#Journey of Rakesh Jhunjhunwala

Link

0 notes

Text

Top Stock Advisors in India You Need to Follow in 2024

Introduction

In the dynamic world of stock markets, having the right guidance can make a significant difference between success and failure. This is where stock advisors come into play. They provide invaluable insights, analysis, and recommendations that help investors navigate through the complexities of the market. In India, several stock advisors have gained prominence for their astute knowledge and successful track records. In this blog, we'll delve into the best stock advisor in India that you need to follow in 2024.

Importance of Stock Advisors

Stock advisors play a crucial role in the investment journey of individuals and institutions alike. They offer expert opinions, research reports, and personalized advice tailored to investors' financial goals and risk appetite. Their insights help investors make informed decisions, mitigate risks, and capitalize on opportunities in the stock market.

Criteria for Selecting the Best Stock Advisors

Before diving into the list of top stock advisors, it's essential to understand the criteria used for their selection. Factors such as market experience, track record, investment philosophy, risk management approach, and transparency are crucial in evaluating the credibility and reliability of stock advisors.

Top Stock Advisors in India in 2024

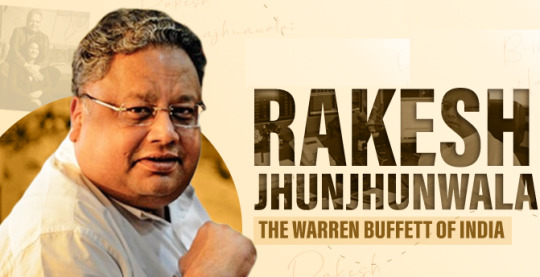

1. Rakesh Jhunjhunwala

Known as the "Big Bull" of Indian stock markets, Rakesh Jhunjhunwala is renowned for his shrewd investment acumen and long-term wealth creation strategies. With decades of experience, he has consistently identified multibagger stocks and is closely followed by investors for his market insights.

2. Porinju Veliyath

Porinju Veliyath is a seasoned investor known for his contrarian approach and value investing principles. He specializes in identifying undervalued stocks with significant growth potential. His investment picks and market commentaries are widely followed by retail and institutional investors.

3. Basant Maheshwari

Basant Maheshwari is a well-known name in the Indian stock market fraternity. He is revered for his disciplined investment approach, focusing on quality businesses with strong growth prospects. Maheshwari's investment philosophy revolves around identifying emerging trends and investing in companies with sustainable competitive advantages.

4. Vijay Kedia

Vijay Kedia is celebrated for his knack for spotting multibagger opportunities in the stock market. He emphasizes the importance of in-depth research, patience, and risk management in investing. Kedia's investment journey and stock picks serve as a source of inspiration for aspiring investors.

5. Raamdeo Agrawal

Raamdeo Agrawal is the co-founder of Motilal Oswal Financial Services and a veteran investor with decades of experience in the stock market. He is known for his deep understanding of market cycles, fundamental analysis, and long-term wealth creation strategies. Agrawal's investment insights are highly valued by investors seeking sustainable returns.

6. Dolly Khanna

Dolly Khanna, also known as Rajiv Khanna, is a prominent investor known for her expertise in small and mid-cap stocks. She has a proven track record of identifying multibagger opportunities in niche sectors. Khanna's investment portfolio and stock picks are closely monitored by market participants for potential investment ideas.

7. Sandip Sabharwal

Sandip Sabharwal is a renowned market commentator and investment advisor known for his insightful analysis and stock recommendations. He provides valuable perspectives on market trends, sectoral outlook, and investment strategies through his writings and media appearances.

Investment Strategies of Top Stock Advisors

Each of the top stock advisors mentioned above follows a distinct investment strategy based on their expertise, experience, and market outlook. While some focus on value investing, others may prefer growth-oriented or contrarian approaches. Understanding their investment philosophies can help investors align their strategies with their financial objectives.

Tips for Following Stock Advisors Wisely

Following stock advisors can be beneficial, but it's essential to approach their recommendations with caution and diligence. Here are some tips for following stock advisors wisely:

Conduct your research before acting on any recommendation.

Consider the suitability of the advice to your investment goals and risk tolerance.

Diversify your portfolio to mitigate risks associated with individual stock picks.

Monitor your investments regularly and stay updated on market developments.

Don't blindly follow stock tips; instead, understand the rationale behind the recommendations.

Conclusion

In the ever-changing landscape of the stock market, having access to reliable guidance and expert opinions is invaluable for investors. The top stock advisors in India mentioned in this blog have earned credibility and respect for their astute insights and successful investment strategies. By following their advice prudently and staying disciplined in your approach, you can enhance your chances of achieving long-term financial success in the stock market.

0 notes

Text

Vinay Dubey: Navigating the Skies of Aviation

Introduction: Pioneering the Aviation Frontier

Vinay Dubey emerges as a distinguished figure in the aviation landscape, having etched his name in the annals of the industry with notable ventures like Jet Airways, GoAir, and the innovative Akasa Air. His journey embodies a narrative of transformation, innovation, and an unwavering commitment to excellence, inspiring both contemporaries and aspiring professionals alike.

Early Career: Foundation at American Airlines

Dubey’s foray into aviation commenced at the esteemed American Airlines, where he began his ascent as an operations research analyst. His swift progression up the hierarchical ladder attested not only to his acumen but also to his innate leadership qualities. During his tenure, Dubey honed his skills, laying a robust foundation of expertise that would shape his future endeavors.

Leadership at Sabre Inc.: A Diversification Phase

Transitioning into the realm of travel technology, Dubey assumed pivotal roles at Sabre Inc., leveraging his insights from American Airlines to navigate the evolving landscape of aviation. This diversification phase underscored his adaptability and strategic foresight, positioning him as a visionary leader with an intricate understanding of industry dynamics.

Charting New Horizons: Jet Airways

In June 2017, Dubey embarked on a transformative journey as the CEO of Jet Airways, a prominent player in the aviation arena. His tenure at the helm marked a significant milestone, characterized by strategic vision and unwavering leadership. Despite facing financial challenges in 2019, Dubey’s steadfast commitment to charting a prosperous course for the airline reflected his resilience in the face of adversity.

A Sojourn with GoAir: Navigating Turbulent Skies

Transitioning to GoAir, Dubey assumed the role of CEO, ushering in a new era marked by strategic insights and operational excellence. However, the journey was not without its challenges, as differing visions and business strategies intersected with the airline’s promoters. Despite these complexities, Dubey’s tenure underscored his resilience and unwavering commitment to upholding principles aligned with his convictions.

Crafting a New Skyline: Akasa Air

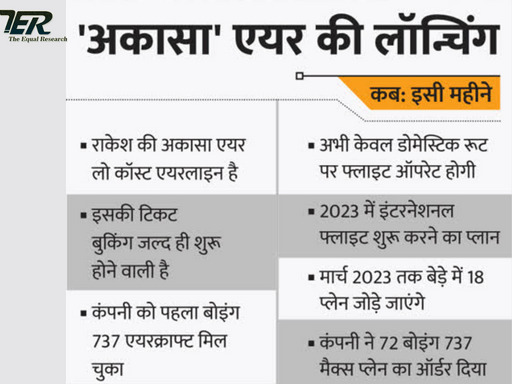

Amidst the backdrop of the COVID-19 pandemic, Dubey’s entrepreneurial spirit soared with the inception of Akasa Air, a testament to his resilience and innovation. Backed by notable investor Rakesh Jhunjhunwala, the airline aims to redefine the paradigm of low-cost travel while prioritizing quality and affordability. With an ambitious fleet expansion plan and strategic positioning, Akasa Air embodies Dubey’s commitment to pioneering new frontiers in the aviation landscape.

Academic Prowess and Personal Touch: A Multifaceted Journey

Beyond his professional endeavors, Dubey’s academic achievements and multicultural outlook underscore his multifaceted journey. With degrees from esteemed institutions like Knox College and the University of North Carolina, his commitment to continuous learning reflects his dedication to personal and professional growth. Furthermore, his ability to harmonize diverse identities and familial responsibilities exemplifies his capacity to navigate the complexities of both professional and personal spheres.

Charting Boundless Horizons: Legacy and Impact

Vinay Dubey’s journey epitomizes visionary leadership and adaptability, inspiring the aviation industry toward new horizons of innovation and progress. As he embarks on new skies with Akasa Air, his legacy resonates as a beacon of inspiration, shaping the narrative of the industry’s evolution. His unwavering commitment to excellence and pioneering spirit exemplify the transformative power of visionary leadership in navigating the ever-evolving landscape of aviation.

Conclusion: A Trailblazer in Aviation

Vinay Dubey’s aviation odyssey serves as a testament to his visionary leadership, adaptability, and unwavering commitment to excellence. From his formative years at American Airlines to his transformative ventures with Jet Airways, GoAir, and Akasa Air, each chapter of Dubey’s journey reflects his resilience and strategic acumen. His legacy inspires a new generation of aviation professionals, guiding the industry toward boundless horizons of innovation and progress. As he continues to shape the narrative of aviation’s evolution, Vinay Dubey stands as a trailblazer, leaving an indelible mark on the skies of the future.

0 notes

Text

Vinay Dubey: Navigating the Skies of Aviation

Introduction: Pioneering the Aviation Frontier

Vinay Dubey emerges as a distinguished figure in the aviation landscape, having etched his name in the annals of the industry with notable ventures like Jet Airways, GoAir, and the innovative Akasa Air. His journey embodies a narrative of transformation, innovation, and an unwavering commitment to excellence, inspiring both contemporaries and aspiring professionals alike.

Early Career: Foundation at American Airlines

Dubey’s foray into aviation commenced at the esteemed American Airlines, where he began his ascent as an operations research analyst. His swift progression up the hierarchical ladder attested not only to his acumen but also to his innate leadership qualities. During his tenure, Dubey honed his skills, laying a robust foundation of expertise that would shape his future endeavors.

Leadership at Sabre Inc.: A Diversification Phase

Transitioning into the realm of travel technology, Dubey assumed pivotal roles at Sabre Inc., leveraging his insights from American Airlines to navigate the evolving landscape of aviation. This diversification phase underscored his adaptability and strategic foresight, positioning him as a visionary leader with an intricate understanding of industry dynamics.

Charting New Horizons: Jet Airways

In June 2017, Dubey embarked on a transformative journey as the CEO of Jet Airways, a prominent player in the aviation arena. His tenure at the helm marked a significant milestone, characterized by strategic vision and unwavering leadership. Despite facing financial challenges in 2019, Dubey’s steadfast commitment to charting a prosperous course for the airline reflected his resilience in the face of adversity.

A Sojourn with GoAir: Navigating Turbulent Skies

Transitioning to GoAir, Dubey assumed the role of CEO, ushering in a new era marked by strategic insights and operational excellence. However, the journey was not without its challenges, as differing visions and business strategies intersected with the airline’s promoters. Despite these complexities, Dubey’s tenure underscored his resilience and unwavering commitment to upholding principles aligned with his convictions.

Crafting a New Skyline: Akasa Air

Amidst the backdrop of the COVID-19 pandemic, Dubey’s entrepreneurial spirit soared with the inception of Akasa Air, a testament to his resilience and innovation. Backed by notable investor Rakesh Jhunjhunwala, the airline aims to redefine the paradigm of low-cost travel while prioritizing quality and affordability. With an ambitious fleet expansion plan and strategic positioning, Akasa Air embodies Dubey’s commitment to pioneering new frontiers in the aviation landscape.

Academic Prowess and Personal Touch: A Multifaceted Journey

Beyond his professional endeavors, Dubey’s academic achievements and multicultural outlook underscore his multifaceted journey. With degrees from esteemed institutions like Knox College and the University of North Carolina, his commitment to continuous learning reflects his dedication to personal and professional growth. Furthermore, his ability to harmonize diverse identities and familial responsibilities exemplifies his capacity to navigate the complexities of both professional and personal spheres.

Charting Boundless Horizons: Legacy and Impact

Vinay Dubey’s journey epitomizes visionary leadership and adaptability, inspiring the aviation industry toward new horizons of innovation and progress. As he embarks on new skies with Akasa Air, his legacy resonates as a beacon of inspiration, shaping the narrative of the industry’s evolution. His unwavering commitment to excellence and pioneering spirit exemplify the transformative power of visionary leadership in navigating the ever-evolving landscape of aviation.

Conclusion: A Trailblazer in Aviation

Vinay Dubey’s aviation odyssey serves as a testament to his visionary leadership, adaptability, and unwavering commitment to excellence. From his formative years at American Airlines to his transformative ventures with Jet Airways, GoAir, and Akasa Air, each chapter of Dubey’s journey reflects his resilience and strategic acumen. His legacy inspires a new generation of aviation professionals, guiding the industry toward boundless horizons of innovation and progress. As he continues to shape the narrative of aviation’s evolution, Vinay Dubey stands as a trailblazer, leaving an indelible mark on the skies of the future.

0 notes

Text

Unlocking the Secrets of Chartered Accountants (CA)

Chartered Accountants (CAs) are financial wizards, wielding expertise in a myriad of accounting practices. Achieving the esteemed status of a certified Chartered Accountant involves completing a rigorous three-tier training program meticulously crafted by the Institute of Chartered Accountants of India (ICAI). This certification serves as the gateway to a rewarding professional journey within the financial realm in India. From auditing financial statements to navigating complex tax landscapes, CAs are the backbone of financial integrity for businesses.

Exploring the Allure of a Career in Chartered Accountancy

Delving into the world of Chartered Accountancy unveils a realm of lucrative opportunities and job security. In an economy driven by financial transactions, the demand for skilled professionals who can navigate fiscal complexities is insatiable. Whether it's managing corporate finances, facilitating tax compliance, or conducting audits, the role of a CA is indispensable across diverse industries.

The Expansive Scope of Chartered Accountancy

The scope of Chartered Accountancy transcends conventional boundaries, encompassing a multitude of sectors and domains. From corporate giants to budding startups, financial institutions to regulatory bodies, CAs find themselves in pivotal roles, steering organizations towards financial success and regulatory compliance. The avenues for CA professionals extend globally, presenting opportunities in international markets and consultancy services.

Spotlight on India's Finest Chartered Accountants

Kumar Mangalam Birla: Revered as the Chairman of the illustrious Aditya Birla Group, Kumar Mangalam Birla epitomizes financial prowess and altruistic leadership. Armed with an MBA from the prestigious London Business School, Birla's contributions extend beyond boardrooms, resonating in philanthropic endeavors focused on healthcare and education for the underprivileged.

Rakesh Jhunjhunwala: Dubbed the "Indian Warren Buffett," Rakesh Jhunjhunwala's journey from a Chartered Accountant to a billionaire investor is nothing short of inspirational. His strategic investments and astute financial acumen have earned him international acclaim, highlighting the transformative potential of financial expertise.

Motilal Oswal: Transitioning seamlessly from a Chartered Accountant to the Founder and Managing Director of Motilal Oswal Financial Services Ltd., Motilal Oswal exemplifies entrepreneurial success. His accolades, including the prestigious "Rashtriya Samman Patra," underscore his significant contributions to India's financial landscape.

Empowering Business Success: The Role of Chartered Accountants

Chartered Accountants in India embody traits essential for entrepreneurial triumph:

Financial Mastery: Armed with extensive financial knowledge, CAs navigate intricate fiscal landscapes with precision, fostering business growth.

Versatility: Beyond numerical prowess, CAs excel in diverse fields, from taxation to auditing, showcasing adaptability crucial for business management.

Analytical Acumen: Distinctive analytical skills empower CAs to dissect complex scenarios, enabling informed decision-making vital for sustained success.

Discipline and Prudence: Rigorous training instills discipline, laying the groundwork for prudent financial management essential in dynamic business environments.

Risk Management: Proficient in risk assessment, CAs navigate uncertainties adeptly, fostering innovation and ensuring long-term business sustainability.

In essence, Chartered Accountants are the architects of financial stability and prosperity, wielding expertise that transcends mere numbers, shaping the trajectory of businesses and economies alike.

0 notes

Text

Explore the remarkable journey of Rakesh Jhunjhunwala, a.k.a The Big Bull. Delve into investment strategies and key leanings from his journey.

0 notes

Text

Ashish Kacholia is a talented investor. He co-founded Hungama Digital with Rakesh Jhunjhunwala. Later, he established his own company, Lucky Securities, in 2003. He prefers to invest in small and medium-sized businesses. Reveal the journey of Ashish Kacholia, the astute investor who conquered the stock market. Learn his secrets today!

#Ashish Kacholia Portfolio#Ashish Kacholia net worth#ashish kacholia's shareholdings#Investor Ashish Kacholia#Latest buy Ashish Kacholia

0 notes

Text

Who is Big Bull Rakesh Jhunjhunwala's Favorite CEOs and Their Remarkable Success Stories

Unveiling the Titans of Business Leadership: Rakesh Jhunjhunwala’s Favorite CEOs and Their Incredible Journeys

Hey there, future financial wizards! Today, we’re diving into the world of investments and business leadership to talk about Rakesh Jhunjhunwala’s favorite CEOs, Bhaskar Bhat, and Adi Godrej. Don’t worry, we’ll break down the complex terms and numbers into simple bites, so you can easily…

View On WordPress

#Big Bull Jhunjhunwala&039;s favourite CEOs#Rakesh Jhunjhunwala&039;s Favorite CEOs#Rakesh Jhunjhunwala&039;s Remarkable Success Stories

0 notes

Text

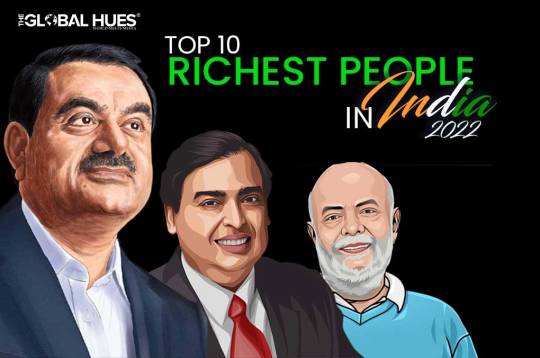

Top 10 Richest People In India 2023

India’s top 2 billionaires position them successfully in the list of the Top 10 richest billionaires in the world. And it’s been more than a year, hence indicating that the country has a record high number of billionaires and industrialists.

Mukesh Ambani and Gautam Adani have become the top industrialists while Cyrus Poonawalla’s Serum Institute of India became the country’s biggest producer of Covid-19 vaccines and earned huge revenue.

It is also important to know the contribution of Savitri Jindal, the only woman on the list of the top 10 richest people in India.

Let’s quickly take a look at the top 10 richest people in India in 2023:

youtube

10. UDAY KOTAK

Net Worth: $13.6 Billion (as of January 2023)

Age: 63 Years

Source of Wealth: Kotak Mahindra Bank

The Indian billionaire, the Founder and Managing Director of Kotak Mahindra Group, Uday Kotak is a renowned personality and is idealised by many around the nation. He was born in 1959 in an upper-middle-class Gujarati Lohana joint family in Mumbai.

Although he built his career as a cricketer, an immediate surgery marked the end of his cricket dreams. Recollecting the hope, he began his entrepreneurial journey by establishing his finance and bill discounting business with a seed capital borrowed from his friends and near & dear ones. As the major part of the investment that he borrowed came from Anand Mahindra, he named his agency ‘Kotak Mahindra’.

9. KUMAR BIRLA

Net Worth: $15.5 Billion (as of January 2023)

Age: 55 Years

Source of Wealth: Hindalco Industries

Another richest billionaire on the list is Kumar Birla, the Chairman of the third largest Indian business conglomerate, Aditya Birla Group. He is also the Chairman of the Indian Institute of Management Ahmedabad and the Chancellor of the Birla Institute of Technology & Science.

He took over the Aditya Birla Group at the age of 28 due to the sudden demise of his father. He faced a lot of scepticism because of his lack of experience but with his sharp business sense, he took the company to the heights.

8. RADHAKISHAN DAMANI

Net Worth: $16.1 Billion (as of January 2023)

Age: 68 Years

Source of Wealth: Avenue Supermarts Limited

A renowned Mumbai-based investor and entrepreneur, Radhakishan Damani is the owner of India’s third-largest mega-retail stores’ chain, ‘DMart.’ Rakesh Jhunjhunwala considers him as his mentor in the Indian share market.

He was born in 1954 to an Indian Marwari family, born and brought up in Bikaner, Rajasthan. He started his career as a stockbroker but soon started stock trading in the Indian stock market. He gained a foothold in the business community only after he overpowered the Indian stockbroker Harshad Mehta.

7. DILIP SHANGHVI

Net Worth: $16.6 Billion (as of January 2023)

Age: 67 Years

Source of Wealth: Sun Pharmaceuticals

Dilip Shantilal Shanghvi is a popular Indian billionaire who is also the Founder of Sun Pharmaceuticals. After Dilip made the company public in 1994, three years later Sun Pharma made its first international acquisition when it bought Detroit-based Caraco Pharmaceutical Laboratories. Among many other acquisitions, the notable one was the purchase of Ranbaxy Laboratories in 2014.

Sun Pharma experienced multifaceted growth under the leadership of sharp-witted Dilip Shanghvi. In 2018, he became a member of the Reserve Bank of India’s central board.

6. LAKSHMI MITTAL

Net Worth: $17.9 Billion (as of January 2023)

Age: 72 Years

Source of Wealth: ArcelorMittal

Successfully securing his position among the top 10 richest persons in India, Lakshmi Narayan Mittal is an Indian billionaire who is the Executive Chairman of the world’s leading steel and mining company ArcelorMittal. He served as the CEO of the company till February 2021.

He was born in Sadulpur in Rajasthan in 1950. He began his career in his family’s steelmaking business in India before he moved to Indonesia in 1976 to set up a small steel company that over time grew to become today’s widely popular ArcelorMittal. He was awarded the Padma Vibhushan, India’s second highest civilian honour, by the President of India in 2008.

5. SAVITRI JINDAL AND FAMILY

Net Worth: $18.1 Billion (as of January 2023)

Age: 72 Years

Source of Wealth: O.P. Jindal Group

Savitri Jindal is a wonderful example of being the only richest woman in a self-proclaimed man’s world. She is the Chairperson Emeritus of Jindal Steel & Power Limited. She is also the President of Maharaja Agrasen Medical College (MAMC), Agroha established in 1998.

After the sudden death of her husband, Om Prakash Jindal in 2005, India’s richest woman Savitri Jindal took over her husband’s steel and power conglomerate. Committed to following the values of OP Jindal, she is running the business with full vigour.

4. CYRUS POONAWALLA

Net Worth: $21 Billion (as of January 2023)

Age: 81 Years

Source of Wealth: Serum Institute of India

Cyrus Poonawalla is the Founder and Managing Director of Cyrus Poonawalla Group, which includes the Serum Institute of India (SII), an Indian biotechnology company manufacturing highly specialised life-saving biologicals.

In 1966, Cyrus incepted the Serum Institute of India to derive therapeutic serum from horse blood. Within two years, the institute launched its first therapeutic tetanus serum and started producing anti-tetanus vaccines. Although he faced a couple of challenges with financing and recognition of the company, Cyrus also stood to fight against all of them.

3. SHIV NADAR

Net Worth: $25.6 Billion (as of January 2023)

Age: 77 Years

Source of Wealth: HCL Enterprise

Another prominent name in the list of top 10 richest billionaires in India is famous billionaire industrialist and philanthropist, Shiv Nadar who is also the Founder of Hindustan Computers Limited (HCL).

Shiv Nadar was born on 14th July 1945, to his father, Sivasubramaniya and mother, Vamasundari Devi in Tiruchendur, Tamil Nadu India. He started his career in 1967 as an engineer at Walchand Group’s Cooper Engineering (COEP) in Pune. After a few years, he quit his job to take up a business-oriented career in partnership with Ajai Chowdhry and other colleagues to establish an enterprise which came to be known as Microcomp under the brand name ‘Televista’. Later, all of them together founded HCL Tech in 1976 to manufacture microprocessors and calculators.

2. MUKESH AMBANI

Net Worth: $88.3 Billion (as of January 2023)

Age: 65 Years

Source of Wealth: Reliance Industries Ltd

Mukesh Ambani is a widely recognized Indian billionaire industrialist who is the Chairman and Managing Director of Reliance Industries Ltd. (RIL), an MNC with diverse businesses including energy, natural gas, mass media, retail, petrochemicals, telecommunications, and textiles.

After the death of his father Dhirubhai Ambani, the brothers Mukesh Ambani and Anil Ambani assumed joint leadership of the Reliance companies but due to feuds between the brothers, Kokilaben Ambani, their mother, split the assets under which Mukesh assumed control of the gas, oil, and petrochemicals units. He grew the business multifariously and became one of the richest persons in India.

1. GAUTAM ADANI

Net Worth: $125.6 Billion (as of January 2023)

Age: 60 Years

Source of Wealth: Adani Group

The first name on the list of richest Indians is none other than Gautam Adani. Born on 24 June 1962, Gautam Adani is the Founder and Chairman of Adani Group. The self-made billionaire operates a world-class integrated infrastructure company that includes coal trading, coal mining, ports, oil and gas exploration, multimodal transportation, transmission, power production, and gas distribution.

In May 2022, Gautami Adani’s firm picked up two well-known companies—Ambuja Cement and ACC—that Holcim owned. He is not only India’s richest person but is also the wealthiest person in the world.

Frequently Asked Questions:

Q. Who is the richest man in Asia?

Gautam Adani

Q. Why Ratan Tata is not in the list of richest people in India?

Ratan Tata is involved in a lot of philanthropy work through Tata Trusts. He is at the 433 position on the IIFL Wealth Hurun India Rich List 2021. 66% of the profits earned by Tata Companies is donated for philanthropic activities.

Q. Who will become the first trillionaire on Earth?

Founder of SpaceX and Tesla, Elon Musk will become the first trillionaire in the future.

Must Read:

TOP 10 RICHEST BILLIONAIRES IN THE WORLD 2023

Top 10 Indian Origin CEOs Leading International Companies

TOP 10 IN-DEMAND SKILLS FOR 2023

SUCCESS STORY OF TIM COOK: A MAN WITH A VISION

HIGHEST-PAID CEOs IN THE WORLD

Success Story Of Mukesh Ambani

TOP 10 NEWSPAPERS IN THE WORLD 2023

Elon Musk: Biography Of A Self-Made Entrepreneur And Billionaire

10 GADGETS TO KEEP YOU COOL THIS SUMMER

7 R’s Of Waste Management – Steps To Sustainability

What Are The 5 Must Watch Netflix Thrillers

0 notes

Text

Big Bull of the Indian Stock Market is no more !!

For someone who made his first big killing by short selling shares at the peak of the 1992 bull market, and then again during the dot com boom of 2001, the moniker of Big Bull against his name would have sometimes left Rakesh Jhunjhunwala amused at the twists of destiny during his three and half decade journey on Dalal Street. Twice he came close to losing it all, only to have Lady Luck back by his side in time to be able to emerge stronger.

The outspoken billionaire investor, trader, entrepreneur, philanthropist, and raconteur (with a penchant for risqué one-liners) died in Mumbai of cardiac arrest. A long-time diabetic, Jhunjhunwala’s health took a sudden turn for the worse over the last couple of months. This time Lady Luck chose to look the other way.

Jhunjhunwala was 62 and is survived by his wife Rekha, two sons, and a daughter.

Son of a senior income tax official, Rakesh Jhunjhunwala was a chartered accountant by training. He began his career in the stock market in 1985, initially by investing money borrowed at very high rates of interest. A client of Jhunjhunwala’s brother handed him Rs 2.5 lakh at 18 percent annum.

Another gentleman by the name of Mendoza handed him Rs 5 lakh and refused to accept any collateral, unlike many others who insisted on some form of security. (Touched by the gesture, Jhunjhunwala would pay him 24 percent interest annually till many years later though he was no longer obliged to.)

Jhunjhunwala invested the funds in Tata Power, and it paid off well. He was on a winning streak for a while, allowing him to build his own capital buffer. But a middling run followed soon after, and Jhunjhunwala struggled for the next couple of years. In later interviews, Jhunjhunwala was candid enough to admit that he could hang in there only because his father was taking care of the household expenses.

Things started looking up for Jhunjhunwala after a big bet on Sesa Goa, an idea suggested to him by a friend and fellow market player Shailesh Bajaj.But an even bolder gamble was on the VP Singh-led Janata Dal’s maiden Budget in 1990. Jhunjhunwala bet the house, convinced that the Budget was likely to be business and market-friendly, and not one with socialist overtones, as the market was fearing.

“VP Singh was a Thakur and understood the business well, so I was confident that he would not do something that would hurt the market,” Rakesh had said in one of his interviews.

The bet paid off handsomely and he returned home with good news for his wife that she could finally buy the air conditioner she had been asking for.

RJ's defining move in career

The defining move of his career came a couple of years later when he joined ranks with the market players who felt that the manic bull market of 1991-92 was unsustainable. Harshad Mehta, the then Big Bull of Dalal Street was spearheading the charge of the bulls, driving shares of companies to dizzying highs irrespective of their fundamentals.

At that time, Jhunjhunwala; however, was still a cub in that camp of bears that had veterans like Manu Manek, Ajay Kayan, and Hemedra Kothari in the midst. All the bears had profited from the upswing initially but quickly came to the conclusion that the lofty valuations could no longer be justified.

Nearly every single member of that cartel, including Jhunjhunwala, was on the edge of ruin, as share prices continued to rise one way despite the spirited efforts of the bears to hammer the stocks through short selling. Eventually, the bears won: shares went into a free fall after it came to light that Harshad Mehta had been ramping up stock prices using bank funds. Jhunjhunwala said he made around Rs 30 crore on his bearish bets.

Having accumulated a tidy pile, Jhunjhunwala turned his attention to identifying stocks that would create wealth in the long run. Seven years of trading would have made him realize that it was something to be practised on the side-the big money could be made only by investing in fundamentally sound companies and reaping the benefits over time. After all, the early birds in MNC stocks like Hindustan Lever, Nestle, and Glaxo, to name a few, were pulling in good money every year through dividends alone.

His mentors

Jhunjhunwala was influenced by value investors like the late Chandrakant Sampat, Radhakishan Damani, and Kamal Kabra among others. But it was the taciturn Damani who left an impression on the young Jhunjhunwala and would remain a mentor to him till the end.

“It is like a relationship very difficult to define,” Jhunjhunwala had said in one of his interviews with CNBCTV18.

“I do not know without my father and him I do not know where I would be. He has really taught me in life and more than that human nature. He has taught me there is nothing greater in life than parents, to react coolly to everything and not to be afraid of anything. And the patience he has to hear other person’s point of view is unbelievable,” Jhunjhunwala said.

So thick were the two that in the 90s, fellow brokers and traders spoke of them in the same breath as GS-Rakesh, never mind the fact that the duo often had conflicting views on the same stock. (Radhakishan Damani was referred to by his family’s BSE broking card- GS Damani).

Between them, Jhunjhunwala and Damani owned a portfolio of some of the finest MNC companies—consumer and pharma mostly- in the 90s. But the traders in them were still alive and kicking, looking for short-term profits whenever possible.

So when Harshad Mehta attempted a comeback in the late 90s, it was inevitable that the duo would face off with him at some point, given their diametrically opposite views on valuation. That deciding battle took place in 1998. True to form, Mehta, ramped up the prices of Videocon, Sterlite, and BPL, with some help from the management.

Convinced that the stock prices did not justify the sky-high valuations, Damani and Jhunjhunwala started short-selling the shares. They lost money initially, but eventually emerged triumphant once Mehta was no longer able to support the prices. Prices of all three stocks went into a tailspin, and would not recover for a long time. This time, the erstwhile Big Bull had been sent packing for good.Less than a couple of years later, Jhunjhunwala was back to doing what he was best known for—targeting stocks of companies he thought to be overvalued. And this time, he was locked in a battle with the upcoming Big Bull of Dalal Street, Ketan Parekh.

Jhunjhunwala was influenced by value investors like the late Chandrakant Sampat, Radhakishan Damani, and Kamal Kabra among others. But it was the taciturn Damani who left an impression on the young Jhunjhunwala and would remain a mentor to him till the end.

Never a fan of technology shares, Jhunjhunwala short sold shares of Parekh’s pet favourites, Himachal Futuristics and Global Telesystems, convinced that the valuations could not sustain. But this time, Jhunjhunwala got his bets horribly wrong.

The stocks rallied for much longer than he had anticipated, and there he was, once again on edge of ruin. Like the previous time, he eventually won when the inevitable meltdown in prices followed at the end of the bull markets. And while his strategy was profitable, it was not good enough to keep him out of the cross hairs of the regulator. Jhunjhunwala and his mentor Damani were accused of market manipulation through the hammering of share prices by unfair means. (Jhunjhunwala would later be exonerated of the charges)

The end of the bull market of 2001 also seemed to have changed Jhunjhunwala’s approach to trading and investing. He now wanted to be seen more as an investor and less of a trader. Investing in the right kind of companies helped burnish that image.

Through repeated short-term bets in these stocks, his average cost of acquisition in many stocks was negligible, and in some cases, after factoring in dividends, splits, and bonuses, even negative. And no longer would he be seen as Damani’s alter ego. It would be Rakesh henceforth, and not GS Rakesh. By then, Damani too had cut down on his stock market plays and was focused on building a retail chain.

One-time rival Ketan Parekh spoke highly of Jhunjhunwala’s conviction as a trader and investor.

“He had the tenacity, which is quite important to succeeding as an investor and trader,” Parekh said.

“Once he was convinced about something, he would double down and hang in there for as long as he could. That takes some doing….and you can see the results in a stock like Titan," Parekh added.

Parekh and Jhunjhunwala may have been arch rivals at the peak of the technology rally of 1999-00, but were on talking terms in recent years, even playing cards on the same table at parties hosted by common friends.

I don't have good habits...

Besides his temper problem, Jhunjhunwala also made no bones about his weakness for the fine things that life had to offer. “I don't have good habits. I smoke like a chimney, drink like a fish, eat like a pig. I don't exercise. So ya, my health worries me,” he once said in an interview with a tabloid in 2013.

Ironical, one would think, considering that the same discipline that made Jhunjhunwala a successful trader and investor was missing when it came to his health habits.

Not that he did not make efforts. “I made a lot of resolutions on my habits and they all failed,” he said in an interview on his 50th birthday.

To well-wishers who advised him to take care of his health, his response was philosophical. “Having come here you are anyway going to die. Might as well have a good time when you are at it.”

Incidentally, United Spirits (then McDowells) and United Breweries were among his biggest holdings when the market was yet to recognise the true worth of stocks. His simple reasoning was that as societies became prosperous demand for liquor would only grow. The stocks went on to become multi-baggers, making handsome profits for him.

His outspoken manner made for good interviews and catchy headlines; you won’t find too many people in his position talking about ‘hot’ female actors on national television. And finesse was not his forte while airing his views at public forums. At a conclave hosted by a general television channel last year, Jhunjhunwala said that new businesses were grossly overvalued and should be sold. But at the same time, he also advised caution in his own unique style.

“Par abhi nahin karne ka. Chaddi nikal jayegi,” he said. (But don’t do it now, you will lose your shorts) For all the TRPs and page views a Jhunjhunwala interview would bring, he could quickly turn on journalists without warning if their line of questioning annoyed him. Something that even people outside of journalism thought to be in poor taste.

And while Jhunjhunwala made a fortune in stocks like Titan, CRISIL, and initially Lupin, there were plenty of lemons in his portfolio as well, something no investor, however intelligent, experienced, or lucky, can escape.

On comparison with Warren Buffett

Jhunjhunwala was often compared to Warren Buffet, a comparison, he did not relish (at least in public). Also, he bristled at any questions relating to his net worth. Oil Baron John Getty’s quote “If you can count it, you don’t have it,” was Jhunjhunwala’s stock response to any such query.

Jhunjhunwala has a massive following among retail investors who hang on to every word of his, hoping to make a fortune someday by imitating his playbook. Strangely, Jhunjhunwala himself has repeatedly said that nobody should buy a stock if the only reason was that some big-name investor had put money in it.

His critics say that Jhunjhunwala’s reputation is more of past glory, resting on a handful of early bets and that he has not had another winner on the scale of Titan.

And yet there is a commonly asked question in financial markets, the answer to which decides how an investor should be judged.

“How much money did you make when you were right and how much did you lose when you were wrong?”

On that parameter, Jhunjhunwala’s score card speaks for itself. The value of his 5 percent stake in Titan alone is worth over Rs 11,000 crore at the current market price and accounts for nearly a third of his portfolio value of listed companies.

And while Jhunjhunwala may not have liked being compared to Warren Buffet, his career in the stock is an embodiment of one of Buffet’s favourite sayings.

“You only have to do a few things right in your life so long as you don’t do too many things wrong.”

1 note

·

View note

Text

Big Bull Rakesh Jhunjhunwala passes away at 62

Rakesh Jhujhunwala, veteran investor, passed away at 62 in Mumbai. Known as 'India's Warren Buffett', and even the Big Bull, Jhunjhunwala began his investing journey in 1985 as a young CA.

0 notes

Text

The Big Bull Of India

The Big Bull Of India 🇮🇳 – Sir Rakesh Jhunjhunwala

Journey (62 years) –Born – 5 July 1960Died – 14 August 2022 (RIP)

Occupation/Profession –Investor, Trader, Chartered Accountant, Entrepreneur, Founder, Business

He had an estimated net worth of $5.5 Billion (as of July 2022) making him the 36th richest man in India. In 2022, he founded Akasa Air, low-cost airline in India.

He is considered as…

View On WordPress

#Business#Chartered Accountant#dalal street#Entrepreneur#Founder#Investor#stock market#the big bull#The Big Bull Of India#The Indian Warren Buffet#The King of Dalal Street#Trader

0 notes

Text

4 Mistakes To Avoid While Investing In Stock Market

Summary: While investing in stocks it is easy to get carried away by numbers and record highs. Don`t make these mistakes in the stock market especially when it’s too tempting.

Investing in a stock market is a serious affair and a long-term game. Despite this, many investors in India tend to succumb to their emotions every time the market hits a new high. There have been many firsts for the Stock Exchange. When it hit 1,000 for the first time, it was an all-time high! And then it reached 10,000, 20,000, 40,000, or 50,000…and with every new record, the story continued.

There will be a time when the Sensex will cross the 100,000 mark and then 500,000, but we don`t know when that will happen. No matter how many records the market is breaking, the basic rules of investing don`t change. If there is one important thing that you should remember while investing in the market, it is that market high is not a destination; it is a journey towards wealth creation.

To ensure that this journey is smooth and produces desired results, you can listen to a business motivational speaker who has a good experience in financial investment.

Here are some golden tips that you should consider before investing in the stock market while it rides the bull:

1. Avoid Fear Of Missing Out

Many people suffer from FOMO or fear of missing out when they could not participate in the stock market rally. Recently, the same happened in India and now there is a strong urge to invest before they lose more. But fear of missing out on some perceived gains should not be the guiding principle when it comes to investment. It is best to avoid FOMO because it will lead to many irrational money decisions that will result in losses.

2. The Market is Smarter

A market is a forward-looking machine. It means that the market always sees things we cannot. It has discounted the third or even the fourth wave of the pandemic. However, there is a huge difference between the market's performance and a nation's economy.

The Sensex has its own rules, which is why the market keeps proving everyone wrong. This is why investors should not overthink. Focus on diversifying your portfolio, asset allocation, and risk profile. Control the controllable before it goes out of control, i.e., your behaviour, your money, and hence your losses. To know everything about Share Market from the scratch, watch here: https://www.youtube.com/watch?v=L_iJCNzDe-s

3. Don`t Invest in Meme Stocks or Trending Stocks

You must have heard about various stocks and their sky-rocket prices without any strong fundamentals in place. It is a pure play of operators and the community. Similarly, many people invest in penny stocks and meme stocks in India based on the news for a quick gain. However, always know the fact that whenever a stock is trending, it is trending for the wrong reasons.

It is important to remember that you are investing in businesses and not in stocks. Find good businesses, and avoid investing in memes and penny stocks. Understand your risk profile, and financial goals, and do thorough research before you pick any stock, the way you do it before buying a car or a house.

4. Don`t Follow Anyone Blindly

Be it Rakesh Jhunjhunwala or Warren Buffett, never follow anyone blindly. These legendary investors are experts in the stock market and there is nothing wrong with their investing advice, but the issue lies in following any advice blindly. If you follow Warren Buffett, you must be aware of his famous quote on diversification. He says, “Diversification is for the ignorant.” It simply means that those who know how to pick the right stock at the right time should only invest in a few stocks instead of spending on multiple stocks across multiple sectors. But this does not always work for a retail investor.

When you invest only in a few stocks, you put yourself at a huge risk of having a concentrated portfolio. So always have a diversified portfolio, unless you have the money, time, and expertise to select stocks like Warren Buffett.

Never invest in one go, especially when the market is showcasing high fluctuation. So unless there is a good correction, always spread your investments into tranches. For example, if you have Rs. 5 lakh to invest, then divide that into five or six months and invest accordingly.

The idea of managing a business is easier said than done and we completely agree with you. This is why to help you move forward with your business goals, we at Bada Business offer an exclusive Business Coaching Program that comes with Foundation courses, specialized courses, and value-added courses.

To know more about our courses, visit: www.badabusiness.com

Source: https://news.badabusiness.com/marketing/4-mistakes-to-avoid-while-investing-in-stock-market-10981.html

0 notes

Text

Made an empire of 43 thousand crores by investing in shares

Rakesh Jhunjhunwala, 62, is nicknamed the Big Bull of the stock market and now owns an airline.

The Big Bull of the stock market, Rakesh Jhunjhunwala, who traveled from Rs 5,000 to Rs 43.39 crore, has a birthday today, July 5. He turned 62. Jhunjhunwala will also enter the aviation sector with the airline "Akasa" this month.

Jhunjhunwala was once a bear in the stock market i.e. bears. He made huge profits through short selling in 1992 when the Harshad Mehta scam came to light. There were several reputable cartels in the Indian stock market in the 1990s.

One of these cartels was that of Manu Manek which was the Bear Cartel. Manu Manek's cartel was called Black Cobra and he was also followed by Radhakishan Damani and Rakesh Jhunjhunwala. Journalist Sucheta Dalal exposed Harshad Mehta's scams after which the stock market crashed.

In such a situation, today we tell you about Jhunjhunwala's investment journey through his learnings and interesting fact graphs related to him.

Rakesh Jhunjhunwala launching “Akasa” airline soon:

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

0 notes