Text

Introduction to Credit Card Security

Credit card security is a critical aspect of our increasingly digital and cashless world, where the convenience of electronic payments comes with the risk of unauthorized access and fraud. With millions of transactions occurring daily, it is vital to safeguard sensitive financial information from falling into the wrong hands. This introduction to credit card security delves into the measures and practices employed to protect consumers and financial institutions from potential threats, ensuring that individuals can confidently use their credit cards for online and in-store purchases while maintaining their peace of mind. From encryption protocols and secure payment gateways to vigilant user behavior and fraud detection systems, a comprehensive approach to credit card security is essential to maintain trust, privacy, and financial stability in today's interconnected global economy. Check

Encryption: One of the primary pillars of credit card security is encryption. When credit card information is transmitted over the internet or stored in databases, it needs to be encrypted. Encryption scrambles the data into an unreadable format during transmission or storage, making it challenging for hackers to decipher the information even if they manage to intercept it.

Secure Payment Gateways: Online transactions involve transmitting credit card data from the user's browser to the merchant's server. Secure payment gateways serve as intermediaries that encrypt and securely transfer this information, reducing the risk of interception and ensuring that the sensitive data is not exposed during the transaction process.

EMV Chip Technology: Europay, Mastercard, and Visa (EMV) chip technology is another critical advancement in credit card security. EMV chip-enabled cards generate a unique transaction code for each purchase, making it much more challenging for fraudsters to clone the card or steal the information for unauthorized use.

Two-Factor Authentication (2FA): Implementing two-factor authentication adds an extra layer of security to credit card transactions. This requires users to provide two different forms of identification, such as a password and a one-time code sent to their mobile device, before completing a transaction.

Tokenization: Tokenization is a process where the sensitive credit card information is replaced with a unique identifier, known as a token. These tokens are used for transactions, reducing the risk of exposing the actual credit card details in case of a breach.

Regular Software Updates: Credit card issuers and merchants must stay up-to-date with the latest security software and patches. Regular updates help fix vulnerabilities and protect against newly discovered threats.

Vigilant User Behavior: Educating credit card users about security best practices is crucial. Users should be cautious when sharing credit card information, avoid using public or unsecured Wi-Fi networks for transactions, and regularly monitor their credit card statements for any suspicious activity.

Fraud Detection Systems: Financial institutions employ sophisticated fraud detection systems to monitor and analyze transactions for unusual patterns or behavior. These systems can help detect and prevent fraudulent activities before they cause significant damage.

Compliance with PCI DSS: The Payment Card Industry Data Security Standard (PCI DSS) outlines security requirements for businesses that handle credit card transactions. Compliance with these standards is essential to ensure the safety of credit card data and avoid potential penalties for non-compliance.

Bottom line:

In conclusion, credit card security is a paramount concern in the modern age of electronic transactions. As the use of credit cards continues to rise, so does the potential for fraudulent activities and data breaches. Maintaining trust and confidence in the financial system requires a concerted effort from individuals, businesses, and financial institutions alike to implement robust security measures. By staying informed about best practices, employing advanced encryption technologies, and adopting vigilant user habits, we can collectively ensure that credit card transactions remain safe and secure, allowing us to enjoy the convenience of cashless payments without compromising our sensitive financial information.

0 notes

Text

20+ Best Secured/FD-Based Credit Cards In India 2023

In India in 2023, demand for secured credit cards and credit cards based on fixed deposits (FDs) is still very high. These financial products give customers a secure and practical way to improve or worsen their credit scores while still enjoying credit card benefits. In this article, we'll take a look at some of the best secured and FD-based credit cards available in India in 2023. Whether you're new to credit or seeking to build your creditworthiness, these options offer a valuable chance to manage your money wisely while benefiting from the advantages that credit cards may offer. Let's look at these credit cards' characteristics so you can choose the one that best suits your needs and financial goals. Check

Main Points

SBI Card Unnati: Requires a fixed deposit, easy approval, and cashback offers.

ICICI Bank Instant Platinum Credit Card: No annual fee, available against a fixed deposit.

Axis Bank Insta Easy Credit Card: Secured against an FD, offers reward points and fuel surcharge waiver.

Kotak Mahindra Bank Aqua Gold Credit Card: No income proof required, available against an FD.

HDFC Bank Regalia First Secure Credit Card: Offers travel and lifestyle benefits, against an FD.

IDBI Bank Secured Credit Card: Against a fixed deposit, helps build credit history.

IndusInd Bank Secured Credit Card: Secured against an FD, with customizable limits.

Canara Bank Secure Credit Card: Against an FD, suitable for low-income individuals.

Standard Chartered Manhattan Platinum Credit Card: Secured against an FD, offers cashback and rewards.

Bank of Baroda Assure Credit Card: Against a fixed deposit, no income proof required.

RBL Bank Fun+ Credit Card: Against an FD, offers rewards and benefits.

Yes Bank Secured Credit Card: Against an FD, helps build or rebuild credit history.

Karnataka Bank VISA Classic Credit Card: Available against an FD, offers convenience.

PNB RuPay Select Credit Card: Secured against an FD, with rewards on spend.

IDFC First Bank Secured Credit Card: Against an FD, suitable for individuals with limited credit history.

Karur Vysya Bank Freedom Credit Card: Against an FD, no annual fee.

Federal Bank SBI Credit Card: Secured against an FD, co-branded with SBI.

Ujjivan Small Finance Bank SBI Credit Card: Against an FD, designed for financial inclusion.

Tata Capital Secured Credit Card: Against an FD, with a focus on credit-building.

AU Small Finance Bank Secured Credit Card: Against an FD, with competitive interest rates.

South Indian Bank VISA Classic Credit Card: Secured against an FD, offers global acceptance.

City Union Bank VISA Classic Credit Card: Against an FD, no joining fee.

Conclusion

Last but not least, the introduction of secured and fixed deposit (FD)-based credit cards in India for 2023 gives people a critical opportunity to establish or rebuild their credit histories while utilising the simplicity and benefits of credit cards. These cards are designed to be user-friendly and to offer a variety of features to satisfy different financial demands and preferences.

0 notes

Text

HDFC Bank Diners Club Premium Credit Card

The HDFC Bank Diners Club Premium Credit Card is the epitome of exclusivity and style in the world of credit cards. To satisfy the discerning demands of people who appreciate the better things in life, this card provides a wide range of benefits that redefine the credit card experience. With VIP dining privileges, free access to airport lounges, and a sizable rewards programme, it is more than simply a financial tool; it is a gateway to an opulent world. Whether you're an enthusiastic traveller or a connoisseur of fine dining, the HDFC Bank Diners Club Premium Credit Card is your key to unlocking a world of premium privileges and experiences, making every swipe a statement of refinement. Check

Main Points

Exclusive Dining Privileges:

Cardholders can enjoy special dining discounts and offers at a wide range of partner restaurants, making every meal a delightful experience.

Airport Lounge Access:

The card provides complimentary access to airport lounges not only in India but also at international airports. This feature ensures a comfortable and relaxing start to your journeys.

Reward Points:

With every transaction, you earn reward points that can be redeemed for a variety of options, including flight and hotel bookings, merchandise, gift vouchers, and more.

Travel Benefits:

The card offers a host of travel-related benefits, including comprehensive travel insurance coverage for you and your family, air accident cover, and emergency assistance services for unexpected situations during your travels.

Golf Benefits:

As a cardholder, you gain access to premium golf courses in India and can even avail of golf lessons to refine your skills.

Milestone Rewards:

The card offers milestone rewards, which means you can earn additional points or vouchers when you achieve specific spending milestones within a billing cycle.

Fuel Surcharge Waiver:

Enjoy fuel surcharge waivers at fuel stations across India when using your HDFC Bank Diners Club Premium Credit Card for fuel purchases.

Insurance Coverage:

This credit card often comes with insurance coverage for lost card liability, purchase protection, and more, providing additional security for your transactions and purchases.

Global Acceptance:

The card is widely accepted not only in India but also internationally, making it convenient for your overseas travel and spending.

Interest-Free Credit Period:

You can enjoy an interest-free credit period on your purchases, giving you the flexibility to manage your expenses efficiently.

Annual Fee Waiver:

Some credit card offers may include an annual fee waiver if you meet certain spending criteria, making it even more cost-effective.

Conclusion

The HDFC Bank Diners Club Premium Credit Card, in summary, is a premium financial tool that goes beyond the concept of a credit card in the traditional sense. With access to airport lounges, travel insurance, and a rewarding points programme, it provides a wide range of premium services. It is designed for those who value comfort and luxury. Whether you're a traveller, a foodie, or just someone who enjoys a little class in everyday life, this card opens the doors to a world of pleasure. Due to its extensive coverage, rewards programme, and worldwide acceptance, the HDFC Bank Diners Club Premium Credit Card is more than just a way to make payments; it also acts as a gateway to a way of life.

0 notes

Text

Best Credit Cards to Earn Club ITC Points and ITC Culinaire Membership

Earning Club ITC points and joining ITC Culinaire can open up a world of luxury and benefits for you if you enjoy fine dining or travel regularly. Members of the exclusive ITC Culinaire Membership programme receive perks like complimentary stays, food discounts, and spa advantages. Making the most of these benefits is practicable by using credit cards that are intended to earn you Club ITC points. In this post, we'll take a closer look at some of the best credit cards that are offered in India that will help you earn Club ITC points more rapidly, accelerating your route to the coveted ITC Culinaire Membership. Check

Main Points

American Express Platinum Card:

Earn 5,000 bonus Membership Rewards Points upon the first year's Card renewal.

Enjoy complimentary membership to the ITC Culinaire program, which includes dining and accommodation benefits.

Accelerated rewards on dining expenses at ITC hotels and restaurants.

Access to premium airport lounges across India.

HDFC Diners Club Black Credit Card:

Earn 5 Club ITC Green Points for every Rs. 150 spent on your card.

Complimentary Club ITC Culinaire Membership.

Access to premium airport lounges worldwide.

Exclusive travel privileges and concierge services.

SBI Card ELITE:

Earn 5X reward points on dining, grocery, and department store spends.

Complimentary Club ITC Culinaire Membership.

Welcome gift vouchers and milestone rewards.

Access to premium golf courses and airport lounges.

Citi Prestige Credit Card:

Earn accelerated reward points on dining and hotel bookings.

Enjoy complimentary Club ITC Culinaire Membership.

Priority Pass access to over 1,000 airport lounges worldwide.

Exclusive travel and lifestyle benefits.

Axis Bank SELECT Credit Card:

Earn 5X reward points on dining and international spends.

Complimentary Club ITC Culinaire Membership.

Fuel surcharge waiver and airport lounge access.

Attractive lifestyle benefits and offers.

IndusInd Bank Pinnacle Credit Card:

Earn accelerated reward points on dining, travel, and hotel expenses.

Complimentary Club ITC Culinaire Membership.

Golf privileges and concierge services.

Movie and dining discounts.

Conclusion

In conclusion, if you want to take advantage of the lavish benefits of an ITC Culinaire Membership and fast accrue Club ITC points, a number of credit cards in India are made to meet your needs. These cards provide significant returns on dining, travel, and hotel purchases in addition to free Club ITC Culinaire Memberships and access to additional advantages. Whether your main goals are expedited reward points, dining discounts, or access to airport lounges, there is a credit card that suits your preferences and could let you embark on a journey filled with grandeur and culinary delights. Make wise choices to maximise your Club ITC points and benefit from ITC Hotels' superiority.

0 notes

Text

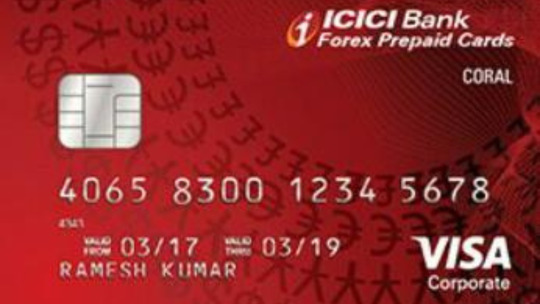

ICICI Bank Coral Prepaid Forex Card

The ICICI Bank Coral Prepaid Forex Card is a versatile financial instrument designed to satisfy the needs of international visitors. Whether you're a traveller seeing new locations or a business person who frequently travels overseas, this prepaid card offers a straightforward and secure way to manage your foreign exchange spending.

The Coral Prepaid Forex Card allows you to load a variety of foreign currencies, eliminating the need to carry cash or traveler's checks. It provides users with access to a huge worldwide network of ATMs and retail establishments, making it the perfect travelling companion. Check

Main Points

Multi-Currency Load: You can load multiple foreign currencies onto a single card, allowing you to avoid the hassle of carrying different currencies or traveler's cheques.

Global Acceptance: The card is widely accepted at ATMs, merchant establishments, and online platforms around the world, providing you with easy access to your funds wherever you go.

Security: The card comes with a PIN-based security feature, ensuring that your funds are safe and protected from unauthorized use. In case of loss or theft, you can also report it and get a replacement card.

Emergency Assistance: Many Coral Prepaid Forex Cards offer emergency assistance services, including card replacement and emergency cash disbursement, in case you run into unforeseen financial troubles while abroad.

Travel Insurance: Some versions of this card offer complimentary travel insurance, covering aspects like medical emergencies, lost baggage, trip cancellations, and more, providing you with added peace of mind during your travels.

Exclusive Discounts: Cardholders often enjoy exclusive discounts and offers on dining, shopping, and travel-related services, helping you save money while abroad.

Online Access: You can easily track your transactions and manage your card online, allowing you to monitor your expenses and balance in real-time.

Reloadable: The card is reloadable, meaning you can add more funds to it as needed, making it a convenient and reusable financial tool for multiple trips.

Currency Conversion: The card typically offers competitive exchange rates, saving you money on currency conversion fees compared to exchanging cash at airports or currency exchange offices.

Customizable: Depending on your needs, you can choose the initial currencies you want to load onto the card. This customization ensures that you have the right mix of currencies for your travel destinations.

24/7 Customer Support: ICICI Bank usually provides round-the-clock customer support, so you can seek assistance or report issues at any time during your journey.

Cashless Transactions: Enjoy the convenience of cashless transactions, whether you're dining, shopping, or booking hotels and flights during your travels.

No Foreign Transaction Fees: With a prepaid forex card, you often avoid foreign transaction fees that are typically associated with using a regular credit or debit card abroad.

Conclusion

The ICICI Bank Coral Prepaid Forex Card, in conclusion, is an invaluable financial instrument for both business and leisure tourists abroad. It offers comfort and security while travelling due to its ability to load a variety of currencies, wide acceptance, and strong security measures. The added benefits, including emergency assistance, travel insurance, and exclusive discounts, make it more appealing to consumers who frequently go abroad. Whether you're a traveller exploring new locations or a business professional managing abroad spending, this card streamlines your financial transactions and ensures you make the most of your travels. Consider the ICICI Bank Coral Prepaid Forex Card if you're seeking for a quick and inexpensive way to send money abroad.

0 notes

Text

BPCL SBI Card vs BPCL SBI Card Octane: Which One To Choose?

When it comes to specialist cards like the BPCL SBI Card and the BPCL SBI Card Octane, navigating the world of credit cards can be overwhelming. Both cards provide alluring advantages designed to cover fuel-related costs, but they are suited to distinct tastes and spending patterns. We'll break out the benefits and features of each card in this guide to help you decide whether to go with the basic BPCL SBI Card or the more expensive BPCL SBI Card Octane. You'll be better able to choose the card that meets your demands and rewards your spending habits by being aware of the subtleties of these products. Check

Main Points

BPCL SBI Card:

Reward Structure: The BPCL SBI Card offers attractive rewards on fuel transactions, with cashback or reward points earned on fuel spends at BPCL petrol pumps. Additionally, it provides rewards on other everyday spends as well.

Joining Bonus: This card often comes with a joining bonus, which could include fuel vouchers, reward points, or cashback upon card activation and meeting specific spending requirements.

Annual Fee: The annual fee for the BPCL SBI Card is typically lower compared to the Octane variant.

Fuel Benefits: The card offers fuel-related benefits like surcharge waivers and cashback on fuel transactions made at BPCL petrol pumps. It's suitable for individuals with moderate fuel consumption.

General Spends: While it does offer rewards on other spending categories, the rewards structure for non-fuel expenses might not be as high as the Octane variant.

BPCL SBI Card Octane:

Premium Benefits: The BPCL SBI Card Octane is a premium variant with enhanced benefits, designed for frequent and high-spending users.

Higher Reward Rates: This card typically offers higher cashback or reward points on fuel transactions compared to the standard card, making it appealing for those who spend a significant amount on fuel.

Lifestyle Benefits: The Octane variant may include additional lifestyle perks such as complimentary airport lounge access, dining discounts, and more.

Annual Fee: Due to its premium features, the BPCL SBI Card Octane usually comes with a higher annual fee compared to the standard card.

Fuel Benefits: Apart from BPCL fuel pumps, the Octane card might offer rewards or benefits on fuel purchases at other petrol stations as well, widening your options.

Priority Customer Service: Premium cards often provide dedicated customer service for quicker issue resolution.

Choosing Between the Two:

Usage Patterns: Consider your monthly fuel consumption. If it's moderate, the standard BPCL SBI Card might suffice. For heavy fuel users, the Octane card could offer more substantial rewards.

Spending Habits: Evaluate your overall spending. If you often dine out, travel, or shop, the Octane card's additional lifestyle benefits might be worth the higher fee.

Budget: Assess whether the annual fee of the Octane card fits into your budget and whether the extra rewards and benefits justify the cost.

Lifestyle Needs: If you value perks like lounge access and dining discounts, the Octane card might align better with your lifestyle.

Conclusion

To sum up, choosing between the BPCL SBI Card and the BPCL SBI Card Octane comes down to striking a balance between your personal preferences and spending tendencies. If your fuel needs are moderate, you prefer a cheaper yearly charge, and you don't need many lifestyle perks, choose the BPCL SBI Card. On the other hand, the BPCL SBI Card Octane is an alluring choice if you routinely spend a substantial amount on fuel and desire premium advantages like access to airport lounges and a wider range of fuel selections, even with its higher annual cost. To determine which card best suits your unique situation, consider your purchasing habits, lifestyle priorities, and financial constraints. Both cards have their perks.

0 notes

Text

What is a Consumer Credit Report?

Consumer credit reports give a thorough overview of a person's credit history and financial habits. Lenders, creditors, and financial institutions utilise this report, which is produced by credit reporting companies, also called credit bureaus, to evaluate a person's creditworthiness. The report contains information about a person's credit accounts, payment history, unpaid debts, and any public documents like liens or bankruptcies. This introduction provides a definition of a consumer credit report and emphasises its importance in assessing someone's financial dependability and capacity for borrowing money. Check

Main Points

Personal Information: The report starts with personal details such as the individual's name, address, date of birth, and Social Security number. This information helps ensure that the report is accurate and belongs to the correct person.

Credit Accounts: The report lists all the credit accounts an individual holds, including credit cards, mortgages, auto loans, personal loans, and more. Each account entry includes details like the account type, account number, credit limit or loan amount, and the date the account was opened.

Payment History: This section records an individual's payment behavior for each credit account. It shows whether payments were made on time, late, or if any payments were missed. Positive payment history can boost a credit score, while late payments can have a negative impact.

Outstanding Balances: The report provides information about the outstanding balances on each credit account. This helps lenders assess an individual's current level of debt and their ability to manage it.

Credit Utilization: Credit utilization ratio is the ratio of the credit card balances to their credit limits. This section of the report indicates how much of a person's available credit they are using. A lower utilization ratio is generally better for credit scores.

Credit Inquiries: The report lists inquiries made by lenders when an individual applies for credit. "Hard inquiries" occur when a person applies for a new credit account, and multiple inquiries within a short period can slightly lower a credit score. "Soft inquiries," like those for pre-approved offers, don't affect the score.

Public Records: Negative financial events such as bankruptcies, foreclosures, tax liens, and court judgments are recorded in this section. These events can significantly impact an individual's creditworthiness and remain on the report for several years.

Collections: If a debt has been sent to a collection agency due to non-payment, this information is also included. Collections can have a negative impact on credit scores.

Credit Score: While the credit report doesn't include the credit score itself, it often provides information about the factors influencing the score. Credit scores reflect an individual's overall credit risk based on the data in the report.

Dispute Information: If an individual identifies inaccuracies or errors on their report, they can dispute the information with the credit reporting agency. The resolution of disputes is often included in the report.

Conclusion

An exhaustive record that provides a full overview of a person's financial past and credit-related habits is a consumer credit report, to sum up. It is extremely important to verify someone's creditworthiness and financial stability using this report, which is kept up to date by credit reporting organisations. It affects factors like interest rates, insurance premiums, and rental agreements, thus its significance extends beyond just obtaining credit cards and loans. By being aware of the information in their credit reports and routinely checking them, people can take proactive measures to improve their credit scores and overall financial health. One's capacity to correct errors, settle inconsistencies, and be informed about their credit report determines their capacity to appropriately manage their finances and get credit.

1 note

·

View note

Text

Air India SBI Signature Credit Card

The Air India SBI Signature Credit Card is a prestigious and feature-rich credit instrument designed to satisfy the rigorous needs of frequent travelers and aviation enthusiasts. With this credit card, you may seamlessly combine exclusive benefits, rewards, and travel benefits. It was developed in collaboration with the national airline of the nation, Air India, and State Bank of India (SBI). Cardholders can take use of a variety of benefits, such as free lounge access, quick mileage accrual for Air India reservations, and attractive discounts on travel-related expenses, thanks to its unique offerings. Because it acts as a gateway to improved travel experiences, the Air India SBI Signature Credit Card is the ideal choice for those seeking unrivaled advantages when travelling. Check

Main Points

Mileage Acceleration: One of the standout features of the card is its accelerated mileage earning on Air India bookings. Cardholders earn bonus reward points on their Air India ticket purchases, helping them accumulate miles faster and making their travel experiences even more rewarding.

Welcome Bonus: The card often comes with an attractive welcome bonus in the form of bonus reward points upon card activation and meeting the initial spending requirements. This bonus kick-starts your rewards journey and enhances the value of the card from the very beginning.

Lounge Access: The Air India SBI Signature Credit Card provides complimentary access to airport lounges, both domestic and international, through the Priority Pass program. This feature allows you to relax and unwind in comfortable surroundings before your flights.

Complimentary Insurance: Cardholders can enjoy various insurance coverages, including air accidental coverage and travel insurance for both domestic and international trips. This ensures added security and peace of mind during your travels.

Exclusive Discounts: The card offers discounts on various travel-related expenses, such as hotel bookings, car rentals, and dining, helping you save money while you explore new destinations.

Redemption Options: The reward points earned can be redeemed for a variety of options, including Air India flight bookings, hotel stays, merchandise, and vouchers from partner merchants. This flexibility allows you to tailor your redemptions to your preferences.

Priority Boarding: Cardholders may enjoy priority boarding privileges on Air India flights, allowing you to settle in early and make the most of your journey.

Milestone Benefits: The card often comes with milestone spending benefits, such as bonus reward points or vouchers, when you reach specific spending thresholds. These rewards further enhance the value of the card and provide incentives for regular usage.

Global Acceptance: Being a Visa Signature card, the Air India SBI Signature Credit Card is widely accepted both domestically and internationally, ensuring seamless transactions wherever you go.

Personal Concierge Services: Cardholders can access personalized concierge services that can assist with travel bookings, reservations, and other lifestyle-related requests, making your travel planning smoother and more efficient.

Annual Fee Waiver: In some cases, the annual fee of the card might be waived for the first year or subsequent years based on meeting spending requirements, making it more cost-effective.

Conclusion

In conclusion, the Air India SBI Signature Credit Card offers a variety of benefits designed especially for travelers, allowing them to earn rewards, benefit from exclusive privileges, and enhance the comfort and value of their journeys.

0 notes

Text

The SBI SimplyCLICK Credit Card is a popular credit card offering from the State Bank of India (SBI). It is designed to cater to the modern lifestyle of online shoppers and frequent internet users. The card comes with a range of benefits and rewards tailored to online spending, making it an attractive choice for those who frequently shop online or use various digital services. With its focus on e-commerce and digital transactions, the SBI SimplyCLICK Credit Card provides users with cashback, rewards points, and discounts on online purchases, along with other perks such as milestone rewards, fuel surcharge waivers, and easy EMI options. This card is an excellent option for individuals seeking to maximize their online spending benefits while enjoying the convenience and security of SBI's widespread network.

Main Points

Online Shopping Rewards: The card offers accelerated rewards for online shopping, allowing cardholders to earn more rewards points for every rupee spent on online transactions, including e-commerce websites, online travel bookings, food delivery services, and more.

Welcome Benefit: Cardholders are often eligible for a welcome e-gift voucher from selected partner websites upon successful card activation.

Milestone Rewards: Users can earn additional rewards points when they reach specific spending milestones on their credit card. These milestone benefits further enhance the overall reward-earning potential.

Amazon.in Gift Card: One of the primary partners of the SimplyCLICK Credit Card is Amazon India. Cardholders can receive an Amazon gift voucher as part of the welcome benefit and earn additional vouchers based on their spending patterns.

Cleartrip Voucher: SBI SimplyCLICK cardholders can also enjoy Cleartrip e-vouchers, which can be redeemed for travel-related services on the Cleartrip website.

Fuel Surcharge Waiver: The card provides a fuel surcharge waiver at petrol pumps, making it more economical for cardholders to fuel up their vehicles.

Easy EMI Option: SBI offers an easy EMI facility that allows cardholders to convert their high-value purchases into convenient monthly installments.

Contactless Payment: The card is equipped with contactless payment technology, allowing users to make quick and secure transactions by simply tapping the card at enabled payment terminals.

Global Acceptance: The SBI SimplyCLICK Credit Card is widely accepted both in India and abroad, making it a convenient payment option for international travel and purchases.

Annual Fee Reversal: The annual fee on the card may be reversed if the cardholder meets the specified annual spending criteria.

Secure Transactions: SBI ensures the security of online transactions through various measures, including one-time passwords (OTPs) and secure online authentication protocols.

Ease of Bill Payment: Cardholders can easily manage and pay their credit card bills through SBI's online banking platforms, making it a hassle-free process.

Interest-Free Grace Period: Cardholders have a interest-free period of up to 20-50 days, depending on the billing cycle, allowing them to make purchases without incurring interest charges if the outstanding amount is paid in full before the due date.

Conclusion

In conclusion, the SBI SimplyCLICK Credit Card is an excellent choice for individuals who frequently shop online and prefer digital transactions. With its focus on providing rewards and benefits tailored to online spending, the card offers accelerated rewards points on e-commerce purchases, travel bookings, and more. Cardholders can enjoy welcome benefits, milestone rewards, and partner vouchers from popular platforms like Amazon and Cleartrip.

0 notes

Text

One of Standard Chartered Bank's most well-known and renowned credit cards is the Standard Chartered Manhattan Credit Card. This card offers a wide range of unique advantages and rewards that are tailored to meet the demands of urban professionals who shop frequently. This credit card, which is named after the busy city of Manhattan, is intended to offer its users a little luxury and convenience. Manhattan is well-known for its dynamic lifestyle and shopping opportunities.

Main Points

Rewards and Cashback: The credit card offers attractive rewards and cashback on various categories, such as dining, grocery shopping, fuel, and more. Cardholders can earn points for every transaction, which can be redeemed for exciting offers and discounts.

Lifestyle Privileges: The card is designed to enhance the overall lifestyle of its users. It provides exclusive access to events, lifestyle benefits, and special offers on entertainment, dining, and shopping experiences.

Travel Benefits: For frequent travelers, the Standard Chartered Manhattan Credit Card often comes with low or zero foreign transaction fees, making it an ideal choice for international spending. Cardholders may also enjoy travel-related discounts and offers.

Online Banking and Mobile App: The credit card comes with a user-friendly online banking platform and a mobile app that allows easy tracking of transactions, payment reminders, and account management.

Global Acceptance: The card is widely accepted both nationally and internationally, enabling users to make hassle-free transactions at millions of merchant outlets and ATMs worldwide.

Security Features: To ensure the safety of its users, the credit card is equipped with advanced security features, including secure chip technology, one-time passwords (OTP), and fraud protection measures.

Easy Application Process: Standard Chartered Bank typically offers a straightforward and convenient application process for the Manhattan Credit Card, making it easily accessible to eligible applicants.

Annual Fee and Charges: While the card offers numerous benefits, it may come with an annual fee and other associated charges. However, some fees may be waived off based on specific spending patterns or promotions.

Customer Support: The bank provides reliable customer support to assist cardholders with any queries, concerns, or assistance related to their credit card account.

Building Credit History: Using the Standard Chartered Manhattan Credit Card responsibly and making timely payments can help individuals build and improve their credit history, which can be advantageous for future financial endeavors.

Conclusion

The Standard Chartered Manhattan Credit Card is an intriguing choice for urban professionals and frequent shoppers searching for a credit card that provides a number of appealing benefits and rewards. With an emphasis on enhancing lifestyle experiences, this credit card offers users exclusive privileges, cashback deals, and rewards on many spending categories like dining out, shopping, and gas.

The card is a good option for travelers who want to make purchases without hassle when traveling because of its travel-related characteristics, such as its low or no international transaction fees.

0 notes

Text

Axis Bank Pride Platinum Credit Card is a premium credit card designed exclusively for members of the Indian armed forces and government. There are other benefits offered, such as the removal of the fuel surcharge, special prices at partner restaurants, eDGE loyalty reward points, conversion to EMIs, free entry to airport lounges, free roadside assistance, and travel insurance.

The yearly fee for the Axis Bank Pride Platinum Credit Card is Rs. 500 for the primary cardholder and Rs. 250 for additional cardholders. However, there are no yearly fees for the first year.

Main points

Fuel surcharge waiver: You can get a waiver of 1% fuel surcharge on all fuel transactions in India with an Axis Bank Pride Platinum Credit Card. This is a great benefit, especially if you drive a lot. The waiver is capped at Rs. 250 per statement cycle.

Discount at partnered restaurants: You can get a 15% discount at partnered restaurants when you use your Axis Bank Pride Platinum Credit Card. This is a great way to save money on your dining expenses. There are over 200 partnered restaurants across India where you can avail this discount.

eDGE loyalty reward points: You earn eDGE loyalty reward points for each transaction you make with your Axis Bank Pride Platinum Credit Card. These points can be redeemed for a variety of rewards, such as air miles, gift vouchers, and merchandise. You earn 4 points for every Rs. 200 spent on the card.

EMV certified PIN protected chip: Your Axis Bank Pride Platinum Credit Card has an EMV certified PIN protected chip. This means that your card is more secure from fraud. The chip makes it more difficult for criminals to steal your card information and use it to make fraudulent purchases.

Conversion to EMIs: You can convert eligible transactions to EMIs with your Axis Bank Pride Platinum Credit Card. This can help you to spread out the cost of your purchases over a longer period of time. You can convert transactions of Rs. 2,500 and above to EMIs.

Complimentary airport lounge access: You can get complimentary access to airport lounges when you travel with your Axis Bank Pride Platinum Credit Card. This is a great way to relax and unwind before your flight. You get access to 12 airport lounges across India with this card.

Roadside assistance: You can get roadside assistance if you break down on the side of the road with your Axis Bank Pride Platinum Credit Card. This is a great peace of mind to have. You get roadside assistance for up to 50 km in case of a breakdown.

Travel insurance: You get travel insurance when you use your Axis Bank Pride Platinum Credit Card to book travel. This can help to protect you in case of unexpected events. The travel insurance covers you for up to Rs. 5 lakhs in case of medical expenses, loss of luggage, and flight cancellation.

Annual fee: The annual fee for the Axis Bank Pride Platinum Credit Card is Rs. 500 for the primary cardholder and Rs. 250 for add-on cardholders. However, there is no annual fee for the first year.

Conclusion

The Axis Bank Pride Platinum Credit Card is a great option for members of the Indian armed forces and government who are looking for a premium credit card with lots of benefits. An EMV certified PIN protected chip, conversion to EMIs, free access to airport lounges, free roadside assistance, and travel insurance are just a few of the advantages offered by the card. It also offers savings at partner restaurants, eDGE loyalty reward points, and discounts at restaurants. The annual fee for the primary cardholder is Rs. 500, while add-on cardholders pay Rs. However, there are no yearly fees for the first year. If you're eligible, I strongly suggest you to submit an application.

0 notes

Text

ITC Hotels, a well-known luxury hotel chain in India, has a reward scheme called Club ITC. Members are rewarded with Club ITC Points, which can be redeemed for a variety of benefits and privileges, including ITC Culinaire Memberships. You can maximise your Club ITC Points gains by using one of the credit cards that offer faster benefits especially created for this scheme.

Main Points

ICICI Bank Coral Credit Card:

Earn accelerated Club ITC Points on hotel stays at ITC Hotels and other retail spending.

Enjoy exclusive benefits such as complimentary movie tickets and discounts on dining.

Access to airport lounges and travel insurance.

Axis Bank Privilege Credit Card:

Earn Club ITC Points on all retail purchases, including hotel stays.

Complimentary access to airport lounges, concierge services, and lifestyle benefits.

Enjoy dining and golf privileges.

HDFC Bank Diners ClubMiles Credit Card:

Earn Club ITC Points as part of the Diners Club Rewards program.

Accelerated rewards on travel and dining expenditures.

Access to airport lounges worldwide.

Standard Chartered Visa Infinite Credit Card:

Accelerated Club ITC Points earnings on hotel stays and eligible transactions.

Exclusive travel and lifestyle benefits, including airport lounge access and concierge services.

Complimentary golf privileges.

Citibank Prestige Credit Card:

Earn Club ITC Points on hotel stays and other spending.

Access to exclusive airport lounges, travel insurance, and lifestyle privileges.

Enjoy complimentary golf rounds and 24/7 concierge services.

Conclusion

These credit cards provide opportunities for faster Club ITC Point accumulation, which may be exchanged for a number of benefits such ITC Culinaire Memberships. It's important to thoroughly investigate the terms and conditions, yearly fees, interest rates, and other associated costs before applying for any credit card. Consider your purchasing habits, manner of life, and specific needs to choose the card that best satisfies your needs.

0 notes

Text

What causes such high credit card interest rates?

Interest rates on credit cards have long been a source of anxiety for consumers. Why these rates are generally higher than those provided for mortgages or auto loans, for instance, baffles many people. Understanding the reasons behind high credit card interest rates is crucial for anyone trying to effectively manage their finances and use credit cards responsibly. Read More

Credit card lending has a higher default risk than other types of loans because it is unsecured and unbacked by any assets. Higher interest rates are used to offset possible losses when debtors are at danger of payment default.

Cost of Funds: To fund their business operations and extend credit to consumers, credit card issuers borrow money. The costs associated with borrowing money from different sources, like deposits or bonds, have an effect on the interest rates levied. Higher interest rates are the effect of increased funding costs for credit cards.

Operational Costs: Credit card firms spend a lot of money on things like customer support, marketing, preventing fraud, and upkeep of the payment system. The cost of providing these services is covered by include these costs in the interest rates.

Regulation Requirements: Government regulators impose compliance fees and regulatory guidelines on credit card issuers. Consumer protection regulations and risk management guidelines are only two examples of measures that may raise expenses and have an effect on interest rates.

Market Competition: Interest rates are affected by market forces because credit card firms operate in a cutthroat industry. If one issuer raises rates, others might do the same to keep profitable. Higher interest rates might also result from weak market competition or market concentration.

Conclusion

Finally, a variety of variables contribute to credit card interest rates that are so high. The need to pay potential losses and the default risk associated with unsecured lending are what drive up rates the most. Credit card firms’ cost of money, which includes borrowing charges, affects the interest rates that cardholders pay. Higher rates are also a result of the operational expenses incurred by credit card companies, such as fraud prevention and customer service. Regulations put in place by the government increase operating costs and affect interest rates. Market competition is also a concern since issuers alter their rates in reaction to changes in the market and factors that affect profits.

0 notes

Text

What Is Credit Card Consolidation and How Does It Work?

Credit card consolidation is a process where you combine multiple credit card debts into a single, more manageable payment. This is typically done through a balance transfer to a new credit card or by taking out a loan to pay off all of the credit card balances. The goal of credit card consolidation is to simplify your debt repayment and potentially lower your interest rate, ultimately reducing the overall cost of your debt. This can help you save money and get out of debt faster. However, it's important to carefully consider the terms of any consolidation option to ensure that it's the right choice for your financial situation.

Steps Involved in Credit Card Consolidation

Evaluate your current credit card debts:

The first step is to gather all of your credit card statements and assess your current debt situation. Make a list of each credit card balance, interest rate, and minimum monthly payment.

Explore consolidation options:

When exploring consolidation options, there are three main options to consider: balance transfer credit cards, personal loans, and home equity loans. Balance transfer credit cards allow you to transfer your credit card balances to a new card with a lower interest rate for a promotional period. Personal loans provide a lump sum of money that can be used to pay off your credit card debts, with a fixed interest rate and repayment term.

Apply for a consolidation loan:

Once you have decided on the best consolidation option, you will need to apply for a loan or line of credit. This will involve filling out an application and providing financial information to the lender.

Transfer your balances:

If you choose a balance transfer credit card, you will need to transfer the balances from your existing credit cards to the new card. Be aware of any balance transfer fees and make sure you understand the terms and conditions of the new card.

Pay off your debts:

With a consolidation loan, you will receive a lump sum of money that can be used to pay off your credit card debts. With a balance transfer credit card, you will make payments to the new card until your balances are paid off.

Make regular payments:

Once your credit card debts are consolidated, it’s important to make regular payments on time. This will help you avoid late fees and penalties, and also improve your credit score.

Bottom line:

In summary, credit card consolidation is a method of combining multiple credit card debts into one payment to simplify debt repayment and potentially reduce the overall cost of debt. This can be achieved through a balance transfer to a new credit card or taking out a loan to pay off all credit card balances. The main benefit is that it can make managing debt easier, but it's essential to weigh the terms and fees of any consolidation option to ensure that it makes financial sense for your situation. Ultimately, credit card consolidation can be a helpful tool for those looking to get out of debt faster and save money on interest payments.

1 note

·

View note