#multi currency prepaid travel card

Text

Multi Currency Prepaid Forex Card Online in India | IndusForex

Multi Currency Prepaid Forex Card by IndusForex is one of the best travel cards in India. One can add up to 14 currencies at a time on a single forex card. Order now for hassle free travel.

#multi currency prepaid card#best multi currency prepaid card#multi currency prepaid travel card#multi currency forex card

0 notes

Text

Explore hassle-free travel with our top-rated multi-currency prepaid Forex card. Get the best exchange rates, convenient reload options, and global acceptance. Order your Forex card today for a smoother journey ahead

0 notes

Text

Get Best Forex Card & Buy Multi-Currency Prepaid Travel Card online. Zenith Forex offers Prepaid Travel Card, ICICI Forex Card, Yes bank Forex Card & Thomas Cook Forex Card Online at industry best rates.

0 notes

Text

Travelex, a UK-based foreign exchange business partnered with Ripple, has teamed up with US-based online travel agency Kayak to streamline trip planning for consumers. Through this collaboration, Travelex's clients can now seamlessly search for flights, hotels, and rental vehicles within the updated Travelex Money app, consolidating vacation planning and financial management in one place.

The revamped app boasts a fresh design, enhanced user experience, and increased control, according to Travelex. Additionally, withdrawal limits at ATMs have been set at £500 for UK-issued cards and AUD$3000 for Australian-issued cards, with minimum load amounts of £50 and $100 AUD respectively. Travelex has also eliminated card collection fees.

With Mastercard affiliation, Travelex customers gain access to Boingo's wireless hotspots, enhancing connectivity while traveling. This collaboration marks a significant milestone in Travelex's digital transformation journey, aligning with its broader strategy to offer crypto-enabled payments, digital remittance solutions, and multi-currency prepaid contactless cards.

Travelex is committed to expanding its suite of digital offerings, including touch-and-go channels, ATM click-and-collect, and touchless channels, catering to evolving consumer needs.

0 notes

Video

youtube

How Canada Post Scams You - The Worst Multi-Currency Travel Prepaid Card

0 notes

Text

Benefits of Prepaid Forex Cards for Travellers

International travel has become more accessible than ever. Whether you are a seasoned globetrotter or planning your first overseas adventure, managing your finances while travelling abroad is crucial. One of the most convenient financial tools for travellers is a multi-currency prepaid Forex card.

Today let us explore the benefits of prepaid Forex cards for travellers and how you can easily obtain one through Muthoot FinCorp ONE.

What is a Prepaid Forex Card?

A prepaid Forex card is a preloaded, multi-currency travel card that allows you to carry foreign exchange in a secure and convenient form. It is like having a wallet with multiple foreign currencies, making it ideal for travellers who visit multiple destinations or those who prefer a cashless payment method. These cards are widely accepted worldwide, just like regular credit or debit cards.

How to Get Multi-currency Forex Cards on Muthoot FinCorp ONE Website

Obtaining a multi-currency Forex card on Muthoot FinCorp ONE is a hassle-free process. You can apply for your multi-currency Forex card online on the website. Additionally, you can use the platform for remittances and reload your existing Muthoot FinCorp ONE Forex card, both online and offline. This flexibility ensures that you can manage your Forex needs conveniently, without the need to visit a physical branch.

Why are Prepaid Forex Cards Important for Travellers?

Security: Prepaid Forex cards are pin protected, reducing the risk of theft and fraud compared to carrying cash. In case of loss or theft, you can block the card and request a replacement.

Competitive Exchange Rates: Muthoot FinCorp ONE offers competitive exchange rates, ensuring that you get more value for your money when you convert currency.

Accepted Worldwide: These cards are widely accepted, including at hotels, restaurants, shops, and ATMs worldwide. You won't have to worry about finding a currency exchange bureau or carrying large amounts of cash.

Multi-currency: With a multi-currency prepaid Forex card, you can load multiple foreign currencies onto a single card. This flexibility is perfect for travellers visiting multiple countries during their trip.

Convenience: Prepaid Forex cards offer 24/7 accessibility, allowing you to withdraw cash from ATMs worldwide or make payments at any time and from anywhere.

Prepaid multi-currency Forex cards are indispensable for modern travellers, offering security, convenience, and flexibility. With Muthoot FinCorp ONE, obtaining and managing your prepaid Forex card is not only easy but also comes with the added assurance of a trusted financial institution. So, the next time you plan your international adventure, make sure to equip yourself with the power of a prepaid Forex card from Muthoot FinCorp ONE.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging Forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

0 notes

Text

Forex Card

A forex card is a foreign currency prepaid card that you can charge with a pre-determined sum. Therefore, you can use the card to pay for your bills when traveling abroad instead of carrying cash. It is a safe and superior method of storing foreign currency.

Key features of a Forex card include:

Multi-Currency Support: Forex cards can hold multiple currencies, making them suitable for travelers visiting multiple countries. Users can load the card with the desired currencies before their trip.

Security: Forex cards are PIN-protected and often have an EMV chip, enhancing security against theft and fraud. They are not linked to your bank account, reducing the risk of financial loss.

Exchange Rate Lock: Users can lock in favorable exchange rates when loading the card, shielding them from fluctuating currency exchange rates during their travels.

Cost-Efficient: Forex cards typically have lower transaction fees and offer better exchange rates compared to traditional credit/debit cards or cash exchanges.

Reloadable: Some Forex cards are reloadable online, allowing travelers to add more funds remotely during their trip.

0 notes

Text

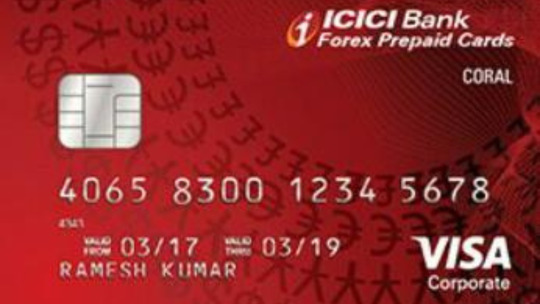

ICICI Bank Coral Prepaid Forex Card

The ICICI Bank Coral Prepaid Forex Card is a versatile financial instrument designed to satisfy the needs of international visitors. Whether you're a traveller seeing new locations or a business person who frequently travels overseas, this prepaid card offers a straightforward and secure way to manage your foreign exchange spending.

The Coral Prepaid Forex Card allows you to load a variety of foreign currencies, eliminating the need to carry cash or traveler's checks. It provides users with access to a huge worldwide network of ATMs and retail establishments, making it the perfect travelling companion. Check

Main Points

Multi-Currency Load: You can load multiple foreign currencies onto a single card, allowing you to avoid the hassle of carrying different currencies or traveler's cheques.

Global Acceptance: The card is widely accepted at ATMs, merchant establishments, and online platforms around the world, providing you with easy access to your funds wherever you go.

Security: The card comes with a PIN-based security feature, ensuring that your funds are safe and protected from unauthorized use. In case of loss or theft, you can also report it and get a replacement card.

Emergency Assistance: Many Coral Prepaid Forex Cards offer emergency assistance services, including card replacement and emergency cash disbursement, in case you run into unforeseen financial troubles while abroad.

Travel Insurance: Some versions of this card offer complimentary travel insurance, covering aspects like medical emergencies, lost baggage, trip cancellations, and more, providing you with added peace of mind during your travels.

Exclusive Discounts: Cardholders often enjoy exclusive discounts and offers on dining, shopping, and travel-related services, helping you save money while abroad.

Online Access: You can easily track your transactions and manage your card online, allowing you to monitor your expenses and balance in real-time.

Reloadable: The card is reloadable, meaning you can add more funds to it as needed, making it a convenient and reusable financial tool for multiple trips.

Currency Conversion: The card typically offers competitive exchange rates, saving you money on currency conversion fees compared to exchanging cash at airports or currency exchange offices.

Customizable: Depending on your needs, you can choose the initial currencies you want to load onto the card. This customization ensures that you have the right mix of currencies for your travel destinations.

24/7 Customer Support: ICICI Bank usually provides round-the-clock customer support, so you can seek assistance or report issues at any time during your journey.

Cashless Transactions: Enjoy the convenience of cashless transactions, whether you're dining, shopping, or booking hotels and flights during your travels.

No Foreign Transaction Fees: With a prepaid forex card, you often avoid foreign transaction fees that are typically associated with using a regular credit or debit card abroad.

Conclusion

The ICICI Bank Coral Prepaid Forex Card, in conclusion, is an invaluable financial instrument for both business and leisure tourists abroad. It offers comfort and security while travelling due to its ability to load a variety of currencies, wide acceptance, and strong security measures. The added benefits, including emergency assistance, travel insurance, and exclusive discounts, make it more appealing to consumers who frequently go abroad. Whether you're a traveller exploring new locations or a business professional managing abroad spending, this card streamlines your financial transactions and ensures you make the most of your travels. Consider the ICICI Bank Coral Prepaid Forex Card if you're seeking for a quick and inexpensive way to send money abroad.

0 notes

Text

0 notes

Text

Foreign Currency Exchange Service in India | Forex

Best Foreign currency Exchange Services

With Orient Exchange you can monitor the daily currency exchange rates with utmost precision and needless to say, find the best rates in the market. We have established in the market as an esteemed money exchanger with years of experience, and have brought along all the industry expertise we have gathered to the online platform. We provide the best services on Foreign exchange offline and also on online platforms.

Foreign Currency Exchange Rates

We provide the best rates on Foreign currency exchange. Orient Exchange, as an RBI approved merchants (category2) has sharpened its place in the market of cash trade as a shipper, in this way we can give better rates to residential clients. You have discovered the most dependable cash changers in India, as we have 23 branches spread out in excess of 20 urban areas skillet in India.

We strictly adhere to the Foreign Exchange Management Act of RBI, so that our customers have a clear and transparent understanding of our rates and policies.

Why choose Orient Exchange for your currency exchange

As an RBI authorized dealer, we are responsible and customer oriented

With more than 20 branches we can help you directly

Live market rate: As an importer of foreign currency, we provide live and real-time market rates.

Best Forex card: Exceptional Forex Card accepted in more than 21 countries and get card with multi-currency options.

Cashback redemption is easy and fast

We have unmatched industry expertise in Outward Remittance

Easy to use online platform

Online Booking: Make your transactions through online platform at the comfort of your home

Home delivery of orders: Book forex online and get your order delivery on the same day.

Exceptional customer service team

Experienced staff to guide you on transactions

Best Forex cards in India.

Forex cards are a convenient, safe and smart way to carry and spend money while travelling abroad. Forex card is a pre-paid traveller’s card that is easy to use. It offers you the flexibility of using it at merchant locations as well as withdrawing money from ATMs. It can be easily reloaded even when you are travelling. Cards offer greater security and increased protection against theft.

How much foreign currency to carry and how to carry it.

The above two questions a traveller need to answer while planning a trip abroad. Though cash is the most preferred way but using only it is not advisable, especially if the trip is going to be long. There are few other ways one can carry forex — traveller’s cheques, which are mostly now out of use due to inconvenience of finding banks/dealers to change the same; plastic money in form of debit /credit cards and prepaid forex cards, also known as prepaid travel card or multi-currency card. Using an international debit /credit card is fine but it is expensive.

For sum spent abroad utilizing Indian debit/ credit Card, the expense will contrast contingent upon guarantor, vendor and money, however would comprises of charges extending from 3.50% to 5.00%; and if credit card is used for withdrawal of foreign currency from ATMs abroad an additional withdrawal charge of 2% to 5% depending on the issuer and servicing bank of ATM is levied.

0 notes

Text

Currency Exchange Tips for Haj and Umrah Pilgrims

Haj and Umrah are sacred pilgrimages undertaken by millions of Muslims every year. As pilgrims embark on their spiritual journey, it is essential to plan ahead and consider various aspects, including currency exchange. Efficient currency exchange can ensure convenience and savings during your trip. In India, Orient Exchange emerges as the best solution for currency exchange, providing competitive rates and excellent service. Let's explore some valuable tips to maximize convenience and savings when converting INR to SAR for your Haj and Umrah pilgrimage.

Plan Ahead and Monitor Exchange Rates:

To get the best value for your money, it's crucial to plan ahead and monitor currency exchange rates. Currencies fluctuate, and by keeping an eye on the rates, you can make an informed decision on when to exchange your Indian Rupees (INR) to Saudi Arabian Riyals (SAR). Orient Exchange offers competitive rates and allows you to track currency rates conveniently through their website or mobile app, helping you seize the right moment for your exchange.

Choose a Reliable Currency Exchange Provider:

Selecting a trustworthy currency exchange provider is paramount for a hassle-free experience. Orient Exchange, a reputable and authorized foreign exchange dealer, ensures transparency, security, and convenience. With their extensive network of branches across India, you can easily find a location near you. Orient Exchange offers competitive rates for INR to SAR conversions, enabling you to save money on your currency exchange.

Avoid Airport Currency Exchanges:

While it may be tempting to exchange your currency at the airport due to convenience, it's generally advisable to avoid airport currency exchange counters. Airport exchanges often have unfavorable rates and additional charges, significantly reducing the value of your exchange. Instead, plan ahead and visit a reliable currency exchange provider like Orient Exchange to obtain the best rates and maximize your savings.

Utilize Forex Cards:

Consider using Forex cards for your pilgrimage. Prepaid cards are loaded with foreign currency and can be used like regular debit or credit cards, providing convenience and security during your trip. Orient Exchange offers multi-currency forex cards, including the Saudi Arabian Riyal (SAR) among other currencies, allowing you to manage your expenses efficiently. These cards also offer benefits such as lower fees, competitive exchange rates, and the ability to reload funds if needed.

Split Your Currency:

To mitigate the risk of losing all your money due to theft or misplacement, it's advisable to split your currency. Carry a combination of cash and prepaid forex cards, keeping them in separate locations such as your wallet, bag, and hotel safe. This way, you'll have access to funds even if one source is compromised. Orient Exchange provides the flexibility to convert your INR to SAR and load them onto a prepaid forex card, ensuring secure and convenient access to your money.

Stay Informed about Local Currency Usage:

While traveling in Saudi Arabia, familiarize yourself with the local currency and its usage. Learn about the denominations, common payment methods, and any cultural norms surrounding currency exchange and tipping. Orient Exchange provides useful information about currency usage and regulations, ensuring you have a smooth experience during your pilgrimage.

In conclusion, when preparing for your Hajj or Umrah pilgrimage, careful consideration of currency exchange is essential. By planning ahead, choosing a reliable currency exchange provider like Orient Exchange, utilizing prepaid travel cards, and staying informed about local currency usage, you can maximize convenience and savings. Orient Exchange offers competitive rates and excellent service, making it the best solution for currency exchange in India. Convert your INR to SAR at the best rate and embark on your spiritual journey with peace of mind.

0 notes

Text

Benefits of Prepaid Forex Cards for Travellers

International travel has become more accessible than ever. Whether you are a seasoned globetrotter or planning your first overseas adventure, managing your finances while travelling abroad is crucial. One of the most convenient financial tools for travellers is a multi-currency prepaid Forex card.

Today let us explore the benefits of prepaid Forex cards for travellers and how you can easily obtain one through Muthoot FinCorp ONE.

What is a Prepaid Forex Card?

A prepaid Forex card is a preloaded, multi-currency travel card that allows you to carry foreign exchange in a secure and convenient form. It is like having a wallet with multiple foreign currencies, making it ideal for travellers who visit multiple destinations or those who prefer a cashless payment method. These cards are widely accepted worldwide, just like regular credit or debit cards.

How to Get Multi-currency Forex Cards on Muthoot FinCorp ONE Website

Obtaining a multi-currency Forex card on Muthoot FinCorp ONE is a hassle-free process. You can apply for your multi-currency Forex card online on the website. Additionally, you can use the platform for remittances and reload your existing Muthoot FinCorp ONE Forex card, both online and offline. This flexibility ensures that you can manage your Forex needs conveniently, without the need to visit a physical branch.

Why are Prepaid Forex Cards Important for Travellers?

Security: Prepaid Forex cards are pin protected, reducing the risk of theft and fraud compared to carrying cash. In case of loss or theft, you can block the card and request a replacement.

Competitive Exchange Rates: Muthoot FinCorp ONE offers competitive exchange rates, ensuring that you get more value for your money when you convert currency.

Accepted Worldwide: These cards are widely accepted, including at hotels, restaurants, shops, and ATMs worldwide. You won't have to worry about finding a currency exchange bureau or carrying large amounts of cash.

Multi-currency: With a multi-currency prepaid Forex card, you can load multiple foreign currencies onto a single card. This flexibility is perfect for travellers visiting multiple countries during their trip.

Convenience: Prepaid Forex cards offer 24/7 accessibility, allowing you to withdraw cash from ATMs worldwide or make payments at any time and from anywhere.

Prepaid multi-currency Forex cards are indispensable for modern travellers, offering security, convenience, and flexibility. With Muthoot FinCorp ONE, obtaining and managing your prepaid Forex card is not only easy but also comes with the added assurance of a trusted financial institution. So, the next time you plan your international adventure, make sure to equip yourself with the power of a prepaid Forex card from Muthoot FinCorp ONE.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging Forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

0 notes

Text

Forex Card

A forex card is a foreign currency prepaid card that you can charge with a pre-determined sum. Therefore, you can use the card to pay for your bills when traveling abroad instead of carrying cash. It is a safe and superior method of storing foreign currency.

Key features of a Forex card include:

Multi-Currency Support: Forex cards can hold multiple currencies, making them suitable for travelers visiting multiple countries. Users can load the card with the desired currencies before their trip.

Security: Forex cards are PIN-protected and often have an EMV chip, enhancing security against theft and fraud. They are not linked to your bank account, reducing the risk of financial loss.

Exchange Rate Lock: Users can lock in favorable exchange rates when loading the card, shielding them from fluctuating currency exchange rates during their travels.

Cost-Efficient: Forex cards typically have lower transaction fees and offer better exchange rates compared to traditional credit/debit cards or cash exchanges.

Reloadable: Some Forex cards are reloadable online, allowing travelers to add more funds remotely during their trip.

Reference:

0 notes

Text

Best Prepaid Forex Card at Interbank rate

Orient exchange and financial and service pvt ltd an AD 2 licence holding company which having pan India 21 branches.Orient exchange will provide better rate and better customer experience to the customer for their foreign trip . Major height light they provide forex card at Inter-bank rate to the customer for the travel purposes of private,business, employment, study etc. forex card provided by orient exchange is globally accepted and it is an multi currency card so customer can carry different country currency in an single card . If you looking for an travel card with inter bank rate then orient exchange card will be an better option, For more information kindly visit the orient exchange website.

Visit: https://www.orientexchange.in/forexcards

0 notes

Text

Best Forex Card | Get Forex Card | Travel Card

Get Multi-Currency Prepaid Travel Card - the best Forex card solution for your international trips. Say goodbye to exchange rate worries and carrying cash abroad. Easily load multiple currencies onto one convenient card, manage your funds online, and enjoy peace of mind knowing you have access to local currency worldwide. Get your Forex card today and experience the convenience, security, and flexibility it offers while exploring new destinations.

0 notes

Text

Banks and fintech firms are launching prepaid cards to boost financial inclusion in the Middle East in 2023

In the Middle East, the prepaid card ecosystem has been growing at a rapid rate over the last few years. The growing percentage of the tech-savvy population is driving the adoption of prepaid cards. With smartphone penetration projected to further grow in the Middle East in 2023, banks and fintech firms are leveraging the increasing smartphone penetration to drive financial inclusion across the region by launching digital prepaid cards.

Qatar Islamic Bank, for instance, announced the launch of the Himyan prepaid card in March 2023. The prepaid card solution is an initiative of the digital bank to develop electronic payment services and support financial inclusion in the country. As a result, the bank has made the prepaid card solution available for customers, non-customers, as well as visitors holding a valid QID or visa.

In the Middle East region, the growth of the prepaid card industry has been also driven by digital banks, which have significantly grown in numbers over the last three to four years. These digital-only banks have launched several innovative payment products in the past, and the trend is expected to further continue in 2023.

ila Bank, one of the fastest-growing digital mobile-only banks in the region, announced the launch of a prepaid card solution in February 2023. The launch of the Bahraini-denominated prepaid card is part of the firm's strategy to boost financial inclusion and facilitate a cashless digital economy.

To drive the adoption of its prepaid card offerings in Bahrain, ila Bank is targeting different consumer segments, including students and travelers. The firm has specifically designed a student-focused prepaid card with tailored benefits. This includes the offering of cashbacks on transactions completed in school cafeterias that are operated by the Eastern Bakery. For travelers, the prepaid card offers a host of other benefits including access to medical insurance and discounts and offers via partner stores and merchants in Bahrain.

Al Salam Bank, another financial institution in Bahrain, launched a revamped multi-currency prepaid card campaign in February 2023. The new campaign comes on the back of the success of the last year’s campaign.

The campaign, which allows cardholders to win BD 1,000 in monthly rewards when spending BD 50 through the Visa prepaid card, will run until December 2023. To make the prepaid card offering more attractive, the bank is also offering cardholders the ability to earn loyalty points and receive discounts on the Bahrain Life platform.

Such campaigns are expected to not only accelerate the financial inclusion in Bahrain, but also the growth of the prepaid card transaction value and volume from the short to medium-term perspective.

Along with banking institutions, fintech firms are also seeking to boost financial inclusion in the region, through their innovative prepaid card products that are launched in strategic collaboration with global payments giants. For instance,

In March 2023, e& money, the financial services arm of e&, announced that the firm had entered into a strategic collaboration with Mastercard to launch a prepaid card solution. The prepaid payment instrument is part of the firm's super app strategy and is targeted toward driving financial inclusion in the United Arab Emirates. With the Mastercard tie-up, cardholders will be able to make transactions at all merchants that accept Mastercard globally.

Initially, the firm has only launched a virtual prepaid card that cardholders can use for online transactions. However, the firm is also expected to launch a physical prepaid card for offline payments from the short-term perspective. The fintech firm has also linked the prepaid card solution with the loyalty program, thereby enabling cardholders to earn cashback and rewards for every dirham spent. In turn, cardholders can redeem their points for free data, minutes, and discount codes, among other benefits.

In another prepaid card offering, Nomo, the international digital Islamic bank based in the United Kingdom, launched a multi-currency card in March 2023. Initially, the card has been launched in Kuwait and is planned for a further rollout to customers across the GCC region. Since its launch in 2021, Nomo has become a popular payment method among Kuwaiti customers spending time internationally. With cross-border payments growing at a rapid rate, PayNXT360 expects the digital bank to record strong growth in 2023.

From the short to medium-term perspective, PayNXT360 also expects many more digital banks and fintech firms to launch prepaid card solutions catering to the needs of different consumer segments in the Middle East market.

To know more and gain a deeper understanding of the prepaid card in the Middle East, click here.

0 notes