#Advisory mandi winner

Text

Sensex Rises Over 300 Points Amid Positive Global Cues, Nifty Trades Above 16,200

Indian equity benchmarks traded higher on opening trades on Friday, taking a cue from global markets.

Indian equity benchmarks traded higher on opening trades on Friday, taking a cue from global markets. Asian stocks followed Wall Street gains overnight as fears of an economic slowdown eased. Additionally, the pound began to recover from recent losses after Boris Johnson stepped down as British Prime Minister.

Trends in Nifty Futures on the Singapore Exchange (SGX Nifty) have indicated a cautious start for national indices.

The 30-stock BSE Sensex Index jumped 316 points or 0.58% to 54,495 at the start of the session, while the broader NSE Nifty jumped 104 points or 0.64% to 16,236.

Small and mid cap stocks were trading on a strong note as Nifty Midcap 100 was up 0.32% and small caps were up 0.59%.

13 of the 15 sector indicators - compiled by the National Stock Exchange - were traded in green. The Nifty Bank and Nifty Auto sub-indices outperformed the NSE platform up 0.67% and 0.77% respectively.

On the specific stock front, M&M was Nifty's best gain as the stock climbed 2.80% to ₹ 1,165.05. Winners also include L&T, Coal India, Axis Bank and NTPC.

The overall market size was positive as 1,715 stocks were advancing while 622 were down on BSE.

In the BSE 30-share index, L&T, M&M, NTPC, Axis Bank, ICICI Bank, UltraTech Cement, PowerGrid, Infosys, Tech Mahindra, Kotak Mahindra Bank, Sun Pharma and Wipro were among the best gainers.

Additionally, shares of Life Insurance Corporation of India (LIC), the country's largest insurer and largest national financial investor, were up 1.17% to ₹ 706.30.

Conversely, Asian Paints, Tata Steel, IndusInd Bank, Hindustan Unilever, Titan, TCS, Bajaj Finance, Dr Reddy's, and Maruti all traded in the red.

Sensex was up 427 points or 0.80% to close at 54,178 on Thursday, while Nifty was up 143 points or 0.89% to settle at 16,133.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

2 notes

·

View notes

Text

Refer friends to Teji Mandi and earn cashback

About Teji Mandi

Teji Mandi came to life to help guide retail investors in their investment journey. We still do the same by also providing you with an actively managed portfolio with an index beating returns at pocket-friendly and flat pricing.

Teji Mandi, a SEBI registered subsidiary of Motilal Oswal Financial Services, is an enterprise built upon the amalgamation of finance and technology. We aim to simplify stock market investing for retail investors by supporting them via advisory services through an app. We offer stock portfolios and share timely rebalance updates about when to buy or sell specific stocks.

About Portfolio

Flagship Portfolio-

Flagship is a concentrated portfolio of 15-20 stocks that blends short-term tactical bets with long-term winners.

This ensures that investors get the advantage of stocks that would compound over a 12-18 month period and can take advantage of the special company/sector situations from a 3-6 month perspective.

Certain tenets of Flagship portfolio:

• This all-weather multi-cap portfolio of 15-20 stocks from the Nifty 500 universe, providing optimum liquidity.

• Teji Mandi Flagship portfolio delivered an annual CAGR of 38.20% (Data as of Aug 17, 2022).

• The rebalance of the portfolio is usually done every month, but it is all subject to market conditions.

• The portfolio is suitable for investors with a low to medium-risk appetite looking to earn above-market returns in a calibrated manner.

• We follow a disciplined selling approach wherein we exit stocks in 3 conditions – Change in the company/ industry fundamentals, negativity around the company/ sector and an extreme macroeconomic/market situation.

Multiplier Portfolio-

The Multiplier portfolio consists of smallcap and midcap stocks. These companies have a lower market capitalisation and are riskier. Still, they have an extremely high potential for growth, which means that these companies hold the promise of significant wealth creation over the long term. The stocks in the Multiplier portfolio are potential multibaggers.

Certain tenets of Multiplier portfolio:

• The companies in the portfolio have a superior track record of capital allocation. Excellent corporate governance, capital allocation track record and strong, sustainable competitive advantages ensure that we identify winners.

• Teji Mandi Multiplier portfolio delivered an annual CAGR of 51.14% (Data as of Aug 17, 2022).

• There is no specific rebalance frequency for the Multiplier portfolio. It is a long-term portfolio and hence not rebalanced at regular intervals.

• The portfolio is suitable for investors with a medium to high-risk appetite looking for aggressive returns in the market.

Referral Program

Refer Teji Mandi app and earn Rs. 300 on every referred subscription. Your friend also gets Rs. 300 cashback in his/her account after subscribing.

Terms and Conditions

This is a limited time offer and applicable only for first-time subscriptions. Referral codes are not applicable for renewals. Teji Mandi reserves the right to disallow the cashback and cancel the subscription if the subscriber is found to misuse the referral code. Read More About Refer and Earn

0 notes

Text

PARSIPPANY — Frank Cahill, Publisher of Parsippany Focus, was named 2018 Parsippany Citizen of the Year by the Lakeland Hills YMCA during their 2018 Annual Dinner and Awards Presentation held on Wednesday, May 16 at The Mansion in Mountain Lakes.

Frank Cahill with Kiwanis member Julie Scarano

Sometimes it seems Frank’s life is also going to the dogs! He is a passionate dog lover, fostering dogs for the Eleventh Hour Rescue and Forever Home Dog Rescue, both in Randolph. Frank has proudly volunteered in Parsippany-Troy Hills for too many years to list. He is Co-Chairman of Parsippany-Troy Hills Economic Development Advisory Committee; Executive Board Member of the Parsippany Area Chamber of Commerce, current President of the Kiwanis Club of Greater Parsippany and publisher of the Parsippany Focus. Frank has volunteered for organizations including the American Cancer Society, Cooley’s Anemia Foundation of NJ and the Juvenile Diabetes Association. Frank has received numerous accolades and awards, but values his volunteer time cooking for individuals at Homeless Solutions or providing shelter, food, and lots of love to his furry foster friends.

The 2018 YMCA Citizens of the Year

Members of the Parsippany High School Small Jazz Combo led by Band Director Greg Dalakian performed during the cocktail hour.

This slideshow requires JavaScript.

The Lakeland Hills Family YMCA also honored other 2018 winners of the annual YMCA Citizen of the Year Awards from their service area towns: Patti Bujtas – Boonton; Kim Forte – Boonton Township; Don Kuser – Denville; Lt. Joseph Napoletano – Kinnelon/Butler; Christine Bakelaar – Lincoln Park; James Sandham Jr. – Montville; Janet Horst – Mountain Lakes; and Rose Phalon – Pequannock.

Former Montville Mayor James Sandham, Jr., with Frank Cahill. Both were honored as Citizens of the Year

These individuals have demonstrated outstanding community service and volunteerism. “The selflessness exhibited by these volunteers is consistent with social responsibility, which is one of the key underpinnings of our YMCA mission and we are looking forward to honoring them,”says Lakeland Hills YMCA Chief Executive Officer, Dr. Viktor Joganow.

In addition to the Citizen of the Year awards the YMCA honored:

Educator Awards:

Kindergarten – 8th Grade Eileen Ludwig School Counselor, Briarcliff Middle School, Mountain Lakes High School Seniors Dr. Ahmed Kandil Business Education Teacher, Parsippany Hills High School

Parsippany honorees: Frank Cahill and Ahmed Kandil

Student Awards:

Parkins – 8th Grade Lexi Thibodeau (Pequannock Valley Middle School, Pompton Plains)

Jake Pryor (Pearl R. Miller School, Kinnelon)

Kogen – High School Seniors Haley Graybush (Morris Knolls High School)

Robert Ezzi (Boonton High School)

Other Awards:

Richard M. Wilcox Award Ian Matty of Mountain Lakes YMCA Volunteers of the Year Mandy Kiely of Mountain Lakes

Savannah Benedetto of Lincoln Park

Trish Costello of Denville

Patricia Delcore of Parsippany

Dave Fulton of Parsippany

Cristina Glynn of Denville

Martin Moratz of Boonton

Bill Olderman of Montville

Michelle Pirozzi of Parsippany

John Powers of Parsippany

Frank Cahill Named “2018 Parsippany Citizen of the Year” PARSIPPANY — Frank Cahill, Publisher of Parsippany Focus, was named 2018 Parsippany Citizen of the Year by the Lakeland Hills YMCA during their 2018 Annual Dinner and Awards Presentation held on Wednesday, May 16 at The Mansion in Mountain Lakes.

0 notes

Text

Tennessee Department of Education Announces 2017-18 Teacher of the Year Finalists

Tennessee Department of Education Announces 2017-18 Teacher of the Year Finalists

Nine Finalists Move Forward for State Recognition, Will Serve on Commissioner’s Teacher Advisory Council

NASHVILLE—The Tennessee Department of Education today announced the nine finalists for the 2017-18 Tennessee Teacher of the Year award. The finalists represent each Center of Regional Excellence (CORE) area in the state, with three finalists in each Grand Division (west, middle, and east). Grand Division winners and the Teacher of the Year will be selected from this group andannounced during an honorary banquet this fall.

"These teachers are our students’ heroes," Education Commissioner Candice McQueen said. “Our educators have a direct, positive influence on students every day. And, because of educators like these nine finalists, Tennessee’s future is bright.”

The final winner will represent Tennessee in the National Teacher of the Year competition and serve as an ambassador for education in the state throughout the year. To qualify, candidates must have been teaching full-time for at least three years, have a track record of exceptional gains in student learning, and be effective school and community leaders. The nine finalists for 2017-18 Tennessee Teacher of the Year are:

West Tennessee

CORE Region

Teacher

School

District

Shelby/Municipals

Stephanie Rice

Crosswind Elementary

Collierville Schools

Southwest

Mandy Fraley

Northeast Middle

Jackson-Madison County Schools

Northwest

Carol Nanney

McKenzie Elementary

McKenzie Special School District

Middle Tennessee

CORE Region

Teacher

School

District

Mid Cumberland

Cicely Woodard

West End Middle

Metro Nashville Public Schools

South Central

Chelle Daniels

West Middle

Tullahoma City Schools

Upper Cumberland

Rebecca Ryan

White County High

White County Schools

East Tennessee

CORE Region

Teacher

School

District

Southeast

Kristin Burrus

Chattanooga School for the Arts and Sciences

Hamilton County Department of Education

East Tennessee

Karen Latus

Bearden High

Knox County Schools

First Tennessee

Nancy Miles

South Side Elementary

Johnson City Schools

These finalists will have the opportunity to serve on Commissioner McQueen’s Teacher Advisory Council for duration of the 2017-18 school year. This council acts as a working group of expert teachers to provide feedback and inform the work of the department throughout the school year. Additionally, to provide continuity and leadership, the three Grand Division winners will continue their term during the 2018-19 school year.

For more information on the Tennessee Teacher of the Year program, visit the department’s website or contact Debby Muskar, director of human capital strategy, at [email protected]. For media inquiries,contact Sara Gast, director of strategic communications and media, at (615) 532‐6260 or [email protected].

0 notes

Text

SIP accounts reach an all-time high of 5.55 crores, investment of 12,276 crores

Despite the continued sale of foreign investors from Indian stock markets, the decline in global markets, the weakness of the rupee, the rise in inflation, retail investors have confidence in mutual funds. Last June, the number of SIP accounts hit an all-time high of 5.55 crore. Not only this, the investment from SIP also reached an all-time high of Rs 12,276 crore.

The mutual fund portfolio grew 31% year-on-year

According to data from Amfi, an association of mutual fund companies, equity funds recorded net investments for the 16th consecutive month in June. The asset under management in the sector reached an all-time high of Rs 35.64 lakh crore. The number of mutual fund portfolios grew 31% year-on-year. These increased to 13.46 crore from 10.25 crore in June 2021.

The number of SIP accounts hit an all-time high of 5.55 crore. The net AUM of the retail schemes (Equity + Hybrid + Solution Oriented) grew 16% yoy to Rs 17.91 lakh crore. Retail schemes saw positive net flow of Rs 13,338 crore in June for the 16th consecutive month after March 2021.

All retail equity schemes recorded positive inflows in June

says NS Venkatesh, CEO of Amfi, the trend of small investors to save through SIPs. The mega trend of financialization of savings also continues in the country. All retail equity schemes, indices, ETFs and FoFs showed positive investments in June. This reflects the confidence of retail mutual fund investors towards long-term growth amidst the ups and downs of the stock market.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

1 note

·

View note

Text

Stock market boomed due to global market trend, Sensex crossed 54 thousand

Good signals from the global market and falling crude prices drove the Indian stock market higher on Thursday. On Thursday morning, Sensex and Nifty began trading with green brands. At the start of the trading session, the 30 point Sensex opened with a gain of 395.71 points to 54,146.68. Meanwhile, the 50-point Nifty opened at 16,113.75. During the pre-opening session, 29 out of 30 Sensex shares rose.

On the other hand, due to buying in the global stock market, there was a slight rise in the US market. The Dow Jones closed with a gain of 400 points, up 70 points. Computer stocks continually strengthen the market. The European market saw an increase of up to 1.5%. The Asian market also showed strength.

The movement of the stock market

Wednesday Earlier Wednesday, after a long stretch, there was a huge rally in the stock market. At the end of the trading session, the 30-point BSE Sensex jumped 616.62 points to close at 53,750.97. Meanwhile, the National Stock Exchange Nifty closed at 15,989.80 points with a gain of 178.95 points.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

1 note

·

View note

Text

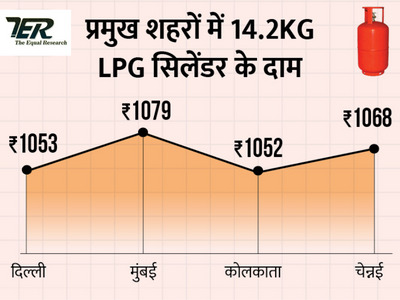

Domestic cylinder price hiked by Rs 50

Rs 1053 will have to be paid on a 14kg bottle in Delhi, the price has risen for the second time in 48 days.

After the reduction in the price of commercial gas cylinders, the prices of domestic gas cylinders increased again after 48 days. According to the latest update from Indian Oil, you will now have to pay Rs 50 more for an unsubsidized 14.2 kg bottle. In the capital Delhi, the price of the 14 kg cylinder has risen from Rs 1003 to Rs 1053.

Earlier on May 19, oil companies had raised the price of domestic LPG gas cylinders by Rs 3,50 paise. At the same time, the prices of commercial gas cylinders have also been increased by Rs.

Cylinder crossed Rs 1100 in these cities

Bihar: Supaul (Rs 1157.5), Patna (Rs 1151), Bhagalpur (Rs 1150.5) and Aurangabad (Rs 1149.5)

Madhya Pradesh: Bhind (Rs.1132), Gwalior (Rs.1137) and Morena (Rs.1137)

Jharkhand: Dumka (Rs 1110.5) and Ranchi (Rs 1110.57)

Chhattisgarh: Kanker (Rs.1141) and Raipur (Rs.1124)

Uttar Pradesh: Sonbhadra (Rs.1140)

The gas cylinder has become more expensive by Rs 218.50 in 1 year

The price of domestic gas cylinder in Delhi on July 1, 2021 was Rs 834.50, which has now risen to Rs 1053. That is, over the past year, the price of domestic gas cylinder has increased by 218 .50. At the same time, the subsidy on this was also removed.

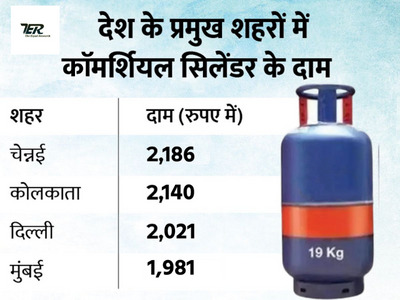

Commercial gas cylinders The cheapest prices

commercial gas cylinders were cut off on July 1. Due to which the price of commercial 19kg bottle in Delhi has risen from Rs 2,219 to Rs 2021. Similarly, from Rs 2,322 in Kolkata, this bottle will now be available for Rs 2,140. The price in Mumbai has risen from Rs 2171.50 to Rs 1981 and in Chennai from Rs 2373 to Rs 2186.

As a result, the price of the gas cylinder has dropped by Rs 198 in Delhi, Rs 182 in Kolkata, Rs 190.50 in Mumbai and Rs 187 in Chennai. In June last month, tariffs for commercial cylinders were reduced by Rs 135. However, no relief was given by oil companies to domestic gas cylinders. The price of a 14.2 kg gas cylinder in Delhi is Rs 1003.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

0 notes

Text

Made an empire of 43 thousand crores by investing in shares

Rakesh Jhunjhunwala, 62, is nicknamed the Big Bull of the stock market and now owns an airline.

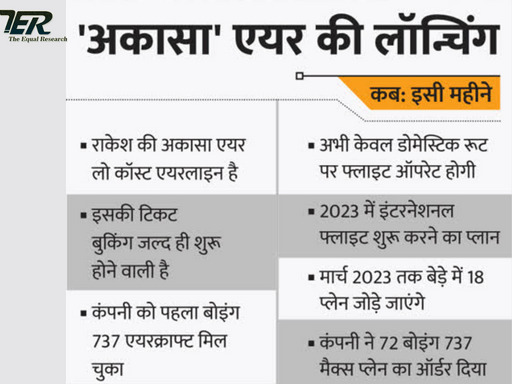

The Big Bull of the stock market, Rakesh Jhunjhunwala, who traveled from Rs 5,000 to Rs 43.39 crore, has a birthday today, July 5. He turned 62. Jhunjhunwala will also enter the aviation sector with the airline "Akasa" this month.

Jhunjhunwala was once a bear in the stock market i.e. bears. He made huge profits through short selling in 1992 when the Harshad Mehta scam came to light. There were several reputable cartels in the Indian stock market in the 1990s.

One of these cartels was that of Manu Manek which was the Bear Cartel. Manu Manek's cartel was called Black Cobra and he was also followed by Radhakishan Damani and Rakesh Jhunjhunwala. Journalist Sucheta Dalal exposed Harshad Mehta's scams after which the stock market crashed.

In such a situation, today we tell you about Jhunjhunwala's investment journey through his learnings and interesting fact graphs related to him.

Rakesh Jhunjhunwala launching “Akasa” airline soon:

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

0 notes

Text

Sensex fell nearly 150 points, Nifty near 15700, selling in metal stocks, M&M and Tata Steel top losers

There is a decline in the Indian stock market today. The Sensex and Nifty indices weakened in today's trading. There is a liquidation of about 150 points in the Sensex. At the same time, Nifty has also moved closer to 15700. There is a sell-off in IT and metal stocks. The Nifty Metal Index is down about 1.95% and the IT Index is down 0.65%. At the same time, the auto index is also down. While the banking and financial indices show gains. The pharmaceutical, real estate and FMCG indices are also in the green.

Right now, the Sensex is up 150 points and trading at the 52,759.89 level. While Nifty is up 37 points at the 15715 level. Today's major losers include Tata Steel, M&M, TCS, Wipro, Tech Mahindra, Dr Reddy's and HDFC.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency#commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

1 note

·

View note

Text

Reliance forays into retail food business

British food chain "Pret a Manger" is joining forces and will open its stores in the country.Reliance Industries is rapidly expanding its portfolio. Reliance Industries has now entered the food retail sector as part of this portfolio expansion strategy. Reliance Brands Limited, a Reliance Group company, has partnered with global fresh food and organic coffee chain 'Pret A Manger' in this regard. Pret A Manger is a UK based company which currently has 550 stores in 9 countries including UK, US, Europe and Asia.

In India, it will be in the hands of Reliance

Reliance Brands Limited will launch Pret A Manger in India and open its stores across the country. Pret A Manger opened its first shop in London in 1986. The company serves home-cooked meals and fresh ready-to-eat meals.

Increased consumer awareness

RBL food closely follows the pulse of Indian consumers. Food awareness has increased among consumers - ready-to-eat foods are becoming the new fad. Like Indians around the world, who want to discover food made from fresh and organic ingredients, Pret has been able to respond well to their request.

Recently signed joint venture agreement with Plastics Legno SPA

Reliance Brands Limited (RBL) has signed a joint venture agreement with Plastics Legno SPA to strengthen the toy manufacturing ecosystem in India. Through this, RBL will gain a 40% stake in Plastic Legno's toy manufacturing business in India. Plastic Legno SPA belongs to the Italian group Sunino, which has been present in the toy manufacturing sector in Europe for more than 25 years.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#currency commodity trading#currency#commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader

0 notes