#bankruptcy attorney in wheeling

Text

Discover smart strategies to safeguard your retirement savings during bankruptcy. Learn how to navigate financial challenges and protect your future. For more information schedule a free consultation with our experienced Wheeling Bankruptcy Lawyers.

#Chapter 7 Bankruptcy In Wheeling#Wheeling Creditor Harassment Attorney#Wheeling Chapter 13 Bankruptcy Attorney#Wheeling Chapter 13 Bankruptcy Lawyer#Wheeling Chapter 7 Bankruptcy Attorneys#Wheeling Chapter 7 Bankruptcy Lawyers#Chapter 7 Bankruptcy Attorneys In Wheeling#Wheeling Bankruptcy Attorney#Wheeling Debt Litigation Attorney#Bankruptcy Law Firm In Wheeling#Wheeling Bankruptcy Lawyers#Bankruptcy Attorney In Wheeling#Wheeling West Virginia Foreclosure Defense Lawyer

0 notes

Text

Bob Floyd masterlist

*All of my fics are 18+. Please do not repost my work without consent or steal my work. Reblogs and comments give me life so please do interact if you'd like!

✤: Fluff

❂: Angst

❀: Smut

Series

❀❂✤ Friends Don't — Bob x OC [Reid Coleman] – Complete

Bob has been your best friend for almost a decade, ever since he quietly volunteered to tutor you in college. The two of you have spent years chasing each other around the globe – Bob as a WSO, you as a travel blogger. You’ve always been the anywhere-but-here girl, and he’s been your rock. But when a surprise diagnosis threatens to crumble your picture-perfect life, you’re on the first flight back to San Diego, desperate to put down roots for the first time. Will Bob finally have it in him to admit that you could be the love of his life? What will he say when he finds out the secret you’ve been skillfully hiding from him? Or worse, what if he doesn’t find out until it’s too late?

❀❂✤ Golden Hour — Bob x Bradley x OC [Dr. Olive James]

Willow, Georgia. Barely even a town, just a speck on a map that you tried to wipe off, mistaking it for a crumb. You’re the outsider: a fancy New York doctor, fresh out of a failed engagement, with zero primary care experience. You’re also the new town doctor, taking over for a recent retiree who was beloved. His son, Bob Floyd, is the other physician at the practice, and takes an immediate dislike to you. But you were looking for a fresh start, and Willow doesn’t seem all that bad if you can get past the fact that there's only one restaurant in town. It helps that you've caught the eye of Bradley Bradshaw, the town attorney, despite the fact that you vowed to take a break from dating. How long until you start to make friends in a town where social circles have been set in stone since elementary school? And what will it take to make Bob Floyd see you’re not as bad as he wants to believe you are?

❀❂✤ The Back Seater and the Baker — Bob x OC [Haley Nichols]

Bob hasn't seen Haley Nichols since he was fifteen. But when Haley shows up out of the blue with one sentence that throws Bob for a loop – "I'm turning thirty in two weeks, are we still on?" – all of the feelings from their childhood return. Bob never thought that Haley would remember the marriage pact the two made when they were just kids, even if he never forgot. So what happens when Bob falls all over again for his childhood crush? And what will Bob do when he discovers the real reason she came back to capitalize on the pact is to secure her inheritance and save her bakery from bankruptcy? Will he believe Haley when she confesses that she loves him, too?

One shots

✤ One Night — Bob x Reader – Complete

You have your eyes on Bob at the Hard Deck, but have to shoot down Jake Seresin first.

✤ Gas Station Tears — Bob x Reader – Complete

After your boyfriend dumps you, your car stalls out in a gas station parking lot. Luckily, Bob Floyd happens to be there to fix your car. Can he fix your heart, too?

❂✤ It Was Never Him — Bob x Reader – Complete

You catch your boyfriend Rooster making out with a girl at the Hard Deck and only one person can comfort you in the aftermath: Bob Floyd.

❂ What Are You Thinking? — Bob x Reader – Complete

Bob Floyd is a quiet man. Sometimes you have to ask him what he’s thinking just to know what wheels are turning inside of his head. He always gives you a response, until one day, years into your marriage, he turns the question on you.

❀ When I'm Done With You — Bob x Reader – Complete

At a fraternity mixer, you lose your (admittedly shitty) boyfriend in the crowd. That’s when Bob Floyd, president of Alpha Tau and your boyfriend’s personal nemesis, finds you and decides to make you his.

❀ She Calls Him Daddy – Bob x Reader – Complete

Coming home from college for winter break, the last thing you expected was to run into your best friend’s father while out shopping for new lingerie to surprise your fuck buddy with. You had always tried to hide your attraction for Mr. Floyd because he was Anna’s father. But all rules are thrown out when Bob invites you over on Christmas Eve while Anna is at her mother’s house. You’ll never be able to look at your friend’s dad the same way ever again.

✤ More Than Enough — Bob x Reader – Complete

The first two times Bob Floyd ends up in your emergency room he’s a mess. You never expected him to return a third time. But when he does, it changes everything.

#bob floyd x reader#bob floyd fanfiction#bob floyd#bob floyd fluff#bob+floyd+x+reader#bob floyd imagine#bob floyd au#bob floyd x oc#bob floyd x you#bob floyd x female reader#bob floyd x y/n

167 notes

·

View notes

Text

On September 19th 1778, Henry, Lord Brougham, the Scottish Whig statesman and jurist was born in Edinburgh.

Henry Brougham, the eldest son of Henry Brougham and Eleanora Syme Brougham, was born at the top of the West Bow, aged 14 he was enrolled at the University of Edinburgh, Henry Brougham displayed a remarkable talent for learning in a city steeped in the cosmopolitanism of the Scottish Enlightenment

He made his way to London, where he began a long career as a Whig politician and reformer. Trained as a lawyer and called to both the Scottish and English bars, Brougham made a name, as well as a substantial income, in this profession. The legal victory for which he acquired the most recognition was his 1820 defense of Queen Caroline in the House of Lords. Brougham had served as her legal advisor since 1812 and became her attorney general when George IV insisted on a divorce soon after inheriting the throne. After Brougham delivered a speech that lasted for two days, the bill to dissolve the royal marriage passed the Lords with only a handful of votes, which convinced the government to drop the matter and avoid what promised to be a crushing defeat in the Commons. As the public demonstrations celebrating the queen's victory demonstrated, popular opinion was firmly with the queen, and thus also with Brougham.

Commentators at the time recognized that Brougham's rhetorical skills far surpassed his understanding of complex legal issues. His particular talents were perfectly suited for politics. He began his political career in journalism, when in 1802 he helped Sydney Smith, Francis Horner, and Francis Jeffrey establish The Edinburgh Review, a quarterly periodical with a strong Whig bias that soon became a leading platform for political debate. I have posted about The Review and it's founders inprevious posts. Brougham frequently contributed articles, which in the first eight years of the Review's run numbered over one hundred. Brougham entered Parliament for the first time in 1810 as MP for Camelford. Though he lost and regained seats in Parliament over the years, he nevertheless managed to attain high political office by serving as lord chancellor from 1830 to 1834 in the administrations of the prime ministers Charles Grey and Lord Melbourne.

Brougham was routinely associated with the radical wing of the Whig Party, since his positions reflected those of many nineteenth-century reform movements. He was an early supporter of the abolitionists and promoted their efforts to end the slave trade.

Brougham encouraged one of the most significant political shifts of the century by making parliamentary reform a main tenet of his election campaign in Yorkshire in 1830 and then by helping to secure passage of the 1832 Reform Act.

is interest in educational policy took him in several directions. First, in 1820 he proposed a bill promoting publicly funded education; the bill failed, but Brougham remained committed to the cause. Second, in 1826 he founded the Society for the Diffusion of Useful Knowledge, which published cheaply priced works aimed at the working classes. And third, he was among the active supporters of England's first nonsectarian university, the Unversity of London.

Brougham became Parliament's most consistent champion of law reform, in part because in 1828 he delivered a brilliant six-hour speech that turned law reform into a popular cause. He established the judicial committee of the Privy Council, a central criminal court, and bankruptcy courts, and he also laid the foundation for a county court system.

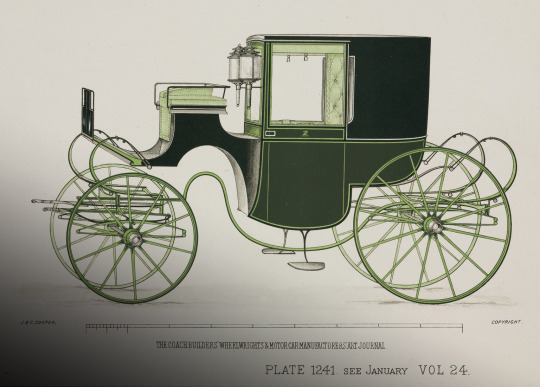

Brougham had an interest in science as well as politics. He was a fellow of the Royal Society and was credited with designing the brougham, a four-wheeled carriage. He died and was buried at Cannes, where his frequent residence during the last three decades of his life helped make the French Mediterreanean town a destination for British tourists.

13 notes

·

View notes

Text

Wheeling Attorney Believes Roxby’s Morris Possessed Pure Intentions

The attorney representing the owners of the Scottish Rite Cathedral in East Wheeling believes Roxby’s indicted developer Jeffrey Morris truly believed he could deliver on the deal he was selling to investors, vendors, and to more than 100 employees.

Morris, 37, was charged with 18 federal counts of wire fraud and 10 counts of tax evasion in September after serving as the president of Roxby Development, a start-up real estate company founded in Wheeling in 2020. Morris partnered with his parents in 2019 to buy the Mount Carmel Monastery and then directed the firm to purchase the Scottish Rite in September 2020, and then the McLure Hotel in July 2021.

David Croft is the Member in Charge of the Spillman, Thomas & Battle office in Wheeling, and he represented the Scottish Rite Masonry in June for the foreclosure process against Roxby Development. Morris also lost the McLure Hotel to foreclosure this past summer.

While his interactions with Morris were limited, Croft did develop impressions.

“As an attorney who has handled a lot of acquisitions in this area for a number of years, I don’t think Jeffrey came into all of this with ill intent at the very beginning,” said Croft, who also is one of five members of the Ohio County Board of Education. “I think he honestly believed, at the start of it all, that he could make it all work out, but then I think he got under it and couldn’t get out.

“I don’t know, but maybe if took on one project at a time, (Morris) would have had a better chance,” he said. “Finish the monastery, and then move on to the Scottish Rite, and then the hotel. But that’s not how he went about it, and toward the end, there was even talk about the Kaufman building and the Mull Center, too.”

The Roxby operation began with only a mingling of employees, a group that included some of his best friends dating back to high school. In the summer of 2021, however, following the acquisition of the McLure Hotel, the company’s workforce swelled to more than 100. On a few occasions, however, paychecks were not delivered as scheduled.

“I think Jeffrey Morris absolutely believed he had a plan. I think he thought he could get a return for his investors. But, at some point he had to know he was robbing Peter to pay Paul, and when the employees had to wait to be paid, red flags went up for a lot of people,” Croft said. “He saw value in the buildings, and his ideas were sound, but it appears he lost control of it somehow and that’s when laws started being broken, allegedly.

“There was a lot of excitement surrounding the projects, and about the improvements the people could see like the painting of the hotel,” the attorney recalled. “But because of the bankruptcy filing, we now know the painting company didn’t get paid, and a small business can’t take a hit like that and they weren’t the only ones.”

The Scottish Rite Cathedral was returned to the Masonry once foreclosure proceedings were completed this summer.

A Pot of Gold?

The Chapter 11 paperwork filed in May by Roxby Development seeking protection from creditors indicated the amount the company was in debt to be between $10 and $50 million, but those pages also revealed Morris had not properly insured the Scottish Rite and McLure properties.

That fact, Croft learned from a colleague, was concerning to federal officials.

“The most significant thing we accomplished at Spillman was to get his request kicked out of bankruptcy court because that process would have given him a long period of time,” he explained. “But he failed to have adequate coverage on the properties and that’s what allowed us to file the motion to dismiss. Once it was, it allowed (lawyer) David Delk to move forward with the foreclosure on the hotel, and me to move forward with the Scottish Rite.”

Croft’s dealings with any legal matters connected to Morris and Roxby Development are minimal at this point, but he still finds some factual information pertaining to the rise and fall of the company very interesting.

“I believe part of the problem as far as the investors are concerned was that it appears they accepted internally generated data instead of third-party information like actual bank statements and documents similar to those,” he said. “Internal information, as far as what I have found, is historically unreliable.

“Right now, I’m sure the federal investigators are putting together all of the numbers, and once they do, I’ll be curious to see the bottom number to see if there are funds missing. I don’t know if that’s a fact or not,” Croft insisted. “If there is, where is it? That’s a fair question.”

According to federal guidelines, each guilty verdict for tax fraud carries a prison sentence up to 20 years and a fine up to $250,000. The penalties for tax evasion depend on the nature of the committed offense.

“I get the impression this case will continue to grow in charges as the investigators continue their work,” Croft said. “But I honestly believe (Morris) still doesn't think he did anything wrong. That's the upside of being pathological.”

Jeffrey Morris was the president of Roxby Development, a company now defunct after he lost the Scottish Rite Cathedral and the McLure House Hotel to foreclosures.

Read the full article

0 notes

Text

Currently Watching & Reading - Sep 2023

I get the occasional ask of what my current favorite series is or what I am reading/watching lately so I thought I'd make a post for it! I'm mostly not going to be writing one every month but maybe seasonally or if I come across something really good.

These are my favorites that I am watching and reading as of now :)

(note: I love slice of life, fantasy and action/drama genres so most of these would fit into one of these categories)

Webtoon: - all ongoing unless otherwise noted

These are the ones I find to be very enjoyable personally and would give an instant recommend:

My S-Class Hunters

Omniscient Reader

Super Star Associate Manager

When the Third Wheel Strikes Back (daily pass series - ongoing)

Magic Words (canvas series)

The Blacksmith Shop (canvas series)

The Tax Reaper

To The Stars and Back

Tata the Cat

Maru is a Puppy

The Greatest Estate Developer

Auto Hunting With My Clones

Extraordinary Attorney Woo

My Miniature Life Manual (daily pass series - ongoing)

Protect the Knight (daily pass series - completed)

A Man's Man

The Sound of Magic: Annarasumanara (daily pass series - completed)

These are series I enjoy but catch up on when possible and recommend according to what genre people like (especially since some of these are either a bit slower paced/drawn out in plot or have lots of fighting/action scenes):

Lookism

The Strongest Florist

From Morning to Night (seasonal break as of Sep 2023)

TACIT (completed as of Sep 2023)

Return of the Mad Demon

Lost In Translation (near completed as of Sep 2023)

Eleceed

Plaza Wars (daily pass series - completed)

A Mark Against Thee (daily pass series - completed)

The Dark Lord's Confession (seasonal break as of Sep 2023)

Weak Hero

Lady Liar

Senorita Cometa

1 second (daily pass - ongoing)

The Fabled Warrior

The Last God of Spring

Saving a Mercenary Unit from Bankruptcy

Novae (canvas series)

The Crown Princess Scandal

Night Owls and Summer Skies (completed as of Aug 2023)

Taste of Illness (daily pass series - completed)

Anime: - all part of the Summer 2023 anime list

Note: most of these are near completion for this season, so if you like binging anime shows, this is the perfect time for that :)

Also, an fyi, I tend to watch anime Japanese Dubbed with English Subtitles so I have no idea how things translate into another language/ if the vibes are different in other dubbed languages

These are the ones I find to be very enjoyable personally and would give an instant recommend, including previous seasons if applicable:

Little Shark's Outings/ Odekake Kozame -- okay, this is my hands down favorite of the whole summer 2023 anime round up and definitely one of my all time favorites; don't be fooled by the fact that it's a kid's show, for only at a minute and thirty-some seconds, this is pure soul-cleansing wholesomeness so I definitely, highly recommend it!!!

The Masterful Cat Is Depressed Again Today

Helck

Link Click - Season 2

All Saints Street - Season 4

These are series I enjoy but catch up on when possible and recommend according to what genre people like/ based on if they enjoyed previous seasons if multi-seasoned anime:

Malevolent Spirits: Mononogatari - 2nd half

Ayaka

The Gene of AI

Bungou Stray Dogs - Season 5

Manga Recommendations

I don't usually read as much manga as I used to, mostly due to lack of ease in accessing and reading them where I live.

These are the only series I keep up with when possible and come under my instant recommend list:

Witch Hat Atelier (on-going)

Bungou Stray Dogs (on-going)

Yotsuba& (on-going)

That's all for now! Will make another post if there are any major changes to the list (mostly it'll be to update the anime recs as the fall 2023 anime season is about to roll in)

Until next time ^_^

0 notes

Text

esendcash.com

esendcash.com

With a large number of Americans filing for bankruptcy every year many are asking, what are the causes? Many attribute it to the real estate meltdown back in 2007 and others blame the credit industry for their lackadaisical attitude on how they give credit cards to individuals. In most cases currently, the perfect storm has been created starting with the real estate market collapse. After the real estate market collapsed, the rest of the economy got drug down with it. These individuals that were living beyond their means are no longer making the easy money that they were in the past.

Every industry suffered, when the credit market dried up, families were no longer taking extravagant vacations and buying new cars. When individuals stop making the money they were in the past or even worse were unemployed, they started to slide down the financial slope into oblivion. The first thing that happens is choices have to be made about eliminating any luxuries. If that doesn't help, the decision needs to be made of which bills to pay and which to default on. This is where the wheels start to come off and the individual should be rushing in to see a bankruptcy attorney immediately. Usually, this is where people that have no available credit on their credit cards, start to look into payday loans. Payday loans in theory, are not a bad thing if they are used for an emergency to get quick cash. But when this is the only money available to survive on, it will lead to disaster.

1 note

·

View note

Text

Dr. Veena Dubal's White Paper

I've had the great pleasure of working with Dr. Veena Dubal over the past couple years since Prop 22 was announced. It was before we met that I first read her White Paper. It is her work that drew me to Rideshare Drivers United. When I met her a year later at Hastings College, she helped myself and about fifty other drivers embark on our Wage Claim Campaign. This eventually would result in over 5,000 drivers in California filing wage claims.

As we wait for the Labor Commission and now the Attorney General to resolve our case, Dr. Veena Dubal's White Paper is still as relevant as ever. Taxi drivers have been faced with bankruptcy and foreclosure without the safety nets described and no thanks to the global pandemic. Drivers still express concerns as to whether big unions can effectively represent and defend them. They wonder if their best interests will ever be negotiated. It seems that the companies, Uber and Lyft, have only been willing to negotiate a living wage for drivers if they agree to remain independent contractors indefinitely, as we've seen in Washington State.

Regardless, Uber and Lyft still control every aspect of the work. So-called independent contractors across these Technology Network Companies (TNCs) have little to no access to information about the 'contracts' they commit to. Drivers typically don't know where a ride will take them until the customer is sitting in their car. Should a driver wish to cancel based on undesirable terms, they're likely to suffer an awkward confrontation at the very least. Not only that, they face threats of deactivation if they don't achieve high 'acceptance rates'. So it seems Uber and Lyft drivers don't have much independence at all. They are forced to work during peak hours (late at night and during the wee hours of the morning) and during holidays for any chance at survival, given that there is no compensation for idle time.

Until the constitutionality of Prop 22 is determined at the state level, drivers continue to be faced with more and more pay cuts with no protections. Drivers continue to die at the wheel leaving families penniless without the benefit of Worker's Compensation. They are frivolously deactivated, often on the whim of a disgruntled passenger who may make false accusations when required to wear a mask. Drivers can't afford to properly maintain their vehicles saddled with fronting the expense of billionaires' fleet. Additionally, the state of California continues to be robbed of payroll taxes and unemployment insurance. Uber and Lyft continue to capitalize on the lack of regulation in TNCs, which continues to threaten the safety and livelihood of the general public.

0 notes

Text

From car enthusiasts, an elegy for Pontiac

Pontiac's GTO was arguably the original muscle car. The car quickly became an icon.

By Michael Pollick

Published: Tuesday, April 28, 2009 at 1:00 a.m.

The Pontiac division of General Motors -- whose GTO was so famous that it became a classic song of the '60s -- will bite the dust, the victim of the automaker's need to reinvent itself and stave off bankruptcy.

For American car fanciers, GM's announcement Monday felt more like a wake than a strategy question.

"You hate to see a long-term brand like that just go away into nothingness," said Martin Godbey, owner of Vintage Motors of Sarasota and director of the Sarasota Classic Car Museum. "It's a huge manufacturing concern that inspires nostalgia with a lot of people, and it is gone."

Then-GM designer John DeLorean immortalized the brand in 1964 with the creation of the Pontiac GTO. A few arguments from Mustang fanciers aside, the GTO was the original muscle car, Godbey said.

DeLorean "took a Pontiac Tempest, a mid-sized two-door production car, and he dropped a big motor in it, put cool wheels on it, a four-speed transmission and hood scoops, and you've got an instant muscle car."

That same year, a rock-and-roll group called Ronny & The Daytonas enshrined the car in a hit song called "G.T.O."

Godbey has two GTO convertibles for sale, including a black beauty with three deuces, a four speed and a 389 (a big V-8 engine). The price tag for this car, with 53,000 original miles, is $69,000.

What about noncollectible Pontiacs? Will prices plummet?

"It is not going to be as dramatic as one would think," said Jesse Toprak, executive director of industry analysis for the auto Web site Edmunds.com. "The reason is that the values for domestic vehicles have suffered so much in recent months that we have probably reached a minimum threshold."

Warranties are not a problem for Pontiac buyers because the government has already promised to back the manufacturer's warranty. Parts should not be a big deal either, a GM spokesman said.

"I would not be worried about that," said Tom Henderson of the GM Services and Parts Operation. "We keep parts on hand typically for seven to eight years after the cessation of vehicle production."

GM's press release indicates that 2010 will be the last model year for Pontiac. "I think it is going to be a very smart idea to consider purchasing a Pontiac this year. You're going to get a lot of car for the money," Toprak said.

For the last few years, GM has been pushing dealers toward consolidating so that they typically offer Buick, Pontiac cars and GMC trucks from one store. There are only a handful of stand-alone Pontiac dealerships left, said attorney Michael Charapp of McLean, Va., who has about 300 car dealers as clients.

In Southwest Florida, for example, most of the economic ramifications from the demise of Pontiac already have occurred, except for the write-off of the marquee by businessmen such as Robert Geyer, president of Sunset Automotive Group. In 2006, Sunset bought the Stinnett Pontiac car dealership, which had been a Sarasota fixture since 1944. In February, Sunset acquired the Carl Black GMC franchise and moved it into its Sunset-Chevrolet-Buick-Pontiac operation at 1800 Bay Road in Sarasota.

Calls to dealership managers in Sarasota, Bradenton, and Punta Gorda were not returned Monday. That might be because the dealers do not really know what to say yet.

A manager at Arcadia Chevrolet-Geo-Buick-Oldsmobile-Pontiac said Pontiac dealers will not know exactly what is going to happen and in what sequence until GM holds an internal get-together via the Internet, expected soon.

One of the biggest concerns facing some of the dealers is survivability of the Buick-GMC combination without Pontiac, Toprak said. That is because Pontiacs provided the most affordable cars in that trio of brands.

"You are left with Buick and GMC, and those two brands are not having the best time these days," Toprak said. "The consumers who do buy a domestic car are going for a cheaper car,

which Buick does not have, and the consumers going for an SUV are going for the car-based SUVs, or crossovers, like the Ford Escape, which GMC does not have much of."

Toprak said that if he were on a GM task force, he would cut all brands except Chevrolet cars and trucks, plus Cadillac and Buick cars.

In addition to selling the Saturn and Hummer brands, already under discussion, that would mean dropping the GMC truck and SUV line, Toprak said. "There is very little difference between Chevy and GMC SUVs and trucks."

The resulting lean, mean lineup would make GM more like Toyota, which offers only three brands: Toyota, Lexus and Scion. Toyota has only 1,200 U.S. dealerships compared with 6,000 for GM.

For the U.S. automaker, "prices go down because there are way too many dealerships for the same brand in one area," Toprak said. He said he would keep Buick because it is an extremely strong brand outside the United States.

"In China, it is a real status symbol to own a Buick."

In the meantime, for car dealership owners, there is a need for emotional as well as financial healing.

"We've been talking to all our GM and Chrysler dealers for several months now about the need to be as lean as possible to make it through whatever restructuring takes place," said Charapp, the dealer attorney. "These days I am a business psychologist as much as I am a lawyer. These people have poured their lives into these dealerships."

#pontiac#trans am#american muscle#firebird#muscle car#gto#american classic#vintage car#the judge#cars

8 notes

·

View notes

Text

helloooo , it’s bøffy again with bby #2 , who is . . . arguably much more established , so i’ll apologize for the length of this before we even begin ! with that out of the way , feel free to give this a “like” if you’d be interested in plotting , and i’ll msg you via tumblr or discord as soon as possible !

stats.

name: valencia montero méndez .

nickname(s): val .

social media username(s): valmont .

age: twenty .

gender identity: cis female .

pronouns: she/her .

sexuality: pansexual .

birthday: 27 december 1999 .

zodiac sign: capricorn .

myer-briggs: estp .

place of birth: madrid, spain .

height: 168 cm (5’6”) .

house: quinby .

major: business .

year: sophomore .

labels: the philophobic, the spitfire, the impecunious, the loose cannon, the firebrand .

positive: adventurous, coquettish, loyal, self-reliant, valiant .

neutral: blunt, furtive, introspective, pragmatic, skeptical .

negative: avaricious, cynical, irreverent, mischievous, reckless .

pinterest: https://www.pinterest.com/sundcynights/roleplay-boolies/valencia-montero/

aesthetic.

jet black faux leather jackets, tears of frustration, no-strings-attached hookups to distract from chronic loneliness, showcasing crimson manicures by extending one’s middle finger, becoming anti-love, numbing one’s pain with bad habits, lace-up combat boots, egotistical attitudes concealing low self-esteem, rebelling against authority, collections of sentimental photos, looks that could kill, midnight adventures, snapping photos to preserve memories, maroon-tinted lips and heavy eyeliner, holding grudges, impulsively cutting one’s own hair, showing unspoken affection through actions, insults diluted with sarcasm, 2 am drunken confessions, self-sabotaging one’s relationships, a bouquet of dead roses stored in an empty vodka bottle, firmly believing that rules were made to be broken .

biography.

TW: brief mentions of or allusions to death, grief, drugs, alcohol, panic disorder, and anxiety .

【𝔴𝔥𝔢𝔯𝔢 𝔰𝔥𝔢 𝔠𝔬𝔪𝔢𝔰 𝔣𝔯𝔬𝔪, 𝔱𝔥𝔢𝔯𝔢'𝔰 𝔫𝔬 𝔰𝔞𝔳𝔦𝔬𝔯𝔰】

valencia montero was born on the 27th of december of 1999 in madrid, spain . with no older siblings to act as babysitters, she relished in the luxury of growing up an only child; nearly everyday was a “bring your child to work” event as she darted between the shelves of her father’s business: a small convenience store . with the family’s income boosted by her mother’s career as an attorney, it was a given that valencia would be supplied with whatever her heart desired . ultimately, she grew up with no need to differentiate between needs and wants .

while some parents wrote heartfelt notes on the napkins that they packed in their child’s lunchbox, valencia’s mother spoke to her daughter via copies of her favorite motivational poems . undoubtedly, her mother’s contagious passion for art easily spread to valencia . at the mere age of 4, her mother enrolled her in ballet classes, hoping to live vicariously through her as she was handed opportunities her self-made mother had only dreamed of . regardless of her mother’s selfish intentions, valencia fell in love with the art of dance, using it to express her joy and pain through much of her childhood .

shortly after valencia’s 13th birthday, tragedy would strike their household . her mother would become the casualty of a hit-and-run car accident . for days, valencia refused to leave her mother’s side, providing nearly round-the-clock care and attention until her mother was taken off life support . ultimately, she was hardly given time to grieve before she was expected to fill the gaping hole her mother left within the household by performing a juggling act in which she futilely attempted to balance the responsibilities of school with helping her father upkeep both his business and their home .

【𝔣𝔞𝔠𝔢 𝔩𝔦𝔨𝔢 𝔞𝔫 𝔞𝔫𝔤𝔢𝔩 𝔟𝔲𝔱 𝔰𝔥𝔢'𝔰 𝔣𝔞𝔯 𝔣𝔯𝔬𝔪 𝔱𝔥𝔞𝔱】

the remainder of secondary school passed by in a blur for valencia . she left the emotional outlet of dance behind, the memories of her mother all too fresh with each performance . thus, peer pressure and a general discontentment with her life left her resorting to alcohol or drugs to temporarily ease her emotional pain . unwilling to face her father in such conditions, she would avoid going home for days, crashing upon the couches of friends for multiple nights in a row . unable to maintain his gradually failing business by himself, her father had no choice but to close the small corner store and file bankruptcy .

the way of living that valencia had grown accustomed to throughout her childhood was seemingly uprooted overnight . with the two of them now relying on her father’s measly unemployment benefits to scrape by, lavish living was no longer an acceptable option. purchases were made on a need-by-need basis . valencia took a rapid tumble down the social ladder . it was impossible to maintain friendships based upon popularity and social status when she no longer had access to the financial means necessary to arrive at school in the trendiest outfits or with the newest iPhone .

as valencia observed the life of the wealthy elites from the sidelines, a small bug named jealousy bit her, injecting her with a resentful longing for their popularity, their material possessions, their mere comfort in life . thus, when the family’s pro bono attorney was finally able to reach a settlement (albeit, a disappointing one) regarding her mother’s death, valencia packed her bags to attend university in claremont, california . she saw an opportunity to reinvent herself in a different country, where nobody was aware of her background . she saw a flicker of hope that she could climb the social ladder yet again .

she arrived to the university as a slightly worse version of her old self . she was very materialistic and high maintenance, continuously expecting the best and nothing less out of herself and everyone else . she would only be seen in seemingly “designer” clothing and accessories, even if they were made of faux leather or were blatant knock-offs . she continuously sought to surround herself with friends of wealth, prestige, or fame . she had a role to play, and even if it was exhausting, she did everything in her power to showcase the image of herself that she wanted others to see .

ultimately, valencia’s one honest portrayal of herself in university was her academic plan . she declared a major in business with a minor in english . although it wasn’t uncommon to see her in class intoxicated by the effects of alcohol or drugs, she was making a genuine effort to graduate with a decent gpa . after feeling guilty and partly to blame over the loss of the family’s business, she entered university with the plan of someday opening up her own corporation, ensuring that she’d have the resources to take care of herself and her family without struggling .

personality.

unsurprisingly, largely surrounding herself with the wealthy while she’s tirelessly living as a double agent, desperately attempting to live amongst them while secretly attempting to stay afloat financially, has done nothing to tame her snappish attitude . ultimately, she’s prone to irritability, and exhaustion only exacerbates it . she lets small, insignificant inconveniences pile up until suddenly, she explodes, and whoever happens to be around at that moment becomes collateral damage .

she’s not one to back down from an argument or fight . she will stand her ground until her opponent merely gives up or walks away . always has an offensive remark at the tip of her tongue, and she typically can identify the telltale signs that she’s getting under someone’s skin . similarly, she’s prone to tears of frustration and/or anger . she will 100% shout at someone with tears falling from her eyes . embarrassing? yes, 100%, but not as much as forfeiting a conflict .

“'cause i feel like i’m the worst, so i always act like i’m the best” could describe her entire personality, honestly . she can occasionally have an aura of haughtiness and pompousness, but it’s mostly a self-defense mechanism to avoid actually having to confront her low self-esteem . ultimately, she’s continuously feeling as if she’s screwing things up and disappointing those around her, which leads to those lingering self-doubts concerning if anyone truly wants her around and truly loves and/or cares about her . despite the cold exterior, she’s actually a softie ? she just wants to feel loved and cared for .

she has a tendency to become absolutely panicked if she’s forced to acknowledge her insecurities . she has built up a whole wall of potential defense mechanisms solely to avoid having to cope with her problems – drugs, alcohol, sex, whatever . if someone blatantly makes note of her insecurities, she’ll be subjected to that heart-pounding, lump-of-anxiety in her throat, dizzying and exhausting sensation of just … pure and utter panic .

she doesn’t really express affection through straight-forward statements . frankly, hell will probably freeze over before you hear her speak the words, “i love you,” platonically or romantically . however, she does show affection in her own unique ways . directing playfully sarcastic quips towards someone, reassuringly squeezing someone’s hand, ensuring that someone gets home safely . ultimately, she’s an “actions speak louder than words,” type person, so if she cares about someone, she won’t waste meaningless words on them; she’ll prove it .

headcanons.

she drives a used 2007 toyota camry solara (claims it “has character”) . sleek red exterior, black interior, and a convertible top ? completely matches her aesthetic . furthermore, she’s the type of impulsive, reckless person you’d expect to drive like a speed demon, but she’s surprisingly cautious behind the wheel . that, along with a mild case of road rage, stems from the anxiety of not being completely in control of every situation occurring on the road . catch her cursing someone out every time she gets cut off and has to slam on her brakes .

red and black are her signature colors . every piece of clothing in her closet, every eyeshadow palette or lipstick tube in her cosmetics’ bag – it’s all red and black . her current style paints a stark contrast against her style choices growing up . catch her wearing every color in the rainbow in those old, sentimental childhood photos she keeps laying around .

she’s not a professional photographer by any means, and doesn’t even own a legit camera . however, she’s continuously reaching for her cellphone to snap photos, and always having to delete old photos to clear space for new ones . ultimately, she became a bit obsessed with preserving memories after losing her mother . so, her close friends can expect a minimum of one selfie or unexpected candid photo per visit . she has a box filled with nothing but photos and sentimental mementos at this point .

she speaks both english and spanish fluently . however, in the united states, she only uses spanish if she’s speaking to another native spanish-speaker, if there’s not a direct english translation for a word, or if she’s speaking too fast for her mind to truly catch up with what she’s saying . thus, unless one is a native spanish speaker, they’ll probably only hear her speak spanish when she’s angry .

her bad habits are definitely fueled by her bad moods . she’s definitely the type to attempt to drink her feelings away, end up feeling even worse, and send a plethora of embarrassing 2 am texts that she’ll probably have to give lackluster explanations for in the morning . similarly, she’ll attempt to combat loneliness with meaningless hook-ups . overall, she has no healthy responses to complex or negative feelings whatsoever .

wanted connections.

these are mostly . . . ideas that i thought of within like, 20 minutes ? so definitely not a comprehensive list or even a well-composed list ; it’s mostly just a few ideas to get us started ! that being said , i am very open when it comes to plots , so please feel free to approach me with any ideas you have as well ! ( also , just a side note , all of these are open to any muse (f/m/nb) !

give me those negative relationships ! ex: enemies , exes , a “will they , won’t they ?” that turned into a “definitely won’t” because one of them did something ridiculous . just . . . please, this girl is vindictive and petty and 100% will drag someone’s name through the dirt if she feels they’ve wronged her . also . . . flip the tables, give me friendships and relationships that she’s screwed up so now there’s just . . . anger on all sides ?

give me those platonic relationships ! ex: unlikely friends , someone who . . . tries . . . to be a good influence , some who she’s a bad influence on , old friends who grew apart for whatever reason , solely party friends . honestly ? she’s a loyal friend , but a frustrating & hard to handle friend . someone can give her the best advice and she’d still push it aside to do what she wants to do . probably comes up with wild plans and ideas that most people would raise their brow and ask “wtf?” in response to , but y’know , she can be persuasive . would and most likely has gotten into a fight or heated argument defending any of her friends in need .

give me those other miscellaneous relationships that we’re all in love with ! ex: flirtationships , friends with benefits , past hook-ups , unrequited crushes (on either side ! ) probably the closest things she’ll get to like a . . . real , committed relationship at this point in her life , but y’know , it’s cool , she’s got plenty of time ! give me those unrequited feelings that she’s totally oblivious to (or just takes advantage of & just . . . “unintentionally” complicates their whole life), those unrequited feelings on her part that just . . . give her a whirlwind of emotions that she ? has ? no ? idea ? how ? to ? deal ? with ? . similarly , give me those hookups & such that she just . . . calls up whenever she needs a distraction from whatever she’s feeling !

#hollis:intro#tw: death#tw: grief#tw: drugs#tw: alcohol#tw: panic disorder#tw: anxiety#i know this is a lot of triggers bt most of these topics are only hinted at or alluded to#that being said#if any of these topics trigger you feel free to message me for a brief description in which they are avoided altogether !

5 notes

·

View notes

Text

Learn how to qualify for a Chapter 13 bankruptcy and regain control of your financial future. Discover the eligibility requirements, benefits, and steps to secure a fresh start through debt reorganization.

#Chapter 7 Bankruptcy In Wheeling#Wheeling Creditor Harassment Attorney#Wheeling Chapter 13 Bankruptcy Attorney#Wheeling Chapter 13 Bankruptcy Lawyer#Wheeling Chapter 7 Bankruptcy Attorneys#Wheeling Chapter 7 Bankruptcy Lawyers#Chapter 7 Bankruptcy Attorneys In Wheeling#Wheeling Bankruptcy Attorney#Wheeling Debt Litigation Attorney#Bankruptcy Law Firm In Wheeling#Wheeling Bankruptcy Lawyers#Bankruptcy Attorney In Wheeling#Wheeling West Virginia Foreclosure Defense Lawyer

0 notes

Text

Quick Property Sale - Discovering Simple Avenues

Suddenly found the home of your favorite luxury? Can't watch for anything? You don't should. If you'd like to sell your current home to obtain enough cash to obtain the new one then ones problems evidently be to solve. But nowadays it takes some time sell building. So here comes short term bridging loan as your friend that may you spend money on your dream house.

Towards no more the game when players can't manage to pay rents on the properties may stay at, the banker will also handles personal bankruptcy. If you flip over the deed to your Monopoly property the mortgage price is listed on the rear of the business card. Just pay the down on his luck player industry price therefore they can pay their rent.

In current times, are generally three basic various industry companies quit help you out in quick property retailing. You can always locate some companies hosted. A good and dependable real estate company acts as the middleman between you and the future potential buyer. In most cases, the company commonly has buyers at your disposal. Sometimes, the company can purchase the property of especially when you want funds very snappy.

What fits your budget and the way of life. Owning a home comes having a lot of manual labor, whereas most rentals are "all inclusive." Lifestyle aside, are you able to afford paying $xxx.xx more every month for a mortgage versus leasing? Ultimately, your decision needs to look at into account what a person realistically afford without developing a negative result on your model.

Secondly, it is bring your finances under control as early as credible. This will have huge impact on a New Landed Property Singapore credit repair. Once the wheel of credit repair starts moving, you will find it simple to keep the financial way of life without any issue.

Mom appeared to be losing her memory, but she still had her super-powers. She convinced the old codger who still had his driver's license and who fell under her spell, to take her on your ride in her fastback Mustang, a ride right for you to her house which we happened to be dismantling is actually. She looked like she was for you to explode, but luckily I a handsome friend helping me in those days and she fell under his spell for several hours, and we sent Mister. Mustang packing while we did liquids.

When the boom ended, things became incredibly ugly for credit institutes with amazing speed. One of several most important favors that real estate speculators did for banking institutions when they bought a foreclosed properly was that in accessory for paying the obscene penalty fees they will also paid released as obscene attorney foreclosure fees. Not to mention repairing the often seriously vandalized property. An angry homeowner can easily do $20,000-$30,000 in causes damage to. When the boom ended every one of these expenses landed on credit institutes head as getting falling safe. The banks never knew what hit the company. I am sure that they still are convinced they were run over by a Mack 18 wheel truck.

1 note

·

View note

Text

The ‘follow-up appointment’

https://wapo.st/2z4uWXR

The ‘follow-up appointment’

'For many people in medical debt, it leads to a courtroom' (THIS SHOULDN'T BE HAPPENING IN AMERICA)

By Eli Saslow | Published August 17 at 5:41 PM ET | Washington Post | Posted August 18, 2019 9:18 AM ET |

POPLAR BLUFF, Mo. — The people being sued arrived at the courthouse carrying their hospital bills, and they followed signs upstairs to a small courtroom labeled “Debt and Collections.” A 68-year-old wheeled her portable oxygen tank toward the first row. A nurse’s aide came in wearing scrubs after working a night shift. A teenager with an injured leg stood near the back wall and leaned against crutches.

By 9 a.m., more than two-dozen people were crowded into the room for what has become the busiest legal docket in rural Butler County.

“Lots of medical cases again today,” the judge said, and then he called court into session for another weekly fight between a hospital and its patients, which neither side appears to be winning.

So far this year, Poplar Bluff Regional Medical Center has filed more than 1,100 lawsuits for unpaid bills in a rural corner of Southeast Missouri, where emergency medical care has become a standoff between hospitals and patients who are both going broke. Unpaid medical bills are the leading cause of personal debt and bankruptcy in the United States according to credit reports, and what’s happening in rural areas such as Butler County is a main reason why. Patients who visit rural emergency rooms in record numbers are defaulting on their bills at higher rates than ever before. Meanwhile, many of the nation’s 2,000 rural hospitals have begun to buckle under bad debt, with more than 100 closing in the past decade and hundreds more on the brink of insolvency as they fight to squeeze whatever money they’re owed from patients who don’t have it.

The result each week in Poplar Bluff, a town of 17,000, has become so routine that some people here derisively refer to it as the “follow-up appointment” — 19 lawsuits for unpaid hospital bills scheduled on this particular Wednesday, 34 more the following week, 22 the week after that. Case after case, a hospital that helps sustain its rural community is now also collecting payments that are bankrupting hundreds of its residents.

“Think of me as the referee,” the judge explained, as he called the first case. “It’s my job to be fair. I’m not going to be chugging for either side.”

On one side of the courtroom was a young lawyer representing the hospital, and he carried 19 case files that totaled more than $55,000 in money owed to Poplar Bluff Regional. Three nearby hospitals in Southeast Missouri had already closed for financial reasons in the past few years, leaving Poplar Bluff Regional as the last full-service hospital to care for five rural counties, treating more than 50,000 patients each year. It never turned away patients who needed emergency care, regardless of their ability to pay, and some people without insurance were offered free or discounted treatment. In the past few years, the hospitals’ total cost of uncompensated care had risen from about $60 million to $84 million. Its ownership company Community Health Systems, a struggling conglomerate of more than 100 rural and suburban hospitals, had begun selling off facilities as its stock price tanked from $50 per share in 2015 to less than $3 as the lawyer approached the judge to discuss the first case.

“We’re seeking fair payment for services we’ve provided. Nothing else,” he said.

Behind him in the courtroom were some of Poplar Bluff Regional’s patients — a population that was on average sicker, older, poorer and underinsured compared with the rest of the United States. More than 35 percent of people in Butler County have unpaid medical debt on their credit report, about double the national rate. Most of the 19 people on the morning docket had been treated in the emergency room and then failed to pay their bill for more than 60 days before receiving a summons to court. Many of them had insurance but still owed their co-pay or deductibles, which have tripled on average in the past decade across the United States. One patient owed more than $12,000 after being treated for a heart attack. Another was being sued for $286. If the hospital won a judgment, it had the right to garnish money from a patient’s paycheck or bank account or it could put a lien against a house.

“I’m hoping to negotiate a payment plan, but I can only afford $20 a month,” one patient told the court.

“I’m late for work, so if there’s someplace I can sign, I guess I’ll just sign,” said another patient, who owed more than $3,000 after spending six hours in the emergency room for chest pain.

“How am I supposed to pay $4,000 to see a doctor if I’m barely making $2,000 a month?” asked another.

One by one the patients came up to plead their cases until the judge called Gail Dudley, 31, who was sitting with her mother in the third row. She had gone to the emergency room at Poplar Bluff Regional in 2017 after passing out because of complications from Type 1 diabetes. The hospital had given her medication to stabilize her blood sugar, kept her overnight for observation, and then sent her home with a bill for $8,342, of which she was still responsible for about $3,000 after insurance. She’d tried to appease the hospital’s billing department by sending in an occasional check for $50, but with accumulating interest and penalty fees, the balance on her account had remained essentially the same for two years.

“I’m grateful for what they did for me, and I know I owe it, but I don’t have that kind of money,” she said.

The judge gestured in the direction of the hospital’s attorney and then looked at Dudley. “Would you like a chance to talk to this gentleman for a moment and see if you two can work something out?”

“Okay,” she said. “We might as well try.”

Matthew McCormick, 27, led Dudley into the hallway to begin the same negotiation he’d been having with dozens of hospital patients each week. On Thursdays he was listed as a hospital attorney for the court docket in Doniphan, population 1,997. Mondays it was Kirksville, Tuesdays were Bloomfield, and Wednesdays often brought him here, to a 95-year-old courthouse in Butler County, where he’d represented Poplar Bluff Regional on more than 450 billing cases so far in 2019.

“We’d like to find a way to work with you on this,” he told Dudley as they sat down together in the courtroom lobby. He reached out to shake her hand. He smiled and offered his business card. For the past year, he’d been working on behalf of the hospital as the newest attorney for a law firm called Faber and Brand, which promised to “use the judicial system to recover money owed.” McCormick’s cases hardly ever went to trial. More than 90 percent of the people being sued weren’t represented by an attorney and at least half failed to show up in court, resulting in default judgments in the hospital’s favor. The rest of the patients McCormick met came into court with little to offer in their own defense except for apologies and stories of poverty, poor health, unemployment and bad luck.

“I’m real sorry about this,” Dudley said. “If I’d been thinking straight, I would never have let them take me to the emergency room. I know I can’t afford that. I wish I could pay you all of it right now.”

“Let’s make this as easy as we can,” he told her. “Is there something you can pay? A little each month?”

“I don’t have anything extra,” she said, thinking about the paycheck she earned for a full-time job as a clerk at Goodwill, which totaled $736 every two weeks. After paying for rent and utilities on a subsidized three-bedroom apartment, groceries, and child care for her 6-year-old son and 3-year-old daughter, she sometimes ran out of money by the end of the month.

“How about $15 out of every paycheck?” she offered, even though she doubted she could afford it. When McCormick didn’t immediately respond, she revised her offer. “Thirty? How’s that?”

“Let’s say thirty,” McCormick said.

He had more patients waiting to negotiate, so he thanked Dudley and led her back into the courtroom to sign her judgment. It said she had agreed to a total claim of $3,021, plus $115 in court costs and 9 percent annual interest. She would send the hospital $60 each month until the balance was paid in full, and if she failed to make a payment the hospital could pursue garnishment of her wages.

“I’m glad you worked something out,” the judge said as he signed off on the agreement.

The court clerk handed Dudley a copy of the judgment, and once she was back outside the courtroom she took out her phone to run the math. If everything went right, and she somehow managed to save and pay $60 each month, she’d be sending checks to Poplar Bluff Regional for the next 5½ years.

In order to make 66 monthly payments, she had to somehow come up with the first, but her bank account was almost empty and payday was still a week away. Dudley left the courthouse, got into the car with her mother, then changed into a polo shirt for work. They drove away from the cobblestone streets of downtown and headed toward Goodwill.

“Could’ve been worse,” said her mother, Norma Garcia, 48. “Sixty isn’t so terrible.”

“It is if you don’t have it,” Dudley said. “Who do you know that’s sitting on an extra sixty each month?”

They drove past a dollar store, a payday lender and a fast-food restaurant advertising “full-time career opportunities” starting at $7.80 an hour.

“Maybe you can borrow it?” Garcia suggested.

“I don’t do credit cards or lenders,” Dudley said. “That’d just be another debt I couldn’t pay.”

“I meant from somebody.”

“Who?” Dudley asked. “Everyone we know is paying the hospital already.”

Their family had lived for three generations in Poplar Bluff’s predominantly black neighborhood just north of downtown, where according to credit records more than half of adults had debt in collections for unpaid auto loans, credit cards or medical bills. Dudley’s aunt had been sued twice by Poplar Bluff Regional and was forfeiting 15 percent of her paycheck to a court-ordered hospital garnishment. Her cousin was being sued for $1,200. Her sister owed $280.

But none of them had cycled through the emergency room as often as Dudley during the past several years. Her two pregnancies had complicated her diabetes, and she’d tried to save money by skimping on insulin. Instead of paying $50 every few months for a preventive medication, she had collapsed at work and been rushed to the emergency room, where she was sent home with thousands of dollars in now-unpaid bills. Poplar Bluff Regional was an ambitious rural hospital — a $173 million facility with a cancer center, a cardiac center, dozens of specialists and state-of-the-art surgical suites — and Dudley believed she was alive because of it. But during the past five years, the average amount that rural patients owed for hospital visits nationwide had doubled, and Dudley was earning $11 an hour at Goodwill as new hospital bills kept arriving in her mailbox.

She owed a $100 co-pay from another hospital visit in November 2018 that had already been sent to collections.

She owed $485 from another trip to the ER in April.

She owed $159 for lab tests, $85 for a doctor’s visit and now $60 for her first court-mandated payment, which was due at the end of the month.

“I’m trying to make peace with the fact that this debt could sit on me forever,” she said.

“Maybe I can help,” Garcia offered, even though she was on disability and avoiding her own billing notices from the hospital, seeking $365 in unpaid deductibles.

“It’s my bill to pay,” Dudley said. She’d been saving a little money for back-to-school supplies, and she said it was enough for her first month’s payment. “I’ll handle it,” she said. “There’s no other choice.”

There was one person in town who did believe patients had another choice, and over the past several years Daniel Moore had begun encouraging his clients to make it.

“Don’t pay one cent,” the lawyer had advised dozens of clients. “I don’t care how much the hospital says you owe. Fight them over it.”

Moore had been working for almost five decades as a self-described “old hillbilly lawyer” out of a converted house downtown. He specialized in criminal defense, with more than 400 cases pending all over the state, and he liked to align himself with the underdog. He’d been unable to afford a doctor himself while growing up on a farm with no running water, so when clients began coming to his office with bills from Poplar Bluff Regional that they could neither pay nor understand, he had agreed to take a look.

What Moore found in some of those itemized receipts didn’t make sense to him either: $75 for a surgical mask; $11.10 for each cleaning wipe; $23.62 for two standard ibuprofen pills; $592 for a strep throat culture; $838 for a pregnancy test. He searched through court records and discovered that the hospital was collecting hundreds of monthly garnishments from hourly employees at places like Quickstop, Earl’s Diner, Wendy’s, Instant Pawn and Alan’s Muffler.

He decided to represent several hospital patients free, and went to court against the hospital for a jury trial for the first time late in 2015. Moore’s client was a Poplar Bluff police officer with decent insurance, an Army veteran who went to the emergency room one afternoon because of chronic stomach problems. He’d been given a battery of tests in the ER, then treated with three IV medications before being discharged after three hours with a bill for $6,373. His insurance had paid some, but the hospital was suing him for co-pays totaling about $1,650, plus interest.

“The facts show that he came to the hospital and received treatment that alleviated his symptoms,” the hospital’s lawyer at the time told the jury. “He received three separate bills. He just didn’t pay the balance.”

“These charges are outrageous,” Moore told the jury. “He doesn’t owe the hospital anything.”

A billing manager from the hospital took the stand and said Poplar Bluff’s prices were in line with other hospitals in rural Missouri. She mentioned the high cost of providing care at rural hospitals, which must pay higher salaries in order to recruit doctors, nurses and specialists while also suffering more from federal cuts to Medicaid and Medicare compared with urban hospitals.

Moore began to question her about each charge on his client’s itemized receipt. Why, he asked, did it cost $800 to spend approximately 40 seconds with a doctor? Why was the hospital charging $211 for an oxygen sensor that was on sale for $16 at Walmart? Then Moore asked about three identical charges on the bill labeled “IV Push,” which each cost $365.

“An IV push, if I understand it, that’s the act of sticking the needle in that little port and then squeezing it,” Moore said. “Is that right?”

“Yes,” the billing manager said.

“So that takes maybe five seconds, right?”

“Yes.”

“So you, the hospital, think that act alone, not counting the drugs inside the IV, which cost thousands of dollars more — that act alone is worth $365.38?”

“Yes,” she said again.

“It makes me so mad,” Moore told the jury, in his closing argument. “If you’re content to let the hospital just crush people, then go on and give them their measly $1,650. But what you can do today is say, ‘Hey, we’re tired of this.’ How many times are we going to let working people take the shaft?”

“In reality, this is a simple bill,” the hospital’s lawyer countered. “All we’re asking for is his co-pay and his deductible. The hospital provided treatment. He still owes.”

The jury deliberated for less than an hour and then found in favor of Moore’s client, wiping away his hospital debts. But whatever sense of victory Moore felt was mitigated over the next months as Poplar Bluff Regional’s lawsuits continued to spread across the civil courts of Southeast Missouri, and he agreed to take on more free cases. “The hospital circuit,” Moore called it, which meant Mondays in Caruthersville, Tuesdays in West Plains and Wednesdays in Poplar Bluff.

On Thursdays it was Doniphan, a town of fewer than 2,000 people, where Poplar Bluff Regional had filed more than 300 lawsuits during the past several years. Moore drove past horse farms and timber plants, parking near an abandoned hospital. Ripley County Memorial had closed six months earlier, and there were locks on the doors and a sign taped above the ambulance bay.

“For Nearest Emergency Services, go 29 miles to Poplar Bluff Regional,” it said, and now several of those Poplar Bluff patients had been summoned right back to downtown Doniphan, to a red brick courthouse at the center of the town square.

They crowded next to each other on a wooden bench in the lobby, waving their hospital bills as fans against the late July heat while they waited for the courtroom to open and then entered one by one: a husband and wife who went for cancer treatments at Poplar Bluff Regional each week but couldn’t afford the co-pays. A community college student who owed more than $7,000 for treatment of a chronic heart condition. And then the judge, who had presided over hundreds of hospital cases during his career and also recused himself from one case a few years earlier, when the patient being sued was his wife.

“How are we all doing today?” he asked, as he looked down at a docket with 14 more cases between a hospital ownership company that couldn’t afford to keep losing money and patients who couldn’t afford to pay. Both sides were drowning in debt, fighting to stay above water, and pulling each other back down.

“It’s another full docket,” the judge said. “We might as well get started.”

Eli Saslow is a reporter at The

Washington Post. He won the 2014 Pulitzer Prize for Explanatory Reporting for his year-long series about food stamps in America. He was also a finalist for the Pulitzer Prize in Feature Writing in 2013, 2016 and 2017

#health care reform#public health#reproductive health#mental health#health#healthcare#us news#us politics#u.s. news#u.s. government#president donald trump#trump administration#trumpism#trump scandals#trumpsucks#trump news#president trump#2020 presidential election#2020 candidates#2020 election

7 notes

·

View notes

Text

Trial for Roxby’s Jeffrey J. Morris Delayed Until Early 2024

At the time 27 additional wire fraud and tax evasion charges against Jeffrey J. Morris were filed on September 26, U.S. Attorney William Ihlenfeld revealed the trial would begin in mid-November.

On Wednesday, the federal prosecutor confirmed the prceedings against the former president of Roxby Development was pushed into early 2024 at the request of Morris’s attorney, Brian J. Kornbrath out of Clarksburg, W.Va. Kornbrath is the federal public defender in West Virginia’s Northern District.

Morris, according to the indictments, allegedly received as much $7 million from more than 20 investors – some local and several from out of the area – to renovate the Mount Carmel Monastery, the Scottish Rite Cathedral, and the McLure House Hotel.

“We had set the trial to begin in the middle of November, but his attorney asked for the delay so he had time to review all of the evidence that we’ve presented on the prosecutorial side of this case,” Ihlenfeld explained. “That was granted because of the amount that is involved. With 18 counts of wire fraud and 10 counts of tax evasion, there are a lot of records to review.

The Scottish Rite Cathedral was returned to the Masonry once foreclosure proceedings were completed this summer.

“This case is very intricate, but thankfully we have a lot of terrific investigators in this office and many more with the Internal Revenue Service that are assisting us in this case,” he said. “Could there be more charges? I learned a long time ago that, when you are in this position, never say never. Our investigators will continue researching all of the records we have obtained, and they will continue looking for even more.”

Ihlenfeld, who is serving for the second time as the Northern District’s chief prosecutor, initially charged Morris with a single count of wire fraud on September 8th and announced at that time the federal government filed the charge because his office had received proof the suspect was scheduled to leave the country.

“I cannot say that trip was involved in a plan to flee, but we did feel it was best to gain control of Morris and of his travel plans,” he explained. “But we are familiar with the fact he lived abroad for several years before he returned to the Wheeling area in 2018, and that traveling overseas was not a new thing for him. We wanted to keep him here because, at the time we filed the first charge, we knew more were coming.

“Mr. Morris knew it, too, because he had made contact and spoken with some federal investigators before any of this appeared in the news here in the valley,” Ihlenfeld said. “He is not incarcerated and he is not required to wear an ankle bracelet at this time, but his travel has been restricted to the Northern District of West Virginia and he is required to communicate his need to travel to our office.”

L&L Painting was not paid the $67,000 it billed Roxby Development for the painting of the McLure House Hotel in July 2021.

Made Whole Again?

The federal prosecutor confirmed he’s discovered many victims in the aftermath of the Roxby Development’s rise and fall in the city of Wheeling.

Investors, vendors, and former employees all have filed lawsuits against Morris and Roxby Development in effort to recover the monies owed from their respective agreements with Morris. According to the Chapter 11 bankruptcy paperwork filed by Morris in May, Roxby possesses between $10-$50 million in debt. Not only is there $5.3 million still owed on the downtown Wheeling hotel, but also more than $500,000 on the note for the Scottish Rite, and thousands more to vendors and former employees.

In fact, Morris made local and regional news soon after purchasing the McLure House by painting the hotel white. Roxby, however, failed to pay L&L Painting of Glen Dale $67,000 for the job.

“And that’s just one example that is listed on that paperwork as far as the debts that are still owed,” Ihlenfeld said. “Of course, that Chapter 11 filing was dismissed by the federal bankruptcy judge (David L. Bissett) because of the lack of maintained insurance on those properties.

The U.S. District Court - Northern District - is headquartered in downtown Wheeling.

“Will those investors be able to recover their money? Will the vendors and former employees ever be paid what they are owed? While we have identified some assets, it does not appear there is enough to make everyone whole again in the future,” he explained. “We will continue searching and investigating every piece of information our people discover, and if funds are found, we’ll be happy to make those dollars go to the people who are owed them.”

According to the federal prosecutor, an individual charged with a single count of federal wire fraud could face as many as 20 years in prison with fines not exceeding $250,000. As for the tax evasion charges, those found guilty face up to five years in prison with fines as much as $250,000 per change plus repayment of the overdue taxes.

That means if Morris is found guilty of all charges, technically he would face as many as 410 years in federal prison and $6.5 million in fines.

“Of course, everyone is innocent until proven guilty, so it is impossible to comment on the topic of possible jail time, but the sentence for one count of federal wire fraud is 20 years with a fine of no more than $250,000. That I can confirm,” Ihlenfeld said. “Once the new court date is determined, that information will be released to the public.”

Read the full article

0 notes

Text

Forensic Audit The Investigator Breed of Accountancy Occupations

When you ask people to give you a listing of exciting careers, accounting is never near the top. The Forensic Insurance Investigator bookkeeping profession field often tends to attract the less active folks: steady, analytical kinds who value security above all else. You're essentially there to keep the wheels of company transforming; a plumbing professional guiding the circulation of cash rather than water.

The expanding shape of the international service market as well as the rumors wracking the business globe have actually highlighted the enhancing need for a rare type of accountant; the forensic accountant is either an outside or internal auditor who is brought in to investigate the scene of a fraudulence, bankruptcy, protections rumor, or various other conflicted circumstance as well as prepare a record determining what occurred. Because its outcomes can be utilized in a court of law, it is called a forensic function mostly.

What's the job like?

There are actually lots of circumstances in which a forensic accounting professional could be required: disagreements as well as lawsuits, insurance coverage cases, injury claims, building audits, insurance coverage fraudulence, aristocracy audits, or Wall Street rumors are some of the specialized in this field. Many accountancy companies have a cupboard of forensic bookkeeping professionals. These individuals are sent out in the after-effects of fraud to assess if the numbers in the books mirror truth, as well as otherwise, after that determine what's truly taking place.

A forensic accountant does not have the deluxe of being able to overlook anything that does not occur on a spreadsheet. They have to take the big image right into account, managing the entire reality of the business circumstance. A forensic accountancy treatment will normally consist of investigating as well as evaluating financial proof, utilizing electronic applications to offer the financial evidence, delivering the searchings for in the kind of reports, collecting and displaying records, as well as maybe affirming in court as a skilled witness. In addition to the expertise of bookkeeping, a forensic accountant needs to additionally know with legal ideas and also treatments.

The two sides of forensic accountancy - investigation and also litigation support, break down right into several smaller sized steps:

In the investigation, you may examine the scenario as well as suggest possible strategies, aid with the security and healing of properties, and also work hand-in-hand with private detectives, forensic paper supervisors, and experts. Individuals might exist. The books may be cooked. Maintain your eyes open!

Throughout lawsuits support, you might be in charge of offering the documentation necessary to sustain or shoot down an insurance claim, providing the initial evaluation of the case recognizing locations of loss, aiding with the examination for exploration, examining the testament, reviewing the opposing professional's report, and also help with the negotiation discussions as well as negotiations. Witnesses and attorneys might negate you. You could have to keep digging deeper right into a cover-up. Most of all, you will certainly have to persuade one judge and also twelve jurors that you're the best individual to be testifying about the situation.

By no means are forensic accounting professionals constrained to a workplace or a court. There is a large range of sectors that keep the services of a forensic accounting professional. Matrimonial disagreements, in which a separation case requires mediation to verify the state of disputed assets, is one area you might not expect. Other situations may be exploring insurance claims of organization neglect, or accident insurance claims.

Service economic loss investigations may cover expropriations, product obligation claims, hallmark and patent infringements and losses stemming from a breach of a non-competition arrangement. The expanding technology sector is an example of an expanding requirement for services relating to item obligation claims as well as license infringements. It's easy to show whether a car's problems could result in a crash, however just how would you prove that the pests in a computer system operating system brought about the loss of possessions when the business which used it was hacked? It's simple to show that a rival duplicated your trademarked layout for your camera, however just how exactly do you defend a license on an arrow?

A forensic accountant combines the skills of a record-keeper, paralegal, as well as a detective rolled right into one. To be proficient at it, you need to have a great dose of inquisitiveness, creativity, perseverance, as well as discernment. You'll need sound specialist judgment and also confidence that you understand your job so well that your expertise and explorations will stand up under cross-examination. The business will certainly pass away or live and also defendants might go to prison based upon the job that you do, so you are challenged to be at your ideal. It is one of the most difficult accounting jobs.

1 note

·

View note

Text

Revolutionize Your Car Service With These Easy-peasy Suggestions

youtube

Our skilled assure - to provide you with the most prestigious luxury journey expertise in South East Queensland - guides Anything we do and is the cornerstone of the Limoso brand. Travel from Brisbane to Gold Coast, and more with Limoso! Providing clean and dependable limo hires in Brisbane, Gold Coast, and throughout South East Queensland, we concentrate on providing company transportation, wedding ceremony limousines, formal car hires, private automotive providers, and airport transfers. We additionally present airport transfers to Brisbane, Gold Coast, Surfers Paradise, Main Seaside, Broadbeach, Coolangatta, and more. Lavish prom and formal limos, wedding automobiles, safety driven autos, company and airport transfers in Brisbane are all just some clicks away. All our London phv drivers are extremely skilled and go through vigorous inner high quality checks to make sure we meet and exceed your expectations. Our V.I.P Automobile Rental Service For A Meet & Greet airport transportation service not only gives that additional touch of class, However helps busy executives be a extra productive by a managing their Airport Transportation Effectively. The latest fashions are available from high rental companies so that you can book on-line now. Whether you're travelling on business, attending a particular event or simply wish to get pleasure from driving within the summer with the highest down, select SIXT in your luxury car hire.