#fedwatch

Text

This fucker is getting the best 15 seconds of uncomfortable deranged green screen music video footage xe has ever seen in xyr life but first let me solemnly contemplate the mailwoman

#mailwomanposting#fedwatch#4dhxh#kig v2#new single soon#upcoming release#stalemate#twitterposting#journal#am i psychotic#WE GON FINNNNND OUT#finding nemo#lost boys#scam likely#who is you dont call me twin#slatt#slatt 💚#hypocrite#narcissistic personality disorder#crabs in a bucket

0 notes

Text

Nguồn cung dồi dào có xoa dịu căng thẳng tỷ giá hối đoái?

Nguồn cung dồi dào có xoa dịu căng thẳng tỷ giá hối đoái?

Điều bất ngờ là sau hai tuần căng thẳng, tỷ giá ngoại tệ ngày 29/8 có dấu hiệu ổn định trở lại dù đồng đô la Mỹ tiếp tục leo thang trên thị trường toàn cầu.

(more…)

View On WordPress

#bảng Anh#căng thẳng#Chủ tịch Fed#dự báo lãi suất#đồng bạc xanh#đồng đô la#euro#Fed#FedWatch#Hoa Kỳ#Ngân hàng Nhà nước Việt Nam#Quỹ Tiền tệ Quốc tế#thị trường ngoại hối#thị trường toàn cầu#Thụy Điển#Thụy sĩ#tỷ giá#tỷ giá ngoại tệ#Usd#yen Nhật

0 notes

Text

Another Fed Rate Hike – S&P Has Been Up on Announcement Day Four in a Row

Persistent inflation remains a thorn in the market and for the Fed. According to the CME Group’s FedWatch Tool there is a 84.0% probability of a 0.75% increase and a 16.0% chance of a 1% hike tomorrow (as of approximately 4:45 pm est). Treasury bond yields, the U.S. dollar and mortgage rates have all risen briskly in anticipation of the Fed’s next rate increase while the stock market has languished.

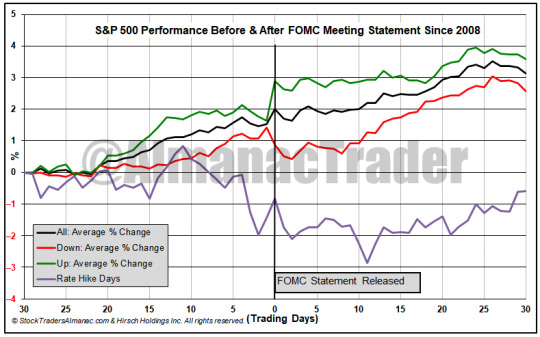

In the chart above the 30 trading days before and after the last 115 Fed meetings (back to March 2008) are graphed. There are four lines, “All,” “Up,” “Down,” and “Rate Hike Days.” Up means the S&P 500 finished announcement day with a gain, down it finished with a loss or unchanged. In 115 Fed meetings, there have been just 13 rate increases. Four have occurred this year. These 13 increases are represented by Rate Hike Days. Of the 13 hike days, S&P 500 was down 7 times and up 6 times with an average gain of 0.63% on all 13. This year’s rate hikes were well received by S&P 500 with gains over 2% in March, May and July and a near 1.5% gain in June. On the day after the last 13 rate hike announcements, S&P 500 has declined 0.74% on average.

2 notes

·

View notes

Text

Welcome to the latest stock Market news for May 16, 2024. Today, the Dow Jones Industrial Average surged to a historic milestone, crossing the 40,000 mark for the first time ever. Investors are buzzing with excitement as the Market continues its upward trajectory. Stay tuned for more updates on this record-breaking day in the world of finance.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

The Dow Jones Industrial Average closed slightly lower Thursday after briefly reaching above 40,000 for the first time. This milestone was achieved due to a bull Market that started in October 2022. Despite a slight pullback in April, the index rallied back in May on the back of strong earnings and favorable inflation readings.

At the end of the trading day, the Dow was down by 38.62 points, closing at 39,869.38. The S&P 500 and the Nasdaq Composite also finished lower, closing at 5,297.10 and 16,698.32 respectively.

The broader Market index saw a new record high, closing above the 5,300 level for the first time ever. The tech-heavy Nasdaq also hit an all-time high. In 2024, the Dow has climbed by nearly 6%, while the Nasdaq and S&P 500 are up 11% each.

Walmart played a significant role in pushing the Dow above 40,000, with the retail giant's stock surging almost 7% on strong fiscal first-quarter results. Other tech-related companies like Amazon, Meta Platforms, and Nvidia have also shown impressive growth year to date.

Expectations of interest rate cuts and optimism surrounding artificial intelligence have boosted investor sentiment. The first Federal Reserve rate cut is anticipated for September, as reported by the CME Group's FedWatch Tool. Tech giants like Amazon and newcomer Meta Platforms have contributed to the Dow's upward trajectory.

Analysts are optimistic about the Market's performance, indicating that the rally still has momentum to continue. This cyclical bull Market shows no signs of slowing down, with investors betting on a resilient economy and strong consumer outlook.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. What is the Dow Jones Industrial Average for May 16, 2024?

The Dow Jones Industrial Average is at 40,000 for May 16, 2024.

2. Why is the stock Market news focused on Dow 40,000?

The Dow hitting 40,000 is a significant milestone and often generates attention as investors track the overall health of the Market.

3. How does reaching Dow 40,000 impact individual investors?

Reaching Dow 40,000 can provide a sense of optimism and confidence for individual investors, as it indicates overall Market growth.

4. Will the stock Market continue to rise after hitting Dow 40,000?

Predicting future stock Market movements is uncertain, but hitting Dow 40,000 can be a positive indicator for continued growth.

5. What other factors are influencing the stock Market news on May 16, 2024?

Various factors such as economic data, corporate earnings, and geopolitical events can also impact stock Market news on May 16, 2024.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Text

Market Review / Outlook of the day Primary Sentiment : Neutral Immediate Trend : Negative with support at lower level BMD Market Re-cap: - Malaysian palm oil futures extended its gains for the second consecutive session, reaching to more-than-one-week high. Market mirrored the continual rise in soybean oil prices, driven by unfavorable weather conditions in Brazil and Russia. Additionally, adverse weather conditions in Indonesia, a major palm oil producer, further bolstered palm prices. - The Malaysian Palm Oil Association (MPOA) projected a 10% rise in output for Malaysia in April compared to March, with Sarawak experiencing the highest surge of 11.3% from the previous month. - Indonesia's meteorological agency cautioned of possible severe weather phenomena from 7th - 13th May, including tornadoes and thunderstorms, which could result in floods and landslides. - There is approximately 64% of Indonesia is set to encounter a dry season from May to August this year, with the hot weather expected to have an adverse effect on palm yields. World Oil and Grains - CBOT Soybean futures exhibited mix performance on Tuesday. Nearby contracts experienced a decline due to profit-taking and spillover pressure from wheat futures, whereas new-crop contracts strengthened. - Soybean planting lagged behind expectations. A report released by the USDA after closed on Monday showed that only 25% of soybeans had been planted, which was lower than the 28% estimated. Over the past week, soybean had climbed due to concerns about floods jeopardizing some unharvested crops in Brazil and dampened U.S. spring planting progress caused by wet weather. Additionally, downward revisions to Argentina's harvest forecast have contributed to the upward trend in prices. Base and Precious Metals - Copper futures surged towards their highest levels in two years on Tuesday due to renewed attention on limited supplies and optimism about increased demand in China, the leading consumer, where officials are strategizing additional steps to support economic growth. - Last week, China announced its intention to bolster the economy through cautious monetary policies and proactive fiscal measures, which entail adjustments to interest rates and bank reserve requirements. - Gold declined on Tuesday after rising in the previous session, with traders maintaining their attention on the likelihood of interest rate reductions by the U.S. Federal Reserve. - According to the CME's FedWatch Tool, traders in the federal funds futures market estimate a probability of around two-thirds that the U.S. central bank will implement rate cuts in September. Market Outlook - Palm oil exhibited a more robust upward yesterday, closing above RM3,900 amid a counter-trend rebound. The price surged by RM68 after fluctuating between RM3,860 to RM3,935. The recent price movement indicates a dominance of bullish sentiment, with the commodity successfully maintaining support around RM3,800. Additionally, hourly stochastic indicators signal an overbought condition. - Today, the market is expected to start with caution, considering the slight price change in U.S. soybean oil overnight and the favorable performance of Dalian palm oil. Opening range: 3910 to 3920 Projected range of the day: 3800 to 4000 Support 3800 Next 3750 Resistance 4050 Next 4100 BMD FCPO Total Open Interest 19/04/2024: 263,873 (-2,908) 22/04/2024: 254,188 (-9,685) 23/04/2024: 254,196 (+8) 24/04/2024: 253,400 (-796) 25/04/2024: 255,102 (+1,702) 26/04/2024: 245,831 (-9,271) 29/04/2024: 241,305 (-4,526) 30/04/2024: 243,746 (+2,441) 02/05/2024: 238,389 (-5,357) 03/05/2024: 230,394 (-7,995) 06/05/2024: 227,559 (-2,835) 07/05/2024: 221,326 (-6,233) Source: Bursa Malaysia Futures

0 notes

Link

Equityworld Trillium Surabaya – Dolar turun awal, membuat emas lebih terjangkau

0 notes

Text

Fed’s Key Inflation Measure Surges 2.8% In March, Exceeding Expectations

(Source – FX Empire)

In March, inflation maintained its upward trajectory, with a pivotal indicator closely monitored by the Federal Reserve indicating persistent price pressures.

The Commerce Department’s report on Friday revealed that the personal consumption expenditures (PCE) price index, excluding food and energy, surged by 2.8% compared to the previous year. This figure remained consistent with February’s reading, surpassing the Dow Jones consensus estimate of 2.7%.

All-Items PCE Price Gauge

When including food and energy, the all-items PCE price gauge registered a 2.7% increase, slightly higher than the estimated 2.6%.

Despite the inflationary data, market response remained subdued, with Wall Street anticipating an upward opening. Treasury yields experienced a decline, with the benchmark 10-year note standing at 4.67%, marking a decrease of approximately 0.4 percentage points during the session. Futures traders, however, exhibited a slightly more optimistic outlook, elevating the probability of two potential rate cuts this year to 44%, according to the CME Group’s FedWatch gauge.

Consumer Spending and Income

Amidst elevated price levels, consumer spending demonstrated resilience, climbing by 0.8% for the month, slightly surpassing the estimated 0.7%. Personal income also witnessed a rise of 0.5%, aligning with expectations and outpacing February’s 0.3% increase.

However, the report indicated a decline in the personal saving rate to 3.2%, reflecting a decrease of 0.4 percentage points from February and a notable decline of 2 full percentage points from the previous year. This decline suggests that households tapped into their savings to sustain spending levels.

Implications for Monetary Policy

The latest inflation data, coupled with Thursday’s concerning figures, is likely to influence the Federal Reserve’s monetary policy stance. With PCE accelerating at a 3.4% annualized rate in the first quarter, well above GDP growth expectations, the Fed is expected to maintain its current interest rate trajectory at least through the summer unless there is a significant shift in economic data.

Fed’s Inflation Target

The Federal Reserve targets a 2% inflation rate, a threshold that the core PCE measure has surpassed for the past three years. The Fed closely monitors the PCE due to its adjustment for changes in consumer behavior and its emphasis on excluding volatile components such as food and energy prices.

The report highlighted a notable divergence in price trends between services and goods. Services prices increased by 0.4% on the month, while goods experienced a modest uptick of 0.1%. This shift reflects a reversal from earlier pandemic-induced trends, where goods inflation dominated. Food prices exhibited a marginal decline of 0.1%, while energy prices rose by 1.2%.

On a 12-month basis, services prices surged by 4%, contrasting with the minimal movement in goods prices, which increased by just 0.1%. Food prices recorded a 1.5% increase, while energy prices saw a gain of 2.6%.

As inflation persists, the Federal Reserve continues to navigate the complex economic landscape, closely monitoring data trends to inform its policy decisions.

Also Read: Federal Reserve Chair Jerome Powell Cautious on Rate Cuts amid Inflation Concerns

0 notes

Text

Mining Update: Bitcoin naar $ 1 Miljoen na halving?

Door Mitchell Weijerman

Welkom bij de nieuwsbrief van deze week, waarin de spanning toeneemt voor de komende halvering van Bitcoin in 2024, een gebeurtenis die de Bitcoin naar nieuwe hoogten zal stuwen! In deze update onderzoeken we hoe Bitcoin op het punt staat om nog schaarser te worden dan goud. Bovendien zet Google zijn stap in de Bitcoin-ruimte door zijn zoekmachine uit te breiden met blockchain-verkenner-mogelijkheden.

We duiken ook in de Amerikaanse banenmarkt en de gevolgen daarvan voor het beleid van de Federal Reserve. Ondertussen zit Sam Bankman-Fried achter de tralies, terwijl Bitcoin sterk blijft presteren en zich opmaakt om de mijlpaal van $1 miljoen te bereiken. De anticipatie rond de halvering is opwindend voor de markt, dus laten we eens duiken in de ontwikkelingen van deze week!

Bi-Wekelijkse Markt veranderingen 23 - 03 / 06 - 04

Nieuws

Arbeidsmarkt VS: Sterker dan verwacht

De Amerikaanse banenmarkt doet het goed. De werkloosheid daalde in maart naar 3,8%, tegen de verwachtingen van 3,9% en de 3,9% van februari . Het overtrof de verwachtingen met de toevoeging van 303.000 banen vorige maand , waar 200.000 was voorspeld. Deze toename van de werkgelegenheid is de sterkste prestatie sinds mei 2023. Een signaal dat de FED nauwlettend in de gaten houdt. Hierdoor zijn de verwachtingen voor de eerste Fed-verruiming verschoven naar juni.

Deze aanhoudende sterke arbeidsmarkt wordt nauwlettend in de gaten gehouden door de Federal Reserve bij haar voorbereidingen. Het werkloosheidscijfer, een belangrijke indicator voor de gezondheid van de arbeidsmarkt, speelt een cruciale rol in het besluitvormingsproces van de Fed met betrekking tot de rentetarieven. Een sterke arbeidsmarkt kan leiden tot loonstijgingen, wat de inflatie kan aanwakkeren, een scenario dat de Fed zorgvuldig wil beheren om haar inflatiedoelstelling van 2% te halen. De huidige werkgelegenheidscijfers kunnen de Fed dus beïnvloeden om de rente te handhaven of aan te passen.

Lagere werkloosheidscijfers duiden meestal op een robuuste economie, maar duiden ook op aankomende inflatiedruk. De Fed, die streeft naar een balans tussen het bevorderen van maximale werkgelegenheid en het beheersen van de inflatie, kan de rentetarieven zo nodig aanpassen om de economische oververhitting te temperen of de groei te stimuleren, wat een direct effect heeft op de markt.

Voorspellingen rentetarieven: Geen renteverlaging in mei

In het licht van de aanhoudende kracht van de arbeidsmarkt heeft de CME Fed Funds Futures markt de kans op renteverlagingen tijdens de bijeenkomst van de Federal Reserve op 1 mei feitelijk van tafel geveegd. Deze aanpassing van de verwachtingen markeert een belangrijke ommezwaai ten opzichte van eerdere voorspellingen aan het begin van het jaar. De grafiek hieronder toont de CME FedWatch Tool die de waarschijnlijkheid van renteveranderingen weergeeft op basis van gegevens van rentehandelaren. We kunnen zien dat voor 1 mei 96% verwacht dat de rente constant blijft (huidige 5,25 - 5,50).

De voorspellingen voor 12 juni geven een andere verwachting weer. De markt verwacht momenteel een kans van 51% op een renteverlaging. Niemand verwacht nog een verhoging. Het feit dat er een renteverlaging op komst is, is bullish voor de markt, want een renteverlaging zal de aandelenprijzen doen stijgen, wat ook positief zal zijn voor de cryptomarkt.

Google implementeert blockchainverkenner in browser

De wereldwijd toonaangevende zoekmachine heeft functionaliteiten toegevoegd voor een Bitcoin blockchain verkenner, die informatie geeft over openbare Bitcoin-adressen. Hoewel er toenemende zorgen zijn over de privacy als gevolg van deze verschuiving, is het een natuurlijke progressie gezien de aard van Bitcoin als een open, transparant grootboek.

De acceptatie van Bitcoin door grote technologieplatforms is een belangrijke stap in de richting van wijdverspreide acceptatie en gebruik. In een toekomst waarin Bitcoin een standaard wordt, kunnen we anticiperen op de integratie ervan in grote techgiganten als Facebook, Apple, Amazon, Google en X, om er maar een paar te noemen. Zoiets voelt nu nog speciaal, maar binnenkort zal het de standaard zijn. Net als je oma die het nut van bankpassen niet begreep, zal Bitcoin de nieuwe standaard worden.

Sam Bankman-Fried 25 jaar opgesloten

Sam Bankman-Fried, is veroordeeld tot 25 jaar achter de tralies, waarmee zijn reis definitief ten einde is. Dit is een signaal voor iedereen in de markt: Het tijdperk van fraude in de ongereguleerde grensstreek is voorbij. Autoriteiten hebben aangetoond dat massale diefstal van miljarden dollars niet ongestraft blijft.

Plan gratis en vrijblijvend een 1 op 1 gesprek met Mitchell Weijerman*

Technische analyse

De stilte voor de bullish storm

Bitcoin heeft momenteel steun gevonden op het $66K-niveau. Op de daily chart schommelt de prijs rond de $70K zonder een uitgebreide beweging in beide richtingen te laten zien.

Er tekent zich een opvallend compressiepatroon af, gekenmerkt door hogere highs en hogere lows die samenkomen. Dit patroon gaat gewoonlijk vooraf aan een significante beweging omhoog of omlaag, waarbij de huidige situatie licht neigt naar een opwaartse uitbraak. Het handelsvolume daalt, wat aangeeft dat de markt zich in een holdingpatroon bevindt, wachtend op een duidelijke richting voordat posities worden ingenomen.

Het weerstandsniveau op $68K wordt momenteel getest, maar de prijs moet deze drempel nog passeren. Mocht er een bullish uitbraak plaatsvinden, dan lijkt het erop dat de markt nieuwe all-time highs zou kunnen bereiken, mogelijk in de richting van $80K. Omgekeerd zou een sterke afwijzing op dit niveau kunnen leiden tot een aanzienlijke daling richting de $60K-steunzone.

Met het halveringsevenement in aantocht en de waargenomen daling van de handelsvolumes, zou dit de stilte voor een significante marktbeweging kunnen zijn. Dit patroon werd ook waargenomen bij de laatste halvering, waar er na een korte dip na de halvering een stormloop van koopactiviteit was.

Bitcoin domineert Ethereum

Laten we eens kijken naar Ethereum. Het ETH/BTC-paar heeft eindelijk het bekende .05-steunniveau doorbroken. Aangezien grote financiële instellingen hun BTC-portefeuilles opbouwen en Ethereum concurreert met verschillende blockchainplatforms voor dominantie in het DeFi-marktaandeel, is het waarschijnlijk dat de ETH/BTC-ratio zijn neerwaartse traject zal voortzetten totdat het nieuwe steun vindt. Het volgende steunniveau ligt op 0,0409. Als het daaronder komt, wordt Ethereum bijzonder interessant voor een investeringsmogelijkheid.

De mogelijke creatie van een ETF voor Ethereum zal de vraag zeker aanzienlijk stimuleren, door beleggers die de piek najagen die werd ervaren met de introductie van Bitcoin ETF's. Volgens de CEO van BlackRock is de creatie van een Ethereum ETF haalbaar.

Volgens de CEO van BlackRock is de oprichting van een Ethereum ETF haalbaar. Voor nu kunnen we wachten en genieten van het delven van Bitcoin.

Ketenanalyse

Halvering op komst: Bitcoin naar 1 miljoen

Nu de halvering van de Bitcoin in 2024 nadert, naar verwachting op 20 april, neemt de verwachting toe. Met bijna 95,7% van het huidige tijdperk achter ons en miners die genieten van een subsidie van 6,25 BTC per blok, is de weg vrij voor belangrijke veranderingen. In tegenstelling tot eerdere halvings is de aankomende gebeurtenis meer een katalysator voor de vraag dan een aanbodschok, aangezien 93% van de eindige Bitcoinvoorraad al in omloop is.

De kernprincipes van Bitcoin zijn schaarste en decentralisatie, die de waarde op lange termijn bepalen. De halvering zal de schaarste van Bitcoin verhogen tot niveaus hoger dan goud! De verlaging van de mijnbouwbeloningen zal de verkoopdruk van mijnbouwers verminderen, waardoor het aanbod subtiel krapper wordt. Maar de belangrijkste katalysator zal zijn dat de markt zich realiseert dat Bitcoin binnenkort schaarser is dan goud in termen van stock-to-flow, een visie op de waarde van Bitcoins geïntroduceerd door PlanB.

PlanB voorspelt dat Bitcoin in de volgende cyclus $1 miljoen kan bereiken. Aangezien dit stock-to-flow model nog niet bewezen heeft dat het fout zit, voegt de voorspelling een extra laag bullishness toe voor wat er na de halvering gaat komen.

Adressen in Winst, Pre-Halving

We hebben twee weken geleden ook naar deze grafiek gekeken. We bevinden ons nog steeds in de rode zone, wat wijst op potentiële verkopen uit portefeuilles. Maar in tegenstelling tot het vorige patroon in 2021 dat in de grafiek wordt weergegeven, naderen we nu de halvering. Daarom zou het niet verstandig zijn om al je zakken te verkopen.

Wees voorbereid; elke dip van meer dan 10% moet worden gezien als een onmiddellijk koopsignaal om Bitcoin met korting te kopen. Ga door met accumuleren, want de halvering staat.

We wensen je een goede week en houd die mining rigs draaiende!

Voor meer informatie over Epic Mining en onze hardware sourcing en hosting diensten, kun je een gesprek plannen met ons team. Elke week analyseren we de beste machines op de markt in termen van ROI. We helpen je graag om aan de slag te gaan of om meer machines aan je portfolio toe te voegen.

*of 1 van Mitchell Weijermans team

Read the full article

0 notes

Text

More Volatility Expected Around Fed Announcement Day

Ever since June’s CPI index was released on July 13, where headline, year-over-year inflation reached a new high for the current cycle of 9.1%, the question has been, will the Fed raise rates by 0.75% or a full 1%? Currently (~1pm est.), the CME Group’s FedWatch Tool is indicating a 75.1% probability of a 0.75% increase and a 24.9% chance of 1%. Tomorrow, the answer will be known when the Fed concludes this month’s meeting. With the Fed so far behind the inflation curve, a full 1% increase might actually be better received by the market. It would accelerate the Fed’s well telegraphed timeline and potentially shorten the duration of pain and uncertainty.

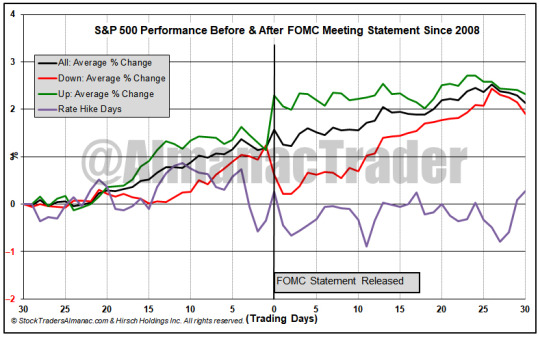

In the chart above the 30 trading days before and after the last 114 Fed meetings (back to March 2008) are graphed. There are four lines, “All,” “Up,” “Down,” and “Rate Hike Days.” Up means the S&P 500 finished announcement day with a gain, down it finished with a loss or unchanged. In 114 Fed meetings, there have been just 12 rate increases. Three occurred this year. These 12 increases are represented by Rate Hike Days. Of the 12 hike days, S&P 500 was down 7 times and up 5 times with an average gain of 0.46% on all 12. This year’s rate hikes were well received by S&P 500 with gains over 2% in March and May and a near 1.5% gain in June. On the day after the last 12 rate hike announcements, S&P 500 has declined 0.90% on average.

2 notes

·

View notes

Text

Centfx

Analysis of Silver Prices: XAG/USD hits a fresh three-year high above $27.00

With gains of over 10%, silver surged strongly and ended the week at three-year highs, having reached levels last seen in June 2021. XAG/USD is up over 2% as of this writing, trading at $27.45 per troy ounce.

An optimistic US employment data that might postpone the Federal Reserve's rate-cutting decision at its June meeting was disregarded by the precious metals market. Market participants lowered their bets on a quarter-percentage-point rate drop in June, while July is still up for grabs, per the CME FedWatch Tool. Silver followed the lead set by Gold, even though the latter is now at record highs. Even though the market is overbought, the Relative Strength Index (RSI) is rising, suggesting that buyers are gaining traction. Having said that, $27.50 and the psychological $28.00 barrier would be the next resistance levels for XAG/USD.

forexsignaltrading #forexstrategy #forexdaytrading #centfx

0 notes

Text

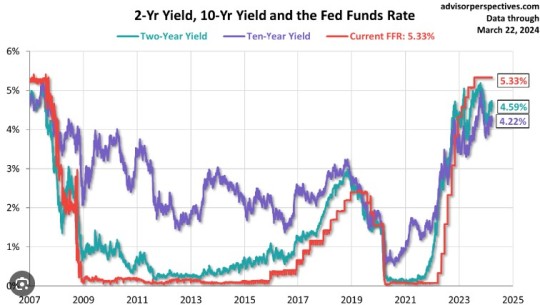

When Growth in not a good thing.

ADP’s private payroll data, released this morning, showed higher growth than anticipated, with 184,000 jobs added in March compared to estimates of 155,000.

Bond traders are currently pricing in a 62% chance of the first Fed rate cut in June, down from 70% last week according to the CME FedWatch Tool.

As the Bond Yields go, so goes the Mortgage Rates.

The graph below provides a clear…

View On WordPress

0 notes

Link

Equityworld Trillium Surabaya – Perhatian investor akan beralih ke data pekerjaan Maret

0 notes

Text

Krispy Kreme ha annunciato un'espansione della partnership nazionale con McDonald's

Gli investitori attendono ulteriori dati macroeconomici per valutare il percorso dei tassi di interesse della Fed.

I riflettori sono puntati sulla lettura cruciale di febbraio dell'indice dei prezzi delle spese per consumi personali (PCE), l'indicatore di inflazione preferito dalla Fed. La pubblicazione è prevista per venerdì, quando i mercati statunitensi saranno chiusi per la festività del Venerdì Santo.

Secondo il FedWatch Tool del CME, gli operatori vedono una probabilità del 69% per un taglio di almeno 25 punti base a giugno, in aumento rispetto al 59% di una settimana fa.

Intanto, gli ordini di beni durevoli sono aumentati più delle attese a febbraio, l'indice immobiliare statunitense FHFA a gennaio ha segnato un -0,1% m/m e +6,3% a/a, mentre l'indice dei prezzi delle case S&P Case-Shiller ha mostrato sempre a gennaio un -0,1% m/m e +6,6% a/a.

Tra le storie di giornata, McCormick ha registrato vendite e utili in aumento nel primo trimestre, UPS ha previsto ricavi in crescita fino a 114 miliardi di dollari nel 2026, Krispy Kreme ha annunciato un'espansione della partnership nazionale con McDonald's.

Guardando ai principali indici, Wall Street riporta una variazione pari a +0,1% sul Dow Jones, mentre, al contrario, l'S&P-500 fa un piccolo salto in avanti dello 0,23%, portandosi a 5.230 punti. In moderato rialzo il Nasdaq 100 (+0,38%); pressoché invariato l'S&P 100 (+0,19%).

Read the full article

0 notes

Text

Bitcoin fiyat performansı kısa vadede piyasa iştirakçilerini endişelendiriyor. Lakin daha geniş Bitcoin birikiminin işaretleri var. BTC yeni haftaya 30.000 doların üzerinde başlıyor. Lakin çok aylık süreç aralığı değişmeyi reddederek hiçbir yere gitmiyor. İşte bu hafta izlenecek 5 şey.Bitcoin fiyat hareketiBTC fiyat hareketi, yatırımcılara trendi değiştirmek ismine ne gerekebileceğini merak ettikleri için hudut bozucu bir deja vu hissinden biraz daha fazlasını veriyor. Düşük vakit dilimlerinde farklılık var. Bitcoin’in tam olarak sahip olmadığı şeyin bir trend olduğunu söylemek daha gerçek olacak. En büyük kripto para ünitesi, boğaların mı yoksa ayıların mı kazanacağına karar veremeden hareket ediyor. Buna nazaran haftalarca üst ve aşağı taraflı hareketler sergiledi. Bu uğraş öngörülebilir bir düzenlilikle devam ediyor. Fakat ne makroekonomik bilgiler, ne kurumsal iştirak ne de diğer bir şey işleri değiştiremedi.Bunu akılda tutarak hareket edelim. Önümüzdeki haftanın Amerika Birleşik Devletleri yahut Federal Rezerv’den gelecek dataların kripto para piyasasını etkilemesi kelam konusu değil. Zincir üzerindeki Bitcoin dataları, yatırımcı tabanı ortasında yine birikim evresine işaret ediyor. Öbür taraftan muhtemelen daha kıymetli bir piyasa hareketinden evvel “fırtına öncesi sessizlik” zihniyetini yansıtıyor. Kripto endişe ve açgözlülük endeksine nazaran, kripto piyasası hassaslığı “nötr” durumda. Şu ana kadar Temmuz ayının en düşük noktasında yer alıyor.Bitcoin haftalık kapanışı volatiliteyi uzak tutuyorBitcoin’in haftalık mum kapanışı canlandırıcı bir biçimde dalgalanmadan vazgeçmeyi tercih etti.Normalde sistemsiz kısa vadeli fiyat hareketlerinin yaşandığı bir devir. Lakin, kapanışta çok az aksaklık var. Öteki taraftan 30.000 dolarlık takviye bile tartışmasız kaldı. BTC/USD böylelikle, üst istikametli likiditeye yönelik bir hareketin yeni yılın en yüksek düzeyleriyle sonuçlandığı ve akabinde dramatik bir düşüşün yaşandığı geçen haftadan bu yana dar bir “mini aralık” içinde devam ediyor. Tanınan trader Daan Crypto Trades, “Bence bu noktada herkes bu aralığı gözleri kapalı görebilir.” diyor.Diğerleri de emsal formda, boğaların aralığı uzun müddet kıramaması nedeniyle Bitcoin için yeni lokal düşük düzeylerin gelebileceği fikrine yaklaştı. Trader Credible Crypto için, bir aydır görülmeyen alan olan 27.400 dolara dönüş masanın dışında değil.https://twitter.com/Crypto_Chase/status/1680778592496631809 Diğer taraftan trader Crypto Tony, 28.300 dolar civarında potansiyel bir aşağı istikametli amaç alanı önerdi. Ayrıyeten bunun “önyargısı olmaya devam ettiğini” ekledi.https://twitter.com/CryptoTony__/status/1680828931409342467 Yerel fiyat noktalarındaki güç açısından, trader Jelle değerli bir noktaya işaret ediyor. Bitcoin’in nispi güç endeksinde (RSI) devam eden bir savaş olduğunu belirtiyor. Ayrıyeten son vakitlerde fiyat yörüngesiyle düşüş eğilimi gösterdiğini vurguluyor. Jelle, son tahlilinin bir kesimi olarak hareket ediyor. Buna nazaran, “Bitcoin geçen hafta düşüş sapmasını ortadan kaldırmaya çalıştı. Lakin süratli bir biçimde darbe aldı.” yorumunu yapıyor.Kazanç dönemi ABD bilgi açıklamalarına öncülük ediyorMakro açıdan ilham verici bir riskli varlık sarsıntısı bekleyenler, ABD’den gelecek değerli dataların eksikliğiyle bu hafta hayal kırıklığına uğrayacak. En kıymetli datalar 20 Temmuz’da teknoloji şirketlerinin çıkarları ve işsizlik müracaatları olacak. Lakin Fed’in faiz artırımına ait kararına yaklaşık iki hafta kaldığı için ufukta dalgalanma kelam konusu.Finansal yorum kaynağı The Kobeissi Letter, yakın tarihli bir toplumsal medya tahlilinin bir kısmında değişik bir cümle kurdu. Cümle “Kazanç dönemi tüm süratiyle devam ediyor. Odak noktasında Temmuz Fed toplantısı var. Ağır birkaç hafta olacak.” halindeydi.https://twitter.com/KobeissiLetter/status/1680577586915622914 CME Group’un FedWatch aracından elde edilen şimdiki iddialara nazaran piyasalar, enflasyonun beklenenden daha süratli gerilediğini gösteren olumlu datalara karşın Fed’in faiz artırımlarına devam edeceğine inanmaya devam ediyor.

17 Temmuz itibariyle, %0,25’lik bir artırım mümkünlüğü neredeyse oybirliği ile %96,1’e ulaştı.Bu ortada izlenmesi gereken bir endeks de, bir yıldan uzun bir müddettir birinci sefer altına düştükten sonra şu anda 100 düzeyini geri almaya çalışan ABD Dolar Endeksi (DXY). Bitcoin daha evvel DXY ile güçlü bir zıt korelasyon sergilemişti. Lakin bu 2023’te kıymetli ölçüde azaldı.Balinalar oyuna geri dönüyorZincir üstü bilgilere dönecek olursak, Bitcoin balinalarının tekrar uyanışı zincir üstü tahlil platformu CryptoQuant’ı heyecanlandırıyor.Katkıda bulunan analist SignalQuant’ın belirttiği üzere, büyük coin dilimlerini yansıtan harcanmamış süreç çıktıları (UTXO’lar) bu yıl klasik boğa piyasası şeklinde artıyor. SignalQuant, 2022’nin ikinci yarısında süratli bir geri çekilmenin akabinde 2023’te balinaların kademeli olarak hayata döndüğünü gösteren UTXO Paha Bantları metriğine atıfta bulundu. CryptoQuant’ın 16 Temmuz’daki Quicktake blog yazılarından birinde enteresan bir yorum var. “Balina grubu’ 2019’da fiyatıyla birlikte artarken, 2023’te de fiyatıyla birlikte yavaş yavaş artıyor. Göstergeleri kademeli olarak artarsa, 1) 2022 sonundaki fiyatının uzun vadeli bir taban olduğundan ve 2) fiyatının artmaya devam edeceğinden daha emin olabiliriz.” diye yazdı.Arz dinamikleri erken boğa piyasası sinyallerini tekrarlıyorZincir üzerindeki en son bilgiler, BTC arzının 30.000 dolar civarında öbür fiyat noktalarından daha fazla hareket ettiğini gösteriyor. Ayrıyeten bu da yatırımcı tabanında kritik bir ilgi noktasını yansıtıyor. Zincir içi tahlil platformu Look Into Bitcoin’e nazaran hareketlilik kelam konusu. Buna nazaran, toplamda 30.200 dolar civarındaki bölgede toplam arzın %3,8’i hareket etti.Aynı vakitte, daha eski, uzun müddettir uykuda olan arz da hayata geri dönüyor. Look Into Bitcoin’in yaratıcısı Philip Swift’e nazaran bu durumun farklı bir istikameti var. Bugüne kadar her Bitcoin boğa piyasasının birinci periyotlarının karakteristik özelliği oldu.Kripto piyasalarından “açgözlülük” kayboluyorOrtalama bir kripto yatırımcısının kararsız tabiatını, klasik hassaslık ölçütü olan Kripto Kaygı ve Açgözlülük Endeksi’nden daha yeterli gösteren çok az şey vardır. Biraz gecikmeli de olsa, Fear & Greed, piyasa iştirakçileri ortasında yerleşik süreç aralıklarında bile süratle değişen ruh halini yakalıyor. Bu durum, üstte bariz bir formda güzelleşen ve aşağıda berbatlaşan hassaslıkla birlikte, kıymetli 30.000 dolar hududu etrafındaki durumdur.Şu anda endeks nötr bölgede, lakin 54/100 ile Temmuz ayının en düşük düzeyinde. Endişe ya da açgözlülükteki aşırılıklar, sırasıyla piyasa toparlanmaları ya da geri çekilmeleri için evvelden ihtar vazifesi görme eğilimindedir.

0 notes

Text

Tổng hợp: Giá sắt lao dốc do áp lực từ cả hai phía cung và cầu

Khép lại phiên giao dịch đầu tuần, sắc đỏ áp đảo trên bảng giá kim loại. Đối với kim loại quý, cả hai mặt hàng đều đóng cửa trong sắc đỏ do áp lực vĩ mô chèn ép. Giá bạc để mất 1,96%, dừng chân tại mức 22,73 USD/ounce. Giá bạch kim chốt phiên tại 881,1 USD/ounce sau khi giảm 3,13%.

Lo ngại Cục Dự trữ Liên bang Mỹ (FED) giữ lãi suất cao lâu hơn so với kỳ vọng trước đây vẫn đang là yếu tố chính gây sức ép lên nhóm kim loại quý, mặt hàng nhạy cảm với lãi suất và biến động tiền tệ. Theo công cụ theo dõi lãi suất FedWatch của CME Group, khả năng hạ lãi suất vào tháng 3 và tháng 5 ngày càng bị hạ thấp và phần lớn kỳ vọng của thị trường hiện tập trung vào khả năng hạ lãi suất từ tháng 6, với xác suất khoảng 70%.

Hơn nữa, trong bối cảnh giá nhà ở và dịch vụ tiếp tục tăng cao, các nhà đầu tư lo ngại chỉ số giá chi tiêu tiêu dùng cá nhân (PCE) của Mỹ được công bố tuần này sẽ tiếp tục tăng. Điều này có thể làm phức tạp thêm quyết định của FED và khiến dòng tiền rời khỏi thị trường kim loại quý. Cụ thể, theo dự báo, chỉ số PCE lõi tháng 1/2024 của Mỹ dự kiến tăng 0,4% so với tháng trước, cao hơn 0,2 điểm phần trăm so với tháng 12/2023 và là mức cao nhất kể từ tháng 4/2023.

Đối với kim loại cơ bản, giá đồng COMEX nối tiếp đà giảm từ phiên cuối tuần trước, chốt phiên tại mức 3,83 USD/pound sau khi giảm 1,69%. Giá quặng sắt cũng để mất 3,84% về 115,43 USD/tấn, mức thấp nhất kể từ cuối tháng 10/2023. Cả giá đồng và giá quặng sắt đều gặp áp lực trước triển vọng tiêu thụ kém sắc tại Trung Quốc, quốc gia tiêu thụ kim loại hàng đầu.

Trang tin Shanghai Metals Market (SMM) cho biết các công trường xây dựng ở nhiều thành phố của Trung Quốc đã bị đình trệ do tình trạng mưa lớn và tuyết.

Hơn nữa, riêng với quặng sắt, dữ liệu từ công ty tư vấn Steelhome cho thấy tồn kho quặng sắt tại các cảng lớn tại Trung Quốc tiếp tục tăng lên, phản ánh nhu cầu chậm chạp. Cụ thể, tồn kho tại các cảng lớn của Trung Quốc đã tăng 2,1% so với tuần trước đó lên 133,1 triệu tấn trong tuần tính đến ngày 23/2, mức cao nhất kể từ tháng 4/2023.

Bên cạnh đó, những lo ngại về rủi ro nguồn cung giảm bớt cũng khiến giá gặp áp lực sau khi tăng hai phiên liên tiếp vào cuối tuần trước. Cơn bão đe dọa các cảng phía tây Australia hiện đang di chuyển ra khỏi khu vực này. Australia là nhà xuất khẩu quặng sắt lớn nhất thế giới và khu vực phía tây Australia là trung tâm khai thác quặng sắt quan trọng nhất của nước này.

Đầu tư hàng hoá

Đầu tư hàng hoá

Đầu tư hàng hoá

0 notes

Text

Bitcoin Drops 2% On Inflation News

Bitcoin dropped to $48,800 as the January Consumer Price Index report showed 3.1% annual inflation, higher than analyst forecasts.

Expectations of a rate cut in May fell to 34% from 52%, CME FedWatch Tool shows.

"Nasty" inflation was short-term damaging, but won't "dampen the mood" in crypto markets, OANDA's Craig Erlam said.

https://www.coindesk.com/markets/2024/02/13/bitcoin-drops-2-on-hotter-than-expected-us-inflation/amp/

0 notes