#Post Office Scheme PPF

Text

Small Savings Schemes 2024-New Interest Rates

Small Savings Schemes 2024

Small Savings Schemes 2024The Inside Scoop on Interest RatesMeet the RatePost Office Plans: What’s Changing?The Money Math: How Rates Are SetPPF Stays Put: No Changes HereBanks vs. Small Savings SchemesSavings Showdown: Big Banks vs. Post Office

Small Savings Schemes 2024- The government just spilled the beans on interest rates for small savings schemes from January…

View On WordPress

#Business news#Changed#fixed deposits#Full#Interest#interest rates#JanMarch#list#nsc#office#post#post office savings schemes#ppf#Public Provident Fund (PPF)#rates#Samriddhi#Savings#schemes#SCSS#senior citizens savings scheme#Small#small savings schemes#Sukanya#sukanya samriddhi

0 notes

Text

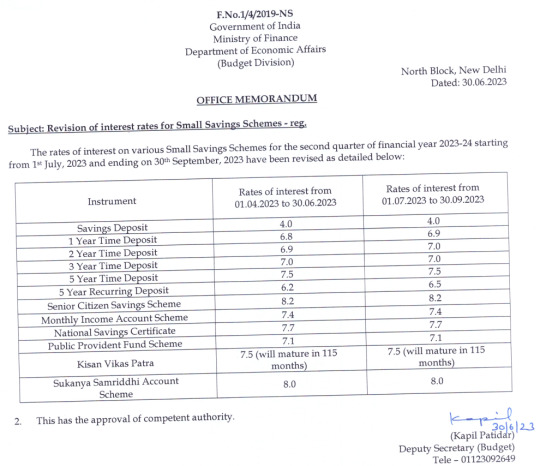

Post office and small savings schemes Interest rates from 1st July 2023

Today's Govt. circular on 'small savings schemes' Interest rates for July to Sep 2023. Interest rates of some schemes have been increased.

#SSY, #KVP, #NSC, #SCSS, #POFD, #MIS, #PPF

The interest rates for the period from 1st July 2023 to 30th September 2023 of ‘Post office and small savings schemes’ like PPF, KVP, SSY, SCSS, NSC, MIS, post office savings deposit, Time deposit, Recurring deposits has been declared on 30th June 2023 (Friday) by the Finance Ministry.

(more…)

View On WordPress

#dEPOSIT#Finance#Fixed deposit#income tax#KVP#MIS#NSC#post office#PPF#SAVINGS#SCSS#small savings schemes#ssy#sukanya samriddhi yojana

0 notes

Text

Post Office PPF Account Scheme : डाकघर पीपीएफ खाता योजना, पोस्ट ऑफिस पब्लिक प्रोविडेंट फंड

Post Office PPF Account Scheme : डाकघर पीपीएफ खाता योजना, पोस्ट ऑफिस पब्लिक प्रोविडेंट फंड

डाकघर पीपीएफ खाता योजना 2022: Post Office PPF Account Scheme पोस्ट ऑफिस पब्लिक प्रोविडेंट फंड एक बचत योजना है जो अपने गारंटीड रिटर्न और कर लाभों के लिए जानी जाती है! पीपीएफ को दूरस्थ क्षेत्रों के लोगों सहित सभी के लिए सुलभ बनाने के लिए, सरकार उपयोगकर्ताओं को भारतीय डाकघरों में पीपीएफ खाते खोलने की अनुमति देती है! डाकघर पीपीएफ खाता वह है जो मुख्य सुविधाओं, ब्याज दरों और अन्य शर्तों के संदर्भ में…

View On WordPress

#Post Office#post office ppf#post office ppf account#post office ppf scheme#post office ppf scheme in hindi#post office saving scheme#post office saving schemes#Post Office Scheme#PPF Account#ppf account benefits#ppf account details#ppf account in post office#ppf account in sbi#ppf account rules#ppf scheme#ppf scheme in post office#ppf scheme post office#public provident fund in post office#public provident fund scheme#sbi ppf account

0 notes

Text

Small Saving Schemes: A setback for those investing in PPF, Sukanya Samriddhi Yojana

Small Saving Schemes: A setback for those investing in PPF, Sukanya Samriddhi Yojana

Small Saving Schemes News: Investors in small government savings schemes have suffered a major setback. Despite the increase in the repo rate by the RBI and the increase in the yield of government bonds, the government decided not to increase the interest rates on savings schemes like NSC, PPF and Sukanya Samriddhi Yojna in the month of July to September. has done. The Department of Economic…

View On WordPress

#Government Saving Schemes#Kisan Vikas Patra#Ministry of Finance#NSC#Post Office Deposit Scheme#PPF#RBI#small saving schemes#small savings scheme#Sukanya samriddhi yojana

0 notes

Text

PPF, सुकन्या समृद्धि और NSC जैसी स्कीम्स के निवेशकों के लिए अच्छी खबर, 30 जून को सरकार देगी बड़ी खुशखबरी!

PPF, सुकन्या समृद्धि और NSC जैसी स्कीम्स के निवेशकों के लिए अच्छी खबर, 30 जून को सरकार देगी बड़ी खुशखबरी!

Photo:INDIA TV

Small Saving

Highlights

छोटी बचत पर वित्त मंत्रालय तय करता है ब्याज दर

पिछले दो साल के छोटी बचत पर ब्याज दरों में कोई बदलाव नहीं हुआ

सरकार अब महंगाई देखते हुए ब्याज दरों में बढ़ोतरी कर सकती है

PPF, सुकन्या समृद्धि और NSC समेत तमाम स्मॉल सेविंग स्कीम्स में निवेश करने वालों निवेशकों को जल्द अच्छी खबर मिल सकती है। करीब दो साल बाद सरकार 30 जून को स्मॉल सेविंग स्कीम्स पर ब्याज दरों…

View On WordPress

#Government Saving Schemes#interest rate hike#Kisan Vikas Patra#ministry of finance#Modi Government likely to change Small savings scheme interest rate#National Saving certificate interest rate#NSC#Post Office Deposit Schemes#post office inter#PPF#PPF Interest rate#rbi#small savings scheme#Small savings Scheme interest rate#sukanya samriddhi yojana#छोटी बचत योजना#छोटी बचत योजनाओं का ब्याज#पीपीएफ#पोस्टल डिपॉजिट स्कीम्स#रेपो रेट#लघु बचत योजना#सुकन्या समृद्धि योजना#स्मॉल सेविंग्स स्कीम

0 notes

Text

PPF, सुकन्या समृद्धि योजना में निवेश करने वालों को जल्द मिल सकती है खुशखबरी

PPF, सुकन्या समृद्धि योजना में निवेश करने वालों को जल्द मिल सकती है खुशखबरी

Small Saving Schemes: अगर आप एनएससी(NSC), पीपीएफ(PPF) और सुकन्या समृद्धि योजनाओं( Sukanya Samridhi Yojna) जैसी बचत योजना में निवेश करते हैं तो जून में आपके लिए खुशखबरी का ऐलान हो सकता है. आरबीआई के रेपो रेट को 40 बेसिस प्वाइंट बढ़ाकर 4.40 फीसदी किए जाने के बाद मौजूदा वित्त वर्ष की दूसरी तिमाही के लिए वित्त मंत्रालय जब इन बचत योजनाओं के ब्याज दरों की समीक्षा करेगी तो इन सेविंग स्कीमों मिलने वाले…

View On WordPress

#NSC#Post Office Deposit Schemes#PPF#RBI#Repo Rate Hike#small saving schemes#Sukanya Smridhi Yojna#छोटी बचत योजना#पीपीएफ#पोस्टल डिपॉजिट स्कीम्स#रेपो रेट#लघु बचत योजना#सुकन्या समृद्धि योजना

0 notes

Text

Types of investment options in India

When it comes to the different types of investment options out there in India the first name that comes to mind is that of the share market. By investing in the equity market, you can create wealth over a longer time.

Certificate of deposit

Certificates of Deposit are money market instruments issued against the funds that an investor deposits. The money in this case is deposited by the investor in a bank for a specified length of time in a dematerialized form.

Bonds

Bonds are a kind of investment that has become rather popular in India. In this case, the investors lend money to the issuer of the instrument, and in lieu of that the borrower pays them interest at a previously specified rate till maturity.

Real estate

Investing in real estate means buying commercial or residential properties that let you appreciate your capital – you may also get regular rental income from the same. In these cases, the rent serves as a steady source of income for you.

FDs (fixed deposits)

FDs are offered by both NBFCs (non-banking financial companies) and banks and are an exceptional way to grow your money while making sure that you get the highest level of safety with your investment.

MFs (mutual funds)

A mutual fund is one where the issuer of the fund pools money from various investors and then invests it in market-linked instruments such as shares, bonds, or a combination of debt and equity instruments.

PPF (Public Provident Fund)

PPF is supposed to be one of the safest investment options in India and this is primarily because Indian government backs it. You can open a PPF account at any post office or a bank that issues them.

NPS (National Pension System)

This is a highly popular investment option among salaried individuals in India. This is backed by the government of India as well and it is a long-term investment option.

ULIP (Unit-Linked Insurance Plan)

ULIPs are tax-saving investment options and provide you with the added advantage of insurance along with the investment component. Here a part of the premium you pay is used for investments and the remaining amount is used for your insurance.

Apart from these, you have the SCSS (Senior Citizens’ Savings Scheme). No matter which of these you choose it is better to proceed through a trusted service provider such as m.Stock if you want to invest in shares for example.

0 notes

Text

Safe Investment Options in India: Securing Your Financial Future

In the ever-changing environment of financial markets, everyone prioritizes ensuring their financial future. For risk-averse investors, navigating the maze of financial possibilities can be difficult. In this tutorial, we'll look at secure investing possibilities in India, specifically for individuals who value stability and security.

Safe Investment Opportunities in India for Risk-Averse Investors

Fixed Deposits

Fixed deposits (FDs) are a traditional option for risk-averse investors. These are low-risk investments in which you deposit a lump sum with a bank or financial institution for a specified period of time and get a predetermined interest rate. FDs offer capital protection and consistent returns, making them a popular alternative for investors seeking a safe haven for their funds.

Mutual Funds

Mutual funds provide a diversified investing approach, making them ideal for risk-averse clients who want their assets managed professionally. With many types of mutual funds accessible, such as debt funds and hybrid funds, investors may select solutions that are appropriate for their risk level. Systematic Investment Plans (SIPs) reduce risks by spreading investments across time.

Post Office Savings Scheme

The Post Office Savings Scheme is a government-backed project that offers a variety of savings and investing opportunities. These programs include the Senior Citizens Savings Scheme (SCSS), Monthly Income Scheme (MIS), and Public Provident Fund (PPF). These programs are appealing to risk-averse investors because of the safety and reliability that comes with government support.

The National Pension Scheme (NPS)

NPS is a long-term retirement-focused investment scheme that encourages systematic savings. NPS offers a well-diversified portfolio that includes equity, term deposits, corporate bonds, liquid funds, and government funds. It provides not just financial stability in retirement but also tax breaks, making it an excellent alternative for risk-averse individuals.

Unit-Linked Insurance Plans (ULIPs)

ULIPs combine insurance coverage with investing potential. These plans provide flexibility by allowing investors to select among equities and debt funds based on their risk tolerance. ULIPs are becoming increasingly popular as a comprehensive financial product due to their ability to generate wealth and provide life insurance.

Public Provident Fund (PPF).

PPF is a long-term investment option that requires a 15-year lock-in period. This government-backed program offers competitive interest rates and tax breaks, making it a popular choice among conservative investors. The rigorous practice of paying yearly to the PPF assures consistent wealth building during the investing period.

Senior Citizens Saving Scheme (SCSS)

SCSS is a low-risk investment option for seniors that delivers regular income in the form of quarterly interest payments. With a five-year tenure, SCSS provides a consistent stream of income for retirees, making it a good choice for risk-averse persons in their golden years.

7.75% Government of India bonds.

Government bonds are regarded one of the most secure investment alternatives. The 7.75% Government of India Bonds, which have a fixed interest rate, provide both capital protection and regular returns. These bonds are a reliable option for risk-averse individuals looking for a safe haven for their assets.

Conclusion

In the search of financial security, selecting the correct investment option is critical. For risk-averse investors, the stated solutions offer a variety of possibilities, each with its own set of features and benefits. Whether you like the stability of fixed deposits, the diversification of mutual funds, or the broad coverage of ULIPs, there is an investing opportunity for everyone. Understanding your financial goals and risk tolerance allows you to develop a well-rounded investing strategy that protects your financial future. Explore the world of safe investments in India and begin your road to financial prosperity and peace of mind.

0 notes

Text

Exploring the Best Post Office Schemes for Students in India

I've been delving into the world of savings and investments recently, and I'm amazed at the plethora of options we have right at our doorstep - the Indian Post Office Schemes! 😊 From the Recurring Deposit (RD) that lets you save a little every month, to the Time Deposit Account (TD) that works like a fixed deposit, there's something for everyone. 💰

What caught my eye is the Monthly Income Scheme Account (MIS) - perfect for those who want a consistent cashflow. 💵 And let's not forget the Public Provident Fund Account (PPF) and National Savings Certificate (NSC) that offer tax savings and a nice return. 🙌

https://fresherblog.com/post-office-schemes/

For my friends with a rural connection or interest in agriculture, the Kisan Vikas Patra (KVP) is a gem. Your investment doubles in less than 10 years. 🚜

The best part? Even students can apply! Just fill out the form and submit it with your ID, address proof, and a snap. Oh, and you'll need some cash or a cheque for the first deposit. 📝

But remember, always read the fine print and make sure the scheme suits your needs and risk tolerance. Happy investing! 😊

#Investing101#PostOfficeSchemes#Savings#PersonalFinance#StudentLife#InvestmentTips#MoneyMatters#India#FinancialFreedom#students#fresherblog#college#college life#desiblr

0 notes

Text

What is the Public Provident Fund Scheme?

All people can invest tax-free through the Public Provident Fund (PPF) savings plans. The government launched the program to promote people's investing and saving behaviours. The system was first announced on June 15, 1968, via GSR 1136. Since then, numerous changes have been made. A new scheme has now been announced by the government, according G.S.R. 915(E), dated December 12, 2019.

A ₹1,50,000 maximum deposit is allowed in a fiscal year, with a ₹500 minimum requirement.

From the third to the sixth fiscal year, a lending facility is offered.

Annual withdrawals are allowed starting with the seventh fiscal year.

After fifteen complete financial years have passed since the account's opening, it matures.

With new deposits, the account can be extended after maturity for an unlimited number of 5-year blocks.

Following maturity, interest can be accumulated at the current rate on an ongoing basis, provided no additional deposits are made.

There is no court ruling or decree that could lead to the attachment of the funds in the PPF account.

Under Income Tax Act Section 80-C, deposits are deductible.

Section 10 of the Income Tax Act exempts the interest earned in the account from income tax.

Overview of Public Provident Funds

Eligibility for Public Provident Funds

Any authorized bank, post office, or nationalized bank may open PPF accounts. Form 1 must be submitted along with the necessary paperwork and the required minimum deposit in order to start a PPF account.

Can I open two PPF accounts?

Under the PPF plan, a person is only allowed to register one account in his name. Furthermore, a person may register a single PPF account in the name of each juvenile or mentally ill person for whom he is the legal or natural guardian. It should be mentioned that any guardian of a kid or someone mentally ill may only open one account in their name. It is not possible to open joint accounts under this scheme

Repercussions for not making the required minimum payment into the account

The account will be deemed cancelled if the depositor does not make the required number of deposits in the subsequent years. However, if the minimum yearly deposit of Rs. 500 is paid for each year of default, together with a penalty of Rs. 50 for each year of default, the account can be reopened during its maturity period. The amount that the investor deposits in the account will not be increased by the amount of the fee.

The account holder will only be permitted to open a new account following the account's closure upon maturity if their PPF account is deemed abandoned. Additionally, the facility for loans and partial withdrawals shall not be available.

The amount in the closed account will still accrue interest at the rate that is periodically relevant to the scheme, even if it is not reopened.

PPF Withdrawal Guidelines

When is it possible to withdraw money?

Only five years from the end of the year the account was opened may money be taken out of the PPF account prior to maturity. If a juvenile or someone mentally incompetent opens the account, withdrawals can be made whenever it's convenient for them, as long as they're still alive.

Maximum amount that can be taken out

A maximum of 50% of the balance in the account's credit at the end of the year immediately prior to the withdrawal or at the end of the previous year, whichever is smaller, may be taken from the PPF account.

If the account has received deposits after maturing, the total amount of withdrawals made throughout the five-year block period cannot exceed 60% of the credit balance at the beginning of the block period. One may choose to make this withdrawal in one lump sum payment or in yearly installments. However, no more withdrawals will be permitted if the account user decides to keep the account open without making any more deposits.

How Can I Take Out My PPF Amount?

The Form 2 application must be submitted. On the other hand, the guardian must provide a certificate if the withdrawal is made from the account on behalf of a minor or someone who is not of sound mind.

Additional circumstances

Before submitting an application for such a withdrawal, the account holder must refund any outstanding debt, including interest, if any has been acquired against the account;

The withdrawal option is only accessible once a year; withdrawals cannot be performed from accounts that have been closed or from account extensions in which the account holder chooses not to make any more deposits.

Is it possible for a Non-Resident to open a PPF account?

It was forbidden for non-residents to invest in the PPF under the prior structure. Nothing in the new plan forbids non-residents from doing anything. Therefore, anyone can choose to use this program, resident or not.

However, in order to open an account under the plan, the applicant needs to submit Form 1, which certifies that they are an Indian citizen living in the country. It is uncertain if Section 2(v)/2(w) of the FEMA Act or Section 6 of the Income-tax Act will be used to determine this residential status.

Therefore, the applicant will not be permitted to sign such a declaration if he is a foreign national or a non-resident of India (as defined by both Acts). Therefore, Form 1 will prevent a non-resident citizen from signing and submitting the application in Form 1, even when the scheme's limitation has been removed. Unlike the previous scheme, if the account holder becomes a non-resident at any point after choosing it, he will not have to cancel the accounts and only need to submit a declaration to an accounts officer stating his change in residency.

#ppf scheme#public provident fund#PPF Amount#PPF Withdrawal Guidelines#bricksnwall#real estate#property

0 notes

Text

Post office schemes interest rate 2023: Which small savings scheme offers highest interest rate - The Economic Times

The government’s small savings scheme offer various deposit schemes catering to different individuals such as girl kid (Sukanya Samriddhi), women investor (Mahila Samman), senior citizens (SCSS), long term investors (PPF, KYC, NSC) and short term investors (Time deposits, RD). Small savings scheme interest rates are revised every quarter by the government and interest rates vary accordingly. For…

View On WordPress

0 notes

Text

With multiple investment options available, identifying where to invest money can be confusing. It is important to understand each of them and then invest in the ones that meet your requirements.

Investment options available in India

1. National Savings Certificate (NSC)

2. National Pension Scheme (NPS)

3. Public Provident Fund (PPF)

4. Unit-linked Insurance Plans (ULIPs)

5. Equity Mutual funds

7. Gold

8. Real Estate Investment Trust (REIT)

9. Post Office Monthly Income Scheme

10. Fixed deposits

11. Government Bonds

12. Sovereign Gold Bonds (SGBs)

0 notes

Text

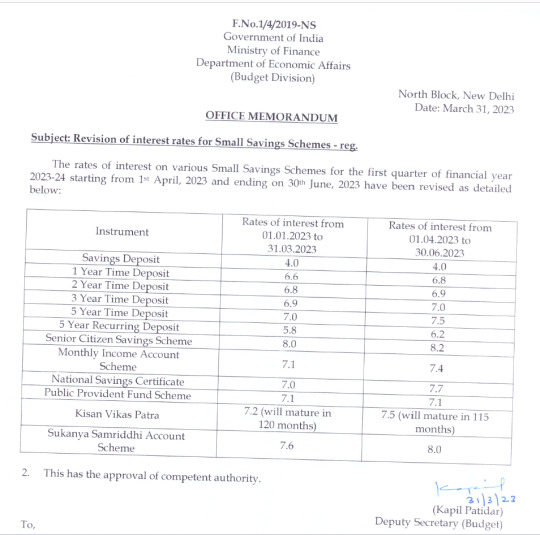

Post office and small savings schemes Interest rates from 1st April 2023

Govt. circular on small savings schemes Interest rates from 1st April 2023 to 30th June 2023. Except PPF, all schemes' rate have been increased.

#SSY, #KVP, #NSC, #SCSS, #POFD, #MIS, #PPF

The interest rates for the period from 1st April 2023 to 30th June 2023 of ‘Post office and small savings schemes’ like PPF, KVP, SSY, SCSS, NSC, MIS, post office savings deposit, Time deposit, Recurring deposits has been declared on 31st March 2023 (Friday) by the Finance Ministry.

(more…)

View On WordPress

#dEPOSIT#Finance#Fixed deposit#income tax#KVP#MIS#NSC#post office#PPF#SAVINGS#SCSS#small savings schemes#ssy#sukanya samriddhi yojana

0 notes

Text

how to make investments

Investors actively seek out how to make investments in monthly income plans from banks, NBFCs, and the post office, as they offer a reliable and regular source of income during retirement.

However, schemes like PPF may not provide annuity benefits, and the Pradhan Mantri Yojana can only be accessed once you turn 60.

Suppose you’re in your early 30s and wondering how to make investments that offer stable returns over both the short-term (5 to 10 years) and the long-term (until retirement). In that case, we have compiled a list of schemes that allow you to effectively leverage the power of compounding and achieve your financial goals.

0 notes

Text

youtube

Where To Invest Money? - ICICI Pru Life

Investment options available in India

1. National Savings Certificate (NSC)

2. National Pension Scheme (NPS)

3. Public Provident Fund (PPF)

4. Unit-linked Insurance Plans (ULIPs)

5. Equity Mutual funds

7. Gold

8. Real Estate Investment Trust (REIT)

9. Post Office Monthly Income Scheme

10. Fixed deposits

11. Government Bonds

12. Sovereign Gold Bonds (SGBs)

0 notes