#how much does it cost to learn forex trading

Text

Learn Forex Trading How to Begin Trading on the internet

Understanding how to trade forex can be an extremely lucrative endeavor when you consider the high profits forex can bring you. Be sure, however, that you are learning from the most qualified and reliable sources is essential as there are a lot of online resources on the market with little credit or precision.

From books and videos to videos and tutorials, information is at your fingertips in every format, should you prefer to learn about the art of trading forex by yourself. Additionally, you can seek a teacher to guide you by enrolling in an online course or even a course. Whatever route you take, you should know the steps you need to take to learn forex trading the right way which is the subject of this article.

How can I get started? Forex Trading in 2022 ?

In addition to being one of the trade methods that gained significant traction in recent times, forex trading is gaining a reputation itself as an effective source of income. Knowing how to trade forex isn't an issue as it provides traders with a quick way to earn money. traders trade If you're still not sure about learning how to trade forex, here are some compelling reasons for you to reconsider.

* Easy extra income

Forex trading is an excellent option to increase your income source if are working at a different job. You could turn Forex your main source of income however, to achieve this then you'll need put in lots of time and effort.

* Flexibility

A market for forex is a location that is flexible. The market is available all hours of the day from Sunday through Friday and allows traders to trade whenever they feel comfortable. Furthermore there is the Forex is also accessible by using a mobile device. This makes trading forex accessible at any time and anywhere.

* High liquidity

As the biggest financial marketplace worldwide, Forex offers great liquidity for the investments that traders trade. More than 10 million individuals participate the forex market, and that's not forgetting the huge liquidity. It allows traders to turn their wealth into money by purchasing or selling currency pair quickly.

youtube

* High profit

If executed correctly, forex trading can let you achieve trades that are highly profitable , if you put in a little. With the aid of analysis, signals for trading, plus market information, you can take advantage of very profitable trades.

* Anyone can do forex trading

The art of trading forex is one that doesn't demand much from the trader, even in its most basic form. At the beginning, anyone with or without experience can learn forex trading quickly and for nothing. After a few dollars investors can be involved in the forex market.

How can I learn about forex trading?

Learning forex trading is open for everyone interested in this field. When you're beginning your learning journey, there are two major parts to pay attention to. First,

* Get the basics

Training yourself through any method is a must. Activities like reading articles or following courses videos can help you increase the knowledge you have about Forex. Understanding topics such as the definition of Forex is and how it functions it, who are the market players, and the factors that drive it can help traders grasp the basics.

In addition, terms that are used in the industry like pip and leverage as well as spreads may make the navigation of the forex market much more easily.

Important - Forex trading is a delicate process that has high risks so you should be aware of as much as you can to avoid mistakes that could cost financial loss some brokers even .

* Demo trading

Once you are confident in the forex trading abilities start a demo account and begin trading using it. Demo forex trading accounts are great tools that can aid new and upcoming traders get a better knowledge of the industry.

Demo accounts use virtual currencies in real-world scenarios, so you're not in danger of losing the capital you have invested. If you have made enough demo trades , and feel as though you've entered a real market, you can open a trading account and begin trading.

Learn the basics to Learn Forex trading.

There are several ways you can begin learning about forex trading. Everyone may not have the same amount of time energy, money, or resources to put into trading forex. Because of this, the preferred method of learning can change from one person another. Let's take a look at the most popular methods. allow traders

* Self-learning

Self-learning is by far one of the most effective and accessible method to learn for any new trader. forex market Anyone with access internet has the ability to easily access a numerous number of articles that are about Forex to learn from them.

There are also webinars, video tutorials and websites dedicated to forex traders who are learning about trading.

Most of these strategies can be found for free. Therefore, you don't have to invest money in order to master forex trading. Forex business books a great source to get an knowing of Forex.

* Forex trading courses

If you have some money and some time to devote to forex education, consider enrolling in Forex learning courses.

These forex courses include more well-organized content and will instruct you on the key skills you will need to do to succeed in the forex market.

If you're under the direction of an expert, you will have a much better chance of comprehending what they're teaching you. But the problem for these courses is they tend to go into more topics that aren't appropriate for beginners. If you can find some courses targeted towards beginners at a minimal cost, take it a shot.

"Forex trading" schools

If you're extremely focused on Forex and would like to know everything you need to know, regardless of the time or expenditure, forex schools may be for you. They come with a dedicated staff that has been specially trained to teach Forex and provides the most beneficial forex learning experience.

There are no forex trading schools that are widely used, and the most exclusive cone can cost you thousands. So, be sure you understand what you're about to enter into before.

Demo trading

With the vast availability of forex brokers, selecting the most appropriate one is the first obstacle traders have to overcome. In the selection process, access and the credibility on the demo account are very vital if you're beginner in the field of trading.

When you choose a broker after examining things such as leverage, spread, minimum deposit, and costs, see if the broker is equipped with a demo-account. A good demo account can allow traders to trade an immense amount in virtual money over many years using various methods and features.

Apply a variety of strategies, techniques to trade and strategies until you have found the one that is most appropriate for you. This way, you'll enjoy a better experience dealing with forex.

How much money will you need to get started Forex trading?

Forex trading is an industry that does not require significant investment initially to get things going. Minimum deposit requirements and amount required to trade vary from one broker to the next. Some brokers allow traders to trade for as little as $50.

Make sure to keep in mind that the amount that you deposit directly mirrors the amount that you receive in the form of profits. Features like leverage and tight spreads let traders earn profits that are greater that what they pay at an increased risk.

If you are keen on trading forex begin by preparing at minimum $500 as a solid capital to get started on your trading career. Limiting yourself to using 1 percent of your account balance to trade forex is also a trading practice that the majority of traders follow.

Conclusion

In order to master forex trading as well as you can is an excellent approach to remain ahead the trends. Since Forex is a complex topic beneath the surface having more data on your side can allow you to improve and earn more money from trades earlier than others.

With a thorough understanding of the world of currencies and markets it is possible to make trades that have a higher chance of success.

There are a lot of educational materials offered to users for learning about forex. Utilize them and practice on an account with a demo to get familiar with the market. After that, make use of the versatility of this market and the services offered by the brokers to become the best forex trader you could be.

FAQs

Is it difficult for you to carry out forex trading?

* Forex trading is a craft that is simple to master but is difficult to master. Anyone with basic knowledge about forex can be able to make trades.

Do I require big sum of money to start forex trading?

It is not necessary to have a large capital to start trading in forex. Some brokers will allow traders to begin trading forex from as little as $50.

Are there ways to earn money trading in forex?

* You can earn a decent sum that represents what is deposited when you trade forex. To earn a lot of money from Forex you'll require substantial capital as well as a vast understanding of the topic.

#learn forex trading#how to learn forex trading#learning forex trading#learn forex trading step by step#forex trading learning#learn about forex trading#learn forex trading for beginners#learn forex trading free#best way to learn forex trading#best site to learn forex trading#how do beginners learn forex trading#how much does it cost to learn forex trading#learn forex trading step by step pdf

0 notes

Text

Janis Urste A Helpful Article About Forex That Offers Many Useful Tips

Janis Urste Professional tips provider. In our growing multinational corporate environment there are companies that need to have access to multiple currencies in order to do business in multiple countries. Forex is a marketplace where currencies are exchanged. It is similar to the stock market but very different in some ways. There are a few helpful bits of information that can assist you in negotiating your way through this market.

Take advantage of changes in oil prices to gain profit on Forex. Many economies are greatly affected by rising costs of oil and their exchange rates are tied to these changes. Luckily, oil typically changes slowly. If it is falling, it will usually continue to fall for months at a time. Follow the cycle of oil prices to earn easy money.

Understanding the direction of trends will greatly improve your profitably on the Forex market. Be current with general trends and which currency is stronger, or even perceived as stronger. Read news releases and follow the direction of the market trends. Keep in mind to not trade after a huge news release though, as you may want to wait and see what the market does.

Be willing to take a break from forex trading when the market isn't going your way. Forex trading can be extremely stressful, and it wears on your mental and physical health especially heavily when you lose. Taking regular trading breaks will help you stick to your plan instead of trading on your emotions.

When pursuing forex trading, a great tip is to always carry a notebook with you. Whenever you hear of something interesting concerning the market, jot it down. Things that are of interest to you, should include market openings, stop orders, your fills, price ranges, and your own observations. Analyze them from time to time to try to get a feel of the market.

If you are interested in Forex trading but do not have the time to invest in learning the basics and strategy, consider a managed Forex trading account. A well-managed Forex trading account can bring in a healthy profit without requiring you to spend many hours learning how Forex works.

When you are learning how to best understand your forex trading data start by understanding the days. Once you have that mastered you can focus on larger and larger scopes of time from weeks and months to years. If you start out without a good understanding of daily goals, you will never comprehend the bigger picture.

Janis Urste Expert tips provider. When choosing a Forex broker, you should go with a person or a firm that allows for day trading. Some brokers will not offer a day-trading platform, and this will drastically cut into your profits. Day-trading is much different than other types of trading, and this is what you will want to do if you're a beginner.

Remember to take into consideration your expectations and your prior knowledge when deciding on an account package. Knowing your strengths and weaknesses will assist you in taking a rational approach. Understand that getting good at trading does not happen overnight. It is commonly accepted that lower leverages are better. If you are just starting, try out a practice account; there are usually no risks involved. Begin with a small investment so you can get comfortable with trading.

Before investing money into an actual Forex account, try practicing on a demo account. It is a proven fact that 90 percent of beginners fail to succeed at Forex trading because of their lack of knowledge. It is recommended you use a demo account for two months or until you are confident that you know what you are doing.

Currency trading is ultimately about winning, and only you fully know yourself and your strengths and weaknesses. Evaluate these carefully so you are fully aware what you are and are not capable of before entering into this field. By being emotionally prepared and knowing exactly what goals you wish to achieve, success will be far easier to obtain.

A good rule of thumb for beginner Forex traders, is to find a broker where your expertise level and trading goals, match up well with what the broker can offer. Make sure the broker deals or has dealt with clients who have similar goals to yourself, so that you know your broker understands what you are trying to achieve.

Janis Urste Qualified tips provider. Forex trading is not something to take lightly. Traders should always practice in a demo Forex trading account before they actually get into the real trading because most beginners fail from their lack of knowledge in that particular area. Many people stay in the demo account for years before going into the real market.

Learn to integrate money management into your Forex trading. This means placing trades with stop losses set appropriately so your losses are limited to 1-3% of your margin. Resist the urge to trade without stops in place or enter into several trades at a time to try and hedge. It's always easier to protect the money you have than to try and make it back by trading more.

Forex trading systems for your computer can be good and bad. You need to know how to use them to get the most for your money. While they will teach you how to deal with the currency market, they do not always reflect exactly what is going on right now. Use each program in combination with common sense.

There are lots of people who like to over-complicate things with convoluted Forex strategy. Don't be one of them. Choose the simplest strategy you can that you understand completely and apply it consistently. If your strategy is too complicated, you will just be confused, and this will lead to mistakes. Additionally, overly complex strategies have too much margin for error.

Janis Urste Best service provider. As has been discussed, Forex is a program for the exchange of foreign currency for global business. By using the information that the above article has provided, you will be better able to understand the benefits that Forex has to offer business and how best to apply these benefits with regards to your situation.

0 notes

Text

Global Financial Solutions Asia Advice For New Forex Traders (And Old Ones As Well!)

Global Financial Solutions Asia Professional tips provider. Trading on the foreign currency exchange, also called forex, can be a great way to make money. It can also be very exciting. It is important to learn to trade without taking too much risk or making rash decisions. Use the tips in this article to learn how to avoid common mistakes and to make the most of your trading experience.

Customer service is something that is overlooked with a software or brokerage service, but you will need to find a customer-friendly service. Most Forex traders are beginners who have a lot of questions. Finding a broker or software system that offers no help beyond what is advertised, is a real let-down. There are great, helpful services out there, so make sure you find one.

With the Forex market being gigantic, the rumor mill surrounding it is also enormous. Always make sure you're avoiding the hearsay and rumors surrounding certain currency pairs. Just look at what happens to investors every decade or so when markets collapse. Avoid this fate by sticking with what is tangible and ignoring the rumors.

When trading in the forex markets, don't always invest the same amount of money in each trade. Your trading position should be a proportion of the amount of capital you have available, not a fixed dollar amount. This helps maximize your potential earnings while minimizing the percentage risk to your equity.

Always do your best to manage risk in Forex trading. Risk management is even more important than profit targets. Remember that one big loss could entirely demolish your trading account, so it is vital that you always follow this rule if you want to be successful and continue with Forex trading.

Regardless of your level of expertise in forex trading, you can benefit from free online forex trading courses. Beginners can learn the basics and experts can learn new strategies. The time invested in these training courses is well-spent as your profits increase by applying your new forex trading knowledge.

Forex trading does not require the purchase of automated software, especially with demo accounts. Just go to the forex website and make an account.

Global Financial Solutions Asia Proficient tips provider. You should avoid trading in a foreign currency that you do not understand. You should start trading in the currency of your country, and perhaps expand to a few other currencies once you feel comfortable. This means you will have to keep track of the value of several currencies on a daily basis.

Set a two percent stop loss for each trade. Forex is never a sure fire game and big wins can turn to losses quickly. It's easy to get wrapped up in the game of it all and risk more of your money than you should. By setting a two percent stop loss you are protecting your account and will stay positive in the market for the long haul.

The momentum line in Forex is always at least one step ahead of the price movement. The momentum line will lead either the advance or decline in prices, so remember to pay attention to this line before you attempt to lock in any trade. Ignoring it may result in some pretty big losses in Forex.

Just like gambling, Forex trading can turn into a dangerous addiction, one that can cause negative consequences. If you feel like you are addicted to Forex trading, you may want to wean yourself off of it. Getting addicted to it could cost you money that you cannot afford to lose.

You can recognize a good investment opportunity when you see small spreads and tight pips. This means you will earn more value and your broker will make less money off your transaction. A rather large spread can also allow you to make money, but you will make more profit proportionally to the money invested with a smaller spread.

You should trade with what you can afford to lose. Use the extra money you have in your bank account, but always ask yourself if there is something better that you could do with this money. Do not base your personal finances on the money you expect to make with forex, in case you are not successful.

Global Financial Solutions Asia Top service provider. If you made a bad trade that resulted on you losing money, do not dwell over it. Move on to the next trade, but be careful to follow your strategy and not to take decisions based on your recent losses. Remember that each trade is independent from the previous one.

Always be careful who you listen to. Don't pay attention to overblown claims. Beginners often make the mistake of believing that a tiny investment will make them rich or make them rich tomorrow. These claims are often being made by others who profit off the naivety of novices because they can't make any money in the market themselves.

Make sure you calculate the risk vs reward radio on every trade you make, not just the big ones. If you fail to make a profit on 10 small trades you'll have a hard time recouping your loss on a single large trade. You want to make double what you're risking for a forex trade to be worthwhile.

Pick and choose a few good trades instead of throwing your money all over the place. Over-trading will not only sap you of money, it will stress you out and stretch you out too thinly. Keeping yourself focused on a couple of trades will help ensure they are successful for you.

One important thing to remember as a beginner at Forex is to start small. If your risk it high it is easy to let emotions rule and lose sight of your goals. By starting with small amounts you can minimize the impact of your emotions and learn to focus on your long-term goals.

Global Financial Solutions Asia Qualified tips provider. In order to make the most of your forex trading experience, you need to learn the basics and avoid the mistakes that many first-time traders make. Use the advice in this article to learn the best way to start forex trading. You can make a lot of money if you use sound advice and stay calm.

0 notes

Text

How much does a forex trading course cost?

If you're interested in diving into the world of forex trading, you've probably considered taking a forex trading course to learn the ropes. Forex trading, or foreign exchange trading, involves buying and selling currencies in the global market to profit from currency fluctuations. It's a complex and dynamic field, and getting proper education can make a significant difference in your success as a trader. However, one common question that arises when it comes to forex trading courses is, "How much do they cost?"

The cost of a forex trading course can vary widely depending on several factors. In this article, we'll explore these factors and give you a better understanding of what to expect when it comes to the price of forex trading courses.

Type of Course:

Forex trading courses come in various formats, each with its own price tag. Here are some common types of courses:

Online Courses: These are often the most affordable option and can range from free to a few hundred dollars. Online courses are self-paced, allowing you to learn at your convenience.

Live Workshops and Seminars: Attending live events, workshops, or seminars conducted by experienced traders can be more expensive, ranging from a few hundred to a few thousand dollars. These events provide a more interactive learning experience.

One-on-One Coaching: Personalized coaching sessions with an expert trader can be the most expensive option, with fees ranging from several thousand to tens of thousands of dollars.

Course Content and Quality:

The depth and quality of the course content can significantly impact the cost. Comprehensive courses that cover a wide range of topics, from fundamental analysis to technical analysis, tend to be pricier. Additionally, courses offered by well-known and reputable institutions or traders may come at a premium.

Duration of the Course:

The duration of the course can affect the cost. Short, intensive courses may be less expensive than longer, more in-depth programs. Some courses are designed to be completed in a few weeks, while others can span several months.

Additional Resources:

Some forex trading courses include access to trading platforms, tools, or trading signals as part of the package. These additional resources can increase the cost of the course.

Support and Mentorship:

Courses that offer ongoing support, mentorship, or access to a community of traders may come with a higher price tag. The value of having guidance and support as you navigate the forex market can be significant.

Reputation and Reviews:

Before enrolling in a forex trading course, it's essential to research the provider's reputation and read reviews from past students. While a course may be expensive, if it has a track record of producing successful traders, it may be worth the investment.

In conclusion, the cost of a forex trading course can vary widely, ranging from free to several thousand dollars or more. It's essential to consider your budget, learning style, and goals when choosing a course. Remember that investing in education can be a valuable step toward becoming a successful forex trader.

If you're looking for a cost-effective way to learn forex trading, JRFX's website offers a range of free resources and constantly updates its platform with various investment techniques. Visit JRFX ( https://www.jrfx.com/?804 ) to explore the world of forex trading and enhance your trading skills at no cost.

0 notes

Text

How Much Does a Forex Robot Cost?

What is a Forex Robot?

A Forex robot is a computer program that uses technical analysis to automatically trade the foreign exchange (Forex) market. These robots are designed to analyze the market and make trades based on predetermined parameters. Forex robots are often used by traders who want to automate their trading strategies and save time. They can also be used by novice traders who want to learn the basics of trading without risking their capital.Forex robots are becoming increasingly popular due to their ability to analyze the market and make trades quickly and accurately. They are also able to make trades without the need for manual intervention. This means that traders can focus on other aspects of their trading strategy while the robot takes care of the trading.

What is EA-VN.COM?

EA-VN Membership is a subscription service that provides traders with access to a range of Forex robots and trading tools. The subscription includes access to a range of robots, tutorials, and resources. The subscription also includes access to a range of trading platforms, including MetaTrader 4 and cTrader.The subscription also includes access to a range of trading strategies and technical indicators. The subscription also includes access to a range of customer support services, including a customer service team and a support forum.

What are the Benefits of EA-VN Membership?

EA-VN Membership provides traders with access to a range of Forex robots and trading tools. The subscription includes access to a range of robots, tutorials, and resources. The subscription also includes access to a range of trading platforms, including MetaTrader 4 and cTrader.The subscription also includes access to a range of trading strategies and technical indicators. The subscription also includes access to a range of customer support services, including a customer service team and a support forum.The subscription also includes access to a range of market analysis tools, including charts, news, and analysis. The subscription also includes access to a range of trading signals and alerts.

How Much Does a Forex Robot Cost?

The cost of a Forex robot varies depending on the features and capabilities of the robot. Generally, the more advanced the robot is, the more expensive it will be. For example, a basic Forex robot may cost as little as $50, while a more advanced robot may cost several hundred dollars.The cost of a Forex robot also depends on the subscription plan you choose. EA-VN offers a range of subscription plans, ranging from basic to advanced. The basic plan is free, while the advanced plan costs $10 per month or $20 3 months, then you can download all the forex ea and indicators on our website.In conclusion, the cost of a Forex robot depends on the features and capabilities of the robot and the subscription plan you choose. EA-VN offers a range of subscription plans, ranging from basic to advanced.

Read the full article

0 notes

Text

Decoding Forex: A Beginner’s Guide to Currency Trading, From a Spanish Trader’s Perspective

Hola, friends around the globe! I’m a Forex trader from the vibrant land of Spain, and I’m here to take you on a journey into the thrilling world of currency trading. Even if you’re new to the concept, don’t fret. By the end of this guide, you’ll have a solid understanding of the basic concepts, terminology, and processes in Forex trading.

Hola, I’m Alejandro Morales, doing my Forex trading from Spain. I’ve been using decodefx.com (Decode Global) for my trades, and trust me, it’s a fantastic platform. It’s user-friendly, secure, and packed with features — everything a trader could ask for. Try it out, I bet you’ll love it as much as I do!

A Snapshot of Forex

In simple terms, Forex, short for “foreign exchange”, is the global marketplace where we trade currencies. It’s a colossal and liquid market, with a daily trading volume surpassing $5 trillion. Forex is a decentralized market — it operates 24 hours a day, five days a week, with trades happening directly between parties across the world.

Dancing with Currency Pairs

In the Forex arena, currencies are always traded in pairs, like EUR/USD (Euro/US Dollar). The first currency, known as the ‘base’ currency, is paired with the second, known as the ‘quote’ or ‘counter’ currency. The exchange rate tells you how much of the quote currency you need to buy one unit of the base currency. If the EUR/USD is trading at 1.20, for instance, you’d need 1.20 US dollars to buy 1 Euro.

Grasping Forex Quotes

A Forex quote comprises a ‘bid’ and ‘ask’ price. The ‘bid’ price represents what you can sell the base currency for, and the ‘ask’ price is what you can buy it for. The ‘spread’ — the difference between these two prices — represents the cost of your trade or the broker’s commission.

The Long and Short of Forex Trading

When you enter a Forex trade, you can go ‘long’ or ‘short’. Going ‘long’ means you’re buying the base currency expecting its value to rise. Going ‘short’, on the other hand, means you’re selling the base currency because you anticipate it will decrease in value.

Leverage: A Powerful Tool

Forex trading is notable for its use of ‘leverage’. Leverage allows you to manage a large sum with a smaller investment. For instance, with a leverage ratio of 100:1, you can control $100,000 with just a $1,000 deposit. But tread lightly — leverage can boost both profits and losses.

The Two Sides of Analysis

A key aspect of successful Forex trading is analyzing the market. This typically involves:

Fundamental Analysis: This involves considering economic data, political events, and social factors that might impact currency values.

Technical Analysis: This involves using charts and indicators to predict how currency prices might move in the future.

The Importance of Risk Management

Forex trading does carry risk, so it’s essential to have a risk management strategy. This can include setting stop-loss orders to limit potential losses and only risking a small portion of your capital on each trade.

Choosing a Forex Broker

To start Forex trading, you’ll need to register with a Forex broker. When choosing, look for a regulated broker with a friendly platform, competitive spreads, and quality customer service.

In Conclusion

Dipping your toes into the Forex trading pool can be a thrilling experience. As long as you understand the basic principles, stay disciplined, and keep learning, you’re on the right track. May your journey in the Forex world be filled with exciting discoveries and successful trades. ¡Buena suerte! (Good luck!)

by Alejandro Morales

0 notes

Text

What is Forex Risk Management? Learn the Basics

Effective Forex risk management allows currency traders to minimize losses that occur as a result of exchange rate fluctuations. Consequently, having a proper Forex risk management plan in place can make for safer, more controlled, and less stressful currency trading. In this piece, we cover the fundamentals of FX risk management and how best to incorporate them into your process.

What is Forex risk management?

Forex risk management comprises individual actions that allow traders to protect against the downside of a trade. More risk means higher chance of sizeable returns — but also a greater chance of significant losses. Therefore, being able to manage the levels of risk to minimize loss, while maximizing gains, is a key skill for any trader to have.

How does a trader do this? Risk management can include establishing the correct position size, setting stop losses, and controlling emotions when entering and exiting positions. Implemented well, these measures can prove to be the difference between profitable trading and losing it all.

Top 5 Fundamentals of Forex Risk Management

1. Appetite for Risk

Working out your appetite for risk is central to proper Forex risk management. Traders should ask: How much am I willing to lose in a single trade? This is particularly important for the most volatile currency pairs , such as certain emerging market currencies . Also, liquidity in Forex trading is a factor that affects risk management, as less liquid currency pairs may mean it is harder to enter and exit positions at the price you want.

If you don’t know how much you are comfortable with losing, your position size may end up too high, resulting in losses that may affect your ability to take on the next trade — or worse.

Let’s say 50% of your trades are winners. In the long term, mathematically you can expect to have runs of multiple losing trades in a row. Over a trading career of 10,000 trades, the odds suggest that you will face 13 sequential losses at some point. This underlines the importance of knowing your appetite for risk, as you need to be prepared, with sufficient money on your account, for when bad runs hit.

So how much should you risk? A good rule of thumb is to only risk between 1 and 3% of your account balance per trade. So, for example, if you have an account of $100,000, your risk amount would be $1,000-$3,000.

2. Position Size

Selecting the right position size , or the number of lots you take on a trade, is important as the right size will both protect your account and maximize opportunities. To select your position size, you need to work out your stop placement, determine your risk percentage and evaluate your pip cost and lot size. For more on how to do these things, click on the link above.

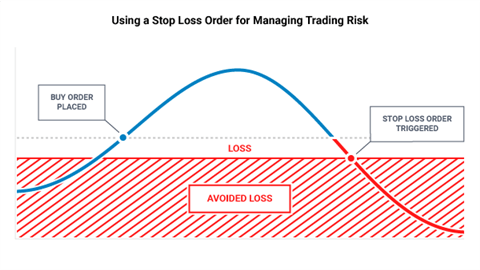

3. Stop Losses

Traders should use stops and also limits to enforce a risk/reward ratio of 1:1 or higher. For 1:1, this means you are risking $1 to potentially make $1. Place a stop and a limit on each trade, ensuring that the limit is at least as far away from current market price as your stop.

The table shows how the outcomes of different risk-reward ratios can change a strategy:

Risk-Reward1–11–2Total Trades1010Total Wins (40%)44Profit Target100 pips200 pips Stop Loss100 pips100 pips Pips Won400 pips800 pips Pips Lost600 pips400 pips Net Gain(-200 pips)200 pips

As can be seen in the table, if the trader was only looking for one dollar in reward for every one dollar risked, the strategy would have lost 200 pips. But by adjusting this to a 1-to-2 risk-to-reward ratio, the trader tilts the odds back in their favor (even if only being right 40% of the time). For a full breakdown of this concept, read more on risk reward ratios for Forex .

4. Leverage

Leverage in Forex allows traders to gain more exposure than their trading account might otherwise allow, meaning higher potential to profit, but also higher risk. Leverage should, therefore, be managed carefully.

While researching how traders fared based on the amount of trading capital being used, Strategist Jeremy Wagner found that traders with smaller balances in their accounts, in general, carried much higher leverage than traders with larger balances. However, the traders using less leverage saw far better results than the smaller-balance traders using levels over 20-to-1. Larger-balance traders (using average leverage of 5-to-1) were profitable over 80% more often than smaller-balance traders (using average leverage of 26-to-1).

Based on this information, at least when starting out, it’s advisable for traders to be very wary of using leverage and to be mindful of the risks it poses.

5. Controlling Your Emotions

It’s important to be able to manage the emotions of trading when risking your money in any financial market. Letting excitement, greed, fear or boredom affect your decisions may expose you to undue risk. To help you take your emotions out of the equation and trade objectively, maintaining a Forex trading journal or log can help you refine your strategies based on prior data — and not on your feelings.

Forex risk management: Top takeaways

In summary, to practice solid Forex risk management, traders should:

Work out their attitude to risk, thinking about risk/reward ratio, position size, and percentage of the account balance for each trade

Place stop losses to protect against the market going against their position

Be wary of leverage and using too much

Keep a handle on emotions

Use a journal to make decisions based on existing data rather than personal feelings.

#youtube#forexbot#accounting#forex online trading#gambit#financialservices#marketing#forex#forextrading

1 note

·

View note

Text

Learn Forex Trading How to Begin Trading on the internet

Understanding how to trade forex can be an extremely lucrative endeavor when you consider the high profits forex can bring you. Be sure, however, that you are learning from the most qualified and reliable sources is essential as there are a lot of online resources on the market with little credit or precision.

From books and videos to videos and tutorials, information is at your fingertips in every format, should you prefer to learn about the art of trading forex by yourself. Additionally, you can seek a teacher to guide you by enrolling in an online course or even a course. Whatever route you take, you should know the steps you need to take to learn forex trading the right way which is the subject of this article.

How can I get started? Forex Trading in 2022 ?

In addition to being one of the trade methods that gained significant traction in recent times, forex trading is gaining a reputation itself as an effective source of income. Knowing how to trade forex isn't an issue as it provides traders with a quick way to earn money. traders trade If you're still not sure about learning how to trade forex, here are some compelling reasons for you to reconsider.

* Easy extra income

Forex trading is an excellent option to increase your income source if are working at a different job. You could turn Forex your main source of income however, to achieve this then you'll need put in lots of time and effort.

* Flexibility

A market for forex is a location that is flexible. The market is available all hours of the day from Sunday through Friday and allows traders to trade whenever they feel comfortable. Furthermore there is the Forex is also accessible by using a mobile device. This makes trading forex accessible at any time and anywhere.

* High liquidity

As the biggest financial marketplace worldwide, Forex offers great liquidity for the investments that traders trade. More than 10 million individuals participate the forex market, and that's not forgetting the huge liquidity. It allows traders to turn their wealth into money by purchasing or selling currency pair quickly.

youtube

* High profit

If executed correctly, forex trading can let you achieve trades that are highly profitable , if you put in a little. With the aid of analysis, signals for trading, plus market information, you can take advantage of very profitable trades.

* Anyone can do forex trading

The art of trading forex is one that doesn't demand much from the trader, even in its most basic form. At the beginning, anyone with or without experience can learn forex trading quickly and for nothing. After a few dollars investors can be involved in the forex market.

How can I learn about forex trading?

Learning forex trading is open for everyone interested in this field. When you're beginning your learning journey, there are two major parts to pay attention to. First,

* Get the basics

Training yourself through any method is a must. Activities like reading articles or following courses videos can help you increase the knowledge you have about Forex. Understanding topics such as the definition of Forex is and how it functions it, who are the market players, and the factors that drive it can help traders grasp the basics.

In addition, terms that are used in the industry like pip and leverage as well as spreads may make the navigation of the forex market much more easily.

Important - Forex trading is a delicate process that has high risks so you should be aware of as much as you can to avoid mistakes that could cost financial loss some brokers even .

* Demo trading

Once you are confident in the forex trading abilities start a demo account and begin trading using it. Demo forex trading accounts are great tools that can aid new and upcoming traders get a better knowledge of the industry.

Demo accounts use virtual currencies in real-world scenarios, so you're not in danger of losing the capital you have invested. If you have made enough demo trades , and feel as though you've entered a real market, you can open a trading account and begin trading.

Learn the basics to Learn Forex trading.

There are several ways you can begin learning about forex trading. Everyone may not have the same amount of time energy, money, or resources to put into trading forex. Because of this, the preferred method of learning can change from one person another. Let's take a look at the most popular methods. allow traders

* Self-learning

Self-learning is by far one of the most effective and accessible method to learn for any new trader. forex market Anyone with access internet has the ability to easily access a numerous number of articles that are about Forex to learn from them.

There are also webinars, video tutorials and websites dedicated to forex traders who are learning about trading.

Most of these strategies can be found for free. Therefore, you don't have to invest money in order to master forex trading. Forex business books a great source to get an knowing of Forex.

* Forex trading courses

If you have some money and some time to devote to forex education, consider enrolling in Forex learning courses.

These forex courses include more well-organized content and will instruct you on the key skills you will need to do to succeed in the forex market.

If you're under the direction of an expert, you will have a much better chance of comprehending what they're teaching you. But the problem for these courses is they tend to go into more topics that aren't appropriate for beginners. If you can find some courses targeted towards beginners at a minimal cost, take it a shot.

"Forex trading" schools

If you're extremely focused on Forex and would like to know everything you need to know, regardless of the time or expenditure, forex schools may be for you. They come with a dedicated staff that has been specially trained to teach Forex and provides the most beneficial forex learning experience.

There are no forex trading schools that are widely used, and the most exclusive cone can cost you thousands. So, be sure you understand what you're about to enter into before.

Demo trading

With the vast availability of forex brokers, selecting the most appropriate one is the first obstacle traders have to overcome. In the selection process, access and the credibility on the demo account are very vital if you're beginner in the field of trading.

When you choose a broker after examining things such as leverage, spread, minimum deposit, and costs, see if the broker is equipped with a demo-account. A good demo account can allow traders to trade an immense amount in virtual money over many years using various methods and features.

Apply a variety of strategies, techniques to trade and strategies until you have found the one that is most appropriate for you. This way, you'll enjoy a better experience dealing with forex.

How much money will you need to get started Forex trading?

Forex trading is an industry that does not require significant investment initially to get things going. Minimum deposit requirements and amount required to trade vary from one broker to the next. Some brokers allow traders to trade for as little as $50.

Make sure to keep in mind that the amount that you deposit directly mirrors the amount that you receive in the form of profits. Features like leverage and tight spreads let traders earn profits that are greater that what they pay at an increased risk.

If you are keen on trading forex begin by preparing at minimum $500 as a solid capital to get started on your trading career. Limiting yourself to using 1 percent of your account balance to trade forex is also a trading practice that the majority of traders follow.

Conclusion

In order to master forex trading as well as you can is an excellent approach to remain ahead the trends. Since Forex is a complex topic beneath the surface having more data on your side can allow you to improve and earn more money from trades earlier than others.

With a thorough understanding of the world of currencies and markets it is possible to make trades that have a higher chance of success.

There are a lot of educational materials offered to users for learning about forex. Utilize them and practice on an account with a demo to get familiar with the market. After that, make use of the versatility of this market and the services offered by the brokers to become the best forex trader you could be.

FAQs

Is it difficult for you to carry out forex trading?

* Forex trading is a craft that is simple to master but is difficult to master. Anyone with basic knowledge about forex can be able to make trades.

Do I require big sum of money to start forex trading?

It is not necessary to have a large capital to start trading in forex. Some brokers will allow traders to begin trading forex from as little as $50.

Are there ways to earn money trading in forex?

* You can earn a decent sum that represents what is deposited when you trade forex. To earn a lot of money from Forex you'll require substantial capital as well as a vast understanding of the topic.

#learn forex trading#how to learn forex trading#learning forex trading#learn forex trading step by step#forex trading learning#learn about forex trading#learn forex trading for beginners#learn forex trading free#best way to learn forex trading#best site to learn forex trading#how do beginners learn forex trading#how much does it cost to learn forex trading#learn forex trading step by step pdf

1 note

·

View note

Text

Decoding Forex: A Beginner’s Guide to Currency Trading, From a Spanish Trader’s Perspective

Hola, friends around the globe! I’m a Forex trader from the vibrant land of Spain, and I’m here to take you on a journey into the thrilling world of currency trading. Even if you’re new to the concept, don’t fret. By the end of this guide, you’ll have a solid understanding of the basic concepts, terminology, and processes in Forex trading.

Hola, I’m Alejandro Morales, doing my Forex trading from Spain. I’ve been using decodefx.com (Decode Global) for my trades, and trust me, it’s a fantastic platform. It’s user-friendly, secure, and packed with features — everything a trader could ask for. Try it out, I bet you’ll love it as much as I do!

A Snapshot of Forex

In simple terms, Forex, short for “foreign exchange”, is the global marketplace where we trade currencies. It’s a colossal and liquid market, with a daily trading volume surpassing $5 trillion. Forex is a decentralized market — it operates 24 hours a day, five days a week, with trades happening directly between parties across the world.

Dancing with Currency Pairs

In the Forex arena, currencies are always traded in pairs, like EUR/USD (Euro/US Dollar). The first currency, known as the ‘base’ currency, is paired with the second, known as the ‘quote’ or ‘counter’ currency. The exchange rate tells you how much of the quote currency you need to buy one unit of the base currency. If the EUR/USD is trading at 1.20, for instance, you’d need 1.20 US dollars to buy 1 Euro.

Grasping Forex Quotes

A Forex quote comprises a ‘bid’ and ‘ask’ price. The ‘bid’ price represents what you can sell the base currency for, and the ‘ask’ price is what you can buy it for. The ‘spread’ — the difference between these two prices — represents the cost of your trade or the broker’s commission.

The Long and Short of Forex Trading

When you enter a Forex trade, you can go ‘long’ or ‘short’. Going ‘long’ means you’re buying the base currency expecting its value to rise. Going ‘short’, on the other hand, means you’re selling the base currency because you anticipate it will decrease in value.

Leverage: A Powerful Tool

Forex trading is notable for its use of ‘leverage’. Leverage allows you to manage a large sum with a smaller investment. For instance, with a leverage ratio of 100:1, you can control $100,000 with just a $1,000 deposit. But tread lightly — leverage can boost both profits and losses.

The Two Sides of Analysis

A key aspect of successful Forex trading is analyzing the market. This typically involves:

Fundamental Analysis: This involves considering economic data, political events, and social factors that might impact currency values.

Technical Analysis: This involves using charts and indicators to predict how currency prices might move in the future.

The Importance of Risk Management

Forex trading does carry risk, so it’s essential to have a risk management strategy. This can include setting stop-loss orders to limit potential losses and only risking a small portion of your capital on each trade.

Choosing a Forex Broker

To start Forex trading, you’ll need to register with a Forex broker. When choosing, look for a regulated broker with a friendly platform, competitive spreads, and quality customer service.

In Conclusion

Dipping your toes into the Forex trading pool can be a thrilling experience. As long as you understand the basic principles, stay disciplined, and keep learning, you’re on the right track. May your journey in the Forex world be filled with exciting discoveries and successful trades. ¡Buena suerte! (Good luck!)

Alejandro Morales

1 note

·

View note

Text

Prosper In The Forex Market Through A Greater Awareness

Pip cupid Top service provider.Have you ever wanted to venture into the foreign exchange market, but were just too intimidated by the whole process? If you really want to learn about forex, there is a lot of helpful information and advice for beginners. Here are some ideas and suggestions to help you get started.

When looking to be a successful Forex trader, it is important that you realize how much of a risk you can take financially. One of the best things about Forex is that you can start with a few hundred dollars, but people who invest more money have a better chance of profiting. So assess your personal risk before joining so you don't end up short-changed.

If you are just starting out in forex trading, avoid overextending yourself by trading in multiple markets at once. You will likely only end up confused. Instead, pick a few major currency pairs that you feel comfortable with, and learn everything you can about their trends. Once you've got the hang of it, you can extend your trading to other currencies.

When placing a stop loss point, never risk more than two percent of the total cost of the initial investment. Limiting your risk in this way, means that you will not lose large amounts of equity in any one market shift. Remember, you can always buy back into a winning currency, but you can't get back the money you lost if you don't sell out in time.

Avoid trading in foreign exchange markets on Mondays and Fridays. Yes, the market is open every day, and since it is international, trades can be done twenty-four hours a day. However, the market is much more volatile on Mondays, when many markets are opening, and on Fridays, when many markets are closing, making it more difficult to see and follow the trends.

Using limit and stop-loss orders when trading on the forex market are essential to making money and reducing losses. In the minute it takes you to place your order the currencies change so using a limit order ensures you get the price you want. Stop-loss limits your risk in the market.

Do not underestimate the power of experience. Make trades, study, and learn. The best Forex traders are those who have been doing it the longest. An experienced trader can see what looks like a great trade on the surface, but they'll know from experience that it's not a good bet. Keep practicing your skills as that is the only way to learn.

Do not place protective stops on round numbers. When placing protective stops on long positions, place your protective stop below round numbers and for short positions set the protective stop above round numbers. This strategy decreases risk and increases the possibility of high profits in all your forex trades.

Pip cupid Qualified tips provider.On the forex market it is tempting to respond enthusiastically to good news for a country by trading in its currrency. This is a mistake. Mainstream news is ultimately external to the forex market, and has not nearly as much to do with the trading as does the activity of the market itself. Good news for a country does not always mean good news for its currency - invest accordingly!

If you plan on day trading in the forex market, be willing to jump on and trade at any time. News that can affect the value of a foreign currency can happen day or night, and you have to be willing to act on it right away if you want to make a quick profit.

A successful trader and an unsuccessful trader have a glaring difference. While the unsuccessful trader is ruined by a downswing, a successful one has the ability to weather the storm. When investing, never risk more than two or three percent of the total account. Several loses in a row is a quick road to ruin otherwise.

Use stocks as long term investments only. Short term stocks can be risky and they can lose a lot of their value very quickly, historically though, stocks have outperformed all other investments. So, when investing in stocks only invest funds that you will not need to access in the short term.

Before trading, formulate a plan and vow to follow it religiously. If you trade without a clear plan, emotions such as hope, fear and greed can influence your trades. Remember, you do not want anything other than market trends and global events to dictate your entry into and exit from the forex market.

If you want to try forex to find out if it is for you or not, you should use internet-based deposits, such as, PayPal. Find a broker that lets you start with small amounts and offer an educational support. For instance, try out brokers such as Marketiva, Forexyard or Oanda.

The momentum line in Forex is always at least one step ahead of the price movement. The momentum line will lead either the advance or decline in prices, so remember to pay attention to this line before you attempt to lock in any trade. Ignoring it may result in some pretty big losses in Forex.

One important thing to note with regards to Forex trading is to define your risk tolerance carefully. In order to find out what kind of trader you are, you must realize what degrees of risks you are comfortable with, and stay away from any trading that may exceed those risk limits.

When trading in the foreign exchange market, you should study the markets carefully. Market fundamentals are important to the success of any foreign exchange trader. Faulty market analysis, while not a career killer, can be detrimental to your overall profit gain and cause more damage for your market mindset in the long run.

Pip cupid Top service provider.Forex is a lot like any other commodities market. What you have learned here is just the beginning. There is much to be learned, and the best thing you can do for yourself is to keep learning as much as you can. If you want to do well, keep these and other tips in mind, and apply them when you are ready to enter the market.

#pip cupid#pip cupid pip cupid#pip cupid most excellent service provider#pip cupid | pip cupid#pip cupid pip cupid#pipcupid

0 notes

Text

Things You Should Know About The Currency Market In India

Indians are well-versed in their nation's equities and stock markets. But a lot of individuals find the Indian currency market to be bewildering. If you want to make money trading forex online, you must have a fundamental understanding of the Indian currency markets. You should educate yourself about investing before you engage in any type of activity.

The same advice that applies to being cautious when you first begin trading on currency markets also applies to being patient while learning how to trade stocks. Since the idea of trading with money may be unfamiliar to you, you might initially feel anxious. However, there are a few fundamentals regarding markets and their operation that you should be aware of before you begin investing. Real-life experiences may teach you more than any book ever could. There are five things you should be aware of because currency exchange is less frequent in India than it is elsewhere.

1. Is currency trading legal in India?

Online forex trading has not gained as much traction in India as other forms of investment. The Reserve Bank of India's restrictions on currency trading are the key reason why investors don't trade currencies. They discover that traditional equity trading, which begins with the opening of a demat account, is simple to comprehend and simple to carry out. But it's not as difficult as it might seem at first to trade currencies in India. For the Reserve Bank of India to permit individuals to trade on the Forex market, the Indian Rupee must be used as the basis currency in all transactions. The list of assets that can be traded has been expanded by the Reserve Bank of India to include GBP-USD, EUR-USD, and USD-JPY. All of them are cross-currency combinations.

2. Understand the various currency markets in India.

It may not be necessary to open a demat account if you wish to trade currencies in India. However, you'll require a Forex trading account, which might be connected to a bank account. Following this, there are two primary categories of currency markets where you can trade. They comprise both futures markets and spot markets. Investors opt to place their money on the futures market due to restrictions on currency trading in India and the poor earnings offered by derivatives utilised in currency trading.

3. What factors affect the Indian Foreign Exchange Markets?

The careful trader should avoid online forex trading. Because monetary and economic fluctuations may have an impact on other nations, you need to be aware of the risks. A variety of geopolitical variables and events affect how much currencies cost. On the other side, central banks frequently have an impact on the forex markets. In order to accomplish this, central banks employ a number of instruments, including those that have an impact on monetary policies, those that alter the conditions under which exchanges are permitted, and those that have an impact on currency markets. The Reserve Bank of India, the nation's central bank, is crucial to how currency markets operate. When necessary, it does this to prevent the Indian Rupee's value from declining.

4. Sign up to trade currency in India

The Securities and Exchange Board of India, also known as SEBI, is in charge of monitoring the intermediaries who operate in the Indian foreign exchange market. You must register with a broker that SEBI has authorized to be regulated if you wish to trade currencies. Brokers who are permitted by SEBI to trade in currencies must hold a valid SEBI license.

5. Trading on the Indian Foreign Exchange Market

The Forex online trading platforms that your broker offers can be used to begin trading on the currency market once you have registered with a SEBI-approved Forex broker and funded your account. Several different trading tactics can help you be successful. However, it's recommended to begin with minor deals if you wish to engage in trading, particularly in countries like India where the foreign exchange market is still developing.

Open an account with Zebu right away to get started trading currencies if you'd like to.

#online trading platform#lowest brokerage#stock market#stock market basics#basics of share market#stock market beginner#stock split#stock trading

0 notes

Video

youtube

What is FX Profitude Creator Russ Horn?

FX Profitude provides deadly accurate, crystal clear signals so you know precisely what your entry and exit points are for any and every trade. The FX Profitude system tells you when there is money to be made on a trade and it is seldom wrong.

FX Profitude shows you only the signals that have high-profit potential so you don't waste your time chasing down false signals.

The FX Profitude System consists of 4 custom-made proprietary powerful indicators, each doing their own job and working together to give you the best signals. It will tell you exactly when to enter and exit trades. This prevents you from overtrading.

FX Profitude Advantages With FX Profitude delivering consistent profitable results, you have the potential for enormous wealth. Profits will follow if you stick to the process. Once you have a live account, you can begin with as little as $50 and gradually grow that account to the point where you can amass massive wealth. And, as you’ve just seen, with a win rate of 91.66% with FX Profitude, you could win far more trades than you lose, allowing you to make a fortune in the shortest amount of time.

FX Profitude Features Review

FX Profitude’s 4 custom-made proprietary powerful indicators will do the heavy work for you. You could trade in as little as 5 minutes per day. FX Profitude is a very straightforward system that uses the market trend to spot big profitable trades. That is why it finds far more profitable trades than unsuccessful ones and it tells you exactly when to enter a buy or sell trade or, even stay out of a trade. Unlike other trading systems, FX Profitude's primary indicator, known as the ARRAY, is specially designed to intelligently analyze the market trend to provide you with more, highly accurate signals.

FX Profitude is the newest forex system that created by Russ Horn the Forex Legend.

Watch the video how it work https://bit.ly/fxprofitude

"Teach a guy to fish, and you will feed him for a lifetime. Help a man get his first fish, and you will feed him for a day."

One of the most charitable people is Russ, both in terms of his knowledge and his time. And being the LEGEND that he is, it comes as no surprise that Russ is not only a consultant to some BIG hedge funds businesses, financial institutions, and high-net-worth individuals, but also one of the most renowned and dependable Forex trainers in the world. And there are more than 10,000 students worldwide... I believe it is safe to claim that he has significantly improved the lives of many people.

Some of his pupils have even gone on to make millions of dollars and rise to the top of the trading world. Russ is the man to go to if you want to learn from someone who has "been there and done that." He is not a paper tiger or a "armchair general" like many other so-called "gurus" out there. All of Russ' claims are supported by experience, knowledge, and—most importantly—results. That’s why…

When Russ Speaks, Wise Traders Pay Attention.

FX Profitude Download https://bit.ly/fxprofitude

High Probability Low-Risk Profit System (HPLRPS). This Secret Profit System reveals everything you need to know about this hidden trading method, and the indicator included in the report also does everything you need to trade profitably. But how much are you willing to pay to potentially identify high probability? Some people buy powerful, robust software programs that cost thousands of dollars, and others hire coaching services from experts that cost almost the same in the end… and while this method could easily sell for $499...You'll get a chance the GRAB THIS Absolutely FREE! Because I want to PROVE to you beyond a shadow of a doubt that having the right tools can make all the difference in your Forex Journey. Accelerate Your Trading Success And Experience Better Trading… Download the Forex HPLRPS indicator.

This will help you identify the best trades and is the key to the HPLRPS Method.

search terms: fx profitude reviews,fx profitude review,fx profitude,fx profitude review 2022,fx profitude login,fx profitude discount,fx profitude software,tradeology fx profitude review,tradeology fx profitude review 2022,fx profitude app,tradeology fx profitude reviews 2022,buy fx profitude,fx profitude indicator,fx profitude system,fx profitude demo,fx profitude live trade,russ horn,shorts,everyday forex,forex beginner,forex indicator,forex system 2022,make money

#fxprofitude #fxprofitudereview #fxprofitudesystem #fxprofitudeindicator #unitedstates #canada #australia #livetrade

https://youtube.com/shorts/_ZNR-RXfe1k

https://youtu.be/m-t3Lp2Uj-0

https://youtube.com/shorts/f2_hzfge-rc

FX Profitude 10 Positions Live Trade https://youtu.be/JPOC_Y1bfcE

#youtube#fxprofitude#fxprofitudereview#fxprofitudesystem#fxprofitudeindicator#unitedstates#canada#australia#livetrade

0 notes

Text

MetaStocks

MetaStocks is a crypto GAMING token created with Anti-Dump Mechanism to protect you from crashes

Today, Chainlink protects tens of billions of dollars across DeFi, insurance, gambling and other critical sectors, and provides a common gateway to all blockchains for global organizations and critical data suppliers.

When it comes to hybrid smart contracts on any blockchain, Chainlink is the gold standard for creating, accessing and selling the oracle services needed to enable them. Using the chainlink oracle network, smart contracts can securely communicate with any third-party API and use off-chain computing to support feature-rich applications.

About Us

MetaStock has provided award-winning analytical tools for independent traders for almost 30 years. Our line of professional-grade trading software and data is designed for active traders of all levels. We have options for day traders, swing traders and position traders to trade stocks, options, futures, FOREX and more. Our global market data gives Thomson Reuters the world leader in real-time data and news. At the heart of MetaStock are PowerTools which give traders the ability to scan the market, backtest, apply buy and sell signals, and even view the possible future price of a particular security with the new FORECASTER MetaStock.

If you are trying to get into the cryptocurrency game, then MetaStock is your best bet. It is a P2E business management game with a powerful artificial intelligence engine developed using Chainlink services.

Company and business

Metastock is a business management game where you have to take on the role of CEO of a COMPANY, buy several companies to become the best CEO of the year.

The game begins when you create your company. You can create as many companies as you want. Each business (node) pays dividends (rewards).

Nodes are collections of data points that reward users for their creation and use. Each node generates a pre-determined number of coins/tokens.

Each token generated can be used to create more nodes to increase the daily reward or sold on the market in exchange for the underlying liquidity paired coin.

The platform gives players the opportunity to create or join their own unique business and manage it by hiring employees and buying assets such as shares and shares. All this will be possible with low transaction fees and no tax payments.

The game begins when you name your company. You can choose a name that is similar to or completely different from your real name, although the name you choose will not determine whether you make money or lose the game.

The only initial cost of setting up a company is the time you spend learning how to use it, but after that your business is free to make as much money as you can handle earning.

The main problem that arises when implementing randomness is that the blockchain does not have a secure native source of randomness. The simplest solution — using a blockhash to generate random numbers — has historically been exploited by validators and miners who secure the underlying blockchain network.

As a verifiable random number generator, Chainlink VRF solves the blockchain randomness problem by combining block data that is still unknown when a request is made with the oracle node's pre-committed private key to generate a random number and cryptographic proof. Metastocks smart contracts will only accept random number input if they have valid cryptographic proofs, and cryptographic tokens can only be generated if the VRF process is tamper-proof. This helps provide users with automated and publicly verifiable evidence directly on the chain that every function in the game using the Chainlink VRF for randomness is provably fair and cannot be tampered with or predicted by oracles, outside entities, or the Metastocks team.

Using Chainlink VRF provides core benefits for our team and our players. For our team, we have a seamless and proven method of implementing random numbers into Metastock. For our players, the Chainlink VRF helps ensure that the integrity of the random number generator — and thus the fairness of in-game outcomes — can be independently verified.

Chainlink Pricing Feed, VR Feed and Guard Integrated Into Metastock

Leverage the chainlink price feed as a tool to help determine company and asset value. The integration of Chainlink Price Feeds, VRF, and Keeper on the mainnet Avalanche, BNB Chain, Fantom, and Polygon was completed by Metastocks on July 17, 2022.

The chainlink price feed requires a stream of high-quality pricing data to determine the overall value of digital assets and player companies. This allows participants to understand the exogenous value of their assets.

It provides decentralized pricing data. This service combines premium data sources and data aggregators to create volume-weighted market asset prices that are resistant to manipulation and cover a wide range of exchanges. Chainlink Price Feeds helps protect tens of billions of dollars for the Web3 DeFi protocol.

By combining the best price data solutions on the market, participants can be sure that all token calculations for digital assets are correct.

Using Keeper comes with a number of key advantages, including the following:

Decentralized Execution

Chainlink Keeper provides reliable, trust-minimized automation that doesn't rely on a single point of failure, reducing the risks associated with centralized servers and manual procedures.

Productivity Boost

Projects using Chainlink Keeper can reduce the amount of time spent on DevOps, reduce the amount of operational overhead, and simplify the software development process.

Enhanced Security

Chainlink Keeper can self-sign on-chain transactions, making it tamper-resistant and immune to Sybil attacks. This allows automatic smart contract execution without revealing the private key.

Simple to use

The codeless graphical user interface of Chainlink Keepers Job Scheduler allows developers to quickly and easily plan time-based automation activities.

Chainlink Keeper Cost Reduction

Run off-chain computing for smart contracts in an efficient manner, allowing developers to create feature-rich decentralized applications (dApps) at lower prices.Key features

P2E Games

A very fun game where you will earn money by creating companies and franchises.

Very low tax

As we know that successful projects are driven by marketing alone, we created a special wallet for this but at the same time with very small taxes to attract new investors.

market

A p2p marketplace for users to buy and sell parts or all of the franchise.

Lend

You can also borrow money from other users to buy franchises.

Metastock at ChainlinkEcosystem

MetaStock is a business management game with a powerful artificial intelligence engine developed using the Chainlink service.

Generate crazy APR with your BNB, AVAX, FTM, MATIC, HECO, ONE, VLX with Metastock decentralized node protocol.

Company Print

Hire employees to earn more money

Create more FREE business with your earnings

Combine your returns and earn passive income. All this with 0 tax tokens.

Chainlink Announcement: August 15, 2022 16:00 UTC

Presale: August 14, 2022 17:00 UTC

Launch: August 15, 2022 17:00 UTC

Play features

P2E Games

A very fun game where you will earn money by creating companies and franchises.

Very low tax

As we know that successful projects are driven by marketing alone, we created a special wallet for this but at the same time with very small taxes to attract new investors.

market

A p2p marketplace for users to buy and sell parts or all of the franchise.

Lend

You can also borrow money from other users to buy franchises

Roadmap

Stage 1

Make landings, games and contracts

Stage 2

Contract audit

Stage 3

Massive marketing with influencers

Stage 4

Launch and pay more marketing

Stage 5

Done developing P2E game

Stage 6

Solving the market, lending and exchanging

Leadership team

Conclusion

Trust-minimized chainlink services play an important role in making Metastocks an engaging, fun and seamless Web3 gaming experience.

“Chainlink effectively fills the gaps for every blockchain native limitation in the most secure and reliable way. After looking through the extensive list of options, we unanimously decided to move forward with only Chainlink services as they provide best-in-class infrastructure for Web3 game developers.” — the Metastock team.

Metastock Information

Web: https://metastock.tech/

Whitepaper : https://metastock-1.gitbook.io/metastock/

SOCIAL LINKS

Main Group https://t.me/metastockportal

Twitter: https://twitter.com/Metastocks_tech

Youtube: https://youtube.com/channel/UCebZpE_xN37tu3OcDO3BPzg

Telegram channel: https://t.me/metastocks_tech

Username: Sidayuu

BTC profile link: https://bitcointalk.org/index.php?action=profile;u=3460659

0 notes

Text

Is it too late to learn Online Forex Trading?

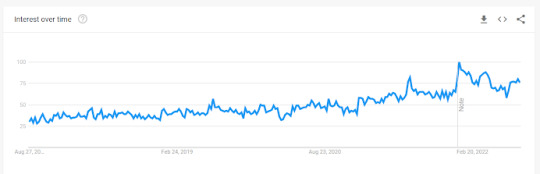

With lifestyle changes and growing inflation, managing costs from the payout of a single job is difficult. Hence, people are constantly searching for different ways to generate passive income. In fact, in the past 5 years, the search volume for the keyword “passive income’ has constantly been soaring.

One of the most common methods has always been investing and trading. Moreover, with the adoption of the internet, online trading has been gaining traction and making itself accessible to the larger mass. While it is regarded as a High Risk High Reward way of generating revenue, the risks are only high when you jump in without any beforehand knowledge.

When Should You learn Online Investing?

Figuratively speaking, investing has no age barrier. Whether you start in your 20’s, 40’s, or even 60’s, different approaches to the trading strategy allow you to reap the benefits of online forex trading. Investing early allows you to experiment with your investments and grants you time to gain better revenues with compounding. When investing in your old age, you have access to more capital, and you would be cautious about investing in the wrong areas based on the experience garnered over the years. Irrespective to when you start, all you need is concrete financial education, which can be built over personal experience or by getting appropriate training and practices from a trusted Online Trading platform.

How to start Online Forex Trading? How much Time does it Take to Learn Trading?

Before starting out, you need to have the right mindset. When starting out, online trading requires time and patience. You need to study the market patterns and ongoing trends and make assumptions based on the predictions. Moreover, how much passive income you generate from online trading also needs to be realistic. Doubling or multiplying your investments over a short period is unrealistic and would always result in disappointment. The trick is to make small improvements and monitor the changes consistently to achieve the long terms goals.

The average time you’ll need to learn online trading depends on different factors such as:

Your goals

Existing trading experience

Available capital

Learning pace

Learning Platform

On average, you need 6 months to gain the necessary skills and knowledge to start out online trading. Additionally, you need to spend 6 more months in trading to gain first-hand experience and identify the nuances of trading in real-time.