#Short supply leading to hike in prices

Text

Another ghost+soap idea because I apparently can't stop giving them the ouchies. This one's a long one.

Ok a while back I on here I said that I hc that soap has a scar on his hand that he got b4 he met ghost. I'm changing that now because I can't stop hurting my boy bubbles

They're sent out on a mission, just the two of them. Price didn't want to send them, it seemed shady, but the higher-ups forced his hand. Intel was limited, backup would be unable to reach their position for days should it be needed, and exfil would be too far to reach in an emergency.

Price was told that the higher-ups needed soap and ghost's exact skill set. As much as price hates it, he is unwilling to send someone incompetent, so he sends his two best soldiers.

~~~

Soap lay flat next to ghost, scope to his eye, as he'd been doing for the last 3 days. They were stationed deep in some foreign mountain range, watching a small group of buildings. Price said he thinks it's a research facility. They were meant to figure out what was being researched, gather what other info they can find, then blow the place sky high.

The place was heavily gaurded, which is what attracted their attention in the first place. Normally soap would be capable of soloing the mission, but there were aspects that would put ghost's skills and experience to use. With the terrain and his pack full of explosives he'd need to be extra careful, which ghost could help with.

They'd been sat in their position for 3 days, watching the guard rotations, trying to find an opportunity to slip inside. Higher-ups had put him in a tight spot in terms of method of explosion, with regulations and everything, they refused to loosen up on. With such short notice, Soap grabbed what he could, as he packed but...

They'd been there for 3 days, ample time to run the numbers and do the calculations. Ample time for him to think up twenty different ways to not succeed. The gaurds would make positioning and timing difficult, not to mention the size of area he had to demolish with his limited supplies, and there was always the chance of underground expansion that they couldn't account for. There just wasn't enough to go around, and it was making him antsy.

---

For 3 days ghost lay prone, next to soap, looking through his scope trying to map out gaurd routines.

Six days and fifteen hours ago price had called both himself and Soap into his office. He informed them of a mission, pushed to priority on short notice. It required the best of their skills.

They had barely three hours to pack, before a twelve hour flight, which led to a three day hike, plus three days of waiting lead them to now.

They had limited supplies, the higher-ups hadn't bothered to clear them for more than the standard. Which was fine for ghost's part, he'd had to do far longer with far less. But soap wasn't so happy. It seemed okay until soap began running numbers.

There wasn't enough material, and too much space. Soap was getting agitated, he could tell because he'd been quiet for 2 days. Mouthing numbers, and scenario to himself, but none of it worked. He never said anything to ghost though.

---

On the 4th day they packed up, they'd move in come nightfall. Soap would follow ghost's lead, planting what he had along the outskirts. He still couldn't figure out how to blow the rest of the area. He'd just have to hope to find something along the way.

They stashed their packs, tents and other supplies a few miles down the mountain, where they could quickly grab it on the way to exfil. The trek back gave took enough time that they had just enough time to check their weapons and ammo one more time before they needed to move.

The tower guards were easy enough to snipe from their elevated position, and they were far enough away that there was no one to hear their shots. As soon as they were down ghost set about, clearing the area in a spiral pattern, stopping when soap signaled just long enough to set the charges.

By the time they reached the middle, soap had long since run out of all but one charge, and he warned ghost as such. The man paused, and the bottom of his mask shifted slightly, before he nodded and continued forward.

The large center building, evidently used for some kind of research, was more heavily guarded that the rest of the area. Not really a problem for them though, nothing they haven't handled before. Again Ghost took point while soap watched his 6, it was routine. They went room by room, slowly, collecting whatever intel of other information they could.

One room they came across looked to be a storage room for chemicals and other such materials. Ghost was about to move on, but Soap stopped him. Maybe he could see if they had any kind of chemical accelerant, or atleast make one. If he could they'd have to go back and reset all the charges, it was a risk, but if it meant a mission success...

Ghost took watch while he scanned shelfs of chemicals. He got lucky with a number of them, and immediately he began doing calculations. This could work. Only thing he needed now was a bunson burner. Which evidently was not in the room, as he searched more and more frantically.

Ghost seemed to notice his agitation because he told him to grab what he needed at move of, soap listened, if slightly unhappily.

The next few rooms they cleared were, luckily, pretty sparce. Much to their luck they did stumble across a lab room, which soap made them stop in. The chemicals he took, if done correctly, could be made into a highly reactive sticky paste. A paste that if he used efficiency could spread their charges up to twice or even 3x the area.

If time was on their side he'd have had half a mind for proper protection and measuring equipment for the chemicals, but it wasn't. So in lieu of personal safety he shucke off his gloves, as it was easier to feel out the correct measurements without them.

In a too quick pour a spash of chemicals landed on the webbing of his hand between the thumb and forefinger. It burned as it it foamed down the back of his hand, and ran a stripe down his palm. Too focused on watching two liquids thicken as he mixed them together to notice.

-------------------

This isn't done yet, but I want to get it out of my drafts and this is a kinda good stopping place. I'll probably just reblog this when I have the next part... maybe

#el rambles#demolition enthusiast john soap mactavish#i accidentally down played his militaristic abilities in this but oh well#unfinished fic#john soap mactavish#simon ghost riley#if you squint#ghostsoap#soapghost#cod mw2#call of duty#cod

43 notes

·

View notes

Text

Disclaimer: These details are what we have currently made and are subject to being changed in the future. I’ll post a notice if a major change is made.

So chronologically Yusuke goes after Ryuji's but my friend is gonna explain Yusuke's so its Haru's turn

Astarte's Adelaide's Meadow

Heavenly Virtue: Charity

Palace Ruler: Haru Okumura

Treasure: Core of the Meadow (Cognitive), Father's death certificate (Reality)

Haru's palace is her father's space station crash landed onto Earth. The Sci-fi aesthetic of the station is destroyed by plants and greenery that covers the palace. It manifests this way from Haru's nurturing and caring nature being mixed in with her complicated relationship with Okumura foods and her father. Adelaide is the name of the saint her new persona is but at the start of the palace, the Infiltrators are lead to believe its called "Astarte's Meadow" as Haru is still renovating the space station and hasn't updated the sign.

Shadow Haru is a forest witch with a long white dress and her short hair turned long and luscious, reaching down to her fingertips.

Shadow Haru is well regarded in her palace with the shadows actually addressing her as "mother", fitting her nurturing nature and her virtue of Charity. Despite this however, Shadow Haru can be quite cruel as in the real world, all Okumura food chains along with other businesses under her control have a unique system of payment. If you're kind and virtuous, you can get items severely discounted or free of charge but if you're judged as evil and or a detriment to society, items are charged at higher prices which can hike up to millions of yen for a simple burger.

This is a problem for the Infiltrators who are judged to be problematic due to them opposing the Phantom Thieves. Hilariously, Akechi's prices are far higher than Sumire and Maruki's but even Maruki, who gave the Thieves therapy, can't get a remotely reasonable price so the Infiltrators will be getting supplies by a different means which will be detailed in another post.

Gameplay wise, her palace has fetch quests as to proceed you have to give vegetables to cognitions. These vegetables are the ones she grew for the Phantom Thieves so can't be found anywhere outside of her palace. Your etiquette with the cognitions will be carefully watched as if your anything short of polite and kind with them, Haru will be alerted and you will likely get into a fight. Aside from fetch quests, you also have to go around collecting parts from the wreckage of the space station to create a laser in order to be able to access her treasure as its hidden away under vines so thick, it could break the Infiltrators' weapons if they tried to force it.

Shadow Haru's distortion views her cognitions as her children and as their mother, it is her duty to ensure they grow happy and healthy in a world rid of corruption and greed. It is from this distortion that causes her Shadow's feelings on her father to look very different. Regular Haru loves her father and mourns him, Shadow Haru has a far more negative view of her father, considering him a greedy spaceman who abandoned her for a utopia he didn't make it to and she chose to stay in his space station to completely wreck it and turn it into her home base as she works with the Phantom Thieves for their utopia.

#persona 5#p5#p5r#persona 5 royal#persona 5 au#persona 5 royal au#haru okumura#kunikazu okumura#the perfect semester au#haru's relationship with her father is complicated#she still loves him#her shadow is simply her being a bit more honest regarding the fact despite wishing he returned to who he was#she holds a lot of resentment over how he treated from being emotionally neglectful to the sugimura stuff#part of her change of heart is her reconciling with her father's death as she never actually gets time to process it

12 notes

·

View notes

Text

Yves here. We’ve been warning for some time that the inflation we are suffering now is due to Covid-induced supply chain breakages, Russia sanctions blowback leading to high energy and commodity prices, and droughts and high heat wrecking crop yields. Labor does not have bargaining power, witness among other things falling real wages and continued record corporate profit share of GDP. But the Fed thinks its job is to break glass and kill demand, as in jobs.

By Jake Johnson. Originally published at Common Dreams

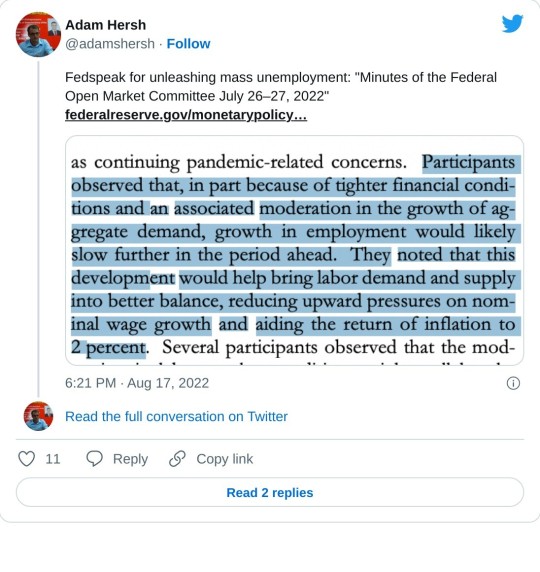

The newly released minutes of the Federal Reserve’s July meeting indicate that U.S. central bank officials have no plans to deviate from aggressive interest rate hikes as they attempt to tamp down high inflation, a policy response that one economist characterized as a commitment to “unleashing mass unemployment.”

“We have a supply-side problem, but rather than trying to restore or raise supply-side capacity the Fed is aiming to push demand down to the level where supply is currently constrained by pandemic, war, and climate crises,” noted Adam Hersh, a senior economist at the Economic Policy Institute.

Published Wednesday, the minutes of the Fed’s July 26-27 policy meeting show that the nation’s central bankers believed at the time that “there was little evidence to date that inflation pressures were subsiding,” reporting that “their business contacts remained concerned about persistently high inflation.”

Fed officials expressed their view on inflationary trends prior to the latest Consumer Price Index (CPI) reading, which suggested that price surges—a problem hardly limited to the U.S.—have cooled slightly while remaining near a four-decade high of 8.5% year over year.

“They judged that inflation would respond to monetary policy tightening and the associated moderation in economic activity with a delay and would likely stay uncomfortably high for some time,” the minutes read. “Participants also observed that in some product categories, the rate of price increase could well pick up further in the short run, with sizable additional increases in residential rental expenses being especially likely.”

While conceding that “supply bottlenecks were continuing to contribute to price pressures,” Fed officials signaled they will stay the course with rate increases aimed at suppressing economic demand, an approach they acknowledged would likely cause higher unemployment. The Fed’s next policy meeting is in September, when another large rate hike is expected even amid evidence of moderating prices as well as slowing economic and wage growth.

“Participants observed that, in part because of tighter financial conditions and an associated moderation in the growth of aggregate demand, growth in employment would likely slow further in the period ahead,” according to the minutes. “They noted that this development would help bring labor demand and supply into better balance, reducing upward pressures on nominal wage growth and aiding the return of inflation to 2%.”

“Participants remarked that a moderation in labor market conditions would likely involve a decline in the number of job openings as well as a moderate increase in unemployment from the current very low rate,” the minutes continue, noting that officials admitted the risk of hiking interest rates “by more than necessary to restore price stability.”

To progressive economists and other analysts, the Fed is flirting with disaster.

In an op-ed for The Guardian on Wednesday, Isabella Weber of the University of Massachusetts Amherst and Mark Paul of Rutgers University observed that “the current inflation situation hasn’t been about all goods in the economy getting more expensive at the same rate.”

“Specific goods—food, fuel, cars, and housing—have been experiencing massive price shocks, raising the general inflation level substantially,” they wrote. “Controlling these changes would require aggregate demand to shrink to unbearable levels for average Americans—essentially making people too poor to buy goods, and thus alleviating bottlenecks. Rate hikes are not only ill-suited to bring down these essential prices but risk a recession throwing millions out of work.”

As an alternative strategy for fighting inflation, Weber and Paul make the case for “targeted price stabilization measures including price controls to limit price increases in systemically significant goods and services: gas, housing, food, electricity, etc.”

“Contrary to conventional wisdom, price controls have a rather successful history in the U.S. when used right, and, while not a magic bullet, they are a powerful tool to tame inflation and protect low- and middle-income Americans,” they note. “This is particularly true when market power—be it from landlords, oil companies, or meat cartels—is at play.”

Weber and Paul specifically express support for Rep. Jamaal Bowman’s (D-N.Y.) recently introduced Emergency Price Stabilization Act, legislation that would establish a White House task force to “proactively investigate corporate profiteering” and propose “measures to ensure adequate supply of relevant goods and services, expand productive capacity, and meet climate and public health standards in the application of any price controls or regulations.”

In an August 4 statement unveiling his bill, Bowman said that “we cannot simply step back and allow the Federal Reserve, which hiked interest rates again last week, to address inflation on the backs of everyday people.”

“That approach means throwing people out of work and risking a recession,” Bowman warned. “Here is the question we must ask: do we have the resources and skills to reach our full productive capacity, make sure everyone in this country has a good job, and manage our economy in the interests of all people? I believe the answer is yes.”

“But we’ll need a new economic playbook to get there,” he added, “and passing my Emergency Price Stabilization Act would be a major step in the right direction.”

#federal reserve#inflazione#inflación#inflacja#economics#capitalism#unemployment#wages#class war#poverty#jobs#recession#economic depression

11 notes

·

View notes

Text

The Ultimate Guide to Dog Walking Gadgets: Making Walks Fun and Convenient

Regular walks are essential for the well-being of our canine companions. Not only do they provide exercise and mental stimulation, but they also strengthen the bond between dogs and their owners. In today’s digital age, innovative gadgets have revolutionized the way we walk our dogs, making the experience more enjoyable and convenient than ever before. In this comprehensive guide, we’ll explore a variety of dog walking gadgets available on Dogerys, a leading online store for dog accessories. From hands-free leashes to GPS trackers, we’ll discover how these gadgets can enhance the walking experience for both dogs and their owners.

Importance of Regular Dog Walks

Before delving into the world of dog walking gadgets, let’s first understand why regular walks are crucial for our furry friends. Dogs, by nature, are active animals that require physical activity to maintain their health and happiness. Regular walks help prevent obesity, reduce behavior problems, and promote socialization with other dogs and humans. Additionally, walking provides mental stimulation by allowing dogs to explore their surroundings and engage their senses. By incorporating regular walks into their routine, dog owners can ensure that their pets lead fulfilling lives both physically and mentally.

Exploring Innovative Dog Walking Gadgets

Now that we understand the importance of regular walks, let’s explore the innovative gadgets that can enhance this experience. Dogerys offers a wide range of high-quality accessories specifically designed to make walks safer, more comfortable, and more enjoyable for both dogs and their owners. Let’s take a closer look at some of the most popular gadgets available:

1. Hands-Free Leashes

Hands-free leashes are perfect for dog owners who want to enjoy a hands-free walking experience. These leashes typically feature a waist belt or harness attachment, allowing owners to walk, jog, or hike with their dogs without having to hold onto a traditional leash. With hands-free leashes, owners can maintain better balance and freedom of movement while keeping their dogs safely by their side.

2. GPS Trackers

GPS trackers are invaluable gadgets for dog owners who want to keep track of their pet’s whereabouts during walks. These devices use GPS technology to pinpoint the location of a dog in real-time, giving owners peace of mind knowing that they can quickly locate their pet if they stray or get lost. Some GPS trackers also offer additional features such as activity monitoring and geofencing, allowing owners to set boundaries and receive alerts if their dog wanders too far.

3. Waste Bag Holders

Waste bag holders are essential gadgets for responsible dog owners who want to clean up after their pets during walks. These compact and convenient holders attach to a leash or belt loop, providing easy access to waste bags whenever they’re needed. With a waste bag holder, owners can ensure that they always have the necessary supplies to clean up after their dogs, promoting cleanliness and hygiene in public spaces.

Recommendations for the Best Dog Walking Gadgets

Now that we’ve explored some of the innovative dog walking gadgets available, let’s discuss recommendations for the best products on Dogerys. Here are some top picks:

1. Personalized Dog Harness

Price: From £20

Description: This personalized dog harness offers a perfect fit for dogs of all sizes and features adjustable straps for maximum comfort. With its reflective design, it provides added visibility during walks, enhancing safety in low-light conditions.

2. Air Tag Dog Collar

Price: From £23

Description: The Air Tag Dog Collar combines style and functionality with its durable construction and built-in air tag holder. It allows owners to attach an air tag for easy tracking of their pet’s location, providing peace of mind during walks.

3. Short Dog Lead

Price: £23

Description: The Short Dog Lead is ideal for close control and training purposes, offering a sturdy yet lightweight design. It provides a secure grip for owners while allowing dogs to walk comfortably by their side.

Tips for Using Dog Walking Gadgets Effectively

To ensure a seamless walking experience with your dog walking gadgets, consider the following tips:

1. Proper Fit: Ensure that harnesses, collars, and leashes fit your dog correctly to prevent discomfort or injury.

2. Training: Take time to familiarize your dog with new gadgets and use positive reinforcement techniques to encourage desired behavior.

3. Maintenance: Regularly inspect and clean gadgets to ensure they remain in good working condition.

4. Safety: Always prioritize safety during walks by staying alert, following leash laws, and avoiding hazards such as traffic or aggressive dogs.

Why Choose Dogerys?

Dogerys is your one-stop destination for premium dog accessories that combine style, functionality, and affordability. Here’s why you should choose Dogerys for all your dog walking needs:

● Quality: Dogerys offers a curated selection of high-quality products designed to meet the diverse needs of modern pet owners.

● Variety: With a wide range of dog walking gadgets, accessories, and essentials, Dogerys has something for every dog and owner.

● Convenience: Enjoy hassle-free shopping with Dogerys’ user-friendly website, secure payment options, and prompt delivery services.

● Customer Satisfaction: Dogerys is committed to customer satisfaction, offering responsive support and a hassle-free return policy.

Frequently Asked Questions (FAQs)

1. What types of dog accessories are available on Dogerys?

Dogerys offers a wide range of accessories to pamper your furry friend, including dog beds, collars, leashes, toys, grooming products, and more. Whether you’re looking for stylish accessories, comfortable bedding, or innovative dog gadgets, Dogerys has everything you need to spoil your canine companion.

2. Do you ship dog accessories to the UK?

Yes, Dogerys ships dog accessories to the UK and worldwide. We offer fast and reliable shipping options to ensure that your furry friend’s essentials reach you promptly and securely. Enjoy the convenience of shopping online and having your favorite dog accessories delivered right to your doorstep.

3. What are the best dog accessories for large breeds?

Large dog breeds have unique needs when it comes to accessories such as beds, collars, and toys. Dogerys offers a selection of premium accessories specifically designed for large breeds, including spacious dog beds, durable collars and leashes, and sturdy toys that can withstand rough play. These accessories provide comfort, safety, and enjoyment for large dogs of all ages.

4. Can I find dog accessories for special occasions like Christmas or Halloween?

Yes, Dogerys offers a variety of festive accessories for special occasions such as Christmas and Halloween. From adorable Christmas outfits and gifts to spooky Halloween costumes and outfits, you’ll find everything you need to celebrate the holidays with your furry friend in style. Make your dog the life of the party with festive accessories from Dogerys.

5. What are some popular dog pampering products available on Dogerys?

Dogerys offers a range of dog pampering products to keep your dog looking and feeling their best. From luxurious dog beds and soothing grooming products to indulgent spa treatments and calming supplements, we have everything you need to pamper your furry friend like royalty. Treat your dog to the ultimate pampering experience with Dogerys’ premium products.

6. Do you offer dog puzzle toys to keep dogs mentally stimulated?

Yes, Dogerys offers a variety of puzzle toys designed to keep dogs mentally stimulated and entertained. These interactive toys challenge dogs’ problem-solving skills and encourage cognitive development while providing hours of fun and excitement. Keep your dog engaged and mentally sharp with stimulating puzzle toys from Dogerys.

7. What are the best dog walking gadgets available on Dogerys?

Dogerys offers a selection of innovative gadgets to enhance the dog walking experience. From hands-free leashes and GPS trackers to waste bag holders and reflective gear, we have everything you need to make walks safe, comfortable, and enjoyable for both you and your furry companion. Explore our collection of top-rated dog walking gadgets and elevate your walks to the next level.

8. Are your dog accessories suitable for all breeds and sizes?

Yes, Dogerys strives to offer dog accessories suitable for dogs of all breeds and sizes. Whether you have a small toy breed or a large working breed, you’ll find products tailored to your dog’s specific needs. From adjustable collars and harnesses to size-appropriate beds and toys, we have something for every dog, no matter their size or breed.

9. Do you offer waterproof dog coats for outdoor adventures?

Yes, Dogerys offers a range of waterproof dog coats to keep your furry friend warm and dry during outdoor adventures. Our coats are made from high-quality materials and feature waterproof and windproof designs to protect your dog from the elements. Whether you’re hiking in the mountains or strolling through the park on a rainy day, our waterproof coats will keep your dog comfortable and cozy.

10. How can I contact customer support for assistance with my dog accessories?

If you have any questions or need assistance with your dog accessories, our friendly customer support team is here to help. You can contact us via email at [email protected], and we’ll be happy to assist you with any inquiries or concerns you may have. Your satisfaction is our top priority, and we’re committed to providing excellent service to ensure that you and your furry friend have the best shopping experience possible.

Conclusion

In conclusion, dog walking gadgets play a vital role in enhancing the walking experience for both dogs and their owners. From hands-free leashes to GPS trackers, these innovative gadgets offer convenience, safety, and peace of mind during walks. By choosing the right gadgets and following best practices, dog owners can ensure that their furry companions enjoy comfortable and enjoyable walks every time. With Dogerys’ extensive selection of premium accessories and top-notch customer service, you can embark on memorable walks with your canine companion with confidence and style. Happy walking!

0 notes

Text

Ammonium Nitrate Prices, Pricing, Trend, Supply & Demand and Forecast | ChemAnalyst

Ammonium Nitrate prices have witnessed significant fluctuations in recent years, impacting various industries reliant on this essential compound. As a widely used fertilizer, ammonium nitrate plays a crucial role in enhancing agricultural productivity. The dynamics of its pricing are influenced by multiple factors, including supply and demand dynamics, raw material costs, geopolitical events, and regulatory changes.

In recent times, the global supply chain disruptions caused by the COVID-19 pandemic have added a layer of complexity to the pricing of ammonium nitrate. The pandemic-induced lockdowns and restrictions affected production and distribution channels, leading to supply shortages in certain regions and subsequent price hikes. Furthermore, fluctuations in energy prices, particularly those of natural gas, a key raw material in the production of ammonium nitrate, have also exerted pressure on its pricing.

Geopolitical tensions and trade disputes can significantly impact the cost of ammonium nitrate. Restrictions on trade, tariffs, and sanctions imposed on major exporting countries can disrupt supply chains and contribute to price volatility. Moreover, regulatory changes aimed at enhancing safety standards and preventing misuse of ammonium nitrate can also influence its pricing. Stricter regulations often necessitate investments in production facilities to comply with safety protocols, which can drive up production costs and, consequently, prices.

The agricultural sector remains a primary consumer of ammonium nitrate, driving demand fluctuations and, consequently, price movements. Shifts in global weather patterns, such as droughts or floods, can impact agricultural output, thereby affecting the demand for fertilizers like ammonium nitrate. Additionally, changing consumer preferences, technological advancements in agricultural practices, and government policies promoting sustainable farming practices also influence demand dynamics and, consequently, prices.

Get Real Time Prices of Ammonium Nitrate: https://www.chemanalyst.com/Pricing-data/ammonium-nitrate-1216

Ammonium nitrate prices also exhibit seasonal variations, with demand typically peaking during the planting seasons. Farmers' purchasing patterns and inventory management practices contribute to seasonal fluctuations in demand, which, in turn, affect prices. Moreover, the interplay between supply and demand dynamics in key producing regions, such as North America, Europe, and Asia-Pacific, further contributes to price volatility.

Market sentiment and speculation can exacerbate price fluctuations in the global ammonium nitrate market. Traders, investors, and speculators closely monitor geopolitical developments, weather forecasts, and regulatory announcements to anticipate future price movements. This speculative activity can amplify short-term price volatility, leading to rapid price changes within relatively brief periods.

Despite the challenges posed by supply chain disruptions and market uncertainties, technological advancements and innovation continue to shape the future of the global ammonium nitrate market. Manufacturers are investing in research and development to enhance production efficiency, reduce environmental impact, and develop safer storage and handling practices. Furthermore, the growing emphasis on sustainable agriculture and the increasing adoption of precision farming techniques are expected to drive long-term demand for fertilizers like ammonium nitrate.

In conclusion, the pricing of ammonium nitrate is influenced by a myriad of factors, including supply and demand dynamics, raw material costs, geopolitical events, regulatory changes, and market sentiment. While short-term price volatility may result from supply chain disruptions, seasonal fluctuations, and speculative activity, long-term trends are shaped by technological advancements, shifting agricultural practices, and evolving regulatory landscapes. As stakeholders navigate these dynamics, maintaining awareness of market fundamentals and adopting proactive risk management strategies is essential to mitigate the impact of price fluctuations on businesses and consumers alike.

Get Real Time Prices of Ammonium Nitrate: https://www.chemanalyst.com/Pricing-data/ammonium-nitrate-1216

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

Data Report: Trends in Precious Metals Investment

In the dynamic world of investment, the allure of precious metals remains steadfast, offering a tangible asset class that serves as a hedge against economic uncertainty and market volatility. This comprehensive data report delves into recent trends shaping the precious SG metals investment landscape, providing in-depth analysis and valuable insights derived from a range of reputable sources and market indices. By examining key indicators, investor sentiment, and performance metrics, this report aims to offer a nuanced understanding of the evolving dynamics within the precious metals market and their implications for investors worldwide.

Key Findings:

Gold: Despite initial volatility stemming from factors such as interest rate hikes and inflation concerns, gold prices exhibited resilience and demonstrated modest gains over the reporting period. The enduring appeal of gold as a safe-haven asset remained intact, bolstered by heightened geopolitical tensions and lingering uncertainties surrounding global economic recovery.

Silver: Silver prices experienced greater volatility compared to gold, reflecting its dual role as both a monetary metal and an industrial commodity. While silver benefited from its status as a store of value, it also faced headwinds from shifts in industrial demand and supply dynamics, resulting in fluctuating price movements.

Platinum and Palladium: The performance of platinum and palladium diverged during the reporting period, with platinum benefiting from increased industrial demand and supply constraints. In contrast, palladium prices were weighed down by concerns over automotive sector slowdowns and supply-demand imbalances, leading to mixed performance across the two metals.

Investor Sentiment:

Despite the inherent volatility of the precious metals market, investor sentiment remained generally positive, underscored by continued interest in safe-haven assets amid ongoing uncertainty. Investors exhibited a diverse range of preferences, with some opting for physical bullion to hedge against inflation and geopolitical risks, while others favored exposure through exchange-traded funds (ETFs) or explored opportunities in mining stocks and related equities.

Implications and Outlook:

The insights gleaned from this data report offer valuable implications for investors navigating the precious metals market. While short-term fluctuations may present challenges, long-term fundamentals such as monetary policy decisions, inflationary pressures, and geopolitical risks continue to underpin investor interest in precious metals as a viable portfolio diversification tool and store of value. Looking ahead, staying abreast of evolving market dynamics and leveraging strategic insights will be essential for investors seeking to capitalize on opportunities and mitigate risks in the ever-evolving landscape of precious metals investment.

Conclusion:

This data report provides a comprehensive analysis of recent trends in SG precious metals investment, offering valuable insights into key market dynamics, investor sentiment, and performance metrics. By synthesizing data from diverse sources and market indices, this report empowers investors with the knowledge needed to make informed decisions and navigate the complexities of the precious metals market effectively.

0 notes

Text

Ok so ... cost of the game and it being a issue

Ever since the insane price hike of this game in 2020 the Fandom has had a on going argument about the cost of the game ...actually a lot longer than that but the arguments died down at times

A long time ago during the end of thec6ds aera yugioh hit its frist real high point with a max rarity tele-dad deck that was close to 2000 ... Konami saw the issue and tried to fix it to keep decks under 300 for a while with a few cards hitting 100 on ans off

Then came 2015 where the tcg desided to get rid of rare cards in main sets and Gove us a super every pack .... this was a mistake

This made the allready bug problem of rarity bumping worse and caused a increase in short prints yes you got more holes per box but most of what you pull was not what you wanted or worth enough to trade for what you wanted causing a spike in the secondary market

They then got rid of unlimites prints a special edition 3 pack promo sets that would reprint a good card form the set abd hove is rather a reprint of a older card or a ocg exclusive they also kepted changing structure decks to keep good reprints out

Then the same 2020 story. Supply abd demand, running put of card stock , inflation all lead to a record breaking year for Konami but let the secondary market run wild the tcg did not help with a lot of sets that had one good reprint that caused everyone to buy boxes of a set flooding the bulk market

Then came the tier 0 area where for about 2 years straight everyone had the same deck and it cost more than my house then the reprint issue got worse the past 3 years of tins abd reprint sets have been horrible because they don't include the card needed to make the deck rum or made it a collector rare so 1 in every Luke 6 cases and the secret rare issues have cause a mess because all the good ones are 1 in every 3 cases

The problem now is the on going high cost and rarity changes then 2023 releasing so many sets screwed up this way no one could keep up

For the players who study the ocg to find decks and cards we like we can't plan anything out fire king because it is a structure deck should have cost 100 to make maybe 150 but do to the tcg changing rarities it is now 900 for the lowest rarity to 3000 for the highest rarity to make

So all of our planning out deck making strategies we plan out mean nothing because the deck is to expensive and I wish it was just one deck no every deck with potential to be good is getting the rarity bumps so all the planning is for nothing because we can't afford to keep spending 1000 to 3000 dollers on decks

Right now yugioh the tcg is having more shops deciding they won't sell the tcg products than ever because buying a pack is useless buying a box useless it's singles or cases

The tcg is becoming so expensive it is going to while its self out

0 notes

Text

Bitcoin's Price Plunges after ETF Approval: What's Next for the Cryptocurrency?

Bitcoin's Price Plunges after ETF Approval 😮❌

The US Securities and Exchange Commission (SEC) recently approved the first 11 Bitcoin exchange-traded funds (ETFs) that directly hold Bitcoins. This is a significant development as it allows for easier investment in the cryptocurrency compared to stand-alone crypto wallets. However, Bitcoin's price has seen a decline in recent days, falling by almost 10% since the ETFs started trading. The volatility of Bitcoin's price makes it difficult to predict its future movement.

In 2022, Bitcoin experienced a drop in price due to factors such as rising interest rates, failures of high-profile tokens and exchanges, and concerns about regulations for the crypto industry. However, in 2023, Bitcoin saw a significant rally driven by slower rate hikes and renewed interest in the crypto market. The recent decline in price seems to be a result of short-term traders taking profits after the ETF approval hype subsided.

Looking ahead, there are three potential catalysts that could drive Bitcoin's price higher. First, the ETF approvals make it easier for institutional investors to accumulate Bitcoin, which could stabilize the price and attract more big investors. Second, Bitcoin experiences a "halving" every four years, which reduces mining rewards and could drive the market price higher due to reduced supply. Lastly, concerns about inflation and fiat currency devaluation could lead more investors to see Bitcoin as a hedge and safe haven asset.

Continue Reading

0 notes

Text

Samsung Electronics Projects 35% Drop in Q4 Operating Profit

Share Post:

LinkedIn

Twitter

Facebook

Reddit

Samsung Electronics recently announced an anticipated 35% decrease in operating profit for the fourth quarter of 2023, a considerable shortfall from expectations. This forecasted decline comes as a surprise, considering the expected recovery in semiconductor prices, which typically forms the crux of the South Korean conglomerate’s profits.

Expected Operating Profit and Revenue

For the period spanning October to December 2023, Samsung Electronics estimates its operating profit to be approximately 2.8 trillion South Korean won ($2.13 billion). This is a significant decrease from the 4.31 trillion won reported during the same period the previous year and slightly lower than the 2.43 trillion won in the preceding quarter.

However, this projection falls notably short of the LSEG’s SmartEstimate, which anticipated a figure closer to 3.7 trillion won. Additionally, the firm estimates a 4.9% decrease in revenue, amounting to 67 trillion won for the fourth quarter compared to the previous year.

Impact on Semiconductor Segment

As the largest manufacturer of dynamic random-access memory (DRAM) chips globally, Samsung’s profitability heavily relies on this segment, commonly found in devices like smartphones and computers. Despite their prowess in semiconductor manufacturing, concerns have arisen regarding the company’s yields compared to competitors like TSMC.

Cory Johnson, Chief Market Strategist at The Futurum Group, highlighted Samsung’s strength in chip production but pointed out concerns about their yields impacting earnings significantly.

Memory Price Fluctuations and Outlook

Last year witnessed a drastic decline in memory chip prices due to excess inventories post-Covid and subdued demand for tech products. Analysts project a rebound in memory prices, starting from the fourth quarter of 2023, attributed to production cuts by suppliers and recovering demand for mobile and PC devices.

This downturn in memory prices heavily impacted Samsung Electronics’ previous earnings, with the third-quarter operating profit plummeting by 77.6% year-on-year. However, signs from Samsung and SK Hynix indicate a potential bottoming out of weak demand following production adjustments.

Optimistic Market Expectations

Analysts like SK Kim from Daiwa Capital Markets anticipate further price hikes in the first half of 2024, leading to a significant earnings rebound for memory manufacturers in the latter half of 2024 and 2025. The expected turnaround in memory chip prices has led to optimism regarding near-term stock performance.

Galen Zeng, Senior Research Manager of Semiconductor Research at IDC, supports this sentiment, citing the strict control of supply and output by memory manufacturers as the reason behind the price increase since November.

Prospects for Semiconductor Market Recovery

Zeng predicts an upturn in the semiconductor market, driven by increased demand for AI applications across various sectors. The turnaround is anticipated to signify the end of the downturn in the semiconductor supply chain, including design, manufacturing, packaging, and testing, by 2023.

As Samsung Electronics gears up to announce its detailed earnings on January 31, the market remains watchful of the semiconductor giant’s performance amidst these fluctuations in memory chip prices and anticipated market recoveries in 2024 and beyond.

0 notes

Text

Gensets Unleashed: The 2023 Guide to the Top 10 Gasoline Generator Sets"

A genset, short for generator set, refers to an engine generator set that converts mechanical energy into electrical energy using fuel. In the context of gasoline generators, they are specifically electrical generators powered by gasoline. These generators are commonly employed as emergency power backup systems in residential or industrial settings, offering a portable source of power.

Request The Sample PDF Of This Report : https://www.alliedmarketresearch.com/request-toc-and-sample/9392

COVID-19 Scenario:

The global market for gasoline gensets has faced significant challenges due to the COVID-19 pandemic:

Economic slowdown in major countries has impacted consumer spending patterns, leading to a decline in demand for gasoline gensets.

Lockdown measures across countries disrupted national and international transport, affecting the supply chain and creating a supply-demand gap.

Insufficient raw material supply hampered gasoline genset production rates, negatively impacting market growth. The situation is expected to improve as governments relax norms for business activities.

Market Dynamics:

Generators operate on various fuels, with gasoline being a common choice, especially for small-sized generators. Gasoline gensets are portable, widely used in residential, outdoor, and construction settings.

Gasoline gensets are favored for their lower cost and maintenance, providing a solution for unstable power supply and blackouts.

Get a Customized Research Report @ : https://www.alliedmarketresearch.com/request-for-customization/9392

Growing demand for gasoline gensets is observed in regions facing frequent power cuts, and they find applications in outdoor activities like camping and hiking.

However, initial high capital investments, safety concerns, and environmental impacts pose challenges to the market's growth.

Regional Analysis:

The U.S. is expected to witness strong growth due to frequent blackouts, sensitive power grid systems, and increasing consumer awareness.

Europe anticipates substantial growth with infrastructure advancements, low fuel prices, and a preference for outdoor activities.

Developing countries like India, China, and Indonesia show growth potential driven by population increase, infrastructure investments, and construction activities.

Enquiry Before Buying : https://www.alliedmarketresearch.com/purchase-enquiry/9392

Key Benefits of the Report:

Analytical depiction of the global gasoline genset industry with current trends and future estimations for investment decisions.

Information on key drivers, restraints, and opportunities with a detailed analysis of market share.

Quantitative analysis highlighting the growth scenario from 2020 to 2027.

Porter’s five forces analysis illustrating buyer and supplier potency.

Detailed global market analysis based on competitive intensity and future competition trends.

Gasoline Genset Market: Global Opportunity Analysis and Industry Forecast, 2020–2027 Report Highlights

By Power Rating

<2 kVA

2-3.5 kVA

3.5-5 kVA

5-6.5 kVA

6.5-8 kVA

8-15 kVA

By End User

Residential

Commercial

Industrial

By Region

North America (US, Canada)

Europe (Germany, UK, France, Russia, Italy, Rest of Europe)

Asia-Pacific (China, Japan, India, Rest of Asia Pacific)

Latin America (Brazil, Mexico, Rest of LATAM)

Middle East

Africa

Key Market Players

Generac, Kohler, Honda, Briggs & Stratton, John Deere, Cummins, Firman Power Equipment, Kirloskar, Yamaha Motor, Atlas Copco, Wacker Neuson, Caterpillar

0 notes

Link

0 notes

Text

The Bitcoin Cash price is up by 9.5% at the time of writing and is committed to gaining more by the end of the intraday session. The bulls hold control over the trend and the price might show gains to test the upper supply levels of $300.

The daily chart illustrates the breakout followed by a retest of the previous breakout zone. The price accumulated the buying volume near the 50-day EMA and surged to break above the previous high, thus forming a positive price action. The price trend analysis states that the BCH crypto price witnessed a surge of over 150% in the last week of June taking the price from $100 to a high of $300. Thereafter the short-term surge triggered a profit booking and the crypto price slumped below the $200 level.However, the bears lost momentum near the 200-day EMA and the price witnessed an accumulation followed by a price hike leading to the breakout of the upper trendline resistance.

Bitcoin Cash Price Prediction Using Price Action Strategy

Recently, the Bitcoin Cash price observed a retest of the breakout near the $200 level where the bulls had firmly established their positions and the price showed a breakout. The overall crypto market is bullish boosting the price trend and the BCH crypto price observed a gain of nearly 10% in the last 24 hours.

Also, the volume analysis shows that the BCH token has received a $186.54 Million volume in the past 24 hours which is 186.54% more than the past day. The volume-to-market cap is 10.21% indicating mild volatility in the crypto.

BCH Price Forecast from Indicators’ point of view

As per the EMA analysis, the BCH price showed a breakout of the 50-day EMA indicating that buyers are dominating the trend. The price is trading above the 200-day EMA.

At the time of publishing, the RSI value of the BCH token is 66.7 and that of the SMA line is 54.3. RSI is headed upwards taking support from the SMA line indicating an optimistic trend.

MACD lines have made a bearish crossover. Also, Histogram bars are being formed above the mean line with increasing height indicating bulls dominating the market.

Conclusion

The Bitcoin Cash price is bullish after breaking out of the upper trendline resistance and retesting the breakout zone near the $200 level. The price is up by 9.5% and might test the $300 level. The price trend is supported by the bullish crypto market and the high volume. The volume-to-market cap is 10.21% indicating mild volatility. The price is above the 50-day and 200-day EMA showing positive momentum.

Technical Levels

Support levels: $202 and $179.3.

Resistance levels: $263.5 and $305.75.

Source

0 notes

Text

Wall Street Divided: Treasury Yields Surge Sparks Intense Debates and Divergent Bets

Hedge Funds Place Bold Wagers Against Treasuries Amid Soaring Yields

Analysts at Goldman Sachs and JPMorgan contend that the recent plunge in Treasuries has been excessive, urging investors to seize the opportunity to buy. Warren Buffett, unfazed by Fitch’s downgrade of U.S. debt, persists in purchasing billions in Treasuries weekly for Berkshire Hathaway.

Meanwhile, billionaire investor Bill Ackman has unmasked a colossal short position against Treasuries, motivated by his anticipation of enduringly elevated inflation. The benchmark 10-year Treasury note’s yield broke the 4% barrier last week, a movement inversely related to prices. This upswing trails the Federal Reserve’s assertive shift towards steep interest rate hikes aimed at quelling inflation.

First image is the treasury bond yeild curve on February 1 2022 (normal)

Second image is the treasury bond yield curve today (inverted) pic.twitter.com/vEHF8ARaD3

— Ryan Patrick Kirlin (@RyanPKirlin) August 7, 2023

Goldman Sachs‘ strategists argue that the confluence of supply dynamics and Fitch’s downgrade doesn’t warrant the spike in yields. They forecast a “tactical” recovery in Treasuries and endorse purchasing 30-year inflation-protected bonds subsequent to yields reaching an 11-year zenith.

JPMorgan, too, views the sell-off as exaggerated. Their analysts attribute the downturn to the liquidation of overpopulated long positions rather than fresh economic insights, expressing particular optimism about 5-year Treasuries.

Billionaire Bill Ackman caused a sensation last week, disclosing a substantial short bet against 30-year Treasuries. He foresees the yield on the 30-year bond surging to 5.5%, driven by forecasts of sustained higher inflation coupled with the corresponding risk premium.

I have been surprised how low US long-term rates have remained in light of structural changes that are likely to lead to higher levels of long-term inflation including de-globalization, higher defense costs, the energy transition, growing entitlements, and the greater bargaining…

— Bill Ackman (@BillAckman) August 3, 2023

Conversely, Warren Buffett’s Berkshire Hathaway persists in acquiring Treasuries at a staggering $10 billion per week. Buffett brushes off apprehensions over Fitch’s U.S. debt downgrade, portraying Treasuries as a “no-brainer” investment, notwithstanding climbing yields.

The divergent wagers underscore the ongoing Wall Street debate regarding the potential longevity of the Treasury yield’s upsurge. Moreover, an inverted yield curve, where short-term rates have surpassed long-term yields, has intensified recession concerns.

This trend in bond markets is considered unusual and is often seen as a sign of an upcoming economic downturn, and it’s been this way for quite some time now. The inversion of the yield curve is a reliable indicator that has historically been followed by a recession in the following six to eighteen months.

What do you think about the wagers over U.S. Treasuries over the last few weeks? Share your thoughts and opinions about this subject in the comments section below.

Read the full article

0 notes

Text

Methyl Ethyl Ketone Prices, Price, Pricing, Trend and Forecast | ChemAnalyst

Methyl Ethyl Ketone (MEK) prices is a vital chemical compound extensively used in various industries, including paints and coatings, adhesives, printing inks, and chemical manufacturing. The pricing dynamics of MEK are influenced by several factors, such as supply and demand dynamics, raw material costs, global economic conditions, and regulatory changes. Understanding the fluctuations in MEK prices is crucial for businesses reliant on this compound for their operations.

One significant factor impacting MEK prices is its production process, which primarily involves the catalytic dehydrogenation of n-butane or n-butene. Therefore, the availability and cost of these feedstocks significantly affect MEK prices. Additionally, MEK is a highly volatile organic compound (VOC), subject to regulatory scrutiny due to its potential environmental and health impacts. Regulatory changes aimed at controlling VOC emissions can influence production costs and subsequently affect MEK prices.

Global economic conditions play a pivotal role in determining MEK prices. Economic downturns can lead to reduced industrial activity, impacting demand for MEK and subsequently exerting downward pressure on prices. Conversely, periods of economic growth typically witness increased demand for MEK across various industries, leading to price hikes. Moreover, currency fluctuations and geopolitical tensions can also influence MEK prices by affecting production costs and trade dynamics.

Get Real Time Prices of Methyl Ethyl Ketone: https://www.chemanalyst.com/Pricing-data/methyl-ethyl-ketone-46

The paints and coatings industry is one of the largest consumers of MEK, accounting for a significant portion of its demand. Therefore, trends in the construction and automotive sectors, major consumers of paints and coatings, directly impact MEK prices. For instance, robust construction activity or a surge in automotive production can drive up demand for paints and coatings, thereby increasing the need for MEK and pushing prices higher.

Supply chain disruptions can also cause fluctuations in MEK prices. Events such as natural disasters, transportation constraints, or labor strikes can disrupt the supply of raw materials or finished products, leading to supply shortages and price spikes. Additionally, the consolidation of MEK producers or changes in production capacities can impact market dynamics and prices.

The global shift towards sustainable practices and environmentally friendly alternatives can influence MEK prices in the long term. As governments and industries increasingly prioritize sustainability, there is growing interest in developing eco-friendly substitutes for MEK. The availability and adoption of these alternatives can affect the demand for traditional MEK and consequently its prices.

Market speculation and trading activities also contribute to price volatility in the MEK market. Traders and investors closely monitor factors such as inventory levels, demand projections, and geopolitical developments to make trading decisions, which can lead to short-term price fluctuations unrelated to underlying supply and demand fundamentals.

In conclusion, the pricing of Methyl Ethyl Ketone (MEK) is influenced by a complex interplay of factors, including supply and demand dynamics, raw material costs, regulatory changes, global economic conditions, industry trends, supply chain disruptions, sustainability initiatives, and market speculation. Businesses relying on MEK must closely monitor these factors to anticipate price movements and mitigate potential risks. By staying informed and adapting to market dynamics, companies can effectively manage their procurement strategies and optimize their operational costs in the competitive landscape of the chemical industry.

Get Real Time Prices of Methyl Ethyl Ketone: https://www.chemanalyst.com/Pricing-data/methyl-ethyl-ketone-46

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

Free Search the Asia Pacific Steel Plate Prices

North America

Steel Plate prices in the North American region upsurged during the first quarter of 2023. Initially, demand picked up moderately, reflecting lower stock levels following the holiday season. Service centers reported increased customer inquiries and shipments, but few were interested in stocking up on steel products, especially with lead times not extending any further than they had. In mid-Q1, the domestic steelmakers kept prices elevated owing to the rising raw material costs. As per the buyer, major players were raising costs to compete with the import offers. In March, mills continued to raise spot market offers, but demand remained steady as buyers continued to review their order books. Lead times increased to 7-8 weeks from 6-7 weeks. Confirmed orders were agreed upon and protected until the order was completed and shipped. Therefore, prices of the Steel plate for Ex-Work Texas were assessed at USD 1702/MT on March 31.

Asia- Pacific

In the first quarter of 2023, the Steel Plate prices showcased an upward momentum in the Asia- Pacific region. In January, demand picked up with a rise in downstream inquiries on the back of stabilized global inflation and China's reopening. However, China's production cuts and the Russia-Ukraine war resulted in tighter supply. Following the Spring Festival holiday, the steel market strengthened more in February, and the steel price continued to rise, signaling a promising start. Steel mills stopped production for more maintenance due to high costs, and output continued to fall, which was good for steel prices. With the arrival of the traditional peak season in March, domestic production was increased due to tight spot supply. Also, the costs of iron ore and coking coal rose due to inventory replenishment and Beijing's tightening control over crude steel production. Steel Wire Rod Prices were under a lot of cost pressure, so the ex-factory price was raised. Therefore, the price of the Steel plate for Ex Shanghai was assessed at USD 648/MT on March 31.

Europe

In the European region, the price trend of Steel Plate followed an upward price trajectory during the first quarter of 2023. The hikes in Steel Plate prices were due to increasing prices of the slab, improved demand, and short supply due to longer plate delivery times. Major manufacturers claimed that big buyers who had avoided restocking in December began to place orders in this quarter. The anticipated rise in import slab prices from Asia following the Lunar New Year holidays in China, as well as good order books at European plate producers, also contributed to the market's bullishness. Sales volumes picked up significantly due to limited inventory and higher downstream demand, and buyers were willing to pay higher prices. Some automotive steel demand revival had also contributed to the upbeat mood. Therefore, the price of the Steel plate for Ex Ruhr was assessed at USD 1165/MT on March 31.

ChemAnalyst tackles the primary difficulty areas of the worldwide chemical, petroleum, pharmaceutical, and petrochemical industries, empowering decision-makers to make informed decisions. It examines and analyses geopolitical risks, environmental concerns, raw material availability, supply chain functioning, and technological disruption. It focuses on market volatility and guarantees that clients manage obstacles and hazards effectively and efficiently. ChemAnalyst's primary expertise has been data timeliness and accuracy, benefiting both local and global industries by tuning in to real-time data points to execute multibillion-dollar projects internationally.

0 notes

Text

Inflation and Real Estate Prices

The Nexus Between Inflation and Home Prices: Unraveling the Complex Interplay

In the intricate web of economic phenomena, the connection between inflation and home prices stands as a compelling subject for scrutiny. Delving into this relationship reveals a dynamic interplay where both variables exert influence on each other. Through a meticulous examination, we can begin to unravel the driving forces behind this nexus.

Acknowledging the Dual Influence: Inflation and Home Prices

The intricate dance between inflation and home prices becomes apparent upon closer analysis. It becomes evident that these two phenomena engage in a mutual tango, with each partner taking turns leading the way.

Supply and Demand Dynamics: A Key Driver

To comprehend the surge in house prices, one must consider the fundamental aspects of supply and demand. Following the great recession, the construction of homes by builders significantly dwindled, leading to a scarcity in supply. Simultaneously, the ever-changing demographics have driven an increased demand for homeownership, exacerbating the situation. This demand surge, coupled with historically low interest rates, has undeniably contributed to the upward trajectory of home prices. Hence, it becomes clear that the surge in prices can be primarily attributed to the dynamics of supply and demand, without necessarily relying on the fluctuations of general inflation.

Unveiling the Impact of Inflation on Home Prices

While exploring this complex interplay, it becomes crucial to scrutinize the role of inflation. During the period under examination, inflation remained relatively subdued. The extraordinary circumstances surrounding the pandemic ushered in a significant idle capacity within the economy, with both manufacturing facilities and service providers operating at only a fraction of their potential. However, with the implementation of stimulus measures, factories reopened, and underutilized capacity was tapped into. Consequently, inflation was contained as supply costs remained stable, and manufacturers were able to meet the growing demand without significant adjustments to their existing infrastructure.

Nevertheless, as the economy neared full capacity prior to the change in administration, a new wave of legislation ushered in record-breaking levels of government spending as part of the build-back-better agenda. Unlike the previous scenario, this additional stimulus lacked the advantage of idle capacity, making it challenging to swiftly expand manufacturing and service capacity in a cost-effective manner. Consequently, in the short term, prices experienced an inevitable increase. In simpler terms, when there is a surge in demand (accompanied by an influx of money) and a dearth of changes in supply, price hikes become an inescapable reality.

Uncovering the Inherent Relationship: Home Prices and Inflation

To ascertain the presence of an inherent relationship between real estate prices and inflation, an extensive examination of data was undertaken. By isolating the Home Price Index provided by the Federal Housing Finance Administration against the consumer price indexing excluding housing, it was possible to explore their connection.

Upon statistical correlation analysis, a noteworthy correlation emerged. Home Price Appreciation was found to exert an influence of approximately 36% on inflation, while inflation increases were observed to impact home prices by approximately 22%. These findings substantiate the existence of an inherent link between these two variables. Although both are subject to various individual factors, their interdependence remains significant.

Compelling Evidence: Home Price Appreciation Outpacing Inflation

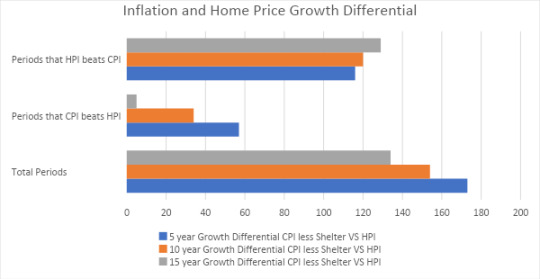

The most intriguing aspect lies in the frequency with which home price appreciation surpasses inflation. An empirical examination conducted over 5, 10, and 15-year periods sheds light on this phenomenon:

1. 5-year periods: Out of 173 5-year periods since 1975, Home Price Appreciation exceeded Consumer Price Inflation in 116 instances, accounting for an impressive 67% of the time.

2. 10-year periods: Out of 154 10-year periods since 1975, Home Price Appreciation outperformed Consumer Price Inflation in 120 instances, accounting for a remarkable 78% of the time.

3. 15-year periods: Out of 134 15-year periods since 1975, Home Price Appreciation surpassed Consumer Price Inflation in 129 instances, accounting for an astonishing 96% of the time.

These findings unequivocally illustrate that Home Price Appreciation inherently outpaces inflation, particularly over the long term. Consequently, real estate emerges as a reliable mechanism for wealth preservation, safeguarding and augmenting one's assets over time.

Beyond the wealth accumulation potential, it is important to highlight the abundant cash flow opportunities presented by real estate investments, further solidifying its appeal.

In Conclusion: Real Estate as a Stable Investment

In summary, real estate stands as a steadfast and stable investment avenue. While it may not promise rapid wealth accumulation, it possesses the potential to generate substantial long-term prosperity. Real estate serves as a predictable and secure method for wealth preservation, effectively shielding one's assets and providing considerable downside protection when approached strategically.

In other words, there’s never a bad time to buy real estate. Just a bad time to sell.

0 notes