#banking and financial institution

Text

Why Cash Flow Analysis is Key to Your Business’s Financial Health

In the fast-paced world of business, profitability is very important, and every company’s financial health depends on a single important aspect: cash flow. Profits may show you a vibrant picture of income exceeding expenses, but they don’t necessarily mean instantly available funds. This is where cash flow analysis steps in. It acts as a powerful tool to understand the lifeblood of your business, i.e., cash.

Read more : https://www.m1nxt.com/why-cash-flow-analysis-is-key-to-your-businesss-financial-health/

#cash flow analysis#financial services near me#banking and financial institution#m1nxt#financial institutions and services

0 notes

Text

According to Federal Deposit Insurance Corporation (FDIC) data, there were 14,417 federally-insured banking institutions in the U.S. in 1985. As of December 31, 2023, the FDIC reports there are only 4,587 remaining. The vast majority of the 9,830 banks that have disappeared since 1985 did not fail – they were merged with other banks.

Today, just four banks control $9.3 trillion in consolidated bank assets or 39 percent of all bank assets. Those four banks are JPMorgan Chase with $3.395 trillion in consolidated assets; Bank of America with $2.540 trillion; Wells Fargo with $1.7 trillion; and Citigroup’s Citibank with $1.685 trillion. (All asset figures are as of December 31, 2023 and come from the Federal Reserve’s statistical release of the largest banks.)

#banks#capitalism#financial institutions#too big to fail#bank of america#Citibank#wells fargo#jp morgan#crisis of legitimacy

10 notes

·

View notes

Text

#SAFE Banking Act#secure banking#banking#cannabis#marijuana#weed#pot#legalization#medical marijuana#mmj#medical cannabis#legalize#senate#finance#financial institution

13 notes

·

View notes

Text

i have a preinterview for a job thats close pays well and im qualified for 😳

#s.txt#and they want financial institution experience omg i literally have that i know what a security is#well actually no i dont i never learned exactly but i DO know its a bank thing so that counts for something. doesnt it.#please hire me i dont want to work with my coworkers anymore they are DOGS

4 notes

·

View notes

Text

The Daily Hodl: Hackers Hit World’s Largest Bank, Forcing Financial Giant to Rely on USB Stick to Settle Trades: Report

Engineers are investigating how hackers managed to crack the New York arm of the Industrial & Commercial Bank of China (ICBC) – a financial institution with $5.74 trillion in total assets.

The hack forced the ICBC to settle trades using a USB stick while forcing banks, brokerages and market makers to reroute trades, reports Bloomberg.

The attack also disrupted the bank’s ability to participate in the Treasury’s bond auction on Thursday.

Investigators believe the ransomware gang Lockbit, which has ties to Russia, is behind the attack.

Without naming names, Bloomberg says banking leaders admit the hack highlights fears that a system-wide attack could one day bring the traditional financial system to a halt.

“The incident spotlights a danger that bank leaders concede keeps them up at night — the prospect of a cyberattack that could someday cripple a key piece of the financial system’s wiring, setting off a cascade of disruptions.”

The ICBC says it’s debating whether to ask for assistance from China’s Ministry of State Security.

The number of ransomware attacks on the financial industry has increased in recent years, according to a report from the cybersecurity firm Sophos.

“The 2023 survey revealed that the rate of ransomware attacks in financial services continues to rise. It went up from 55% in the 2022 report to 64% in this year’s study, which was almost double the 34% reported by the sector in the 2021 report. Although the sector experienced an increased attack rate, it was below the cross-sector average of 66%.”

Sophos says financial institutions are stepping up their efforts to stay secure.

The firm’s survey of 3,000 cybersecurity/IT leaders, including 336 in the financial services sector, found 81% of organizations say their data is encrypted, a 50% rise over the previous year.

#ICBC#Hackers Hit World’s Largest Bank#Forcing Financial Giant to Rely on USB Stick to Settle Trades#bank hacks#cyber security#stolen money#financial institutions#hacks#cybersecurity in america

6 notes

·

View notes

Text

AN OPEN LETTER to THE U.S. CONGRESS

Hold Bank Execs Financially Accountable for Mismanagement! Pass the DEPOSIT Act.

274 so far! Help us get to 500 signers!

I am writing to urge you to pass the Deliver Executive Profits on Seized Institutions to Taxpayers (DEPOSIT) Act that was recently introduced by Sen. Richard Blumenthal and U.S. Reps Adam Schiff (D-CA) and Mike Levin (D-CA).

This important legislation would hold executives at failed banks financially responsible for their mismanagement and prevent them from selling off shares of stock, potentially profiting from their bank failure -- like Silicon Valley Bank CEO Greg Becker might have done when he sold $3.6 million of stock shortly before the collapse of SVB.

American taxpayers shouldn’t be left holding the bag and bailing out banks while their executives are walking away with multi-million dollar compensation and bonus packages. Please respond in writing and let me know you co-sponsored this bill. Thanks!

▶ Created on March 24, 2023 by Jess Craven

📱 Text SIGN PNFKGB to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#AN OPEN LETTER to THE U.S. CONGRESS#Hold Bank Execs Financially Accountable for Mismanagement! Pass the DEPOSIT Act.#274 so far! Help us get to 500 signers!#Deliver Executive Profits on Seized Institutions to Taxpayers (DEPOSIT) Act#Sen. Richard Blumenthal#Adam Schiff#Mike Levin#Silicon Valley Bank#CEO Greg Becker#holding the bag#bailing out#multi-million dollar compensation#bonus packages#▶ Created on March 24 2023 by Jess Craven#📱 Text SIGN PNFKGB to 50409#🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409#JESSCRAVEN101#PNFKGB#resistbot#U.S. Congress#DEPOSIT Act#bank executives#financial accountability#mismanagement#legislation#accountability#taxpayer protection#banking industry#executive responsibility#financial regulation

2 notes

·

View notes

Text

Regulatory Environment of Financial Institutions.

Financial regulations are laws and rules that govern financial institutions. Regulations of financial institutions focus on providing stability to the financial system, fair competition, consumer protection, and prevention and reduction of financial crimes. By the mid-1970s, the global financial system witnessed market-oriented reforms that led to liberalization in the financial system, such as the reduction of interest rate controls, removal of investment restrictions on financial institutions and a line of business restrictions, and control on international capital movements. The modern trend observed is that financial sector regulation is moving toward a greater cross-sector integration of financial supervision. In 1998, the adoption of the Basel Accord, which required international banks to attain an 8% capital adequacy ratio was a major significant milestone in banking regulations. The collapse of the global financial system that led to the global crisis can be attributed to the systemic failure of financial regulation. Basel I defined bank capital and bank capital ratio based on two-tier systems. The Basel II framework consisted of Part 1, the scope of application and three pillars, the first one being minimum capital requirements, the second one a supervisory review process, and the third pillar is market discipline. The Basel III framework prepared new capital and liquidity requirements for banks.

Learn more about Regulatory Environment of Financial Institutions related to the publication - Strategies of Banks and Other Financial Institutions: Theories and Cases.

#Financial regulations#Regulations of financial institutions#financial security#financial industry#financial markets#financial risk management#bank capital ratio#Basel Accord#interest rate controls#international capital movements#banking system#4 december#sustainable development goals#international day of banks

2 notes

·

View notes

Text

do NOT let fresh mothers still on the epidural write a name on the birth certificate. irrevocable damage to all life on earth.

#yes i file taxes/receive financial aid/own a bank account#no every other financial institution in this country cannot find any proof that i've ever been alive#i am the schrödinger's us citizen

5 notes

·

View notes

Text

Top 7 Microfinance Companies in India & their Challenges in 2022-23

These top 7 private lending companies have been around for a while and seem to be going great guns; however, there are a few challenges they are facing as of now.

#nbfc#nbfc registration#microfinance#finance#digital lending#banking#finance companies#financial institutions#economy#2023

2 notes

·

View notes

Text

M1 NXT: Your Cross Border Digital Trade Finance Platform

Experience the future of trade finance with M1 NXT, your go-to platform for Cross Border Digital Trade Finance. As a leading provider of supply chain finance solutions, we offer a seamless, competitive, secure, and paperless online marketplace for trade transactions. Explore our digital marketplace for international factoring products, approved for sandbox testing under regulatory supervision. Join us at https://www.m1nxt.com/m1-nxt/to streamline your trade finance journey and unlock efficiency in your operations.

Visit: https://www.m1nxt.com/m1-nxt/

#m1nxt#supply chain finance#cash flow analysis#financial services#banking and financial institution#Cross Border Digital Trade Finance.

0 notes

Text

Another aspect of the Gaza Genocide that I want to talk about is the complicity of Internet banking and crowdfunding websites like GoFundMe.

I have seen multiple Gazans raise enough money to leave for Egypt, but the banks and the crowdfunding websites freeze their money or cancel their funds for "suspicious activity" or whatever. Every day that passes in Gaza supplies get more scarce, conditions get more deadly, and the price to cross into Egypt gets more expensive. I've seen people, like ghost-90 here on Tumblr, raise the full amount to get their entire family out of Gaza, but their money gets frozen for so long that the original goal is only a fraction of the price now needed to cross the boarder.

These financial institutions should not be allowed to get away with contributing to the death toll in Gaza. They are intentionally keeping people trapped in a kill zone by withholding money that is rightfully theirs.

I'm so pissed and angry that every avenue for relief for Palestinians is being cut of left and right. It is vile that Gazans are being extorted for 10s of thousands of dollars by the Egyptian gov just to save their family's lives, but even when they play by this corrupt game, the world still finds a way to make them suffer.

My heart is with every Palestinian for the rest of time, from river to sea you will all be free. 🇵🇸❤️

28K notes

·

View notes

Text

Palestinian banks could be cut off from the Israeli banking system starting next week following a decision by Israel’s finance minister to cease dealings between the two financial institutions, according to a report on Thursday by Israeli newspaper Haaretz.

Israeli Prime Minister Benjamin Netanyahu has two days to convene a cabinet meeting to discuss reversing plans by Finance Minister Bezalel Smotrich to isolate Palestinian banks from both the Israeli and international banking systems.

The Palestinian economy is based on the Israeli currency, the shekel, making it reliant on ties to Israel and its financial dealings with the rest of the world must go through the Bank of Israel and Israeli banks.

We call this Apartheid.

#yemen#jerusalem#tel aviv#current events#palestine#free palestine#gaza#free gaza#news on gaza#palestine news#news update#war news#war on gaza#apartheid#end the occupation#end the apartheid#economy

26K notes

·

View notes

Text

The Benefits of Diversifying Investments with NBFI Fixed Deposits

In the complex world of investment, diversifying your portfolio is akin to spreading your sails to catch the wind from multiple directions. One often overlooked but highly rewarding option is investing in fixed deposits (FDs) from large corporate houses managed by non-banking financial institutions (NBFIs). This article explores the advantages of such investments and how they can serve as a robust component in your diversified portfolio.

What are Non-Banking Financial Institutions?

Non-banking financial institutions are entities that offer banking services but do not hold a banking license. These institutions are pivotal in providing consumer financial services, including consumer loans, investments, and FDs from large corporate houses. Unlike traditional banks, NBFIs can offer higher interest rates on deposits, making them an attractive option for investors.

Higher Interest Rates

One of the primary benefits of FDs from large corporate houses through NBFIs is the potentially higher interest rates compared to traditional bank FDs. These institutions often provide more competitive rates to attract investors, which can significantly enhance your returns, especially in a low-interest-rate environment. Investing in non-banking financial institutions can yield better profit margins over time.

Diversification Benefits

Diversification is a fundamental investment strategy aimed at reducing risk by allocating investments among various financial instruments, industries, and other categories. By adding FD from large corporate houses managed by NBFIs to your portfolio, you're not only investing in different financial products but also in institutions beyond the usual banking sector. This can help mitigate risks associated with the performance of any one sector or institution.

Enhanced Safety with Non-Banking Financial Institutions

Non-banking financial institutions are subject to regulatory oversight, albeit different from traditional banks. Many investors find FDs from large corporate houses appealing because these entities are often large, well-established, and have a lower risk of default. Additionally, many NBFIs offer insurance on their FDs up to a certain amount, which adds an extra layer of security for your investment.

Flexibility and Accessibility

FDs from large corporate houses through NBFIs often come with more flexible terms than those offered by banks. This includes better rates for shorter-term deposits and more options concerning the frequency of interest payouts. Furthermore, the process of setting up an FD with an NBFI is usually straightforward, making it an accessible option for both seasoned and novice investors.

Supporting the Economy

Investing in non-banking financial institutions not only benefits you but also contributes to the broader economy. NBFIs play a crucial role in providing consumer loan and other financial services to parts of the economy not typically served by traditional banks. By investing in FDs from large corporate houses, you're indirectly supporting economic activities and innovation in various sectors.

Conclusion

In conclusion, diversifying your investment portfolio with FDs from large corporate houses through non-banking financial institutions offers numerous benefits. From higher interest rates and increased safety to helping support the broader economy, these investment vehicles provide a compelling case for inclusion in any well-rounded investment strategy. Whether you're looking to enhance your returns, reduce risk, or support economic growth, NBFIs can provide the tools you need to achieve your financial goals.

Remember, while non-banking financial institutions offer excellent opportunities, it's crucial to conduct thorough research and consider your financial situation and goals before investing. With the right strategy, FDs from large corporate houses can be a valuable addition to your investment portfolio.

0 notes

Text

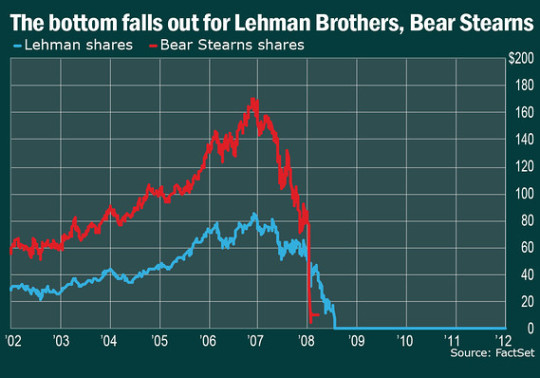

The 2008 Market Crash: Causes, Impacts, and Lessons Learned

l. Introduction

The 2008 market crash stands as one of the most significant financial upheavals in modern history, reshaping economies and livelihoods around the globe. Understanding the causes and impacts of this crisis is crucial for navigating future economic challenges.

ll. Background of the 2008 Market Crash

A. Economic conditions leading up to the crash

Prior to 2008, the United States…

View On WordPress

#2008 financial crisis#2008 market crash#economic impact#financial crisis#financial institutions#financial regulation#financial regulation failures#financial system flexibility#global financial meltdown#global recession#government dole#government intervention#housing market collapse#Lesson learned#Market Crash#Responsible lending practices#Risk Management#role of the central bank#subprime lending#subprime mortgage crisis

0 notes

Text

Scope Ratings Affirms KfW’s AAA Rating: A Critical Analysis of Practical Implications

In its latest rating assessment, Scope Ratings has reaffirmed the AAA issuer rating of KfW (Kreditanstalt für Wiederaufbau), Germany’s governmental development bank, with a stable outlook. This decision mirrors the credit stance of its principal backer, the Federal Republic of Germany, which holds a parallel AAA/stable sovereign credit rating. Notably, the reaffirmation applies equally to KfW’s…

View On WordPress

0 notes

Text

NUBIFIE Shuts Down Heritage Bank Head Office Over Sack of 1000 Workers

Touchaheart Nigeria reports that The National Union of Banks, Insurance and Financial Institutions Employees (NUBIFIE), has shut down Heritage Bank’s head office in Lagos following the sack of over 1000 personnel by the management of lender led by Mr. Akinola George-Taylor without following due process.

The union said it had resolved to continue with the picketing until the management of the…

View On WordPress

#Heritage Bank#Insurance and Financial Institutions Employees#National Union of Banks#NUBIFIE#Sack#Touchaeart Nigeria

0 notes