#pension administration software providers

Text

Quantum Computing in Retirement Plan Industry

Introduction

Competition in the 401(k) retirement plan industry is increasing. Administrators and recordkeepers want to stay afloat amidst rising fee pressures, evolving demographics, and changing customer preferences. Leveraging technology is one way to achieve the desired outcomes. Quantum computing is among the advanced technologies that can provide recordkeepers and retirement plan administrators with a competitive edge. Quantum computing can help optimize your retirement plan administration services by assisting your transition from legacy systems. In addition, it can significantly improve recordkeeping speed and accuracy while reducing costs. Let’s break down how quantum computing can help 401(K) plan administrators and recordkeepers advance in the retirement plan industry.

What is quantum computing?

Quantum computing is a form of computing that utilizes subatomic particles to solve problems much faster than traditional computers. It uses qubits (quantum bits) instead of bits of binary code to store and process data. Qubits work differently than bits because they can be in multiple states simultaneously (called superposition). It means that quantum computers can process more information simultaneously, which makes them faster and more powerful than traditional computers. Recordkeepers can utilize these capabilities to speed up complex tasks like analyzing large datasets. Additionally, quantum computers can access complex algorithms designed to solve optimization problems. They can work with data with noise or other errors without sacrificing accuracy or speed.

How does quantum computing help with retirement planning?

Quantum computing offers retirement plan administrators and recordkeepers a massive advantage when monitoring account balances and tracking plan transactions. By utilizing the power of quantum computing, administrators and recordkeepers can create more efficient plans for their clients. For instance, it allows them to quickly identify optimal investment strategies by analyzing massive amounts of data about market trends, participant preferences, and other factors that affect retirement planning decisions. Additionally, it helps them identify opportunities for cost savings by reducing the time spent on manual processes such as fund selection and rebalancing. By leveraging quantum computing technology, retirement plan administrators can reduce operational costs while improving customer service levels at the same time. Finally, it helps them better assess risk using sophisticated algorithms to simulate various scenarios to determine which strategies will yield the best outcomes over time. As a result, they can identify potential fraud or compliance issues quickly and accurately.

The benefits of quantum computing in Retirement planning

Using quantum computing for retirement planning offers numerous advantages compared to traditional systems:

Make better decisions by quickly analyzing vast amounts of data without sacrificing accuracy or precision.

Reduces costs by eliminating manual processes.

Enhances 401(K) compliance and year-end reporting capabilities.

Improves security on a single platform rather than across multiple systems.

Solve complex optimization problems such as portfolio management and asset allocation.

Conclusion

Quantum computing has the potential to revolutionize the 401(k) retirement plan industry by providing administrators and recordkeepers with an unprecedented level of efficiency. Retirement plan service providers must be willing to embrace new technologies to stay ahead of their competition. You can leverage the superior speed and performance capabilities of quantum computing. It offers a versatile approach to solving complex optimization problems while reducing costs associated with manual processes. As the retirement landscape evolves, quantum computing will undoubtedly play an important role in retirement plan administration.

Authors: Congruent Solution

#401k plan administration software#401k plan compliance testing#pension administration software providers#retirement plan administration services

0 notes

Text

Best Pension Administration Software Providers in India - Infotrack

Looking for the best pension administration software providers in India? Check out infotrack systems retirement management solutions for streamlined and efficient pension management. Our software simplifies pension administration for employers and provides a hassle-free experience for retirees. Contact us today to learn more.

#pension administration system software#pension administration software#pension management software in India#pension administration software providers#retirement management solutions

0 notes

Text

Kyriba Enterprise Software For Office Of The Cfo

The Continuous Professional Development is a set of the training activities which professionals take on to develop and improve their expertise and abilities. You can achieve CPD by way of several sorts of learning, like attending conferences, coaching workshops, and events, e-learning courses and many more. Making CPD points is an important demand of many professional our bodies within the United Kingdom. The number of clients utilizing Sage software program is greater than six million, many businesses are growing, which belief in Sage to help to handle their corporations. Sage certifications are the symbols that you would possibly be a competent Sage user, and it provides credibility to potential employers that you're absolutely up-to-speed and ready to start utilizing the techniques right away. Whether you are new to F&A or an skilled professional, typically you need a refresher on common finance and accounting terms and their definitions.

youtube

Release liquidity to all your suppliers for a risk-free return, whereas producing millions in price financial savings and making certain a wholesome supply chain. Want to achieve our 20,000 monthly web site visitors with your thrilling opportunity? Upload your open role on our website and increase your company’s reach instantly. With our talent for spotting the proper mixture of skills, experience, and character for your function, you can really feel assured we’ll secure the best match. RED Global helps you overcome the challenges of grownup studying with tailored coaching options for your particular objectives.

Signal As A Lot As Circulate

Fragmented methods architectures and inefficient local processes have turned liquidity reporting into a difficult task, whereas world danger management stays a daunting, largely handbook, exercise. Today’s realities imply all that complexity and disparity need to be urgently addressed, and resilience towards multiple kinds of risk must be well embedded into treasury processes and methods architectures. Kyriba's cloud platform delivers treasury, threat management, funds and dealing capital solutions supported by real-time connectivity. Watch this video to see an outline of how our merchandise assist our 2,500+ corporate prospects handle their liquidity and unlock value. A non-disruptive introduction of S/4HANA Central Finance for company treasury would, typically, involve the delivery of a liquidity reporting layer alongside improved governance in areas corresponding to checking account administration . Moving ahead, treasury can deploy extra functionality on the central finance instance and use it not only as a reporting layer but as a transactional hub.

Taulia’s early payment and invoicing solutions are designed to swimsuit suppliers of all sizes so you can achieve your goals with only one provider.

Some of our shoppers include pension funds, consultants, wealth managers, platform providers and independent financial advisors.

However, the implementation of know-how required to help this role has not at all times been ideal.

The foundation of the eligibility is on international accounting and auditing standards and compliant to the IFAC.

Risk Management is organized via Chief Risk Offices for every core enterprise and critical operation. Risk managers present shared support to BNY Mellon for operational risk companies for Global Corporate Trust, Depositary Receipts, Treasury Services and Global Operations in EMEA. Compliance helps guarantee BNY Mellon's companies maintain appropriate processes to adjust to applicable laws, regulations, BNY Mellon policies and ethics. This is achieved by way of enterprise - and enterprise partner - specific groups of pros, underneath centralized global administration. BlackLine is a high-growth, SaaS enterprise that is remodeling and modernizing the way finance and accounting departments operate.

What Online Sap Courses Am I In A Position To Study?

As we mentioned, the usually centralised nature of treasury makes this surroundings an ideal landscape. A range of treasury processes from POBO, PINO, and money pooling to hedge administration, EMIR reporting, and bonds issuance can be centrally deployed on CFIN making probably the most of all the most recent and biggest S/4 capabilities. Central Finance technical deployment ought to precede any cutover of the S/4 Treasury functionality, to permit time to test the database’s resilience and verify its good functioning earlier than the business go-live. As a project stakeholder, you will also want to guarantee that processes in the source methods are well-defined, understood and followed.

It has tens of millions of presentations already uploaded and out there with 1,000s extra being uploaded by its customers daily. Whatever your space of curiosity, here you’ll have the flexibility to find and consider shows you’ll love and possibly obtain. Unlock working capital for yourself and accelerate funds to suppliers with third-party funding to keep your money available longer.

Launched in 2018, the Digital Office works across all BNY Mellon lines of business to deal with client priorities and regulatory issues. As a end result, candidates who be a part of will work with a really cross-functional staff to re-imagine challenging enterprise issues and construct new options. In-person and digital technical, monetary and professional studying & growth. When you are a graduate of this coaching programme, you would possibly be valuable with the verified CPD points. It is important if you are an accountant to realize CPD factors to take care of your accounting membership to cooperate with Professional Accounting Bodies like AAT, ACCA, ICAEW, CIMA etc. necessities. We exclusively structure our CPD Training for ACCA CPD courses along with CPD courses for other accounting our bodies similar to AAT, ICAEW, CIMA, etc.

click reference around the world get access to key sources to develop expertise, work together with friends in F&A to trade ideas and leading practices, and share their suggestions to guide future product improvement. The path from traditional to trendy accounting is totally different for each group. BlackLine’s Modern Accounting Playbook delivers a proven-practices approach to assist you identify and prioritize your organization’s crucial accounting gaps and map out an achievable path to success. Create, evaluation, and approve journals, then electronically certify, submit them to and store them with all supporting documentation.

Decision-making in a modern treasury and finance function depends heavily on know-how excellence. Centralize your enterprise-wide payments to manage money, eliminate fraud danger and cut back total payment costs in your group. Kyriba's Connectivity-as-a-Service connects to 1,000 banks, 10,000 ERP instances, and a network of apps, platforms and methods to unify knowledge and automate real-time decision-making for ERPs, Treasury and Payables/Receivables. All of our programs are delivered by our licensed, experienced trainers with huge information and experience in their chosen subject. With offices in London, New York, Boston and San Francisco, Newton manages US$145 billion of belongings .

Taulia is a leading supplier of working capital solutions, centered on enabling patrons and suppliers to choose when to pay and receives a commission, freeing up cash for every business to thrive. Deloitte LLP is the United Kingdom affiliate of Deloitte NSE LLP, a member firm of Deloitte Touche Tohmatsu Limited, a UK private firm limited by assure (“DTTL”). DTTL and every of its member corporations are legally separate and independent entities. Please seeAbout Deloitte to be taught more about our global community of member corporations. Its versatile configure as per country particular requirements of Reporting, Tax and Depreciation. We are recruiting for an SAP Treasury Consultant with the experience to add worth to present tasks and the ambition to additional develop within treasury administration and different treasury systems.

#sap cash management training uk#sap cash management course uk#sap cash management training london#sap cash management course london

2 notes

·

View notes

Text

Comprehensive Payroll Services in Oxford: Enhancing Business Efficiency and Compliance

In today's fast-paced business environment, efficient management of payroll services in Oxford is crucial for any company aiming to maintain compliance and enhance operational efficiency. Oxford, a hub of both historical significance and modern business, is no exception. As businesses in Oxford strive to stay competitive, the role of comprehensive payroll services cannot be overstated.

Why Opt for Comprehensive Payroll Services?

First and foremost, payroll management extends beyond mere salary distribution. It encompasses the accurate calculation of wages, deductions, and tax withholdings — all pivotal for compliance with government regulations. A mistake in these areas can lead to hefty penalties and damage to a company's reputation. This is where professional payroll services come in, offering meticulous attention to detail that ensures compliance with all applicable laws and regulations.

Enhancing Business Efficiency

Outsourcing payroll services can significantly free up business resources, allowing management and staff to focus on core activities rather than administrative burdens. For businesses in Oxford, where innovation and efficiency drive competitiveness, being bogged down by payroll management can be a disadvantage. Payroll providers leverage advanced software and expertise to streamline processes, reduce errors, and ensure timely payroll execution, thereby boosting overall business efficiency.

Navigating Complex Regulations

Oxford businesses must navigate a complex array of employment laws and tax regulations. Professional payroll services stay abreast of the latest changes in legislation, ensuring that your business always remains compliant. This is particularly beneficial for businesses that lack in-house expertise in these areas.

Customised Solutions for Diverse Needs

Every business in Oxford has unique needs based on its size, industry, and business model. Comprehensive payroll providers offer tailored services that include everything from standard payroll processing to more complex aspects like pension contributions and benefits management. This customisability ensures that irrespective of the business type — from startups to established enterprises — the payroll needs are met effectively.

Security and Confidentiality

With the rising threat of data breaches, maintaining the confidentiality and security of sensitive payroll information is paramount. Professional payroll services are equipped with secure systems to protect your data from unauthorized access and cyber threats, providing peace of mind and safeguarding employee information.

Conclusion

For businesses in Oxford, choosing a comprehensive payroll service provider is not just about outsourcing an administrative task; it’s about enhancing business efficiency, ensuring compliance, and securing sensitive data. By partnering with a reliable payroll service, businesses can focus more on growth and innovation, secure in the knowledge that their payroll obligations are being managed professionally. This strategic decision can lead to improved operations, better compliance, and ultimately, greater success in the competitive Oxford business landscape.

0 notes

Text

Hse SAP HR Payroll System

The HSE SAP HR Payroll System: A Powerful Tool for Irish Healthcare

The Health Service Executive (HSE) is Ireland’s publicly funded healthcare system, providing various health and welfare services. To manage its vast workforce effectively, the HSE relies on a robust Human Resources (HR) and payroll system– SAP HR. SAP is a renowned enterprise software solution designed to streamline and automate complex business processes.

Key Features of the HSE SAP HR Payroll System

The HSE’s SAP HR payroll system offers a comprehensive suite of features to support the complex needs of the healthcare sector:

Employee Self-Service: Employees have access to a secure portal where they can:

View and download payslips.

Update personal information (address, bank details, etc.)

Submit leave applications

Manage and track expense claims.

Payroll Processing: The system automates the end-to-end payroll process, ensuring timely and accurate payments to healthcare staff. This includes:

Calculating salaries, wages, and overtime

Processing deductions (taxes, pension contributions, etc.)

Compliance with Irish tax and employment regulations

HR Management: The system aids HR teams with:

Employee data management (recruitment, onboarding, performance records)

Absence and leave tracking

Workforce analytics and reporting

Change Management: A built-in change control mechanism helps ensure that all system updates are controlled and well-documented.

Benefits of the HSE SAP HR Payroll System

Enhanced Efficiency: Automating routine HR and payroll functions significantly reduces manual workload and administrative overhead. This frees up time for strategic HR initiatives.

Improved Accuracy: The system’s automation features minimize errors in payroll calculations and data entry. This ensures employees are paid correctly and on time.

Compliance: The system maintains compliance with ever-changing tax laws and regulations, keeping the HSE clear of penalties or fines.

Data-Driven Decision Making: Customizable reports and workforce analytics capabilities provide valuable insights to support HR strategy and decision-making.

Employee Empowerment The self-service portal gives employees more control over managing their information, reducing the need for HR intervention in basic tasks.

Challenges and Considerations

Like any large-scale software implementation, the HSE SAP HR Payroll system presents some challenges:

Complexity: SAP systems are known for their complexity, requiring specialized IT support and staff training to leverage their potential fully.

Change Management System updates or configuration changes must be carefully managed, tested, and communicated to users to minimize disruption.

Data Security Housing-sensitive employee and payroll data makes the system a potential target for cyberattacks, demanding robust security measures.

Continuous Improvement

The HSE remains committed to maximizing the value of its SAP HR Payroll system. This may involve:

Integration with other systems: Connecting the system with time & attendance or benefits platforms can further streamline operations.

User Training: Regular training and support ensure users get the most out of the system.

Exploring Cloud-based Options: Cloud-based SAP solutions offer advantages in terms of scalability and flexibility.

Conclusion

The HSE SAP HR Payroll system is a critical backbone for managing payroll and HR operations within the Irish healthcare system. While the system brings challenges typical of large-scale software endeavors, its efficiency, accuracy, and compliance benefits are significant. With a focus on continuous improvement, the HSE can optimize this powerful tool for the long term.

youtube

You can find more information about SAP HR in this SAP HR Link

Conclusion:

Unogeeks is the No.1 IT Training Institute for SAP HR Training. Anyone Disagree? Please drop in a comment

You can check out our other latest blogs on SAP HR here – SAP HR Blogs

You can check out our Best In Class SAP HR Details here – SAP HR Training

———————————-

For Training inquiries:

Call/Whatsapp: +91 73960 33555

Mail us at: [email protected]

Our Website ➜ https://unogeeks.com

Follow us:

Instagram: https://www.instagram.com/unogeeks

Facebook: https://www.facebook.com/UnogeeksSoftwareTrainingInstitute

Twitter: https://twitter.com/unogeeks

0 notes

Text

Payroll Unleashed: The Smart Guide to Outsourcing in the UK

Outsourcing payroll services in the UK is a strategic move for many businesses, from small startups to large corporations. The process involves transferring payroll responsibilities to a third-party provider, ensuring compliance with UK tax laws and regulations while streamlining operations. Here's a comprehensive guide to understanding and navigating the process of payroll outsourcing in the UK.

Step 1: Assessing Your Payroll Needs

Identify Your Requirements: Before you begin, assess your company's specific payroll needs. Consider the number of employees, frequency of pay, benefits administration, and any unique aspects of your workforce.

Step 2: Choosing the Right Provider

Research Providers: Look for providers with a strong track record in the UK market. They should offer scalable solutions and demonstrate compliance with HM Revenue & Customs (HMRC) regulations.

Evaluate Services: Ensure the provider offers the services you need, such as PAYE, National Insurance contributions, pension auto-enrolment, and year-end tax documents.

Step 3: Due Diligence and Compliance

Check References: Speak with current clients of the provider to gauge their satisfaction and the provider's reliability.

Verify Compliance: The provider must adhere to UK employment law, GDPR, and HMRC requirements. Confirm their compliance through certifications or audits.

Step 4: Transitioning to the Outsourced Service

Data Transfer: Safely transfer employee data to the provider. This should be done securely to protect sensitive information.

Integration: The provider's system should integrate seamlessly with your existing HR and accounting software.

Step 5: Managing the Relationship

Communication: Establish clear lines of communication with the provider. Regular updates and reports are essential for transparency.

Service Level Agreements (SLAs): Define SLAs to set expectations for service delivery, accuracy, and timeliness.

Step 6: Ongoing Evaluation

Monitor Performance: Regularly review the provider's performance against the agreed SLAs.

Feedback Loop: Create a mechanism for feedback from your employees on the payroll service to ensure their satisfaction.

Conclusion

Outsourcing payroll services in the UK can lead to increased efficiency, compliance, and cost savings. By carefully selecting a provider and establishing a strong working relationship, businesses can reap the benefits of outsourced payroll services.

1 note

·

View note

Link

0 notes

Text

United Kingdom Third Party Pension Administration Software Market to Witness Excellent Revenue Growth Owing to Rapid Increase in Demand

A third-party pension administration software is an all-encompassing solution specially designed to help the third-party administrators, product providers, systems integrators, technology companies, and government state pension schemes as well as it is beneficial to their end-clients. The software enables the efficient management of all types of pension plans by giving administrators a holistic view of each member’s records.

Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/186892-united-kingdom-united-kingdom-third-party-pension-administration-software-market?utm_source=Organic&utm_medium=Vinay

Latest released the research study on Global United Kingdom Third Party Pension Administration Software Market, offers a detailed overview of the factors influencing the global business scope. United Kingdom Third Party Pension Administration Software Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the United Kingdom Third Party Pension Administration Software The study covers emerging player’s data, including: competitive landscape, sales, revenue and global market share of top manufacturers are Aquila, Capita, SAP, Procentia Inc, Barnett Waddingham LLP, XPS Pensions Group, Trafalgar House Pensions Administration Limited, Civica, Independent Transition Management Limited

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Southeast Asia.

0 notes

Text

5 Benefits of Working with Cardiff Accountants

Whether you're starting a new business or growing an existing one, every company needs accountants Cardiff. However, many business owners wonder exactly how accountants add value beyond basic compliance duties.

Let's uncover the top ways tailored accounting guidance pays dividends for Cardiff enterprises long term. Read on for 5 leading benefits that Tax Advice Cardiff delivers—from strategic insights to cost savings and beyond. Working with the right Cardiff-based accountants ignites growth in measurable ways.

1. Aim Strategic Advisory

When you're mired in daily operations, getting a 30,000-foot view of your business trajectory is tough. Qualified Accountants Cardiff provides an objective bird' s-eye assessment of your company's current positioning and insightful ideas to catapult forward.

The best Accounting Firms in Cardiff go beyond rearward-looking number crunching to forward-focused planning and consultations on strategic options. So that they meet your unique needs. This is a game changer that business leaders often can’t access on their own—accelerating intelligent decision-making to drive winning outcomes.

2. Cost Saving Measures

Every business wants to maximize profits without overspending. Your Chartered Accountants in Cardiffpinpoint areas of unnecessary expenditure that may be flying under your radar. By scrutinizing budgets/actuals and enhancing financial modeling, money-saving solutions emerge, spanning: inventory management, payment terms, energy spending, insurance, software consolidations, and much more. Sound accountants easily fund their own fees through ongoing cost containment measures year after year.

3. Better Access to Finance

When the time comes to secure business loans/funding for growth, Cardiff accountants ensure your paperwork and financial reporting meet banker expectations for optimal terms. Beyond tidy paperwork, great accountants actually enhance access to funding by using insights into your business profile. Superior debt packages, working capital, merchant loans, government incentives, and other types of funding manifest when accountants apply their numeric magic touch.

4. Streamlined Payroll & Pensions

With ever-changing UK employment legislation, managing payroll/pensions without skills and nimble systems creates endless hassles. Tax Accountant Cardiff optimises these critical functions while ensuring compliance. Outsourcing these headaches saves time and provides comprehensive staff payment/benefits support - so you focus on value-driving aspects of your enterprise. Accountants make personnel functions smooth from accurate salary calculations and payslip issuance to auto-enrolment pension guidance and reporting.

5. Reduced Stress & Anxiety

Perhaps most profoundly, working with Cardiff accountants alleviates stress/anxiety business owners frequently report over financial matters. Rather than losing sleep wondering if you’re staying compliant, making the right tax assessments, leveraging government initiatives to the max, and other nagging worries, a supportive accountancy partner steps in to guide optimally.

Removing worries about losing profitability, missing opportunities, or making legal/administrative mistakes lets you reclaim mental/emotional energy to channel into core business growth with renewed clarity and inspiration.

Conclusion

The wide range of upsides of working with proficient Cardiff accountants make engaging audit/advisory experts a pivotal catalyst powering enterprise growth and stability long term. To experience firsthand the many tangible benefits—from expansive strategic insights to robust cost management and beyond—contact the respected accountancy specialists at Hayvenhursts today by visiting https://hayvenhursts.co.uk/.

0 notes

Text

Republican Rivals Duel for Dollars: Net Worths Ahead of First Debate

While the first Republican presidential debate heats up in Wisconsin, the candidates' bank accounts are drawing just as much attention.

https://cutt.ly/fwGJhwR4

With Donald Trump opting out (surprise!), the spotlight falls on the contenders vying for the party's nomination and their financial firepower.

Doug Burgum: This North Dakota governor, boasting a cool $1.1 billion, reigns supreme as the wealthiest candidate. His tech empire, Great Plains Software, built his fortune, leaving him second only to Illinois's Democratic governor in terms of state leader net worth.

Chris Christie: Estimates for the former New Jersey governor's wealth vary, with some whispers of $19 million and others settling around $5 million. His legal career and political ventures, including a stint as US Attorney and governor, have contributed to his coffers.

Ron DeSantis: Florida's controversial governor, despite his recent popularity surge, trails the pack with a modest $1.17 million. His salary and book advance barely hold a candle to his predecessor's $255 million net worth.

Nikki Haley: The former South Carolina governor and ambassador navigated a rocky financial past before her $8 million fortune blossomed. Post-Trump administration, lucrative speaking engagements and book deals fueled her financial comeback.

Asa Hutchinson: Arkansas's ex-governor, raised on a farm, boasts a down-to-earth $1.5 million. His house and government pensions form the bulk of his wealth.

Mike Pence: From congressman to governor to Trump's vice president, it took Pence nearly two decades to become a millionaire.

His public speaking tour and book deals have since quadrupled his net worth to $4 million.

Vivek Ramaswamy: This Ivy League-educated candidate, with a $630 million fortune, is the debate's second-richest contender.

His successful biotech company and "anti-woke" index fund provider have made him a Wall Street heavyweight.

Tim Scott: This South Carolina senator, aiming for historic firsts, has amassed a $3.88 million net worth. His insurance career and congressional salary paved the way for his political aspirations.

The Absent Billionaire: Donald Trump, despite his refusal to participate, remains the financial elephant in the room.

His estimated $2.5 billion, shrouded in secrecy and controversy, continues to be a topic of much speculation.

As the Republican race heats up, the candidates' financial profiles offer another layer of intrigue.

From tech titans to governors on the rise, their diverse fortunes paint a fascinating picture of the party's landscape.

Who will emerge victorious on the debate stage, and will their bank accounts play a role in their ultimate success? Only time will tell.

Feedback Poll

0 notes

Text

Pension Administration Software Market Size, Share, Forecast-2030

0 notes

Text

Impact of Inflation on the retirement plan industry

Introduction

The retirement plan industry is heavily impacted by inflation as it affects the purchasing power of participants’ savings and investments. It has a significant effect on people’s 401(k) accounts. As prices in the economy increase, retirement plan administrators must be aware of how inflation will affect their 401(k) portfolio so they can adjust their strategy accordingly.

Inflation in the U.S. is driven by the Consumer Price Index (CPI), which measures the average prices of food, fuel, and energy. It recently reached 9.1% for the year ending June 2022, the highest 12-month rate since December 2008. As a result, retirement plan administrators must factor in that participant savings may lose some of their purchasing power over time.

Challenges faced by plan sponsors/employers

Plan sponsors are already facing the challenge of labor shortages caused by The Great Resignation. In addition, inflation adds to their problems as employees expect a competitive 401(k) in terms of matching employer contributions. The critical challenges of plan sponsors are:

Employee retention: Employers struggle to retain quality employees as they seek higher wages, more benefits, and increased retirement contributions. Responses to Betterment’s Survey indicate that employees prioritize jobs offering 401(k) and expect employer-matching contributions.

Hiring the best talent: Attracting the best candidates while controlling recruitment costs has become challenging. Top talent prioritizes financial benefits, and 65% of employees rate a high-quality 401(k) plan as a motivator.

Rising demand for 401(k) matching programs: Employers are pressured to provide a 401(k) matching program to remain competitive. As employees value it, 92% of employers offer a matching contribution for their 401(K) plan.

How can retirement plan providers help clients?

Retirement plan providers can help clients create a comprehensive retirement plan that addresses their business and participant needs. They help plan sponsors understand the complexities of their retirement plan, such as investment options, employee eligibility, and employer contributions.

Retirement plan service providers can help plan sponsors through the following:

Offer 401(k) plan options: Retirement plan service providers can provide their clients with various 401(k) plan options, such as traditional, Roth, and other custom plans based on sponsor needs.

Focus on financial wellness: Retirement plan service providers can help Plan sponsors create a comprehensive financial wellness strategy and provide ongoing support to plan participants. It may include educational resources, one-on-one counseling services, webinars, or retirement planning and investing seminars.

Help plan participants save more: From adopting automatic enrollment to discussing the SECURE Act with clients, plan administrators can help improve the plan’s performance. It is important to be aware of recent changes in 401(k) rules and regulations, such as the elimination of Required Minimum Distributions (RMDs)

Provide plan benchmarking analysis: Retirement plan service providers should work with plan sponsors to analyze their current plans and help them compare their performance against other plans in similar industries.

Use technology to save costs: Transitioning to a digital platform can significantly reduce the costs of maintaining and administering a retirement plan. In addition, utilizing technology for plan communications, participant enrollment, and fund selection can help streamline the process and increase efficiency.

Stay relevant and reasonable using technology

Retirement plan service providers such as recordkeepers and 401(k) plan administrators can combat inflation using technology. Automated plan tools help keep costs low, allowing plan administration service providers to remain competitive in the marketplace and provide a reasonable retirement plan for employees. Congruent Solutions offers comprehensive retirement plan administration software and service, which can help to reduce the administrative burden and costs associated with managing a retirement plan. Our automated platform uses AI and Cloud computing to ensure compliance and security of participant data. Ride the inflation wave by keeping plan administration and recordkeeping fees constant and delivering better value to clients.

Author: Congruent Solution

#401k plan administration software#pension administration software providers#retirement plan administration services

0 notes

Link

#pension administration software#pension management software#pension management system#pension administration software providers#retirement management solutions#software#services#business#hrms software in india

0 notes

Text

Superannuation Accounting Services | SMSF Accounting Services

SMSF Accounting Services can assist trustee, financial planners, accountants, tax agent and SMSF administrators in the preparation of annual accounts, tax return and independent audit of the self-managed super fund. We can also help in the TBAR lodgement, BAS preparation and lodgement and PAYG lodgements.

SMSF is a retirement saving vehicle which gives control to trustee to manage the retirement savings of the fund members. SMSF can have up to six members where mostly members act as fund trustees or director of corporate trustee of the fund and look after the management of the fund. Other names given to SMSF are DIY Fund, family fund or dad and mum fund. Some important points to consider when deciding to start an SMSF: time and skill to handle this, costs involved, need to comply with superannuation rules and regulations, admin work involved in the management of the fund.

Once the SMSF is set up and you started taking control of your retirement savings we can help in the rollover and contributions for members in to the SMSF by providing the electronic service address (ESA) from BGL Simple Fund 360 software to comply with the super stream standards.

We will provide you with the trustee and employer notification letter which has the ESA and super stream details and this can be provided to members employer for contributions.

For the preparation of accounts and tax return we use specialist SMSF accounting software BGL simple fund 360 where a variety of SMSF members and investments reports can be generated to easily understand the funds financial position and regular performance.

We can provide the variety of financial reports including: Statement of financial position, operating statement, member statements, investment summary report, investment income report, realised capital gain report, unrealised capital gain report, investment performance report, minutes of meetings, annual return.

Once the members have decided to start pension from the fund after satisfying all conditions of pension start, we can help in the accounting of the SMSF accounts. In our SMSF software we can handle start of pension account and if any changed required in future from accounting side.

At some stage in future SMSF might needs to be wind up. We can assist in the winding up of the super fund by preparing final accounts and tax return and independent audit of the fund. Once the audit in completed we can lodge the final SMSF tax return and to cancel funds registration with the tax office.

As a client of Superannuation Accounting Services, you will have assistance of professionals who are qualified and experts in the SMSF field and always ready to help you with tax and compliance related queries in timely and professional manner. Our team of professionals can also help with SMSF tax advise and assist if there is ATO audit.

If you are looking for professional superannuation accounting services at affordable price where all the work is done by qualified and experienced professionals in Australia based office, please feel free to contact SMSF Accounting Services.

Call at 0412850242 and Get More Detailed Information Herehttps://www.smsfaccountingservices.com.au/superannuation-accounting-services/

0 notes

Text

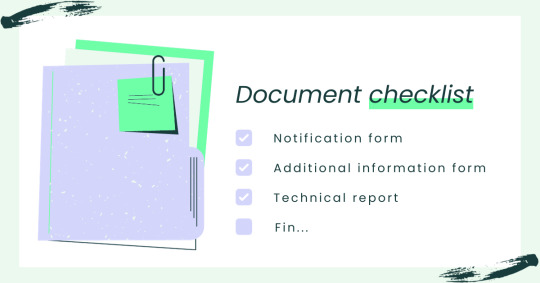

Which documents are required for submitting an R&D claim?

Whether you’re a first-time R&D claimer, or you’ve previously claimed, it’s important to keep track of the latest regulations about the necessary documents for an R&D claim. The purpose of the documentation is to showcase your endeavours in contributing to the technological and scientific advancement in your industry. Listing the correct information about your trial and error attempts, and the costs involved, helps HMRC to reward you with the tax benefit you deserve for your endeavours. Let’s dive into the documentation you need for your upcoming R&D claim.

First-time claimants: The claim notification form

In the case of applying for R&D tax credits for the very first time, you need to inform HMRC in advance of the full claim through the claim notification form. You are responsible for notifying your claim, if:

This is your initial claim.

You claimed for the previous tax year, but you submitted the claim after the deadline of the claim notification period (which concludes 6 months after the end of the accounting period).

Your last claim was lodged over 3 years before the final date of the claim notification period.

You must submit the claim notification form no later than 6 months after the conclusion of the relevant accounting period. Failing to meet this deadline will result in an invalid claim. You will need to provide the following information:

The Unique Taxpayer Reference (UTR) of the company, must correspond to the one provided in your Company Tax Return.

The primary senior internal contact within the company responsible for the R&D claim, such as a company director.

The contact information of any agent involved in the R&D claim.

The start and end dates of the accounting period for which you are claiming the tax relief or expenditure credit should match the dates indicated in your Company Tax Return.

The start and end dates of the period of account.

A brief overview of the planned high-level activities, such as the purpose of software development, to demonstrate that the project aligns with the standard definition of R&D. Please note that you do not need to include supporting evidence on the form, but you will be required to provide additional information on the supplementary form.

Existing claimants: An information form

From August 1st, 2023, HMRC requests an additional information form to support all your claims. This needs to be submitted first, before filing your corporate tax return (CT600). To fill out this form, you need the following information:

Company details - You need to provide your Unique Taxpayer Reference (UTR), employer PAYE reference number, VAT registration number, and the classification code indicating your business type.

Contact details - Information regarding any agent engaged in your R&D claim or the primary R&D contact within your team participating in the claim.

Accounting period start and end date - The accounting period start and end dates you provide for claiming tax relief must align with the dates specified in your Company Tax Return.

Details of qualifying expenditure - You need to detail your eligible costs such as staff PAYE costs/pension contributions, subcontractors’ costs, consumables, software purchases, travel costs, and utility bills.

Details of your qualifying indirect activities - You’ll need to classify the amount of qualifying expenditure for each project of qualifying indirect activities that do not directly lead to resolving the uncertainty. This may include:

Developing information services to support R&D, such as creating reports summarising R&D findings.

Providing direct support activities for R&D, including maintenance, security, administration, clerical tasks, finance, and personnel activities that are specifically related to R&D.

Undertaking ancillary activities necessary for initiating R&D, such as hiring and compensating staff, leasing laboratory facilities, and maintaining R&D equipment, including computers utilised for R&D purposes.

Delivering training programs that directly support the R&D project.

Conducting research carried out by students and researchers at universities.

Performing research activities, including data collection, to develop new scientific or technological testing methods, surveys, or sampling techniques. Note that this research may not qualify as R&D on its own.

Conducting feasibility studies that provide information to guide the strategic direction of a particular R&D endeavour.

Project details - You are required to provide information about the total number of projects you are claiming for during the accounting period, along with their respective details. The specific requirements are as follows:

If you are claiming for 1 to 3 projects, you must describe all the projects that encompass 100% of the qualifying expenditure.

If you are claiming for 4 to 10 projects, you need to describe a minimum of 3 projects that account for at least 50% of the total expenditure.

If you are claiming for 11 to 100 (or more) projects, you are required to provide details of the projects that represent a minimum of 50% of the total expenditure. At least 3 projects must be described. In cases where the qualifying expenditure is distributed among numerous smaller projects, you should provide information on the 10 largest projects.

A description of each project - We have designed the following questions to determine your qualifying activities related to each project considering the eligibility criteria.

What is the primary domain of science and technology?

What was the initial level of scientific or technological knowledge that the company aimed to enhance?

What specific progress or advancement in scientific or technological knowledge did the company strive to achieve?

What were the uncertainties or unknowns encountered in the scientific or technological aspects of the project?

How did your project intend to overcome these uncertainties?

Which tax relief are you claiming, and what is the corresponding amount?

Other required documents for R&D claim

There isn’t an official list from HMRC, that details exactly the record system you need to claim for R&D tax credits. HMRC has an understanding that first-time claimants most likely don’t have all the relevant documentation in their first year. To prevent extensive enquiries into your claim, here’s what we recommend you include:

1. Technical documentation

This should encompass a comprehensive explanation of the R&D project, including its objectives, technical hurdles, and the measures taken to surmount them. This may entail project plans, design documents, test results, and technical reports.

2. Financial documentation

You must present evidence of the expenses incurred during the R&D project, which encompasses employee costs, subcontractor costs, materials costs, and other pertinent expenditures. This can involve invoices, timesheets, and receipts.

3. Corporate tax documentation

You are expected to provide information regarding the company's corporate tax position, including tax returns, accounts, and tax computations.

4. Accounting documentation

Detailed accounting information must be provided to substantiate the claim, including general ledger accounts, trial balances, and profit and loss statements.

5. Payroll documentation

Payroll records for all employees involved in the R&D project, such as timesheets, salary and bonus details, and PAYE and NI contributions, should be submitted.

6. Statutory accounts

The most recent set of statutory accounts for the company, comprising the balance sheet, profit and loss account, and any associated notes, should be included.

7. Subcontractor agreements

If subcontractors were utilised during the R&D project, copies of their contracts and evidence of the payments made to them should be provided.

9. Technical review report

A technical review report summarising the R&D project, highlighting the technical advancements achieved, the technical challenges encountered, and the methods employed to overcome them, should be included.

10. Any other relevant documentation

Any additional pertinent documentation that you believe will support your R&D tax credit claim, such as research papers, conference papers, or any other relevant records associated with the R&D project, should also be submitted.

Making an R&D claim retrospectively

Naturally, if you’re not aware of what R&D tax credits are, you’re not going to gather all the relevant documents needed for your R&D claim. If you lack records and want to make an R&D claim, you can make reasonable estimates of your expenditure. Our R&D tax credit specialists can help you do this in accordance with HMRC’s standards. Book a free consultation now.

Best practices for R&D documentation

We’ve completed over 2400 claims for our clients across various industries. From our extensive experience, we’ve pulled together the following best practices for creating documents for R&D claim, so you can provide HMRC with everything they need to send you out your R&D benefit quickly.

Create detailed project records and store them in one location

Maintain detailed records of all R&D projects, including project plans, objectives, and timelines. Document the problem you're trying to solve and how your R&D efforts are addressing it. Keep these located in one centralised place as opposed to being spread across different team members’ local drives, in long email chains, or written on pieces of paper.

Maintain a log of all expenses

Record and maintain logs of all expenses related to the R&D activities. This includes salaries, materials, equipment, and any other costs directly associated with the project.

Record the time spent by employees on R&D activities

With time tracking, you need to include not just researchers but also support staff who contribute to the project indirectly. This is important because you can only claim the proportion of staff wages that these staff directly work on R&D activities. There are various time tracking software on the market that can simplify time tracking for you.

Document the evolution of your project: The good, bad, and ugly

Maintain a project diary or log that chronicles the progress of the R&D project. Include details of any challenges faced and how they were overcome. Include all failures too, these are a testament to the fact you are contributing to overcoming uncertainty. This could be in the form of test results and incorrect design specifications, as two examples.

Don’t throw out evidence

If applicable, keep records of prototypes, models, or experimental setups. These can serve as tangible evidence of your R&D work.

Save all collaboration records

If you collaborate with external parties, keep records of agreements and communications. This includes any contracts or agreements with research partners or subcontractors.

Seek professional advice

If you're unsure about any aspect of R&D documentation, seek advice from professionals who specialise in R&D tax incentives to ensure you're fully compliant. We can take leadership of your documentation, on behalf of you, and complete a confident R&D claim with all supporting documents. Speak to us.

Final thoughts

By understanding what HMRC requires as part of your documents for an R&D claim and following these best practices for documenting your R&D activities and expenditures, you can strengthen your R&D claim and increase your chances of receiving the tax incentives you're entitled to. The key to stress-free documentation is to keep all documentation updated regularly; it shouldn’t be an afterthought. Remember that each R&D claim may have specific requirements, so it's essential to stay informed about the latest guidelines and regulations from HMRC.

0 notes

Text

Market Mastery: Understanding and Capitalizing on Financial Tendencies

In a global pushed by financial uncertainties and evolving financial areas, the capacity to navigate one's particular finances is a vital life skill. Achieving economic achievement involves a combination of strategic planning, disciplined keeping, and knowledgeable investment decisions. In this article, we shall discover critical principles and realistic methods to assist you master your finances and function towards a more secure and affluent future.

Setting Apparent Financial Targets:

Start by defining your short-term and long-term financial goals. Whether it's saving for an urgent situation finance, purchasing a home, or planning for retirement, having clear objectives provides a roadmap for your economic journey. Break up bigger goals into smaller, feasible milestones to monitor your progress and remain motivated.

Creating a Budget:

A budget is just a foundational software for financial management. Track your income and costs to know your spending habits. Categorize costs into requirements (housing, utilities, groceries) and non-essentials (entertainment, dining out). That consciousness enables you to allocate resources more effortlessly, ensuring that you reside within your suggests while preserving for the economic goals.

Emergency Account:

Establishing an urgent situation fund is a crucial stage towards economic security. Intention to truly save three to six months' price of residing expenses. That account serves as a security net, giving financial security in unexpected conditions such as for example work loss or medical emergencies.

Debt Administration:

Assess and prioritize your debts. High-interest debts, such as for instance charge cards, can impede economic progress. Develop an idea to pay off debts thoroughly, starting with these holding the greatest interest rates. Consolidation or refinancing may also be practical alternatives to improve debt repayment.

Trading Correctly:

Diversify your investment portfolio to mitigate risks and enhance potential returns. Discover numerous investment cars such as stocks, securities, shared funds, and real estate. Consider visiting with an economic advisor to custom an investment technique that aligns along with your chance patience, time horizon, and financial goals.

Pension Preparing:

It's never too early to begin planning for retirement. Make the most of employer-sponsored pension options, such as 401(k) accounts, and discover additional retirement savings options. Consistent benefits to pension accounts with time may result in significant wealth deposition, ensuring a cushty retirement. fractional controller services

Constant Understanding:

Stay informed about financial areas, expense trends, and changes in financial landscapes. Financial literacy empowers you to create informed conclusions and adapt to changing economic conditions. Numerous on the web sources, workshops, and instructional programs may improve your financial knowledge.

Regular Economic Check-ups:

Occasionally review your economic strategy and change it as needed. Life situations, financial problems, and particular targets may possibly change, requesting modifications to your allowance, savings, and expense strategies. Normal economic check-ups ensure your strategy stays appropriate and effective.

Developing Generational Wealth:

Look at the broader affect of your economic decisions on future generations. Train your loved ones about economic literacy and impress responsible money habits. Property planning, including wills and trusts, is yet another aspect to take into account when developing and keeping generational wealth.

Realization:

Understanding your finances is a continuous journey that needs dedication, control, and adaptability. By setting clear targets, developing a budget, managing debt, and making informed investment decisions, you are able to work towards reaching financial success. Often reassess your economic program, stay qualified, and grasp a long-term perspective to construct a good basis for a affluent future.

0 notes