#betting brokerage

Text

why is it i get the vibe that blanche "blink" appleton's husband, charles appelbaum appleton the "dry goods" importer might have something to do with prohibition?

my theory is they met at columbia bc charles appleton is listed as a 1921 graduate, and in 1940 they were living in murray hill new york.

his dad was a russian jewish immigrant and her dad was into stock brokerage and banking, but i've hit a paywall looking for his draft record (he's have been 18 in 1918) or any record of his "import" business

his death date is listed as 1952 so theoretically she could've been a widow who remarried? the divorce records are also behind a paywall ...

also um *extremely* circumstanial but: charles had an older brother listed as louis b. appleton, death date "unknown" and i've found several random piecemeal listings of a louis b. "buzzy" appleton being a new york "speculator" in a couple of brokerage court cases as well as a mentioned involvement in horsetrack betting?

like, ok that's very leading info but again this was new york in the 20s

i'm just saying maybe i can't locate "charles appleton" easily because he went by a nickname like his brother maybe did and wife definitely did? like maybe the stuff about blanche appleton having "connections" is not so far-fetched?

@awheckery @monstrousgourmandizingcats one of y'all with the login credentials have time to look at this guy? "dry goods importer" but no business name?

#like i don't want to jump to cliches or stereotypes but uh signs are pointing in a direction#if you just google louis b. appleton you get the jr. from boston who was a film producer though#somewhere there's a death date listed as 1957 but i can't tell if that's really him#but like nothing for free access about charles appelbaum appleton no record of marriage divorce death etc without paid access :/

18 notes

·

View notes

Text

Outlook 2023, BONDS is the place to be.

OUTLOOK 2023,

BONDS IS THE PLACE TO BE.

BY

SHREY BHOOTRA

STANDARD 7th

SCHOOL – THE BISHOPS SCHOOL CAMP, PUNE.

INTRODUCTION.

In this paper I will be talking about the outlook of 2023 and why this year bonds are a safer and better bet compared to equities.

1. Indian stock market lags behind its global peers in 2023.

The Indian stock market, which had been a star performer in 2022 despite global headwinds, has been lagging behind its global peers since the start of 2023. The domestic benchmark indices, the Sensex and Nifty 50 gave a return of 5.78% and 4.33% in the calendar year 2022 respectively. Since the start of calendar year 2023 the Nifty 50 index has gone down from 18,197 to 17,567, while the Sensex has gone down from 61,167 to 59,745 which means they have both gone down by 4.47% and 2.33% already! The markets in 2023 started the year well before facing challenges as the month went on. The underperformance has been attributed to a range of factors, including continuous selling of FPIs, the reopening of the Chinese economy, the sell-off in the Adani group stocks and the depreciation of the Indian Rupee. On January 25th the Nifty 50 and Sensex tumbled 1.25% and 1.27% respectively, a day after the Hindenburg released a report alleging the Adani Group of certain accusations, on the following day the two indices lost another 1.61% and 1.45% in value, taking the cumulative loss to 2.83% and 2.70% in just two trading sessions. The banking stocks which had given loans to the Adani group of companies also took a brunt on concerns over the debt exposure to the Adani group, the Banking sector which had been the driving force behind the index growth over the past few years was now facing headwinds causing the Nifty 50 to underperform. According to the PTI report foreign investors pulled out Rs 28,852 crores from equities in the month of January 2023, making it the worst outflow since June 2022. This came following a net investment of Rs 11,119 crore is December 2022 and Rs36,238 crore in November. The Indian Rupee started January 2023 on a strong note, strengthening 1.60% in the first three weeks, however it gave up its gains as the month progressed and ended January with a fall of 1.18% at 81.73 against the US Dollar. The Indian Rupee ended 2022 as the worst performing currency with a fall 11.3%, its biggest annual decline since 2013. In December 2022 the global brokerage Goldman Sachs said that India is likely to underperform its peers in 2023 due to expensive valuations. The Indian market had been a strong outperformer in 2022 due to stronger domestic fundamentals, but valuations have turned expensive compared to global peers. Another cause for the equity markets not performing well is inflation, inflation in the month of January 2023 in India was 6.52% compared to 5.72% in the month of December 2022, when inflation is high it reduces the purchasing power of common households thus also having a negative effect on the equity markets. The main cause of rise in inflation in India is because of food inflation, the CPI food index rose to 5.9% in January 2023 from 4.2% in December 2022.

2. Why are bonds the place to invest in 2023.

Since the equity markets have not been performing well since the start of the year, bonds are the next best place to invest, retail investors, DIIs and FIIs have been pulling money out of the market and have been investing in bonds. Since bonds provide a predictable income stream and have stable returns and have a lower risk people prefer to invest in bonds this year over equities. The US one year bond yield is currently at 5.0541%.

- SHREY BHOOTRA

23.3.23

2 notes

·

View notes

Text

my 1 piece of advice for high school grads and anyone going to college is that you should study something you like and enjoy. doesn’t have to be your passion, it just has to be something you find interesting enough to spend 4+ years on. at bare minimum it should be something you can tolerate.

because I studied English fiction for 6 years across undergrad and grad school and I still ended up working at a major investment company. I’m not rolling in dough but I can afford to live alone, drive a brand new car, contribute to both a retirement plan and a brokerage account, feed myself, pay for healthcare, and still have fun money left over. I’m not rich, but I’m still comfortable and I’m still in a place of financial privilege (which is kinda wild to me). I have all that and I still got to study what I loved for 6 years.

finance isn’t my passion, but I find a lot of enjoyment and fulfillment in my job. It’s not my passion but there are things I’m newly passionate about within the realm of investing—someday I’d like to work in financial planning, because I find that I like helping people who aren’t sure what they’re doing when it comes to this stuff. At the moment I’m planning to stay with this company for the long term. But if I was offered a job working in a creative field that would offer me the same or better benefits and pay? I’d probably leave this job immediately.

And I’m fully aware of the privilege I have in this. I know many people can’t afford to pursue their passions in college. But that’s my point and that’s why I’m saying you just need to find something you like enough that you have the motivation to keep going. Because if you have absolutely no interest or enjoyment in your studies or your work, you’re going to be miserable. That alone makes it not worth it. I’d also be willing to bet you’re going to be a mediocre student because you don’t have any intrinsic motivation to succeed. And it WILL show.

So again, I understand if you aren’t able to study what you actually love in college, but you should study something that you can eagerly show up for and take seriously. Don’t just pick a degree because you’ve been told it’s going to lead to a high paying job.

6 notes

·

View notes

Text

I don't have a Gambling Enterprise. It's a Decentralized Economy.

Forex (Gambling News Network)

Real Estate (Resorts)

Central Bank (Poker)

Online Brokerage (Online Gambling)

Capital Markets & Options Trading (Sports Betting)

Market Crash Short Selling (Fantasy Sports Live Betting)

Transportation (Car Rental and Professional Tracks)

CHIGGA PROPERTY

2 notes

·

View notes

Text

What is options trading for beginners?

Besides stocks, there is a growing interest in options trading. Options are financial contracts that derive their values from an underlying asset, such as stocks, ETFs, bonds, etc.

Options trading involves buying or selling underlying assets at a fixed price on a future date.

Options trading can be more complex than trading stocks. When you buy stocks, you fill an order for the number of shares you want to purchase. Your broker executes the trade at the prevailing price or the price limit set by you. But options trading requires understanding advanced strategies and knowledge of asset price movement.

How does options trading work?

When traders buy or sell options, they have the right to exercise the options at any point before their expiry date. But simply obtaining an options contract doesn't require one to execute its terms at expiration. Due to this feature, options are regarded as derivative securities. It also means that, unlike shares, options don't represent ownership in a company. The market price of the options is, therefore, the proportion of the underlying asset price.

How to trade options

Open an options trading account: Brokerage firms will screen probable options traders for their experience, understanding of risks, and financial preparedness. They will note these factors in the options trading agreement. The broker will ask you for,

Investment objective

Trading experience

Financial details

Types of options you want to trade

The broker will assign you an initial trading level based on the answers.

Nowadays, you can open an options trading account online with brokers like Angel One.

Pick options you want to buy: You can select from the available options contracts in NSE. For your understanding, a call option gives you the right to buy an underlying asset at a fixed price on a future date. A put option allows the holder rights, but no obligations, to sell underlying stocks at a predetermined rate on a future date. The decision to buy a call or put option will depend on your understanding of asset price movement.

If you expect the asset price to rise, you will obtain a call option. Conversely, you'll buy a put option when you expect the asset price to fall.

Predict option strike price: An option only remains valuable if the underlying asset price finishes close to the strike price on expiry or the contract is 'in the money. It means above the strike price if it's a call option and below the strike price in case of put options. You'll want to buy options with a strike price that reflects where you expect the stock price to move during the option's lifetime.

The price you pay for an option is the premium. It has two components - time value and intrinsic value. The higher the premium, the lower your profit.

Determine the option time frame: Every option has an expiration period or the last date you can exercise your rights. The expiry date is not random. The option's expiry date in India is fixed on the last Thursday of a month. Options are not suitable for long-term investment. Options traders bet on the short-term movement of the asset price. Hence, options are available for 1-month, 2-month, and 3-month duration.

An option's time value decay as it moves close to the expiration date. If you don't monitor the movement of the asset price or don't execute the option on time, it may expire worthlessly.

Now trade options with angel One. Open an options trading account and start investing.

2 notes

·

View notes

Text

NFT Cards - Why Are They So Valuable?

Authenticated NFTs are the most valuable of all tokens. They are a form of revenue and investment, and as such they are also valuable. These tokens are the most valuable in the market today, so why are they so valuable? Read on to learn more about NFT cards and their potential as investment opportunities. The value of Authenticated NFTs is increasing as the game moves forward, and a profit-driven gamer can take advantage of this.

Authenticated NFTs are the most valuable of all tokens

While most tokens are valuable, authenticated NFTs are the most sought-after of all. As their owners gain access to exclusive Discord groups, these tokens become more valuable. Authenticated NFTs also have special features. For example, the Bored Ape Yacht Club gives its members access to an exclusive Discord. Many other NFTs are more exclusive than others.

Authenticated NFTs are the most desirable of all tokens, as they allow the buyer to own an original digital asset. They contain a built-in authentication, which serves as proof of ownership. They are valuable because collectors value digital bragging rights more than the actual items themselves. Furthermore, authenticated NFTs introduce the concept of scarcity in the digital world, which makes them valuable as collector's items.

In addition to being valuable, some NFTs can earn their owners a lot of money. A gamer bought 64 lots on the virtual land platform Decentraland, which were then combined to create a single estate. The estate went on to sell for more than $80,000, and the road access alone made the estate valuable. Another investor paid $222,000 for a segment of a digital Monaco racing track in the F1 Delta Time game. By buying NFTs representing that portion, the owner is entitled to receive 5% of the entry fees and dividends from the race.

They are a form of revenue streams

There are two primary ways to monetize NFT tokens: through a player's actions and by allowing others to buy and sell them. One method is through physical trading cards. Many collectible items can be sold at a high price, so the demand for these tokens is high. Likewise, a player can use the tokens to support a team. The other method is through royalties.

Traditional works of art are valued because they are unique. The same cannot be said for digital files. As a result, the tokenisation of artwork creates a real-world version of the work. As NFTs have limited production, creators have more control over their products. Some creators have even used the NFTs to increase the value of their assets. Moreover, there is a possibility to create exclusive limited editions of these collectibles, thus boosting their values.

As the esports and gaming markets grow by leaps and bounds, NFTs are becoming an increasingly important part of the industry. NFTs allow fans to watch tournaments online and interact with other players and viewers. They have become intangible memorabilia of the esports community. If esports players are able to generate a significant revenue from NFTs, the industry will continue to grow.

They are a form of investment

NFTs are digital assets whose owners are granted rights to reproduce the assets. These cards are a great way to build a digital fine art collection and collectibles, as well as to buy exclusive assets from your favorite online creators, brands, and celebrities. As a collector, you'll appreciate the value of your NFTs over time, and you can use them to buy new ones, too.

Just like online brokerage accounts and robo-advisors, NFTs can make you money, but they aren't necessarily a sure bet. They are considered speculative assets, such as sports cards, and offer little to no cash flow. As a result, conservative investors will likely steer clear of this type of investment. Nonetheless, if you have some spare cash or are just curious about cryptocurrency, you can purchase NFTs.

In recent weeks, there have been several high-profile sales of NFTs. One famous artist, 3lau, has made over $11.7 million selling NFTs. In exchange for buying a NFT, the buyer will receive a digital token representing an authentic version of his album, access to exclusive music, and a limited edition vinyl copy. The musician's real name is Justin Blau. He said he was "blown away" by the amount of money he earned, and the prices that were set. This has shown the public's appetite for new and innovative forms of investing.

2 notes

·

View notes

Text

Are Yachts A Smart Investment?

The seas are together with friendly dolphin fish, manatees, and many other varieties of fishes and animals. Guides and captains of Siesta Key within your boat still give you advice on the greatest places to observe them. Siesta Key is the true Garden of Eden in every sense. Can be a tropical trees, flowering shrubs, beautiful birds and a good variety of life provides. See beautiful birds along its bays and beaches, ever present for the puppies enthusiast.

Go to the horse backrounds. On many Saturday afternoons, the Barbados Turf Club holds race meetings in the Garrison Savannah racecourse. Betting is controlled and always honest. Read the people, the friends and lay a bet or two; such a wonderful method spend a lazy day.

Does the brokerage employ direct email advertising and marketing? We keep a communication marketing connected with several thousand boaters, a proficient number of whom are patrons. On a bi-monthly basis we email these buyers with a publication about new vessels on the market, price changes, boating headlines and other subjects of marine passion. Your yacht will be marketed listed. It sends customers to the website.

Boat holidays can wind up being much over your traditional holiday. When you can rent a boat for a few days, it's also possible to rent a boat for seasons at once. This gives that you nice, long holiday the actual really less expensive than you'd expect. It's certainly cheaper to spend three weeks on a boat holiday than always be be to invest three weeks in a hotel, where you'd likewise to mull over buying food, paying for transportation or parking, and paying admission to events. Having a Boat Holiday, it's all included-the accommodations and those activities. You will need to supply food, however, but buying groceries is less expensive eating at restaurants each and every meal.

The "Isle of Patmos" is noted for the famous writings of Saint John the Divine, who wrote the book of Revelations in the Greek New Testament for the Holy Bible verses. He was exiled to this island after attempts on his life failed. аренда лодки в греции на неделю stop here, and the island has beaches having a beautiful vis. Skala is the main town, which caters to cruise ship travellers. However visit the monastery of Saint John above Skala, and the Monastery of the Apocalypse which built all over cave where Saint John had his vision of end periods. There are connections by ferry to Kos, Rhodes, Leros and Kalymnos, together small boat to the city of Lipsi.

Almost all House boats come with televisions and music systems and other such basic entertainment ??? ?????????? ????? ? ?????? musical instruments. For a little extra they may well come along with DVD players and refrigerators and wash machines various other really luxurious gadgets.

Go bird and animal watching. Most forest parks and camping sites have brochures or leaflets for your different regarding animals that will be found around pick a that count watching and to look out for. A fun thing to enjoy is to buy books on wildlife before your camping trip and are game with your children and then determine who can spot the animals extremely. Just be particular you maintain your children at a safe duration.

#botel#stay#hotel#rent a boat#yachts#boat rentals near me#boat rental near me#ibiza#barcelona#Spain#Mallorca#menorca#malaga#palma#la palma#airbnb#boat#yacht#vacation#rent a yacht#boat rentals#yacht rentals#boating#fishing#sleep

5 notes

·

View notes

Text

Best Commodity Tips Provider For Online Trading

In recent years, commodity trading has become a great substitute for traditional investing vehicles. With the notable exception of some agricultural commodities and metals, commodity volatility is considerably low and predictable, according to some investors, making commodity trading easier than stock trading. In addition to offering several additional advantages, Best commodity tips provider for trading allows investors to diversify their asset allocation strategy, insure against inflation, and obtain respectable leverage.

When individuals think of investing, they usually think about buying stocks or maybe debt, which they may buy directly or through mutual funds. But commodity trading is also an option. Raw resources are called commodities, and they are utilised to make refined goods. Because commodities are standardised, they can be purchased, sold, and traded exactly like any other financial asset because there are two distinct units of each commodity in equal proportion. Commodity trading has never been simpler thanks to the proliferation of digital trading platforms. Here are some pointers for beginning virtual commodities training.

Commence Small: It is advised that traders start off with modest investments. This will provide you greater leeway to make mistakes as you gain experience and prevent you from being disappointed if you lose at first.

Recognise the Fundamentals: Recognise the different commodities that are traded: energy, metals, agricultural, and environmental commodities. It is wise to start by practising your trade and learning the most popular methods through a simulation.

Understand Your Trading Options: Commodity futures contracts are the most popular type of commodity trading. In these contracts, the seller promises to sell the commodity in question to the buyer at a certain price at a later date. Let's take an example where you decide to purchase 10 grammes of gold for Rs. 50,000 in 30 days. The price of gold in 30 days is INR 53,000. It is now possible to purchase gold for Rs. 50,000 and sell it for Rs. 53,000, making up the difference.

Spread your bets: One of the best strategies for commodity trading is to diversify. To minimise dangers, it is sage to avoid putting all of your eggs in one basket. You may evaluate whether commodities are low- or high-risk by spreading your cash over a variety of them while maintaining trade balance and investment protection. But be careful not to overinvest in commodities, since this might offset any possible profits.

Leverage: Since commodities are frequently highly leveraged investments, it is probable that you would borrow money from your broker to finance your commodity trading in the hopes of realising substantial gains.

To be precise, prior to using trading tools: With the Best commodity tips provider for online trading tools such as price alerts, watchlists, global search bars, charting tools, portfolio management tools, and so forth is one of the greatest online trading tips. Instead of behaving impulsively, these tools can assist you in making well-informed judgements.

Select The Best Broker

The most underrated of all Best commodity tips provider you would find on the internet is the one that matters the most - the broker like Globe Capital.

A broker plays a prominent role in determining the benefits of trading in commodities. For example, if the broker’s online platform is slow, the order execution might get delayed. Moreover, if the brokerage is too high, your actual profit might be less.

Fortunately, many Best commodity tips provider online let you open a free online account and trade with 0% brokerage. Moreover, they also provide an app for carrying out online transactions on the go. Additionally, you can learn about commodities by reading the blogs published on their website.

Conclusion:

Like other online trading platforms like Globe Capital, online commodities trading has a number of advantages over traditional trade, including convenience and accessibility. As long as you follow the fundamental guideline of not overtrading, exercise patience, control risks, do a thorough investigation, and put the tactics and recommendations to use, you may make a great living as an investor through online commodities trading.

#Globecapital#finance_services#invest_in_mutual_funds_online#best_trading_platform#Best commodity tips provider

0 notes

Text

GRAINS-Supply glut pushes US wheat towards lowest levels since 2020 CANBERRA, March 14 (Reuters) - Chicago wheat futures on Thursday slid towards their lowest levels since 2020 as supply of cheap Russian grain continued to push down prices and undermine the competitiveness of U.S. crops. Soybean and corn futures also edged lower amid plentiful supply from the Americas. FUNDAMENTALS The most-active wheat contract on the Chicago Board of Trade (CBOT) Wv1 was down 0.7% at $5.40-1/4 a bushel, as of 0030 GMT, and nearing Monday's nadir of $5.23-1/2, the lowest since August 2020. CBOT soybeans Sv1 fell 0.2% to $11.94-1/4 a bushel having hit $11.99-1/4 on Tuesday, its highest since Feb. 8. Corn Cv1 was down 0.2% at $4.40-1/2 a bushel after climbing to $4.45 on Tuesday, its strongest since Feb. 6. Russia, the world's top wheat exporter, is flooding the global market with cheap supply as it draws down inventories ahead of an expected bumper harvest. Refinitiv data show benchmark Russian wheat export prices slipped below $200 a metric ton ($5.44 a bushel) this week for the first time since August 2020. Around 500,000 metric tons of U.S. wheat export sales to China have been cancelled in the past week, according to the U.S. government, likely due to the recent slide in prices. Farm office FranceAgriMer increased its forecast of French soft wheat stocks this season to a 19-year high due to weakening export prospects. Australian farmers are likely to plant more wheat in the coming growing season at the expense of canola, which is forecast to be less profitable, Rabobank said. Agricultural maritime exports from Ukraine, a significant wheat and corn exporter, are expected to fall by 20% in March from February, Spike Brokers said. Commodity funds were net sellers of Chicago wheat futures on Wednesday, adding to an already significant bearish position, traders said. Speculators are also betting on lower corn and soybean prices. For soybeans, Argentina's Rosario grains exchange bumped up its forecast for the country's 2023/24 harvest by 500,000 metric tons to 50 million tons after ample rainfall in February. Argentina is one of the world's top two exporters of soybean oil and meal, along with neighbouring Brazil. Argentina's main agricultural area will likely receive more precipitation in the next few days, the Rosario exchange said. In Brazil, benchmark industry estimates of the soybean crop have deviated even further from each other this month following a season blemished by questionable weather. U.S. farmers meanwhile plan to reduce corn plantings by about 1.2% this year and expand their soybean plantings by about 2.7%, a survey by commodity brokerage Allendale showed. MARKETS NEWS A gauge of global stock markets edged lower and U.S. Treasury yields rose modestly on Wednesday, as investors looked to the next round of data on inflation and consumer health for clues on the direction of Federal Reserve policy.

0 notes

Text

Alok Kumar Agarwal Alankit: Why Mutual Funds Reign Supreme for Novice Investors in Equities

Investing in a Mutual Fund through a SIP (Systematic Investment Plan) is a great choice for new investors. Starting with an index fund is a safer bet because it has lower volatility. However, be prepared for market ups and downs when investing in stocks. So, it's wise to think long-term to benefit from compounding," suggests Alok Kumar Agarwal Alankit.

Mutual funds are quite simple to invest in and can be bought through a brokerage account or directly from the Mutual Fund company. Nowadays, many apps make investing easier, making Mutual Funds accessible to beginners.

Another perk is that Mutual Funds offer liquidity, meaning you can easily convert your investment into cash. Most mutual funds can be bought and sold on any business day, adding to their appeal as a liquid investment option.

Read More

0 notes

Text

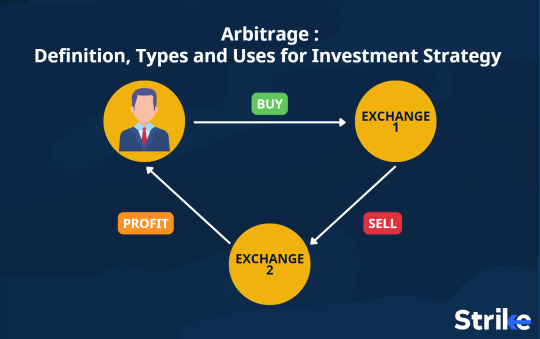

Exploring the World of Arbitrage: Strategies, Risks, and Rewards

Introduction:

Arbitrage, often hailed as the holy grail of investing, is a sophisticated strategy that exploits price differentials in various markets to generate profits with minimal risk. In its essence, arbitrage involves buying an asset in one market and simultaneously selling it in another at a higher price, thus profiting from the price gap. This financial maneuver has been a cornerstone of trading practices for centuries, evolving alongside advancements in technology and globalization. In this article, we delve into the intricacies of arbitrage, exploring its strategies, risks, and rewards.

Understanding Arbitrage:

At its core, arbitrage relies on the efficiency of markets. In a perfectly efficient market, where prices adjust instantaneously to reflect all available information, opportunities for arbitrage would be nonexistent. However, markets are rarely perfectly efficient due to various factors such as transaction costs, information asymmetry, and behavioral biases.

Types of Arbitrage:

Arbitrage opportunities can manifest in various forms across different markets. Here are some common types:

Spatial Arbitrage: Spatial arbitrage exploits price differentials between geographically separate markets. For example, a commodity might be priced differently in different countries due to supply-demand imbalances, regulatory disparities, or transportation costs.

Temporal Arbitrage: Temporal arbitrage capitalizes on price differences over time. This could involve exploiting price variations between different trading sessions, futures contracts with different expiration dates, or seasonal fluctuations in commodity prices.

Statistical Arbitrage: Statistical arbitrage, also known as pairs trading, involves identifying mispriced relationships between related assets. Traders use statistical models to predict the convergence of prices between the assets and take positions accordingly.

Merger Arbitrage: Merger arbitrage, also called risk arbitrage, involves exploiting price discrepancies between the current market price of a target company and the price offered by an acquirer in a merger or acquisition deal. Traders bet on the successful completion of the merger and the eventual convergence of prices.

Currency Arbitrage: Currency arbitrage involves exploiting price differences in the foreign exchange market. This can occur due to discrepancies in exchange rates between different currency pairs or across different forex platforms.

Strategies and Techniques:

Successful arbitrageurs employ various strategies and techniques to identify and capitalize on arbitrage opportunities:

Market Monitoring: Constant vigilance is key to spotting fleeting arbitrage opportunities. Arbitrageurs utilize sophisticated algorithms, automated trading systems, and real-time data feeds to monitor multiple markets simultaneously.

Risk Management: Despite its reputation for risk-free profits, arbitrage is not devoid of risks. Market volatility, execution risks, and regulatory changes can erode potential profits. Effective risk management strategies, such as position sizing, diversification, and hedging, are crucial for mitigating these risks.

Speed and Efficiency: In today's hyper-competitive markets, speed is of the essence. High-frequency trading (HFT) firms leverage cutting-edge technology and ultra-fast connectivity to execute arbitrage trades within microseconds, capitalizing on fleeting price differentials.

Transaction Cost Optimization: Transaction costs, including brokerage fees, exchange fees, and bid-ask spreads, can eat into arbitrage profits. Therefore, minimizing transaction costs through negotiation, routing optimization, and smart order routing is essential for maximizing returns.

Risks and Challenges:

While arbitrage offers the promise of risk-free profits, it is not without its challenges and pitfalls:

Execution Risks: The success of arbitrage trades hinges on precise execution timing. Delays in order execution, slippage, and market disruptions can erode potential profits or turn a profitable trade into a loss-making one.

Regulatory Risks: Arbitrage strategies operate within a complex regulatory landscape characterized by varying rules and restrictions across different jurisdictions. Regulatory changes, enforcement actions, and compliance costs can impact the viability of arbitrage trades.

Liquidity Constraints: Arbitrage opportunities may be limited by liquidity constraints, particularly in niche markets or during periods of market stress. Illiquid markets can exacerbate execution risks and widen bid-ask spreads, eroding potential profits.

Model Risk: Statistical arbitrage strategies rely on predictive models that may fail to accurately capture market dynamics under changing conditions. Model risk, including parameter estimation errors and overfitting, can undermine the effectiveness of arbitrage strategies.

Conclusion:

Arbitrage remains a potent tool in the arsenal of sophisticated traders seeking to exploit inefficiencies in financial markets. While the allure of risk-free profits is enticing, arbitrage is not without its complexities and challenges. Successful arbitrageurs must navigate a myriad of risks, employ cutting-edge technology, and adhere to rigorous risk management practices to capitalize on fleeting opportunities. In an ever-evolving market landscape, mastering the art of arbitrage requires a blend of skill, discipline, and adaptability.

0 notes

Text

Remarkable, Moreau. Just Remarkable!

"You like what I've DONE? I think Viola's my finest work to date!"

"This X-ray tells the whole story. How you are able to fuse two mammalian types into one body... incredible! You, know...if I hadn't been MARRIED to her I'd hardly RECOGNIZE her!"

"Hey... I TOLD you not to marry a fashion model. They are just TOO... HIGH... MAINTENANCE! In EVERY WAY! I mean... HOW many procedures had she had in the last YEAR?"

"Oh... GOD... if you count the BOTOX... at least a DOZEN! And she was NEVER satisfied! Nip.. tuck... NIP... TUCK!! I just had had ENOUGH... I mean... that stuff ain't CHEAP... and then I thought getting her one of YOUR procedures! I knew that WHATEVER she thought of it... it would be her last ONE! So I pointed her toward you, sort of casual, like, saying how you do such CUTTING EDGE work in the field."

"Well, I gave her the usual promise... that she wouldn't RECOGNIZE herself after I was done with her. And that is one promise I ALWAYS keep! The... the LOOK on their FACES when they get their first peek at themselves in the MIRROR NEVER gets old! I'll bet she never REALIZED how becoming to her a brindle coat would be. And then... the panicked SQUEALS? PRICELESS!"

"If she'd just been a LITTLE nicer to me, I can't help thinking we could have AVOIDED all this unpleasantness. But there was nothing else for it. A DIVORCE would've cleaned me OUT!

"I know... I know... if I had a NICKEL for every time a client told me THAT. But, you're a COLLEAGUE... so I gave you a special RATE."

"And I can't tell you how much I thank you for THAT! You know, Moreau... this... this is NOT my kink at ALL, you understand... but... DAMN she's cute like that! I'd... I'd STILL do her in a HOT MINUTE, and that's no LIE! Wait... was that a GASP? Can she UNDERSTAND us?"

"Every WORD, Dr. Auchinsloss! Her human mind and memories are completely INTACT. Inside that pig body, she's still the same 'sweet, unspoiled lady' who won your heart a year ago. Unfortunately for her, her human speech center and pig larynx, tongue and throat are just not a good match. She can only grunt and squeal from now on, I'm afraid"

"So... you were saying you had something SPECIAL in mind for her?"

"Oh DEFINITELY! She's MUCH too pretty to waste on the boars! I mean... she STILL has her fashion model looks! I was thinking of selling her to the Heavy Petting Zoo... but even THAT would be a waste of her talents. No... I think she's going through my online MARRIAGE brokerage!"

"MARRIAGE brokerage!?"

"You heard me RIGHT. You'd be SURPRISED how many men out there DREAM of having a lovely pig girl of their very OWN. A lot of my clients come from the BIBLE BELT... big shock there... but the REAL high rollers come from the Middle EAST."

"You're KIDDING!"

"Not at ALL. The appeal of the FORBIDDEN, you know. I don't think there's a sheik in SAUDI doesn't have at least ONE of my girls in their harem... or private zoo... or WHEREVER they keep them. It's so ADORABLE when they put a VEIL on them!"

"Amazing! So... TELL me, Moreau... how is it that you ARRIVED at this... um... UNIQUE avocation?"

"About all I can SAY, Auchinsloss... is... The MUPPET Show was a POWERFUL gateway drug!"

#photomanipulation#pig#piggirltransformation#pig_girl_transformation#pig_girl_tf#piggirl#pigtransformation#pig girl#forcedtransformation#pig transformation

1 note

·

View note

Text

Paperless Customer Onboarding through eKYC Solutions!

No doubt, everyone is familiar with a KYC or Know Your Customer process, which is performed in banks or other financial institutions. These are applied for customers that allow them access the financial services and products with a valid customer identification. eKYC solutions have been an essential part of mitigating financial crime risks and avoiding fraud activities.

Why is Manual Know Your Customer not a good bet for Businesses?

Handling the traditional KYC process was a challenging job when it came to bulk customer verification. It was a time-consuming task, and the customer was required to share their sensitive information with bank personnel. So, it could increase fraud risk for fintech companies, lead them to penalties, and lose revenue.

What is e-KYC Online?

e-KYC has changed the current scenario of the Know Your Customer process, which is based on online customer verification through PAN and Aadhaar. It ensures compliance with AML regulations and reduces the risk of leaking sensitive information to customers. Customers do not need to bring physical documents because eKYC software integrates with DigiLocker to fetch essential papers for further verification.

Importance of EKYC Software Solutions

After the pandemic, the government of India is strongly promoting the use of digitalization in everyday life for its citizens. The use of UPI was a good instance that boosted digital payments. When it comes to manual KYC methods, these were tedious and more complex than other aspects of customer onboarding. As a result, presenting physical identity documents or proof of address slows down the entire process, which leads to friction for customers, and failure of transactions & agreements.

EKYC is a faster, reliable, paperless, and simple process that helps to automate and speed up the KYC process. It allows instant document verification rather than taking days or weeks to complete for manual methods.

Whether it is the bank or brokerage company, e-KYC can be a value-added opportunity for businesses to save time & money and enhance customer experience.

Firms can easily connect with more customers on a daily basis, reducing the steps to comply with KYC laws and providing additional customer screening and monitoring through real-time online and database checks.

Advantages of implementation of e KYC Online for companies

When a company upgrades from manual KYC to e KYC, it becomes crucial to consider compliance requirements with business, information security, the ease of onboarding process for customers, and, of course, the available budget.

· Zero paper or document requirement, which contributes to saving the environment.

· Mitigates the friction in customer experiences.

· Accomplish all regulatory requirements for all relevant regions.

· eKYC online provides real-time screening, which makes this system more reliable.

· Customer verification within a few minutes, and PAN and Aadhaar-based verification.

· Businesses can invest their time in making new policies rather than wasting their energy on the customer account opening workload.

· No need to check out manual customer documents and leads to grow and scale your business.

· Reduce the chances of human errors which may occur during manual processes.

· Promotes instant approvals, and customers enjoy speedy account creation.

Bottom Line

Overall, the adoption of eKYC solutions has ushered in a new experience for enterprises. Transforming the cumbersome manual Know Your Customer processes into a streamlined, efficient, and secure digital experience was a good initiative for a positive outcome. The advantages of eKYC are far-reaching, from mitigating fraud risks and complying with AML regulations to reducing operational costs and enhancing customer experiences. As we navigate the digital age, businesses that transition to eKYC are not only saving time and money but also contributing to a more environmentally friendly approach by eliminating paper documentation.

Original Reference: https://elejrnl.com?p=3813523

0 notes

Text

0 notes