#famotidine manufacturer

Text

#DBA manufacturer#lumefantrine manufacturers#intermediate manufacturers#famotidine manufacturer#intermediates of famotidine manufacturer#intermediates of famotidine

0 notes

Text

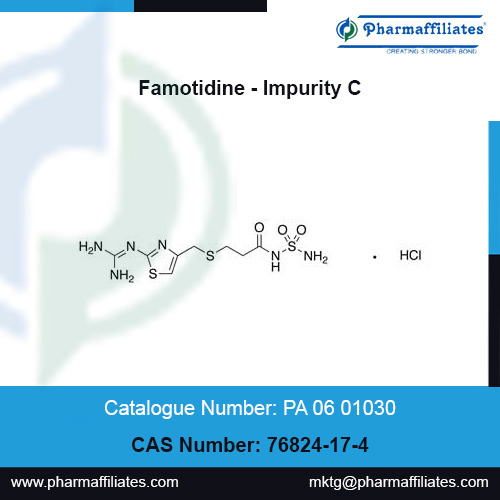

CAS No : 76824-17-4 | Product Name : Famotidine - Impurity C | Chemical Name : [3-[[[2-(Diaminomethyleneamino)-4-thiazolyl]methyl]thio]propionyl]sulfamide Hydrochloride | Pharmaffiliates

Buy highly pure Famotidine - Impurity C, CAS No : 76824-17-4, Mol.Formula : C8H15ClN6O3S3, Mol.Weight : 374.89, from Pharmaffiliates. Login as registered user for prices, availability and discounts.

#CAS No : 76824-17-4#Product Name : Famotidine - Impurity C#pharmacopeial impurities#pharma manufacturing#pharmaffiliates#PA 06 01030#Chemical Name : [3-[[[2-(Diaminomethyleneamino)-4-thiazolyl]methyl]thio]propionyl]sulfamide Hydrochloride

0 notes

Text

GERD Drugs and Devices Market Demand Analysis, Statistics, Industry Growth Research Report till 2027

The Global GERD Drugs and Devices market Report offers extensive knowledge and information about the GERD Drugs and Devices market pertaining to market size, market share, growth influencing factors, opportunities, and current and emerging trends. The report is formulated with the updated and latest information of the GERD Drugs and Devices market further validated and verified by the industry experts and professionals. The report additionally sheds light on the emerging growth opportunities in the business sphere that are anticipated to bolster the growth of the market.

Gastroesophageal Reflux Disease is growing due to the intake of analgesics, smoking, decrease in the prevalence of Helicobacter pylori infection, consumption of certain types of food and drinks, high body mass index (BMI), family history of GERD, and limited physical activity. The growing incidence of the disease will drive the demand for the GERD drug and devices market.

The factors impacting the growth of the market are the rise in the trend of self-medication and increased awareness of GERD. Moreover, the constant occurrence of GERD disorders, as well as changes in lifestyle, are propelling the market demand. The expiration of the patent on most of the drugs is paving the way for new over the counter and generic drugs. The poor reimbursement of procedures and devices, low safety, and efficacy are restricting the adoption of the GERD drugs and devices market.

Click the link to get info@ https://www.emergenresearch.com/industry-report/gerd-drugs-and-devices-market

Some Key Highlights of Report

In November 2020, Sandoz Inc. announced it had shipped pantoprazole sodium to supply the hospitals for injection, 40 mg to Civica Rx. It is a part of a multiyear collaboration for the reduction in supply shortages with several other pipeline medicines.

H2 blockers are a group of drugs that reduces the amount of acid produced by the cell lining of the stomach. They are also known as histamine H2-receptor antagonists but are also known as H2 blockers. They include ranitidine, cimetidine, nizatidine, and famotidine, among others.

The MUSE or Medigus Ultrasonic Surgical Endostapler is an extensive endoscopic device that incorporates the latest technological advancement for the delivery of patient-friendly option for Transoral Fundoplication, the procedure intended for the treatment of GERD.

Overview of the TOC of the Report:

Introduction, Scope, and Overview

Opportunities, Risks, and Drivers

Competition landscape analysis with sales, revenue, and price

Extensive Profiling of the key competitors with the sales figures, revenue, and market share

Regional analysis with sales, revenue, and market share for each region for the forecast period

Country-wise analysis of the GERD Drugs and Devices market by type, application, and manufacturers

GERD Drugs and Devices Market Segmentation based on types

GERD Drugs and Devices Market segmentation based on applications

Historical and forecast estimation

Competitive Landscape:

Furthermore, the report includes an in-depth analysis of the competitive landscape. The segment covers a comprehensive overview of the company profiles along with product profiles, production capacities, products/services, pricing analysis, profit margins, and manufacturing process developments. The report also covers strategic business measures undertaken by the companies to gain substantial market share. The report provides insightful information about recent mergers and acquisitions, product launches, collaborations, joint ventures, partnerships, agreements, and government deals.

Key participants include Johnson & Johnson, AstraZeneca PLC, Takeda Pharmaceutical Company Limited, Pfizer Inc., Novartis AG, GlaxoSmithKline Plc, Merck & CO., Inc., Boston Scientific Corporation, Eisai Co., Ltd., and Ironwood Pharmaceuticals, Inc., among others.

For the purpose of this report, Emergen Research has segmented into the global GERD Drugs and Devices Market on the basis of route of administration, drug type, device type, and region:

Route Of Administration Outlook (Revenue, USD Billion; 2017-2027)

Oral

Parenteral

Drug Type Outlook (Revenue, USD Billion; 2017-2027)

H2 Receptor Antagonist

Proton Pump Inhibitor (PPIs)

Antacids

Device Type Outlook (Revenue, USD Billion; 2017-2027)

MUSE –Medigus Ultrasonic Surgical Endostapler

LINX Management System

Stretta Therapy

Bravo Reflux Testing System

Digitrapper reflux testing system

Others

Key takeaways of the Global GERD Drugs and Devices Market report:

The report sheds light on the fundamental GERD Drugs and Devices market drivers, restraints, opportunities, threats, and challenges.

It elaborates on the new, promising arenas in the leading GERD Drugs and Devices market regions.

It examines the latest research & development projects and technological innovations taking place in the key regional segments.

The research report reviews the regulatory framework for creating new opportunities in various regions of the GERD Drugs and Devices market

It focuses on the new revenue streams for the players in the emerging markets.

Furthermore, the report offers vital details about the rising revenue shares and the sizes of the key product segments.

Thank you for reading our report. Customization of the report is available. To know more, please connect with us, and our team will ensure the report is customized as per your requirements.

Take a Look at our Related Reports:

healthcare it market

https://www.google.bi/url?q=https://www.emergenresearch.com/industry-report/healthcare-it-market

coal tar market

https://www.google.bi/url?q=https://www.emergenresearch.com/industry-report/coal-tar-market

ir spectroscopy market

https://www.google.bi/url?q=https://www.emergenresearch.com/industry-report/ir-spectroscopy-market

eubiotics market

https://www.google.bi/url?q=https://www.emergenresearch.com/industry-report/eubiotics-market

nanotechnology market

https://www.google.bi/url?q=https://www.emergenresearch.com/industry-report/nanotechnology-market

ed-tech and smart classroom market

https://www.google.bi/url?q=https://www.emergenresearch.com/industry-report/ed-tech-and-smart-classroom-market

digital payment market

https://www.google.bi/url?q=https://www.emergenresearch.com/industry-report/digital-payment-market

signal conditioning modules market

https://www.google.bi/url?q=https://www.emergenresearch.com/industry-report/signal-conditioning-modules-market

About Us:

At Emergen Research, we believe in advancing with technology. We are a growing market research and strategy consulting company with an exhaustive knowledge base of cutting-edge and potentially market-disrupting technologies that are predicted to become more prevalent in the coming decade.

Contact Us:

Eric Lee

Corporate Sales Specialist

Emergen Research | Web: www.emergenresearch.com

Direct Line: +1 (604) 757-9756

E-mail: [email protected]

Visit for More Insights: https://www.emergenresearch.com/insights

Explore Our Custom Intelligence services | Growth Consulting Services

0 notes

Text

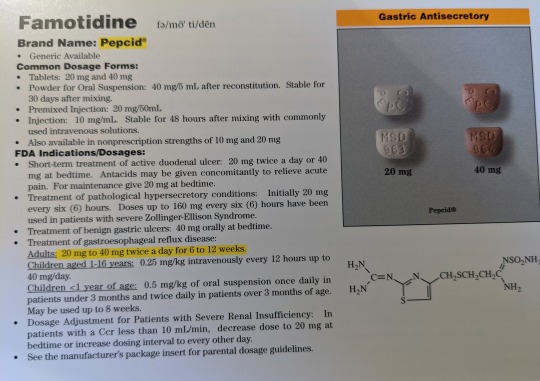

Famotidine

Brand Name: Pepcid

Generic Available

Common Dosage Forms:

Tablets: 20 mg, 40 mg

Powder for Oral Suspension: 40 mg/5 mL after reconstitution. Stable for 30 days after mixing.

Premixed Injection: 20 mg/50 mL

Injection: 10 mg/mL. Stable for 48 hours after mixing with commonly used intravenous solution.

Also available in nonprescription strengths of 10 mg and 20 mg.

FDA Indications/Dosages:

Short-term of active duodenal ulcer: 20 mg twice a day or 40 mg at bedtime. Antacids may be given concomitantly to relieve acute pain. For maintenance give 20 mg at bedtime.

Treatment of pathological hypersecretory conditions: Initially 20 mg every 6 hours. Doses up to 160 mg every 6 hours have been used in patients with severe Zollinger-Ellison Syndrome.

Treatment of benign gastric ulcers: 40 mg orally at bedtime.

Treatment of gastroesophageal reflux disease:

Adults: 20-40 mg twice a day for 6-12 weeks.

Children aged 1-16 years: 0.25 mg/kg intravenously every 12 hours up to 40 mg/day.

Children <1 year of age: 0.5 mg/kg of oral suspension once daily in patients under 3 months and twice daily over 3 months of age. May be used up to 8 weeks.

Dosage Adjustment for Patients with Severe Renal Insufficiency: In patients with a Ccr less than 10 mL/min, decrease dose to 20 mg at bedtime or increase dosing interval to every other day.

See the manufacturer’s package insert for parenteral dosage guidelines.

Pharmacology/Pharmacokinetics:

Famotidine competitively inhibits histamine at the H2 receptors, including receptors on gastric cells. This inhibition is reversible. Both the acid concentration and volume of gastric secretion are suppressed. Changes in pepsin secretion are suppressed. Changes in pepsin secretion are proportional to volume output. Famotidine inhibits basal, nocturnal, and food stimulated gastric secretion. Onset of action occurs within one hour. Duration of action is approximately 10-12 hours.

Drug Interactions:

May decrease warfarin clearance.

Contraindications/Precautions:

Contraindicated in patients hypersensitive to famotidine. Use with caution in patients with impaired renal function. In patients with a creatinine clearance less than 10 mL/min, decrease dose to 20 mg at bedtime or increase dosing interval ti every other day. Use with caution during pregnancy and lactation. Pregnancy Category B.

Adverse Effects:

Headache (4.7%), dizziness (1.3%), constipation (1.2%), diarrhea (1.7%), and transient irritation at the injection site.

Patient Consultation:

Shake suspension well and discard unused portion after 30 days.

Antacids may be given concomitantly to relieve acute pain.

Store in a cool, dry place away from sunlight and children.

If a dose is missed take it as soon as possible. If it is closer to the time of your next dose than the dose you missed, skip the missed dose and return to your dosing schedule. Do not double doses.

Contact a physician if the above side effects are severe or persistent.

0 notes

Text

Regeneron joins Lilly in seeking emergency OK for COVID-19 antibody

Regeneron has followed Eli Lilly in asking the FDA for emergency approval of its COVID-19 antibody therapy, shortly after the drug was thrust into the spotlight by being used to treat President Trump.

The request for emergency use authorization (EUA) for REGN-COV2 comes amid a spike in interest about antibodies against the SARS-CoV-2 coronavirus, driven by Trump’s assertions that the drug was instrumental in his apparently swift recovery from the infection and is a “cure” for COVID-19.

That rise in demand is however already forcing a reality check about how many patients may be able to get REGN-COV2 treatment. In its statement on the EUA request, Regeneron says it has supplies available to treat 50,000 patients, adding that should rise to 300,000 “within the next few months.”

That’s far from what will be needed, points out former FDA Commissioner Scott Gottlieb in a tweet suggesting demand could be more than 7,500 patients per day.

About 15% of Covid cases diagnosed each day are over 65. Based on that age criteria alone, >7,500 patients per day could be indicated for this drug, 225K per month. We need more supply, which may not be possible now for 2020, but could be available in 2021 if we take right steps. https://t.co/zRibzAK0IP

— Scott Gottlieb, MD (@ScottGottliebMD) October 8, 2020

The US has had more than 7.5 million cases of COVID-19 and 213,000 deaths to date, with around 50,000 new cases every day.

Regeneron has been working on ramping up manufacturing capacity for REGN-COV2, with the help of $450 million in funding from the US government, and recently enlisted the aid of Roche to expand capacity. The US has rights to the first 300,000 doses under that funding agreement.

Shares in Regeneron continued their inexorable rise on the news, with another surge after Trump’s comments, and the stock is now trading at twice their value from a year ago at close to $600.

The cocktail of two antibodies targets two components in the spike protein on SARS-CoV-2 with the aim of preventing attachment of the virus to host cells and interrupting infection.

The clinical data behind the EUA comes from a study in 275 patients, and looks promising. The latest readout from the trial showed the drug reduced both viral load and the time to alleviation of symptoms in non-hospitalised patients with COVID-19.

The greatest benefit was seen in patients who had not mounted their own immune response against the virus, according to trial investigators. Results in hospitalised COVID-19 patients are due later this year, and the antibody drug is also being tested for prophylaxis of SARS-CoV-2 infection.

There are still plenty of dissenting voices about REGN-COV2 however, suggesting that it’s far too early to make a judgment on how well it works.

One US physician pointed out that Trump was also treated with dexamethasone – a potent steroid shown clinically to improve survival in COVID-19 – that can make patients feel “20 years younger” – an effect reported by Trump.

The President was also treated with Gilead Sciences’ Veklury (remdesivir) – also shown to reduce the duration of symptoms in trials – as well as various other remedies including zinc and vitamin D supplements, the heartburn drug famotidine, melatonin and aspirin.

Regeneron’s request came hard on the heels of Lilly’s EUA filing for its antibody cocktail LY-CoV555 for use in higher-risk patients who have been recently diagnosed with mild-to-moderate COVID-19. The company has said it could be able to produce up to a million doses of the drug.

Meanwhile, other companies including AstraZeneca and GlaxoSmithKline/Vir are also working on antibody-based therapies for the disease. It’s clear however that if approved, these drugs will have to be used thoughtfully and sparingly to eke out limited supplies.

The post Regeneron joins Lilly in seeking emergency OK for COVID-19 antibody appeared first on .

from https://pharmaphorum.com/news/regeneron-joins-lilly-in-seeking-emergency-ok-for-covid-19-antibody/

0 notes

Text

#Specialty Chemicals#Commodity Chemicals#intermediate manufacturers#sulfamide manufacturer#famotidine manufacturer

0 notes

Text

FDA Warning About Heartburn Medications, What Is The Contaminant?

https://sciencespies.com/news/fda-warning-about-heartburn-medications-what-is-the-contaminant/

FDA Warning About Heartburn Medications, What Is The Contaminant?

The U.S. Food and Drug Administration (FDA) has learned that some acid-reducing and heartburn medicines, including Zantac, contain low levels of a cancer-causing impurity. (Photo Illustration by Paul Hennessy/SOPA Images/LightRocket via Getty Images)

SOPA Images/LightRocket via Getty Images

More

This announcement could give you some heartburn.

The U.S. Food and Drug Administration (FDA) has issued warning about a commonly-used type of heartburn medication. And this warning included some impure thoughts. Testing has found batches of ranitidine to be contaminated with an impurity called NDMA. If you think that this news doesn’t apply to you because you take Zantac, think again. Zantac is actually one brand name for ranitidine. Ranitidine can decrease acid secretion in your stomach acid by blocking histamine H2 receptors and therefore is frequently used to treat stomach ulcers and heartburn, otherwise known as gastroesophageal reflux disease or GERD, which rhymes with turd.

NDMA doesn’t stand for North Dakota-Massachusetts but instead is short for N-nitrosodimethylamine. It’s classified as a probable human carcinogen, meaning that there is a good chance that the compound can cause cancer. If you’ve heard of this chemical compound before, it may be because this was the contaminant found in certain blood pressure medications, Angiotensin II Receptor Blockers (ARBs), last year, as I covered previously for Forbes.

If you recall, NDMA contamination did result in blood pressure medication recalls. So the obvious questions are will ranitidine be recalled, what should you do if you are taking ranitidine, and what rhymes with ranitidine? The answers are “no, not at the present moment”, “talk to your doctor and possibly select an alternative medication”, and “passionate scene or plasma choline.”

The levels of NDMA detected in the ranitidine were apparently quite low, lower than the levels found in the blood pressure medications that were recalled. Ingesting such levels probably won’t put you at risk for developing cancer. There is a good chance that you have already been exposed to NDMA since it can be a contaminant in your environment, food, and water. What matters is how much goes into your body over time. As a result, it is a good idea to try to minimize your intake of NDMA.

Therefore, while the FDA “is not calling for individuals to stop taking ranitidine at this time,” you may want to find alternatives if you can. Ranitidine is certainly not the only medication available for heartburn, stomach ulcers, and other stomach acid-related problems. There are other H2-receptor blockers that work by the same mechanism as ranitidine. These include nizatidine (sold via the brand name Axid), famotidine (Pepcid, Pepcid AC), and cimetidine (Tagamet, Tagamet HB). All of these also sort of rhyme with “passionate scene” and “plasma choline.”

If you are on ranitidine, check with your doctor. You may not even need to be on such medications. For example, for heartburn, there are a number of options including lifestyle modifications such as eating less oily or acidic foods, cutting down on alcohol intake, adjusting when and how you sleep, and wearing more loose-fitting clothes (i.e., no more spandex tuxedos).

With all the blood pressure medication recalls over this past year, this latest FDA announcement does seem like déjà vu all over again. The question is whether drug manufacturers are maintaining appropriate safety and quality control measures and how these are being monitored. As more and more manufacturing is being done overseas, it can be harder and harder to keep track of what’s happening. It can be tempting to cut manufacturing costs but producing drugs is not the same as making handbags. Even a small mistake can have serious consequences. The thought of that alone could give you heartburn.

#News

0 notes

Text

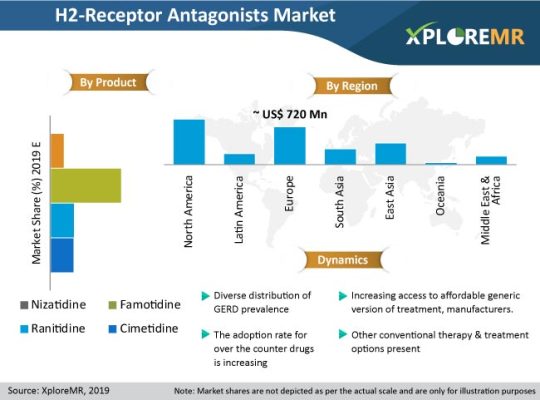

Global H2 Receptor Antagonist Market research Likely to Emerge over a Period of 2019-2029

A recent market study published by XploreMR - “H2 Receptor Antagonist Market: Global Industry Analysis 2014-2018 & Forecast, 2019-2029” consists of a complete research on the most important market dynamics influencing the same. A thorough research on the factors levelling the current growth parameters of the H2 receptor antagonist market is explained, the present growth prospects for the market are obtained with maximum precision.

The H2 receptor antagonist market report features the unique and salient factors that are likely to significantly impact the development of the H2 receptor antagonist market during the forecast period. It can help market players to modify their manufacturing and marketing strategies to envisage maximum growth in the H2 receptor antagonist market in the upcoming years. The report provides detailed information about the current and future growth prospects of the H2 receptor antagonist market in the most comprehensive manner for the better understanding of readers.

Chapter 1 – Executive Summary

The H2 receptor antagonist market report commences with an executive summary of the key findings and key statistics of the H2 receptor antagonist market. It also includes the market value (US$ million) estimates of the leading segments of the H2 receptor antagonist market.

Get Sample Copy of this report @ https://www.xploremr.com/connectus/sample/3989

Chapter 2 – Market Overview

Readers can find detailed market structure including all the inclusions and exclusion, which helps the reader understand the scope of the H2 receptor antagonist market report. This section also includes prominent definition for H2 receptor antagonist market, which helps understand the basic information about the H2 receptor antagonist. This section also highlights the inclusions and exclusions,

Chapter 3 – Key Market Trends

This section explains about the key trends followed by the manufacturer and consumer in H2 receptor antagonist market. This section provides list of key major mergers and acquisitions which helps in building a comprehensive understanding. Major product offerings form each manufacture is also marked in this chapter. Competition of Zantac v. Tagamet is also briefly explained. It helps reader to understand trends impacting the growth of H2 receptor antagonist market.

Chapter 4 – Key Success Factors

This chapter highlights the key success factors of the H2 receptor antagonist market report, which include disease epidemiology, key regulations, clinical trials, five forces analysis and a competitive assessment for drug types. Readers can find the detailed requirements and scenarios present in the H2 receptor antagonist market.

Chapter 5 – Global H2 Receptor Antagonist Market: Pricing Analysis

This section highlights the average price of H2 receptor antagonist in different region throughout the globe. The pricing benchmark for manufacturer level pricing and distributor level pricing is analysed in this section.

Chapter 6 – Global H2 Receptor Antagonist Market Value Analysis 2014-2018 & Forecast, 2019-2029

This section explains the global market analysis and forecast for the H2 receptor antagonist market. It also highlights the incremental opportunity for the H2 receptor antagonist market along with the absolute dollar opportunity for every year between the forecast period of 2019-2029.

Chapter 7 – Market Background

This chapter explains the key macro-economic factors that are expected to influence the growth of the H2 receptor antagonist market over the forecast period. Along with macroeconomic factors, this section also highlights the opportunity analysis for the H2 receptor antagonist market. This chapter also highlights the key dynamics of the H2 receptor antagonist market, which include the drivers and restraints.

Chapter 8 – Global H2 Receptor Antagonist Market Analysis 2014-2018 & Forecast, 2019-2029, By Drug Type

Based on drug type, the H2 receptor antagonist market is segmented as Cimetidine, Ranitidine, Famotidine and Nizatidine.

Request for Check Discount @ https://www.xploremr.com/connectus/check-discount/3989

Chapter 9 – Global H2 Receptor Antagonist Market Analysis 2014-2018 & Forecast, 2019-2029, By Indication

Based on Indication, the H2 receptor antagonist market is segmented as Gastric Acidity, Peptic Ulcers and gastroesophageal reflux disease. This section helps readers understand the penetration of H2 receptor antagonist market over the forecast period.

Chapter 10 – Global H2 Receptor Antagonist Market Analysis 2014-2018 & Forecast, 2019-2029, By Dosage Form

Based on dosage form, the H2 receptor antagonist market is segmented as tablet, solution for injection, suspension, capsule and syrup. In this chapter, readers can understand the global market attractive analysis based on dosage form

Chapter 11 – Global H2 Receptor Antagonist Market Analysis 2014-2018 & Forecast, 2019-2029, By Distribution Channel

Based on distribution channel, the H2 receptor antagonist market is segmented as hospital pharmacies, retail pharmacies, online pharmacies and drug stores. In this chapter, readers can understand the global market attractive analysis based on distribution channel segment.

Chapter 12 – Global H2 Receptor Antagonist Market Analysis 2014-2018 & Forecast, 2019-2029, By Region

This chapter explains how the H2 receptor antagonist market will grow across various geographic regions such as North America, Latin America, Europe, East Asia, South Asia, Oceania and the Middle East & Africa (MEA).

Chapter 13 – North America H2 Receptor Antagonist Market Analysis 2014-2018 & Forecast, 2019-2029

This chapter includes a detailed analysis of the growth of the North America H2 receptor antagonist market along with a country-wise assessment, which includes the U.S. and Canada. Readers can also find the key takeaways of this region, and market growth based on drug type, indication, dosage form, distribution channel and country for North America H2 receptor antagonist market

Chapter 14 – Latin America H2 Receptor Antagonist Market Analysis 2014-2018 & Forecast, 2019-2029

This chapter contains a snapshot of the Latin America H2 receptor antagonist market. It includes the growth prospects of the H2 receptor antagonist market in the leading LATAM countries such as Brazil, Mexico and the rest of Latin America region.

Chapter 15 –Europe H2 Receptor Antagonist Market Analysis 2014-2018 & Forecast, 2019-2029

This section contains important growth prospects of the H2 receptor antagonist market based on drug type, indication, dosage form, distribution channel in several European countries, such as the U.K., Germany, France, Italy, Spain, Benelux, Russia and the rest of Europe.

Chapter 16 –East Asia H2 Receptor Antagonist Market Analysis 2014-2018 & Forecast, 2019-2029

This chapter highlights the growth of the H2 receptor antagonist market focusing on China, Japan and South Korea. This section also helps readers understand the key factors that are responsible for the growth of the H2 Receptor Antagonist market in East Asia.

Chapter 17 – South Asia H2 Receptor Antagonist Market Analysis 2014-2018 & Forecast, 2019-2029

India, Indonesia, Thailand, Malaysia are the leading countries in the South Asia region that are taken as the prime subjects of assessment to obtain the growth prospects of the South Asia H2 receptor antagonist market. Readers can find detailed information about the growth parameters of the South Asia H2 Receptor Antagonist market during the period 2019-2029.

Chapter 18 – Oceania H2 Receptor Antagonist Market Analysis 2014-2018 & Forecast, 2019-2029

Readers can find important factors that can significantly impact the growth of the H2 receptor antagonist market in Australia and New Zealand during the forecast period based on the market segmentation.

Chapter 19 – MEA H2 Receptor Antagonist Market Analysis 2014-2018 & Forecast, 2019-2029

This chapter provides information about the growth of the H2 receptor antagonist market in the major countries of the MEA region, such as GCC Countries and South Africa, during the period 2019-2029.

Request Methodology of this report @ https://www.xploremr.com/connectus/request-methodology/3989

Chapter 20 – Competition Landscape

In this chapter, readers can find a comprehensive list of all the leading manufacturers in the H2 receptor antagonist market, along with detailed information about each company, which includes the company overview, revenue shares, strategic overview, and recent company developments. Some of the players featured in the H2 receptor antagonist market report, are Abbott, Alembic Pharmaceuticals Ltd, Cadila Healthcare Ltd, Caple, Cipla Ltd., Dr Reddy'S Laboratories Ltd., Glenmark Pharmaceuticals Ltd., Helios Pharmaceuticals, Intas Pharmaceuticals Ltd., Sanofi S.A., Teva Pharmaceutical Industries Ltd. and GlaxoSmithKline Plc.

Chapter 21 – Assumptions and Acronyms

This chapter includes a list of acronyms and assumptions that provide a base to the information and statistics included in the H2 receptor antagonist market report.

Chapter 22 – Research Methodology

This chapter helps readers understand the research methodology followed to obtain various conclusions and important qualitative information & quantitative information about the H2 receptor antagonist market.

About us:

XploreMR is one of the world’s leading resellers of high-quality market research reports. We feature in-depth reports from some of the world’s most reputed market research companies and international organizations. We serve across a broad spectrum – from Fortune 500 to small and medium businesses. Our clients trust us for our unwavering focus onquality and affordability. We believe high price should not be a bottleneck for organizations looking to gain access to quality information.

Our team comprises an eclectic mix of experienced market research specialists, search engine specialists, web designers, online marketers, and business writers. The team is highly committed to going above and beyond, and serving the research needs of our clientele.

Contact us:

111 North Market Street, Suite 300,

San Jose, CA 95113, United States

Tel: +1-669-284-0108

E-mail: [email protected]

Website: www.xploremr.com

0 notes

Text

Antacid Medications Market – Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2018 – 2026

Antacids are used to treat acid reflux that causes heartburn, indigestion, and stomach upset. They provide quick relief from heartburn, which is a major symptom of gastroesophageal reflux disease and indigestion. Treatment with antacids is symptomatic and is usually recommended for minor symptoms. Antacids include magnesium carbonate, aluminum hydroxide, and magnesium trisilicate. Some people have reported allergic reactions to antacids. Antacids with magnesium may cause diarrhea, while those containing calcium and aluminum may cause constipation. Long-term use may cause kidney stones and may increase the risk of contracting osteoporosis. Popular antacid brands include Alka seltzer, Gelusil, Milk of Magnesia, Maalox, Gaviscon, Mylanta, Rolaids, and Tums.

Request Sample: https://www.coherentmarketinsights.com/insight/request-sample/91

Antacid medications market taxonomy – Formulation, Drug and Demographic

Antacid medications market is classified by various ways such as by formulation, drug and Demographic. On the basis of formulation, the antacid medications market is classified as tablets, capsules, suspensions, and drops. On the basis of demographic, antacid medications market is classified as products for pediatrics and products for adults. On the basis of drug, antacid medications market is classified as histamine-2 (H2) blockers, proton pump inhibitor, and pro-motility agents. Examples of H2 blocker include Nizatidine, Ranitidine, Cimetidine, and famotidine. Proton pump inhibitors used for acid reflux include Rabeprazole, Esomeprazole, Lansoprazole, Pantoprazole, and Omeprazole. Pro-motility agents stimulate the muscles of gastrointestinal tract and strengthen lower esophageal sphincter, and reduce reflux into esophagus. Metoclopramide is used to treat heartburn associated with GERD.

Increasing incidence of acid reflux in North America fueling growth of the antacid medications market

Increasing trend of self-medication consequently fuels demand for OTC digestive products for treatment of gastrointestinal distress. Antacids are used to neutralize acidity and thus, are expected to lead to rampant increase in demand for the same in North America due to rising incidence of gastroesophageal reflux disease (GERD) in the region. According to a study conducted by American Gastroenterological Association and published in International Foundation for Functional in February 2016, approximately one-third of the population in U.S. suffers from GERD. According to a study published in National Center for Biotechnology Information (NCBI) in June 2014, the range of GERD prevalence was 18.1%–27.8% in North America, 8.7%–33.1% in the Middle East, 8.8%–25.9% in Europe, 2.5%–7.8% in East Asia, and 11.6% in Australia. Increasing prevalence of GERD creates a favorable environment growth of the antacid medications market.

Various companies manufacture antacids and other products for indigestion. Some of these are GlaxoSmithKline plc, Dabur India Limited, Abbott Laboratories, and Pfizer, Inc. Sun Pharma launched an ayurvedic digestive remedy called Pepmelt to compete with popular antacids such as Eno (GSK consumer healthcare), Digene (Abbott India), Pudin Hara (Dabur), and Gelusil (Pfizer).

0 notes

Text

How Two Common Medications Became One $455 Million Specialty Pill

By Marshall Allen, The Atlantic, June 20, 2017

Everything happened so fast as I walked out of the doctor’s exam room. I was tucking in my shirt and wondering if I’d asked all my questions about my injured shoulder when one of the doctor’s assistants handed me two small boxes of pills.

“These will hold you over until your prescription arrives in the mail,” she said, pointing to the drug samples.

Strange, I thought to myself, the doctor didn’t mention giving me any drugs.

I must have looked puzzled because she tried to reassure me.

“Don’t worry,” she said. “It won’t cost you any more than $10.”

I was glad whatever was coming wouldn’t break my budget, but I didn’t understand why I needed the drugs in the first place. And why wasn’t I picking them up at my local CVS?

At first I shrugged it off. This had been my first visit with an orthopedic specialist, and he, Dr. Mohnish Ramani, hadn’t been the chatty type. He’d barely said a word as he examined me, tugging my arm this way and bending it that way before rotating it behind my back. The pain made me squirm and yelp, but he knew what he was doing. He promptly diagnosed me with frozen shoulder, a debilitating inflammation of the shoulder capsule.

But back to the drugs. As an investigative reporter who has covered health care for more than a decade, the interaction was just the sort of thing to pique my interest. One thing I’ve learned is that almost nothing in medicine--especially brand-name drugs--is ever really a deal. When I got home, I looked up the drug: Vimovo.

The drug has been controversial, to say the least. Vimovo was created using two readily and cheaply available generic, or over-the-counter, medicines: naproxen, also known by the brand name Aleve, and esomeprazole magnesium, also known as Nexium. The Aleve handles your pain, and the Nexium helps with the upset stomach that’s sometimes caused by the pain reliever. So what’s the key selling point of this new “convenience drug”? It’s easier to take one pill than two.

But only a minority of patients get an upset stomach, and there was no indication I’d be one of them. Did I even need the Nexium component?

Of course I also did the math. You can walk into your local drugstore and buy a month’s supply of Aleve and Nexium for about $40. For Vimovo, the pharmacy billed my insurance company $3,252. This doesn’t mean the drug company ultimately gets paid that much. The pharmaceutical world is rife with rebates and side deals--all designed to elbow ahead of the competition. But apparently the price of convenience comes at a steep mark-up.

Think about it another way. Say you want to eat a peanut butter and jelly sandwich every day for a month. You could buy a big jar of peanut butter and a jar of grape jelly for less than 10 bucks. Or you could buy some of that stuff where they combine the peanut butter and grape jelly into the same jar. Smucker’s makes it. It’s called Goober. Except in this scenario, instead of its usual $3.50 price tag, Smucker’s is charging $565 for the jar of Goober.

So if Vimovo is the Goober of drugs, then why have Americans been spending so much on it? My insurance company, smartly, rejected the pharmacy’s claim. But I knew Vimovo’s makers weren’t wooing doctors like mine for nothing. So I looked up the annual reports for the Ireland-based company, Horizon Pharma, which makes Vimovo. Since 2014, Vimovo’s net sales have been more than $455 million. That means a lot of insurers are paying way more than they should for their Goober.

And Vimovo wasn’t Horizon’s only such drug. It has brought in an additional $465 million in net sales from Duexis, a similar convenience drug that combines ibuprofen and famotidine, aka Advil and Pepsid.

This year I have been documenting the kind of waste in the health-care system that’s not typically tracked. Americans pay more for health care than anyone else in the world, and experts estimate that the U.S. system wastes hundreds of billions of dollars a year. In recent months I’ve looked at what hospitals throw away and how nursing homes flush or toss out hundreds of millions of dollars’ worth of usable medicine every year. We all pay for this waste, through lower wages and higher premiums, deductibles, and out-of-pocket costs. There doesn’t seem to be an end in sight--I just got a notice that my premiums may be increasing by another 12 percent next year.

With Vimovo, it seemed I stumbled on another waste stream: overpriced drugs whose actual costs are hidden from doctors and patients. In the case of Horizon, the brazenness of its approach was even more astounding because it had previously been called out in media reports and in a 2016 congressional hearing on out-of-control drug prices.

Health-care economists also were wise to it.

“It’s a scam,” said Devon Herrick, a health-care economist with the National Center for Policy Analysis. “It is just a way to gouge insurance companies or employer health-care plans.”

Unsurprisingly, Horizon says the high price is justified. In fact, the drug maker wrote in an email, “The price of Vimovo is based on the value it brings to patients.”

And Horizon stressed Vimovo is a “special formulation” of Aleve and Nexium, so it’s not the same as taking the two separately. But several experts said that’s a scientific distinction that doesn’t make a therapeutic difference. “I would take the two medications from the drugstore in a heartbeat--therapeutically it makes sense,” said Michael Fossler, a pharmacist and clinical pharmacologist who is chair of the public-policy committee for the American College of Clinical Pharmacology. “What you’re paying for with [Vimovo] is the convenience. But it does seem awful pricey for that.”

Public outrage is boiling over when it comes to high drug prices, leading the media and lawmakers to scold pharmaceutical companies. You’d think a regulator would monitor this, but the Food and Drug Administration told me they are only authorized to review new drugs for safety and effectiveness, not prices. “Prices are set by manufacturers and distributors,” the FDA said in a statement.

I dutifully took my Vimovo for several days, until I noticed it kept me awake until 3 in the morning--a rare side effect. (Perhaps they need to add a third drug to the combo.) I probably have more than 50 pills left in the bottle on my bedside table. Maybe I could sell it back to Horizon for $1,500.

3 notes

·

View notes

Text

H2-Receptor Antagonists Market to Garner Brimming Revenues by 2030

H2-Receptor Antagonists Market: Introduction

Histamine H2 receptor antagonist, also known as H2-blockers, are a class of medications that are used in the treatment of acid-peptic disease including duodenal and gastric ulcers, inflamed stomach gastroesophageal reflux disease, common heartburn, and peptic ulcers. These medications are available over-the-counter (OTC) and with the doctor’s prescription. Common H2 receptor blockers include nizatidine, famotidine, and cimetidine.

In April 2020, the Food and Drug Administration (FDA) recalled all forms of withdrawal prescription and over-the-counter (OTC) ranitidine drugs from the U.S. market immediately. This recommendation was made, as unacceptable levels of N-nitrosodimethylamine (NDMA), a probable carcinogen (cancer-causing chemical), were found in some ranitidine products.

Report Overview @

https://www.transparencymarketresearch.com/h2-receptor-antagonists-market.html

Key Drivers and Restraints of Global H2-Receptor Antagonists Market

High prevalence and increasing incidence of duodenal and gastric ulcers, inflamed stomach gastroesophageal reflux disease, and peptic ulcer disease in developed countries has led to the development of novel therapeutics drugs. Biopharmaceutical companies have made significant investments in R&D activities, and a large number of pipeline products are at different stages of clinical approvals, which are likely to commercialize during the forecast period.

Planning To Lay Down Future Strategy? Request Brochure Of H2-Receptor Antagonists Market

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=77626

According to International Foundation for Gastrointestinal Disorders, Inc., the prevalence of gastroesophageal reflux disease (GERD) was 18.1% to 27.8% in North America, 8.8% to 25.9% in Europe, 2.5% to 7.8% in East Asia, 8.7% to 33.1% in the Middle East, 11.6% in Australia, and 23.0% in South America in 2019. GERD is a chronic and highly prevalent disorder that can potentially lead to serious medical complications, and the medical expense involved in the diagnosis, treatment, and management of the disease is significant.

Rising awareness about gastroesophageal reflux disease and acid-peptic disease, availability of treatment options, and management of these diseases, have increased the demand for the treatment of H2-receptor antagonists in developing countries. Governments and other non-profit organizations spread awareness and educate people about gastric acid management through campaigns and educational and clinical workshops.

Retail pharmacies is projected to be a highly attractive segment during the forecast period. Rising chain of retail pharmacies and easy access to these pharmacies are likely to propel the segment during the forecast period. Moreover, retail pharmacies are considered as the first point of contact for self-medication. Easy availability of pharmaceutical drugs and some integrin antagonists at retail pharmacies is projected to drive the retail pharmacies segment during the forecast period.

To Obtain All-Inclusive Information On Forecast Analysis Of H2-Receptor Antagonists Market , Request A Discount

https://www.transparencymarketresearch.com/sample/sample.php?flag=D&rep_id=77626

Asia Pacific to Lead Global H2-Receptor Antagonists Market

In terms of geography, the global H2-Receptor Antagonists market can be segmented into five key regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America and Europe are expected to hold major share of the global H2-receptor antagonists market during the forecast period, owing to developed health care infrastructure and large patient population along with increasing technological development in these regions.

Increase in government intervention in emerging markets has led to a surge in awareness about diseases and improvement in health care infrastructure. Additionally, socioeconomic development has been observed in emerging economies across Asia, Africa, and Latin America. These factors contribute to the overall increase in spending capacity of the population.

Request For Covid19 Impact Analysis –

https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=77626

Key Players Operating in Global H2-Receptor Antagonists Market

Manufacturers operating in the global H2-receptor antagonists market are increasingly investing in research & development of new and innovative techniques for new and improved dosage foam. These players are also focused on offering highly efficient and patient compliant products.

Leading companies operating in the global H2-receptor antagonists market are:

Perrigo Company plc

Mylan N.V.

Fresenius SE & Co. KgaA

Teva Pharmaceutical

Apotex Inc.

AbbVie

Takeda

Roche

Celgene

Galapagos

Eli Lilly

Pfizer

EA Pharma Co. Ltd.

InDex Pharma

More Trending Reports by Transparency Market Research –

Ozone Therapy in Dermatology Market -

https://www.prnewswire.co.uk/news-releases/tmr-projects-strong-growth-for-ozone-therapy-in-dermatology-market-advanced-ozone-generators-to-drive-5-0-cagr-led-growth-during-2019-2027-893684835.html

Ophthalmic Surgical Technologies Market –

https://www.biospace.com/article/ophthalmic-surgical-technologies-market-femtosecond-systems-likely-to-dominate-the-market/

0 notes

Text

How Covid 19 Famotidine Market Demand Rising From 2020

How Covid 19 Famotidine Market Demand Rising From 2020

Apr 29, 2020: The ‘Global and Chinese Famotidine Industry, 2012-2022 Market Research Report’ is a professional and in-depth study on the current state of the global Famotidine industry with a focus on the Chinese market. The report provides key statistics on the market status of the Famotidine manufacturers and is a valuable source of guidance and direction for companies and individuals…

View On WordPress

0 notes

Text

FDA says all ranitidine drugs should be recalled on safety concerns

The FDA has asked drugmakers to pull all prescription and over-the-counter products based on ranitidine off the market immediately, after a review failed to alleviate concerns about a cancer risk.

The move extends voluntary recalls last year by several drugmakers – including Sanofi, Sandoz and the drug’s original developer GlaxoSmithKline – which were implemented after preliminary investigations last summer suggested a carcinogenic impurity was present in a range of ranitidine products.

Now, the US regulator says new evidence from its probe into the nitrosamine contaminant known as N-nitrosodimethylamine (NDMA) shows that the level increases in some ranitidine products over time when stored at room temperature.

That “may result in consumer exposure to unacceptable levels of this impurity,” it said, as it implemented a ban on new and existing prescriptions for the gastrointestinal drug, commonly known as Zantac and used to treat conditions like heartburn.

Low levels of NDMA are ingested in the diet as the substance is found in food and water, but not at levels expected to cause an increase in cancer risk.

“We didn’t observe unacceptable levels of NDMA in many of the samples that we tested,” said Janet Woodcock, who leads the FDA’s Centre for Drug Evaluation and Research (CDER),

“However, since we don’t know how or for how long the product might have been stored, we decided that it should not be available to consumers and patients unless its quality can be assured,” she added.

Testing found that NDMA increased during normal storage conditions, and that there was a bigger rise if samples were exposed to higher temperatures during distribution and handling by patients.

Put simply, “the older a ranitidine product is, or the longer the length of time since it was manufactured, the greater the level of NDMA,” according to the FDA.

The FDA has been investigating NDMA and other nitrosamine impurities in blood pressure and heart failure medicines called angiotensin II receptor blockers or ‘sartans’ since last year, and is also looking into levels in diabetes drug metformin.

Meanwhile, in Europe the CHMP has also asked manufacturers of all drugs considered at risk of NDMA impurities to review their products and report the outcome by 1 October this year.

The FDA is advising consumers to stop taking any OTC ranitidine products they may have and dispose of them at home.

They should also consider using other approved OTC products that have similar uses. So far, NDMA hasn’t been found in in famotidine, cimetidine, esomeprazole, lansoprazole or omeprazole, which are all alternative treatments for heartburn.

People prescribed ranitidine should seek medical advice before stopping treatment, it adds.

The post FDA says all ranitidine drugs should be recalled on safety concerns appeared first on .

from https://pharmaphorum.com/news/fda-says-all-ranitidine-drugs-should-be-recalled-on-safety-concerns/

0 notes

Text

#Specialty Chemicals#Commodity Chemicals#intermediate manufacturers#sulfamide manufacturer#famotidine manufacturer#famotidine intermediates manufacturer#intermediates of famotidine manufacturer#intermediates of famotidine

0 notes

Text

Global Famotidine Market Precise Outlook From 2020-2023

Apr 29, 2020: The 'Global and Chinese Famotidine Industry, 2012-2022 Market Research Report' is a professional and in-depth study on the current state of the global Famotidine industry with a focus on the Chinese market. The report provides key statistics on the market status of the Famotidine manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.Firstly, the report provides a basic overview of the industry including its definition, applications and manufacturing technology.

To Request A Sample Copy Of This Report @: https://www.radiantinsights.com/research/global-and-chinese-famotidine-cas-76824-35-6-industry-2017/request-sample

Then, the report explores the international and Chinese major industry players in detail. In this part, the report presents the company profile, product specifications, capacity, production value, and 2012-2017 market shares for each company. Through the statistical analysis, the report depicts the global and Chinese total market of Famotidine industry including capacity, production, production value, cost/profit, supply/demand and Chinese import/export. The total market is further divided by company, by country, and by application/type for the competitive landscape analysis. The report then estimates 2017-2022 market development trends of Famotidine industry.

To Browse Full Research Report @:

https://www.radiantinsights.com/research/global-and-chinese-famotidine-cas-76824-35-6-industry-2017

Analysis of upstream raw materials, downstream demand, and current market dynamics is also carried out. In the end, the report makes some important proposals for a new project of Famotidine Industry before evaluating its feasibility. Overall, the report provides an in-depth insight of 2012-2022 global and Chinese Famotidine industry covering all important parameters.

Table of Contents

Chapter One Introduction of Famotidine Industry

1.1 Brief Introduction of Famotidine

1.2 Development of Famotidine Industry

1.3 Status of Famotidine Industry

Chapter Two Manufacturing Technology of Famotidine

2.1 Development of Famotidine Manufacturing Technology

2.2 Analysis of Famotidine Manufacturing Technology

2.3 Trends of Famotidine Manufacturing Technolog

Chapter Three Analysis of Global Key Manufacturers

3.1

3.1.1 Company Profile

3.1.2 Product Information

3.1.3 2012-2017 Production Information

3.1.4 Contact Information

3.2

3.2.1 Company Profile

3.2.2 Product Information

3.2.3 2012-2017 Production Information

3.2.4 Contact Information

3.3

3.2.1 Company Profile

3.3.2 Product Information

3.3.3 2012-2017 Production Information

3.3.4 Contact Information

3.4

3.4.1 Company Profile

3.4.2 Product Information

3.4.3 2012-2017 Production Information

3.4.4 Contact Information

Continued……………….

To See More Reports of This Category by Radiant Insights:

https://latestmarkettrends.news.blog/

About Radiant Insights:

Radiant Insights is a platform for companies looking to meet their market research and business intelligence requirements. It assist and facilitate organizations and individuals procure market research reports, helping them in the decision making process. The Organization has a comprehensive collection of reports, covering over 40 key industries and a host of micro markets. In addition to over extensive database of reports, experienced research coordinators also offer a host of ancillary services such as, research partnerships/ tie-ups and customized research solutions.

Media Contact:

Company Name: Radiant Insights, Inc

Contact Person: Michelle Thoras

Email:

Phone: (415) 349-0054

Address: 201 Spear St #1100, Suite #3036

City: San Francisco

State: California

Country: United States

For more information, Visit:

https://wordpress.com/home/futureautomobile.wordpress.com

0 notes

Text

Ranitidine (Zantac) recall expanded, many questions remain

Update: On April 1, 2020, the FDA requested manufacturers to withdraw all prescription and over-the-counter (OTC) ranitidine drugs (Zantac, others) from the market immediately, due to the presence of a contaminant known as N-Nitrosodimethylamine (NDMA). Although the FDA did not observe unacceptable levels of NDMA in many of the samples they tested, they have determined that the impurity in some ranitidine products increases over time and when stored at higher than room temperatures. As a result of this recall, ranitidine products will no longer be available for prescription or OTC use in the US.

The FDA is also advising consumers taking OTC ranitidine to stop taking this medication, including any unused ranitidine medication they may still have at home. Other FDA-approved OTC medications are available to treat heartburn. Patients taking prescription ranitidine should speak with their doctor about other treatment options before stopping the medicine.

As anticipated, recall of the popular heartburn medicine ranitidine (Zantac) has expanded. But we still have more questions than answers.

As I mentioned in my original blog post on this topic, the online pharmacy Valisure, which originally alerted the FDA to the issue, found what they called “extremely high levels” of the probable cancer-causing substance N-nitrosodimethylamine (NDMA) in ranitidine products.

The FDA has indicated that its own preliminary testing has detected low levels of NDMA in ranitidine.

Testing methods may have influenced NMDA results

The FDA has clarified that the testing method that found the “extremely high levels” of NDMA applied high heat, at a level much higher than normal body temperature. In other words, the testing did not reflect typical conditions under which the medication would be stored or taken.

The FDA is asking all companies that manufacture ranitidine, as well as other similar medications (both H2 blockers, the class of drugs to which ranitidine belongs, and proton-pump inhibitors, or PPIs, a different class of drugs used for similar conditions), to test their products using lower heat closer to normal body temperature. So far, there is no indication that these other products are affected; the FDA is likely asking for these tests only as a precaution.

As of now, the FDA has allowed ranitidine to remain on the market. Still, some manufacturers have issued voluntary recalls and some pharmacies have pulled it off the shelves.

FDA estimates ranitidine NMDA risk with other medications

The FDA has not yet released the results of its own tests of ranitidine. But they previously estimated the likely impact of NDMA found in another class of medications, called angiotensin receptor blockers, on the risk of cancer. That estimate provides some context for the current circumstances.

Angiotensin receptor blockers, including the drug valsartan (Diovan), are used to treat high blood pressure and other heart conditions. They were recalled beginning last year due to the presence of NDMA and other related impurities. The FDA estimated that, if 8,000 people took the highest dose of valsartan containing NDMA every day for four years, there would be one additional case of cancer over the lifetimes of these 8,000 people.

Currently, we do not know how the amount of NDMA found in ranitidine compares to the amount found in valsartan.

Until we know more, the best course of action if you are taking ranitidine is to talk to your doctor about whether treatment is still needed. For some conditions, the benefits likely outweigh the risks. Although some ranitidine products remain available, consider alternative medications such as cimetidine (Tagamet) or famotidine (Pepcid) if you need long-term treatment.

Follow me on Twitter @JoshuaJGagne

The post Ranitidine (Zantac) recall expanded, many questions remain appeared first on Harvard Health Blog.

Ranitidine (Zantac) recall expanded, many questions remain published first on https://drugaddictionsrehab.tumblr.com/

0 notes