#doorstep cash loans

Text

CARD TO CASH

#Our Services:#Card to cash Bank Account#Credit card to Bank Transfer.#Transfer Money Credit Card To Bank Account.#Credit card to Instant cash.#Maintaining Cash in Bank Accounts better than have accredit card.Turn your credit card limit to cash instantly for easy use of money .#We accept all kinds or credit cards just one swipe get instant money your bank account#Looking for Loan? We provide case against your credit card at your Doorstep.#We do PAN INDIA also.#Just a Call Away!#Spot Cash in all Major Credit cards#https://wa.me/9963606965?text=#More Info:+91-9963606965#Location:Shastri Rd#Ashoknagar#Karimnagar#Telangana 505001#creditcard#bank#transfer#instantcash#bankaccount#goodcredit#cibl

0 notes

Text

like a flash in the night.

summary: your relationship with bai yi is purely transactional... or she'd like you to believe.

notes: 1.5k words, fic, a commission for @mh8 (who I have to thank for giving me a chance to write about miss bai yi <3), descriptions of violence + lightest suggestive content

i.

Bai Yi was taking advantage of you.

You would be a fool not to realize it; the only time she ever called you was when she needed a favor or a place to crash. You had learned to temper your expectations when your phone rang and Bai Yi’s silky voice was on the other line, when she flirted or wheedled or made another empty promise to treat you to a nice meal (a meal you would, inevitably, end up footing the bill for).

But when she showed up on your doorstep, bruised and cheerful, you still ran to see her, heart pounding.

“You’re an angel!” Bai Yi exclaimed, clasping her hands together dramatically when you swung open the door. “I know you wouldn’t let me down, hm?”

You could slam the door in her face for once, you thought. Tell her to go somewhere else, or to come back when she finally planned on paying back the money she borrowed from you.

But you only sighed at her theatrics, and gestured impatiently for her to come inside. “You can’t keep doing this, Bai. I have a life, and I can’t drop everything to help you every time you run into trouble. What is it this time? Debt collectors? Syndicate gangsters?”

Bai Yi had the decency to slip off her heels before she entered your apartment properly, throwing them carelessly at the doorway. You paused to line them up at the entrance, toes pointing towards the door, as she ambled down the hall as if she owned the place.

“Can’t I come just because I miss you, angel?”

You flushed at the sound of the nickname. “I don’t believe that.”

“Well…”

“Bai,” you said firmly. “What did you do?”

“I may have borrowed some money and promised to pay it back last week…”

“Oh my god.”

“But, ah, I had some emergency expenses to finance, so all of the cash I was going to put towards my loans? Gone! Just like that!”

You doubted she actually had any money to pay the loans back with; more likely than not, she had spent it all on some shady business venture investment and lost all her cash in the process. You followed the sound of her carefree voice down the hall, only to end up in front of your bedroom. Bai Yi was circling your bed, running a finger along the duvet.

“Bai Yi,” you said. “You’re on the run from loan sharks? Again?”

She shrugged, before diving onto your bed. “Yup! K.K. will get it all sorted out, though, so don’t even worry about it.”

“Bai–”

“I’m tired from being on the run. Angel, could you please close the door for me?”

You watched as Bai Yi pulled your comforter over herself, head sinking into the pillows you had fluffed just that morning.

“At least take off your street clothes!” you said, exasperated.

“Sorry, angel. If you want to get me naked, you’ll have to try harder.”

You shut your bedroom door irritably. It looked like it would be another night sleeping on the couch for you.

ii.

“Bai Yi, I swear to god, if you make me lose my apartment, I am going to toss you to MBCC myself!”

“Angel, don’t be so hasty! Don’t things always work out for us?”

You growled, biting back a string of curses as Bai Yi’s motorcycle cut around a corner so sharply your head almost touched the warm asphalt. The breeze whipped away her laughter; even in a situation where the two of you were on the run from Syndicate loan sharks, Bai Yi couldn’t take a single second of it seriously.

“Fuck!” you yelled as the motorcycle jostled over a pothole and swerved around a pedestrian, who screamed bloody curses after you two.

“You have to hold onto me tighter,” Bai Yi instructed, eyes still glued to the road. “Try not to cop a feel.”

“You’re disgusting. I’m not–” Another sharp turn, another close brush with the pavement where your head almost cracked like an egg, and you decided you could save the witty remarks before your brains ended scrambled up all over the streets of Syndicate.

Reluctantly, you looped your arms around Bai Yi’s waist, so tightly you could feel her muscles tensing under her skin, feel the rumble of her laughter echo straight into your heart as she sped through narrow roads and dark alleyways. You rested your head against her back, squeezing your eyes shut as you nuzzled against her jacket. She smelled like sun-warmed leather, and cheap alcohol, and something you couldn’t quite place– it was the smell of the city itself, of cracked pavements and the faint tang of blood.

She had always promised to take you out for a spin on her bike, but you never imagined she would fulfill under such strenuous circumstances.

You couldn’t help but smile a little into her jacket. As unreliable as Bai Yi was, she had always shown you a good time.

iii.

You had never seen that expression on Bai Yi’s face before.

She was always ready with an easy smile or an over-dramatic frown to flash at you. Sometimes you forget just how strong she really was. It was strange to see her mouth so thin, her gaze cold and calculating, a barely-contained anger edging all of her words. She was like a predator, ready to strike at the first sign of weakness, power and tension rolling under her skin.

“They have nothing to do with this,” she said slowly. “Let them go.”

The gangster holding a knife at your throat barked out a wheezy laugh. “Listen, Bai Yi. They–” He yanked you closer to the knife, metal scraping your throat, and Bai Yi’s eyes tracked him “--got involved as soon as they met you.”

Her hand twitched on the handle of her swords, and the gangster hissed, pressing the blade into the skin of your neck, just enough for you to gasp at the sudden pain as a trickle of blood trailed onto your collarbone.

That must have been the final straw for Bai Yi. She snarled, and in the space between one blink and the next, the gangster’s head was lying on the floor, his face still frozen in a haughty grimace.

You couldn’t even call it a fight; it was a one-sided slaughter. Everytime you blinked, there was another head rolling on the floor, another body crumpling like a broken doll. In under a minute, Bai Yi was calmly wiping the blood off her swords with a coat ripped off a nearby corpse, before sheathing them into their scaboards.

That strange, intense expression still hadn’t faded off her face as she strode towards you, anger still vibrating in every inch of her body.

“Are you okay?” she said. Her fingers drifted towards your face, as if she wanted to touch you; but they only hovered over your skin as complicated emotions warred across her face, each flashing by too fast for you to gauge what they were.

You shook your head; you were still trying to process what just happened, but the shock must have caught up to you, because your legs gave way. Bai Yi easily caught you before you could fall. Her grip was surprisingly strong but gentle, and her arm curled protectively around you, pulling you closer towards her body.

“Let’s go home,” she said softly. “You need some rest.”

“Bai, I–”

“Don’t say anything,” she said quietly. “I’m sorry. I should have known better than to bring trouble to your door.”

You nodded, and the two of you simply stood like that for a while. When you moved to step away, her hands lingered, as if she wanted to hold you close to her forever.

“Next time,” you said slowly, as Bai Yi led you towards her motorcycle, “You have to treat me to dinner at a restaurant. A nice one.”

“Are you asking me on a date?” she said.

“No. You’re going to be the one to ask me,” you replied. You thought she might have smiled, but you couldn’t be sure.

iv.

Che folded his arms as he surveyed the apartment building across from the alley he, K.K. and Bai Yi were lurking in. “So you want me to stake out this place?”

“Just for the next few weeks,” Bai Yi said. “Make sure the, ah, person I told you about doesn’t meet with any trouble.”

“Why this place, Bai Yi?” K.K. said curiously. “Don’t tell me you borrowed from another loan shark.”

Che rolled his eyes. “It’s not like that, K.K. This is where the boss’s secret lover lives.”

“Her what?” K.K. hissed.

“We’re not in that kind of relationship,” Bai Yi said lightly.

Che appraised her, raising one eyebrow. “You sure?”

“I don’t get attached. You know that, Che. Come on! It would be sad for all the gorgeous women in Syndicate if I settled down so easily, don’t you think?”

Don’t get attached, my ass. Why do you look at them like that, then? Che bit back his words; Bai Yi knew her feelings best, and if she didn’t have a reason for revealing them, then neither did he.

The trio gave one last glance at the apartment complex, Bai Yi’s lingering on a particular window on the third floor, before they vanished into the night.

#liya writes#path to nowhere#bai yi#bai yi x reader#path to nowhere x reader#x reader#BAI YI BAI YIIIII#RIPS OPEN MY SHIRT. OH MY GOD AHH AHHHHHHHH#im normal.#AHHHHHHHHHHHHHHHHHH#shes everything 2. me.

260 notes

·

View notes

Text

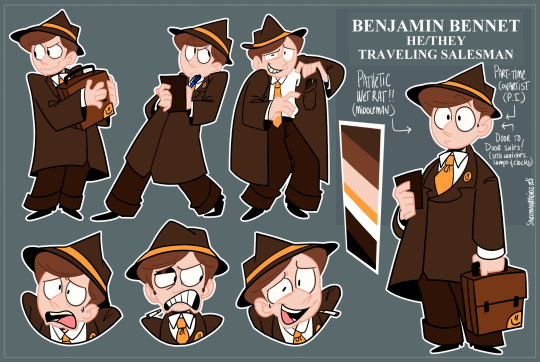

Benjamin Bennet | 2023 Reference Sheet

🐀💼

The traveling salesman! You may spot him going from door to door offering people a catalogue of lamps, watches and clocks, but he never fails to show up at your doorstep.

As his job does not pay much, he owes a bunch of loan sharks money and is on the verge of debt. Because of this, he has a side job of being a conartist private investigator, selling information on bounties or people in general to get a bit of cash.

17 notes

·

View notes

Text

How Urgent Doorstep Loans Can Help to Overcome Financial Hitches?

Are you looking for quick cash to cover all your unforeseen expenses like debts or any other bills without the hassle of traditional bank loans? You must take urgent doorstep loans. Unlike any other option, it is a convenient solution that helps people who are facing unexpected financial crises. In general, this kind of loan lets anyone get fast access to funds at their doorstep. Most importantly, this will eliminate the need for long processes and tedious paperwork.

In general, urgent doorstep loans allow people to experience straightforward borrowing. Whether you are dealing with any unforeseen medical bills or other urgent expenses, these loans can offer instant financial relief without any complications.

Overall, the application process is simple. Once you get approval then, a representative will visit you to finalize your loan agreement, and the expert disburses the funds. This process eliminates the stress of visiting a lending institution.

Through this loan, one can easily borrow moderate amounts of money, and it comes with manageable installments that perfectly suit you.

In what ways can urgent doorstep loans be beneficial?

Urgent doorstep loans allow you to experience a lot of benefits. First, it is ideal for people who are facing unexpected financial complications. Unlike any form of conventional loan, these finances offer quick access to cash and help address pressing expenses with ease. It even eliminates the need for third-party involvement, so you can get the money when you want.

With doorstep loans, anyone can access the funds mainly because it is perfect for people who have mobility issues or busy schedules. On the other hand, these loans also offer more flexibility.

Moreover, these loans can be available for people even with bad credit. By the way, people with poor credit histories also get a much-needed financial lifeline during emergencies.

Besides, these loans also provide flexible repayment terms. This factor allows anyone to repay the loan through simple yet manageable installments. Mainly, this factor also helps ease the financial strain of complicated repayment terms. Overall, this also makes your budget more straightforward to manage.

Taken as a whole, urgent doorstep loans facilitate more convenience and flexibility in borrowing. If you have unexpected expenses and need quick cash to sort out the complications, you must take advantage of this loan. Nowadays it is also simple to get the door step debt consolidation loans for bad credit in the UK from a direct lender online. It helps to overcome the complications created by amount overdues or outstanding bills.

Using loans as such will help you in improving your credit score too. It is because you will clear all the pending debts and that will enhance your financial record.

Do doorstep loans for bad credit require collateral?

Actually, you do not need to offer any form of collateral while applying for bad credit doorstep loans in the UK. These are known as unsecured, so it eliminates the requirement of security. Instead of accessing your credit score or your credit history, the lenders will focus on some other factors, including your job status, income, etc.

Bad credit doorstep loans are perfect for getting access to quick funds during hard times. Since it does not require collateral, the complete process is simple yet straightforward. Overall, it is one of the accessible borrowing choices for people who do not have any valuable assets to pledge as security.

Without any collateral, it is simple to apply online, or you can also get the loan over the phone. Once you get approval for, the representative will offer the money by visiting your home. This personal approach also enhances more convenience and convenience for borrowers. Mainly, it is ideal for those who face complications in visiting traditional branches.

While collateral is not required, it is still essential to know the critical aspects related to the loan. Most lenders impose stricter eligibility standards and follow some rules when it comes to offering these kinds of loans.

Overall, if you need instant money, then you may choose doorstep loans; this kind of loan can offer you a convenient solution without any collateral. Nevertheless, try to carefully consider the terms before proceeding. This will allow you to choose the correct option based on your financial situation.

Conclusion:

Getting urgent doorstep loans from a direct lender offers you a convenient way to get money for urgent needs. Unlike any other choice, it is exclusive for people who are facing unexpected financial emergencies.

By using these funds, you can quickly sort out all your financial needs. The complete process is done online. This factor ensures convenience, but it is essential to focus on some critical aspects while choosing a loan.

Especially try to compare the loan terms with different lenders; this will allow you to finalize suitable urgent doorstep loans based on your exact situation. By the way, you will get the funds that offer excellent relief when you need them.

0 notes

Text

Surpass Unemployment: 5 Effective Tips and Job Portals in Ireland!

Unemployment is one of the stop-breaking things for Irish people who are deliberately looking for jobs. Sometimes, the lack of skills may become the reason behind unemployment. And sometimes, you don't find the right fit according to your skills.

You may find the salary amount to be too low to meet your ends. Skipping a job and waiting for the next best opportunity may be the right decision many times.

You skip a job and wait for the right job when you are sure about yourself. Being unsure about your skills and still doing so is not a good idea. But if you are the one with high self-esteem and the right approach toward your career, then you can make it.

People with such zeal get support from various direct lending institutions in Ireland. They receive loans for unemployed Ireland. If you do not know how these loans work, then you can develop your understanding below.

What are the criteria for unemployed people to receive loans?

Loans for the unemployed are just like financial security. This security comes to the rescue of people going through adverse financial stances in unemployment. Security is available to Irish people above 18 years old. There are various other things you should take into account. Right below, you will find the valid points for receiving loans for jobless people.

The minimum age is 18 years old to meet the eligibility criteria.

Registration under the electoral roll to provide your citizenship status.

Paid utility bills for address proof.

Your ID proof.

Direct lender's eligibility criteria may differ. One lender may ask you to provide documents, while another may not ask you to do so. So choose the lender that provides you with the loan on easy terms and conditions.

Once you receive the loan, you also need to discover the right methods to utilize such loans. There are several ways you can utilize loans for jobless individuals. Dive into the diverse ways and make that are apt to your individual situation.

Study abroad:

If you find valuable insights in abroad courses that may elevate you in your career, then you can go ahead. Study abroad with loans for unemployed people. Get funds from reliable lending institutions.

Excel in your field, and become flawless. If you have a valid sum of money to take charge of your expenses, then you should go ahead. But here choose instant cash loan in 1 hour Ireland to bridge the small gap of funds. These loans are apt for short term funding.

Pursue short-term courses:

If you find yourself stuck in the whole field, you can master one thing at a time. There are various short-term online courses that provide insightful experiences. You can pursue such courses and enable yourself to grab the right job opportunity.

Sharpen your skill:

You can sharpen your skills through comprehensive solutions. There are various short-term guidance plans that help you to advance your knowledge and skills. If you find the right option to accelerate your growth in the relative field, then go ahead.

Bear your regular expenses:

Suppose you find yourself stuck in taking care of your regular expenses. You can borrow loans for people with no job. Meet your regular ends while searching for a job, and repay on the salary day.

Get a subscription of paid tools:

IT professionals or some other job field experts may require access to paid tools. If you require access to a few advanced tools, then you can do it. While searching for a job, you can access such tools to gain excellent knowledge and insights related to the subject.

What are the major substitutes for loans for unemployed people?

Payday loans

Doorstep loans

Education loans

Credit card

What are the top 5 job portals for Seeking Jobs in the UK?

Linkedin

Indeed

Glassdoor

Totaljobs

Reed

Final Thoughts to Jobseekers!

There are various other job portals you can search online, and apply for your relative field. Search online putting some extra pressure on your finger tips. Cover your expenses while finding the job of your dreams. Meet your expenses till then with loans without a job. Request your lender to extend the grace period for the repayment.

The extension of the grace period will help in skipping the bad credit score if you do not find a job till then. While looking for a job, you are most likely taking much more time than you think. This happens in the case of your dream job. Still, many people get jobs faster.

The magic about succeeding with such loans is the choice of the repayment tenure. As you will be able to pay on the salary day choose the maximum time you need to get the job added with the salary day time.

Description:

Surpass the unemployment with proven tips and reputed job portals. Handle your monthly expenses with loans for unemployment and payback on your salary day.

For more information about quick loan ireland, no credit check same day loans, short term no credit check loans visit our website - https://www.myloansclick.com/

Our Contact Address:

69 Ranelagh, Dublin 6, D06 F2K2, Ireland

69 Ranelagh, Dublin, D06 V378

Mobile: 0353-19062765

Email: [email protected]

0 notes

Text

Essential tips for saving money while booking a hotel

Accommodation bills after airfares, by all accounts, rock a travel budget. Despite frequent travelling, people find it all but impossible to save money on the travel cost. Advanced booking is not always a solution. The sites you are using for booking are also an important factor in adding up the cost. Ask your friends if they know a site offering the best accommodation deals. Here are the essential tips for saving money on booking a hotel:

Shop around

We are creatures of habit. We would like to stick to the same travel agent to book an airline and accommodation time after time. We do not want to bear the hassle of choosing a different travel agent every time we want to book a holiday, which, of course, sounds rational, but what if you can save your money with the discomfort of shopping around?

“Do not grab the first offer you see,” said Paula, a money advisor of 24CashFlow. “Comparing prices will pay you off. The comparison must be made in terms of the benefits you are receiving. Low prices may mean fewer facilities.”

Contact the hotel directly

A rate-parity clause can keep you from availing yourself of discounts and added facilities your hotel might offer you if you contact them directly. Do not believe in the prices of the hotel website; you rather pick up your phone and contact them. However, there is a chance that you will find some hotels charge you the same price and even higher than the travel agent's price.

Booking your hotel with an online travel agent brings other benefits. You will be reliant on them to make any complaint, change the booking and seek a refund. Your travel agent will be acting as an intermediary between you and your hotel. You can seek urgent doorstep loans if you do not have enough money to pay your agent’s fees.

Avoid last-minute booking

The last minute booking is not recommended to seek a cheaper deal. “You should book your hotel at least three months in advance,” said the money advisor. “Do not afraid of asking them for added benefits. Make sure you are not being charged the same price. Research is still important.”

“Only if you are open-minded about where you are going or who you are going to stay with will the minute booking be a good choice,” he added. “Otherwise, you should book in advance.”

Sign up for a loyalty programme

“Many people think loyalty programmes are for racking up points to redeem them later,” said the money advisor, “but they are also known for offering discounts on your hotel stays.” You should sign up for a loyalty programme even if you do not travel very often. Loyalty programmes are aimed at encouraging people to book directly by offering them discounts. Some loyalty programmes like AAA carry fees to join. They can slash your accommodation costs.

Use a review site

The availability of a hotel at lower prices does not mean that it is worth staying. Sometimes, you do not get what you expected. Therefore, it is crucial to review a website. Google reviews and social media reviews will help you make a good decision about your hotel choice.

Check an independent site like a TripAdvisor to check detailed reviews by former guests.

Do not believe in the star rating system. The number of amenities, not the quality of the place, determines it. The number of positive and negative reviews also affects the overall rating.

Never trust the testimonials on the website of a hotel. They are false that the hotel itself writes.

At the time of booking a hotel, you should haggle for the best price. It is possible only when you are booking the hotel directly without the help of a travel agent.

Consider hostels

When you are "cash-strapped", hostels will be a better preference. They can offer massive savings, but research thoroughly to ensure you do not get trapped in a dirty hostel. Make sure there are facilities for breakfast and internet access. The "Hostelz.com" site will let you compare the prices and check reviews from past guests. Some hostels will allow you to receive extra discounts if you sign up for a membership. In the event of a tight budget, you can apply for loans for the unemployed in the UK.

The final word

There are a lot of ways to book a hotel at lower prices. Comparison shop and check reviews to ensure the hostel is worth staying at. It is advisable to contact a hotel directly because you will get a room at lower prices than the travel agent. Book your accommodation in advance to get hefty discounts. Sign up for a loyalty programme to seek additional benefits and cashback.

#bad credit loans#unsecured loans#personal loans#payday loans#finance#loans#long term loans for bad credit#loans for unemployed#find the best loan for you

0 notes

Text

Why Bandhan Bank Can Be Your Partner in Progress

The journey of entrepreneurship is paved with ambition and innovation. But to translate ideas into reality, securing the right funding is essential. Bandhan Bank emerges as a compelling choice, offering a comprehensive suite of business loan products designed to empower your business growth. This blog explores ten compelling reasons why Bandhan Bank can be your trusted partner in fulfilling your business loan needs.

1. Diverse Loan Products to Fuel Your Growth:

Bandhan Bank doesn't offer a one-size-fits-all solution. They understand that businesses have different needs at various stages. From microloans for nascent ventures to term loans for established businesses, Bandhan Bank Business loan offers a spectrum of loan products to cater to your specific requirements.

2. Competitive Interest Rates:

While interest rates are subject to change, Bandhan Bank strives to offer competitive rates on their business loans. This translates to potentially lower borrowing costs and improved cash flow for your business.

3. Streamlined Application Process:

Bandhan Bank understands the value of your time. Their application process is designed to be simple and efficient, minimizing complex documentation and expediting loan approvals.

4. Doorstep Service for Your Convenience:

Bandhan Bank prioritizes customer convenience. They offer doorstep banking services, where a dedicated Relationship Officer visits your business premises to assist you with the loan application process.

5. Flexibility in Repayment Options:

Understanding that cash flow can fluctuate, Bandhan Bank offers flexible repayment tenures and structures. Choose a repayment plan that aligns with your business's financial rhythm.

6. Empowering Micro and Small Businesses:

Bandhan Bank has a strong commitment to supporting the growth of micro and small businesses, which are the backbone of the Indian economy. Their loan products and services are tailored to cater to the specific needs of these businesses.

7. Focus on Rural and Underbanked Sectors:

Bandhan Bank extends its reach to rural and underbanked sectors, providing financial inclusion to businesses that might otherwise struggle to access traditional banking channels.

8. Digital Banking Solutions for Efficiency:

Bandhan Bank embraces technology, offering user-friendly digital banking solutions. This allows you to manage your finances conveniently, monitor transactions, and make loan repayments online.

9. Value-Added Services Beyond Financing:

Bandhan Bank goes beyond just providing loans. They offer value-added services like financial literacy workshops and business advisory support to empower your entrepreneurial journey.

10. A Bank with a Social Mission:

Bandhan Bank operates with a social mission at its core, focusing on financial inclusion and empowerment. Choosing Bandhan Bank aligns your business growth with a positive social impact.

Conclusion

Bandhan Bank emerges as a strong contender for your business loan needs. Their diverse loan options, competitive rates, and commitment to customer convenience make them a valuable partner in propelling your business growth. With a focus on micro and small businesses, rural outreach, and financial inclusion, Bandhan Bank goes beyond traditional banking, offering a blend of financial solutions and social responsibility. So, if you're seeking a reliable partner to build your business brick by brick, consider Bandhan Bank. Explore their loan products, leverage their flexible and convenient services, and embark on your entrepreneurial journey with confidence!

0 notes

Text

Discovering the Convenience of Doorstep Loans in Blackpool

In a world where unexpected financial crises can strike at any time, having access to quick and easy options is critical. This is where doorstep credits move toward, offering a life saver to people confronting unforeseen costs in Blackpool. Let's take a closer look at what doorstep loans are, how they work, and why they are becoming more and more popular in this lively coastal town.

Getting to Know Doorstep Loans:

Doorstep advances, otherwise called home credit advances, are a sort of private advance that is conveyed straightforwardly to your doorstep. Doorstep loans, in contrast to conventional bank loans, which necessitate multiple visits and extensive paperwork, provide a hassle-free borrowing experience. They are made for people who may have trouble getting mainstream credit for a variety of reasons, like having bad credit or having irregular income.

How are Doorstep Loans Operated?

Obtaining doorstep loans in Blackpool is a straightforward process. In the wake of applying either on the web or via telephone, a delegate from the loaning organization visits your home to examine your monetary requirements and survey your capacity to reimburse the credit. When endorsed, the advance sum is given to you in real money, extremely close to home. Ensuing reimbursements are likewise gathered face to face, regularly on a week after week or fortnightly premise, making it helpful for borrowers to deal with their credit commitments.

The Appeal of Doorstep Loans in Blackpool:

All in all, what makes doorstep credits so engaging, especially in a town like Blackpool? First, they cater to people who prefer face-to-face interactions by providing instant cash access without the need for a bank account or internet access. People who live in remote areas or don't have easy access to transportation will especially appreciate this accessibility.

Additionally, doorstep loans permit borrowers to select a repayment plan that coincides with their income cycle. This can be especially useful for people with sporadic or occasional pay, for example, those functioning in the travel industry, which is common in Blackpool.

In addition, doorstep loans frequently consider applicants with less-than-perfect credit scores, offering a lifeline to those who might have been turned down by conventional lenders. Financial assistance is made available to a wider range of people as a result of this inclusive approach, enhancing the community's economic resilience.

In conclusion, doorstep loans in Blackpool who are confronted with unexpected expenses or temporary cash shortages can rely on doorstep loans as an essential financial tool. Their comfort, openness, and adaptability pursue them a well-known decision among occupants looking for speedy and bother free getting arrangements. Nonetheless, it's fundamental to get dependably and just when important to try not to fall into a pattern of obligation. Doorstep loans can indeed be a useful resource in times of need when properly managed.

1 note

·

View note

Text

Start Your Own Business With SahiBandhu Gold Loan

Establishing a business is an ambitious and exciting venture that needs both a strong financial base and a brilliant idea. Securing sufficient funding is essential to any successful entrepreneurial endeavour, and this is where SahiBandhu Gold Loan comes into play as a game-changing option for aspiring business owners. Take the road to success as you leverage the advantages of gold loan to confidently start your own business, turning entrepreneurial aspirations into thriving realities.

The Importance of Financial Support for Starting a Business

While many people have dreams of becoming entrepreneurs, the reality of starting their own business frequently presents its own set of financial difficulties. The expenses of launching a business can be overwhelming, ranging from finding a good site to recruiting a skilled staff to buying equipment. Turning entrepreneurial dreams into real, sustainable businesses requires financial assistance.

Having access to cash is crucial for meeting beginning expenditures, controlling ongoing expenses, and overcoming unanticipated obstacles, regardless of the size of the business. In addition to facilitating the launch of the company, financial backing serves as a safety net, giving the required buffer during the early stages of operation when income generation may be difficult.

Introduction to SahiBandhu Gold Loan

SahiBandhu Gold Loan is a strategic partner for entrepreneurs aiming at executing their company ideas, not merely a provider of financial services. The idea is to use gold, a valuable and reliable item, as collateral to get the money required to launch business ventures. This method reduces the difficulties that are frequently connected to conventional loans and makes it possible for a larger group of people to obtain the funding required for the start-up, expansion of their businesses and business funding.

SahiBandhu also provides gold loan for MSME and its precise evaluation of gold loan rates per gramme ensures borrowers make the most of their gold assets. Following are a number of outstanding benefits that you’ll receive when you apply for a gold loan from SahiBandhu, which distinguishes us as a top gold loan supplier.

Loan Eligibility and Documentation: SahiBandhu promises no paperwork, which makes the loan application process entirely digital. It also provides explicit eligibility standards, which expedites the application process for gold loans. This suggests that a wide range of borrowers can apply for a gold loan in a simple and straightforward way.

Competitive Interest Rates: SahiBandhu offers competitive interest rates on gold loans, keeping a close watch on the current gold rate. As a result, you may make use of your gold jewellery and fair financing options. Before accepting the loan, it’s critical to inquire and compare interest rates on gold loans to ensure you obtain the finest terms possible.

Fast and Easy Processing: SahiBandhu provides speedy loan processing since we understand that sometimes you need money right away and want to provide you access to it as soon as possible. In order to maximize the loan amount against your gold jewellery, its is advised to be informed about the current gold rate.

Flexible Gold Loan Repayment Options: Individuals with different financial needs can choose from a variety of unique repayment arrangements. There are three methods available for paying back your gold loan.

Doorstep Gold Loan Service: Fund your business effortlessly with SahiBandhu with its hassle-free doorstep gold loan services.

You will have to fill a simple online application and submit your information. Soon after this, you will be assisted by a SahiBandhu representative.

The weight and purity of the gold collateral determines the loan amount eligibility;, identity and address credentials are among necessary verification papers.

The Smart calculator on SahiBandhu Gold Loan’s website, provides transparency when calculating gold loan amount and interests.

After the application is filed, a representative will come to your house to complete KYC and proceed with the process of loan disbursement.

The gold is sealed and safely kept in the storage until the loan is approved.

You will receive a direct deposit of the authorized loan amount in your bank account within 30 minutes.

The gold ornaments are swiftly returned upon repayment, making SahiBandhu’s doorstep gold lending services an easy, clear cut and borrower focused financial option.

SahiBandhu Gold Loan Repayments

For customer easy and make your gold loan repayment hassle-free, we have flexible gold loan repayments options to repay your gold loan.

SahiMax: With this repayment option, you have the choice to pay only the interest on your loan for the duration of it, or you can choose to pay the principle amount in full at the time of loan closure. This technique aligns repayments with cash flow cycles, which makes money management easier.

SahiDelight: This repayment option is intended to be simple to use and hassle-free. It ensures a clear path to debt-free finances and makes budgeting a breeze.

SahiFlexi: Depending on how much of the loan amount you actually utilise, you may pay interest each month while using SahiFlexi’s gold overdraft option. This approach is ideal for those whose financial situation fluctuates regularly since it ensures that they only pay for what they use, giving them greater financial control.

The Bottom Line

In the journey to start your own business, SahiBandhu Gold Loan stands out as a compelling option that extends a helping hand where it matters most i.e your initial capital. From its quick processing to the use of gold as collateral, SahiBandhu not only addresses the financial needs of budding entrepreneurs but also paves the way for a smoother, more secure journey towards business success. So, if you’re considering to start your own business, SahiBandhu Gold Loan is not just an option; it’s the catalyst for turning your business dreams into a flourishing reality.

#gold loan benefits#gold loan#gold loan for business#gold loan for startup#best gold loan service#low interest gold loan#lowest gold loan interest rate#SahiBandhu#sahibandhu gold loan

0 notes

Text

Card to cash Bank Account

#Our Services:#Card to cash Bank Account#Credit card to Bank Transfer.#Transfer Money Credit Card To Bank Account.#Credit card to Instant cash.#Maintaining Cash in Bank Accounts better than have accredit card.Turn your credit card limit to cash instantly for easy use of money .#We accept all kinds or credit cards just one swipe get instant money your bank account#Looking for Loan? We provide case against your credit card at your Doorstep.#We do PAN INDIA also.#Just a Call Away!#Spot Cash in all Major Credit cards#https://wa.me/9963606965?text=#More Info:+91-9963606965#Location:Shastri Rd#Ashoknagar#Karimnagar#Telangana 505001#creditcard#bank#transfer#instantcash#bankaccount#goodcredit#cibl

0 notes

Text

Education Loan Against Property Education Loan Against Property in Delhi Capified

Education Loan Against Property

Capified are engaged in offering Education Loan Services Against Property. As a leading service provider, we offer the perfect solution to finance our clients education. We take pride in helping our clients in turning their dreams into reality. The approval on loan is quick, rendering the procedure simpler. Further making it simple, the documentation procedure is assisted by our team of experts to make the experience pleasant for you. We offer lower rates of interest that our clients can reasonably afford.

Education Loan Against Property in Delhi

Capified is the best provider of education loan against property in Delhi to their clients. Our range of all services is widely appreciated by our clients. We are offering finance consultant services to clients for secured loan needs. The specified assistance is offered against properties owned by clients. So, clients owing commercial or residential property can make use of the value of the same by opting for loan against property.

Education Loan on Property

Get the education loan on property from Capified that has a hassle-free procedure. Processing fees and rate of interest charged is fairly attractive, so that our customers could be able to make prompt choices and avail maximum benefits. Further, processing is viable by considering the borrower’s financial performance. Clients can ask for loans against property either for business or personal purposes such as trade expansion, working capital, repayment of expensive loans, and various other needs.

Study Loan on Property

We are the pioneer in the field of global education that has brought the concept of overseas education to the doorstep of every student. We are the one-stop solution for all your study needs and have a command on education opportunities. We have provided assistance for course and university selection, application, and admission assistance application documentation, banks loans for study, and assistance with student accommodations.

Benefits of Loan Against Property for Education

Loan Against Property can be a great option for education as it offers lower interest rates and higher loan amounts compared to personal loans. It allows you to leverage the value of your property to fund your education expenses. The rate of interest in Loan Against Property is lower than the educational loans. Thus, a LAP is always cost-effective. The tenor for Loan Against Property is always longer and can last up to 15 years as compared to a 5-7 year tenor of an education loan.

Education loan against property in india

Get the education loan against property in India from Capiefied. This offers an affordable loan against property options to fit their finances. Our loan against property for education makes repayment stress-free giving you your choice of the tenor. Our education loan on property offers a high-value amount, flexible tenor, simple eligibility terms, and disbursal within a fixed interval of time.

READ MORE...Cash Against Property Loan Against Property in Delhi Gurgaon Noida - Capified

0 notes

Text

Get Instant Loan Against Gold Ornaments

Financial emergencies can arise unexpectedly. At Muthoot FinCorp ONE we understand the importance of quick and hassle-free access to funds. With our Gold Loan services, you can now get instant cash by leveraging the value of your gold ornaments. Whether you prefer doorstep service or a visit to one of our branches, Muthoot FinCorp ONE ensures a seamless experience for customers across India.

Unlocking the Value of Your Gold: Muthoot FinCorp ONE offers Gold Loan services that allow you to unlock the value of your gold instantly. Using our Gold Loan Amount Calculator, available on the Muthoot FinCorp ONE app or website, you can determine the worth of your gold ornaments within seconds. This transparent and efficient process eliminates the need for lengthy valuation procedures and provides you with the accurate loan amount you can avail. Whether you're in urgent need of funds for personal or business purposes, Muthoot FinCorp ONE ensures that you can access the maximum value of your gold.

Convenience and Flexibility: Muthoot FinCorp ONE understands the importance of convenience in financial transactions. With our Gold Loan services, you have the flexibility to choose between getting a loan from the comfort of your home or visiting any of Muthoot FinCorp Ltd.’s 3600+ branches across India. Our doorstep service ensures that our Loan Managers visit your home for a hassle-free loan processing experience. Alternatively, you can visit a branch near you and complete the process quickly. This flexibility eliminates wait times and allows you to access funds as per your convenience.

Competitive Interest Rates: Muthoot FinCorp ONE offers Gold Loans at competitive interest rates as low as 0.83% per month*. These attractive interest rates make borrowing affordable and help you manage your finances more effectively. At Muthoot FinCorp ONE we believe in transparency and ensures that our Gold Loan services are not only convenient but also cost-effective, making them an ideal choice for individuals looking for quick access to funds against our gold ornaments.

Safe and Secure Storage: When you choose Muthoot FinCorp ONE for your Gold Loan needs, you can rest assured knowing that your gold ornaments are in safe hands. They follow BIS Standard 9400 compliance for gold storage, ensuring the highest level of safety. With our home visits by OTP-verified Loan Managers, your gold is securely stored at the nearest Muthoot FinCorp branch. During transit, your gold is insured and tracked, providing you with peace of mind throughout the loan tenure. Muthoot FinCorp ONE prioritizes the safety and security of your gold, allowing you to focus on your financial needs without any worries.

Muthoot FinCorp ONE's Gold Loan services offer a convenient and efficient way to access funds against your gold ornaments. With quick loan processing, competitive interest rates, and secure storage, Muthoot FinCorp ONE ensures a seamless experience for customers across India. Unlock the value of your gold today and fulfill your financial requirements with ease.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

0 notes

Text

Gold buyers

Gold Buyers | Diamond Buyers | Platinum Buyers

HINDUSTAN GOLD COMPANY is known for serving our valued customers for more than 20 years and is an ISO 9001:2015 certified company. it is the pioneer company in india to introduce the concept of buying gold at the current online price.

Hindustan gold company is the trusted Gold Buyers company for selling your gold get the best price for the gold you need to sell. We believe gold is an asset that also has emotions. Our team members are well trained professionals to handle your emotion and provide transparency on the valuation of the gold you desire to sell.

We have an advanced Spectrometer & computerized valuation for checking GOLD purity. Our team members have experience in evaluating your GOLD in-house and at your doorsteps. We provide Instant Valuation & spot cash on your Gold. We can also do a bank transfer as NEFT/IMPS, as per RBI Guidelines.

If you need us to help you release pledged Gold from Banks / Gold loan companies or pawn brokers. Call us on 80885 50033 or visit us at our nearest branches. Click here to view our branch pages and you can visit any of our branches nearby and get spot cash for gold current market price now.

0 notes

Text

Streamlining the Road to Ownership: Exploring Car Purchase Sites

In the digital age, the process of buying a car has evolved, with car purchase sites becoming a popular avenue for consumers seeking convenience and transparency. This article will delve into the world of online car purchase platforms, highlighting the benefits, considerations, and the evolving landscape of purchasing a vehicle through these sites.

The Rise of Online Car Purchase Platforms

Car purchase sites have emerged as a transformative force in the automotive industry, offering a streamlined and user-friendly experience for buyers. These platforms facilitate the entire car-buying process, from browsing and selection to financing and delivery, all from the comfort of your home.

Convenience at Your Fingertips

Perhaps the most significant advantage of using car sales Oahu sites is the unparalleled convenience they provide. Buyers can explore a vast inventory of vehicles, compare prices, and read reviews without leaving their homes. The ability to conduct thorough research and make informed decisions online has revolutionized the traditional car-buying experience.

Transparent Pricing and Information

Car for cash Hawaii sites prioritize transparency in pricing and information, a welcome departure from the sometimes-opaque nature of traditional dealerships. Buyers can access detailed information about each vehicle, including specifications, maintenance history, and pricing breakdowns. Transparent pricing structures contribute to a more informed and confident purchasing process.

Extensive Vehicle Selection

Online platforms boast extensive inventories, offering a wide range of makes and models to suit diverse preferences and budgets. Whether you're in the market for a brand-new vehicle or a reliable used car, car purchase sites provide a plethora of options, often allowing users to filter and customize their search based on specific criteria.

Virtual Showrooms and Test Drives

Car purchase sites leverage technology to create virtual showrooms, enabling users to explore vehicles in detail through high-quality images, videos, and interactive features. Some platforms even offer virtual test drives, allowing buyers to experience the feel of a vehicle from the comfort of their screens before making a decision.

Financing Solutions and Online Approval

Many car purchase sites offer integrated financing solutions, simplifying the financing process for buyers. Online tools allow users to calculate monthly payments, explore loan options, and even receive pre-approval for financing—all without the need for a visit to a physical financial institution.

Home Delivery and Hassle-Free Returns

The evolution of car purchase sites has extended to include hassle-free delivery options. Once a purchase is made, the vehicle can be delivered directly to the buyer's doorstep. Some platforms even offer trial periods with hassle-free return policies, allowing buyers to experience the vehicle in real-life conditions before committing to the purchase.

Evolving Customer Support Models

As car purchase sites gain popularity, customer support models are evolving to meet the needs of online buyers. Live chat support, responsive customer service teams, and online assistance throughout the purchasing process ensure that buyers have the support they need at every step.

Considerations for Buyers

While the benefits of car purchase sites are evident, buyers should exercise due diligence. Research the reputation of the platform, read user reviews, and ensure that the site complies with regulations. Additionally, carefully review the terms and conditions, including warranties, return policies, and any associated fees.

Conclusion

Car purchase sites have redefined the car-buying experience, offering unprecedented convenience, transparency, and an extensive array of options. As technology continues to shape the automotive landscape, online platforms are likely to play an increasingly significant role in connecting buyers with their dream vehicles. By embracing the benefits and navigating considerations, consumers can confidently embark on the road to car ownership through these innovative and user-friendly platforms. https://www.autozillahawaii.com/

0 notes

Text

89

Tuesday, aka Halloween, and I realise far too late that I now live in a trick or treat-dense neighbourhood. Of course this lends a wholesomeness to my surroundings that I benefit from every other day of the year, but I dropped the ball today. Three children come and go from my doorstep in costume and I systematically disappoint them all, telling them I would completely understand being “tricked” for my mistake. The first two boys, aged about 5 and 7, do a weird and poorly choreographed dance at me. The third tiny girl looks as though she will cry, and her father gives me a look like I have just blocked humanitarian aid from Gaza. I want to tell him that I have no idea what day it is, let alone whether there is a holiday being celebrated. Also that I’m a recovering bulimic and don’t care to have confections in the house if I can help it. It occurs to me as I close the door regretfully that I could’ve told everybody I “ran out of sweets an hour ago”, but even though I don’t love most children I feel some rubicon is crossed by lying to them. So I disappoint them all, albeit honestly. A crestfallen child, by the way, is scarier than any Halloween costume

Before this I use the time spent commuting home to write the text for my minuscule show in Aspen, about how much I love Botero. Though I resent having to do so much of the extra legwork in exhibition-making because curators have learned I can write passably, writing the text is easy to do because I have been wanting to defend Botero’s work for a long time. I will show a giant Diet Coke painting alongside the creepy family portrait V loaned from one of her collectors - a tiny woman sitting on her giant father’s lap. I believe it will be perfect. This is all arranged after I sit in the gallery and answer logistical questions about my studio - how to keep it from overfilling, or from a fire. V says, correctly, that emptying out the space a little will mean that fewer things burn, and that I might then want to kill myself less. I sip coffee and we talk and laugh about the scam email R found in his inbox recently from someone claiming to be Larry Gagosian:

Our bank discover a mistake in the attached art work bank account number.

Regards,

Larry Gagosian

Art Dealer

980 Madison Avenue

NY 10075

“Is this what my entire run with Larry boils down to”, I ask V and her team, “a fake email with an attachment titled wrongbankingdetails.pdf?” And perhaps it is. In a way this fake email is a lot more eloquent than some of Larry’s real ones. C will later critique it for having too many correct spellings. We watch videos of Gordon Ramsay and arrange C’s hypothetical future finances when he finally wins the house raffle Omaze he regularly enters. This quarter’s property is a £5m house in Chelsea. He will sell it, hook his family up, and then buy a new house near to mine in cash. Once this is all in order, I will ask him to spend every subsequent Halloween with me to be the treasurer of the candy and explain to the children at my door that I am hiding because I’m bulimic

0 notes

Text

Small Business Bridge Loans: Fostering Expansion and Growth

With bridging loans from Kinetic Finance, you can unleash the growth potential of your small business! Our customized solutions are created to support your success, whether you need to capture a fresh opportunity, expand your business, or fill cash flow voids. We fill the financial gap with quick approvals and flexible terms so you can focus on what really matters—your business. Our expert team understands the unique challenges of small businesses, and we're committed to your success. Don't let financial hurdles hold you back; step into a future of expansion and prosperity with Kinetic Finance by your side. Apply today and watch your business thrive!

0 notes