#corporatetaxuae

Text

Understanding VAT in the UAE: A Definitive Guide for Businesses

The introduction of Value-Added Tax (VAT) in the United Arab Emirates (UAE) has seized the business community's attention with its wide-ranging implications. The transition to a VAT system can be daunting for those navigating the labyrinth of tax laws, particularly newcomers. However, by gaining a comprehensive understanding of VAT and its application in the UAE, businesses can streamline their processes and ensure compliance, minimizing the risk of penalties.

This deep-dive blog post aims to demystify VAT for UAE businesses, providing essential information and actionable insights to comply with the legal framework and incorporate this new regime into business strategies.

A Primer on VAT

VAT in a Nutshell

Value-added tax (VAT) is a consumption tax levied on a product at every stage of the production process as the value is added. It is ultimately borne by the end consumer and acts as a significant revenue generator for governments worldwide. The UAE implemented VAT on January 1, 2018, per the GCC VAT framework, aiming to diversify government revenue sources and reduce dependency on oil and gas.

VAT vs. Sales Tax

Although similar, VAT and sales tax align differently in legal systems. VAT is a multi-stage tax, where the tax amount is collected incrementally at the time of the sale, whereas sales tax is a single-point charge levied at the point of purchase by the final consumer.

Navigating VAT Law in the UAE

Summary of VAT Law

The UAE's VAT law provides a comprehensive framework for VAT registration, compliance, and payment. The law outlines the tax rates and categories of taxable supplies and includes provisions for specific sectors such as real estate, healthcare, and education.

Critical Components of VAT Law

Understanding the critical components of the VAT law is crucial for businesses to ensure adherence. These include the registration threshold, input and output tax, returns filing, and penalties for non-compliance.

Exemptions and Zero-Rated Supplies

Certain supplies are exempt or zero-rated within the VAT framework. Businesses need to differentiate between these categories, as they can impact the amount of VAT recoverable.

Place and Time of Supply

The place and time of supply are pivotal concepts that determine when and where VAT should be accounted for. This could become complex when dealing with international trade, e-commerce, and services.

The VAT Registration Process

Who Should Register?

Compulsory registration is mandated for businesses exceeding the thresholds set by the UAE VAT law. Voluntary registration is also an option for companies aiming to recover VAT on costs and improve credibility.

The Registration Process

The process necessitates completing a VAT registration form, including a thorough understanding of the legal obligations and any tax liabilities that may arise post-registration.

VAT Registration for Special Cases

Special provisions exist for entities involved in groups or partnerships, which require a unique approach to VAT registration.

Managing Multiple Registrations

Managing multiple VAT registrations is essential to compliance for businesses operationally divided across GCC countries.

Implementing VAT in Business Operations

Adjusting Accounting and Invoicing Systems

The introduction of VAT demands significant adjustments in financial accounting systems to track and report VAT transactions accurately.

Staff Training and Awareness

Equipping staff with VAT knowledge is crucial to ensuring accurate invoicing, refund claims, and VAT return preparation.

Impact on Pricing and Contracts

The pricing of goods and services should reflect the VAT implications. Existing contracts may also need to be revised to avoid disputes and ensure legal compliance.

VAT Reporting and Compliance

Filing VAT Returns

VAT UAE returns need to be filed regularly, with precise output and input tax details.

Audits and Record-Keeping

A robust record-keeping system enables businesses to respond to audits and maintain transparent financial reporting.

VAT Compliance Technology

Leveraging technology, such as VAT-compliant software, simplifies the reporting process and minimizes errors.

Managing VAT Payments and Refunds

Understanding the payment procedures for VAT liability and the conditions for claiming a refund is central to cash flow management.

Dealing with VAT Audits and Disputes

VAT Audit Triggers

Identifying potential triggers for a VAT audit allows businesses to rectify discrepancies preemptively.

Preparing for a VAT Audit

Preparation, including organizing records and evidence, streamlines the audit process and ensures a positive outcome.

Resolving Disputes with the Authorities

In the case of disputes, businesses should be aware of their rights and have clear procedures in place for resolution with the tax authorities.

Future-Proofing with VAT Compliance

Evolving with VAT Amendments

VAT law is not static and is subject to amendments. Businesses must stay abreast of changes and adjust their operations accordingly.

Leveraging VAT for Strategic Decisions

VAT can inform pricing, sourcing, and investment decisions. By incorporating VAT into decision-making, businesses can capitalize on potential savings and growth opportunities.

Aligning with Global VAT Trends

Keeping an eye on global VAT trends assists businesses in benchmarking their practices and ensuring long-term competitiveness.

Conclusion

Navigating the VAT landscape in the UAE requires a proactive approach and continuous learning. By staying informed, maintaining robust processes, and harnessing technology, businesses can turn the challenge of VAT compliance into a strategic advantage. VAT must be viewed not merely as a legal obligation but as a catalyst for transformation and growth in the region.

1 note

·

View note

Text

Learn whether UAE corporate taxes apply to all business types.

.

Click the link below to know more :

1 note

·

View note

Text

Views on Taxation: A Brief History of Taxation and Its Global Impact!

Taxation plays a vital role in the development of societies and economies worldwide, and it is essential for ensuring that governments can provide essential public goods and services to their citizens.

The Corporate Group can help businesses with tax advisory services by providing expert guidance and insights on tax-related issues such as compliance, planning, and risk management. With their in-depth knowledge of tax laws and regulations, we help businesses minimize their tax liabilities and optimize their tax strategy to achieve their financial goals.

Connect with us today!

🌐 www.corporategroup.me

📞 +971 4 565 6680

📧 [email protected]

#corporategroupuae#corporategroup#uae#CGME#taxadvisory#taxation#dubaitax#corporatetax#taxservicesindubai#financialgoals#taxadvisoryservices#taxplanning#middleeast#corporatetaxuae#taxlaw#dubai#business#businessgrowth

0 notes

Text

Hallmark Auditors is a Dubai-based auditing firm that offers a range of auditing services, including financial statement auditing, internal auditing, and tax consulting. The firm is known for its commitment to providing high-quality services to clients while adhering to industry regulations and standards.

#corporatetaxuae#CorprateTax#CorporateTaxLaw#vatdubai#vatuae#VAT#taxuae#taxdubai#taxrefund#taxseason#taxseason2023#UAENews

0 notes

Text

Most businesses need a CFO, but occasionally owners try to do it themselves, particularly if their revenue is insufficient to cover the added expense. Here, CFO services in Dubai are important because they can provide the creative and practical financial guidance needed to keep up with the rapidly changing business environment and boost income.

#corporatetaxuae#CorprateTax#CorporateTaxLaw#vatdubai#vatuae#VAT#taxuae#taxdubai#taxrefund#taxseason#taxseason2023#UAENews#CFOservices

0 notes

Photo

A free Tool to Check Your Corporate Tax Eligibility for Freezone Companies. Check yours Now !!!

https://zfrmz.com/ch8nRhGpE7y18Ga48ZVJ

0 notes

Text

"Individuals will be subject to UAE Corporate Tax?"

Follow MASAR CHARTERED ACCOUNTANTS For more updates

For Free Consultancy. We are Always Available for you.

📧 [email protected]

📞+971 56 442 2333

🌐 https://masaraudit.ae/

#corporatetaxuae #ct #uaetax #dubai #uaecorporatetax #taxadvisory #taximplementations #Corporatetaximplmenataions #CTindividuals #Individuals #masarcharteredaccountants

#corporate tax in uae#uae corporate tax#tax agency in uae#corporate tax in dubai#tax advisor#masar#vat services

0 notes

Text

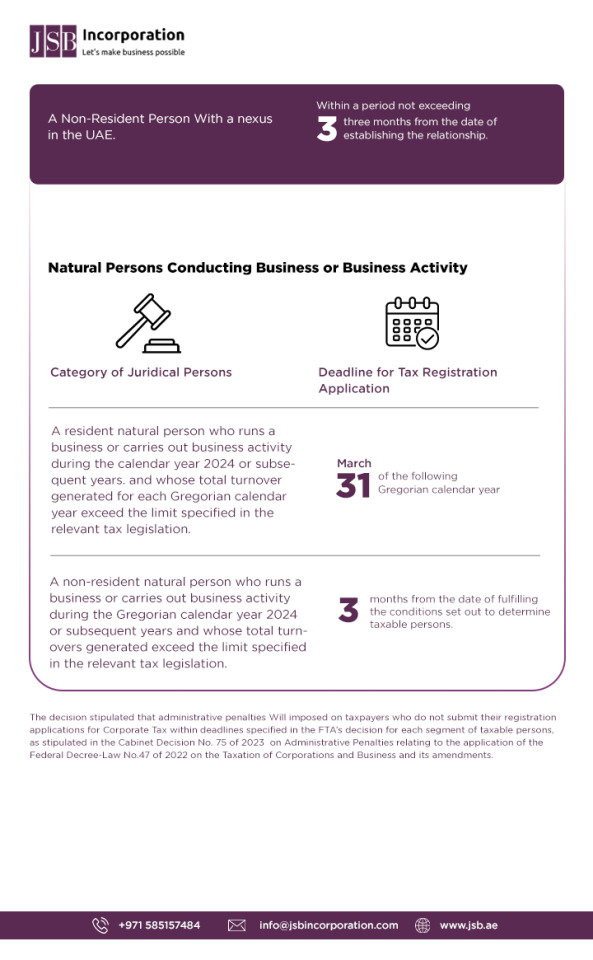

Attention‼️UAE Corporate Tax Update 🔊

Certain UAE businesses must register for Corporate Tax by 31st May 2024. Failure to do so will result in a fine of AED 10,000. This penalty is designed to encourage timely compliance with tax regulations.

To know more, call +971 585157484

or email us at [email protected]

#JSBIncorporation #TaxUpdate #UAECorporateTax #TaxUpdate #TaxRegulations #CorporateTaxuae

#UAEupdatesCorporateTax2024 #taxupdate2024

JSB Incorporation

0 notes

Text

Dubai, UAE: Home to the World’s Lowest Corporate Tax

Dubai, United Arab Emirates (UAE), has long been recognized as a global business hub, attracting entrepreneurs and corporations from around the world. One of the most compelling reasons for businesses to set up shop in Dubai is its incredibly low corporate tax rate, often hailed as the world’s lowest. In this blog, we’ll delve into the significance of Dubai’s corporate tax policy and why it makes the emirate a preferred destination for businesses, with insights from PrivateWolf, your trusted partner in UAE business setup.

A Tax Haven for Businesses

Dubai’s allure as a tax haven for businesses stems from its commitment to fostering a business-friendly environment. The UAE, of which Dubai is a key emirate, has no federal corporate income tax, making it a particularly enticing destination for entrepreneurs and corporations alike.

Dubai’s Zero Corporate Tax

In Dubai, businesses established in free zones can enjoy a remarkable zero percent corporate tax rate for an extended period, often up to 15 to 50 years, depending on the specific free zone. These free zones are designed to promote various industries, from technology and finance to logistics and media, and each offers unique benefits tailored to those sectors.

Benefits of Dubai’s Zero Corporate Tax

1- Tax Efficiency:

Dubai’s zero corporate tax policy translates into significant tax savings for businesses. The absence of corporate income tax allows companies to retain a larger portion of their profits, enabling reinvestment and growth.

2- Attracting Global Investments:

Dubai’s tax advantages have attracted substantial foreign investments. Multinational corporations find the emirate an ideal location to establish their regional or international headquarters, facilitating global business operations.

3- Business Expansion:

With more resources available for expansion and innovation, businesses in Dubai can explore new markets, develop cutting-edge technologies, and diversify their offerings.

4- Attracting Talent:

Dubai’s tax advantages not only benefit businesses but also appeal to skilled professionals seeking employment opportunities in a financially favorable environment.

Why Choose PrivateWolf for Your Business Setup in Dubai?

PrivateWolf is your reliable partner for business setup in Dubai, providing expert consultation and guidance. Our team of experts understands the nuances of Dubai’s business landscape, including its tax policies. We can assist you in navigating the process of setting up your business in Dubai’s free zones, ensuring that you maximize the benefits of the zero corporate tax regime.

Conclusion:

Dubai’s status as a global business hub is enhanced by its incredibly low corporate tax policies, making it an attractive destination for entrepreneurs and corporations seeking tax efficiency and business growth. With a zero percent corporate tax rate for businesses in select free zones, Dubai continues to solidify its reputation as a tax haven and a strategic location for global business operations.

To embark on your journey to business success in Dubai, partner with PrivateWolf. Visit PrivateWolf today to explore our services and learn how we can assist you in setting up and thriving in Dubai’s tax-efficient business landscape.

M.Hussnain

Private Wolf

facebook

Instagram

Twitter

Linkedin

#corporatetax #dubaibusinesssetup #dubaicorporatetax #freezone #taxfree #corporatetaxuae #uae #dubai #businessindubai

0 notes

Text

#corporatetaxuae#CorprateTax#CorporateTaxLaw#vatdubai#vatuae#VAT#taxuae#taxdubai#taxrefund#taxseason#taxseason2023#UAENews

1 note

·

View note

Photo

Our team of experts is here to help you navigate the complexities of corporate tax law and ensure that you're in compliance with all relevant regulations.

From tax planning and preparation to audit representation and resolution, we've got you covered. Trust us to provide you with the expertise and guidance you need to optimize your tax strategy and minimize your liability.

For Consultation: https://bit.ly/3FwQX4W

Contact with our Expert :

🌐 https://rvguae.com/

✉ [email protected]

📲 +971 56 164 3075 | +971 56 679 6910

Please subscribe to our YouTube channel for informative videos related to the latest laws and updates.

🎞 https://bit.ly/3NQKKTP

0 notes

Photo

https://rvguae.com/top-10-corporate-tax-consultants-in-dubai/

Since the Ministry of Finance announced the introduction of Corporate Tax by 1 June 2023, hiring the best Corporate Tax Consultant in Dubai has become a requirement for many businesses; A Corporate tax consultant is the need of the hour as companies prepare for the new tax regime;

0 notes

Photo

Are you ready with your accounts for New corporate tax 2023 in UAE?

Our Professionals will guide in best way.

For Consultation: https://bit.ly/3FwQX4W

For more information and inquiries:

🌐 https://rvguae.com/

✉ [email protected]

📲 +971 56 164 3075 | +971 56 679 6910

For informative videos related to latest laws and updates, please subscribe to our YouTube channel.

https://bit.ly/3NQKKTP

0 notes

Photo

The Corporate Tax will be effective from the financial year beginning June 1, 2023. Hence, choosing the correct jurisdiction becomes even more essential, and you may realize how important it is to select a jurisdiction while starting a business in UAE.

0 notes

Text

Will an individual's employment income be subject to UAE Corporate Tax?

Follow MASAR CHARTERED ACCOUNTANTS for more updates.

For Free Consultancy. We are Always Available for you.

[email protected]

+971 56 442 2333

https://masaraudit.ae/

#corporatetaxuae #ct #uaetax #dubai #uaecorporatetax #taxadvisory #masarcharteredaccountants #taxation #taxindividuals

0 notes

Text

Will an individual's employment income be subject to UAE Corporate Tax?

Follow MASAR CHARTERED ACCOUNTANTS for more updates.

For Free Consultancy. We are Always Available for you.

[email protected]

+971 56 442 2333

https://masaraudit.ae/

corporatetaxuae #ct #uaetax #dubai #uaecorporatetax #taxadvisory #masarcharteredaccountants

#corporate tax in uae#uae corporate tax#tax agency in uae#corporate tax in dubai#vat services#tax advisor#audit firms in dubai

0 notes