#intra africa trade

Text

Support both the member states and private sector to effectively participate in the new trading environment.

The operationalisation of the AfCFTA Adjustment Fund aims to support both the member states and private sector to effectively participate in the new trading environment established under the AfCFTA. As with any major trade liberalisation regime, the AfCFTA Agreement will introduce near-term disruptions, as tariff revenues by State Parties are reduced, industrial sectors are disordered, businesses and supply chains are reorganised, and employment is dislocated – often in ways that cannot be anticipated. The estimated requirement for uninterrupted implementation of the AfCFTA Agreement and to eliminate the adjustment cost is at $10 billion over the next six to ten years. The Adjustment fund will for instance, be meaningful for a country experiencing challenges with its textiles and clothing sector to access the fund for retraining of workers or for recapitalization, procuring machinery for goods, or to increase competitiveness The Adjustment Fund consists of a Base Fund, a General Fund and a Credit Fund. The Base Fund will consist of voluntary contributions from State Parties, grants and technical assistance funds to address tariff revenue losses as tariffs are progressively eliminated. It will also support countries to implement various provisions of the AfCFTA Agreement, its Protocols and Annexes. The General Fund will mobilise concessional funding, while the Credit Fund will mobilise commercial funding to support both the public and private sectors, enabling them to adjust and take advantage of the opportunities created by the AfCFTA.

#Adjustment Fund#creatingoneafrica#afcfta#intra africa trade#intraregional trade.#voluntary contributions#commercial funding#concessional funding#public sector#private sector#industrial sector#textiles sector#clothing sector#trading environment

0 notes

Video

youtube

Answering White People's Questions About Slavery: The London History Show

#i thought my knowledge on the subject was pretty good#but this goes into several areas where i knew very little like relationship between intra-african slavery and the transatlantic slave trade#and the relationship between the slave trade and the colonialism in africa#highly recommended

2 notes

·

View notes

Text

AFRICA’S VISA DISASTER

Why are Africans making life hard for themselves by closing colonially-imposed borders to each other? Why does an African from one part of the continent need a visa to visit any other part? It makes no cultural or economic sense - hindering trade and intra-African relations.

Here’s South African entrepreneur Vusi Thembekwayo making the point powerfully to an audience in Nigeria. He relates his absurdly roundabout travel route from South Africa and compares it with the effortless ease with which he can move around Europe.

Is this a leaf we should be taking out of Europe’s book?

9 notes

·

View notes

Text

Partially funded by the United States, the $555-million project is expected to boost mineral export and intra-African trade and cements Angola's diplomatic pivot to the West, analysts said.[...]

Currently stretching about 1,700 kilometres (1,050 miles), the railway was completed around 100 years ago by British investors interested in getting copper out of Africa.

The Angolan section of the line was closed during the height of the country's 1975-2002 civil war and remained in disuse afterwards due to damage.

Rebuilt by a Chinese company, it reopened in 2015 but traffic has struggled to take off.[...]

The oil-rich country has long held close ties to China and Russia. Its ruling party was supported by the Soviet Union in the civil war against US-backed rebels.

But under President Joao Lourenco, it has moved closer to Washington.

9 Jul 23

10 notes

·

View notes

Text

"Visit Africa: Navigating the African Continental Free Trade Area for Boosting Intra-African Tourism"

By Julien Reteno

In recent years, the African continent has taken a significant leap forward in the quest for economic integration with the African Continental Free Trade Area (AfCFTA). This ambitious trade agreement, brokered by the African Union, aims to create a single market for goods and services, thereby facilitating the free movement of people and investments across the continent. The AfCFTA holds the potential to revolutionize African economies, encouraging the diversification of income sources, increasing trade volumes, and fostering innovation.

The importance of economic integration in Africa cannot be overstated. It encourages economies of scale, reduces trade barriers, and fosters a more competitive business environment. By promoting intra-African trade, the AfCFTA can help to reduce the continent's reliance on external markets, thereby strengthening its resilience against global economic shocks.

The Potential of Intra-African Tourism

Despite the diverse attractions and rich cultural heritage that Africa offers, the tourism industry on the continent has traditionally focused on attracting international tourists. Yet, as Africa's economies develop and incomes rise, there is growing recognition of the potential for intra-African tourism. African tourists visiting other African countries can contribute to economic growth, foster cultural exchange, and promote unity among African nations.

President Cyril Ramaphosa of South Africa has noted, "This is a sector of our economy that can grow exponentially, and I believe we have not reached its full potential. We tend to think of tourism as associated with pleasure motives all the time. But it can also embrace business tourism, education tourism, health tourism and religion. Tourism is the new gold mine."

The AfCFTA, by promoting the free movement of people, can significantly boost intra-African tourism. By making it easier and more affordable for Africans to travel within the continent, the AfCFTA can help to unlock the full potential of Africa's tourism industry.

Visit Africa: A Catalyst for Change

In the burgeoning landscape of African tourism, one platform stands out for its innovative approach and commitment to promoting intra-African tourism - Visit Africa. This comprehensive platform aims to make booking trips across the continent a seamless experience, thereby encouraging more Africans to explore the beauty and diversity of their own continent.

Visit Africa stands at the intersection of technology and tourism. It leverages digital tools to

provide a user-friendly interface, comprehensive information, and secure booking options. By removing the hassle from planning and booking trips, Visit Africa makes it easier for Africans to explore their own continent.

Furthermore, Visit Africa is perfectly positioned to leverage the opportunities provided by the AfCFTA. By promoting the free movement of people and services, the AfCFTA can facilitate the growth of platforms like Visit Africa, which are built on the premise of intra-African tourism.

Going Beyond the Beaten Track

Visit Africa distinguishes itself by going beyond the well-trodden tourist paths. It works closely with tourism authorities across the continent to highlight lesser-known destinations, thereby helping to develop new tourism markets. This approach fosters a more balanced and sustainable development of the tourism industry, promoting local economic development and job creation in regions that have been overlooked in the past.

For instance, Visit Africa has been instrumental in promoting tourism in destinations like the serene Lake Malawi, the ancient rock-hewn churches of Lalibela in Ethiopia, and the lush landscapes of the Rwenzori Mountains in Uganda. By shedding light on these hidden gems, Visit Africa not only offers travelers a unique and authentic experience but also contributes to the socio-economic development of these regions.

Fostering Collaboration and Knowledge Sharing

One of the key strategies of Visit Africa is to facilitate collaboration and knowledge sharing among tour operators. This initiative bridges the gap between operators in more developed markets and those in emerging destinations, thereby helping to disseminate best practices and innovative ideas.

For example, a tour operator in Tanzania, a country with a well-developed safari tourism industry, can share insights on sustainable tourism practices, effective marketing strategies, and customer service excellence with a counterpart in a less developed market like Togo. This exchange of knowledge and expertise can help the latter to enhance its service offering, attract more tourists, and contribute to the growth and development of the tourism industry in Togo.

Cross-Border Tourism in the AfCFTA Era.

The advent of the AfCFTA heralds a new era for cross-border tourism. The agreement, by promoting free movement of people and services, opens up new opportunities for cross-border tour itineraries, campaigns, and offers. Visit Africa, in line with this new reality, is working tirelessly to facilitate such cross-border initiatives. For instance, Visit Africa is exploring opportunities to create itineraries that span multiple countries, allowing tourists to experience the diverse cultures, landscapes, and wildlife of Africa. Imagine a tour that starts in the historic city of Marrakech in Morocco, takes you through the vibrant markets of Lagos in Nigeria, leads you to the stunning Victoria Falls in Zambia and Zimbabwe, and ends with a relaxing beach holiday in the Seychelles. Such cross-border tours can provide a unique experience for tourists and promote regional integration.

Connecting the Diaspora

The African diaspora plays a crucial role in boosting tourism on the continent. The deep emotional and cultural ties that members of the diaspora maintain with their home countries make them keen tourists and ambassadors of African destinations. Visit Africa and the AfCFTA both recognize this potential and are working towards facilitating diaspora tourism.

Visit Africa's platform is designed to cater not only to residents of the continent but also to the African diaspora. It provides comprehensive information on destinations, offers convenient booking options, and promotes unique experiences that resonate with the diaspora's desire to connect with their roots.

Moreover, the AfCFTA, by promoting the free movement of people and reducing barriers to travel, can facilitate the return of the diaspora to the continent, whether for tourism, business, or permanent return. This influx of diaspora tourists can contribute significantly to the growth of the tourism industry.

Challenges and Opportunities

Despite its immense potential, intra-African tourism faces several challenges. These include the lack of infrastructure, visa restrictions, high cost of travel, and limited awareness of Africa's diverse tourist attractions. However, with the implementation of the AfCFTA and the innovative efforts of platforms like Visit Africa, these challenges can be turned into opportunities.

For instance, the AfCFTA can stimulate investment in tourism infrastructure by creating a more attractive business environment. It can also facilitate the relaxation of visa restrictions and reduce the cost of travel by promoting competition and efficiency in the aviation industry. Meanwhile, Visit Africa, through its digital platform, can raise awareness of Africa's diverse attractions and make it easier for visitors to plan and book their trips.

Looking Forward

As we gaze into the future of the African economy, it becomes increasingly clear that the African Continental Free Trade Area will play a transformative role. Platforms like Visit Africa are poised to ride this wave of change and leverage the opportunities it offers to turbocharge intra-African tourism. By shining a light on lesser-known destinations, fostering collaboration among tour operators, facilitating cross-border tours, and connecting the diaspora, Visit Africa is an instrumental player in unlocking the potential of the AfCFTA and redefining the contours of African tourism.

As eloquently articulated by President Ramaphosa, "Africa is pristine. It has beautiful wide beaches, and some of the oldest and diverse flora and fauna. We have majestic scenery from the ancient Sahara Desert to the savannah grasslands of the Maasai Mara and the southern point where the Indian and Atlantic oceans meet. I am proud to say as Africans that we have world-class national parks at the forefront of conservation of rare and endangered species."

The horizon is aglow with possibilities for intra-African tourism, and platforms like Visit Africa are forging a path towards a more integrated, inclusive, and sustainable tourism industry that truly cherishes and showcases the beauty and diversity of the African continent.

Julien Reteno is the passionate author and CEO of PANEOTECH, the company behind the groundbreaking Visit Africa platform. With a deep-rooted love for Africa and a vision to promote intra-African tourism, Julien has dedicated his career to unlocking the continent's vast potential in various industries. As a seasoned traveler and entrepreneur, Julien understands the transformative power of tourism in fostering economic growth and cultural exchange. Through Visit Africa, Julien envisions a seamless and immersive experience for African travelers, connecting them with diverse destinations and showcasing the beauty and richness of their own continent. With his leadership and unwavering commitment, Julien strives to make Visit Africa the go-to platform for exploring Africa's hidden treasures. Through his writings and initiatives, Julien aims to inspire Africans and the global community to embark on their own extraordinary journeys of (re)discovery within Africa.

2 notes

·

View notes

Text

Brazil, the Russian Federation, India, China and South Africa (BRICS) Trade in Services Report Offers Insights for Growth

BRICS countries – Brazil, the Russian Federation, India, China and South Africa – are increasingly important players in global services markets, despite pandemic-induced setbacks. BRICS countries accounted for 10% of global services exports and 13% of global services imports in 2020.

The International Trade Centre report, BRICS Trade in Services Report 2022, finds that BRICS countries can improve competitiveness in services trade by improving domestic policies, developing stronger business networks, leveraging regional transport and logistics initiatives and improving data collection and sharing the information between BRICS regulators.

The report updates an ITC report from 2017 with the latest data on sectors and modes of supply for each BRICS country and analyses intra-BRICS trade. This provides insight into trade patterns and opportunities for collaboration with and among BRICS countries.

Continue reading.

#brazil#russia#india#china#south africa#politics#brazilian politics#economy#russian politics#indian politics#chinese politics#south african politics#mod nise da silveira#image description in alt

1 note

·

View note

Text

Drawing Lessons from Cambodia's Success: Towards Rice Self-Sufficiency in Africa

March 29, 2024

Cambodia currently ranks 10th among the world's largest rice producers, both for domestic consumption and export, according to the Cambodia Rice Federation. Much of this success can be attributed to the visionary leadership of former Prime Minister Samdech Hun Sen, whose strategic policies have transformed the country's rice sector. As African nations grapple with the challenge of achieving rice self-sufficiency and reducing dependency on imports, there are valuable lessons to be gleaned from Cambodia's success.

1. Investment in Quality Rice Seed Distribution

One of the cornerstones of Cambodia's rice success story lies in its investment in the development and distribution of quality rice seeds. By prioritizing research and development in agriculture, Cambodia has been able to breed high-yielding, disease-resistant rice varieties suited to its local conditions. This investment has not only boosted productivity and yields but has also empowered smallholder farmers to improve their livelihoods.

African countries can draw inspiration from Cambodia's approach by investing in similar initiatives tailored to their unique agro-climatic contexts. For instance, Nigeria, with its diverse ecological zones, could invest in breeding rice varieties optimized for different regions, from the humid south to the arid north. By ensuring widespread access to these improved seeds, African nations can catalyze agricultural transformation and drive towards self-sufficiency.

Real Case Study - Senegal: Senegal provides a pertinent case study in this regard. The Senegalese government, recognizing the importance of quality seeds, launched the National Seed Program to promote the adoption of certified seeds among rice farmers. Through partnerships with research institutions and private sector stakeholders, Senegal has seen significant increases in rice yields, contributing to its goal of rice self-sufficiency.

2. Setting Ambitious Export Targets

Cambodia's ambitious target of exporting 1 million tonnes of rice by 2025 serves as a testament to the power of setting clear, ambitious goals. This target not only propelled the country towards greater self-sufficiency but also incentivized stakeholders across the value chain to work collaboratively towards a shared vision.

African countries can emulate Cambodia's approach by setting their own ambitious export targets and implementing supportive policies to achieve them. Take Ghana, for example, which has set a goal to become a net exporter of rice by 2023. Through targeted investments in infrastructure, technology, and farmer training, Ghana aims to not only meet domestic demand but also tap into regional markets, contributing to economic growth and rural development.

3. Strengthening Trade Agreements

Cambodia's success in securing trade agreements for the import of Cambodian rice with key partners such as China, Indonesia, and the European Union has been instrumental in expanding market access and driving export growth. These agreements have provided Cambodia with stable markets and enhanced its competitiveness on the global stage.

African nations can learn from Cambodia's experience by prioritizing regional and international trade agreements to facilitate the movement of rice across borders. The African Continental Free Trade Area (AfCFTA) presents a significant opportunity for intra-African trade in rice, with the potential to create a single market of over 1.3 billion people. By leveraging platforms like AfCFTA and bilateral agreements, African countries can unlock new markets, attract investment, and bolster their rice sectors.

Conclusion

In conclusion, Cambodia's journey towards rice self-sufficiency and export competitiveness offers valuable insights for African countries seeking to transform their own agricultural sectors. By investing in quality seed distribution, setting ambitious export targets, and strengthening trade agreements, African nations can emulate Cambodia's success and realize their potential as rice-producing powerhouses. Through shared experiences, strategic partnerships, and concerted efforts, Africa can chart a path towards food security, economic prosperity, and sustainable development for generations to come. Let us heed the lessons of Cambodia and embark on a collective journey towards a brighter, more prosperous future for all.

I hope you enjoyed reading this post and learned something new and useful from it. If you did, please share it with your friends and colleagues who might be interested in Agriculture and Agribusiness.

Mr. Kosona Chriv

Senior Advisor to the General Manager and Head of Global Marketing and Sales

Sahel Agri-Sol SAS

WhatsApp/Telegram: +855 69 247 974

Email: [email protected]

Website: https://sahelagrisol.com

Facebook: https://www.facebook.com/sahelAgri-Sol

LinkedIn: https://www.linkedin.com/company/sahel-agri-sol

WeChat ID: wxid_8r2809zfgx4722

Sahel Agri-Sol SAS is a leading producer and exporter of premium agricultural commodities based in Mali. Our range of high-quality products is exported globally and includes:

Sesame

Gum Arabic

Groundnuts

Peanut Butter

Cashew Nuts

Shea Nuts

Shea Butter

Ginger Powder

Dried Ginger

Dried Hibiscus

With a commitment to excellence and sustainability, we ensure that our products meet the highest standards, providing our customers with satisfaction and reliability.

Photo: a rice field in Cambodia (credit: nalin a / Flickr CC BY-NC

-ND 2.0 DEED Attribution-NonCommercial-NoDerivs 2.0 Generic )

0 notes

Text

Navigating the Gateway to Prosperity: Ghana's Pivotal Role in African Trade and Finance

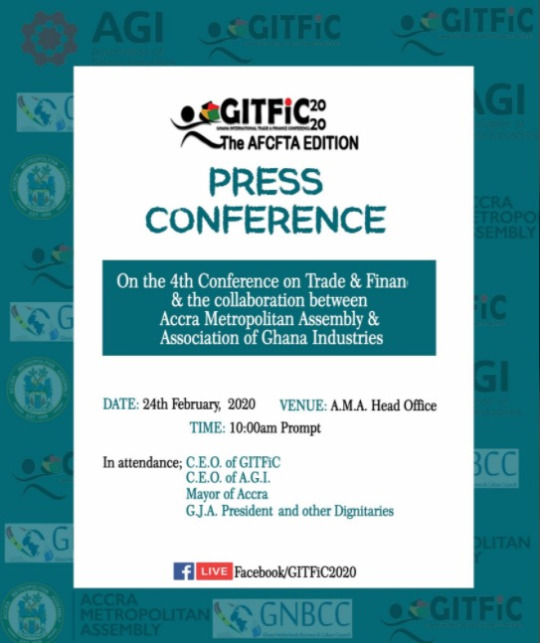

In the heart of West Africa, Ghana stands as a beacon of trade and finance, offering a strategic nexus for international and regional economic collaborations. The nation's commitment to fostering global partnerships and enhancing intra-African trade is evident through its active participation and organization of various key events. This article delves into the vibrant landscape of International Trade Conferences in Ghana, Media Press Conferences, Monthly Research Reports, Regional Seminars on the African Continental Free Trade Area (AfCFTA), and the burgeoning sector of Trade Finance both within Ghana and across Africa.

International Trade Conferences in Ghana

Ghana's capital, Accra, and other major cities frequently host international trade conferences that serve as crucial platforms for dialogue, networking, and the forging of lucrative trade agreements. These conferences attract delegates from around the globe, keen on exploring business opportunities in Ghana's thriving markets and beyond. Key stakeholders discuss global trends, share insights, and explore innovative solutions to overcome challenges in international trade.

Media Press Conferences in Ghana

Media press conferences in Ghana are pivotal events that bridge the communication gap between the government, business entities, and the public. These press conferences are essential for announcing significant trade agreements, launching new economic policies, or introducing trade and finance initiatives. They offer a transparent medium for stakeholders to present their perspectives, achievements, and future plans to a broader audience, ensuring that information flows freely and accurately.

Monthly Research Reports in Ghana

The publication of monthly research reports plays a significant role in Ghana's trade and finance landscape. These reports provide in-depth analyses of market trends, economic performance, trade statistics, and policy impacts. Researchers and economists meticulously compile data to offer valuable insights that guide businesses, investors, and policymakers. These reports are instrumental in shaping strategic decisions and fostering a knowledge-driven economic environment.

Regional Seminars on AfCFTA

Regional seminars on the AfCFTA are transformative events that underscore Ghana's commitment to the African Continental Free Trade Area, aiming to create a single market for goods and services across 54 countries. These seminars focus on educating stakeholders about the benefits and challenges of AfCFTA, discussing strategies for effective implementation, and exploring the potential for economic transformation across the continent. Ghana's proactive approach in these seminars demonstrates its leadership in advocating for a united and prosperous Africa.

Trade & Finance Research in Ghana

Trade and finance research in Ghana is a dynamic field that addresses the complexities of the global and African economic landscapes. Researchers delve into various aspects of trade finance, including risk management, trade barriers, financing options, and economic policies. This research is crucial for identifying opportunities for growth, enhancing trade efficiency, and mitigating risks associated with cross-border trade. The insights garnered from this research contribute to the development of robust trade finance systems that support Ghana's and Africa's economic aspirations.

Trade Finance in Ghana and Africa

Trade finance represents the financial instruments and products that facilitate international trade and commerce. In Ghana and across Africa, trade finance is pivotal in overcoming the challenges posed by trading across borders. It provides the necessary liquidity, reduces payment risks, and ensures smooth transaction processes. Financial institutions in Ghana are increasingly offering innovative trade finance solutions that cater to the unique needs of African markets, thereby enhancing trade flows and contributing to economic growth.

In conclusion, Ghana's role in shaping the landscape of trade and finance in Africa is significant and multifaceted. Through international trade conferences, media press conferences, comprehensive research reports, regional seminars on AfCFTA, and innovative trade finance solutions, Ghana is paving the way for a more integrated, prosperous, and sustainable African economy. These efforts not only highlight Ghana's strategic importance in the global trade arena but also underscore its commitment to fostering economic development and unity across the continent. As Ghana continues to host and participate in these pivotal events, it strengthens its position as a key player in Africa's economic future, driving progress and prosperity for all.

For More Info: -

Book 8TH GHANA INTERNATIONAL TRADE & FINANCE CONFERENCE

Afcfta trade in Ghana

Social media link:-

https://twitter.com/GITFiC2020

1 note

·

View note

Text

CONSULTANCY SERVICES TO SUPPORT THE MANAGEMENT OF NAKONDE CARGO SCANNER DEPLOYMENT 2024 - TMA

TRADEMARK AFRICA TENDER FEBRUARY 2024

REQUEST FOR PROPOSALS (RFP)

TradeMark Africa (TMA) is a leading African Aid-for-Trade organisation that was established in 2010. TMA aims to grow intra-African trade and increase Africa’s share in global trade while helping make trade more pro-poor and more environmentally sustainable. Our focus on reducing the cost and time of trading across borders…

View On WordPress

0 notes

Text

Lagos State Unveils Plans for Cocoa Industry Expansion by 2025

The Lagos state government has announced plans to establish three cocoa processing plants with an annual production capacity of 10,000 metric tonnes each by 2025.

Commissioner for Commerce, Cooperatives, Trade and Investment, Folashade Ambrose-Medebem, revealed these initiatives at the International Cocoa and Chocolate Forum held in Lagos.

Representing Governor Babajide Sanwo-Olu, Ambrose-Medebem highlighted the administration's vision to capitalize on the state's strategic geographical location, aiming to transform Lagos into a key cocoa trading hub within Nigeria.

The government also aims to train and empower approximately 20,000 cocoa agro-processors and small to medium enterprises (SMEs) by 2025 through various programs.

"We are already working on a strategic roadmap to explore the potentials of cocoa, increasing its local processing to 40% of total production," Ambrose-Medebem stated. The ambitious plan includes the establishment of three major cocoa processing plants, each with a minimum annual processing capacity of 10,000 metric tonnes.

Emphasizing the benefits of cocoa processing, the Commissioner stressed the importance of strategic partnerships within the cocoa value chain to generate revenue, create jobs, and contribute to economic diversification and development.

The declining global ranking of Nigeria in cocoa production, falling behind Ivory Coast, Ghana, and Indonesia, underscores the urgency for such initiatives.

"With this vision and resources, Lagos state is committed to leading this transformation. Together, we can create a sustainable and prosperous future for the cocoa industry, our economy, and our people," Ambrose-Medebem declared.

Nigeria's cocoa production has faced a significant decline over the past four decades, losing its status as the top global producer. In response, the Nigeria Export and Import Bank (NEXIM) previously launched a platform to connect cocoa farmers, aggregators, and processors across Africa, aiming to enhance value addition and promote intra-African trade in the cocoa value chain.

Recall that the Supreme Court had in its verdict yesterday affirmed the victory of Sanwo- Olu at the last general election.

Read the full article

0 notes

Text

Identify restrictions on market access and national treatment affecting the supply of services into the country

Conducting the AfCFTA Regulatory Audits on Trade in Services that identify restrictions on market access and national treatment affecting the supply of services into the country as defined in the AfCFTA Trade in Services Protocol. The report details descriptions that document each trade restriction and its legal reference. For example, one of the areas where this data is particularly useful is in the tourism sector. By understanding the restrictions on market access and national treatment impacting tourism services, countries can work to remove those barriers and create a more open and welcoming environment for tourists. This, in turn, can help to boost the economy through increased tourism revenue.

#Trade in Service#creatingoneafrica#tourism sector#market access#trade#Regulatory Audits#afcfta#intra africa trade#regional integration

0 notes

Text

How DFIs, Local Investors Can Drive Economic Development in Nigeria 2024.

How DFIs Local Investors Can Drive Economic Development in Nigeria 2024.

How DFIs and Local Investors Can Drive Economic Development in Nigeria 2024 and Beyond by Dr Kenny Odugbemi

Development Finance Institutions (DFIs) tend to look for investments that can drive economic development in a market where there is ease of doing business through digital interface

✓Government to local investors (manufacturers, entrepreneurs, SME's, involved with production of goods and services for export

✓Government to foreign investment

✓ Federal Government to State Government business network through regional coordination

Nigeria is blessed with the following

✓ abundant natural resources, eg- raw materials and varieties of mineral deposits

✓human capacity with right competence, and developing infrastructure which is a driving force that will aid mobility of commerce, with huge young demographics of working population with purchasing capacity.

✓Availability of infrastructure cuts across regional industrial hubs across 36 states including Abuja

✓ Availability of forex without any trade restrictions

Nigeria has a lot of opportunities for development impact Development Finance Company, focusing on encouraging small business growth across 36 states including Abuja

Nigeria has really grown and evolved but our commitment to Nigeria, its businesses and local communities, remains the same over the years.

We have made commitments targeted at supporting local SMEs through financial institutions.

Investments, such as syndicated loan package, trade agreement through Federal Government and a network of big Manufacturers and exporter across different sectors through Advisers’ Growth Fund, aim to address such buffer banking penetration and operations in the country, which stands at just 15 per cent despite having the second largest banking sector on the continent.

The timing couldn’t be better. our President Senator Bola Tinubu had be jetting round Europe and Africa sub-region to attract FDA's and sign billion dollar Capita injection to support our production capacity across all sectors especially power and other essential infrastructure that had capacity to kick start high level production of goods that can be exported to earn more dollar to buffer up our depleting foreign reserve, provide employments for 53% of our unemployed youths L

Nigeria has just signed the African Continental Free Trade Agreement, which is expected to increase intra-African trade by up to 52 per cent by 2024 and beyond.

According to the African Development Bank. Increasing financing to SMEs across the country will enable them to participate in the new framework and benefit from the opportunities it presents.

Investing in financial systems is a driver of and important pre-conditions to economic growth

Nigerian companies come from across a range of sectors. has the potential with the commitment to buffer up local investment in the country, this will require FDI's inflow to support their commercial and sustainable businesses

Accelerate their growth to create sustainable jobs, services and opportunities to benefit the Nigerian people.

Furthermore, the recent strategic drive by our President with other delegation to see FDI'S inflow and other investments aligns with the priorities of the Central Bank of Nigeria, which is focused on driving consumer credit, SME lending and mortgages.

In July 2023 CBN issued a memo as sanctions on our commercial banks in Nigeria to ensure a loan-to-deposit ratio of under 60 per cent, forcing them to either increase their lending to meet the threshold or face requirements to increase the amount they must hold on their balance sheets.

The measure has been designed to help meet the target of 95 per cent financial inclusion by 2024 and beyond.

As the largest economy in Africa, Nigeria has the capacity to become increasingly attractive to overseas investment.

This year the IMF upgraded Nigeria’s GDP growth forecasts to 3.2 per cent in 2024 presenting potential for other investors to move into the market buoyed by the forecast.

It is not just the financial sector that provides opportunities for impacted investors.

African development bank has pledge $320 million invested in Nigeria both directly and indirectly, to support Youth entrepreneurship development

.It is noteworthy to state Secretary of States from USA, UK, Germany, UAE and others have visited Nigeria to see first-hand abundant opportunities across 6 regions and Abuja especially Hybrid Power automation and upgrade in Nigeria, and other infrastructure that can support our yearning to improve on our production for exports to earn more foreign exchange

Nigeria Priority Investment Industries

Nigeria is one of the fastest developing countries in the world, one of the resource-richest countries in the world, the most strategically situated country in Africa, and the largest market in Africa with a population of over 220 million people and a rapidly growing middle-class.

With the Africa Continental Free Trade Agreement (AfCFTA) in the making soon to be the largest single trading block in the world and with Nigeria being one of the major players, Nigeria's economy is projected by experts to be enroute to top 10 economies of the world by 2050, and possibly clocking a GDP of over $6 trillion.

The driving force behind this rapid growth are the vibrant industries, all of which have been wholly privatised to attract and boost local and foreign investments. As a result of favourable government policies and incentives, the Ease of Doing Business in Nigeria has steadily improved, attracting Foreign Direct Investments (FDI) from countries like China, the United Kingdom, France, Canada and the United States.

The following are the most attractive industries to invest in Nigeria, due to existing favourable government policies in way of tax holidays, special incentives and privileges as well as protections for foreign investors.

✓Agriculture

This covers all related activities including Commercial Farming, Livestock, Aquaculture, Hydroponics and others. Among numerous other advantages, Agro-industrial ventures benefit from a five-year tax holiday, an agricultural credit scheme guaranteed by the Central Bank of Nigeria (CBN), subsidized fertilizers and zero import duties on raw materials used to make livestock feed. According to the Nigerian Investment Promotion Commission (NIPC), the agricultural sector contributes 25% of Nigeria’s Gross Domestic Product (GDP) and accounts for 48% of the labour force. The sector’s growth rate over the last 5 years averaged 4%. Crop production dominates the sector, accounting for 22.6% of GDP alongside livestock (1.7%), fisheries (0.5%) and forestry (0.3%).

The Government's Agriculture Promotion Policy 2016-2020 has achieved significant progress in creating a conducive commercial environment to meet domestic food demands, generate exports, and attract foreign investment, among other merits.

✓Industry

Nigeria is a natural location for a variety of industrial activities due to the availability of natural resources, affordable labour cost and large market. Its manufacturing sector is reemerging due largely to the improving performance of the consumer and household goods industries and growth of the middle-class. Nigeria produces a large proportion of goods and services for the West African subcontinent. The industry sector contributes an annual average of 23% of the GDP. The major activities include oil & gas (9%), manufacturing (7%), and construction (5%). The sector is strategic to the government’s objective of diversifying the economy in line with the Economic Recovery & Growth Plan.

✓Petroleum

Oil, natural gas and related products account for 90% of Nigeria's total export volume and more than 80% of the government revenues. Nigeria is Africa's largest producer of petroleum and the 6th largest in the world, with an average capacity of 2.5 million barrels of crude oil daily. As a member of OPEC, Nigeria also ranks as the world's 8th largest exporter and has the largest natural gas reserves in Africa, ranking 7th position globally. However, the local refining capacity is only 24% which creates a huge gap between the demand for refined petroleum products and local supply. Towards bridging this gap, the downstream industry has been open to private sector participation and foreign investments and with the passing of the new PIA (Petroleum Industrial Act) in August 2021, conditions have become much more favourable to foreign investors. With various government schemes and new policies like better profit sharing, Nigeria's oil and gas industry remains one of the most lucrative sectors to invest in. For this reason, Oil giants like Total, Chevron, ExxonMobil, Elf, Shell, ConocoPhillips, Eni and China's CNOOC all maintain operations in Nigeria.

✓Manufacturing

The manufacturing sector in Nigeria is geared towards accelerating industrial capacity to increase the sector’s contribution to GDP. The Government's target is to generate an additional US$20 to US$30 billion in manufacturing revenues over the next 3 to 5 years and substitute imports and diversify exports, diversify the economy from petroleum, create jobs and generate wealth. Foreign investors are welcome to take part wholly or jointly in manufacturing or industrial projects like food processing - fruit, vegetable oils, oil seeds, roots and tubers processing, cereal and grain milling; Sugar production, Confectionaries and beverages, ceramic and glass production, solid mineral processing and so on.

✓Construction

After experiencing a 7.5% decline in 2020 due to the economic effects of Covid-19, Nigeria’s construction is expected to make a 4% recovery growth in 2021. With the steady expansion of the real estate market and state support in the infrastructure and energy sector, Nigeria’s construction market is due to increase 3.2% annually between 2022 and 2025. Favourable Government policies and programs like the $2.7bn Infra-Co fund backed by the Central Bank of Nigeria (CBN), the Nigerian Sovereign Investment Authority (NSIA) and the Africa Finance Corporation Companies (AFCC); has attracted a investors into the sub-sector and boosted the confidence of existing players like Julius Berger, China Civil Engineering Construction Company (CCECC), Reynolds and Arab Contractors.

✓Mining

Mining is a growing and thriving sector accounting for 0.3% of national employment, 0.02% of exports and about $1.4 billion to Nigeria's GDP, according to a recent report by the Federal Ministry of Mines and Steel Development. With untapped minerals like Baryte, Limestone, Gypsum, Lead/Zinc, Gold and more, Nigeria is literally a goldmine waiting to be explored. Despite its comparatively low production and output, the mining sector thrives within a well defined regulatory structure supported by active professional bodies and agencies that are increasingly shaping policies, creating programs and incentives favourable to investors in order to unleash this huge economic potential of this sector.

✓Energy

The energy sector is one of the most exciting due to the room it leaves for a variety of possible innovations and creativity in the entire energy value chain ranging from power generation to conversion to storage to distribution to meter reading to billing etc. Currently, Nigeria's largest power source is the post-colonial Kianji hydroelectric power dam with a compromised capacity of Nigeria's total supply of almost 12000MW attained as of 2023. With a fast growing population and rapid industrialisation of the country, the current power capacity is said to be only 12% of what the country needs. In order to bridge the huge gap between demand and supply of energy in the country, the Federal Government had liberalised, diversified and commercialized the energy sector and also put in place tax holidays, investment incentives and other protections for foreign direct investors in this sector.

✓Services

The Nigerian services sector has remained resilient amidst hard-hitting economic circumstances. The strength of the sector has hinged on its consumer-facing nature which have seen it grow into a significant economic force. Over the last decade, the sector has met pent-up consumer demand and served a fast-growing middle class. Buoyed by government policies and increased private investments, growth in the sector has driven the diversification of the economy.

✓Trade Services

Due to a growing generation of Nigerian consumers, wholesale and retail sales (trade services) have become the second largest sectoral contributor to our GDP

Nigeria is one of the most attractive investment markets for retailers in Sub-Saharan Africa, largely attributed to a growing middle class. A wide range of foreign investors, including South Africa’s retail giants - Shoprite and Pick n Pay, the Dutch retailer SPAR, and many more operate in Nigeria. These foreign investments are complemented by a host of domestic private investors who are building a chain of retail stores all across the country.

✓ICT Sub-sector

The information and communication sub-sector contributed 12% in 2018 and has grown at about 4% over the last 5 years, making it the fastest growing and largest telecommunications industry in Africa. With a population size of about 206 million, less than 60% of whom are active internet users, the information, communications and technology (ICT) industry presents attractive investment opportunities. Through various electronic platforms, Nigeria’s ICT network has revolutionized business transactions by providing a highly mobile-technology-driven population seamless ability to bank, invest, purchase, distribute, communicate, and explore anytime and anywhere access to the internet is available. This trend has opened doors to investment in many aspects of ICT including hardware, software, network, apps and related services.

✓Financial Sector

Following wide and far-reaching reforms, the Nigerian financial and insurance industry has steadily evolved into a more diversified, stronger and more reliable industry equipped to stimulate and support economic growth and sustainable industrial development of the country. According to the NIPC, the industry contributes about 3.2% to Nigeria’s GDP. With the launch of the new e-Naira digital currency in October 2021,

Nigeria has enhanced the integration of electronic payments into our financial system, a step that has reduced the flow of physical cash in the economy and is gradually transforming the country into a cashless environment.

✓Banking industry

The banking industry is regulated and supervised by the Central Bank of Nigeria (CBN) under the Banks and Other Financial Institutions Act (BOFIA), CAP.B3, LFN, 2004. The industry has developed robustly driven by technology, with service offerings across various electronic platforms.

Our electronic banking potential of about 40% of the population is still largely unbanked. will latent potential that provides a huge opportunity for investors.

✓Insurance Industry

Nigeria’s insurance industry is one of the biggest in Africa, although its penetration is very low compared to its potential market size due largely to cultural and religious beliefs. Despite this, the industry remains resilient with total investment income in excess of N50 billion (US$160 million). With the implementation of the Pension Reform Act 2014 and the sustained implementation of tight monetary regime by the Central Bank of Nigeria, the insurance industry is expected to continue in the path of growth which is estimated to be at an annual average of 10% .The industry is regulated by National Insurance Commission (NAICOM) which is charged with the effective administration, supervision, regulation and control of the business of insurance in Nigeria.

✓Tourism and Hospitality

Tourism is one of the most important growing sectors of the Nigerian economy due to its inter-relativity to other sectors like Transportation, Infrastructure, Construction, Real Estate, ICT and the food industry. The government gave priority status to the Tourism Industry as far back as 1990 when the National Tourism Policy was launched, with the main policy thrust being to generate foreign exchange earnings, create employment opportunities, promote rural enterprises and national integration, among other things.

Nigeria’s Vision 2010 had set 2005 as the nation’s year of tourism, though not much was actualized due to crumbled infrastructure and the government's poor implementation. However, today the tourism policies and programmes will now be aimed at making Nigeria the “Ultimate Tourism Destination in Africa” with a particular focus on boosting private sector involvement with investment incentives. Nigeria is blessed with a vibrant culture and multiple festivals with international marketing potential, historical sites and naturally stunning sites ranging from tropical forests, magnificent waterfalls, beaches and climatic conditions with resort potentials conducive for holidaying.

✓Transport and Logistics

The transportation, logistics and supply chain sub-sector is one of the fastest growing industries in Nigeria due to its dependence on other fast growing sectors like infrastructure construction, trade and eCommerce. With an estimated growth of $160 million annually, the sector is promising in every sense of the word. This is why the federal government has embarked on an aggressive campaign to transport and distribution networks, workforce, road infrastructure, road congestion, road conditions, interstate highway access, vehicle taxes and fees, railroad access, water port access,, air cargo access, etc. to ensure innovation within the infrastructure development cycle of logistics and supply chain a well as attract local and foreign investments.

✓Education and Training

The rapid industrialisation of Nigeria has seen a sharp increase in demand for skilled labour education. An estimated 80,000 Nigerians go abroad each year to obtain an education or some type of short-term training. That number, added to an existing 180 million people in the country within the learning age. There is an increasing demand for affordable education and training in specialized fields like ICT courses, Business, sciences and Foreign Languages.

Due to the global pandemic curbing young people's ability to travel and study abroad, the market for quality education within the country is reaching an all-time high. With the exemption of profit taxes for education providers, as well as other incentives in place, the Government hopes to achieve home-trained labour-force for the growing industry and service sectors.

✓Healthcare and medical

For thousands of years, Nigerians have traditionally believed in preventing healthcare through naturally healthy food and cleansing herbs.

Read the full article

0 notes

Text

African Politics News Updates: Navigating the Continent's Ever-Changing Political Landscape

The political landscape of Africa is a complex tapestry of diverse ideologies, leadership transitions, and socio-political movements. From democratic progress and regional collaborations to governance challenges and societal aspirations, this article aims to provide an overview of the latest African politics news updates. By exploring the continent's political developments, we gain insight into the ongoing efforts, successes, and struggles that shape Africa's political future.

Democratic Transitions and Governance:

Many African nations have made significant strides in strengthening democratic institutions and promoting transparent governance. Several countries have witnessed peaceful transitions of power through democratic elections, exemplifying the continent's commitment to democratic principles. Countries such as Ghana, Senegal, and Malawi have held successful elections, emphasizing the importance of inclusive political processes and the will of the people. However, challenges such as corruption, weak institutions, and electoral irregularities persist in some regions, necessitating continued efforts to uphold democratic values.

Regional Collaborations and Integration:

Regional collaborations and integration efforts are gaining momentum across Africa. The African Union (AU) continues to play a vital role in fostering unity, peace, and development on the continent. The African Continental Free Trade Area (AfCFTA) is a landmark agreement that aims to create the world's largest free trade area, fostering economic integration and boosting intra-African trade. Collaborative initiatives like the East African Community (EAC), Economic Community of West African States (ECOWAS), and the Southern African Development Community (SADC) further promote regional cooperation in areas such as security, infrastructure development, and economic stability.

Socio-Political Movements and Activism:

Socio-political movements and civil society organizations are instrumental in driving change and advocating for the rights and aspirations of African citizens. Across the continent, grassroots movements are demanding accountability, social justice, and equal rights. Youth-led initiatives are particularly noteworthy, with young Africans at the forefront of advocating for political reform, climate action, and social inclusion. Movements like the #EndSARS protests in Nigeria and the Sudanese Revolution serve as powerful reminders of the agency and resilience of African citizens in shaping their political landscape.

4. Security and Conflict Resolution:

While progress has been made in resolving conflicts and maintaining peace, Africa continues to face security challenges in various regions. Armed conflicts, terrorism, and political instability remain significant issues in countries such as Libya, Somalia, Mali, and the Democratic Republic of Congo. Regional and international efforts, including peacekeeping missions by the United Nations and regional organizations, are striving to restore stability and promote conflict resolution. The pursuit of lasting peace and security remains a priority for the continent, as it is essential for social development and economic prosperity.

The political landscape of Africa is a dynamic arena that encompasses both progress and challenges. Democratic transitions, regional collaborations, and socio-political movements continue to shape the continent's political future. While Africa celebrates democratic successes and economic integration, there is still work to be done in addressing governance issues, promoting inclusive politics, and resolving conflicts. By staying informed about the latest African politics news updates, we can appreciate the efforts, complexities, and aspirations that define Africa's political landscape, and support the continent's journey towards sustainable development and good governance.

1 note

·

View note

Text

The Atlantic Slave Trade and its Impact on Spanish America

The Atlantic Slave Trade played a crucial role in shaping the socio-economic fabric of Spanish America. This extensive trade network, which spanned centuries, had implications on both the African and American continents. This article looks into the intricate details of this historical event, outlining its origins, evolution, and enduring effects on the Spanish colonies in the Americas. The content of this article was taken from a lecture by Dr Kate Quinn (UCL), and Dr. André Jockyman Roithmann (UCL), as well as secondary readings we were required to complete, and additional secondary readings that were optional (all linked below).

In the late 15th century, the European powers began exploring new territories, driven by the pursuit of wealth, power, and religious expansion. Christopher Columbus' voyage in 1492 marked the beginning of the European colonization of the Americas, leading to the establishment of several European empires. In the late 15th century, the European powers began exploring new territories, driven by the pursuit of wealth, power, and religious expansion. Christopher Columbus' voyage in 1492 marked the beginning of the European colonisation of the Americas, leading to the establishment of several European empires.

By the start of the 16th century, Spain's attempts at enslaving indigenous populations were proving fruitless. The mounting demand for labor, particularly for mining and agriculture, led the Spanish to tap into a new labor force: African slaves. Several factors contributed to the selection of Africans as the primary labor source. The ocean currents facilitated the transportation of Africans to the Caribbean, and being from well-developed agricultural societies, Africans were well-versed in organised tropical agriculture. Now on the topic of the African slave trade, between 1492 and 1820, approximately 10 to 15 million Africans were forcibly transported to the New World, greatly exceeding the number of whites who migrated to the Americas before the 1830s. This massive influx of African slaves significantly shaped the demographic makeup of the Spanish colonies in the Americas, as there were now more Africans on the land than indigenous or Spanish citizens. The African slaves brought to the Spanish Americas hailed from diverse regions across the African continent. The initial generations of slaves in the Caribbean, Mexico, and Peru mainly originated from Upper Guinea. However, by the mid-seventeenth century, when the intra-American trading routes emerged, a significant influx of diverse African cultures and peoples began. The Spanish derived a concept for this "intermingling" of people - Mestizaje (the intermixing of indigenous peoples, Africans, and Europeans), which contributed to the overall diversity of the Spanish Empire's population. This process of racial and cultural fusion resulted in a highly mixed African-descended population in Spanish colonies, unlike in other European colonies where the population was predominantly African or European.

It is safe to say that the Spanish empire benefitted greatly from the slave trade, both economically and socially through its standing in the New World. Spanish America, stretching from California to Buenos Aires, was the largest and most populous European imperial domain in the New World till at least 1810. The economic power of the Spanish colonies was deeply intertwined with the African slave trade. While indigenous peoples mined most of the silver, the backbone of colonial exports, enslaved Africans played a significant role in other economic sectors. They were instrumental in the cultivation of sugar, coffee, and tobacco – the first goods sold to a mass consumer market. The Spanish colonies continued to expand, largely due to their black populations. This growth defies the common misconception that the Spanish Empire's links with Africa waned after 1640. In fact, the slave trade remained of central importance throughout all four centuries of Spanish colonialism in the New World.

Overall, the Atlantic Slave Trade left an indelible mark on Spanish America, influencing its demographics, economy, and social structure. The forced migration of millions of Africans to the New World significantly shaped the Spanish colonies' development, leaving a lasting legacy that continues to resonate in contemporary societies.

Sources

Lecture by Dr Kate Quinn

Lecture by Dr André Jockyman Roithmann

Eltis, D. (1993). Europeans and the Rise and Fall of African Slavery in the Americas: An Interpretation. The American Historical Review., 98(5). https://doi.org/10.2307/2167060

Bergad, L. (2007) The Comparative Histories of Slavery in Brazil, Cuba, and the United States. Cambridge: Cambridge University Press (New Approaches to the Americas). doi: 10.1017/CBO9780511803970.

Borucki, A. (2015). Atlantic History and the Slave Trade to Spanish America. The American Historical Review., 120(2), 433–461. https://doi.org/10.1093/ahr/120.2.433

Newson, Linda A., and Susie Minchin, editors. From Capture to Sale: The Portuguese Slave Trade to Spanish South America in the Early Seventeenth Century. Brill, 2007. JSTOR, http://www.jstor.org/stable/10.1163/j.ctv29sfpzt. Accessed 5 Dec. 2023.

0 notes

Text

Video - Driving food security with appropriate conformity and compliance standards across Africa and beyond

Ghana News Today – home for all trending entertainment news & insights. We break all latest news and entertainment trends as it happens. check out the new exclusive below.

Bureau Veritas, a global leader in testing, inspection, and certification, highlighted its support for agricultural productivity and export trade at the Intra-Africa Trade Fair in Egypt. The firm discussed food security by…

View On WordPress

0 notes

Text

AATB: Transforming African Commerce Dynamics

Paving the Way for Transformation in the African Fashion Industry

In a landmark development at the Intra Africa Trade Fair 2023 in Cairo, Egypt, the Arab Africa Trade Bridges Program (AATB) has inked two pivotal agreements aimed at fostering sustainable growth and development.

Eng. Hani Salem Sonbol, a key figure at the helm of ITFC, Acting CEO of ICD, and Secretary General of the AATB Program joined forces with Dr. Hermogene Nsengimana, the General Secretary of ARSO, to sign a Grant Agreement.

This groundbreaking pact focuses on harmonizing African standards for textiles and leather products, heralding a transformative era for the African Fashion Industry. Notably, it builds upon the successful harmonization of pharmaceutical and medical device standards, aligning with the objectives of the African Continental Free Trade Area (AfCFTA) agreement.

Transformative Harmonization Initiatives

The signed Grant Agreement within the AATB Program takes a giant leap toward transforming the landscape of the African Fashion Industry. By harmonizing standards for textiles and leather products, the initiative sets the stage for a significant overhaul, aligning seamlessly with the broader goals of the AfCFTA agreement.

This strategic move follows the recent success in harmonizing pharmaceutical and medical device standards, marking a concerted effort to elevate trade development and enhance quality in Africa.

Empowering Enterprises through Strategic Partnerships

Spearheading a strategic move, Hani Salem Sonbol and Ms. Pamela Coke-Hamilton, Executive Director of ITC, initiated Phase Two of the transformative "How to Export with the AfCFTA” Program. This collaborative effort with Afreximbank solidifies a Partnership Agreement between ITFC and ITC under the AATB program.

Directly benefiting several African countries, including Benin, Cameroon, Senegal, and Togo, the comprehensive training program aims to impart the fundamentals of exporting within the framework of intra-African trade.

Unlocking Potential - Building Capacity for Intra-African Trade

The primary objective of the "How to Export with the AfCFTA” Program is to raise awareness about the technical nuances and potential opportunities arising from the AfCFTA agreement.

This transformative training initiative empowers enterprises to evaluate their standing in the context of new trading opportunities. With this knowledge, businesses can better equip themselves to strategize and make informed decisions to leverage the benefits presented by the AfCFTA agreement.

Strategic Agreements for Economic Impact

Recognizing the pivotal role of both large and small businesses in Africa's economic growth and structural transformation, these strategic agreements underline the AATB program's commitment to promoting trade and investment development.

These initiatives are poised to create a positive economic impact across the continent, reinforcing the program's influence in shaping African commerce's future. They reinforce the program's influence, shaping the future of African commerce.

Sources: THX News & International Islamic Trade Finance Corporation.

Read the full article

#AATBprogramharmonizationsuccess#AfCFTAagreementtrainingprogram#Africaneconomicimpactpartnerships#AfricanFashionIndustrystandards#ArabAfricaTradeBridgesProgram#ExportingwithAfCFTA#IntraAfricaTradeFair2023#SustainablegrowthinitiativesAfrica#Tradeandinvestmentdevelopment#TransformativeAfricancommercestrategies

0 notes