#Important Disclaimer: This review is for informational purposes only and should not be considered financial advice. It's crucial to condu

Text

Project Serenity - 33% Life-time Commissions

Digital - membership area

#Finding Financial Peace with Project Serenity: A Membership Worth Exploring#Financial planning can be a daunting task#especially in today's ever-changing economic landscape. For years#I felt overwhelmed by investment options and unsure of how to navigate the complexities of the financial world. This is where Project Sere#A Curated Approach to Financial Education#Project Serenity is a digital membership area designed to empower individuals to take control of their financial futures. The platform pro#including insightful articles#informative webinars#and interactive workshops. These resources cover a wide range of topics#from investment fundamentals and portfolio diversification to wealth-building strategies and navigating the ever-evolving world of finance.#Expert Guidance for Informed Decisions#What truly sets Project Serenity apart is its focus on expert guidance. The platform offers insights from seasoned financial professionals#wealth managers#and experienced investors. Their knowledge and experience provide members with a valuable framework to make informed financial decisions#A Supportive Community for Shared Growth#Project Serenity fosters a supportive and collaborative environment. Members can connect with each other through online forums and discuss#ask questions#and learn from one another's financial journeys. The sense of community is valuable#especially for those who might feel lost in the world of finance.#Building a Brighter Financial Future#Since joining Project Serenity#I've gained a newfound confidence in managing my finances. The platform's educational resources have equipped me with the knowledge and too#Important Disclaimer: This review is for informational purposes only and should not be considered financial advice. It's crucial to condu#Overall#Project Serenity offers a valuable resource for anyone seeking to improve their financial literacy and build a secure financial future. I#expert guidance#and a supportive community make it an excellent choice for individuals at any stage of their financial journey.

1 note

·

View note

Text

Mutual Funds Made Easy: A Guide to Beginners.

What is a Mutual Fund?

Hey buddy, Mutual funds are a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. The mutual fund is managed by a professional fund manager who makes investment decisions on behalf of the investors, to maximize returns while minimizing risk.

Types of Mutual Funds

There are several types of mutual funds, including equity funds, fixed-income funds, balanced funds, index funds, and specialty funds. Equity funds invest in stocks, fixed-income funds invest in bonds, and balanced funds invest in a mix of stocks and bonds. Index funds are designed to track a specific market index, such as the S&P 500, while specialty funds focus on a particular sector or industry.

Benefits of investing in mutual funds

Mutual funds offer several benefits, including diversification, professional management, convenience, and flexibility. Diversification is important because it helps reduce the risk of losses by spreading investments across many different assets. Professional management ensures that your money is invested by a trained and experienced professional. Mutual funds are also convenient because they can be purchased and sold through a brokerage account or financial advisor. Additionally, they offer a high level of flexibility, allowing you to buy or sell shares at any time.

Risks of investing in mutual funds

All investments come with some level of risk, and mutual funds are no exception. The value of mutual funds can fluctuate based on changes in the financial markets, and past performance is not always an indicator of future performance. Additionally, mutual funds charge fees and expenses, which can eat into your returns over time.

Choosing a mutual fund

When choosing a mutual fund, it’s important to consider your investment goals, risk tolerance, and investment time horizon. You should also research the fund’s fees and expenses, as well as its historical performance. Finally, consider working with a financial advisor who can help you choose the right mutual funds for your portfolio.

I will give two tips on checking to choose a mutual fund before investing first one is

Performance History: Look at the fund’s past performance over a period of time, preferably five to ten years. While past performance is not an indicator of future returns, it can give you an idea of how the fund has performed during different market conditions. You can check easily on grow app or whatever app you like it.

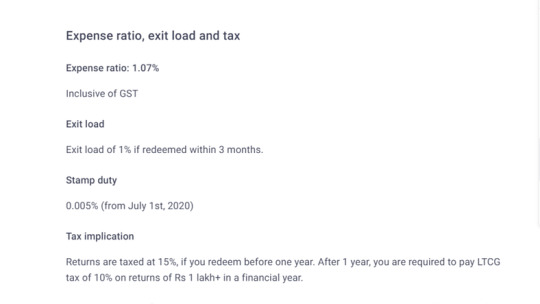

Expense Ratio: The expense ratio represents the cost of managing the fund and is deducted from your returns. Look for funds with a lower expense ratio, as high fees can eat into your returns over time.

I will show pictures of higher expense ratios and lower expense ratios.

Monitoring your mutual fund

After you invest in a mutual fund, it’s important to monitor your investment regularly to ensure that it continues to meet your investment goals. This may involve reviewing the fund’s performance, fees, and expenses, as well as rebalancing your portfolio periodically to maintain a diversified mix of investments.

Remember, mutual funds can be a great way to invest in the stock market and other assets without having to choose individual stocks or assets yourself. However, it’s important to do your research and carefully consider the risks and potential rewards before investing.

Hope you enjoy and like this blog post. Later on, I will post a full detailed blog on Mutual funds. Make sure to share with your friends and comment with your opinions and subscribe.

Disclaimer:

The information provided on this blog is for educational and informational purposes only and should not be considered financial advice. I am not a certified financial advisor and do not hold any professional licenses in the finance industry. Any financial decisions you make based on the information provided on this blog are at your own risk. Please consult with a certified financial advisor before making any significant financial decisions.

2 notes

·

View notes

Text

youtube

Tail Coverage in Medical Malpractice Insurance is a crucial but often misunderstood aspect of medical practice. This informative video demystifies Tail Coverage, explaining what it is, why it's important, and how it works. Whether you're a healthcare professional, a medical student, or simply interested in the nuances of medical malpractice insurance, this video provides clear, comprehensive insights. #shorts

🔍 Highlights of This Video:

-Tail Coverage Explained: A detailed explanation of what Tail Coverage is in medical malpractice insurance.

-Importance for Healthcare Professionals: Understand why Tail Coverage is essential, especially when transitioning between jobs or retiring.

-How Tail Coverage Works: Insight into the mechanics of Tail Coverage, including when and how to obtain it.

-Costs and Considerations: Discuss the financial aspects of Tail Coverage and factors to consider before purchasing.

🩺 Target Audience: Ideal for healthcare professionals, medical students, and anyone involved in the medical industry.

🔔 Subscribe for More Medical Insights: Stay informed about important aspects of medical practice and insurance by subscribing to our channel!

🌟 Protect Your Career with Expert Contract Review at Chelle Law! 🌟

Are you a healthcare professional stepping into a new role? Only sign your employment contract with the proper guidance! At Chelle Law, our experienced attorneys specialize in medical contract review and negotiation. We understand the complexities of healthcare contracts and are committed to protecting your interests.

#TailCoverage #MedicalMalpracticeInsurance #HealthcareProfessionals

For more information, visit our blog post at:

https://www.chellelaw.com/what-is-tail-coverage-medical-malpractice-insurance/

🔗 Connect and Learn More:

Chelle Law

Website: https://chellelaw.com

Facebook Group: https://www.facebook.com/ChelleLawPLC

Email: [email protected]

602.344.9865

The information contained in this video is provided for informational purposes only and should not be construed as legal advice on any subject matter. You should not act or refrain from acting based on any content included in this video without seeking legal or other professional advice. This video contains general information and may not reflect current legal developments or address your situation. We disclaim all liability for actions you take or fail to take based on any content on this site. The operation of this site does not create an attorney-client relationship between you and Chelle Law. Any information sent to us through the comments is not secure and will not be treated as confidential.

Timecodes:

0:00 - Intro

0:14 - Two Types of Healthcare Policies

1:04 - Tail Insurance Policy vs. Occurrence-Based Policy

1:41 - Tips for Employees

2:41 - Sample Scenarios

4:55 - Contact Chelle Law

What is Tail Coverage Medical Malpractice Insurance? published first on https://www.youtube.com/@chellelaw/

0 notes

Photo

New Post has been published on https://www.dawgsinc.com/springfield-mo-vacant-property-ordinances-for-investors-rehabbers-and-realtors/

SPRINGFIELD, MO – Vacant Property Ordinances For Investors, Rehabbers, And Realtors

Every U.S. state holds the power to create laws and regulate them according to their particular needs – which is why it is essential to consider the specific ordinances in Springfield if you are contemplating investing in vacant properties.

This article reviews a few important statutes you should know about to prevent fines and violations on your Springfield vacant property investment.

DISCLAIMER – The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information. This website contains links to other third-party websites. Such links are only for the convenience of the reader, user or browser; DAWGS does not recommend or endorse the contents of the third-party sites.

Readers of this website should contact their attorney to obtain advice with respect to any particular legal matter. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client relationship between the reader, user, or browser and website authors, contributors, contributing law firms, or committee members and their respective employers. The content on this posting is provided “as is;” no representations are made that the content is error-free.

Buildings And Building Regulations

Several sections from the Dangerous, Blighted And Nuisance Building Code are paramount for vacant property owners. They define what makes a property a nuisance, outline inspector duties, and detail the notification, abatement, and cost collection processes. Understanding these regulations is vital for property compliance, avoiding financial burdens, and ensuring the security of vacant structures. From inspection expectations to legal obligations, these sections provide a comprehensive guide for property owners. For vacant property owners, the following sections from the Code of Ordinances are likely to be particularly relevant:

Building Inspectors, Notice Of Public Nuisance & Order Of Abatement

Section 26-62 is your baseline, delineating what deems a building dangerous, blighted, or a nuisance. This understanding is crucial for vacant property owners to avert the designation of their property as a nuisance. Section 26-63 is equally vital, outlining inspectors’ duties, particularly in inspecting vacant buildings–knowing what to expect during city inspections is essential if you own a vacant property. Complementing this, Section 26-65 details the intricate process of notifying owners about dangerous structures and the subsequent abatement orders. Vacant property owners must grasp these procedures to navigate potential designations and safeguard their properties. For a more thorough and comprehensive understanding of these ordinances, we recommend to delve deeper into them.

Standards for Alleviating Public Nuisance & Financial Responsibilities for Property Owners

Section 26-67 sets standards for abating dangerous, blighted, or nuisance buildings, guiding vacant property owners on actions needed for compliance. Understanding these benchmarks is crucial to proactively address issues and maintain property conformity. In Section 26-71, the ordinance elucidates how the city recovers abatement costs if an owner fails to act. For vacant property owners, comprehending these financial responsibilities is paramount to avoid unforeseen burdens. Section 26-79 reinforces the legal obligation for owners to permit entry to city inspectors, underscoring the importance of cooperation in maintaining compliance. Make sure to read carefully these sections for a comprehensive grasp of essential property management protocols.

Legal Obligations – Permits & Boarding Up

Section 26-81 places a legal obligation on vacant property owners, making it unlawful to leave unoccupied buildings open without proper permits. This underscores the responsibility of property owners to secure their premises, preventing potential hazards and unauthorized access. Complementing this, Section 26-83 further emphasizes the need for permits, prohibiting the boarding of unoccupied buildings without valid documentation. Vacant property owners must navigate these regulations to ensure compliance, safeguarding their properties and the community. Explore the detailed requirements for comprehensive insights.

We recommend reading the full article for an in-depth exploration of how these ordinances impact vacant property management. Knowledge empowers responsible property ownership.

Land Development Code

The Land Development Code is essential for vacant property owners, guiding adherence to zoning, construction, and maintenance standards. It ensures responsible development, aligning with community visions and promoting overall neighborhood well-being. Here are a couple of article we believe you should be familiar with:

International Property Maintenance Code

Article VII holds significant relevance for owners of vacant properties in Springfield. Adopted on February 24, 2020, this code specifically addresses the maintenance and regulation of vacant structures and lands. Property owners are mandated to keep their vacant properties clean, safe, secure, and sanitary to prevent area blight and uphold public health and safety standards.

For those failing to comply, substantial fines are in place as outlined in the penalty clause (Sec. 36-617). The first offense incurs a minimum fine of $200.00, followed by $400.00 for the second offense, and a subsequent $500.00 for each subsequent violation. The enforcement of these fines aims to deter neglect and ensure timely compliance with the International Property Maintenance Code.

Preservation of Structures in Certain Areas of the City

Article XII addresses the unique challenges of maintaining structures in Springfield’s older business sections. Enacted to control, preserve, and rehabilitate these properties, the code sets detailed standards for exterior maintenance, structural elements, and overall upkeep. It emphasizes the importance of preserving historic buildings, promoting public health, and preventing deterioration. Non-compliance can result in penalties, including fines under Section 1-7 of the Springfield City Code. The article aims to enhance property values and encourage redevelopment in the city’s older business areas by ensuring the proper maintenance of structures.

Fire Prevention Code

Within Amendments and additions you’ll find Section 311. This section addresses the management of vacant premises, specifically targeting abandoned properties posing safety risks. If the owner cannot be identified, buildings prone to unauthorized occupation, illegal activities, or structural hazards are deemed abandoned. The provision empowers authorities to declare them unsafe, compelling demolition or rehabilitation in accordance with the International Property Maintenance Code, International Building Code, and local ordinances. This regulatory measure aims to mitigate dangers posed by neglected structures, safeguard public safety, and maintain community well-being through systematic intervention in the face of persistent vacancy-related issues.

Nuisance And Housing Code

The Nuisance and Housing Code outlines critical regulations governing property conditions and maintenance, ensuring that vacant properties adhere to health and safety standards. Compliance is essential for vacant property owners to avoid fines and legal consequences. Below, you will find a few relevant articles:

Housing

Article III of the Nuisance And Housing Code outlines regulations for property maintenance, applicable to all property types, including vacant ones. Governed by the International Property Maintenance Code, it establishes minimum conditions and responsibilities for property owners. The city manager is authorized to conduct inspections to ensure compliance with health and safety standards, emphasizing public well-being. Though specific details about vacant properties are not provided, the comprehensive framework underscores the importance of maintaining all properties to prescribed standards. Property owners, including those with vacant properties, are expected to adhere to these regulations for the overall welfare of the community.

Nuisance

Article VII obliges property owners to maintain a nuisance-free environment. This includes proper debris disposal, tree care, and more. For vacant property owners, compliance is crucial to prevent violations, ensuring a community free from nuisances. Adhering to regulations contributes to a cleaner, safer neighborhood, preserving property value. Owners share responsibility for community aesthetics. Sec. 74-386 outlines penalties for violations, emphasizing the importance of adherence. Penalties range from $25.00 for the first offense to $300.00 for the fourth and subsequent offenses within a 12-month period, underscoring the commitment to community welfare.

Need help with your vacant investment property?

DAWGS provides vacant property security D.A.W.G.S. (Door And Window Guard Systems) manufactures and rents attractive steel panels that are far superior to plywood board-up services when it comes to protecting your vacant investment properties and being up to code with the ordinances of the city.

Better than plywood board-up, DAWGS provides security to property owners and protects neighborhoods from the many problems associated with leaving vulnerable buildings vacant. With DAWGS on the scene, you can manage your property with the confidence and security granted by steel door and window security shutters.

Whether in new construction or rehabbing an existing property, our vacant property security systems protect your building and everything in it.

For more information, get in touch today.

NOTE: The information contained in this site is provided for informational purposes only, and should not be construed as legal advice on any subject matter. You should not act or refrain from acting on the basis of any content included in this site without seeking legal or other professional advice. The contents of this site contain general information and may not reflect current legal developments or address your situation. We disclaim all liability for actions you take or fail to take based on any content on this site.

0 notes

Text

Understanding the Unique Coverage Needs of Luxury and Sports Cars

As car technology advances, more and more luxury and sports cars are hitting the market. These vehicles come with a hefty price tag and often require specialized maintenance and repairs. As a result, it's important to understand the unique coverage needs of these types of cars when considering an automobile warranty plan.

Nova Warranty is dedicated to providing you with the best coverage for your car. We’re a direct Vehicle Service Contract provider, providing you with the best coverage at a price that works for your budget.

Luxury Cars

Luxury cars are known for their high-end features, advanced technology, and premium performance. These vehicles often require specialized maintenance from certified technicians to ensure proper care and upkeep. The high cost of parts and labor for luxury cars can quickly add up, making an automobile warranty plan a wise investment for owners.

When it comes to choosing an automobile warranty plan for a luxury car, it's important to consider the specific coverage options available. Some plans may offer more comprehensive coverage for high-end features such as navigation systems, advanced driver assistance technology, and entertainment systems. It's also important to consider the length of coverage and if it aligns with the manufacturer's warranty.

In addition to standard wear and tear coverage, some automobile warranty plans may also offer specific luxury car benefits such as concierge services or reimbursement for a rental vehicle while your car is being repaired. These added perks can provide peace of mind and convenience for luxury car owners.

Sports Cars

Similar to luxury cars, sports cars are known for their high-performance capabilities, advanced technology, and unique design. However, these vehicles also come with a higher risk of mechanical failures due to their more aggressive driving style. As such, it's important to choose an automobile warranty plan that provides coverage for the unique needs of sports cars.

When considering an automobile warranty plan for a sports car, it's important to look for plans that cover mechanical failures and repairs associated with high-performance features such as turbochargers, transmission, and suspension systems. These types of repairs can be costly without warranty coverage, making it essential to have proper protection in place.

Furthermore, sports car owners often customize their vehicles with aftermarket parts and modifications. It's important to choose an automobile warranty plan that provides coverage for these types of upgrades as well. This can help protect your investment and ensure that any repairs or replacements are covered under the warranty.

In conclusion, luxury and sports cars require unique coverage needs when it comes to choosing an automobile warranty plan. It's important to carefully consider the specific features and technology of these vehicles in order to select a plan that provides adequate coverage for potential repairs and maintenance. With the right warranty plan, owners can have peace of mind knowing that their high-end vehicles are protected and well-maintained for years to come.

So whether you're driving a luxury sedan or a sports car, be sure to do your research and choose an automobile warranty plan that meets the unique needs of your vehicle. With proper coverage, you can enjoy all the benefits of owning a high-end car without worrying about unexpected repair costs. So keep these considerations in mind when choosing an automobile warranty plan for your luxury or sports car.

Disclaimer: The content provided in this guide is for informational purposes only and should not be considered legal or financial advice. It is always important to review the specific terms and conditions of an automobile warranty plan before making a purchase decision.

First, let's start with the most common type of plan - a basic powertrain warranty. This typically covers the engine, transmission, and drivetrain components of a vehicle for a specific time period or mileage limit.

Next, a comprehensive warranty offers more extensive coverage for a wider range of vehicle components. This is often referred to as a bumper-to-bumper or exclusionary policy and can include everything from the powertrain to electrical systems, suspension, and HVAC systems.

Some automobile warranty plans also offer additional coverage options, such as for electronics and technology systems. Additionally, some plans may offer added benefits such as roadside assistance or trip interruption coverage.

It's also important to consider the duration of coverage. Some plans may have a specific time limit, while others may be based on mileage. It's important to choose a plan that aligns with your estimated usage of the vehicle to ensure adequate coverage during your ownership.

In conclusion, when choosing an automobile warranty plan, it's important to consider the specific needs and features of your vehicle, as well as the coverage options and reputation of the provider. By carefully reviewing these factors, you can select a plan that provides adequate protection for your vehicle and gives you peace of mind on the road.

Member Spotlight:

Address Line: 300 Delaware Ave, Wilmington, DE, 19801.

Phone: (888) 490-6672

Website Link: https://novawarranty.com/

Nova Warranty team of experienced agents is knowledgeable in all aspects of automobile protection plans. We understand that every vehicle is unique and we strive to provide policies tailored to your needs.

Get Map Directions: https://maps.app.goo.gl/5fAewkJpT5pxRuhH8

0 notes

Text

Is It Time to Hire a Certified Public Accountant?

Are you considering a new business start-up?

Is your business going through some difficult times financially?

Do you need guidance with your tax planning?

These are just a few of the reasons why people look to a CPA for direction with their businesses.

Hiring a Certified Public Accountant (CPA)

Do you feel prepared for the ever changing complex business world we live in today? Or are you feeling overwhelmed – especially when it is time to setup and/or clarify your business operations and accounting systems.

Your success starts with the choice you make when hiring a CPA. When looking for a CPA ask for referrals and check the CPA’s credentials. Then set up an initial appointment.

When meeting with a qualified CPA, determine that they are committed to education and today’s cutting edge technologies. Check that their services address all of your current needs. Also that they are focused on preparing your business for the ever changing business world of today.

Reviewing Services:

Tax Preparation and Tax Planning – Working with you to implement tax and cash flow strategies to minimize the amount of taxes you pay. Freeing up cash flow for investment and growth, and working with tax dollars as a source of working capital.

Accounting Systems – Set-Up, Planning and Software Support – Understanding today’s technology and utilizing accounting software like Quickbooks and Xero.

New Business Start-Up Planning – Creating a solid foundation for your business to stand on using today’s cutting edge technologies.

Controllership – Discussing and determining if you need a controller to help monitor and maintain your business.

Working with Cashflow – Applying operational, investing, and financing activities in order to work with a sound cash flow planning system.

Forensic Accounting – Combining forensic investigating, auditing and accounting by collecting and analyzing financials for the purpose of shedding light on discrepancies, when necessary, in the courtroom or boardroom.

Work with Us

With Vidussi Makara Group, LLC, you can be confident that you are working with a firm that is committed to education and cutting edge technologies to give you superior services. We understand how businesses and individuals can fall into the trap of not filing their income tax or paying their taxes when they fail to plan.

Don’t wait until you have IRS tax problems to contact us.

Do take the time NOW to schedule an appointment so we can plan ahead or review any tax problems you have incurred.

Contact us online, or call us today at our Naples office (239) 384-9688 or Fort Myers office (239) 278-0762.

-Mark

This information is based on facts, assumptions and representations as stated and authorities that are subject to change. We will not update this information for subsequent legislative or administrative changes of future judicial interpretations.

LEGAL NOTICE AND DISCLAIMER: The information within this blog is for informational and educational purposes only and is not tax advice and should not be used as such. The facts of each individual situation can have significantly different outcomes when applying tax law. The hiring of a CPA is an important decision not to be based solely on advertisements.

0 notes

Text

Investor Visa Category EB-5: Is It Right for You?

What is an EB-5 Visa?

EB-5 is a specially designed visa program for investors from other nations who want to set up a business and settle in the US permanently. To obtain an EB-5 visa, the investors must fulfill mandatorily specified criteria specified by USCIS. The eligibility for an EB-5 visa is to invest significant money in a new commercial enterprise in the United States that creates or preserves at least ten full-time jobs for U.S. workers. The EB-5 visa program intends to boost the US economy by creating more jobs and capital investment by foreign investors in the US.

How Can I Tell If An EB-5 Visa Is Right For Me?

Knowing if a particular visa category favors you is the first mandate to apply for that visa category. To know if you can apply for an EB-5 visa, you should have a clear idea about all the requirements of an EB-5 visa and why it is especially known as a US investors visa.

The EB-5 is the pathway for US citizenship through investment which indicates that the person seeking the EB-5 visa has to be an investor of a particular amount of capital in the US.

To know if you are eligible for an EB-5 visa or US investor visa, you must be ready to invest a net worth of at least $800,000 (or $1,050,000 if the investment is made in a Targeted Employment Area). You must invest the required amount of money in a new commercial enterprise that creates or preserves at least ten full-time jobs for U.S. workers.

What Are The Benefits of the EB-5 Visa?

The EB-5 visa process can be complex and time-consuming, but it can be a valuable option for foreign nationals looking to immigrate to the United States. The EB-5 visa offers several benefits, including:

The direct access to US markets.

The ability to live and work permanently in the United States.

The ability to bring family members to the United States.

The ability to travel freely between the United States and the home country.

What Happens If Your EB-5 Petition Fails?

Failing an EB-5 visa petition can be daunting and frustrating. Here are some of the reasons why an EB-5 petition may be denied:

The investor does not meet the requirements for the EB-5 visa, such as having a net worth of at least $800,000 (or $1,050,000 if the investment is made in a Targeted Employment Area).

The investment is not made in a new commercial enterprise that creates or preserves at least ten full-time jobs for U.S. workers.

The investor has a criminal or financial history that makes them ineligible for the EB-5 visa.

The investment is made in a fraudulent project or has no reasonable chance of success.

If your EB-5 petition is denied, you cannot obtain an EB-5 visa or live and work permanently in the United States. You may also lose your investment in the project. If you are considering applying for the EB-5 visa, reviewing the requirements carefully and ensuring eligibility is important. You should also consult with an experienced immigration attorney to discuss your options and to help you prepare your application.

What Time Is Required For EB-5 Application?

The time required for an EB-5 application or US investor visa varies depending on several factors, including the country of citizenship, the type of investment, and other allied factors. However, the EB-5 application process can generally take 12 to 24 months.

Disclaimer: This post is for informational purposes only and does not constitute legal advice. For personalized guidance, please consult with a qualified immigration attorney.

0 notes

Text

Gold Miner Achieves ‘Strong’ Q2/19 Results, Increases Oxide Guidance

Source: Streetwise Reports 08/01/2019

Production, costs, guidance and financials of this miner are reviewed in this CIBC report.

In a July 30 research note, CIBC analyst Cosmos Chiu reported that Alacer Gold Corp.’s (ASR:TSX; ALACF:OTMKTS; AQG:ASX) “Q2/19 results included solid production and better-than-expected sales that drove an earnings per share beat.”

Chiu reviewed Alacer’s production and related cost during Q2/19. The company produced 99,500 ounces (99.5 Koz), above CIBC’s forecasted 98.1 Koz. The all-in sustaining cost (AISC) was also better than expected, coming in at $669 per ounce versus CIBC’s $743 per ounce estimate.

Production for all of H1/19 totaled 95 Koz, on the lower end of full-year guidance of 90110 Koz. Consequently, Alacer increased oxide production guidance for the year to 125145 Koz at an AISC of $650700 per ounce, down from previous cost guidance of $700750 an ounce.

The Çöpler sulfide oxide plant, currently being ramped up, outperformed in Q2/19, delivering 57 Koz, a 53% quarter-over-quarter increase.

Year-to-date production at Çöpler was 94 Koz, against full-year 2019 guidance of 230270 Koz. The plant remains on track to meet the lower end of that range. “We currently model 229 Koz production from the sulfides in 2019, at an AISC of $622 per ounce,” Chiu commented.

As for Alacer’s Q2/19 financials, Chiu noted, adjusted EPS of $0.08 exceeded CIBC’s $0.04 forecast and consensus’ $0.03 projection, primarily due to higher-than-expected sales from the Çöpler sulfide plant.

Cash flow per share also was a beat at $0.13 versus CIBC and consensus’ $0.11 estimate.

At the end of Q2/19, Alacer had $125 million in cash, including restricted cash, and net debt of about $180 million. CIBC estimates that Alacer’s free cash flow in 2019 will surpass $150 million, based on the current gold price of $1,425 per ounce.

Finally, Chiu presented potential upcoming key catalysts. They include continued ramp-up of Çöpler, exploration results from the Çöpler complex and engineering study results regarding the addition of a stand-alone leach pad at Çöpler or a significant expansion of the existing one.

CIBC has an Outperformer rating and a CA$6 per share target price on Alacer Gold, whose stock is currently trading at around CA$5.21 per share.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures from CIBC, Alacer Gold Corp., Earnings Update, July 30, 2019

Analyst Certification:

Each CIBC World Markets Corp./Inc. research analyst named on the front page of this research report, or at the beginning of any subsection hereof, hereby certifies that (i) the recommendations and opinions expressed herein accurately reflect such research analyst’s personal views about the company and securities that are the subject of this report and all other companies and securities mentioned in this report that are covered by such research analyst and (ii) no part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.

Analysts employed outside the U.S. are not registered as research analysts with FINRA. These analysts may not be associated persons of CIBC World Markets Corp. and therefore may not be subject to FINRA Rule 2241 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account.

Potential Conflicts of Interest:

Equity research analysts employed by CIBC World Markets Corp./Inc. are compensated from revenues generated by various CIBC World Markets Corp./Inc. businesses, including the CIBC World Markets Investment Banking Department. Research analysts do not receive compensation based upon revenues from specific investment banking transactions. CIBC World Markets Corp./Inc. generally prohibits any research analyst and any member of his or her household from executing trades in the securities of a company that such research analyst covers. Additionally, CIBC World Markets Corp./Inc. generally prohibits any research analyst from serving as an officer, director or advisory board member of a company that such analyst covers.

In addition to 1% ownership positions in covered companies that are required to be specifically disclosed in this report, CIBC World Markets Corp./Inc. may have a long position of less than 1% or a short position or deal as principal in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon.

Recipients of this report are advised that any or all of the foregoing arrangements, as well as more specific disclosures set forth below, may at times give rise to potential conflicts of interest.

Important Disclosure Footnotes for Alacer Gold Corp. (ASR)

CIBC World Markets Inc. expects to receive or intends to seek compensation for investment banking services from Alacer Gold Corp. in the next 3 months.

( Companies Mentioned: ASR:TSX; ALACF:OTMKTS; AQG:ASX,

)

from The Gold Report – Streetwise Exclusive Articles Full Text https://ift.tt/2YDqfCB

from WordPress https://ift.tt/2OzhBBn

1 note

·

View note

Link

Women’s health apps are big business, you see. Users pay Natural Cycles a $10 monthly or $80 annual subscription fee, which includes an oral thermometer. But all that industrious tracking of periods, and sex, and basal body temperature—Natural Cycles takes one to three cycles to “get to know you”—is also valuable as a database. Even in its anonymized, aggregated form, pharmaceutical firms, the insurance industry, and marketing agencies are interested.

Natural Cycles’ privacy policy states that in using the app each user grants the company and any of its partners broad rights to “use, reproduce, distribute, modify, adapt, prepare derivative works of, publicly display, publicly perform, communicate to the public, and otherwise utilize and exploit a user's anonymized information.”

It’s not that different from the privacy policies of other consumer apps, says Christine Bannan, consumer privacy counsel for the Electronic Privacy Information Center. Other popular cycle-tracking apps like Clue and Glow also reserve the right to share pooled, anonymized data with third parties. “These policies are just used by companies as disclaimers to reserve future things they might want to do,” she says. But the sensitivity of fertility information makes that potentially more concerning, than say social media data, says Bannan. “I think that it’s important for potential users to be aware that they don’t necessarily have the rights they would for health data like traditional medical records, under HIPAA.”

Berglund says Natural Cycles’ only revenue stream at the moment is the app’s subscription service, and that selling customer data to third parties isn’t part of the company’s business plan. “We’ve never shared any data for financial purposes,” she says. But that may not always be the case. “I can’t say we’ll never share data, there’s no guarantees in life of what will happen.”

The company already shares some anonymized and aggregated data with regulators like the FDA, and with academic research partners in Sweden, the UK, and the US, according to Berglund. She says they have to seek approval from an ethical review board for each research project, to evaluate whether or not the blanket consent users sign to use the service can be applied to any additional studies.

Natural Cycles stores user data in an encrypted cloud environment, and every week a pooled, anonymized version of the data gets pulled onto the company’s local servers to run the analysis that powers its app. So if you decide you want to delete your data, it should get scrubbed from the cloud first, and then from the company’s models, during that weekly overwriting process, according to Berglund. But according to the company’s privacy policies, it’s under no obligation to delete any data it has already distributed elsewhere.

read more

36 notes

·

View notes

Text

Crypto Quantum Leap - 50% Commissions

Digital - membership area

#Crypto Quantum Leap: A Valuable Resource for Navigating the Cryptocurrency Landscape#The world of cryptocurrency can be overwhelming#especially for newcomers. With ever-fluctuating markets#complex technical jargon#and a constant stream of new projects#it's easy to feel lost. This is where Crypto Quantum Leap comes in.#A Comprehensive Learning Platform#Crypto Quantum Leap is a digital membership area designed to empower individuals of all experience levels to understand and participate in#including video tutorials#in-depth articles#and interactive courses. These resources cover a wide range of topics#from the fundamentals of blockchain technology to technical analysis and investment strategies.#High-Quality Content from Industry Experts#What truly sets Crypto Quantum Leap apart is the quality of its content. The platform features contributions from industry experts#cryptocurrency analysts#and experienced traders. Their knowledge and insights provide valuable guidance for members#helping them navigate the complexities of the crypto market with confidence.#Building a Supportive Community#Crypto Quantum Leap fosters a supportive community environment. Members can connect with each other through online forums and discussion bo#ask questions#and learn from one another. The sense of community is invaluable#especially for those who might feel isolated in their journey towards understanding cryptocurrency.#Investing with Knowledge and Confidence#Since joining Crypto Quantum Leap#I've gained a much deeper understanding of the cryptocurrency market. The platform's educational resources have equipped me with the knowle#I feel far more confident in navigating its complexities thanks to Crypto Quantum Leap.#Important Disclaimer: This review is for informational purposes only and should not be considered financial advice. The cryptocurrency mar#Overall#Crypto Quantum Leap is a valuable resource for anyone seeking to understand and participate in the cryptocurrency market. Its comprehensive#high-quality content

1 note

·

View note

Text

How mutual funds should be considered for long-term investment?

When it comes to investing for your future, there are a lot of investment vehicles to choose from. Although there is no specified formula or handbook that investors are expected to follow, there is one general rule that impacts your mutual fund performance: Invest for the long term.

When you invest for the long term your mutual fund performance harnesses the power of compounding. When you make a mutual fund analysis, your age and financial responsibility play an important part in your investment decisions. Since youngsters can afford to have an aggressive stance in investing as they have fewer financial responsibilities such as retired parents, a spouse, children, or car or home loans to pay off, they are encouraged to start their investments early. A young individual thereby, is able to withstand the market swings. Moreover, investing in equity for the long term allows you to take advantage of compounding in your mutual fund performance (i.e., the returns begin earning returns thereby adding to the principal).

Compounding involves two factors that make it work: the reinvestment of earnings, and time. The more time you give your investments, the more chance to build your wealth.

Although there have been ups and downs, historical mutual fund performance over the last 5 years and beyond needs to be reviewed before you align your portfolio for the long term.

Let’s understand the benefits of investing with a long term horizon:

• Long term investments carry specific financial goals and give options to investors to invest small amounts at regular intervals per month which has the potential to provide long term risk adjusted returns. An SIP is one of the best investment vehicles.

• When you make a mutual fund performance comparison, the rate of returns is likely to fluctuate and remain volatile. However in long-term investments have potential to provide risk adjusted returns.

You have the potential to correct investment mistakes in the long term. Anyone can be a long-term investor; you don't have to be an investment expert to invest in well-run businesses for the long term. While it is natural that you will make mistakes; even the best investors have been wrong. But a regular review of mutual fund performance indicators every six months can help correct at least some of these mistakes. In addition, it is important to hold on to investments that have historically demonstrated strong growth.

Disclaimer: The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

0 notes

Text

How ELSS should be chosen to complement existing portfolio

Usually, we all look for investment opportunities that can help us build an adequate sum of wealth, get regular returns, and/or save taxes. There could be several investment schemes in the market to save your taxes, but ELSS i.e. Equity linked saving schemes is a one - stop solution for all your tax saving and wealth creation needs. Usually 80 % of asset allocation needs to be in equity funds. ELSS SIP is also an easy option for investing where the minimum investment amount is Rs 500.

ELSS funds are also called tax saving schemes as they offer tax exemption of up to Rs. 150,000 from your annual taxable income under Section 80C of the Income Tax Act and comes with a three-year lock-in during which they cannot be redeemed or switched. Among other tax saving instruments, ELSS is the scheme with the shortest lock-in.

Six Key factors To Consider While Choosing ELSS Fund

1. Portfolio composition A major portion of ELSS funds are equity funds that invest their major chunk into diversified equity or equity-related instruments. The Fund manager has the flexibility to allocate the stocks as per his calculations, research basis of the market conditions, objective of the fund, and his own risk-taking capability to achieve that objective (i.e. Large Cap / Mid Cap). You can review what is the portfolio composition of the fund based on market cap and stability of its investment patterns. Prefer to choose the funds that have steady investment pattern and that stay true to its label. Choose quality of companies invested in while assessing the ELSS schemes. Evaluate the stocks concentration in the portfolio and percentage of top five stocks in the portfolio. Thoroughly check all allocation made to large cap / mid cap / small cap companies in the ELSS tax -saving schemes.

2. Risk Involved and Expected Returns

ELSS is an Equity Linked Scheme and it requires you to identify your risk appetite. Risk and returns on investments are interlinked. One must ensure to check the risk and returns involved while choosing ELSS funds. Some Mutual Funds could be giving higher returns but risk involved also could be equally high. Therefore, the key to decide your risk appetite while assessing a suitable fund for you. Risk involved can also be calculated from ratios like Sharpe Ratio which is a measure of risk-adjusted return.

3. Return Expectation of the ELSS Funds

While selecting the ELSS mutual fund, it does not make sense to chase returns. Last one-year’s performer may not be consistent next year. Hence, investor must review the trend of the fund in respect of rate of returns delivered. Also, one should consider the rate of return as well as the consistency with which those returns are delivered. Select the scheme based on your preference with the portfolio style and strategy. Make sure to analyze the records of the fund for a period exceeding 5 years. This is an ideal duration, as the fund goes through multiple cycles of ups and downs in the market. This helps the investor to track the past performance of the particular scheme.

4. Expense Ratio of ELSS Funds

Investor should choose the fund with low or moderate expense ratio along with the higher rate of returns.

5. Fund Manager’s performance Examine whether the fund manager is able to deliver consistency of performance across market cycles Check fund manager’s profile and his/her record not just in this fund but other funds he/she manages

6. Fund House

This is an important factor to select the Tax- Saving fund. Investor must consider the asset management company’s investment philosophy, do a deep background check of its financial stability and company policy before investing

In order to understand how to allocate to ELSS funds, compare ELSS to the other equity funds held, so that there is no duplication in style and portfolio composition.

Disclaimer: The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

0 notes

Text

How diversification with the help of equity and debt mutual funds is important in times of volatility

The sharp fall in equity markets during the onset of Covid in March last year in 2020 was a wake-up call for investors to diversify their investments across sectors, assets and market caps. As the adage goes about not putting all your eggs in the same basket, if you invest your entire money in stocks of a single company or a single asset, you may end up losing money.

Some company stocks could be more volatile than others. Thus, it is a prudent decision to invest in a portfolio of different stocks. As a retail investor, it is complex and time-consuming to pick and manage multiple stocks. This is where equity mutual funds can help. Equity mutual funds invest in different stocks, thereby overcoming concentration risks and helping you minimize the downside risks.

The meaning of an equity mutual fund is a scheme that as per the scheme information document invests a minimum of sixty-five per cent of its net assets in equity and equity-related instruments.. It is suitable for investors with a high-risk appetite and a long-term investment horizon. There are different types of equity mutual funds such as categorization as per market capitalization; Large, mid and small cap, categorizing as per styles; value & contra, sectorial/thematic funds, ELSS (Equity Linked Savings Scheme) etc.

The current pandemic has shifted the focus of retail investors towards debt mutual funds. A debt mutual fund, also known as a fixed income fund invests in bonds and other debt securities. It invests in Treasury bills (T-bills), Government securities (G-secs), Debentures, Commercial Paper, Certificates of Deposit and others.

When you compare Equity Funds vs. Debt Fund, equity mutual funds generally have the potential of generating higher returns over the long-term. If you have a long term horizon and have a risk capacity to bear volatility, then an equity mutual fund is for you. However, if you are looking for a short-term horizon of less than three years, then you might consider investing in debt mutual funds that are relatively less volatile and has potential to help you achieve short term goals.

A portfolio mix of equity and debt mutual funds has potential to help to minimize downside risks due to market ups and downs. Last but not the least, a periodical review is needed to ensure that the assets you have invested in are aligned to your intended goals. As you near your financial goals, you may want to have a greater proportion of your portfolio invested in debt mutual funds than in equity mutual funds. Those who are starting to invest and do not have too many financial obligations and to investment for long term may choose to invest a larger portion of their investments in equity mutual funds.

Disclaimer: The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

0 notes