#itdepartment

Photo

Spidel India - Digital Marketing Agency We offers out of the box solutions, to grab the attention of your niche customers. 1• Digital Marketing 2. Marketing Strategy 3. SEO Research #digitalmarketing #digitalmarketingagency #india #indiagovernment #indiagov #itdepartment #marketingstrategy #strategy #seo #seoresearch #seoresellerinsights #instagram #instagramers (at Patna, India) https://www.instagram.com/p/CjN7VQzvgae/?igshid=NGJjMDIxMWI=

#digitalmarketing#digitalmarketingagency#india#indiagovernment#indiagov#itdepartment#marketingstrategy#strategy#seo#seoresearch#seoresellerinsights#instagram#instagramers

0 notes

Link

The Income Tax Department claimed to have seized unaccounted assets worth Rs 390 crore, including Rs 58 crore in cash and 32 kg of gold, in a raid in Maharashtra's Jalna on August 3. Income Tax Department sources said that raids were conducted in Jalna last week and it lasted for 4-5 days.

The Income Tax Department has said that it has launched a search operation on two major trading companies engaged in the manufacture of steel TMT bars in Maharashtra. The search operation on 3 August covered more than 30 premises spread across Jalna, Aurangabad, Nashik and Mumbai. Several incriminating evidences were recovered during the search operation.

0 notes

Text

youtube

Part 1/3: How God used me to expose my wicked manager 😳😡😩😭🙏🏽🙏🏼🙏🥳🥳🥳😄🤣😂🤣😎😜😝🤪💃💃🏿💃🏼😀😇🥳

#manager #managers #itdepartment #hr #humanresources #lies #expose #vindicator #defender #coworker #coworkers #performancereview #terminated #fired #resign #money #HolySpirit

2 notes

·

View notes

Text

Are most IT departments offering fully remote or hybrid work environments? #RemoteWork #HybridWork #ITDepartments #WorkEnvironment In recent years, the landscape of work environments has seen a significant shift. With advancements in technology and a newfound emphasis on work-life balance, many companies, including those within the IT industry, have begun to explore remote and hybrid work options for their employees. If you find yourself wondering whether most IT depa... Read more: https://mymetric360.com/question/are-most-it-departments-offering-fully-remote-or-hybrid-work-environments/?feed_id=52748

0 notes

Text

Department of Information Technology !

Mr. Alok Kumar ( Batch 2015 - 2019, B.Tech IT) is here to take you on an exciting adventure into the world of web hosting. 🌐

Are you curious about how websites magically appear on the internet? Well, today we're going to learn just that! 💻

.

https://www.iimtindia.net/

Call Us: 9520886860

.

#ITDepartment #WebsiteLaunch #TechResources #IIMTIndia #iimtgroupofcolleges

#IIMTian #IIMTGreaterNoida #IIMT #IIMTNoida #IIMTDelhiNCR

0 notes

Video

youtube

చంద్రబాబుకు సెక్షన్ 153సీ కింద నోటీసు జారీ చేసిన ఐటీ అధికారులు #itdepart...

0 notes

Text

📱 𝐌𝐨𝐛𝐢𝐥𝐞 𝐃𝐞𝐯𝐢𝐜𝐞 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 (𝐌𝐃𝐌) is security software that allows #itdepartments to enforce policies that secure, monitor, and control end-user #mobiledevices. Including mobile phones, it extends tablets, laptops, and even IoT (#internetofthings) devices.

📲 #mobiledevicemanagement ̳n̳e̳e̳d̳s̳ ̳t̳w̳o̳ ̳e̳l̳e̳m̳e̳n̳t̳s̳ ̳i̳n̳ ̳a̳ ̳d̳a̳t̳a̳ ̳c̳e̳n̳t̳e̳r̳:̳

🔶 𝐀 𝐬𝐞𝐫𝐯𝐞𝐫 𝐜𝐨𝐦𝐩𝐨𝐧𝐞𝐧𝐭, wherein IT administrators build and share policies via a management console.

🔶 𝐀 𝐜𝐥𝐢𝐞𝐧𝐭 𝐜𝐨𝐦𝐩𝐨𝐧𝐞𝐧𝐭, that receives and executes the controls on end-user mobile devices.

📲 #mdmsolutions are one of the various types of device #managementsolutions. The primary types of #endpointmanagementsolutions that impact mobile devices include the following:

🔴 𝐌𝐨𝐛𝐢𝐥𝐞 𝐃𝐞𝐯𝐢𝐜𝐞 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 (𝐌𝐃𝐌): #mdm solutions are focused only on mobile device management.

🔴 𝐄𝐧𝐭𝐞𝐫𝐩𝐫𝐢𝐬𝐞 𝐌𝐨𝐛𝐢𝐥𝐢𝐭𝐲 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 (𝐄𝐌𝐌): #emmsolutions can manage physical mobile devices and include visibility into and rule over the content and applications hosted on those devices.

🔴 𝐔𝐧𝐢𝐟𝐢𝐞𝐝 𝐄𝐧𝐝𝐩𝐨𝐢𝐧𝐭 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 (𝐔𝐄𝐌): #uemsolutions unify management across all business endpoints, providing the power to operate computers and mobile devices using a single solution.

🔴 𝐌𝐨𝐛𝐢𝐥𝐞 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 (𝐌𝐀𝐌): #mam is a subset of #enterprisemobilitymanagement that allows organizations to control, secure and deploy #mobileapplications on employee and corporate-owned devices when MDM focuses on operating and connecting mobile devices.

📲 #mdmservices are a subset of #emm solutions that is a subset of #uem solutions. While all deliver the exact capability to manage mobile devices, solutions are increased levels develop their range to include other systems like applications, content, computers, etc.

💡 Our #mobiledevicemanagementsolutions allow organizations to protect every single employee. However, where they are or which web network they are using too. We provide visibility of every device across the company, then handle and protect each. It ensures organizations understand which devices are accessing their networks and from where so that they can continually evaluate their possible risk and take a more aggressive strategy for endpoint security.

#web development#app development#web design#application development#game development#technology#casino game development company#game development company#mdm#mobile device management#mdmsoftware#mdmsolution#mobileapp#mobile app development#mobile application development#mobile app developer company#userexperience#softwaredevelopment#businessgrowth#appdevelopment#mobileappdevelopment

0 notes

Text

youtube

चुनाव से पहले इस तरह की बातें फैलाना और चर्चा करना बीजेपी की पुरानी आदत रही है..

https://www.youtube.com/watch?v=uMlRYWSQZ8E

युग चरण के साथ देखिये देश-विदेश की सभी महत्वपूर्ण और बड़ी खबरें |

- इंटरनेशनल मोनेटरी फंड (IMF) ने कहा है की वो भारत से चावल की कुछ निश्चित किस्मों के एक्सपोर्ट पर लगाया गए बैन को हटाने के लिए बातचीत करेगा |

- The International Monetary Fund (IMF) has said that it will hold talks with India to lift the ban on exports of certain varieties of rice.

- एसकेआईटी कॉलेज के इलेक्ट्रिकल इंजिनीयरिंग डिपार्टमेट के फाइनल ईयर के स्टूडेंट्स ने बाइक चोरी को रोकने के लिए अपना एक प्रोजेक्ट तैयार किया है |

- Final year students of electrical engineering department of SKIT college have prepared their own project to stop bike theft.

- लाल डायरी पर मचे सियासी बवाल पर पूर्व डिप्टी सीएम सचिन पायलेट ने कहा कि बीजेपी के पास कोई मुद्दा नहीं बचा है |

- Former Deputy CM Sachin Pilot said on the political uproar over Lal Diary that BJP has no issues left.

- सरकारी नौकरी की तैयारी कर रहे बेरोज़गारो के लिए शानदार मौका है |

- This is a great opportunity for unemployed people who are preparing for government jobs.

- सीरिया में गुरूवार रात हुए एक विस्फोट में कम से कम छह लोग मारे गए और 23 अन्य घायल हो गए |

- At least six people were killed and 23 others were injured in an explosion in Syria on Thursday night.

Watch the latest Hindi news Live on the World's Most Loved News Channel on YouTube.

Latest News about Politics , Sports , Entertainment, Crime at Yugcharan Channel. Un Biased News Reporting !

Follow this link to join our WhatsApp group to get Latest News Updates :

https://chat.whatsapp.com/FRKXh6rZlttH99KKEP2PXv

Subscribe our channel for the latest news: https://www.youtube.com/@yugcharan

Like us: https://www.facebook.com/theyugcharan

Follow us: https://twitter.com/theyugcharan

Telegram : https://t.me/TheYugCharanpaper

Instagram : https://www.instagram.com/theyugcharan/

Website : https://yugcharan.com

#today_breaking_news #Breaking_news #Latest_news #Hindi_News #News #NewsHindiLive #LiveTVNews #HindiNews #imf #export #chawal #banned #skitcollege #engineering #college #itdepartment #students #project #laaldairy #breaking_news #bjpnews #sachinpilot #purvdipti #governmentjob #government #governmentcompanies #news #seria #visphotaknewsbulletin #visphotaknews #death #itdepartment

via yugcharan https://www.youtube.com/channel/UCbT6O9BlRulH48ph5QmCYEg

July 28, 2023 at 04:17PM

0 notes

Text

Navigating the Landscape of Bank Recruitment in the U.S.

Estimated reading time: 14 minutes

Table of contents- I. Introduction

- II. Steps to Securing a Bank Job in the U.S.

- III. Is a Banking Career a Good Choice in the U.S.?

- IV. Highest Paying Jobs in U.S. Banks

- V. Bank Recruitment Stages in the U.S.

- VI. The Employment Landscape: Bank Jobs in the U.S.

- VII. Navigating Challenges in U.S. Bank Recruitment

- VIII. Conclusion

I. Introduction

As pillars of the U.S. financial landscape, banks perform a critical function. They are at the heart of amyriad of activities, from safeguarding our hard-earned savings to extending credit that facilitates bothpersonal aspirations and commercial expansions. In effect, our banking institutions are instrumental indriving the nation's economic engine, spurring growth, and fostering financial well-being.

At the crux of a bank's seamless operation and its capacity to serve the economy is a critical process -bank recruitment. This procedure goes beyond simply filling a job position. It's a rigorous andcarefully orchestrated process of spotting, assessing, and bringing on board the talent capable ofsteering the financial ship. The importance of bank recruitment is underscored by the fact that everybanking role, from entry-level to executive, is a cog in the vast financial apparatus, contributing to thebank's stability, innovation, and customer engagement.

In the journey through this article, we'll shine a spotlight on the mechanics of bank recruitment withinthe U.S., exploring its processes, challenges, and the integral role it plays in sculpting the future ofAmerican banking.

II. Steps to Securing a Bank Job in the U.S.

Securing a bank job in the United States can be an enriching path leading to a stable andrewarding career. However, it's important to remember that the journey into the banking sector can becompetitive and requires a keen understanding of the recruitment landscape, coupled with the rightqualifications and skills. Here's an expanded breakdown of the steps typically involved:

Identify Your Area of Interest: The banking sector is as vast as it is diverse. It spans variousdepartments such as retail banking, investment banking, risk management, compliance, andinformation technology, among others. Each area offers a unique set of roles and responsibilities. Asan aspiring banking professional, your first step is to identify the role that suits your skills, interests,and long-term career aspirations.

Acquire the Necessary Qualifications: A solid educational background is essential in the bankingindustry. Typically, a bachelor's degree in finance, business, economics, or a related field is thebaseline requirement for most banking jobs. However, specialized roles might demand furtherqualifications. For instance, investment bankers often hold an MBA, while roles in bank ITdepartments might require a background in computer science or related certifications. It's crucial toresearch your chosen area and understand its specific educational requirements.

Build Relevant Skills: In addition to academic qualifications, banks look for a host of skills thatensure a candidate's effectiveness in the role. These may include analytical acumen, technicalproficiency, excellent communication skills, and the ability to work effectively within a team.Moreover, in the age of digital banking, skills such as data analysis, proficiency in financial analysissoftware, and understanding of digital banking systems can give you a significant competitive edge.

Gain Practical Experience: Hands-on experience in the form of internships or entry-level jobs can beinvaluable in gaining industry insights, developing practical skills, and enhancing your resume. Theseexperiences expose you to the real-world banking environment, helping you understand its dynamicsand demands.

Networking: In many industries, and banking is no exception, it's often about 'who you know.' Attendjob fairs, industry events, or engage in professional networking platforms to connect with bankingprofessionals, potential mentors, and peers. Staying informed about job openings and maintaining astrong professional network can be instrumental in landing a bank job.

Application Process: This step involves marketing yourself effectively to potential employers. Craft acompelling resume and cover letter, tailored to the specific job role, that highlight your qualifications,experiences, and skills. Once you spot a job opportunity that aligns with your aspirations, submit yourapplication.

Prepare for Interviews: If your application passes the initial screening, you'll be invited for aninterview. This is your chance to articulate your passion for banking, explain why you're interested inthe specific role, and elaborate on your qualifications and experiences. Prepare for potential questions,do your research on the bank, and practice your answers.

Post-interview Follow-ups: After the interview, it's a good practice to send a follow-up email. Thisshould express gratitude for the opportunity and reiterate your interest in the role.

Patience, persistence, and ongoing skill development are key in your banking career journey.Each bank has its unique recruitment process, and staying adaptable is essential. As the bankingindustry continues to evolve, so should you – by engaging in continuous learning and skillsenhancement, ready to seize the opportunities that come your way.

III. Is a Banking Career a Good Choice in the U.S.?

A career in banking has been traditionally viewed as a stable, respectable choice with plentifulopportunities for growth. The U.S., being the world's largest economy with a well-establishedfinancial sector, offers a diverse range of roles within banking that can cater to a variety of interestsand skill sets. However, like any other career path, it comes with its unique set of pros and cons.Here's an analysis to help you determine if banking is the right career choice for you.

Pros of a Banking CareerCompetitive Salary and Benefits: Banking jobs are known for offering attractive compensationpackages. In addition to the base salary, banks often provide benefits such as health insurance,retirement plans, and bonuses.

Opportunities for Career Advancement: The banking sector is hierarchical, which means there's aclear path for upward mobility. With dedication and performance, you can climb the corporate ladderto reach senior-level positions.

Variety of Roles: Whether you're interested in financial analysis, customer service, risk management,or technology, banks have a role that suits your interests and skills.

Stability: Banks are foundational elements of the economy, offering more job security compared tomany other industries.

Professional Development: Banks often provide robust training programs for their employees,fostering continual learning and professional growth.

Cons of a Banking CareerStress and Pressure: Banking can be a high-pressure industry with demanding work hours, especiallyin roles such as investment banking. Meeting targets and dealing with large financial transactions cancontribute to stress.

Bureaucracy and Politics: Like any large organization, banks can be bureaucratic. Navigating officepolitics can sometimes pose challenges.

Technological Disruption: The rise of fintech and digital banking is causing a shift in traditionalbanking jobs. While it opens up new opportunities, it may also make some roles obsolete.

When considering a career in banking, it's crucial to weigh these pros and cons. Reflect onyour personal career goals, your tolerance for stress and long hours, and your willingness to adapt toindustry changes. A banking career can be incredibly rewarding for those who thrive in a fast-paced,dynamic environment where meticulous analysis, customer service, and financial acumen are valued.

IV. Highest Paying Jobs in U.S. Banks

The banking industry in the U.S. is known for offering lucrative compensation packages.However, some roles stand out as being particularly high-paying due to their responsibilities,complexity, and the level of expertise required. Here's a description of a few top-paying jobs in U.S.banks and an overview of the skills and qualifications necessary for these roles.

Investment Banker: Investment Bankers play a crucial role in helping corporations, governments,and other entities to raise capital. They advise clients on mergers and acquisitions, and manage andunderwrite securities issuance. This role typically requires a bachelor's degree in finance, economics,or a related field. An MBA can be particularly advantageous. Key skills include financial modeling,negotiation, and a deep understanding of financial markets.

Risk Manager: Risk Managers are tasked with identifying, evaluating, and mitigating financial risksthat a bank could potentially face. They use various predictive models and strategies to prevent losses.A bachelor's degree in finance, business, or a related field is typically required, while an advanceddegree or certifications like FRM (Financial Risk Manager) can enhance job prospects. Skills in dataanalysis, problem-solving, and risk assessment are essential.

Financial Manager: Financial Managers oversee the financial health of the bank. They preparefinancial reports, direct investment activities, and develop plans for the bank's long-term financialgoals. These roles typically require a bachelor's degree at minimum, but many employers prefercandidates with a master's degree and substantial experience in a finance-related role. Analytical skills,detail orientation, and strategic planning are important abilities for this job.

Quantitative Analyst: Quantitative Analysts, or 'Quants,' apply mathematical and statistical methodsto financial and risk management problems. They design and implement complex models that banksuse to make decisions about risk, investments, pricing, and more. They usually hold a degree in aquantitative field like math, physics, or engineering, although many also have postgraduatequalifications. Key skills include proficiency in data analysis, knowledge of programming languages,and strong numerical abilities.

Compliance Officer: Compliance Officers ensure that the bank adheres to all relevant legal andinternal rules and regulations. They identify potential areas of compliance vulnerability and developcorrective action plans. A bachelor's degree in law, business administration, finance, or a related fieldis typically required, and additional certifications may be preferred. Attention to detail, knowledge oflegal aspects, and ethical integrity are critical skills for this role.

Each of these roles commands a high salary due to the expertise required and the significantresponsibilities that they entail. However, they also demand a robust educational background, a solidfoundation of skills, and often, substantial industry experience. But for those willing to commit to thenecessary career path, they can offer a rewarding and lucrative career in the banking industry.

V. Bank Recruitment Stages in the U.S.

The recruitment process in the banking sector in the United States is a well-structured and thoroughprocedure, designed to select the best talent for the role. It all begins with a comprehensive jobanalysis, where the bank delineates the duties, responsibilities, and qualifications required for a specific job role. The output of this stage is a detailed job description that clearly outlines what the job entails and what is expected of a potential candidate.

Once the job description is ready, the job is advertised through various channels such as the bank'sown website, job boards, social media platforms, and recruitment agencies. The aim is to attract a widepool of applicants who are interested in and qualified for the role.

As applications pour in, the HR team at the bank undertakes the task of screening each application.This typically involves a review of the applicants' resumes and cover letters to identify thosecandidates whose skills, qualifications, and experience align with the job's requirements.

Candidates who make it through the initial screening are then invited for an initial interview. This isoften conducted via phone or video call by a member of the HR team. The aim of this stage is to gaugethe candidate's interest in the role, their understanding of the job, and their overall fit within theorganization.

For certain roles, the bank may also administer assessment tests designed to evaluate the candidate'stechnical skills, aptitude, or even their compatibility with the job role and the bank's culture.Candidates who successfully navigate the initial interview and any necessary assessment tests maythen be invited for a second, often more in-depth interview. This is typically conducted by seniormembers of the team or department and allows the bank to delve deeper into the candidate's suitabilityfor the role.

At this point, if a candidate is deemed suitable, the bank may proceed to reference checks. Thisinvolves contacting the references provided by the candidate to verify the candidate's previousemployment, work ethic, and performance.

After successful reference checks, the chosen candidate is extended a job offer. This offer outlines thecompensation package, the job role's specifics, and any other terms and conditions of employment.Finally, once the job offer is accepted, the bank's onboarding process begins. This phase involvesvarious orientation sessions and training programs to help the new hire integrate into the bank'sculture, understand their role and responsibilities, and start their new job on a strong footing.

The recruitment stages, although broadly similar, can vary from one bank to another depending ontheir individual hiring policies and procedures. However, understanding the overall process canprovide a valuable framework for candidates navigating the bank recruitment landscape in the U.S.

VI. The Employment Landscape: Bank Jobs in the U.S.

Banking is a cornerstone of the U.S. economy, and employment in this sector forms a significantportion of the country's job market. As per the latest data from the U.S. Bureau of Labor Statistics (asof the last update in September 2021), over 1.9 million people were employed in the banking sector inthe U.S., which doesn't include those working in associated industries such as financial planning,investment services, and insurance.

The banking sector in the U.S. is diverse, providing a wide array of job opportunities for individuals with various skill sets and qualifications. Whether it's retail banking, corporate banking, investment banking, or ancillary services, these roles play a crucial part in maintaining the financial health of thenation.

In terms of the economy, the role of bank employment is multifaceted. On one hand, bank jobscontribute directly to economic growth by providing employment opportunities and contributing toincome generation. This, in turn, influences consumer spending, which fuels the broader economy.

Moreover, the services that banks offer – from facilitating savings and investments to providing loansfor individuals and businesses – are vital for economic activity.

On the other hand, banks also contribute indirectly to the economy. They play a crucial role inmaintaining financial stability, which is a precondition for sustainable economic growth. By managingrisks and serving as intermediaries for financial transactions, banks ensure the smooth functioning ofthe financial system. This, in turn, supports other sectors of the economy, from construction andmanufacturing to retail and services.

With ongoing advances in technology and financial regulations, the banking employment landscape inthe U.S. is continually evolving. Roles in areas such as fintech, cybersecurity, and data analytics areon the rise, reflecting changes in how banking services are delivered. At the same time, traditionalbanking roles remain critical for delivering personalized services, maintaining customer relationships,and ensuring regulatory compliance.

In conclusion, bank jobs in the U.S. form a critical component of the country's job market and play asignificant role in the economy. Whether it's through providing employment, facilitating economictransactions, or ensuring financial stability, the banking sector's contribution to the U.S. economycannot be overstated.

VII. Navigating Challenges in U.S. Bank Recruitment

The process of recruiting the best talent in the U.S. banking sector is not without its challenges. Theindustry faces several obstacles in its pursuit of the right candidates, and successfully navigating thesechallenges requires strategic planning, flexibility, and innovation.

One of the most common challenges in bank recruitment is the highly competitive nature of the jobmarket. With numerous banks and financial institutions vying for top talent, attracting and retainingskilled professionals can be an uphill battle. This competition is particularly intense for roles in areassuch as investment banking, risk management, and emerging fields like fintech and data analytics.Another significant challenge lies in aligning candidate skills with the evolving needs of the bankingindustry. The rapid advancement of technology and changing regulatory landscapes have led to shiftsin the industry's skill requirements. Consequently, finding candidates with the right mix of technicalexpertise, industry knowledge, and adaptability is a demanding task.

The multigenerational workforce presents yet another challenge. With baby boomers, Generation X,millennials, and Generation Z all coexisting in the workplace, banks need to cater to diverseexpectations in terms of work culture, flexibility, career growth, and learning opportunities. Balancingthese varying needs can be tricky but is essential to create an inclusive and productive workenvironment.

To overcome these challenges, banks employ several strategies. One common approach is employerbranding, where banks work on portraying themselves as attractive places to work. This can involvehighlighting benefits like competitive salaries, opportunities for career advancement, strongmentorship programs, and a positive work culture.

To tackle the skills gap, many banks invest heavily in training and development programs. Theseinitiatives not only equip employees with necessary skills but also help in retaining talent by offeringpathways for career growth. Furthermore, banks are increasingly partnering with universities andeducational institutions to influence curriculum design and ensure a steady pipeline of graduates withthe required skill sets.

To cater to a multigenerational workforce, banks are working towards creating flexible and inclusivework environments. This can include flexible working hours, remote working options, robust diversityand inclusion policies, and tailored training and development programs.

In summary, while the process of bank recruitment in the U.S. presents its fair share of challenges, theindustry continues to find innovative ways to attract and retain the talent it needs. Whether throughstrong employer branding, investment in employee development, or the creation of inclusive workenvironments, U.S. banks are continuously evolving their recruitment strategies to meet thesechallenges head-on.

VIII. Conclusion

The role of banks in the U.S. economy is undeniably significant, from providing essential financialservices to being major employers. In the journey to securing a bank job in the U.S., understanding therecruitment process, the desirable qualifications, and the various roles available in the industry canprovide a valuable advantage.

While banking continues to be an attractive career choice in the U.S, one must consider various factorssuch as career progression, work-life balance, and the evolving nature of banking jobs.

Read the full article

0 notes

Photo

It’s never too late to rise and shine.🚀 #teamworkmakesthedreamwork - - - #liftupothers #entrepreneurlife #techpreneur #techentrepreneur #creativeentrepreneur #engineeringlife #engineeringdesign #engineeringstudents #stemeducation #stemforkids #paperplanes #iterate #iterations #agilemethodology #techies #designstudio #itdepartment #itconsultant #techyeah #techgeek #geekygifts #geeklife #aerospaceengineer #nasajpl #siliconvalley #siliconbeach #aerospace #artandtech #artandtechnology https://instagr.am/p/CejM688p_Rt/

1 note

·

View note

Photo

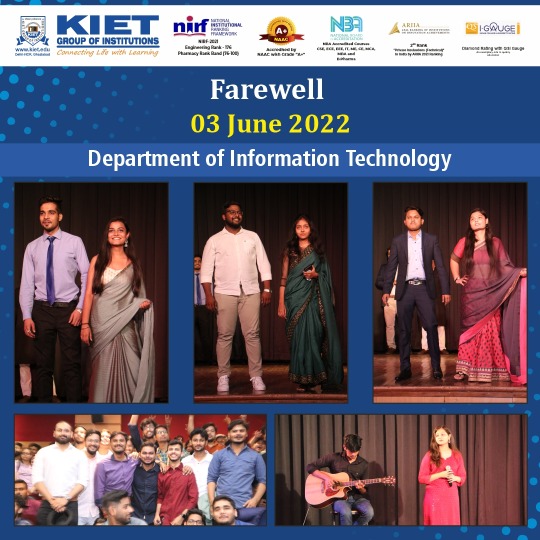

“Every new beginning comes from some other beginning’s end.” Dawn of a new beginning for our final year students was celebrated with great zeal and enthusiasm.

The IT Department gave a dazzling farewell to the 2022 passing-out batch.

Here are the glimpses of the scintillating yet emotive goodbye.

KIET Group of Institutions, Delhi NCR

Website: www.kiet.edu | Toll-Free: 1800 313 0056

#kiet_group_of_institutions #KIETGZB #kietengineeringcollege #KIET #AKTU #AICTE #TopEngineeringCollege #student #KIETGroupofInstitutions #TopEngineeringCollegesinDelhiNCR #BestEngineeringCollegesinDelhiNCR #ITDepartment #InformationTechnology #ITDepartmentFarewell2022 #June2022Farewell #BiddingFarewell #ITFarewell2022

#KIET Group of Institutions#IT Department Farewell 2022#Best Engineering College in Delhi NCr#Top Engineering College in Delhi NCR#Department of Computer Science Farewell 2022#Department of Computer Science KIET#KIET Engineering College#KIET Ghaziabad

0 notes

Photo

Breaking News| Income Tax Department seized assets worth over ₹1,000-crore allegedly linked to Maharastra's Deputy Chief-Minister Ajit Pawar, said an IT official. The NCP leader & Dputy CM Pawar said, "We pay taxes every year. Since I am the Finance Minister, I am aware of the fiscal discipline. All entities linked to me have paid taxes." The IT department seized 5 properties of Pawar along with a raid on the house of Pawar's sister. #Maharashtra #DeputyCM #ChiefMinister #RAID #itdepartment #itraid #ajithpawar #ncp #ncpmaharashtra https://www.instagram.com/p/CVw4v-EJeqG/?utm_medium=tumblr

1 note

·

View note

Photo

Humor for IT veterans😅😅🤷♂️ #it #itdepartment #informationtechnology #floppydisk #systemrestore #donoterase https://www.instagram.com/p/Buxeu06lTXM/?utm_source=ig_tumblr_share&igshid=sdhyt811d3x2

26 notes

·

View notes

Text

Are most IT departments offering fully remote or hybrid work environments? #RemoteWork #HybridWork #ITDepartments #WorkEnvironment In recent years, the landscape of work environments has seen a significant shift. With advancements in technology and a newfound emphasis on work-life balance, many companies, including those within the IT industry, have begun to explore remote and hybrid work options for their employees. If you find yourself wondering whether most IT depa... Read more: https://mymetric360.com/question/are-most-it-departments-offering-fully-remote-or-hybrid-work-environments/?feed_id=36289

0 notes

Photo

The I-T department raided Akhilesh Yadav’s associates.

Check here: https://hydnews24.com/politics/the-i-t-department-raided-akhilesh-yadavs-associates/

0 notes

Text

Do something today that your future self will thank you for 🌟✨✨

#Thankyou you for giving me the opportunity 🥰

#future#creative#opportunity#onlineearning#outsourcing#digitalamarketing#itdepartment#successs#certificate

0 notes