: Balance sheet versus income statement

To understand how well your small business is doing, you need to know both how it’s doing on a particular time frame (e.g., every month and quarter) as well as how it’s doing overall (how much it is actually worth). If you’ve ever thought of selling your franchise, this really matters.

Getting a holistic picture of your business’s financial health is critical so that you’re not blindsided by bad news—you thought you were doing well because you had a great few months… but when you want to sell your franchise, you suddenly find out that it isn’t worth as much as you thought.

Think of it like going to the doctor. Maybe

you haven’t gained weight in the past six months (yay!) and you think you’re in great shape. But if you look back since your early 20s, you’ve put on an extra 30 pounds and your blood pressure is too high. If you simply track your weight month to month, you only get a limited view. If you examine other factors and your health overall, you know that you need to make a few changes.

How to gauge what your business is really worth

Let’s discuss how we can look at the overall health of your business. To start, let’s look at the differences between income statements and balance sheets, and what you can learn from them.

An income statement is what most small business owners tend to look at most.

As you know, it shows you how much you’re bringing in (revenue) and how much you’re spending (expenses) over a specific time period (e.g., monthly or quarterly). There’s a bit more to it (for example, to be accurate you need to organize everything by categories) but that’s the gist.

The income statement shows you your bottom line, which is your revenue minus expenses—profit—during a specific period. It’s a great way to see the impact of certain costs (e.g., looking at your biggest expenses) on your bottom line.

But just knowing dollars in, dollars out, and what’s left over every month won’t tell you what your company is actually worth. To do that, you need your balance sheet to show you the big picture.

Using the balance sheet to get the big picture.

The balance sheets pulls together three things: what your business owns (assets like property, equipment and inventory); what it owes (liabilities including loans, expenses, payroll); and what’s left after liabilities (your equity as an owner).

In addition to tracking assets, liabilities and the resulting equity, the balance sheet shows the total worth of a company, not just how it’s doing on a particular time period (like the income statement).

Looking at both your income statement and balance sheet is super important. It can show you red flags, like the fact that perhaps your liabilities are higher than your assets. To a potential buyer of your franchise, that would show a weak financial position. But if you knew that because you were keeping up to date and accurate books, you could make important changes to put yourself in a better position.

The bottom line for small business owners who want to understand the true value of their business?

Start with your books. Keep your financials current and accurate. One of our clients recently told us that they immediately valued a business twice as much if its books were current and accurate. To investors or potential buyers, how you keep your books is a sign of how the business is valued.

#Hirebookkeepers#SmallBusinessSolutionsCA#bookkeepingservicesCA#affordablerecordkeepingLA#outsourceBookkeepersLA#reliablebookkeepersLA#LosAngelesCPAfirm

2 notes

·

View notes

Text

How do record-keepers and bookkeepers help startups! Find out more! Visit us!

#bookkeepingla#reliablebookkeepersla#thebookkeepersrus#bestbookkeepers#losangeles#california services#recordkeepingcalifornia#honest recordkeepers#affordablerecordkeepingla

0 notes