#equity financial brokerage market

Text

Opportunities in the Financial Brokerage Sector: Market Analysis and Major Players

Dive into the Financial Brokerage Market Share with comprehensive insights. Explore market size, growth projections, and revenue analysis to make informed decisions in this pivotal financial industry.

#financial brokerage#brokerage industry#online brokerage market share#financial brokerage firms#analysis of financial brokerage industry#equity financial brokerage market#financial brokerage business models#financial brokerage industry analysis#financial brokerage industry reports#financial brokerage industry trends

0 notes

Text

Mutual Funds Made Easy: A Guide to Beginners.

What is a Mutual Fund?

Hey buddy, Mutual funds are a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. The mutual fund is managed by a professional fund manager who makes investment decisions on behalf of the investors, to maximize returns while minimizing risk.

Types of Mutual Funds

There are several types of mutual funds, including equity funds, fixed-income funds, balanced funds, index funds, and specialty funds. Equity funds invest in stocks, fixed-income funds invest in bonds, and balanced funds invest in a mix of stocks and bonds. Index funds are designed to track a specific market index, such as the S&P 500, while specialty funds focus on a particular sector or industry.

Benefits of investing in mutual funds

Mutual funds offer several benefits, including diversification, professional management, convenience, and flexibility. Diversification is important because it helps reduce the risk of losses by spreading investments across many different assets. Professional management ensures that your money is invested by a trained and experienced professional. Mutual funds are also convenient because they can be purchased and sold through a brokerage account or financial advisor. Additionally, they offer a high level of flexibility, allowing you to buy or sell shares at any time.

Risks of investing in mutual funds

All investments come with some level of risk, and mutual funds are no exception. The value of mutual funds can fluctuate based on changes in the financial markets, and past performance is not always an indicator of future performance. Additionally, mutual funds charge fees and expenses, which can eat into your returns over time.

Choosing a mutual fund

When choosing a mutual fund, it’s important to consider your investment goals, risk tolerance, and investment time horizon. You should also research the fund’s fees and expenses, as well as its historical performance. Finally, consider working with a financial advisor who can help you choose the right mutual funds for your portfolio.

I will give two tips on checking to choose a mutual fund before investing first one is

Performance History: Look at the fund’s past performance over a period of time, preferably five to ten years. While past performance is not an indicator of future returns, it can give you an idea of how the fund has performed during different market conditions. You can check easily on grow app or whatever app you like it.

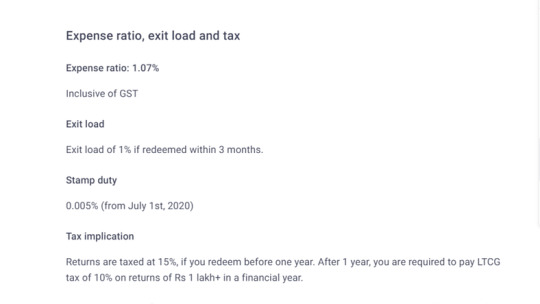

Expense Ratio: The expense ratio represents the cost of managing the fund and is deducted from your returns. Look for funds with a lower expense ratio, as high fees can eat into your returns over time.

I will show pictures of higher expense ratios and lower expense ratios.

Monitoring your mutual fund

After you invest in a mutual fund, it’s important to monitor your investment regularly to ensure that it continues to meet your investment goals. This may involve reviewing the fund’s performance, fees, and expenses, as well as rebalancing your portfolio periodically to maintain a diversified mix of investments.

Remember, mutual funds can be a great way to invest in the stock market and other assets without having to choose individual stocks or assets yourself. However, it’s important to do your research and carefully consider the risks and potential rewards before investing.

Hope you enjoy and like this blog post. Later on, I will post a full detailed blog on Mutual funds. Make sure to share with your friends and comment with your opinions and subscribe.

Disclaimer:

The information provided on this blog is for educational and informational purposes only and should not be considered financial advice. I am not a certified financial advisor and do not hold any professional licenses in the finance industry. Any financial decisions you make based on the information provided on this blog are at your own risk. Please consult with a certified financial advisor before making any significant financial decisions.

2 notes

·

View notes

Text

Investment Banks and Finance Companies.

Investment banks offer services in equity capital markets, leveraged debt capital markets, commercial real estate, asset finance and leasing, and corporate lending services. The major functions of investment banks are raising funds, asset management, mergers and acquisitions advisory services, brokerage services, and market making. The asset management function of investment banks involves managing the funds of corporations and investing in stocks, fixed-income securities/bonds, derivatives investments, and other types of investments. Investment banks are actively involved in mergers and acquisitions by performing the functions of deal making. Securities underwriting is the process by which investment banks raise investment capital from investors in the form of equity and debt capital on behalf of companies and government authorities. Underwriters offer a set of services for initial public offerings (IPOs) or seasoned equity offerings. The methods used for IPO pricing are the fixed price method and book building process. The debt capital markets services divisions of investment banks solicit structures and execute investment-grade debt and related products, which include new issues of public and private debt. The strategic changes in investment banks has often been cited as a reason for the economic crisis that crippled the global economy.

Finance companies are specialized financial institutions that make loans to individuals and corporations for the purchase of consumer goods and services. The three major types of finance companies are consumer finance, business or commercial finance, and sales finance.

Learn more about Investment Banks and Finance Companies related to the publication - Strategies of Banks and Other Financial Institutions: Theories and Cases.

#initial public offerings (IPOs)#investment capital#investment banks#sales finance#consumer finance#business or commercial finance#and#international day of banks#4 december#asset liability management

2 notes

·

View notes

Text

Best Stock broker in India

Best Stockbroker in India

There are several benefits to choosing a reputed stockbroker in India. These include the fact that they offer a wide range of services. They also offer products for a variety of asset classes. In addition to this, they have a significant presence in different business and retail segments. Moreover, they have won several awards and were named as one of the most promising brands in India.

Parasram

Parasram is the best Stock Broker in India. PARASRAM, a renowned & customer focused Financial Market player, is among the top stock broking groups in India, having memberships of leading Stock Exchanges. The group is a Depository Participant with NSDL and CDSL. We are One Stop Financial Supermarket currently caters to more than 130,000 High Net-worth Investors, NRIs, Corporate and retail clients through nationwide web of branch offices and business associates.

Upstox

Upstox is one of the leading discount brokers in India. It offers a free trading platform and waives off the account opening fees. However, it does charge a fee for call & trade, auto square off, and research. There are also some downsides to Upstox, such as their lack of NRI trading options and monthly unlimited trading plans.

Upstox is one of the largest online brokerage firms in India and has been in business for 11 years. It provides trading in stocks, mutual funds, forex, IPOs, and commodities. It also provides important information for investors including market analysis, technical data, and equity derivatives. In addition, the company charges a low flat commission of Rs20 per trade, which is considerably lower than other online brokers in the country.

Motilal Oswal

The following article compares Nj Wealth and Motilal Oswal, two full service brokers in India. We compared brokerage charges, trading platforms, customer support, and complaints to see which one is better for your needs. Nj Wealth has a reputation for being the best broker in India for investors, but if you're looking for an affordable option, Motilal Oswal is the way to go.

Motilal Oswal offers several different types of products for retail investors. In addition to stock trading, investors can also trade in a variety of commodities including bullion and agro commodities. These products are available on the MCX and NCDEX.

Sharekhan

Sharekhan is a 21-year-old trading platform with over 2 million registered clients across India. It offers a range of products that help investors create a diversified portfolio. The platform also provides guidance and relationship managers who help clients with their investing. Furthermore, the website offers market news updates, auto investing, and learning resources.

Sharekhan is a subsidiary of BNP Paribas and is regulated by the Securities and Exchange Board of India. Sharekhan is also one of the oldest online brokers in India. It is part of the global BNP Paribas group, which is a publicly listed company. It is crucial to research a broker's background before deciding which one to use.

Sharekhan offers full service stockbroking and a range of investment and trade products. Its large network of branches covers more than 600 cities throughout India. The company is also renowned for its high-quality customer care and support. Sharekhan also offers excellent online trading platforms.

Zerodha

Zerodha is a discount broker that's fast gaining in popularity. They offer a variety of investment options, including stocks and futures. The company is registered with the Securities and Exchange Board of India, which means that they're regulated by the government. In addition, Zerodha offers educational resources that can help new investors understand the basics of investing.

Unlike other brokerage firms, Zerodha offers a digital platform for investing. You can open an account within 24 hours, and use Aadhar-Esign to speed up the process. You'll also need to submit income proof, a net worth certificate, and a form 16 acknowledgment.

Angel broking

Angel Broking offers multiple services to its clients. It is headquartered in Mumbai and has over 11,500 offices throughout India. Founded in 1987, Angel Broking makes money through the brokerage fees it charges on each trade it executes. These fees are part of the brokerage the client pays for the services he or she receives. In addition, Angel Broking offers free research tips and excellent offline support.

Angel Broking is a regulated broker and follows the National Commodity and Derivatives Exchange Limited (NCDEX) and Multi-Commodity Exchange of India (MCX). The company is a custodian of the CDSL, which regulates the brokerage industry. However, Angel Broking does not offer any form of segregated account or financial compensation in case of ruin. Clients can deposit and withdraw funds using their bank accounts or via a debit card.

9 notes

·

View notes

Text

2024 IPO Calendar: Key Dates and Companies

The initial public offering (IPO) market continues to be a hotbed of activity, with exciting new companies seeking to raise capital and join the public stock exchanges. As an investor, navigating the IPO landscape can be both thrilling and daunting. The potential for high returns beckons, but so does the risk of overhype and unforeseen challenges.

Before you jump on the IPO bandwagon in 2024, here's a comprehensive checklist to equip you for informed investment decisions:

Understand Your Investment Goals and Risk Tolerance:

What are your investment goals? Are you seeking long-term growth, short-term gains, or diversification? IPOs can offer all three, but with varying degrees of risk.

How comfortable are you with risk? IPOs are inherently speculative. New companies haven't established a long track record of performance. Be honest about your risk tolerance before committing any capital.

Research the Company Thoroughly:

Read the Red Herring Prospectus: This document, mandated by the Securities and Exchange Board of India (SEBI), provides a wealth of information about the company, including its business model, financials, management team, risk factors, and future plans.

Dig Deeper: Don't just rely on the prospectus. Analyze industry trends, competitor performance, and the overall market sentiment.

Seek Out Independent Analysis: Look for research reports from reputable financial institutions or independent analysts to gain diverse perspectives.

Scrutinize the Company Financials:

Revenue Growth: Analyze the company's revenue growth trajectory. Look for consistent and sustainable growth, not just a one-time spike.

Profitability: While profitability isn't always a deal-breaker for high-growth companies, understand their path to becoming profitable.

Debt Levels: Excessive debt can be a significant burden. Evaluate the company's debt-to-equity ratio and its ability to manage its debt obligations.

Evaluate the Management Team:

Experience and Expertise: Assess the management team's experience in the industry and their track record of success.

Leadership and Vision: Look for a leadership team with a clear vision for the company's future and the ability to execute their plans.

Corporate Governance: Ensure the company adheres to good corporate governance practices with transparency and accountability.

Understand the IPO Structure:

Fresh Issue vs. Offer for Sale (OFS): In a fresh issue, the company raises new capital, while in an OFS, existing shareholders sell their stake.

Pricing: Analyze the IPO pricing compared to industry benchmarks and the company's valuation. Is it a fair price that reflects the company's true potential?

Lock-in Period: Be aware of any lock-in periods where you might not be able to sell your shares immediately after the IPO.

Consider the Market Conditions:

Overall Market Sentiment: A bull market can fuel IPO hype, while a bear market might lead to post-listing price corrections.

Industry Performance: Evaluate how companies in the same industry are performing. Look for tailwinds that might benefit the IPO.

Liquidity: Ensure the IPO has sufficient liquidity, meaning enough shares are available for trading to ensure you can easily enter and exit your position.

Develop an Investment Strategy:

Allocation: Determine how much of your investment portfolio you're comfortable allocating to IPOs. Remember, diversification is key.

Entry and Exit Strategy: Decide on a price point for entry and a target return for exiting your investment.

Risk Management: Have a risk management plan in place, including stop-loss orders to limit potential losses.

Choose a Reputable Broker:

IPO Access: Ensure your broker has access to IPO offerings and can guide you through the application process.

Experience and Expertise: Choose a broker with a strong reputation in handling IPOs and providing sound investment advice.

Fees and Charges: Be aware of any brokerage fees or charges associated with participating in IPOs.

Remember: IPOs are not guaranteed successes. By following this checklist and conducting thorough research, you can increase your chances of making informed investment decisions and navigating the exciting world of 2024 IPOs.

Disclaimer: This blog is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Here is the list of IPO 2024

Kronox Lab Sciences IPO GMP Today

Awfis Space Solutions IPO GMP Today

Go Digit IPO GMP Today

Aadhar Housing Finance IPO GMP Today

TBO TEK IPO GMP Today

Indegene IPO GMP Today

JNK India IPO GMP Today

Vodafone Idea IPO GMP Today

Bharti Hexacom IPO GMP Today

SRM Contractors IPO GMP Today

Krystal Integrated IPO GMP Today

Popular Vehicles IPO GMP Today

BLS-E Services IPO GMP Today

Nova Agri Tech IPO GMP Today

Azad Engineering IPO GMP Today

RBZ Jewellers IPO GMP Today

Muthoot Microfin IPO GMP Today

Suraj Estate Developers IPO GMP Today

DOMS IPO GMP Today

India Shelter Finance IPO GMP Today

Sattrix Information Security IPO GMP Today

TBI CornI PO GMP Today

Associated Coaters IPO GMP Today

Aimtron Electronics IPO GMP Today

Ztech India IPO GMP Today

Beacon Trusteeship IPO GMP Today

Vilas Transcore IPO GMP Today

GSM Foils IPO GMP Today

Rulka Electricals IPO GMP Today

Quest Laboratories IPO GMP Today

Indian Emulsifier IPO GMP Today

Veritaas Advertising IPO GMP Today

Mandeep Auto Industries IPO GMP Today

ABS Marine Services IPO GMP Today

Piotex Industries IPO GMP Today

Aztec Fluids & Machinery IPO GMP Today

Premier Roadlines IPO GMP Today

Energy Mission Machineries IPO GMP Today

TGIF Agribusiness IPO GMP Today

Finelistings Technologies IPO GMP Today

Refractory Shapes IPO GMP Today

0 notes

Text

Groww Crosses 10 Million Active Users base with major focus on tier 2/3 cities

The Indian online broking landscape is witnessing a significant shift, with Groww emerging as a leader in active users. The company is projected to surpass a staggering 1 crore (10 million) active users in May 2024, solidifying its position ahead of established players like Zerodha and AngelOne.

Groww’s Meteoric Rise

Groww’s meteoric rise can be attributed to several key factors. Firstly, the platform prioritizes user experience. Unlike competitors with a purely trading-focused approach, Groww emphasizes user education and investment guidance. This strategy resonates with a wider audience, particularly those new to the investment landscape. Industry sources credit Groww’s commitment to user-friendliness and educational resources as a key differentiator.

Targeting Tier 2/3 Cities Fuels Growth

Furthermore, Groww has strategically targeted India’s tier 2 and tier 3 cities. These regions are often overlooked by traditional financial institutions, but Groww’s marketing efforts, coupled with word-of-mouth recommendations, have successfully attracted a new wave of investors from these areas. This focus on expanding reach beyond major metropolitan centers has significantly bolstered their user base.

Market Activity and IPO Boom Contribute

The current market conditions have also played a role in Groww’s success. Increased activity in the equity markets and a surge in startup initial public offerings (IPOs) have created a fertile ground for new investors. Groww’s user-friendly platform and educational resources position them perfectly to capitalize on this influx of interest in the investment world.

The Battle for Market Share

While Groww currently enjoys a lead in terms of active users, the online brokerage landscape is a multifaceted battleground. Zerodha, although trailing in user base, maintains a strong focus on the trading community, aiming to establish itself as the industry leader in terms of revenue and profitability. For the financial year 2022–23 (FY23), Zerodha reported a significant 38.5% growth in revenue, reaching Rs 6,875 crore compared to the previous year. They also showcased impressive profit growth of 39%, with profits reaching Rs 2,907 crore in FY23. This focus on profitability positions Zerodha strategically within the online broking space.

Read more: Marketing News, Advertising News, PR and Finance News, Digital News

0 notes

Text

PE ratio ineffective for valuing certain sectors and stocks in India: Kotak Securities

According to brokerage firm Kotak Securities, the PE multiple (price-to-earnings multiple)—a key valuation metric used by investors to evaluate the relative value of a stock or an index—is an ineffective valuation methodology for several sectors and stocks in India where earnings do not meaningfully translate into FCF (free cash flow) or returns to shareholders.

Kotak believes many low PE sectors and stocks may not be as cheap as their headline numbers suggest.

"We revisit the futility of PE valuations for valuing several sectors and stocks in India, given (1) low FCF-to-PAT in such sectors, (2) continued investment for incremental volumes and (3) continued investment in low-return businesses," said Kotak in a note on May 28.

The PE ratio is a simple way to measure how expensive or cheap a company's stock is compared to its earnings. However, the PE ratio can be an ineffective way to assess the valuation of certain companies, particularly in sectors where earnings do not accurately reflect the company's financial health or ability to generate cash.

Free cash flow (FCF) measures how much cash a company generates after accounting for capital expenditures.

Kotak believes that the PE ratio is not useful for valuing companies in several sectors, such as automobile, tyres, cement, and speciality chemicals, and the type of companies, such as state-owned oil, gas, and fuel providers as in these sectors earnings don't effectively translate into free cash flow (FCF) or dividends.

"The market’s focus on PE (high or low is less relevant) is misplaced for such sectors, without taking cognisance of conversion of PAT to FCF," said Kotak.

Giving the cement sector as an example, Kotak underscored that cement companies will continue to have high capex to deliver incremental volumes in the future. This will result in their FCF trailing PAT due to their low fixed asset turnover ratio.

"Cement companies had low FCF relative to their PAT, which will likely persist. We see strong volume growth, driven by housing and infrastructure demand, but the industry must incur large capex to support the growth. The debate around profitability is less relevant," said Kotak.

Similarly, Kotak said the oil, gas, and consumable companies, especially PSUs, will continue to invest in their core businesses, resulting in very low FCF relative to PAT.

Kotak pointed out that specialty chemicals companies have ambitious plans, requiring large capex, which results in low FCF in the medium term. They have historically seen low FCF/PAT ratios.

"The current high PE valuations of the sector are underpinned by expectations of strong FCF generation in the future, which may or may not materialise once the growth phase is overdue to (1) the contractual nature of the business and (2) increased competition over time," said the brokerage firm.

While PE may not be an effective method of valuing high-growth companies, state-owned firms, and capital-intensive sectors, experts say other valuation metrics, such as enterprise value to EBITDA (EV/EBITDA) and return on equity (RoE), might provide a more comprehensive and accurate assessment of a company's financial performance and potential.

RoE shows how well a company is using the money invested by its shareholders to generate profits.

EV/EBITDA provides insight into a company's operating performance and shows whether it is fairly valued, overvalued, or undervalued compared to its peers.

#PEValuationDebate#KotakSecuritiesInsights#FreeCashFlowAnalysis#SectorValuationMetrics#FinancialPerformanceAssessment

0 notes

Text

In-Depth Analysis of BNP Paribas SA's Strategic Deals and Acquisitions

BNP Paribas SA is one of the largest banking groups in the world, with a significant presence across Europe, Asia, and the Americas. This comprehensive analysis focuses on BNP Paribas's strategic deals and acquisitions, providing insights into the company's growth strategy, market expansion, and financial performance. Understanding these deals sheds light on BNP Paribas's approach to maintaining its leadership position in the global banking sector.

Overview of BNP Paribas SA

Founded in 1848 and headquartered in Paris, France, BNP Paribas offers a wide range of financial services, including retail banking, corporate and institutional banking, asset management, and insurance. The bank's extensive network and diversified service offerings make it a key player in the global financial industry.

Core Services and Market Reach

BNP Paribas operates through three main business divisions:

Retail Banking: Provides a comprehensive range of financial products and services to individuals, small businesses, and corporates.

Corporate and Institutional Banking (CIB): Offers financing, advisory, and market solutions to large corporates, financial institutions, and government entities.

Investment Solutions: Includes asset management, insurance, and private banking services, catering to a wide array of client needs.

BNP Paribas's global presence is bolstered by its strategic partnerships, subsidiaries, and a strong digital banking platform, which enhances its service delivery and customer engagement.

Strategic Deals and Acquisitions

BNP Paribas has a robust history of strategic deals and acquisitions aimed at expanding its market footprint, enhancing service offerings, and driving growth. Here, we review some of the most significant deals and their impact on the company's strategic objectives.

Acquisition of Fortis Bank (2008)

One of BNP Paribas's most notable acquisitions was the purchase of a majority stake in Fortis Bank during the financial crisis in 2008. This deal was pivotal for several reasons:

Market Expansion: The acquisition significantly expanded BNP Paribas's presence in Belgium and Luxembourg, strengthening its position in the European market.

Customer Base: By integrating Fortis's customer base, BNP Paribas enhanced its retail banking and wealth management services.

Asset Growth: The deal added substantial assets to BNP Paribas's portfolio, boosting its financial stability and market competitiveness.

Acquisition of DAB Bank (2014)

In 2014, BNP Paribas acquired DAB Bank, a German direct bank specializing in online brokerage and financial services.

Digital Banking Enhancement: This acquisition reinforced BNP Paribas's digital banking capabilities, aligning with the growing trend towards online financial services.

Market Penetration: It provided BNP Paribas with greater access to the German market, one of the largest in Europe, enhancing its competitive edge.

Partnership with Orange Bank (2016)

BNP Paribas entered into a strategic partnership with Orange Bank in 2016, focusing on the French digital banking market.

Innovation and Technology: The partnership leverages Orange's technological expertise and BNP Paribas's financial acumen to offer innovative digital banking solutions.

Customer Engagement: It aims to attract a tech-savvy customer base, particularly younger demographics, by providing seamless, mobile-first banking services.

Acquisition of Deutsche Bank's Prime Brokerage and Electronic Equities (2019)

In 2019, BNP Paribas acquired the prime brokerage and electronic equities businesses of Deutsche Bank.

Strengthening CIB Division: This acquisition bolstered BNP Paribas's Corporate and Institutional Banking division, enhancing its capabilities in prime brokerage and equity trading.

Client Base Expansion: The deal added numerous high-profile clients to BNP Paribas's portfolio, increasing its market share in the institutional banking sector.

Partnership with Tink (2020)

BNP Paribas formed a partnership with Tink, a leading European open banking platform, in 2020.

Open Banking Capabilities: This partnership enables BNP Paribas to offer enhanced open banking services, facilitating better financial management tools for customers.

Data Integration: By integrating Tink's platform, BNP Paribas can leverage data analytics to provide personalized financial services and improve customer experience.

Impact of Strategic Deals on Financial Performance

The strategic deals and acquisitions undertaken by BNP Paribas have had a significant impact on its financial performance and market positioning. Key financial metrics influenced by these deals include:

Revenue Growth

Enhanced Service Offerings: By expanding its service portfolio through acquisitions and partnerships, BNP Paribas has been able to attract new customers and increase revenue streams.

Geographical Diversification: The bank's presence in new markets, especially through acquisitions like Fortis Bank and DAB Bank, has contributed to diversified revenue sources and reduced reliance on any single market.

Profitability and Cost Efficiency

Economies of Scale: Integrating acquired businesses has allowed BNP Paribas to achieve economies of scale, reducing operational costs and enhancing profitability.

Synergy Realization: Strategic deals often result in synergies, such as shared technology platforms and streamlined processes, which improve cost efficiency and profit margins.

Market Positioning

Competitive Edge: The acquisitions have strengthened BNP Paribas's market position, making it one of the top banking institutions globally with a comprehensive range of services.

Brand Strength: Successful integration of acquired businesses and strategic partnerships has enhanced BNP Paribas's brand reputation as a forward-thinking, customer-centric bank.

Financial Stability

Asset Growth: Acquisitions like Fortis Bank significantly increased BNP Paribas's asset base, providing greater financial stability and resilience against market fluctuations.

Capital Adequacy: The bank has maintained strong capital adequacy ratios, supported by the growth in equity and retained earnings from profitable acquisitions.

Future Strategic Directions

BNP Paribas's strategic deals and acquisitions have set a solid foundation for future growth. The bank continues to explore opportunities in the following areas:

Digital Transformation

Investment in Fintech: BNP Paribas is likely to continue investing in fintech companies and digital banking platforms to enhance its technological capabilities and offer cutting-edge financial services.

Customer-Centric Innovations: Focusing on customer experience through personalized services, leveraging data analytics, and AI-driven solutions.

Sustainable Finance

Green Investments: Increasing focus on sustainable finance and green investments aligns with global trends towards environmental responsibility and offers new revenue opportunities.

ESG Integration: BNP Paribas aims to integrate environmental, social, and governance (ESG) criteria into its investment and lending decisions, catering to the growing demand for responsible banking.

Global Expansion

Emerging Markets: Exploring opportunities in emerging markets, particularly in Asia and Africa, to tap into high-growth regions and expand its global footprint.

Strategic Partnerships: Forming alliances with local banks and financial institutions to navigate regulatory landscapes and establish a strong presence in new markets.

Conclusion

BNP Paribas SA's strategic deals and acquisitions have been pivotal in shaping its growth trajectory, enhancing its market position, and driving financial performance. By continually adapting to market trends and investing in innovative solutions, BNP Paribas remains a leading force in the global banking industry.

0 notes

Text

Cutting Costs: The Best Low Brokerage Trading Accounts for Investors

Introduction

In the world of investing, minimizing costs is just as crucial as maximizing returns. One of the primary costs for investors is brokerage fees, which can significantly eat into profits over time. Thankfully, the rise of discount brokers and competitive brokerage plans has made it easier for investors to keep their costs low while trading. In this blog, we'll explore some of the best low brokerage trading account available for investors in India, ensuring you can make informed choices to optimize your investment strategy.

Low brokerage trading accounts have revolutionized the way retail investors participate in the stock market. By significantly reducing the cost of transactions, these accounts make it easier for investors to trade more frequently without worrying about high fees. Whether you're a day trader, a long-term investor, or someone just starting out, choosing the right low brokerage account can help you retain more of your hard-earned profits.

Why Low Brokerage Matters

Brokerage fees can add up quickly, especially for active traders. High brokerage charges can reduce net returns, making it harder to achieve investment goals. Low brokerage trading accounts offer a cost-effective solution, allowing investors to trade more efficiently. By minimizing these costs, investors can focus on making profitable trades without the burden of hefty fees.

Zerodha

Overview

Zerodha, founded in 2010, is a trailblazer in the discount broking space in India. It has become synonymous with low-cost trading, attracting a large customer base with its transparent pricing model and user-friendly platform.

Features and Benefits

Brokerage Fees: Zerodha charges a flat fee of Rs 20 per trade for equity and commodity trading, or 0.03% (whichever is lower).

Platform: Kite, Zerodha’s trading platform, is known for its simplicity and advanced features.

Research and Tools: Offers various tools and educational resources to help traders make informed decisions.

Why Choose Zerodha?

Zerodha's low-cost structure, combined with its powerful trading platform, makes it an ideal choice for both new and experienced traders. The flat fee structure ensures transparency and predictability in trading costs.

Upstox

Overview

Upstox, backed by Ratan Tata, is another prominent player in the discount brokerage market. Known for its affordability and feature-rich trading platforms, Upstox caters to a diverse range of investors.

Features and Benefits

Brokerage Fees: Charges a flat fee of Rs 20 per trade for intraday and F&O trades, and zero brokerage on delivery trades.

Platform: Upstox Pro offers advanced charting tools, fast order execution, and a user-friendly interface.

Support and Education: Provides extensive educational content and customer support to assist traders.

Why Choose Upstox?

Upstox stands out for its competitive pricing and robust trading platform, making it a great option for active traders who require advanced tools and low costs.

5Paisa

Overview

5Paisa, a subsidiary of IIFL, offers a comprehensive trading experience with a focus on affordability. It caters to retail investors looking for low-cost brokerage services.

Features and Benefits

Brokerage Fees: Charges Rs 20 per order across all segments.

Platform: 5Paisa’s trading app is feature-rich, providing tools for market analysis and research.

Additional Services: Offers mutual fund investments, insurance, and personal loans, making it a one-stop-shop for financial services.

Why Choose 5Paisa?

5Paisa’s low brokerage rates and wide range of financial products make it an attractive choice for investors looking for a versatile and economical trading platform.

BlinkX by JM Financial

Overview

BlinkX is a new entrant from JM Financial, aiming to provide low-cost brokerage services with a focus on technology and customer satisfaction.

Features and Benefits

Brokerage Fees: Competitive rates with zero brokerage on delivery trades and Rs 20 per order for intraday and F&O.

Platform: BlinkX offers a sleek and intuitive trading platform with advanced features for analysis.

Support: Focuses on providing excellent customer service and support to its users.

Why Choose BlinkX?

BlinkX’s competitive pricing and commitment to customer satisfaction make it a strong contender in the low brokerage space, especially for those seeking a new-age trading platform.

Angel One

Overview

Angel One, formerly known as Angel Broking, is one of the oldest brokerage firms in India that has adapted to the discount brokerage trend by offering low-cost plans.

Features and Benefits

Brokerage Fees: Offers a flat fee of Rs 20 per trade for F&O and intraday trading.

Platform: Angel One’s trading platform is comprehensive, offering tools for both beginners and advanced traders.

Research: Provides extensive research reports and recommendations.

Why Choose Angel One?

Angel One combines the reliability of a traditional brokerage with the cost benefits of a discount broker, making it a solid choice for investors seeking comprehensive services at lower costs.

ICICI Direct

Overview

ICICI Direct is a well-known name in the brokerage industry, offering a range of investment options and balancing full-service brokerage with competitive pricing.

Features and Benefits

Brokerage Fees: Offers various plans, including flat-rate options for active traders.

Platform: ICICI Direct’s platform is robust, providing a wide range of tools and resources.

Services: Offers banking and brokerage services under one roof, providing convenience and comprehensive support.

Why Choose ICICI Direct?

ICICI Direct’s strong reputation and comprehensive service offerings, combined with its competitive brokerage plans, make it a viable option for those seeking reliability and convenience.

HDFC Securities

Overview

HDFC Securities offers a blend of traditional and modern brokerage services, with competitive pricing options for cost-conscious investors.

Features and Benefits

Brokerage Fees: Provides various plans tailored to different trading needs, including low-cost options.

Platform: The trading platform is user-friendly and packed with features for all types of traders.

Support: Known for excellent customer support and service reliability.

Why Choose HDFC Securities?

HDFC Securities’ reputation for reliability and its flexible brokerage plans make it an attractive option for investors who value both service quality and cost efficiency.

Groww: Simple and Low-Cost Trading

Overview

Groww started as a mutual fund investment platform and has expanded into stock trading, offering simple and low-cost brokerage services.

Features and Benefits

Brokerage Fees: Charges zero brokerage on equity delivery and Rs 20 per order on intraday and F&O.

Platform: The Groww app is intuitive and easy to use, making it ideal for beginners.

Additional Services: Also offers investments in mutual funds and other financial products.

Why Choose Groww?

Groww’s user-friendly interface and low-cost structure make it a perfect choice for new investors looking to start their trading journey without high costs.

INVEZT

Overview

INVEZT is an emerging brokerage firm focusing on providing low-cost trading solutions with advanced technology.

Features and Benefits

Brokerage Fees: Offers highly competitive brokerage rates, ensuring cost-effective trading.

Platform: INVEZT’s platform is designed for ease of use, with advanced features for seasoned traders.

Support: Provides robust customer support and educational resources.

Why Choose INVEZT?

INVEZT’s focus on low fees and advanced technology makes it a compelling option for investors seeking a modern, cost-effective trading solution.

m.Stock

Overview

m.Stock by Mirae Asset offers a combination of low brokerage fees and advanced trading tools, catering to a diverse range of investors.

Features and Benefits

Brokerage Fees: Charges zero brokerage on delivery trades and Rs 20 per order on intraday and F&O.

Platform: The m.Stock platform offers advanced charting, research tools, and seamless trading experiences.

Additional Services: Provides access to mutual funds and other investment products.

Why Choose m.Stock?

m.Stock’s blend of low costs and advanced trading tools makes it an excellent choice for investors looking for a comprehensive and economical trading platform.

Choosing the Right Low Brokerage Account

When selecting a low brokerage trading account, consider the following factors:

Trading Volume: Your trading frequency can influence the best choice. Active traders may benefit more from flat-fee structures.

Platform Features: Ensure the platform offers the tools and features you need for your trading strategy.

Customer Support: Reliable customer support can make a significant difference, especially when issues arise.

Additional Services: Some brokers offer additional services like mutual fund investments, which might be beneficial.

Reputation: The broker’s reputation and reliability are crucial for ensuring the safety of your investments.

Conclusion

Cutting costs is essential for maximizing returns in stock market investments. The brokers listed above offer some of the best low brokerage trading accounts in India, each with unique features and benefits. By choosing the right account, you can minimize your trading costs and focus on building a profitable investment portfolio. Whether you’re a beginner or an experienced trader, these low-cost options provide the tools and services you need to succeed in the market.

0 notes

Text

Empowering Investors: National Stock Exchange Programs

Educational Initiatives

One of the cornerstone initiatives of the NSE is the NSE Academy. This institution is dedicated to providing comprehensive financial education across various levels. It offers a range of programs that cater to different segments of society, from students and professionals to investors and regulatory bodies.

Certified Programs: The NSE Academy offers certification courses in various domains such as equity derivatives, currency derivatives, mutual funds, and financial planning. These courses are designed to impart practical knowledge and skills that are essential for a career in the financial markets.

Financial Literacy Programs: Recognizing the importance of financial literacy, the NSE conducts numerous workshops and seminars aimed at educating the general public. These programs cover basic financial concepts, investment strategies, and risk management techniques. The goal is to empower individuals to make informed financial decisions and achieve financial independence.

School and College Programs: The NSE has also forged partnerships with educational institutions to integrate financial education into the curriculum. Programs like the NSE Financial Literacy Quiz and the NSE Academy Certification in Financial Markets (NCFM) in schools and colleges help inculcate financial awareness from a young age.

Investor Awareness and Protection

Investor protection is a core mandate of the NSE. To this end, the exchange has developed several initiatives to safeguard the interests of investors.

Investor Awareness Campaigns: The NSE regularly conducts investor awareness programs across the country. These campaigns aim to educate investors about their rights and responsibilities, National Stock Exchange Programs the importance of informed investing, and the ways to avoid fraudulent schemes.

Grievance Redressal Mechanism: The NSE has a robust grievance redressal mechanism in place to address investor complaints efficiently. This mechanism ensures that investors have a reliable platform to resolve issues related to trading, brokerage, and other market-related activities.

NSE Investor Helpline: The NSE operates an investor helpline that provides assistance and guidance on various investment-related queries. This service is designed to support investors in navigating the complexities of the financial markets.

Technological Advancements

The NSE is at the forefront of technological innovation in the financial sector. It leverages cutting-edge technology to enhance market efficiency, transparency, and security.

SMARTs Technology: The NSE utilizes the SMARTs (Surveillance, Monitoring, Analysis, and Reporting Technologies) system to monitor trading activities in real-time. This technology helps detect and prevent market manipulation and ensures a fair trading environment for all participants.

Trading Platforms: The NSE has developed advanced trading platforms such as the NSE NOW (Neat on Web), which provides seamless and secure access to trading for investors and brokers alike. These platforms are designed to offer high-speed trading with minimal latency.

Corporate Social Responsibility (CSR)

In addition to its core activities, NSE courses the NSE is actively involved in various CSR initiatives aimed at social development and community welfare.

Skill Development Programs: The NSE supports skill development programs that focus on enhancing employability in the financial sector. These programs provide vocational training and skill enhancement opportunities for underprivileged youth.

Community Outreach: The NSE engages in various community outreach programs that address issues such as education, healthcare, and sustainable development. These initiatives are aligned with the broader goal of fostering inclusive growth and development.

0 notes

Text

Understanding Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) have emerged as a popular investment vehicle for those looking to diversify their portfolios without the need to directly purchase and manage real estate properties. Understanding Real Estate Investment Trusts (REITs) is crucial for both novice and seasoned investors seeking to tap into the lucrative real estate market with reduced risk and greater liquidity.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate across a range of property sectors. Modeled after mutual funds, REITs pool the capital of numerous investors to purchase and manage real estate properties, providing individual investors with the opportunity to earn a share of the income produced through commercial real estate ownership.

Types of REITs

Equity REITs

Equity REITs invest in and own properties. Their revenue is primarily generated through leasing space and collecting rents on the properties they own. They also earn income from the sale of properties that have appreciated in value.

Mortgage REITs

Mortgage REITs provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities. They earn income from the interest on these financial instruments.

Hybrid REITs

Hybrid REITs combine the investment strategies of both equity REITs and mortgage REITs, generating income through a mix of rent and interest from property holdings and real estate loans.

Advantages of Investing in REITs

Diversification

Investing in REITs allows for diversification within a real estate portfolio. By spreading investments across various types of properties and geographic locations, investors can mitigate risks associated with specific markets or property types.

Liquidity

Unlike direct real estate investments, REITs are traded on major stock exchanges, providing greater liquidity. Investors can buy and sell shares with relative ease, similar to stocks, which is not possible with traditional real estate investments.

Dividends

REITs are required by law to distribute at least 90% of their taxable income to shareholders as dividends. This ensures a steady income stream for investors, often making REITs an attractive option for those seeking regular dividend payments.

Professional Management

REITs are managed by experienced professionals who handle the day-to-day operations and strategic planning for the properties. This professional management can lead to better property performance and enhanced returns for investors.

Risks Associated with REITs

Market Risk

Like all investments traded on public markets, REITs are subject to market risk. Their value can fluctuate based on market conditions, interest rates, and economic factors, which can affect the overall return on investment.

Interest Rate Risk

REITs are particularly sensitive to changes in interest rates. When interest rates rise, the cost of borrowing increases, which can negatively impact the profitability of REITs, especially mortgage REITs that rely heavily on borrowed funds.

Property-Specific Risks

The performance of a REIT can be influenced by factors affecting specific properties or types of properties, such as changes in tenant demand, property management issues, or local economic conditions.

How to Invest in REITs

Direct Purchase

Investors can purchase shares of publicly traded REITs directly through a brokerage account. This method provides the benefits of liquidity and ease of trading, similar to stocks.

REIT Mutual Funds and ETFs

Investors can also gain exposure to REITs through mutual funds and exchange-traded funds (ETFs) that invest in a diversified portfolio of REITs. This approach offers additional diversification and professional management.

Private REITs

Private REITs are not traded on public exchanges and are typically available only to accredited investors. These REITs may offer higher potential returns but come with higher risks and lower liquidity.

Conclusion

Understanding Real Estate Investment Trusts (REITs) is essential for investors looking to diversify their investment portfolios with real estate exposure without the complexities of direct property ownership. REITs offer numerous advantages, including diversification, liquidity, and steady income, while also presenting risks such as market volatility and interest rate sensitivity. By carefully evaluating the types of REITs and their associated risks, investors can make informed decisions that align with their investment goals.

0 notes

Text

Title: Demystifying the Stock Market: A Beginner’s Guide to Investing

The stock market often evokes images of bustling trading floors, flashing tickers, and the potential for enormous wealth. For beginners, however, it can seem like an impenetrable world filled with jargon and risks. This guide aims to demystify the stock market, explaining what it is, how it works, and how you can start investing wisely.

What is the Stock Market?

The stock market is a network of exchanges where investors can buy and sell shares of publicly traded companies. It provides a platform for companies to raise capital by selling stock and for investors to purchase ownership in those companies. The most well-known stock exchanges include the New York Stock Exchange (NYSE) and the Nasdaq.

Key Components of the Stock Market

Stocks: Also known as shares or equities, stocks represent a fraction of ownership in a company. When you buy a stock, you become a shareholder and own a part of that company.

Stock Exchanges: These are the marketplaces where stocks are traded. Examples include the NYSE and Nasdaq. They provide the infrastructure and regulations for trading activities.

Indices: Stock indices, such as the S&P 500 and Dow Jones Industrial Average (DJIA), track the performance of a group of stocks. They provide a snapshot of market trends and overall economic health.

How the Stock Market Works

The stock market operates on the principles of supply and demand. Here's a simplified explanation:

Issuance of Stocks: Companies issue stocks to raise money for expansion, paying off debt, or other corporate activities. This is often done through an Initial Public Offering (IPO).

Buying and Selling: Investors buy and sell stocks on stock exchanges. They place orders through brokers, who execute these transactions.

Price Determination: Stock prices are determined by supply and demand. When more people want to buy a stock (demand) than sell it (supply), the price goes up. Conversely, if more people are selling a stock than buying it, the price goes down.

Participants in the Stock Market

Several key players make up the stock market ecosystem:

Retail Investors: Individual investors who buy and sell stocks for their personal portfolios.

Institutional Investors: Organizations such as mutual funds, pension funds, and insurance companies that trade large volumes of stocks.

Brokers: Intermediaries who facilitate buy and sell orders on behalf of investors.

Market Makers: Firms or individuals who provide liquidity by being ready to buy and sell stocks at any time.

Why Invest in the Stock Market?

Investing in the stock market offers several benefits:

Potential for High Returns: Historically, stocks have provided higher returns compared to other asset classes such as bonds and savings accounts.

Ownership and Voting Rights: As a shareholder, you have ownership in the company and can vote on important corporate matters.

Dividend Income: Some companies pay dividends, which are portions of their earnings distributed to shareholders.

Risks of Stock Market Investing

While the stock market can be lucrative, it also comes with risks:

Market Risk: The overall market can decline, leading to a decrease in stock prices.

Company-Specific Risk: Individual stocks can be affected by company performance, management decisions, and industry conditions.

Liquidity Risk: Some stocks may not be easily sold without impacting their price.

Getting Started with Stock Market Investing

For beginners, here are some steps to start investing in the stock market:

Educate Yourself: Learn about basic investment principles, market terminology, and financial statements.

Set Financial Goals: Determine your investment objectives, risk tolerance, and time horizon.

Choose a Broker: Select a reputable brokerage firm that offers user-friendly platforms and educational resources.

Start Small: Begin with a small investment that you can afford to lose. This helps you learn without significant financial risk.

Diversify: Spread your investments across different sectors and asset classes to reduce risk.

Stay Informed: Keep up with market news, economic indicators, and company performance to make informed decisions.

Practical Tips for Beginners

Patience is Key: Investing is a long-term endeavor. Avoid the temptation to react to short-term market fluctuations.

Regular Contributions: Consistently invest a portion of your income. This approach, known as dollar-cost averaging, can reduce the impact of market volatility. Want to know more

0 notes

Text

Algorithmic Trading Market Key Players Analysis, Opportunities and Growth Forecast to 2025

The Insight Partners recently announced the release of the market research titled Algorithmic Trading Market Outlook to 2025 | Share, Size, and Growth. The report is a stop solution for companies operating in the Algorithmic Trading market. The report involves details on key segments, market players, precise market revenue statistics, and a roadmap that assists companies in advancing their offerings and preparing for the upcoming decade. Listing out the opportunities in the market, this report intends to prepare businesses for the market dynamics in an estimated period.

Is Investing in the Market Research Worth It?

Some businesses are just lucky to manage their performance without opting for market research, but these incidences are rare. Having information on longer sample sizes helps companies to eliminate bias and assumptions. As a result, entrepreneurs can make better decisions from the outset. Algorithmic Trading Market report allows business to reduce their risks by offering a closer picture of consumer behavior, competition landscape, leading tactics, and risk management.

A trusted market researcher can guide you to not only avoid pitfalls but also help you devise production, marketing, and distribution tactics. With the right research methodologies, The Insight Partners is helping brands unlock revenue opportunities in the Algorithmic Trading market.

If your business falls under any of these categories – Manufacturer, Supplier, Retailer, or Distributor, this syndicated Algorithmic Trading market research has all that you need.

What are Key Offerings Under this Algorithmic Trading Market Research?

Global Algorithmic Trading market summary, current and future Algorithmic Trading market size

Market Competition in Terms of Key Market Players, their Revenue, and their Share

Economic Impact on the Industry

Production, Revenue (value), Price Trend

Cost Investigation and Consumer Insights

Industrial Chain, Raw Material Sourcing Strategy, and Downstream Buyers

Production, Revenue (Value) by Geographical Segmentation

Marketing Strategy Comprehension, Distributors and Traders

Global Algorithmic Trading Market Forecast

Study on Market Research Factors

Who are the Major Market Players in the Algorithmic Trading Market?

Algorithmic Trading market is all set to accommodate more companies and is foreseen to intensify market competition in coming years. Companies focus on consistent new launches and regional expansion can be outlined as dominant tactics. Algorithmic Trading market giants have widespread reach which has favored them with a wide consumer base and subsequently increased their Algorithmic Trading market share.

Report Attributes

Details

Segmental Coverage

Functions

Programming

Debugging

Data Extraction

Back-Testing & Optimization and Risk Management

Application

Equities

Commodities

FOREX

Funds and Others

Regional and Country Coverage

North America (US, Canada, Mexico)

Europe (UK, Germany, France, Russia, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, Australia, Rest of APAC)

South / South & Central America (Brazil, Argentina, Rest of South/South & Central America)

Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA)

Market Leaders and Key Company Profiles

AlgoTrader GmbH

Trading Technologies International, Inc.

InfoReach, Inc.

Tethys Technology, Inc.

Lime Brokerage LLC

FlexTrade Systems, Inc.

Tower Research Capital LLC

Virtu Financial

Hudson River Trading LLC

Citadel LLC

Other key companies

What are Perks for Buyers?

The research will guide you in decisions and technology trends to adopt in the projected period.

Take effective Algorithmic Trading market growth decisions and stay ahead of competitors

Improve product/services and marketing strategies.

Unlock suitable market entry tactics and ways to sustain in the market

Knowing market players can help you in planning future mergers and acquisitions

Visual representation of data by our team makes it easier to interpret and present the data further to investors, and your other stakeholders.

Do We Offer Customized Insights? Yes, We Do!

The The Insight Partners offer customized insights based on the client’s requirements. The following are some customizations our clients frequently ask for:

The Algorithmic Trading market report can be customized based on specific regions/countries as per the intention of the business

The report production was facilitated as per the need and following the expected time frame

Insights and chapters tailored as per your requirements.

Depending on the preferences we may also accommodate changes in the current scope.

Author’s Bio:

Anna Green

Research Associate at The Insight Partners

0 notes

Text

Demystifying Investment Banking in India – A Focus on SBICAPS to IDBI Bank

India's investment banking landscape has undergone a remarkable transformation, ushering in a new era marked by the prominence of key players wielding significant influence within the financial realm. Among these titans, SBICAPS, HDFC Bank, ICICI Securities, and IDBI Bank have emerged as stalwarts, shaping the trajectory of capital flows, mergers and acquisitions, and advisory services in the country. This comprehensive article delves into the intricate operations, diverse services, and substantial contributions of these esteemed institutions to India's vibrant capital markets.

SBICAPS: Pioneering Financial Solutions

As a subsidiary of the esteemed State Bank of India (SBI), SBICAPS boasts a rich heritage spanning over three decades in India's financial landscape. Renowned as on

e of the nation's premier investment banks, SBICAPS offers a multifaceted range of services, including investment banking, project advisory, debt syndication, and equity capital markets.

In the sphere of investment banking, SBICAPS excels in facilitating capital raising endeavors for corporations through various channels such as initial public offerings (IPOs), follow-on public offerings (FPOs), and private placements. Leveraging the expertise of seasoned professionals, the bank provides strategic guidance, meticulous structuring, and seamless execution of transactions, leveraging its extensive network and market insights to optimize outcomes.

Furthermore, SBICAPS assumes a pivotal role in debt syndication, steering fundraising initiatives for infrastructure projects, corporate expansions, and working capital needs. Through robust relationships with domestic and international lenders, the bank tailors debt financing solutions to ensure optimal capital structuring and competitive financing terms, thereby fueling growth and development.

Moreover, SBICAPS actively engages in equity capital markets, offering brokerage services, research insights, and investment advisory to institutional and retail investors alike. With a robust distribution network, the bank facilitates access to primary and secondary market offerings, empowering investors to make informed decisions and optimize their portfolios for long-term success.

Also Read: Rise of ESG Investing: Evaluating Environmental, Social, and Governance Factors

ICICI Securities: Driving Innovation for Financial Excellence

As a subsidiary of ICICI Bank, ICICI Securities stands as a leading investment bank and brokerage firm in India, celebrated for its innovative solutions, robust infrastructure, and client-centric approach. With a formidable presence across various asset classes, including equities, fixed income, and commodities, ICICI Securities delivers a broad spectrum of financial services tailored to meet diverse client needs.

Specializing in equity and debt capital markets, as well as advisory services, ICICI Securities' seasoned professionals provide comprehensive support to clients, spanning deal structuring, valuation, regulatory compliance, and execution. In the realm of debt capital markets, the bank aids corporates and government entities in fundraising endeavors through bond issuances, commercial paper placements, and structured debt products, leveraging its extensive network to deliver efficient financing solutions.

Additionally, ICICI Securities' equity capital markets team delivers research, trading, and investment advisory services to institutional and retail investors, supported by cutting-edge technology for seamless execution of transactions. The bank's robust distribution network ensures accessibility to primary and secondary market offerings, enhancing liquidity and market efficiency for all stakeholders.

HDFC Bank: Spearheading Innovation in Investment Banking

As a prominent private sector bank in India, HDFC Bank has established itself as a dominant force in the investment banking arena, harnessing its robust brand reputation, extensive clientele, and formidable infrastructure. The bank offers a comprehensive suite of investment banking services customized to meet the diverse needs of corporations, institutions, and individuals alike.

Within the realm of investment banking, HDFC Bank specializes in mergers and acquisitions (M&A), capital raising, and advisory services, collaborating closely with clients to execute complex transactions and drive strategic growth initiatives. Its debt capital markets division assists corporates in fundraising through bond issuances, structured debt instruments, and syndicated loans, leveraging market insights and innovative structuring capabilities to deliver efficient financing solutions.

Furthermore, HDFC Bank's equity capital markets team provides brokerage services, research coverage, and investment advisory to domestic and foreign investors, ensuring seamless execution of transactions and enhancing market liquidity. The bank's steadfast commitment to innovation and excellence reinforces its position as a key player in India's investment banking landscape.

Also Read: Risk Management in Investment Portfolios: Diversification and Beyond

IDBI Bank: Empowering Financial Growth

IDBI Bank, a significant contributor to India's financial sector, offers a range of investment banking services tailored to meet the diverse needs of corporations, institutions, and individuals. Specializing in areas such as mergers and acquisitions, capital raising, and advisory services, IDBI Bank collaborates closely with clients to execute strategic transactions and foster growth opportunities.

In the domain of debt capital markets, IDBI Bank facilitates fundraising for various projects and corporate initiatives through innovative structuring and strong relationships with lenders. Its equity capital markets team provides brokerage services, research coverage, and investment advisory to investors across different segments, ensuring seamless execution of transactions and enhancing market efficiency.

Also Read: Navigating Market Dynamics: The Vanguard Investment Banks of India From SBICAPS, HDFC Bank, And ICICI Securities

Conclusion: Driving Value in India's Financial Landscape

In conclusion, investment banks in India such as SBICAPS, HDFC Bank, ICICI Securities, and IDBI Bank play pivotal roles in shaping India's financial landscape, fostering capital formation, facilitating corporate growth, and driving market efficiency. Through their diverse service offerings, profound market expertise, and client-centric approach, these institutions significantly contribute to the development and sophistication of India's capital markets.

As India continues its journey of economic growth and financial modernization, the role of investment banks remains indispensable in fueling innovation, entrepreneurship, and sustainable development. With unwavering commitment to excellence and innovation, SBICAPS, HDFC Bank, ICICI Securities, and IDBI Bank are poised to navigate the evolving dynamics of the Indian financial ecosystem, driving value creation for clients and stakeholders alike.

0 notes

Text

Investing In Property

Real estate is often a popular investment option for investors seeking passive income, a hedge against inflation and other tax advantages. However, investing in property requires careful consideration and strategic planning. Choosing the right investment property will depend on cash flow and risk tolerance, as well as the economic environment and any current or anticipated interest rates.

Real-estate investments come in many different forms, from owning rental properties to owning commercial and retail space. For investors who are new to this type of investment, it’s important to work with a trusted financial professional to learn the ins and outs of how this type of investment works. Some of the most common types of real estate investment include:

Residential rentals

Investing in residential rental properties is one of the most popular ways for investors to generate passive income and build equity. This type of investment involves buying and renting out single-family homes or multifamily homes (where the investor lives in one unit while renting the others). This strategy is ideal for investors looking to reduce their living expenses while generating income from rental properties.

To maximize returns, it’s important to choose an in-demand area that is on the verge of a population boom or an economic upswing. Additionally, it’s essential to look for low vacancy rates and a cost-effective way to manage the property.

In addition to owning rental properties, investors can also choose to buy raw land and develop it for future use. This is a great opportunity for investors who are interested in long-term gains as the value of land typically appreciates over time. It’s also important for investors to consider the current and projected demand for land in their region.

Investors who are looking for more hands-off investment options may want to look into a real estate investment trust or crowdfunding platform. These investments allow investors to invest in income-generating property without the hassle of managing a building. Typically, these investment vehicles are publicly traded and can be purchased through a traditional brokerage.

If you’re new to this type of investment, it’s recommended that you seek the advice of professionals like a home inspector and real estate attorney. They can help you identify potential problems and navigate complicated contracts. They can also provide you with insights into the local market that may not be obvious to novices.

In order to start investing in property, it’s important to get preapproved for a mortgage. This will give you the flexibility to act quickly when opportunities arise. You can find investment properties by working with a real estate agent, consulting the MLS, getting to know your local areas and watching for vacant or foreclosed properties. Once you have your mortgage approval, you can begin searching for properties and finding out if you’re eligible to leverage your investment with a single- or multifamily home loan.

At Triple M Finance, our experience and a wealth of industry connections allow us to assist you with your application from start to finish and make the process simple. We take the time to get to know each and every client’s indvidual needs and circumstances to ensure we provide you with your ideal financial solution.

#investing in property#investment property information australia#investment property deductions#investment property purchase

0 notes

Text

What screener is best for intraday equity cash trading?

Choosing the best screener for intraday equity cash trading depends on your specific trading strategy, preferences, and the features you prioritize. Here are a few popular screeners used by intraday traders:

Zerodha Pi: Zerodha offers its proprietary trading platform, Pi, which includes a screener feature. It allows traders to screen stocks based on various criteria, including price, volume, volatility, and technical indicators. Since Zerodha Pi integrates directly with Zerodha trading accounts, it's convenient for intraday traders using Zerodha as their brokerage.

TradingView: TradingView is a widely used platform offering advanced charting tools and customizable screeners. It provides a vast range of technical indicators and allows users to create custom screeners based on their trading strategies. TradingView is web-based and also offers a mobile app, making it accessible for intraday traders on various devices.

ChartMill: ChartMill is a web-based screener that provides various stock screening criteria, including technical indicators, fundamental data, and custom filters. It's user-friendly and offers both free and paid subscription options with additional features.

Investing.com Screener: Investing.com offers a comprehensive stock screener tool that allows users to filter stocks based on technical and fundamental criteria. It covers multiple stock exchanges worldwide and provides real-time data, making it suitable for intraday trading.

Screener.in: While primarily focused on fundamental analysis, Screener.in also offers some basic technical indicators. It's a free tool that provides financial data and ratios for Indian stocks, making it useful for intraday traders who incorporate fundamental analysis into their trading strategies.

Ultimately, the best screener for intraday equity cash trading depends on your specific requirements and preferences. It's essential to choose a screener that aligns with your trading strategy and provides the necessary features and data to make informed trading decisions. Additionally, consider factors such as usability, reliability, and cost when selecting a screener for intraday trading.

Top of Form

LTP Calculator Overview:

LTP Calculator is a comprehensive stock market trading tool that focuses on providing real-time data, particularly the last traded price of various stocks. Its functionality extends beyond a conventional calculator, offering insights and analytics crucial for traders navigating the complexities of the stock market.

Also Available on Play store - Get the App

Key Features:

Real-time Last Traded Price:

The core feature of LTP Calculator is its ability to provide users with the latest information on stock prices. This real-time data empowers traders to make timely decisions based on the most recent market movements.

User-Friendly Interface:

Designed with traders in mind, LTP Calculator boasts a user-friendly interface that simplifies complex market data. This accessibility ensures that both novice and experienced traders can leverage the tool effectively.

Analytical Tools:

Beyond basic price information, LTP Calculator incorporates analytical tools that help users assess market trends, volatility, and potential risks. This multifaceted approach enables traders to develop a comprehensive understanding of the stocks they are dealing with.

Customizable Alerts:

Recognizing the importance of staying informed, LTP Calculator allows users to set customizable alerts for specific stocks. This feature ensures that traders receive timely notifications about significant market movements affecting their portfolio.

Vinay Prakash Tiwari - The Visionary Founder:

At the helm of LTP Calculator is Vinay Prakash Tiwari, a renowned figure in the stock market training arena. With a moniker like "Investment Daddy," Tiwari has earned respect for his expertise and commitment to empowering individuals in the financial domain.

Professional Background:

Vinay Prakash Tiwari brings a wealth of experience to the table, having traversed the intricacies of the stock market for several decades. His journey as a stock market trainer has equipped him with insights into the challenges faced by traders, inspiring him to develop tools like LTP Calculator.

Philosophy and Approach:

Tiwari's approach to stock market training revolves around education, empowerment, and simplifying complexities. LTP Calculator reflects this philosophy, offering a tool that aligns with his vision of making stock market information accessible and understandable for all.

Educational Initiatives:

Apart from his contributions as a tool developer, Vinay Prakash Tiwari has actively engaged in educational initiatives. Through online courses, webinars, and seminars, he has shared his knowledge with aspiring traders, reinforcing his commitment to fostering financial literacy.

In conclusion, LTP Calculator stands as a testament to Vinay Prakash Tiwari's dedication to enhancing the trading experience. As the financial landscape continues to evolve, tools like LTP Calculator and visionaries like Tiwari sir play a pivotal role in shaping a more informed and empowered community of traders.

0 notes