#gold ira investment

Text

How to Invest in Gold in an IRA 2024 | Know The Best Way |

How to Invest in Gold in an IRA 2024 | Know The Best Way |

Hello guys welcome to my blog, today I'll talk about How to Invest in Gold in an IRA 2024 | Know The Best Way and I'll tell you my personal experience of it. So let's start the blog,

Steps to start investing in a gold IRA

Follow these four steps to open a gold IRA.

Step 1: Choose a gold IRA company to work with

Choosing a gold IRA company is the first step toward opening your IRA. These companies will help you set up an account, transfer funds, purchase your metals, and send your gold and silver to an approved depository for storage.

In some cases, the company will also act as custodian of your account, meaning it will handle the paperwork and IRS compliance for your IRA.

Gold is a popular investment, and you can choose from many gold IRA companies, each with unique fees, services, and customer service quality. If you're opening a gold IRA, you'll want to choose carefully to ensure you get the best service at the best possible price.

Once you choose your company, you'll need to complete the paperwork to open your IRA and then deposit funds into the account. You'll also need your driver's license (or other state-issued ID) and details from your retirement accounts if you plan to transfer money from a 401(k) or other IRA.

>>>Click Here To Get Your FREE Gold IRA Kit<<<

Step 2: Fund your account

After opening your account, you will need to deposit funds into it before you can start buying and investing in metals.

You have three options for funding your Gold IRA:

Cash Contribution: You can use cash, check or wire transfer to deposit funds into your account, just as you would with a normal savings or investment account. Your bank may charge a fee if you choose a wire transfer.

Rollover: You would use a rollover if you plan to take a distribution from your retirement account and roll it over to your gold IRA. If you want to go this route, contact your current account administrator to get the process started.

You can also choose to take a cash distribution from your account and deposit it into your Gold IRA. Just make sure you do it within 60 days, otherwise you could face a 10% penalty (unless you're over age 59½.)

Transfers: You can also make direct account-to-account transfers. To do this, you will fill out a form with your current account administrator, or your Gold IRA custodian can contact you on your behalf. These types of transfers can take up to five days and are tax and penalty-free.

Most investors choose direct transfers to minimize the potential for hassles and penalties.

Step 3: Select your metals

Once the money has cleared, and your account is funded, you can begin purchasing your gold, silver, and other precious metal investments. The IRS only allows metals of a specific type and purity to be placed in a self-directed IRA, so be careful what you buy.

The exact process for purchasing your metals will depend on which company you open an account with. In some cases, your gold IRA firm will sell IRS-approved metals so you can purchase your coins and bullion from them.

With other companies, you must purchase your investments from a separate precious metals dealer and instruct your custodian to purchase the items on your behalf using your IRA funds.

For example, Oxford Gold Group offers direct metals sales, and you can work with your designated account director to purchase the approved metals of your choice.

Once they are purchased, they are shipped via an insured courier to Delaware Depository Service Company or Brink's Global Services facility for safe and secure storage.

>>>Click Here To Get Your FREE Gold IRA Kit<<<

Step 4: Monitor the performance of your metals

Your ability to monitor the performance of your gold IRA depends on the account custodian. Some companies provide online dashboards to monitor the performance of your investments, but others do not.

If regular updates and insight into the performance of your IRA is a priority for you, ask a representative if the company offers these services. Your custodian should be able to give you access to such monitoring.

What to consider before starting a gold IRA account

Before you open your gold IRA, it’s important to understand how these accounts work and what they entail. Here are the basics:

Type of account

To get started, you need to know what type of account you want to open. Self-directed IRAs can be traditional IRAs or Roth IRAs, and the difference depends on how you want your money to be taxed.

Contribution limits

There is a limit on how much you can invest in a gold IRA, which varies by age.

Store your gold

You must store the gold and silver purchased through a Precious Metals IRA at an approved bank or depository. Some companies market "self-storage" IRAs, but their legality is questionable, and you could face IRS penalties or fines for holding your gold purchases.

That said, you can choose to take your gold, silver or other metals as distributions later once you become eligible. (You can take them earlier, but you'll have to pay a 10% penalty.)

Fees

Gold IRAs come with fees. These can include:

Fees on typical IRA accounts are often much lower (or sometimes nonexistent), and they don’t include storage fees.

Why open a gold IRA?

Making a Gold IRA part of your long-term retirement planning can be a smart move for several reasons. First, it can diversify your portfolio. If you're heavily invested in stocks, mutual funds, exchange-traded funds (ETFs) and other securities tied to the stock market, your portfolio may be at greater risk if the markets struggle.

Investing some of those funds in gold, silver and other precious metals is one way to reduce that risk and ensure that your portfolio can withstand market downturns. (This helps ensure you're not investing too much in one area, so if the value of one type of asset or security decreases, you have investments elsewhere to use during retirement.) .)

Precious metals—and gold in particular—can be an excellent hedge against inflation because their value often increases when the value of the U.S. dollar decreases.

Don't forget about the opportunity for profit. Gold prices have risen in recent years, and many experts believe this will continue to happen.

>>>Click Here To Get Your FREE Gold IRA Kit<<<

How long does it take to open a gold IRA?

You should be able to complete the Gold IRA application process in 10 to 15 minutes. Processing is also fast, and in most cases your account can be opened within one business day.

The rest depends on the speed of your funding. As long as the custodian of your current account responds promptly, transfers and rollovers usually take about seven to 10 business days. Physical checks sent by mail may take longer to deposit into your account.

Again, these deadlines may vary by IRA company, so be sure to ask the firm you're considering.

When can I withdraw from my account?

According to IRS rules, you can begin taking penalty-free distributions from your account at age 59½. Before then, a 10% penalty applies on withdrawals.

Once you reach age 70½ (or 72 depending on your birthday), you will need to take minimum distributions each year. The exact amount will depend on your age, account type and other factors. You can choose to take your distribution in cash or through the actual metals you purchase. These are called "in-kind" distributions.

If you're looking to start a Gold IRA account to diversify your investment portfolio, protect against inflation, boost your long-term wealth, or achieve any other investment goal, be sure to compare your options first. Gold IRA companies can vary, and it is important to choose the best one for your investment goals to ensure a comfortable and hassle-free retirement.

As a starting point, you can check out our picks for the best gold IRA companies.

Gold IRA FAQ

Can I transfer funds from another retirement account to a Gold IRA?

Yes, you can transfer funds from a retirement account, such as a 401(k) or another IRA, to a Gold IRA through a direct transfer or rollover process.

What types of metals can I invest in with a gold IRA?

With a gold IRA, you can invest in a variety of IRS-approved precious metals, including gold, silver, platinum and palladium, subject to specific purity requirements.

How do I store metals in my gold IRA?

The metals in your gold IRA must be stored with an IRS-approved depository to comply with IRS regulations. Self-storage of IRA metals is not legal and may result in penalties.

1 note

·

View note

Text

A Comprehensive Guide to Rolling Over Your 457b into a Gold IRA

Are you interested in securing your retirement funds while diversifying your investment portfolio? In this comprehensive guide, the process of rolling over a 457b into a Gold IRA will be explored in detail. Whether you are a diligent individual looking to maximize your retirement benefits or an experienced investor seeking to safeguard your assets against market volatility, this guide provides…

View On WordPress

#401k to gold ira#401k to gold ira rollover#401k to gold ira rollover guide#457b#457b to gold ira#457b to gold ira rollover#457b to gold ira rollover guide#augusta precious metals#gold investing#gold investment#gold ira#gold ira companies#gold ira guide#gold ira investing#gold ira investment#gold ira rollover#gold ira rollover guide#gold ira rollovers#invest in gold#precious metals ira#what is a gold ira#what is a gold ira rollover

0 notes

Text

Importance of Promoting High Ticket Affiliate Offers

High ticket affiliate offers are products or services that cost hundreds or thousands of dollars and pay you a large commission for every sale or referral. These offers can help you earn more money online with less effort and traffic than low ticket offers.

Here are some of the benefits of promoting high ticket affiliate offers:

– You can earn more money with fewer sales. For example, if you…

View On WordPress

#Affiliate Marketing#CJ Affiliate#email list#Fiverr#Gold IRA Investment#High Ticket Affiliate Offers#Impact#Liquid Web#ShareASale#Shopify#social media

0 notes

Text

Gold Ira Investment

How To Budget Your Gold IRA Investment? Factors That Affect The Cost

Setting up a Gold ira investment account can be wise, especially during uncertain economic times. A Gold IRA account is a self-directed individual retirement account that allows you to invest in physical gold and other precious metals to diversify your portfolio and protect your savings from market fluctuations.

However, before you decide to set up a Gold IRA account, there are some essential things you need to know to ensure that you make informed decisions and maximize your investment potential. In this article, we will discuss some key things you should know when setting up a Gold IRA account:

Eligible Metals

Not all precious metals are eligible for a Gold IRA account. The IRS only allows certain coins and bars that meet specific purity standards. Your coins should be pure.

Make sure you research and choose metals that the IRS approves to avoid tax penalties.

Choosing A Custodian

To set up a Gold IRA account, you must choose a custodian specializing in precious metal investments.

Your custodian will help you purchase and store your metals and ensure that you comply with IRS regulations.

Make sure you choose a reputable and experienced custodian with a track record of providing quality service and security.

Storage Options

One of the most significant advantages of a Gold IRA account is owning and storing your metals physically.

You can choose between storing your metals at an off-site custodian's vault or a private vault at your home.

Consider the costs and risks associated with each option and choose the one that works best for your needs and budget.

Fees And Expenses

Setting up a Gold IRA account involves various fees and expenses, including custodian fees, storage fees, and transaction fees. Ensure you understand all the costs and factor them into your investment decision.

Look for a custodian offering transparent and competitive fees and avoiding hidden fees or high-pressure sales tactics.

Risks And Benefits

Like any investment, a Gold IRA account comes with risks and benefits. While precious metals can offer a hedge against inflation and economic uncertainty, they also come with volatility and liquidity risks.

It's essential to have a balanced and diversified portfolio that includes various asset classes to minimize your overall risk.

Conclusion

Setting up a Gold IRA account is a smart way to protect your savings from market fluctuations and diversify your portfolio. However, it's essential to understand the eligible metals, choose a reputable custodian, consider storage options, factor in fees and expenses, and weigh the risks and benefits.

By researching and making informed decisions, you can maximize your investment potential and enjoy the benefits of owning physical gold and other precious metals.

To know more about the Best gold ira companies, visit our website.

0 notes

Text

Finding the Best Gold Ira Investment and Custodian for You

Finding the Best Gold Ira Investment and Custodian for You

Before investing in a gold IRA, it is essential to do your research. There are a variety of review websites and social media outlets where you can find out what others have to say about precious metals individual retirement account company. You should also visit Better Business Bureau, Business Consumer Alliance, and Trust link to get a feel for a company’s reputation.

Companies

When it comes…

View On WordPress

0 notes

Text

#birch gold group#Birch Gold Group review#401k to gold ira rollover#401k accounts#401k crypto#401k#investors#financial#retirement planning#retirement#gold investment#gold stock#silver stacking#gold coins#silver coins

8 notes

·

View notes

Text

The Benefits of Investing in Physical Gold with Fusco Insurance, Retirement & Wealth Planning Services

The Benefits of Investing in Physical Gold with Fusco Insurance, Retirement & Wealth Planning Services

The Timeless Appeal of Gold

Investing in physical gold has long been considered a wise financial move for those looking to diversify their portfolios and safeguard their wealth. Unlike paper currency, gold has intrinsic value and has stood the test of time as a reliable store of value. Here are some key benefits of investing in physical gold:

Hedge Against Inflation: Gold is often seen as a…

View On WordPress

#Asset Protection#financial security#Fusco Insurance#Gold Investment#Inflation Hedge#Investing#IRA Rollovers#Liquid Assets#Long-Term Value#Physical Gold#Portfolio Diversification#Precious Metal IRAs#retirement planning#Risk Management#Tangible Assets#Wealth Planning

0 notes

Text

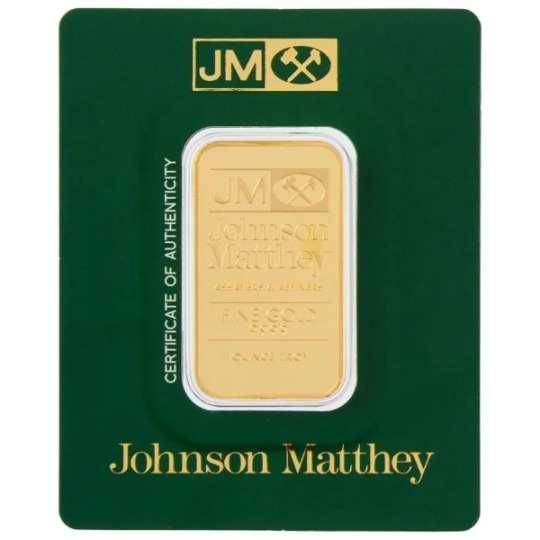

Gold Bullion Bars | Nyfederalgold

Looking for pure Gold Bullion Bars in USA? Nyfederalgold is one of the well-established and trusted organisation for purchasing coins, bullion and bars. We have team of professionals who are there to give you best advice as per your portfolio. You can diversifying your retirement portfolio with precious metals of gold, silver and platinum. You’ll will have a powerful tool to protect your wealth as well as potentially grow it over time.

Visit Here:- https://nyfederalgold.com/

#Gold Bullion Bars#Convert 401K to Gold#401K to Gold IRA Rollover#Gold and Silver Bullion#Gold Is a Great Hedge to Invest#Investing in Gold Bullion#Ny federal gold#Nyfederalgold#Ny federal gold bullion bars#Ny federal gold online

0 notes

Text

Investing in Augusta Precious Metals After Retirement: A Guide to Secure Your Financial Future

Retirement marks a significant milestone in one's life, signaling the end of the traditional workforce and the beginning of a new chapter filled with leisure, travel, and pursuing long-awaited passions. However, with retirement comes the responsibility of managing finances to ensure a comfortable and secure future. One avenue increasingly popular among retirees is investing in precious metals, particularly through reputable companies like Augusta Precious Metals. In this article, we'll explore why investing in Augusta Precious Metals could be a prudent choice for retirees and provide a comprehensive guide to getting started.

Why Augusta Precious Metals? Augusta Precious Metals is a renowned name in the field of precious metal investments, offering a range of products and services tailored to meet the needs of retirees and investors seeking stability and security in their portfolios. Here are some reasons why Augusta Precious Metals stands out:

check full Augusta Precious Metals review here -> https://www.reddit.com/r/postpox/comments/1befkha/augusta_precious_metals_review/

Expertise and Reputation: With years of experience in the industry, Augusta Precious Metals has built a solid reputation for trustworthiness and reliability. Their team of experts provides invaluable insights and guidance to investors, especially those navigating the complexities of retirement planning.

Diverse Investment Options: Augusta Precious Metals offers a variety of investment options, including gold, silver, platinum, and palladium. These metals have historically served as safe-haven assets, preserving wealth during times of economic uncertainty and inflation.

Retirement-Specific Solutions: Augusta Precious Metals specializes in retirement accounts such as Gold IRAs, which allow investors to hold physical precious metals within their tax-advantaged retirement accounts. This offers retirees a hedge against market volatility and currency devaluation, safeguarding their savings for the future.

Transparency and Customer Service: Transparency is key when it comes to investing, especially for retirees who prioritize capital preservation. Augusta Precious Metals prides itself on transparent pricing, no hidden fees, and exceptional customer service, ensuring a seamless investing experience for clients.

Getting Started with Augusta Precious Metals: Now that we understand why Augusta Precious Metals is a compelling option for retirement investing, let's delve into the steps to begin your journey:

Research and Education: Before diving into precious metal investments, take the time to educate yourself about the market dynamics, historical performance, and potential risks. Augusta Precious Metals provides abundant educational resources, including articles, guides, and personalized consultations to help investors make informed decisions.

Determine Your Investment Goals: Assess your financial goals, risk tolerance, and time horizon to formulate a tailored investment strategy. Whether you're looking to preserve wealth, generate income, or diversify your portfolio, Augusta Precious Metals offers customized solutions to align with your objectives.

Open a Gold IRA Account: If you're interested in incorporating precious metals into your retirement portfolio, consider opening a Gold IRA account with Augusta Precious Metals. This process involves selecting a custodian, funding your account, and choosing the desired metals for inclusion. Augusta Precious Metals simplifies this process with dedicated IRA specialists guiding you every step of the way.

Select Your Precious Metals: Once your Gold IRA is established, you can start selecting the specific precious metals to include in your portfolio. Augusta Precious Metals offers a range of products, including coins and bars, sourced from reputable mints and refineries worldwide. Your dedicated account executive can assist you in choosing the right mix of metals based on your preferences and objectives.

Secure Storage and Maintenance: Augusta Precious Metals ensures the safe storage of your physical metals in IRS-approved depositories, providing peace of mind knowing your assets are protected. Regular account reviews and ongoing support from their team help you stay informed and optimize your portfolio as needed.

Conclusion: Investing in Augusta Precious Metals after retirement offers a compelling opportunity to diversify your portfolio, protect against economic uncertainties, and preserve wealth for future generations. With a reputation for excellence, transparent practices, and personalized service, Augusta Precious Metals is well-equipped to guide retirees through the process of precious metal investing with confidence and peace of mind. By following the steps outlined in this guide and leveraging the expertise of Augusta Precious Metals, you can embark on a path towards a financially secure retirement.

Remember, while precious metal investments can offer stability and security, it's essential to consult with financial professionals and conduct thorough research to ensure your investment strategy aligns with your unique circumstances and goals. With prudence and guidance, investing in Augusta Precious Metals can be a valuable addition to your retirement plan, safeguarding your financial future for years to come.

1 note

·

View note

Text

IRA Comparison Guide

Website: https://www.iracomparisonguide.com

Address: 4283 Express Lane, Suite TH1342, Sarasota, FL 34249

Phone: (941) 538-6941

Your ultimate resource for informed financial planning! Offering insights, analysis, and comprehensive reviews on Individual Retirement Accounts (IRAs). Discover expert insights and make informed decisions on gold and silver backed IRAs with IRA Comparison Guide.

#Financial planner#Investment Services#gold ira#precious metal ira#self directed gold ira#silver ira

1 note

·

View note

Text

The Golden Opportunity: Why Gold IRA Investment is Worth Considering

Invest in gold to protect your retirement funds. Invest in precious metals’ growing potential and stability.

How To Start A Gold IRA Investment

A gold IRA investment is a bit different from a traditional IRA investment. Precious metal investment does not provide common assets such as bonds and stocks. It grows your wealth in a different way than a traditional IRA.

Before we look at the best…

View On WordPress

#finance#gold investment#gold ira#gold retirement account#gold savings account#Investing#investment#ira#ira investment#precious metals investment#precious metals ira#retirement#retirement investments#roth-ira#self directed ira

0 notes

Text

Should You Get a Gold IRA? [Updated 2024]

Should You Get a Gold IRA? [Updated 2024]

Hello guys and girls do you want to know about Should You Get a Gold IRA Then You Are at the right place. In this article I will tell you what What Are gold ira is? How does gold ira work? What are the pros and cons of gold ira? FAQs And What Is My Final Opinion?

So let’s start the blog,

Should You Get a Gold IRA: What Is a Gold IRA?

Sometimes known as a precious metals IRA, a gold IRA allows you to hold physical gold as part of your retirement portfolio. Gold can come in a variety of forms, including bars or coins. You can also hold other approved precious metals such as silver, platinum and palladium.

A Gold IRA has the same contribution limits and withdrawal requirements as other IRAs. For example, the contribution limit for an IRA in 2023 is $6,500, or $7,500 if you are age 50 or older.

When you buy gold through a Roth IRA (a gold IRA), you only pay taxes on your contributions, not on the gains," says Colin Plum, CEO of Noble Gold Investments in Los Angeles. “With a traditional IRA, you can postpone paying your taxes until you retire, so you can use that money to invest in other things.

You must wait until age 59 1/2 to take withdrawals. If you do not do so, you may face penalties on the amount withdrawn. After age 72, you must take withdrawals, known as required minimum distributions, from a Traditional IRA. There are no required distributions associated with a Roth IRA during your lifetime.

Diversify your retirement>>>

Learn about simple process and get answers to common questions about gold IRAs.

Get Zero Gold IRA Fees for 10 Years

Get The Link Below...

>>>Get Your FREE Gold IRA Kit Here<<< Click On This Link To Learn More.

How to Set Up a Gold IRA

If you want to open a gold IRA, you'll need to start with a Self-Directed IRA. This is a type of account that gives you more control over your investment options. You also need a custodian, which is a financial institution approved by the IRS to handle self-directed IRAs. You can set up the account as a Self-Directed Roth IRA or a Self-Directed Traditional IRA.

Once you have a Self-Directed IRA, you can add contributions and select investments. For this step, you need a metals dealer who will execute the transaction. When you make investments, they must meet IRS standards in terms of purity and weight.

Advantages and Disadvantages of Gold IRAs

Advantages

Gold IRAs have many of the same benefits as investing in gold. Gold is often used as a hedge against inflation, allowing investors to hedge against uncertainty in the broader market. Furthermore, while it is possible for the price of a specific stock or bond to fall to zero, the price of gold can never go to zero.

A gold IRA also has the same taxs benefits as a normal IRA, allowing interest to accumulate tax-free until the owner is ready to retire. However, there is a penalty if the account holder takes distributions before age 59.

Disadvantages

Due to the additional costs associated with investing in gold, gold IRAs have higher maintenance fees than other types of IRAs. In addition to brokerage fees and account setup fees, the investor must pay additional costs for storage and insurance of the precious metal. They may also be additional charges on top of sales costs and additional account closing fees.

Gold is a highly liquid asset, meaning it may be difficult to find buyers for a large sale without a discount in the price. Furthermore, it is also relatively volatile, meaning the price can rise or fall rapidly. Since IRA owners are required to take distributions when they reach age 73, they may be forced to sell the gold at a lower price than they wished.

Costs of a Gold IRA

Gold investments must be stored in a depository approved by the IRS. You will have to pay the storage fee along with the insurance cost. There are also fees associated with purchasing and shipping precious metals. You may face management fees associated with your custodian, which may be higher than other retirement accounts.

Diversify your retirement>>>

Learn about simple process and get answers to common questions about gold IRAs.

Get Zero Gold IRA Fees for 10 Years

Get The Link Below...

>>>Get Your FREE Gold IRA Kit Here<<< Click On This Link To Learn More.

How to Decide if a Gold IRA Is Right for You

When you have an IRA that is invested in stocks and bonds, you have three ways to grow your money. The fund may appreciate because the shares you purchased are worth more. You can receive dividends from shares and invest them. Reinvesting the interest you earn from bonds or bond funds can also grow your money.

"When you own a hard asset like gold through a gold IRA, you eliminate two of the three ways that your money can grow," says Lambert. "Gold does not pay interest or dividends." You will rely on capital appreciation and time to work in your favor.

Lambert says, "I would challenge people who are thinking of putting their retirement in the hands of a gold IRA to look at the long-term price history of gold and decide if they're willing to bet their retirement on it." Are."

The Bottom Line

Gold IRAs are generally defined as alternative investments, meaning they are not traded on a public exchange and require special expertise to determine pricing. While gold has the potential for high returns, it is easy to be blinded by its shine. Gold prices may fall unexpectedly.

When gold is rising, you also need to decide whether you will buy at the top of the market or near it if you invest at that point.

If you're considering a gold IRA, consult a financial advisor to determine how the metal will fit with your portfolio's overall goals. In general, it is never a good idea to put all your eggs in one asset basket.

If gold seems like a solid option for you, Sentell doesn't suggest putting more than a third of your retirement funds into a gold IRA. Gottlieb recommends investing no more than 10% to 15% of your personal total portfolio in gold, whether in paper form [which is not allowed in gold IRAs] or in physical holdings.

0 notes

Text

A Guide to Safely Investing in a Gold IRA for Retirement at 66

She took the leap and decided to venture into the world of investing in a Gold IRA for her retirement at the age of 66. With a desire to secure her financial future, she embarked on a journey to discover the ins and outs of this safe investment option. In this comprehensive guide, we will explore the essential steps and considerations necessary for anyone looking to safely invest in a Gold IRA.…

View On WordPress

#401k to gold ira rollover#401k to gold ira rollover guide#gold investing#gold investment#gold ira#gold ira for retirement#gold ira for retirement at 66#gold ira for retirement at age 66#gold ira investing#gold ira investment#gold ira rollover#gold ira rollovers#invest in gold#precious metals ira#retirement#retirement investment#retirement plan#retirement planning#roth tsp#thrift savings plan#thrift savings plan explained#tsp strategy#what is a gold ira

0 notes

Text

Best Gold Ira

Gold IRA Investment: What You Need To Know Before You Invest

Investing in gold is becoming increasingly popular as investors look for alternative ways to diversify their portfolios and protect their wealth. One way to invest in gold is through a gold IRA, which allows you to hold physical gold in your retirement account.

However, before you jump into a Best gold ira investment, there are several things you need to know. In this article, we'll answer frequently asked questions to help you understand the ins and outs of investing in a Gold IRA.

What Is A Gold Ira?

A Gold IRA (Individual Retirement Account) is a self-directed IRA that allows you to invest in physical gold and other precious metals.

This type of IRA is designed to help you diversify your retirement portfolio and protect your assets from inflation and market volatility.

Why Invest In A Gold Ira?

Investing in a Gold IRA provides many of perks. Gold has historically been a safe-haven asset that tends to hold its value during economic downturns.

It also has a low correlation to stocks and bonds, which can help reduce your portfolio's overall volatility.

Additionally, a Gold IRA allows you to invest in physical assets that you can hold in your possession, giving you more control over your investments.

How Do I Set Up A Gold Ira?

Setting up a Gold IRA is similar to setting up a traditional IRA. You'll need to find a custodian specializing in self-directed IRAs and allowing for precious metal investments.

You'll then need to fund the account and select the gold products you wish to purchase.

What Types Of Gold Products Can I Invest In With A Gold Ira?

With a Gold IRA, you can invest in various physical gold products, including coins, bars, and bullion. The specific products you can invest in may vary depending on the custodian you choose.

Are There Any Restrictions On Investing In A Gold Ira?

Yes, there are some restrictions on investing in a Gold IRA. For example, you cannot invest in collectible coins with a Gold IRA, as these are not considered qualified investments.

Additionally, there are limits to the amount of gold you can hold in your IRA, which may vary depending on your age and other factors.

How Do I Store My Gold Investments With A Gold Ira?

Your gold investments must be stored securely, such as in a depository or a bank vault.

Your custodian can help you arrange storage and ensure your gold is properly insured.

Conclusion

For those seeking to diversify their retirement portfolios and safeguard their wealth, investing in a Gold IRA can be a great choice.

Understanding the basics of a Gold IRA and the various investment options available allows you to make informed decisions about your financial future.

With the help of trusted Gold Ira Investment, you can set up your Gold IRA and start investing in physical gold products that can provide stability and security for your retirement years.

0 notes

Text

Best Gold Investment Companies Operating on the US Market

This is a list of the best gold investment companies in the US. Article provided by Nikola Roza of nikolaroza.com

https://nikolaroza.com/best-gold-silver-ira-companies/

1 note

·

View note