#business broker Minneapolis

Text

Peterson Acquisitions: Your Minneapolis Business Broker

2299 Waters Dr, Mendota Heights, MN 55120

(651) 387-0376

https://petersonacquisitions.com/minneapolis-business-broker-minnesota/

Peterson Acquisitions: Your Minneapolis Business Broker! We help people buy and sell closely-held companies. Most of our clients are first time sellers and buyers, so we are masters at guiding people through the process of buying a business or selling a company. Contact us today to learn what your business may be worth and what you can do to improve it. We have a huge number of educational tools to help business buyers and sellers.

Services: Sell Your Business, Business valuation, Business assessment, Business analysis, Swinging Doors - Get the Book, Buy a Business, Business Coaching Session

Facebook

Twitter

Linkedin

Youtube Channel

Foursquare

Pinterest

Tumblr

Google Maps

#Business Broker Minneapolis#Business broker near me#Sell my business Minneapolis#Buy a company Minneapolis#Best Minneapolis Business Broker#What is my company worth#Sell my business in Minneapolis#Buy a company in Minneapolis#What is my company worth Minneapolis

1 note

·

View note

Text

Time's Up for the 6% Real Estate Commission: Lessons from a $1.8 Billion Verdict

Minnesota, Feb 2024 – Following a historic $1.8 billion verdict, the real estate sector is at an opportunity. As the clock is running out on its applicability, the conventional 6% commission model—long regarded as normal practice—is coming under heavy criticism. This landmark legal outcome serves as a wake-up call, demanding a reevaluation of fee structures, service offerings, and the overall client experience. Real Estate Corners in Minnesota is committed to serving with the highest level of response and attention. Real Estate Corners offers affordable flat fee MLS listing services in MN for sale by owner properties.

The 6% commission has been the norm in real estate transactions for years. This business model has been the lifeblood of agents' and brokers' operations, frequently without question. But things are starting to change. The sector is ready for change due to changes in client demands and technological advancements.

The real estate community is still recovering from the $1.8 billion verdict that was handed down in a well-known case. It emphasizes how important it is for every transaction to be open, accountable, and innovative. Customers want explanations because they are becoming increasingly critical about the value they get in return for their hard-earned money.

Fee structures are a crucial topic of attention. Although the 6% commission model is profitable for agents and brokers, it may be too costly for customers, particularly in the current competitive market. Commission costs are rising in tandem with housing prices, which makes many buyers and sellers feel undervalued.

Furthermore, the development of technology has given customers extraordinary access to information. Buyers and sellers have a greater ability to make judgments when they have access to useful information about property listings, transaction histories, and market trends through online and mobile application platforms. This includes leveraging resources like the Minneapolis Multiple Listing Service by Real Estate Corners, providing comprehensive data and insights for informed decision-making in the local market.

In this era of digital transformation, real estate professionals must adopt technology as a tool for enhancing the client experience. Agents and brokers can spare their clients time and money by streamlining the purchasing and selling process through the use of data analytics, artificial intelligence, and virtual reality.

Ultimately, the $1.8 billion verdict serves as a reminder that the real estate industry is not immune to change. As the clock ticks on the 6% commission model, stakeholders must seize this opportunity to adapt and innovate. By embracing transparency, efficiency, and client satisfaction, we can enter a new era of real estate that benefits everyone involved.

About the Company:

Real Estate Corners is a licensed real estate company in Minnesota since 2001. As leaders in the flat fee real estate industry, they offer homeowners two options to sell their properties while saving them thousands of dollars in selling commissions. With over 20 years of experience selling residential and commercial properties, their team has the knowledge, expertise, and resources to deliver exceptional results for clients of all sizes. Providing top-quality service to each client is their top priority, and their highly skilled and experienced professionals are committed to assisting you every step.

Address: 2792 118th Cir NE, Blaine, Minnesota, USA

Phone Number: (612) 483-1230

E-Mail: [email protected]

Website: https://realestatecorners.com/

0 notes

Text

Saga of Wall Street's pandemic darlings ends with tears

New Post has been published on https://medianwire.com/saga-of-wall-streets-pandemic-darlings-ends-with-tears/

Saga of Wall Street's pandemic darlings ends with tears

Oct 12 (Reuters) – Think about something novel you started doing two-and-a-half years ago to make life easier during the COVID lockdown and chances today are that there is a related story about a stock market casualty.

Add investor worries about soaring inflation and an economic slowdown that tipped Wall Street into a bear market this year, and you will find a bleak picture for the companies that became hugely popular during the pandemic.

Connected stationary bike maker Peloton Interactive (PTON.O) told employees last week that its fourth round of job cuts this year is a bid to save the company. Its problems put a spotlight on other pandemic hot-shots like Zoom Video Communications (ZM.O), Nautilus Inc (NLS.N), DocuSign Inc (DOCU.O) and DoorDash Inc (DASH.N).

Growth investors pushed Peloton stock to a $171.09 record in early 2021. Demand was so strong for its bikes that restless consumers had to wait out long delivery delays. But Peloton shares are now down 95% from their peak, closing at $8.53 on Wednesday. The S&P 500 (.SPX) by comparison is down about 25% from its record high in January this year.

Others bought exercize gear from Nautilus during the pandemic, sending its stock up to $31.30 in early 2021. It last traded at $1.65.

Zoom became synonymous with online meetings as many people worked remotely and even turned to video conferences for social gatherings. But Zoom’s shares were last at $75.22 versus its $588.84 peak, reached in October 2020.

Other stay-at-home favorites were online retailer Amazon.com (AMZN.O) and food delivery service DoorDash . People also flocked to consumer-friendly brokers like Robinhood Markets (HOOD.O) while stuck at home with no sports to bet on. But after scaling $85 in August 2021, Robinhood last traded at $10.66.

“These are companies with good enough ideas that they get enough funding. They catch a wave like COVID, their use explodes,” said Kim Forrest, chief investment officer at Bokeh Capital Partners in Pittsburgh. But once that growth slows, investors lose interest.

“They kind of used up all the air in their universe, and they have nowhere to grow. So, while people might still be using the Peloton, not enough people are buying the Peloton,” said Forrest.

Daniel Morgan, portfolio manager at Synovus Trust in Atlanta, Georgia, says Peloton may appear cheap, but he is wary because it is not profitable. Its price-to-sales multiple has fallen to 0.8, on a trailing 4-quarter basis, from an average multiple of 6.6 since it went public in Sept. 2019, Morgan said.

Wall Street expects Peloton to report an adjusted loss per share of $2.07 for its fiscal year ending in June compared with a loss of $7.69 in its fiscal year 2022, according to Refinitiv.

Zoom has been making money and its valuation also appears cheap at 35 times earnings per share versus an average multiple of 135 since its April 2019 debut, Morgan said.

Still, he is concerned about its profit decline. Zoom’s adjusted earnings per share is expected to fall 27% for its fiscal year ending in January versus 2022 growth of 55.5%, according to Refinitiv.

Morgan also pointed to a growth slowdown for DoorDash and retail giant Amazon.com as they are also being hurt by soaring inflation and economic uncertainty.

“Each company is going to have to see how their particular business model can execute in a normalized environment,” he said.

Carol Schleif, deputy chief investment officer at BMO’s family office in Minneapolis, cautioned against investing in companies that look cheap and have loyal customers. It’s all about management, balance sheets and projected income, she said.

While one possible outcome for pandemic favorites with slowing growth could be a buyout by a larger company, Schleif is wary of making this bet.

“Buying a stock because you think it’s going to get taken out, that’s a risk. I wouldn’t be willing to do it with any money I wasn’t willing to lose,” she said. “It’s not really investing. It’s more opportunistic.

Reporting By Sinéad Carew, Lance Tupper and Chuck Mikolajczak; Editing by Alden Bentley and Richard Pullin

Our Standards: The Thomson Reuters Trust Principles.

Read the full article here

0 notes

Text

Nightingale minneapolis

#Nightingale minneapolis code#

Since then Elie has brokered over $800 million of real estate-deals ranging from $5 million to $50 million-before starting The Nightingale Group. They two of them began concentrating on commercial property acquisition in 2003, pri-marily functioning in an owner’s representative capacity. And when that wasn’t enough for him, Elie partnered with Simon Singer, working on real estate investments during the evenings in what would become The Nightingale Group, LLC. Health Care Indiana, Home Health Care Indiana, Indianapolis, Lebanon, Carmel, Chicago, Burr Ridge, San Diego, Minneapolis, Las Vegas, Physical therapy. Contemporary American, Cocktail Bar, Wine Bar Hours of operation. In this case a network engineering business. So it’s no coincidence that his first real job was starting a business. Address: 810 W Lake St, Minneapolis, MN 55408. The lanes are vintage (don’t mind the slope), but the staff and ambiance here are some of the best you’ll find in town. Who made a mini-business out of ordering 10 pizzas and selling it by the slice. For more than 25 years, the 8 lanes and 90 seat theater of this Uptown Minneapolis icon have been the go-to neighborhood spot.

#Nightingale minneapolis code#

Working with Simon, Elie negotiates contracts, structures financing, and manages each property in the firm’s expanding portfolio.Įlie is the classic entrepreneur - the kind of kid who made a mint selling and trading baseball cards and candy growing up. Nightingale Food & Cocktails Claimed Review 69 reviews 154 of 1,140 Restaurants in Minneapolis - American Bar Vegetarian Friendly 2551 Lyndale Avenue South, Minneapolis, MN 55405 +1 61 Website Menu Closed now : See all hours See all (39) Get food delivered Order online Ratings and reviews 4. Restaurant Minneapolis Minneapolis The dress code here is. The location that once held a run down gyro/grocery store is now a gorgeous, modern restaurant, small but well designed and with lots of cozy tables. During the Company’s first years in business, the partners acquired seventeen commercial properties. Delivery & Pickup Options - 287 reviews of Nightingale 'A friend and I stopped into this new spot for dinner last night and it just happened to be their grand opening. Elie co-founded The Nightingale Group, LLC, with partner Simon Singer, in 2005.

0 notes

Text

The Of Selling Homes

Brokers that deal with customers generally look for residential or commercial properties that match the requirements set forth by their clients, conduct settlements, prepare offers, and assist the buyers with any type of other issues leading up to the closing day. Sellers' brokers, on the other hand, determine the marketplace values of their clients' homes, listing and program residential or commercial properties, communicate with sellers concerning offers, and also help in the offer procedure.

In basic, associate brokers do not manage other agents. Each actual estate workplace has one assigned broker.

They also earn payments from their very own offers, however unlike realty representatives, they do not need to divide their commission with "the office." Realtors A Realtor is a property specialist that belongs to the National Organization of Realtors (NAR), the largest trade association in the UNITED STATE Although the term "Realtor" is typically confused with that of "realty representative," the classification is open to a range of occupations within the genuine estate market, consisting of: Residential and business realty brokers Salespeople Residential property managers Evaluators Just how to come to be a Realtor Any person that intends to come to be a Real estate professional needs to satisfy four demands: Have a legitimate and energetic actual estate license Be proactively engaged in the property service Not have a record of main sanctions including amateur conduct Not have actually filed for any kind of recent or pending insolvency Next, the individual requires to sign up with among the National Organization of Realtors' local actual estate organizations, pay a single application fee, as well as pay yearly subscription because of preserve their Real estate professional status.

4 million participants across the nation, 65% of whom were qualified sales representatives. An additional 22% of these were brokers, as well as 15% held broker associate licenses.

It can not, nonetheless, be made use of as a classification of the specialist's certificate status.

Are the terms "real estate representative" and also "Realtor" interchangeable? Those inside the industry understand that they're not, yet they also recognize it appears to be a little an industry secret many consumers aren't certain in any way what the distinction is in between a realty agent as well as a Real estate professional, or whether there also is one.

Realtor thing works. The titles "realty agent" as well as "Realtor" are usually utilized mutually. Because making use of the term "actual estate agent" can be a bit clunky and also verbose, those that may not be familiar with the distinctions in between the two designations typically utilize the term "Real estate professional" as a shorthand to refer to anyone that remains in business helpful individuals deal actual estate.

Both actual estate agents as well as Realtors are accredited to offer real estate, each title refers to a particular type of genuine estate professional, as well as there are significant differences between the 2. A real estate agent is any individual who is certified to assist people deal industrial or property.

All property representatives have to pay a yearly licensing cost as well as restore them each or 2 years, depending upon the state. In some states, representatives might have to complete a particular amount of proceeding education and learning courses before their licenses can be renewed. A Realtor is a trademarked term that describes a property representative that is an energetic participant of the National Organization of Realtors (NAR), the biggest profession association in the USA.

The association was initially established in 1908 as the National Organization of Realty Exchanges and transformed its name in 1916 to The National Organization of Property Boards. That exact same year, Charles N. https://www.thecopengrand.com , a property agent in Minneapolis and vice head of state of the National Organization of Realty Boards, proposed the usage of the term "Real estate professional" to give participants of the association a means to distinguish themselves from non-members.

There have NAR has dealt with legal obstacles saying that "Real estate professional" is a generic term and ought to not be a trademark. Headquartered in Chicago, NAR has more than 1 million participants throughout the country as well as subscription is not limited to just genuine estate representatives and also brokers.

1 note

·

View note

Link

Consulting with an extremely experienced professional business broker will be truly helpful when you want to sell your company. They can guide you to a successful sale. Click the link to read the article to know in details about it.

#Business broker Minneapolis#business sale broker Minneapolis#companies for sale Minneapolis#best business brokers Minneapolis#sell my business Minneapolis

1 note

·

View note

Text

My theory re: post-COVID touring trends is that more and more bands/artists of comparable stature and fan demographics are going to start adopting the Hold Steady approach to playing shows. Rather than a typical coast-to-coast or regional circuit, you'll have clusters of back-to-back dates plotted around weekends in specific cities, with a lot of buffer space in between and long lead times for announcements. A Weds/Thurs/Fri/Sat residency in New York, for instance, then three months later one in L.A. or Chicago, then Minneapolis, wherever the audience and the audience's money is.

There are financial benefits to playing shows this way. You're going directly to where demand is strongest, rather than the usual route of big-city-to-small-town boom-and-bust, where you're hemorrhaging money every stop until you hit the New York or L.A. or Chicago and (hopefully) make up the intermediate losses. A necessary evil, maybe, if you want to put your name out there and your live act on the map, but if you're a band like the Hold Steady (or Greg Dulli, or the Mountain Goats, or Liz Phair, or Sloan...), who are you trying to convert that you haven't already? You know your fanbase, your contingent of diehards, the proportion that can be expected to shell out for transit and lodging a handful of times a year. You can run the numbers.

There's logistical and psychological benefits, too: it lessens the risk of COVID exposure and breakthrough infections imploding a whole tour (also technically a financial benefit, if it reduces your insurance outlays). If you're a musician with kids and a family, it softens the emotional blow of being out on the road and away from your loved ones for long stretches of time.

This is purely theoretical and would depend on contracting specifics I don't have insight into the way I do, say, fashion financing, but I wonder if it could even get certain artists out of non-compete clauses. The big brokers/showrunners like AEG usually put those in their deals: if you're running a tour through us at our venues that we do business with exclusively, you can't play any shows within X miles of those venues in Y period of time that are not also AEG-exclusive venues. For example: when the Afghan Whigs go on tour and play a show at Webster Hall (an AEG/Bowery Presents venue), they are contractually barred from booking a gig the for the same week at Bowery Ballroom (an independent club). But if there's eight weeks between you and your next cluster of tour dates... the same restrictions might not necessarily hold.

12 notes

·

View notes

Text

Minnesota: Ilhan Omar Connected Cash-For-Ballots Voter Fraud Scheme Corrupts Elections

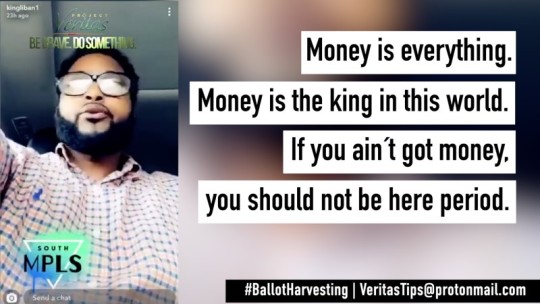

Ilhan Omar Connected Cash-For-Ballots Voter Fraud Scheme Corrupts Elections: 'These Here Are All Absentee Ballots...Look...My Car Is Full..." 'Money Is The King Of Everything'

Ballot Harvester Liban Mohamed: “Money is Everything. Money is the King in this World. If You Got No Money, You Should Not Be Here, Period. You Know What I am Saying? Money is Everything and a Campaign is Managed By Money.”

Mohamed: “Numbers Do Not Lie. Numbers Do Not Lie. You Can See My Car is Full. All These Here Are Absentee Ballots. Can’t You See? Look at All These, My Car is Full.”

Paid Voter: “When We Sign The Voting Document and They Fill It Out Is When They Give Us The Money,”… “The Minute We Signed The Thing [Ballot] For The Election. That’s When We Get paid.”

Ballot Harvesting Triangle: River Plaza Apartments, Horn Towers seniors Community and 980 Hennepin Polling Site All Subject to Fraud

Minneapolis Somali Community Insider: “It’s an Open Secret” … “She [Ilhan Omar] Will Do Anything That She Can Do To Get Elected and She [Omar] Has Hundreds of People on The Streets Doing That.”

Seniors at Horn Towers Ballots Compromised; Harvester: We “Request” Ballots For The Seniors and Then Take Them Away.

[Minneapolis--Sept. 27, 2020] Project Veritas investigators revealed a ballot harvesting scheme here involving clan and political allies and associates of Rep. Ilhan Omar (D.-Minn.) in the first of a series of reports.

“Numbers don’t lie. Numbers don’t lie. You can see my car is full. All these here are absentees’ ballots. Can’t you see? Look at all these, my car is full. All these are for Jamal Osman... We got 300 today for Jamal Osman only,” said Liban Mohamed in a series of Snapchat videos posted July 1 and July 2 on his own Snapchat profile.

Mohamed said he was collecting the ballots to help his brother win the city’s Aug. 11 special election for a vacant Ward 6 city council race—which was held the same day as the primary for Omar’s MN-05 congressional seat. Ward 6 is the heart of the city’s Somali community and the Omar’s political base.

James O’Keefe, the founder and CEO of Project Veritas, said: “Ballot harvesting is real and it has become a big business. Our investigation into this ballot harvesting ring demonstrates clearly how these unscrupulous operators exploit the elderly and immigrant communities—and have turned the sacred ballot box into a commodities trading desk.”

O’Keefe said, “We are showing Americans what is really going on in one of our great cities—but, it's not me saying—we have the operators on tape saying it all themselves.”

Our investigation found that among three locations inside Ward 6, a ballot harvesting triangle, where the scheme operates: the Riverside Plaza apartments, the senior citizen community at Horn Towers and the Minneapolis Elections and Voter Services office at 980 E. Hennepin Ave., which also functions as a voting location and ballot drop-off site.

Mohamed continued: “Money is everything. Money is the king in this world. If you got no money, you should not be here period. You know what I am saying.”

Mohamed said that his political methods are interwoven with money. “Money is everything and a campaign is managed by money. You cannot campaign with $200 or $100 you got from your grandmother or grandfather. You cannot campaign with that. You gotta have an investment to campaign. You gotta have fundraisers.”

Hennepin County Attorney Jeff Wojciechowski told a Project Veritas journalist on a recorded line the ballot harvesting conduct described to him was: “Illegal, and we will be investigating.”

Somali insider stepped forward to expose election corruption in Minneapolis

Central to the Project Veritas investigation was Omar Jamal, political insider active in the city’s Somali community. Jamal works with the Ramsey County Sheriff Department and is the chairman of the Somali Watchdog Group. “I have been involved in the community for the last 20 years.”

“Omar Jamal is the latest brave Project Veritas Insider to come forward and expose a voter fraud scheme in Minnesota that will shock you,” said O’Keefe. “When we spoke with Omar Jamal, he actually repeated part of our PV Insider motto: 'Do Something.'”

Jamal said he was motivated to reach out to Project Veritas, because he wants to eliminate the corruption that weakens his community, such as the ballot harvesting practiced by Minnesota’s Democratic-Farmer-Labor Party, in which Ilhan Omar has emerged as a rising power broker.

“It's an open secret,” he said. “she [Omar] will do anything that she can do to get elected and she has hundreds of people on the streets doing that.”

The political insider said he hopes there is still time to clean up elections in the country.

“If American people don't pay attention to what's happening, the country will collapse,” he said.

“The regulations, if you ignore that and you let corruption and fraud become a daily business and then tough luck, the country will not exist as they [Americans] know it,” Jamal said.

“I'm afraid it's already too big to stop, you know, maybe it's too late. Maybe it's already too big to stop,” he said. “There's a lot of people invested in this, you know, and they don't care how they did it: ‘We win,’ and that's it.”

Ballot Harvester described how his own ballot was harvested by Omar operatives

Jamal, as part of his participation in the investigation, interviewed a Somali-American who functions as a ballot harvester his community. In the interview, the harvester described how he was paid to vote in the Aug. 11 special election and primary, along with a Project Veritas undercover journalist.

The harvester said Somali-American vote-buying operatives from the Omar machine came to his apartment building to oversee the voter filling out the paperwork.

Omar operatives request the ballots and fill them out for the voters, he said.

“They come to us. They came to our homes. They said: ‘This year, you will vote for Ilhan,’” he said. “They said: ‘We will make the absentee ballots. We will fill out the forms for you and when you get them back, we will again fill it out and send it.”

There was no need to go to the voting site, because the Omar operatives told him: “You stay home and you will not go to the place.”

After the ballots are signed and documented the harvester said he got paid.

“When we sign the voting document and they fill it out is when they give us the money,” he said. “The minute we signed the thing [ballot] for the election. That’s when we get paid.”

Ballot harvester describes how he targets elderly voters

Omar Jamal: So they [ballot harvesters] will request it [the ballot] for the elderly?

Ballot harvester: Yes. They [ballot harvesters] request [the ballot] for them [the elderly].

Omar Jamal: And it [the ballot] is taken away from them [elderly]?

Ballot Harvester: Yes. It [the ballot] is taken away from them [elderly].

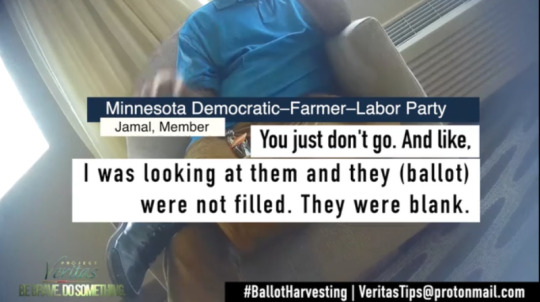

DFL operative describes why he did not speak up about the election corruption

A political operative, known as Jamal, for Minnesota’s Democratic-Farmer-Labor Party, which functions as the state’s official chapter of the national Democratic Party, told a Project Veritas undercover journalist he was afraid to speak up when he saw abuses of the voting system.

“They fight you if you speak up,” Jamal said. “Like what? Like what can I do? Like get jumped? Hell no. They ain’t got—no, no, I’m good.”

The DFL operative said he also saw Mohamed’s Snapchat videos. “I was looking at them and they were not filled. They were blank.”

“Liban didn't get it in a unique way,” he said. “He just gets them the way that everybody before him, or even, maybe even after him will do, which is go to the elders, maybe bait them and collect and help to them and he’s helping them--so, I think that's the process of collecting from the seniors, from their buildings.”

The Insider said another corrupting effect is the miseducation of the city’s new immigrants.

“We have to understand that the immigrants mostly, here now, are first generation immigrants,” he said.

“Through no fault of their own the new immigrants are learning about democracy from the ballot harvesters," he said. "When they get here, because of that ignorance, not knowing how this, all things work. Sometimes they even think it's legal.” – he said.

Documented ballot harvesting, vote buying violates federal and state law

Jered Ede, the chief legal officer for Project Veritas, said Mohamed and his confederates may have violated both state and federal election laws, some carrying a maximum penalty of five years imprisonment.

“The federal laws, 18 USC §597 and 52 U.S.C. §10307(c), are quite clear,” he said. “In the case of 18 USC §597, it is punishable by up to two years in prison and in the case of 52 USC §10307 it’s punishable by up to $10,000 in fines and up to five years in prison.”

The Minnesota statute, 211B.13(1) prohibits paying a person or receiving money to register to vote or to vote, he said. “This is a state felony punishable by more than one-year imprisonment.”

Beyond paying voters, there are also state and federal laws regarding intimidation of voters, he said.

“The federal laws 52 USC §20511, 18 USC §594 and 52 USC §10307(b) and the Minnesota statue 211B.07 law prohibit anyone from using undue influence threats intimidation or fraud to influence a person’s vote or to influence them to vote at all,” he said.

It's also a violation of federal law for anyone who votes for others illegally:

“The punishment under 52 USC §10307(e) also goes up to five years’ incarceration and a $10,000 fine,” he said.

“In addition to those statutes, Minnesota has another statute, 211B.11(3), which makes it a misdemeanor to induce or persuade a voter to vote for or against a candidate, while transporting the voter to the polls,” he said.

Former campaign worker comes forward

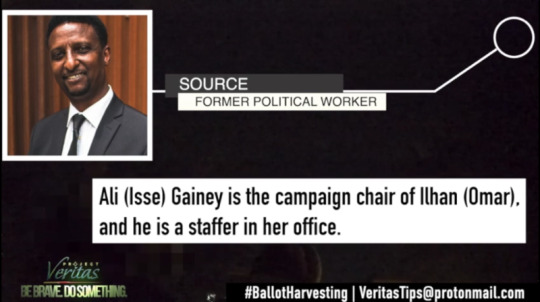

One Minneapolis-based source, who is a former political worker, told Project Veritas journalists on the night of the Aug. 11 special election and primary that Omar’s campaign manager Ali Isse Gainey is a key player in the ballot harvesting scheme.

The source said, “[Gainey], who's working in Ilhan’s campaign is the one who is managing the voting place. They bring them. They line them. They put the open ballots in there and then they take them in and say, ‘Here,’ and the people mark [the ballots]."

The practice is pervasive she said.

“They're accepting temporary addresses; they're accepting all kind of shenanigans,” she said.

“People that are showing their ID: ‘I moved 30 days ago, my ID's not come back.’ ‘OK, just give us the last four of your social and tell us the address,' and then somebody else will say 'Yeah.’ They will send people who are helping them vote and saying: ‘Yeah, I can vouch for this madness,’” she said.

The former campaign worker said Isse and the Omar-connected political machine have turned voter fraud into an organized process for application, registering and tracking the harvested ballots from collection to delivering to polls.

“They have perfected this system,” she said. “This is what they do. They will tell you we are applying for your ballot. They take a picture of your social security and your driver's license. They have a database. When the ballot comes, they track it, sometimes, they make fake emails. They track the ballot. Then, they come and pick up the ballot—unopened,” she said.

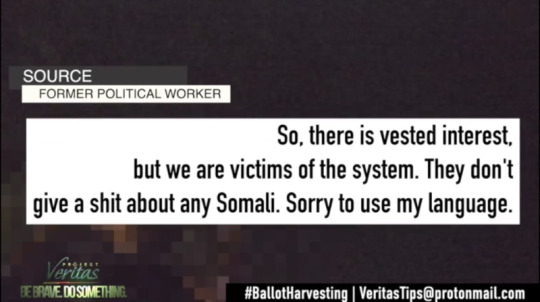

“So, there is vested interest, but we are victims of the system,” she said. “They [the Omar political machine] don't give a shit about any Somali.”

Our source was disgusted by the exploitation of her vulnerable community.

“No, and the ones that didn't vote on ballots, the young people, and the women and stuff, they were paying cash, cash, cash,” she said. “They were carrying bags of money. And when you vote and they mark you off, then you get in the van, they give you the cash.”

58 notes

·

View notes

Text

Find the Top Brokers Dealer Companies Contact Details

A broker-dealer firm purchases and sells securities for customers yet in addition execute exchanges for its own advantage. As such, it is a broker when it exchanges for customers, and it is a dealer when it purchases and sells for itself.

In the United States, many broker-dealers are online platforms. A broker-dealer directs the matter of purchasing and selling securities by filling one of two jobs in a transaction.

Below we have mentioned a list of the top 8 Broker-Dealer Companies to enrich your company info database search.

Ameriprise Financial, Inc.

The main office is in Minneapolis. It started in 1894 and is the subsidiary of American Express Company. It has around 12000 brokers and $474 billion in assets. To know the contact details of this company, you can use a B2B global database.

Charles Schwab

Established in 1971 and is situated in San Francisco. It is one of the main brokerages and IRA overseer firms in the U.S. As of Dec. 31, 2019, Charles Schwab held $4.04 trillion in customer resources, with a sum of 12.3 million dynamic brokerage accounts. It additionally works with Schwab Bank, probably the biggest bank in the United States, which permits its brokerage customers to interface their exchanging accounts with financial records.

Fidelity Investments

It is the country's biggest holder of 401(k) retirement reserve funds plans. Established in 1946 as Fidelity Management and Research, the organization is situated in Boston.

As indicated by the organization's site, Fidelity had $7.3 trillion in client resources as of March 31, 2020, with a functioning 30.8 million brokerage accounts. The organization likewise flaunted 32 million individual investors.

E*TRADE

Established in 1982, E*TRADE started as a holding organization and has changed into a main online markdown brokerage agency. The organization was hit hard during the 2007-2008 monetary emergency in light of high subprime contract portfolios. Its stock dropped 86.7% in 2007 preceding the organization carried out an extensive turnaround plan.

TD Ameritrade

It was established in 1971 and is settled in Omaha, Nebraska. The firm became TD Ameritrade after the old Ameritrade obtained TD Waterhouse Group in 2006. It acquired St. Louis-based adversary Scottrade in 2017. Customer accounts were completely integrated into the TD Ameritrade framework by February 2018.

Firstrade

For Chinese-talking financial backers, Firstrade is fabulous. Firstrade's help for Chinese-talking clients requires 24/7 client care. With regards to transactions, Firstrade keeps things basic, offering financial backers free stock, ETF, shared asset, and alternatives exchanges.

Tastyworks

Tastyworks was made by option experts, and it shows the inventive developments on the stage. This client-driven broker joins low commissions, innovation and interesting assets to assist you with concocting option trading. The client experience of the Tastyworks stage is amazing in the cell phones.

Robinhood

Robinhood was established to assist regular individuals with simple admittance to the monetary business sectors and spearheaded the idea of zero-commission stock exchanging after its launch in 2015. Financial backers requiring an IRA account or to purchase shared assets will need to look somewhere else. They take $0 commissions.

3 notes

·

View notes

Text

HII Commercial Real Estate Loans Minneapolis MN

Happy Investments, Inc. has been a Commercial Mortgage Broker serving Nationwide Since 2005. Happy Investments, Inc. focusing on Commercial Real Estate Mortgage loans. Our specialty is providing financing to people with Complicated Financial Situations. Our Company has many Commercial Mortgage programs feature Competitive Interest Rates, Low Down Payment Requirements, Flexible Underwriting Guidelines, each of these features are designed to make your Mortgage Loan more Affordable. We Provide Commercial Hard Money Loans, Commercial Private Money Loans, Commercial Real Estate Equity Loans, Commercial Loans, Commercial Construction Loans, Transnational Funding, Hotels/Motels, Multifamily, Industrial, Mixed Use, Retail, Office, Self-Storage, Nursing and Assisted Living, Medical Building Loans, SBA Loans, Doctors Loans and Many More

HII Commercial Real Estate Loans Minneapolis MN, Offer Mortgage Loans Locally and Nation Wide, Provide Commercial Mortgage Real Estate Loans, Business loans for Commercial Real Estate, Private Money Commercial Real Estate, Hotels/Motels, Transnational Funding, Multifamily, Industrial, Mixed Use, Golf Courses, Retail, Office, Self-Storage, Nursing and Assisted Living Loans, Apartments Loans, SBA Loans, Doctors Loans and Many More

Contact Us:

HII Commercial Real Estate Loans Minneapolis MN

819 2nd Ave S #414 - C

Minneapolis, MN 55402

Phone: 612-444-7015

Email : [email protected]

Website: http://www.happyinvestmentsinc.com/commercial-mortgage-loans-minneapolis-mn/

1 note

·

View note

Note

🌹 🏴 🖤🌎 for Evie and Nyx both

Thank you Anda :D

🌹 What clan do they belong to and how do they feel about them?

Evie

She’s a Gangrel, though she doesn’t really have any loyalty to the clan overall. Having been sired the way she was - attacked and abducted, and then dragged off in front of LA’s Kindred for trial - she wasn’t really overly exposed to any other Gangrel besides Skelter and Beckett. Skelter doesn’t discuss the Gangrel at all iirc, and Beckett makes it pretty clear that he doesn’t overly care for the obsession with separation by bloodline, and so Evie’s overall opinion is influenced by them both.

Throw in her disgust with the typical nature of the Gangrel embrace, and yeah. She’s not the biggest fan of the clan in general.

Nyx

Answered Here

🏴 What are their allegiances? (Camarilla/Anarch/Independent/etc)

Evie

During Bloodlines, she considered herself to be an Anarch, through and through. But she ultimately took the Autarkis ending because she had no idea if Nines had survived the werewolf attack, and was terrified that the Anarchs might blame her for killing him if he hadn’t.

When she was reunited with them outside the building, she was glad to see them, but that changed the second Nines said ‘we sure could use you.’ She struck out alone, got picked up by Beckett, and has proudly considered herself Autarkis ever since.

Nyx

She’s loyal to the Nosferatu, her sire, and no one else. However, she’s officially recognised as Autarkis, as she doesn’t swear fealty to the local Camarilla, Anarchs, or Sabbat. Even if the latter did have some ideas about recruiting her. At the end of the day, she’s an information broker, and finds that being officially neutral serves her and her business best.

🖤 How do they feel about being turned? (How did they adjust? Do they feel differently now than they did when they were first turned?)

Evie

Well given that she got tossed into the deep end, she didn’t get much time to process it. During Bloodlines and for a while after, she resents it. She was recovering from her trauma just fine and had a good life living with Sam, learning how to be a better adjusted person. And then it all unravelled and she’s ended up having to make use of her old survival tactics again just to get by while working for Lacroix.

But after a few years with Beckett, learning and growing and unlearning and travelling, she’s come to see the good sides of the deal. She enjoys seeing places she never would have seen before, and the powers are handy, and she has a good mentor in Beckett. It’s come with the good and the bad.

Nyx

It was certainly a shock when she initially came to and found herself with a mouth full of shark teeth. But once she got over the initial shock and fear, and had her first feed, she started to see the possibilities of what she could do with her skills, her new powers, and an eternity to perfect both. Sure, sometimes she gets into trouble, but it’s what keeps unlife interesting.

🌎 Do they try to retain any part of their humanity?

Evie

Absolutely. Evie has Very High Humanity throughout Bloodlines and beyond; she maxed out the stat in the game, but Humanity 10 would be a bit much even for her, so she’s canonically Humanity 8.

She was young when she was embraced, and very idealistic. Her idealism was encouraged by the Anarchs and by Beckett, and both have had a huge influence on her. To her, her convictions and principals and beliefs are very important to her, and she means to stand by them as best she can, even if it’s not always easy.

Nyx

She does. Maybe not to the same extent as Evie does, but just because she looks like a monster and feeds like one doesn’t mean she needs to be an arsehole. Especially because it can and does bring trouble. After all, someone’s careless, sloppy feeding habits brought werewolves into St Paul and Minneapolis, and another person with the same shitty habits brought the Second Inquisition.

Nyx knows what she is, but she doesn’t need to make trouble for herself or her clan. Holding to her humanity is the best way of staying under the radar in her book.

8 notes

·

View notes

Link

If you want to know how to grow your business, read this article, that can help you and your team reach your growth goals.

#business consulting services St. Paul#business consultant Minneapolis#Business broker Minneapolis#best consulting firms Minneapolis

0 notes

Text

Pyramid Scheme Lawyers

Pyramid Scheme Lawyers + Corporate Crime Laws + How To Get Out

Call Us 24 Hours A Day 800-270-8184 or Emergency Cell 818-355-4076

Have you been wrongfully accused of defrauding investors by running a Pyramid Scheme or what we now refer to as a Bernie Madoff Scheme?

In today's sophisticated investment environment, there is sometimes a fine line between a legitimate business opportunity or investment medium and felony investment fraud.

In a pyramid scheme, investors try to make money by enlisting other investors who, in turn, enlist more people. Typically, participants are asked to pay to join and become a distributor of a product or service. Those who get in early make money from later investors. When the supply of new investors runs dry, however, the entire pyramid collapses, some people do loose money.

Today, e-mail and the Internet are often used to recruit pyramid scheme investors.

The Federal Ponzi scheme

Felony Ponzi scheme is like a felony pyramid scheme, but is restricted by one central figure. Rather than a business investment opportunity, a Ponzi scheme involves an obscure investment vehicle with an unreasonably high rate of return. Early investors are paid by the investments of later on investors. But fraud transaction records encourage them to believe that the investment itself is actually generating the promised rate of return.

The scheme was named for Charles Ponzi, who became famous for using the technique to defraud investors in the early 20th century but now has taken new heights with Bernie Madoff.

What To Do Next?

If you have been accused of being involved in a felony pyramid scheme, you should hire a criminal lawyer or attorney to help you with your case. Felony Pyramid Scheme lawyers and felony attorneys represent individuals who have been charged with Ponzi and Pyramid Scheme crimes by arguing their cases in courts of law. After your arrest on grounds of conducting a pyramid scheme, request a Federal lawyer or contact a private criminal lawyer or felony attorney immediately, Wise Laws can help your for sure.

Tallahassee Pyramid Scheme Lawyers - Orlando Pyramid Scheme Lawyers - Dallas Pyramid Scheme Lawyers - Fort Worth Pyramid Scheme Lawyers - Honolulu Pyramid Scheme Lawyers - Boise Pyramid Scheme Lawyers - Bismarck Pyramid Scheme Lawyers - Grafton Pyramid Scheme Lawyers - Raleigh Pyramid Scheme Lawyers - Durham Pyramid Scheme Lawyers - Santa Fe Pyramid Scheme Lawyers -Albuquerque Pyramid Scheme Lawyers - Albany Pyramid Scheme Lawyers - Phoenix Pyramid Scheme Lawyers - Peoria Pyramid Scheme Lawyers - Las Vegas Pyramid Scheme Lawyers - Louisville Pyramid Scheme Lawyers - Little Rock Pyramid Scheme Lawyers - Los Angeles Pyramid Scheme Lawyers - Miami Pyramid Scheme Lawyers - Des Moines Pyramid Scheme Lawyers - New Haven Pyramid Scheme Lawyers - Indianapolis Pyramid Scheme Lawyers - Detroit Pyramid Scheme Lawyers - Joplin Pyramid Scheme Lawyers - Biloxi Pyramid Scheme Lawyers - Oklahoma City Pyramid Scheme Lawyers - Portland Pyramid Scheme Lawyers - Sioux Falls Pyramid Scheme Lawyers - Nashville Pyramid Scheme Lawyers - Memphis Pyramid Scheme Lawyers - Houston Pyramid Scheme Lawyers -Tacoma Pyramid Scheme Lawyers - Minneapolis Pyramid Scheme Lawyers - Provo Pyramid Scheme Lawyers - Tulsa Pyramid Scheme Lawyers - Annapolis Pyramid Scheme Lawyers - Sacramento Pyramid Scheme Lawyers - Denver Pyramid Scheme Lawyers - Charlotte Pyramid Scheme Lawyers - Boston Pyramid Scheme Lawyers - Olympia Pyramid Scheme Lawyers - Atlanta Pyramid Scheme Lawyers - Santa Monica Pyramid Scheme Lawyers - Malibu Pyramid Scheme Lawyers - Tucson Pyramid Scheme Lawyers - Scottsdale Pyramid Scheme Lawyers - Beverly Hills Pyramid Scheme Lawyers -Boca Raton Pyramid Scheme Lawyers

Your criminal attorney will not only be familiar with laws concerning pyramid schemes in your state, but will also have knowledge of any precedents or recent cases which might have a relevant bearing on your case. Additionally, skilled criminal lawyers are well versed in the customs of court and the political and legal climate of that particular jurisdiction regards these schemes. Therefore, they will be able to work in your best interest, possibly brokering a plea deal or arguing for your felony defense should your case go to felony trial.

24 Hours 7 Days per week LOCAL Lawyer For Pyramid Scheme

2 notes

·

View notes

Text

FICO Scores Decoded…

FICO’s History

FICOis a business analytic software company. They are based in San Jose, California. FICO was founded by Bill Fair and Earl Isaac in 1956. Their FICO score has become the main credit score used to determine consumer credit risk.

FICO was founded in 1956 as Fair, Isaac and Company. William Fair was one of the original founders and was an engineer by trade.

Earl Isaac was another founder and was a mathematician by trade. The two met while working at the Stanford Research Institute in Menlo Park California. In 1958, FICO pitched their first credit risk analysis system to 50 American lenders.

FICO went public in 1986 and is traded on the New Your Stock Exchange under the ticker symbol FICO. The company debuted its first general-purpose FICO score in 1989.

Scores are based on credit reports and range from 300 to 850. Lenders use the scores to gauge a potential borrower’s creditworthiness.

Fannie Mae and Freddie Mac first began using FICO scores to help determine which American consumers qualified for mortgages bought and sold by the companies in 1995.

Originally called Fair, Isaac and Company, this name was changed to Fair Isaac Corporation in 2003.The company rebranded again in 2009, and is now called FICO, making their name the same as the signature FICO score they offer.

Originally it was based in San Rafael California. They moved to Minneapolis Minnesota in 2004. They then moved back to San Jose California in 2013.

The FICO Score… What You Should Know

The most widely used credit score is the FICO Score. The FICO score is a mathematical model that is used to depict a consumer’s risk of going 90 days late on an account within the next 24 months. Lenders use the FICO Score to help them make billions of credit decisions every year.

FICO calculates the FICO Score based solely on information in consumer credit reports maintained at the credit reporting agencies. FICO credit scores range from 300 to 850.

That FICO Score is calculated by a mathematical equation that evaluates many types of information from your credit report, at that credit reporting agency.

By comparing this information to the patterns in hundreds of thousands of past credit reports, the FICO Score estimates your level of future credit risk.

You have three FICO credit scores, one for each of the three credit bureaus: Equifax, TransUnion, and Experian. Each FICO Score is based on information the credit bureau keeps on file about you.

The FICO Score from each credit reporting agency considers only the data in your credit reports at that agency.

Your credit score may be different at each of the main credit reporting agencies. If your current scores from the credit reporting agencies are different, it’s probably because the information those agencies have on you differs.

If your information is identical at all three credit reporting agencies, each FICO Score should be very close.

For your FICO Score to be calculated, your credit report with the bureau from which you want your score must contain enough information, and enough recent information, on which to base your credit score.

Generally, that means you must have at least one account that has been open for six months or longer, and at least one account that has been reported to the credit reporting agency within the last six months.

Finally!!! The Answer to Why You Have So Many Credit Scores

There are MANY different credit scores out there. There are credit scores consumers can pull themselves through credit monitoring, mortgage scores, auto scores, and

many more.

There are actually over 16 different credit “scorecards” that exist today with FICO alone. Each of these scorecards will reflect different credit scores. These scorecards are designed to help particular industries better gauge credit risk.

The mortgage industry for example is more concerned with a consumer’s past mortgage history than anything else. So they weight home loan history heavier into the total score calculation than other accounts.

So a consumer’s credit monitoring score might be 660, but then when they apply for a mortgage their score might be much lower due to some past negative mortgage accounts on the report. Their mortgage score might even be higher than their consumer score if they have past positive mortgage accounts.

A credit score that a consumer pulls themselves will not be the same as their Mortgage Industry Option Score, the scores lenders and brokers use to access mortgage default risk.

Their mortgage score won’t be the same as their auto score that car dealers pull either which is knows as the Auto Industry Option Score, because the auto score weighs past auto history heavier into the score makeup versus consumer scores.

These different credit scorecards are designed to help specific industries better determine risk. Due to there being so many industries that offer credit, there are also just as many credit scores available.

Plus, different scores are offered by different companies creating even more credit scores. FICO is the biggest provider of consumer credit scores.

But now even the credit bureaus themselves are in the credit scoring game providing their Vantage score.

The Credit Bureau’s Secret Credit Score

Vantage Score is the credit bureaus’ own credit score, designed to compete with FICO.

Vantage Score was unveiled by the three bureaus on 14 March 2006. All three main credit reporting agencies use the same formula to calculate the Vantage Score.

Vantage Score has scores as high as 990 while FICO scores can only be as high as 850. So even though a 700 FICO score reflects good consumer credit, a 700 Vantage score reflects below average personal credit.

Here are Vantage Score 2.0 risk levels: “A” credit scores range from 900–990, “B” credit scores range from 800–899, “C” credit scores range from 700–799, “D” credit scores range from 600–699, and “F” credit scores range from 501–599.

Obviously, scores going up to 990 versus FICO scores going up to 850 have created an issue with lenders. This is one of the main reasons that Vantage Score hasn’t become widely accepted. So the bureaus have now changed their score range with Vantage Score 3.0 which was released in 2013. With the new Vantage Score scores only go as high as 850, mimicking the FICO top score.

How Credit Scores Are Calculated – The Inside Scoop

Fair Isaac and Vantage Score hold their credit scoring formulas as a close secret much like the formula for Coca-Cola or your grandma’s legendary double chocolate-chip

cookies.

This can be very frustrating for consumers when they see remarks on the credit report like “too many revolving debt accounts” and not knowing exactly what that means.

Fortunately, Fair Isaac and Vantage Score have issued some public information about how they calculate credit scores.

Payment History: The top rated factor for both models is payment history. This is because lenders want to know a person’s payment history – past and present.

This category can be broken down into three subcategories:

Recency – This is the last time a payment was late. The more time that passes the better.

Frequency – One late payment looks a heck of a lot better than a dozen, and

Severity –A payment 30 days late is not as serious as a payment 60 or 120-days late. Collections, tax liens, foreclosures, repossessions, charge-offs, and bankruptcies are credit score killers.

You can improve this aspect of your score by paying your bills on time. Also, the more accounts you have paid as agreed to offset the ones you don’t will also help your score.

So if you do have late payments reporting on your credit, you can offset these by adding new positive accounts and making sure you have a lot of accounts you are paying as agreed to offset the accounts not paid as agreed.

Fair Isaac and Vantage Score hold their credit scoring formulas as a close secret much like the formula for Coca-Cola or your grandma’s legendary double chocolate-chip cookies.

This can be very frustrating for consumers when they see remarks on the credit report like “too many revolving debt accounts” and not knowing exactly what that means.

Fortunately, Fair Isaac and Vantage Score have issued some public information about how they calculate credit scores.

How much is owed: The score looks at the total amount owed on all accounts as well as how much you owe on different types of accounts (mortgage, auto, etc). Using a higher percentage of the credit limits will worry lenders and hurt the credit score. People who max out their limits have a much greater risk of default.

Utilization: When it comes to revolving debt-credit cards, the formula looks at the difference between the high limit and balances. For example, let’s say your customer has a MasterCard with a credit limit of $10,000 and they have spent $2,000 of it.

This is a 20% utilization ratio. The lower the ratio, the higher the credit score. So, if you are looking for a quick credit score boost, pay down any accounts you can.

With FICO, 30% of your credit score is based on utilization, while 35% is based on payment history. Utilization is the 2nd highest weighted aspect of your scores. This means if you are over utilizing your revolving accounts you can damage your scores as much as if you were paying your payments late each month.

Anything over 30% of your limit being used will lower your credit scores. Adding credit cards to your report with high limits can also SIGNIFICANTLY and quickly raise your scores, sometimes as much as 100 points or more.

One more important tidbit, CLOSED ACCOUNTS do not help and can hurt if there is a balance remaining. A long perpetuated myth has been to close accounts that are not in use but this will hurt consumers in several ways.

As you now know, overall and individual account utilization plays a major role in credit scoring. If consumers close old accounts, your overall utilization rate will increase which will cause their score to decrease.

Fair Isaac and Vantage Score hold their credit scoring formulas as a close secret much like the formula for Coca-Cola or your grandma’s legendary double chocolate-chip cookies.

This can be very frustrating for consumers when they see remarks on the credit report like “too many revolving debt accounts” and not knowing exactly what that means.

Fortunately, Fair Isaac and Vantage Score have issued some public information about how they calculate credit scores.

Length of credit history / Depth of credit: This is less important than the previous factors, but it still matters. It considers (1) the age of the oldest account and (2) the average age of all your accounts.

It is possible to have a good score with a short history, but typically the longer the better. Young people, students, and others can still have high credit scores as long as the other factors are positive. With FICO, this is the 3rd largest aspect of the score calculation.

If a person is new to credit then there is little they can do to improve a credit score. No newly added accounts can be back-dated to improve this score aspect.

You can get added as an authorized user to a family member’s account that has been in long-standing, and that can improve this aspect of your score.

Average age of accounts is another important reason to keep all accounts open. If a consumer has multiple accounts that they’ve had for some time but don’t use, they are still benefiting from the average age of the accounts open in their credit file. Also make sure you use each of your accounts at least once every six months.

Credit issuers must reserve the money offered in credit limits for their clients’ use, so they don’t like having accounts sitting dormant that are not making them money, if an account sits dormant for a long enough time, many creditors nowadays will cancel the account due to inactivity.

Additionally, credit reporting agency will calculate an account as inactive if there has not been any activity in the most recent six month period of time, an inactive account does not benefit your score as much as an active account.

New Credit / Recent Credit: New credit is not always a bad thing. However, opening new accounts can hurt a credit score, particularly if a consumer applies for lots of credit in a short time and doesn’t have a long credit history. The score factors in the following: How many accounts the consumer applied for recently, how many new accounts the consumer has opened, how much time has passed since the consumer applied for credit, and how much time has passed since the consumer opened an account.

The model looks for “rate shopping.” Shopping for a mortgage or an auto loan may cause multiple lenders to request your credit report many times each, even though a person is only looking for one loan. Auto dealers are notorious for running 3 to 15 credit reports. This is called shot gunning the credit.

Luckily, to compensate for this, the score counts multiple auto and mortgage specific inquiries in any 30-day period as just one inquiry. The specific calculation for cut-off dates and types is confusing; we will go over that in detail in upcoming chapters.

For most people, a credit inquiry really won’t have an impact on your credit score. Groupings of inquiries WILL adversely affect your scores. However, inquiries can have a greater impact if you have few accounts or a short credit history.

Large numbers of inquiries also mean greater risk. According to MyFico.com, people with six inquiries or more on their credit reports are eight times more likely to declare bankruptcy than people with no inquiries on their reports.

This can be very frustrating for consumers when they see remarks on the credit report like “too many revolving debt accounts” and not knowing exactly what that means.

Fortunately, Fair Isaac and Vantage Score have issued some public information about how they calculate credit scores.

Types of credit you use / depth of credit: Both models want to see a healthy mix of credit, but they are vague on what this means. They recommend you have a balance of both revolving debts like credit cards and installment loans like auto loans or a mortgage.

The preferred number of credit cards reporting is three.You shouldn’t have more than two mortgages reporting. More than two auto loans are too much. Installment loans also score better if you have two or less.

Here again is how your FICO score breaks down: 35% of your score is based on payment history, 30% of your score is based on utilization, 15% of your score is based on length of credit history, 10% of your score is based on new credit or inquiries, and 10% of your score is credit mix.

FICO 9… What You Should Know…

FICO’s newest credit score is known as FICO 9. This new score includes many changes from prior FICO models.

One change is that medical collections are no longer scored the same as regular collections, they are weighted much less. FICO anticipates that a consumer with the median credit score of 711 whose only negative collection issue is medical-related will see their score increase by 25 points.

Other changes to the model will better gauge the ability of a consumer who has a limited credit history, known in the business as a thin file, to repay a prospective debt. These types of people might not have a score in the past, but will now with the new version.

Non-traditional credit, such as your residential rental history, will be taken into consideration. This means that consumers who have little to no credit history but pay rent on time will get a boost.

Paid-off and settled collections will be ignored with FICO 9. Under the previous FICO model, if you let an account go into collection, your credit score would take a hit for as long as that collection is on your credit report (seven years).

Now, as long as the collection has a zero balance, it will be ignored. This is HUGE as paying off collections used to actually prolong how long the account stayed on your reports and resulted in more damage.

5 Quick Tips to Raise Your FICO Score

Check out these tips to raise your FICO credit scores:

Pay your bills on time and beg for forgiveness if you pay late.

Have lots of positive credit on your report, and make sure you are using it at least every six months, don’t forget a good credit mix.

Have open credit cards, three preferably, and keep your balances very, very low. Also, get the highest credit limit accounts you can get.

If your credit file is new, get added as an authorized user but only on a FAMILY MEMBER’s account.

Do NOT apply for too much credit all at once unless buying a car or home, then you need to do your shopping within a 30-day time period.

Source: https://ebprofessionals.com/

FICO Scores Decoded… published first on https://ebprofessionals.com/

1 note

·

View note

Text

FICO Scores Decoded…

FICO’s History

FICOis a business analytic software company. They are based in San Jose, California. FICO was founded by Bill Fair and Earl Isaac in 1956. Their FICO score has become the main credit score used to determine consumer credit risk.

FICO was founded in 1956 as Fair, Isaac and Company. William Fair was one of the original founders and was an engineer by trade.

Earl Isaac was another founder and was a mathematician by trade. The two met while working at the Stanford Research Institute in Menlo Park California. In 1958, FICO pitched their first credit risk analysis system to 50 American lenders.

FICO went public in 1986 and is traded on the New Your Stock Exchange under the ticker symbol FICO. The company debuted its first general-purpose FICO score in 1989.

Scores are based on credit reports and range from 300 to 850. Lenders use the scores to gauge a potential borrower’s creditworthiness.

Fannie Mae and Freddie Mac first began using FICO scores to help determine which American consumers qualified for mortgages bought and sold by the companies in 1995.

Originally called Fair, Isaac and Company, this name was changed to Fair Isaac Corporation in 2003.The company rebranded again in 2009, and is now called FICO, making their name the same as the signature FICO score they offer.

Originally it was based in San Rafael California. They moved to Minneapolis Minnesota in 2004. They then moved back to San Jose California in 2013.

The FICO Score… What You Should Know

The most widely used credit score is the FICO Score. The FICO score is a mathematical model that is used to depict a consumer’s risk of going 90 days late on an account within the next 24 months. Lenders use the FICO Score to help them make billions of credit decisions every year.

FICO calculates the FICO Score based solely on information in consumer credit reports maintained at the credit reporting agencies. FICO credit scores range from 300 to 850.

That FICO Score is calculated by a mathematical equation that evaluates many types of information from your credit report, at that credit reporting agency.

By comparing this information to the patterns in hundreds of thousands of past credit reports, the FICO Score estimates your level of future credit risk.

You have three FICO credit scores, one for each of the three credit bureaus: Equifax, TransUnion, and Experian. Each FICO Score is based on information the credit bureau keeps on file about you.

The FICO Score from each credit reporting agency considers only the data in your credit reports at that agency.

Your credit score may be different at each of the main credit reporting agencies. If your current scores from the credit reporting agencies are different, it’s probably because the information those agencies have on you differs.

If your information is identical at all three credit reporting agencies, each FICO Score should be very close.

For your FICO Score to be calculated, your credit report with the bureau from which you want your score must contain enough information, and enough recent information, on which to base your credit score.

Generally, that means you must have at least one account that has been open for six months or longer, and at least one account that has been reported to the credit reporting agency within the last six months.

Finally!!! The Answer to Why You Have So Many Credit Scores

There are MANY different credit scores out there. There are credit scores consumers can pull themselves through credit monitoring, mortgage scores, auto scores, and

many more.

There are actually over 16 different credit “scorecards” that exist today with FICO alone. Each of these scorecards will reflect different credit scores. These scorecards are designed to help particular industries better gauge credit risk.

The mortgage industry for example is more concerned with a consumer’s past mortgage history than anything else. So they weight home loan history heavier into the total score calculation than other accounts.

So a consumer’s credit monitoring score might be 660, but then when they apply for a mortgage their score might be much lower due to some past negative mortgage accounts on the report. Their mortgage score might even be higher than their consumer score if they have past positive mortgage accounts.

A credit score that a consumer pulls themselves will not be the same as their Mortgage Industry Option Score, the scores lenders and brokers use to access mortgage default risk.

Their mortgage score won’t be the same as their auto score that car dealers pull either which is knows as the Auto Industry Option Score, because the auto score weighs past auto history heavier into the score makeup versus consumer scores.

These different credit scorecards are designed to help specific industries better determine risk. Due to there being so many industries that offer credit, there are also just as many credit scores available.

Plus, different scores are offered by different companies creating even more credit scores. FICO is the biggest provider of consumer credit scores.

But now even the credit bureaus themselves are in the credit scoring game providing their Vantage score.

The Credit Bureau’s Secret Credit Score

Vantage Score is the credit bureaus’ own credit score, designed to compete with FICO.

Vantage Score was unveiled by the three bureaus on 14 March 2006. All three main credit reporting agencies use the same formula to calculate the Vantage Score.

Vantage Score has scores as high as 990 while FICO scores can only be as high as 850. So even though a 700 FICO score reflects good consumer credit, a 700 Vantage score reflects below average personal credit.

Here are Vantage Score 2.0 risk levels: “A” credit scores range from 900–990, “B” credit scores range from 800–899, “C” credit scores range from 700–799, “D” credit scores range from 600–699, and “F” credit scores range from 501–599.

Obviously, scores going up to 990 versus FICO scores going up to 850 have created an issue with lenders. This is one of the main reasons that Vantage Score hasn’t become widely accepted. So the bureaus have now changed their score range with Vantage Score 3.0 which was released in 2013. With the new Vantage Score scores only go as high as 850, mimicking the FICO top score.

How Credit Scores Are Calculated – The Inside Scoop

Fair Isaac and Vantage Score hold their credit scoring formulas as a close secret much like the formula for Coca-Cola or your grandma’s legendary double chocolate-chip

cookies.

This can be very frustrating for consumers when they see remarks on the credit report like “too many revolving debt accounts” and not knowing exactly what that means.

Fortunately, Fair Isaac and Vantage Score have issued some public information about how they calculate credit scores.

Payment History: The top rated factor for both models is payment history. This is because lenders want to know a person’s payment history – past and present.

This category can be broken down into three subcategories:

Recency – This is the last time a payment was late. The more time that passes the better.

Frequency – One late payment looks a heck of a lot better than a dozen, and

Severity –A payment 30 days late is not as serious as a payment 60 or 120-days late. Collections, tax liens, foreclosures, repossessions, charge-offs, and bankruptcies are credit score killers.

You can improve this aspect of your score by paying your bills on time. Also, the more accounts you have paid as agreed to offset the ones you don’t will also help your score.

So if you do have late payments reporting on your credit, you can offset these by adding new positive accounts and making sure you have a lot of accounts you are paying as agreed to offset the accounts not paid as agreed.

Fair Isaac and Vantage Score hold their credit scoring formulas as a close secret much like the formula for Coca-Cola or your grandma’s legendary double chocolate-chip cookies.

This can be very frustrating for consumers when they see remarks on the credit report like “too many revolving debt accounts” and not knowing exactly what that means.

Fortunately, Fair Isaac and Vantage Score have issued some public information about how they calculate credit scores.

How much is owed: The score looks at the total amount owed on all accounts as well as how much you owe on different types of accounts (mortgage, auto, etc). Using a higher percentage of the credit limits will worry lenders and hurt the credit score. People who max out their limits have a much greater risk of default.

Utilization: When it comes to revolving debt-credit cards, the formula looks at the difference between the high limit and balances. For example, let’s say your customer has a MasterCard with a credit limit of $10,000 and they have spent $2,000 of it.

This is a 20% utilization ratio. The lower the ratio, the higher the credit score. So, if you are looking for a quick credit score boost, pay down any accounts you can.

With FICO, 30% of your credit score is based on utilization, while 35% is based on payment history. Utilization is the 2nd highest weighted aspect of your scores. This means if you are over utilizing your revolving accounts you can damage your scores as much as if you were paying your payments late each month.

Anything over 30% of your limit being used will lower your credit scores. Adding credit cards to your report with high limits can also SIGNIFICANTLY and quickly raise your scores, sometimes as much as 100 points or more.

One more important tidbit, CLOSED ACCOUNTS do not help and can hurt if there is a balance remaining. A long perpetuated myth has been to close accounts that are not in use but this will hurt consumers in several ways.

As you now know, overall and individual account utilization plays a major role in credit scoring. If consumers close old accounts, your overall utilization rate will increase which will cause their score to decrease.

Fair Isaac and Vantage Score hold their credit scoring formulas as a close secret much like the formula for Coca-Cola or your grandma’s legendary double chocolate-chip cookies.

This can be very frustrating for consumers when they see remarks on the credit report like “too many revolving debt accounts” and not knowing exactly what that means.

Fortunately, Fair Isaac and Vantage Score have issued some public information about how they calculate credit scores.

Length of credit history / Depth of credit: This is less important than the previous factors, but it still matters. It considers (1) the age of the oldest account and (2) the average age of all your accounts.

It is possible to have a good score with a short history, but typically the longer the better. Young people, students, and others can still have high credit scores as long as the other factors are positive. With FICO, this is the 3rd largest aspect of the score calculation.

If a person is new to credit then there is little they can do to improve a credit score. No newly added accounts can be back-dated to improve this score aspect.

You can get added as an authorized user to a family member’s account that has been in long-standing, and that can improve this aspect of your score.

Average age of accounts is another important reason to keep all accounts open. If a consumer has multiple accounts that they’ve had for some time but don’t use, they are still benefiting from the average age of the accounts open in their credit file. Also make sure you use each of your accounts at least once every six months.

Credit issuers must reserve the money offered in credit limits for their clients’ use, so they don’t like having accounts sitting dormant that are not making them money, if an account sits dormant for a long enough time, many creditors nowadays will cancel the account due to inactivity.

Additionally, credit reporting agency will calculate an account as inactive if there has not been any activity in the most recent six month period of time, an inactive account does not benefit your score as much as an active account.

New Credit / Recent Credit: New credit is not always a bad thing. However, opening new accounts can hurt a credit score, particularly if a consumer applies for lots of credit in a short time and doesn’t have a long credit history. The score factors in the following: How many accounts the consumer applied for recently, how many new accounts the consumer has opened, how much time has passed since the consumer applied for credit, and how much time has passed since the consumer opened an account.

The model looks for “rate shopping.” Shopping for a mortgage or an auto loan may cause multiple lenders to request your credit report many times each, even though a person is only looking for one loan. Auto dealers are notorious for running 3 to 15 credit reports. This is called shot gunning the credit.

Luckily, to compensate for this, the score counts multiple auto and mortgage specific inquiries in any 30-day period as just one inquiry. The specific calculation for cut-off dates and types is confusing; we will go over that in detail in upcoming chapters.

For most people, a credit inquiry really won’t have an impact on your credit score. Groupings of inquiries WILL adversely affect your scores. However, inquiries can have a greater impact if you have few accounts or a short credit history.

Large numbers of inquiries also mean greater risk. According to MyFico.com, people with six inquiries or more on their credit reports are eight times more likely to declare bankruptcy than people with no inquiries on their reports.

This can be very frustrating for consumers when they see remarks on the credit report like “too many revolving debt accounts” and not knowing exactly what that means.

Fortunately, Fair Isaac and Vantage Score have issued some public information about how they calculate credit scores.

Types of credit you use / depth of credit: Both models want to see a healthy mix of credit, but they are vague on what this means. They recommend you have a balance of both revolving debts like credit cards and installment loans like auto loans or a mortgage.

The preferred number of credit cards reporting is three.You shouldn’t have more than two mortgages reporting. More than two auto loans are too much. Installment loans also score better if you have two or less.

Here again is how your FICO score breaks down: 35% of your score is based on payment history, 30% of your score is based on utilization, 15% of your score is based on length of credit history, 10% of your score is based on new credit or inquiries, and 10% of your score is credit mix.

FICO 9… What You Should Know…

FICO’s newest credit score is known as FICO 9. This new score includes many changes from prior FICO models.

One change is that medical collections are no longer scored the same as regular collections, they are weighted much less. FICO anticipates that a consumer with the median credit score of 711 whose only negative collection issue is medical-related will see their score increase by 25 points.

Other changes to the model will better gauge the ability of a consumer who has a limited credit history, known in the business as a thin file, to repay a prospective debt. These types of people might not have a score in the past, but will now with the new version.

Non-traditional credit, such as your residential rental history, will be taken into consideration. This means that consumers who have little to no credit history but pay rent on time will get a boost.

Paid-off and settled collections will be ignored with FICO 9. Under the previous FICO model, if you let an account go into collection, your credit score would take a hit for as long as that collection is on your credit report (seven years).