#Europe Hydrogen Gas Generator Market

Text

Europe Gas Generator Market Growth, Trends, Demand, Industry Share, Challenges, Future Opportunities and Competitive Analysis 2033: SPER Market Research

The Europe Gas Generator Market encompasses the production, distribution, and utilization of gas-powered generators across European countries. With increasing concerns about energy security, environmental sustainability, and power reliability, the demand for gas generators is rising. Key drivers include the transition to cleaner energy sources, infrastructure development, and backup power requirements. Additionally, advancements in gas generator technology, such as improved efficiency and reduced emissions, contribute to market growth. Key players focus on innovation, product differentiation, and service quality to meet the diverse needs of customers and capitalize on market opportunities in Europe.

#Europe Gas Generator Market#Europe Gas Generator Market Challenges#Europe Gas Generator Market Competition#Europe Gas Generator Market Demand#Europe Gas Generator Market Future Outlook#Europe Gas Generator Market Growth#Europe Gas Generator Market Report#Europe Gas Generator Market Revenue#Europe Gas Generator Market Segmentation#Europe Gas Generator Market Share#Europe Gas Generator Market Size#Europe Gas Generator Market Trends#Europe Hydrogen Gas Generator Market#Europe Industrial Gas Generator Market#Europe Laboratory Gas Generators Market#Europe Large Generator Market#Europe Natural Gas Generator Market#Europe Natural Gas Generator Market Forecast#Europe Natural Gas Generator Market Opportunities#Europe Power Generator Market#Europe Residential Gas Generator Market#Gas Generator Market

0 notes

Text

ESSEN, Germany (AP) — For most of this century, Germany racked up one economic success after another, dominating global markets for high-end products like luxury cars and industrial machinery, selling so much to the rest of the world that half the economy ran on exports.

Jobs were plentiful, the government's financial coffers grew as other European countries drowned in debt, and books were written about what other countries could learn from Germany.

No longer. Now, Germany is the world’s worst-performing major developed economy, with both the International Monetary Fund and European Union expecting it to shrink this year.

It follows Russia's invasion of Ukraine and the loss of Moscow's cheap natural gas — an unprecedented shock to Germany’s energy-intensive industries, long the manufacturing powerhouse of Europe.

The sudden underperformance by Europe's largest economy has set off a wave of criticism, handwringing and debate about the way forward.

Germany risks “deindustrialization” as high energy costs and government inaction on other chronic problems threaten to send new factories and high-paying jobs elsewhere, said Christian Kullmann, CEO of major German chemical company Evonik Industries AG.

From his 21st-floor office in the west German town of Essen, Kullmann points out the symbols of earlier success across the historic Ruhr Valley industrial region: smokestacks from metal plants, giant heaps of waste from now-shuttered coal mines, a massive BP oil refinery and Evonik's sprawling chemical production facility.

These days, the former mining region, where coal dust once blackened hanging laundry, is a symbol of the energy transition, dotted with wind turbines and green space.

The loss of cheap Russian natural gas needed to power factories “painfully damaged the business model of the German economy,” Kullmann told The Associated Press. “We’re in a situation where we’re being strongly affected — damaged — by external factors.”

After Russia cut off most of its gas to the European Union, spurring an energy crisis in the 27-nation bloc that had sourced 40% of the fuel from Moscow, the German government asked Evonik to keep its 1960s coal-fired power plant running a few months longer.

The company is shifting away from the plant — whose 40-story smokestack fuels production of plastics and other goods — to two gas-fired generators that can later run on hydrogen amid plans to become carbon neutral by 2030.

One hotly debated solution: a government-funded cap on industrial electricity prices to get the economy through the renewable energy transition.

The proposal from Vice Chancellor Robert Habeck of the Greens Party has faced resistance from Chancellor Olaf Scholz, a Social Democrat, and pro-business coalition partner the Free Democrats. Environmentalists say it would only prolong reliance on fossil fuels.

Kullmann is for it: “It was mistaken political decisions that primarily developed and influenced these high energy costs. And it can’t now be that German industry, German workers should be stuck with the bill.”

The price of gas is roughly double what it was in 2021, hurting companies that need it to keep glass or metal red-hot and molten 24 hours a day to make glass, paper and metal coatings used in buildings and cars.

A second blow came as key trade partner China experiences a slowdown after several decades of strong economic growth.

These outside shocks have exposed cracks in Germany's foundation that were ignored during years of success, including lagging use of digital technology in government and business and a lengthy process to get badly needed renewable energy projects approved.

Other dawning realizations: The money that the government readily had on hand came in part because of delays in investing in roads, the rail network and high-speed internet in rural areas. A 2011 decision to shut down Germany's remaining nuclear power plants has been questioned amid worries about electricity prices and shortages. Companies face a severe shortage of skilled labor, with job openings hitting a record of just under 2 million.

And relying on Russia to reliably supply gas through the Nord Stream pipelines under the Baltic Sea — built under former Chancellor Angela Merkel and since shut off and damaged amid the war — was belatedly conceded by the government to have been a mistake.

Now, clean energy projects are slowed by extensive bureaucracy and not-in-my-backyard resistance. Spacing limits from homes keep annual construction of wind turbines in single digits in the southern Bavarian region.

A 10 billion-euro ($10.68 billion) electrical line bringing wind power from the breezier north to industry in the south has faced costly delays from political resistance to unsightly above-ground towers. Burying the line means completion in 2028 instead of 2022.

Massive clean energy subsidies that the Biden administration is offering to companies investing in the U.S. have evoked envy and alarm that Germany is being left behind.

“We’re seeing a worldwide competition by national governments for the most attractive future technologies — attractive meaning the most profitable, the ones that strengthen growth,” Kullmann said.

He cited Evonik’s decision to build a $220 million production facility for lipids — key ingredients in COVID-19 vaccines — in Lafayette, Indiana. Rapid approvals and up to $150 million in U.S. subsidies made a difference after German officials evinced little interest, he said.

“I'd like to see a little more of that pragmatism ... in Brussels and Berlin,” Kullmann said.

In the meantime, energy-intensive companies are looking to cope with the price shock.

Drewsen Spezialpapiere, which makes passport and stamp paper as well as paper straws that don't de-fizz soft drinks, bought three wind turbines near its mill in northern Germany to cover about a quarter of its external electricity demand as it moves away from natural gas.

Specialty glass company Schott AG, which makes products ranging from stovetops to vaccine bottles to the 39-meter (128-foot) mirror for the Extremely Large Telescope astronomical observatory in Chile, has experimented with substituting emissions-free hydrogen for gas at the plant where it produces glass in tanks as hot as 1,700 degrees Celsius.

It worked — but only on a small scale, with hydrogen supplied by truck. Mass quantities of hydrogen produced with renewable electricity and delivered by pipeline would be needed and don't exist yet.

Scholz has called for the energy transition to take on the “Germany tempo,” the same urgency used to set up four floating natural gas terminals in months to replace lost Russian gas. The liquefied natural gas that comes to the terminals by ship from the U.S., Qatar and elsewhere is much more expensive than Russian pipeline supplies, but the effort showed what Germany can do when it has to.

However, squabbling among the coalition government over the energy price cap and a law barring new gas furnaces has exasperated business leaders.

Evonik's Kullmann dismissed a recent package of government proposals, including tax breaks for investment and a law aimed at reducing bureaucracy, as “a Band-Aid.”

Germany grew complacent during a “golden decade” of economic growth in 2010-2020 based on reforms under Chancellor Gerhard Schroeder in 2003-2005 that lowered labor costs and increased competitiveness, says Holger Schmieding, chief economist at Berenberg bank.

“The perception of Germany's underlying strength may also have contributed to the misguided decisions to exit nuclear energy, ban fracking for natural gas and bet on ample natural gas supplies from Russia,” he said. “Germany is paying the price for its energy policies.”

Schmieding, who once dubbed Germany “the sick man of Europe” in an influential 1998 analysis, thinks that label would be overdone today, considering its low unemployment and strong government finances. That gives Germany room to act — but also lowers the pressure to make changes.

The most important immediate step, Schmieding said, would be to end uncertainty over energy prices, through a price cap to help not just large companies, but smaller ones as well.

Whatever policies are chosen, “it would already be a great help if the government could agree on them fast so that companies know what they are up to and can plan accordingly instead of delaying investment decisions," he said.

7 notes

·

View notes

Text

The Role of Renewable Energy Sources in Powering the Green Hydrogen Market

According to a new report published by Allied Market Research, the green hydrogen market was valued at $2.5 billion in 2022, and is estimated to reach $143.8 billion by 2032, growing at a CAGR of 50.3% from 2023 to 2032.

Green hydrogen, also known as renewable hydrogen, is a form of hydrogen produced using renewable energy sources, such as solar, wind, or geothermal power. Furthermore, the demand for proton exchange membrane electrolyzer is anticipated to witness growth during the forecast period, owing to economic growth in emerging markets continues to surge.

Request Sample Pages: https://www.alliedmarketresearch.com/request-sample/11675

In 2023, Asia-Pacific accounts for the largest green hydrogen market share, followed by Europe and North America.

Major Companies

Green Hydrogen Systems, Air Liquide, Shell plc, Enapter S.r.l., Plug Power Inc., Ballard Power Systems, Linde plc, Reliance Industries, GAIL (India) Limited and Adani Green Energy Ltd.

The green hydrogen market is expected to be driven by factors such as the promising growth of the food and beverages, medical, chemical, and petrochemical industries.

Demand for power generation has escalated due to global population growth, coupled with urbanization and industrialization, leading to increase electricity consumption.

The food and beverage segment are projected to manifest a CAGR of 51.6% from 2023 to 2032, and has significant proportion in green hydrogen market size. Rise in the food and beverage industry significantly influences the green hydrogen market, primarily due to intensive energy demand of the industry.

Food and beverage production requires substantial energy for processing, packaging, refrigeration, and transportation. Green hydrogen presents a sustainable solution to meet these escalating energy demands, especially in processes were direct electrification not efficient.

Rise in living standards and technological advancements also contribute to higher energy needs, especially in emerging economies where electricity access has expanded rapidly.

Ongoing R&D efforts focus on enhancing electrolyzer efficiency, durability, and scaling up production, leading to cost reductions and improved performance. This trend aligns with ambitious governmental targets and corporate commitments aimed at fostering the green hydrogen industry, spurring innovation and market growth.

Increasingly stringent regulations and carbon pricing mechanisms incentivize to transition of industries into low-carbon alternatives, propelling its market penetration. These converging green hydrogen market trends collectively position green hydrogen as a pivotal player in the sustainable energy landscape, driving a fundamental shift toward cleaner, more resilient energy systems across the globe.

Enquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/11675

the electrification of transportation and heating sectors, driven by the push for cleaner energy sources, further amplifies the demand for power generation. This growth in demand provides a significant opportunity for the green hydrogen market.

Green hydrogen emerges as a versatile solution as traditional energy sources struggle to meet these escalating demands while maintaining environmental sustainability.

This symbiotic relationship between the rise in demand for power generation and the need for clean energy solutions positions green hydrogen as a key player in meeting the escalating energy needs sustainably.

The push toward decarbonization and the reduction of greenhouse gas emissions in the transportation sector amplifies the appeal of green hydrogen market opportunities.

Carbon Solutions, a greenhouse gas reduction consultancy, in May 2023, stated that less than 1% of the 10 million metric tons of hydrogen produced in the U.S. at present counts as green hydrogen. Instead, 76% is derived from natural gas or coal, and 23% is a by-product of petroleum refining or other chemical processes.

Globally, the hydrogen market is about 96 million metric tons per year. The report from Carbon Solutions puts number of electrolyzers operating in the U.S. at just 42, with a combined hydrogen production capacity of about 3,000 tons per year.

Get a Customized Research Report: https://www.alliedmarketresearch.com/request-for-customization/11675

The U.S. Department of Energy (DOE) aims to have 10 million tons of clean hydrogen flowing per year by 2030, 20 million tons by 2040, and 50 million tons by 2050. About half that production is expected to come from renewably powered electrolysis. The U.S. government is projected to invest $8 billion in several hydrogen hubs across the country by 2026 and produce about 250 times as much hydrogen per day.

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

2 notes

·

View notes

Text

Efficiency in the Ice Age: Efficiency and Sustainability in Cryogenic Tanks

for Cryogenic Gases

Cryogenic tanks are specialized vessels used for storage of liquefied gases at very low temperatures. They find widespread application across industries like healthcare, metallurgy, semiconductors, etc. where gases like nitrogen, oxygen, argon, hydrogen are required in liquid form. Cryogenic tanks offer advantages like ease of transportation of large volumes of gases over long distances. The demand for cryogenic gases is growing due to their increasing usage in welding & metal manufacturing processes and for medical applications like cryosurgery.

The global cryogenic tanks market is estimated to be valued at US$ 6.51 Bn in 2024 and is expected to exhibit a CAGR of 5.0% over the forecast period 2023 to 2030.

Key Takeaways

Key players operating in the cryogenic tanks market are ArcelorMittal, China Baowu Group, Nippon Steel Corporation, POSCO, Shagang Group, Ansteel Group, Glencore, Sumitomo Metal Mining Company, Linde, INOX India Pvt., Cryofab, FIBA Technologies, Air Products and Chemicals, Inc., M1 Engineering, Chart Industries, Wessington Cryogenics, Isisan, Lapesa, Auguste Cryogenics, and Hoover Ferguson Group, Inc.

The key opportunities in the market include increasing demand for liquified natural gas and growing research in cryogenic sciences. Countries across North America, Europe, Asia Pacific and Latin America are investing heavily in development of liquid hydrogen infrastructure which is driving the global expansion of cryogenic tanks market.

Market Drivers

The primary driver for cryogenic tanks market is the surging demand for industrial, medical and research gases. Particularly, the demand for nitrogen, oxygen and argon is growing rapidly from metal manufacturing, semiconductor fabrication, healthcare and food processing industries. Countries worldwide are also promoting usage of green fuels like liquified natural gas and liquid hydrogen which requires cryogenic storage and transportation, thereby propelling the cryogenic tanks market growth. Strict safety regulations regarding the handling and transportation of industrial gases is also driving adoption of specialized cryogenic vessels.PEST Analysis

Political: The cryogenic tanks market is impacted by regulations and standards set by organizations like ASME, DOT and National Board of Boiler and Pressure Vessel Inspectors for design, construction, testing and transportation of cryogenic vessels.

Economic: Factors like global GDP growth, industrial production and investments in end use industries influence demand for cryogenic vessels in the market.

Social: Rising demand for LNG as fuel in transportation and power generation drives usage of cryogenic vessels for storage and transportation of LNG.

Technological: Advancements in materials and manufacturing technologies enable production of cryogenic vessels that are lighter, more durable and have higher storage capacity. Insulation technologies also improve efficiency of cryogenic storage and transportation.

Geographical regions with high market concentration:

The cryogenic tanks market sees significant value concentration in regions with high industrial activity and investments in end use industries. North America, Europe and Asia Pacific hold major share of the global cryogenic tanks market value owing to strong demand from petrochemical, power generation and healthcare industries in countries like U.S., Germany, China and India.

Fastest growing region:

The Asia Pacific region is projected to be the fastest growing market for cryogenic tanks during the forecast period. This rapid growth can be attributed to increasing industrialization, rising LNG demand and investments in new production capacities in major economies of China and India. Factors like government initiatives to increase usage of cleaner fuels and expand industrial infrastructure also support market growth in the Asia Pacific region.

0 notes

Text

Unlocking Market Insights: Exploring the Process Analyzer Market Size, Share, Trends

In the realm of industrial processes, accuracy, efficiency, and reliability are paramount. Enter process analyzers – sophisticated instruments designed to monitor and analyze various parameters in real-time, enabling industries to maintain quality, ensure compliance, and optimize operations. As the global demand for process optimization and automation intensifies, the process analyzer market is poised for significant growth, driven by advancements in liquid and gas analysis technologies, industry-specific applications, and regional expansions.

Understanding the Market Landscape

The global process analyzer market is on an upward trajectory, poised to expand from USD 7.8 billion in 2023 to USD 9.3 billion by 2028, registering a steady Compound Annual Growth Rate (CAGR) of 3.6%. This growth is fueled by the increasing adoption of process analyzers across a wide range of industries, including pharmaceuticals, chemicals, oil & gas, water treatment, and food & beverage.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=148603279

Market Segmentation by Liquid Analyzer

MLSS (Mixed Liquor Suspended Solids): MLSS analyzers are used in wastewater treatment plants to measure the concentration of suspended solids in mixed liquor, enabling efficient process control and optimization.

Total Organic Carbon (TOC): TOC analyzers quantify the amount of organic carbon present in water or liquid samples, providing insights into water quality, pollution levels, and treatment efficiency.

pH: pH analyzers measure the acidity or alkalinity of a liquid sample, crucial for maintaining optimal conditions in various industrial processes, including chemical manufacturing, food processing, and pharmaceutical production.

Liquid Density: Liquid density analyzers determine the density of liquids, enabling precise measurement and control of product quality and composition in industries such as petrochemicals, beverages, and pulp & paper.

Conductivity: Conductivity analyzers measure the electrical conductivity of a liquid, providing valuable information about its chemical composition, concentration, and purity in applications ranging from water treatment to industrial manufacturing.

Dissolved Oxygen: Dissolved oxygen analyzers monitor the concentration of oxygen dissolved in water, essential for aerobic biological processes in wastewater treatment, aquaculture, and environmental monitoring.

Market Segmentation by Gas Analyzer

Oxygen: Oxygen analyzers measure the concentration of oxygen in gas streams, crucial for combustion control, environmental monitoring, and safety applications in industries such as power generation, steel production, and healthcare.

Carbon Dioxide: Carbon dioxide analyzers quantify the concentration of CO2 in gas samples, used in applications such as beverage carbonation, greenhouse gas monitoring, and indoor air quality assessment.

Moisture: Moisture analyzers measure the moisture content in gas streams, vital for process control and quality assurance in industries such as pharmaceuticals, food processing, and semiconductor manufacturing.

Toxic Gas: Toxic gas analyzers detect and quantify the presence of hazardous gases in the environment, ensuring worker safety and regulatory compliance in industries such as chemical manufacturing, petrochemicals, and mining.

Hydrogen Sulfide: Hydrogen sulfide analyzers monitor the concentration of H2S in gas samples, crucial for odor control, environmental compliance, and safety in industries such as wastewater treatment, oil & gas, and pulp & paper.

Market Segmentation by Industry and Region

The process analyzer market caters to a diverse range of industries, including:

Pharmaceuticals

Chemicals

Oil & Gas

Water Treatment

Food & Beverage

Pulp & Paper

Power Generation

Semiconductor Manufacturing

Geographically, the market spans regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each presenting unique opportunities and challenges for market players.

Driving Efficiency and Compliance

As industries strive for operational excellence, compliance with regulatory standards, and sustainability, process analyzers emerge as indispensable tools for real-time monitoring, analysis, and control of critical parameters. From liquid to gas analysis, pH to TOC, oxygen to hydrogen sulfide, process analyzers empower industries to optimize processes, enhance product quality, and mitigate risks in an ever-evolving landscape.

With the global process analyzer market poised for steady growth, fueled by technological advancements, industry-specific applications, and regional expansions, organizations must stay agile and proactive to harness the full potential of process analyzer solutions. By embracing innovation, collaboration, and data-driven insights, industries can navigate complex challenges, drive efficiency gains, and achieve sustainable growth in the dynamic world of process automation.

0 notes

Text

Syngas & Derivatives Market Analysis. Dynamics, Players, Type, Applications, Trends, Regional Segmented, Outlook & Forecast till 2033

Syngas & Derivatives Market was valued at USD 219.82 Billion. in 2023 and the total Syngas & Derivatives revenue is expected to grow at 9.3% from 2024 to 2033, reaching nearly USD 532.9 Billion in 2033.

Definition:

The Syngas & Derivatives Market encompasses the production, trade, and utilization of syngas (synthesis gas) and the various chemicals and fuels derived from it. Syngas itself is a non-condensable gas mixture primarily composed of hydrogen, carbon monoxide, and varying amounts of carbon dioxide, methane, and other elements.

Overview:

This market plays a crucial role in various industries:

Chemicals: Syngas serves as a key building block for numerous chemicals, including methanol, ammonia, and acetic acid.

Power Generation: Syngas can be directly combusted in gas turbines for electricity production.

Liquid Fuels: Through various synthesis processes, syngas can be transformed into liquid fuels like gasoline and diesel.

Gaseous Fuels: Syngas itself can be utilized as a clean-burning fuel source for industrial processes and transportation.

The global Syngas & Derivatives Market is experiencing steady growth, driven by several factors:

Key Trends:

Growing Demand for Clean Fuels: As environmental regulations tighten and the push for cleaner energy sources intensifies, syngas is gaining traction as a potential alternative fuel due to its lower emissions compared to traditional fossil fuels.

Utilization of Diverse Feedstocks: Technological advancements are enabling the production of syngas from various feedstocks, including coal, natural gas, biomass, and even waste materials. This diversification ensures a more sustainable supply chain.

Integration with Renewable Energy: Syngas production can be integrated with renewable energy sources like solar and wind power. This allows for the storage and utilization of renewable energy in the form of syngas when needed.

Advancements in Gasification Technologies: Continuous development in gasification technologies is leading to more efficient and cost-effective syngas production processes.

Market Scope:

The Syngas & Derivatives Market can be segmented based on various factors:

Feedstock: Coal, natural gas, biomass, waste materials, etc.

Production Technology: Entrained flow gasification, fluidized bed gasification, etc.

Syngas Type: High-heating value syngas, low-heating value syngas

Derivative Products: Methanol, ammonia, synthetic fuels, etc.

End-Use Applications: Power generation, chemicals production, transportation fuels, etc.

Geographic Region: Asia Pacific, North America, Europe, etc.

Understanding these segments helps analyze the market dynamics and identify potential growth areas.

Conclusion:

The Syngas & Derivatives Market offers promising opportunities for companies involved in syngas production, technology development, and the manufacturing of syngas-derived products. With increasing focus on sustainability and cleaner energy solutions, the market is expected to witness significant growth in the coming years.

Receive the FREE Sample Report of Syngas & Derivatives Market Research Insights @ https://stringentdatalytics.com/sample-request/syngas-&-derivatives-market/13375/

Market Segmentations:

Global Syngas & Derivatives Market: By Company

• KBR Inc.

• Haldor Topsoe

• Mitsubishi Heavy Industries

• Nippon

• Oxea GmbH

• Methanex

• Royal Dutch Shell

• Siemens AG

• GE Energy

• Dow Chemical

• BASF

• Chicago Bridge

• Iron Company

• Linc Energy.

Global Syngas & Derivatives Market: By Type

• Coal

• Natural Gas

• Petroleum By-products

• Biomass/Waste

Global Syngas & Derivatives Market: By Application

• Chemical

• Liquid Fuels

• Power Generation

• Gaseous Fuels

Regional Analysis of Global Syngas & Derivatives Market

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Syngas & Derivatives market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Click to Purchase Syngas & Derivatives Market Research Report @ https://stringentdatalytics.com/purchase/syngas-&-derivatives-market/13375/?license=single

Key Report Highlights:

Key Market Participants: The report delves into the major stakeholders in the market, encompassing market players, suppliers of raw materials and equipment, end-users, traders, distributors, and more.

Comprehensive Company Profiles: Detailed company profiles are provided, offering insights into various aspects including production capacity, pricing, revenue, costs, gross margin, sales volume, sales revenue, consumption patterns, growth rates, import-export dynamics, supply chains, future strategic plans, and technological advancements. This comprehensive analysis draws from a dataset spanning 12 years and includes forecasts.

Market Growth Drivers: The report extensively examines the factors contributing to market growth, with a specific focus on elucidating the diverse categories of end-users within the market.

Data Segmentation: The data and information are presented in a structured manner, allowing for easy access by market player, geographical region, product type, application, and more. Furthermore, the report can be tailored to accommodate specific research requirements.

SWOT Analysis: A SWOT analysis of the market is included, offering an insightful evaluation of its Strengths, Weaknesses, Opportunities, and Threats.

Expert Insights: Concluding the report, it features insights and opinions from industry experts, providing valuable perspectives on the market landscape.

Report includes Competitor's Landscape:

➊ Major trends and growth projections by region and country

➋ Key winning strategies followed by the competitors

➌ Who are the key competitors in this industry?

➍ What shall be the potential of this industry over the forecast tenure?

➎ What are the factors propelling the demand for the Syngas & Derivatives ?

➏ What are the opportunities that shall aid in significant proliferation of the market growth?

➐ What are the regional and country wise regulations that shall either hamper or boost the demand for Syngas & Derivatives ?

➑ How has the covid-19 impacted the growth of the market?

➒ Has the supply chain disruption caused changes in the entire value chain?

Customization of the Report:

This report can be customized to meet the client’s requirements. Please connect with our sales team ([email protected]), who will ensure that you get a report that suits your needs. You can also get in touch with our executives on +1 346 666 6655 to share your research requirements.

About Stringent Datalytics

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs.

Reach US

Stringent Datalytics

+1 346 666 6655

Social Channels:

Linkedin | Facebook | Twitter | YouTube

0 notes

Text

Biomass Gasification Market: Unlocking Market Potential

Renewable Energy Mandates and Policies and Technological Advancements are the factors propelling the market growth.

According to TechSci Research report, “Global Biomass Gasification Market - Industry Size, Share, Trends, Competition Forecast & Opportunities, 2028”. Global Biomass Gasification is anticipated to project robust growth in the forecast period with a CAGR of 8.58% through 2028. Biomass is organic matter that is obtained from plants and animals. It is a renewable source that can be used for generating energy. It is capable of providing energy in form of heat as well as electricity upon burning and later turning the heat into electricity. Biomass Gasification is a process in which organic and fossil fuels are converted into gases. It is carried out through a controlled amount of oxygen and steam without any combustion. This process is carried out at high temperatures without allowing the matter to burn or combust.

Biomass Biomass Gasification is a process where biomass obtained from organic matter is converted into gases such as carbon dioxide, hydrogen, and carbon monoxide in a controlled environment. This process is carried out through different gasifiers. Carbon monoxide hence produced reacts with water in a water-gas shift reaction and produces more hydrogen and carbon dioxide from which hydrogen is further used as fuel.

Biomass Biomass Gasification is gaining momentum owing to several factors, one of them being a municipal solid waste. MSW consists of biomass such as paper, cardboard, wood chippings, leaves, and leather products, and non-biomass products such as plastic, glasses, and metal. There are several concerns linked to municipal solid waste (MSW). Handling and managing MSW has raised so many questions as disposing of such huge amounts of waste, directly and indirectly, impacts the earth’s environment.

According to the U.S. Energy Information Association (EIA), in 2018, a total of 12% of total MSW was burnt in waste-to-energy biomass Biomass Gasification plants. MSW is used for producing energy which has led to increased contribution from the source in the biomass Biomass Gasification market. It acts as a driving factor for the biomass Biomass Gasification market growth.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on " Global Biomass Gasification Market.”

https://www.techsciresearch.com/report/biomass-gasification-market/14961.html

Based on Application, Power segment is expected to hold the largest share of Biomass Gasification market during the forecast period, The power application dominated the market share and is expected to grow at a higher CAGR during the projection period. This can be attributed to the fact that the power sector is actively working on an energy transition from coal-based to economical and environmentally friendly options, biomass is expected to grow its contribution with increased advancements in Biomass Gasification technology.

The electric power sector uses wood and biomass-derived wastes to generate electricity for sale to the other sectors. Biomass energy provided about 4.8 quadrillion Btu and is equal to about 5% of total U.S. primary energy consumption. The U.S. had a total of 9% consumption of biomass energy in the power sector for the year 2021.

Based on Region, Europe will dominate the market, Europe region has the presence of major industry players which contributed towards its dominance in the market share for 2021. It is expected to continue as it is actively working on its energy shift towards renewable sources for primary energy production which will act as a strong driving factor for the market growth. Europe is 90% dependent on imported fossil gas and offers no significant support to ensure the fast deployment of renewable gases.

Key market players in the Global Biomass Gasification Market are following: -

Vaskiluoto Voima Oy

Beltran Technologies, Inc.

Valmet Corporation

KASAG Swiss AG

Goteborg Energi AB

Ankur Scientific Energy Technologies Pvt. Ltd.

Thyssenkrupp AG

Infinite Energy Pvt. Ltd.

Download Free Sample Report

https://www.techsciresearch.com/sample-report.aspx?cid=14961

Customers can also request for 10% free customization on this report.

“The global biomass gasification market is influenced by multiple key drivers that underscore its significance in the sustainable energy landscape. Increasing renewable energy mandates and government policies aimed at curbing carbon emissions have fueled the adoption of biomass gasification. Growing environmental concerns and a commitment to mitigating climate change contribute to its appeal as a clean energy solution. Technological advancements play a crucial role, enhancing efficiency and reducing costs, thereby bolstering the commercial viability of biomass gasification technologies. This progress includes improved gas cleaning and purification techniques, ensuring compliance with stringent environmental standards.

The diversification of biomass sources, coupled with the utilization of waste materials, broadens the scope of biomass gasification. Its role in rural development and job creation, particularly by utilizing locally available biomass resources, adds an economic dimension to its attractiveness. Additionally, biomass gasification serves as a dual-purpose solution, addressing waste management challenges while producing renewable energy.

Corporate sustainability initiatives and a global shift towards greener practices further stimulate market growth, as businesses increasingly integrate biomass gasification into their strategies to meet environmental targets. Collectively, these factors position biomass gasification as a pivotal player in the global transition to sustainable and environmentally friendly energy solutions.” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based global management consulting firm.

Biomass Gasification Market – Global Industry Size, Share, Trends, Opportunity, and Forecast Segmented by Source (Solid Biomass, Liquid Biomass, Biogas, Municipal Waste, Others), By Application (Chemical, Liquid Fuel, Gaseous Fuel, and Power), By Region, By Competition 2018-2028has evaluated the future growth potential of Global Biomass Gasification Market and provides statistics and information on market structure, size, share, and future growth. The report is intended to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities present in the Global Biomass Gasification Market.

Browse Related Research Reports:

Smart Meters Market

https://www.techsciresearch.com/report/global-smart-meters-market/3909.html

Diesel Power Engine Market

https://www.techsciresearch.com/report/global-diesel-power-engine-market/2184.html

High Voltage Capacitors Market

https://www.techsciresearch.com/report/high-voltage-capacitors-market/16557.html

Contact Us-

TechSci Research LLC

420 Lexington Avenue, Suite 300,

New York, United States- 10170

M: +13322586602

Email: [email protected]

Website: www.techsciresearch.com

#Biomass Gasification Market#Biomass Gasification Market Size#Biomass Gasification Market Share#Biomass Gasification Market Trends#Biomass Gasification Market Growth

0 notes

Text

Exploring the Dynamics: E-fuels Market Expected to Attain USD 28.3 Billion by 2031 with 64.5% CAGR

The global e-fuels market is poised for significant growth from 2023 to 2031, driven by the increasing focus on renewable energy sources, decarbonization efforts, and the transition towards sustainable transportation solutions. E-fuels, also known as synthetic fuels or electrofuels, offer promising alternatives to traditional fossil fuels, presenting opportunities for reducing greenhouse gas emissions and mitigating the impacts of climate change. With advancements in technology and growing environmental concerns, the e-fuels market is experiencing rapid expansion and innovation, shaping the future of energy production and consumption.

The global industry was valued at US$33.6 Mn in 2022 and is forecasted to advance at a CAGR of 64.5% from 2023 to 2031, reaching US$28.3 Bn by the end of 2031.

The e-fuels market is witnessing robust growth globally, driven by the need for clean and sustainable energy solutions to combat climate change and reduce dependence on fossil fuels. E-fuels are produced using renewable energy sources such as wind, solar, or hydroelectric power through the process of electrolysis, converting water and carbon dioxide into synthetic fuels like hydrogen, methane, or methanol.

Download Sample of the Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=83697

Market Segmentation:

By Service Type: Includes production, distribution, and storage services.

By Sourcing Type: Comprises hydrogen, methane, methanol, and others.

By Application: Covers transportation, power generation, industrial processes, and others.

By Industry Vertical: Encompasses automotive, aviation, marine, energy, and others.

By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Regional Analysis:

Europe is anticipated to dominate the e-fuels market, driven by stringent environmental regulations, government incentives for renewable energy projects, and growing investments in hydrogen infrastructure.

North America is expected to witness significant growth, supported by increasing adoption of electric vehicles, renewable energy initiatives, and investments in sustainable transportation solutions.

Asia Pacific region is projected to experience rapid expansion, fueled by urbanization, industrialization, and government efforts to reduce emissions and promote clean energy technologies.

Market Drivers and Challenges:

Drivers: Increasing awareness about climate change, government regulations promoting renewable energy adoption, advancements in electrolysis technology, and the need for energy security and independence.

Challenges: High production costs, limited infrastructure for e-fuels distribution, scalability issues, and competition from conventional fossil fuels.

Market Trends:

Growing investments in electrolyzer technology and renewable energy infrastructure.

Expansion of hydrogen refueling stations and e-fuel production facilities.

Integration of e-fuels in aviation, shipping, and heavy-duty transportation sectors.

Future Outlook:

The future outlook for the e-fuels market is promising, with increasing momentum towards sustainable energy solutions and decarbonization initiatives globally. Technological advancements, supportive government policies, and collaborations across industries are expected to drive market growth and foster innovation in the coming years.

Key Market Study Points:

Analysis of market dynamics and regulatory frameworks shaping the e-fuels market.

Evaluation of key technological advancements and innovations in e-fuels production and distribution.

Assessment of market opportunities and challenges in different industry verticals and regions.

Identification of key stakeholders, market trends, and growth drivers driving market expansion.

Competitive Landscape:

The e-fuels market is characterized by the presence of key players such as Audi AG, Porsche AG, Climeworks AG, Sunfire GmbH, and Siemens Energy AG. These companies are actively engaged in research and development initiatives, strategic partnerships, and investments in infrastructure to drive market growth and enhance their competitive position.

Recent Developments:

Launch of pilot projects and demonstration plants for e-fuel production and utilization.

Strategic partnerships and collaborations between automotive manufacturers, energy companies, and technology providers.

Investments in renewable energy projects and electrolysis technology to scale up e-fuels production.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=83697<ype=S

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision-makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyze information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

0 notes

Text

The individual dimension of activity against global warming, French version ( english )

My French friends: I studied economics/management DEUG/Ensette in Strasbourg, France between 1990 and 1992. There I composed, among other things, the basics of my first piano concerto, Strasbourg, in the quality of Tchaikovsky. Of course I know that France is 75% dependent on nuclear power and is the third strongest nuclear power in the world as a security measure and this corresponds to the peaceful use of nuclear energy. As for the latter, I hope for a common nuclear umbrella, the EU, to also protect my home country Europe. In this regard, I have some understanding that France sees nuclear energy as an ecological force in transition and neglects long-term perspectives.

First of all: I am Oliver Frederic Dieck O.F.D. This isn't about gay climate or crazy revenge on God. It's about the earth's revenge for making us humans the real cancer of the earth, and about how the earth can be healed through better behavior. In my opinion, it's enough if a she is melting down faceing me. In short: What can we do on an individual level:

Some ideas :

Don't buy things that are actually greenwashed as a marketing argument. Refer to the true costs from start to finish, social costs and environmental costs included. No other calculation makes sense to make it better in reality.

We need to add a badge or plaque to every product that shows the real environmental cost, including the information, like we do with cigarettes and tobacco these days, with the information “It might kill you”.

We need to impose additional taxes that reflect the real costs, including the costs to ecological society worldwide, and add this to pricing. Maybe if we do it in this pedagogical way we need to cut taxes elsewhere

We need a peaceful world without madness like cold or hot wars in order to have the resources to correct our actions. Mutual deterrence is not the way forward. There is no real alternative to law and peaceful imprisonment. We don't need dictators and criminals in leadership worldwide. That's all. Then proceed carefully.

-Just-in-time production and outsourced production must change. Interdependencies, alternatives for risk reduction and engines that use, for example, hydrogen gas or other modern technologies. Then it is possible to continue with global production. Otherwise not.

-Don't believe too much in the words of politicians who prefer goodwill solutions rather than equal legal frameworks that force all market participants to be ecologically responsible. Otherwise nothing will happen that would deceive us for another decade until our certain end, as it has been for four decades including the relocation of production to then prosperous China, India and so on.

There are too many of us on this planet of 8 billion people. But in developed countries with women studying and free access to safe sex condoms, at least the behavior of the population has changed drastically. We Europeans are dying out. We must take personal measures for the next generations, also to keep the social and economic system and the intergenerational contracts stable. But it will work in the same way elsewhere if there is also a modernization of religion and enlightenment. I think that the development of the Earth is the main key to halting the explosive growth on Earth.

In Germany, my home state in Europe, one in seven workers depends on the automobile industry. In France it is different but similar. Therefore, it is necessary to advance new responsible technologies for our personal prosperity and the solution to our global climate problems.

Eat less meat, more eggs, fish and poultry and of course fruits and vegetables. Favor sources in your area.

Don't buy fast fashion clothes based on the latest trends. Most of the time, fashion just sells goods by artificially creating a new trend every year. Buy something good in your individual style with lasting quality and be satisfied with it.

Do not throw everything away and recycle it if necessary. Repair is the option. New is not an argument for quality!

Demonstrate, use your social network and vote.

-In short: Stop fighting for your individual freedom. Fight against the reasons that force us to gradually use our freedoms less and ultimately limit them to zero out of responsibility.

Kind regards, Oliver Frederic Dieck. O.F.D for short Oli.

#climatewarming#climate action#climatechange#environment#fridaysforfuture#gretathünberg#cop#un#eu#europe#europeelections#diliverychainlaw#unitednations#oliverfredericdieck#usa#greatbritain#ireland#australia#ofd#canada#luisaneubauer

0 notes

Text

Exploring the Global Ammonia Market: Insights and Trends

Ammonia is an inorganic compound with the formula NH3. It is a colourless gas with a characteristic pungent smell. It is mainly used as a fertilizer in agriculture and also found its applications in various other industries like chemicals, pharmaceuticals, textiles, refrigerants etc. Ammonia is produced on an industrial scale using the Haber-Bosch process.Ammonia provides nitrogen to plants which is an essential nutrient for crop growth. Rising global population and need for food security has increased the demand for fertilizers significantly over the past few decades. Ammonia being a key fertilizer ingredient has benefitted from this growing demand.

The Global ammonia market is estimated to be valued at US$ 114 billion in 2031 and is expected to exhibit a CAGR of 6.5% over the forecast period 2024-2031.

Key Takeaways

Key players operating in the ammonia market are Yara International ASA, BASF SE, CF Industries Holdings, Inc., Nutrien Ltd., Potash Corporation of Saskatchewan Inc., Dangyang Huaqiang Chemical Co., Ltd., Shanxi Jinfeng Coal Chemical Co Ltd., GTS Chemical Holdings plc.,Togliattiazot, OCI Nitrogen B.V., Agrium Inc., Sabic, and Koch Fertilizer, LLC among others.

The rising global population has increased the demand for food significantly. As per UN estimates, the global population is expected to reach around 9.7 billion by 2050 which will further drive the demand for ammonia as fertilizer.

New technologies like methane pyrolysis are being developed which helps in more efficient production of ammonia. This would help boost its supply and meet the growing demand cost effectively.

Market Trends

Growing preference for nitrogen-based fertilizers - Nitrogenous fertilizers like ammonia, urea etc. see higher demand over other fertilizers due to their high nitrogen content and economic viability. This trend is expected to drive ammonia consumption.

Increase in natural gas based capacity additions - Many new ammonia plants are being set up based on natural gas due to abundant availability and relatively lower prices vis-à-vis other feedstocks. This is expected to boost ammonia output.

Market Opportunities

Rising biofuel production - Ammonia is used as a key ingredient in biodiesel production. Increasing global targets for biofuel blending is expected to generate more demand for ammonia.

Use in hydrogen economy - Ammonia is emerging as a potential carrier and storage medium for hydrogen. Its use in hydrogen-based transportation and power generation systems can open new avenues.

Impact of COVID-19 on Ammonia Market Growth

The COVID-19 outbreak has severely impacted the global ammonia market in 2020. The imposition of lockdowns led to the closure of many manufacturing facilities, disrupting the entire supply chain. With decline in industrial activity, the demand for ammonia fell drastically across major end-use industries like fertilizers, textiles, refrigeration, pharmaceuticals etc. This led to oversupply situations in North America and Europe. Some of the projects planned for capacity expansion were also stalled during this period owing to labor shortages and financial constraints faced by the companies.

However, with gradual lifting of restrictions and restarting of industries from mid-2021, the market started recovering. The demand is steadily rising from agricultural sector to meet the increasing food demand of the growing global population. Fertilizer plants are ramping up their productions to pre-COVID levels. Manufacturers are focusing on developing innovative and cost-effective production technologies to cater to the reviving demands. Project expansion activities have also resumed. The market is anticipated to get back on the growth trajectory and surpass its pre-pandemic size by 2024. Continuous investments in agricultural sector will be crucial for the sustainable growth of ammonia market in the coming years.

Europe remains the largest regional market for ammonia, accounting for over 30% of the global supply in 2023. Availability of raw materials, technical expertise and widespread fertilizer manufacturing facilities contribute to its dominance. However, Asia Pacific is identified as the fastest growing regional market, expanding at a CAGR of around 8% during the forecast period. Increased agricultural activities and growth of allied industries like textiles are driving the demands in countries like China, India and Indonesia. Governments in the emerging economies are promoting urea fertilizer production to improve farm outputs. This makes the Asia Pacific region most lucrative for ammonia producers seeking new investment avenues.

0 notes

Text

Demand for Green Hydrogen Forecasted to Drive Market to USD 103.1 Billion by 2032

The green hydrogen market, valued at USD 3.9 Billion in 2022, is poised for remarkable expansion to USD 103.1 Billion by 2032, boasting a notable Compound Annual Growth Rate (CAGR) of 38.6%. As a pivotal player in the global shift towards sustainable energy, green hydrogen, generated through water electrolysis using renewable sources like wind and solar power, emerges as a promising clean and versatile energy carrier. The market experiences rapid evolution, propelled by several factors. Primarily, mounting concerns regarding climate change and the imperative to mitigate greenhouse gas emissions fuel investments in renewable energy and low-carbon technologies, prominently including green hydrogen production. Furthermore, government initiatives and ambitious decarbonization objectives across various nations propel the adoption of green hydrogen as a cornerstone of their energy transition endeavors.

The growth of the green hydrogen market is driven by several key factors:

· Rising Demand for Clean Energy: Green hydrogen, produced using renewable energy sources, is viewed as a promising solution to decarbonize various sectors, including transportation, industry, and power generation.

· Government Support and Policies: This includes subsidies, grants, tax credits, and carbon pricing mechanisms aimed at accelerating investments in green hydrogen infrastructure and projects.

· Technological Advancements: Advances in electrolysis technology, renewable energy generation, and hydrogen storage solutions are driving down the costs of green hydrogen production.

· Renewable Energy Integration: The increasing deployment of renewable energy sources, such as wind and solar power, is providing abundant and cost-effective energy inputs for green hydrogen production.

· Decarbonization Imperative: Green hydrogen offers a sustainable alternative to fossil fuels for industrial processes, enabling companies to reduce their carbon footprint and meet environmental targets.

Top Companies are:

Several prominent players are actively shaping the green hydrogen market landscape. Companies such as NEL ASA, Air Liquide, ITM Power, ENGIE, Siemens, Air Products Inc., Linde, Messer Group GmbH, Plug Power Inc., and Cummins Inc. are at the forefront of driving innovation and adoption in the industry. NEL ASA and ITM Power are notable for their expertise in electrolyzer manufacturing, providing advanced solutions for green hydrogen production. Air Liquide, Linde, and Air Products Inc. are leading suppliers of industrial gases, including hydrogen, and are expanding their offerings to include green hydrogen produced from renewable sources.

Market Segmentations:

By Technology (2023–2032)

· Proton Exchange Membrane Electrolyzer

· Alkaline Electrolyzer

· Solid Oxide Electrolyzer

By Renewable Sources (2023–2032)

· Solar Energy

· Wind Energy

· Others

By Distribution Channel (2023–2032)

· Pipeline

· Cargo

By Application (2023–2032)

· Power Generation

· Transportation

· Industry Energy

· Industry Feedstock

· Building Heat & Power

· Others

For Further Information Regarding this Report: Ask For Discount:

Regional Analysis

Europe leads the charge in green hydrogen development and implementation, driven by ambitious targets outlined in the European Union’s (EU) Green Deal and Hydrogen Strategy. Countries like Germany, the Netherlands, and Denmark are making substantial investments in green hydrogen initiatives, including the installation of electrolyzers, establishment of hydrogen production facilities, and development of hydrogen infrastructure. The European Clean Hydrogen Alliance, launched by the European Commission, further fosters collaboration and investment in green hydrogen projects across the region.

Meanwhile, the Asia-Pacific region is poised for rapid growth in the green hydrogen market. Several countries in the region are actively pursuing green hydrogen development, with Australia standing out due to its abundant renewable resources and significant potential for green hydrogen production. The Australian government has outlined a comprehensive national hydrogen strategy, leading to numerous projects in the pipeline. Japan, with its strong focus on hydrogen as part of its energy transition strategy, and South Korea and China, which are also heavily investing in green hydrogen projects, contribute to the region’s accelerating adoption of green hydrogen technologies.

Recent developments in the green hydrogen market include:

· Investment Surge: There has been a significant increase in investment in green hydrogen projects globally, driven by growing interest in renewable energy and decarbonization efforts.

· Technological Advancements: Innovations in electrolysis technology and renewable energy sources are making green hydrogen production more efficient and cost-effective.

· Government Initiatives: Many governments are introducing policies and incentives to support the development of the green hydrogen sector, including subsidies, tax incentives, and targets for renewable hydrogen production.

· Industry Partnerships: Collaboration between companies across various sectors, including energy, transportation, and manufacturing, is accelerating the deployment of green hydrogen technologies and infrastructure.

· Project Deployments: Several large-scale green hydrogen projects are underway worldwide, including production facilities, hydrogen refueling stations, and pilot projects in various sectors like transportation and industrial processes.

Key highlights of the report include:

1. The report delivers thorough Market analysis, furnishing valuable insights to guide strategic decision-making.

2. The comprehensive research outlined in the study enhances the depth of your presentations and marketing strategies.

3. By offering crucial insights into key market competitors, the study empowers businesses with a strategic edge.

4. It delivers a precise assessment of evolving market dynamics, ensuring readers stay abreast of the latest industry trends.

5. With meticulous breakdowns of various market niches, the report facilitates informed decision-making processes.

0 notes

Text

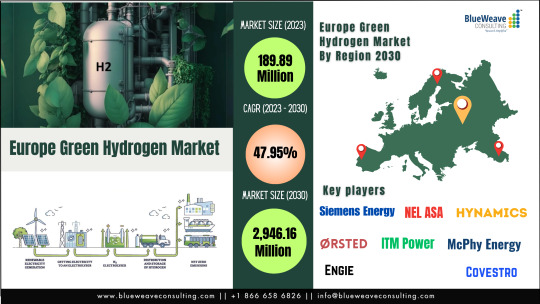

Europe Green Hydrogen Market size at USD 189.89 million in 2023. During the forecast period between 2024 and 2030, BlueWeave expects the Europe Green Hydrogen Market size to boom at a robust CAGR of 47.95% reaching a value of USD 2,946.16 million by 2030. The Europe Green Hydrogen Market is propelled by an increasingly high demand for sustainable energy solutions. Green hydrogen, generated through electrolysis using renewable sources like solar and wind power, serves as a clean alternative to traditional fuels. Its popularity is escalating due to its capacity to significantly reduce carbon emissions, meeting the burgeoning expectations for eco-friendly fuels and positioning itself as a long-term replacement for fossil fuels. In Europe, heightened environmental concerns and a demand for cleaner energy across various industrial sectors further drive the market. With the continent's commitment to decarbonization, green hydrogen, easily transportable through pipelines, assumes a strategic role. Collaborative efforts and initiatives like the European Hydrogen Bank and the REPowerEU plan underscore a commitment to fair competition and the promotion of renewable hydrogen. Also, the green hydrogen demand is expected to expand at a high CAGR, driven by significant applications in fuel, chemical feedstock, and a rising demand from the refining and iron & steel industry. A surge in demand for green hydrogen is expected over the forecast period.

Impact of Geopolitical Tensions on Europe Green Hydrogen Market

Europe Green Hydrogen Market is impacted by geopolitical tensions in several ways. The recent invasion of Ukraine has highlighted Europe's vulnerability to Russian oil and gas dependencies, prompting urgent measures to diversify energy sources. In response, the European Union has unveiled plans to reduce reliance on Russian gas, with hydrogen emerging as a pivotal element in this strategy. Hydrogen, as an energy carrier, holds the promise of providing a clean alternative in industries difficult to decarbonize. While the push for green hydrogen is gaining momentum, challenges persist, including the dominance of fossil fuel-derived hydrogen. The geopolitical landscape is shifting, and the evolving energy trade dynamics are expected to significantly impact the Europe Green Hydrogen Market, making it a crucial element in Europe's quest for energy security and independence. The global transition to a low-carbon economy, spurred by recent events like Russia-Ukraine war, has significant implications for energy value chains. Green hydrogen, with its versatility, gains economic and political momentum and is poised to play a crucial role in achieving a carbon-free future. Current challenges to green hydrogen adoption, such as limited infrastructure and cost concerns, are being reshaped by recent spikes in fossil fuel prices. While green hydrogen is becoming cost-competitive with blue and grey hydrogen, the International Renewable Energy Agency (IRENA) forecasts a substantial decline in green hydrogen costs by up to 85% by 2050, making it a crucial element in Europe's quest for energy security and independence.

Sample Request @ https://www.blueweaveconsulting.com/report/europe-green-hydrogen-market/report-sample

0 notes

Text

Governor Fubara Pursues Increased German Investment in Rivers State

Governor Siminalayi Fubara of Rivers State engaged in closed-door discussions with Mr Jochen Schindelarz, the Vice Consul-General of Germany to Nigeria, alongside a German business delegation at the Government House in Port Harcourt.

Following the meeting, Mr Schindelarz, speaking to reporters, expressed satisfaction with Governor Fubara's commitment to maintaining a safe climate for investments within the state, emphasizing the pivotal role security plays in fostering economic growth.

Mr Sebastian Glaeser, the leader of the German Industry and Commerce delegation in Nigeria, revealed plans for reciprocal business ventures, including sponsoring representatives from Rivers State to Europe to showcase investment opportunities.

Governor Fubara with the German delegation

Both the Port Harcourt Chamber of Commerce, Industry, Mines and Agriculture (PHACCIMA) and the German chamber have been tasked with facilitating these visits, aimed at attracting increased direct foreign investments to the state.

Highlighting existing investment successes in the oil and gas sector, Mr Glaeser underscored the importance of diversifying investments into areas such as hydrogen, agriculture, and industrial products.

He emphasized the significance of industry leaders' visits to Europe for trade fairs, road shows, conferences, and business forums to explore potential partnerships and synergies between Rivers State's resources and European markets.

The collaborative efforts between Governor Fubara's administration and the German delegation signify a strategic move towards enhancing economic opportunities and fostering sustainable growth in Rivers State.

This was contained in a statement released by the governor on Friday.

Read the full article

0 notes

Text

Power-to-Gas Market Estimated to Witness High Growth Owing to Rising Concerns About Green Energy Storage

Power-to-gas systems use surplus renewable power like wind and solar to produce hydrogen or synthetic natural gas through electrolysis. The produced hydrogen can be stored and distributed through the existing gas network or used as a fuel directly. It provides a long-term solution for storing surplus renewable energy. Power-to-gas also helps decarbonize sectors like industry, transportation, and buildings. The global power-to-gas market is estimated to be valued at US$ 39.13 Bn in 2023 and is expected to exhibit a CAGR of 15% over the forecast period 2024 to 2031, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

One driver that is leading to high growth of the power-to-gas market size is rising concerns about green energy storage. Renewable energy sources like solar and wind have intermittent generation which makes it challenging to balance electricity supply and demand. Power-to-gas provides a viable solution by enabling the storage of surplus renewable power in the form of hydrogen. This stored energy can later be used as a fuel or converted back to electricity as per demand. Power-to-gas helps maximize the utilization of renewable sources and support their higher adoption for a sustainable energy transition. The ability of power-to-gas to store excess renewable energy for long durations is a key factor driving increasing investments in this technology.

SWOT Analysis

Strength: Power-to-gas technology enables storage of surplus renewable energy production from wind and solar through conversion into hydrogen or methane. This provides an important energy storage solution and helps in better utilizing renewable sources. By converting electricity to hydrogen or methane, power-to-gas provides an efficient way to store energy over long periods of time in the existing gas infrastructure.

Weakness: Power-to-gas plants require large investments and have high capital costs. Their efficiency is also relatively low as energy is lost during the conversion process from electricity to gas. Additionally, public acceptance of producing and storing hydrogen or methane is still limited due to safety concerns.

Opportunity: Many countries are targeting increased adoption and share of renewable energy to meet climate goals. This presents an opportunity for greater utilization of power-to-gas technology to balance intermittent renewables production and ensure grid stability. Rising natural gas demand also provides an outlet to use hydrogen or methane derived from power-to-gas.

Threats: Cheaper battery storage alternatives or development of more direct long-term electricity storage solutions could reduce the advantages of power-to-gas. Strict emission norms may also affect use of methane derived from power-to-gas if carbon capture is not viable. Dependence on government policy support for renewable energy and power-to-gas also poses regulatory threats.

Key Takeaways

The global power-to-gas market is expected to witness high growth over the forecast period supported by increasing renewable energy adoption worldwide. The market size is estimated to reach US$ 39.13 billion by 2024.

Regional analysis: Europe currently dominates the power-to-gas market accounting for over 50% share due to favorable government policies and initiatives supporting renewable energy and power-to-gas in countries like Germany, France and Italy. Asia Pacific is expected to be the fastest growing market led by China due to major capacity additions in renewable energy.

Key players: Key players operating in the power-to-gas market are Codexis Inc., Abzena, Ltd., Enantis s.r.o, GenScript Biotech Corp., Waters Corporation, PerkinElmer, Inc., Bruker Corporation, Agilent Technologies, Bio-Rad Laboratories Inc., and Thermo Fisher Scientific Inc., among others. These companies are focusing on technology advancements and strategic partnerships to strengthen their presence in the high growth power-to-gas market.Get more insights on this topic:https://www.newswirestats.com/power-to-gas-market-size-and-outlook/

#Power-to-Gas#Power-to-Gas Market#Power-to-Gas Market size#Power-to-Gas Market share#Coherent Market Insights

0 notes

Text

Renewable H2: Analyzing Market Dynamics in the Green Hydrogen Industry

The global green hydrogen market is witnessing unprecedented growth, emerging as a key player in the transition towards sustainable energy solutions. This press release provides insights into the market size, current trends, future growth prospects, application insights, and a snapshot of the competitive landscape through comprehensive market analysis.

Free Sample Copy of This Report at: https://www.econmarketresearch.com/request-sample/EMR0023

Market Size and Trends:

The green hydrogen market is experiencing remarkable expansion, driven by the global commitment to decarbonization and the increasing demand for clean energy alternatives. Recent market assessments project the market size to reach [insert market size] by [insert year], showcasing a robust compound annual growth rate (CAGR). Key trends shaping the market include:

Renewable Energy Integration: Green hydrogen is produced using renewable energy sources, such as wind and solar power, making it a key contributor to the integration of renewable energy into various sectors.

Electrolysis Technology Advances: Technological advancements in electrolysis processes, including proton exchange membrane (PEM) and alkaline electrolyzers, are enhancing the efficiency and cost-effectiveness of green hydrogen production.

Rising Investments and Projects: Increasing investments from governments, industries, and energy companies are driving the development of large-scale green hydrogen projects, signaling a shift towards a hydrogen-based economy.

Ask For Discount: https://www.econmarketresearch.com/request-discount/EMR0023

Future Growth Prospects:

The future of the green hydrogen market looks promising, with several factors contributing to sustained growth. Anticipated future growth drivers include:

Hydrogen-Based Mobility: Green hydrogen is gaining traction as a fuel for zero-emission transportation, with applications in fuel cell vehicles, buses, trucks, and shipping.

Industrial Applications: Industries such as steel and chemical manufacturing are exploring green hydrogen as a clean alternative for high-temperature processes, contributing to decarbonization efforts.

International Collaboration: Collaborative efforts between countries and industries are fostering the development of a global green hydrogen market, with projects aiming to produce, export, and utilize green hydrogen on a large scale.

Application Insights:

Green hydrogen applications span various sectors, offering a versatile and clean energy solution. Key application insights include:

Transportation: Green hydrogen is used as a fuel for fuel cell vehicles, providing a zero-emission alternative to traditional gasoline and diesel-powered vehicles.

Industry: Industries such as steel, chemicals, and refineries are incorporating green hydrogen in their processes, reducing carbon emissions and promoting sustainable manufacturing.

Power Generation: Green hydrogen is used as a fuel for power generation, either directly in gas turbines or through conversion to electricity in fuel cells, contributing to grid stability.

Competitive Landscape and Regional Analysis:

The green hydrogen market features a competitive landscape with key players driving innovation and project development. Major companies in the market include [insert major companies], which are actively involved in scaling up green hydrogen initiatives.

Regionally, Europe is leading the way in green hydrogen development, with ambitious targets and significant investments. Asia-Pacific is also a key region, particularly with initiatives in Australia and Southeast Asia. North America is witnessing growing interest, and international collaboration is fostering the emergence of a global green hydrogen market.

In conclusion, the green hydrogen market is not just a solution; it's a catalyst for sustainable energy transformation. As the industry continues to evolve, collaboration, innovation, and widespread adoption will be critical for unlocking the full potential of green hydrogen as a clean energy source.

Get Full Information: https://www.econmarketresearch.com/industry-report/green-hydrogen-market/

Key Market Players:

Air Liquide

Air Products and Chemicals, Inc.

Air Products Inc.

Bloom Energy

Cummins Inc.

ENGIE

Linde plc.

Nel ASA

Siemens Energy

Toshiba Energy Systems & Solutions Corporation

Uniper SE

About Us:

Econ Market Research is an all-inclusive resource for providing useful insight gleaned through industry research. Through our syndicated and consulting research services, we assist our clients in finding solutions to their research needs. Industries including semiconductor and electronics, aerospace and defence, automobiles and transportation, healthcare, manufacturing and construction, media and technology, chemicals, and materials are among our areas of expertise.

Contact Us:

Econ Market Research Private Limited.

E-mail:[email protected]

Phone: +1 812 506 4440

Website: — Https://Www.Econmarketresearch.Com

Connect with us at LinkedIn | Facebook | Twitter | YouTube

0 notes

Text

Powering Tomorrow: Trends and Future Prospects in the E-Fuel Market"