#madoff: the monster of wall street

Video

youtube

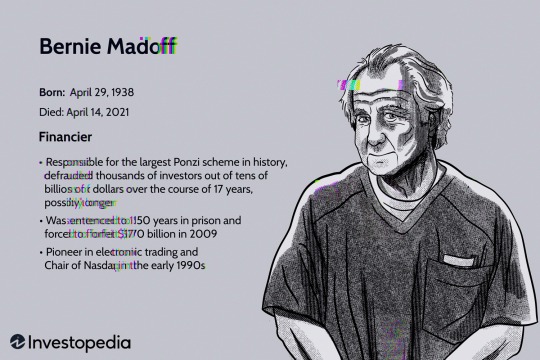

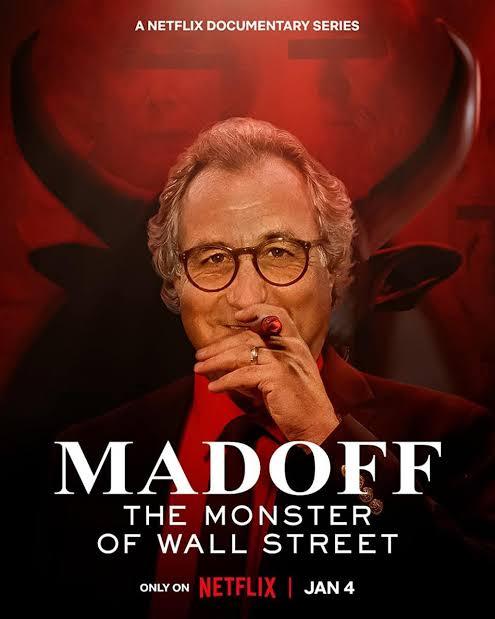

A recent Netflix documentary series called Madoff: The Monster of Wall Street by Emmy Award–winning filmmaker Joe Berlinger tells the story of the largest Ponzi scheme in history.

Besides the infamous character mentioned in its title, the series' other villain is the Securities and Exchange Commission (SEC), which received complaints about Bernie Madoff starting in the early 1990s, and yet, it not only failed to catch him but helped enable his fraud. During one investigation, all SEC investigators had to do was check an account number to verify trades had actually occurred, which they hadn't, of course, because all of Madoff's trades were fake.

The Netflix series acknowledges that the SEC was complicit in Madoff's scam and that he could have been caught if one investigator assigned to the case had done about 30 minutes of checking. But then it also blames deregulation and free market capitalism for making the fraud possible.

"Resources that had been in New York City, on Wall Street's doorstep, devoted to white-collar crime, to fraud, were being steered away [from Wall Street]," says Henriques of the George W. Bush administration era during which Madoff's operation reached its peak. "For the SEC, this was an exacerbation of an existing problem, as a result of a deregulatory campaign that began with the election of Ronald Reagan in 1980."

Instead of making lazy allusions to the evils of free market capitalism, to better understand the lessons of the Madoff saga, director Joe Berlinger should have consulted the work of the free market economist George Stigler, who won the Nobel Prize in part for his work on "regulatory capture."

In a 1971 paper, "The Theory of Economic Regulation," Stigler argues that while many people believe that "regulation is instituted primarily for the protection and benefit of the public," in fact, it mainly serves the purposes of the largest companies being regulated, which form a symbiotic relationship with their regulatory overseers.

"My thesis is that the industry body in the long run must act by and for the industry," said Stigler in a 1971 speech before the American Enterprise Institute. "The political realities of life dictate that the regulatory bodies become affiliated with and help in what it believes to be the necessary conditions for the survival of its industry."

Stigler's essay focuses mainly on how regulators help existing companies by protecting them from competition, but his theory can also be used to better understand the SEC's failure to catch Madoff. In a 1972 essay, Stigler writes that "the regulating agency must eventually become the agency of the regulated industry…. each needs the other." That's because the career lawyers at the SEC making the decisions have much more to gain personally from having a positive relationship with big industry players than antagonizing them.

What if Harry Markopolos' warnings hadn't been filtered through the SEC? The average person might be better equipped to spot a con man than we give him credit for. But the myth that regulators are primarily motivated to protect the interests of the public causes many to suspend their better judgment.

"The individual consumer, if he is not hampered, is in general capable of a large measure of self-defense against fraud, mishaps, bad luck, and the like," said Stigler in his 1971 speech. "Not all consumers are intellectually competent and well-informed, but most consumers know how to build up defenses against the many vicissitudes that lie in real life. And it is primarily because we have socially so often hampered these effects that we have injured the consumer."

The big takeaway from Madoff: The Monster of Wall Street is that regulators unwittingly facilitated his fraud, just as they may have done with Sam Bankman-Fried and his alleged con. As you watch the Netflix series, think about whether we should really be giving these regulators more time or power. Are they helping us or themselves?

3 notes

·

View notes

Text

The only people who can deceive you completely are people you trust completely. And the price of trusting anyone is that they can betray you like that.

2 notes

·

View notes

Text

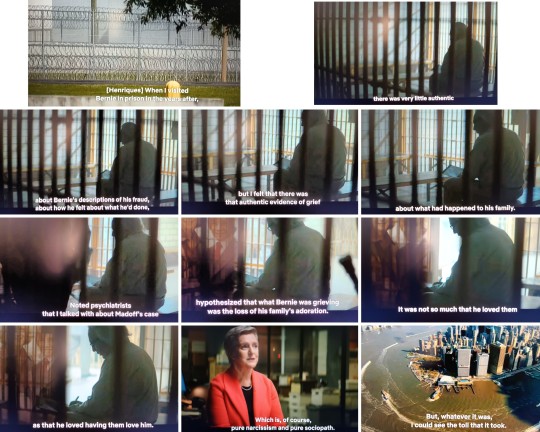

It is so easy for ordinary people to see the sadness, grief & other such emotions of narcissistic people and think they're normal reactions of empathy when they're actually emotions based on very, very selfish and superficial things.

0 notes

Video

youtube

Madoff: The Monster of Wall Street - Trailer

With an innovative visual approach, Madoff: The Monster of Wall Street is a four part edge-of your seat financial thriller which reveals the truth behind Bernie Madoff’s infamous multibillion-dollar global Ponzi scheme and the ways in which a willfully blind financial system allowed it to flourish for decades.

#Madoff: The Monster of Wall Street#trailers#bernie madoff#netflix#crime docs#wall street#ponzi scheme

1 note

·

View note

Text

Official Trailer For Netflix Documentary Series MADOFF: THE MONSTER OF WALL STREET

Official Trailer For Netflix Documentary Series MADOFF: THE MONSTER OF WALL STREET

From Director and Executive Producer Joe Berlinger, Netflix has released this official trailer for MADOFF: THE MONSTER OF WALL STREET

RELEASE DATE: January 4, 2023

EPISODES: 4 X 60

DIRECTOR: Joe Berlinger

EXECUTIVE PRODUCERS: Joe Berlinger, Jon Kamen, Jon Doran, Jen Isaacson, Samantha Grogin, Eve Rodrick

PRODUCTION COMPANY: RadicalMedia

About MADOFF: The Monster of Wall Street

MADOFF: The Monster…

View On WordPress

0 notes

Text

"People want to believe in good returns without downside risk. Everybody wants that in their portfolio, but they're chasing the Holy Grail. The Holy Grail doesn't exist in real life, nor does it exist in finance."

(Markopolos - Madoff: The Monster of Wall Street - Episode 4)

1 note

·

View note

Text

2023 Favoritest True Stories

Good documentarian viewings, shared in a particular order (the order in which I watched them):

Madoff: The Monster of Wall Street

Eat the Rich: The GameStop Saga

Stolen Youth: Inside the Cult at Sarah Lawrence

Low Country: The Murdaugh Dynasty

Boom! Boom! The World vs Boris Becker

Still: A Michael J. Fox Movie

Love to Love You, Donna Summer

The American Gladiators Documentary

Natalia

Burden of Proof

Duggars

Angel City

Wham!

Project Greenlight

Stephen Curry: Underrated

Glitch: The Rise and Fall of HQ Trivia

Last Call: When a Serial Killer Stalked Queer New York

Telemarketers

The YouTube Effect

Wanted: The Escape of Carlos Ghosn

The Big Conn

Savior Complex

Missing: The Lucie Blackman Case

Last Stop Larrimah: Murder Down Under

Yellow Door: ’90s Lo-fi Film Club

The Pigeon Tunnel

aka Mr. Chow

Beckham

Till Murder Do Us Part: Soering vs Haysom

Albert Brooks: Defending My Life

The Greatest Show Never Made

American Symphony

The Great Heisman Race of 1997

20 Days in Mariupol

Bobi Wine: The People’s President

To Kill a Tiger

0 notes

Text

My favorite TV shows, movies, and music* of 2023

My favorite TV shows, movies, and music* of 2023

Following my post on the standout books I read this year, here’s the best of what I watched and listened to in 2023:

📺 TV

— “Madoff: The Monster of Wall Street” (Netflix) This documentary series reinforced for me not just how shocking his crimes were, but how much his victims suffered.

— “Wham!” (Netflix) George Michael, Andrew Ridgeley, 80s pop music. What more do you need to know?

— “Beckham”…

View On WordPress

0 notes

Text

Review Netflix Film "Madoff: The Monster of Wall Street".

This time, I would like to share something a bit different but still related to financial industry. This is an advise for us-as parents, for our kids and our grand children about the importance of integrity. Not to be greedy, integrity is above all.

“Madoff: The Monster of Wall Street” adalah film Netflix yang menceritakan kisah nyata dari Bernard Madoff, pengusaha finansial dan penipu besar…

View On WordPress

0 notes

Text

January

Books

Finished reading:

Audiobook – Moby Dick by Herman Melville, 1851

Book – Old Possum's Book of Practical Cats by T. S. Eliot, 1939

Currently reading:

Book – How Far the Light Reaches by Sabrina Imbler, 2022

Book – What the Eyes Don't See by Mona Hanna-Attisha, 2018

Media

Finished watching:

TV series – The Crown starring Claire Foy, Olivia Colman, Imelda Staunton; 2016 – TBD

TV series – The Sandman starring Tom Sturridge; 2022 – TBD

Docuseries – Madoff: The Monster of Wall Street produced by Joe Berlinger; 2023

Movie – Belle starring Gugu Mbatha-Raw; 2013

Movie – The Menu starring Ralph Fiennes and Anya Taylor-Joy; 2022

Movie – The Pale Blue Eye starring Christian Bale; 2022

Comedy special – Inside starring Bo Burnham; 2021

Currently watching:

TV series – The Righteous Gemstones starring John Goodman, 2019 – TBD

YouTube series – Binging with Babish starring Andrew Rea at Babish Culinary Universe, 2016 – TBD

YouTube series – Tasting History with Max Miller starring Max Miller at Tasting History, 2020 – TBD

Projects

Finished projects:

Recipes – Houston Cooks by Francine Spiering, 2019

Current projects:

Recipes – Food & Wine 40th Anniversary Special Edition ed. by Hunter Lewis et al., 2018

Recipes – Good Drinks by Julia Bainbridge, 2020

Cross-stitch – Feminist Cross-Stitch by Stephanie Rohr, 2019

0 notes

Text

Sickening to profit off of the pain and misery of so many others.

1 note

·

View note

Video

youtube

MADOFF: The Monster of Wall Street | Official Trailer | Netflix

Not very well made, but a chilling tragedy, led by a truly narcissistic individual, and the disaster inflicted on so many regular hard-working people - once by Madoff, and again inconceivably by the US government!

#OdedFriedGaon #OdedMusic #OdedInformation

0 notes

Quote

The only people who can deceive you completely are people you trust completely

Madoff: The Monster of Wall Street

0 notes

Text

MADOFF: The Monster of Wall Street

It was such a good documentary. Not too long, not too short.

I would have liked to understand better the fraudulent operation behind that scheme.

Honestly, people are as guilty as Bernie Madoff, they are just so so greedy. How can someone even believe to have 100% return without any loses.

And the institutions are as guilty as him too.

I really felt sorry for the mathematician, Markopolos who knew that Madoff was a fraud and did everything to show it, but no one believed him, until it was too late.

Some people are just too stupid.

Worst JP Morgan Chase "acknowledged a lack of oversight in monitoring Bernie Madoff's bank transactions, but the company claimed that no employee knowingly assisted in the fraud."

Some quotes :

"- And the choice he made was, he could live with himself as a liar much more easily than he could live with himself as a failure." (Episode 1)

"- He's both Bernie's savior, if you will, and Bernie's deep, enraging enemy, because Bernie, as the ultimate control freak, has allowed somebody to basically control him." (Episode 2)

"- For what Madoff needed to reassure his investors. Even before Madoff himself knew what he needed." (Episode 2)

"- A white-collar crime is different than a blue-collar crime. A blue-collar crime, the bodies drop before you investigate. And a white-collar crime, they drop afterwards." (Episode 4)

"- He chose, the methodology of death that he did, a painful solution, to atone for his sins of omission." (Episode 4)

"- Why would anybody trust me to give me business? Turn their money over to me? But the first thing I learned: Whatever you do in this business, never break your word. Your word was your bond, literally, and that was it. You trusted everybody. But nothing in this industry is what it looks like." (Episode 4)

"- People knew not to ask too many questions. If you're getting good returns and you're getting lots of money, and you're not to as any questions, you don't ask any questions. And, you know, greed has a way of doing that to people." (Kotz - Episode 4)

"- JP Morgan Chase has pled guilty to five massive criminal conspiracies involving billions of dollars within the last six years. When they get caught, they're never required to disclose the profits they made on the scheme. They just pay a fine and they go on." (Episode 4)

"- You know, my dad's crime... it killed my brother quickly and it's killing me slowly." (Mark Madoff - Episode 4)

"- Noted psychiatrists that I talked with about Madoff's case hypothesized that what Bernie was grieving was the loss of his family's adoration. It was not so much that he loved them as that he loved having them love him. Which is, of course, pure narcissism and pure sociopath." (Episode 4)

"- And the price of trusting anyone is that they can betray you liked that." (Episode 4)

"- People want to believe in good returns without downside risk. Everybody wants that in their portfolio, but they're chasing the Holy Grail. The Holy Grail doesn't exist in real life, nor does it exist in finance." (Markopolos - Episode 4)

#madoff#bernie madoff#the monster of wall street#madoff the monster of wall street#documentary#netflix

0 notes

Text

Bernie Madoff Gets the Serial-Killer Treatment in ‘Madoff: The Monster of Wall Street’

Bernie Madoff Gets the Serial-Killer Treatment in ‘Madoff: The Monster of Wall Street’

Oscar-nominated filmmaker Joe Berlinger has spent so much time investigating serial killers in the last four years that he recently felt, to put it simply, “a little serial-killered out.” He’d profiled Ted Bundy, John Wayne Gacy, and Jeffrey Dahmer in chart-topping Netflix documentaries; directed Zac Efron as Bundy in Extremely Wicked, Shockingly Evil and Vile; and helmed a five-episode…

View On WordPress

0 notes

Note

I think the dogwhistle post movie poster was “Madoff, the monster of wall street” on netflix

Thank you!!!

0 notes