#GetRichSlowly

Text

"Unlocking Financial Freedom: My Journey to Legally Earning +10 ETH Daily with Uniswap Bot in 2023 🚀💰 #CryptoSuccess"

youtube

#CryptoWealth#PassiveIncome#DeFi#UniswapBot#FinancialFreedom#Ethereum#CryptoInvesting#CryptoGains#Blockchain#SmartContracts#CryptoStrategies#InvestmentJourney#CryptoTrading#DigitalAssets#CryptoEarnings#MoneyMaking#InvestmentTips#Crypto2023#ETH#GetRichSlowly#Youtube

0 notes

Photo

Best time to get started is now. #personalfinance #buildwealth #debtfreecommunity #getrichslowly #mogulgrind https://www.instagram.com/p/CQ3nDObjoaW/?utm_medium=tumblr

1 note

·

View note

Photo

Join your humble Bitches, @bgrkitty & @bgrpiggy, along with such luminaries as @our_nextlife, @webravelygo, @jdroth, @richandregular, and MOAR in Ecuador this summer for a conference on all things financial independence! 🎆🎇✨🌟💫⭐️💥 We’ll talk about how to get to financial freedom AND (more importantly) what to do once you get there. Register for the Ecuador Financial Independence Chautauqua right heckin here: abovethecloudsecuador.com/FI-chautauqua . . . . #personalfinance #womendopersonalfinance #adulting #money #financialindependence #fichautauqua #FIRE #ecuador #bossbitch #bitchesgetriches #getrichslowly #ournextlife #richandregular #bravelygo https://www.instagram.com/p/B9FFA9AnIgP/?igshid=xdl68kixigen

#personalfinance#womendopersonalfinance#adulting#money#financialindependence#fichautauqua#fire#ecuador#bossbitch#bitchesgetriches#getrichslowly#ournextlife#richandregular#bravelygo

2 notes

·

View notes

Photo

How to #getrichquick 😁👨💻💰 #getrich #getrichordietrying #getrichslowly #digitalbusiness #digitalmarketing #digitalincome #digitalmarketer #internetincome #internetmarketing #internetmarketingtraining #internetbusiness #internetmarketinglifestyle #mindsetmatters #mindsetcoach #mindsetshift #mindsetofgreatness #success #successtips #successdiaries https://www.instagram.com/p/B8RVC1Apax1/?igshid=1m6sm32xvaqbj

#getrichquick#getrich#getrichordietrying#getrichslowly#digitalbusiness#digitalmarketing#digitalincome#digitalmarketer#internetincome#internetmarketing#internetmarketingtraining#internetbusiness#internetmarketinglifestyle#mindsetmatters#mindsetcoach#mindsetshift#mindsetofgreatness#success#successtips#successdiaries

0 notes

Photo

Stages of financial independence . . . * Total Financial Dependence - Everyone got support from someone else in life. . * Financial Solvency - The point you can support yourself financially. . * Financial Stability - You now have some savings. . * Debt Freedom - You dont have any debts anywhere. . * Financial Security - You have enough investment income to cover basic and living costs. . * Financial Independence - You have enough investment income to cover your current lifestyle. . * Financial Freedom – You have enough investment income to cover your dreams and sustain your lifestyle. . * Financial Abundance. – You have enough investment income that you cannot possibly spend this money. . Let us hear your feelings about each stage. Share with someone who needs to know. . . Seasoned financial advisers on monimata.com are ever ready to give you required support . . . #financialabundance #radicalpersonalfinance #getrichslowly #masteringmoney #financialplanner #fakingnormal #financialalternatives #financialstory #retirementcrisis #cuttingcost #beincharge #survival #sidegigs #grants #retirementplan #riskplanning #managemarketrisks #retirementaccount #Retirementsavings #retirementplans #equity #consultancy #financialconsultancy #financialeducation #debtfreedom #debtpaydown #wealthstewardship #retireearly https://www.instagram.com/p/B8MfuorHN7l/?igshid=ehvqm1uhb6zp

#financialabundance#radicalpersonalfinance#getrichslowly#masteringmoney#financialplanner#fakingnormal#financialalternatives#financialstory#retirementcrisis#cuttingcost#beincharge#survival#sidegigs#grants#retirementplan#riskplanning#managemarketrisks#retirementaccount#retirementsavings#retirementplans#equity#consultancy#financialconsultancy#financialeducation#debtfreedom#debtpaydown#wealthstewardship#retireearly

0 notes

Photo

"The path to wealth can take a million different twists and turns, but the end result will always be better than it would be had you not tried in the first place." #GetRichSlowly . The journey to wealth will be worth the investment. Know that. . Follow @bbwcn to learn how to invest in stocks, business and real estate so you can create generational wealth from scratch. . Click the link in our bio to get instant access to our FREE WEBINAR: "Starting From Zero: How To Build Wealth From Scratch" . #financialindependence #financialeducation #moneylessons #generationalwealth #buildwealth #financialfreedom #financialliteracy #passiveincome #thinkandgrowrich #investinyourself #startabusiness #richdadpoordad #beyourownboss #wealthbuilder #moneytalks #buildyourempire #successdriven #changeyourmindset #reachyourgoals #billionairemindset #billionairebelief #stockmarket #stockinvesting #tradingstocks (at Torrance, California) https://www.instagram.com/p/B1HSUEdpkLh/?igshid=7vzn1ej8pyax

#getrichslowly#financialindependence#financialeducation#moneylessons#generationalwealth#buildwealth#financialfreedom#financialliteracy#passiveincome#thinkandgrowrich#investinyourself#startabusiness#richdadpoordad#beyourownboss#wealthbuilder#moneytalks#buildyourempire#successdriven#changeyourmindset#reachyourgoals#billionairemindset#billionairebelief#stockmarket#stockinvesting#tradingstocks

0 notes

Photo

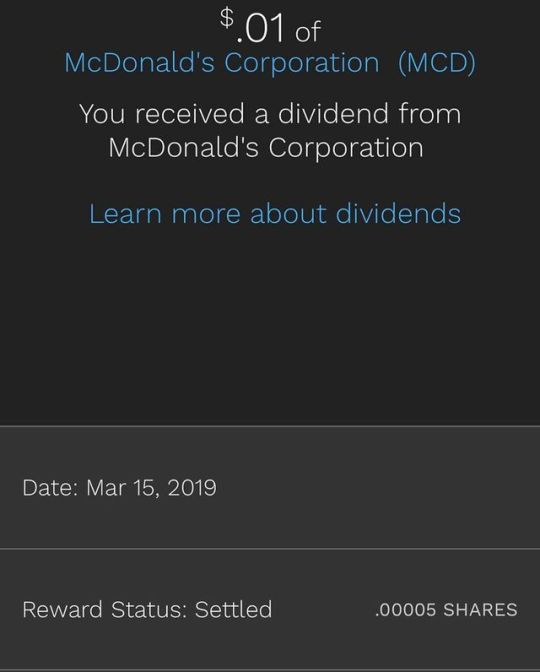

To the naysayers who say you can get anything for a Penny. Back in March, I got five hundred thousandths of a share of stock in McDonald's. What do you say to that? . . . . . . #bumped #mcdonalds #penny #stocks #dividends #getrichslowly #money https://www.instagram.com/p/ByOYxUAliAs/?igshid=1s4e6rf2j98bo

0 notes

Photo

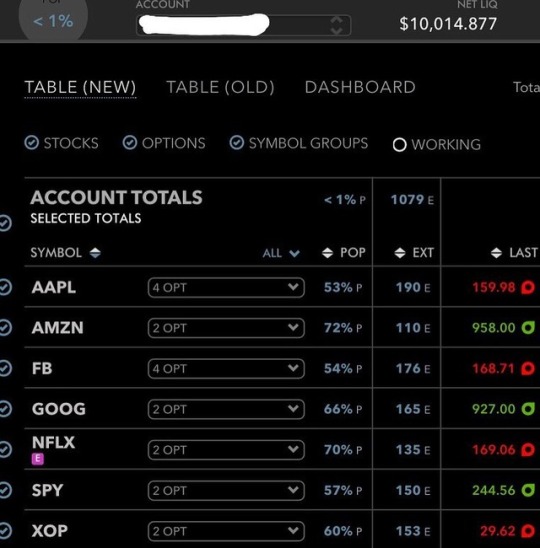

Started trading the "Bet Account" Monday. First day in the #green. Celebrate the little things. #slowandsteady #getrichslowly #thereisnoeasybutton

0 notes

Photo

When you say something in print, expect to get called on it, even more than a decade later... My first book was designed to feature "timeless" investment advice, and I think it mostly succeeded. ⠀ ⠀ Someone called me on my "invest where you spend" philosophy this week, stating that if she followed that, she'd only ever invest into retailers and manufacturers, never resources or mining...⠀ ⠀ Remember that when you buy an appliance, eg. a washing machine, that a %$ goes to the retailer, a %$ goes to the manufacturer, and a %$ goes to whomever dug up the steel, copper and so on. ⠀ ⠀ #investwhereyouspend ⠀ ⠀ It's not rocket surgery, but it can make you more money than brain science 👍😉😆 #investing #stockmarket #wtym #buildwealth #getrichslowly

0 notes

Text

Status Update

Just a quick note to let you all know that my “work vacation” is going well. I’m in the middle of 7-10 days off from publishing new money articles here to focus exclusively on the business side of the blog. So far, so good. I’m getting tons done because I know I don’t have to worry about writing new material.

As part of this, I’m working on some of the behind-the-scenes infrastructure around here.

We’re going to change the way Get Rich Slowly URLs display, moving from the old date-based format to a more modern title-only format. In theory, this should be straightforward — but you never know. Things may be a little messy now and then.

We’re also going to move GRS to a secure server so that URLs will now start with https: instead of http:. Again, this should be easy but we also realize there may be some bumps along the way.

Yes, re-implementing the forums are also on the task list. We’re having some issues with the database. Hang in there!

Now that I’m back at GRS, readers are once again sending me tons of links, videos, and story ideas. To reduce the mess in my main inbox, I’ve created a new email address for this sort of thing. If you want to send in something for me to write about, use editorial at getrichslowly (.org not .com).

Those are some of the front-facing changes, but there’s also tons of work under the hood too. For instance, I just got a notice from Google this morning that they believe GRS has too many broken outbound links in old articles. Fixing those is a colossal task, and it’s but one example of the kinds of repairs we’re making.

At this point, it’s looking to me as if my “time away from publishing” is going to be on the longer end of my estimate. I may post an occasional article now and then, but regular publishing won’t resume for at least a week (March 1st), and there’s a chance that I won’t be back until Monday the 5th.

The post Status Update appeared first on Get Rich Slowly.

from Finance http://www.getrichslowly.org/2018/02/22/status-update/

via http://www.rssmix.com/

0 notes

Text

How To Find The Perfect Assisted Living Homes In Whatcom County

The retirement age is fast approaching for a large group of people from the baby boomer generation. Many people are looking forward to it and some are dreading it. Whichever category you're in some forethought about what you want to experience is in order. Don't think that is not a life changing experience and time for adjustment will be necessary. Whether you are looking forward to it or not, there will, most likely, be some emotional as well and psychological feelings that appear. Richard Barrington has provided some info on retirement experience as how to live comfortably in retirement at getrichslowly.

Retirement lifestyles depend on your financial success — but financial success is part reality and part perception. In fact, if you moderate what you perceive as financial success, you could improve the financial reality of your future. It’s particularly important to consider this as you approach retirement, but this dynamic actually starts well before you’re ready to retire. It has to do with what kind of lifestyle you think you need. Get Rich slowlyG

Where do our attitudes about retirement originate? The strongest influence on your retirement attitude comes from your parents. What kind of retirement experience did they have? Was it a positive or negative time for them? How did they spend their time? Friends and co-workers can also influence your retirement attitudes. Our culture frequently views retirement and aging as a negative. Take an honest inventory of your views around retirement.

Read more about the best assisted living homes Whatcom County .

Two couples, both senior citizens, began an experiment recently. One couple is from near Chicago, the other from near Dallas. They converged in the Scottsdale area, and began sharing a domicile which met their mutual needs. They are part time residents in their respective locations, thus enabling a two home convenience in various seasons. Ben Steverman has described about retirement experience as how to retire in the age of forty at bloomberg.

The “4 percent rule” is a bedrock of retirement planning. But does it apply to those who quit working before 65? The rule of thumb holds that retirees who spend only 4 percent of their investment portfolio annually, adjusted for inflation, will be able to stretch out their savings for the rest of their life. For example, a $1 million brokerage account gets you $40,000 a year to spend. Bloom Berg

You have earned your dream lifestyle and now it is time for you to kick back and savor the results of your endeavors. While you no longer want to be consumed with worry over finances, neither are you of a mindset to conquer the world and get enormously rich anymore. The idea of 'Making millions of dollars' no longer is a top priority in our lives. You just do not want to have to worry about money any longer.

The frustration, loneliness, helplessness and a strong feeling that he or she is good for nothing, engulfs his or her mind and can lead to a sort of psychological trauma and stress. Not that all retiring people are fall in this category. But, this is a fact in the life of many. A study conducted by survey on many retired had proved that a high percentage of retired people passed away within the first year of their retirement. The study implies the stress the retired experience due to being old for a job and left with lots of meaningless hours in hand. Danielle Andrus has said about retirement experience as positive experience and negative emotions about retirement at thinkadvisor.

“This came out of a survey where we were trying to find out how people’s expectations for retirement prior to retirement compared to their actual experiences in retirement,” Steve LaValley, head of research for MassMutual, told ThinkAdvisor on Tuesday. “We found people had high expectations for retirement in general and for the most part they were actually being fulfilled, although at somewhat lower levels in actual retirement.” Think Advisor

Watch this video for more info on Retirement Experience

youtube

0 notes

Video

Awwww man too funny and #true. Spotted via @cristinososa. There’s #noquickfix. If it sounds too good to be true then it probably is. #getrichslowly @djkhaled #djkhaled #Mogulgrind https://www.instagram.com/p/B0K1IURn4Hf/?igshid=163nxbvg55my7

1 note

·

View note

Link

Spring has sprung and and along with all the birds and the bees you have also received your bundle of joy this year. Hopefully, your job has good benefits for maternity/paternity leave but either way there are things to consider if you want to keep you household finances balanced.

0 notes

Text

What to do with a windfall

Everyone will make occasional financial mistakes - even Get Rich Slowly's founder, J.D. Roth:

In 1995, my father died after a long battle with cancer and he left a little bit of life insurance. I think I got $5,000 or something like that, and at that time I had over $20,000 in credit card debt.

If I had been smart, I would have paid off some of that credit card debt, but I wasn’t. Instead, I went out and bought a new computer and video game stuff.

So, here I am with a chance to knock off a quarter of my debt, and instead I end up spending even more money. And to me this is an example of the kind of failures that I used to have all the time…

In the past year, we had windfalls from tax refunds (if you can characterize a return of an interest-free loan from the government as a windfall), a bonus I earned at work, and some generous christmas gifts received from family members.

So if the best way to use a windfall is not to buy more video games, what is it?

1. Build your emergency fund. This one might sound surprising - after all, if you happen to be in debt, shouldn't that be paid down first? Nope - an emergency fund equivalent to at least 3-6 months of your take-home income should be your first priority. Even though an immediate debt paydown may seem appealing, if you face a household emergency in the future and don't have the funds to cover it, you may be forced to borrow money less advantageously from high-cost sources like credit cards, payday loans or pawn shops - which come with even more interest than the debt you would have paid down. Remember that your emergency fund can be liquid and earning slightly more than nothing.

2. Pay down debt. Yep, this makes number two on the list. If you are in debt - especially higher-interest loans like credit cards, and some auto loans and student loans, using a windfall to make extra payments can lower the interest you pay over the life of the loan and bring you one step closer to being debt-free. Even with "good" debt like a mortgage or subsidized student loans, early repayment can be a great plan, but it can have tax implications, so do your homework first.While it might be tempting to increase your savings rate before fully paying down high-interest debt, remember that paying down debt with an 8% interest rate is like earning a guaranteed 8% return on your money.

3. Increase your savings. If your high interest debt is gone - or you're not contributing enough to your 401(k) to receive a full employer match - throw more of that windfall into a 401(k), IRA or Roth IRA, or other longer-term savings vehicle. This money should not be in a high-interest savings account unless you think you may need it within the net 1-3 years for a down payment on a house, car purchase, or other use.

4. Have some fun. Yes - have some fun! Because our emergency fund is already solid, the bonus this year went first to paying down additional debt, then to increasing retirement savings - but we also went out to a nice dinner to celebrate a year of hard work.

0 notes

Text

Status Update

Just a quick note to let you all know that my “work vacation” is going well. I’m in the middle of 7-10 days off from publishing new money articles here to focus exclusively on the business side of the blog. So far, so good. I’m getting tons done because I know I don’t have to worry about writing new material.

As part of this, I’m working on some of the behind-the-scenes infrastructure around here.

We’re going to change the way Get Rich Slowly URLs display, moving from the old date-based format to a more modern title-only format. In theory, this should be straightforward — but you never know. Things may be a little messy now and then.

We’re also going to move GRS to a secure server so that URLs will now start with https: instead of http:. Again, this should be easy but we also realize there may be some bumps along the way.

Yes, re-implementing the forums are also on the task list. We’re having some issues with the database. Hang in there!

Now that I’m back at GRS, readers are once again sending me tons of links, videos, and story ideas. To reduce the mess in my main inbox, I’ve created a new email address for this sort of thing. If you want to send in something for me to write about, use editorial at getrichslowly (.org not .com).

Those are some of the front-facing changes, but there’s also tons of work under the hood too. For instance, I just got a notice from Google this morning that they believe GRS has too many broken outbound links in old articles. Fixing those is a colossal task, and it’s but one example of the kinds of repairs we’re making.

At this point, it’s looking to me as if my “time away from publishing” is going to be on the longer end of my estimate. I may post an occasional article now and then, but regular publishing won’t resume for at least a week (March 1st), and there’s a chance that I won’t be back until Monday the 5th.

The post Status Update appeared first on Get Rich Slowly.

from Finance http://www.getrichslowly.org/2018/02/22/status-update/

via http://www.rssmix.com/

0 notes