#Investor program

Text

eToro Review 2024

New Post has been published on https://www.tokenlivenews.xyz/review/etoro-review-2024/

eToro Review 2024

About eToro

eToro is one of the world’s leading social trading networks, with over 30 million registered users and an array of innovative trading and investment tools. Since 2007, eToro has been a leader in the global fintech revolution.

eToro’s trusted platform provides 30+ million users in over 140 countries with access to over 5,000 financial instruments. With its cutting-edge features, a user-friendly interface, and unique products, eToro has created a collaborative trading community where members share insights, learn from each other and build on each other’s success.

This multi-asset platform offers a full range of learning materials, making it a one-stop shop for both beginner and experienced investors.

The knowledge of the community and the variety of instruments and trading tools, make for a platform where all traders and investors can find unique features to help them trade.

youtube

A world of trading opportunities

With a US$50 entry bar and a simple onboarding process, eToro brings the markets closer to traders than ever before. eToro’s diverse offering includes stocks, cryptocurrencies, forex (CFDs), commodities (CFDs), indices (CFDs), commodities,, ETFs and Smart Portfolios, as well as copy trading.

Stocks

eToro offers a wide variety of over 3,000 stocks from 20 exchanges worldwide. At eToro, you can trade stocks as the underlying asset, CFDs and ETFs.

The ability to purchase fractions of shares, enabling investors to invest in expensive stocks at lower prices.

Buying a stock on eToro by opening a BUY (long), non-leveraged position, means investing in the underlying asset and dividends are paid in proportion to the number of stocks owned.

Leveraged positions and Short (SELL) are executed as CFDs.

Free access to TipRanks’ expert stock analysis

0% commission on real stocks

Investing in stocks on eToro is commission free, making investing in the world’s leading stocks more affordable than ever. What’s more, there are also no limits on commission-free trades, and investors can buy fractional shares.

Zero commission means that no additional broker/dealing fee has been charged when trading stocks.

eToro also absorbs Stamp Duty and Financial Transaction Tax for clients where applicable, representing an additional saving of 0.5% in the UK, 1% in Ireland, 0.3% in France and 0.1% in Italy.

Please note:

Zero commission applies to all stocks available on the eToro platform when investing in non-leveraged BUY stock positions.

Zero commission does not apply to stock CFDs.

Other fees may apply. For additional information regarding fees, click here.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees

Forex

Currency trading on eToro allows you to buy and sell a range of 49 international currency pairs. eToro’s easy-to-use simple platform, the competitive fees and the availability of trading tutorials and tools makes it a great place to trade forex.

Competitive fees

Great trading and risk management tools such as the trading stop-loss

Get input and discuss markets with the eToro community, and follow or copy experienced forex traders.

Buy or sell currencies with or without using leverage via CFD.

Commodities

eToro’s platform enables traders and investors to trade 26 commodities via CFDs, including: gold, silver, natural gas, oil and more.

A variety of leverage options are available depending on the underlying asset.

Keep informed with eToro’s news feed and the community’s discussions.

eToro also offers some ETFs that track commodities, and stocks of various companies which produce commodities.

Indices

eToro offers 20 options for trading major indices in the US, Europe and Asia.

Buy or sell indices via CFDs with or without using leverage.

Trade and invest in the major global and local markets.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

youtube

eToro Crypto

eToro offers over 40 leading cryptocurrencies, over 14 crypto crosses and innovative tools that you won’t find anywhere else. eToro Crypto offers an all-round crypto solution: a trading platform, a wallet, and an exchange, all with the security of a regulated fintech leader that you can trust.

You can open a crypto position with $10.

You can trade crypto through a variety of CryptoPortfolios, managed by eToro’s Investment Committee.

Ability to copy a variety of Popular Investors who trade crypto.

Real and CFD Crypto

When opening long (BUY) crypto positions on eToro without using leverage (be aware of the risks associated with leverage, since it can multiply both profits and losses), the crypto is purchased and held by eToro on the user’s behalf. Short (SELL) and leveraged positions opened for cryptocurrencies on eToro are executed using CFDs (reminder, crypto CFDs are not available in the UK).

In addition, there are over 60 crypto-related assets available for trade on eToro. This means that users can trade two different types of cryptocurrencies against each other. By default, the US dollar is the fiat currency that all cryptocurrencies are paired against for trading.

AU disclaimer: eToro AUS Capital Ltd ACN 612 791 803 AFSL 491139. eToro offers both real cryptoassets as well as cryptoassets as OTC Derivatives. Real cryptoassets are unregulated & highly speculative. Being unregulated, there is no consumer protection. Your capital is at risk. Leveraged positions and short positions are OTC Derivatives, which are regulated financial products. OTC Derivatives are considered risky financial products, speculative and include leverage. Not suitable for all investors. Capital at risk. See PDS and TMD

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Cryptoassets are highly volatile and unregulated in the UK. No consumer protection. Tax on profits may apply.

Smart Portfolios

Smart Portfolios are innovative, long-term investment portfolios, created and periodically rebalanced by eToro analysts around a certain theme. Each with its own unique investment strategy, Smart Portfolios are a convenient and diversified way to access major market trends shaping our world today, without paying portfolio management fees. There are 70 Smart Portfolios of three different types:

Top Trader Smart Portfolios, which comprises the best-performing traders on eToro, according to a predefined strategy.

Market Smart Portfolios, which bundles together a select combination of instruments, according to a predefined theme.

Partner Smart Portfolios, which have been created by our partners. Examples are: TipRanks, a stock analyst software company, WeSave, a French robo-advisor and Meitav Dash, a multibillion-dollar investment company.

AU disclaimer:

eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Smart Portfolios are not exchange-traded funds or hedge funds and are not tailored to your specific objectives, financial situations and needs. Your capital is at risk. See PDS and TMD.

UK and EU Disclaimer:

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

So much more than instruments

Social Trading

eToro pioneered social trading back in 2010 and is now one of the largest social trading communities in the world. eToro enables over 30+ million users around the world to communicate, share thoughts, knowledge and ideas about the financial markets on its feed.

CopyTrader™

CopyTrading is a groundbreaking social trading feature introduced by eToro in 2010. It offers added value to any type of trader — ranging from easy exchange and access to information, to the ability to copy fellow traders, to the opportunity of joining the Popular Investor Program and earning monthly payments from being copied.

Users can automatically copy top-performing traders.

Users can copy many traders simultaneously.

Users can stop the copy, pause it, and add or remove funds at any time.

AU disclaimer: eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Social trading. eToro does not approve or endorse any of the trading accounts customers may choose to copy or follow. Assets held in your name. Capital at risk. See PDS and TMD

youtube

Popular Investor Program

The Popular Investor Program allows traders to build their own investment business and earn up to a 1.5% annual fee in Assets Under Management (AUM).

Traders must qualify for the Popular Investor program which includes responsible trading, low-risk scores and a minimum investment track record.

eToro provides the tools and support to help Popular Investors grow their AUM, and thus, their earnings, which we augment by featuring them on the platform, in blog posts and other marketing campaigns.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

$100K virtual eToro account

eToro users can practise their trading and explore the eToro platform for free with a 100K virtual account.

Follow each instrument’s real-time trends with advanced analysis tools.

Experiment with different risk levels by applying leverage, stop-loss and take-profit.

Connect with top traders from all over the world and copy their portfolios.

Try eToro’s ready-made thematic portfolios.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Keeping users updated

eToro believes that knowledge is power, and that the more knowledge our users have, the better they trade. Therefore, eToro keeps our users educated and informed about the financial markets with daily blogs, daily market updates, notifications, social media posts and more.

eToro’s news feed

The news feed on eToro is a personalised social news feed incorporating elements from the worlds of social media and the markets. It helps users to follow the financial events and traders they like, interact with fellow members of the eToro community, open discussions and much more.

Similar to other social networks, users can post their own updates, tag instruments or people, share posts to their feed, comment on others’ posts and gradually create a feed that is tailor-made to their trading and investing interests.

Users receive notifications when a user they are copying writes a new post, an asset on their watchlist becomes volatile and many other important updates. Notifications appear both on the web platform and as push notifications straight to their mobile device.

eToro Academy

The eToro Academy provides all of the resources needed to learn how to be successful in trading and investing, in an enjoyable way. You can find beginner and advanced videos on all types of financial assets and investing subjects, and 101 courses with a summer school! Check podcasts, explainer videos and guides to get the information you need on any market subject.

Basic eToro Facts

Number of traders: Over 30 million

Available languages: 19

Broker regulated by the following agencies: FCA (UK), ASIC (Australia), CySEC (Cyprus), GFSC (Gibraltar)

Leverage limitations for ESMA clients:

30:1 for major currency pairs (such as EUR/USD)

20:1 for non-major currency pairs (such as EUR/NZD), gold and major indices

10:1 for commodities with the exception of gold and non-major equity indices

5:1 for individual equities and other reference values

2:1 for cryptocurrency

Be aware of the risks associated with leverage; it can multiply both profits and losses.

Leverage limitations for ASIC clients:

Up to 20:1 for certain instruments

Be aware of the risks associated with leverage; it can multiply both profits and losses.

Total number of assets: Over 5,000

Number of assets by category: Indices 20+, Currencies 49+, Stocks 3,000+, Commodities 25+, ETF 315+, Cryptocurrencies 70+

Minimum first deposit amount: US$50 (minimum first deposit amount per country)

Minimum withdrawal amount: US$30

Withdrawal Fee: $5

Deposit and withdrawal options: Credit/ Debit cards, Paypal, Neteller, Rapid Transfer, Ideal, Klarna/Sofor Banking, Bank Transfer, Online Banking-Trustly, POLi, Przelewy24, Payoneer, SKRILL.

Trading Glossary

Annual General Meeting (AGM): A meeting conducted annually where the members of an organisation gather to discuss and vote on key issues. Public companies hold annual general meetings for shareholders.

Annualised return: A measure of how much an investment has increased on average each year, during a specific time period. The annualised return is calculated as a geometric average to show what the compounded annual return would look like.

Arbitrage: The process of simultaneous buying and selling of an asset from different platforms, exchanges or locations, to cash in on the price difference.

Ask: The lowest price at which a seller will sell the stock at any given time.

Averaging down: An investment strategy that involves a stock owner purchasing additional shares of a previously initiated investment after the price has dropped. The second purchase will result in a decrease in the average price at which the investor purchased the stock.

Averaging up: An investment strategy that involves a stock owner purchasing additional shares of a previously initiated investment after the price has risen.

Balance sheet: A document summarising a company’s assets, liabilities and shareholders’ equity at a specific point in time.

Bear market: A bear market is defined by a prolonged drop in investment prices. It generally indicates a broad market index falling by 20% or more from its most recent high.

Bid: The highest price a buyer will pay to buy a specified number of shares of a stock at any given time.

Blockchain: A shared, immutable, decentralised and public digital ledger that is used to record transactions across many computers in a way that the record cannot be altered retroactively without the alteration of all subsequent blocks and the consensus of the network.

Blue-chip stocks: Shares of an established, profitable and well-recognised corporation. Blue chips have a large market capitalisation, are listed on a major stock exchange, and have a history of reliable growth and dividend payments.

Bull market: A bull market is defined by a prolonged rise in investment prices.

Cash flow statement: A financial statement that summarises the movement of cash and cash equivalents (CCE), that come in and go out of a company.

CFD: An agreement between a trader (you) and the broker (e.g., eToro) to exchange the difference between the price of an asset at the opening and closing of the trade. It is a popular financial tool that allows investors to potentially benefit from price movements without owning the actual asset.

Close: The price of the last trade at the end of a trading day.

Cold and hot storage: Cold storage refers to holding cryptocurrency offline in a secure hardware wallet, while hot storage refers to storing cryptocurrency on a device connected to the Internet, such as an exchange.

Day trading: The practice of buying and selling financial instruments on the same trading day.

Decentralised: A system or network that is not controlled by a single entity, but instead is distributed across a number of nodes.

Dividend: A payment made by a corporation to its shareholders, usually in the form of cash or additional shares.

Earnings report: A report released by a company that details its financial performance over a given period, including revenue, expenses, and profits.

ETF: Exchange-Traded Fund, which is a type of investment fund that is traded on a stock exchange like a stock.

Exchange: A marketplace where financial instruments, such as stocks, bonds, and cryptocurrencies, are bought and sold.

Execution: The process of completing a trade or order, which may involve buying or selling an asset at a specific price.

FIAT: A term used to describe government-issued currency.

Forex: Short for “foreign exchange,” which is the market for trading currencies.

Futures: A financial contract in which the buyer agrees to purchase an asset at a future date for a predetermined price.

High: The highest price of a financial instrument reached during a given period.

HODL: A term used in the cryptocurrency community to describe holding on to cryptocurrency for the long term, rather than selling it for short-term gains.

Income statement: A financial statement that details a company��s revenues, expenses, and profits over a given period.

Index: A group of stocks or other financial instruments that represent a particular market or sector.

Interest: The cost of borrowing money, typically expressed as a percentage of the amount borrowed.

IPO: Initial Public Offering, which is the first time a company offers its stock to the public.

Leverage: The use of borrowed money to increase the potential return on an investment.

Long: A position in which an investor owns an asset with the expectation that its value will increase.

Low: The lowest price of a financial instrument reached during a given period.

Margin: The amount of money an investor borrows from a broker in order to make an investment.

Market cap: The total value of all outstanding shares of a company’s stock, calculated by multiplying the current stock price by the number of outstanding shares.

Order: An instruction given by an investor to buy or sell a financial instrument at a specific price.

Penny stock: A stock that trades at a low price, typically less than $5 per share.

Portfolio: A collection of investments held by an individual or institution.

Public and private keys: A pair of cryptographic keys that are used to authenticate transactions in a cryptocurrency network.

Quote: The current market price of a financial instrument.

Rally: A period of sustained price increases in a financial instrument or market.

Sector: A group of companies that operate in a similar industry.

Share market: A marketplace where stocks and other financial instruments are bought and sold.

Short: A position in which an investor borrows an asset with the expectation that its value will decrease, allowing the investor to buy it back at a lower price and profit from the difference.

Short squeeze: A phenomenon in financial markets where a sharp rise in the price of an asset forces traders who previously sold short to close out their positions.

Spread: The difference or gap between two prices, rates, or yields. One common use of “spread” is the bid-ask spread, which is the gap between the bid (from buyers), and the ask (from sellers), price of a security or asset.

Stop-loss: A type of order that investors or traders use to limit their potential losses in the stock market. It works by automatically selling a security when its price reaches a certain level, known as the stop price.

Take-profit: A take-profit order (T/P) is a type of limit order that specifies the exact price at which to close out an open position for a profit. If the price of the security does not reach the limit price, the take-profit order does not get filled.

Tax report: A form or forms filed with a tax authority that reports income, expenses, and other pertinent tax information. Tax returns allow taxpayers to calculate their tax liability, schedule tax payments, or request refunds for the overpayment of taxes.

Trading alert: A notification that an asset on your watchlist displays volatility.

Trailing stop loss:

A trailing stop loss order adjusts the stop price at a fixed percent or number of points below or above the market price of a stock.

Volatility: The rate at which the price of an instrument increases or decreases for a given set of returns.

Volume: Volume is simply the amount of asset traded in a particular stock, index, or other investment over a specific period of time.

Yield: Yield refers to how much income an investment generates, separate from the principal. Yield is often expressed as a percentage, based on either the investment’s market value or purchase price.

youtube

#CFD#Commission#Commodities#eToro#eToro Crypto#Forex#Indices#Investor program#Smart Portfolios#Social trading#Stocks#Virtual eToro account#Review

0 notes

Text

Rudraksh Group Lists Features of Quebec Immigrant Investor Program (QIIP)

0 notes

Text

Unlocking the American Dream: The EB-5 Visa Program

In a world where global mobility is becoming increasingly common, the United States remains a coveted destination for many aspiring immigrants. The land of opportunity, innovation, and cultural diversity has consistently attracted individuals seeking a better life for themselves and their families.

#immigration#immigration benefits#immigration requirements#investment opportunities#investment options#investor program#green card pathway#financial returns#direct investments#eb-5 program

0 notes

Text

#financial#reptiblr#python#ratblr#one piece#poster#programming#puppies#1950s#pink#retro#loan#investors#personal finance#investments#investing

5 notes

·

View notes

Text

The craziest part is, if the streaming services just adopted a limited series model they could do the exact same thing they’re doing now but with only a quarter of the backlash

#the people in charge rarely know what they’re doing#in a world where you produce shows with diverse cast and storylines for 1-2 seasons max purposely#your budgeting gets tighter#your writer’s room knows what’s up so the stories are complete#you get to boast about your diverse programming even though you’re still giving people scraps#and you keep the investors happy by not being too woke or whatever the investors are afraid of

7 notes

·

View notes

Text

Enroll in our comprehensive training program and master the art of real estate investment

Discover the world of real estate investment with Real Estate Investing Women's comprehensive training program, which is designed to provide aspiring investors with the knowledge, skills, and tactics they need to succeed in the competitive real estate market. Whether you're new to real estate investing or looking to diversify your portfolio, our training program provides expert advice and practical insights to help you make sound investments and achieve financial success.

Unlock the Secrets of Great Real Estate Investments:

Our training program covers all areas of real estate investing, including property selection, financing, deal analysis, and risk management. With a focus on real-world scenarios and hands-on learning, you'll obtain the knowledge and confidence required to discover profitable investment opportunities and maximize your profits.

Expert-led training for all skill levels:

Our training program, conducted by seasoned individuals with years of industry expertise, provides expert-led teaching customized to your skill level and investment objectives. Whether you're a new investor trying to lay a firm foundation or an experienced investor searching for advanced methods, our program offers tailored training and support to help you succeed.

Comprehensive Curriculum and Real-World Results:

Our training curriculum includes a wide range of important issues for real estate investment success, such as market analysis, property assessment, financing choices, negotiating strategies, and more. Through engaging seminars, case studies, and practical exercises, you'll acquire hands-on experience and learn how to confidently navigate the complexity of the real estate market.

Why Choose the Real Estate Investing Women's Training Program?

Real Estate Investing Women aims to empower women in the real estate investment business. Our training program is intended to equip ambitious investors with the knowledge, skills, and assistance they require to thrive in real estate. With expert-led education, a thorough curriculum, and a supportive community of like-minded investors, our program prepares you for success in real estate.

Take The First Step Towards Real Estate Investment Success:

Ready to realize your full potential as a real estate investor? Enroll in Real Estate Investing Women's full training program today and begin your journey to wealth creation through strategic real estate investing. With expert advice, practical insights, and a supportive community by your side, you'll be well-equipped to meet your investment objectives and build a brighter financial future.

#real estate investment training#great real estate investments#real estate investor training program

1 note

·

View note

Text

Canada Immigrant Investor Program

Consisting of 10 provinces and three territories, Canada extends from the Atlantic to the Pacific and northward into the Arctic Ocean, covering 9.98 million square kilometres (3.85 million square miles) in total, making it the world’s second-largest country by total area. Canada shares the world’s longest border with the United States. Though sparsely populated overall, Canada is home to bustling mega-cities and large expanses of wide-open country ranging from mountains, to prairie, to ancient hardwood forests. Canada enjoys a high quality of life, and a strong and stable economy.

0 notes

Text

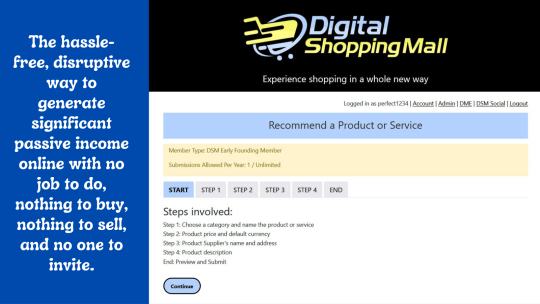

Digital Shopping Mall is on the verge of pushing a button that will initiate a revolutionary new world order, where financial freedom becomes accessible to everyone who participates in it, particularly the early birds engaging in DSM's groundbreaking ground-floor opportunities.

https://social.digitalshoppingmall.net/content/perma?id=12603&cd1=4&cd2=4

#digital shopping mall#digital shopping points#digital shopping coin#affiliate income#passive income#work from home#affiliate program#angel investors#early investors#cryptocurrency#service recommendations#product recommendations#recommendation commissions#endorsement commissions#new economic order#new monetary system#new world order

0 notes

Text

Exquisite Luxury Homes for Sale in Miami, Florida: A Showcase of Elegance by Fabrice Ernandes

Miami, Florida – renowned for its vibrant culture, stunning beaches, and a thriving real estate market. Nestled within this tropical paradise is an exclusive collection of luxury homes curated by Fabrice Ernandes, a name synonymous with sophistication and opulence. As a premier real estate professional, Ernandes has established a reputation for connecting discerning buyers with the most extraordinary properties in Miami.

0 notes

Text

Investing in the American Dream: The EB-5 Visa Program

In a world where global mobility is becoming increasingly common, the United States remains a coveted destination for many aspiring immigrants. The land of opportunity, innovation, and cultural diversity has consistently attracted individuals seeking a better life for themselves and their families. One avenue that has gained significant attention in recent years is the EB-5 Visa Program, a unique and attractive way for foreign investors to obtain permanent residency in the United States. In this article, we will explore what makes the EB-5 Visa Program so special and why it's a path worth considering for those with entrepreneurial ambitions.

The EB-5 Visa Program, created by the U.S. government in 1990, is designed to stimulate economic growth and job creation in the United States by offering foreign investors and their immediate families the opportunity to become lawful permanent residents, often referred to as "green card" holders. Unlike other visa categories, the EB-5 program doesn't require applicants to have specific job offers, family relationships, or extraordinary skills. Instead, it hinges on an investment of capital in a new commercial enterprise that leads to job creation.

To qualify for the EB-5 program, foreign investors must commit a minimum investment of $1.05 million in a new commercial enterprise within the United States. However, if the investment is made in a Targeted Employment Area (TEA), which is either a rural area or an area with high unemployment, the minimum investment requirement is reduced to $800,000. This lower investment threshold is an attractive feature for many investors.

Advantages of the EB-5 Visa Program

Path to Permanent Residency: The EB-5 program provides a direct path to obtaining a green card, allowing investors and their immediate families to live and work anywhere in the United States.

Education Opportunities: Green card holders can access the U.S. education system, including in-state tuition rates at public universities, making it an excellent choice for families with educational aspirations.

Business Freedom: Investors have the flexibility to start and manage their own businesses in the United States without the constraints of employer-sponsored visas.

Quality of Life: The United States offers a high quality of life, with access to world-class healthcare, a diverse cultural landscape, and numerous opportunities for personal and professional growth.

Conclusion

The EB-5 Visa Program presents a unique and attractive opportunity for foreign investors looking to pursue their American dream. It not only provides a path to permanent residency in the United States but also offers the chance to make a significant impact on the U.S. economy through job creation. With its lower investment threshold in targeted areas, it has become increasingly accessible to a broader range of investors. If you're seeking a way to make the United States your home and invest in your future, the EB-5 Visa Program is undoubtedly worth exploring as your ticket to the land of opportunity.

#immigration#green card pathway#financial returns#eb-5 program#direct investments#investor program#investment opportunities#immigration benefits#immigration requirements#investment options

0 notes

Text

Discover Paradise: Vanuatu Citizenship Program with LatitudeWorld

Embark on a journey to tropical bliss with the Vanuatu Citizenship Program, expertly guided by LatitudeWorld. Immerse yourself in the serene beauty of Vanuatu while LatitudeWorld navigates the seamless path to securing your citizenship. Enjoy visa-free travel, financial advantages, and a unique island lifestyle. Let LatitudeWorld be your trusted partner in making your dreams of Vanuatu citizenship a reality. Elevate your life with LatitudeWorld, where every step is a step closer to your island paradise.

#citizenshipinvestment#investors#maltacitizenship#uae goldenvisa#maltainvestment#latitudeworld#vanuatu citizenship program

0 notes

Text

Obtaining a USA Green Card without the Diversity Visa (DV) Lottery involves alternative avenues for immigration. Non-DV pathways may include employment-based sponsorship, family reunification, refugee or asylum status, or specialized immigrant programs. These options offer individuals an opportunity to secure permanent residency in the United States based on specific eligibility criteria. By navigating these alternative routes, applicants can pursue their American dream through diverse immigration channels outside the traditional DV Lottery process. Each pathway has its own set of requirements and procedures, providing individuals with various routes to achieve permanent residency in the United States.

#USA Green Card#Diversity Visa Lottery#Alternative immigration pathways#Employment-based sponsorship#Family reunification#Refugee and asylum status#Specialized immigrant programs#EB-5 Immigrant Investor Program#Permanent residency#Immigration options#Non-DV US immigration#US Immigration Eligibility criteria#US Family ties#US Job opportunities#Humanitarian circumstances#Immigration diversity#USA immigration#Non-DV Lottery routes#US Green Card application#US Immigration Policie

1 note

·

View note

Text

Top 2024 Investment Programs: Experts Recommend the Best Second Passports for Offshore Investment

In today’s globalized world, the concept of investing offshore and obtaining a second passport has become increasingly popular among savvy investors. As we step into 2024, certain investment programs have risen to the top, highly recommended by experts for those seeking to diversify their portfolios while gaining the flexibility and benefits of a second citizenship. Here are the top investment…

View On WordPress

#Antigua & Barbuda#Citizenship by Investment#citizenship investment program#Cyprus#Cyprus Investment Programme#Grenada#Investment Programs#Malta Individual Investor Programme#MIIP#Montenegro#Portugal Golden Visa#second passport#Second Passport Investment Programs#Vanuatu

0 notes

Text

https://abroadroutes.com/destinations/united-states/study/

#“”“EB-5 Investor Visa Program#Immigrant Investor Visa Application#Applying for EB-5 Visa#U.S. EB-5 Investment Program#EB-5 Visa Assistance“”“

0 notes

Video

youtube

Two Grant Programs for Real Investors and Real Estate Agents- Must See 2...

0 notes