#cpa training USA

Text

Is CPA a High-Paying Job in the USA?

In the United States, the salary for accountants varies based on factors such as experience, education, location, and industry. On average, entry-level accountants can expect a starting salary ranging from $50,000 to $60,000 per year. With a few years of accounting jobs in the USA for Indians, this figure can rise to the range of $60,000 to $75,000.

Mid-level accountants, with five to ten years of experience, often earn between $75,000 and $100,000 annually. Those who advance to managerial or senior positions can command salaries exceeding $100,000, with top-tier professionals in specialized fields or managerial roles earning well into six figures.

The location within the U.S. plays a significant role in determining accounting job salaries in the US. Metropolitan areas and regions with a high cost of living generally offer higher compensation to accountants to offset living expenses.

Industries also influence accounting salaries, with professionals in finance, corporate management, and information technology often earning higher than those in non-profit or government sectors.

In conclusion, the accountant's salary range in the US by experience level and it reflects a competitive compensation structure, with ample room for growth. As businesses continue to recognize the importance of skilled financial professionals, the demand for qualified accountants remains strong, contributing to the overall attractiveness of the profession in terms of both financial rewards and career advancement opportunities.

#cpa salary USA#cpa jobs USA#cpa training USA#accounting job salaries in the US.#accounting jobs in the USA for Indians

0 notes

Text

Watch "RajYogi Online Money" on YouTube

#online banking usa#online money#affiliatemarketing#how to make money online#cpa training#digitalmarketing#helth and fitness#cash master#blog#youtube

4 notes

·

View notes

Video

youtube

Best Paid CPA Marketing Traffic Tutorial 2022 ✅($0.03 = 1 USA Click)

#cpa#cpa paid tutorial#cpa marketing#cpa marketing training#paid traffic#paid cpa traffic#usa traffic#usa cpa traffic#make money online#make money fast

3 notes

·

View notes

Text

Mastering Financial Management: Your Guide to CMA, IFRS, and CPA Certification in Dubai

Are you ready to elevate your career in finance to new heights? Whether you’re aiming for management positions, seeking to specialize in international financial reporting standards, or aiming to become a Certified Public Accountant (CPA), or Certified Management Accountant (CMA) Dubai offers exceptional opportunities for professionals like you. With the right guidance and training, you can unlock doors to success in the dynamic world of finance.

At Emerge Management Training Center, we understand the importance of staying ahead in today’s competitive landscape. That’s why we offer comprehensive courses tailored to meet the demands of aspiring finance professionals in Dubai. From Certified Management Accountant (CMA) to International Financial Reporting Standards (IFRS) and Certified Public Accountant (CPA) certification, we provide the best-in-class training to help you excel in your career.

Mastering Financial Management with CMA Courses:

Our CMA USA course in Dubai is designed to equip you with the knowledge and skills required to excel in management accounting roles. Led by experienced instructors, our CMA classes in Dubai cover essential topics such as financial planning, analysis, control, decision support, and professional ethics. With IMA’s comprehensive curriculum and hands-on approach, you’ll gain the confidence to tackle real-world challenges and drive business success.

Becoming an Expert in IFRS with Our Training in Dubai:

In today’s global economy, proficiency in International Financial Reporting Standards (IFRS) is essential for finance professionals. Our IFRS training in Dubai provides you with a deep understanding of international accounting principles, enabling you to navigate complex financial reporting requirements with ease. Whether you’re looking to enhance your career prospects or expand your knowledge base, our expert-led courses ensure you stay ahead of the curve in the ever-evolving field of accounting and finance.

Achieve CPA Certification with the Best Exam Prep Classes in Dubai:

Aspiring to become a Certified Public Accountant (CPA)? Our CPA Exam prep classes in Dubai UAE are designed to help you succeed. With a focus on exam readiness and comprehensive coverage of CPA exam topics, our courses prepare you to ace the CPA exam with confidence. From financial accounting and reporting to auditing and taxation, we provide the guidance and support you need to achieve your goals and advance your career in accounting.

Why Choose Emerge Professional Development?

Experienced Instructors: Learn from industry experts with extensive experience in finance and accounting.

Comprehensive Curriculum: Our courses cover all aspects of CMA, IFRS, and CPA certification, ensuring you’re well-prepared for success.

Flexible Learning Options: Choose from in-person classes, online sessions, or a blend of both to suit your schedule and preferences.

Career Support: Gain access to career guidance, networking opportunities, and job placement assistance to take your career to new heights.

Don’t let opportunities pass you by. Invest in your future with professional development courses from Emerge. Visit our website today to learn more about our CMA Dubai, IFRS, and CPA certification programs in Dubai. Unlock your potential and take the next step towards a successful career in finance.

Contact us:

+971 4352 1133 | +971 504577375

www.emerge.pro

#CMA#CMA Classes#CMA Dubai#CMA USA#CPA#CPA Classes#CPA Dubai#CPA USA#Emerge#Emerge Management Training Center#EMTC#IFRS#IFRS Certificate

0 notes

Text

https://fintram.com/us-cpa-course-syllabus/

#cpa trainng in india#us cpa course#cpa course#uscpa coaching#uscpain india#cpa usa#cpa exam#cpa training

0 notes

Text

#best cpa us training institute in india#cpa usa#hi-educare#cpa usa training in india#cima#cpa offers#cfa

0 notes

Text

Popularity of US CMA Course in India | Zell Education

The Growth in Popularity of US CMA Course in India

Overview

The Certified Management Accountant (CMA) credential provided by the Institute of Management Accountants in USA has gained significant attraction all over India since its advent, almost ten years ago. The field of financial planning, analysis, control and decision support are provided by the CMA qualification. It prepares management accountants and finance for action required in the strategic management within a global economy that is increasingly becoming dynamic. Lets discuss the popularity of US CMA course in India.

According to IMA, as of 2022 in terms of number CMA holders across the world India is second after US. The popularity of US CMA amongst India’s accounting professionals is indicative that the fleeing population prefers to occupy jobs globally, and for higher salary. The number of CMA course and certification registrations has been increasing at over 20% year-on-year, showing clear interest in the program. Important factors are pushing more Indian accounting and finance professionals to earn the US CMA designation.

Increasing MNCs Establishing Presence in India

India has seen a steady rise in multinational companies (MNCs) setting up operations in the country over the past two decades due to economic liberalization and market-friendly policies. MNCs now contribute significantly to India’s GDP and job creation.

The popularity of US CMA certification can be attributed to its worldwide recognition and strategic financial planning concepts relevant to business expansion. Many of these MNCs have their headquarters in the US or have global shared services centers based there. They prefer to hire candidates with US certifications like the CMA due to the following reasons:

Uniformity in Accounting Practices: Adoption of US certifications leads to alignment of Indian operations with the global accounting practices followed within the organization. This enables smoother functioning.

Performance Benchmarking: Global finance teams are able to set goals objectively, measure performance, and compare results across different country operations.

Talent Development: Structured training helps staff develop expert finance skills as per globally benchmarked standards regardless of their geographical location. This aids in succession planning and talent mobility across regions.

The increased presence of US MNCs and alignment of Indian arms to US corporate culture has significantly boosted the popularity of credentials like the CMA in India in the last 5-7 years.

Worldwide Recognition

The US CMA qualification is recognized and valued worldwide, especially in countries like the United States, Canada, the Middle East and China. This gives it a global edge and international mobility for certified professionals. Owing to the popularity of US CMA in the workforce, many B-schools have started offering preparatory courses for the exam.

Portability Across Countries

CMA-certified accountants enjoy swift visa processing and ease of getting work permits across global economic hubs like:

1. United States: The IMA-CMA certification is licensed by all 50 American states and considered at par with other US accounting credentials like CPA, CFA etc. It is the fastest pathway for immigration to the USA through programs like H1B and EB2. Over 100,000 CMAs are currently employed in America.

2. Canada & Australia: Management accountants with a US CMA are prized by Canadian employers for accounting, strategy and financial planning roles across various industries. Certified CMAs also get extra migration points while applying for PR visas as skilled professionals. The same is the case with Australia.

3. Middle East: Countries like UAE, Qatar, Saudi Arabia and Oman are actively recruiting senior finance professionals and CXOs holding the reputed CMA qualification from the USA, offering lucrative tax-free salary packages.

4. China & Hong Kong: The majority of Fortune 500 companies have offices in China. They prefer employing CMA credential holders for uniformity in global accounting practices and seamless collaboration between regional teams.

Globally Benchmarked Program

The US CMA course is administered by the IMA (Institute of Management Accountants), the world’s leading finance association dedicated solely to management accounting and financial management professionals.

The 2-part CMA exam is competency-based and tests real-world application of knowledge on Financial Planning & Analysis, Corporate Finance, Decision Analysis, Risk Management, Investment Decisions and Professional Ethics.

It meets the highest global benchmarks in rigor and quality of the curriculum. Partnerships with renowned business schools like McGill Executive Institute (Canada) further bolster its pedigree as a gold standard in financial planning and analysis.

These reasons have exponentially boosted the global reputation of the US CMA certification in the last decade and expanded its scope beyond American shores into every major world economy.

A Short-Term Professional Program

The US CMA course is designed as a flexible and structured certification that can be completed alongside full-time work in just 12-16 months. The popularity of US CMA among entrepreneurs is growing as it helps them make key investment and financing decisions for rapid growth.

Self-Paced Learning: Professionals can self-learn the subjects at their convenience without needing to enroll in full-time classes. Study manuals, online classes, mock tests and expert mentorship provide a structured framework.

Exam-Based Testing: The evaluation methodology is exam-based, objective and focuses on practical real-world applications of knowledge through analysis of scenarios and problems.

2 Parts: There are two exam parts, each having two papers – multiple choice questions and essay-type descriptive questions. Candidates can give the parts one by one at their own pace.

Accessible from Anywhere: CMA allows professionals from any geography to improve their skills by giving online proctored exams in their city. This removes geographical barriers.

CMA-certified professionals need just two years of relevant work experience in fields like budgeting, financial planning & analysis, management accounting, costing etc.

This can be completed along with self-paced exam preparation over 1.5 years. So, within 12-16 months of signing up, financial executives can fulfill all CMA requirements without needing to take a career break.

Career Prospects with Top-Tier Employers

The US CMA opens up rewarding career opportunities both in India and abroad. Surveys show certified management accountants earn 35%-45% higher compensation compared to non-credentialed peers. Despite the growing popularity of US CMA courses, enrollments remain male-dominated, though experts encourage more women to acquire this strategic financial skillset.

In India, CMA-certified professionals are increasingly valued by large corporates, multinationals, consulting firms, banks and accounting practices for the following roles:

Financial Planning Managers

Cost Accounting Managers

Investment Analysts

Business Analysts

Business Development Managers

Finance Controllers

Commercial Managers

Top global recruiters like Amazon, Deloitte, E&Y, Goldman Sachs, JP Morgan Chase, Walmart, Shell and IBM actively hire and reward CMA credential holders with lucrative salary packages.

Kickstart Your Entrepreneurial Journey with a Head Start

For professionals aspiring to launch their ventures, the CMA course provides a strong foundation across all critical areas to set up and manage a company as certified management accountants.

Financial Planning: Prepare accurate cash flow statements, balance sheets, working capital projections, cost & profitability analysis and funding requirements for smooth business operations.

Costing: Expertise in decision-making concepts like target costing, life cycle costing and value analysis to maximize profitability and efficiency.

Regulatory Compliance: Knowledge of tax codes and laws across GST, corporate and labor laws applicable for business entities in India for legal compliance.

Technology Integration: Learn manufacturing, retail and service industry best practices to optimize performance via emerging digital technologies like AI, predictive analytics, blockchain etc.

Strategic Thinking: Understand market dynamics to identify new growth avenues, competition mapping, trends analysis and craft differentiated business strategies.

Leadership Skills: IMA’s management accountant code of ethics instills principles of trust, accountability, transparency and integrity to lead by example.

With the popularity of US CMA, IMA’s India chapter is actively organizing information seminars and preparation workshops in metro cities. This 360-degree skillset positions certified CMAs as the ethical backbone for corporates and gives entrepreneurs a strategic head start to set up, manage and scale their own companies.

Conclusion

The rising popularity of US CMA courses in India is attributable to the country’s integration with the global economy and the increased presence of MNCs with bases in America. The course is widely respected worldwide for its rigorous curriculum. It expands the career prospects of Indian candidates beyond geographical borders while helping global corporations benchmark professional competencies. The exam-based structure also makes it a convenient and fast-track option for working professionals to upgrade their finance skills and earnings potential without a career break. No wonder it is emerging as the preferred global finance credential for smart Indian millennials looking to take their careers to new heights both within and outside India.

FAQs

Does US CMA have value in India?

Yes, the US CMA credential is highly valued in India due to the rising presence of MNCs with US headquarters who prefer to align their global operations with American business culture and accounting practices. It provides uniform training in finance concepts to Indian employees, enabling easier performance management across geographical locations.

Does US CMA have scope?

The US CMA certification has immense scope in India as well as abroad. Surveys show CMA-certified professionals earn 35-45% higher than non-credentialed peers. Top global and Indian corporates across banking, financial services, information technology and manufacturing sectors actively recruit and reward CMA credential holders for a variety of strategic finance roles.

Is US CMA worth doing?

Yes, US CMA is absolutely worth pursuing for Indian finance professionals looking for global job mobility and higher earning potential. The course expands career opportunities abroad while opening up senior management roles with attractive salary packages across top Indian and multinational corporations.

Where is CMA most demanded?

The US CMA credential is highly in demand in India, the United Arab Emirates (UAE), China, Canada, Australia and New Zealand due to rising globalization and the presence of multinational companies in these countries. Job surveys show that certified management accountants tend to earn higher remuneration compared to non-credentialed accounting and finance professionals in these regions.

Anant Bengani, brings expertise as a Chartered Accountant and a leading figure in finance and accounting education. He’s dedicated to empowering learners with the finest financial knowledge and skills.

0 notes

Text

youtube

Picture getting a global accounting certificate that lets you land top jobs in just 6-8 months by passing only two exams. Now, it’s possible with a US CMA certification which is recognised across 170+ countries. Learn core accounting skills such as financial reporting, corporate finance, budgeting, forecasting, cost management, and more.

𝗧𝗵𝗲 𝗪𝗼𝗿𝗹𝗱 𝗼𝗳 𝗖𝗠𝗔 Certified Management Accountant (CMA) is the globally recognised highest credential in management accounting administered by the Institute for Management Accountants (IMA), USA. The US CMA Course is recognised across 170+ countries. It is the most sought-after accounting and finance certification by companies and recruiters worldwide. The CMA course is an advanced-level credential appropriate for accountants and financial professionals. The US CMA certification covers accounting, business, finance and analytics. It helps to master 12 core skills that are extensively required to lead the world of accounting and finance.

𝐋𝐞𝐚𝐝 𝐓𝐡𝐞 𝐖𝐨𝐫𝐥𝐝 𝐎𝐟 𝐀𝐜𝐜𝐨𝐮𝐧𝐭𝐢𝐧𝐠 𝐀𝐧𝐝 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐖𝐢𝐭𝐡 𝐈𝐦𝐚𝐫𝐭𝐢𝐜𝐮𝐬 ✅ ᴍᴏɴᴇʏ ʙᴀᴄᴋ ɢᴜᴀʀᴀɴᴛᴇᴇ We have complete faith in your abilities and the exceptional education we offer. We want to assure you that with our Money Back Guarantee if you are unable to pass all your CMA exams,we will refund you 50% of the course fee. Your success is our highest priority.

✅ ᴛᴏᴘ ᴘʟᴀᴄᴇᴍᴇɴᴛꜱ After becoming a CMA, learners can work with Fortune 500 companies and pursue global management and accounting careers. The students will also be prepared to work with the top brands in financial industry, accounting, consulting, and MNCs across multiple business domains. ✅ ɢᴜᴀʀᴀɴᴛᴇᴇᴅ ɪɴᴛᴇʀᴠɪᴇᴡꜱ Our CMA program includes a comprehensive pre-placement boot camp, resume-building services, and interview preparation sessions. We provide soft skills training, placement assistance, and guaranteed interviews with top companies. ✅ ᴜɴʟɪᴍɪᴛᴇᴅ ᴀᴄᴄᴇꜱꜱ ᴛᴏ ꜱᴛᴜᴅʏ ᴍᴀᴛᴇʀɪᴀʟꜱ All students will have limitless access to CMA course books, a question bank, practice papers, MCQs, flashcards, learning videos, live classes, and revision tools. The study content is powered by Surgent which has a passing rate of 95% in CMA Exams ✅ ᴇxᴘᴇʀᴛ ᴍᴇɴᴛᴏʀɪɴɢ Experienced Imarticus faculty with CMA, CA, CFA, and CPA qualifications provide personalised mentoring sessions to all learners. Exam-specific doubt-clearing sessions are also available to ensure that concepts are crystal clear and students pass the exams on the first attempt. ✅ ʙᴀꜱɪᴄꜱ ᴛᴏ ᴘʀᴀᴄᴛɪᴄᴀʟꜱ CMA study at Imarticus begins with the fundamentals of accounting and then moves on to core CMA Curriculum. Besides this, students get additional learning on practical tools such as MS Excel, Advanced Excel, Financial Modelling, etc which not only prepares the

0 notes

Text

My computer needs better ideas. So. Ok. This idea makes no sense. You believe you can form a group of people that do nothing, for everything. Hm. This isn't the stock market, but it is. See a stock market determines what products are stocked on your shelves. Still, we believe this is not an easy long term investment. Also we believe this has nothing to do with food. See the world is flat, except the worst part. You can't even try to cause a car accident on a hill. Still whenever you talk about stocks you say let's do this as if we want to jump a car off a hill under the train tracks and hit a car. That's your strategy. Then quick but a new car, and these fines you recommend are good as well. At this point you're just insulting me. The stock market losses are good as well. Ok. Nevermind talking with you. Hypothetically it's until you lose everything forever or never invest once. You need to take your losses forever. That's my best advice. Anyways. Not anyways. In a commune we have limited opportunity for work, and we do not support reasonable work. It is implied wink wink we are a commune. Like if you ask to support yourself be reasonable as an independent. I don't like the girls or boys in my family. No. No work. No government aid. See commune. You can't move on or forward because commune. For example. No one has money for rent. You're looking at vindictive souls mad you can have a room. Well the commune didn't want to do positive and clean itself. See capitalism is what happens when we produce a product for the stock market. Obviously no one here produces their own product. So how does one not be in a commune when your society as a whole can not participate in labor. Let me just make this clear. No one took the baby dollars, and also was able to afford to work a job the stock market supplies for regular people. See your strength is your weakest link and you have no weakest link. You actually created a commune which does not support work. We support begging. So I think. Let's stop begging. Let's do a little work. No. No. This is not an opportunity. How are you even alive. Do a little work stop begging. No opportunity. No I know at best a social network took over a low income branch of distribution. Then you said police go away no free donut hand outs here. You are fat with donut. Why can you not see. He is fat with donut. Do you believe he sent his other members to work for herself? See this isn't adding up. You can not even match the drivers to a database. See no one is safe. Your commune has no computer ID for safety or money anywhere. You are supporting actual murder for work theory. See now I can't work. To much risk. So see behavior of commune is break computer break communication. Tell if try try bad call police because commune good for one persons. Still not dead. See not making sense. So you are so confused by labels you do not know where your country is. Could I try. No. That is a country. Could I try, no. You have this much room to try. Then no. There is no space here to try. So no time. See police. The police are called when no one has any time left. Look crisis forever. The last of the orcs really. They never die. Even when they always die. My skin is green because I can L out of nothingness. Hypothetically can you be alive and go to work. No because the police are dead. Now you fight police for money. What I'm saying is your supposedly capitalism society has no choice but to make work possible. You can't ask people to cry to work. Oh I worked but we all cried and died because work makes no sense. Technically at these rates let's be clear. I can not pay the government. See the government must distribute money to low income workers to make money, as a whole. Your strategy is lazy. There is no incentive to even pretend we should continue. See strength is not an opportunity we as a body ever changing can afford, we lost our strength. We did, we all did. So you too must lose your strength.

0 notes

Text

Navigating the Global Landscape: Can an Indian CA Inter-SM Work in the USA?

In the ever-evolving world of finance and accounting, the Chartered Accountancy (CA) qualification in India holds immense prestige. As Indian professionals aspire to broaden their horizons and explore international opportunities, a common question arises: Can an Indian CA Inter-SM (Strategic Management) professional work in the USA? In this article, we will delve into the intricacies of this query, exploring the challenges and opportunities that come with such a transition.

Understanding the CA Inter-SM Qualification

The CA Inter-SM, or Strategic Management, is a crucial module in the Chartered Accountancy curriculum in India. It equips candidates with skills in strategic decision-making, risk management, and organizational leadership. The knowledge gained is invaluable not only in the Indian business landscape but also in the global context.

Challenges in Transitioning to the USA

Working in the USA as a foreign-trained professional presents certain challenges, and it's essential to be aware of them before embarking on such a journey. The primary hurdle lies in the recognition of foreign qualifications. The USA has its own set of accounting standards, and the American Institute of Certified Public Accountants (AICPA) plays a pivotal role in accrediting professionals.

Educational Equivalency and CPA Certification

To work in the USA, Indian CA Inter-SM professionals must navigate through the complexities of educational equivalency. While the CA qualification is highly regarded globally, it may not be a direct substitute for the Certified Public Accountant (CPA) certification in the USA. The CPA is widely recognized and required for most accounting and auditing roles in the country.

Aspiring individuals often need to undergo a process of evaluation and may be required to complete additional coursework to meet the educational requirements set by state boards of accountancy. This process can be time-consuming and may involve significant effort and dedication.

Role of Parag Gupta at StudyByTech

StudyByTech, led by renowned faculty Parag Gupta, has emerged as a prominent institute for CA Inter-SM preparation. Parag Gupta, often hailed as India's best faculty for CA Inter-SM, brings a wealth of experience and expertise to the table. The institute provides top-notch study materials and offers a comprehensive array of online and offline classes, making it a go-to choice for CA aspirants.

While StudyByTech excels in preparing candidates for the CA Inter-SM examination, the institute also acknowledges the global aspirations of its students. Parag Gupta, with his deep understanding of the industry, emphasizes the importance of staying informed about international qualifications and certifications.

Opportunities and Resources for Indian CAs in the USA

Despite the challenges, there are ample opportunities for Indian CA Inter-SM professionals in the USA. The country has a robust and dynamic business environment that values diverse skill sets. Networking and building connections with professionals in the field can open doors to potential employers and mentors.

Moreover, the growing trend of globalization has increased the demand for professionals with international qualifications. Companies operating globally appreciate individuals who bring a unique perspective and a deep understanding of different business landscapes.

Conclusion

In conclusion, the prospect of an Indian CA Inter-SM working in the USA is both challenging and promising. While the journey may involve overcoming hurdles related to educational equivalency and certification, the global demand for skilled finance and accounting professionals creates a pathway for success.

StudyByTech, under the guidance of Parag Gupta, not only equips its students with the knowledge needed for the CA Inter-SM examination but also encourages them to think globally. As the world becomes increasingly interconnected, the ability to navigate international standards and certifications becomes a valuable asset.

Aspiring professionals should approach this transition with a strategic mindset, understanding the requirements of the USA's accounting landscape. With the right guidance, preparation, and a commitment to continuous learning, Indian CA Inter-SM professionals can indeed find success in the challenging yet rewarding realm of the USA's financial and accounting sector. Join for more daily information on the WhatsApp Channel

Read more: ICAI

0 notes

Text

Ways CPAs Help Small Businesses Grow and Succeed

Small businesses often face unique challenges in managing their finances, but Certified Public Accountants (CPAs) play a crucial role in helping them grow and succeed. Through their specialized accounting services for small businesses, CPAs provide invaluable support in various areas, ensuring financial stability, compliance, and strategic decision-making. This holds not only in the United States but also in countries like India, where accounting firms cater specifically to the needs of small businesses.

One of the primary ways CPAs assist small businesses is by providing accurate and timely financial reporting. By maintaining organized records and preparing financial statements, CPAs enable small business owners to gain insights into their financial health and make informed decisions. This is particularly essential for startups and growing businesses in India, where accounting firms specializing in small business services offer tailored solutions to meet their unique needs.

Moreover, CPAs help small businesses navigate complex tax laws and regulations, maximizing tax savings and minimizing liabilities. By staying updated on tax code changes and identifying eligible deductions and credits, CPAs ensure compliance while optimizing tax strategies for small businesses. This expertise is invaluable for entrepreneurs in India seeking accounting firms that can help them manage their tax obligations efficiently.

CPAs also play a pivotal role in financial planning and budgeting for small businesses. By analyzing cash flow, forecasting financial projections, and developing budgeting strategies, CPAs assist small business owners in managing resources effectively and achieving their growth objectives. This proactive approach to financial management is essential for small businesses looking to expand and thrive in competitive markets, whether in the US or India.

Furthermore, CPAs provide advisory services that go beyond traditional accounting functions.

They offer strategic guidance on business operations, risk management, and investment decisions, helping small businesses identify opportunities for growth and mitigate potential challenges. This holistic approach to financial management is particularly beneficial for startups and emerging businesses seeking the expertise of the best CPAs for small business success.

In conclusion, CPAs play a critical role in helping small businesses grow and succeed by providing essential accounting services tailored to their needs. Whether it's managing finances, ensuring tax compliance, or offering strategic advice, CPAs are indispensable partners for small business owners seeking to achieve their goals, both in India and around the world.

#CPA recruitment#CPA training#CPAs USA#Accounting professionals recruitment#CPA Recruiting firms#CPA recruitment solutions#accounting outsourcing companies in usa#Source top CPA talent#CPA Hiring#CPA Candidates#certified public accountant near me#certified public accountant requirements#CPA Shortage

0 notes

Text

Get Rich Quick Schemes vs. Sustainable Online Money Making writing a blog.

The internet has opened up a world of opportunities for people to make money online, but not all money-making opportunities are created equal. On one end of the spectrum are Get Rich Quick schemes that promise quick and easy riches with little effort, while on the other end are sustainable online money-making opportunities that require hard work and dedication, but offer a long-term source of income. In this article, we'll compare Get Rich Quick schemes with sustainable online money-making through blogging and explore why the latter is the better choice.

What are Get Rich Quick schemes?

Get Rich Quick schemes are often characterized by promises of quick and easy riches without any effort or investment. These schemes may take different forms, such as pyramid schemes, multi-level marketing, or other fraudulent activities. They may involve enticing people with promises of making thousands of dollars in a short period of time, without requiring any specific skills or experience. Some of the common characteristics of Get Rich Quick schemes include:

Unrealistic claims: Get Rich Quick schemes often make unrealistic claims that sound too good to be true, such as making thousands of dollars overnight or earning a six-figure income in a month.

Low investment and high returns: These schemes often require a low investment or no investment at all, with the promise of high returns in a short period of time.

Lack of transparency: Get Rich Quick schemes often lack transparency and provide little or no information about how the money-making process works.Read More...

#online money#affiliatemarketing#how to make money online#digitalmarketing#helth and fitness#blog#cash master#youtube#online banking usa#cpa training

0 notes

Text

Enhancing Transparency: The Role of Assurance Services in Auditing

In the world of finance and business, transparency is paramount. It fosters trust, accountability, and confidence among stakeholders, be they investors, regulators, or the public. Assurance Services in Auditing play a pivotal role in ensuring this transparency, particularly in the realm of auditing.

Understanding Assurance Services

Assurance services encompass a wide range of activities performed by certified professionals to enhance the reliability and credibility of information. While auditing is a core component, these services go beyond financial statements and can include reviews, compilations, and examinations of various data, processes, and systems.

The Importance of Assurance Services

Reliable Financial Reporting: Assurance services ensure the accuracy and truthfulness of financial statements. This is critical for investors and creditors who rely on these statements to make informed decisions.

Compliance and Regulatory Standards: Assurance professionals help organizations comply with complex regulatory frameworks, such as the Sarbanes-Oxley Act in the United States. This reduces the risk of legal issues and penalties.

Risk Mitigation: Through rigorous examination, assurance services identify potential risks and weaknesses in an organization's processes and controls. This early detection allows for proactive risk mitigation.

Improved Internal Controls: Assurance services often involve evaluating an organization's internal controls. This can lead to the enhancement of these controls, reducing the likelihood of fraud or errors.

Stakeholder Confidence: When stakeholders know that an independent and competent third party has reviewed an organization's operations, they have greater confidence in the information provided.

Types of Assurance Services

Financial Statement Audits: The most well-known assurance service, these audits verify the accuracy of financial statements. Auditors assess an organization's accounting principles, estimates, and overall financial health.

Review Engagements: In reviews, auditors provide limited assurance on financial statements, primarily focusing on analytical procedures and inquiries. This is often a more cost-effective option for smaller organizations.

Compilation Services: For this service, the auditor assembles financial data into financial statements without providing any assurance. It's a straightforward presentation of the information provided.

Agreed-Upon Procedures: In this engagement, auditors perform specific procedures agreed upon by the client and report their findings. These procedures can vary widely and are tailored to the client's needs.

The Role of Assurance Professionals

Assurance professionals, such as Certified Public Accountants (CPAs), Certified Internal Auditors (CIAs), and Certified Information Systems Auditors (CISAs), are at the forefront of this critical function. They undergo rigorous training and education to become experts in evaluating and verifying financial and operational data.

These professionals maintain independence and objectivity while conducting their assessments, ensuring an unbiased and honest evaluation of an organization's processes and controls. Their reports are a valuable resource for management, boards of directors, and external stakeholders.

Click here for more about CPA Services in the USA.

Conclusion

Assurance services in auditing are the cornerstone of transparency and trust in the world of finance and business. They provide an invaluable service by verifying the accuracy of financial information, identifying risks, and enhancing internal controls. The role of assurance professionals in this process cannot be overstated, as they bring expertise, objectivity, and integrity to their evaluations.

In a constantly evolving business landscape, assurance services continue to adapt and expand to meet the changing needs of organizations and their stakeholders. As technology advances and regulations become more complex, the demand for these services remains as strong as ever, ensuring that transparency and reliability in financial reporting remain at the forefront of business practices.

0 notes

Text

Top Micro Bikini Competition Events

Micro Bikini Competitions; what are they?

Hey readers, today we’re going to talk about Bikini Competitions where athletes are required to wear Micro Bikini Bottoms to compete to win! Let’s recap a bit for newer athletes on what a Micro Bikini is; A Micro Bikini is one where the back bottom coverage has less glute exposure (or coverage) than your standard Bikini.

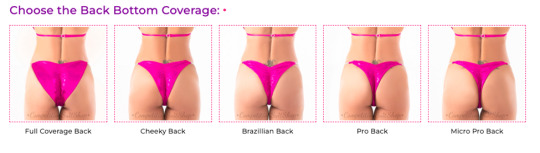

At www.competitionsuitshop.com we offer 5 styles of back bottom coverage, from full coverage (standard bikini), cheeky (which as the name suggests is starting to show more skin), then we start getting into the Micro category - Brazilian, Pro and Micro Pro. The latter coverages are ideally for pro-level athletes who are a) are very experienced and confident on stage and b) they need to maximize glute display to score the highest points for their aesthetic and athletic presentation to the judges.

The most popular bodybuilding contests these days are Micro Bikini Competitions, where pro level athletes are competing at the highest level to either win the show, earn their pro card, and above all a title such as the prestigious Ms. Olympia.

As the sport continues to grow, and athletes develop better programs in terms of nutrition, training, supplements, coaching, online presence and overall acceptance and support; the gap between pro and amateur physiques are definitely becoming less divided. Also, keep in mind that if you’re spending a good chunk of your time and money, and have set your mind to stage, you may as well commit to looking your darn best on stage. It may be your only shot (although we have it on good authority that it’s more a life changing sport than a one-off done and dusted bucket list tick) to be under the floodlights, to look your best, and to make memories that will last a lifetime! Therefore you really want to flaunt your hard-earned physique with the Micro Bikini option.

Now what are the most popular Micro Bikini Competitions?

NPC and CPA

Let’s broadly break this down into the Natural vs Non-Natural competition categories. The non-natural federations have been the dominant force in bodybuilding in general, with the National Physique Committee or NPC being the largest, most well-known Amateur organization in the world. Whilst the term Amateur is used, it is very much open to all pros and non-pros, looking to either compete as a first-timer or win a show and turn pro with a Pro Card qualification as an IFBB PRO.

The most popular NPC contests are National Championships and State Championships that are held annually such as NPC USA Championship. The Canadian equivalent of that is the Canadian Physique Alliance, with the CPA Vancouver Open drawing huge crowds annually. There are almost 500 NPC competitions held each year, and the winners of each category earns a pro card to compete in the International Federation of Bodybuilding and Fitness or IFBB contests.

IFBB and OLYMPIA

There are two IFBB bodies, IFBB PRO and IFBB ELITE. Not to go into politics on the divide and licensing, but the IFBB PRO is the more popular of the two pro federations, largely because it has the rights and hosts the most prestigious Mr. Olympia event. Mr. Olympia is how the world knows and recognizes bodybuilding because of the fame and legacy of Arnold Schwarzenegger.

Olympia is the most coveted prize in bodybuilding, it is held once a year, and the participants are selected through Olympia Qualifiers, which are IFBB PRO contests featuring only professional athletes. Needless to say, these are all Micro Bikini Competitions. The most popular IFBB PRO contests are the Amatuer Olympia which are held worldwide. There were 11 of these events held in 2023.

Other organizations that are independent from the NPC and IFBB are Physical Culture Association or PCA; their largest shows are in the UK and growing more in South East Asia.

OCB and ICN

Women’s Bodybuilding has really taken off in the Natural Bodybuilding federations lately. The largest of these platforms are the OCB (Organization of Competitive Bodybuilders) in the U.S.A and the ICN (International Competition Network) in Australia. There are over a hundred OCB shows that take place across the United States annually.

It is no secret that bodybuilding and steroid supplementations are commonly used. This is not to discredit the hard-work that athletes still have to put in. However, for those wishing to compete in all-natural, anti-doping, drug-tested shows, these federations provide a great alternative for both Professional and Amateur competitors. The largest OCB event held annually is the Yorton Cup.

Read our other blogs also:

Best Bikinis for Competition | Micro Bikini Competition Suits: You’re Ultimate Guide to Winning Styles

#bikini competition#micro bikini competition suits#bikini competition suit#mircro bikini competition suits#Micro Bikini Competitions

0 notes

Text

Top 4 Outsourced Bookkeeping Companies for CPA Firms in Vietnam

The traditional practice of maintaining an in-house team of accounting experts needs to be updated. Today, businesses recognize the value of outsourcing bookkeeping services, which provides financial relief and alleviates the mental burden on business owners. This shift in approach has breathed new life into the CPA market, simultaneously leading to increased workloads for CPA service providers in the USA and worldwide.

Much like any other enterprise, CPA firms are not merely responsible for managing accounts and navigating through tax seasons; they must also contend with many intricate tasks associated with the client lifecycle. Building and nurturing client relationships through regular discussions and meetings is a pivotal aspect of their responsibilities. Furthermore, these firms must allocate resources to attract new clients while concurrently scouting for skilled bookkeepers and accounting professionals. Providing them with an optimal work environment to maintain their productivity is another facet of their operational challenges. These cumulative demands have steadily amplified the pressure on companies offering CPA services to local businesses, leading them to seek professional outsourced bookkeeping firms tailored to the needs of CPA practices.

Read more: 9 Best Bookkeeping Practices for Small Businesses

Top Reasons to Consider Outsourcing CPA Jobs

Partnering with an outsourced bookkeeping company can offer multiple advantages if you run a CPA firm and seek ways to streamline your practice. Let’s delve into the top three reasons for collaborating with an outsourced company and utilizing their bookkeeping services for CPAs.

1. Expertise in Accounting Software, Tools, and Technologies

In the past, businesses were tasked with selecting and managing accounting software for their financial needs. However, today, companies that provide outsourced bookkeeping services offer various tools and technologies. The accounting and financial management field is continuously evolving, marked by innovations and advancements.

As a result, CPA firms encounter challenges in keeping up with the ever-changing landscape of accounting tools, software, and technologies. These challenges can be effectively addressed by teaming up with a reputable outsourced bookkeeping company. These outsourcing firms take responsibility for the following:

Procuring licenses for leading accounting solutions.

Acquiring and maintaining various accounting software and tools.

Recruiting and employing accounting experts proficient in these software solutions and tools.

Conducting training sessions to ensure financial managers, bookkeepers, and accountants are well-versed in these tools and technologies.

Staying ahead by investing in cutting-edge technology and bookkeeping and financial management tools.

Outsourced bookkeeping companies catering to CPA firms expertly manage these activities, ensuring they provide top-tier offshore bookkeeping services for CPAs and their clients. By entrusting these service providers, CPA firms can relieve themselves from the intricacies of mastering diverse accounting and bookkeeping tools and technologies, allowing them to focus on their core business operations.

2. Exceptional Scalability and Flexibility to Cater to Variable Client Demands

Another compelling reason to consider partnering with a reputable outsourced bookkeeping company for CPA firms is their unmatched flexibility and scalability. Like various other business models and industries, providers of bookkeeping outsourcing services also experience peak seasons. For instance, the workload for CPA firms during tax season can skyrocket, while at other times, bookkeeping and accounting activities may operate in a lower gear.

Outsourced bookkeeping for CPAs presents the flexibility to adjust services according to the ebbs and flows of demand. Whether a CPA firm exclusively utilizes fixed-cost services or has engaged dedicated accounting experts from outsourced bookkeeping companies, they can expand or contract their services based on workload, budget, and specific preferences. This scalability and flexibility alleviate the stress on businesses and pave the way for enhanced profitability. There are no concerns about the legal and operational aspects of staffing or worries about a shortage of expertise. Outsourced bookkeeping providers come equipped with everything a CPA firm could need.

3. Streamlined CPA Practices to Enhance Focus on Core Competencies

When a CPA firm collaborates with one of the premier outsourced bookkeeping companies designed for CPA firms, operations can seamlessly shift into autopilot mode. These companies take charge of all bookkeeping, accounting, and financial management tasks for clients of CPA firms in the United States and worldwide. Moreover, these outsourced companies also expertly manage client communications, creating a stress-free environment for CPA firms.

CPA firms can unburden themselves from concerns regarding software procurement, HR management, technology adoption, and more. The outsourced bookkeeping provider efficiently oversees these responsibilities. Consequently, CPAs can focus on strategic pursuits such as client acquisition, lead nurturing, business expansion, and more. Businesses can significantly bolster their core competencies and overall focus by shedding these worries.

In summary, forging partnerships with outsourced bookkeeping companies tailored for CPA firms represents a savvy strategic move. It bestows numerous advantages and a potent competitive edge to CPA companies, ensuring they can thrive in a dynamic and demanding industry.

Read more: A Complete Guide to Bookkeeping for Small Business in 2023

Top 5 Outsourced Bookkeeping Companies for CPA Firms in Vietnam

The global landscape of outsourced bookkeeping for CPA firms is filled with numerous reputable companies, each contributing to the industry’s success. Here, we present a list of the top 5 outsourced bookkeeping companies for CPA firms that have consistently made their mark in this field.

1. Bestarion

Bestarion started as a company providing software development and business process outsourcing (BPO) services.

In 2019, Bestarion expanded their business into providing outsourcing finance & accounting (F&A) solutions to accounting firms in the US. Their team comprises highly skilled, dedicated and enthusiastic young professionals like CPAs, Accountants and Data Entry who are dedicated to driving a difference that matters for our clients.

Bestarion offers complete Finance & Accounting Solutions for CPA Firms, including Bookkeeping, Payroll, Tax and Compliance services. With the trust from its clients, Bestarion partners with many CPA firms in US providing a better solution to optimize the cost in traditional accounting practices and therefore helping them to improve the company’s presence in the professional services market, and therefore, attract new accounts. All these partners have given positive compliments and choose Bestarion as a reliable partner for long-term cooperation.

2. InCorp Vietnam

Formerly recognized as Cekindo, InCorp Vietnam has emerged as a prominent player in Market Entry and Business Process Outsourcing (BPO) services. Established in 2015, the company has since made its mark in various domains, offering an array of services including business consulting, HR services, non-voice BPO/back office services, and finance & accounting outsourcing (FAO).

Headquartered in Ho Chi Minh City, Vietnam, InCorp Vietnam operates with a dedicated midsize team. Their core mission is to provide transparent and reliable solutions to overseas clients looking to establish their presence not only in Vietnam but also in the broader Asia-Pacific region.

3. Innovature BPO

Established in 2014, Innovature BPO has evolved into a dynamic player in the outsourcing landscape base in Vietnam. Their collective expertise spans Finance & Accounting, Customer Services, and Post-Production Services, serve clients in North America, Canada, the UK, Australia, and other APAC regions. Presently, Innovature BPO boasts a diverse team of approximately 200 professionals hailing from various corners of the globe. Innovature BPO is always famous for providing clients with the best service efficiency within tight timeframes.

4. Odyssey Resources

Odyssey Resources was originally formed in 1998, and was one of the first movers to offer Australian outsourced services in 2006 in Vietnam. This company specializes in Outsourced Australian tax returns, bookkeeping, compliance review, superannuation SMSF returns.

Odyssey Resources approaches quality assurance. They ensure all services meet Australian standards for excellence and are made locally by great professionals. The strength of Odyssey Resources is its large scale with extensive experience in the services they are providing. In addition, Odyssey Resources is highly appreciated for its excellent customer service and formal attitude and can answer clients’ inquiries 24/7.

Critical Considerations for Choosing the Right Outsourced Bookkeeping Company for CPA Firms

In this article, we have presented a selection of the top 5 companies renowned for delivering exceptional bookkeeping outsourcing services to CPA firms in Vietnam. However, the list extends beyond these five, with numerous firms vying to offer services in this domain. As a CPA professional, making an informed choice among the available outsourced bookkeeping companies for CPA firms is essential. To ensure that your decision yields both short-term and long-term benefits, there are three key considerations to consider during the selection process.

1. Specialization in Serving CPA Firms

The first and most crucial aspect to examine is a company’s experience and proficiency in serving international CPA firms. A company exclusively concentrating on accounting, bookkeeping, and related financial management services holds a distinct advantage over those juggling multiple business domains, such as IT solutions. Specialization in the financial sector ensures a deeper understanding of CPA firms’ unique needs and challenges.

2. Data Security and Protective Measures

Professional outsourced bookkeeping companies for CPA firms strongly emphasize data protection and security. They achieve this through top-tier tools, well-defined protocols, and a commitment to transparent services. The finest companies also offer the option to work within your secure environment. It is imperative to thoroughly assess the security and data protection measures that your prospective partner has in place to safeguard your sensitive information.

3. Effective Communication and Collaboration

The reality of time zone differences is apparent when partnering with outsourced bookkeeping companies for CPA firms, many of which offer cost-effective services from different time zones. This could introduce communication gaps and language barriers, among other challenges in the collaborative process. Therefore, engaging in open and candid discussions about how communication and collaboration will be managed with the selected company is crucial. Clear communication channels and strategies are vital to the success of your partnership.

4. Seamless Transition to the Outsourced Bookkeeping Model

Outsourced bookkeeping companies catering to CPA firms should have a well-defined procedure for assuming responsibility for bookkeeping and other accounting tasks. To ensure a smooth transition, adhere to the following steps:

Requirement Discussion: Clearly outline your requirements before agreeing with the outsourced bookkeeping company. Address even the minutest details to avoid any misunderstandings.

Documentation: Develop a comprehensive proposal and a legally binding Non-Disclosure Agreement (NDA) to document all terms and conditions.

Automation: Encourage your service provider to incorporate automation into their processes to save time and enhance efficiency and accuracy.

Reporting: Request timely reports to inform you about any modifications the outsourced bookkeeping company made.

Collaboration: Establish clear guidelines for how your teams will collaborate effectively.

By keeping these considerations at the forefront of your decision-making process, you can select an outsourced bookkeeping company best suited to the unique needs of your CPA firm, resulting in a productive and harmonious partnership.

Read more: The Cost of Outsourced Bookkeeping Services for Your CPA Firm

Selecting Bestarion as Your Preferred Outsourced Bookkeeping Company for CPA Firms

If you are searching for one of the foremost outsourced bookkeeping companies to cater to your CPA firm, look no further than Bestarion. With a rich history of delivering top-tier outsourced bookkeeping and accounting services spanning numerous years, Bestarion has consistently demonstrated its commitment to excellence.

Our philosophy revolves around ensuring maximum client satisfaction, and to uphold this commitment, we offer a distinct advantage: payment is only required if our services meet your satisfaction. Quality is the cornerstone of Bestarion and each and every employee here feel responsible for this.

Why choose Us?

Flexible Pricing Model: Hourly Rate, Fixed Fee (Budget based), Value Based (Project based), FTE (Full Time Equivalent) Model

High Cost-Saving: Our service will cost 60% less than hiring an in-house accountant if you are mainly looking for experts. Also, having a pool of resources under one roof is far more logical than hiring one accountant.

Data Security: In addition to our internal security measures, Bestarion is also an ISO 27001-certified company, IRS security 6, and GDPR. We ensure that our client’s data is always protected.

Guarantee of Satisfaction: We have worked with US accounting businesses for a long time and are well acquainted with accounting in the USA. Also, many satisfied clients have stayed with us for over five years.

Scalability: State-of-the-art infrastructure, availability of experienced human resources, and defined processes make it easy to scale up the operations on short notice.

Transparency: Our experts can provide daily progress reports and answer any questions.

Frequently Asked Questions (FAQs)

What are the Advantages of Outsourcing Bookkeeping to CPA Firms?

Outsourcing bookkeeping to CPA firms brings several benefits, including cost savings, enhanced accuracy, scalability, and the ability to concentrate on core services like tax preparation and consulting.

How Can I Identify the Leading Outsourced Bookkeeping Companies for CPA Firms?

To pinpoint the top outsourced bookkeeping companies, consider their experience, range of services, compatibility with technology, commitment to data security, and client feedback. To make a well-informed decision, conduct thorough research and assess your options.

Do Outsourced Bookkeepers Work Remotely or On-Site?

Many outsourced bookkeeping companies offer remote and on-site options to accommodate your firm’s preferences and needs. Remote bookkeeping has gained popularity thanks to secure cloud-based accounting software.

How Can I Integrate Outsourced Bookkeeping Services with My CPA Firm’s Existing Systems and Software?

Ensure that the selected bookkeeping company employs compatible accounting software and technology. Most providers can seamlessly integrate with your current systems, ensuring a smooth transition.

Do Outsourced Bookkeeping Companies Provide Ongoing Support and Communication?

Indeed, most outsourced bookkeeping companies maintain regular communication with their clients, delivering updated reports and addressing any questions or concerns. Opt for a provider with a communication style that aligns with your firm’s preferences.

Conclusion

Choosing one of the top outsourced bookkeeping companies for CPA firms opens the door to many advantages. These outsourced service providers adeptly manage the myriad challenges often encountered by CPA firms. From adopting cutting-edge technology tools and accounting software solutions to recruiting highly skilled bookkeeping experts, these firms are equipped to deliver best-in-class offshore bookkeeping services.

By teaming up with one of the most reliable outsourced bookkeeping companies for CPA firms, your CPA firm gains the freedom to allocate resources and focus on crafting superior strategies to drive business growth exponentially. Remember the key factors we’ve discussed throughout this article to make the right choice.

Bestarion stands out as one of the trusted and widely recognized companies in this industry, having empowered numerous CPA firms. Could your firm be the next success story?

Our Outsourcing Bookkeeping Services can boost your revenue. We hope you to schedule a meeting with our business head to have all your questions answered. Your path to growth and success starts with a conversation—so why wait?

Read more:

Top 10 Bookkeeping Tips for Small Businesses

Top 10 BPO Companies in Vietnam 2023

#bookkeeping services#cpa firm#outsourced bookkeeping#vietnam company#outsourced bookkeeping company

0 notes

Text

Offshore Accounting to India: A Strategic Move for CPA Firms in Canada, USA, Australia, and New Zealand

Introduction

The accounting profession has undergone changes in today's globalized world, with technology and outsourcing playing pivotal roles. One of the most notable trends in recent years is the growing popularity of offshore accounting services. CPA firms in Canada, the USA, Australia, and New Zealand have increasingly turned to outsourcing their accounting functions to countries like India. In this blog, we'll explore why offshore accounting to India is considered a substantial benefit to CPA firms in these four nations.

Cost-Efficiency

Cost efficiency is one of the most compelling reasons for CPA firms in Canada, the USA, Australia, and New Zealand to offshore their accounting operations to India. Labor costs in India are significantly lower compared to these Western countries. This cost differential allows CPA firms to allocate their resources more efficiently, freeing up capital to invest in critical areas such as technology, marketing, and business development. Lower operating costs can also result in increased profitability for the firm, which is especially vital in today's competitive market. Remoteaccounting24x7 is a company that provides bookkeepers and accountants to CPA firms in Canada, the USA, Australia, and New Zealand.

Skilled Workforce

India boasts a vast pool of skilled and well-educated professionals in accounting and finance. Many professionals hold advanced degrees and certifications like Chartered Accountants (CA) or Certified Public Accountants (CPA), making them well-equipped to handle complex accounting tasks. CPA firms benefit from this wealth of talent, as they can tap into a skilled workforce without the challenges of recruitment, training, and turnover they might face domestically.

Time Zone Advantage

The time zone difference between India, North America, Australia/New Zealand can be strategically advantageous for CPA firms. While North American firms close for the day, their offshore teams in India can continue working. This allows for faster turnaround times on the projects and enhanced client service. The ability to operate round the clock can be a significant competitive edge, especially when dealing with critical financial deadlines.

Access to Advanced Technology

India has rapidly emerged as a hub for technology and innovation. Offshore accounting firms in India often have access to cutting-edge accounting software and tools that enable them to provide high-quality services to their international clients. This access to advanced technology helps CPA firms streamline their inhouse operations, reduce errors, and enhance the overall quality of their work.

Scalability

The flexibility and scalability of offshore accounting in India are vital attractions for CPA firms. Outsourcing allows firms to quickly scale their operations up or down in response to changing client needs or seasonal fluctuations in workload. This scalability ensures that firms remain agile and responsive in a dynamic business environment.

Focus on Core Competencies

Offshoring accounting tasks to India enables CPA firms to concentrate on their core competencies, such as client relations, strategic planning, and business growth. Delegating routine accounting and bookkeeping tasks to skilled professionals in India frees up valuable time and resources for firms to focus on value-added services and expanding their client base.

Enhanced Competitive Position

By leveraging the benefits of offshore accounting in India, CPA firms can offer competitive pricing to their clients while maintaining profitability. This can be a game-changer in a market where clients are increasingly price-sensitive. Lower costs translate into a stronger competitive position and the potential for increased market share.

Conclusion

Offshore accounting to India is a strategic move that can significantly benefit CPA firms in Canada, the USA, Australia, and New Zealand. The cost-efficiency, access to a skilled workforce, time zone advantage, advanced technology, scalability, and enhanced competitive position are just a few reasons why this practice has gained traction in accounting. By leveraging the advantages of offshoring, CPA firms can achieve cost savings, improve efficiency, and focus on delivering high-quality services to their clients, ultimately strengthening their position in the global market. As the accounting landscape continues to evolve, offshore accounting to India remains a viable and valuable strategy for CPA firms seeking growth and success.

0 notes