#hubert horan

Text

Lies, damned lies, and Uber

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me TONIGHT in PHOENIX (Changing Hands, Feb 29) then Tucson (Mar 10-11), San Francisco (Mar 13), and more!

Uber lies about everything, especially money. Oh, and labour. Especially labour. And geometry. Especially geometry! But especially especially money. They constantly lie about money.

Uber are virtuosos of mendacity, but in Toronto, the company has attained a heretofore unseen hat-trick: they told a single lie that is dramatically, materially untruthful about money, labour and geometry! It's an achievement for the ages.

Here's how they did it.

For several decades, Toronto has been clobbered by the misrule of a series of far-right, clownish mayors. This was the result of former Ontario Premier Mike Harris's great gerrymander of 1998, when the city of Toronto was amalgamated with its car-dependent suburbs. This set the tone for the next quarter-century, as these outlying regions – utterly dependent on Toronto for core economic activity and massive subsidies to pay the unsustainable utility and infrastructure bills for sprawling neighborhoods of single-family homes – proceeded to gut the city they relied on.

These "conservative" mayors – the philanderer, the crackhead, the sexual predator – turned the city into a corporate playground, swapping public housing and rent controls for out-of-control real-estate speculation and trading out some of the world's best transit for total car-dependency. As part of that decay, the city rolled out the red carpet for Uber, allowing the company to put as many unlicensed taxis as they wanted on the city's streets.

Now, it's hard to overstate the dire traffic situation in Toronto. Years of neglect and underinvestment in both the roads and the transit system have left both in a state of near collapse and it's not uncommon for multiple, consecutive main arteries to shut down without notice for weeks, months, or, in a few cases, years. The proliferation of Ubers on the road – driven by desperate people trying to survive the city's cost-of-living catastrophe – has only exacerbated this problem.

Uber, of course, would dispute this. The company insists – despite all common sense and peer-reviewed research – that adding more cars to the streets alleviates traffic. This is easily disproved: there just isn't any way to swap buses, streetcars, and subways for cars. The road space needed for all those single-occupancy cars pushes everything further apart, which means we need more cars, which means more roads, which means more distance between things, and so on.

It is an undeniable fact that geometry hates cars. But geometry loathes Uber. Because Ubers have all the problems of single-occupancy vehicles, and then they have the separate problem that they just end up circling idly around the city's streets, waiting for a rider. The more Ubers there are on the road, the longer each car ends up waiting for a passenger:

https://www.sfgate.com/technology/article/Uber-Lyft-San-Francisco-pros-cons-ride-hailing-13841277.php

Anything that can't go on forever eventually stops. After years of bumbling-to-sinister municipal rule, Toronto finally reclaimed its political power and voted in a new mayor, Olivia Chow, a progressive of long tenure and great standing (I used to ring doorbells for her when she was campaigning for her city council seat). Mayor Chow announced that she was going to reclaim the city's prerogative to limit the number of Ubers on the road, ending the period of Uber's "self-regulation."

Uber, naturally, lost its shit. The company claims to be more than a (geometrically impossible) provider of convenient transportation for Torontonians, but also a provider of good jobs for working people. And to prove it, the company has promised to pay its drivers "120% of minimum wage." As I write for Ricochet, that's a whopper, even by Uber's standards:

https://ricochet.media/en/4039/uber-is-lying-again-the-company-has-no-intention-of-paying-drivers-a-living-wage

Here's the thing: Uber is only proposing to pay 120% of the minimum wage while drivers have a passenger in the vehicle. And with the number of vehicles Uber wants on the road, most drivers will be earning nothing most of the time. Factor in that unpaid time, as well as expenses for vehicles, and the average Toronto Uber driver stands to make $2.50 per hour (Canadian):

https://ridefair.ca/wp-content/uploads/2024/02/Legislated-Poverty.pdf

Now, Uber's told a lot of lies over the years. Right from the start, the company implicitly lied about what it cost to provide an Uber. For its first 12 years, Uber lost $0.41 on every dollar it brought in, lighting tens of billions in investment capital provided by the Saudi royals on fire in an effort to bankrupt rival transportation firms and disinvestment in municipal transit.

Uber then lied to retail investors about the business-case for buying its stock so that the House of Saud and other early investors could unload their stock. Uber claimed that they were on the verge of producing a self-driving car that would allow them to get rid of drivers, zero out their wage bill, and finally turn a profit. The company spent $2.5b on this, making it the most expensive Big Store in the history of cons:

https://www.theinformation.com/articles/infighting-busywork-missed-warnings-how-uber-wasted-2-5-billion-on-self-driving-cars

After years, Uber produced a "self-driving car" that could travel one half of one American mile before experiencing a potentially lethal collision. Uber quietly paid another company $400m to take this disaster off its hands:

https://www.economist.com/business/2020/12/10/why-is-uber-selling-its-autonomous-vehicle-division

The self-driving car lie was tied up in another lie – that somehow, automation could triumph over geometry. Robocabs, we were told, would travel in formations so tight that they would finally end the Red Queen's Race of more cars – more roads – more distance – more cars. That lie wormed its way into the company's IPO prospectus, which promised retail investors that profitability lay in replacing every journey – by car, cab, bike, bus, tram or train – with an Uber ride:

https://www.reuters.com/article/idUSKCN1RN2SK/

The company has been bleeding out money ever since – though you wouldn't know it by looking at its investor disclosures. Every quarter, Uber trumpets that it has finally become profitable, and every quarter, Hubert Horan dissects its balance sheets to find the accounting trick the company thought of this time. There was one quarter where Uber declared profitability by marking up the value of stock it held in Uber-like companies in other countries.

How did it get this stock? Well, Uber tried to run a business in those countries and it was such a total disaster that they had to flee the country, selling their business to a failing domestic competitor in exchange for stock in its collapsing business. Naturally, there's no market for this stock, which, in Uber-land, means you can assign any value you want to it. So that one quarter, Uber just asserted that the stock had shot up in value and voila, profit!

https://www.nakedcapitalism.com/2022/02/hubert-horan-can-uber-ever-deliver-part-twenty-nine-despite-massive-price-increases-uber-losses-top-31-billion.html

But all of those lies are as nothing to the whopper that Uber is trying to sell to Torontonians by blanketing the city in ads: the lie that by paying drivers $2.50/hour to fill the streets with more single-occupancy cars, they will turn a profit, reduce the city's traffic, and provide good jobs. Uber says it can vanquish geometry, economics and working poverty with the awesome power of narrative.

In other words, it's taking Toronto for a bunch of suckers.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/29/geometry-hates-uber/#toronto-the-gullible

Image:

Rob Sinclair (modified)

https://commons.wikimedia.org/wiki/File:Night_skyline_of_Toronto_May_2009.jpg

CC BY 2.0

https://creativecommons.org/licenses/by-sa/2.0/deed.en

#pluralistic#uber#hubert horan#fraud#toronto#geometry hates cars#urbanism#ontpoli#olivia chow#self-regulation#transport#urban planning#taxis#transit#urban theory#labor#algorithmic wage discrimination#veena dubal

901 notes

·

View notes

Text

After nearly 15 years, Uber claims it’s finally turned an annual profit. Between 2014 and 2023, the company set over $31 billion on fire in its quest to drive taxi companies out of business and build a global monopoly. It failed on both fronts, but in the meantime it built an organization that can wield significant power over transportation — and that’s exactly how it got to last week’s milestone.

Uber turned a net profit of nearly $1.9 billion in 2023, but what few of the headlines will tell you is that over $1.6 billion of it came from unrealized gains from its holdings in companies like Aurora and Didi. Basically, the value of those shares are up, so on paper it looks like Uber’s core business made a lot more money than it actually did. Whether the companies are really worth that much is another question entirely — but that doesn’t matter to Uber. At least it’s not using the much more deceptive “adjusted EBITDA” metric it spent years getting the media to treat as an accurate picture of its finances.

Don’t be fooled into thinking the supposed innovation Uber was meant to deliver is finally bearing fruit. The profit it’s reporting is purely due to exploitative business practices where the worker and consumer are squeezed to serve investors — and technology is the tool to do it. This is the moment CEO Dara Khosrowshahi has been working toward for years, and the plan he’s trying to implement to cement the company’s position should have us all concerned about the future of how we get around and how we work.

[...]

Uber didn’t become a global player in transportation because it wielded technology to more efficiently deliver services to the public. The tens of billions of dollars it lost over the past decade went into undercutting taxis on price and drawing drivers to its service — including some taxi drivers — by promising good wages, only to cut them once the competition posed by taxis had been eroded and consumers had gotten used to turning to the Uber app instead of calling or hailing a cab.

As transport analyst Hubert Horan outlined, for-hire rides are not a service that can take advantage of economies of scale like a software or logistics company, meaning just because you deliver more rides doesn’t mean the per-ride cost gets significantly cheaper. Uber actually created a less cost-efficient model because it forces drivers to use their own vehicles and buy their own insurance instead of having a fleet of similar vehicles covered by fleet insurance. Plus, it has a ton of costs your average taxi company doesn’t: a high-paid tech workforce, expensive headquarters scattered around the world, and outrageously compensated executive management like Khosrowshahi, just to name a few.

How did Uber cut costs then? By systematically going after the workers that deliver its service. More recently, it took advantage of the cost-of-living crisis to keep them on board in the same way it exploited workers left behind by the financial crisis in the years after its initial launch. Its only real innovation is finding new ways to exploit labor.

385 notes

·

View notes

Text

0 notes

Text

0 notes

Text

The Uber Delusion

Hubert Horan's broadside of Uber for American Affairs starts out like this and doesn't let up:

Since it began operations in 2010, Uber has grown to the point where it now collects over $45 billion in gross passenger revenue, and it has seized a major share of the urban car service market. But the widespread belief that it is a highly innovative and successful company has no basis in economic reality.

An examination of Uber's economics suggests that it has no hope of ever earning sustainable urban car service profits in competitive markets. Its costs are simply much higher than the market is willing to pay, as its nine years of massive losses indicate. Uber not only lacks powerful competitive advantages, but it is actually less efficient than the competitors it has been driving out of business.

This is one of those articles where I want to excerpt the entire thing; it's just so jammed packed with goodies about a company that represents everything I hate about "tech" and Silicon Valley.

In reality, Uber's platform does not include any technological breakthroughs, and Uber has done nothing to "disrupt" the economics of providing urban car services. What Uber has disrupted is the idea that competitive consumer and capital markets will maximize overall economic welfare by rewarding companies with superior efficiency. Its multibillion dollar subsidies completely distorted marketplace price and service signals, leading to a massive misallocation of resources. Uber's most important innovation has been to produce staggering levels of private wealth without creating any sustainable benefits for consumers, workers, the cities they serve, or anyone else.

A later section is titled "Uber's Narratives Directly Copied Libertarian Propaganda".

In the early 1990s, a coordinated campaign advocating taxi deregulation was conducted by a variety of pro-corporate/libertarian think tanks that all received funding from Charles and David Koch. This campaign pursued the same deregulation that Uber's investors needed, and used classic political propaganda techniques. It emphasized emotive themes designed to engage tribal loyalties and convert complex issues into black-and-white moral battles where compromise was impossible. There was an emphasis on simple, attractive conclusions designed to obscure the actual objectives of the campaigners, and their lack of sound supporting evidence.

This campaign's narratives, repeated across dozens of publications, included framing taxi deregulation as a heroic battle for progress, innovation, and economic freedom. Its main claims were that thousands of struggling entrepreneurial drivers had been blocked from job opportunities by the "cab cartel" and the corrupt regulators beholden to them, and that consumers would enjoy the same benefits that airline deregulation had produced. In a word, consumers were promised a free lunch. Taxi deregulation would lead to lower fares, solve the problems of long waits, provide much greater service (especially in neighborhoods where service was poor), and increase jobs and wages for drivers. Of course, no data or analysis of actual taxi economics showing how these wondrous benefits could be produced was included.

Horan reserves a healthy chunk of his criticism for the media, whose unwillingness to critically cover the company -- "the press refuses to reconsider its narrative valorizing Uber as a heroic innovator that has created huge benefits for consumers and cities" -- has provided a playbook for future investors to exploit for years to come. Blech. What a shitshow.

12 notes

·

View notes

Text

Uber’s alleged path of destruction

*Emperor lacks clothing, according to him.

https://americanaffairsjournal.org/2019/05/ubers-path-of-destruction/

Uber’s Path of Destruction

by Hubert Horan

Since it began operations in 2010, Uber has grown to the point where it now collects over $45 billion in gross passenger revenue, and it has seized a major share of the urban car service market. But the widespread belief that it is a highly innovative and successful company has no basis in economic reality.

An examination of Uber’s economics suggests that it has no hope of ever earning sustainable urban car service profits in competitive markets. Its costs are simply much higher than the market is willing to pay, as its nine years of massive losses indicate. Uber not only lacks powerful competitive advantages, but it is actually less efficient than the competitors it has been driving out of business.

Uber’s investors, however, never expected that their returns would come from superior efficiency in competitive markets. Uber pursued a “growth at all costs” strategy financed by a staggering $20 billion in investor funding. This funding subsidized fares and service levels that could not be matched by incumbents who had to cover costs out of actual passenger fares. Uber’s massive subsidies were explicitly anticompetitive—and are ultimately unsustainable—but they made the company enormously popular with passengers who enjoyed not having to pay the full cost of their service.

The resulting rapid growth was also intended to make Uber highly attractive to those segments of the investment world that believed explosive top-line growth was the only important determinant of how start-up companies should be valued. Investors focused narrowly on Uber’s revenue growth and only rarely considered whether the company could ever produce the profits that might someday repay the multibillion dollar subsidies.

Most public criticisms of Uber have focused on narrow behavioral and cultural issues, including deceptive advertising and pricing, algorithmic manipulation, driver exploitation, deep-seated misogyny among executives, and disregard of laws and business norms. Such criticisms are valid, but these problems are not fixable aberrations. They were the inevitable result of pursuing “growth at all costs” without having any ability to fund that growth out of positive cash flow. And while Uber has taken steps to reduce negative publicity, it has not done—and cannot do—anything that could suddenly produce a sustainable, profitable business model.

Uber’s longer-term goal was to eliminate all meaningful competition and then profit from this quasi-monopoly power. While it has already begun using some of this artificial power to suppress driver wages, it has not achieved the Facebook- or Amazon-type “platform” power it hoped to exploit. Given that both sustainable profits and true industry dominance seemed unachievable, Uber’s investors decided to take the company public, based on the hope that enough gullible investors still believe that the company’s rapid growth and popularity are the result of powerfully efficient innovations and do not care about its inability to generate profits.

These beliefs about Uber’s corporate value were created entirely out of thin air. This is not a case of a company with a reasonably sound operating business that has managed to inflate stock market expectations a bit. This is a case of a massive valuation that has no relationship to any economic fundamentals.

Uber has no competitive efficiency advantages, operates in an industry with few barriers to entry, and has lost more than $14 billion in the previous four years. But its narratives convinced most people in the media, investment, and tech worlds that it is the most valuable transportation company on the planet and the second most valuable start-up IPO in U.S. history (after Facebook).

Uber is the breakthrough case where the public perception of a large new company was entirely created using the types of manufactured narratives typically employed in partisan political campaigns. Narrative construction is perhaps Uber’s greatest competitive strength. The company used these techniques to completely divert attention away from the massive subsidies that were the actual drivers of its popularity and growth. It successfully framed the entire public discussion around an emotive, “us-versus-them” battle between heroic innovators and corrupt regulators who were falsely blamed for all of the industry’s historic service problems.

Uber’s desired framing—that it was fighting a moral battle on behalf of technological progress and economic freedom—was uncritically accepted by the mainstream business and tech industry press, who then never bothered to analyze the firm’s actual economics or its anticompetitive behavior.

In reality, Uber’s platform does not include any technological breakthroughs, and Uber has done nothing to “disrupt” the economics of providing urban car services. What Uber has disrupted is the idea that competitive consumer and capital markets will maximize overall economic welfare by rewarding companies with superior efficiency. Its multibillion dollar subsidies completely distorted marketplace price and service signals, leading to a massive misallocation of resources. Uber’s most important innovation has been to produce staggering levels of private wealth without creating any sustainable benefits for consumers, workers, the cities they serve, or anyone else.

Uber Cannot Produce Sustainable Profits

Prior to its IPO, Uber publicly released limited P&L results. These showed GAAP net losses of $2.6 billion in 2015, $3.8 billion in 2016, $4.5 billion in 2017, and $3.9 billion in 2018.1

In its April IPO S-1 prospectus, Uber recast all its historical P&L results, allegedly to isolate the terrible results in three major markets (China, Russia, and Southeast Asia) that Uber has abandoned from the results of its ongoing operations (which are the primary concern of potential investors).2 But Uber’s S-1 included $5 billion—roughly $3 billion in divestiture gains and $2 billion representing Uber’s valuation of its untradeable equity/debt positions in the companies that took over its failed operations—as part of net income from its ongoing operations. This deliberate misstatement was designed to give potential investors the impression that... (((etc etc etc)))

3 notes

·

View notes

Text

Uber is a Ponzi scheme, with no hope of becoming profitable, cutting costs by making drivers’ lives miserable, writes Hubert Horan at American Affairs. Claims of innovation are nonsense; it’s a taxi company.

2 notes

·

View notes

Text

The Uber Bubble: Why Is a Company That Lost Billions Claimed to Be Successful?

https://braveneweurope.com/hubert-horan-the-uber-bubble-why-is-a-company-that-lost-20-billion-claimed-to-be-successful

Comments

0 notes

Text

No, Uber's (still) not profitable

Going to Defcon this weekend? I'm giving a keynote, "An Audacious Plan to Halt the Internet's Enshittification and Throw it Into Reverse," on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

Bezzle (n):

1. "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it" (JK Gabraith)

2. Uber.

Uber was, is, and always will be a bezzle. There are just intrinsic limitations to the profits available to operating a taxi fleet, even if you can misclassify your employees as contractors and steal their wages, even as you force them to bear the cost of buying and maintaining your taxis.

The magic of early Uber – when taxi rides were incredibly cheap, and there were always cars available, and drivers made generous livings behind the wheel – wasn't magic at all. It was just predatory pricing.

Uber lost $0.41 on every dollar they brought in, lighting $33b of its investors' cash on fire. Most of that money came from the Saudi royals, funneled through Softbank, who brought you such bezzles as WeWork – a boring real-estate company masquerading as a high-growth tech company, just as Uber was a boring taxi company masquerading as a tech company.

Predatory pricing used to be illegal, but Chicago School economists convinced judges to stop enforcing the law on the grounds that predatory pricing was impossible because no rational actor would choose to lose money. They (willfully) ignored the obvious possibility that a VC fund could invest in a money-losing business and use predatory pricing to convince retail investors that a pile of shit of sufficient size must have a pony under it somewhere.

This venture predation let investors – like Prince Bone Saw – cash out to suckers, leaving behind a money-losing business that had to invent ever-sweatier accounting tricks and implausible narratives to keep the suckers on the line while they blew town. A bezzle, in other words:

https://pluralistic.net/2023/05/19/fake-it-till-you-make-it/#millennial-lifestyle-subsidy

Uber is a true bezzle innovator, coming up with all kinds of fairy tales and sci-fi gimmicks to explain how they would convert their money-loser into a profitable business. They spent $2.5b on self-driving cars, producing a vehicle whose mean distance between fatal crashes was half a mile. Then they paid another company $400 million to take this self-licking ice-cream cone off their hands:

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

Amazingly, self-driving cars were among the more plausible of Uber's plans. They pissed away hundreds of millions on California's Proposition 22 to institutionalize worker misclassification, only to have the rule struck down because they couldn't be bothered to draft it properly. Then they did it again in Massachusetts:

https://pluralistic.net/2022/06/15/simple-as-abc/#a-big-ask

Remember when Uber was going to plug the holes in its balance sheet with flying cars? Flying cars! Maybe they were just trying to soften us up for their IPO, where they advised investors that the only way they'd ever be profitable is if they could replace every train, bus and tram ride in the world:

https://48hills.org/2019/05/ubers-plans-include-attacking-public-transit/

Honestly, the only way that seems remotely plausible is when it's put next to flying cars for comparison. I guess we can be grateful that they never promised us jetpacks, or, you know, teleportation. Just imagine the market opportunity they could have ascribed to astral projection!

Narrative capitalism has its limits. Once Uber went public, it had to produce financial disclosures that showed the line going up, lest the bezzle come to an end. These balance-sheet tricks were as varied as they were transparent, but the financial press kept falling for them, serving as dutiful stenographers for a string of triumphant press-releases announcing Uber's long-delayed entry into the league of companies that don't lose more money every single day.

One person Uber has never fooled is Hubert Horan, a transportation analyst with decades of experience who's had Uber's number since the very start, and who has done yeoman service puncturing every one of these financial "disclosures," methodically sifting through the pile of shit to prove that there is no pony hiding in it.

In 2021, Horan showed how Uber had burned through nearly all of its cash reserves, signaling an end to its subsidy for drivers and rides, which would also inevitably end the bezzle:

https://pluralistic.net/2021/08/10/unter/#bezzle-no-more

In mid, 2022, Horan showed how the "profit" Uber trumpeted came from selling off failed companies it had acquired to other dying rideshare companies, which paid in their own grossly inflated stock:

https://pluralistic.net/2022/08/05/a-lousy-taxi/#a-giant-asterisk

At the end of 2022, Horan showed how Uber invented a made-up, nonstandard metric, called "EBITDA profitability," which allowed them to lose billions and still declare themselves to be profitable, a lie that would have been obvious if they'd reported their earnings using Generally Accepted Accounting Principles (GAAP):

https://pluralistic.net/2022/02/11/bezzlers-gonna-bezzle/#gryft

Like clockwork, Uber has just announced – once again – that it is profitable, and once again, the press has credulously repeated the claim. So once again, Horan has published one of his magisterial debunkings on Naked Capitalism:

https://www.nakedcapitalism.com/2023/08/hubert-horan-can-uber-ever-deliver-part-thirty-three-uber-isnt-really-profitable-yet-but-is-getting-closer-the-antitrust-case-against-uber.html

Uber's $394m gains this quarter come from paper gains to untradable shares in its loss-making rivals – Didi, Grab, Aurora – who swapped stock with Uber in exchange for Uber's own loss-making overseas divisions. Yes, it's that stupid: Uber holds shares in dying companies that no one wants to buy. It declared those shares to have gained value, and on that basis, reported a profit.

Truly, any big number multiplied by an imaginary number can be turned into an even bigger number.

Now, Uber also reported "margin improvements" – that is, it says that it loses less on every journey. But it didn't explain how it made those improvements. But we know how the company did it: they made rides more expensive and cut the pay to their drivers. A 2.9m ride in Manhattan is now $50 – if you get a bargain! The base price is more like $70:

https://www.wired.com/story/uber-ceo-will-always-say-his-company-sucks/

The number of Uber drivers on the road has a direct relationship to the pay Uber offers those drivers. But that pay has been steeply declining, and with it, the availability of Ubers. A couple weeks ago, I found myself at the Burbank train station unable to get an Uber at all, with the app timing out repeatedly and announcing "no drivers available."

Normally, you can get a yellow taxi at the station, but years of Uber's predatory pricing has caused a drawdown of the local taxi-fleet, so there were no taxis available at the cab-rank or by dispatch. It took me an hour to get a cab home. Uber's bezzle destroyed local taxis and local transit – and replaced them with worse taxis that cost more.

Uber won't say why its margins are improving, but it can't be coming from scale. Before the pandemic, Uber had far more rides, and worse margins. Uber has diseconomies of scale: when you lose money on every ride, adding more rides increases your losses, not your profits.

Meanwhile, Lyft – Uber's also-ran competitor – saw its margins worsen over the same period. Lyft has always been worse at lying about it finances than Uber, but it is in essentially the exact same business (right down to the drivers and cars – many drivers have both apps on their phones). So Lyft's financials offer a good peek at Uber's true earnings picture.

Lyft is actually slightly better off than Uber overall. It spent less money on expensive props for its long con – flying cars, robotaxis, scooters, overseas clones – and abandoned them before Uber did. Lyft also fired 24% of its staff at the end of 2022, which should have improved its margins by cutting its costs.

Uber pays its drivers less. Like Lyft, Uber practices algorithmic wage discrimination, Veena Dubal's term describing the illegal practice of offering workers different payouts for the same work. Uber's algorithm seeks out "pickers" who are choosy about which rides they take, and converts them to "ants" (who take every ride offered) by paying them more for the same job, until they drop all their other gigs, whereupon the algorithm cuts their pay back to the rates paid to ants:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

All told, wage theft and wage cuts by Uber transferred $1b/quarter from labor to Uber's shareholders. Historically, Uber linked fares to driver pay – think of surge pricing, where Uber charged riders more for peak times and passed some of that premium onto drivers. But now Uber trumpets a custom pricing algorithm that is the inverse of its driver payment system, calculating riders' willingness to pay and repricing every ride based on how desperate they think you are.

This pricing is a per se antitrust violation of Section 2 of the Sherman Act, America's original antitrust law. That's important because Sherman 2 is one of the few antitrust laws that we never stopped enforcing, unlike the laws banning predator pricing:

https://ilr.law.uiowa.edu/sites/ilr.law.uiowa.edu/files/2023-02/Woodcock.pdf

Uber claims an 11% margin improvement. 6-7% of that comes from algorithmic price discrimination and service cutbacks, letting it take 29% of every dollar the driver earns (up from 22%). Uber CEO Dara Khosrowshahi himself says that this is as high as the take can get – over 30%, and drivers will delete the app.

Uber's food delivery service – a baling wire-and-spit Frankenstein's monster of several food apps it bought and glued together – is a loser even by the standards of the sector, which is unprofitable as a whole and experiencing an unbroken slide of declining demand.

Put it all together and you get a picture of the kind of taxi company Uber really is: one that charges more than traditional cabs, pays drivers less, and has fewer cars on the road at times of peak demand, especially in the neighborhoods that traditional taxis had always underserved. In other words, Uber has broken every one of its promises.

We replaced the "evil taxi cartel" with an "evil taxi monopolist." And it's still losing money.

Even if Lyft goes under – as seems inevitable – Uber can't attain real profitability by scooping up its passengers and drivers. When you're losing money on every ride, you just can't make it up in volume.

Image: JERRYE AND ROY KLOTZ MD (modified) https://commons.wikimedia.org/wiki/File:LA_BREA_TAR_PITS,_LOS_ANGELES.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

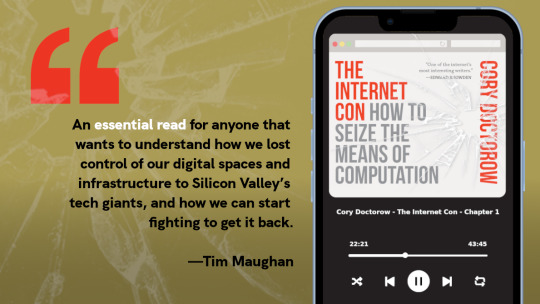

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/09/accounting-gimmicks/#unter

Image:

JERRYE AND ROY KLOTZ MD (modified)

https://commons.wikimedia.org/wiki/File:LA_BREA_TAR_PITS,_LOS_ANGELES.jpg

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#bezzles#hubert horan#uber#rideshare#accounting tricks#financial engineering#late-stage capitalism#narrative capitalism#lyft#transit#uber eats#venture predation#algorithmic wage discrimination

1K notes

·

View notes

Quote

Uber is the breakthrough case where the public perception of a large new company was entirely created using the types of manufactured narratives typically employed in partisan political campaigns. Narrative construction is perhaps Uber’s greatest competitive strength. The company used these techniques to completely divert attention away from the massive subsidies that were the actual drivers of its popularity and growth. It successfully framed the entire public discussion around an emotive, “us-versus-them” battle between heroic innovators and corrupt regulators who were falsely blamed for all of the industry’s historic service problems. Uber’s desired framing—that it was fighting a moral battle on behalf of technological progress and economic freedom—was uncritically accepted by the mainstream business and tech industry press, who then never bothered to analyze the firm’s actual economics or its anticompetitive behavior.

In reality, Uber’s platform does not include any technological breakthroughs, and Uber has done nothing to “disrupt” the economics of providing urban car services. What Uber has disrupted is the idea that competitive consumer and capital markets will maximize overall economic welfare by rewarding companies with superior efficiency. Its multibillion dollar subsidies completely distorted marketplace price and service signals, leading to a massive misallocation of resources. Uber’s most important innovation has been to produce staggering levels of private wealth without creating any sustainable benefits for consumers, workers, the cities they serve, or anyone else.

Hubert Horan, Uber’s Path of Destruction

31 notes

·

View notes

Photo

Hubert Horan: What Will it Take to Save the Airlines? | naked capitalism | The airlines are facing an existential crisis, yet no one in power is inclinded or even equipped to intervene.... https://www.nakedcapitalism.com/2020/06/hubert-horan-what-will-it-take-to-save-the-airlines.html

0 notes

Link

0 notes

Text

0 notes

Link

0 notes