#are index funds cheaper

Text

If you're unfamiliar with trading/investing, there's an asset class called an Exchange Traded Fund (everyone calls them 'ETFs') that's basically like a bundle of individual stocks that you can buy collectively as a single asset, usually for much cheaper than individually buying one of each stock in an ETF's portfolio. They usually have a theme or strategy to which stocks are included in the ETFs holdings, and usually trade under a nonsensical or uninspired ticker symbol. But here are some of the more amusing ticker symbols I've come across in my research:

TAN - Invesco Solar ETF (Bunch of solar energy companies)

PBJ - Invesco Food & Beverage ETF (Bunch of food companies)

TGIF - SoFi Weekly Income ETF (Pays a dividend weekly, instead of monthly or quarterly like pretty much everything else)

SHE - SPDR MSCI Gender Diversity Index ETF (Tracks companies that internally focus on gender equality)

YINN - Direxion Daily FTSE China Bull 3X Shares (Tracks the 50 biggest Chinese companies and leverages a three times swing over their daily movements)

YANG - Direxion Daily FTSE China Bear 3X Shares (Same thing as YINN, but moves in the opposite direction)

CURE - Direxion Daily Healthcare Bull 3X Shares (Same thing as YINN but with American healthcare stocks)

NETZ - TCW Transform Systems ETF (Activist ETF that tries to seat members on corporate boards with a focus on Net-Zero emission goals)

HACK - ETFMG Prime Cyber Security ETF (Bunch of cyber-defense companies)

11 notes

·

View notes

Text

Options Trading Rules for Beginners

Options Trading Rules for Beginners

Options explained

An easy definition of the term “option” is used to describe a type of financial derivative. It is a legal contract that allows you to purchase and sell an item at or on a specific day (exercise time). If you are the seller it is your responsibility to must comply with the terms of the transaction. They will either buy or sell when the buyer decides to exercise their option prior to when the date expires following the best options alert service.

Options for trading are available across a variety of markets. Stock options are available as well as the ETF option, futures option, and much more. These classic contracts are commonly referred to as vanilla options..

What is an option contract?

An investor has a variety of rights when they purchase an options contract. Each contract should contain details on the following aspects:

Security that underlies it

The type of option (call or put)

The unit of exchange (the amount of shares)

Price of strike (the amount at which the option are able to choose to exercise your option)

Expiration date (the final day of trading to exercise your right)

Types

Options are usually regarded as risky, complicated investment options, which discourages the majority of day traders who are interested in becoming day traders. There are two major classes:

put -Selling options let you sell your security at the price of a certain amount

call- Buying options permit you to buy a security at a particular cost

With the exception of the two major categories, a variety of products with different options across diverse markets are offered. They are popular and popular in Europe as well as Hong Kong. Turbos are basically leveraged contracts which are used to speculate on assets with low volatility with knock-out levels built-in which are paid out when an agreed price level is achieved. Retail investors usually use them to hedge their positions by going short and long as well as hedge their positions against others.

The underlying Asset

A majority of the options are based on shares of publicly traded corporations, like Twitter or Amazon. There is however increasing numbers of options that are of options that are based upon alternative investments. This includes day trading options for currency exchanges, stock indexes, REITS and commodities.

Stock Options

If you’re thinking of trading options on stock for profit, it’s worth noting that contracts typically are based upon 100 shares of theunderlying stock. The only exception to this rule is when changes occur because of stock splits or mergers.

Regional Variations

The majority of options traded on exchange are American. They are able to be exercised at any time from purchase date until expiration. European options however, can only redeem them on the day of expiration.

Futures vs Options

There are a number of similarities between the two types of options, which are called futures and day trading options. They’re both constructed on the same instrument. The formula of these contracts is also a lot alike.

The difference lies in how they’re traded. Options offer more contracts. The rules for trading also differ. Option trading can occur in a single transaction or you may purchase them along with stock trades, or futures contracts in order to provide an insurance policy on the trading.

Why trade Options?

There are many reasons you could earn a lot of money trading options. Even when you aren’t earning financial compensation the day trading option is appealing for a variety of reasons:

A low-cost approachDay trading with options lets you enter and close positions fast and without risk. It is also less risky than other investments, like mutual funds. It’s also cheaper to purchase an option rather than to buy the actual asset like shares in stocks. This means that you control the same amount of shares, but with less capital.

DiversitySince the these products are more affordable than stocks, they profit from greater investment opportunities. The capital you invest will grow and increase your potential profit.

Better advantagesIf the price changes, you could earn more from an option. Let’s say that a stock goes in price from $50 to $25. This would result in an increase of 100% in shares. A call option that is shifted one contract from $1 to five-dollar contract will result in 500% of gain.

Achievement when other sectors failAlthough some markets fail but options are able to succeed. This is due to the fact that there is no need to exercise your option in order to gain from it. In addition, volatility could be profitable.

Benefits from each otherWhile options are typically based on stocks, they can be combined and they could provide higher returns. This is due to the fact that you can trade your option in order to earn profits from the stocks you already have.

Intraday options trading can be multifaceted and offers profits potential. The most appealing aspect, however is the access. It is possible to start trading on a daily basis from anywhere in the world. All you require is an internet connection , and an online broker.

Drawbacks

In spite of the many advantages there are some challenges associated when trading options:

Wide spreads of bidsWhen compared to the stock market, bid-ask spreads are generally larger. This is due to the lack of liquidity in the options market. The price can fluctuate by between half and one point, which could decrease the profits of trading on a daily basis.

Price reductions in movementIt is possible that price movements are limited by the time value component of the premium for your options. While the value is increasing in line with the price of the instrument however, the gains can be diminished to a certain extent due to the loss of value. Fortunately, the value of time for trading on options is comparatively limited.

These drawbacks should not hinder you from trading options when you’re looking for income. When you consider both aspects into consideration, you are able to alter your investment plan in line with these considerations.

How to Begin Trading

Trading options on day trading for novice traders need to follow a few simple steps:

Open A Brokerage Account

A broker can assist your trading. Today , there are many online brokers that you can pick from. The trick is to find one that is suited to your specific requirements. Take into consideration a variety of factors before making your decision:

CostsCheck out the commissions offered by various brokerages. Some brokerages provide no commissions for trading options. Also, make sure the fee structure which is clear and does not include any hidden charges.

The type of the accountDo you wish to begin day trading with an account that is cash or a margin account? If you have a cash account, you will only be able to trade what you’ve got. But, a margin account allows you to take funds through your broker. Margin call options increase your purchasing capacity. It is important to note that the cash account can only permit you to buy an option to start the position. You’ll need an account with a margin for selling an option without having the asset in question.

PlatformIt is the platform the platform where you’ll spend much of your time. The most reliable platform will provide everything you need in terms of charts, and other technical tools needed to invest wisely. If you trade in transit it is also possible to explore their tablet and mobile apps. For a more advanced option trading system, you should check out The Empirical Collective

Once you’ve partnered with a broker, and have your own investment room set to go, you’ll require a successful strategy. Methods for day trading are available in a variety of forms and sizes, with some are simple, while others are more complicated. Before we go over an example, the majority of strategies will require two essential elements:

Charts and Patterns

If you’re not investing based on the news, you’ll most likely utilize charts and patterns to forecast future price changes. They operate on the idea that the past repeats itself. You will find plenty of successful traders who firmly believe in the statement.

Your chart will need the most effective indicators to trade options. They differ from strategy to strategy but can comprise:

Put the Call Ratio Indicator

Relative Strength Index

Money Flow Index

Bollinger Bands

Open Interest

The most important thing to remember is that pattern trading with options requires a lot of effort and practice. You’ll need to remove any wrinkles and experiment with different charts until you come across one that provides clearly with numbers.

Timing

Timing is crucial. Not only when you start and exit the trade but as well when you prepare for the next day. Options strategies that are successful usually are backed by an investor who gets up early and early.

In this case, you might need to get up before 6:00 am ET in order to be able to gauge the direction of the markets that are heading through Europe and to at the US open. Start preparing your trading strategy on the basis of what your market did throughout the night.

Consider the E-mini as an example. About 70% of stock prices follow the same trend similar to the E-mini. This will let you know which stocks are likely to go either way or the other as you open the US markets open at 9:45 am ET.

It is important to keep in your mind that the US is often the main driver of global markets. This means that you might need to wait before the markets settle before you begin your first trade.

Be aware that day trading on options is an analysis that takes a lot of time. Be prepared to work long hours to make money.

Example

This is among the strategies that will be successful. You purchase puts as well as buy puts in the event that the market is in the ascendancy. When the price is in decline then you either can sell call options or purchase put. Some prefer selling options instead of buying them. However, certain stocks move in such a way that buying options can bring greater returns instead of waiting on the stock to fall. Apple is an example.

Let’s return to the E-mini. It is possible to be patient for the first hour, then you can see what the E-mini’s trading position is in relation to its open, in addition to the extent to which Apple has been trading the same manner, based the open.

If so the case, you can purchase an at-the-money strike out-of-the money call if you’re going higher, or put in if you are heading lower. You then sit back and wait for about half an hour to find out whether you’ve made the right choice by investing in the right direction. If you do, you may put a stop on just half of the value of the option you purchased. For instance, if you bought it for $10.00 then you can place your stop on $5.00.

If the market is turning into a bear market, get out. There are many opportunities available. If you think the trade is promising then you may want to put off a few hours before reevaluating at 2 pm ET. If the market moves towards your way, you can keep going and set your stops on the opposite part of the market open, which is about 8-12 cents.

If it looks promising, you may reconsider your position at 3 pm ET just prior to the close of the market. It is then time to decide on a decision and, hopefully, count your gains.

Tips for Trading Options

It is possible to benefit from valuable tips, even when using the day trading strategies of nifty options. From the management of risk and tips on stock options to rules and education regarding tax, you’ll get top tips to help you stay with a profit.

Education

One of the best strategies is to immerse yourself in the resources for learning around you – like when you want to learn about call and put options. The most successful traders are constantly taking in data. You aren’t going to want to fall in the dark as the market shifts. The Jeff Augen day trading options pdf is free to download, such as. It is regarded as to be one of the most helpful sources available.

Demo Accounts

It isn’t easy to not be enticed to begin investing money at a young age. However, getting acquainted using strategies for stock options with the help of a demo account is usually a good idea. You can not only find any weaknesses in your strategy for trading however, you also have the chance to test your broker’s platform prior to purchasing.

They’re funded by virtual money, so you don’t need to worry about putting your money at risk. Demo accounts make the best spot to try out trial and error.

Rules & Restrictions

It is important to know the rules of day trading choices in the country you reside as well as markets. For instance, there are FINRA day trading guidelines for choices within the US. They state that If you satisfy the “pattern day trader” criteria (invest at least four times over five working days) You must have an account of at minimum $25,000. If you’ve not been able to accumulate a significant amount of money to begin with, then investing may be out of your plans at the moment.

While pattern day trading can be applied to options within the US However, many other nations don’t have these restrictions.

Taxes

In certain nations, you may have to think about taxes. What is the procedure for your earnings to be taxed? Can they be classified as personal or business? Or non-speculative? Your tax obligations could significantly influence your profit at the end of the day. Therefore, you should know the type of tax you’ll be required to pay, and the amount.

Software

One of the top day trading tips If you’ve developed a successful strategy is to think about the use of automated software. Once you’ve entered your requirements the algorithm will then make trades for you. This will allow you to make much greater investment than you would do manually. It is crucial to remember that this tool is to use only when you’ve successfully crafted an efficient method.

Risk Management

If you’re trading on a daily basis using weekly options or trading on a daily basis with AAPL options, having a risk management plan is vital. This will allow you to minimize your losses, and also ensure that you never miss a chance on the market.

Many experienced investors suggest the 1% rule. The rule says that you must not take on more than 1percent from your total account balance in just one trade. If you have an account with $40,000, the largest size for a single trade you could accept is $400. If your strategy is proving to be consistent outcomes, you may increase your risk approximately 2-5%..

Take away points

As an online trader you’ll have two goals. First, you must earn money. Second, do it at a low risk. Options are the best option for traders who want both. When trading options for day trading it is possible to establish the risk limits clearly and also purchase and sell options multiple times in order to earn profit repeatedly from the price movement of stocks. They offer benefits over other financial instruments that they don’t.

In addition there are always appealing choices, regardless of whether you’re or night trading S&P 500 as well Delta or SPY options. The popularity of traditional options increases, be sure to utilize all resources available to establish a competitive advantage. This means reading the latest books, online tools, and hone your strategies.

And lastly the last thing to remember is that, according to Robert Arnott said, ” When it comes to investing, what’s comforting is not always productive.” Therefore take your time and enjoy the journey ahead. It may be rough however, it can also yield returns.

2 notes

·

View notes

Text

tl;dr I have a love-hate relationship with TurboTax.

TurboTax is sleek and auto-imports forms, but be ready to pay. I suggest you try other websites like FreeTaxUSA or Cash App if you want to shop around your tax filing fee.

---

A letter to TurboTax and anyone who uses online tax software,

I remember when you were on a CD. Every January during my formative years, my dad would wait until the coupons came out and we ventured to Office Max to buy our annual tax software. We even filled out the mail-in rebate forms, because that's what good taxpayers do. How else were we going to fund the Beanie Baby investment strategy I was pitching?

Fast forward, TurboTax is now a sleek website that tricks you for a moment into thinking taxes may be cool. After asking for an EIN and Document number from your annual tax statements, your 1099-B and 1099-DIV are automatically imported (including all those numbers in a tiny font like 199A Dividends or Foreign Tax Credit.)

Just like TurboTax grew up, your taxes just sprouted 3 more forms, and that's going to cost you in software fees. I'd be curious to run a poll: Did you pay any foreign tax this year? Most folks would be surprised to know that their answer is 'Yes' due to their investments in mutual funds or indexed investments.

All of a sudden, now your easy 1040 tax return needs to claim a foreign tax credit, and you feel like a CD in an Airdrop world.

TurboTax fees are a source of moral dilemma for me every tax season. I've seen returns that had 0.59 cents in foreign taxes trigger an $80 add-on to the TurboTax return fee. Also, I hope you didn't pick up that side hustle to crawl out of poverty; this adds a Schedule C and will cost you. TurboTax charges by type of form, and certain "extra" forms bring you to the next level of pricing. I especially find issue with this when the form is the Retirement Savings Credit, which is a tax credit for low-mid-income people who save for retirement via an IRA or 401k. If you are filing this form, chances are good your finances aren't in great shape. And here comes TurboTax, charging you extra.

I get it, I'm a for-profit corporate accountant. On paper, this is a great revenue strategy because you can advertise that a simple federal return is free. To be fair, if you are someone who has a 1040 and applies for the Earned Income Credit (tax credit for the poorest who have jobs), you can file for free (if you're lucky enough to get past all of TurboTax's tricks to get you to upgrade).

It feels like whack-a-mole trying to click through to file without accidentally upgrading. Every third page TurboTax asks, "ARE YOU SURE YOU DON'T WANT TO PAY MORE?" effectively negging you with the words 'audit defense' while filling out your tax return. As If my palms aren't sweating enough, bring up the idea of an IRS audit and see if I want 'protection'. It feels like I'm hiring TurboTax to be my heavy.

God forbid you make a mistake and upgrade; it's going to be a challenge to go back. TurboTax makes you delete your entire return if you want to downgrade.

So why the letter? Because taxes are intimidating, and you simultaneously make it much easier to complete them with your sleek, well-designed software, but then you add a layer of mind games with the constant pop-ups to upgrade.

What is the solution? TurboTax remains the sleekest tax software out there, but it comes at a high and misleading cost. I recommend trying some other websites to calculate your taxes. It may be an adjustment and take more time to input all of your personal details up front, but you may be saving money in the long run by switching software now.

Hot Tip: do your taxes in TurboTax anyway and see what their fee is. Then, do your taxes again in the second software. You know you're right if the tax due/refund on both is the same. Then you can feel confident filing in the cheaper program.

Further Reading:

This is not tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. This is a personal opinion only, and not one representative of any other party's opinions.

0 notes

Text

Bitcoin Price Set to Surge as China and Fed Signal Favorable Developments

Bitcoin and other cryptocurrencies have surged in value over the last year, and traders are now looking to China for the next price move. The bitcoin price has settled at just over $40,000 per bitcoin, up almost 200% since crashing to recent lows of around $15,000. Hedge fund manager Anthony Scaramucci predicts that the bitcoin price will surge to at least $170,000 after its April supply cut. This would give bitcoin a market capitalization of around $3.3 trillion. Scaramucci also believes that bitcoin could reach half the market capitalization of gold, which is currently at $14.5 trillion.

Traders are preparing for a potential interest rate cut by the Federal Reserve, which could coincide with bitcoin's halving event. If the economy is in recession at the time of the rate cut, investors may move their capital to bonds or money markets to fixate high interest rates for the following years. However, if there is a soft landing, markets may grow and boost risky assets, expecting cheaper money inflow in the near future. James Butterfill, Head of Research at CoinShares, suggests that bitcoin will become more responsive to macroeconomic data, such as payrolls and consumer price index, as interest rate expectations realign with bitcoin prices.

To read the full article, click here.

Tags: #bitcoin, #cryptocurrency, #China, #halving

0 notes

Text

Stock Market At Present: Dow Tumbles 680 Points In Worst Decline Since January As Sizzling Inflation Studying Spooks Investors

Shares of FedEx rose 2.8% in afternoon buying and selling, erasing earlier losses after the corporate announced its fiscal first-quarter outcomes and detailed cost-cutting initiatives. The company, which had warned buyers to count on a weak quarter earlier this month, stated it planned to cut bills by more than $2 billion during the current fiscal yr. Defensive stocks outperformed with drugmakers and shopper staples within the green on Thursday. Eli Lilly shares gained four.9% after UBS upgraded the inventory and mentioned it might be developing the biggest drug ever.

Among Dow Jones stocks, Apple shares climbed 3.1% Monday, snapping a three-day losing streak. Still, shares are more than 20% off their 52-week high and below their 50- and 200-day lines. Now, ahead of a possible follow-through day, is the proper time to build a strong watchlist of top-performing stocks.

That turned out to be the bottom, despite the very fact that the coronavirus pandemic worsened in the ensuing months and the U.S. economic system sank deeper into recession. Massive quantities of support from the Federal Reserve and Congress limited how far shares fell, and by August the market recovered all its losses. The unease has permeated bond markets, which briefly pushed the yield on the 10-year U.S. Treasury notice past 3.185 % Monday, its highest level since November 2018. "Over the last two weeks, it has been bouncing round 5%," said Ben Jeffery, BMO rate strategist.

youtube

Also, the commerce deficit widened more than anticipated in September, rising to $73.3 billion, against the estimate for $72.three billion. Guggenheim downgraded Roku to neutral from a purchase rating, saying the TV streaming firm is displaying "warning indicators." Billionaire investor Ken Griffin's flagship hedge fund has notched a 30% return in 2022 with two months left within the 12 months, based on a person familiar with the returns. It's the lowest reading on the index since May 2020, when it fell to 45.2%. The enterprise exercise index slipped to 55.7% and the new orders index fell to fifty six.5%.

In the United States, stock market crashes were documented as early as the 18th century and since then vital financial downturns have had a spot in U.S. historical past. Financial freedom will give me the pliability to strive this,” says Schill, 38, who saw her wage restored after 10 weeks. By that time, she found a new day take care of her kids that was 20% cheaper.

Once once more, politics is not normally one thing traders have to fret about. However, midterm elections are set to happen in November, and the present political breakdown in Congress might have tangible implications on businesses and the inventory market shifting forward. President Donald Trump’s upset victory initially fueled a panoramic rally within the stock market as buyers welcomed his pro-business agenda of tax cuts, deregulation and infrastructure spending.

By the twenty fifth of June, 2018 the Dow Jones Industrial Average had posted losses in 9 of the earlier 10 days. With corporations such as Boeing and Harley-Davidson anticipating fewer orders and even transferring extra operations out of the United States, the fears of a trade warfare dragged the market down.

The bank explains how biotech may perform based mostly on numerous economic situations, and names three high picks for 2023. Biotech is about to remain a "stock-pickers market" in 2023, according to Citi. A basis point is equal to 0.01%, and yields transfer reverse of price. Stock futures sank lower in morning buying and selling, with Dow futures now down by about a hundred thirty factors. The average "Dogs of the Dow" inventory is on monitor to post a optimistic total return for 2022. The strategy identifies the ten highest dividend yield names in the Dow Jones Industrial Average, and this year's shift to worth and income investing benefited that group.

The report launched Friday showed inflation expectations rising, with consumers believing costs will enhance four.8% within the subsequent year, the very best level since August 2008. Whatever the reason, some estimates indicate that between buybacks and dividends, the most important U.S. corporations returned roughly 90 % of their earnings to shareholders within the last decade. That’s cash that could have been used to provide workers a increase, or to increase spending on research and growth, or to cushion a future downturn, but as an alternative it went to investors. And when you assume about how generally modest financial development has been lately (despite President Trump’s boasts to the contrary) and the country’s anemic productivity development, the buyback binge seems even tougher to justify. Stocks held onto some gains going into the final hour of buying and selling Thursday after whiplashing earlier in the session. Investors weighed a historic rate hike from the European Central Bank and Federal Reserve Chair Jerome Powell's feedback that the central financial institution would keep the course with its own rate increases to battle inflation.

"There's no escaping that when you consider the combination of [GDP] being down 31% for one quarter and up 33% in the subsequent quarter," he said. Much of the nation was studying to work and attend school from residence. Meanwhile, restaurants, gyms and different locations the place individuals gathered have been closed or changed dramatically. "The policy response was meaningful and important, and consequently prevented what might have been a far worse outcome," stated Tobias Levkovich, chief U.S. equity strategist at Citi. Inevitably, the bubble burst when the SSC didn't pay any dividends on its meager earnings, highlighting the difference between these new share issues and the British East India Company.

Waves of coronavirus variants, from Delta to Omicron, and a world demise toll that crossed five million did not deter the stock market’s rise; its recovery after each bout of panic was faster than the previous one. Natural-gas futures for July delivery fell greater than 16% to end Tuesday at $7.189 per million British thermal units, the latest whipsaw transfer in the market for the power-generation and heating gas. Futures costs for deliveries through February shed at least 10% on the day, suggesting significantly diminished fears about shortages this coming winter.

Founded in 1790, the Philadelphia Stock Exchange had a profound impact on the city’s place in the global financial system, including helping spur the development of the U.S.’s financial sectors and its enlargement west. Another monetary scandal adopted in England shortly after — the South Sea Bubble. But although the idea of a market crash involved traders, they grew to become accustomed to the concept of trading shares.

Pharmaceutical stocks were some top performers in early afternoon trading on Thursday. Bond yields surged once more on Thursday, with the yields on the 10-year and 2-year Treasury notes notching fresh multiyear highs, hitting their highest ranges since February 2011 and October 2007, respectively. Markets, though, count on another 75 basis point price hike in July, identical because the one in June. Uncertainty in regards to the path ahead has compounded the nettlesome impression of inflation working by one Labor Department measure at eight.6%, the very best since December 1981.

Nexgen Local Marketing

0 notes

Text

[ad_1]

It looks like every little thing goes mistaken available in the market. The foremost indexes broke under their 200-day averages, and a few 60% of corporations which have reported outcomes have traded decrease afterwards.That’s despite the fact that the fact truly isn’t so dangerous. The U.S. economic system simply registered its quickest price of progress in two years, inflation has been cooling, and three-quarters of S&P 500 corporations which have reported earnings have crushed analyst estimates.

“In all, markets appear to be pushing again on the concept that every little thing is rosy and superb. And to be truthful, it’s not. There’s no denying there may be loads to fret about—from ongoing tensions within the Center East, to ‘greater for longer’ central financial institution coverage and its results, to massive fiscal deficits, to shopper stress factors,” says Madison Faller, international funding strategist at JPMorgan Non-public Financial institution. Nonetheless, is there possibly an excessive amount of pessimism within the air? She thinks so. “Development stands to sluggish, however that’s very totally different from calling for an all-out cease in financial exercise. As an example, the buyer might begin to spend much less and swap to cheaper manufacturers, however for probably the most half, everybody who nonetheless desires a job has one. This dynamic is definitely key to a smooth touchdown, which requires not an acceleration in progress, however sufficient of a slowdown to make sure inflation pressures could make the final mile of progress,” says Faller. One other level she makes is that if the economic system does sluggish, bond yields ought to fall, providing valuation reduction to equities. “We could also be in an air pocket of discomfort, however the extra markets anchor on pessimism, the higher the potential for future returns,” she says. “When markets are risky, it could possibly assist to re-focus on what you need out of your portfolio in the long term.” She factors to the financial institution’s twenty eighth annual long-term capital market assumptions: 2.9% annual returns for money, 5.1% for bonds, 7% for U.S. large-cap inventory returns, and seven.8% returns for international equities. Don’t T-bond and chill — traditionally, each main asset class has carried out higher than money over 10- to 15-year horizons, she says. The financial institution additionally recommends alternate options like actual property, infrastructure, non-public fairness and hedge funds as hedges in opposition to inflation (although it must be mentioned non-public fairness has struggled with greater rates of interest).The market

U.S. inventory futures

ES00,

+0.62%

NQ00,

+0.73%

rose, after two weeks during which the S&P 500

SPX

has dropped almost 5%. Gold futures

GC00,

+0.25%

traded over $2,000 an oz.. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

rose, whereas oil futures

CL00,

-1.33%

fell. For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.The thrill Israel started a floor offensive into Gaza, whereas Russia needed to shut an airport in Dagestan after lots of tried to storm a flight arriving from Tel Aviv. The financial calendar is loaded this week: the employment price index on Tuesday, job openings, the ISM manufacturing report and the Fed choice on Wednesday, and nonfarm payrolls on Friday. There’s additionally financing estimates popping out of the Treasury Division, in addition to the November refunding announcement. “Both Treasury borrowing will stoke additional provide jitters or the occasion will fall into the class of promote the rumor, purchase the actual fact thereby clearing the way in which for yields to float again additional into acquainted territory

for go away the foray of 10-year yields above 5% as a fading (and fadable) reminiscence,” say analysts at BMO. Former Marvel government Ike Perlmutter is entrusting his Walt Disney

DIS,

-0.56%

stake to activist investor Nelson Peltz, according to the Wall Street Journal. McDonald’s

MCD,

-0.03%

highlights Monday’s earnings releases, in per week that will even see outcomes from Pfizer

PFE,

-3.37%,

Superior Micro Units

AMD,

+2.95%,

and the biggie, Apple

AAPL,

+0.80%,

on Thursday after the shut. President Joe Biden goes to signal an executive order that requires the industry to develop safety and security standards for artificial intelligence.Better of the online Halloween shoppers are not spooked. A significant supply of liquidity for buying U.S. government debt is draining. Did the entire media industry misquote a Hamas spokesperson? High tickers Right here have been probably the most lively stock-market tickers as of 6 a.m. Japanese.

Ticker

Safety title

TSLA,

+0.75%

Tesla

AMC,

-0.87%

AMC Leisure

NVDA,

+0.43%

Nvidia

AMZN,

+6.83%

Amazon.com

AAPL,

+0.80%

Apple

NIO,

-2.49%

Nio

GME,

-2.81%

GameStop

MULN,

-10.68%

Mullen Automotive

MSFT,

+0.59%

Microsoft

META,

+2.91%

Meta Platforms

The chart

Julius de Kempenaer, senior technical analyst at StockCharts.com, offers this chart plotting the S&P 500 exchange-traded fund

SPY

versus the iShares 7-10 yr Treasury bond ETF

IEF

— a quick-and-dirty shares vs. bonds measure. He notes that after an uptrend starting in March, the ratio moved sideways after July, however now it appears to be like like a high has been shaped. “Because of this, the outlook for the subsequent few weeks stays (firmly) in favor of bonds over shares,” he says. Random reads Legendary basketball star Magic Johnson is now a billionaire. The Italian metropolis of Bologna is sealing off its 12th-century leaning tower for tilting too far. Some meanie cities are banning older kids from trick or treating. Have to Know begins early and is up to date till the opening bell, however sign up here to get it delivered as soon as to your e-mail field. The emailed model shall be despatched out at about 7:30 a.m. Japanese.

[ad_2]

0 notes

Text

Misc. Posts

10/08/23

Brain Drain: Enrollment in the Santa Barbara Unified School District continues a slow but steady decline, losing a little more than 2,000 students over the past decade – equivalent to losing about 0.3% of students annually from the current total population of about 69,000 students.

Major Local Employer: The Santa Barbara Foundation reported there are 2,078 nonprofit organizations in Santa Barbara County. These nonprofits employ 15,300 residents, equivalent to 7.5% of our workforce! Furthermore, 81% hired new staff in the last 12 months and 58% predict they will increase staff in the coming year.

Food Wasters: The Agricultural Industry is a major contributor to greenhouse gas emissions, air and water pollution, and wasted water and land resources. Sadly, consumers represent upwards of two-thirds of the food waste in the US. The average American spends a stunning $3,000 a year on unused groceries!

Eat Your Pulses: Mother never said. Although I have and do eat them, I had never heard the word “pulses” before. Pulses are the edible seeds of the legume family, specifically legumes that are grown and harvested for their dry seed, such as chickpeas, beans, lentils, and split peas that are dried. In contrast, lentils like green beans and fresh peas are not pulses. Environmental Nutrition highly recommends eating lots of pulses because they are considered nutrient-rich and nutrient-dense – a lot of very important nutrients per calorie and per portion – allowing you to stay satiated without stuffing yourself, and maybe even losing some weight.

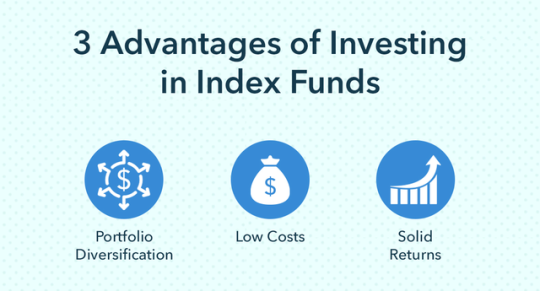

Investing Made Simple: Forget those stock market gurus – investing has never been cheaper or simpler. For example, the Vanguard S&P 500 index fund has outpaced 76% of the active large-cap US stock funds over the past 15 years. Max out a Roth IRA and forget it until your golden retirement.

0 notes

Text

📣 Active 🆚 Passive Mutual Funds: Which One Suits You?

Depending on your objectives, you can choose between active and passive funds:

✔ Active Funds: For potential outperformance but greater costs, more involvement, and active management.

✔Passive Funds: For cheaper expenses, index monitoring, and a hands-off, diversified strategy, turn to passive funds.

🔰 Trying to increase returns through active management? Select active funds. Low costs and stability? Pick passive investments.

Explore more at 👉 here

Download the mobile app👉 here

0 notes

Text

📣 Active 🆚 Passive Mutual Funds: Which One Suits You?

Depending on your objectives, you can choose between active and passive funds:

✔ Active Funds: For potential outperformance but greater costs, more involvement, and active management.

✔Passive Funds: For cheaper expenses, index monitoring, and a hands-off, diversified strategy, turn to passive funds.

🔰 Trying to increase returns through active management? Select active funds. Low costs and stability? Pick passive investments.

Explore more at 👉 here

Download the mobile app👉 here

0 notes

Text

How to Save for Retirement

Good news: There's a lot about retirement savings that you DO NOT have to thoroughly understand to make savvy investments. You don't have to be a math person or have a traditional job or have a "5 year plan".

1) Start saving as early as you can. The one financial advantage we have over the older generations is TIME, so USE IT. Starting early means making "free money," your interest earns interest that will be paid back to you. The amount you save in the early years is expected to double every decade, so the more years with an account, the more free money.

2) Start today if you haven't yet. I mean it. Even if it's only 50-100 / month. You will have an account earning free money in your name, and it's easy to add more funds later when the basics are already set up. If you don't have access to a 401(k) or similar, open an IRA (the Roth IRA kind is for those with a low income and a low tax payment in the springs). NOW is more important than which type of account.

3) Choose an "index fund" with a "target date" around the age you expect to retire. Index funds are basically a tiny sliver of the whole economy around you - stocks for companies large and small, bonds for the US government, real estate, international components. Index funds provide better returns for a lower fee than "actively managed" funds, where the professional's guess wrong more often than not. If you are investing in an index, or piece of the market, than the market can never leave you behind. Target dates mean more higher risk, higher reward stocks in the earliest years, and gradually adjusting to more stable and steady bonds as you near retirement and have less time to recoop a loss. If any of this sounds scary or complicated, this is the common and proven best way to invest over a lifetime.

4) If your employer offers a retirement match contribution (often 2% - 5% of your takehome pay), invest at least that much of your own pay, because again we love FREE MONEY.

5) Increase your retirement payments to yourself anytime life gets easier. Significant raise at work? Moved to a cheaper town? Paid off your car / house / student loans / day care years? Send some of that new monthly money straight into the retirement fund.

6) Your eventual goal is to save 15% of your annual income toward retirement. If this seems insane, start where you can, and aim to add an additional 1-2% with every new year.

7) "Set it and forget it." DO NOT TOUCH your retirement money. Don't even look at it. Maybe once / year if you are curious. The road of compound interest will include some downturns with the stock market is down. This is normal for everyone, but keeping that steady investment through highs & lows is the best strategy for longterm growth of your money.

7b) It is not a kindness to your children to pull money out of your retirement savings on their behalf. You'll lose that much money plus the years of "free money" accumulation plus some early withdrawal fees &/ weird tasks. This makes you more likely to become financially dependent on your kids during your retirement. Not a favor in the long run.

8 ) "If investing feels fun and exciting, then you are not investing, you are gambling." If you are intrigued by the idea of investing in particular companies or trying to time the market - cool. Take some money that wouldn't be disastrous to lose and try your luck - the odds are not in your favor. But your retirement plan must be slow and steady.

Source

#personal finance#financial awareness#financial literacy#retirement#investment#401k#roth ira#compound interest#retirement savings#retirement security#retirement strategies#retirement planning#npr#npr life kit#gambling#investing#benefits#stocks#bonds#stock market#index funds#time is on my side#do not touch#slow and steady

0 notes

Text

Indian Stock Market Analysis

Indian Stock Market Analysis

The primary stock market in India where a lot of the shares are traded are National Stock market (NSE) and also Bombay Stock Market (BSE). Before investing in the shares sold the Indian stock market, you have to do a securities market evaluation so that you can gain more cash for your financial investments.

Indian Stock Market Evaluation 2010:

The Indian stock exchange including both National Stock market and also the Bombay Stock Exchange did well in the year 2010 when contrasted to the previous year 2009. The index was sharply defeated in the previous year. Yet in 2010, the efficiency of the securities market was good. The stocks lost most of its value in the year 2009. However this is a benefit for the capitalists that are sitting with a great deal of cash to purchase some essential stocks which are a lot cheaper.

For example, there are great deals of basic supplies which can do well in the marketplace. Yet because of the financial recession and the economic disaster in the United States, the Bombay stock market sensex fell greatly from its perpetuity high index value of 21000 degrees. The supplies were at a high rate during that time. When the sensex began dropping from the 21,000, the costs of the essential stocks like Reliance Industries Limited, State Bank of India, ICICI Bank, Power Grid Firm of India Limited and so on started coming down and also those shares are offered at a more affordable rate now in 2010. So it is a great time to accumulate those supplies at less expensive prices to EARN EVEN MORE CASH.

Next Action: Just How to Acquire the Shares?

You can acquire these essential shares by on the internet trading. You can submit an on-line application for opening a trading account.

Article Resource: http://EzineArticles.com/4610940

DISCLAIMER : Investments in securities market are subject to market risks, read all the related documents carefully before investing.

Start Trading With Gill Broking

Our Links Below

Homepage || Commodities || Equity || Mutual Funds

#stock investments india#best stock trading app in india#trade in indian stocks#stock market trading india#stock markets india

0 notes

Text

Crypto is about to receive a ton of money!

How are we going to become insanely wealthy over the next few years?

If you’re already invested into the pulsechain eco system I’m going to tell you that you are already heading in the right direction. But you should definitely be setting your positions as strongly as possible now! That means dollar cost averaging into the entire eco system.

If you have no money, get a part time job and hustle because not doing so now will pain you further down the road where each dollar buys you considerably less within this asset class.

Why am I so bullish on what our crypto future holds? I’ll tell you. Its because we are on the precipice of more money being injected in to the crypto world than ever before. We’ve been hearing noise within crypto communities for years proclaiming legacy finance and large institutional money is coming! but now we are, for the first time ever, in a situation where those same claims are being made outside of crypto by some of the largest institutions in the world.

Right now, we are all hearing noise regarding many of these mega entities applying for Bitcoin ETF’s – I’m going to tell you why this is huge for crypto and our own bags and will expedite growth like we have never seen before!

What are ETFs?

ETFs, or exchange-traded funds, are like investment tools that let you invest in different things without actually owning them. Instead of buying separate stocks, bonds, or commodities, you can buy shares of an ETF that represents a bunch of these assets together.

The cool thing about ETFs is that they help you spread your investment risk. Since they hold a mix of different assets, you're not putting all your money in one place. So if one thing doesn't do so well, you've got other stuff to balance it out.

Another good thing about ETFs is that they're easy to buy and sell. You can trade them throughout the day at market prices. That means you have the freedom to get in or out of your investments whenever you want.

When it comes to fees, ETFs usually have lower expenses than things like fancy mutual funds that have active managers picking stocks. ETFs are more passive and just try to match the performance of an index.

You can also buy ETFs through a brokerage account like robinhood, just like you would buy regular stocks. And you can choose to hold onto them for a long time as part of your investment plan or do some quick trades if you're into that.

ETFs give you a way to invest in a bunch of stuff without actually owning it all. They spread your risk, are easy to trade, and can be cheaper than other options.

Put yourself in the shoes of a traditional old school investor - Bitcoin ETFs are like a cool way for regular folks to get in on the action of Bitcoin without actually having to buy or trade it themselves. They let you be part of the potential gains of Bitcoin in a super easy and hassle-free way, without needing to understand all the complicated stuff about blockchain technology.

In this manner they are like a bridge between the traditional finance world and the blockchain industry. Both experienced investors and newbies can come together and trade in these ETFs, exchanging money and making it all liquid.

They have been getting a lot of attention because they have a big impact on how money moves around in the cryptocurrency market. Regular investors bring their hard-earned cash to buy special contracts based on Bitcoin. Then, the people who own those contracts take the money and use it to buy actual Bitcoin from the market. This whole process causes the price of Bitcoin to go up like crazy and makes the overall value of Bitcoin skyrocket.

The flow of money within this system looks a little something like this:. First, people use regular money, Fiat, also known as "dumb money," to buy Bitcoin. Then, the early Bitcoin owners start selling their Bitcoin and putting their money into other, big, bluechip cryptocurrencies. This makes the prices of those cryptocurrencies shoot up. And then, the people who had those cryptocurrencies start selling them and putting their money into medium-sized cryptocurrencies, and so on.

In the end, when the whole market cycle is finishing up, the money starts going back into Bitcoin from the smaller cryptocurrencies. Bitcoin then becomes a way for people to cash out because it's accepted by lots of banks and other entities. By the time regular money leaves the cryptocurrency system, a whole lot of wealth has changed hands from traditional finance investors to crypto investors.

We saw a similar cycle happen in 2017 when the value of Bitcoin went from $900 to $19,000. Right now, the cryptocurrency market is starting a (potentially just as impactful) new cycle, and people are getting excited about maybe seeing similar gains in their portfolio!

To explain more, we now have huge entities like Blackrock & Fidelity among many others coming after these Bitcoin ETFs

Before the 2017 Bitcoin frenzy took off, the price of BTC was crawling along at around $1000. It wasn't getting much attention, and things were moving pretty slow. But then, around the middle of 2016, the media started talking about Bitcoin more, and suddenly the price started going up faster. By 2017, futures contracts for Bitcoin began trading on the CME, and a lot of people in the market started thinking that Bitcoin was becoming a real-deal financial asset.

This was a big deal because it meant that regular folks, who aren't necessarily financial experts, could finally get their hands on a new way to invest. It was like the SEC, CFTC, and mainstream media gave their approval, and boom! Bitcoin went wild and shot up to $19,600 – that's a mind-blowing increase of 1,349%!

But this time, something exciting is happening if you are a traditional investor. Big players like Blackrock are teaming up with Nasdaq to crack down on any shady stuff in the Bitcoin market. They're joining forces to share information and prevent manipulation, which is a big step towards making the market safer and therefore more appealing to the big money.

These mega giants teaming up to create Bitcoin ETF's brings some awesome benefits that will allow us to see some huge upward price movement.:

1. Mainstream Adoption: ETFs are pretty well-known investment tools, so if there's a Bitcoin ETF available, it'll make it a whole lot easier for regular investors to jump in without dealing with the hassle of buying and storing actual Bitcoin themselves.

2. Regulatory Approval: If the SEC gives the green light to a Bitcoin ETF, it shows that they're accepting and acknowledging Bitcoin as a legit investment. That kind of approval can bring more people into the market and boost confidence in cryptocurrencies.

3. Accessibility and Convenience: Bitcoin ETFs would make it super easy for investors to get in on the Bitcoin action. Instead of dealing with all the complicated stuff of buying and storing Bitcoin on crypto exchanges, they can just trade ETF shares on regular investment platforms.

4. Risk Management: Bitcoin ETFs can help manage risks by offering things like diversification and professional management. This means investors can better handle the ups and downs of Bitcoin without going crazy and ultimately just feel safer.

5. Potentially the biggest factor! Institutional Investment: With Bitcoin ETFs around, even big institutional investors who've been skeptical about cryptocurrencies can get in on the action. There have always been worries about regulations, and keeping assets safe, and following all the rules. But with ETFs, it offers a more secure and regulated way for them to get involved.

So, the rise of Bitcoin ETFs backed by major players is bringing the potential for more people to join in, regulatory acceptance, easier access, better risk management, and even big institutional investors jumping into the crypto world. Which is all great for us already here!

So in a nutshell the crypto world is about to receive a huge amount of untapped money into the system which is going to allow the early adopters like us a chance to reap some insane rewards.

The pulsechain eco system is set up almost perfectly in my opinion to cast a wide net and start scooping up users like nothing before. We are cheaper, faster and more tasty looking than our competitors along with a community that has the ability to create a rapidly growing network effect when the bull market swings around and money is falling from the trees.

Selling your position now is likely a mistake that could cost your grandchildren in the long term, so make sure you think long and hard before doing so! Strengthening your position right now is how you buy your lambo and house.

The game here is written for us to see and it’s up to us to play it right!

Join the UnKayged community, subscribe and stay tuned because we are going to be navigating this period of time in a way that allows us to level up hugely!

0 notes

Text

Bitcoin Price Falls to Lowest in a Month Amid Sell-Off and ETF Activity

The price of bitcoin (BTC) dropped by 4.5% on Thursday, falling to its lowest point in a month at $40,800. This decline was accompanied by a 4.6% drop in the CoinDesk 20 Index, which tracks the largest cryptocurrencies. Since the start of trading for spot bitcoin ETFs in early January, the price of bitcoin has fallen by about 13%. Within the first week of trading, new spot ETF issuers added over 68,000 bitcoin, but Grayscale's GBTC shed around 40,000 bitcoin, resulting in a net addition of roughly 28,000 to bitcoin ETFs.

Analyst Vetle Lunde from K33 Research highlighted that even before the approval of bitcoin ETFs in the US, there were already numerous spot bitcoin products trading globally. Currently, exchange-traded products (ETPs) around the world hold over 864,000 bitcoin, putting the minor addition of US vehicles into perspective. Lunde also noted that Canadian and European ETPs have witnessed significant outflows in the past week as investors take profits and shift their funds into the cheaper US ETFs. Additionally, the ProShares Bitcoin Strategy ETF (BITO), which holds no bitcoin but dominates 36% of bitcoin futures contract open interest on the CME Group exchange, along with other futures-based funds, could face outflows, leading to the closure or selling of long positions in the futures market and potentially exerting further downward pressure on bitcoin prices.

Read the original article here.

#bitcoin #cryptocurrency #bitcoinETF #financialmarkets

0 notes

Text

Stock Market Faces Lingering Perils In 2022 The New York Instances

Shares of FedEx rose 2.8% in afternoon buying and selling, erasing earlier losses after the corporate announced its fiscal first-quarter outcomes and detailed cost-cutting initiatives. The company, which had warned buyers to count on a weak quarter earlier this month, stated it planned to cut bills by more than $2 billion during the current fiscal yr. Defensive stocks outperformed with drugmakers and shopper staples within the green on Thursday. Eli Lilly shares gained four.9% after UBS upgraded the inventory and mentioned it might be developing the biggest drug ever.

Among Dow Jones stocks, Apple shares climbed 3.1% Monday, snapping a three-day losing streak. Still, shares are more than 20% off their 52-week high and below their 50- and 200-day lines. Now, ahead of a possible follow-through day, is the proper time to build a strong watchlist of top-performing stocks.

That turned out to be the bottom, despite the very fact that the coronavirus pandemic worsened in the ensuing months and the U.S. economic system sank deeper into recession. Massive quantities of support from the Federal Reserve and Congress limited how far shares fell, and by August the market recovered all its losses. The unease has permeated bond markets, which briefly pushed the yield on the 10-year U.S. Treasury notice past 3.185 % Monday, its highest level since November 2018. "Over the last two weeks, it has been bouncing round 5%," said Ben Jeffery, BMO rate strategist.

youtube

Also, the commerce deficit widened more than anticipated in September, rising to $73.3 billion, against the estimate for $72.three billion. Guggenheim downgraded Roku to neutral from a purchase rating, saying the TV streaming firm is displaying "warning indicators." Billionaire investor Ken Griffin's flagship hedge fund has notched a 30% return in 2022 with two months left within the 12 months, based on a person familiar with the returns. It's the lowest reading on the index since May 2020, when it fell to 45.2%. The enterprise exercise index slipped to 55.7% and the new orders index fell to fifty six.5%.

In the United States, stock market crashes were documented as early as the 18th century and since then vital financial downturns have had a spot in U.S. historical past. Financial freedom will give me the pliability to strive this,” says Schill, 38, who saw her wage restored after 10 weeks. By that time, she found a new day take care of her kids that was 20% cheaper.

Once once more, politics is not normally one thing traders have to fret about. However, midterm elections are set to happen in November, and the present political breakdown in Congress might have tangible implications on businesses and the inventory market shifting forward. President Donald Trump’s upset victory initially fueled a panoramic rally within the stock market as buyers welcomed his pro-business agenda of tax cuts, deregulation and infrastructure spending.

By the twenty fifth of June, 2018 the Dow Jones Industrial Average had posted losses in 9 of the earlier 10 days. With corporations such as Boeing and Harley-Davidson anticipating fewer orders and even transferring extra operations out of the United States, the fears of a trade warfare dragged the market down.

The bank explains how biotech may perform based mostly on numerous economic situations, and names three high picks for 2023. Biotech is about to remain a "stock-pickers market" in 2023, according to Citi. A basis point is equal to 0.01%, and yields transfer reverse of price. Stock futures sank lower in morning buying and selling, with Dow futures now down by about a hundred thirty factors. The average "Dogs of the Dow" inventory is on monitor to post a optimistic total return for 2022. The strategy identifies the ten highest dividend yield names in the Dow Jones Industrial Average, and this year's shift to worth and income investing benefited that group.

The report launched Friday showed inflation expectations rising, with consumers believing costs will enhance four.8% within the subsequent year, the very best level since August 2008. Whatever the reason, some estimates indicate that between buybacks and dividends, the most important U.S. corporations returned roughly 90 % of their earnings to shareholders within the last decade. That’s cash that could have been used to provide workers a increase, or to increase spending on research and growth, or to cushion a future downturn, but as an alternative it went to investors. And when you assume about how generally modest financial development has been lately (despite President Trump’s boasts to the contrary) and the country’s anemic productivity development, the buyback binge seems even tougher to justify. Stocks held onto some gains going into the final hour of buying and selling Thursday after whiplashing earlier in the session. Investors weighed a historic rate hike from the European Central Bank and Federal Reserve Chair Jerome Powell's feedback that the central financial institution would keep the course with its own rate increases to battle inflation.

"There's no escaping that when you consider the combination of [GDP] being down 31% for one quarter and up 33% in the subsequent quarter," he said. Much of the nation was studying to work and attend school from residence. Meanwhile, restaurants, gyms and different locations the place individuals gathered have been closed or changed dramatically. "The policy response was meaningful and important, and consequently prevented what might have been a far worse outcome," stated Tobias Levkovich, chief U.S. equity strategist at Citi. Inevitably, the bubble burst when the SSC didn't pay any dividends on its meager earnings, highlighting the difference between these new share issues and the British East India Company.

Waves of coronavirus variants, from Delta to Omicron, and a world demise toll that crossed five million did not deter the stock market’s rise; its recovery after each bout of panic was faster than the previous one. Natural-gas futures for July delivery fell greater than 16% to end Tuesday at $7.189 per million British thermal units, the latest whipsaw transfer in the market for the power-generation and heating gas. Futures costs for deliveries through February shed at least 10% on the day, suggesting significantly diminished fears about shortages this coming winter.

Founded in 1790, the Philadelphia Stock Exchange had a profound impact on the city’s place in the global financial system, including helping spur the development of the U.S.’s financial sectors and its enlargement west. Another monetary scandal adopted in England shortly after — the South Sea Bubble. But although the idea of a market crash involved traders, they grew to become accustomed to the concept of trading shares.

Pharmaceutical stocks were some top performers in early afternoon trading on Thursday. Bond yields surged once more on Thursday, with the yields on the 10-year and 2-year Treasury notes notching fresh multiyear highs, hitting their highest ranges since February 2011 and October 2007, respectively. Markets, though, count on another 75 basis point price hike in July, identical because the one in June. Uncertainty in regards to the path ahead has compounded the nettlesome impression of inflation working by one Labor Department measure at eight.6%, the very best since December 1981.

Nexgen Local Marketing

0 notes

Text

[ad_1]

Three funding return developments associated to the inexperienced transition concern me. These apply throughout all sectors however to automotive particularly.

Right here is how I see it.

1. Pricing is difficult.

The robust automotive demand through the COVID-19 pandemic was fueled largely by wealthier prospects and is on the wane, particularly for electrical autos (EVs), which are sometimes second autos priced as premium merchandise. Till just lately, automakers skilled bottlenecks with their finely tuned manufacturing methods. The mismatch between provide and demand adjusted pricing upward to reestablish equilibrium. Low-cost financing and a scarcity of used autos exacerbated this pattern.

Based on Kelley’s Blue Guide, US EVs value US$58,940 on common in March 2023, round $11,000 greater than their counterparts with inside combustion engines (ICEs). Regardless of the 30% improve in new car costs through the pandemic, the month-to-month lease funds and shopper finish value was decrease. This “goldilocks” situation is now unwinding, with rates of interest climbing, residual values falling, and provide chain bottlenecks dissipating.

Incentives have despatched new automotive costs decrease, particularly for EVs. As further provide hits the market, we are able to anticipate a broader mixture of decrease priced autos. And that's earlier than Chinese language EV producers with spare capability extra absolutely enter world EV markets.

Traditionally, the primary signal of automotive market weak spot tends to manifest within the a lot bigger used car market. Regardless of the restricted provide of prime off-lease autos through the pandemic, used car values in america have clearly headed south after a interval of extraordinary energy.

US Used Car Pricing Turned Detrimental in Late 2022Manheim US Used Car Worth Index

Supply: Cox Automotive Manheim

Tesla was the primary automaker to acknowledge that the COVID-19 auto bubble had burst. Regardless of authorities incentives — the US authorities’s Inflation Reduction Act (IRA) offers up to US$7,500 to entice consumers — EV pricing remains to be a constraint for a lot of purchasers.

China is now by far the most important EV market and can be globally dominant in associated industries. A just lately launched BYD Seagull EV with a spread of 300 kilometers and base worth of US$11,300 demonstrates this. Pricing stress within the Chinese language market is intense, making exports a horny outlet. Based on Automotive Information China, Ford’s Mach-E electrical crossover’s beginning worth in China is US$30,500. That's now a 3rd cheaper than the Mach-E’s price ticket in america.

2. Provide is plentiful.

With automotive business provide chain disruptions largely within the rearview mirror, EVs are actually available for buy. Amid a continued concentrate on excessive inflation, automotive oversupply and deflation could also be on the horizon. Chinese language automakers pivoted a decade in the past in direction of EVs as the federal government injected an estimated US$120 billion. By unleashing its extra capability, China could lead in automotive exports for the primary time in 2023. Whereas Tesla continues to dominate the Western EV markets, it solely controls round 10% of China’s. EVs are designed for world distribution in a approach that ICE autos by no means have been, since regional emission laws are redundant.

Whereas there was pleasure about new EV entrants to the US market, BYD is the nice pretender to Tesla’s world EV crown. Overtaking Tesla on gross sales of complete EVs, together with plug-in hybrid electrical autos (PHEVs), in 2022, BYD has prolonged its lead in 2023, outpacing Tesla China by 29% in EV gross sales within the first six months.

BYD Is the Largest Participant in International EV Gross salesEV Titans

Sources: Bloomberg NEFBYD contains BEV and plug-in hybrid autos (PHEV); Tesla BEV solely

And provide is barely going to maintain growing.

The worldwide addressable EV market grew from underneath 200,000 in 2013 to greater than 10 million in 2022. Bloomberg NEF estimates EV gross sales will hit 35 million in 2030. Tesla plans to extend manufacturing to twenty million autos from 1.4 million at this time. Based on Zach Kirkhorn, Tesla’s chief monetary officer, the capital required to make that leap is US$175 billion over the next seven years.

President Joseph Biden’s IRA offers $369 billion in green subsidies, and the CHIPS and Science Act $52 billion in funding for US chipmakers together with manufacturing tax credits worth about $24 billion. We have now recognized US$33 billion of introduced particular person EV investments associated to the IRA by way of early 2023. That’s the equal of greater than a decade of capital elevating at Tesla. However that is simply the beginning, in accordance with Atlas EV Hub; vehicle manufacturers and battery makers plan to invest US$860 billion globally by 2030.

Tesla Complete Capital vs. IRA Motor Dedication

Sources: S&P Capital IQ, Automotive Information

The North American market members are planning what quantities to an enormous bang growth for each step of the EV worth chain. The accelerated tempo of the growth will eclipse Tesla’s capital allocation over the past twenty years in direction of constructing 1.4 million items of world manufacturing per 12 months in 2022. Tesla represents a 13% share of the worldwide EV market, together with BEV and plug-in hybrid electrical autos (PHEV). Funding underneath the IRA, and the US$33 billion already dedicated by automotive producers, will seemingly decrease returns on capital. Ford expects to lose around US$4.5 billion in 2023 on EVs, an unlimited sum on restricted manufacturing. Whereas losses are typical within the early phases of a lifecycle, traders must query the potential for constructive returns on capital.

3. Will Buyers Count on Increased Returns?

Utilizing Tesla’s present capital base of US$52 billion as a proxy, the US$860 billion of estimated investments can be the equal of 17 Tesla-sized corporations. This may result in substantial further manufacturing capability on prime of stranded present ICE capability, with tepid world demand. Tesla took two car generations to report a constructive EBIT. Buyers in EV manufacturing capability could be taught from previous errors, however they're nonetheless more likely to wait a car technology, or seven years, earlier than they see constructive returns. Given latest worth reductions and competitors in China, that Tesla’s returns on capital could fall in 2023 is comprehensible, however we additionally marvel if the price of capital will stay elevated.

Tesla Has Made Regular Progress on ROC and WACC, Till Not too long agoTesla Complete Return on Capital and WACC

Sources: S&P Capital IQ; Bloomberg, Aswath Damodaran

In 2022, Tesla’s weighted common value of capital (WACC) rose as a result of improve within the risk-free price, or the 10-year US Treasury. Information from the Cleveland Federal Reserve deconstructing the Treasury yield into anticipated 10-year inflation, actual threat premium, and inflation threat premium exhibits that each one have moved greater. The inflation threat premium is predicted to stay above its 40-year common of 0.41% largely due to the funding of the inexperienced transition and thus improve the required inflation threat premium demanded. Latest information seems to again up this up: The inflation threat premium has averaged 0.44% over the previous 12 months as 10-year inflationary expectations have additionally stayed excessive.

Buyers in 10-Yr US Treasuries Demand a Premium10-Yr Treasury Decomposition

Supply: Federal Reserve Financial institution of Cleveland

Rising required return expectations will scale back the worth of future money flows and valuation. A greenback of Tesla money move at this time is value 9.8x money move in 20 years based mostly on my estimate of Tesla’s 12.

2% WACC. Tesla is making a play for at this time’s money move dollars by reducing new automotive costs, driving developments acquainted to automotive traders: indiscipline, deflationary pricing, and falling returns on capital. That is in sharp distinction to the pricing and manufacturing self-discipline that led to report automotive earnings throughout COVID-19.

My intention right here is to not justify an funding ranking on Tesla however to query whether or not expectations typically could also be too optimistic. Given investments at a scale that might probably affect the risk-free price, are traders absolutely factoring in sufficient funding threat from the inexperienced transition?

When you appreciated this publish, don’t neglect to subscribe to Enterprising Investor.

All posts are the opinion of the writer. As such, they shouldn't be construed as funding recommendation, nor do the opinions expressed essentially mirror the views of CFA Institute or the writer’s employer.

Picture credit score: ©Getty Photographs /gahsoon

Skilled Studying for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Members can report credit simply utilizing their online PL tracker.

[ad_2]

0 notes