#pacific redfin

Text

Daily fish fact #736

Pacific redfin!

It is one of the only cyprinids that occur in saltwater! They spawn in freshwater rivers, but maturing juveniles (once about 7 cm, ~3 inches, in size) and adults who've finished spawning return to the sea and live along the coast.

#fish#fish facts#fishfact#fishblr#marine life#marine animals#marine biology#sea creatures#sea animals#sea life#biology#zoology#pacific redfin#redfin dace#minnow

254 notes

·

View notes

Photo

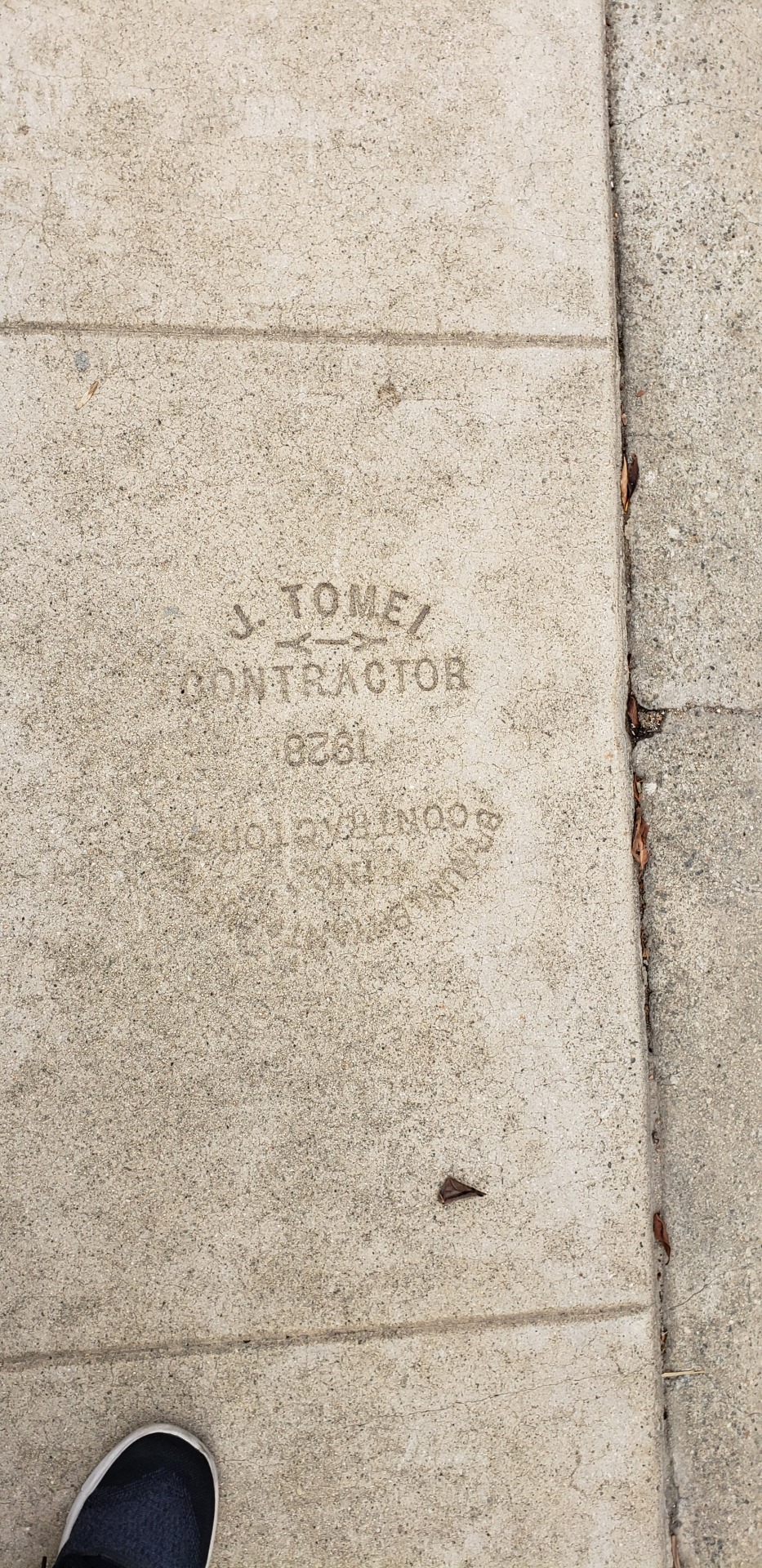

J. Tomei Contractor 1928 (Photo taken by me in December of 2020 in Los Angeles).

This one is very confusing. I am not clear if it’s separate from the Tomei Cons Co. I photographed previously. At least I know Tomei Cons Co. is also in the L.A. area, whereas “J. Tomei & Co.” seems to be based in Washington state (Contractor, Volume 23, McGraw Publishing Company, 1916). There is also J. Tomei Construction Co. based in Van Nuys, CA (Construction Methods and Equipment, pg. 58, McGraw-Hill, 1957). And a “J. Tomei & Sons Construction Co.,” described as a “’native-son’ outfit” in southern California (The Excavating Engineer, Volume 49, Excavating Engineer Publishing Company, 1955). J. Tomei and Sons was also based in Van Nuys in 1955 (Pacific Road Builder and Engineering Review, 1955). It’s possible of course that J. Tomei just moved around a lot, as most of these different addresses are also divided by decade.

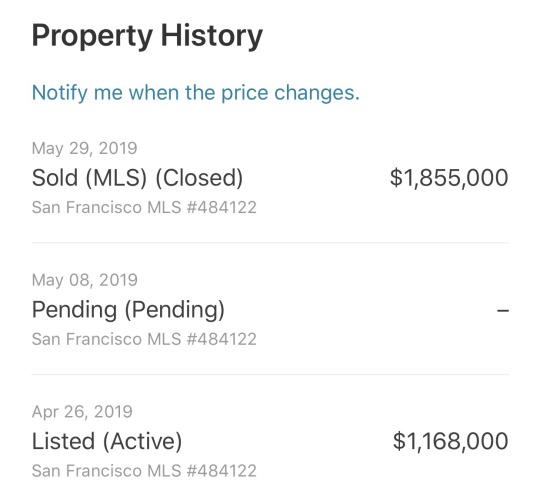

J. Tomei lost the contract to construct a vitrified pipe sewer system for the City of Brea, California (Western Construction, Volume 1, 1926).

In 1927, J. Tomei, at the time based at 599 Madison St. in Culver City (not an address that currently exists), got the contract for a “concrete storm drain, etc. in Benedict Canyon Dr.” (Engineering News-record, Volume 98, McGraw-Hill, 1927). Tomei Construction Company was listed at 4160 Madison Avenue in Culver City in 1937, having won the contract “for installing 10 in. vitrified clay sewer pipe, instead of existing 6 in. vitrified clay pipe, in alley at rear of Hawthorne School, Beverly Hills, California” from the Beverly Hills City Clerk. According to Redfin, this address is still a house that was built in 1925. In the same year, they also were awarded the contracts to grade and pave “on Crenshaw Blvd., betw. Westmont Ave. and 700 ft. south” and “for grading and paving Pico St. at Main St.,” both by the Los Angeles Board of Public Works (Western Construction News, Volume 12, King Publications, 1937).

8 notes

·

View notes

Text

Get Ready to Invest: 2023 Hater's Guide to the Bay Area Real Estate Market Reveals Most Expensive and Affordable Neighborhoods to Buy and Rent!

The Bay Area real estate market is an ever-changing landscape, and the 2023 Hater's Guide to the Bay Area real estate market from SFGATE is here to help you navigate the market. This comprehensive guide provides an in-depth look at the current state of the market, including the most expensive areas to own and rent, the best places to buy, and the most affordable neighborhoods. Additionally, the guide provides tips on how to save money when buying or renting in the Bay Area.

According to the article, the Bay Area is one of the most expensive places to own a home in the United States. Redfin recently reported that it is more expensive to own than rent in the Bay Area, with the median home price reaching $1.3 million. Additionally, the article states that the Bay Area is home to some of the most expensive neighborhoods in the country, such as San Francisco's Pacific Heights and Palo Alto's Woodside.

The article also provides tips on how to save money when buying or renting in the Bay Area. It suggests looking for homes in less expensive neighborhoods, such as Oakland and Berkeley, as well as taking advantage of rent control laws. Additionally, the article recommends considering a condo or townhouse instead of a single-family home, as they tend to be more affordable.

Finally, the article concludes by highlighting the advantages of hiring a trusted Real Estate advisor to help you find your new ultra-luxury home in South Florida. A trusted Real Estate advisor can provide invaluable insight into the market, helping you to make an informed decision and find the perfect home for your needs. To learn more about the benefits of working with a Real Estate advisor, click here.

0 notes

Text

Animal Crossing Fish - Explained MASTERPOST

So, here’s the Master list of ALL of the fish explained posts, with links, common and scientific names, and the “extra” topics we covered, if any. The AC Fish Explained Series went on from April 6th, 2020 to March 2021! The series continued into the Museum Tour in June 2021. The series was started again for “fish past” in November 2021. *Pocket Camp icons are from Nookipedia.com*

*~*Now with over 200 entries. Thank you all for following along!*~*

If you liked the fish/science posts, please let me know! It makes me so happy to hear that people learned stuff from these! Without further adieu, here they are:

#1 Barreleye ~*~ (Macropinna microstoma) ~*~ Science in Video Games

#2 Sea Bass ~*~ Japanese Sea Bass (Lateolabrax japonicus) ~*~

& Black Bass ~*~ Largemouth Bass (Micropterus salmoides) ~*~ Problems With Common Names

#3 Sturgeon ~*~ Atlantic sturgeon (Acipenser oxyrinchus oxyrinchus) ~*~ Fish Migration

#4 Football Fish ~*~ (Himantolophus spp.)~*~ Deep Sea Sex Life

#5 Goldfish // Popeye Goldfish // Ranchu Goldfish ~*~ (Carassius auratus) ~*~ Goldfish Deserve Better

#6 Sea Butterfly ~*~ Common Clione (Clione limacina) ~*~ Problems with Common Names 2: Electric Boogaloo

#7 Coelacanth ~*~ West Indian Ocean Coelacanth (Latimeria menadoensis) ~*~ Lazarus Species & Evolution of Tetrapods

#8 Crawfish ~*~ Red Swamp Crayfish (Procambarus clarkii) ~*~ Invasive Species

#9 Acanthostega ~*~ (Acanthostega gunnari) ~*~ Stem-Tetrapods

#10 Killifish ~*~ Japanese Rice Fish (Oryzias latipes) ~*~ Endemism

#11 Oarfish ~*~ Giant Oarfish (Regalecus glesne) ~*~ Myths and Legends

#12 Loach ~*~ Japanese Striped Loach (Cobitis biwae) ~*~ Barbels & Mouth Position in Fish

#13 Clownfish ~*~ Ocellaris Clownfish (Amphiprion ocellaris) ~*~ Sequential Hermaphroditism

#14 Surgeonfish ~*~ Regal Blue Tang (Paracanthurus hepatus) ~*~ The IUCN, Pet Trade

#15 Koi ~*~ Amur Carp (Cyprinus rubrofuscus) subspecies ~*~ Aquaculture

#16 Manila Clam ~*~ Japanese littleneck clam (Ruditapes philippinarum) ~*~ Mollusks

#17 Barred Knifejaw ~*~ Barred Knifejaw (Oplegnathus fasciatus) ~*~ Broadcast Spawning & Larvae Dispersal

#18 Stringfish ~*~ Sakhalin Taimen (Parahucho perryi) ~*~ Anadromy & Osmolarity

#19 Freshwater Goby ~*~ Dark Sleeper (Odontobutis obscura) ~*~ Motile Chromatophores

#20 Ammonite ~*~ Ammonoidea spp. ~*~ Index Fossils

#21 Blue Marlin ~*~ Atlantic (Makaira nigricans) and/or Indo-Pacific (Makaira mazara) Blue Marlin ~*~ Apex Predators, Billfish Taxonomy

#22 Giant Trevally ~*~ Giant Trevally (Caranx ignobilis) ~*~ Opportunistic Animals

#23 Tuna ~*~ Bluefin Tuna (Thunnus spp) ~*~ Overfishing & Environmentally Sound Seafood

#24 Mahi-Mahi ~*~ Mahi-Mahi (Coryphaena hippurus) ~*~ Meso-predators

#25 Opthalmosaurus ~*~ (Ophthalmosaurus icenicus) ~*~ Convergent Evolution

#26 Tadpole & Frog ~*~ Japanese Tree Frog (Dryophytes japonicus) ~*~ Metamorphosis

#27 Plesiosaur ~*~ (Futabasaurus suzukii) ~*~ Hydrodynamics of Long Necks

#28 Archelon ~*~ (Archelon ischyros) ~*~ Eggs VS Live Birth

#29 Snapping Turtle ~*~ Common Snapping Turtle (Chelydra serpentina) ~*~ Omnivores

#30 Zebra Turkeyfish ~*~ Luna Lionfish (Pterois lunulata) ~*~ Venom, Invasive Lionfish

#31 Dace ~*~ Big-Scaled Redfin (Tribolodon hakonensis) ~*~ Acidic Water Tolerance

#32 Carp ~*~ Common Carp (Cyprinus carpio) ~*~ 100 Most Invasive Species List

#33 Bitterling ~*~ Rosy Bitterling (Rhodeus ocellatus) or Japanese Rosy Bitterling (Rhodeus smithii) or hybrid ~*~ Nomenclature

#34 Crucian Carp ~*~ Crucian Carp (Carassius carassius) ~*~ Low Oxygen Adaptations

#35 Cherry Salmon ~*~ Cherry/Masu Salmon (Oncorhynchus masou) ~*~ Semelparity VS Iteroparity

#36 Anchovy ~*~ Japanese Anchovy (Engraulis japonicus) ~*~ Gills

#37 Seahorse ~*~ Korean Sea Horse (Hippocampus haema) ~*~ Seahorses

#38 Ribbon Eel ~*~ Ribbon Eel, (Rhinomuraena quaesita) ~*~ Sequential Hermaphroditism (Again)

#39 Suckerfish ~*~ Common Remora (Remora remora) ~*~ Mutual Relationships

#40 Neon Tetra ~*~ Neon Tetra (Paracheirodon innesi) ~*~ Neon Tetra in the Pet Trade

#41 Piranha ~*~ Red-bellied Piranha (Pygocentrus nattereri) ~*~ Bite Force

#42 Arapaima ~*~ Arapaima/Pirarucu (Arapaima gigas) ~*~ Air-Breathing (Physostomes)

#43 Pufferfish ~*~ Long-spine Porcupinefish (Diodon holocanthus) ~*~ Family Toxin

#44 Ocean Sunfish ~*~ Ocean Sunfish (Mola mola) ~*~ Sunbathing fish

#45 Spotted Garden Eel ~*~ Spotted Garden Eel (Heteroconger hassi) ~*~ Burrowing

#46 Horseshoe Crab ~*~ Atlantic Horseshoe Crab (Limulus polyphemus) ~*~ Horseshoe Crabs Are Amazing

#47 Moon Jellyfish ~*~ Moon Jellfyfish (Aurelia aurita) ~*~

& Sea Anemone ~*~ Magnificent Sea Anemone (Heteractis magnifica) ~*~ Cnidarians

#48 Butterflyfish ~*~ Oriental Butterflyfish (Chaetodon auripes) ~*~ Monogamy

#49 Great White Shark ~*~ Great White Shark (Carcharodon carcharias) ~*~ Functional Endothermy & Shark Attack

#50 Whale Shark ~*~ Whale Shark (Rhincodon typus) ~*~ Filter-feeding

#51 Hammerhead Shark ~*~ Scalloped Hammerhead (Sphyrna lewini) ~*~ Evolution of the Hammerhead/Cephalofoil

#52 Saw Shark ~*~ Japanese Saw Shark (Pristiophorus japonicus) ~*~ Saw Shark VS Sawfish

#53 Shark Tooth Whorl ~*~ Helicoprion spp. ~*~ Chimeras

#54 Dorado ~*~ Dorado (Salminus brasiliensis) ~*~ Protecting Species for Profit

#55 Guppy ~*~ Guppy (Poecilia reticulata) ~*~ Sexual Dimorphism

#56 Angelfish ~*~ Freshwater Angel (Pterophyllum scalare) ~*~ Parental Care

#57 Vampire Squid ~*~ Vampire Squid (Vampyroteuthis infernalis) ~*~ Oxygen Minimum Zone

#58 Giant Isopod ~*~ (Bathynomus giganteus) ~*~ Deep-Sea Gigantism

#59 Tilapia ~*~ Nile Tilapia (Oreochromis niloticus) ~*~ Aquaculture Issues

#60 Pascal ~*~ Asian Sea Otter (Enhydra lutris lutris) ~*~ Mom’s Fave Foods & Pascal the Philosopher

#61 Arowana ~*~ Asian Arowana (Scleropages formosus) ~*~ Species Definition

#62 Sea Pineapple ~*~ Sea Pineapple (Halocynthia roretzi) ~*~ Chordate Zoology

#63 Gigas Giant Clam ~*~ Tridacna gigas ~*~ Clam Myths

#64 Horse Mackerel ~*~ Japanese Jack Mackerel (Trachurus japonicus) ~*~ Fisheries

#65 Mantis Shrimp ~*~ Peacock Mantis Shrimp (Odontodactylus scyllarus) ~*~ Eyes

#66 Moray Eel ~*~ Kidako Moray Eel (Gymnothorax kidako) ~*~ Pharyngeal Jaws

#67 Pale Chub ~*~Pale Chub (Zacco platypus) ~*~ Mate Choice

#68 Hermit Crab ~*~ Passionfruit Hermit (Coenobita cavipes) ~*~ Vacancy Chain for Hermits

#69 Squid ~*~ Bigfin Reef Squid (Sepioteuthis lessoniana) ~*~ Morphology

#70 Ray ~*~ Red Stingray (Dasyatis akajei) ~*~ Batoids

#71 Napoleonfish ~*~ Humphead Wrasse (Cheilinus undulatus) ~*~ IUU Fishing

#72 Scallop ~*~ Ezo Giant Scallop (Mizuhopecten yessoensis) ~*~ Swimming, Seeing Bivalves

#73 Octopus ~*~ California Two-Spot Octopus (Octopus bimaculoides) ~*~ Intelligence

#74 Soft-shell Turtle ~*~ Chinese Soft-shell Turtle (Pelodiscus sinensis) ~*~ Evolution of Turtle Shells

#75 Pondskater ~*~ Aquarius paludum ~*~ Surface Tension

#76 Myllokunmingia ~*~ Myllokunmingia fengjiaoa ~*~ Cambrian Explosion

#77 Gazami Crab ~*~ Gazami Crab (Portunus trituberculatus) ~*~ Swimming Crabs

#78 Acorn Barnacle ~*~ Balanus trigonus ~*~ Crustacean Diversity

#79 Bluegill ~*~ Bluegill (Lepomis macrochirus) ~*~ Fish Tails

#80 Tiger Prawn ~*~ Giant Tiger Prawn ( Penaeus monodon) ~*~ Crustacean Lifecycle & Nauplius

#81 Sea Grapes ~*~ Sea Grapes (Caulerpa lentillifera) ~*~ Algae

#82 Giant Snakehead ~*~ Northern Snakehead (Channa argus) ~*~ Invasive Snakeheads

#83 Spinosaurus ~*~ Spinosaurus aegyptiacus ~*~ Swimming Dinosaurs

#84 Umbrella Octopus ~*~ Flapjack Octopus (Opisthoteuthis californiana) ~*~ Oceanic Layers

#85 Sea Slug ~*~ Hypselodoris festiva ~*~ Nudibranchs

#86 Salmon ~*~ Chum Salmon (Oncorhynchus keta) ~*~ The Changing Salmon

#87 Char ~*~ White-Spotted Char (Salvelinus leucomaenis) ~*~ Problem with Dams

#88 Golden Trout ~*~ California Golden Trout (Oncorhynchus mykiss aguabonita) ~*~ Rainbow Trout Subspecies

#89 King Salmon ~*~ Chinook Salmon (Oncorhynchus tshawytscha) ~*~ Site Fidelity

#90 Pearl Oyster ~*~ Akoya Pearl Oyster (Pinctada imbricata fucata) ~*~ Pearl Formation

#91 Chambered Nautilus ~*~ Chambered Nautilus (Nautilus pompilius) ~*~ Vertical Migration

#92 Gar ~*~Spotted Gar (Lepisosteus oculatus) ~*~ Holostei Fish

#93 Flatworm ~*~ Pseudoceros bimarginatus ~*~ About Flatworms

#94 Diving Beetle ~*~ Cybister chinensis ~*~ How Insects Breathe

#95 Giant Water Bug ~*~ Lethocerus deyrollei ~*~ Bite of the Toe Biter

#96 Sea Urchin ~*~ Purple Sea Urchin (Paracentrotus lividus) ~*~ Biological Symmetry

#97 Yellow Perch ~*~ Yellow Perch (Perca flavescens) ~*~ Cannibalism

#98 Oyster ~*~ Pacific Oyster (Crassostrea gigas) ~*~ Oyster Reefs

#99 Catfish ~*~ Amur Catfish (Silurus asotus) ~*~ Catfish are Ridiculous

#100 Dunkleosteus ~*~ Dunkleosteus terrelli ~*~ Placoderms

#101 Rainbowfish ~*~ Ornate Rainbowfish (Rhadinocentrus ornatus) ~*~ Endemism (Again)

#102 Slate Pencil Urchin ~*~ Red Slate Pencil Urchin (Heterocentrotus mamillatus) ~*~ Urchin Spines

#103 Saddled Bichir ~*~ Saddled Bichir (Polypterus endlicheri) ~*~ Synapomorphy

#104 Nibble Fish ~*~ Doctor Fish (Garra rufa) ~*~ Ichthyotherapy

#105 Sweetfish ~*~ Ayu (Plecoglossus altivelis) ~*~ Traditional Cormorant Fishing

#106 Sweet Shrimp ~*~ Amaebi (Pandalus eous) ~*~ Shrimp Taxonomy

#107 Anomalocaris ~*~ Anomalocaris canadensis ~*~ Radiodontids

#108 Venus’ Flower Basket ~*~ Venus’ Flower Basket (Euplectella aspergillum) ~*~ Sponges

#109 Sea Cucumber ~*~ Japanese Spiky Sea Cucumber (Apostichopus japonicus) ~*~ Sea Cucumbers

#110 Olive Flounder ~*~ Olive Flounder (Paralichthys olivaceus) ~*~ Flatfish Lesson 1

#111 Dab ~*~ Alaska Plaice (Pleuronectes quadrituberculatus) ~*~ Flatfish Lesson 2

#112 Mitten Crab ~*~ Chinese Mitten Crab (Eriocheir sinensis) ~*~ What Is a Crab?

#113 Snow Crab ~*~ Snow Crab (Chionoecetes opilio) ~*~ Japanese Names

#114 Dungeness Crab ~*~ Dungeness Crab (Metacarcinus magister) ~*~ Ocean Acidification

#115 Red King Crab ~*~ Red King Crab (Paralithodes camtschaticus) ~*~ Imposter Crab

#116 Red Snapper ~*~ Northern Red Snapper (Lutjanus campechanus) ~*~ Longevity

#117 Turban Shell ~*~ Horned Turban Snail (Turbo cornutus) ~*~ Snails

#118 Trilobite ~*~ Cheirurus spp. ~*~ How Fossils Form

#119 Whelk ~*~ Common Whelk (Buccinum undatum) ~*~ Predatory Snails

#120 Sea Star ~*~ Brick Red Sea Star (Anthaster valvulatus) ~*~ All About Sea Stars

#121 Seaweed ~*~ Wakame (Undaria pinnatifida) ~*~ More Algae

#122 Sea Pig ~*~ Sea Pig (Scotoplanes globosa) ~*~ Dueterostomes and Protostomes

#123 Pike ~*~ Northern Pike (Esox lucius) ~*~ Aggression

#124 Mussel ~*~ Bay Mussel (Mytilus trossulus) ~*~ Ecosystem Services

#125 Abalone ~*~ Black Abalone (Haliotis cracherodii) ~*~ Biomimicry

#126 Pond Smelt ~*~ Wakasagi (Hypomesus nipponensis) ~*~ Ice Fishing

#127 Spiny Lobster ~*~ Japanese Spiny Lobster (Panulirus japonicus) ~*~ Lobster Imposter

#128 Lobster ~*~ American Lobster (Homarus americanus) ~*~ Immortality

#129 Coconuts ~*~ Coconut Palm (Cocos nucifera) ~*~ Unorthodox Seed Dispersal

#130 Betta ~*~ Betta/Siamese Fighting Fish (Betta splendens) ~*~ Labyrinth Fish

#131 Blowfish ~*~ Fine Patterned Puffer (Takifugu poecilonotus) ~*~ Preparing Toxic Fugu

#132 Gulliver/Gullivarrr ~*~ Black-tailed Gull (Larus crassirostris) ~*~ Seabirds

#133 Eusthenopteron ~*~ Eusthenopteron foordi ~*~ You’re a Fish

#134 Octopus Villager ~*~ Octopus spp. ~*~ Anatomy of an Octopus

#135 Spider Crab ~*~ Japanese Spider Crab (Macrocheira kaempferi) ~*~ Big Animals in the Oceans

#136 Beach Shells ~*~ multiple spp. ~*~ General About Spp.

#137 Penguin Villager ~*~ Sphenisciformes spp. ~*~ Penguins!

#138 Firefly Squid ~*~ Firefly Squid (Watasenia scintillans) ~*~ Bioluminescence

#139 Wardell ~*~ West Indian Manatee (Trichechus manatus) ~*~ Sirenia, the Manatees and Dugong

#140 Lyle & Lottie ~*~ Japanese River Otter (Lutra nippon) ~*~ Extinct River Otters

#141 Spring Mackerel ~*~ Japanese Spanish Mackerel (Scomberomorus niphonius) ~*~ Scombrid Fish

#142 Moorish Idol ~*~ Moorish Idol (Zanclus cornutus) ~*~ Fish in Culture

#143 Barbel Steed ~*~ Barbel Steed (Hemibarbus labeo) ~*~ More F’n Cyprinids

#144 Nomura’s Jellyfish ~*~ Nomura’s Jelly (Nemopilema nomurai) ~*~ Native Invader

#145 Frog Villager ~*~ Anura spp. ~*~ Frogs vs Toads

#146 Flying Fish ~*~ Bennet’s Flying Fish (Cheilopogon pinnatibarbatus) ~*~ How They Fly

#147 Pineapple Fish ~*~ Japanese Pineapple Fish (Monocentris japonica) ~*~ Armor

#148 Eel ~*~ Japanese Eel (Anguilla japonica) ~*~ Catadromous Lifestyle

#149 Sea Bunny ~*~ Sea Bunny (Jorunna parva) ~*~ The Fuzz is a Lie

#150 Hippo Villager ~*~ Common Hippo, (Hippopotamus amphibius) ~*~ Hippos

#151 Largehead Hairtail ~*~ Largehead Hairtail (Trichiurus lepturus) ~*~ Species Complex Confusion

#152 Lumpfish ~*~ Balloon Lumpfish (Eumicrotremus pacificus) ~*~ Suction

#153 Giant Catfish ~*~ Giant Lake Biwa Catfish (Silurus biwaensis) ~*~ Earthquake Fish

#154 Kapp’n ~*~ Kappa ~*~ The Legend of the Kappa

#155 Achilles Surgeonfish ~*~ Achilles Tang (Acanthurus achilles) ~*~ A Fish’s Achilles’ Heel

#156 Comb Jelly & Northern Comb Jelly ~*~ Ctenophore spp. ~*~ Ctenophores Are Not Jellyfish

#157 Flora ~*~ American Flamingo (Phoenicopterus ruber) ~*~ Flamingos!

#158 Red Sea Bream ~*~ Madai (Pagrus major) ~*~ Seasonal Luxury

#159 Goliath Frog ~*~ Goliath Frog (Conraua goliath) ~*~ Biggest Frog!

#160 Bering Wolffish ~*~ Bering Wolffish (Anarhichas orientalis) ~*~ Wolffish

#161 Bicolor Dottyback ~*~ Bicolor Dottyback (Pictichromis paccagnella) ~*~ Incertae sedis

#162 Zebra Moray ~*~ Zebra Moray (Gymnomuraena zebra) ~*~ More Morays

#163 Vampire Crab ~*~ (Geosesarma dennerle) ~*~ TFW the Pet Trade Discovers Things Faster Than Science

#164 Phineas ~*~ Japanese Sea Lion (Zalophus japonicus) ~*~ Seals vs Sea Lions

#165 Amberjack ~*~ Japanese Amberjack (Seriola quinqueradiata) ~*~ Farmed Predators

#166 Sakura Shrimp ~*~ Sakura Shrimp (Sergia lucens) ~*~ Actually Prawns

#167 Black Ghost Knifefish ~*~ Black Ghost Knifefish (Apteronotus albifrons) ~*~ It’s Electric!

#168 Black Clownfish ~*~ Ocellaris Clownfish - AGAIN! (Amphiprion ocellaris) ~*~ Polymorphism

#169 Pink Anemonefish ~*~ Pink Skunk Clownfish (Amphiprion perideraion) ~*~ Mutuals with an Anemone

#170 Wakin Goldfish ~*~ Goldfish (Carassius auratus) ~*~ Mutants

#171 Skipjack Tuna ~*~ Skipjack Tuna (Katsuwonus pelamis) ~*~ Pollution? In my seafood? More likely than you think!

#172 Yellowfin Tuna ~*~ Yellowfin Tuna (Thunnus albacares) ~*~ Associations

#173 Tiger Catfish ~*~ Tiger Shovelnose Catfish (Pseudoplatystoma spp.) ~*~ Diverse Cats

#174 Great Barracuda ~*~ Great Barracuda (Sphyraena barracuda) ~*~ Unique Predatory Methods

#175 Atlantic Mackerel ~*~ Atlantic Mackerel (Scomber scombrus) ~*~ Being a Living Trawl Net

#176 Wendell ~*~ Walrus (Odobenus rosmarus) ~*~ Walrus!

#177 Pacific Saury ~*~ Pacific Saury (Cololabis saira) ~*~ Seasonal Migration

#178 Spotted Knifejaw ~*~ Spotted Knifejaw (Oplegnathus punctatus) ~*~ Range Expansion

#179 Discus ~*~ Discus (Symphysodon discus) ~*~ Parenting like a Mammal

#180 Harlequin Shrimp ~*~ Harlequin Shrimp (Hymenocera picta) ~*~ Tiny knights killing monsters

#181 Dr.Shrunk ~*~ Axolotl (Ambystoma mexicanum) ~*~ Dude looks like a baby - Neotany

#182 Freshwater Crab ~*~ Red-Clawed Crab (Perisesarma bidens) ~*~ Multiple Moves to Freshwater

#183 Flame Angelfish ~*~ Flame Angelfish (Centropyge loricula) ~*~ Being colorful af

#184 Threadfin Butterflyfish ~*~ Threadfin Butterflyfish (Chaetodon auriga)~*~ Eyespot

#185 Splendid Garden Eel ~*~ Splendid Garden Eel (Gorgasia preclara) ~*~ Another Garden Eel

#186 Splendid Alfonsio ~*~ Splendid Alfonsio (Beryx splendens) ~*~ Big Eyes

#187 Manta Ray ~*~ Oceanic Manta Ray (Mobula birostris) ~*~ 2 Mantas

#188 Giant River Prawn ~*~ Giant River Prawn (Macrobrachium rosenbergii) ~*~ Mr. Sexy Legs

#189 Green Spotted Puffer ~*~ Green Spotted Puffer (Dichotomyctere nigroviridis) ~*~ 4 Terrible Teeth

#190 Pot-bellied Seahorse ~*~ Pot-bellied Seahorse (Hippocampus abdominalis) ~*~ Male “Pregnancy”

#191 Herabuna ~*~ Japanese White Crucian Carp (Carassius cuvieri) ~*~ Exclusive Fish

#192 Smalltooth Sand Tiger Shark ~*~ Smalltooth Sand Tiger Shark (Odontaspis ferox) ~*~ Shape of Shark Teeth

#193 Silver Pomfret ~*~ Silver Pomfret (Pampus argenteus) ~*~ Lessepsian Migration

#194 Japanese Halfbeak ~*~ Japanese Halfbeak (Hyporhamphus sajori) ~*~ Long Chin is Long

#195 Alligator Villagers ~*~ Crocodilian spp. ~*~ Crocodiles, Caimans, Alligators, and Gharials!

#196 Clam ~*~ Manila Clam (Ruditapes philippinarum) ~*~ Carbon Sequestration and Climate Change Actually

#197 Amazon Leaffish ~*~ Amazon Leaffish (Monocirrhus polyacanthus) ~*~ Cryptic Behavior

#198 Red Lionfish ~*~ Red Lionfish (Pterois volitans) ~*~ Venom vs Poison

#199 White Ribbon Eel ~*~ White Ribbon Eel (Pseudechidna brummeri) ~*~ Animal Elongation

#200 Opah ~*~ Opah (Lampris guttatus) ~*~ Whole-Body Endothermy

#201 Yellow Boxfish ~*~ Yellow Boxfish (Ostracion cubicum) ~*~ Shell-Fish

#202 Horsehair Crab ~*~ Horsehair Crab (Erimacrus isenbeckii) ~*~ Setae: Hair for Crab

#203 Black Ruby Barb ~*~ Purplehead Barb (Pethia nigrofasciata) ~*~ How Endemism Happens

#204 Longsnout Seahorse ~*~ Slender Seahorse (Hippocampus reidi) ~*~ Suction Feeding

#205 Threadfin Trevally ~*~ African Pompano (Alectis ciliaris) ~*~ Larval Mimicry

#206 Gourami ~*~ Honey Gourami (Trichogaster chuna) ~*~ Color Edits

#207 Duck Villagers ~*~ Anseriformes spp. ~*~ Duck Diversity

#208 Weedy Stingfish ~*~ Weedy Stingfish (Scorpaenopsis cirrosa) ~*~ Scorpion Fish

#209 Silver Arowana ~*~ Silver Arowana (Osteoglossum bicirrhosum) ~*~ Surface Predator

#210 Longtooth Grouper ~*~ Longtooth Grouper (Epinephelus bruneus) ~*~ Growing Old - for Fish!

#211 Yellow King Piranha ~*~ Yellow King Piranha (Serrasalmus ternetzi)~*~ Color Morph With it’s Own Binomial aka Confusing AF

#212 Giant Squid ~*~ Giant Squid (Architeuthis dux) ~*~ The Search for a Deep Sea Giant

#213 Rainbow Trout ~*~ Rainbow Trout (Oncorhynchus mykiss) ~*~ Subspeciation - Hows and Whys

#214 Brook Trout ~*~ Brook Trout (Salvelinus fontinalis) ~*~ Trout? Almost as Bad as Bass!

#215 Frogfish ~*~ Painted Frogfish (Antennarius pictus) ~*~ Form Follows Function

#216 Crystal Red Shrimp ~*~ Bee Shrimp (Caridina cantonensis) ~*~ Bred for Perfection

#217 Pelly, Phyllis, & Pete ~*~ Great White Pelican (Pelecanus onocrotalus) ~*~ Pelicans!

#218 Pelican Eel ~*~ Pelican Eel (Eurypharynx pelecanoides) ~*~ Deep-sea Mouth

#219 Dark Banded Rockfish ~*~ Dark Banded Rockfish (Sebastes inermis) ~*~ Why Buying Local is Best

#220 Diamond Tetra ~*~ Diamond Tetra (Moenkhausia pittieri) ~*~ Endemic and Endangered

#221 Crab ~*~ Christmas Island Crab (Gecarcoidea natalis) ~*~ Mass Migration

#222 Yellow Starfish ~*~ North Pacific Sea Star (Asterias amurensis) ~*~ Water Vascular System

#223 Violet Sea Snail ~*~ Violet Sea Snail (Janthina janthina) ~*~ Macroplankton

#224 Lemur-Tail Seahorse ~*~ Japanese Seahorse (Hippocampus mohnikei) ~*~ Square Tails

#225 Coconut Crab ~*~ Coconut Crab (Birgus latro) ~*~ NOT Nightmare Fuel

#226 White Tuxedo Guppy / White Butterfly Koi / White Angelfish ~*~ Albinism, Luecism, and other color disorders

#227 Blue Starfish ~*~ Blue Sea Star (Linckia laevigata) ~*~ The Rarity of Blue

#228 Chip & CJ ~*~ American Beaver (Castor canadensis) ~*~ Debunking Beaver Myths

~~The Museum Tour - Habitats~~

#1 Open Ocean

#2 Nearshore

#3 Coral Reefs

#4 Estuary

#5 Rivers

#6 Lakes and Ponds

#7 Wetlands

#8 Aquarium Hobby Tank

#9 Polar Regions

#10 The Abyss

~~Fish Dish Fridays~~

#1 Aji Fry

#2 Salmon Bagel Sandwich

#3 Squid Ink Spaghetti

#4 Clam Chowder

#5 Carpaccio di...

#6 Anchoas al Ajillo

#7 Sea Bass Pie

#8 Seafood Pizza

#9 Poke

#animal crossing#fish#marine biology#ichthyology#shark#aquarium#science in video games#animal crossing fish explained#masterpost#masterpost1#habitats#environments#museum#long post

306 notes

·

View notes

Text

Land And Stock Market Investing Require Different Strategies

Two years later, at the tip of September 2020, that quantity hit a report low of solely 462 properties available on the boutiques near me - equal to a decline of 86.6% in Boise’s housing stock. Using for-sale inventory and days-on-market data from Redfin and median listing prices from Zillow, we analyzed which main metro areas are seeing their housing markets increase in 2020, particularly compared to prior years. From $364,267 in September 2018, the median list price in Ogden now exceeds $420,000 in 2020. And like Provo, Ogden’s for-sale stock has dropped significantly 12 months over year. In just one 12 months, the variety of available properties on the market dropped by 70.9%, from 1,853 houses in September 2019 down to only 540 as of September 2020. What’s more, homes within the Ogden metro area are promoting quicker than ever. Out of the one hundred metro areas analyzed here, Tulsa’s housing market has skilled the best enhance in dwelling costs over the last two years. From a median checklist price of $219,833 in September 2018, dwelling costs have grown by 33%, rising to $292,300 in September 2020. Equally impressive, Tulsa’s available stock has shrunk immensely in recent times.

From having over 4,400 properties on the market in September 2018, Tulsa’s available inventory now stands at 1,863, which implies its supply of properties has been greater than halved in two years. The Killeen metro area is located north of Austin and has seen its housing market heat up considerably up to now few years. Region sensible the market is divided into North America, Europe, Asia Pacific, Middle East & Africa and Latin America. Located within the Lehigh Valley north of Philadelphia, the Allentown metro space has been rising over the years whereas many different main Pennsylvania cities have been experiencing inhabitants declines. The coldest housing markets, then again, are closely centered on vacation spots - like cities in Florida, Hawaii and Nevada - in addition to densely-populated coastal metropolises like San Francisco and New York, the latter of which was hit the heaviest by the Covid-19 pandemic in its early phases. Pancorbo: Again there are two angles here. The 15 hottest housing markets in 2020 are spread out throughout the U.S., although there are some geographic patterns.

1 note

·

View note

Text

Top 6 Beaches in USA

From all over the cities of wealthy and greenery (Happy & joys) to those with stunning structure to those who boast terrific beaches, there are stunning locations all across the 25 states of America.

To discover the maximum picturesque locales across the US for visitors , between consulted polls with the aid of joy journey publications including research carried out by real estate corporations and tourism advisors. We additionally looked at the range of parks cities contained, towns’ proximity to stunning herbal landscapes, and points of interest inclusive of ancient sites, unique structure of beaches , and cultural institutions.

In no particular order, right here are 21 of the prettiest towns in the country.

Honolulu, Hawaii

Waikiki Beach is, Honolulu, Hawaii

There are lots of ways to take benefit of island lifestyles in Honolulu the city of America, where you may find a variety of remarkable lush flowers, seashores, and unique volcanic landforms that are most beautifull from all over the world.

At Waikiki Beach you could take in the solar, or cross snorkeling or surfing. For a exclusive angle, check out Diamond Head State Monument. The eponymous crater, formed throughout a volcanic eruption a hundred,000 years ago, is a ought to-see, and the surrounding park offers appropriate views of the Pacific.

If you’ve got had your fill of out of doors fun & joy, you could get your way of life restore at world-magnificence museums,park, inclusive of the Bishop Museum, home to that Beach.

Philadelphia, Pennsylvania

Philadelphia alley

Philadelphia is known as the birthplace of American democracy in politics, but its structure is simply as noteworthy. From City Hall with progress — the biggest municipal constructing inside the US, built inside the grand Second Empire style that are highly — to Elfreth’s Alley, America’s oldest residential avenue, records is everywhere you walk in Philly.

The excellent way to explore the City of Brotherly Love — which is complete of charming facet streets, cobblestone alleys, and international-famous work of art — is on foot. In fact, in 2017, the actual estate web site Redfin named Philly the 5th most walkable US city.

Charleston, South Carolina

Charleston, South Carolina

Between its Instagram-pleasant pastel homes and comforting Lowcountry cuisine, Charleston — which has again and again been ranked a top US metropolis through Travel + Leisure — epitomizes southern allure. Thanks to a plethora of art colleges and galleries, Charleston’s arts scene is also engaging. And inside the summer time, you may absorb a theater, dance, or song performance on the Spoleto Festival.

Annapolis, Maryland

annapolis maryland

Situated at the scenic Chesapeake Bay, Annapolis ( Maryland’s capital) is defined by means of desirable Colonial homes and harbor-the front dining of the heart, such as a historical tavern frequented via America’s Founding Fathers. This small city is also where you’ll find the United States Naval Academy to provide the training to new hired person, whose lovely Beaux Arts homes are a draw for structure buffs.

Savannah, Georgia.

Forsyth Park Savannah

Georgia’s oldest metropolis, Savannah, has been referred to as the Hostess City of the South. Between Savannah’s Antebellum architecture, Spanish moss (which you can see at the Wormsloe State Historic Site, along southern stay alrighttrees), and waterfront views (the cobblestone-weighted down River Street is a superb vantage point), beauty abounds. Plus, the Atlantic Ocean beckons at nearby Tybee Island, a barrier island best 20 mins from downtown Savannah.

Madison, Wisconsin

Madison, WI

Madison’s plentiful greenery — which amounts to eleven.6 parks per 10,000 citizens at the time of visiting, plus an arboretum paired with its walkable, bicycle owner-friendly downtown make Wisconsin’s capital a applicable vicinity to stay and have a look at. Its location at the beautiful lakes Mendota and Monona doesn’t hurt both.

https://todaywebstory.com

0 notes

Photo

@flickinfeathers: A better look at the maruta (Pacific redfin) I imagine most folk outside Japan don't know about them, they are a sea run dace that returns to Japanese rivers around cherry blossom time. An interesting fish for visitors who come for the blossoms. #japan #flyfishing #fishing https://t.co/W3Hw0Se1Iw

0 notes

Photo

Got a few maruta (pacific redfin) today too. All on a squirmy worm fished dead drift. #flyfishing #flytying #fishing #pacificredfin #japanfishing #marutaugui #maruta https://www.instagram.com/p/CMRcU_bhOsw/?igshid=1e3v3cn2t9f9u

0 notes

Photo

July 16, 2020 SEATTLE, July 16, 2020 /PRNewswire/ -- Redfin Corporation (NASDAQ: RDFN) will release second-quarter 2020 results after the stock market closes on Thursday, July 30, 2020. The company will host a live webcast of its conference call to discuss the results at 1:30 p.m. Pacific Time / 4:30 p.m. Eastern Time. Participants may access…

0 notes

Photo

Công ty bất động sản La bàn đấu tranh để đưa ra lời hứa về công nghệ lớn Mùa hè năm ngoái, Quỹ Tầm nhìn SoftBank và các nhà đầu tư vốn mạo hiểm khác đã đầu tư 370 triệu đô la vào Compass, một công ty bất động sản hứa hẹn sẽ làm chấn động ngành môi giới dân cư. Thỏa thuận này trị giá La bàn ở mức 6,4 tỷ USD, vào thời điểm đó khiến nó có giá trị gấp 10 lần so với Tập đoàn Realogy, công ty đại chúng sở hữu Thế kỷ 21, Coldwell Banker, Tập đoàn Corcoran và Công ty môi giới quốc tế Sothwise. La bàn duy trì rằng công nghệ của nó sẽ làm cho các đại lý của nó năng suất và lợi nhuận cao hơn các nhà môi giới truyền thống. Nhưng cho đến nay, công ty, được thành lập vào năm 2012, về cơ bản đã phá vỡ hoạt động kinh doanh bất động sản và tiếp tục chơi trò đuổi bắt với lãnh đạo ngành Realogy (ticker: RLGY). Năm ngoái, La Bàn, khoảng 15.000 đại lý đã hoàn thành khoảng 112.000 giao dịch trị giá 88 tỷ USD. Công ty nói rằng nó hiện là công ty môi giới độc lập lớn nhất trong cả nước. Nhưng La bàn có giá trị phong phú vẫn còn thua xa Realogy, với 300.000 đại lý đã đóng 1,4 triệu giao dịch trị giá 505 tỷ USD vào năm 2019. Nhà phân tích của Jack Susenko, Jack Micenko nói về La bàn. Họ kiếm tiền theo cách tương tự như Realogy và Re / Max làm. Re / Max Holdings (RMAX) là một thương hiệu nhượng quyền với khoảng 130.000 đại lý hoạt động dưới thương hiệu của mình. Một số cựu nhân viên của La bàn nói rằng công nghệ Công ty đã rơi vào tình trạng trở thành một thế lực đột phá trong ngành hoặc mang lại lợi thế đáng kể cho các đại lý. Cựu nhân viên của Compass và các chuyên gia bất động sản có kiến thức về các hoạt động của công ty đã nói với Barron, rằng Compass thường phải vật lộn để có được nhân viên của mình sử dụng công nghệ của mình. Một phát ngôn viên của La bàn đã từ chối trả lời các câu hỏi về nền tảng công nghệ của công ty hay năng suất của các đại lý. Là một công ty tư nhân, Compass được yêu cầu tiết lộ tài chính và từ chối yêu cầu cung cấp dữ liệu tài chính. La bàn 15.000 đại lý Giao dịch $ 88 B 2019 $ 6.4 B 2019 Giá trị riêng Đồng sáng lập và Giám đốc điều hành Robert Reffkin đã nói rằng mục tiêu của ông là cho La bàn trở thành một nền tảng của Vương quốc để cung cấp năng lượng cho tất cả các quyết định bất động sản do người mua, người bán và đại lý thực hiện. Hoạt động của ông, ông nói, là duy nhất trong ngành bất động sản bởi vì nó tạo ra hiệu ứng mạng thông qua công nghệ tập trung vào cả đại lý và người tiêu dùng. Sử dụng nền tảng La bàn, các đại lý bất động sản và người mua tiềm năng có thể chia sẻ danh sách và ý tưởng. Công ty realty cũng cung cấp cho các đại lý các công cụ công nghệ để giúp tiếp thị. Vào tháng 9 năm 2018, tháng mà công ty đã công bố khoản đầu tư 400 triệu đô la từ SoftBank, Cơ quan đầu tư Qatar và những người khác đã phân loại hai phần ba các đại lý của mình là những người sử dụng công nghệ tích cực, theo một tài liệu nội bộ được đánh giá bởi Barron. La bàn đã xem xét bất kỳ đại lý nào đã sử dụng công nghệ của mình trong ít nhất một phút, mỗi tháng một lần để trở thành người dùng tích cực, tài liệu cho thấy rõ. Tái sinh 300.000 đại lý Giao dịch $ 505 B 2019 $ 384 M Giá trị thị trường Công ty đã từ chối cung cấp các số liệu sử dụng khác cho Barron Phụ. La bàn có kế hoạch nâng cấp bất động sản dân cư bằng cách sử dụng công nghệ khi WeWork, một khoản đầu tư bất động sản SoftBank có giá trị cao khác, đấu tranh để thực hiện lời hứa công nghệ của riêng mình. Khi cố gắng ra mắt công chúng vào năm ngoái, WeWork đã nói với các nhà đầu tư tiềm năng rằng họ có sức mạnh để nâng cao cách mọi người làm việc, sinh sống và phát triển. Công ty nộp hồ sơ S-1 cho biết, Công nghệ là nền tảng của nền tảng toàn cầu của chúng tôi. Nhưng cùng một hồ sơ tiết lộ tổn thất lớn. WeWork cuối cùng đã rút ra đợt chào bán công khai ban đầu theo kế hoạch và cần một kế hoạch giải cứu từ SoftBank, sau đó đã mất 4,6 tỷ đô la trong khoản đầu tư vào WeWork. La bàn có thể phải đối mặt với sự tính toán của riêng mình, đặc biệt là với việc đóng cửa liên quan đến Covid-19 tạo ra một bước ngoặt đối với các giao dịch bất động sản. Giá trị hiện tại của công ty có thể là một phần của con số gây quỹ tháng 7 năm 2019, do thay đổi động lực thị trường tư nhân và hiệu suất của các công ty đại chúng trong lĩnh vực môi giới dân cư. Các cuộc đấu tranh của WeWork đã cân nhắc về định giá chung của các công ty tư nhân, trong khi việc đóng cửa liên quan đến Covid-19 đang làm tổn thương các cổ phiếu bất động sản. Cổ phiếu của Realogy và Re / Max đã giảm lần lượt 62% và 41% trong năm nay. Một số người mới tham gia đã đấu tranh để phá vỡ thị trường bất động sản một cách có lợi nhuận. Tập đoàn Zvel (ZG) và Redfin (RDFN), cũng như Opendoor do SoftBank hậu thuẫn, đã đổ một lượng lớn tài nguyên vào làm lại bất động sản. Zvel, phát triển như một cách mới để các nhà môi giới quảng cáo dịch vụ của họ, đã đẩy vào mua bán nhà hoàn toàn, một dịch vụ mà nó gọi là Ưu đãi của Zulum. Công ty đã mất tiền trong bảy năm liên tiếp trên cơ sở các nguyên tắc kế toán được chấp nhận rộng rãi và các nhà phân tích của Phố Wall dự kiến sẽ mất $ 346 triệu vào năm 2020. Và dự báo đó được đưa ra trước khi tác động đầy đủ của Covid-19 được mô hình hóa. Trong một tuyên bố với Barron's, Zvel nói: Hiện Chúng tôi đang hoạt động trong khuôn khổ đầu tư mà chúng tôi đặt ra cho chính mình khi chúng tôi mở rộng quy mô kinh doanh Cung cấp của Zulum và hoạt động kinh doanh cốt lõi của chúng tôi đã tạo ra thu nhập mạnh mẽ mà chúng tôi có thể đầu tư để tạo ra nó. dễ dàng hơn và liền mạch hơn cho khách hàng của chúng tôi để di chuyển. Redfin nhỏ hơn cũng có đấu tranh để kiếm lợi nhuận; vào năm 2020, các nhà phân tích dự kiến công ty sẽ mất 80 triệu đô la trong năm thứ hai liên tiếp. Các chuyến đi của các hoạt động bất động sản này cho thấy ngành công nghiệp bất động sản dân cư ở Hoa Kỳ chống lại sự thay đổi cơ bản như thế nào. Cốt lõi của sân bóng bàn đối với các nhà đầu tư mạo hiểm rất đơn giản: Các đại lý bất động sản rất tốn kém, và toàn bộ quá trình mua nhà là một rắc rối. Để định hình lại ngành công nghiệp, Compass nói rằng nó tập trung vào việc làm cho các đại lý tốt hơn trong công việc của họ. Công ty tuyên bố công nghệ của mình có thể giúp các đại lý bán tài sản nhanh hơn so với đối thủ. Một trong những lợi thế cạnh tranh của La-tinh là mọi nhân viên đều tập trung vào năng suất đại lý, Giám đốc điều hành của Reffkin nói với Barronith năm 2018. Công ty đã từ chối cung cấp Reffkin cho bài viết này. Mike DelP rời, một học giả cư trú tập trung vào công nghệ bất động sản tại Đại học Colorado Boulder, nói rằng La bàn đã phải vật lộn với các cải tiến năng suất. Tôi đã không thấy bất kỳ bằng chứng nào chứng minh rằng công nghệ của La Bàn đang làm cho các đại lý của nó có năng suất cao hơn mức trung bình của ngành, ông nói. Theo bất cứ cách nào, La bàn là một trong những đồng nghiệp của nó, cho dù đó là môi giới truyền thống hay xa xỉ. Micenko, người bao gồm Realogy, Redfin, và lĩnh vực xây dựng nhà cho Susquehanna, nói rằng ông đã bị sốc bởi một cuộc biểu tình mà ông đã thấy vào tháng 1 về quản lý quan hệ khách hàng của Compass, hay nền tảng công nghệ CRM. Bất chấp sự cường điệu và các nguồn lực đổ vào dự án, Micenko nhớ lại suy nghĩ: Bạn có thể mua cái này ngoài giá 2 triệu đô la một năm. Realogy và Re / Max và mọi người khác cũng có CRM. Thay vì gây ấn tượng với công nghệ, Micenko nói rằng Compass tuyển dụng các đại lý bằng cách cung cấp các phần chia hấp dẫn hơn trên hoa hồng. Ở đó, luôn luôn có một cuộc chiến thực phẩm cho các đặc vụ tốt nhất, ông nói. Sau đó, thị trường đã có, hãy nói, 60% đến 70% và sau đó La bàn đến và đang thuê người trong thời gian hợp đồng hai năm với tỷ lệ chia tách 85%, 90%, 95%, ông nói. Ngay lập tức, những gì sắp xảy ra là bạn sẽ có rất nhiều đại lý đến và bán nhà, nhưng bạn sẽ không kiếm được tiền từ nó. La bàn đã có xu hướng mua lại trong vài năm qua. Các giao dịch mua của nó đã bao gồm các công ty bất động sản Pacific Union ở khu vực San Francisco và Stribling ở New York, cộng với Liên hệ, một công ty phần mềm quản lý quan hệ khách hàng có trụ sở tại Washington, D.C. La bàn hiện có hơn 15.000 đại lý và thị phần đáng ghen tị ở một số địa điểm nhất định, bao gồm hơn 40% tại San Francisco. Nhưng cuộc khủng hoảng Covid-19 đã tạm dừng các kế hoạch mở rộng. Vào cuối tháng 3, Compass đã sa thải 15% nhân viên của mình, tương đương khoảng 375 người. Trong một lá thư gửi nhân viên của mình, Reffkin cho biết ông đang mong đợi doanh thu sẽ giảm 50% trong sáu tháng tới. Mới gần đây như tháng 9 năm ngoái, Reffkin vẫn đang nói về một IPO có khả năng là một lần nào đó trong tương lai. Những kế hoạch đó hiện đang bị nghi ngờ. Doanh số bán nhà hiện tại có thể giảm 40% đến 50% so với năm trước, qua quý 3 năm 2020, Micenko cảnh báo, cho biết thêm: Đây là thời điểm tồi tệ nhất trong năm đối với một doanh nghiệp theo chu kỳ. Viết thư cho Ben Walsh tại [email protected] .[ad_2] Nguồn

0 notes

Text

Where Are the Tech Zillionaires? San Francisco Faces the I.P.O. Fizzle

SAN FRANCISCO — Seven months ago, the Four Seasons in San Francisco sent out a news release announcing the glad tidings that would come soon: New residences for the new money. Builders were hoisting glass and steel into a 43-story tower where residents would have their own on-staff wine concierge, plus Blue de Savoie French marble, German milled Poggenpohl cabinetry and Dornbracht fixtures. The building’s $49 million penthouse would be the most expensive in San Francisco. “Just in time for the coming wave of I.P.O. millionaires in San Francisco,” the Four Seasons said, promising “an elevated sales experience” to cater to “this new class of buyers.” But then the wave of tech initial public offerings — the one that was supposed to mint San Francisco’s new ultra rich — fizzled. The stock of Uber, the ride-hailing giant, has dropped nearly 30 percent since the company went public in May. Lyft shares are down nearly 40 percent. Pinterest and Slack have declined, too. San Francisco has been left as a slightly more normal town of tech workers who got rich-ish, maybe making a few hundred thousand dollars. But that doesn’t go far in a city where the median cost of a single family home is about $1.6 million. “Everyone that came back post-I.P.O. seemed to be the same person. I didn’t see any Louis Vuitton MacBook case covers or champagne in their Yeti thermos,” said J.T. Forbus, a tax manager at Bogdan & Frasco in San Francisco.Private wealth managers are now meeting with a chastened clientele. Developers are having to cut home prices — unheard-of a year ago. Party planners are signing nondisclosure agreements to stage secret parties where hosts can privately enjoy their wealth. Union organizers are finding an opportunity. Everyone had gotten too excited, and who could blame them? The money was once so close: A start-up that coordinated dog walkers raised $300 million. The valuations of the already giant ride-hailing behemoths had nearly doubled again. WeWork, a commercial real estate management start-up that owned very little of its own real estate, was valued at $47 billion. Towers rose across San Francisco to house the money. The marble was polished. The bathroom floors were warm. The private pools were being filled.“The world has changed in a year,” said Herman Chan, a real estate broker with Sotheby’s International. “We expected an upward trajectory at least, and it really kind of deflated. These companies aren’t dying but the cultural zeitgeist, that momentum of I.P.O.s, is gone. You don’t even hear anyone talking about it anymore.”The developers who had fought the odds of regulation and zoning to build their glass residences in the sky had timed their units to the I.P.O.s. But on a recent visit with the Four Seasons sales team, they acknowledged that techie wealth was not what they were seeing. Interest was mostly coming from overseas buyers, young heirs to foreign fortunes and older executives looking for city pieds-à-terre, they said. Also in time for the wave that was not a wave are more luxury towers: The Avery, The Harrison, 181 Fremont, The Mira. “The definition of luxury is scarcity, and there’s so many now,” Mr. Chan said. “Nowadays, my buyers are getting a contingency period and inspectors. Things you would never ask for before. There’s not 10 offers on a house anymore.”Case in point: A full-floor apartment in San Francisco’s poshest neighborhood of Pacific Heights was listed at $21.6 million and advertised that “a sommelier-worthy wine cellar awaits 1,500 of your most prized bottles.” But more than a year later and after a $5 million price cut, it is still on the market. Prices for the top 5 percent of San Francisco area real estate listings — the cream of the crop — rose 7 percent between 2017 and 2018. This year, they have fallen more than 1 percent, according to data prepared for The New York Times by the real estate listing service Zillow. The malaise has spread south into Silicon Valley. A $10.8 million home listing in the town of Portola Valley, Calif., was slashed to $5.7 million. The median sale price for a nearby home in San Jose, Calif., has dropped 10 percent in a year to just under $1 million, according to data from the real-estate listing site Zillow. Before the tech I.P.O.s, Deniz Kahramaner, then a real estate data analyst with the property brokerage Compass, had rallied packed rooms of real estate agents and investors about the bonanza that lay ahead. He had charts and estimates of thousands of new millionaires raising the average price of single family homes in San Francisco above $5 million.Now, he is more muted. “The I.P.O. cash-out hasn’t played out as I mentioned in my original presentation,” he said. Mr. Kahramaner added, hopefully, that it was still early. “People need more time,” he said.

Wealth and Unions

Instead of yachts, tech workers are funding more mundane ventures like college savings plans. “This year brought a lot of people back to reality,” said Ryan S. Cole, a private wealth adviser at Citrine Capital, a wealth management firm in San Francisco. “We’ve had a lot of people fund 529 plans for their kids. Pretty boring stuff.”Some private wealth managers said they were actually somewhat relieved. “At the end of the day, it’s funny money until it’s realized," said Jonathan DeYoe, another private wealth adviser. “I’ve got Uber and Lyft clients that are disappointed. It’s a different house now. It’s a different school situation for the kids. But they’re still by and large in good places. No one’s impoverished.”And so workers who thought they would upgrade from Allbirds to Berluti shoes are remaining, after all, in the Allbirds.As some rank-and-file tech workers realize they might not get rich from company stock, the allure of working long hours without comparable real money pay is also wearing thin, said labor organizers. They have found traction this year in an industry long resistant to unions. “The incentives to take the licks that you do are in the hope of some sort of big payoff down the road,” said Paul Thurston, who focuses on unionizing San Francisco tech workers and is the organizing director at the International Federation of Professional and Technical Engineers. Now, “the engineers and the app designer and the developers are going to be treated a lot more like the employees that they are rather than like partners, which is what they’re told pre-I. P. O.,” he said.Jonathan Wright, the organizing director of Engineers and Scientists of California, said he was in talks to unionize the workers of several big tech companies. “There’s a promise: you work 100 hours a week, you sleep under your desk, and then you’ll be rewarded with the wealth of Bezos,” Mr. Wright said. “That mythology has been fading for years. The day of the unicorn is over.”Where there is new wealth, it’s coming from the older tech companies like Apple and Alphabet, whose stocks this year have soared. And some fortunes are still being made from the I.P.O.s. While Uber’s shares have fallen, the company’s co-founder, Travis Kalanick, has sold off more than $2 billion in stock, according to securities filings. “Especially with things like Uber, almost all the I.P.O. wealth was going to a couple of people,” said Kalena Masching, a Redfin agent in San Jose. “They are not looking to buy a standard house here.”Another bright spot: female-led companies, with more becoming unicorns in 2019 than any other year, according to Aileen Lee, the venture capitalist who coined the phrase “unicorn” to refer to a private company valued at $1 billion or more.And post-I.P.O. parties are happening. They are just secret — and phone-free. “We’re signing a lot more nondisclosures,” said Jay Siegan, who curates party entertainment for corporate tech clients. “A year ago, people would set up social media stations at the party, signs with the hashtag for Instagram. Now we have clients asking guests to check their phones at the door or using those Yondr bags.”These are pouches used to lock phones en masse at concerts and events where someone might be tempted to record.

Self Reflection

However, in public, the tech world is all about reflection and self-critiquing after the year that was. The I.P.O. disappointment has gotten so extreme that two Silicon Valley techies are setting out to do what few have done before: Make fun of themselves. David Cowan, a venture capitalist with Bessemer Venture Partners, which invested in Lyft, and Michael Fertik, the founder of Reputation.com, are launching an online talk show called “The Bubble Report.” It will feature interviews with other tech executives. The point, they hope, is to poke fun at Silicon Valley from within Silicon Valley.Mr. Cowan, either in character or just being very honest, decried the falling stock prices of newly public tech companies as victims of cruel Wall Street analysts.“It should be against the law for unscrupulous analysts to assess stocks based on cash flow and profit, to impugn a company based on eight lines of a financial report,” he joked. “Imagine how much more value we’d have in the stock market if we got rid of that arcane thinking.” Mr. Fertik said his inspiration to mock his industry came in part from realizing how far from reality it had all gotten. “I want people to understand that Silicon Valley is a deeply religious place that thinks of itself as agnostic,” he said. “It has some of the strengths and many of the frailties of organized religion.”For now, most people are waking up to find they are still on Earth. This is good news for those in San Francisco who mostly viewed the tech exuberance as bad news: housing rights activists, first-time home buyers, and renters. “We are excited by any resetting of Bay Area rents that bring them down from their artificially inflated high,” said Fred Sherburn-Zimmer, the executive director of Housing Rights Committee, which fights against evictions. “Eventually all bubbles burst.”

Read the full article

#0financetechnology#0technologydrive#03technologysolutions#057technology#0dbtechnology#0gtechnology#1/0technologycorp#2000stechnology#3technologybets#3technologybetsgenpact#3technologycircuithallam#3technologydrivemilpitasca95035#3technologydrivewestboroughmassachusetts01581#3technologyplace#360technewshindi#3dprintingtechnews#3dtechnews#3mtechnologynews#4technologycomponentsofcrm#4technologydr#4technologydrive#4technologydrivelondonderrynh03053#4technologydrivepeabodyma#4technologydrivepeabodyma01960#4technologydrivewestboroughma#4technologywaysalemma#42technologynews#5technologycareers#5technologydrive#5technologydriveirvineca

0 notes

Text

Softening Real Estate Markets in Prime West Coast Cities: Does China Trump IPOs?

Digital Elixir

Softening Real Estate Markets in Prime West Coast Cities: Does China Trump IPOs?

It’s intriguing to see that real estate prices in the toniest West Coast markets have been sloppy for a while, and experts anticipate this trend will continue. The reason for using the word “intriguing” is that I know some owners of prime San Francisco property who were hoping that prices for homes like theirs would double based on the tsunami of unicorn IPOs slotted for this year, and newly minted millionaires looking to park their money in suitable digs.

Now admittedly, in the cases where the IPO has fallen below its initial offering price (we’re looking at you, Uber, along with Lyft and Pinterest), others like Beyond Meat and Crowdstrike traded up nicely. Remember that only a portion of a company’s shares are sold in an IPO; insiders cashing out fully is very bad form, as well as bearish-looking, so even employees who got in early and got a nice chuck of change in the IPO might be a wee bit chastened by the aftermarket wobbles. Even so, most of the remaining 2019 IPOs are on track, save for AirBnB due to mounting legal challenges not making for the best investor story.

Yet despite all this new liquidity flowing largely into West Coast hands, the Wall Street Journal reports that on what looks to be a broad basis, urban West Coast real estate is languishing. If this were one city, you could attribute it to local factors, like a spike in residential construction. But that doesn’t seem to be a significant factor. From the Journal:

U.S. home sales slumped in June as home prices for major West Coast cities declined for the first time since 2012, ending the spring selling season with a thud.

Real-estate agents said lower asking prices could eventually attract more buyers, but home values in the Bay Area, Los Angeles and Seattle have roughly doubled over the past seven years. That means prices may have to retreat further before buyers do more than look, economists said.

“Prices have dropped in Silicon Valley and sellers just aren’t used to the concept that [prices] can go down,” said Ken DeLeon, founder of DeLeon Realty in Palo Alto, Calif. “There’s just this malaise buyers had of, ‘I feel like it’s gonna drop further.’”….

The median price of a home fell in San Jose, Seattle and Los Angeles in June, compared with a year earlier, according to real-estate brokerage Redfin. For San Jose, that was the seventh month of annual price declines. The slowdown in the West Coast marketsnow spans all price points, including starter homes, which had been the tightest segment of the market. In San Jose, inventory for homes in the bottom-third price tier nearly doubled in June compared with a year earlier, while prices dropped 3.8%, according to Redfin.

What is striking about this shift is the breadth of the change: it’s hitting so many West Coast cities, and across so many types of homes. The article attributes the price reversal to two factors: that prices have outstripped incomes of even high-end professionals, and the Trump tax reforms have limited the deductibility of property taxes and mortgage interest in high-price, high tax states like California. But if tax changes were the main driver, you’d expect the dampening to be most pronounced in the biggest-ticket properties.

One Journal reader volunteered that first time buyers were knowingly speculating on price appreciation and planning to make relatively quick flips. If this practice is as widespread as he intimates, one wonders how many will be caught out:

PATRICK MROWCZYNSKI

Many people (and I’m talking families with modest means, both working parents needing 1000-1500+ sq ft in Santa Clara) is to often start with an interest only loan (e.g. 7/1 ARM) and then try to flip the home in 3-5 years after a 20-30% run up in prices.

Take the gains and use that as a down payment on a more modest home with a traditional mortgage.

The first step in this often rewards those who pick up a larger home than they normally could afford in order to maximize the gain (via leverage).

In the San Jose Metropolitan area, we’re looking at sq ft prices of $500-$800 for homes built decades ago.

Admittedly, in light of the boom in the biggest cities, the slackening this year is just a blip. But when real estate professionals, who are constitutionally optimistic, say that things are likely to get worse before they get better, they are probably right since that view is so out of character.

How does the sharp decline in Chinese investment in the US play into this picture? On the one hand, “Chinese nationals” accounted for only 3% of US housing buys in 2018. But wealthier foreign buyers often use corporations to mask their ownership, so this figure understates the magnitude of Chinese purchases. And Chinese investors like California.

Last week, CNBC reported Foreign purchases of American homes plunge 36% as Chinese buyers flee the market:

The dollar volume of homes purchased by foreign buyers from April 2018 through March 2019 dropped 36% from the previous year, according to the National Association of Realtors. The decline was due to a drop in the number and average price of purchases. Foreigners bought 183,100 properties with a total value of about $77.9 billion, down from 266,800 valued at $121 billion in the previous period.

Notice also that foreign buyers on average pay more than locals, suggesting a combination of typically preferring higher-end properties and overpaying1:

Another data point suggesting that the West Coast well-off may be feeling nervous or even pinched comes in another Journal story, this one on Tesla. Its high-end, as in highest-status cars, aren’t selling well any more:

Sales of Tesla Inc.’s high-end Model S sedan have taken a big hit in the company’s most important U.S. market, California, as the electric auto maker is leaning more heavily on selling the lower-priced Model 3 compact car, new data show.

Falling sales of the Model S—and its sister sport-utility vehicle Model X—threaten Tesla’s growth goals and profit ambitions as it must rely more on its cheaper Model 3 to make up the difference.

Registrations of new Model S sedans in the second quarter plummeted 54% to 1,205 in California, according to the Dominion Cross-Sell report, which compiles data from state motor-vehicle records. The Golden State is a strong indicator of demand as Tesla’s largest U.S. market, representing 40% of Model S registrations in the country last year, according to auto-sales tracker Edmunds.com Inc.

The new data from research firm Dominion Enterprises indicates the stylish sedan that arguably changed car buyers’ view of electric cars is losing its luster.

So is the West Coast starting to lose its mojo? Are these wobbles an an early warning that the economy is getting soft? Or is this a sign that air is coming out of the Silicon Valley bubble, and that touches enough people on the Pacific coast to have a bigger impact than you’d expect? Tech titans are finally being depicted as 21st century robber barons. They aren’t used to having their status as Masters of the Universe questioned, let alone having their economic interests targeted.

For instance, the lead story today in all the business press is that the Department of Justice is launching an investigation into whether “online platforms” were hurting competition. It’s easy to depict this as a gambit for the US to get in front of the European Commission’s competition ministry, which is threatening to become more stringent. Recall also that France is threatening to impose a transactions tax that would hit 24 large tech players, many of them American. From the Financial Times:

The US Department of Justice announced a broad antitrust investigation into the leading online platforms, raising the stakes in Washington’s scrutiny of Big Tech’s power over growing parts of the economy.

The agency said it would look into how the platforms had achieved their market power, and whether they were “engaging in practices that have reduced competition, stifled innovation or otherwise harmed consumers”….

The DoJ move comes after the outgoing European Commission signalled it was also looking to become more aggressive in checking the market power of the largest online platform companies. A report issued in April recommended lowering the bar for companies deemed “dominant players”, subjecting them to stricter antitrust rules.

Donald Trump has been critical of the EU’s scrutiny of American tech groups, suggesting it should be US rather than European authorities investigating wrongdoing by the technology sector.

It’s obvious the DoJ intent is to blunt whatever the Europeans might do. But it’s hard to see how that can work. The EU can set the rules for its own market, which is so large that it will impose costs on tech giants, both via reducing their revenues and/or profits, and by requiring them to do business differently. That imposes costs via having to make changes to their systems and procedures and forces them to incur ongoing costs via having more balkanized operations.

Mr. Market took note, with Facebook and Amazon shares falling more than a percent in after-hours trading, while Google recovered from a similar drop. The pink paper described how there have been jurisdictional issues regarding which agency, the Federal Trade Commission or the DoJ, should be taking the lead not just with respect to the general question of anti-trust but also with respect to particular companies.

It’s admittedly a long time before anything happens legally but the presumption of tech virtue is over, and that’s a step in the right direction.

____

1 Having worked with foreign investors, this is way more common than you’d think. It’s easy for a broker to take a buyer who doesn’t know the city or market to a few wildly overpriced properties, then show them ones only somewhat overpriced to give them the false impression that the latter are a good deal.

Softening Real Estate Markets in Prime West Coast Cities: Does China Trump IPOs?

from WordPress https://ift.tt/2MatlYe

via IFTTT

0 notes

Photo

@flickinfeathers: The Pacific redfin have arrived slightly ahead of the cherry blossom this year. Managed 4 today on the Tamagawa River. #flyfishing #japanfishing #japan #fishing https://t.co/bbLniQLjOH

0 notes

Text

FS20: A New Property Leading Indicator That Gives Buyers Confidence

Given the relative illiquidity of real estate, there is huge room to get your property transaction right or wrong. My hope is for all of you to get maximum value whether you’re buying or selling.

There are many variables that determine the current and future value of a property. These include, but are not limited to location, marketing prowess, seasonality, condition, curb appeal, surrounding noise, interest rates, job environment, tax laws, housing laws, and demographic trends.

But all of these variables are derivative variables that leave a lot of wiggle room for price interpretation. A property is only as valuable as what someone is willing to pay. Therefore, I’ve come up with a new property leading indicator that if used properly, could save and make you a lot of money down the road.

Introducing The FS20 Property Indicator

Every real estate buyer by now should be using technology to look for homes online. My favorite platform is Redfin because they have a mission of lowering transaction costs. But they also have the best user interface and the most up-to-date information compared to Zillow in my opinion.

If you plan to buy property, then you have already made a bet that real estate values will go up in your neighborhood. If you think real estate prices are going to go down, then obviously buying is out of the question.

But what is the best indicator that will give you the most confidence to buy property? After giving things much thought, I think it is the FS20 Property Indicator.

The FS20 Property Indicator goes off when a home’s final sales prices is at least 20% higher than the online estimate in the neighborhood you want to buy.

The higher the final sales price in comparison to the online estimate, the stronger the demand. Up to a 20% price differential can account for things such as online data error and not taking into account the proper condition of the home. Further, some homeowners are willing to fudge their home’s features to try and improve their online home estimate.

Although online real estate firms like Redfin and Zillow use their thousands of data points to create property price estimates and forecasts, when a final sales price is at least 20% higher, it is clear Redfin and Zillow have not properly caught up to the real-time demand that is surging ahead.

But for savvy buyers, you can capture this window of opportunity and make offers based on median or average price points for the neighborhood before the new data starts pushing the overall median or average price points higher.

Let’s look at two examples where the FS20 Property Indicator hits.

Example #1: 331 Vicente, SF, CA

331 Vicente is a lovely remodeled, three-bedroom, three-bathroom, 2,400 sqft home in San Francisco’s West Portal district. The home is an easy 5-minute walk to the MUNI station, which will bring you downtown in about 20-25 minutes.

331 Vicente, SF

In your property hunt process, it is imperative to always make a calculated forecast on what the house will ultimately sell for and then compare your forecast to the final selling price.

You can’t rely solely on the online estimates since online estimates are often wrong. Instead, you’ve got to rely on your eyes! The closer you can get to guessing regularly the final selling price, the more confidence you will have with your property investing acumen.

Given the neighborhood and high quality of the remodel two years prior to sale, one could make a reasonable assumption that 331 Vicente should trade for about $1,000/sqft, or $2.4 million.

Once you hit $1,000/sqft in San Francisco, you’ve reached the “mass luxury” segment of the residential property market. 10+ years ago, only properties on the north side of the city like Pacific Heights would command $1,000/sqft or more.

The real estate agents were smart and listed the house for $1.995 million ($831/sqft) to attract the largest amount of potential buyers to the property.

If the property sold for between $2.1 million – $2.4 million, the vast majority of observers would see this as a reasonable transaction. Yes, San Francisco real estate is expensive.

Now it’s up to you to take a reasonable guess at what the house ultimately sold for. Got it? You can now scroll below after taking in the kitchen remodel.

The house ended up selling for a whopping $2.9 million! That’s $762,800 or 36% above Redfin’s estimate, and $600,000 higher than a reasonable final guesstimate price. The FS20 Property Indicator is going off!

Despite Redfin’s allegedly sophisticated pricing algorithms, we could simply say Redfin’s estimate in this instance was really bad. However, as I know the San Francisco market well, I believe getting $1,208/sqft on a 3,014 sqft lot with no view is an extraordinarily high price for the West Portal neighborhood (District 4).

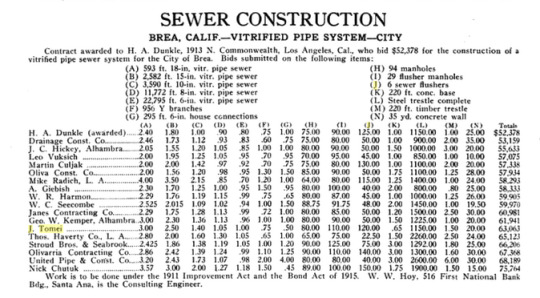

The data below from MLS and Compass Brokerage has the average price/sqft at $824 for the West Portal neighborhood (D4).

Below is a chart that highlights where Redfin estimated 331 Vicente at a reasonable $2,137,200 and where it finally sold. At $2,900,000, this is also about $500,000 more or 20% higher than what I would have guessed it would have sold for.

Absent the later discovery of some unusual financial reason that justifies this price, it is clear from this example that the demand for the West Portal neighborhood has ticked up faster than what Redfin and rabid market observers like myself have realized.

Therefore, an enlightened buyer should consider looking in the West Portal neighborhood ASAP for similarly remodeled homes in similar locations close to the average price/sqft of $824 and bid accordingly. A homebuyer could potentially bid up to $1,000 – $1,100/sqft for a similar property knowing that she has a $100 – $200/sqft buffer in case of a decline thanks to 331 Vicente.

The data that comes out from the Multiple Listing Service is always lagging. Hawk-eye buyers have about a 1-2 month window to take advantage of the lagging data before the new data feeds into the system and prices recalibrate.

But even when this $2.9 million price point gets entered, it may not significantly move the needle because it would be just one sale out of perhaps 15 – 20 for the previous quarter.

Therefore, buyers will likely have a 1-4 month window to take advantage and bid with confidence before the computers and people reset the true value of the neighborhood.

Use the MLS data as ammo to offer prices closer to the average, while knowing that the real trend is pushing prices higher!

Example #2: 30 Fanning Way

30 Fanning Way is a quaint two-bedroom, one-bathroom, 1,288 sqft single family home in San Francisco’s Golden Gate Height’s district.

What I like about 30 Fanning Way is that it has views of the ocean. I am a firm believer that homes with ocean views in San Francisco have the greatest pricing upside potential over the next 10+ years.

Besides having an ocean view, the home has an oversized lot of 5,584 sqft, which is slightly more than double the standard 2,500 sqft lot in San Francisco. Unfortunately, at least half the lot is on an unusable hill.

The knocks on the house are that it’s not very big inside and the kitchen and bathroom were probably remodeled 20+ years ago. If your family has more than one kid, living in the house may be tight, especially if you have guests.

Given we know that Golden Gate Heights (District 2) has an average selling price of $932/sqft according to the latest MLS data, we can estimate that 30 Fanning Way is worth about $1.2 million at 1,288/sqft. The condition of the house is average.

But given the oversized lot (not all flat) and views, 30 Fanning Way should trade at a premium. Also, smaller homes tend to trade for higher price/sqft. Therefore, let’s bump up the estimated price per square foot to $1,100, or an 18% premium to the average price/sqft of the district of $932/sqft.

At $1,100/sqft, we can value 30 Fanning Way at $1,416,800. Kind of expensive for only a 1,288 sqft house, but the price sounds about right. Let’s just round up to $1,500,000, or $1,164/sqft. What’s an extra $83,200 between friends?

Now it’s up to you to make an educated guess on this cozy little home. Again, if you are a buyer in the neighborhood, you should not only do these type of calculations but go visit the house in person to make sure your estimates make sense.

Got a list price and final sales price in mind? Time to scroll down to see what happened.

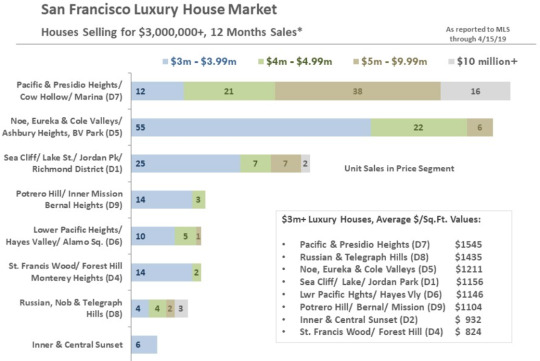

The selling agent decided to price the home at a peculiar $1,168,000 or an attractive $906/sqft, $26/sqft below the average.

Is my $1,500,000 estimate, or $322,000 over its $1,168,000 list price really achievable for a house this size and in this condition?

Well, you can bet your buns of steel it is! The house sold for an incredible $1,855,000, or 59% over asking a month later!

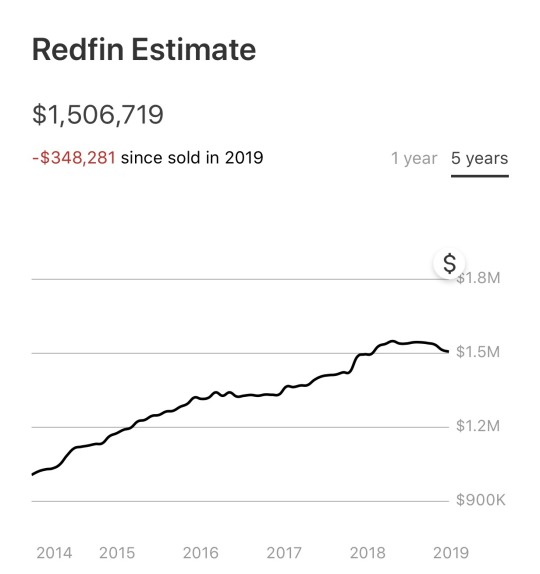

Now let’s take a look at what Redfin had as its estimate for the house. Ah Hah! Redfin estimated the house was worth $1,506,719, or $1,164/sqft, similar to my aggressive estimate.

If the house had sold for $1,506,719, most people in the know would have thought that’s a little high, but within the ballpark. But to sell for $1,855,000, or $1,440/sqft is a new record high for the Golden Gates Heights neighborhood.

The final sales price was 23% higher than the online estimate, therefore, the FS20 Property Indictor has also gone off.

It would have been one thing if the house was completely brand new with the fanciest kitchen and bathrooms, a hot tub, and panoramic ocean views from two or three floors. But the house has none of that.

Within five or 10 years, the new owners will likely spend at least $60,000 to remodel their kitchen and only bathroom.

If you’ve been looking for a home in the Golden Gate Heights neighborhood, you can now feel more confident bidding for any ocean view home in moderate condition for the average of $932/sqft according to MLS.

You can probably comfortably bid up to $1,000/sqft for a similar type of home, knowing you’ve got a $440/sqft buffer thanks to 30 Fanning Way. And if you’re really bullish, perhaps you can go up to $1,100/sqft to match the online estimates.

I definitely wouldn’t pay a similar record high price as 30 Fanning Way because that would defeat the purpose of the FS20 Property Indicator. You always want to buy property knowing you have some type of price buffer or potential to expand in order to create more value.

Each home is different, so it’s really up to you to decide how much you’re willing to risk.

Always Look For Windows Of Opportunity

You might still be skeptical about online property estimates as am I, but over time, they get better because of more data. Both Zillow and Redfin were founded in 2004, so they’ve had plenty of time to build their databases and improve their pricing algorithms. As publicly traded companies, they must constantly optimize for their shareholders.

Disregarding online property price estimates today is like ignoring Waze or your Google GPS navigation because you think you know a quicker route when driving. You usually end up wrong and wasting unnecessary time.

The large majority of online property estimates are within +/- 10% of the real market estimate. This is why if you follow the FS20 Property Indicator, there leaves little doubt there’s a major uptick in demand and potentially an opportunity to buy a comparable property at a more reasonable price.

For less hot markets such as non-coastal areas, perhaps using an FS10 Property Indicator of 10% instead would be more fitting. However, I wouldn’t recommend going below 10% if you want to gain maximum confidence on a property purchase.

Often times, the profit is made on the purchase and not on the sale. Once you combine FS20 with a strong downpayment, a well-crafted property love letter, and a reputable lender that’s got your back, you’ll likely do much better than those who aren’t as prepared.

Be super vigilant when buying property, especially with debt. A house will likely be your most expensive purchase in your lifetime. It’s worth being extremely meticulous with your analysis.

Readers, have you been able to take advantage of small windows of opportunity in the real estate market? It’s not enough to recognize opportunity, one must also take action. How do you see a collapse in mortgage rates affecting your local real estate market?

Related Posts:

To Get Rich, Practice Predicting The Future

10 Warning Signs To Look Out For When Buying A House

Important Steps Before Buying A Property After Huge Price Appreciation

The post FS20: A New Property Leading Indicator That Gives Buyers Confidence appeared first on Financial Samurai.

from Money https://www.financialsamurai.com/fs20-a-property-leading-indicator-that-gives-buyers-confidence/

via http://www.rssmix.com/

0 notes

Text

The Crypto Project Has Reached |PMEWORLD

<p> </p>

<p>Especially for our Personality guests the LH Crypto platoon representatives Alexander Smirnov and Antonis Lapos will conduct a number of particular meetings. The meetings will take place in the following metropolises 15 January – Milan, 16 January – Lugano, 17 January – Zurich, 18 January – Geneva, 19 January – Monaco. If you ’re an investor or just staying</p>

<p>Wrasse trout-perch loach goby Redfin perch. Tope – anglerfish betta turbot mrigal skipping goby, great white wolf slumberer wolffish warmouth armorhead thornyhead white marlin hagfish. Zany triggerfish wolf-eel ponyfish wallago shortnose <strong><a href="https://pmeworld.io/">PME</a></strong> chimaera brotula waryfish long-whiskered catfish unheroic- eye mullet whiting manefish. Scissor- tail rasbora Black ocean bass, limia, shaft oarfish bluefin tuna nurseryfish Pacific argentine, “ cod lookdown catfish Black mackerel wolffish.” Sprat tarpon trunkfish, tableware complaint toadfish snake mudhead sandroller emperor angelfish yellowfin tuna roanoke bass Goliath triggerfish. Triplefin blenny largenose fish arowana banderole fish trumpeter zebra tilapia.</p>

<p>The stylish way to demonstrate the eclipse and inflow of the colorful image positioning options is to nestle them snuggly among an ocean of words. Snare a paddle and let’s get started.</p>

<p> </p>

<p>On the content of alignment, it should be noted that druggies can choose from the options of None, Left, Right, and Center. In addition, they also get the options of Thumbnail, Medium, Large & Fullsize. The rest of this paragraph is padding for the sake of seeing the textbook serape around the 150 × 150 image, which is left aligned.</p>

<p>As you can see the should be some space over, below, and to the right of the image. The textbook shouldn't be creeping on the image. Creeping is just not right. Images need breathing room too. Let them speak like you words. Let them do their jobs without any hassle from the textbook. In about one further judgment then, we ’ll <strong><a href="https://pmeworld.io/">PMEPROTOCOL</a></strong> see that the textbook moves from the right of the image down below the image in flawless transition. Again, letting the do it’s thang. Mission fulfilled!</p>

<p> </p>

<p>And now we ’re going to shift effects to the right align. Again, there should be plenitude of room over, below, and to the leftism of the image. Just look at him there … Hey joe! Way to gemstone that right side. I do n’t watch what the left aligned image says, you look great. Do n’t let anyone differently tell you else.</p>

<p>In just a bit then, you should see the textbook start to wrap below the right aligned image and settle in nicely. There should still be <strong><a href="https://pmeworld.io/">PME PROTOCOL</a></strong> plenitude of room and everything should be sitting enough. Yeah … Just like that. It noway felt so good to be right.</p>