#Online Accountant

Text

Oh no I slipped out of my hoodie!

#alt aesthetic#alt girl#alternative#girls with gauges#girls with tattoos#LexiLapis#girls with piercings#online accountant#tumblr girls#beautiful#grunge#grungy aesthetic#grungy girls#grungy style

3K notes

·

View notes

Text

🚀 Bạn muốn trở thành chuyên gia kế toán thuế? 🚀

Tham gia khóa học của chúng tôi ngay hôm nay để:

🎯 Nắm vững kiến thức từ cơ bản đến nâng cao

🎯 Thực hành trên tình huống thực tế

🎯 Nhận chứng chỉ giá trị, mở rộng cơ hội việc làm

👉 Đăng ký ngay để nhận ưu đãi hấp dẫn!

🌐Website: https://khoahocketoanthue.edu.vn/

☎Hotline: 0815 552 558

🖇️Facebook: https://www.facebook.com/khoahocketoanthue1/

🪪Email: [email protected]

📚 Khóa học Kế toán Thuế 💼 | 📈 Tối ưu thuế, tăng lợi nhuận | 🤝 Giảng viên tận tâm | 🎓 Chứng chỉ uy tín | 🚀 Nâng tầm sự nghiệp | 👉 Đăng ký ngay!

#Trungtâmkếtoántphcm #kếtoánvănphòngtphcm #khóa_học_kế_toán #kế_toán_tổng_hợp #kế_toán_thực_hành #trung_tâm_dạy_kế_toán #Đàotạokếtoántphcm #Hocketoanotphcm #Trungtamketoantphcm

2 notes

·

View notes

Text

Khóa học Kế toán Thuế Chuyên Sâu - Nâng Tầm Kỹ Năng Chuyên Môn Của Bạn!

Bạn đang tìm kiếm cơ hội phát triển sự nghiệp trong lĩnh vực Kế toán Thuế? Khóa học Kế toán Thuế Chuyên Sâu tại Trung tâm Tin học Hướng nghiệp chính là chìa khóa dẫn bạn đến thành công!

Tại sao nên chọn Khóa học Kế toán Thuế Chuyên Sâu tại đây?

Nội dung đào tạo chuyên sâu: Cung cấp kiến thức toàn diện về hệ thống thuế Việt Nam, bao gồm thuế thu nhập doanh nghiệp, thuế thu nhập cá nhân, thuế giá trị gia tăng, thuế môn bài, v.v.

Giảng viên giàu kinh nghiệm: Đội ngũ giảng viên là những chuyên gia uy tín trong lĩnh vực Kế toán Thuế, có nhiều năm kinh nghiệm thực tế và khả năng truyền đạt kiến thức hiệu quả.

Phương pháp giảng dạy hiện đại: Kết hợp lý thuyết và thực hành, sử dụng giáo trình tiên tiến, case study thực tế và phần mềm kế toán chuyên dụng.

Học viên được hỗ trợ nhiệt tình: Trung tâm luôn sẵn sàng hỗ trợ học viên trong suốt quá trình học tập, giải đáp thắc mắc và cung cấp tài liệu tham khảo bổ sung.

Cơ hội việc làm rộng mở: Sau khi hoàn thành khóa học, học viên có thể tự tin ứng tuyển vào các vị trí Kế toán, Chuyên viên Kế toán, Giám đốc Kế toán tại các doanh nghiệp trong và ngoài nước.

Hãy tham gia Khóa học Kế toán Thuế Chuyên Sâu ngay hôm nay để nâng tầm kỹ năng chuyên môn và mở ra cánh cửa thành công trong sự nghiệp của bạn!

Liên hệ ngay để được tư vấn miễn phí:

Website: https://khoahocketoanthue.edu.vn/

Hotline: 0812 114 345

Email: [email protected]

Facebook: https://www.facebook.com/ketoanthuehuongnghiep/

Hãy cùng Khóa học Kế toán Thuế Chuyên Sâu chinh phục ước mơ thành công của bạn!

2 notes

·

View notes

Text

How does online accounting service work?

Just send your receipts and statements by email, fax, scan (or) give us access to your computer so that we can fetch your data directly from your own computer. We will do your accounting work using either one of the following 3 methods

Use online accounting software (example: Xero, QuickBooks online)

Remotely connect to your computer and do your accounting

Do work from our computer and send you the completed reports and backups Contact us today to learn more about our online accounting services

#online accounting#accounting outsourcing#online accountant#uk accountant#virtual accountants#virtula accounting services#virtual accounting

0 notes

Text

www.danielhorvat.com

#accountant#spicy accountant#taxes#tax accountant#online accountant#tax filing#Canadian accountant#bookkeeping#Canadian tax return#financial accounting#cost accounting

1 note

·

View note

Text

Discover The Best And Dedicated eCommerce Accountants

In the ever-evolving landscape of eCommerce, staying on top of financial matters is crucial for success. From managing transactions and taxes to optimizing profits and minimizing risks, the expertise of eCommerce accountants is invaluable. These professionals specialize in navigating the unique financial challenges of online businesses, providing essential guidance and support to ensure financial stability and growth.

The Importance of eCommerce Accountants:

Expertise in eCommerce Platforms: eCommerce accountants possess specialized knowledge of the financial systems and platforms commonly used in online retail, such as Shopify, WooCommerce, and Amazon Seller Central. They understand the intricacies of eCommerce transactions, payment gateways, and inventory management, enabling them to provide tailored financial solutions for online businesses.

Tax Compliance and Optimization: Tax laws and regulations for eCommerce businesses can be complex and constantly changing. eCommerce accountants ensure compliance with tax requirements, including sales tax, income tax, and international tax obligations. They also identify tax-saving opportunities and strategies to optimize tax deductions and credits, helping online retailers minimize their tax liabilities and maximize profitability.

Financial Analysis and Reporting: eCommerce accountants analyze financial data and performance metrics to provide insights into the health and profitability of online businesses. They generate accurate and timely financial reports, including income statements, balance sheets, and cash flow statements, to help business owners make informed decisions and identify areas for improvement.

Services Offered by eCommerce Accountants:

Bookkeeping and Accounting: eCommerce accountants manage day-to-day financial transactions, including sales, expenses, and inventory updates. They maintain accurate and up-to-date accounting records, reconcile accounts, and ensure compliance with accounting standards and regulations.

Tax Planning and Preparation: eCommerce accountants develop tax strategies tailored to the unique needs and circumstances of online businesses. They prepare and file tax returns, assist with sales tax registration and compliance, and advise on tax implications related to eCommerce activities, such as nexus issues and cross-border sales.

Financial Forecasting and Budgeting: eCommerce accountants help online retailers forecast future financial performance and develop realistic budgets and financial projections. They analyze historical data, market trends, and business goals to create comprehensive financial plans that guide strategic decision-making and resource allocation.

Profitability Analysis and Cost Optimization: eCommerce accountants analyze the profitability of products, sales channels, and marketing campaigns to identify opportunities for cost optimization and revenue growth. They conduct break-even analysis, calculate key performance indicators (KPIs), and recommend strategies to improve profit margins and operational efficiency.

How eCommerce Accountants Contribute to Financial Success:

Strategic Financial Guidance: eCommerce accountants provide strategic financial guidance and support, helping online retailers make informed decisions that drive growth and profitability. Their expertise enables businesses to navigate financial challenges, seize opportunities, and achieve their long-term goals.

Compliance and Risk Management: By ensuring compliance with tax laws and regulations, eCommerce accountants help mitigate risks and protect online businesses from costly penalties and audits. Their proactive approach to tax planning and risk management safeguards financial integrity and enhances business sustainability.

Optimized Financial Performance: Through financial analysis, forecasting, and budgeting, eCommerce accountants help optimize financial performance and maximize profitability. By identifying inefficiencies, reducing costs, and capitalizing on revenue-generating opportunities, they contribute to the overall success and sustainability of online retailers.

Conclusion:

In conclusion, eCommerce accountants play a vital role in the financial success of online businesses. Their specialized expertise in eCommerce platforms, tax compliance, financial analysis, and strategic planning enables them to provide invaluable guidance and support to online retailers. From managing day-to-day transactions to optimizing profitability and mitigating risks, eCommerce accountants empower businesses to achieve their financial goals and thrive in the competitive eCommerce landscape. By partnering with eCommerce accountants, online retailers can navigate financial challenges with confidence and position themselves for long-term success in the dynamic world of online commerce.

#online accountants uk#shopify accountants#online accountants#ecommerce accountants#amazon accountants#online accountant

0 notes

Text

Unicorn Accountants for Accounting Services

Before you hire an accountant, know a few details first-hand. To know if we could help you, set up a discovery call with us.

0 notes

Text

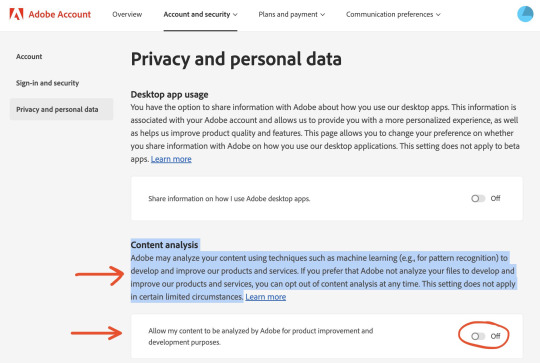

You know, every so often I think I should update my pirated copy of CS2.

Then I see things like this, and remember that I don't need it more than I need it, you know?

Dated 3/22/23

#adobe#photoshop#privacy#ai#online security#adobe accounts#adobe photoshop#art#yes I know about all of the alternatives#but I'm old#so leave me alone dammit

24K notes

·

View notes

Text

#+18 or +adult only#18+ account#18+ only#long hair#onlyf@nz#thick vibes only#onlyfrenz#onlytease#online#huge natural melons#huge cleavage#huge natural breasts#melons#juicy melons#huge chest#cleavege#large bust#huge tiddies#tittiporn#tittituesday#natural titts#bouncing titts#slim and stacked#stacked

4K notes

·

View notes

Text

5 more stars! :0)

#im prolly gonna set up an online account to sell these some day#slow and steady#ive been reading the tags and they make me so happy#i love that people are like me in some way and find joy from a simple star#enjoy the adventure#byebye 4 now#agere#age regression#sfw agere#kidcore#mine#transparent#transparent image#transparent png

1K notes

·

View notes

Text

Being cheeky at work 😈😘

#alt aesthetic#alt girl#alternative#girls with gauges#girls with tattoos#girls with piercings#online accountant#tumblr girls#cheeks 🍑#phat ass cheeks#sexy ass cheeks#bum cheeks#short skirt#skirt#mini skirt#grungy aesthetic#grunge aesthetic#grungy style#grunge style#grungy girls#grungy blog#grungie#grunge#LexiLapis

2K notes

·

View notes

Text

Bend me over 😜

#18+ account#18+ post#18+ content#18+ blog#18+ only#sexy peachy bum 🍑#perfect bum#bootie peach#peach ass#hot as hell#hot nude#so hot 🔥🔥🔥#hot as fuck#bootiful#cutie w a bootie#big bootie#big round butt#onlyf@nz#online#+18 or +adult only#onlytease#onlyfans tease#only friends the series#onlyfanz

1K notes

·

View notes

Text

What is PAYE (Pay As You Earn)?

Kindly visit our Website for further information's.

0 notes

Text

Find Out The Outstanding And Professional Amazon Accountants

In the ever-expanding world of e-commerce, Amazon stands as a behemoth, offering unparalleled opportunities for businesses to reach global markets and thrive in the digital age. However, with great opportunity comes great complexity, especially when it comes to managing finances on the Amazon platform. Amazon accountants play a crucial role in helping businesses navigate the intricacies of Amazon's financial ecosystem, providing expertise, insights, and strategies to optimize financial performance and compliance.

The Importance of Amazon Accountants:

Financial Compliance: Amazon operates within a complex regulatory environment, with tax laws, accounting standards, and reporting requirements that vary by region and jurisdiction. Amazon accountants help businesses navigate these regulations, ensuring compliance with tax obligations, financial reporting standards, and other regulatory requirements.

Cost Optimization: Selling on Amazon involves various fees, charges, and expenses, including referral fees, fulfillment fees, and advertising costs. Amazon accountants analyze these costs and expenses, identify opportunities for cost optimization, and develop strategies to maximize profitability and efficiency.

Revenue Maximization: Maximizing revenue on Amazon requires strategic pricing, promotion, and inventory management decisions. Amazon accountants analyze sales data, monitor market trends, and identify opportunities to increase revenue through pricing optimization, promotional campaigns, and inventory management strategies.

Risk Management: Selling on Amazon comes with inherent risks, including account suspension, intellectual property disputes, and counterfeit product issues. Amazon accountants help businesses mitigate these risks by implementing robust internal controls, monitoring for fraudulent activity, and responding effectively to compliance inquiries and disputes.

Services Offered by Amazon Accountants:

Financial Reporting: Amazon accountants prepare and analyze financial statements, including income statements, balance sheets, and cash flow statements, to provide businesses with insights into their financial performance and position on the Amazon platform.

Tax Planning and Compliance: Amazon accountants develop tax planning strategies to minimize tax liabilities and ensure compliance with tax laws and regulations. They handle tax registrations, filings, and audits, helping businesses navigate the complexities of cross-border taxation and international commerce.

Profitability Analysis: Amazon accountants conduct profitability analysis to evaluate the financial performance of individual products, product categories, and sales channels on the Amazon platform. They identify high-margin products, assess pricing strategies, and optimize product mix to maximize profitability and return on investment.

Inventory Management: Amazon accountants help businesses optimize inventory levels, minimize stockouts, and reduce carrying costs by implementing inventory management best practices. They analyze sales data, forecast demand, and develop inventory replenishment strategies to ensure optimal stock levels and availability.

Benefits of Hiring Amazon Accountants:

Expertise and Experience: Amazon accountants possess specialized knowledge and experience in navigating the financial complexities of the Amazon platform. They stay abreast of changes to Amazon's policies, procedures, and fee structures, ensuring that businesses remain compliant and competitive in the marketplace.

Cost Savings: By outsourcing accounting and financial management functions to Amazon accountants, businesses can save time, resources, and overhead costs associated with hiring and maintaining an in-house accounting team. Amazon accountants provide cost-effective solutions tailored to the unique needs and budget constraints of each business.

Strategic Insights: Amazon accountants offer strategic insights and recommendations to help businesses optimize their financial performance and achieve their growth objectives. They leverage data analytics, market research, and industry expertise to identify opportunities, mitigate risks, and drive business success on the Amazon platform.

Compliance Assurance: Amazon accountants ensure compliance with Amazon's policies, procedures, and reporting requirements, reducing the risk of account suspension, penalties, and other adverse consequences. They stay informed about changes to Amazon's terms of service and proactively address compliance issues to protect businesses from legal and regulatory risks.

Conclusion:

Amazon accountants play a vital role in helping businesses navigate the financial complexities of selling on the world's largest online marketplace. From financial reporting and tax planning to profitability analysis and inventory management, Amazon accountants offer a wide range of services to support businesses at every stage of their Amazon journey. By leveraging their expertise, experience, and strategic insights, Amazon accountants empower businesses to optimize their financial performance, achieve compliance, and succeed in the competitive landscape of e-commerce. Investing in the services of Amazon accountants is not just about managing finances – it's about unlocking the full potential of the Amazon platform and realizing long-term business growth and success.

#online accountants#online accountants uk#online accountant#ecommerce accountants#amazon accountants#shopify accountants

0 notes

Text

I think it’s weird how hostile the art community, on Twitter especially, has become towards children as of late? Like artists that i follow one or two people in common with, I’ll go to their bio and there’ll be something saying “minors fuck off” (or something more violent like kys) and like… dude did the 🔞 emoji not suffice? I completely get not wanting to engage with children (I’m gradually reaching a point where someone follows me and I see they’re 15 or so and get Stressed™️), but that’s still a human person. Grown ass adults will have some weird hatred of kids online for the crime of being children. Something they can’t change.

#the accounts I’m talking about aren’t even always nsfw. these people are just like this#I think it’s weird. like maybe the proshitter crowd is so… obsessed with some mythisized Evil Minor that they fear monger about online#that they forget what it’s like to be a child online… or how to properly engage with them at all.#not saying that adults don’t have the right to exist in adult only spaces bc ngl!!! kids will be stupid sometimes#but like I’m not going to tell them to die about it. just block and move on#honking

628 notes

·

View notes

Text

Just a small heads-up!

These are my OFFICIAL social accounts!:

►TUMBLR:

jakei95.tumblr.com (@jakei95)

xtaleunderverse.tumblr.com (@xtaleunderverse)

metadorablog.tumblr.com (@metadorablog)

►TWITTER (X):

@jaelarteo

►YOUTUBE:

@Jakeiartwork (Jael Peñaloza)

►DEVIANTART:

Jakeiartwork

►INSTAGRAM:

Jakei95

►FACEBOOK PAGE:

Jakeiarts

►TIKTOK:

Jakeiartwork

Other accounts using my real name or nickname in these or any other socials not listed here ARE NOT RUN BY ME!

#jakei says something#heads up#jakei95#jael peñaloza#online impersonation#trying to report impersonation accounts but it's gonna take a while for support's response

1K notes

·

View notes